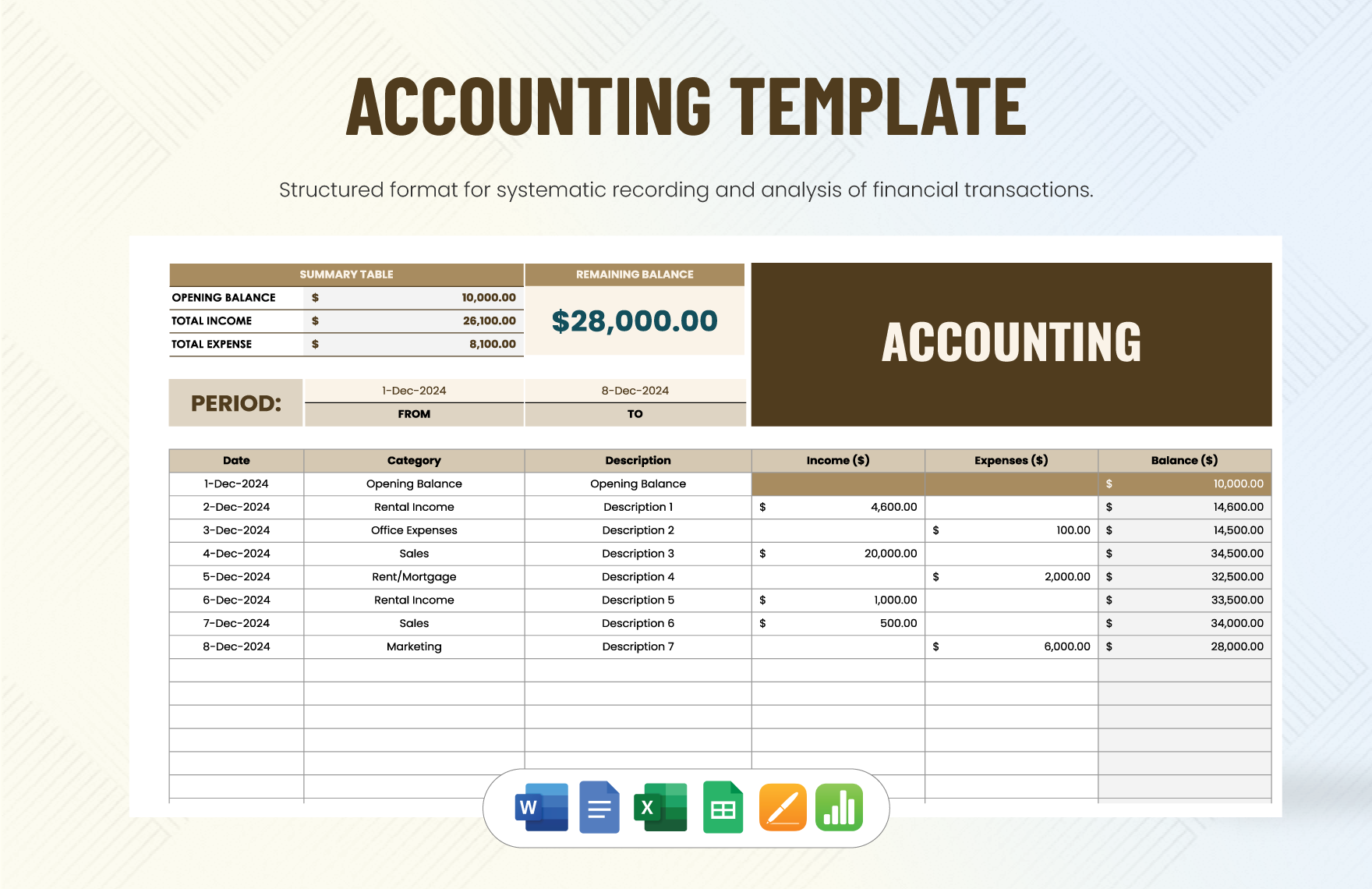

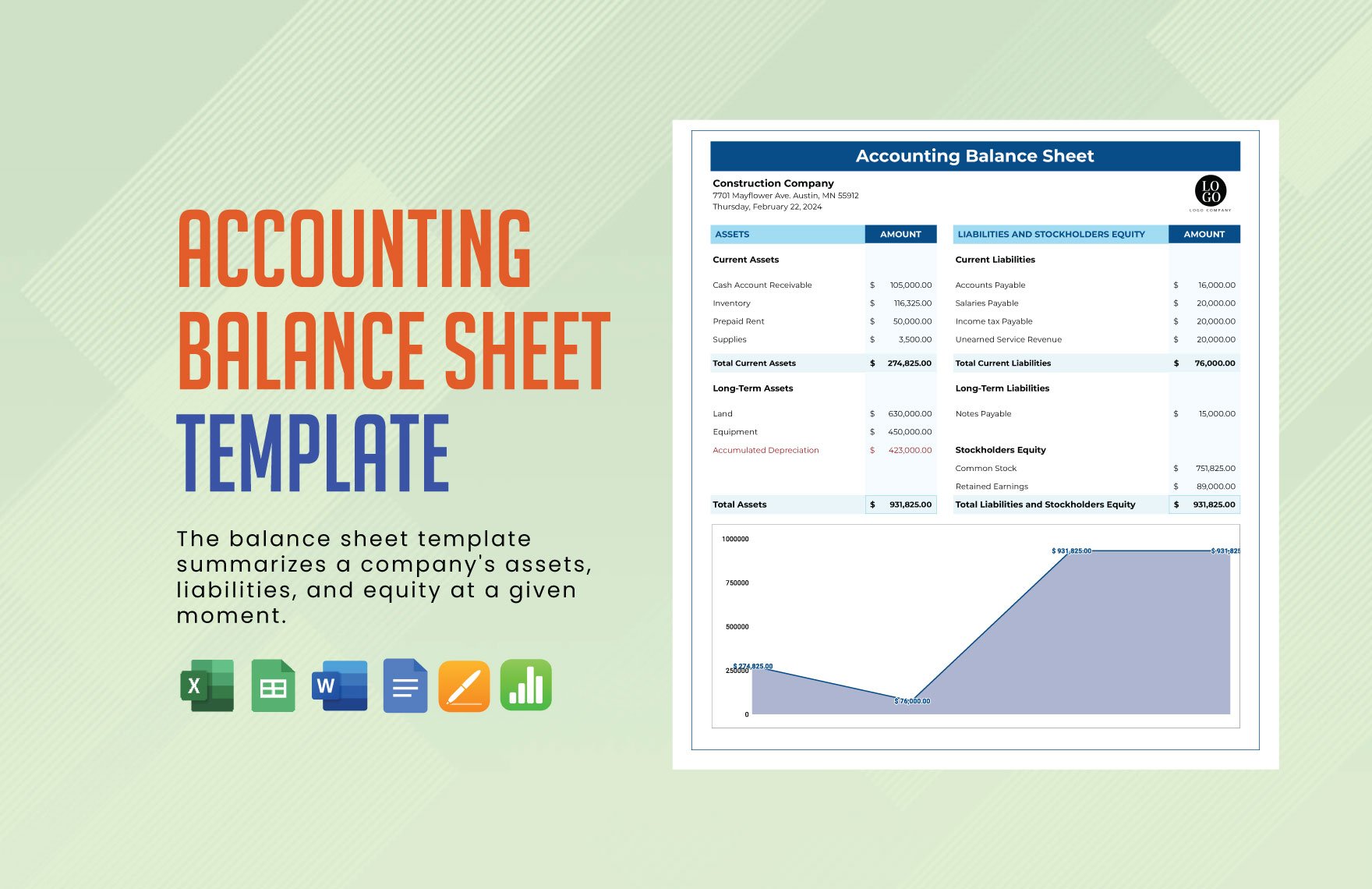

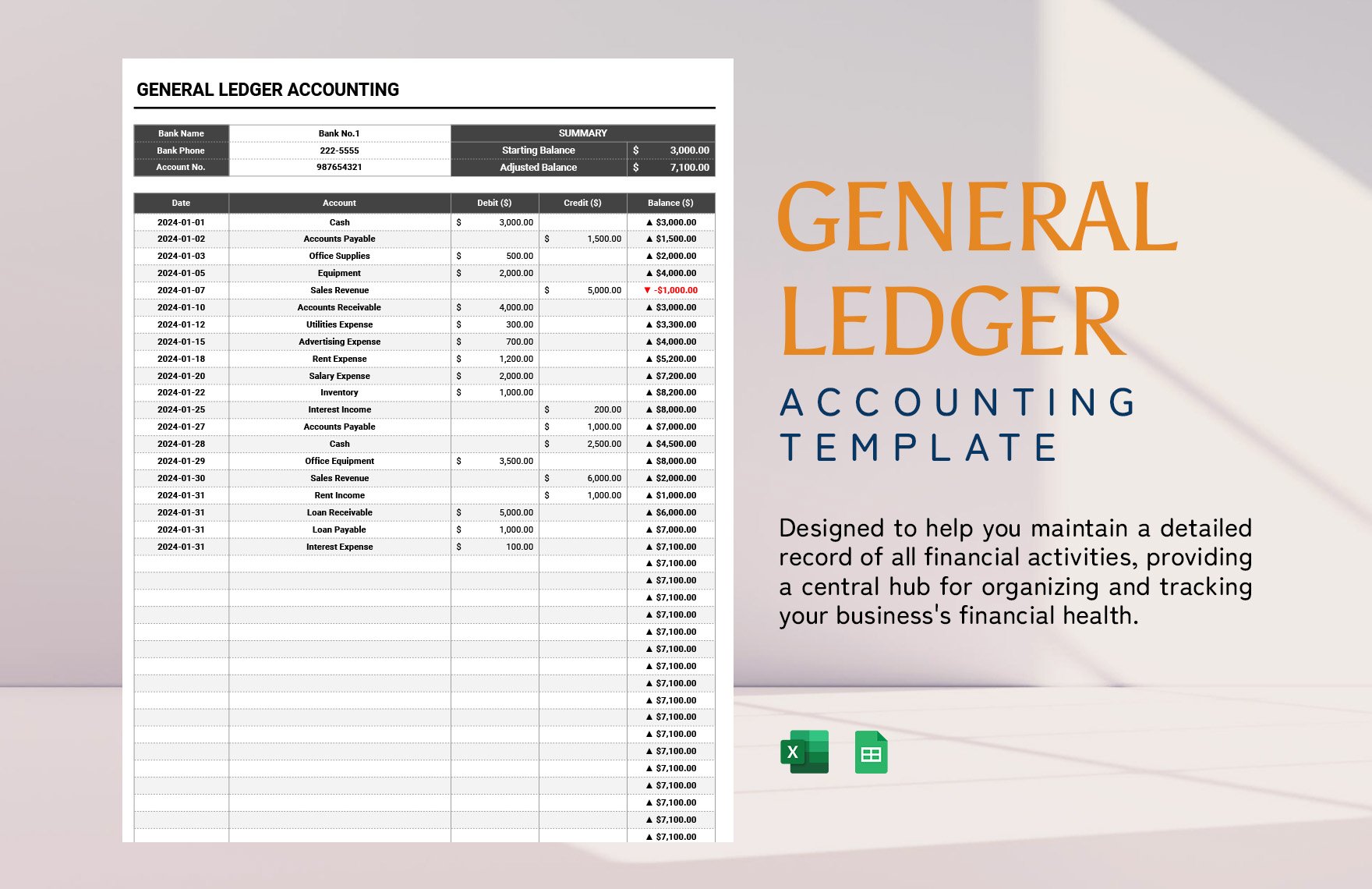

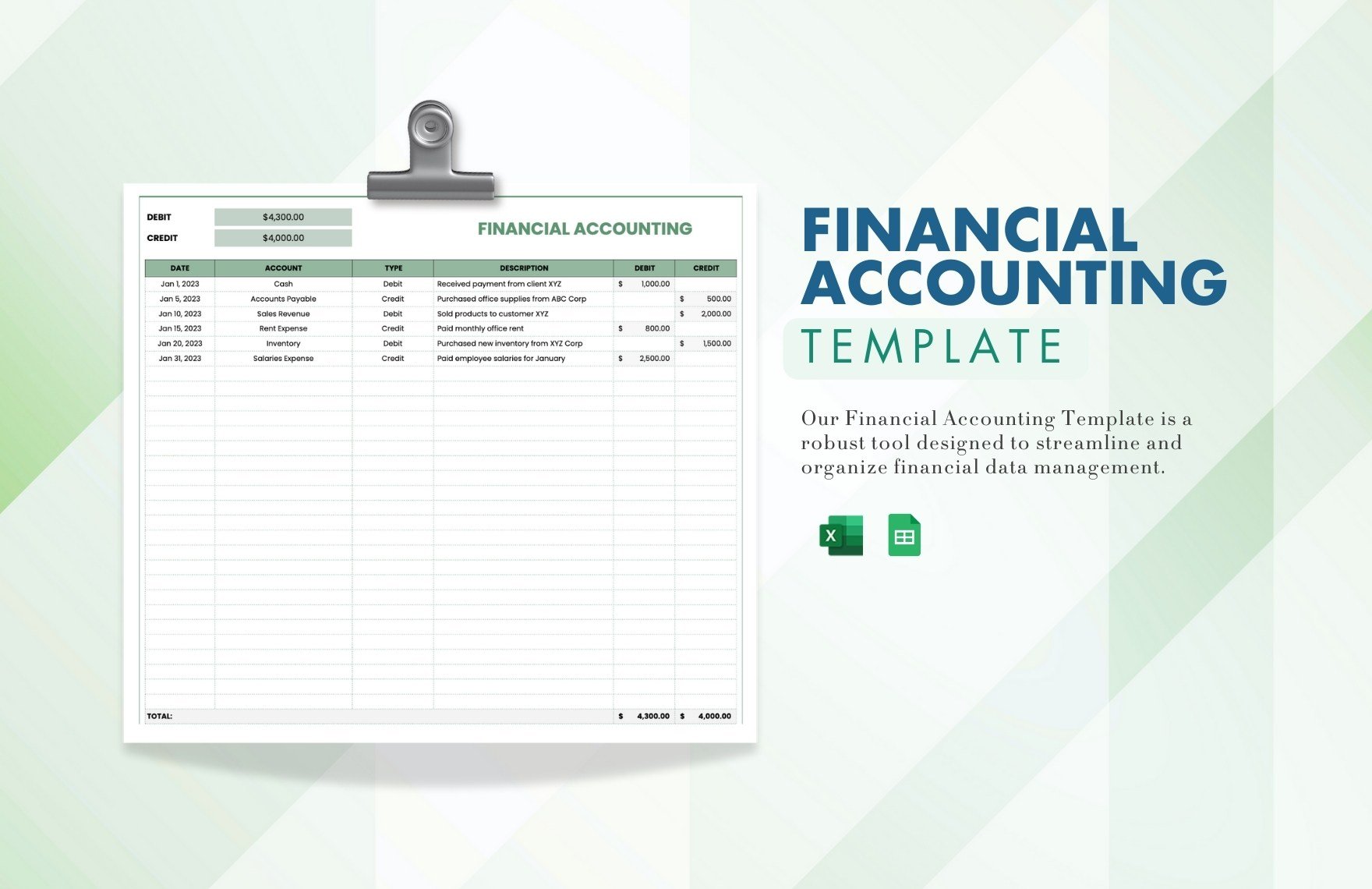

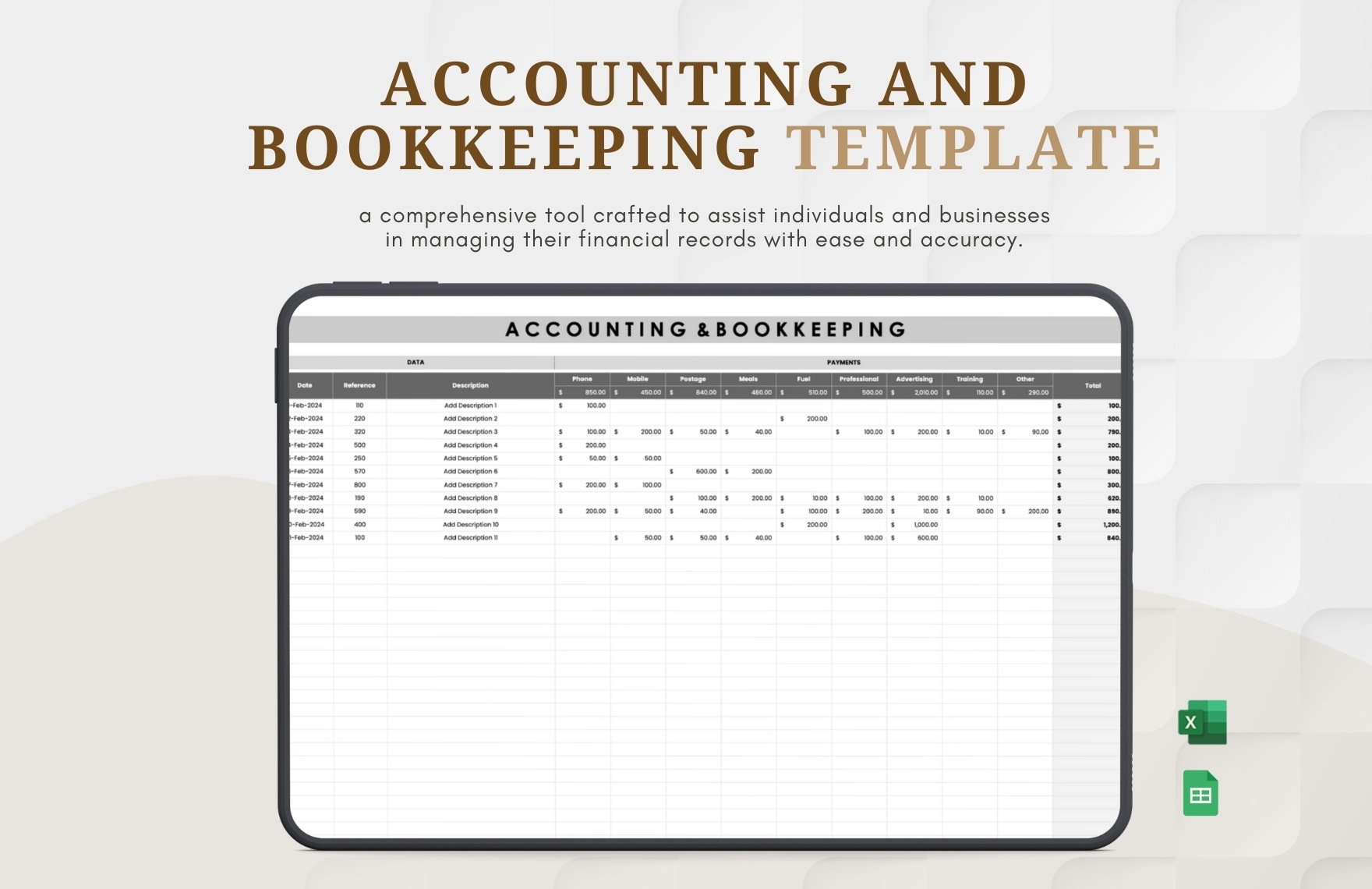

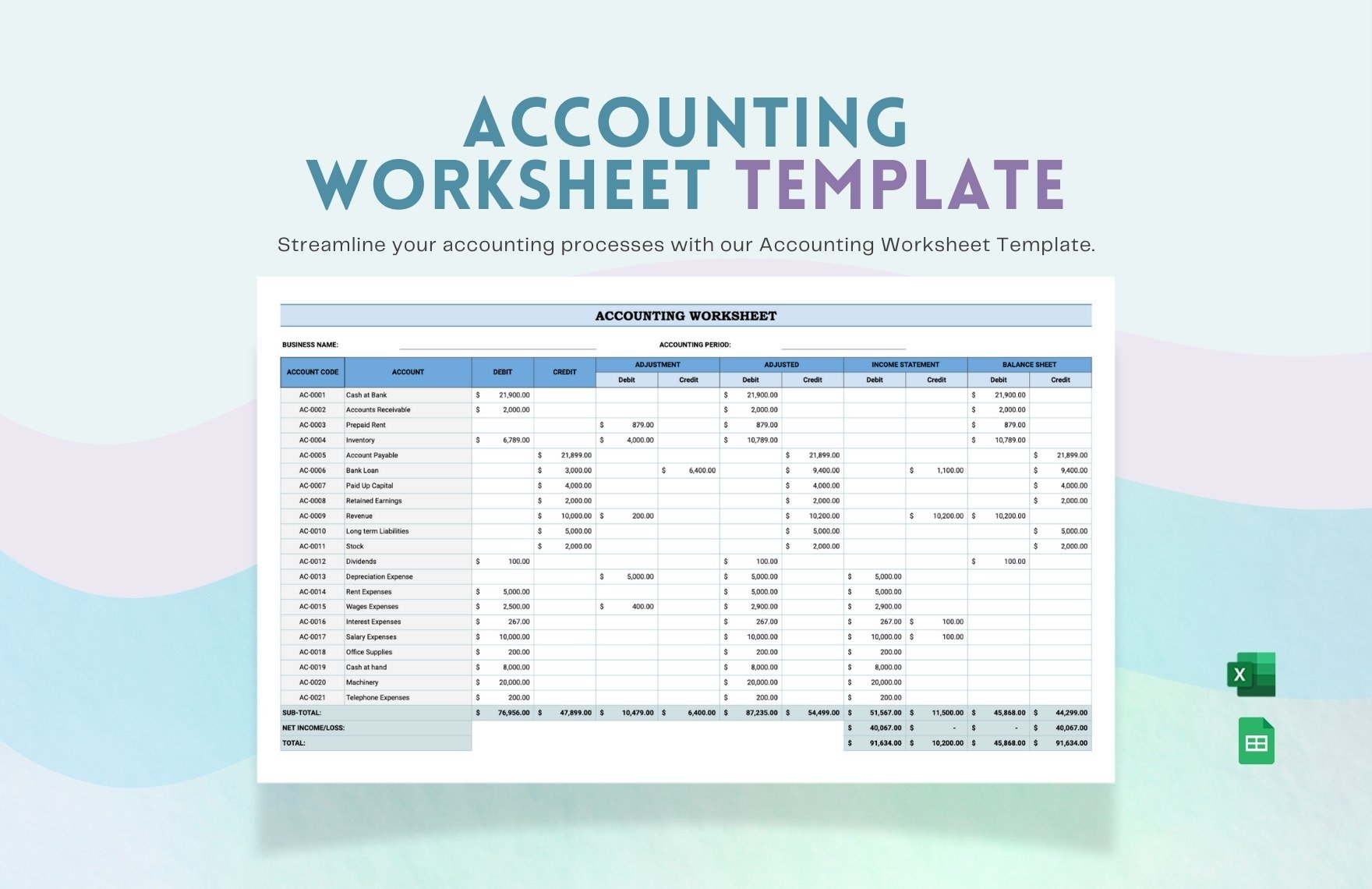

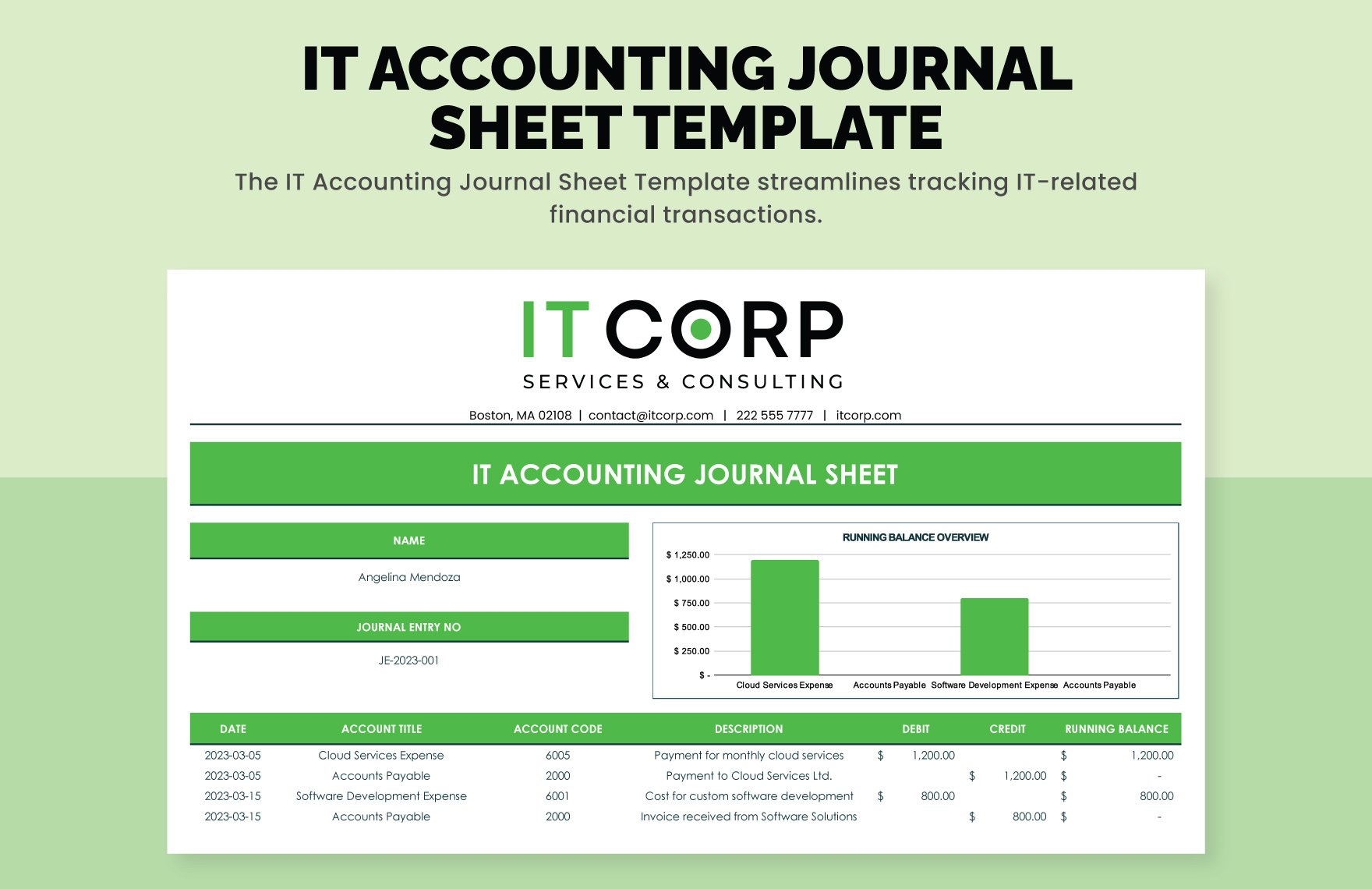

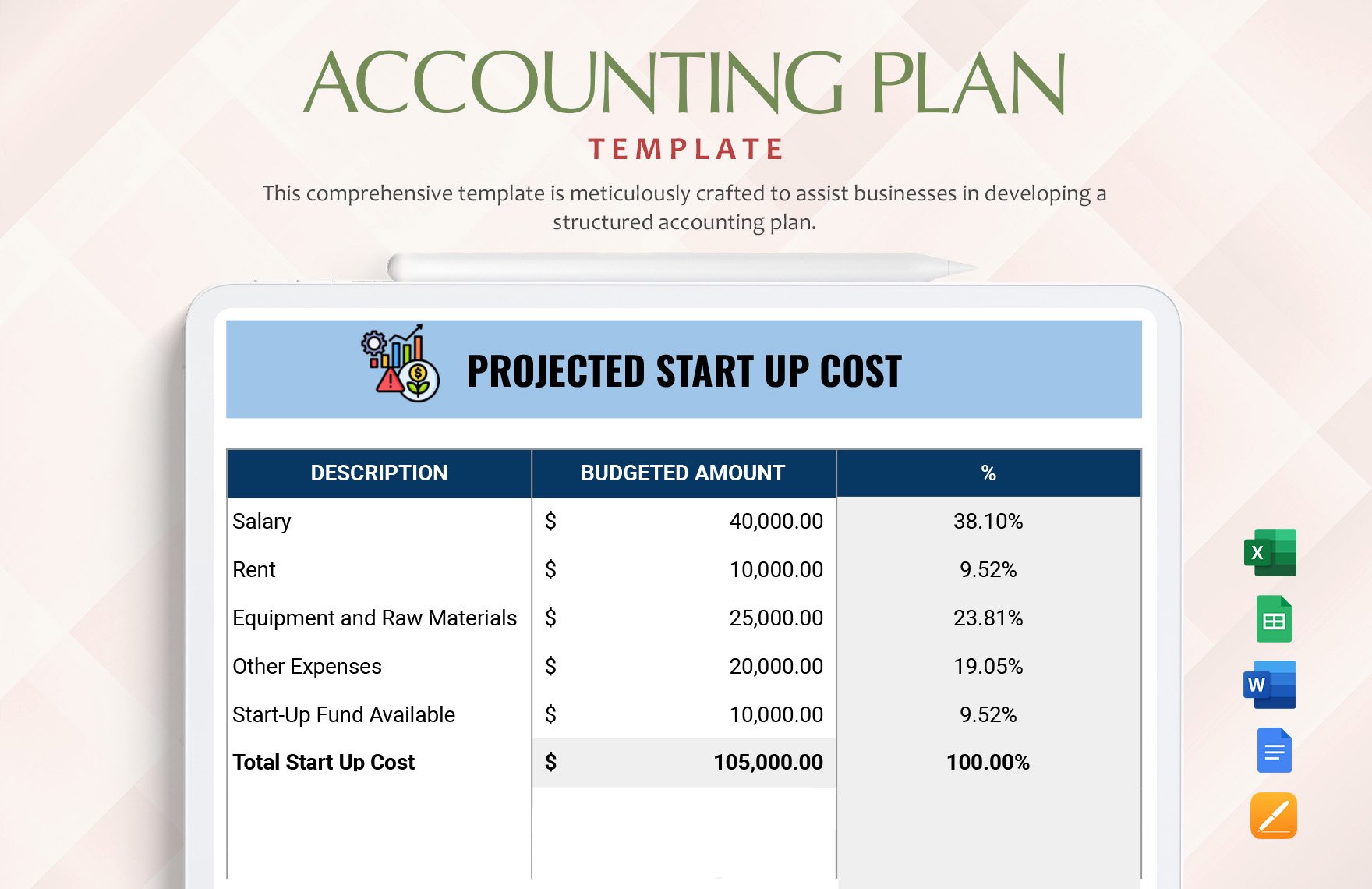

Managing the financial records of your company is quite challenging, especially if you don't have certain documents that will help you organize everything. We want to help you get started, so you can produce an effective and useful document that you can use in your business' accounting and bookkeeping. We offer 100% customizable and professionally made accounting templates that are fully compatible in Microsoft Excel. Template.net offers a variety of document types that are industry-compliant and well-researched such as balance sheets, income statements, expense reports, and more. Use our pro templates to create the perfect document for what your business needs and enjoy the convenience that comes with these editable and ready-made files. What are you waiting for? Download and subscribe now!

How to Make an Accounting Invoice in Microsoft Excel?

An invoice, also known as a bill, is a legally binding a formal document sent by a supplier to the buyer after the goods or services have been provided. It is an important document in the business' accounting and bookkeeping. The role of an invoice is to establish an obligation on the part of the purchaser to pay the purchased items or the rendered service. Like any other documents, invoice can either be printed or electronic. According to John Rampton in his State of Invoicing for 2017, e-invoicing are on the rise because of the cost, time savings and efficiency, however, printed invoices are still popular across the globe. It is undeniable that invoices would be a great help during transactions, therefore, everyone in the industry, especially accountants, should know how to make an invoice. Here are some guidelines that you can use in creating an invoice.

1. Use Microsoft Excel

There are various software programs that you can used in making an accounting invoice. You can either use Google Docs, Google Sheets, Microsoft Word, Numbers, or Apple Pages, but I suggest that you use Microsoft Excel. The advantage of using MS Excel is that it is easy to navigate and it has powerful tools that can analyze large amounts of data which will enable you to accomplish all your needs.

2. Include Invoice Number, Invoice Date, and Due Date

The invoice date and invoice number will help you track all the invoices that you sent to the buyer. Invoice numbering system is up to you, however, refrain from repeating the number in your invoice because it might confuse you. Beneath the invoice number and date should be the agreed due date. Indicating the due date will make the the buyer aware of the deadline of the payment. Always remember that the aforementioned details should always be present in an invoice.

3. Provide your Business Information and the Client's Information

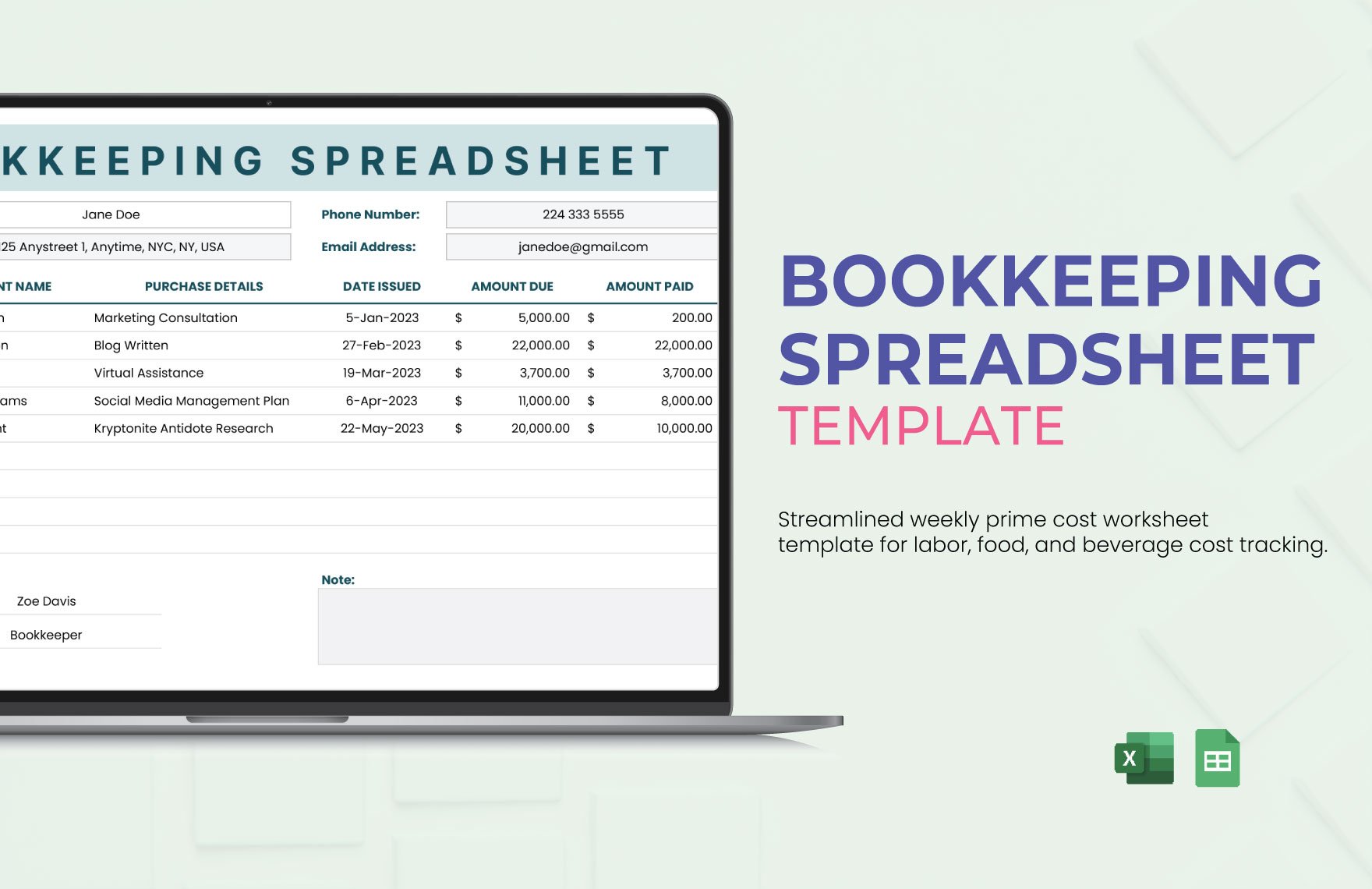

The details of the supplier and the purchaser should always be present in any accounting or bookkeeping documents. These details includes the company name, phone number, business address, and the email address of the seller and the purchaser. However, if the transaction does not include big companies, you have to specify the names of both parties. Indicating the purchaser's contact information allows the seller to track their company payments and whereabouts, especially if their bill has long been due.

4. Put a Description About the Purchased Item

Providing the details about the purchased item or the rendered service in an invoice is necessary. As much as possible, be specific and detailed in creating an invoice. You are being transparent to your client if you provide a detailed description about the product or the service. If the purchased item is an automobile, you may specify the model, engine type and size, color, odometer, quantity, unit price, total purchase, and the tax.

5. Terms of Payment

During the transaction, be sure to ask your client how they are supposed to pay you and the process that they want to. At the bottom part of your sample invoice, indicate the date of sale, price of sale, and the method of payment. If your client opt to pay you through PayPal, then you have to provide your PayPal email. Meanwhile, if they choose to pay through checks, please specify in the invoice your account number and the bank details.