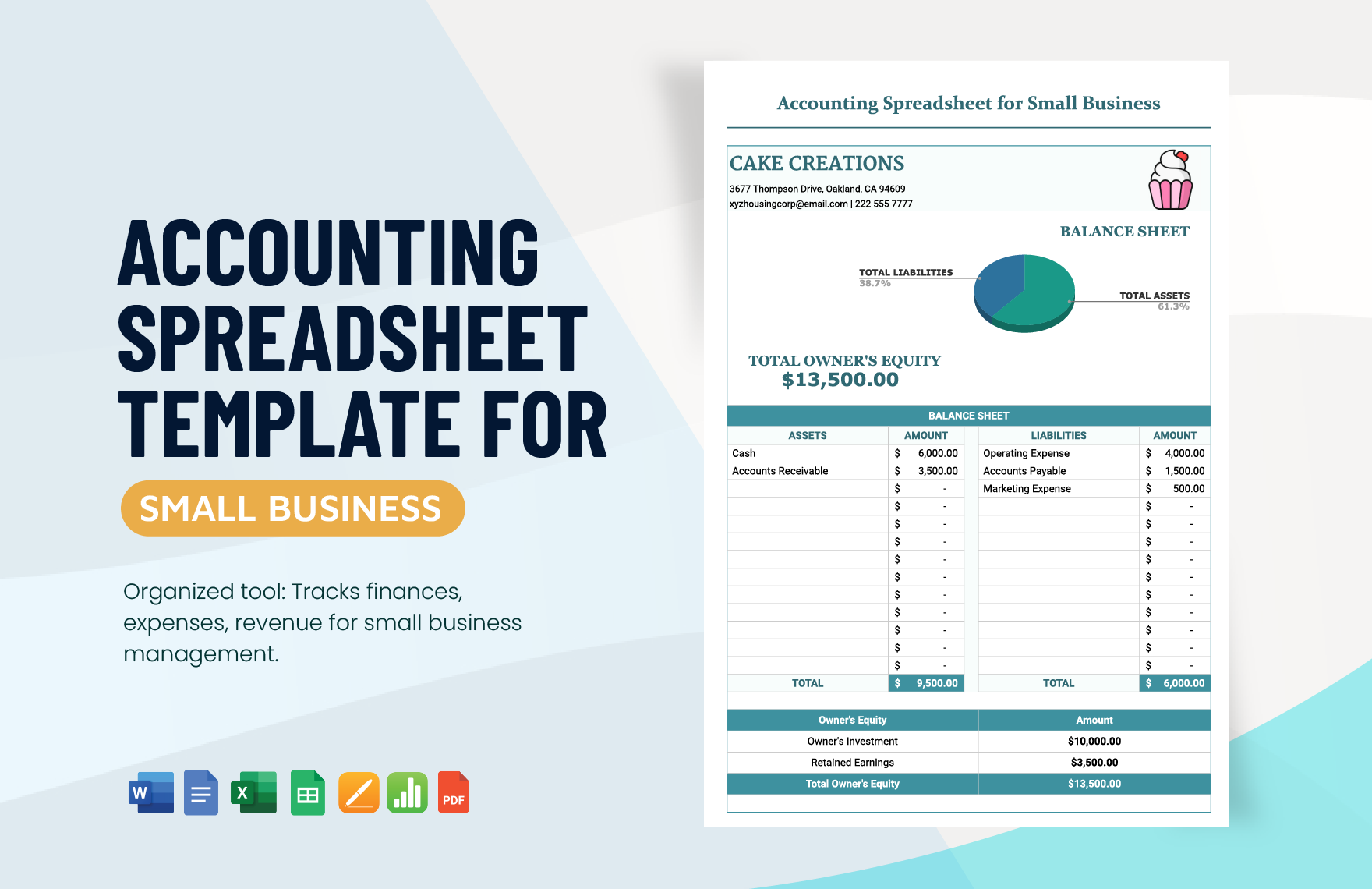

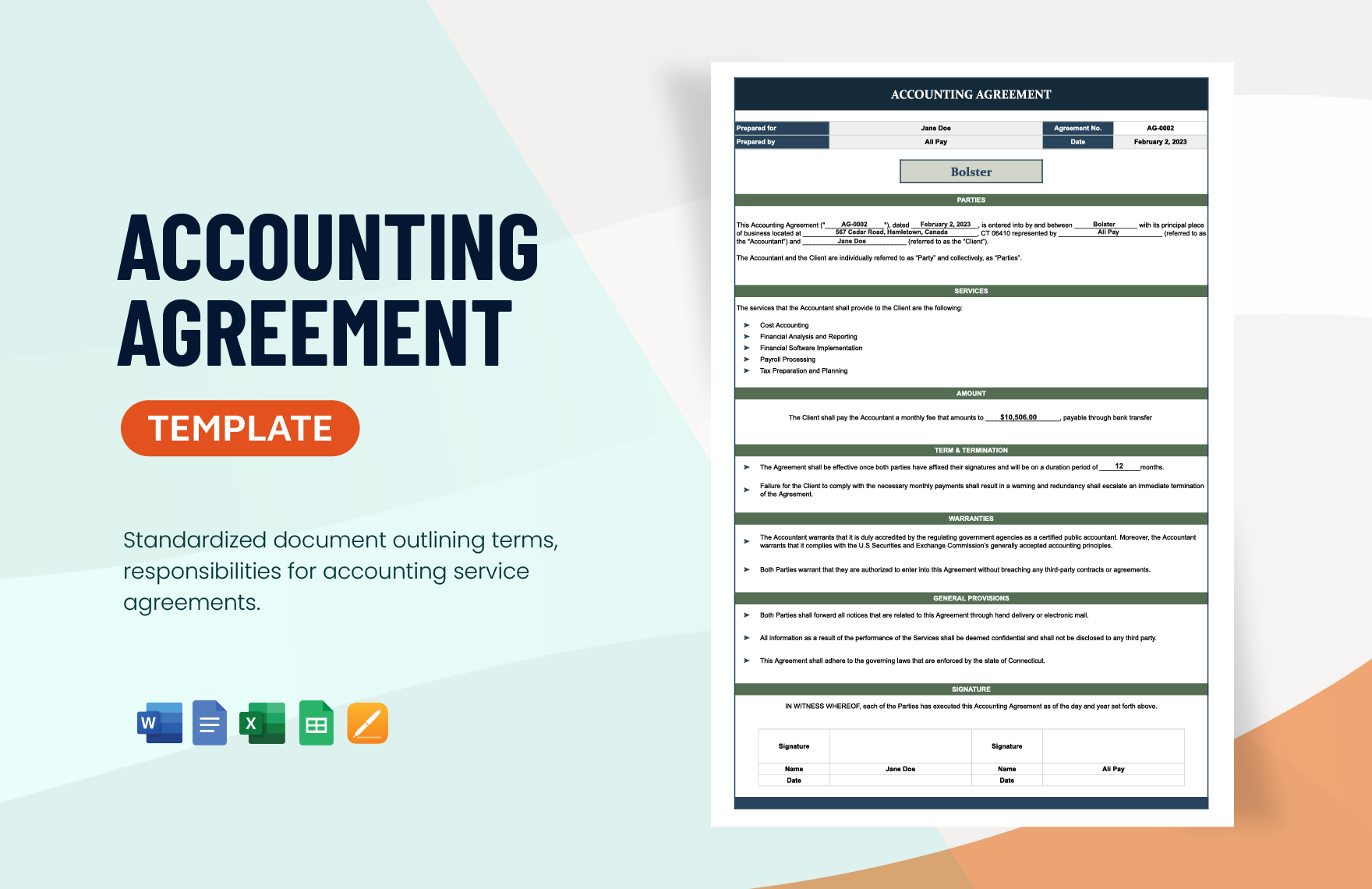

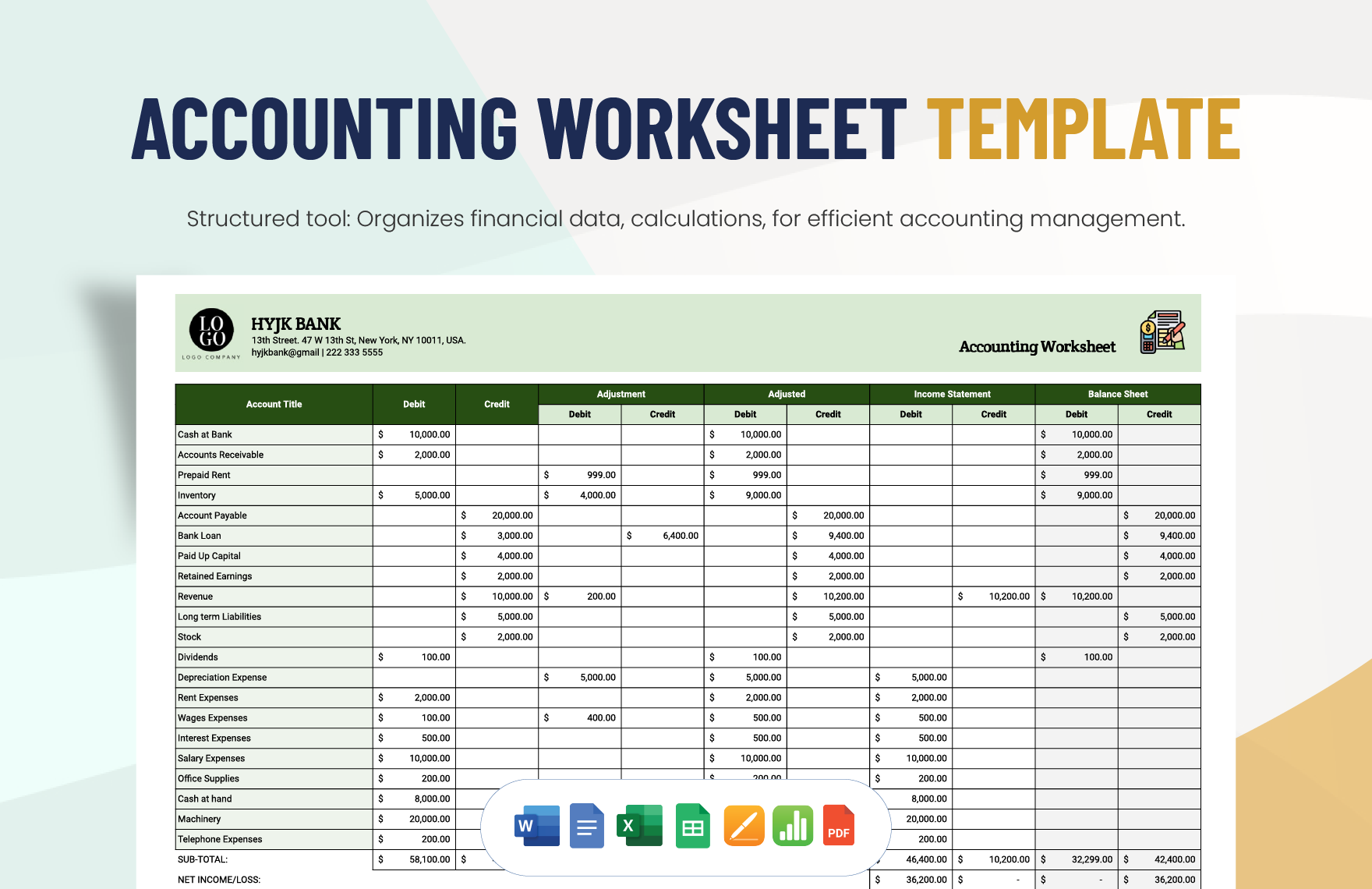

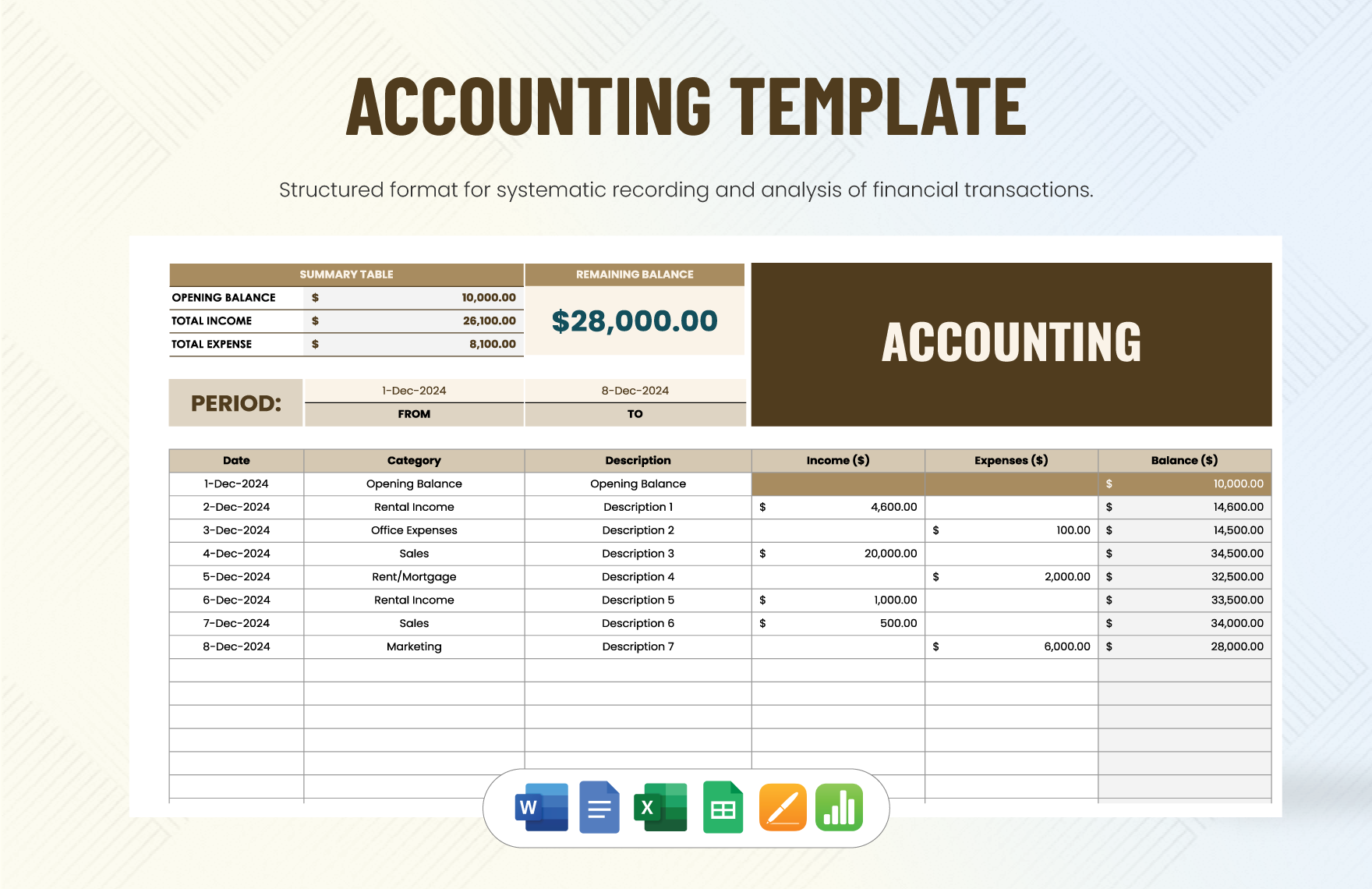

Record your financial transactions and get the job done in Google Docs with these ready-made Accounting Templates. Store, sort, retrieve, summarize, and present your results in various reports and analyses with the use of our premium templates to help you draft high-quality accounting documents for your business. Downloadable anytime, and anywhere at any device, these files are compatible in web-based applications, especially in Google Docs. 100% customizable, printable, and editable for you to manage your financial records and ensure accurate accounting. Don't waste any time and download our Accounting Templates today!

How to Create an Accounting Statement in Google Docs?

Accounting statements are made to provide clear and accurate information on the results of your company's operation, financial position, and cash flows. This allows your company to evaluate your financial performance and create better decision making, planning, and forecasting.

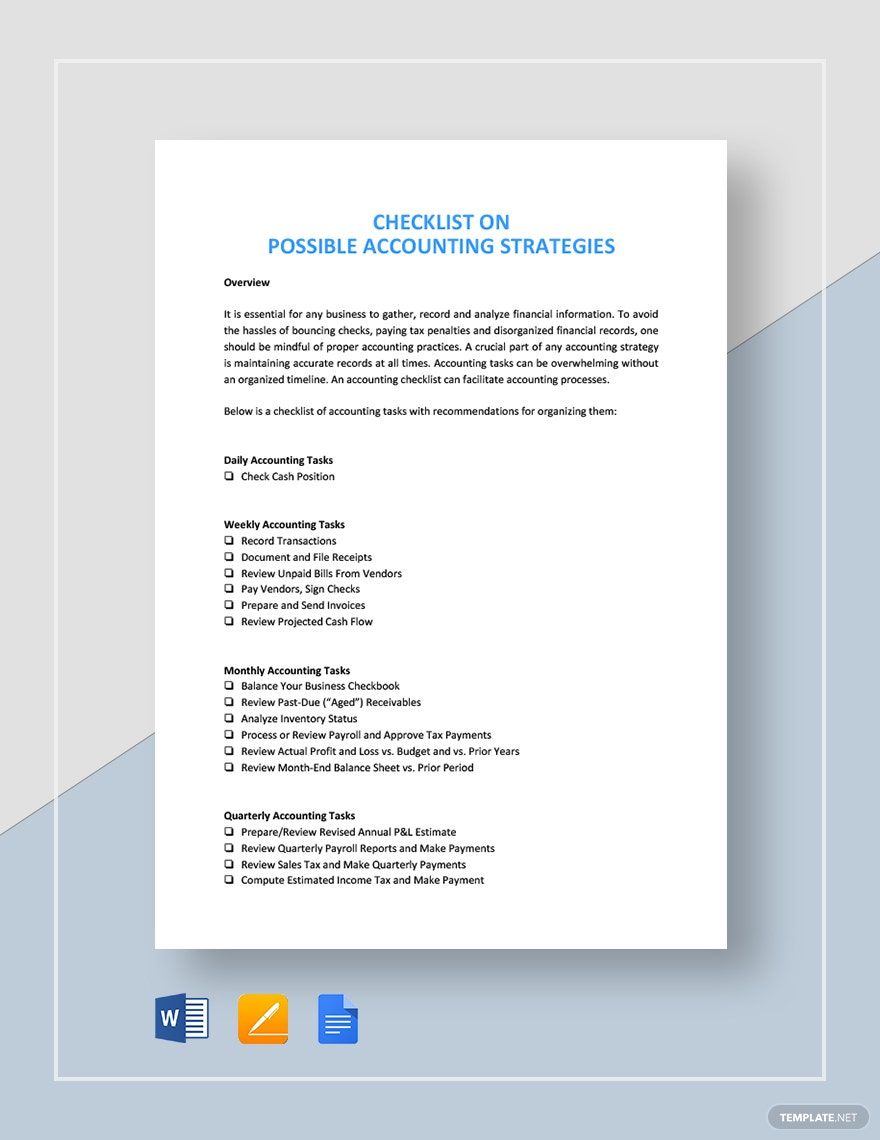

Preparing accounting statements are one of the most tedious and intimidating tasks to be made by an accountant. But, accounting statements are critical to your business. Without them, your company won't be able to continue its operations. To lighten up your work, here are a few tips on creating accounting statements in Google Docs.

1. Analyze and Record Your Financial Transactions

Your business holds a lot of transactions every day. To formulate your accounting statement, you need to gather all business records that connect with any financial transactions such as your receipts, invoices, and bank statements. Make sure that you have a complete copy and record of these documents and check for any discrepancies.

2. Post Transactions to Your Ledger

Your ledger is mostly made up of journal entries of your complete business transactions, listed in chronological order. Every time you enter a transaction, it has to show two accounts which is your debit and credit. Yor debit equals to the money that goes out from your company's account, while your credit equals to the money that goes inside your company's account.

3. Prepare Your Unadjusted Trial Balance

At the end of the accounting period, your unadjusted trial balance is prepared. This is done by totaling all your company's debit and credit accounts, and by calculating your total balance. Make sure that your company debits balance with your company credits to justify your financial report.

4. Create Your Adjusting entries

After you input your entries, it is time you adjust your entries. Make sure that your only statement contain relevant information to a particular period. This includes your deferrals, accruals, missing transaction adjustments, and tax adjustments. Your deferrals consist of the money you spend before seeing any results from your revenue, while your accruals don't immediately record with your revenue. Next is your missing transaction adjustments that help you trace forgotten transaction in your bookkeeping and your tax adjustments that account your depreciation and tax deductions.

5. State Your Adjusted Trial Balance

Create another trial balance sheet and check all your adjusting entries you have made. The purpose of your adjusted trial balance is to prove that your ledger's debit and credit are still balances even after all the adjustments made. Make sure that everything is balanced or else you will have to review your entries at the very beginning of your document.

6. Provide Yor Financial Statements

Lastly, it is time for you to provide your financial statements. Start with your balance sheet and income statement. Your balance shall summarize your company's assets, liabilities, and owner's equity, while your income statement shall summarize expenses and revenues. Once you have settled both of them, you may proceed to review your cash flow and check your cash in and out for every company's activities and performances.