Enhance Your Business Contracts with Professionally Designed Guarantee Agreement Templates in Microsoft Word by Template.net

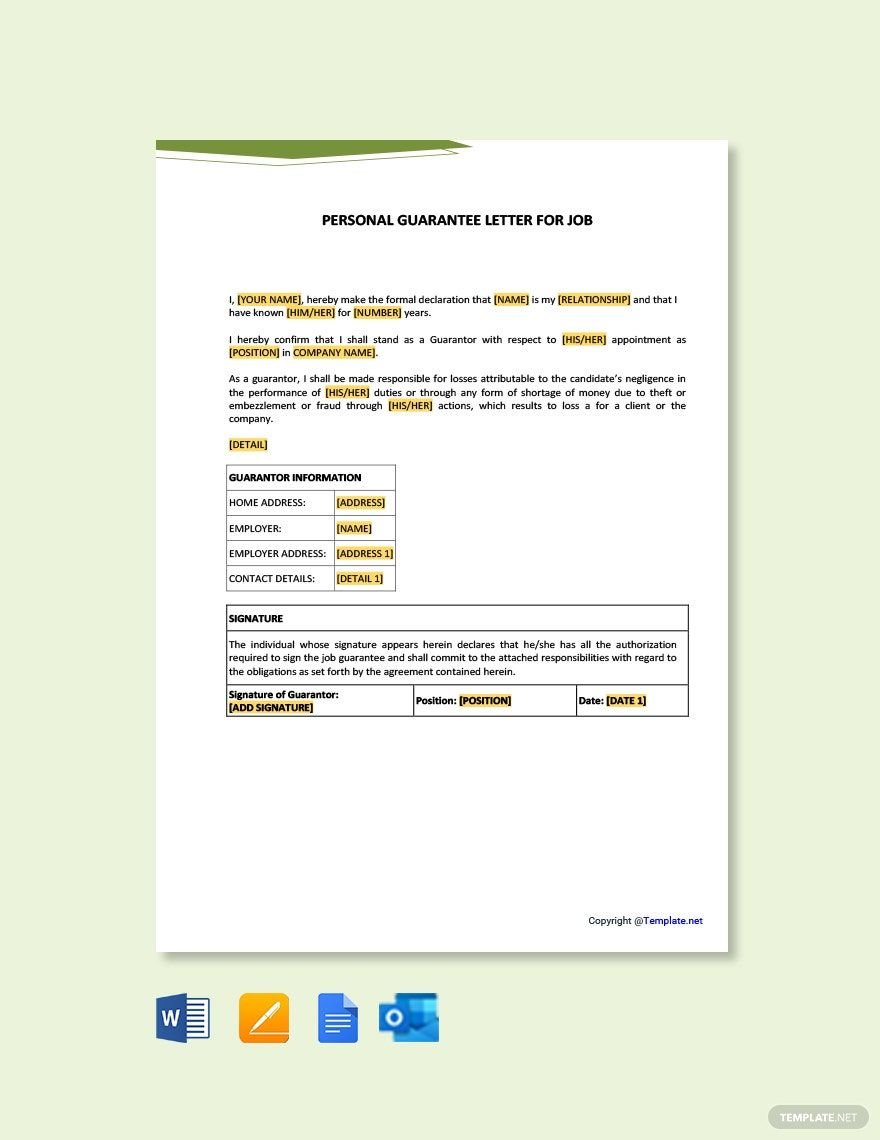

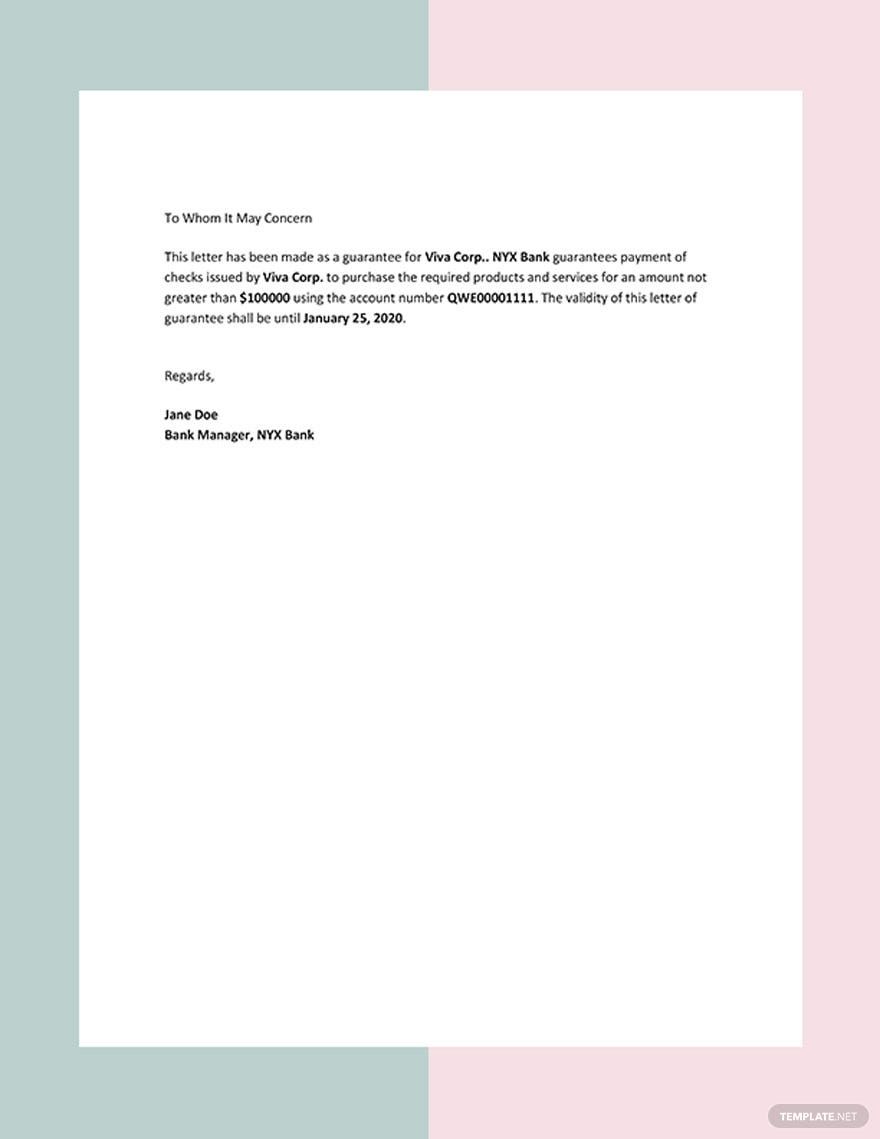

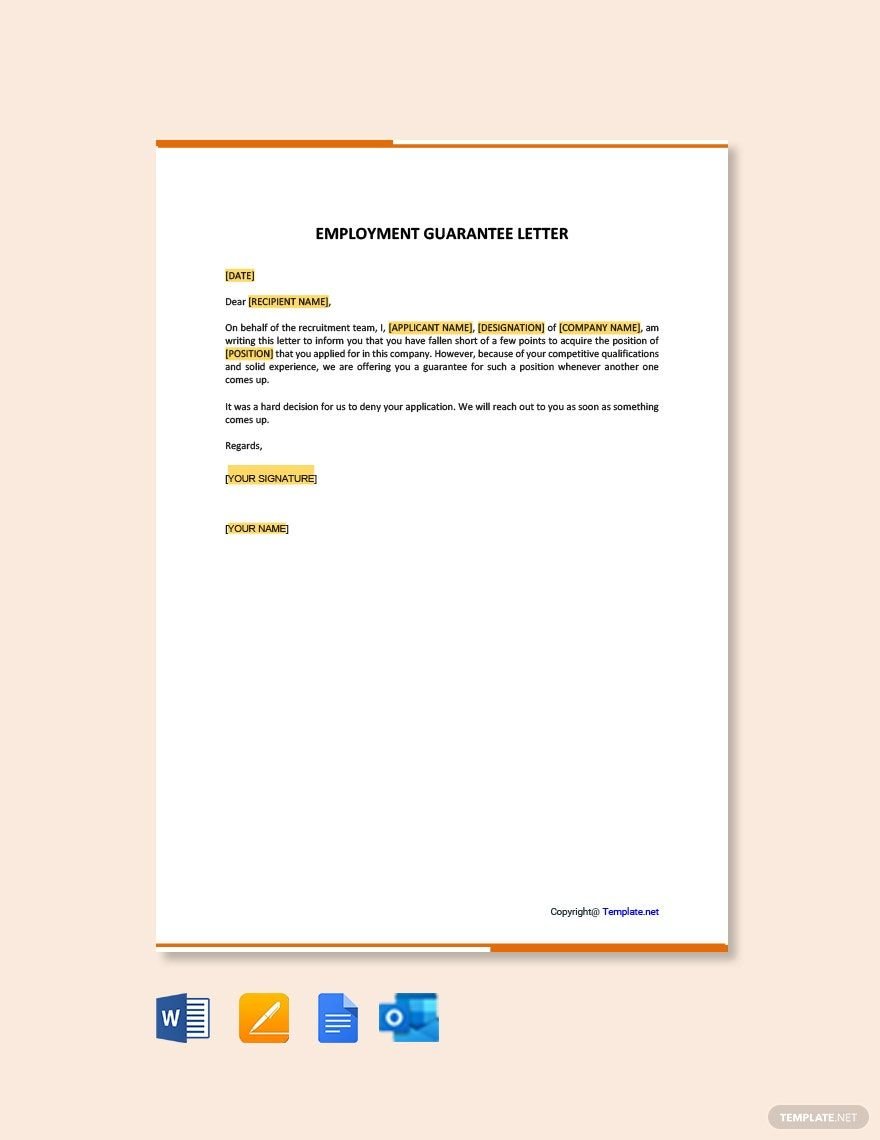

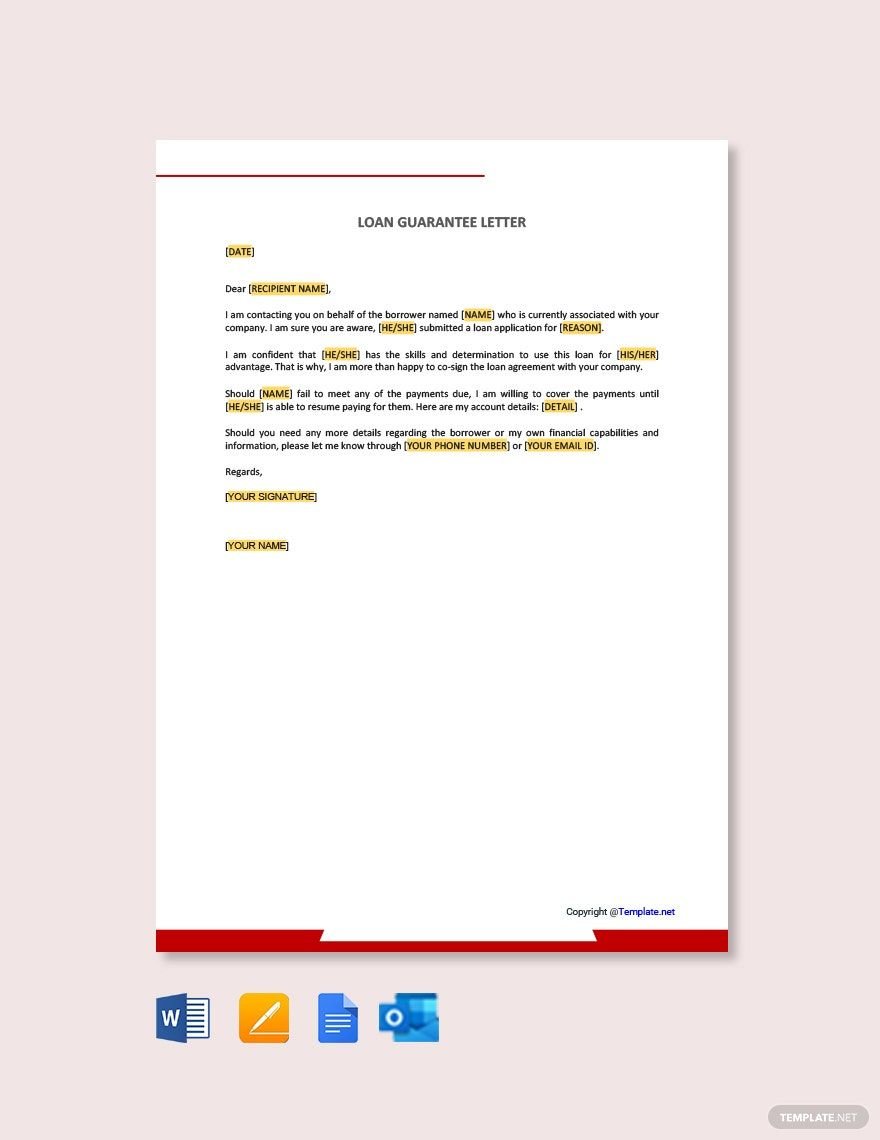

Transform your document creation process with our pre-designed Guarantee Agreement Templates in Microsoft Word by Template.net, designed to streamline your business operations. These templates are perfect for professionals and businesses seeking to craft legal documents without the hassle of starting from scratch. Experience the ease of creating professional-grade agreements quickly and efficiently, with no design experience required. Whether you're preparing to guarantee a loan or formalize a business partnership, our templates cover all your bases. With free pre-designed templates and readily downloadable and printable files in Microsoft Word, you can effortlessly customize your documents to fit specific needs. Save time and effort with beautiful pre-designed templates that simplify your workflow, designed for both print and digital distribution.

Discover a wealth of options with our vast selection of premium pre-designed templates in Microsoft Word, offering endless possibilities for meeting your business needs. Stay ahead with our library, which is regularly updated with new designs, ensuring you always have the latest tools at your disposal. Share your completed agreements seamlessly, with options to download or share via link, print, or email for increased reach. We encourage you to explore both free and premium templates for maximum flexibility, allowing you to tailor documents that perfectly align with your brand image and contractual obligations. By taking advantage of all Template.net's offerings, you can ensure that your guarantee agreements are not only comprehensive but also professionally presented.