Bring Your Legal Agreements to Life with Subordination Agreement Templates from Template.net

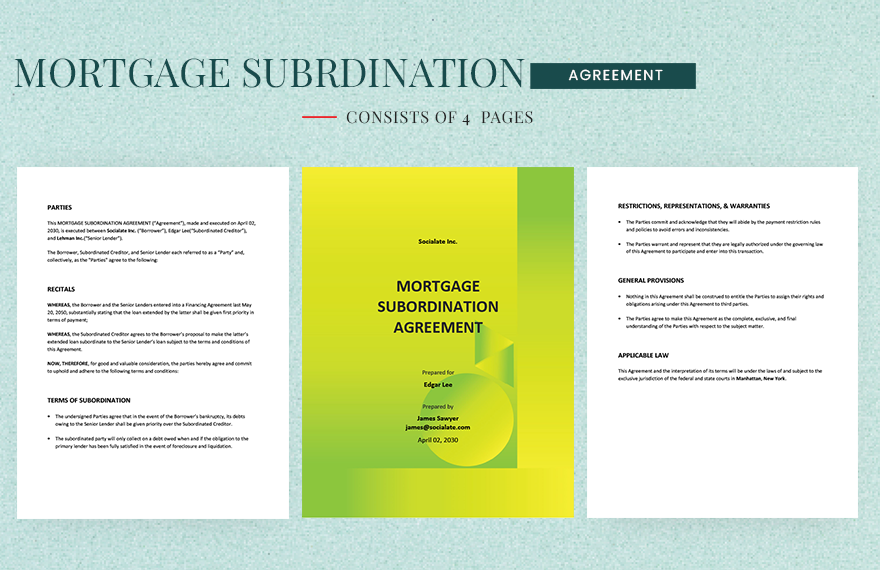

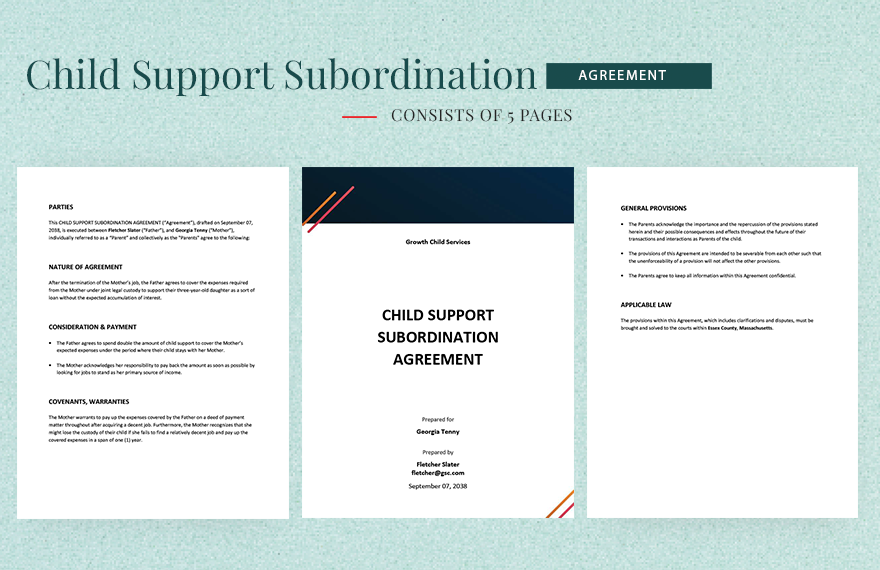

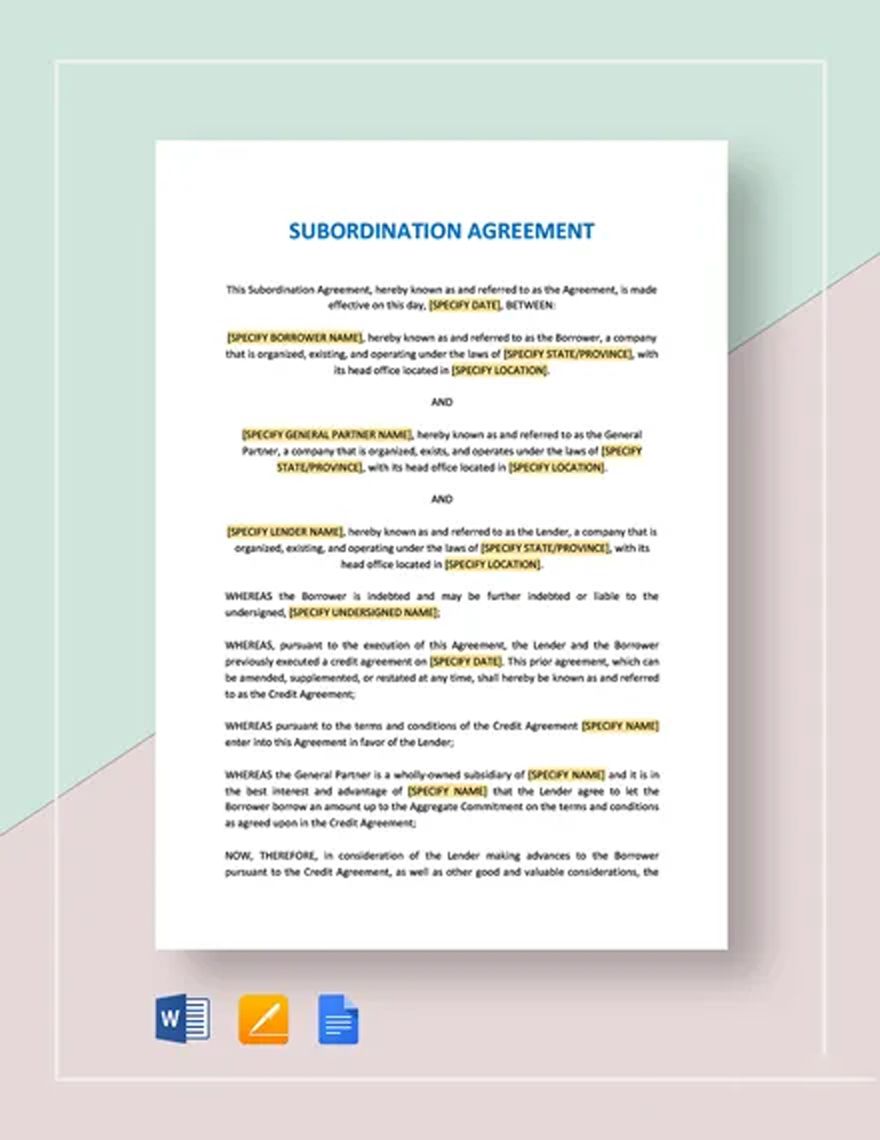

Keep your legal and real estate professionals engaged, streamline documentation processes, and ensure compliance with Subordination Agreement Templates from Template.net. Designed for real estate professionals and legal advisors, these templates empower you to draft precise and legally sound agreements effortlessly. Whether you're structuring a deal to promote asset sales or need to delineate lender priorities, our templates have you covered. Each template includes essential clauses, relevant terminology, and customization areas for lender and borrower details, making it an ideal choice for intricate transactions. No specialized legal skill is required to utilize these templates, saving you time and reducing the overhead costs of hiring a professional. Customize layouts for digital use or print distribution to fit your clients' needs seamlessly.

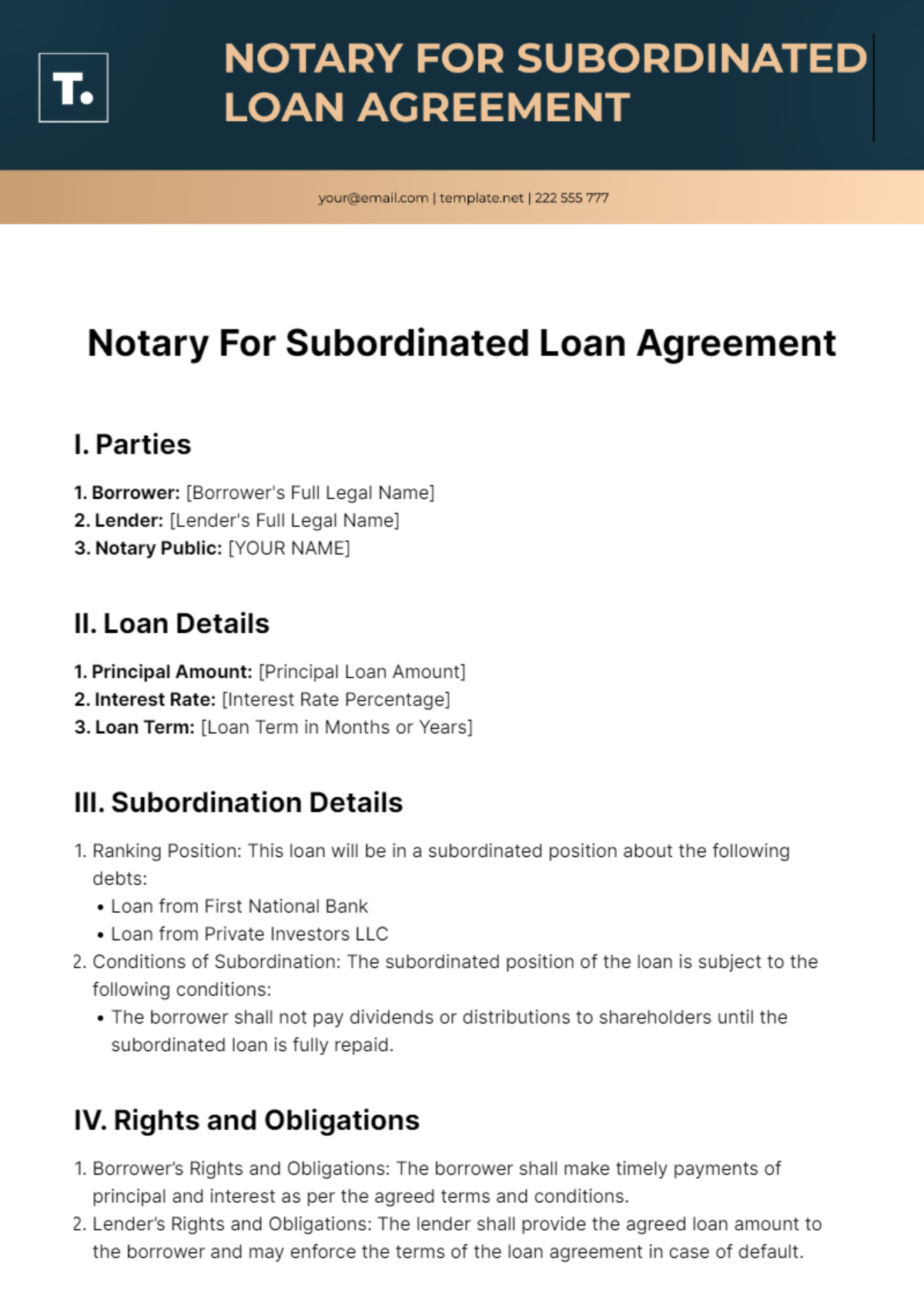

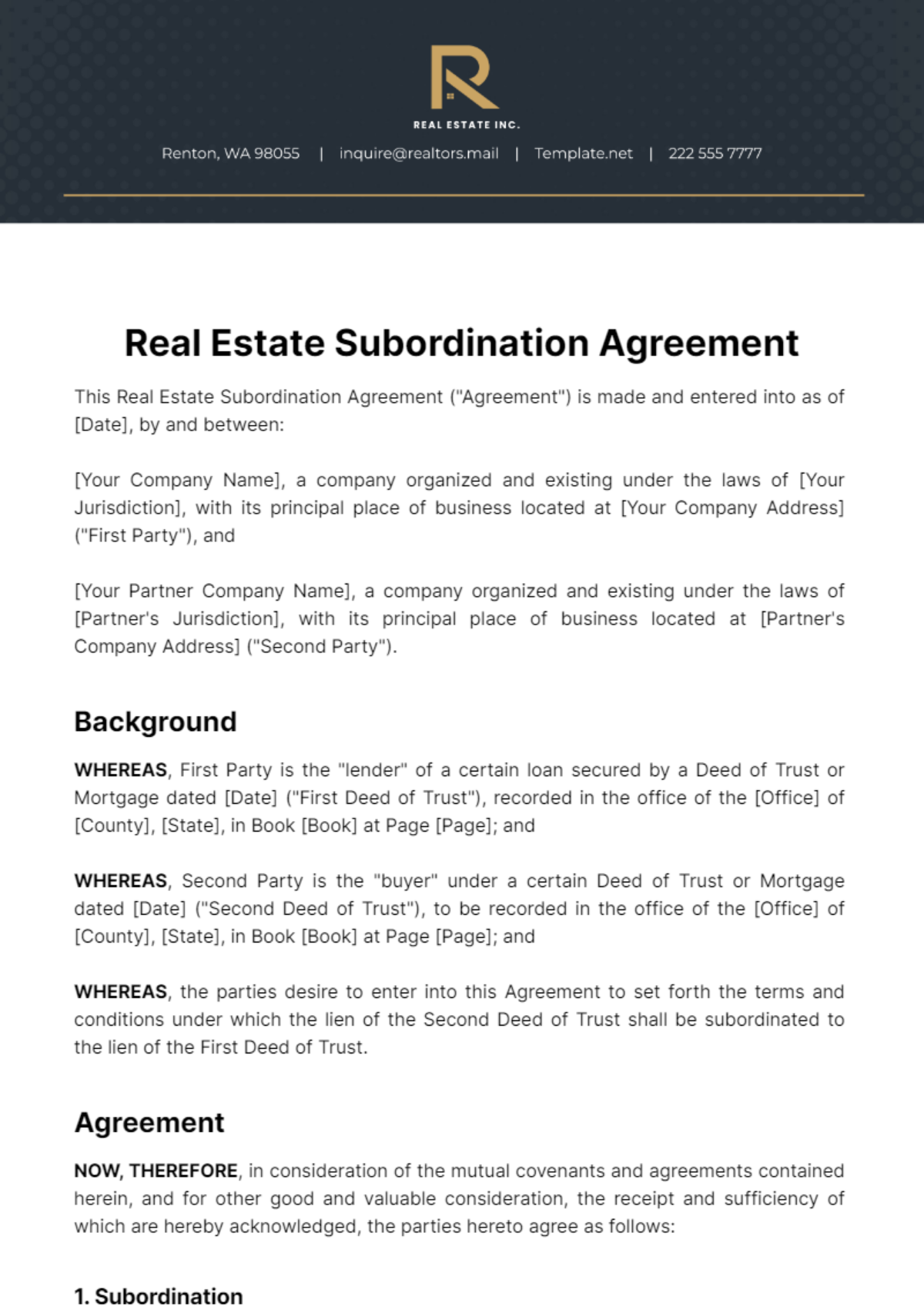

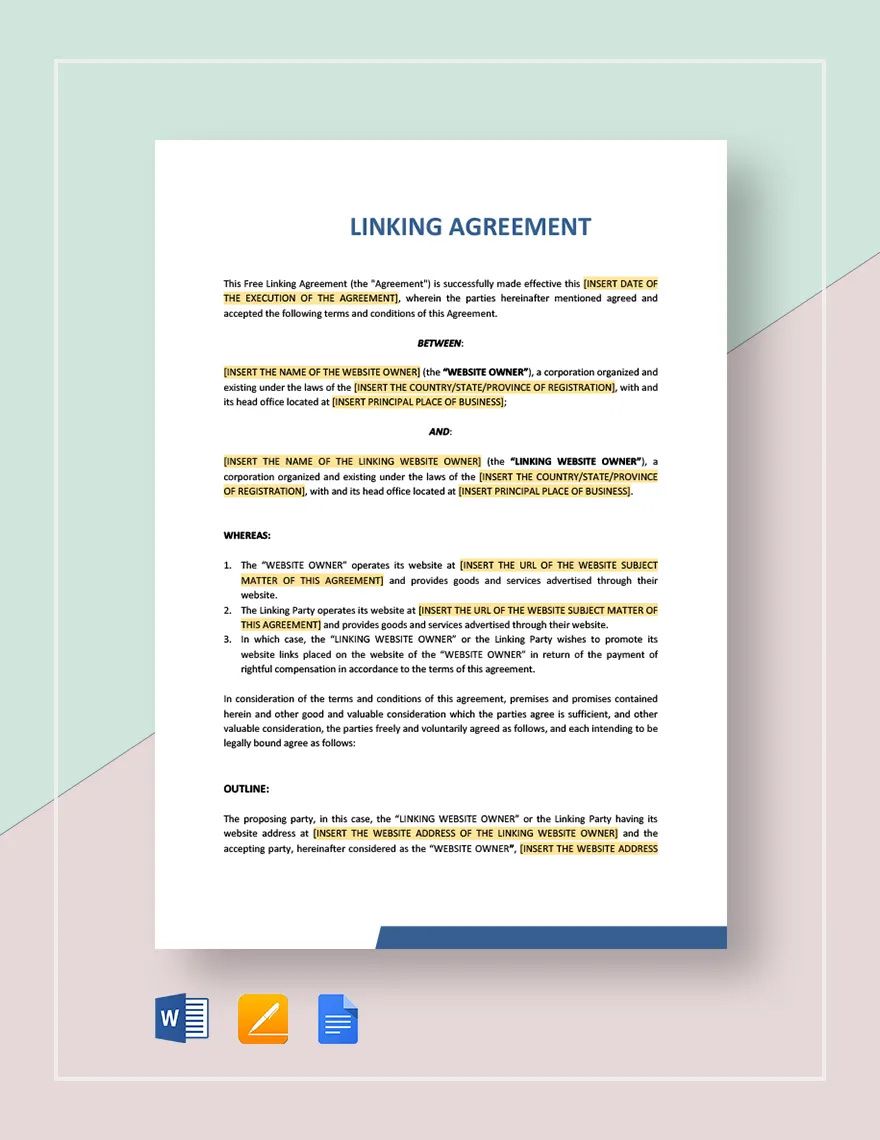

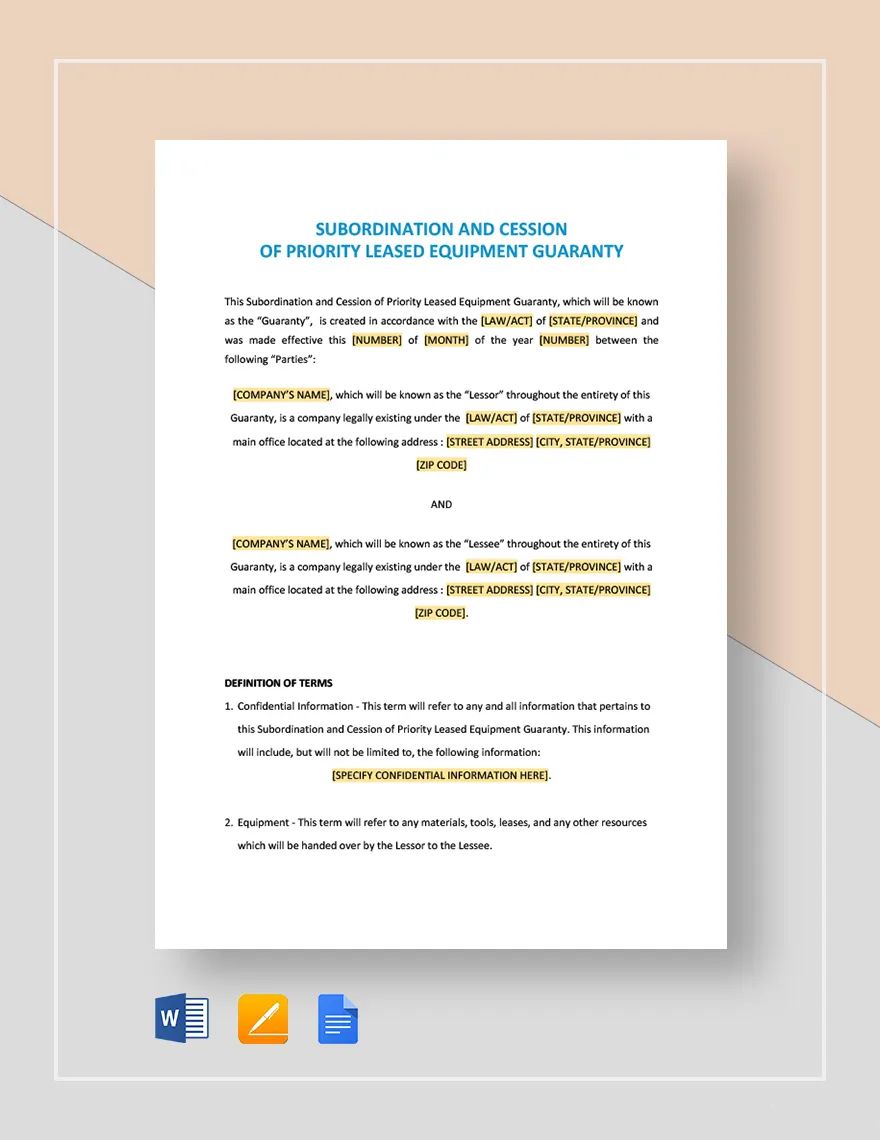

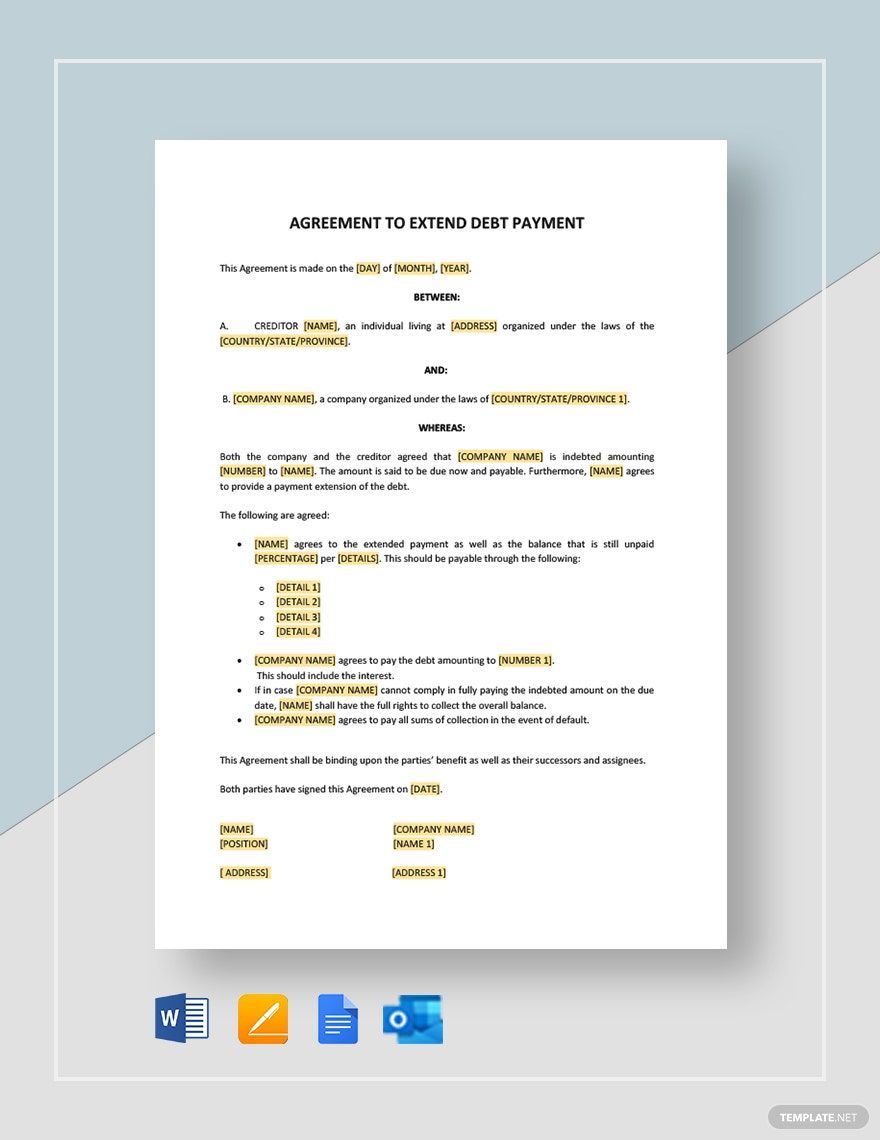

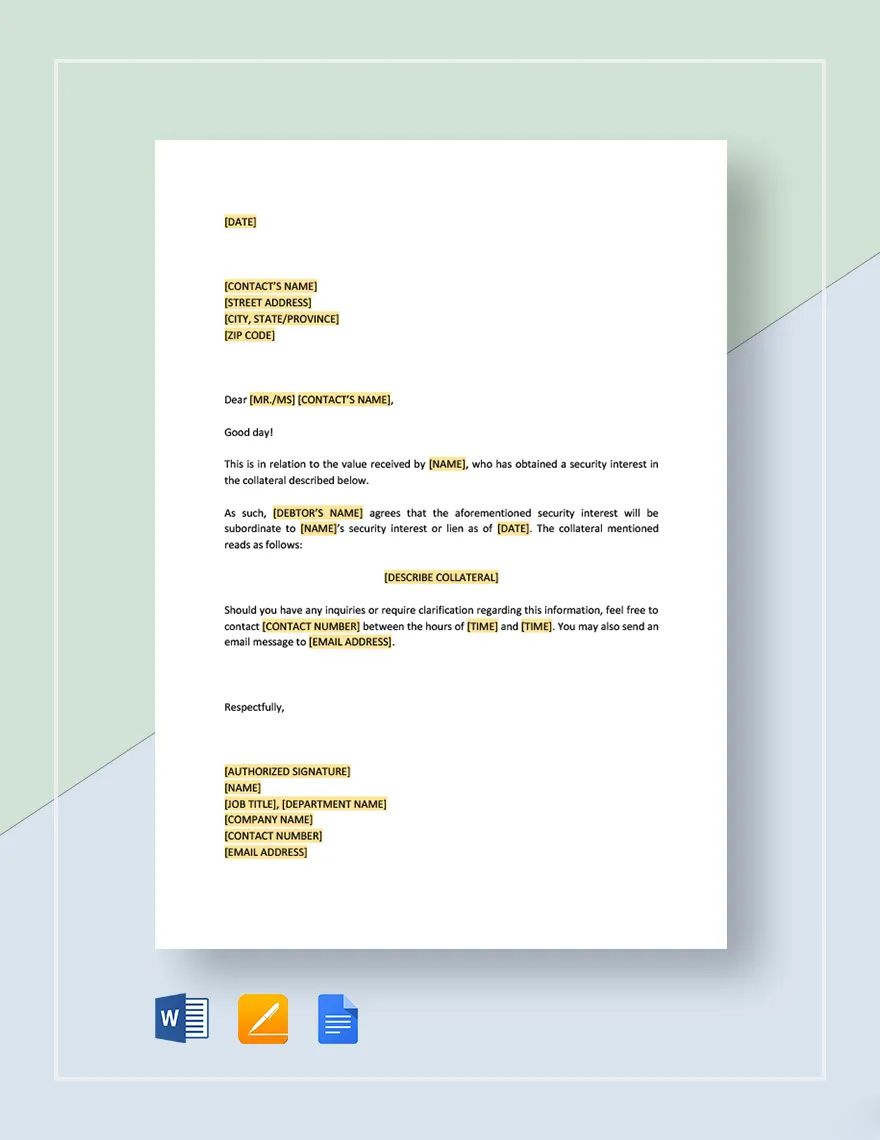

Discover the many Subordination Agreement Templates we have on hand to simplify your legal documentation process. Start by selecting a template that matches your specific transaction requirements, then easily swap in your own assets or tweak the colors and fonts to align with your branding needs. For a more refined touch, drag and drop additional icons or graphics, and consider adding animated effects to your digital agreements for an engaging presentation. With our templates, the possibilities are endless and completely skill-free, ensuring that you can produce professional-quality documents without legal expertise. Our library is regularly updated with the latest designs and templates to keep you ahead in the legal documentation game. When you’re finished, effortlessly download or share via email, export as a PDF for print, or even integrate it into your digital repositories.