Make Your Legal Preparations Seamless with Trust Agreement Templates from Template.net

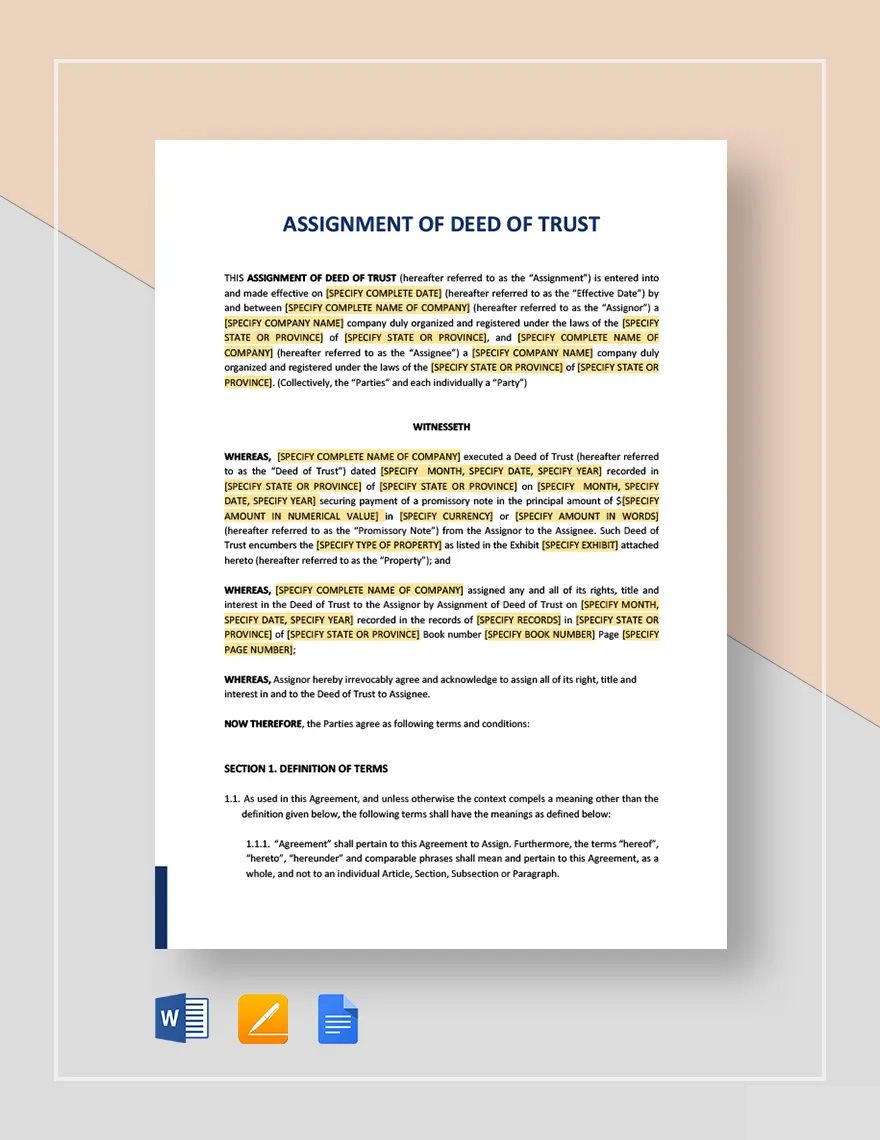

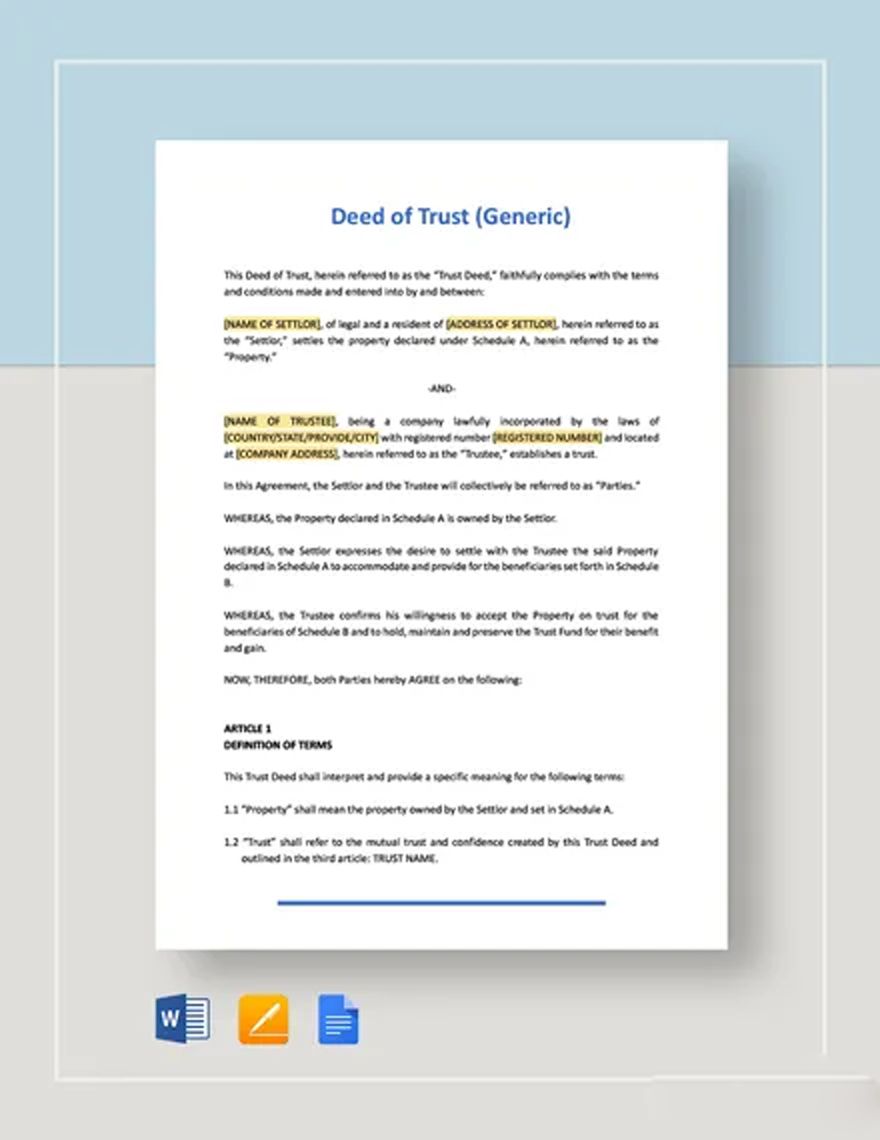

Keep your legal team engaged, streamline your document creation, and ensure accuracy with Trust Agreement Templates from Template.net. Perfect for legal professionals, estate planners, and individuals looking to establish trust agreements, these templates make the complex world of legal paperwork more accessible and manageable. Whether you're formalizing a family trust or creating a revocable trust, this collection provides the structure you need. Each template includes essential components like time frames, responsibilities, and pertinent contact information, ensuring all necessary details are covered. No legal drafting experience is required; enjoy professional-grade design and formatting for free, with options for digital or print distribution that will save you both time and resources.

Discover the many trust agreement templates we have on hand, designed to streamline your workflow and elevate your document quality. Choose a template that suits your needs, easily swap in your assets, and tweak colors or fonts to align with your branding or preferences. Add advanced touches by dragging and dropping icons or graphics, and consider adding animated effects for digital documents. The possibilities are endless and skill-free, making the process more enjoyable even for those without legal expertise. With regularly updated templates and new designs added weekly, there's always something fresh to explore. When you're finished, download or share your document via email or export it for print, ensuring it's ready for any channel or client collaboration.