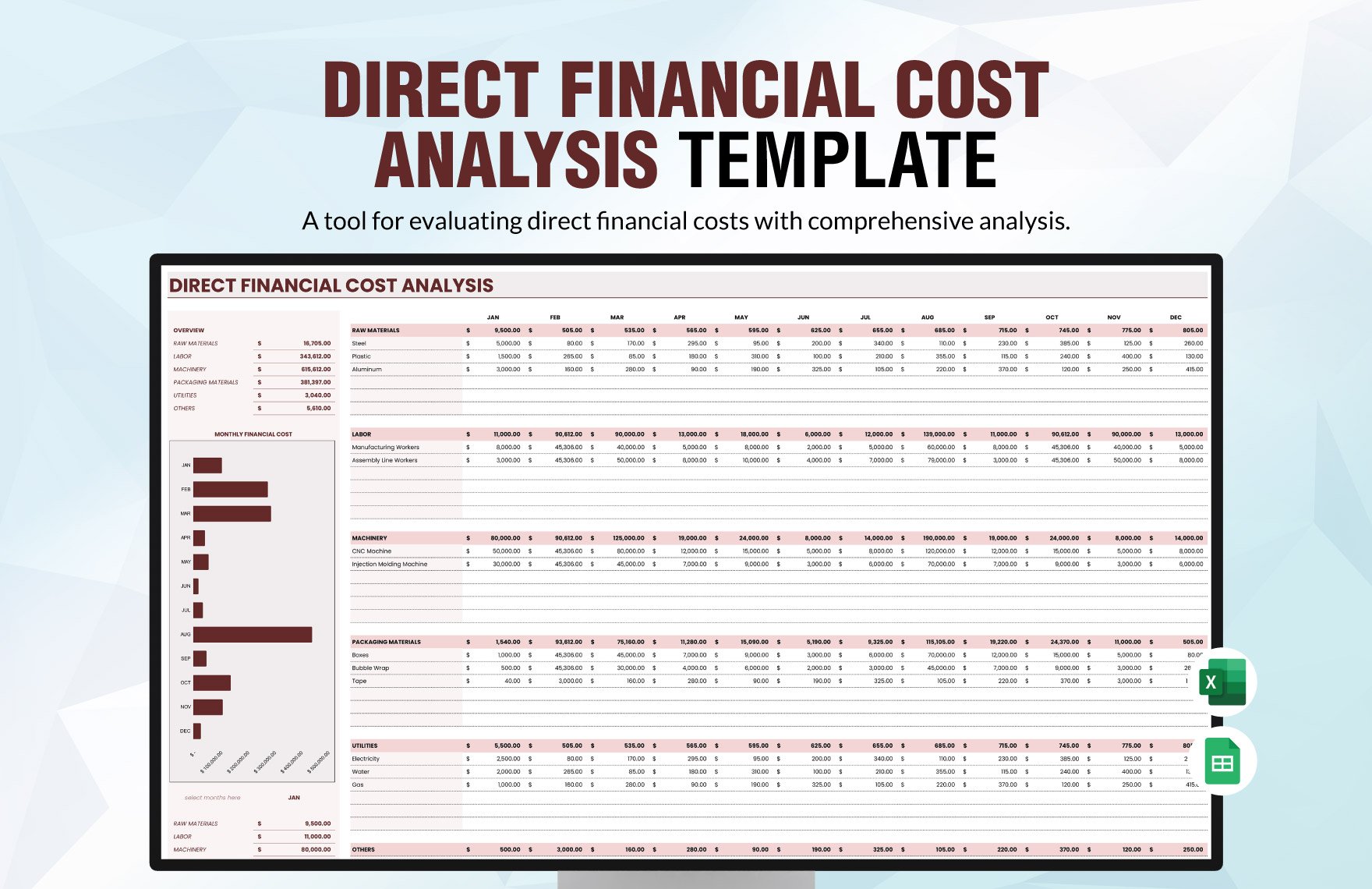

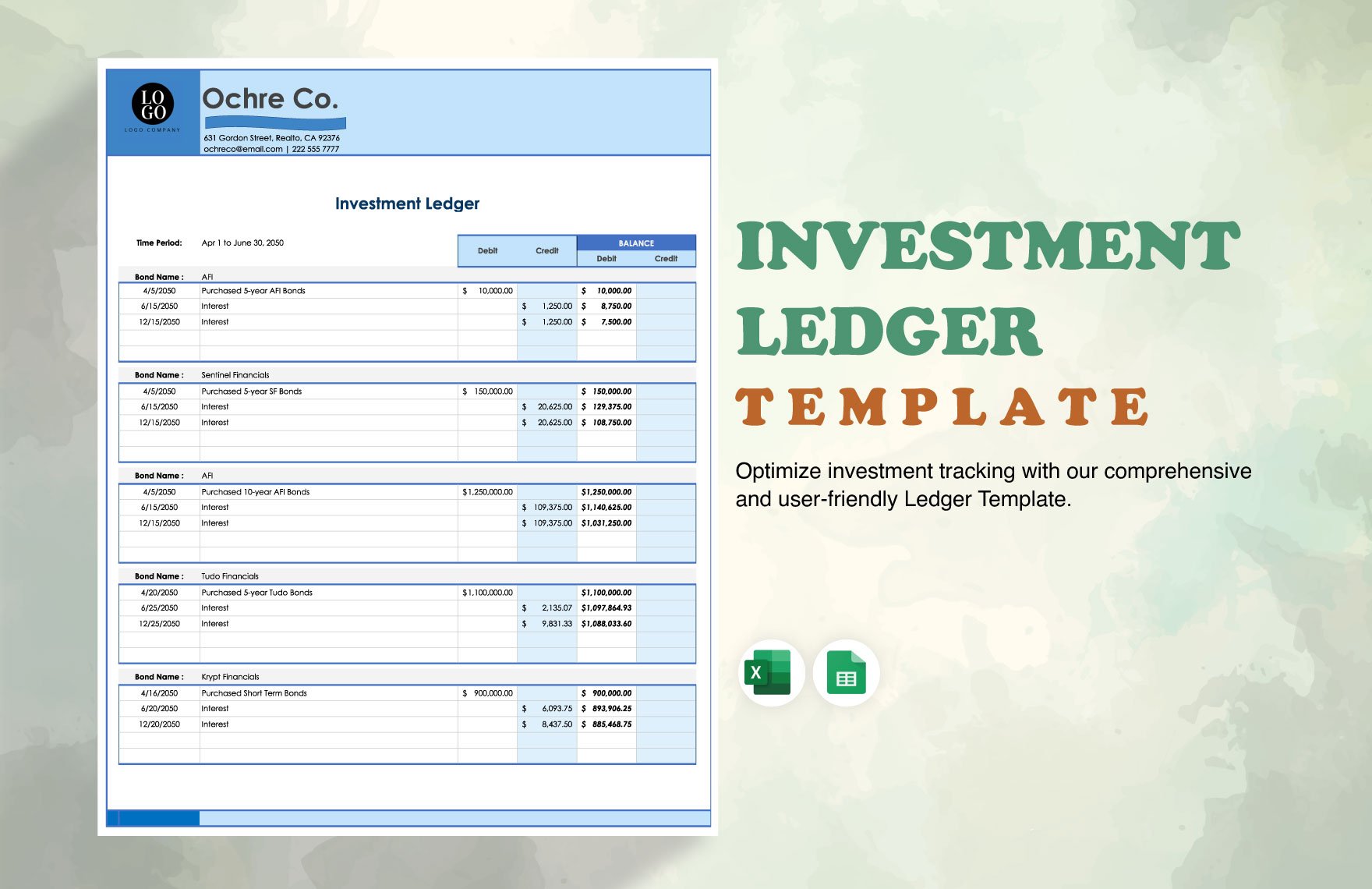

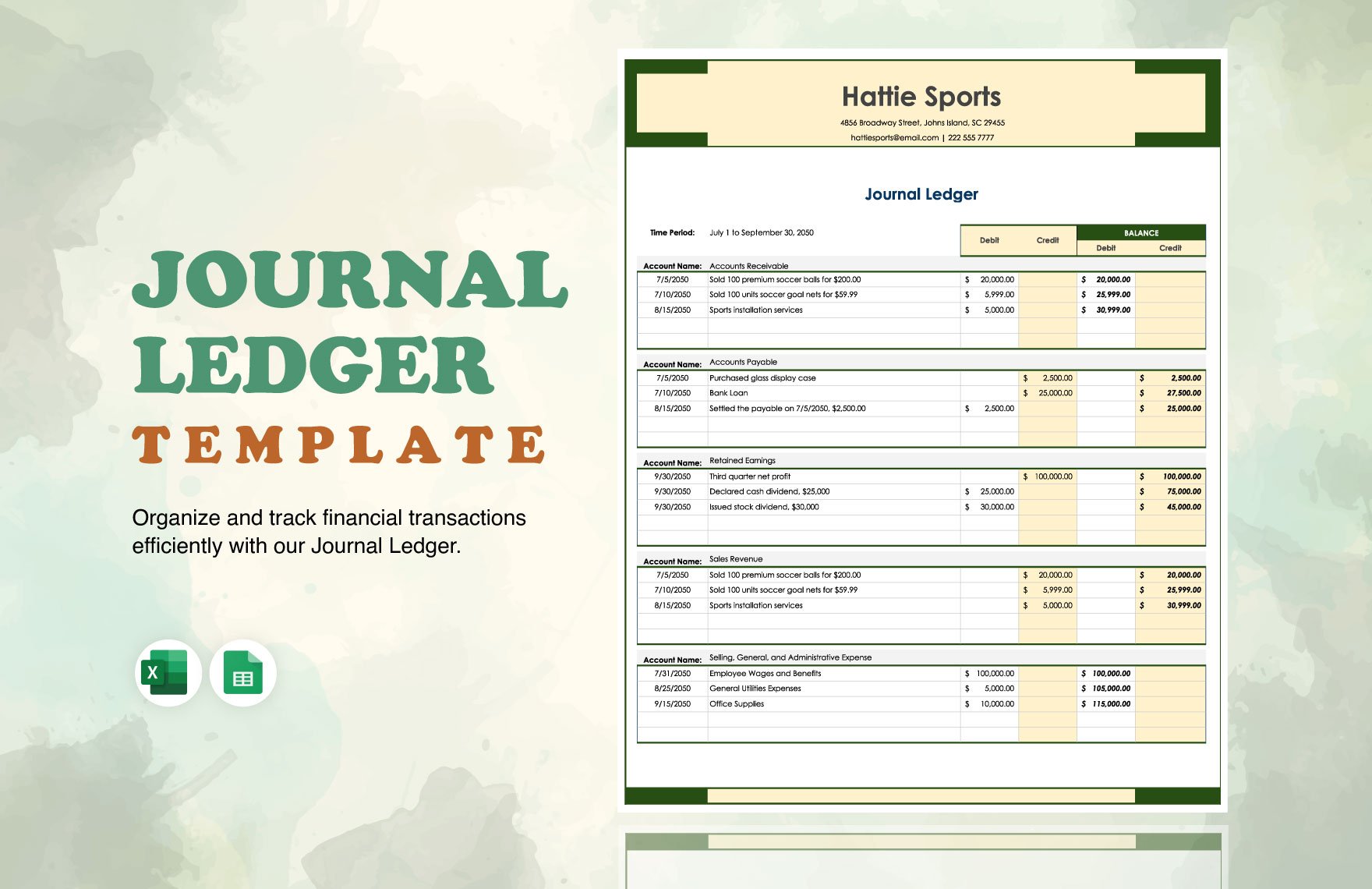

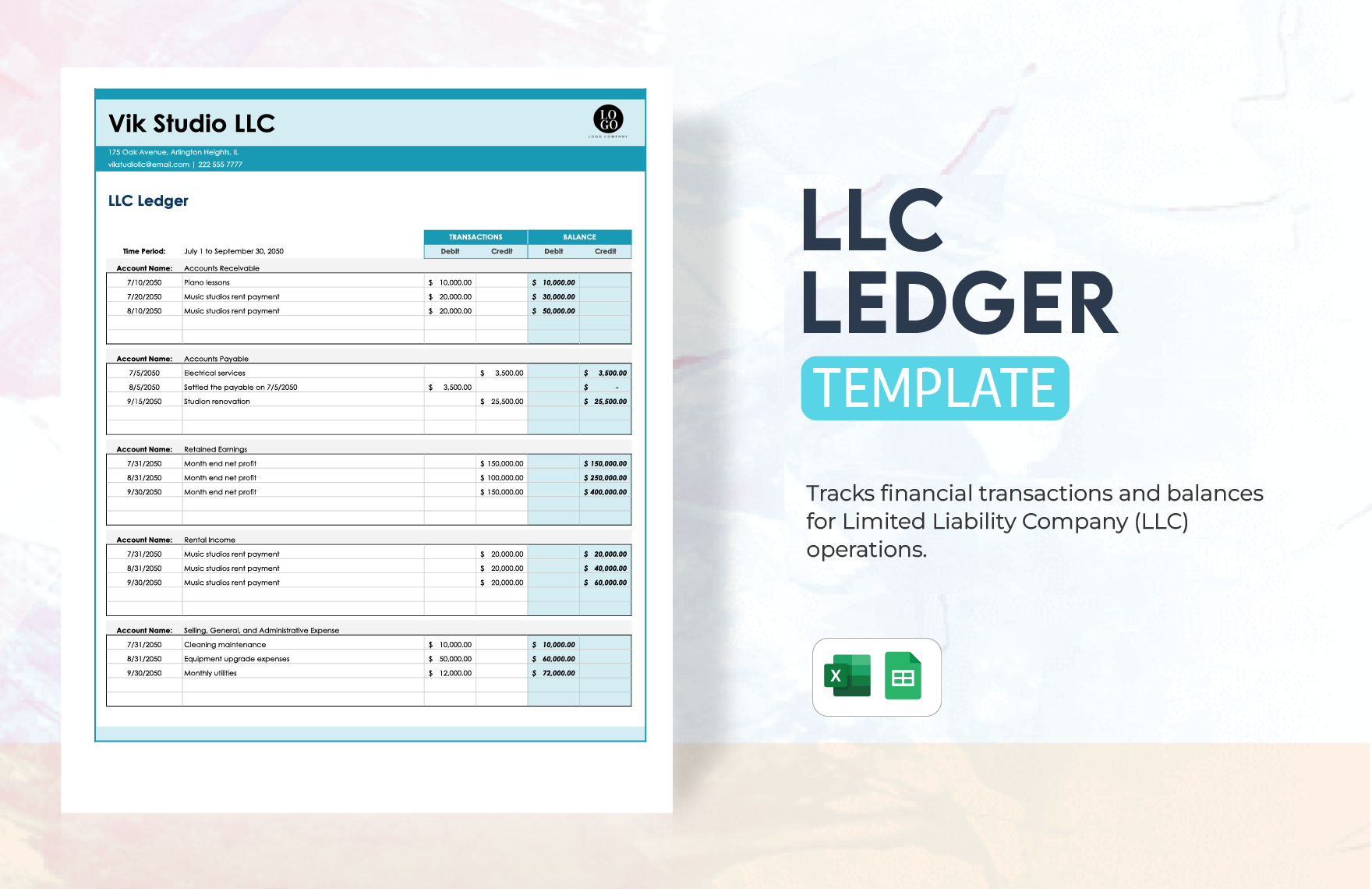

There is absolutely no doubt that financial health is one of the best indicators of your business's potential for long term growth. As a matter of fact, finance is considered as the language of every business. That is why Template.net Pro offers you a wide variety of high-quality financial analysis templates, fit for any kind of financial overview and financial breakdown analysis. These quick templates assure you of a hassle-free editing experience because all of them are 100% customizable and downloadable in various formats of Google Docs, MS Word, and Apple Pages. If you download these premium financial analysis templates now, we assure you that all of them are professionally designed with original suggestive headings and content. Waste no more time, and click that download button right now!

What Is Financial Analysis?

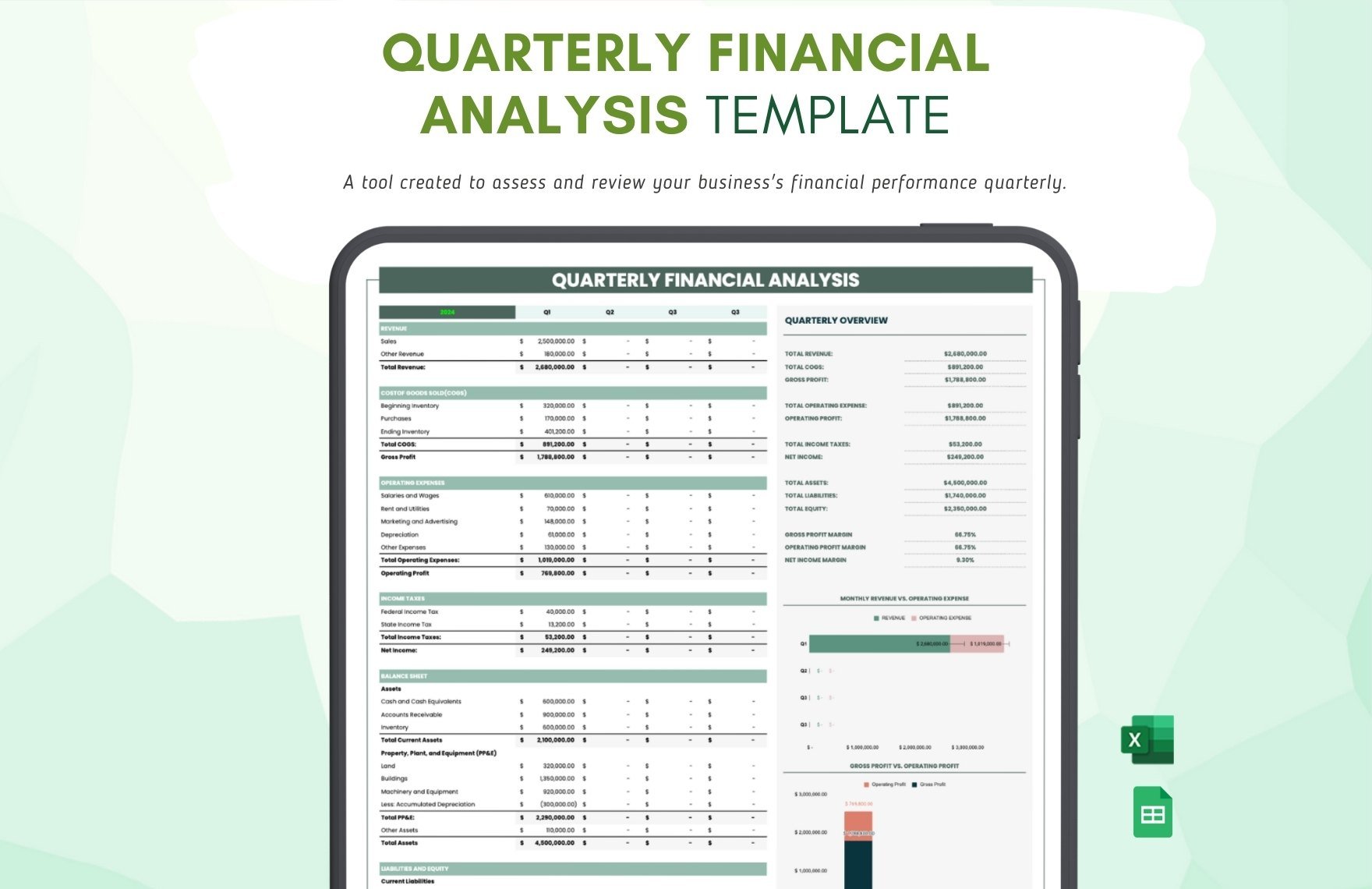

Financial analysis is a process of evaluating and assessing finance-related entities to determine whether a certain business is viable, stable, solvent, and profitable. It is usually conducted by financial analysts by focusing on the company's income statement, balance sheet, and cash flow statement. In simpler terms, financial analysis is a presentation of the performance and suitability of a business.

How To Make A Financial Analysis

Financial analysis, if put into context, is like a business plan. It also serves as a roadmap for businesses on how they should use financial data to determine and assess the overall performance of the company and to make possible recommendations about how it can move forward. It is a simple analysis that determines whether investing in a particular project would be a good choice of investment or not. Creating a financial analysis can be a very formidable task that requires a lot of advanced knowledge and experience. Rightfully saying so, we have come up with several rules of thumb that you can consider as you venture out to your financial analysis making.

1. Identify The Economic Industry

The first step in creating a constructive financial analysis is to identify and study the business's economic industry. This particularly includes the creation, manufacturing, and distribution of the products and services. There are different methods that you can use to help you acquire the necessary data needed such as Porter's Five Forces and economic attributes analysis.

2. Determine Company Strategies

Next, you need to look at the nature of each product and services being offered by the company firm, including the product performance, level of profit margins, creation of brand loyalty, and control of costs. Additionally, factors like business operation analysis can also be considered helpful in this step to fully obtain what needs to be identified.

3. Asses The Company's Financial Statements

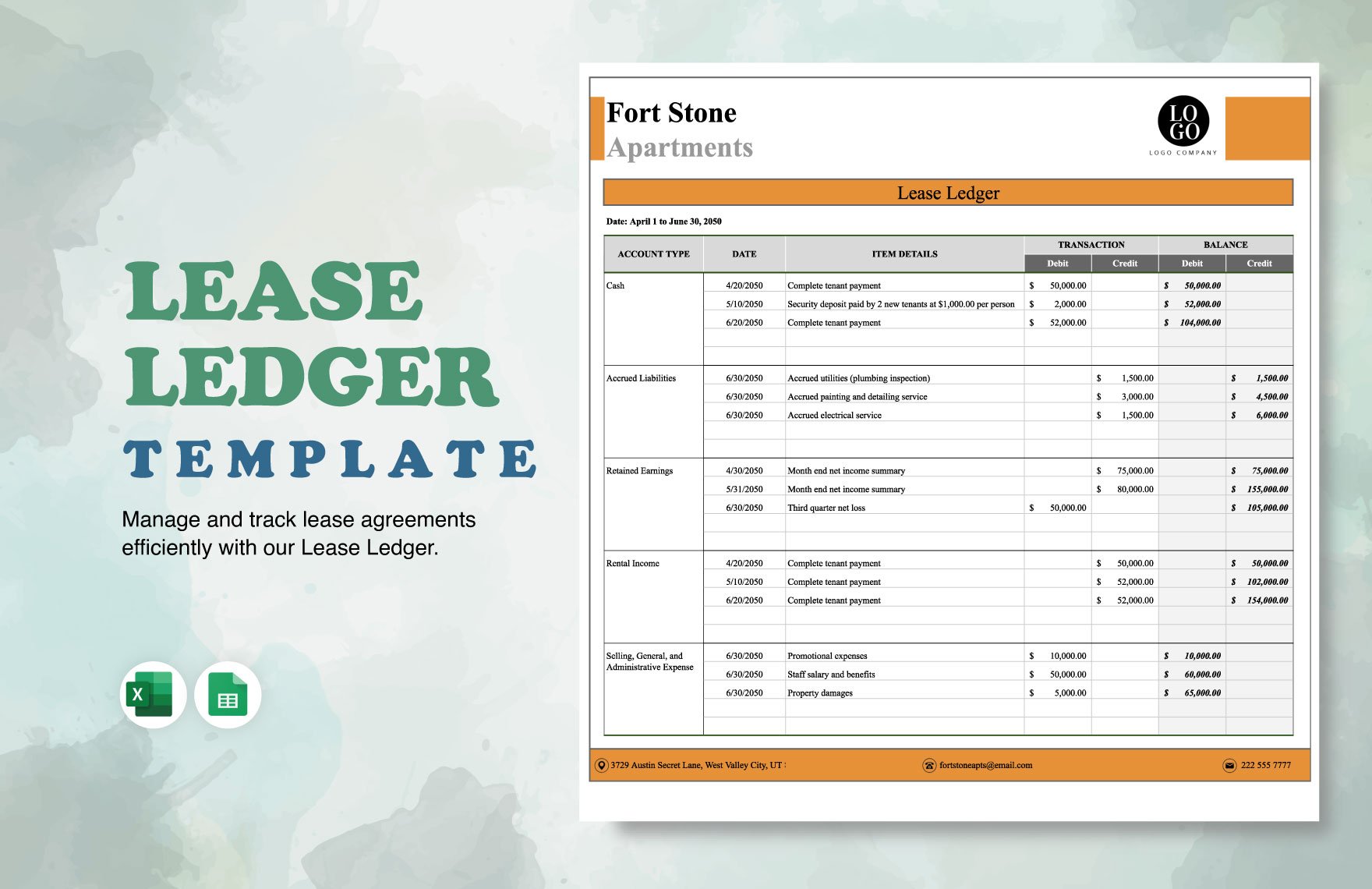

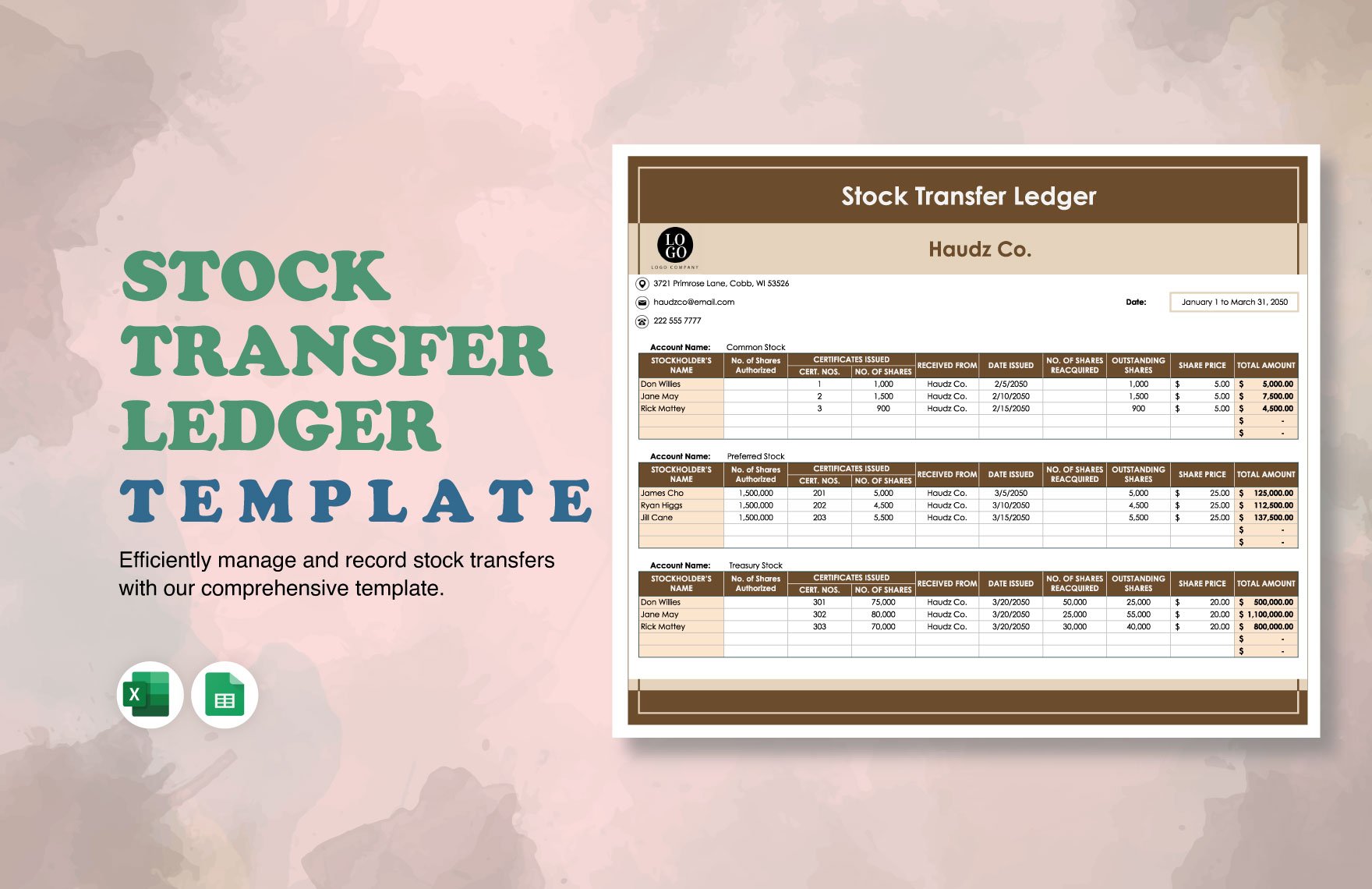

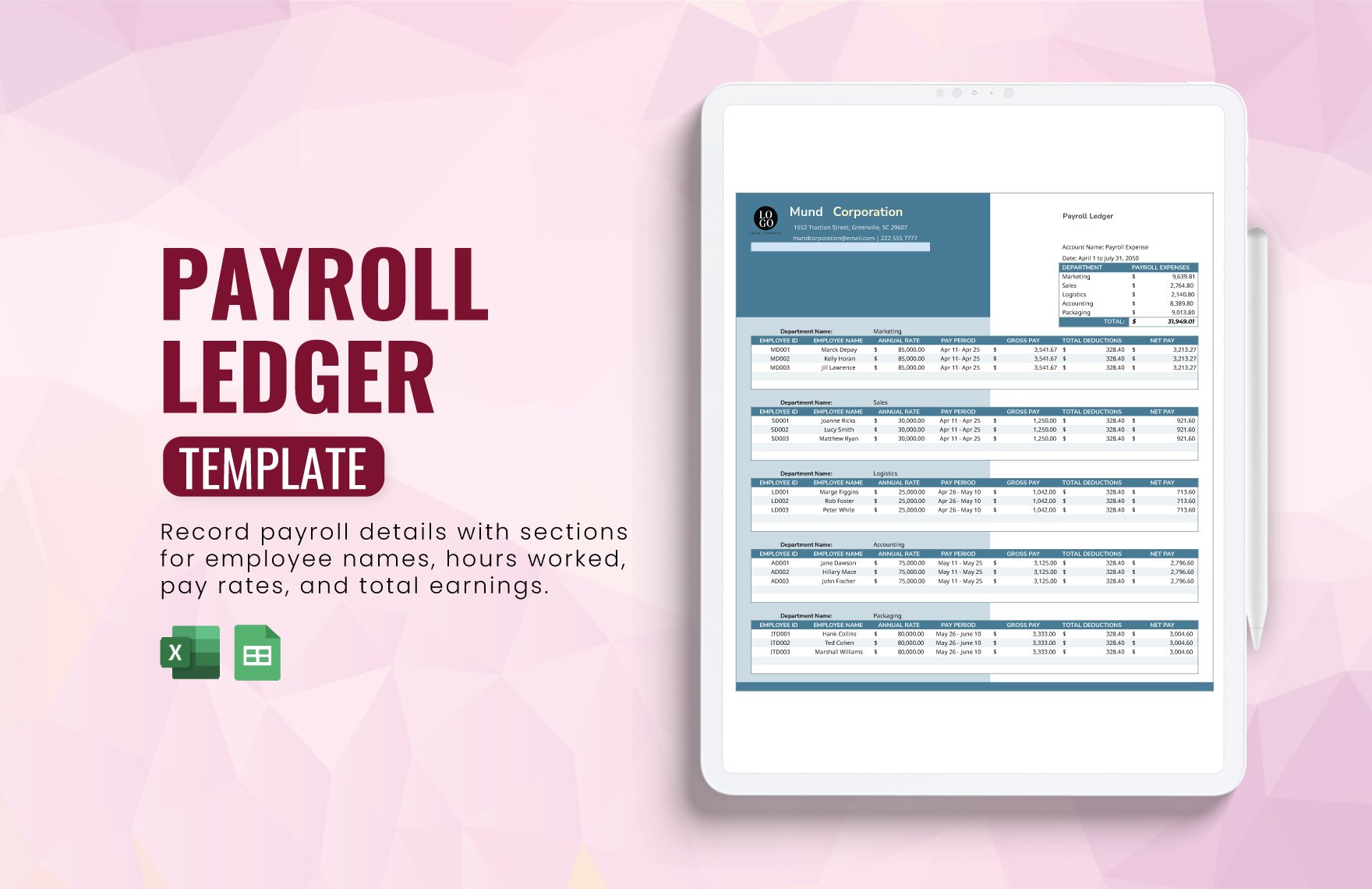

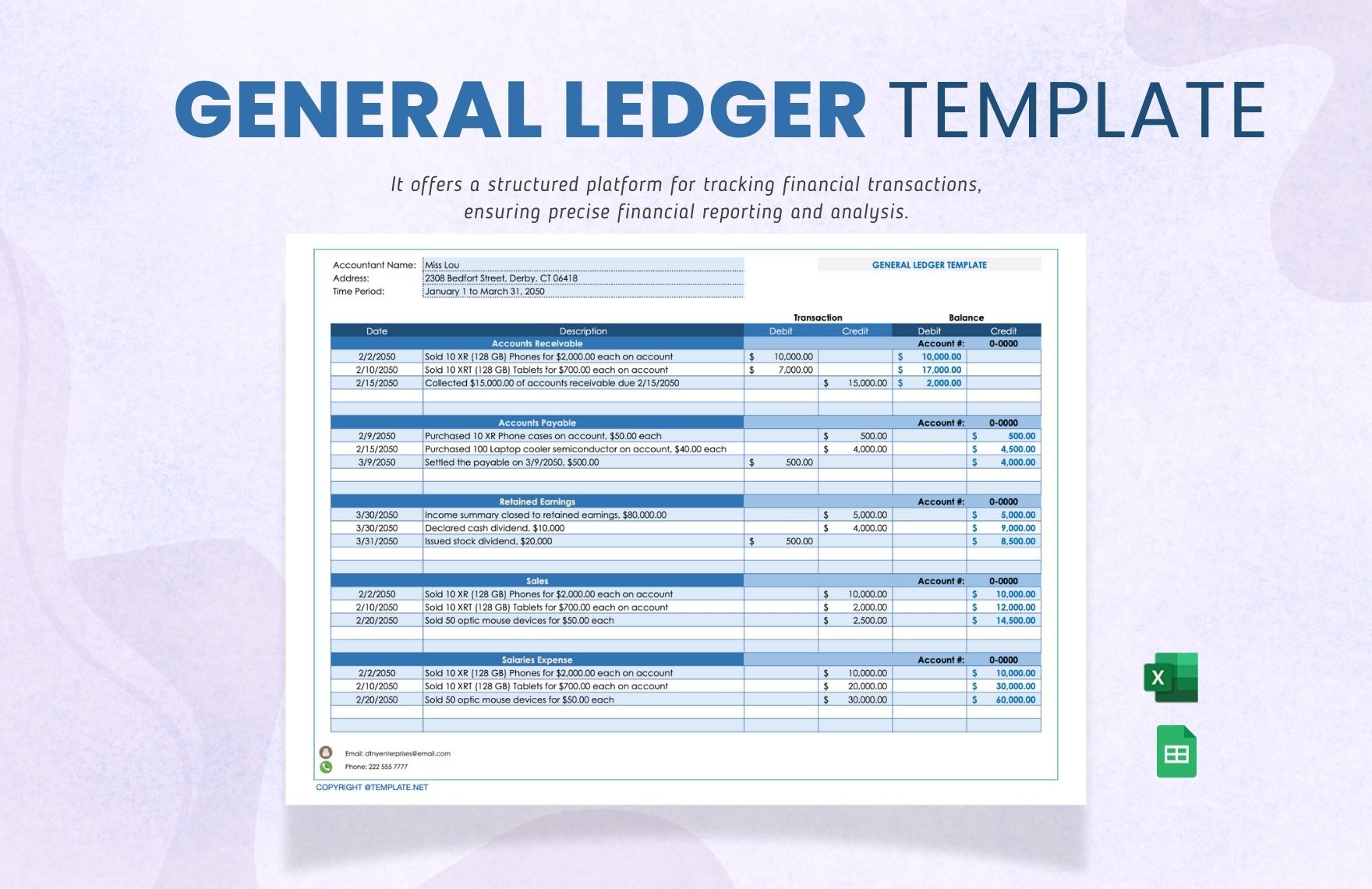

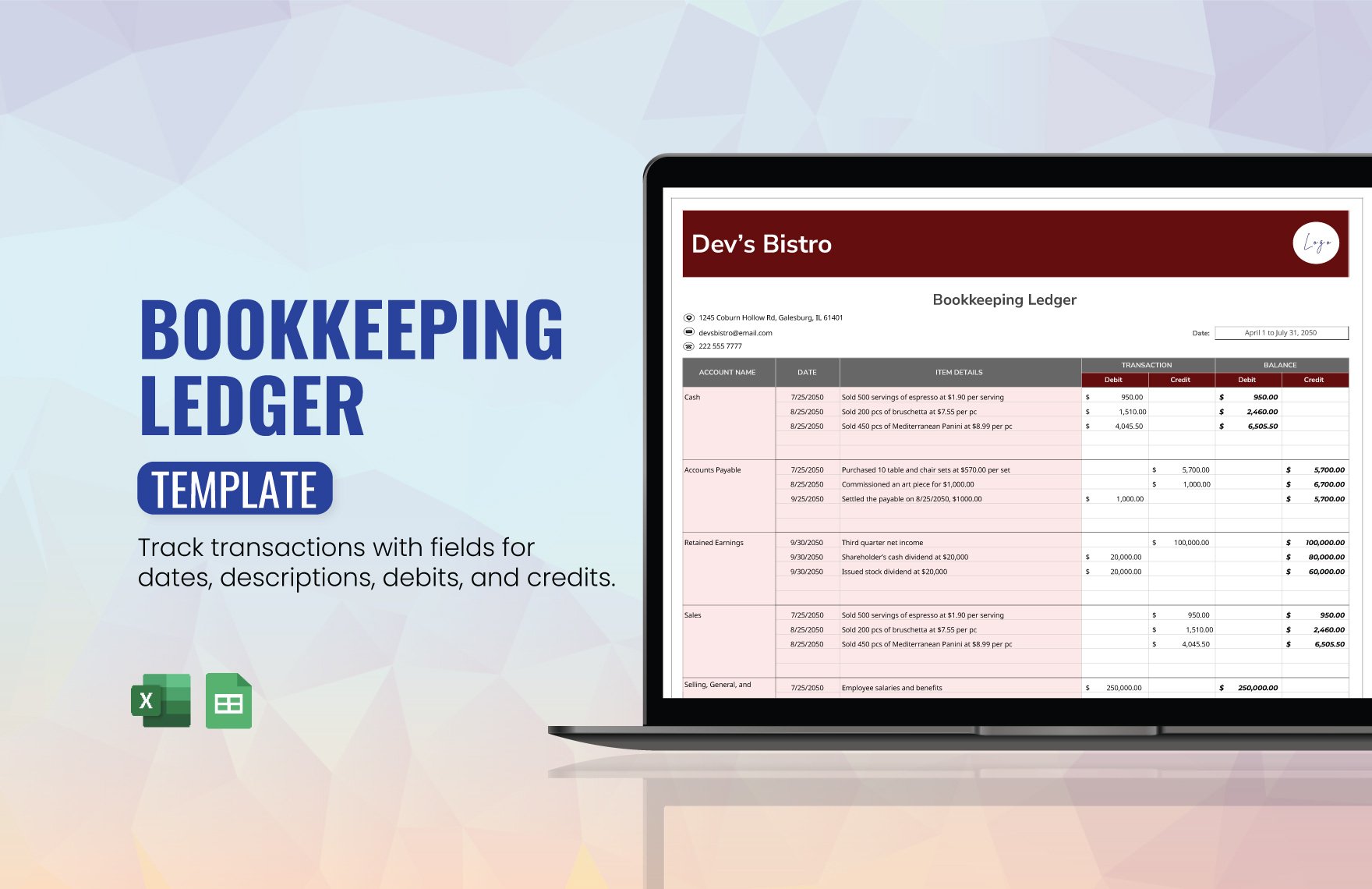

Another step to consider is to conduct a company evaluation by reviewing the financial statements of the business in accordance with relevant accounting standards. Start with the balance sheet accounts, and from there assess and determine whether the balance sheet is a complete and thorough representation of the company's economic position. In conducting a financial audit, the main objective is to identify clearly whether the quality of earnings is a complete representation of the company's economic performance.

4. Analyze The Business Profitability

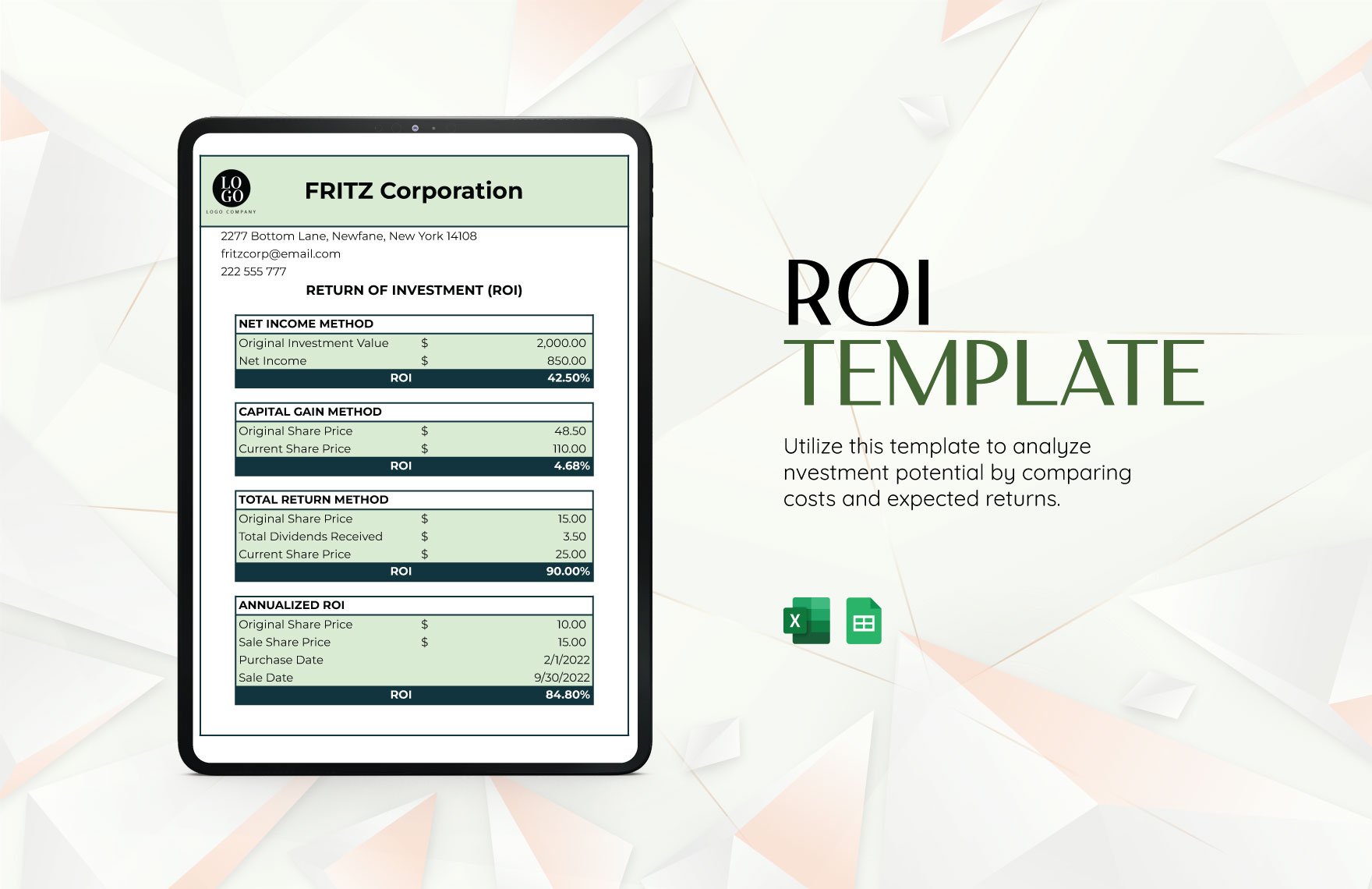

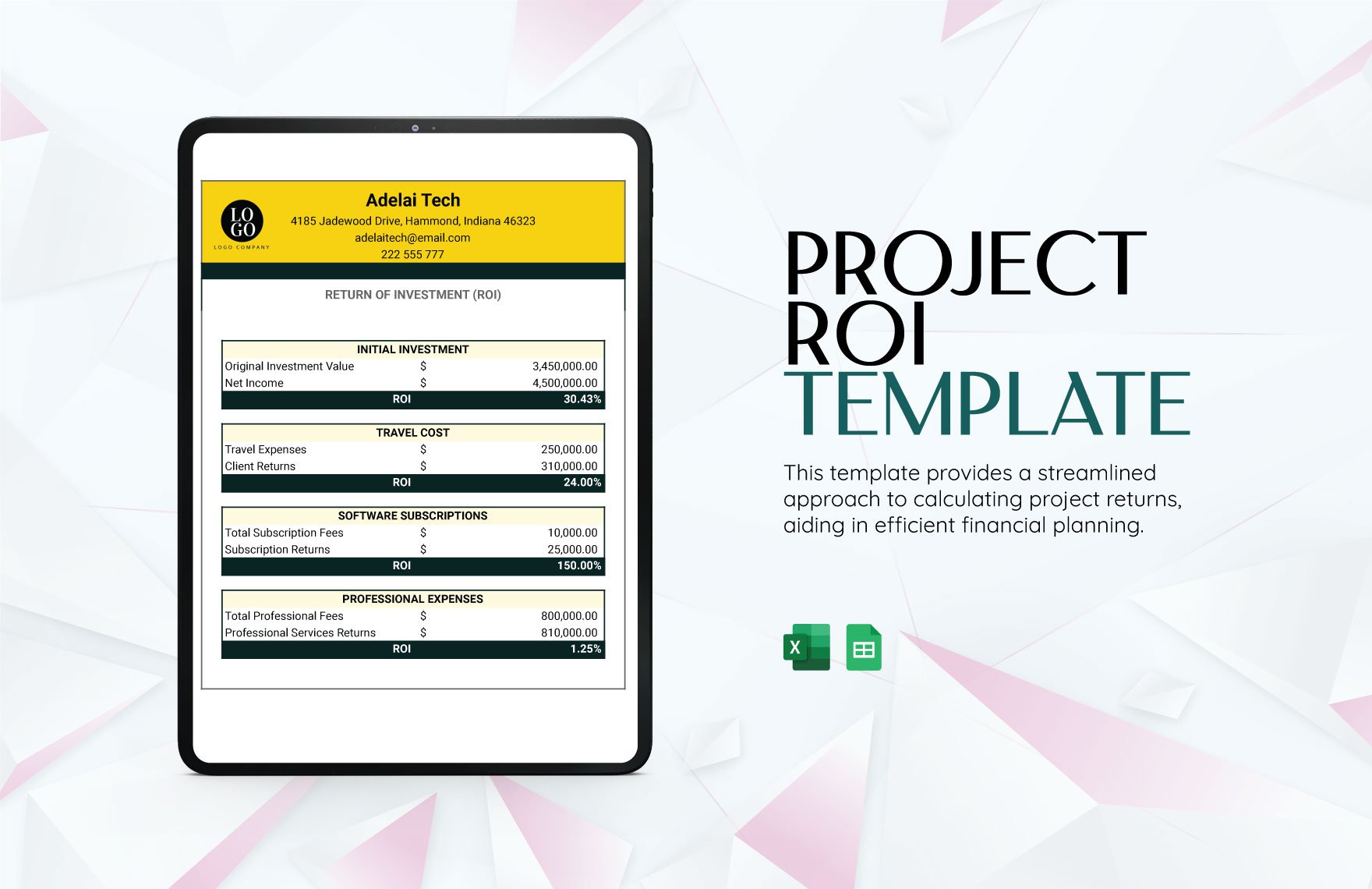

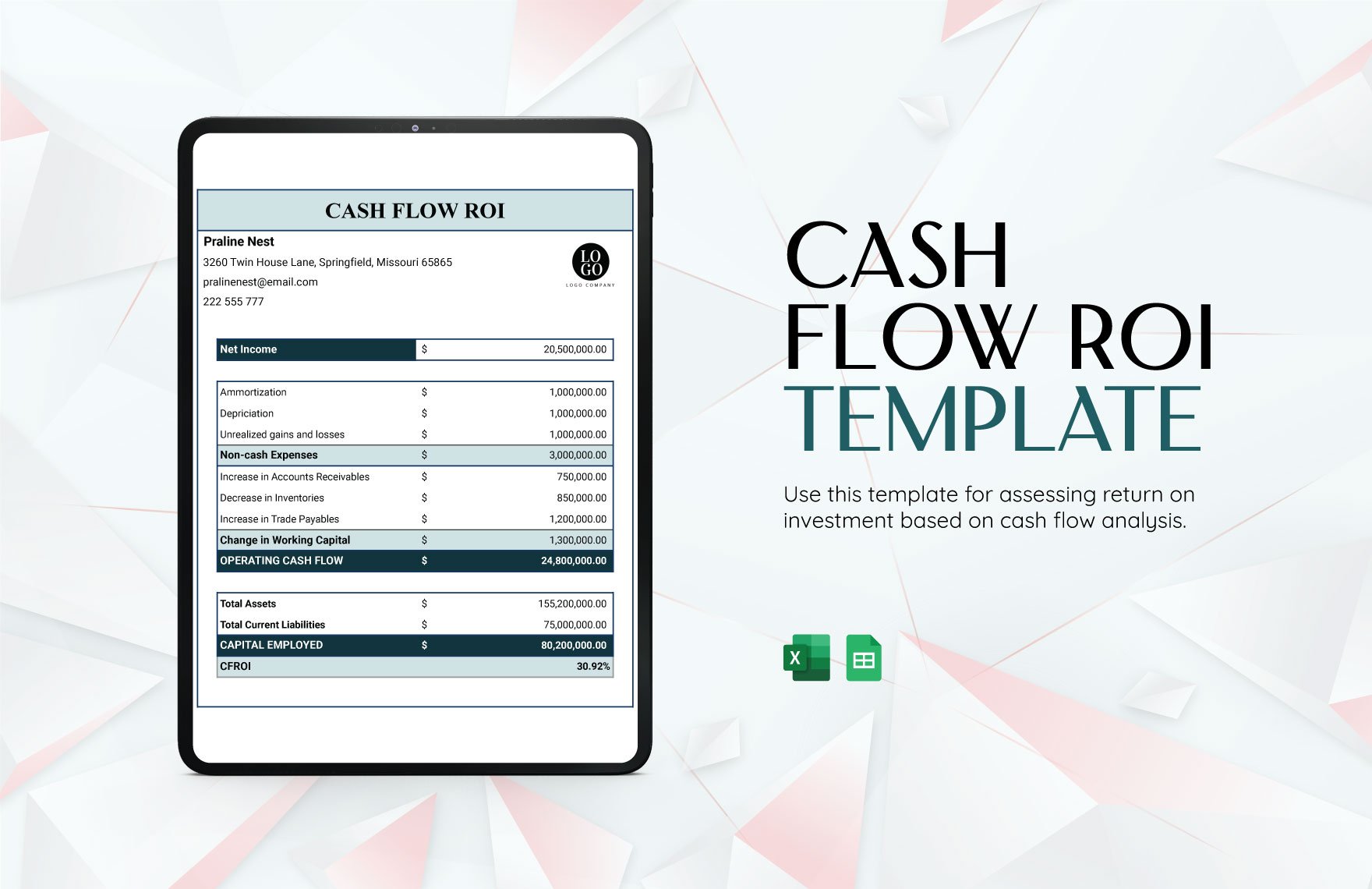

In analyzing business profitability, two broad questions need to be asked. How profitable are the operations of the company relative to its assets? How profitable is the company from a shareholder's perspective? This step is where financial analysts should add value to the overall evaluation of the company's business operations.

5. Prepare Your Analysis

The last step is to prepare your simple financial forecast for the future of the company firm. Although it seems to be a very hard task to do, financial analysts should make reasonable and unbiased forecasts. Present your accomplished financial analysis based on techniques such as the percent of sales approach.