- Sufficient: Sufficiency in this context means the measure of quantity. Audit evidence is considered to be sufficient when they are available in sufficient quantity. An auditor can apply different audit procedures to obtain sufficient audit evidence like test checking.

- Reliable: Audit evidence that is obtained by the auditor is persuasive rather than conclusive. This means that we cannot consider such evidence 100% reliable for forming an opinion. The reliability of audit evidence depends on its source and nature of such evidence.

- Source: Audit evidence must be obtained from a reliable source or the evidence that is obtained within the enterprise is known as the internal source. Evidence that is collected from an outside enterprise like confirmation from the third party is known as the external source. External sources are considered more reliable.

- Nature: The nature of the evidence must also be essential like it can be a documentary including bills or vouchers or visual like the physical verification of fixed assets. It can also be oral like confirmation from employees.

- Relevant: The audit evidence must be relevant. It depends on the purpose of audit procedures whether the audit evidence obtained by the auditor is relevant or not.

Table of Contents

- 11+ Audit Evidence Templates in PDF | MS Word

- 1. Audit Evidence Template

- 2. International Standard Audit Evidence

- 3. Future Project Addressing Audit Evidence

- 4. Audit Evidence Update Template

- 5. Audit Evidence in Auditing

- 6. Auditing Standard Audit Evidence

- 7. Impact of Audit Evidence on Auditor’s Report

- 8. Audit Evidence Objectives

- 9. Final Audit Evidence

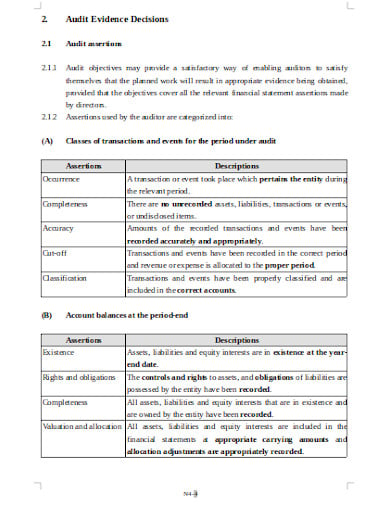

- 10. Audit Evidence Decisions Template

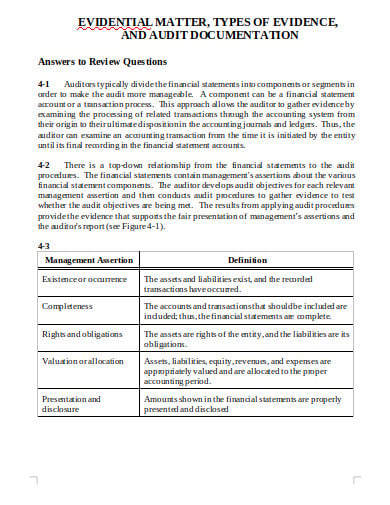

- 11. Types of Audit Evidence

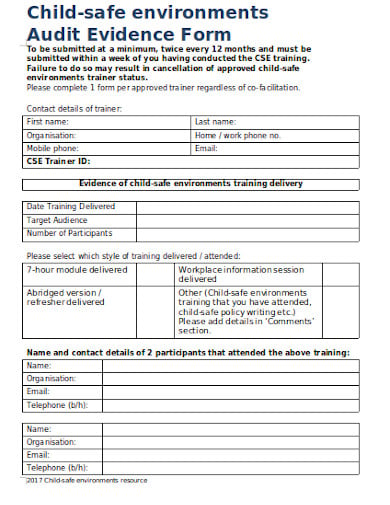

- 12. Audit Evidence Form

- How to Collect Audit Evidence?

- Why is Audit Evidence Important?

- What is Essential for Good Audit Evidence?

11+ Audit Evidence Templates in PDF | MS Word

The information or data that is used by auditors as a part of their audit work to conclude their opinion on whether or not financial statements are prepared accordingly with the applicable financial frameworks is known as audit evidence. The auditors need to make sure that the evidence that they obtain is sufficient enough with the appropriate quality to make the conclusion. This has to be done before they can make a conclusion on the financial statements as a whole or any part.

11+ Audit Evidence Templates in PDF | MS Word

1. Audit Evidence Template

aicpa.org

aicpa.org2. International Standard Audit Evidence

ifac.org

ifac.org3. Future Project Addressing Audit Evidence

iaasb.org

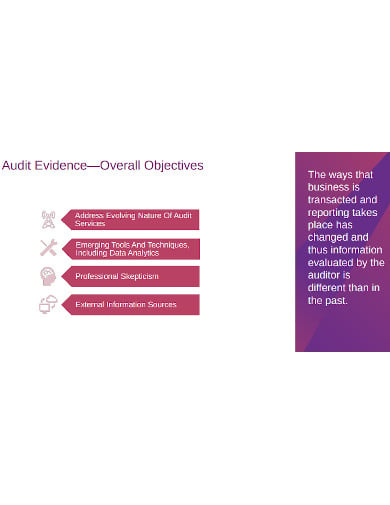

iaasb.org4. Audit Evidence Update Template

iaasb.org

iaasb.org5. Audit Evidence in Auditing

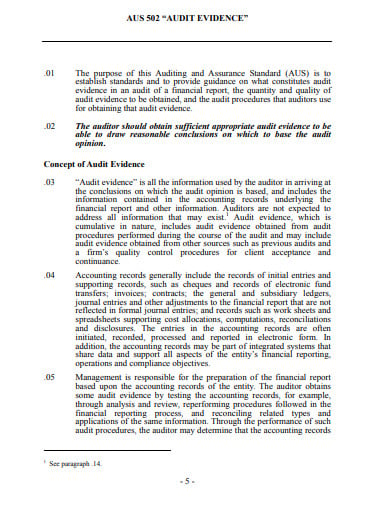

auasb.gov.au

auasb.gov.au6. Auditing Standard Audit Evidence

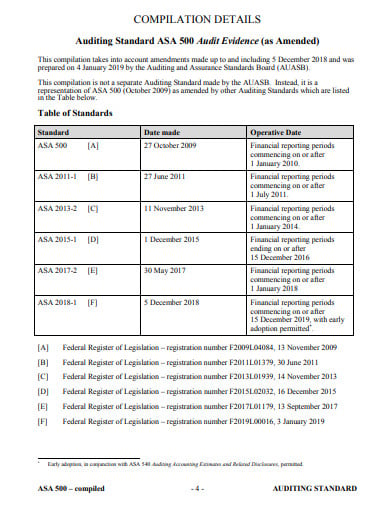

auasb.gov.au

auasb.gov.au7. Impact of Audit Evidence on Auditor’s Report

semanticscholar.org

semanticscholar.org8. Audit Evidence Objectives

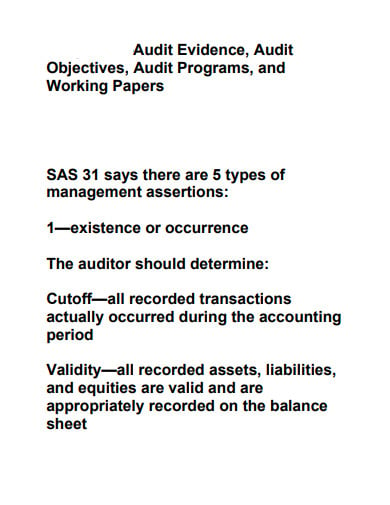

ruby.fgcu.edu

ruby.fgcu.edu9. Final Audit Evidence

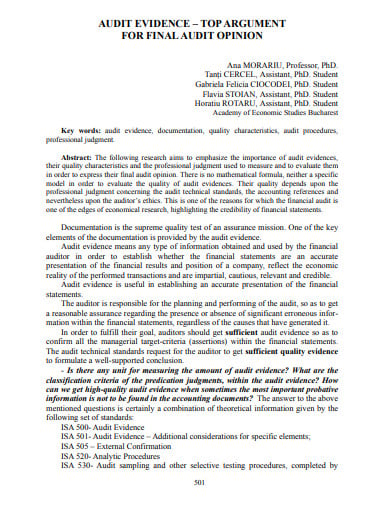

semanticscholar.org

semanticscholar.org10. Audit Evidence Decisions Template

yolasite.com

yolasite.com11. Types of Audit Evidence

personal.utdallas.edu

personal.utdallas.edu12. Audit Evidence Form

education.sa.gov

education.sa.govHow to Collect Audit Evidence?

There are various ways or audit procedures through which audit evidence is obtained. Some of the commonly used procedures are as follows:

-

Inspection

This way involves examining records or any documents whether it is internal or external, in paper form or electronic form, or other media or even a physical examination of an asset. A proper inspection of records and documents gives audit evidence of varying degrees of reliability, depending on their nature and source.

-

Observation

The observation process consists of looking at a process or procedure that is being performed by others. For instance, the auditor’s observation of inventory counting by the personnel or of the performance of control activities.

-

External Confirmation

This process represents audit evidence that is obtained by the auditor as a direct written response to the auditor from a third party i.e is the confirming party, in paper form, or by any electronic or another medium. The external confirmation procedures are commonly relevant when addressing assertions that are associated with certain account balances and their elements.

-

Documentation

The documentation process refers to the auditor’s examination of the client’s documents and records. This information is essential and should be included in the financial statements. The documents that are examined by the auditor are the records that are used by the client to provide information for conducting its business in an organized manner.

-

Recalculation

The recalculation process consists of checking the mathematical accuracy of documents or records and it may be performed manually or electronically.

-

Reperformance

This process involves the auditor’s independent execution of the various procedures or control that were originally performed as a part of the entity’s internal control.

-

Analytical Process

This type of procedure consists of evaluations of certain financial information through the evaluation of some relationships among both financial and non-financial data. It also encompasses such investigation as it is necessary for identified fluctuations or relationships that are usually inconsistent with other relevant information.

-

Inquiry

This procedure consists of seeking information of knowledgeable persons including both financial and non-financial, within the entity or outside the entity. This inquiry is mainly used extensively throughout the audit in addition to other audit procedures. This may range from some formal written inquiries to informal oral inquiries.

Why is Audit Evidence Important?

The data produced by the accounting system alone may not be sufficient to base the auditor’s opinion in case an auditor wants to express his independent opinion on the financial statement furnished to him. The results produced may turn out to be defective is the accounting system itself are defective. Thus, he should ensure the accuracy and authenticity of the information furnished to him before making such an opinion. The auditor must gather valid evidence and verify them as well. The evidence must also be complete and competent to give an idea, about the fairness of the accounting data.

Audit evidence has gained much importance in the company audits all over the world and not only the shareholders but others can rely on the audited financial statements. The auditor can form an opinion or conclude only after verifying all the competent evidence collected by him. In case of any failure to get enough evidence before expressing any audit opinion, it shall be considered as professional misconduct. Such auditors shall also be banned from practicing the profession. Therefore, the auditor needs to obtain sufficient evidence to be on the safer side.