Table of Contents

- 11+ Audit Trail Templates

- 1. Audit Trail Module

- 2. Audit Trail Software

- 3. Configuration Audit Trail

- 4. Building an Audit Trail

- 5. Audit Trail System

- 6. Audit Trails and Logs

- 7. Audit Trail Information

- 8. Validate Audit Trail

- 9. Audit Trail Profiles

- 10. Examination Audit Trail

- 11. Faculty Audit Trail

- 12. Electronic Audit Trail

- How can you create audit trail or audit log book?

- What is the use of the audit trails?

- How does the audit trail work?

- Where can you make use of the audit trails?

11+ Audit Trail Templates in PDF | DOC

An Information or the data log apprehends the record that builds up an audit trail, and these reports assemble these data so that analysts can study them. And this report serves business purposes such as the lost transaction recovery, any kind of cheating detected, disaster recovery, and regulatory compliance. The term ” audit trail” is also referred to as an audit log that records the detailed transaction relating to any item in the accounting sheet.

11+ Audit Trail Templates

1. Audit Trail Module

electric.com

electric.com2. Audit Trail Software

agilent.com

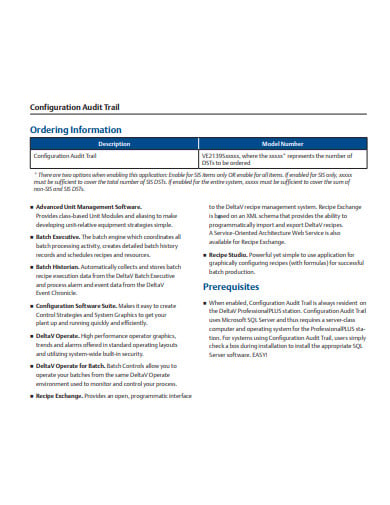

agilent.com3. Configuration Audit Trail

emerson.com

emerson.com4. Building an Audit Trail

integrigy.com

integrigy.com5. Audit Trail System

semanticscholar.org

semanticscholar.org6. Audit Trails and Logs

waters.com

waters.com7. Audit Trail Information

marshalldennehey.com

marshalldennehey.com8. Validate Audit Trail

uva.nl

uva.nl9. Audit Trail Profiles

europa.eu

europa.eu10. Examination Audit Trail

usda.gov

usda.gov11. Faculty Audit Trail

org.uk

org.uk12. Electronic Audit Trail

labcompliance.com

labcompliance.comHow can you create audit trail or audit log book?

Step 1: Mention the username

There are a few things that you must mention in the audit log or the trail. It is important to mention the username in the audit book, as without writing about it audit book is incomplete. The audit book is used to record income and expenses.

Step 2: Mention the date-time

You must mention the date and time in the audit book or the logbook. With the exact date and time, you can easily record the details in it. The date and time are for keeping the records according to the exact date and time.

Step 3: Mention the type of changes

You must mention the different changes in the logbook or in the record. Whenever you see any kind of changes or improvisation in the inventory. Then, it is the changes that you must mention serially and sequentially. It can be changed in expenses or income.

Step 4: Mention the timesheet, activity, etc

You must mention the timesheet, activity and the different elements in the logsheet or audit log to make the organization aware of the different activities within it. There are different things in it as it is the record book or kind of logsheet used in the organization.

Step 5: Verify the facts

When you see that there is the changes or difference in the facts or it is possible that the figures can be incorrect. You must immediately correct it in the audit book. You must always carefully insert the figures for the income and expenditure of the company. Otherwise, the final calculation will be incorrect and wrong.

What is the use of the audit trails?

The audit trail is for maintaining the sequence of the records of the finance or the transactions over the period of the time. When you claim the deduction for the office supplies on the business tax return and it includes the itemized dated receipt from the end of the seller and it is also mentioned as the debit on the company’s book for the purchase. The audit trail is made up of either the electronic records or the paper records. The electronic trails are in the audit trail database.

The audit trails are used to verify and track the different types of transactions including the transactions and businesses in the brokerage account. The trade information can be traced to its sources. And the audit trails are significant and useful tools when it determines the validity of accounting entry, the sources of funds or the businesses. These are used in accounting when the examiner needs to examine the figure such as the revenue and the net earnings, or the earning per share.

And it is the task of the audit trail to review and change it if figures are inappropriate in nature. The audit trail is also used to evaluate the improper market activity. When you find any type of error or mistake, then you create the journal entry documenting the facts. And then conducting the audit trail will help to prevent fraud and discrepancy.

How does the audit trail work?

The audit trail must help you know how to handle accounting in the company’s book. As the data entry mistakes will take place term wise. And it is the duty of the audit trail that works to prevent tax fraud. All the elements in the audit trails are checked and verified. So, it is important that the company goes under the financial audit every year or annually. With these, the auditor verifies that your tax return and other deductions are accurate and correct.

The analyzation or every payment is supported by the invoice that is been reviewed and approved by someone with the authority to pay it. These errors or mistakes are mentioned in the audit logbook and then review it. When you verify it, after completing the final entries you find that each element is segmented. The audit trails are important as it comes in handy during the tax audit or fraud investigation.

Where can you make use of the audit trails?

The audit trails are one of the most important tools for your business and trade. It not only tracks and records the income and expenses but also provides the record of the way that you conduct your business. It is recording the rate of transactions in the business organization. It has in it the different types of expenditure and the deduction that each of the company faces during their financial tenure.