Table of Contents

- 10+ Compliance Audit Templates in PDF | Word

- 1. Compliance Audit Templates

- 2. Compliance Auditing and Monitoring Template

- 3. Regulatory Compliance Audit

- 5. Compliance Audit Report Template

- 6. Compliance Audit Procedures in PDF

- 7. Financial and Compliance Audit

- 8. Compliance Audit Plan Template

- 9. Compliance Audit Regulation in PDF

- 10. Standard Compliance Audit Template

- 11. Compliance Audit Checklist in DOC

- How to Conduct a Compliance Audit?

- Role of a Compliance Auditor

- Participants of Compliance Audits

- What are the Types of Compliance Review?

- What are the Challenges of Compliance Auditing?

- Compliance VS. Internal Audit

10+ Compliance Audit Templates in PDF | Word

A compliance audit is defined as a process of evaluation or assessment to ensure that an organization is following its external laws, rules, and regulations or internal guidelines like corporate bylaws, policies, etc. It also determines if an organization is obeying an agreement or not. The audit reports prepared after conducting the audit evaluates the strength and thoroughness of compliance preparations, security policies, risk management procedures, and user access controls.

10+ Compliance Audit Templates in PDF | Word

1. Compliance Audit Templates

aicpa.org

aicpa.org2. Compliance Auditing and Monitoring Template

bch.org

bch.org3. Regulatory Compliance Audit

weaver.com

weaver.com5. Compliance Audit Report Template

entsoe.eu

entsoe.eu6. Compliance Audit Procedures in PDF

wcc.state.md.us

wcc.state.md.us7. Financial and Compliance Audit

eca.europa.eu

eca.europa.eu8. Compliance Audit Plan Template

nerc.com

nerc.com9. Compliance Audit Regulation in PDF

sharepoint.com

sharepoint.com10. Standard Compliance Audit Template

lms.idielearning.org

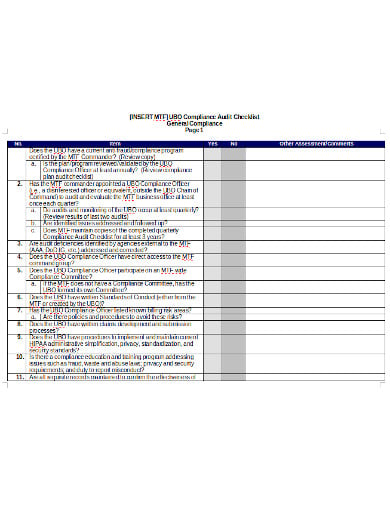

lms.idielearning.org11. Compliance Audit Checklist in DOC

health.mil

health.milHow to Conduct a Compliance Audit?

The management team must understand that they are ultimately responsible for creating internal controls and also ensures compliance whether the audit is internal or external. The following steps will help you while conducting a compliance audit:

- The organization must contact the auditor. Then the auditor and the organization will decide if the auditor’s skills are a good fit.

- The auditing firm must then send a proposal either to the company or to the attorney for instances where compliance audits should cite client-attorney privileges.

- The auditor then describes the guidelines for the adult and what is required at a preliminary meeting. The auditor may then provide some auditing checklists so that the client can prepare.

- The auditor may work by phone if it is a small organization. The organization must complete the audit questionnaires and supply the auditor with the required documents. The auditor then works on-site to view the documents, walk-through workspaces, study the security features and the infrastructure, and interviews and employees.

- The audit report should then be delivered within a relatively short time. In case of the social compliance audits of facilities, the inversion may be as fast as the next day. The auditor must present and discuss the report and makes recommendations to address any areas of risk at the final meeting. Auditors must also verify that measures have been met or not.

Role of a Compliance Auditor

An auditor is referred to an individual or person who conducts an audit. They are often considered as free agents or third party agents who are not a part of the organization that is being audited. A compliance auditor particularly evaluates and investigates about the part of the company that is related to how compliant they are with the rules and guidelines. They may ask a series of questions to certain administrators like who has left the organization, when they have left, which users were added, etc.

Participants of Compliance Audits

Many departments in one firm may be subject to an audit depending on the type of audit, that may be from finance to payroll to production to sales, etc. Employees throughout the hierarchy may be interviewed by the auditors and particular emphasis is placed on managers. AU 801 is one of the compliance audits that holds management responsible for understanding compliance requirements and ensures that adequate controls are in place to sustain compliance. With other types of audits like SOX compliance audits, the CEOs and CFOs are required to attest to the integrity of controls and the accuracy of financial reports.

What are the Types of Compliance Review?

The compliance audit generally performs its audit against some requirements like:

-

Local Law and Regulation

The entity must make sure that they are operating properly in compliance with the law, and other related law. The business might need to set up some proper business procedures and processes to ensure this. They might need a legal consultant to have their decision advised and also needs the legal department to review some significant process. It has to make sure that the penalty is minimized and the right procedure that complies with the law is in place. The entity may also need its internal audit department to have its review on the compliance section with the local law requirements. The internal will then assess the significant procedures and process and certain official documents.

-

Business Related Directives and Framework

Other than reviewing against the local law and directives, a compliance auditor may need to review compliance with the directives and framework related to it. For instance, in case an organization is listed on the stock exchange outside the country that they are operating. Then they must make sure that the entity complies with the requirement of that stock exchange requirement. The compliance auditor may need to review these areas by checking if the related entity’s current practices follow the requirements or not.

-

Policy, Procedure, and Processes

The compliance auditor also performs its audit against the entity’s internal policy, procedure, and processes. All these internal policies and procedures are very important to the entity for sustainable growth. Failure in complying with the internal policy and procedure may lead to a waste of time and resources.

What are the Challenges of Compliance Auditing?

Compliance may seem to present organizations with a particular difficulty in which they are liable for penalties whether they work to comply or not. In case some deficiencies are discovered in a regulatory audit, it may be subject to fines. Nonetheless, any deficiencies that are not discovered in an audit, an organization may be put through a third-party lawsuit. Deficiencies that are disclosed in self-auditing and self-reporting can also collect significant penalties.

Compliance VS. Internal Audit

External audits that are also considered as a formal compliance audits are carried out by independent third parties and follow a specific format that is determined based on the compliance directives that are being assessed. The reports derived from the evaluation measures if an organization is complying with the state, federal or corporate regulations, rules, and standards. This auditor’s report is used by regulators to assess possible fines for noncompliance. Internal audits may be used by an external compliance auditor to further evaluate compliance and regulatory risk management efforts.

Internal audits are normally carried out by the employees of a company to measure the overall risks to compliance and security and to determine whether the company is following internal guidelines or not. Internal audits generally occur throughout the fiscal year and reports that can be used by management teams to identify areas that require improvement. It calculates the objectives of the company against the output and strategic risks.