Table of Contents

- 1. Statutory Audit Report Template

- 2. Statutory Auditor Format Download

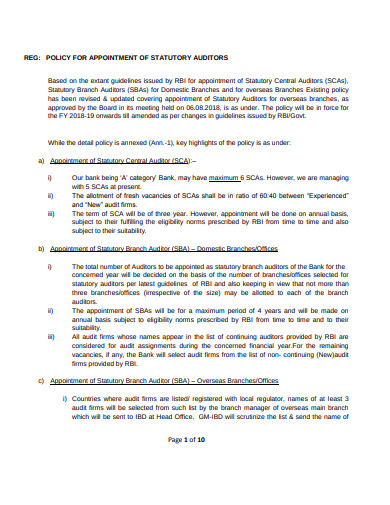

- 3. Sample Statutory Auditors Policy Template

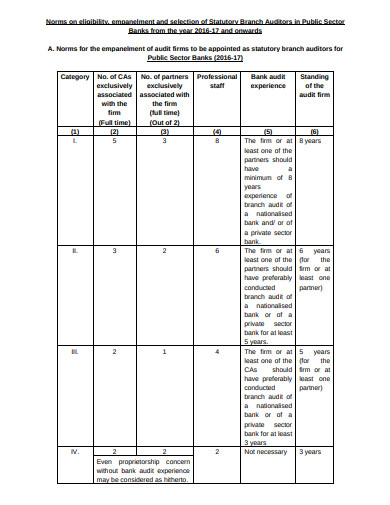

- 4. Printable Statutory Branch Audits in DOC

- 5. Statutory Branch Auditors Sector Template

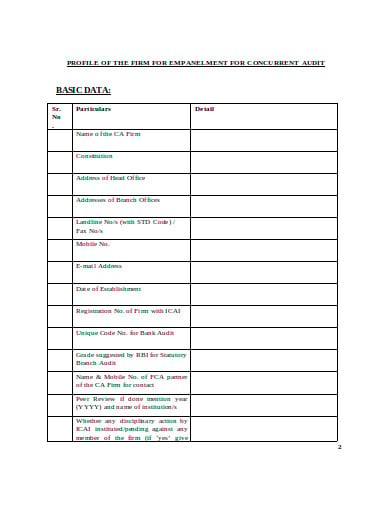

- 6. Basic Statutory Audit Data Example

- 7. Statutory Audit Appointment Service Format

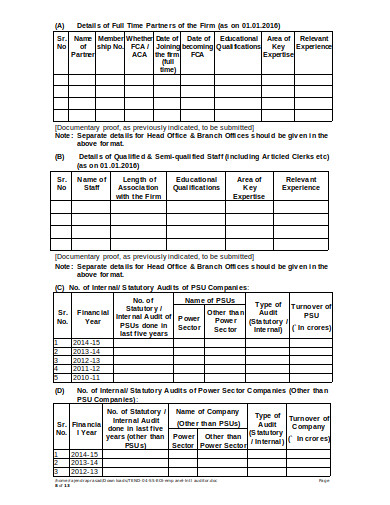

- 8. Simple Internal Statutory Audit Information

- 9. Statutory Audit Checklist Template Download

- 10. Charted Account Statutory Audit Form

- 11. Professional Bank Statutory Audit Letter

- What are the Important Elements to be Included in a Statutory Audit?

- How Does a Statutory Audit Work?

- What are the Reasons Behind Having a Statutory Audit?

- What are the Clauses for Statutory Auditing?

Statutory Audit

A statutory audit is a lawfully required audit of the exactness of an organization’s or government’s budget reports and records. The reason for a statutory review is to decide if an association gives a reasonable and exact portrayal of its budgetary situation by looking at data, for example, bank adjusts, accounting records, and money related exchanges.

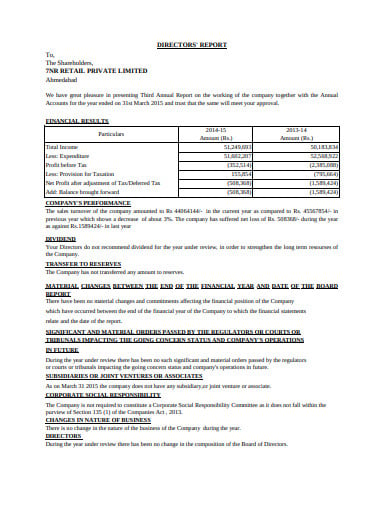

1. Statutory Audit Report Template

nrretailltd.in

nrretailltd.in2. Statutory Auditor Format Download

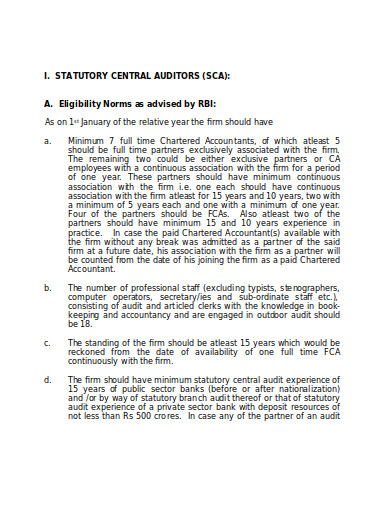

canarabank.com

canarabank.com3. Sample Statutory Auditors Policy Template

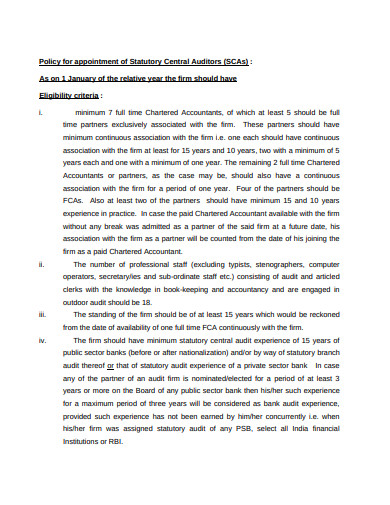

bankofindia.co.in

bankofindia.co.in4. Printable Statutory Branch Audits in DOC

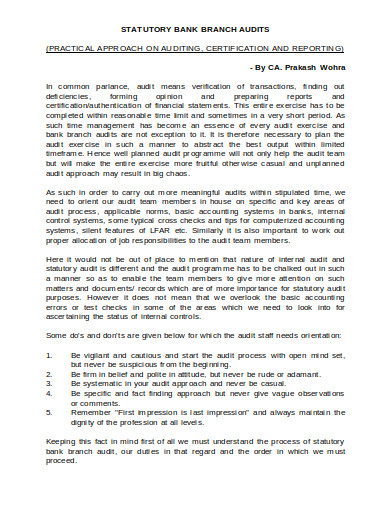

indore-icai.org

indore-icai.org5. Statutory Branch Auditors Sector Template

rbidocs.rbi.org.in

rbidocs.rbi.org.in6. Basic Statutory Audit Data Example

bggb.in

bggb.in7. Statutory Audit Appointment Service Format

pnbindia.in

pnbindia.in8. Simple Internal Statutory Audit Information

guvnl.com

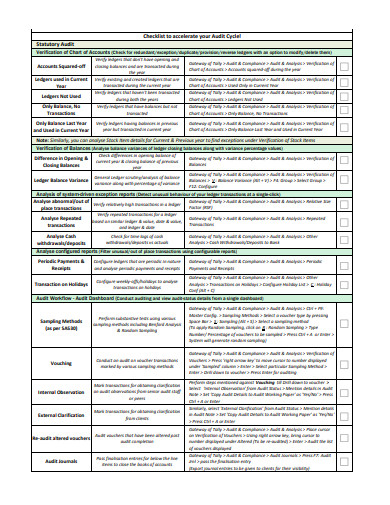

guvnl.com9. Statutory Audit Checklist Template Download

mirror.tallysolutions.com

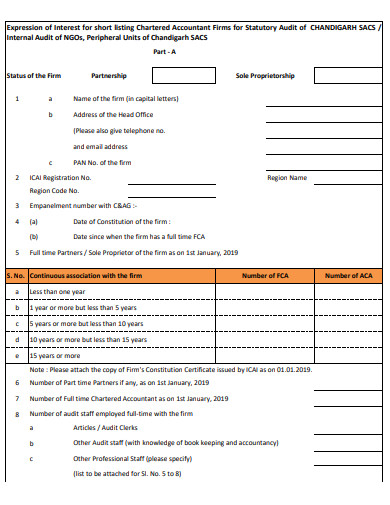

mirror.tallysolutions.com10. Charted Account Statutory Audit Form

chandigarhsacs.org.in

chandigarhsacs.org.in11. Professional Bank Statutory Audit Letter

hdfcbank.com

hdfcbank.comWhat are the Important Elements to be Included in a Statutory Audit?

- A statutory audit is a legitimately required audit of the precision of an organization’s or government’s fiscal reports and records.

- A review is an assessment of records held by an association, business, government substance, or person, which includes the investigation of money related records or different territories.

- The reason for a budgetary review is frequently to decide whether assets were dealt with appropriately and that every single required record and filings are exact.

- Firms that are liable to reviews incorporate open organizations, banks, financiers and venture firms, and insurance agencies.

How Does a Statutory Audit Work?

The term statutory signifies that the review is required by the resolution. A resolution is a law or guideline instituted by the authoritative part of the association’s related government. Rules can be sanctioned at various levels including government, state, or metropolitan. In business, a resolution likewise alludes to any standard set by the association’s initiative group or directorate.

What are the Reasons Behind Having a Statutory Audit?

- A review is an assessment of records held by an association, business, government substance, or person. This, for the most part, includes the investigation of different monetary records or different regions. During a monetary review, an association’s records concerning salary or benefit, venture returns, costs, and different things might be incorporated as a feature of the review procedure. A few of these things are additionally utilized when computing a consolidated proportion.

- The reason for a money related review is regularly to decide whether assets were dealt with appropriately and that every single required record and filings are precise. Toward the start of a review, the inspecting substance makes referred to what records will be required as a component of the assessment. The data is assembled and provided as mentioned, enabling the inspectors to play out their examination. If errors are discovered, proper outcomes may apply.

- Being dependent upon a statutory review isn’t an innate indication of bad behavior. Rather, it is frequently a custom intended to help forestall exercises, for example, the misappropriation of assets by guaranteeing standard assessment of different records by a skillful outsider. The equivalent likewise applies to different sorts of reviews.

- Being dependent upon a statutory review isn’t characteristic of any bad behavior, as the motivation behind the review is to deflect such exercises.

What are the Clauses for Statutory Auditing?

-

Extraordinary Considerations

Not all organizations need to experience statutory reviews. Firms that are liable to reviews incorporate open organizations, banks, business and venture firms, and insurance agencies. Certain foundations are likewise required to finish statutory reviews. Private companies are commonly absolved. Organizations must meet specific size and worker base—for the most part under 50 representatives—to be excluded from a review.

-

Instances of Statutory Audits

State law may necessitate that all districts submit to a yearly statutory review. This may involve looking at all records and monetary exchanges, and making the review results accessible to the general population. The object is to consider the neighborhood government responsible for how it goes through citizens’ cash. Numerous administration organizations take an interest in standard reviews. This guarantees any assets dispensed by the bigger legislative element, for example, at the government or state level, have been utilized fittingly and as per any related laws or necessities for their utilization.

It is likewise basic for worldwide organizations to have some outside governments that expect access to the aftereffects of a statutory review. For instance, accept that XYZ Corp is situated in the United States yet works together normally and works branches in Europe. It might be legally necessary for a European nation to have a statutory review performed on those specialty units.