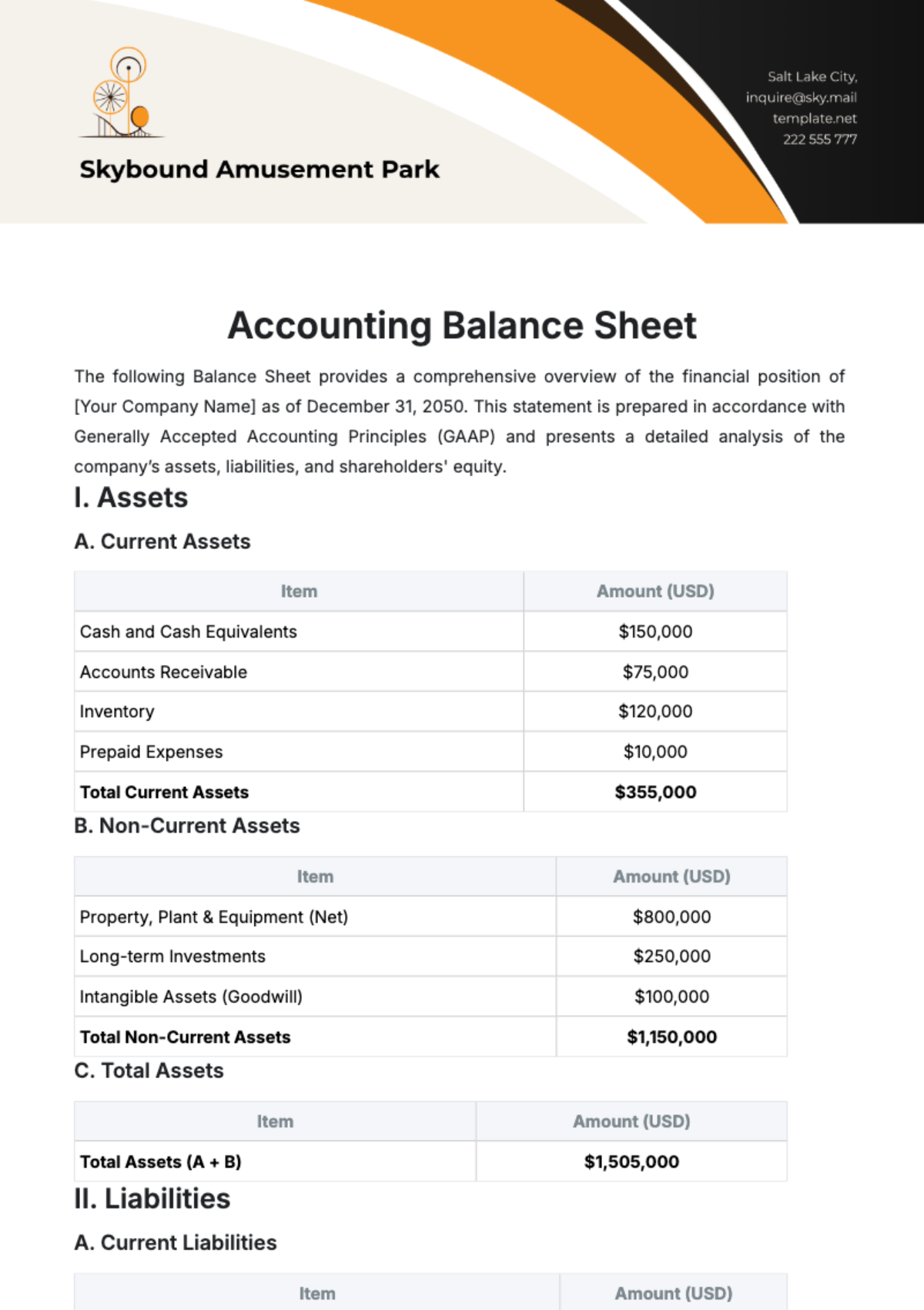

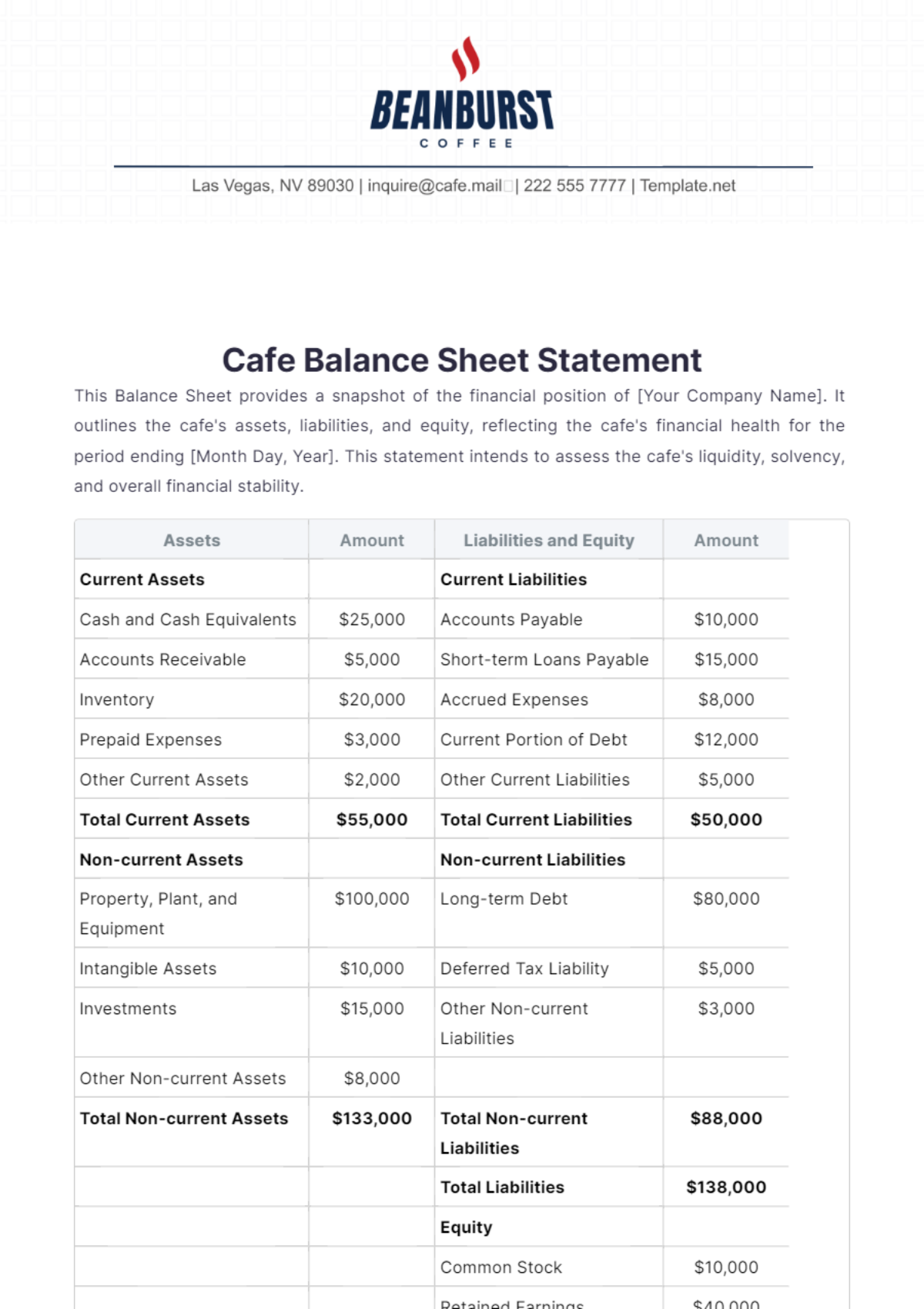

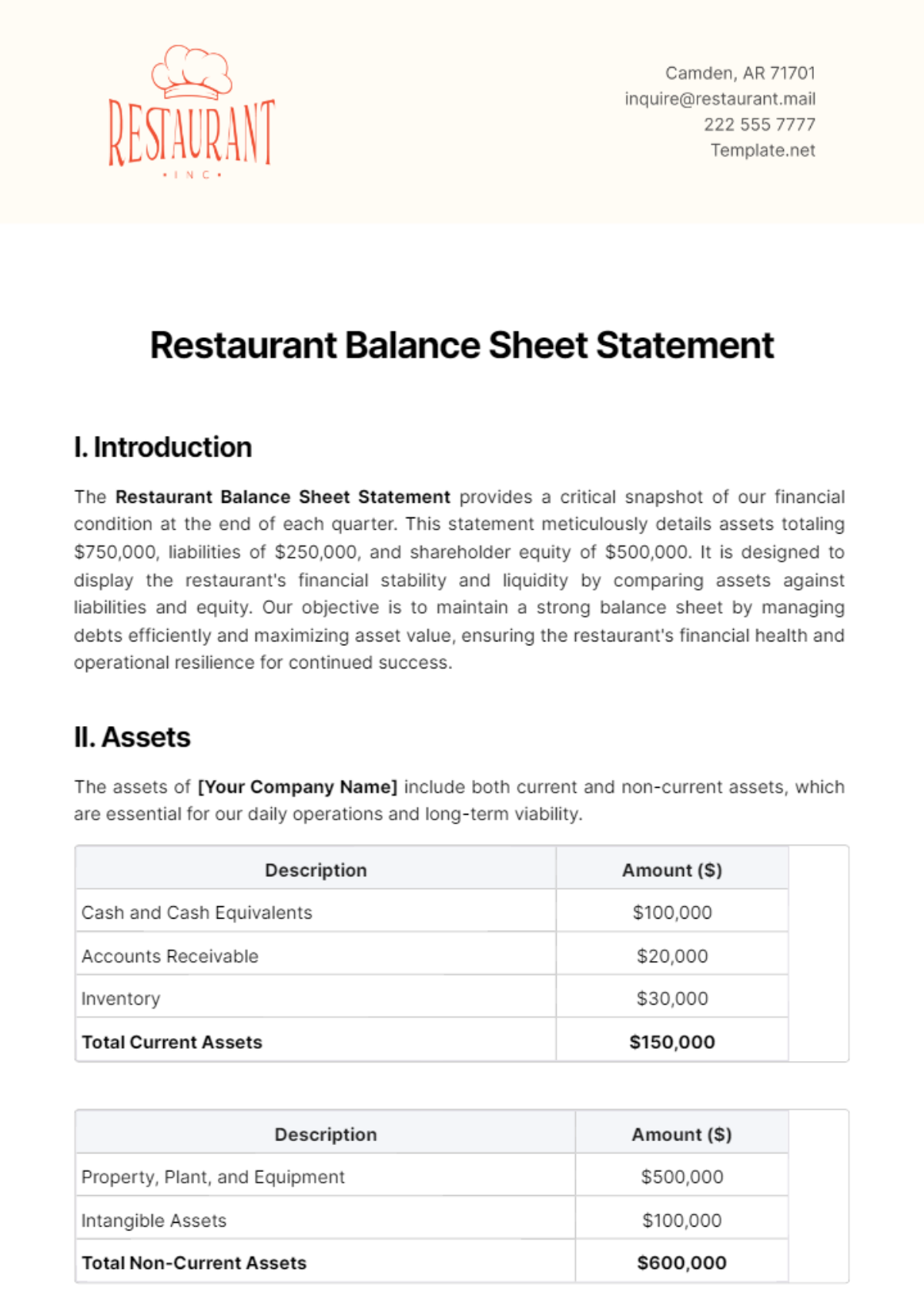

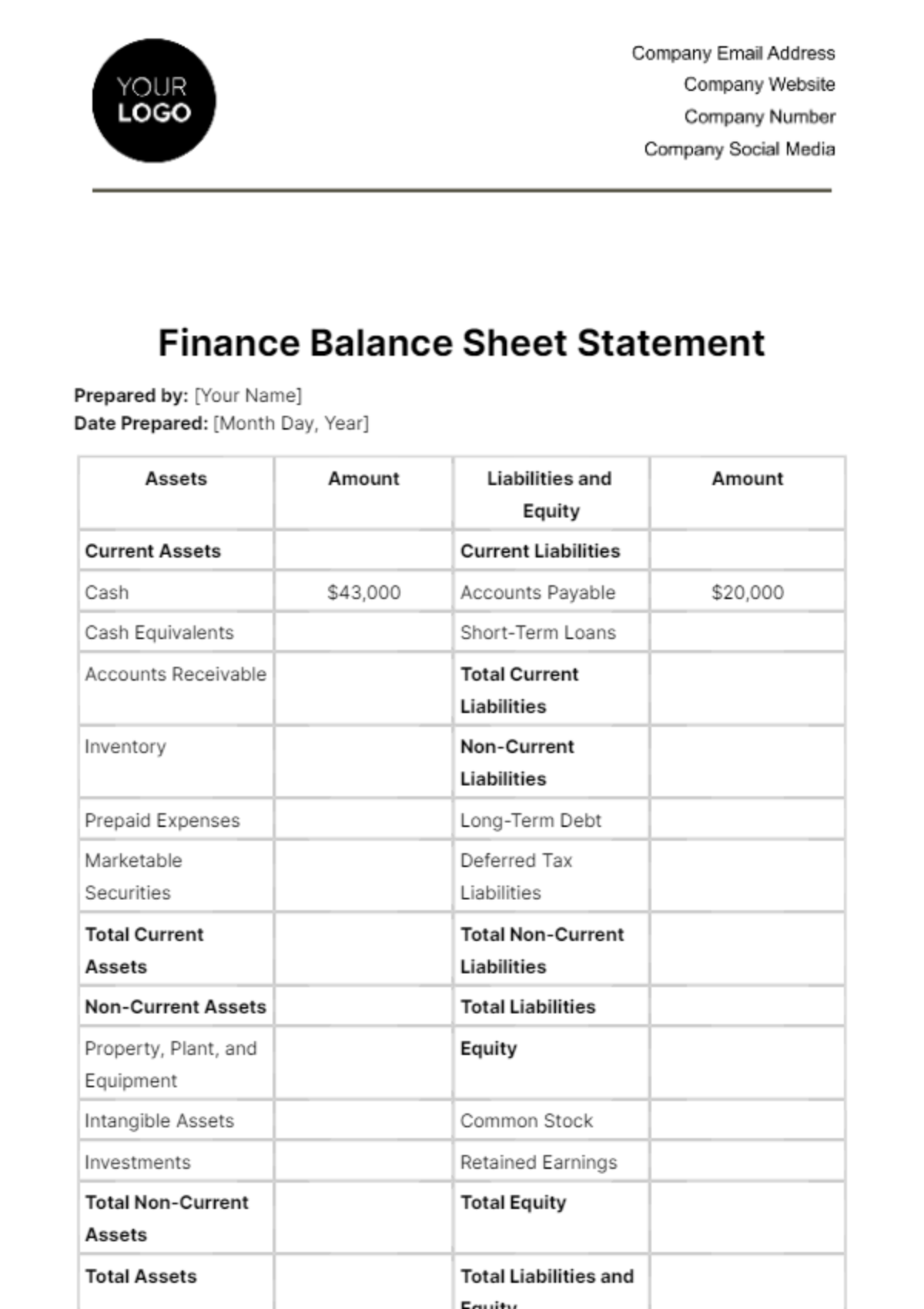

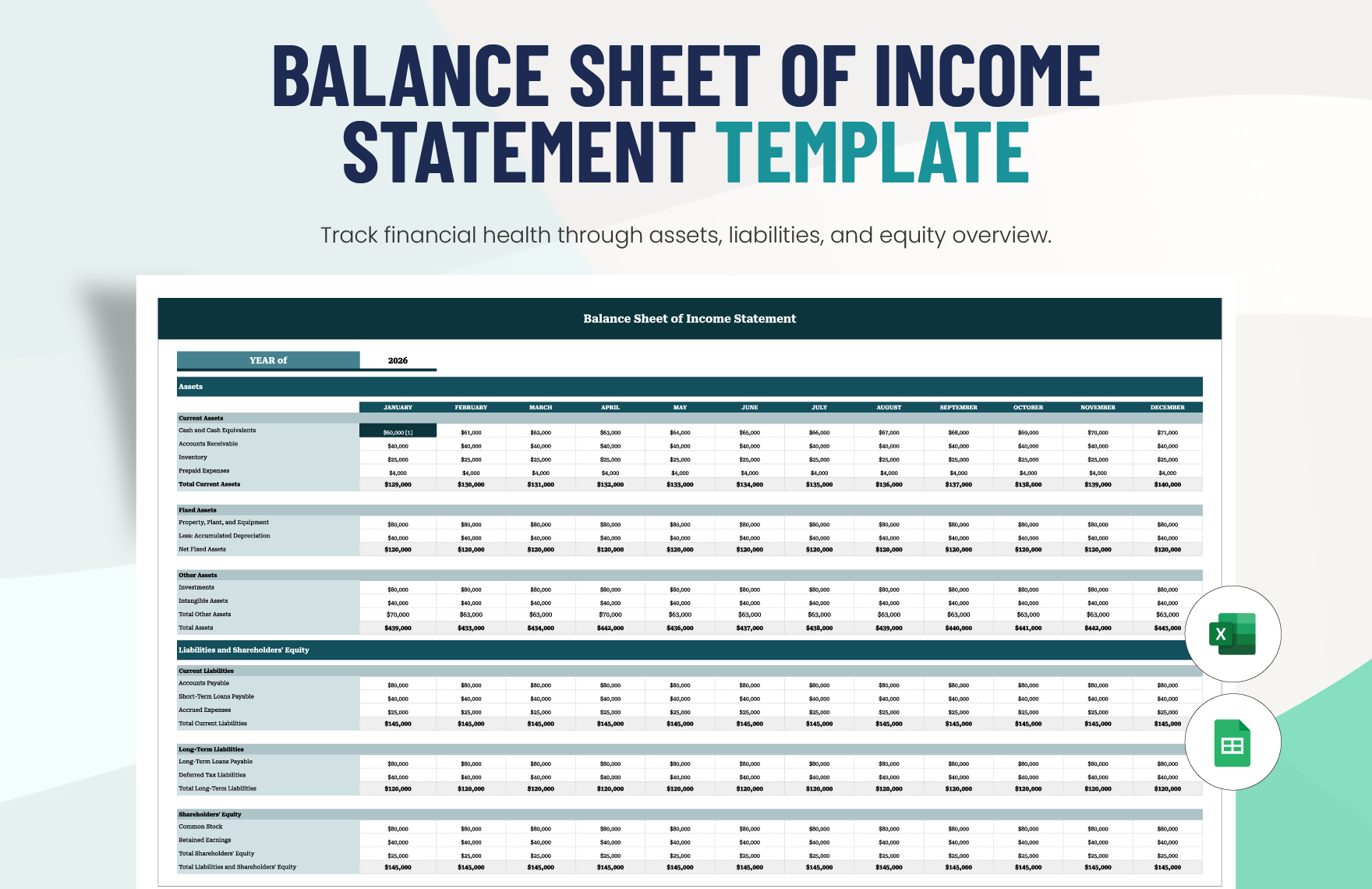

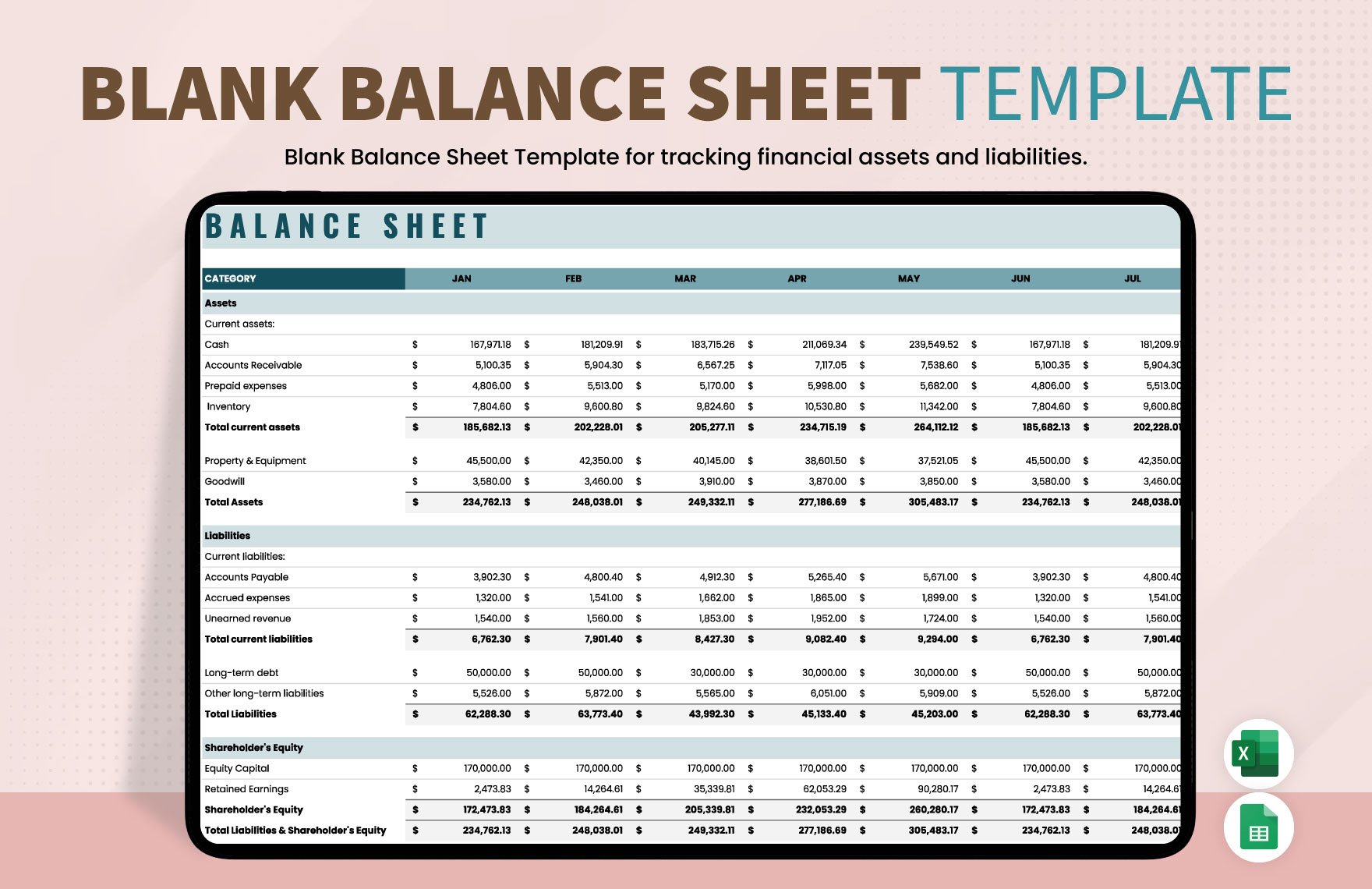

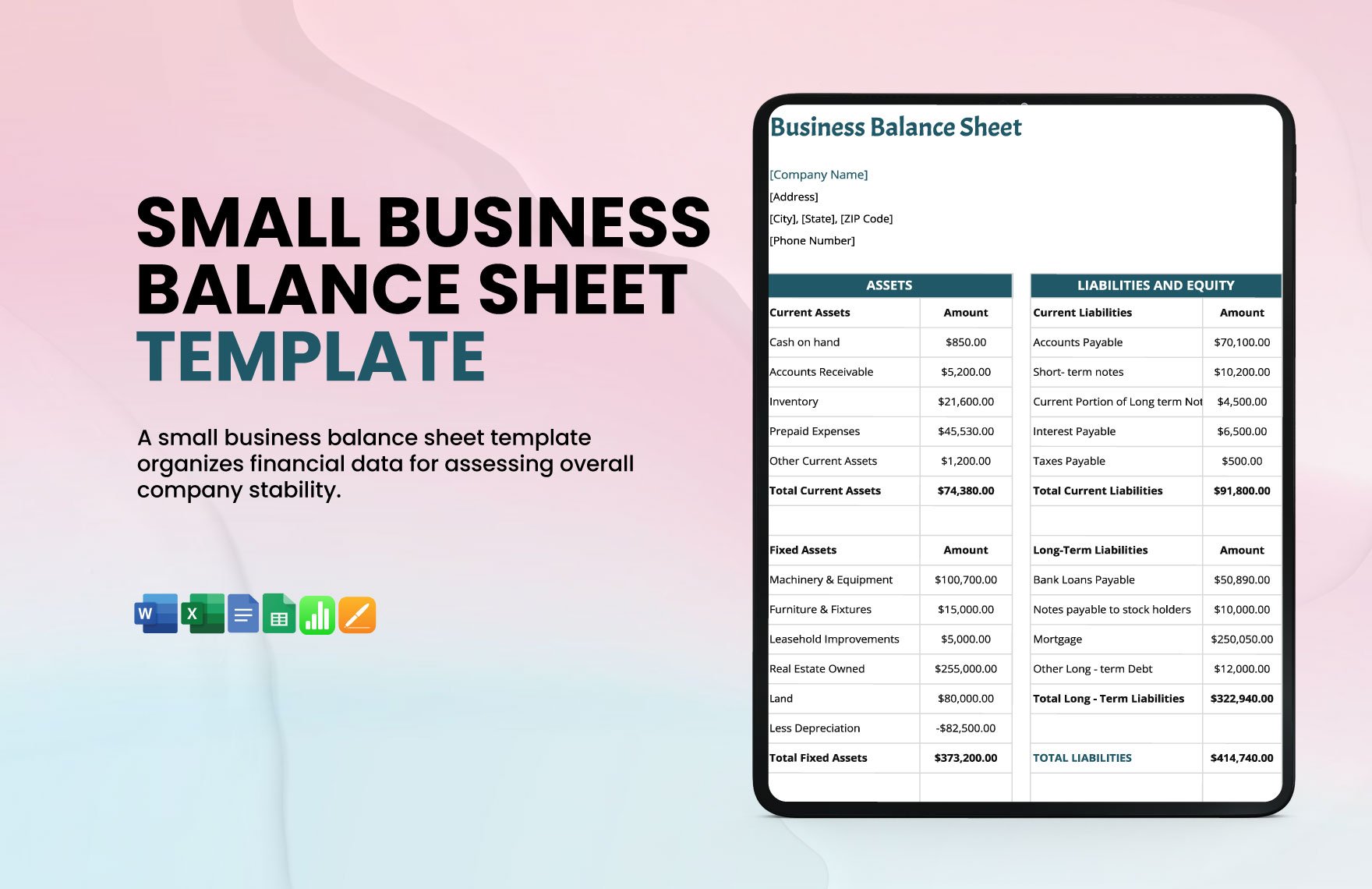

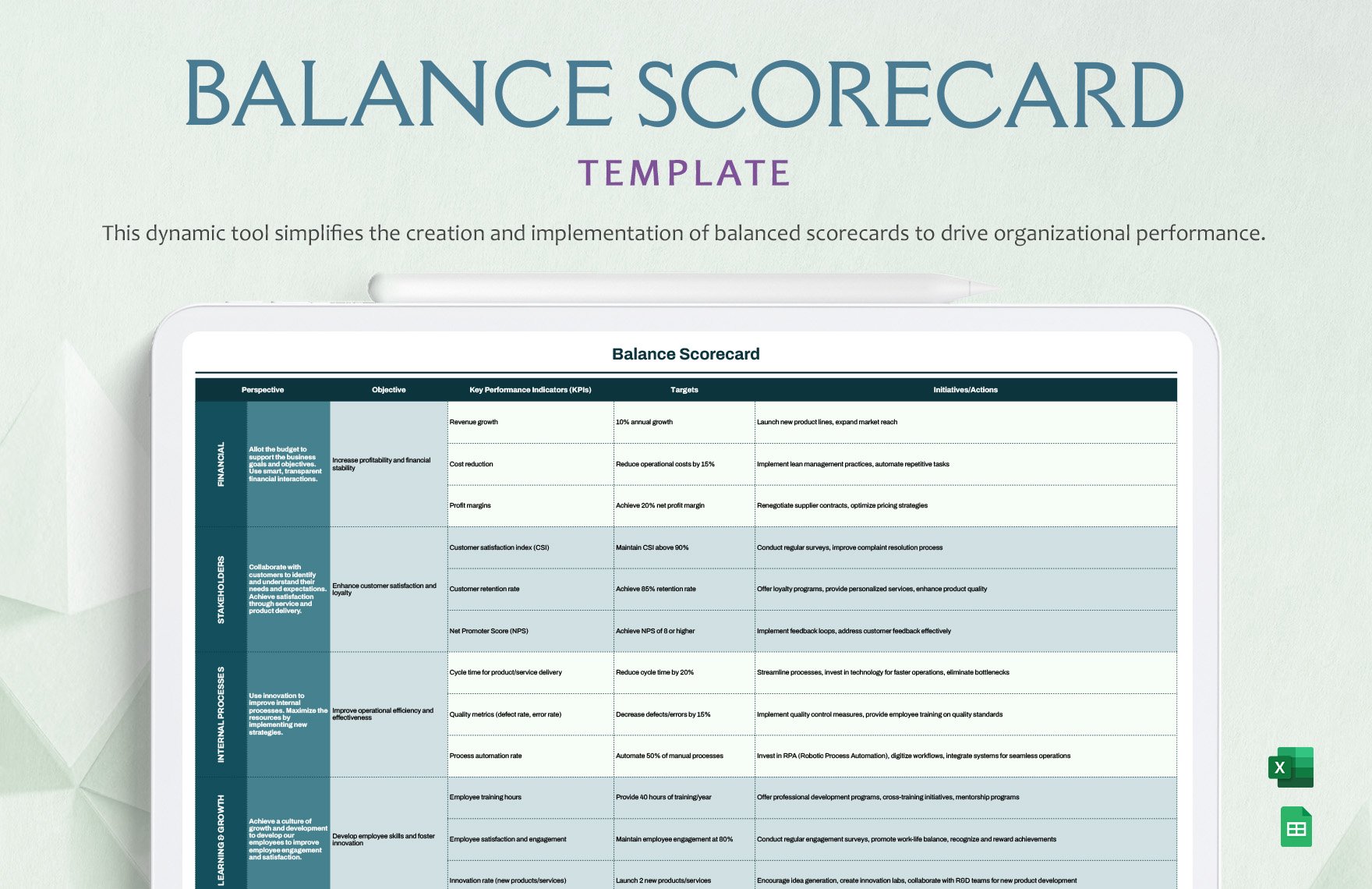

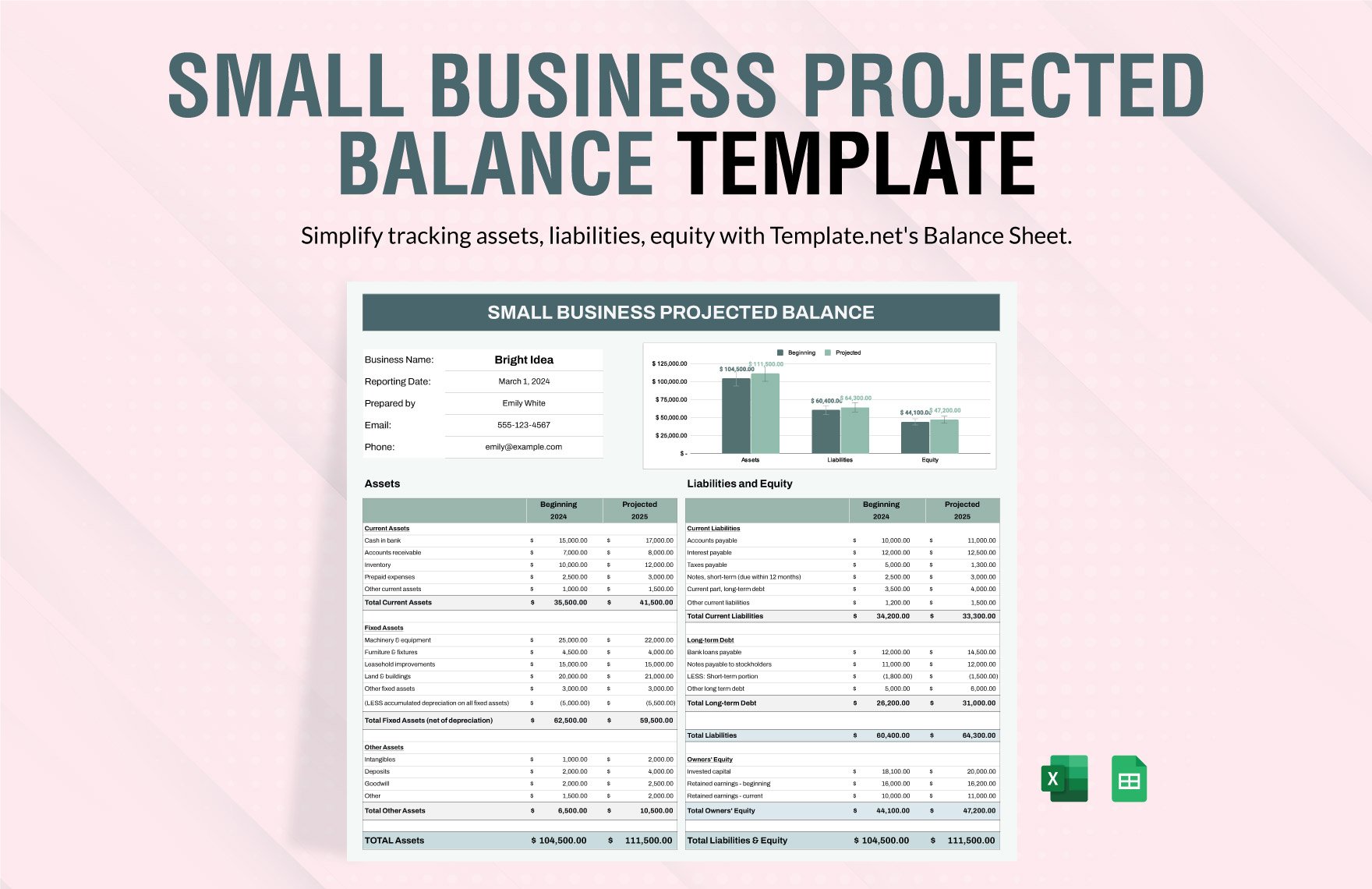

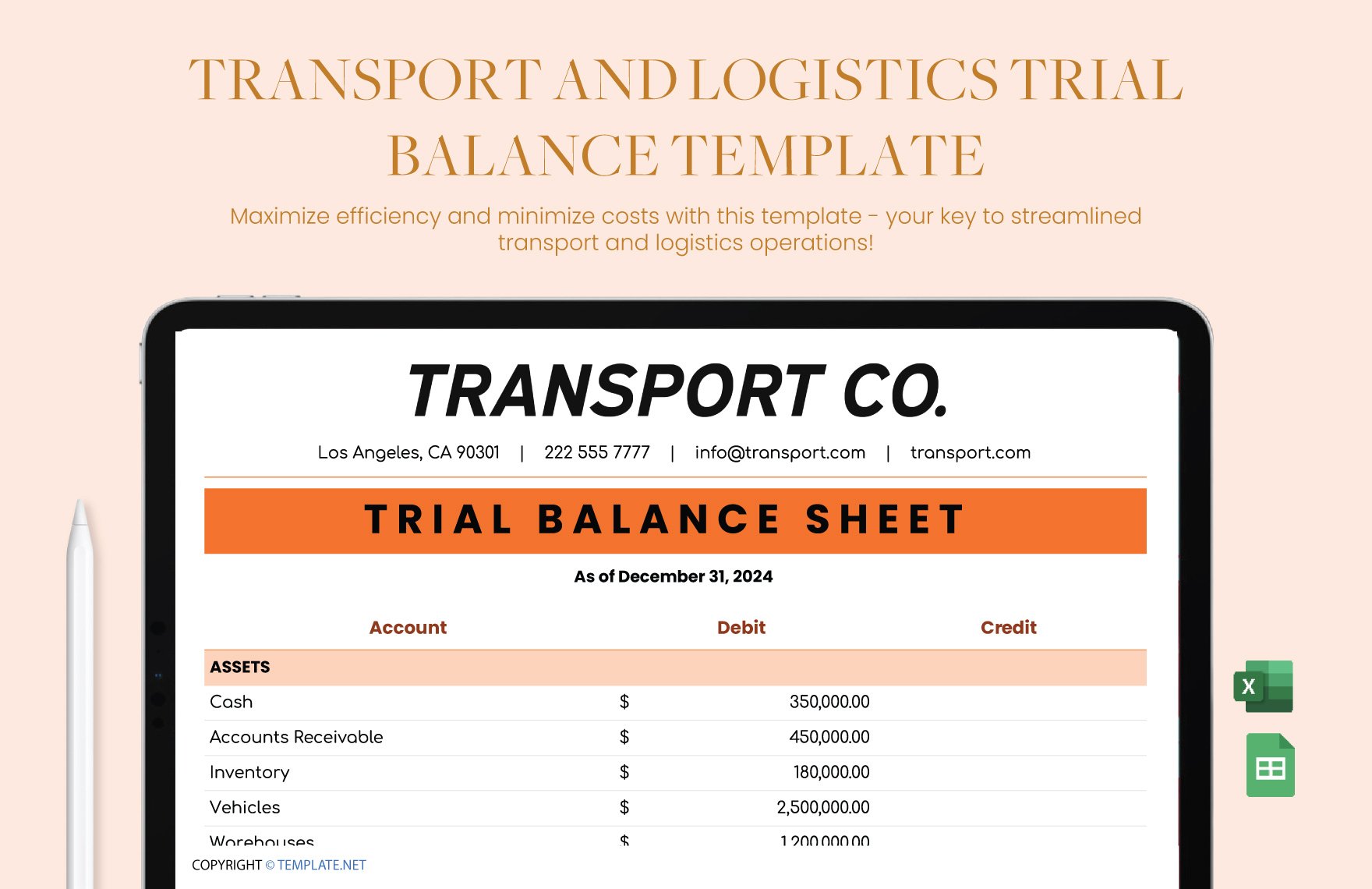

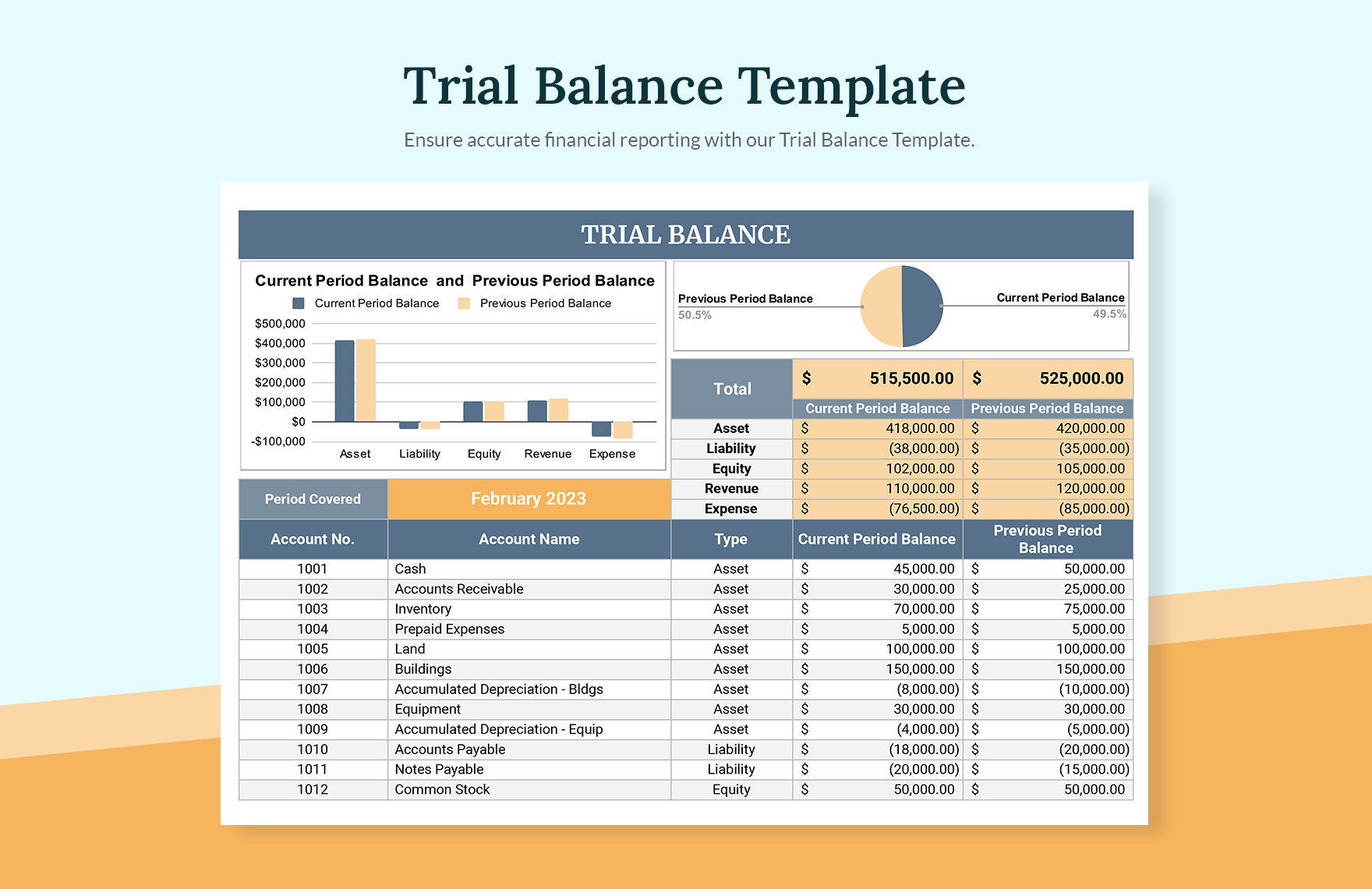

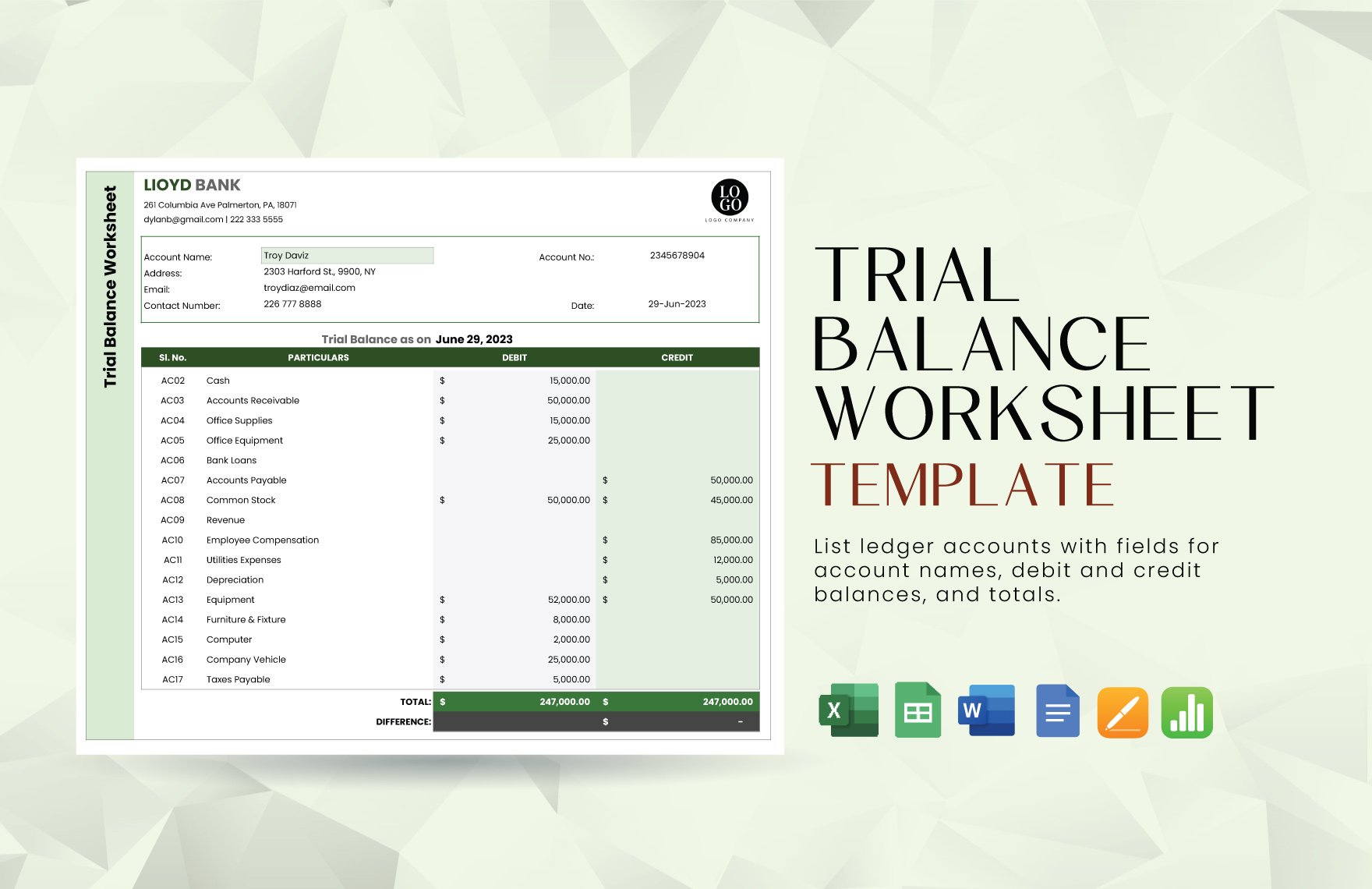

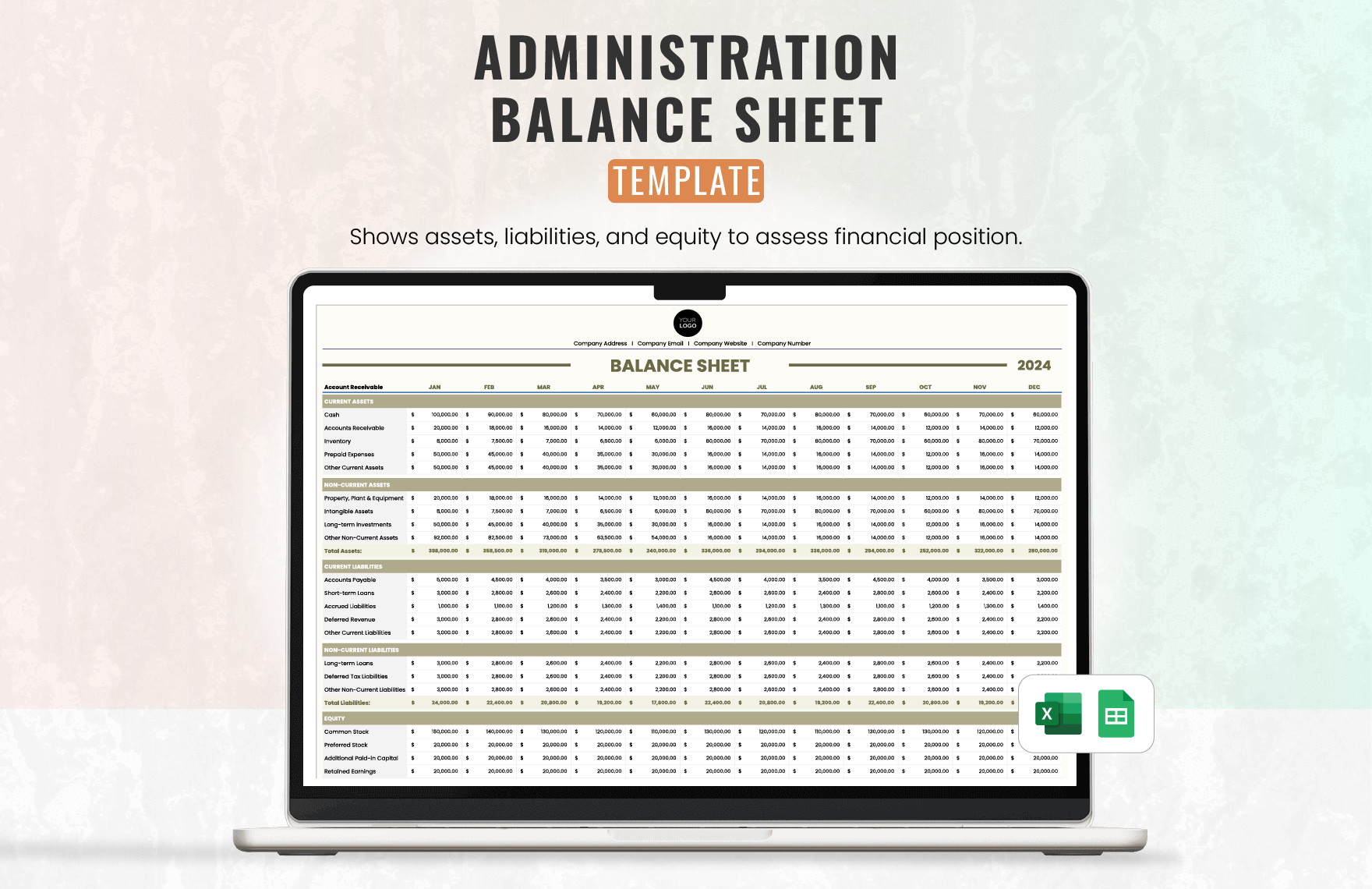

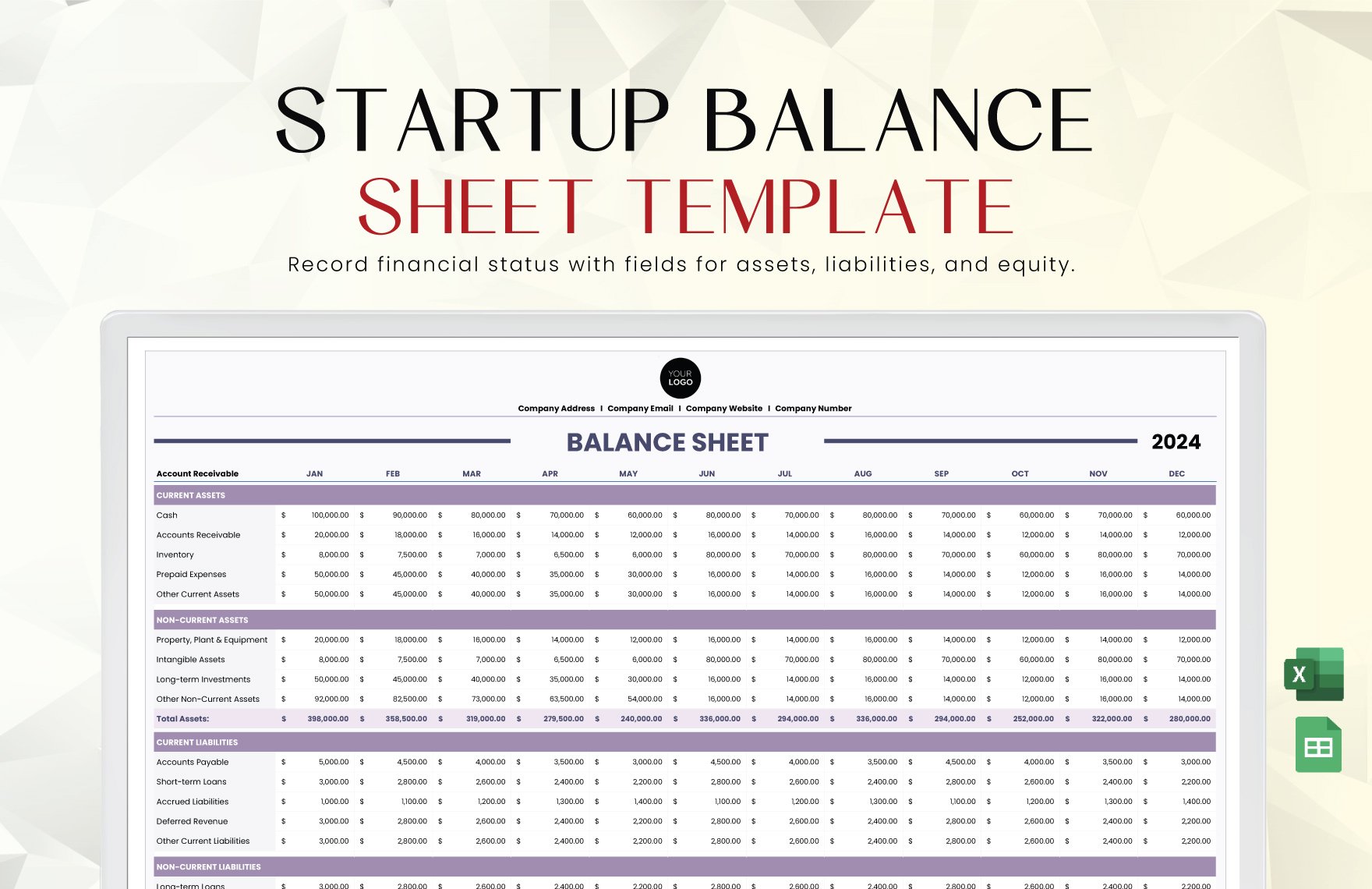

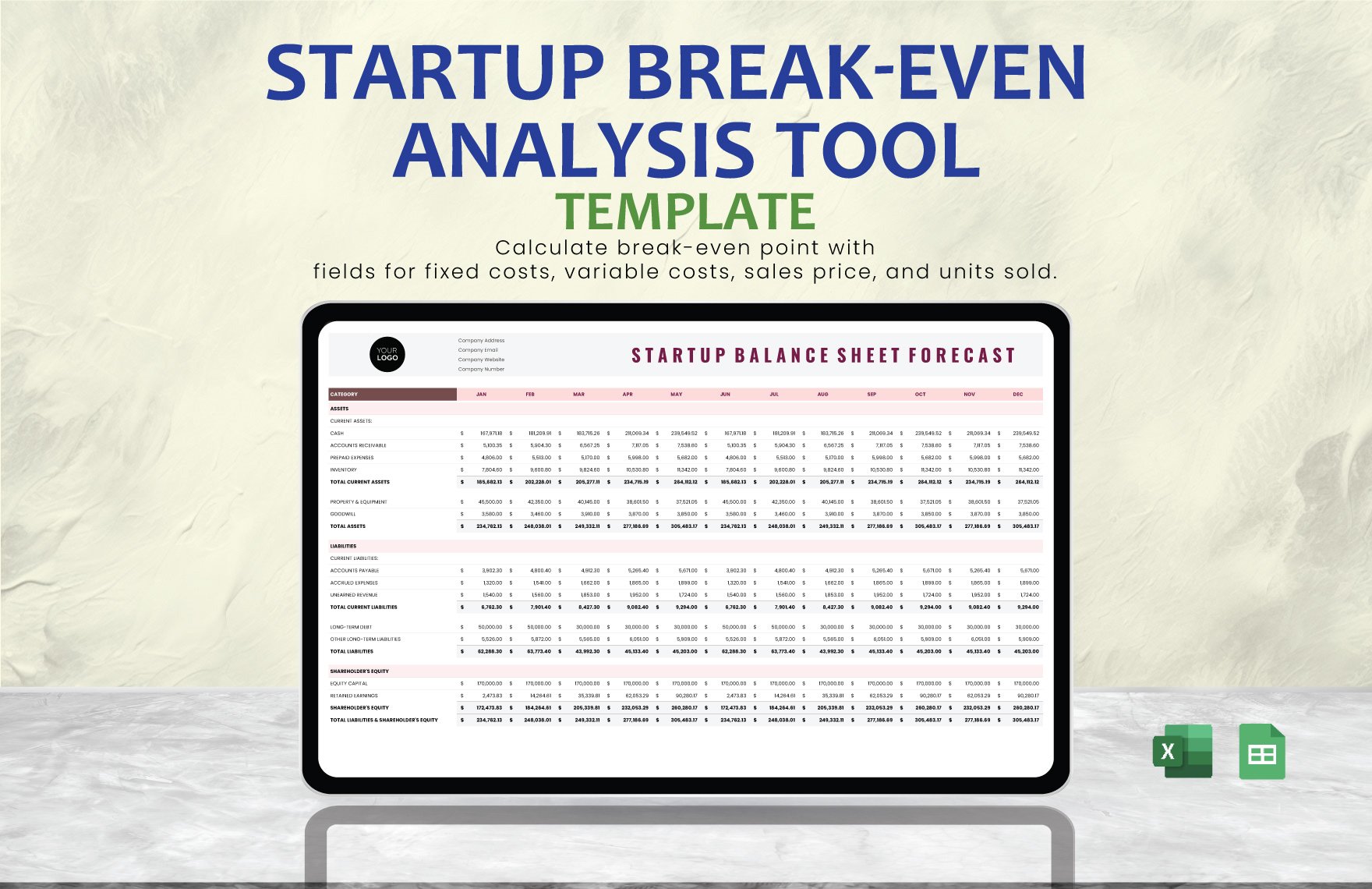

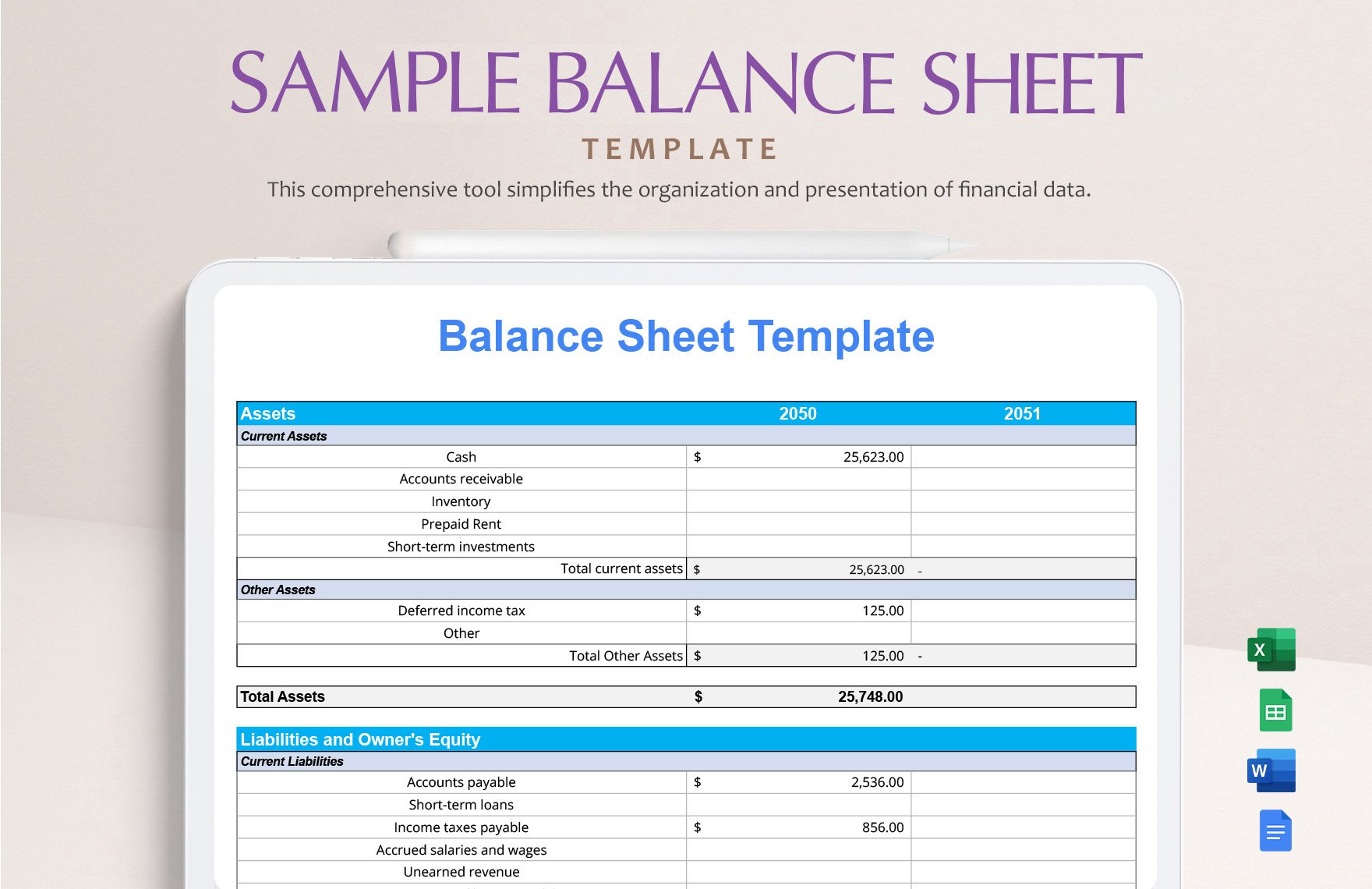

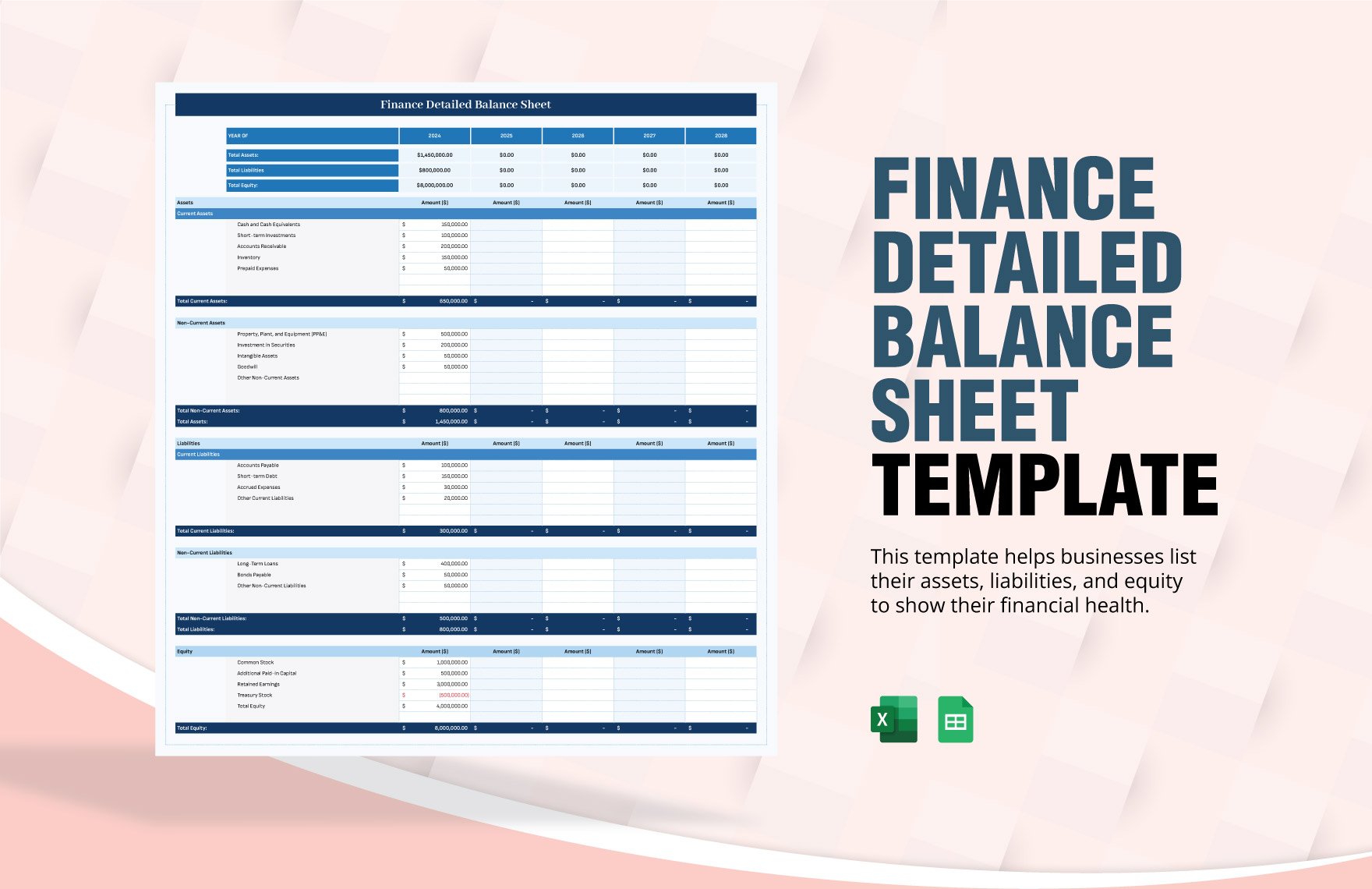

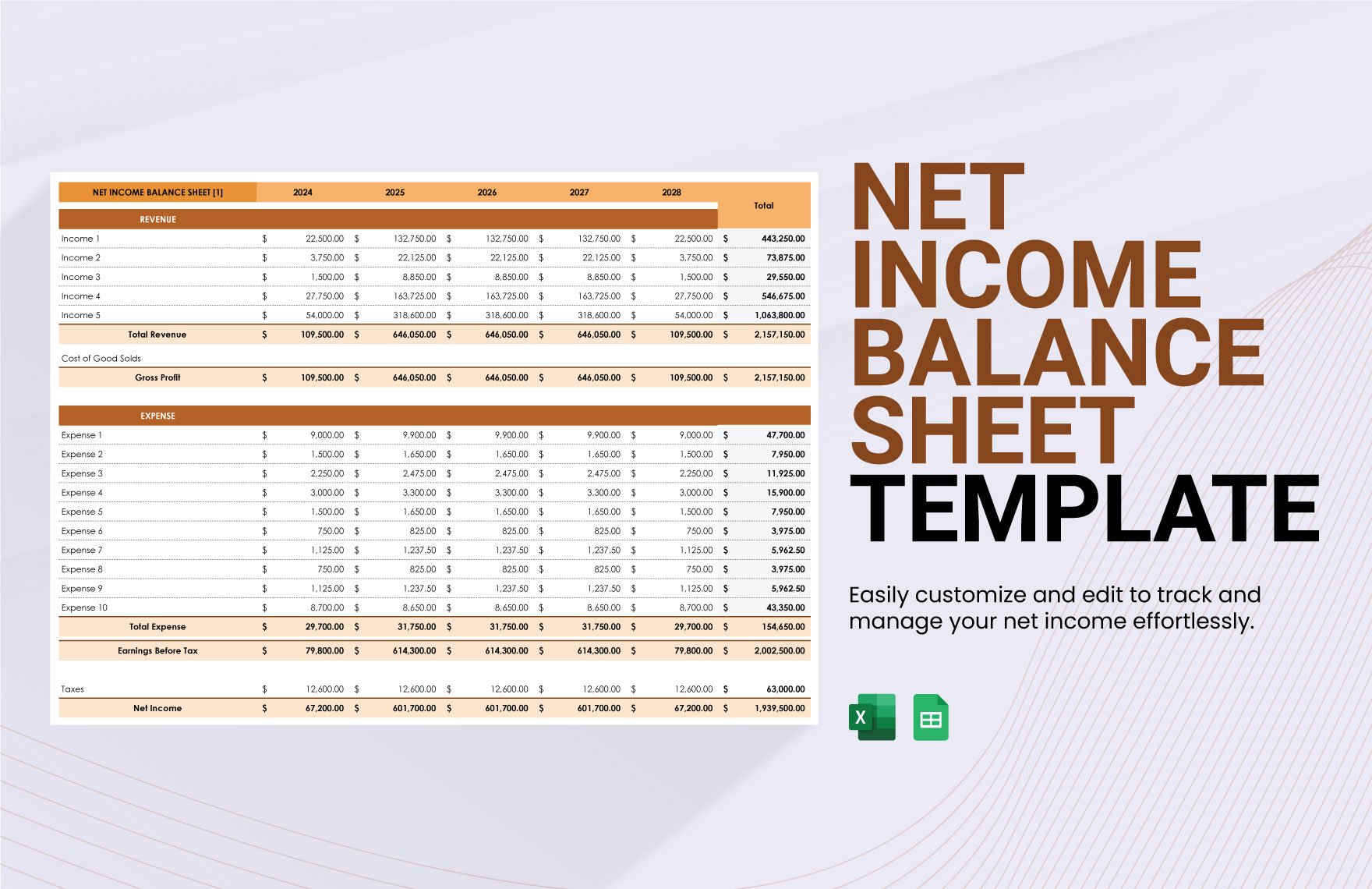

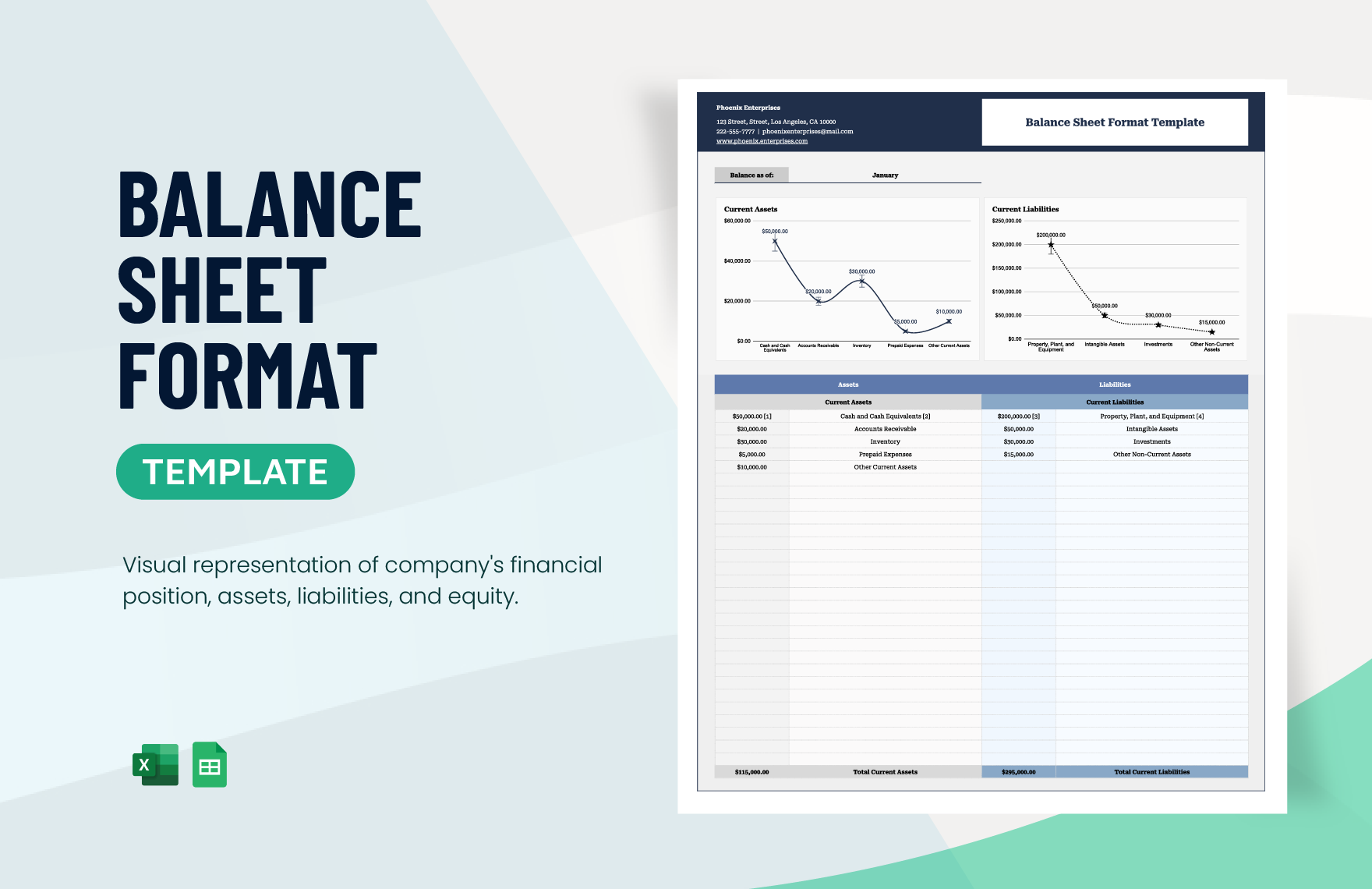

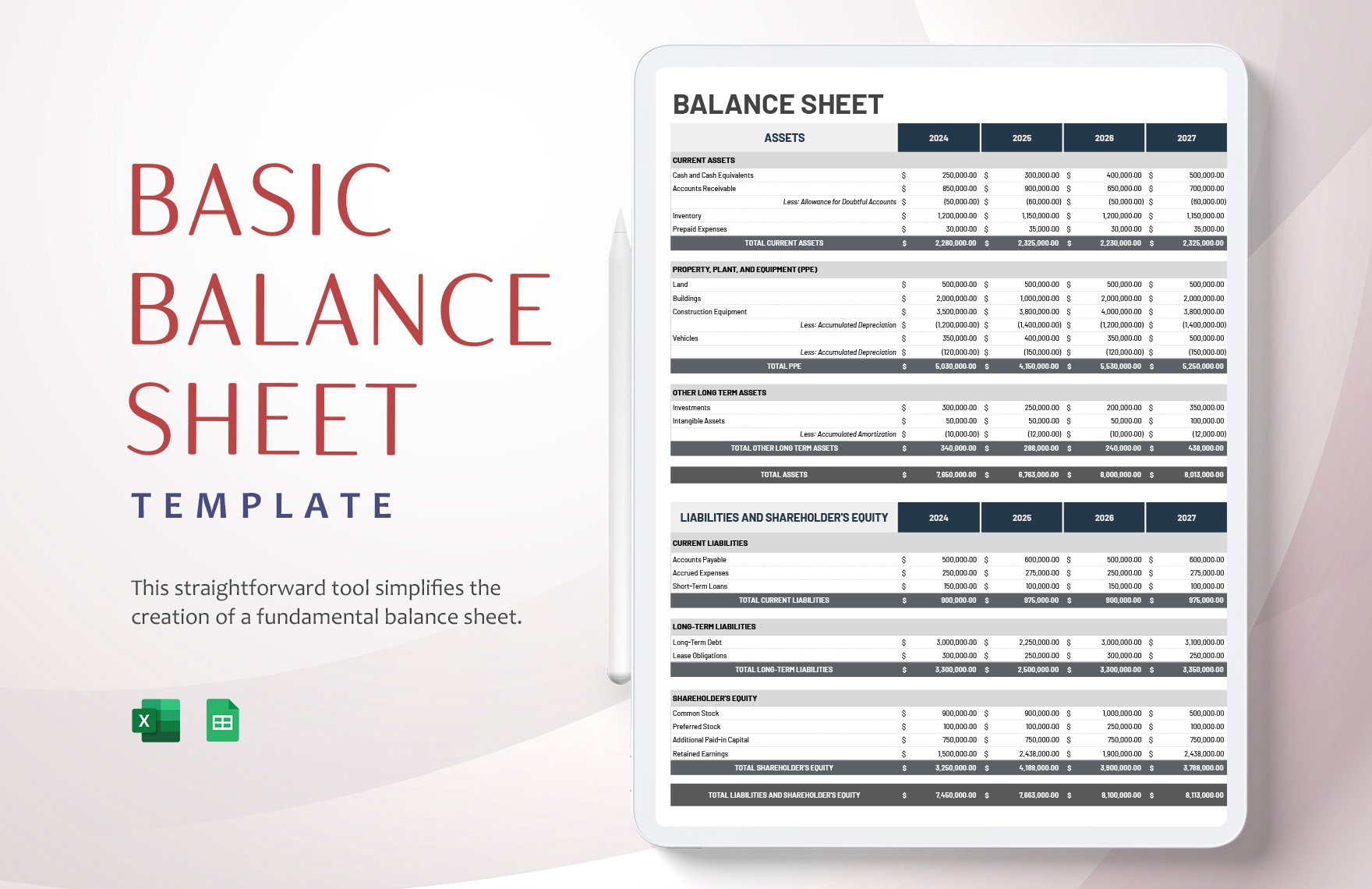

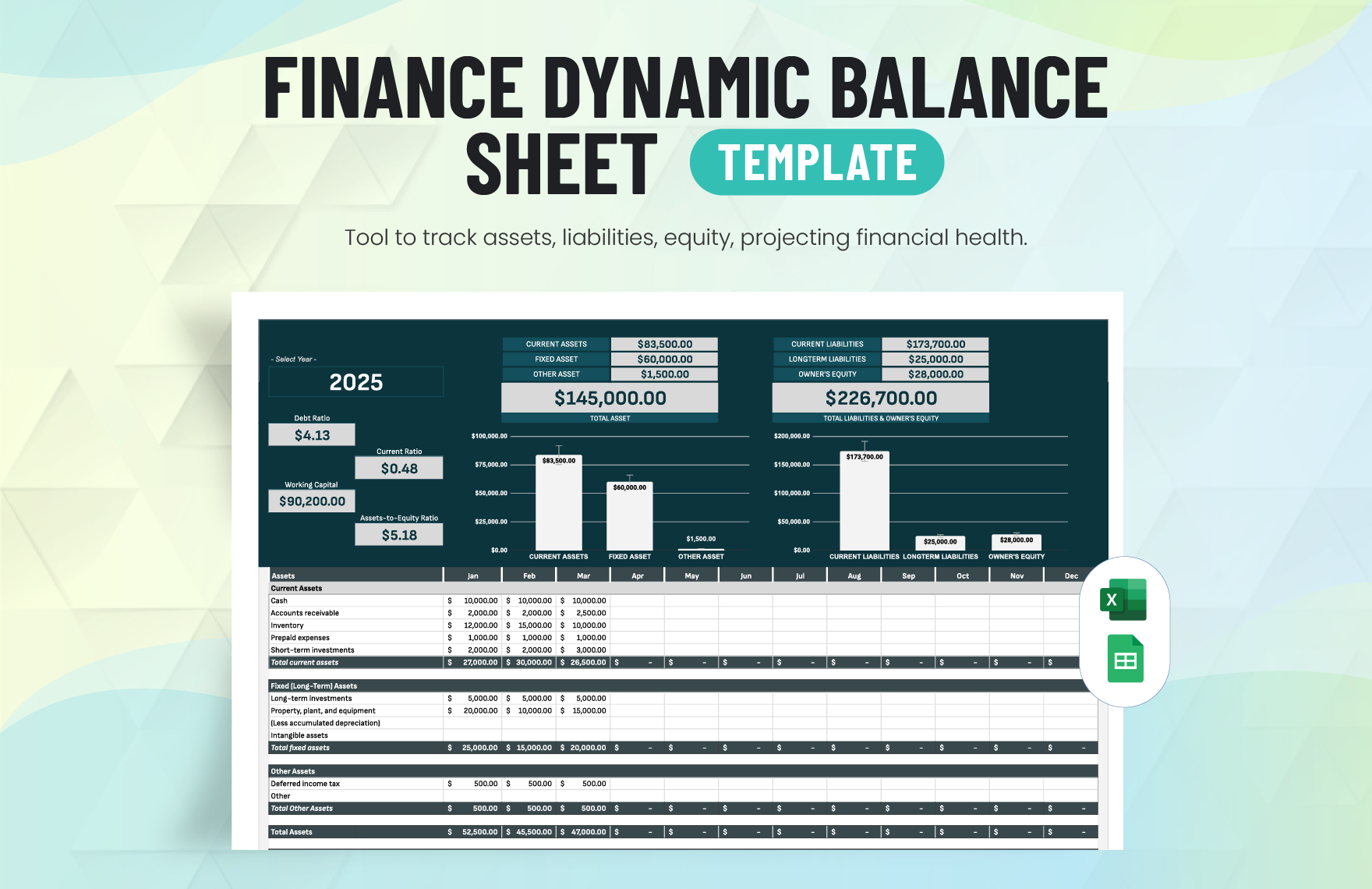

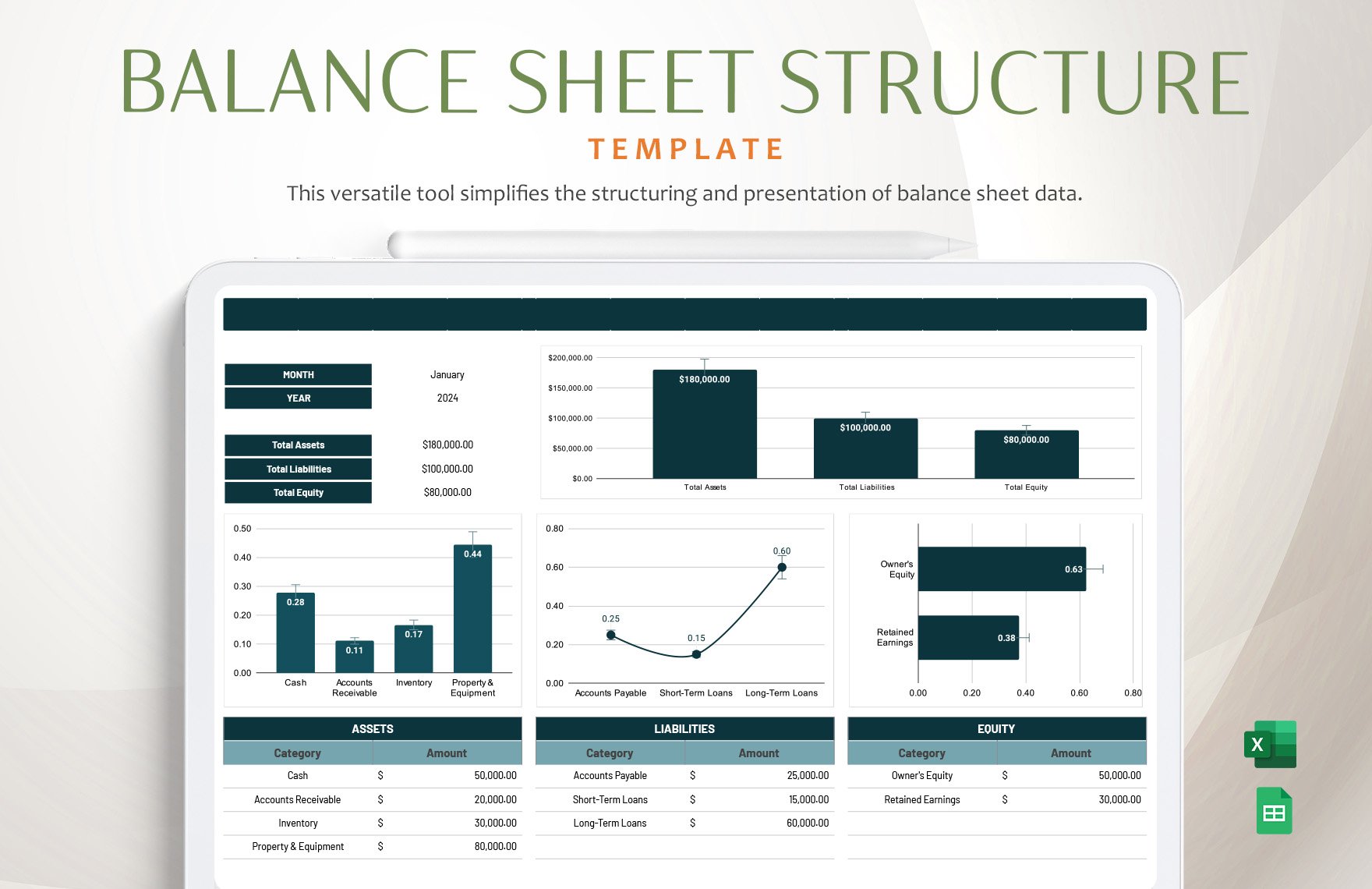

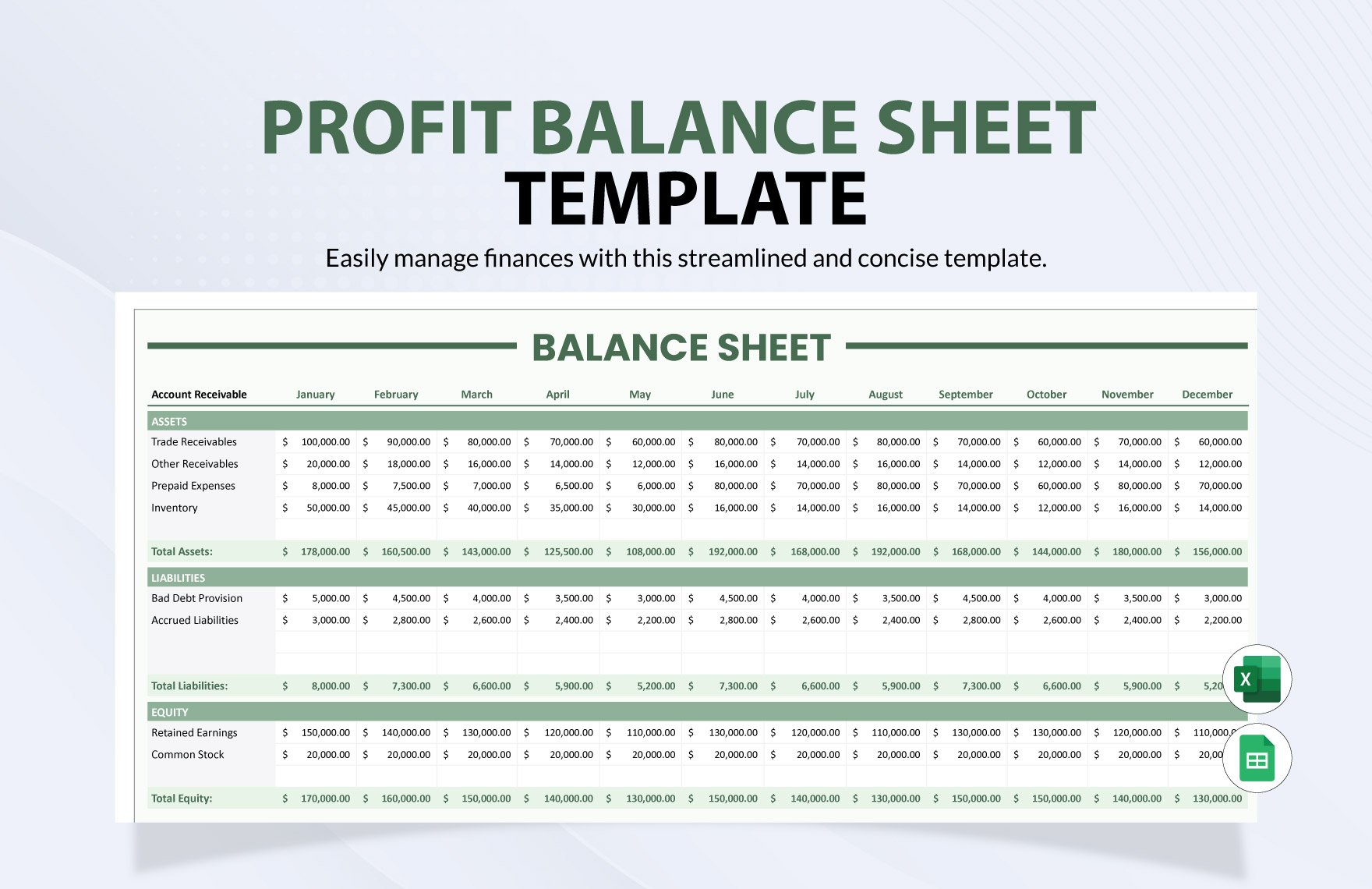

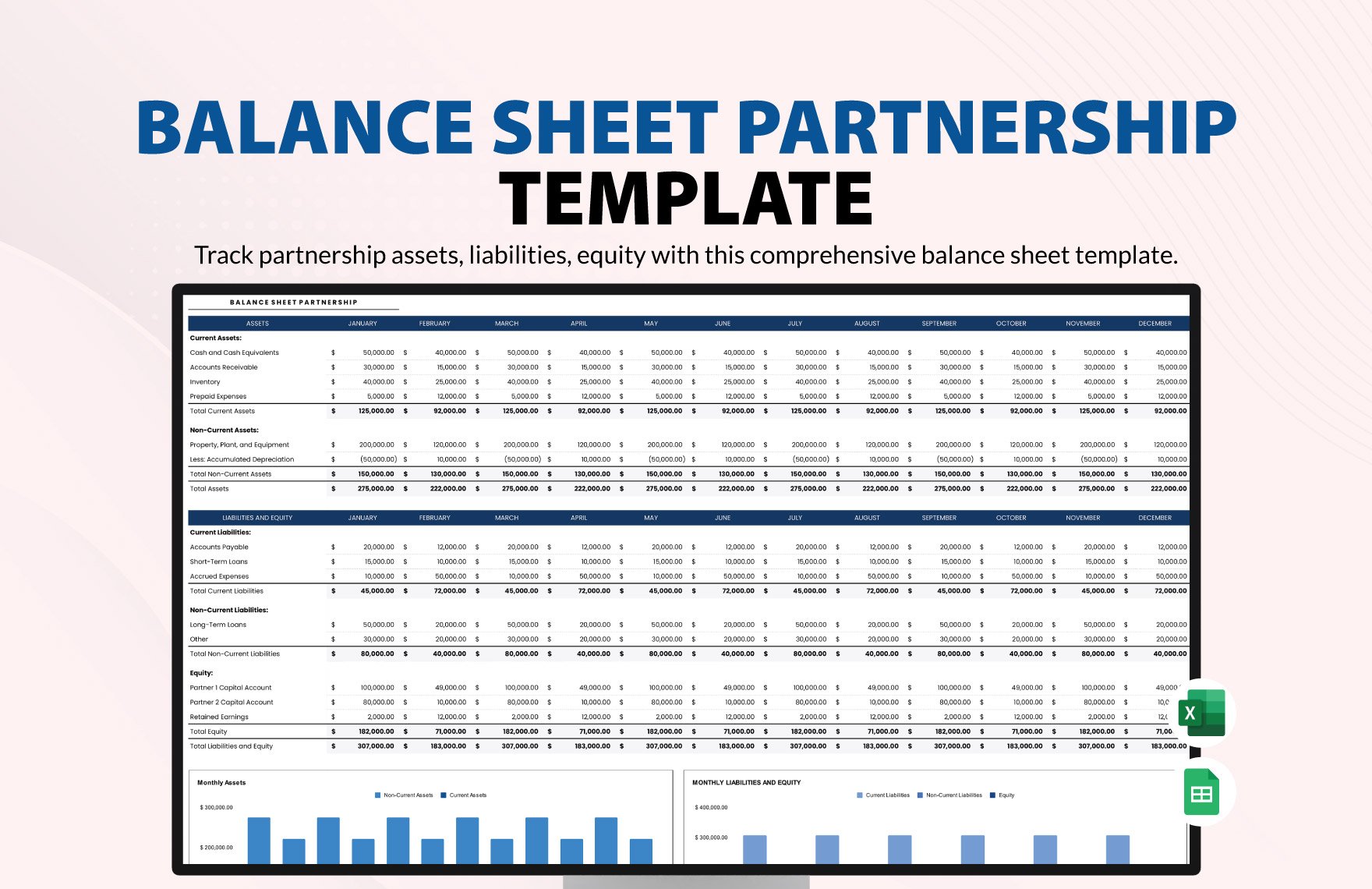

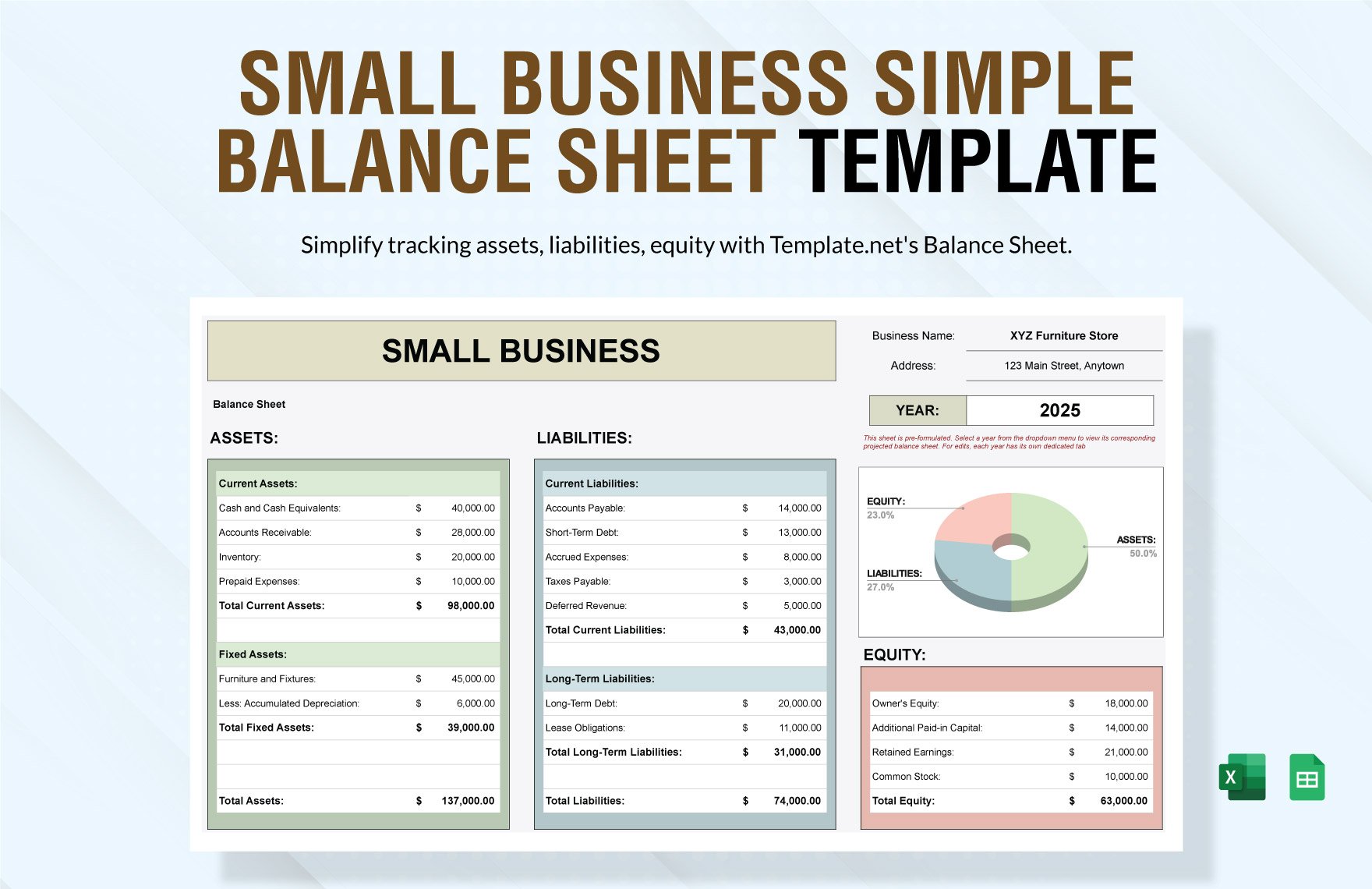

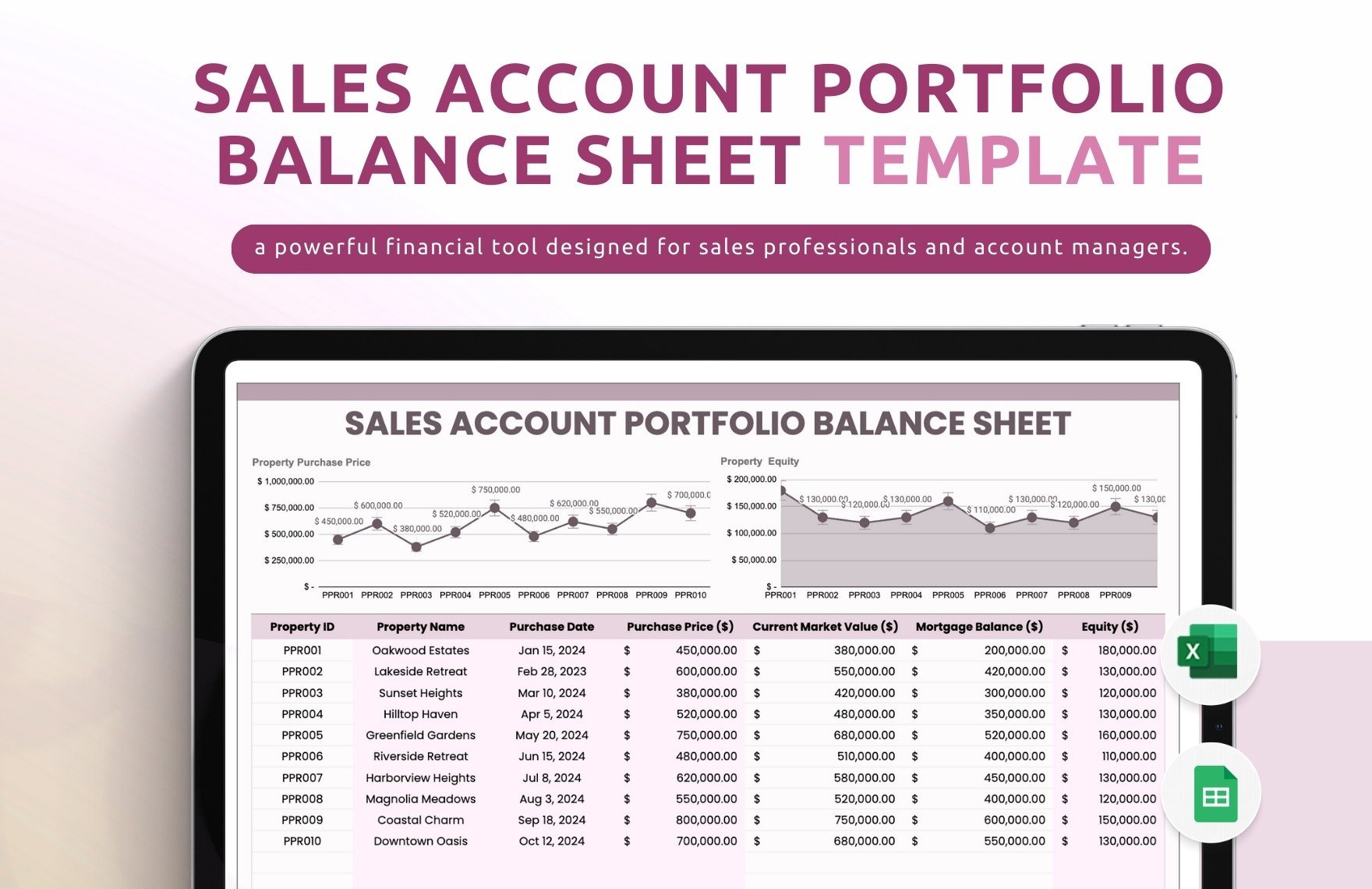

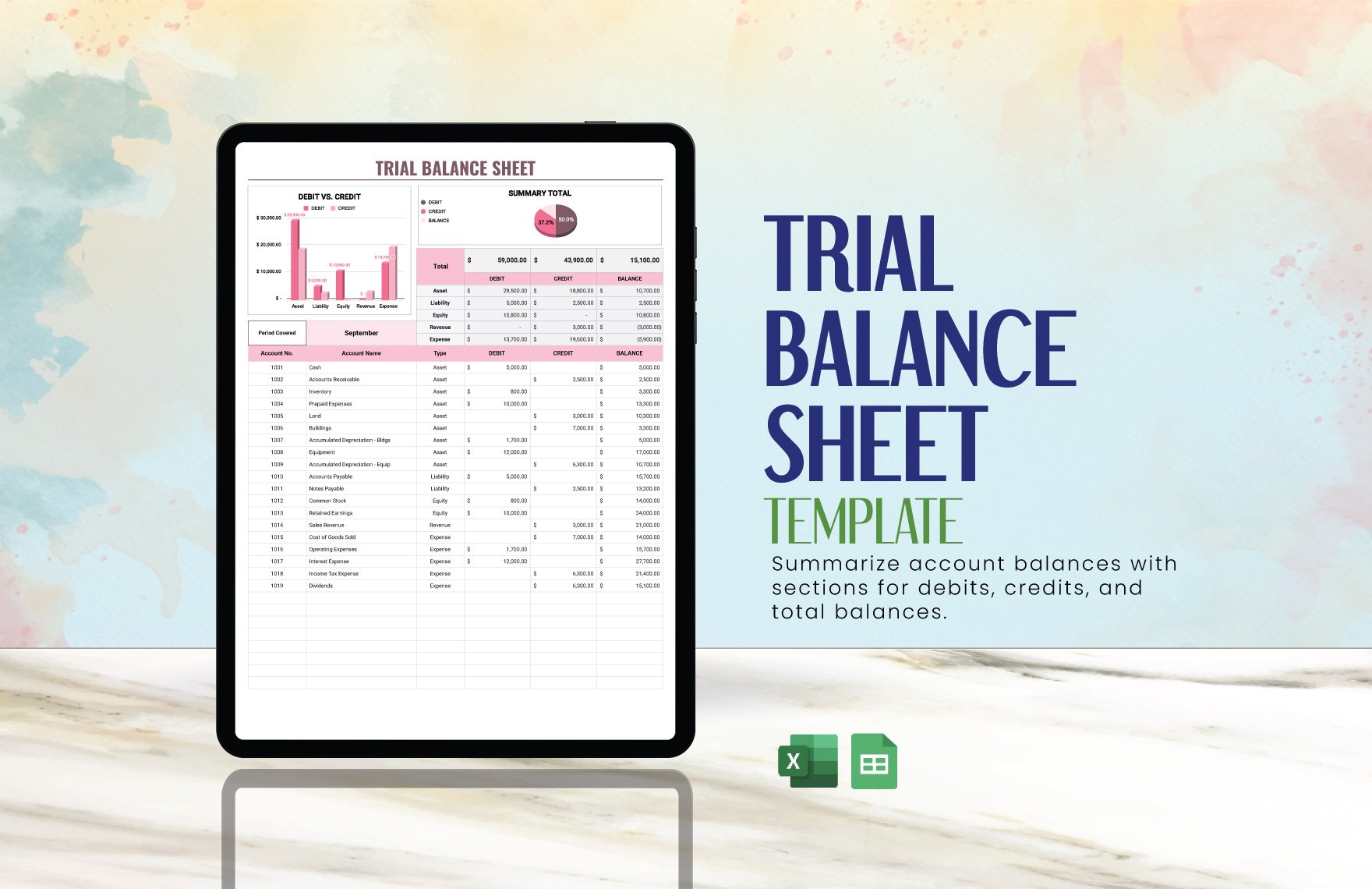

Bring your Financial Reporting to life with Balance Sheet Templates from Template.net.

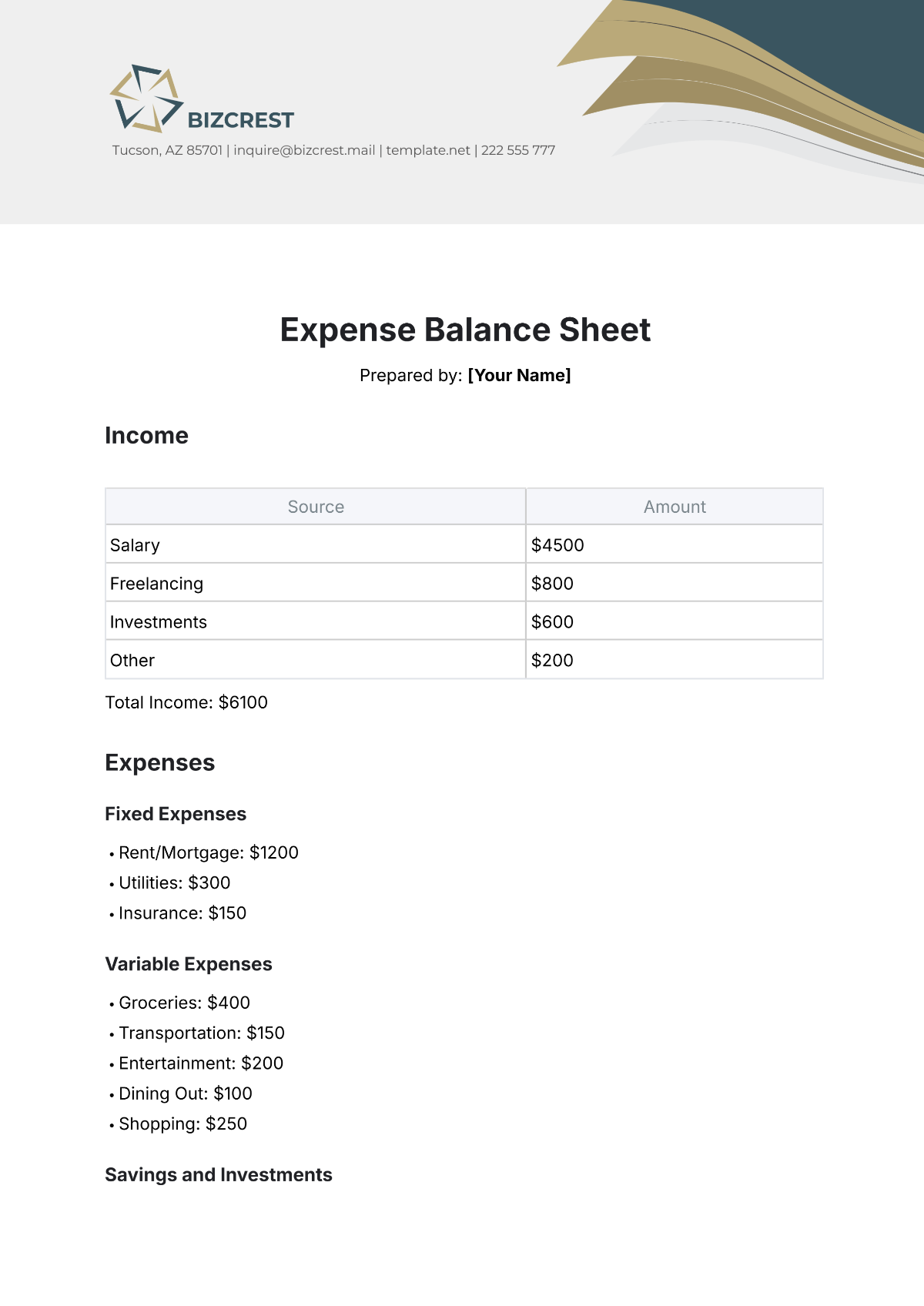

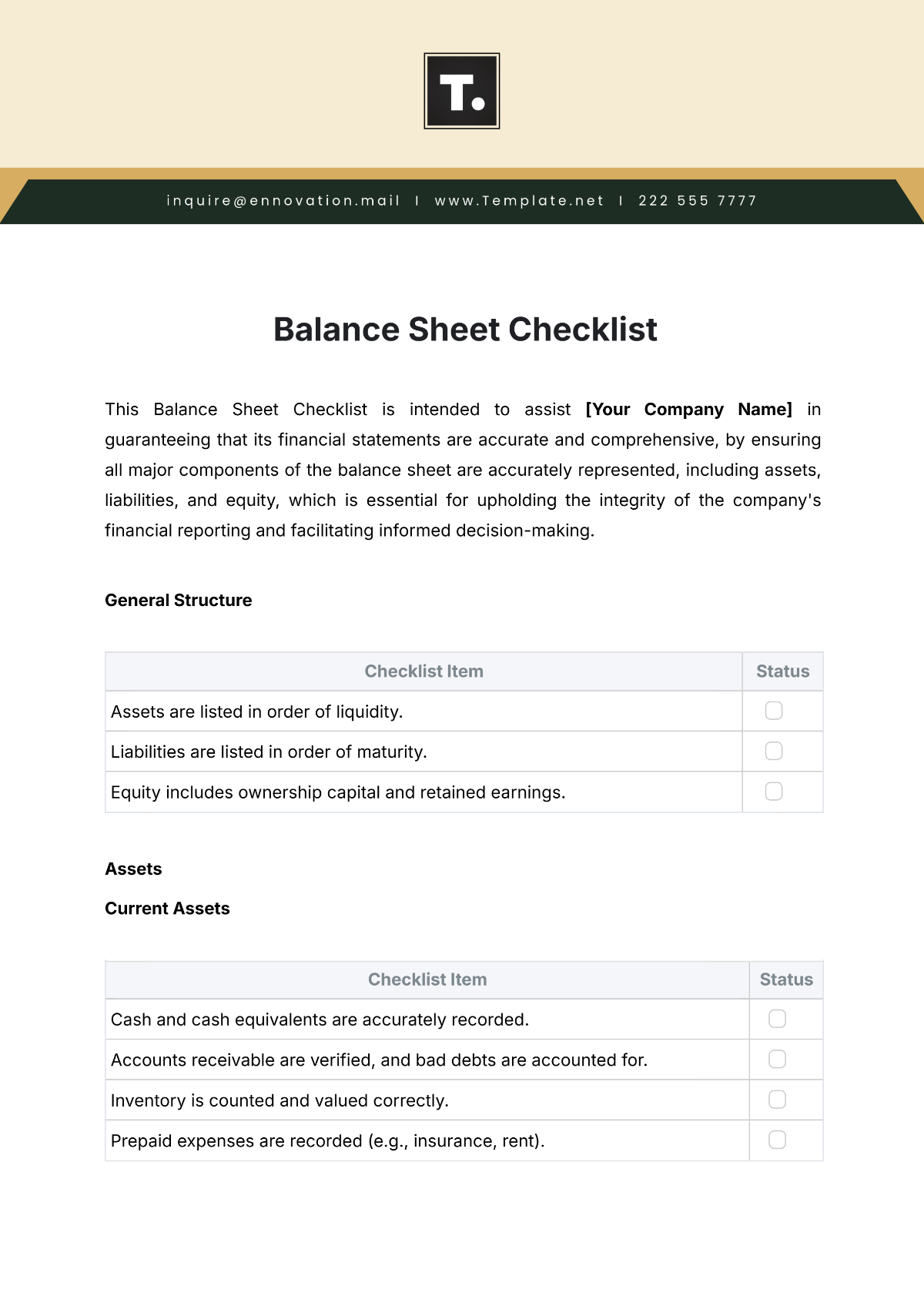

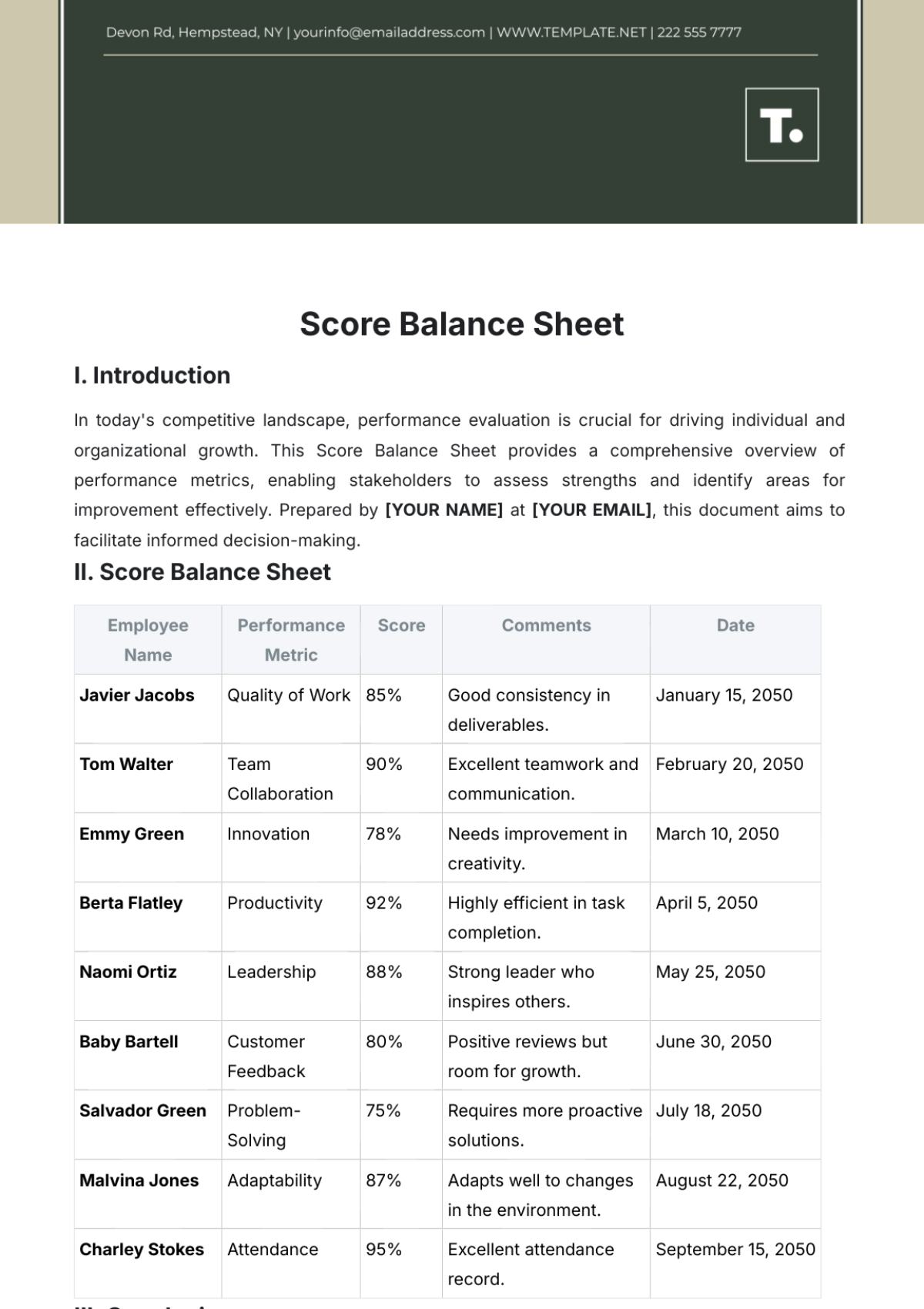

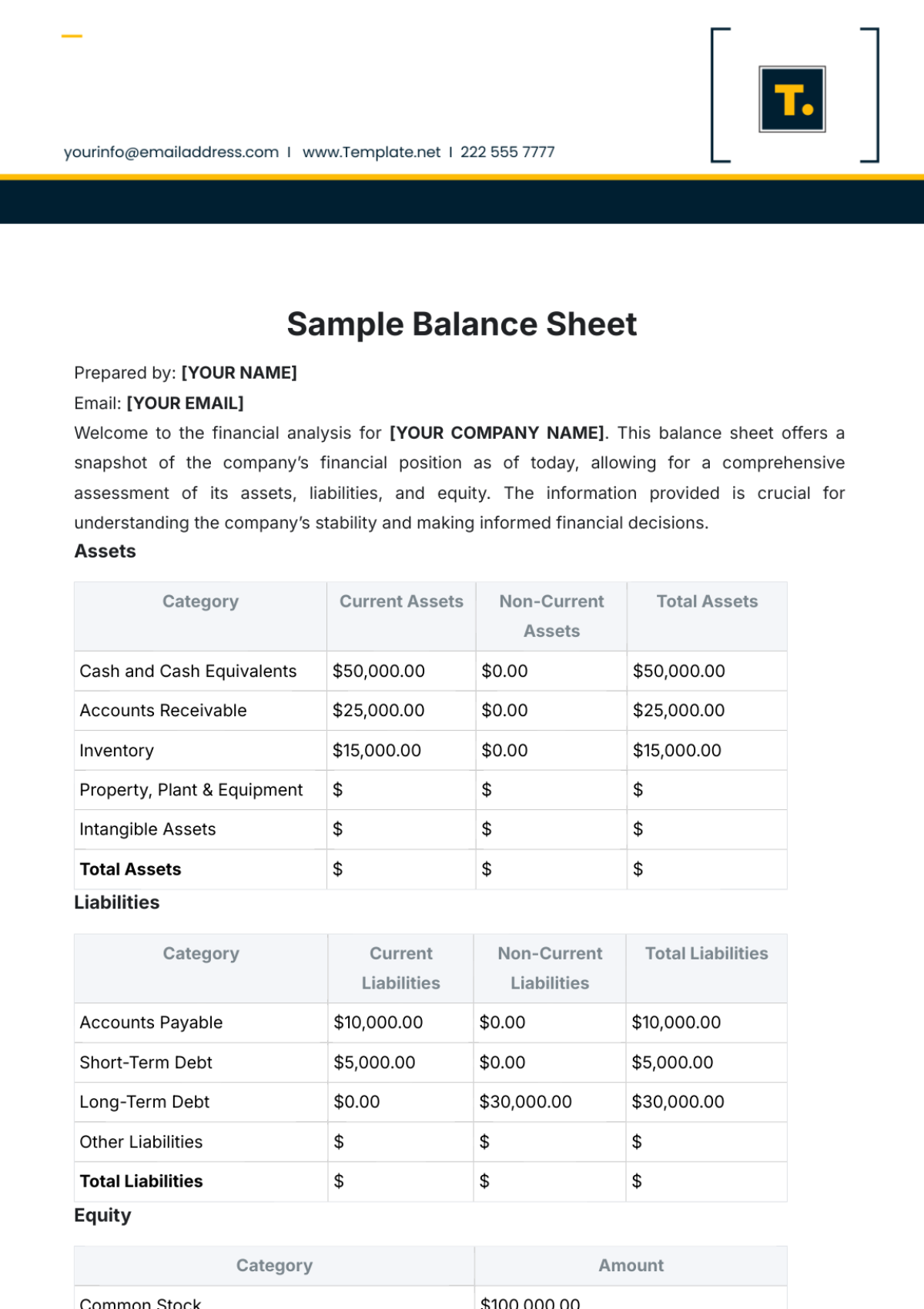

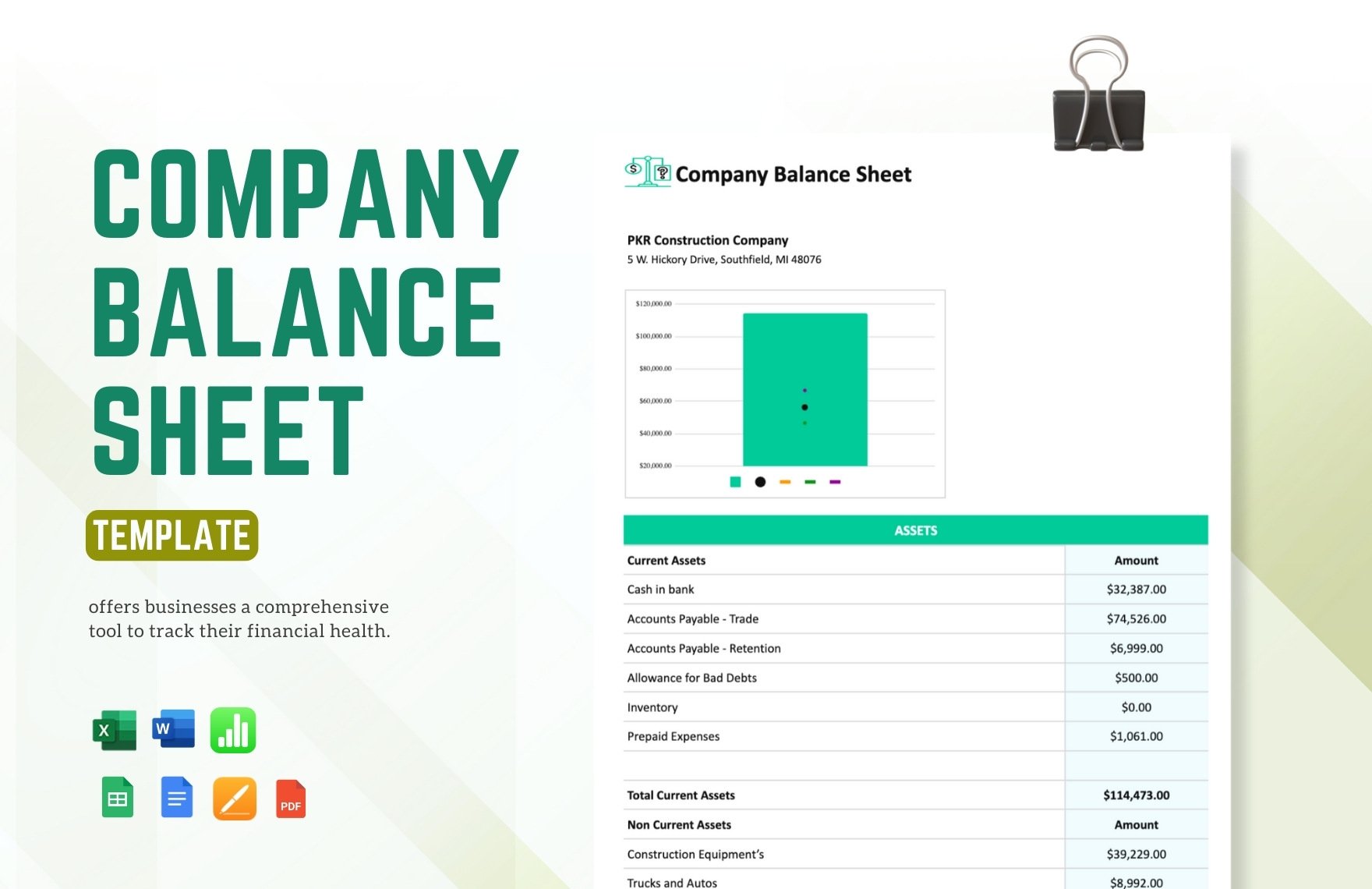

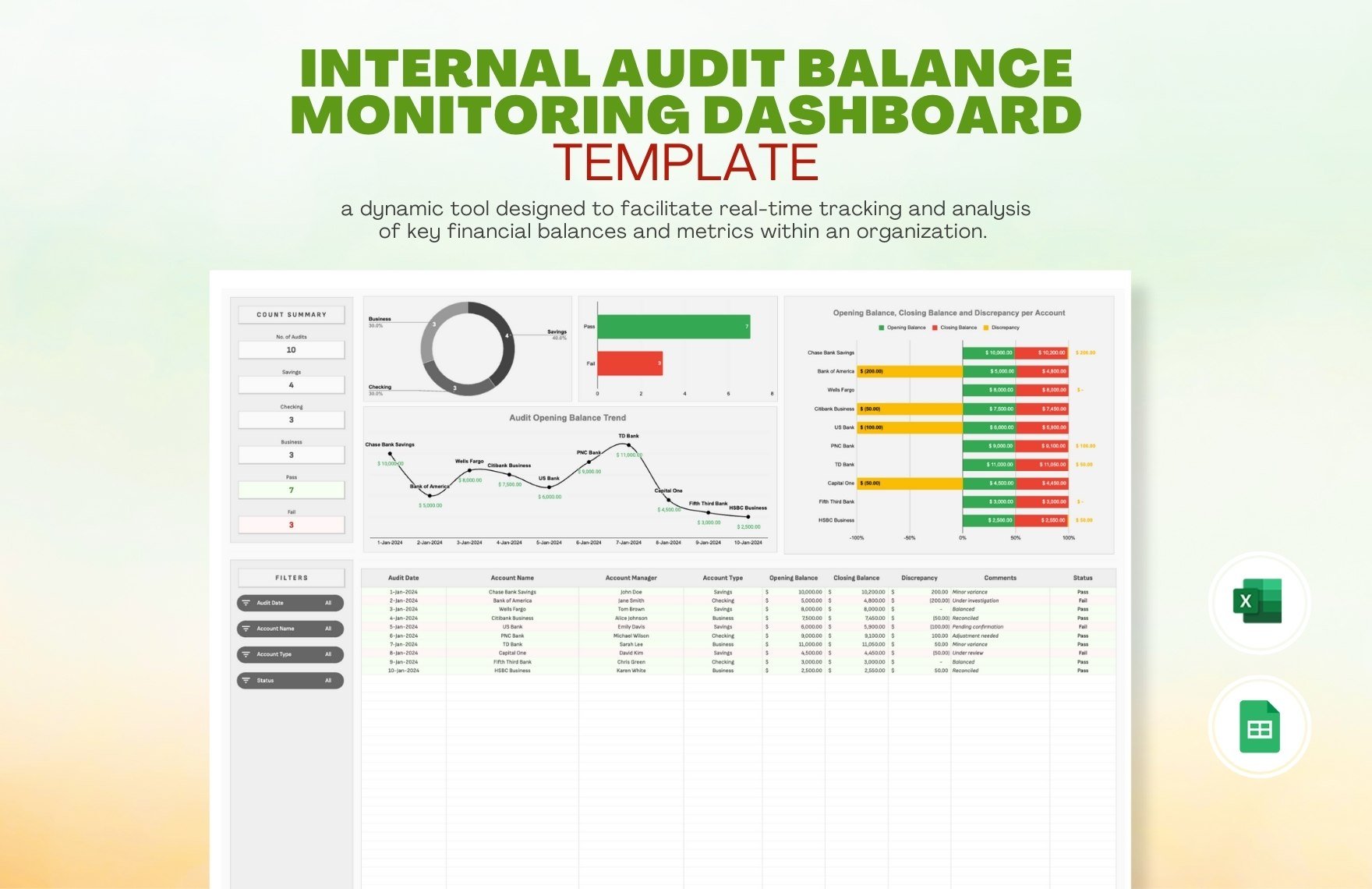

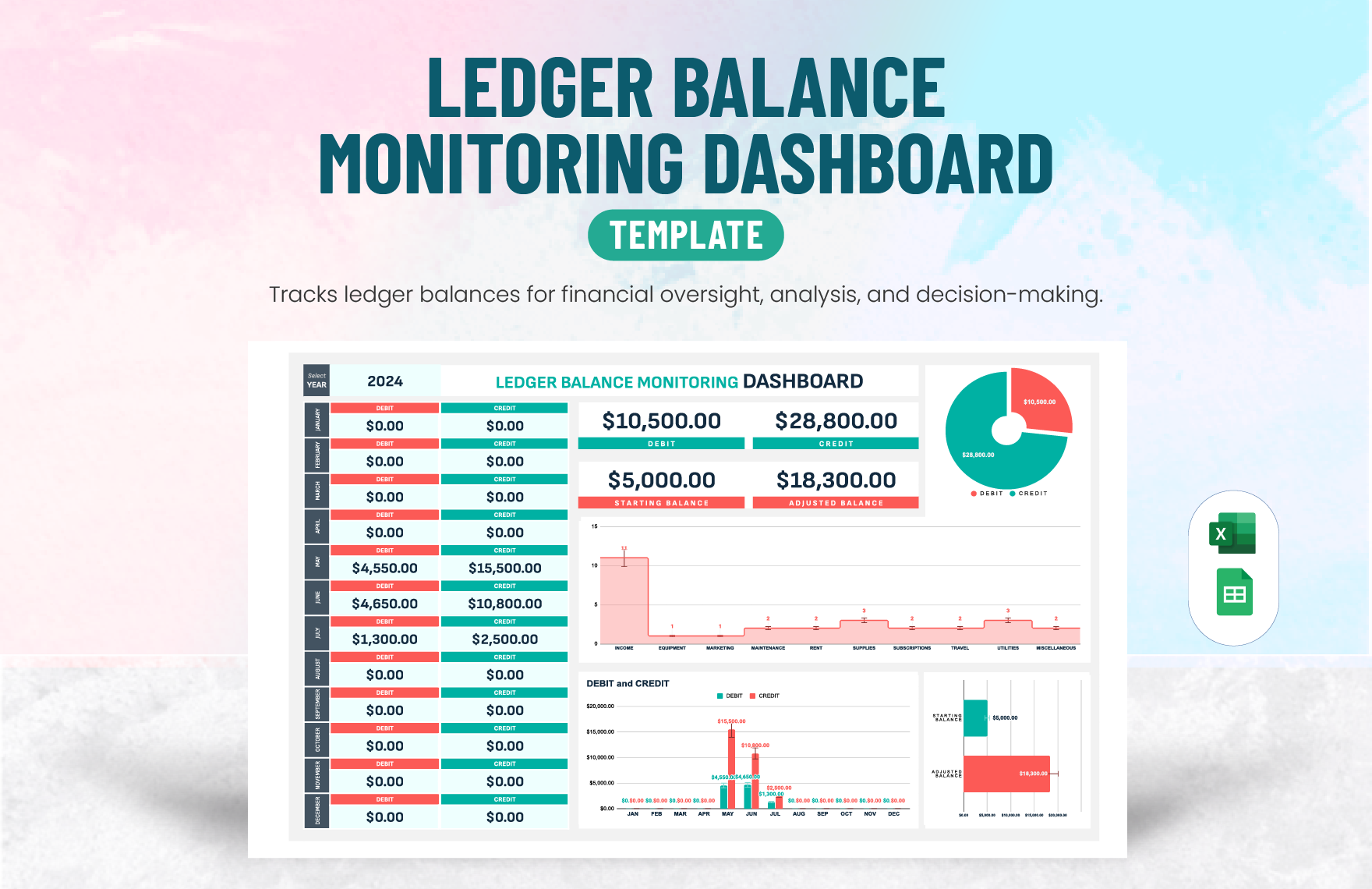

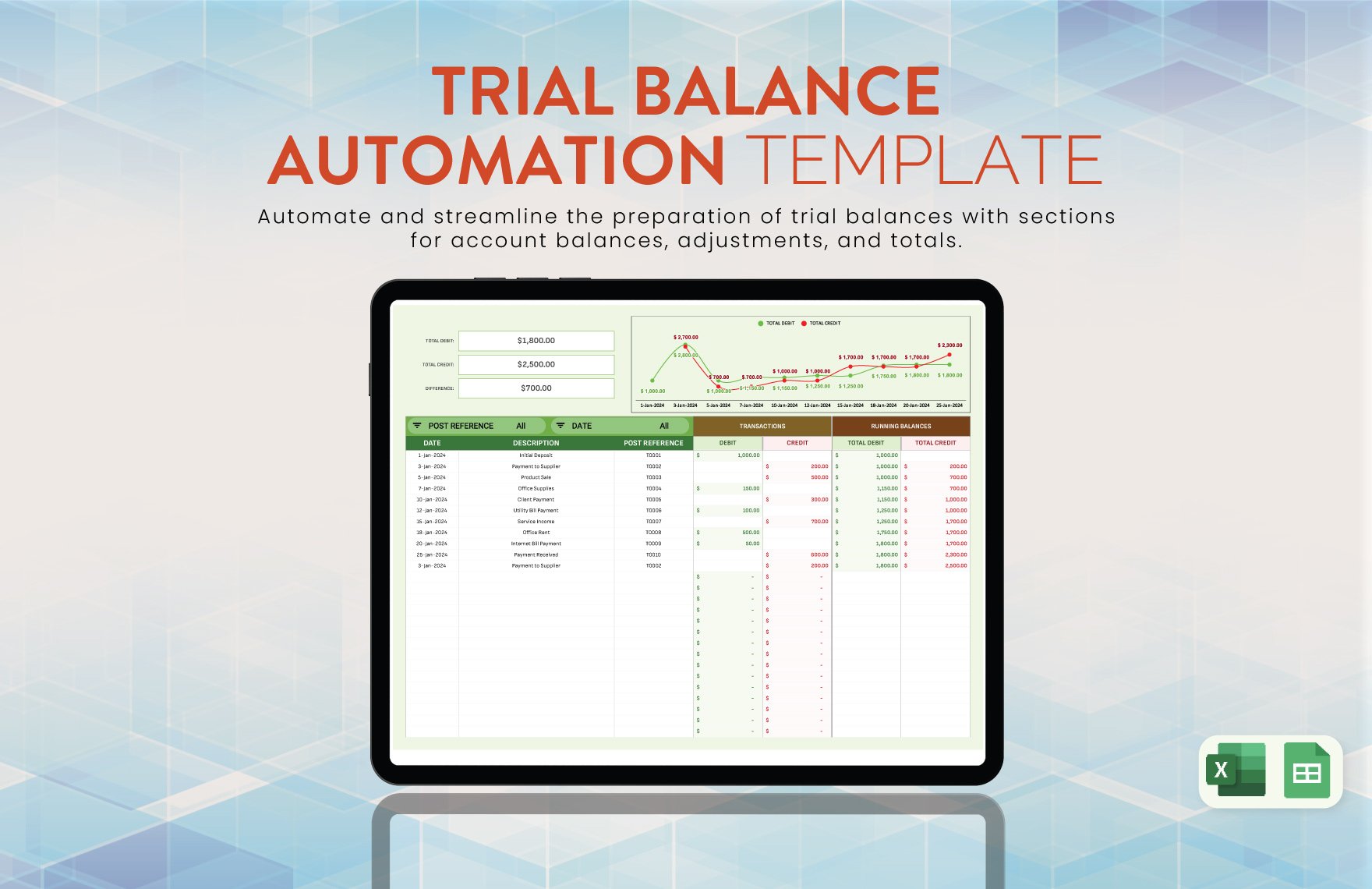

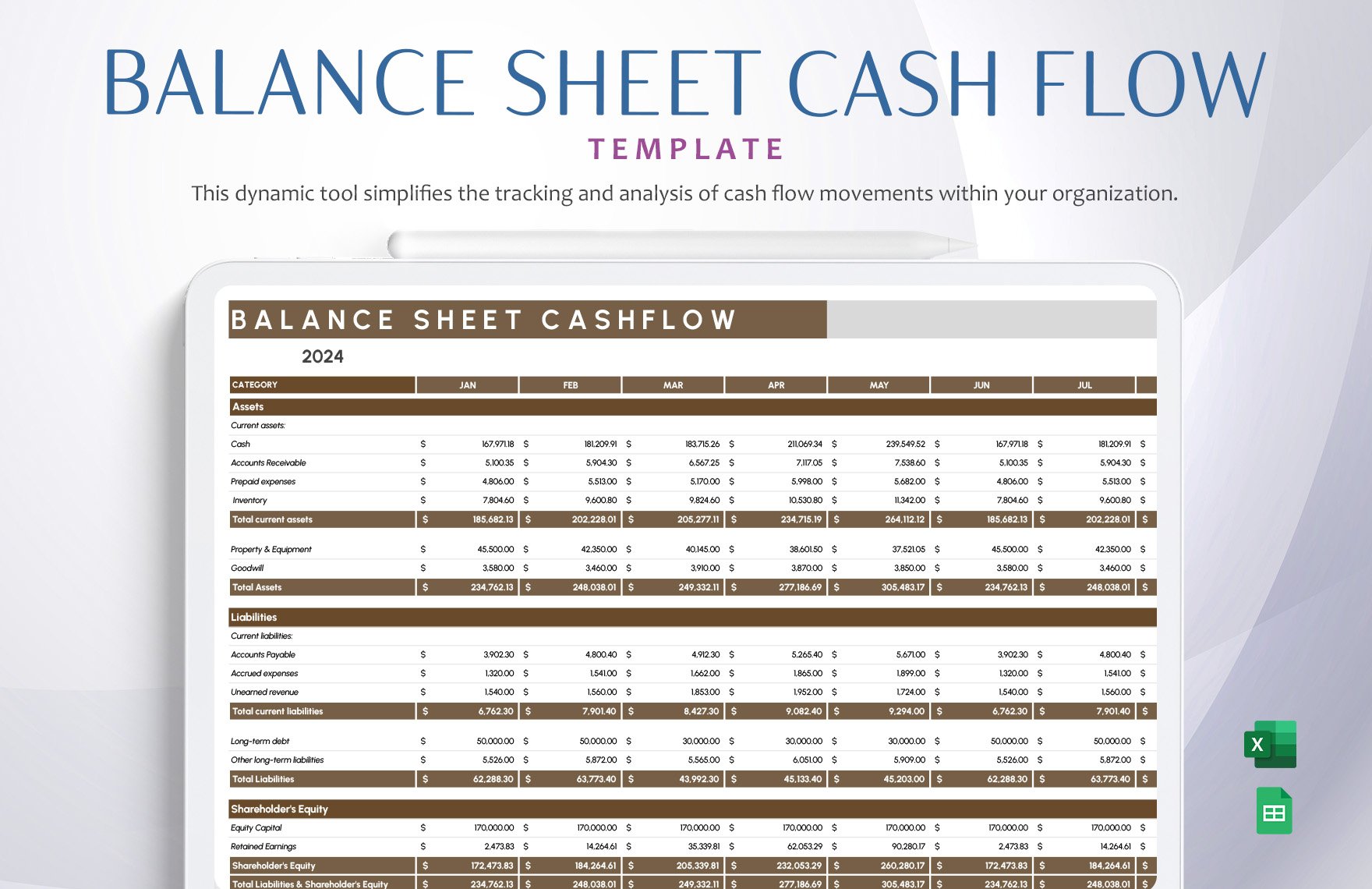

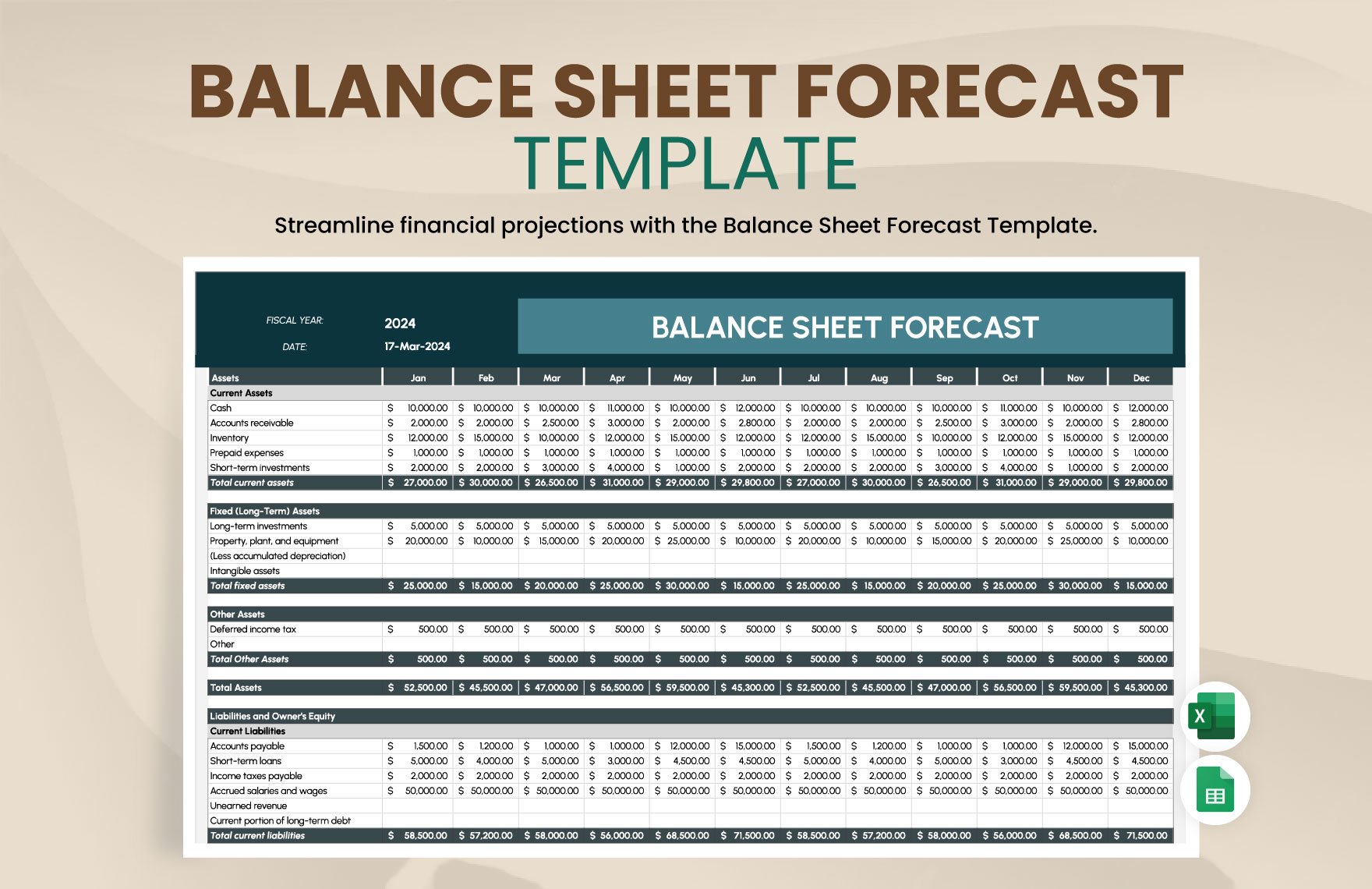

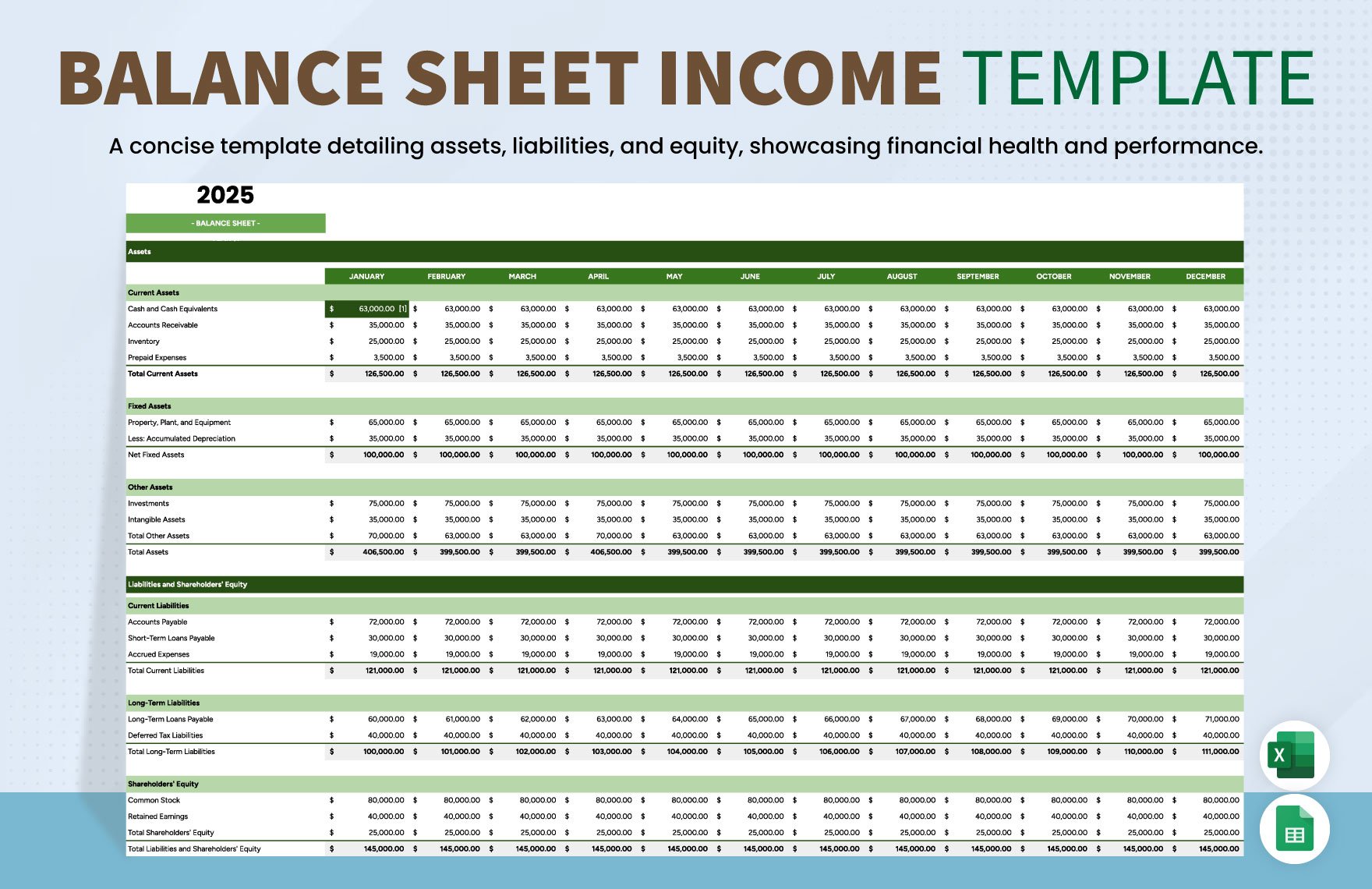

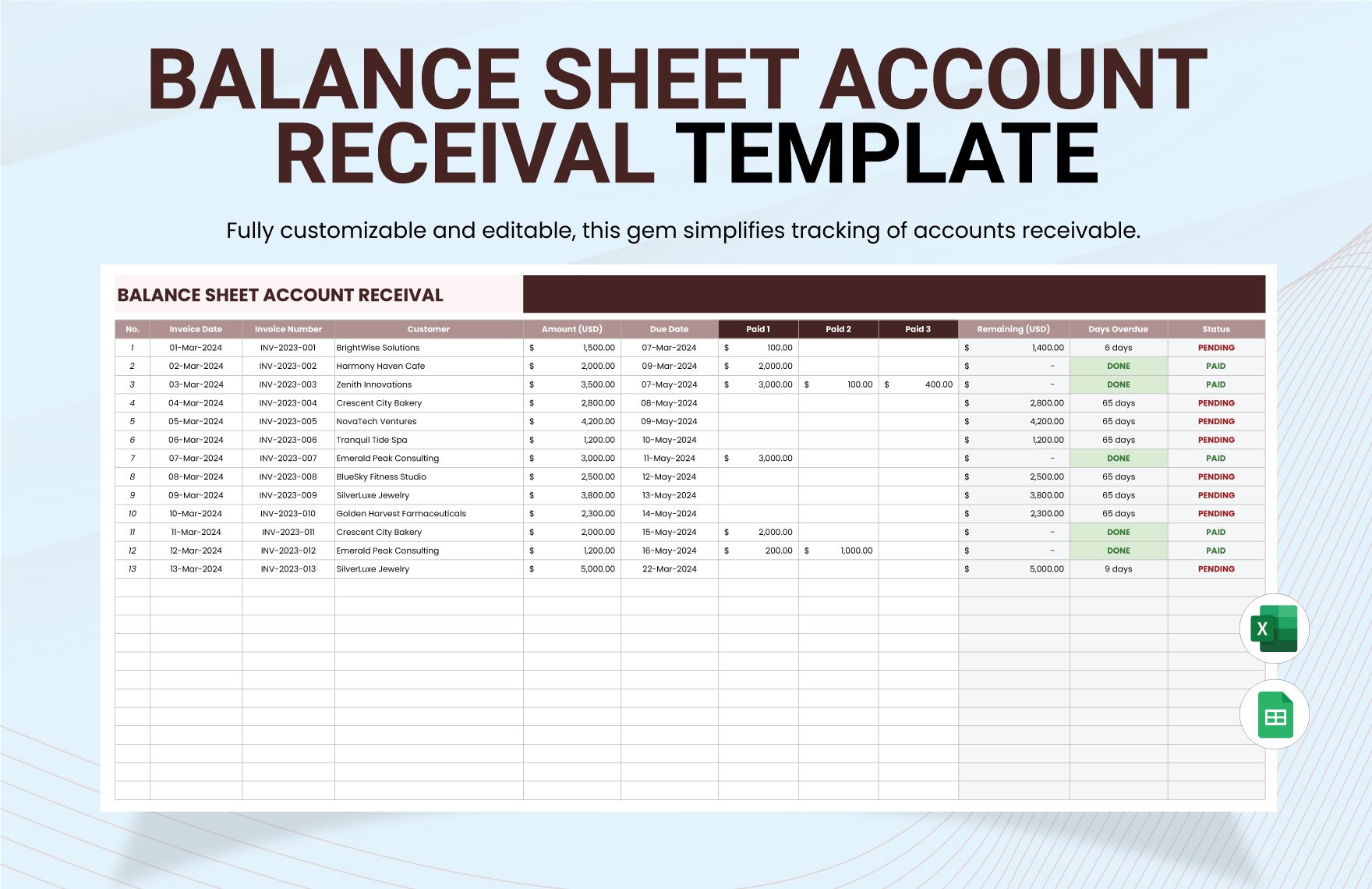

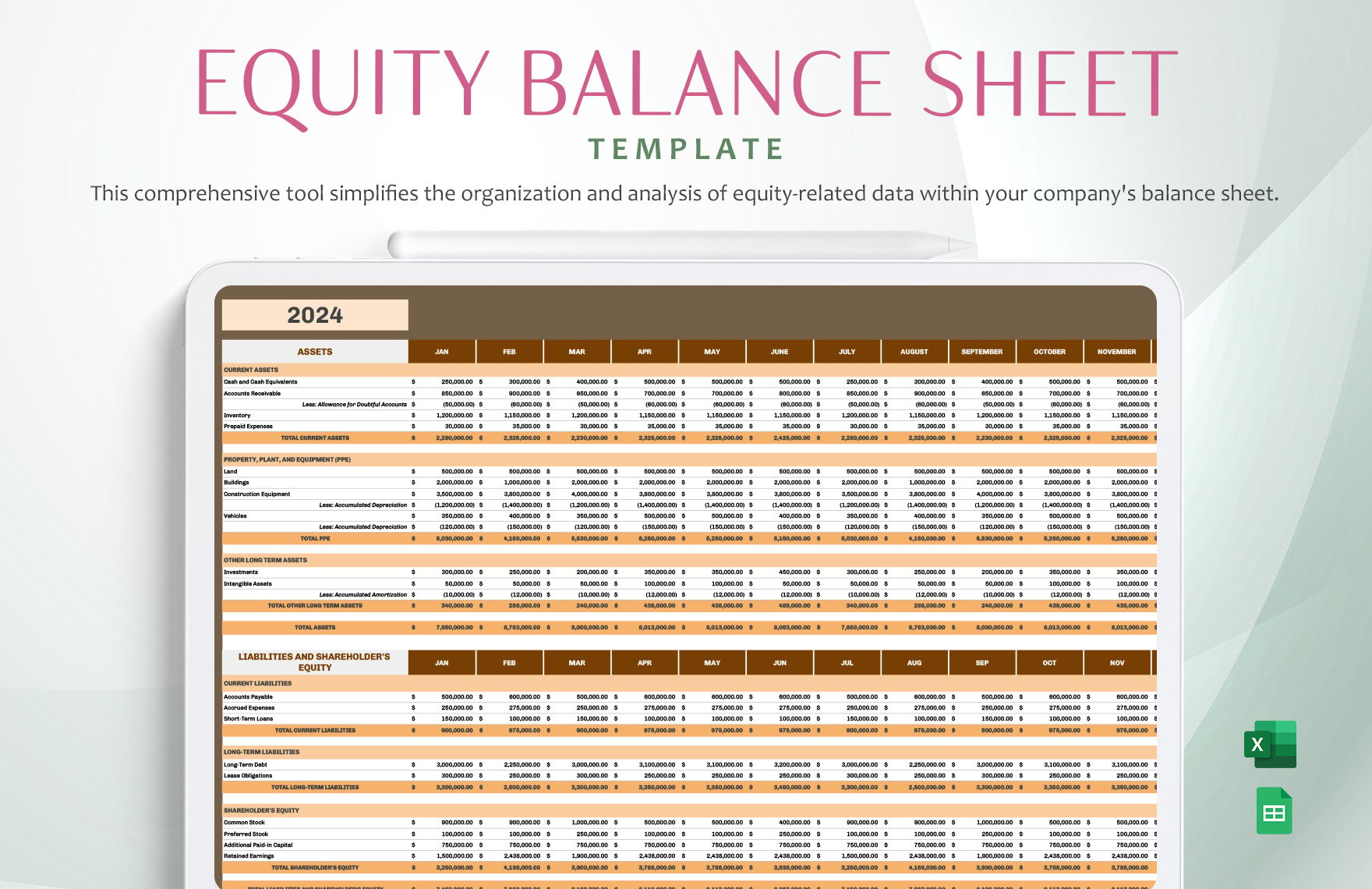

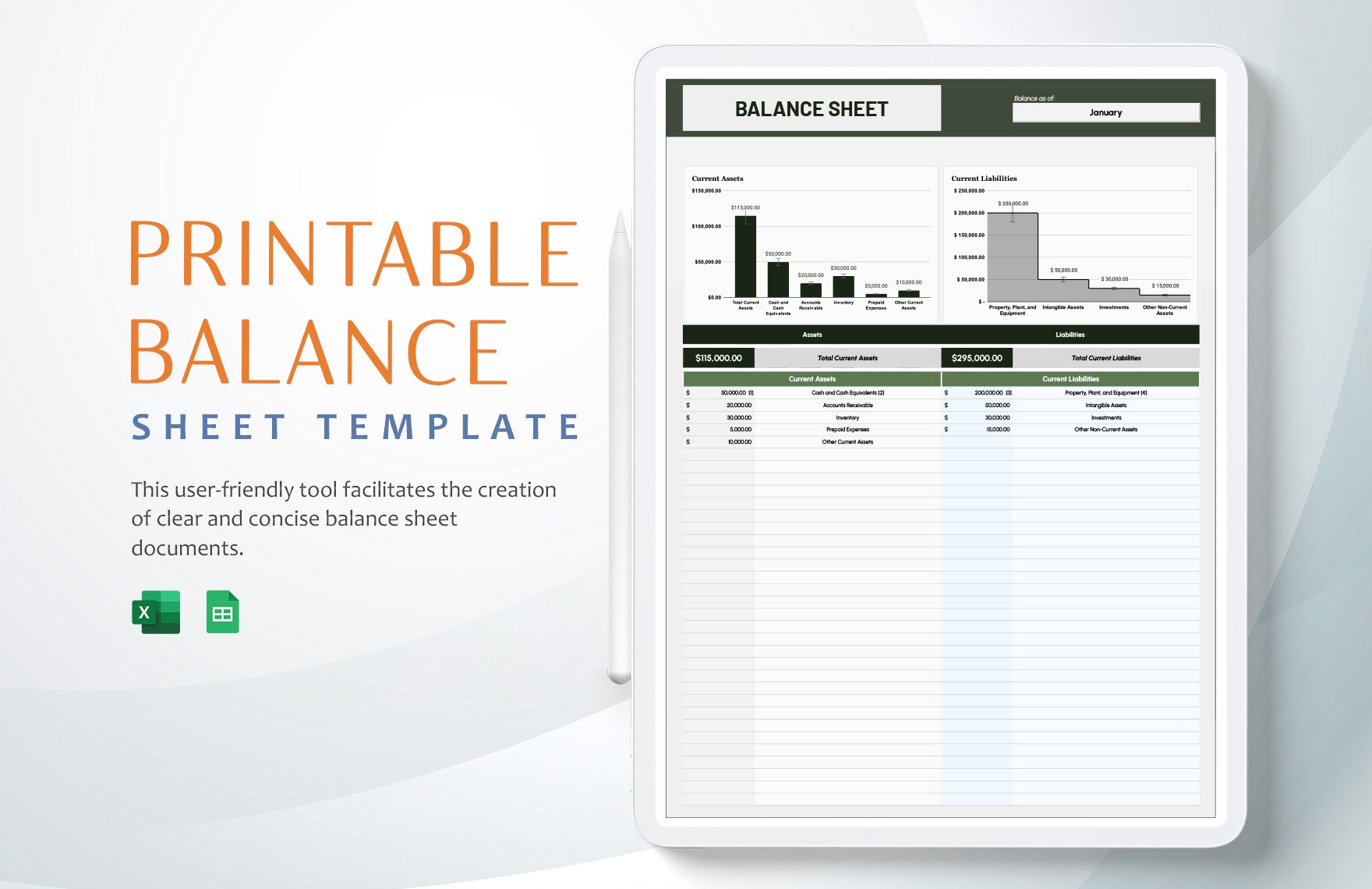

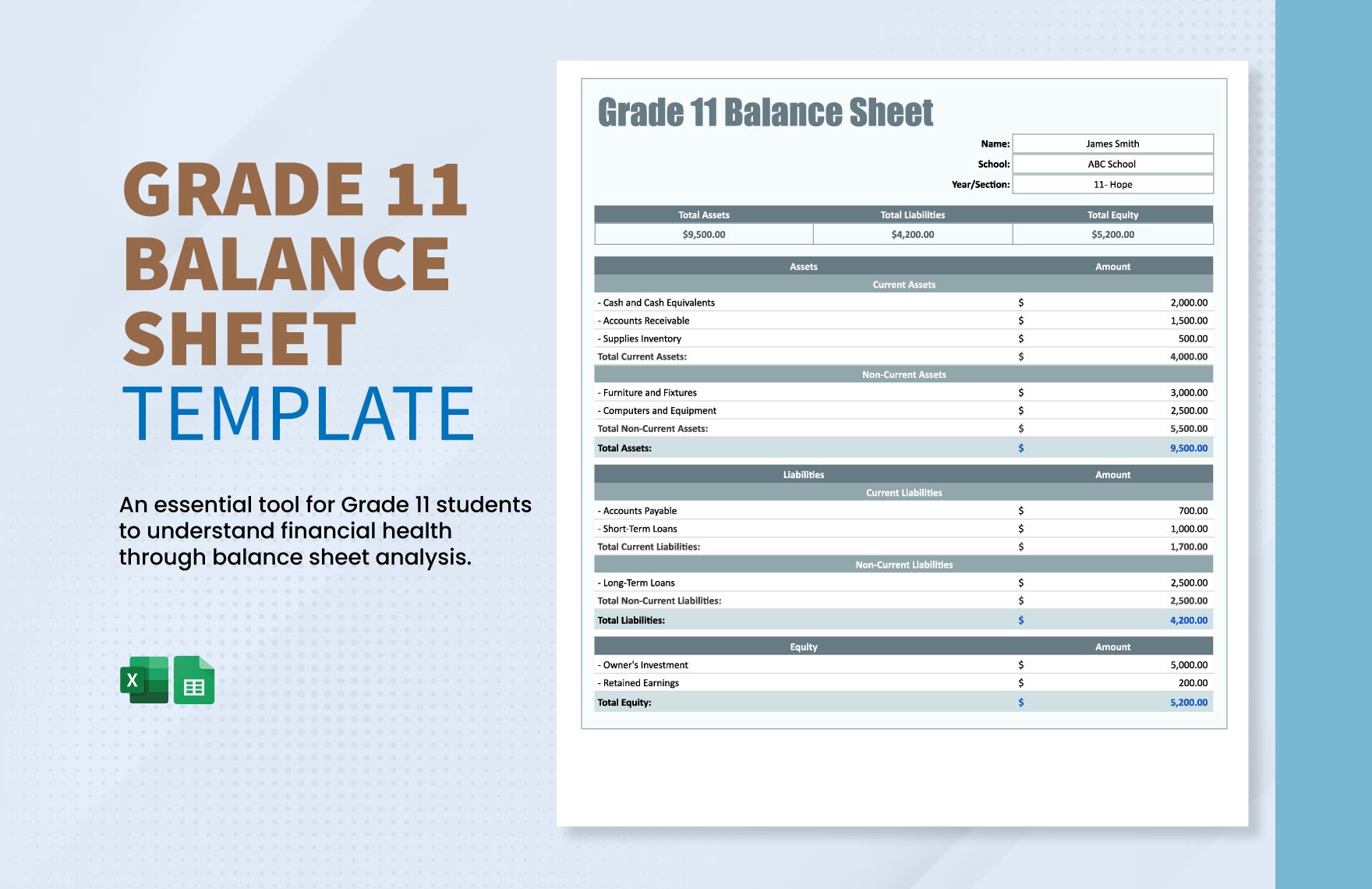

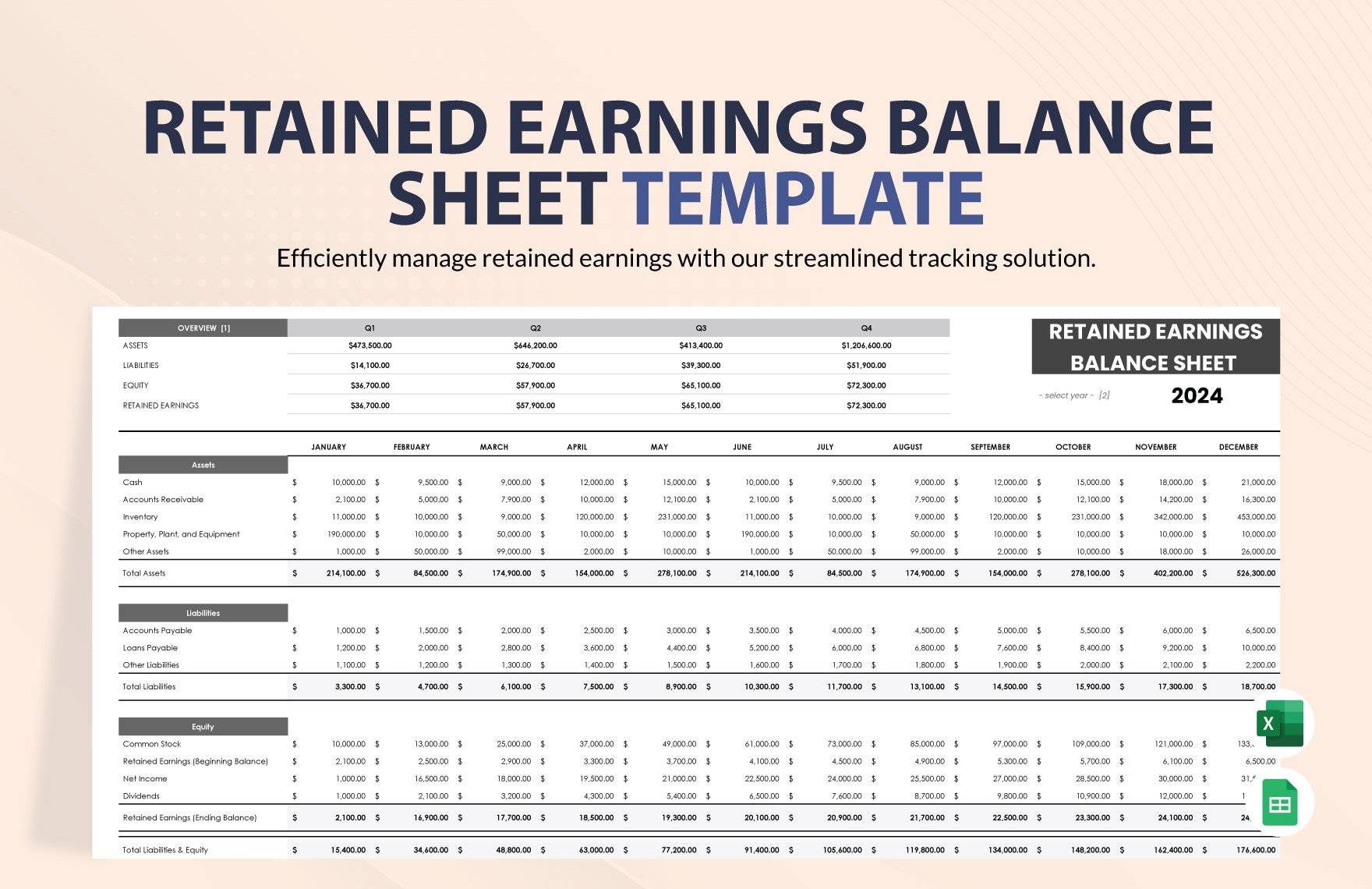

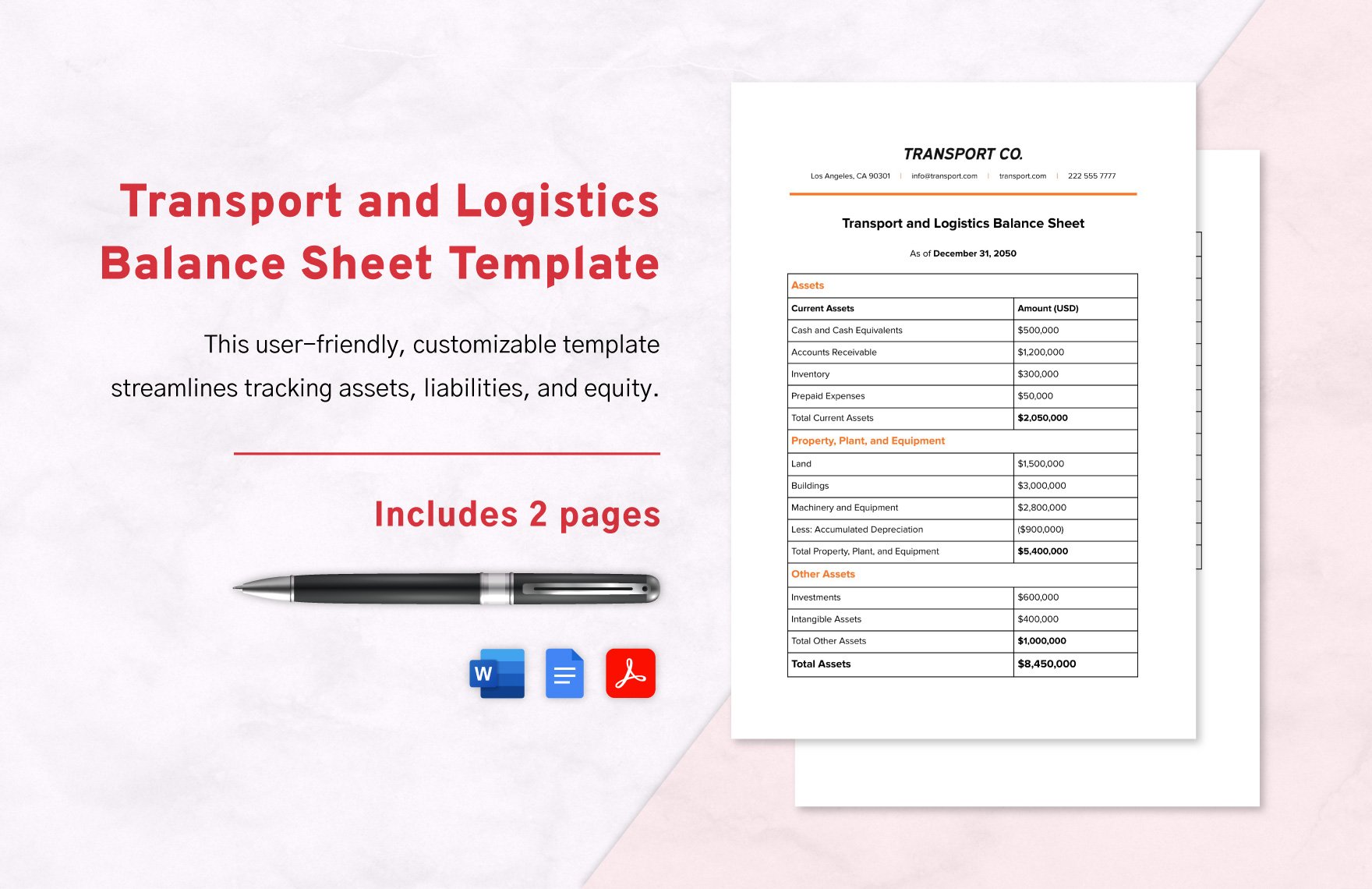

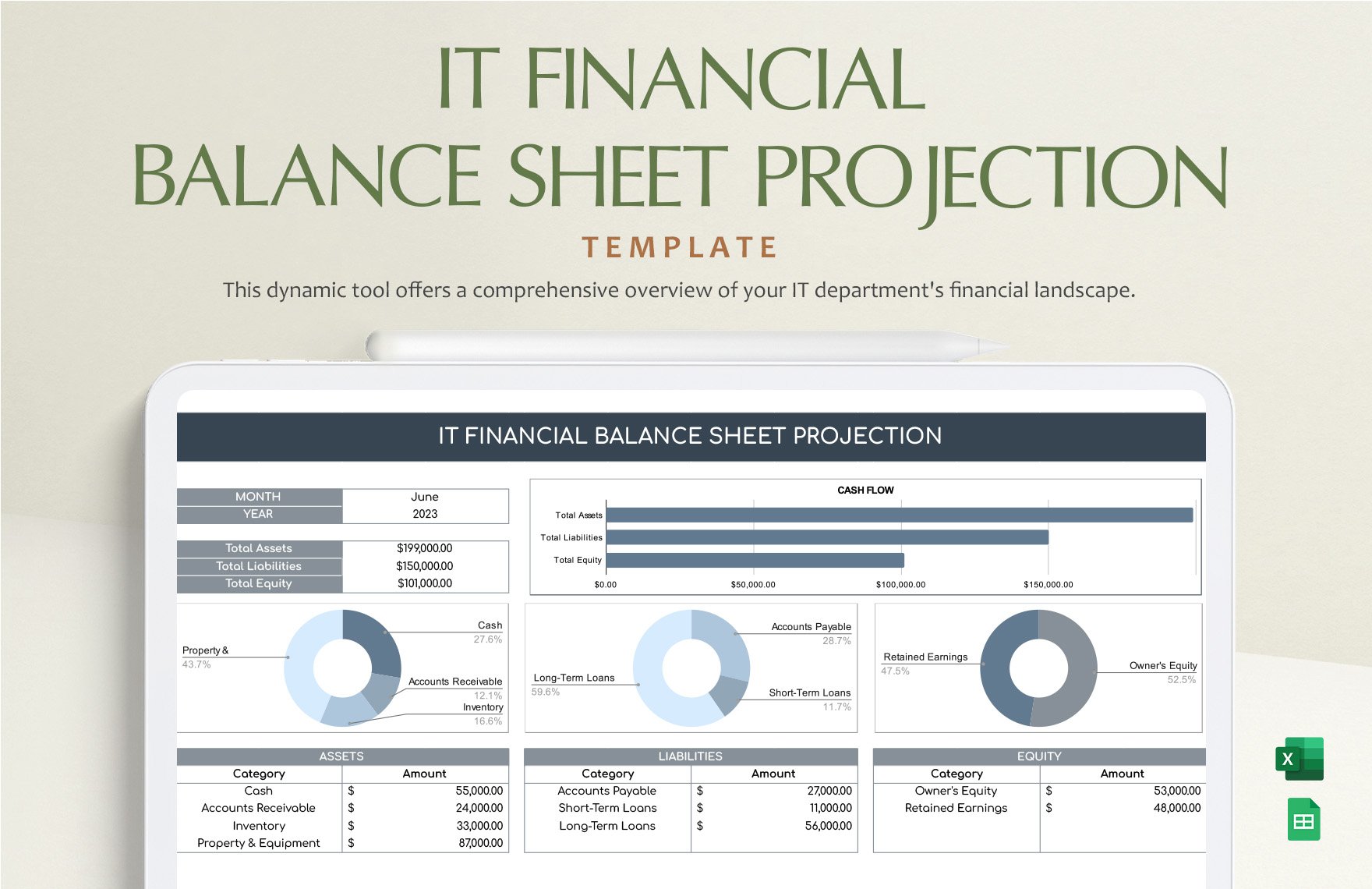

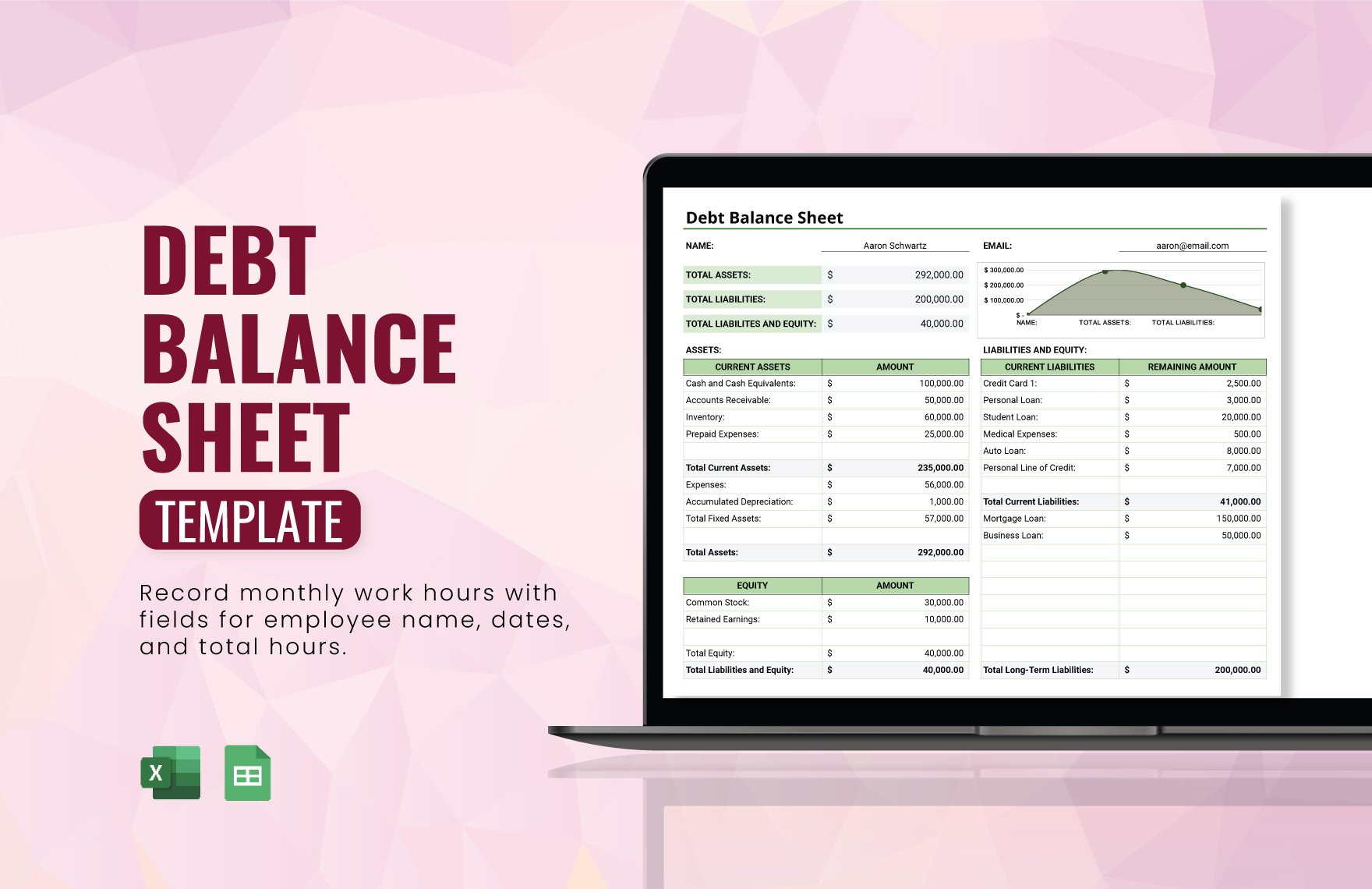

Keep your financial analysts engaged, streamline your reporting process, and ensure accuracy with ease. These Balance Sheet Templates are perfect for accountants, financial managers, and business owners who want to craft professional-grade balance sheets effortlessly. Whether you're preparing for a quarterly review or gearing up to present your financials to stakeholders, our templates are designed to help you make a lasting impression. Each template comes with customizable fields and formulas to include pertinent details like dates, revenue, expenses, and net income. Plus, no advanced spreadsheet skills are required, so you can achieve a polished look without any hassle. Save time and effort with our expertly crafted templates and ensure that you maintain a consistent, reliable reporting format.

Discover the many Balance Sheet Templates we have on hand at Template.net. Selecting the right template is simple—just browse through our extensive library, pick one that suits your needs, and start swapping in your data. You can easily tweak colors and fonts to match your brand identity and add advanced touches like icons and graphics for a more comprehensive overview. Thanks to our AI-powered text tools, crafting insightful notes and annotations becomes a seamless experience. The possibilities are endless, and anyone can use them, regardless of skill level. Our library is regularly updated with new designs, ensuring you stay ahead of financial reporting trends. When you’re finished, effortlessly download or share your balance sheet via print or email, making them ideal for multiple channels and convenient for real-time collaboration.