Bring your business management to new heights with pre-designed Bookkeeping Templates in Apple Pages by Template.net

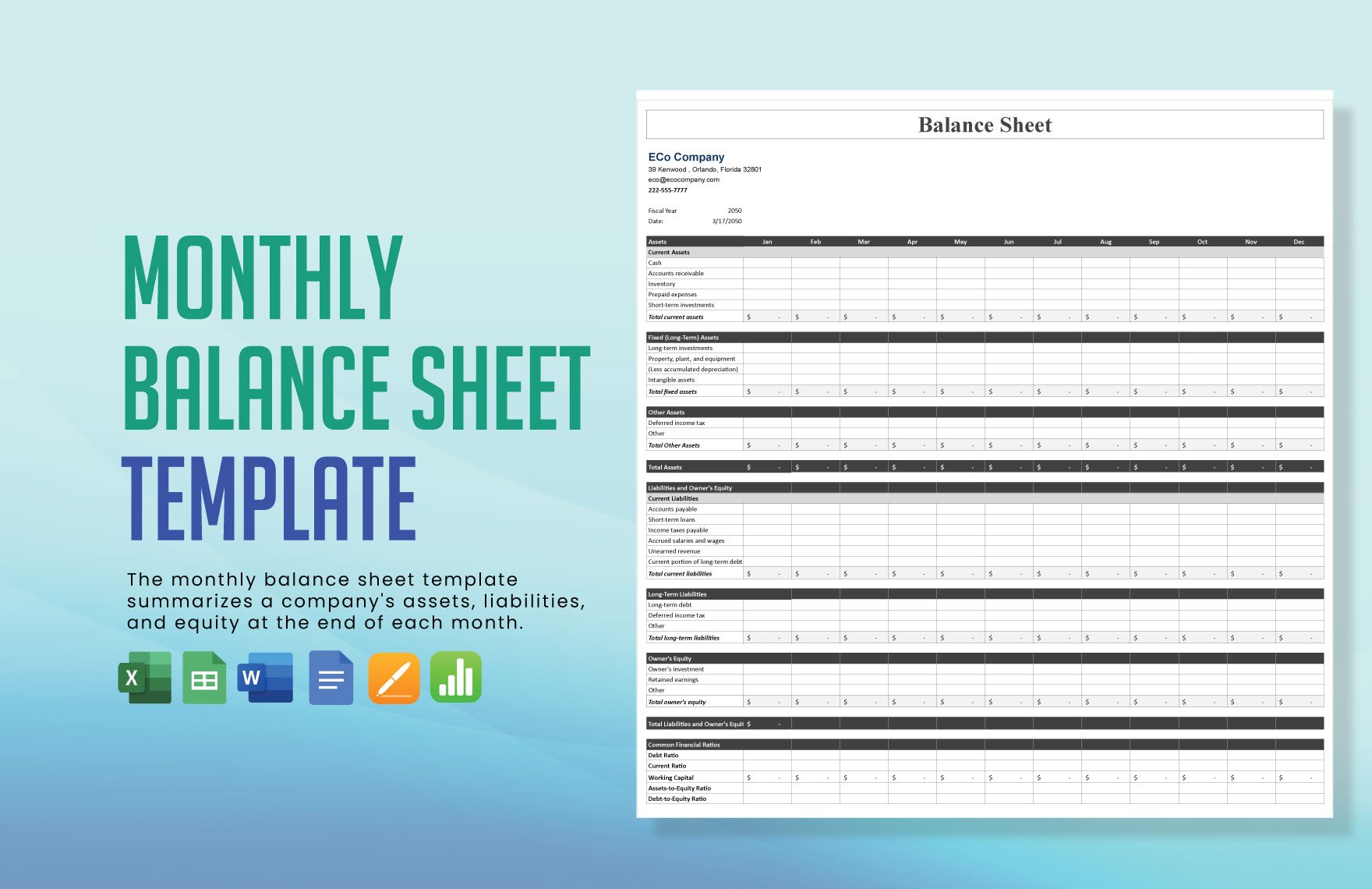

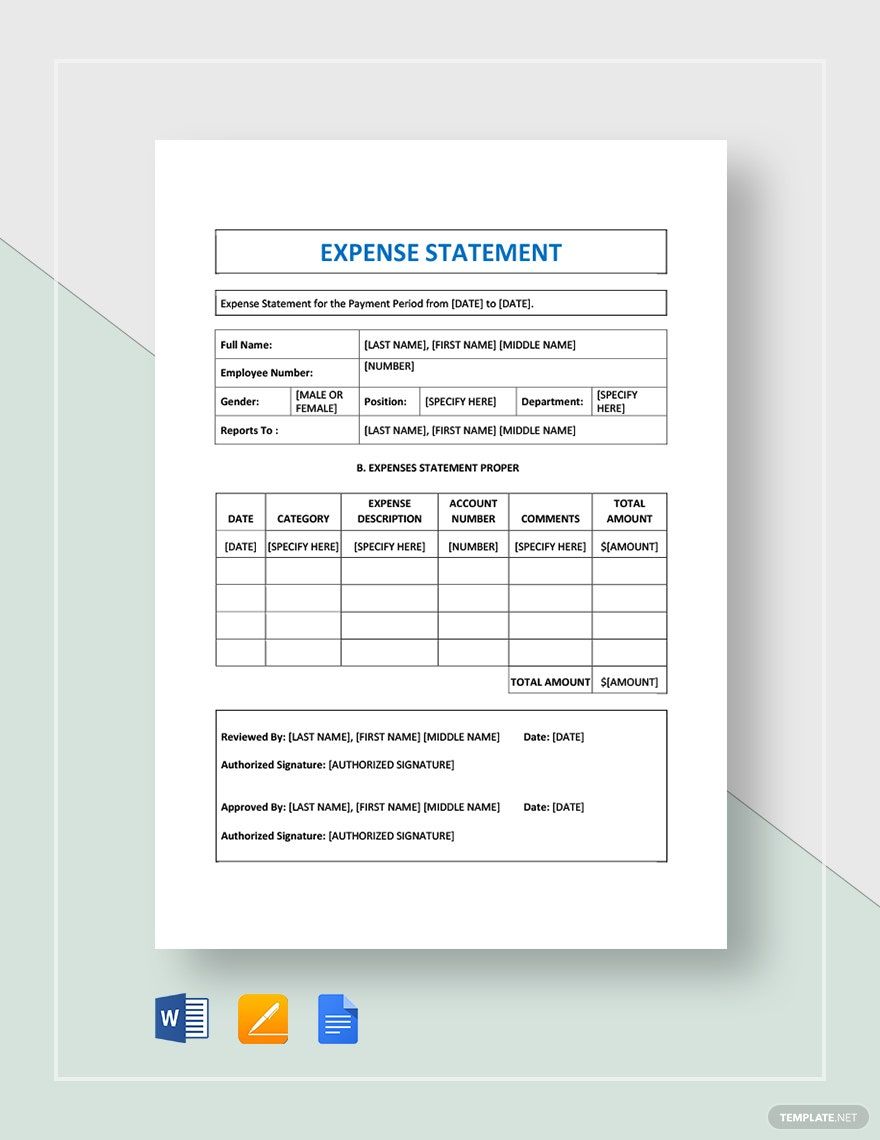

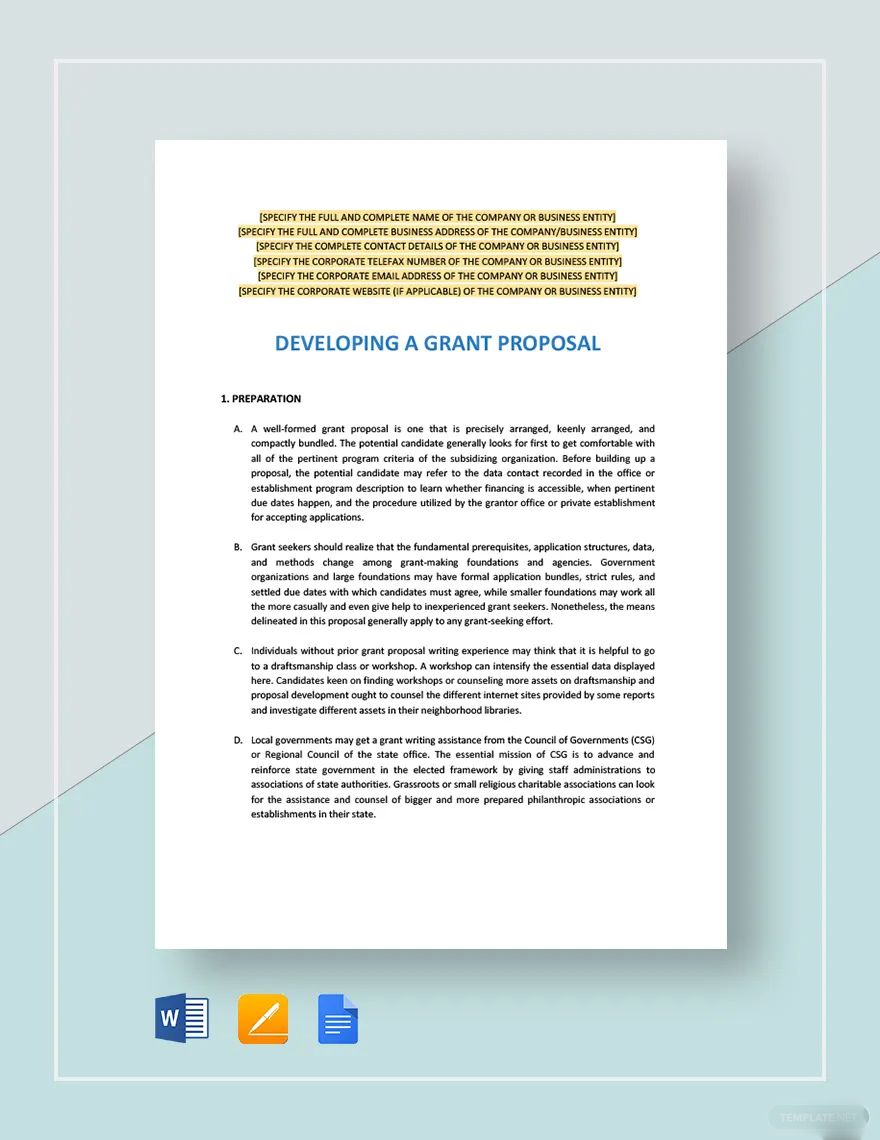

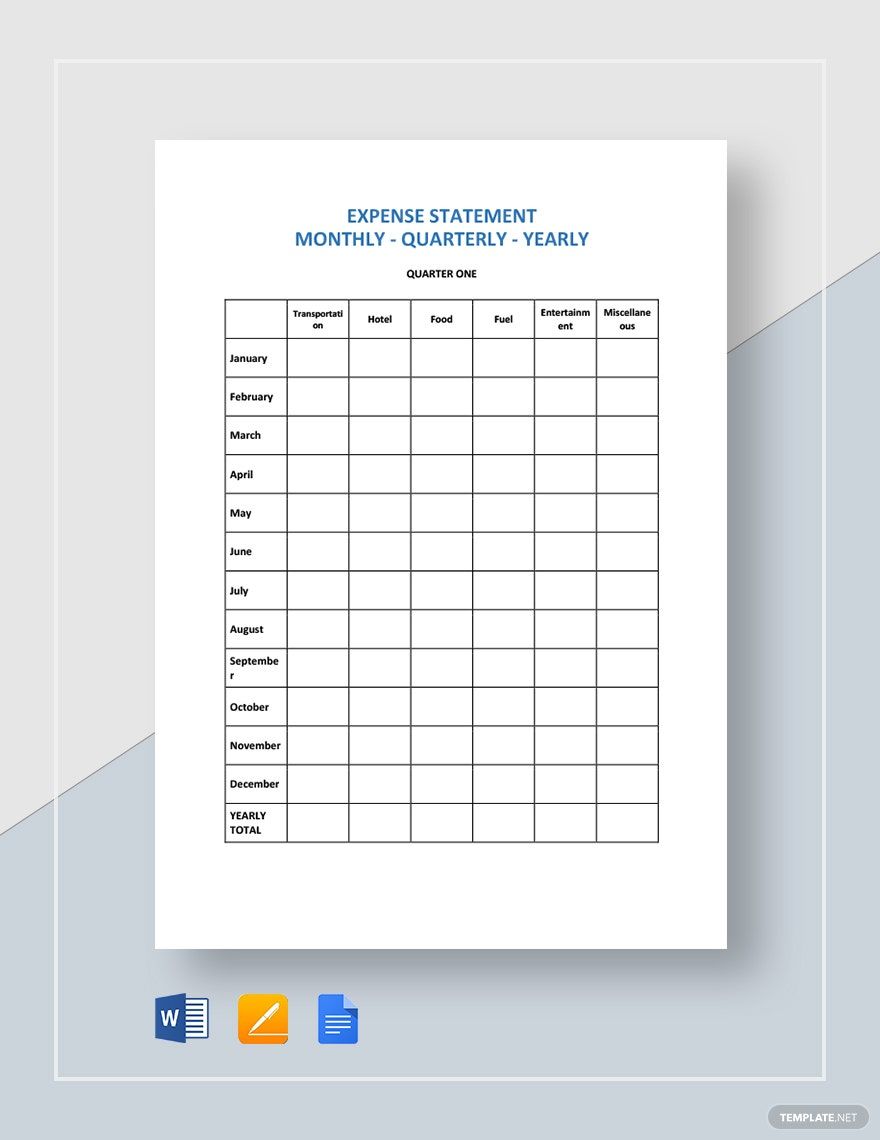

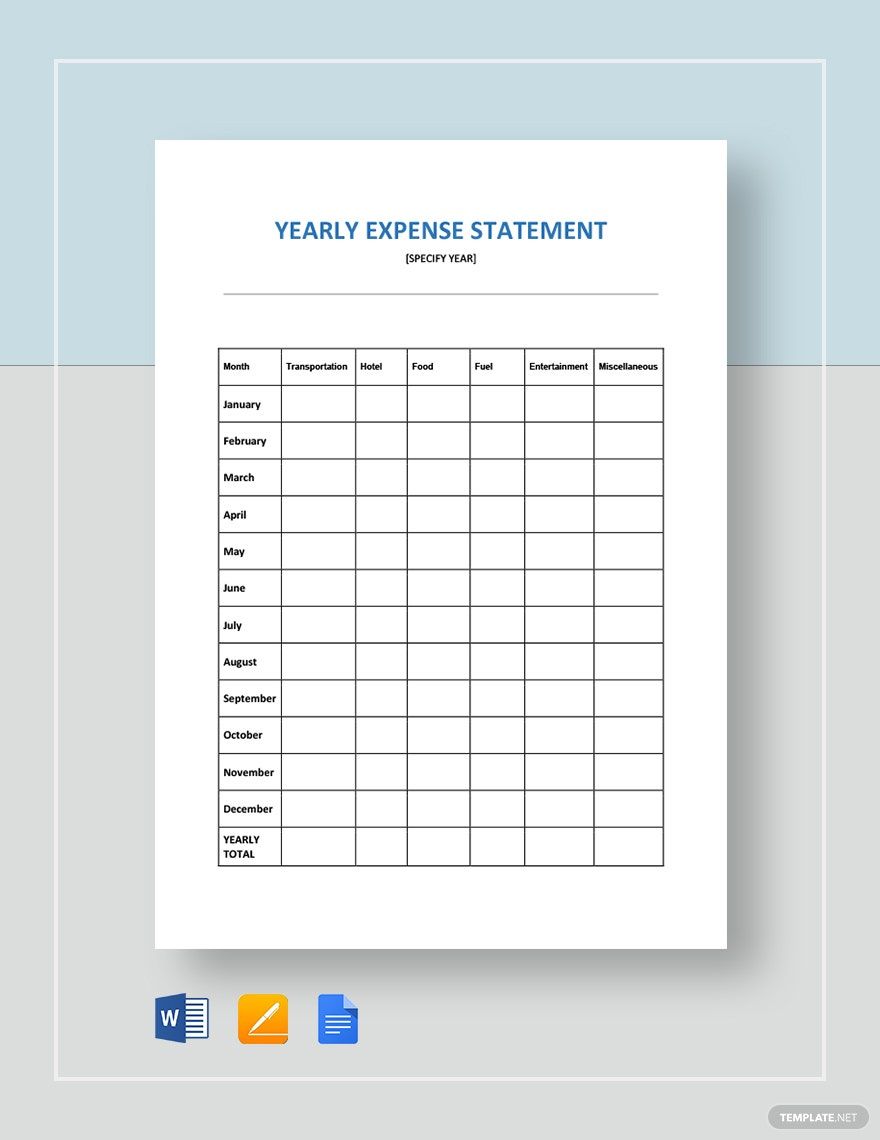

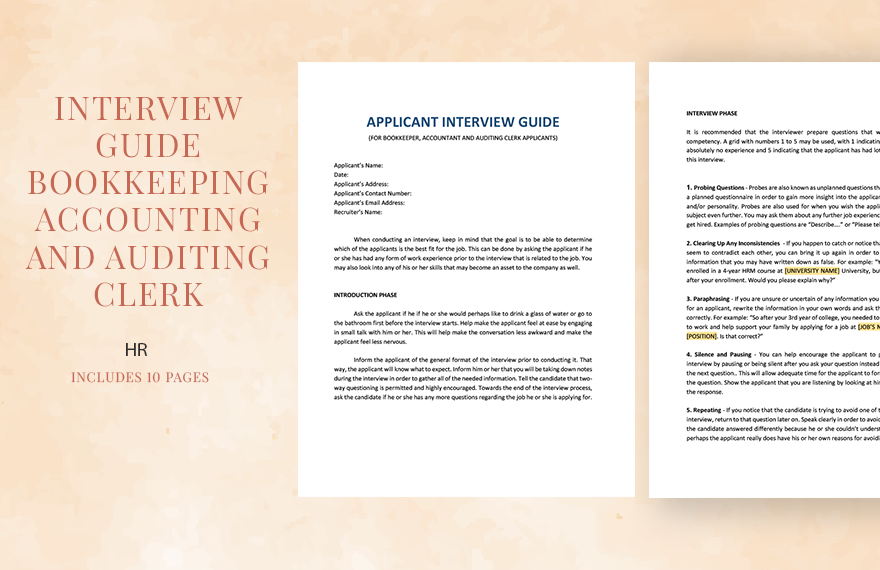

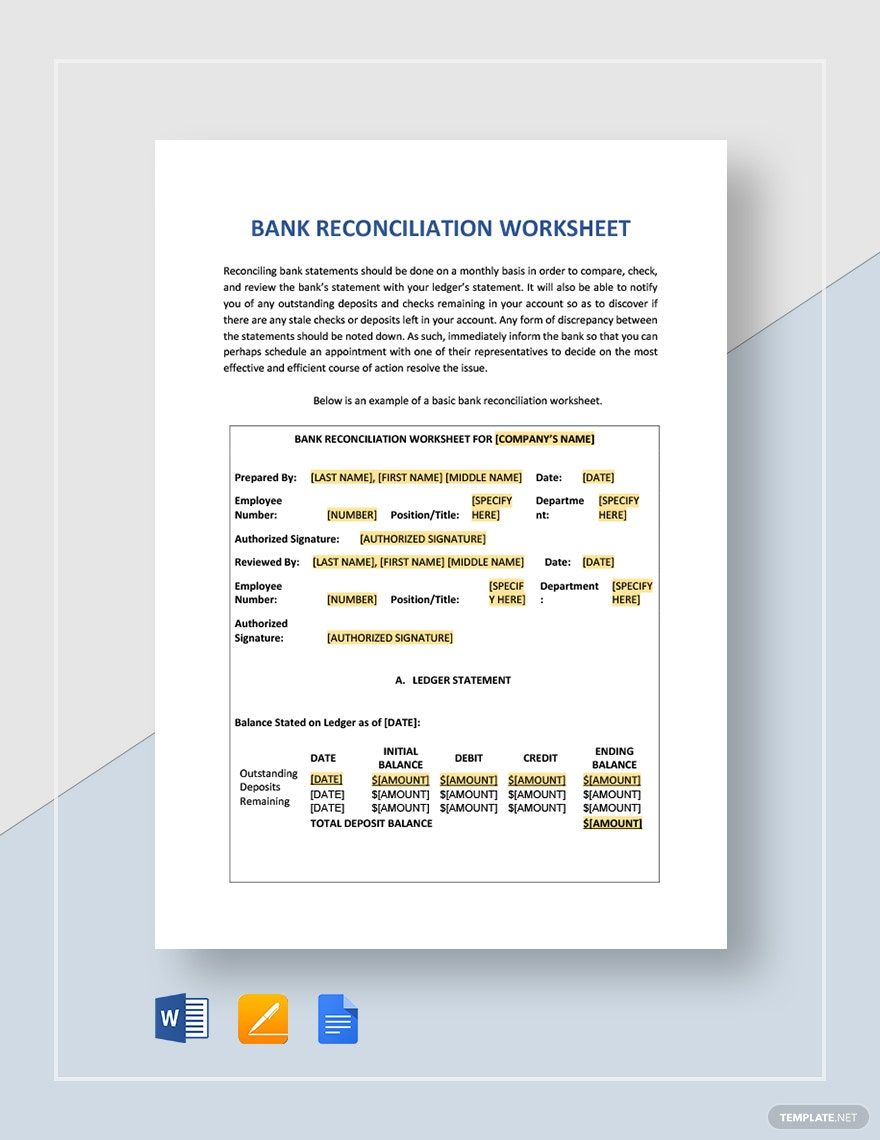

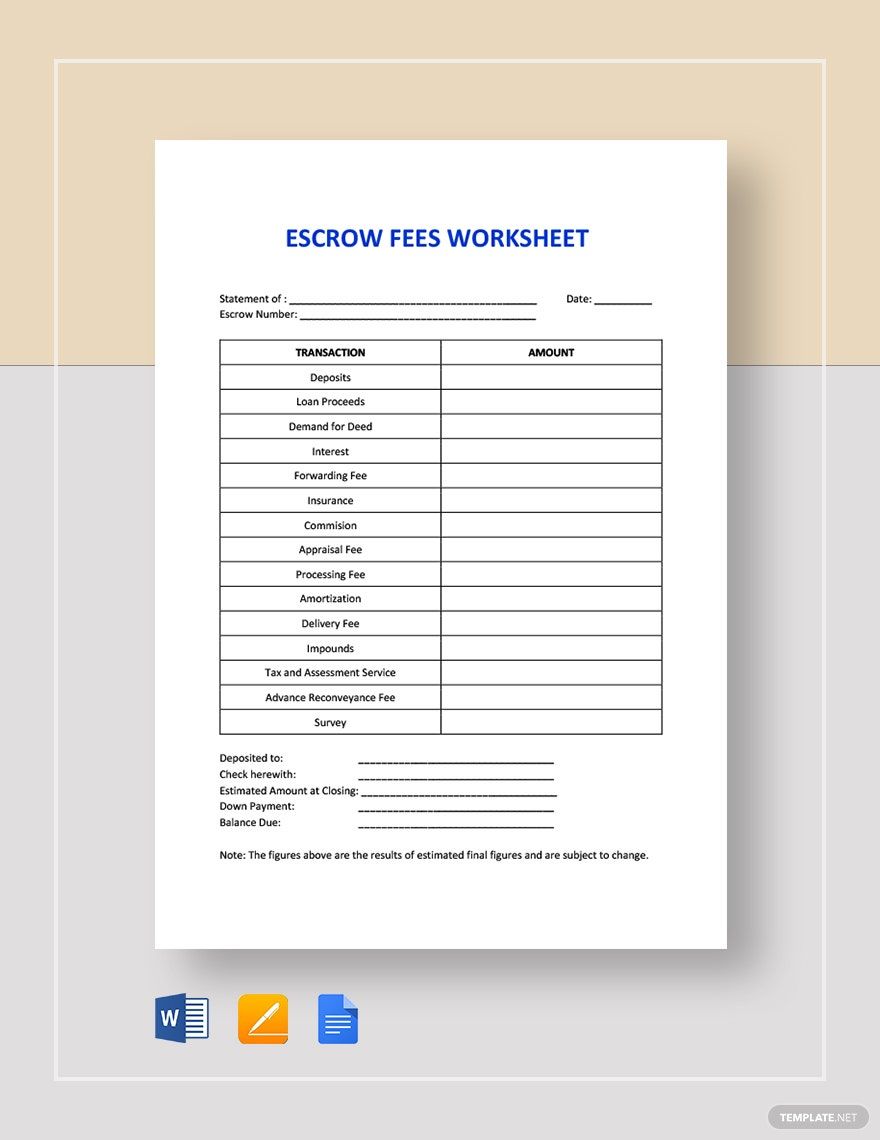

Free pre-designed templates from Template.net bring ease and professionalism to your bookkeeping tasks, making them ideal for business owners and financial managers alike. Create professional-grade financial reports and track expenses effectively with no design experience necessary. Whether you're preparing quarterly reports or organizing annual budgets, these templates ensure your financial documents look sharp and professional. With downloadable and printable files available in Apple Pages format, you can effortlessly customize layouts for both social media sharing and digital distribution. Explore our collection, which includes beautiful pre-designed templates and unbeatable free templates to streamline your financial management tasks.

Explore more beautiful premium pre-designed templates in Apple Pages, offering even greater options for customizing your business's financial strategies. Our library is regularly updated with fresh designs to keep your accounting documents up-to-date and aesthetically cutting-edge. For wider reach, download or share your tailored documents via link, print, or email. Get the best of both worlds by leveraging our free and premium templates for maximum flexibility, enhancing both your physical and digital financial presentations.