Bring Your Budget Planning to Life with Annual Budget Templates from Template.net

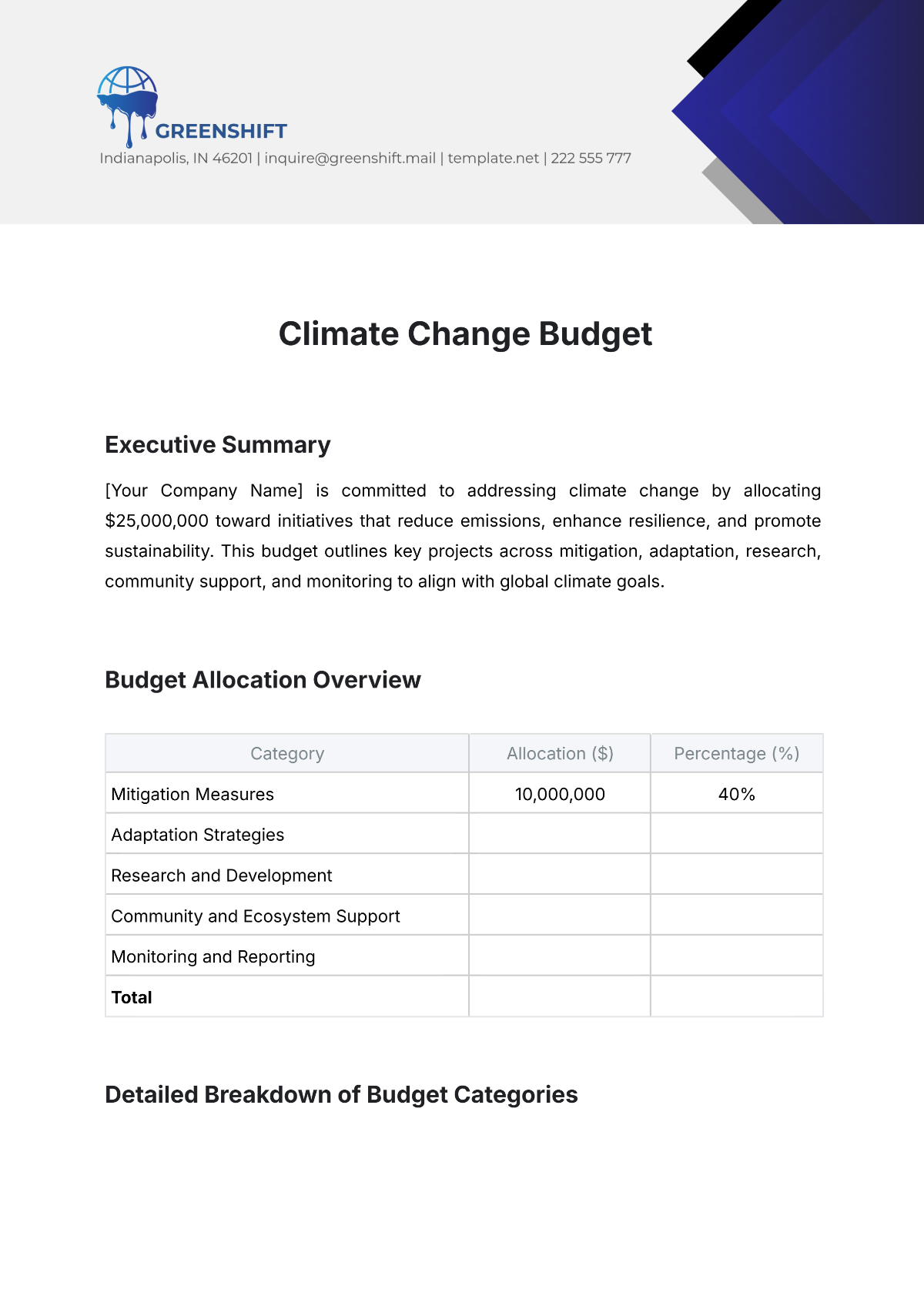

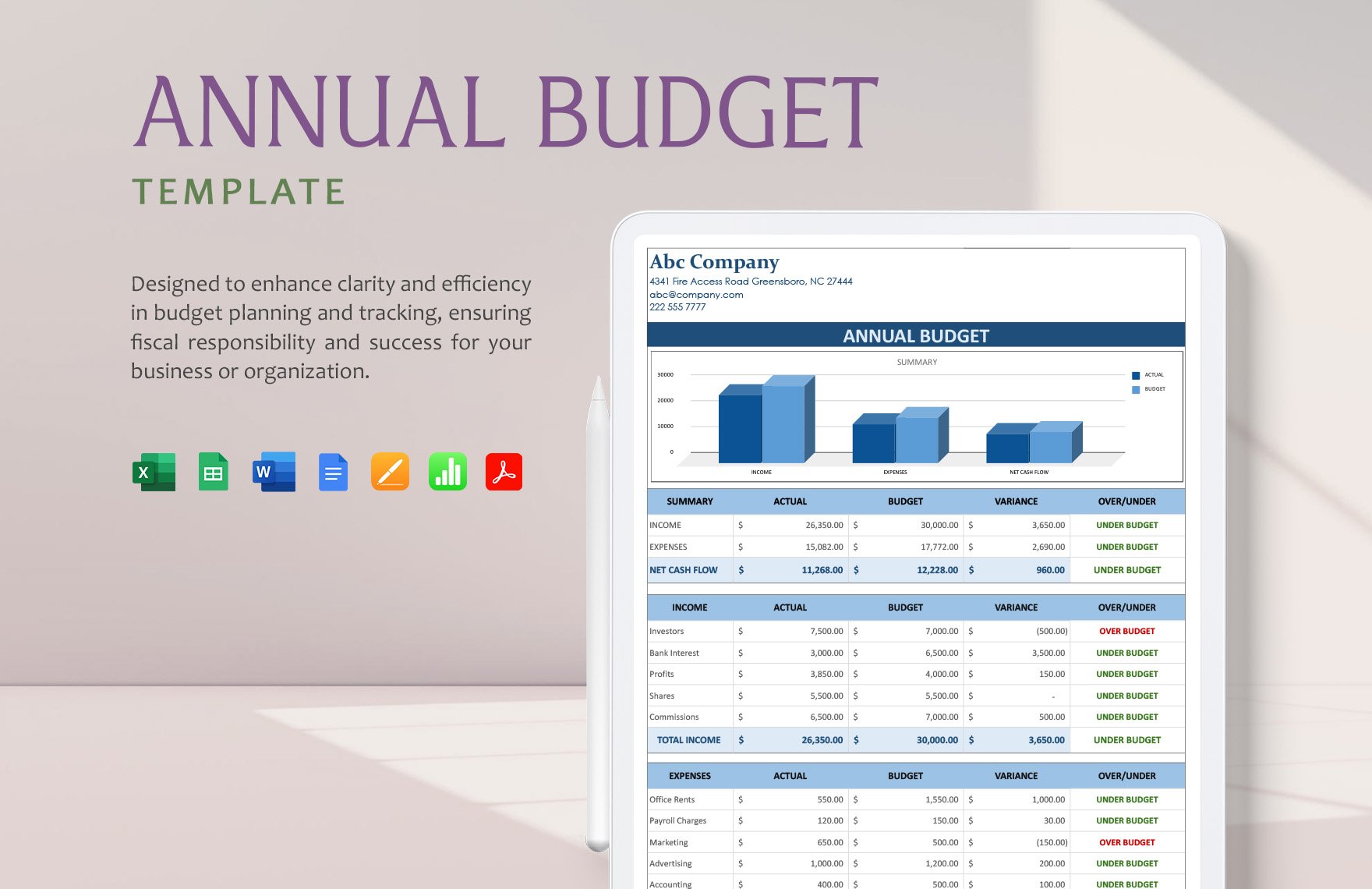

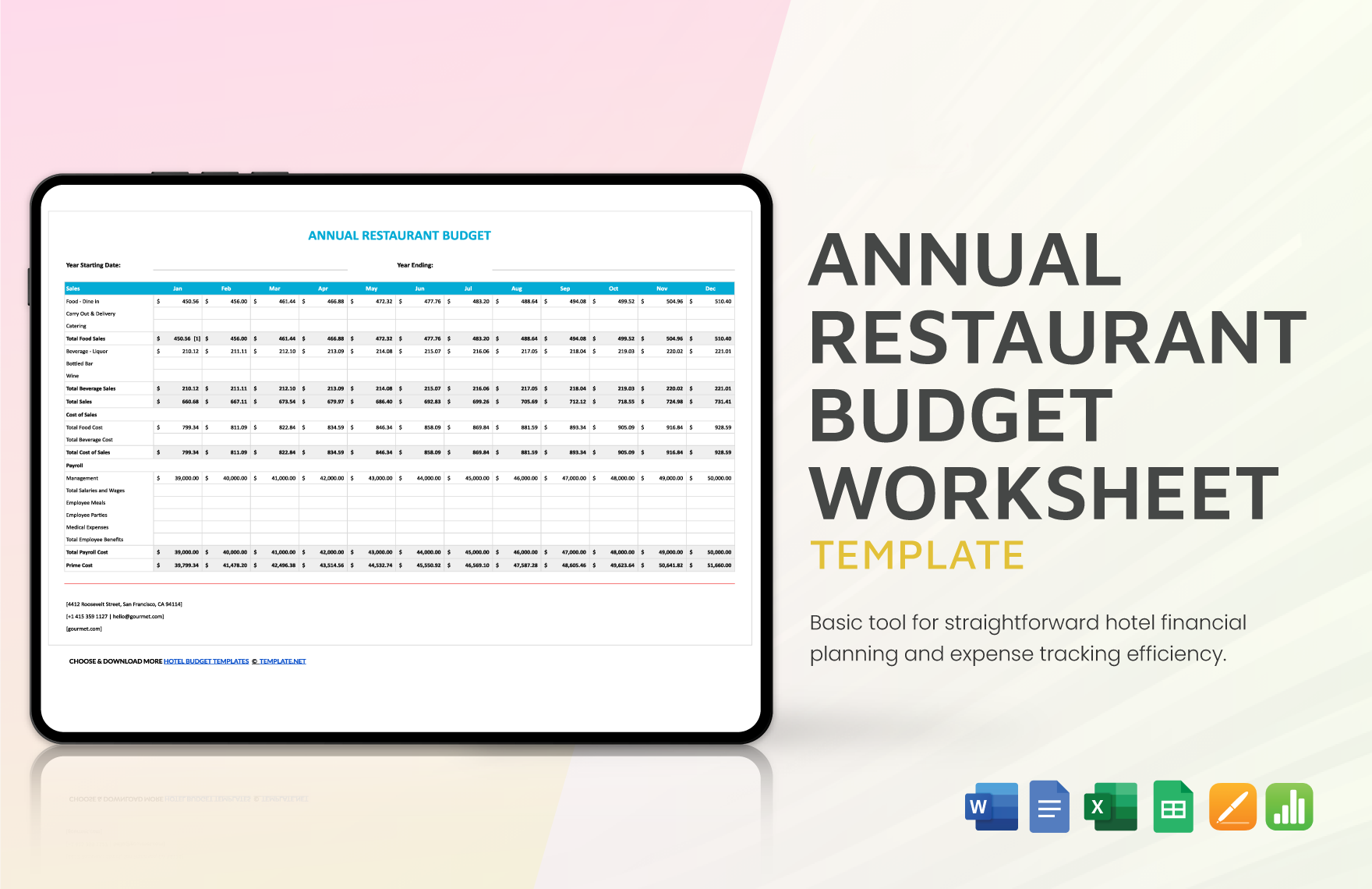

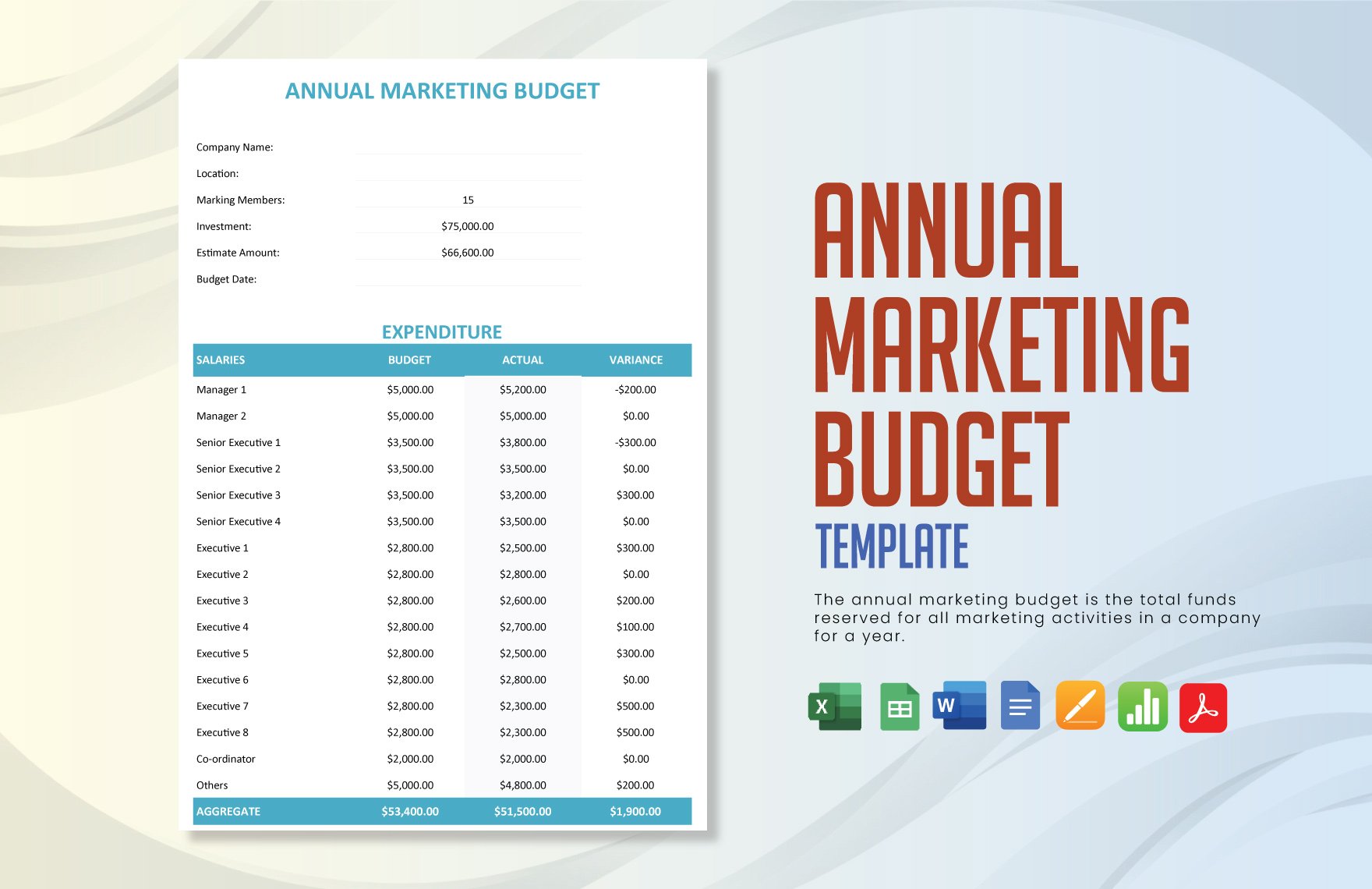

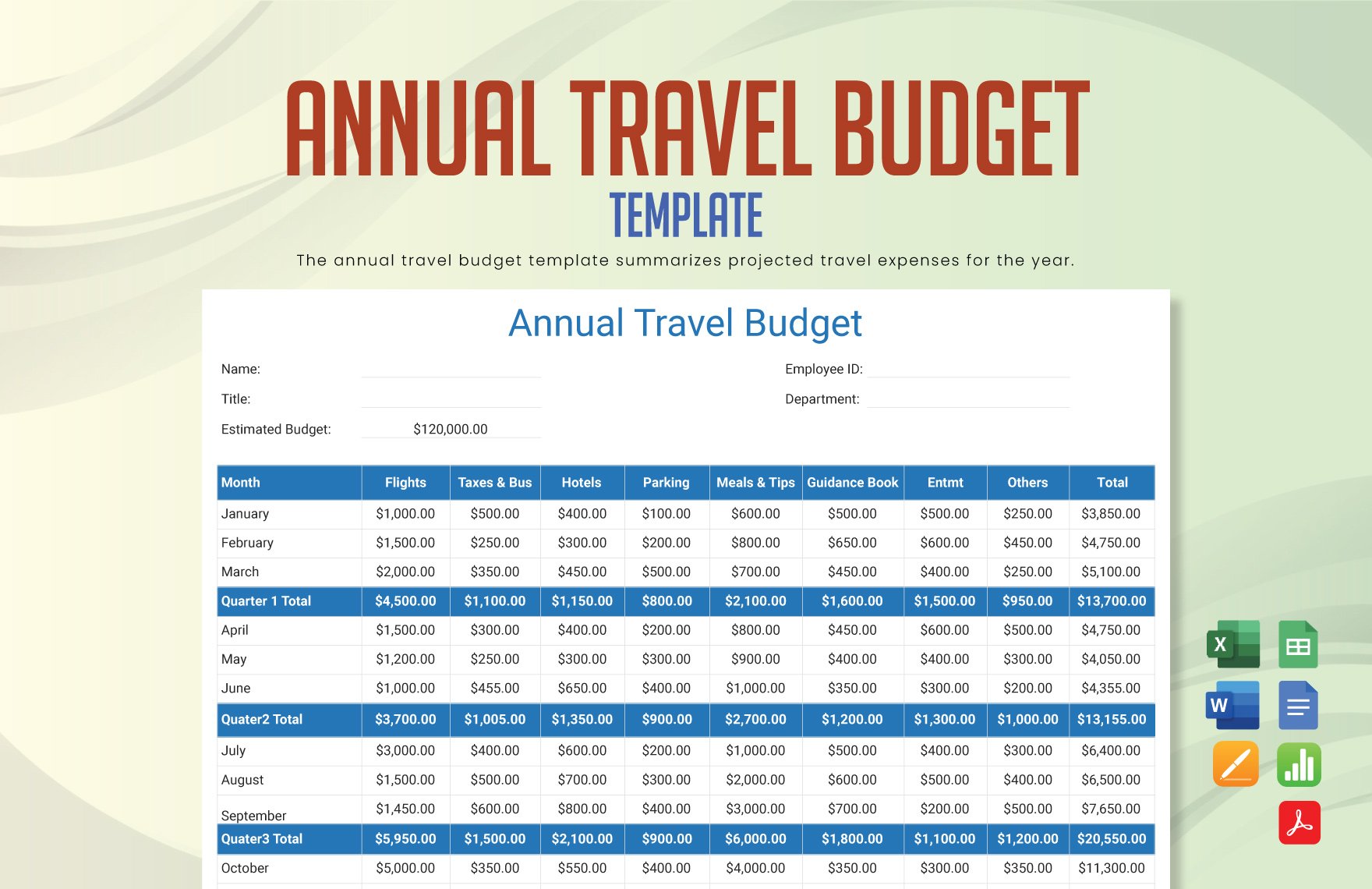

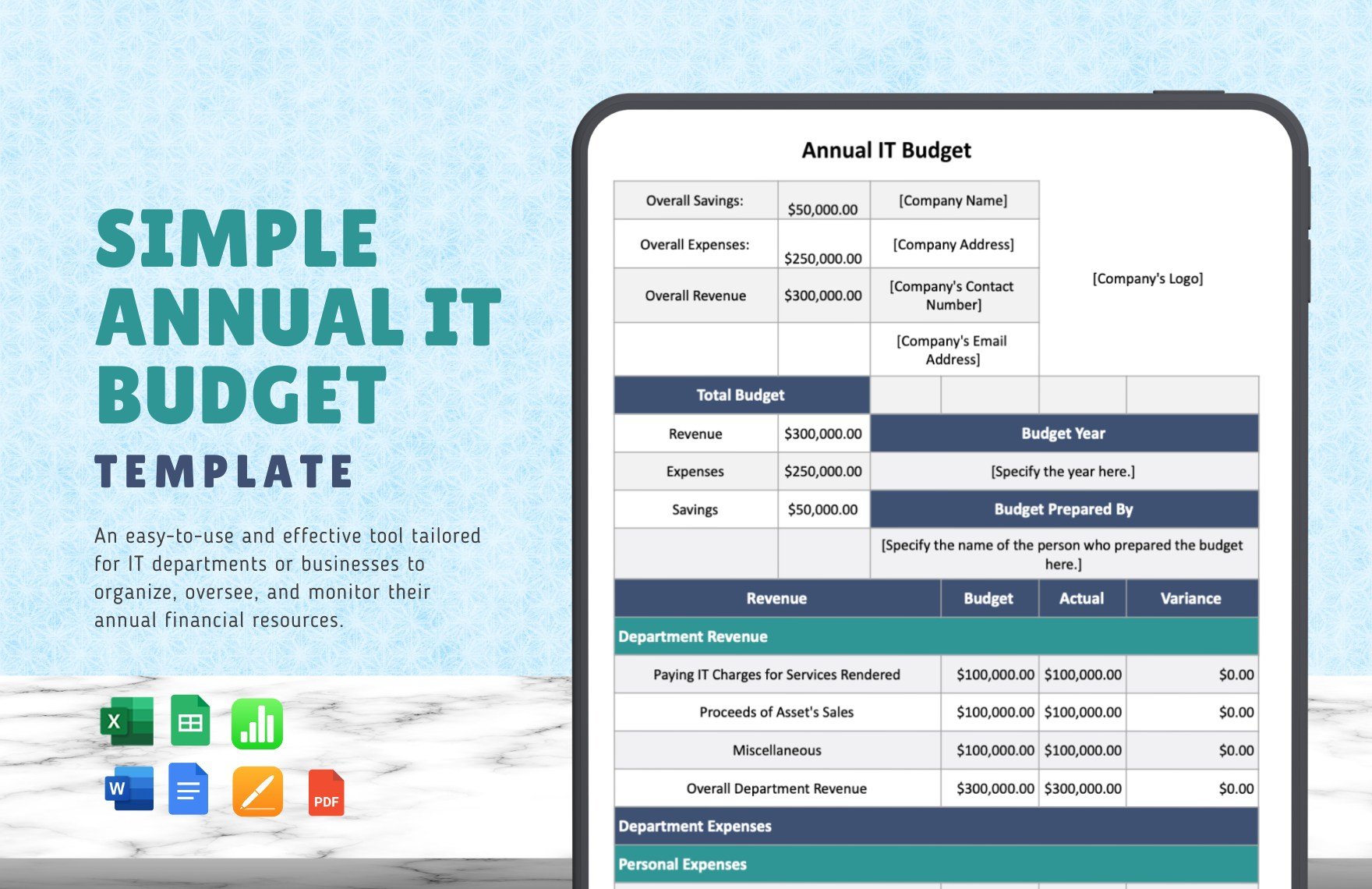

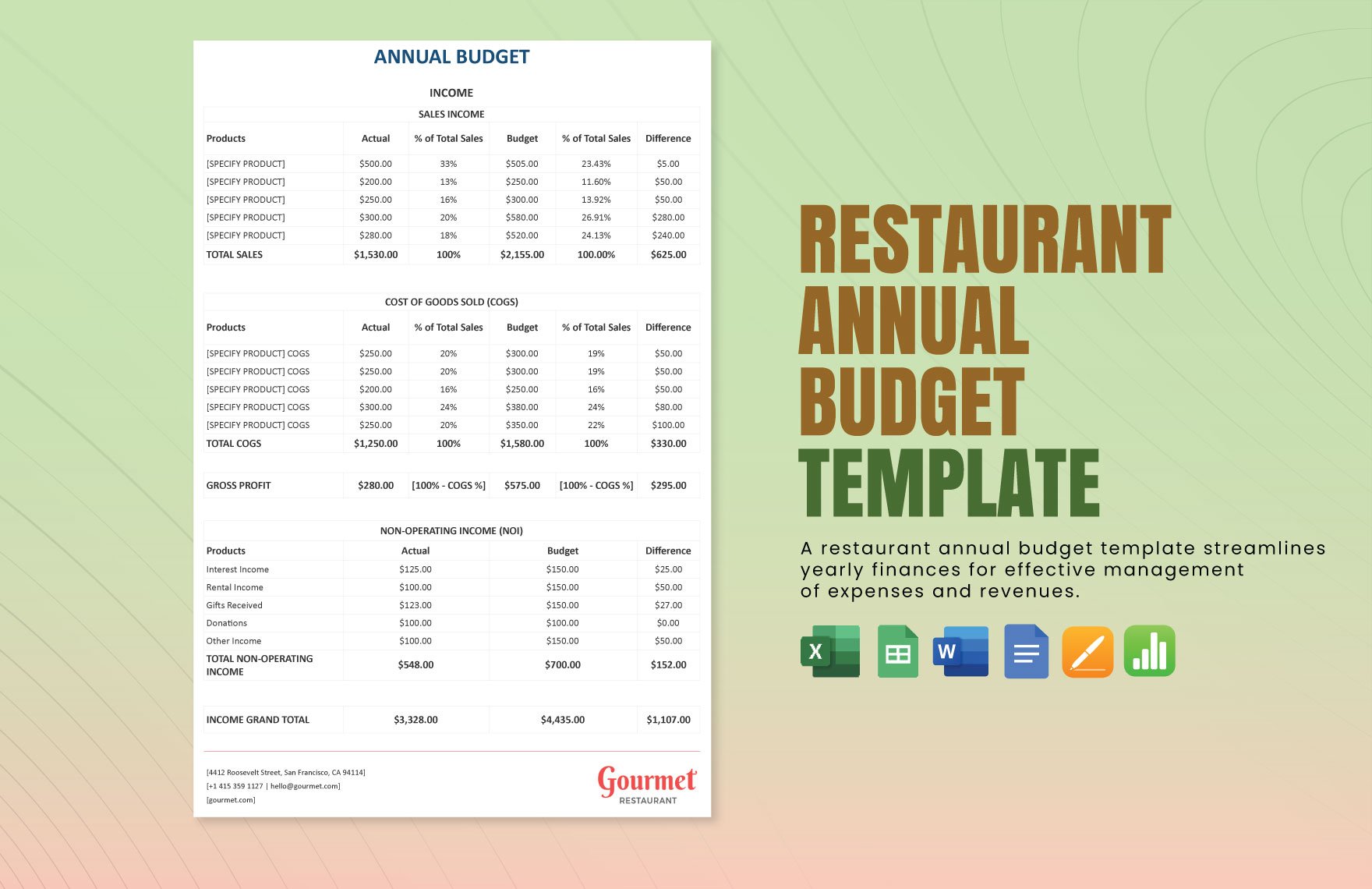

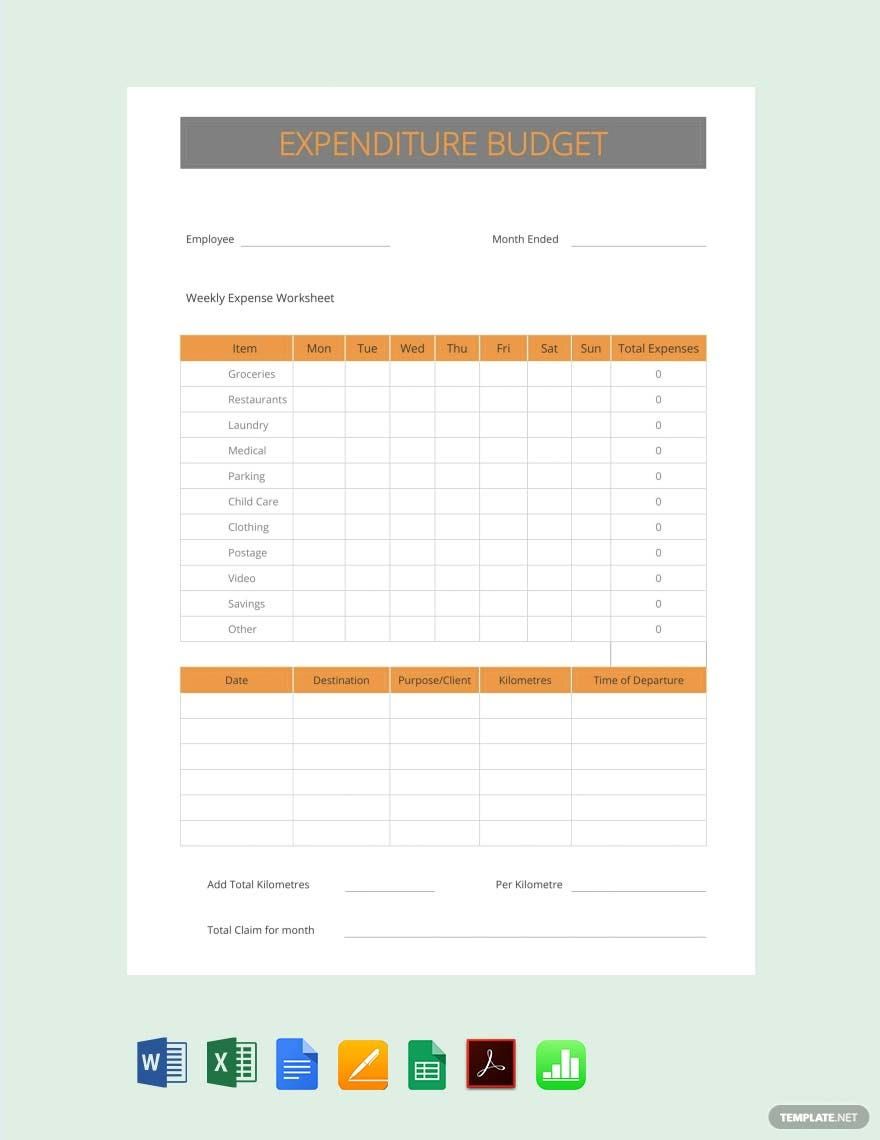

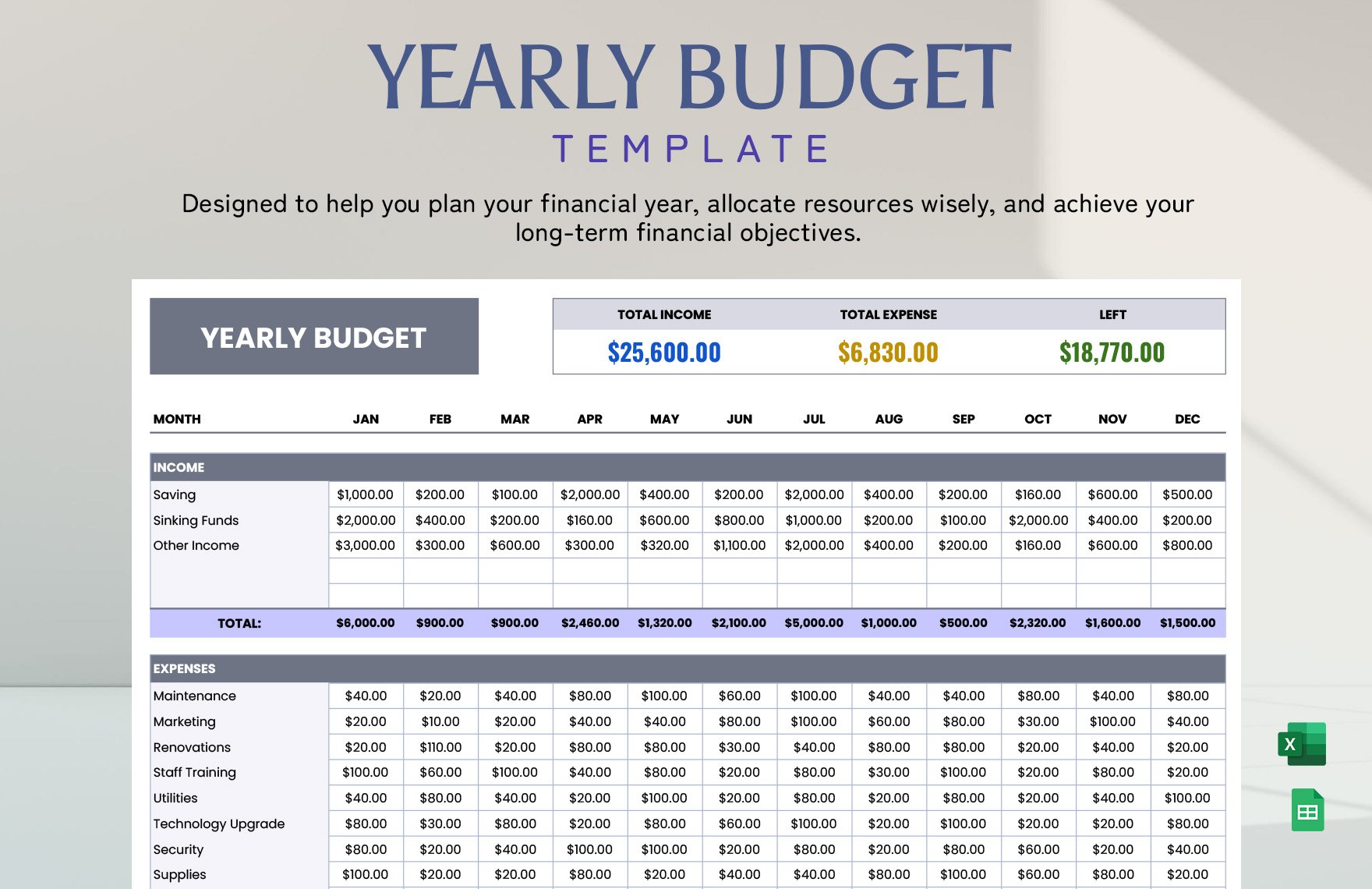

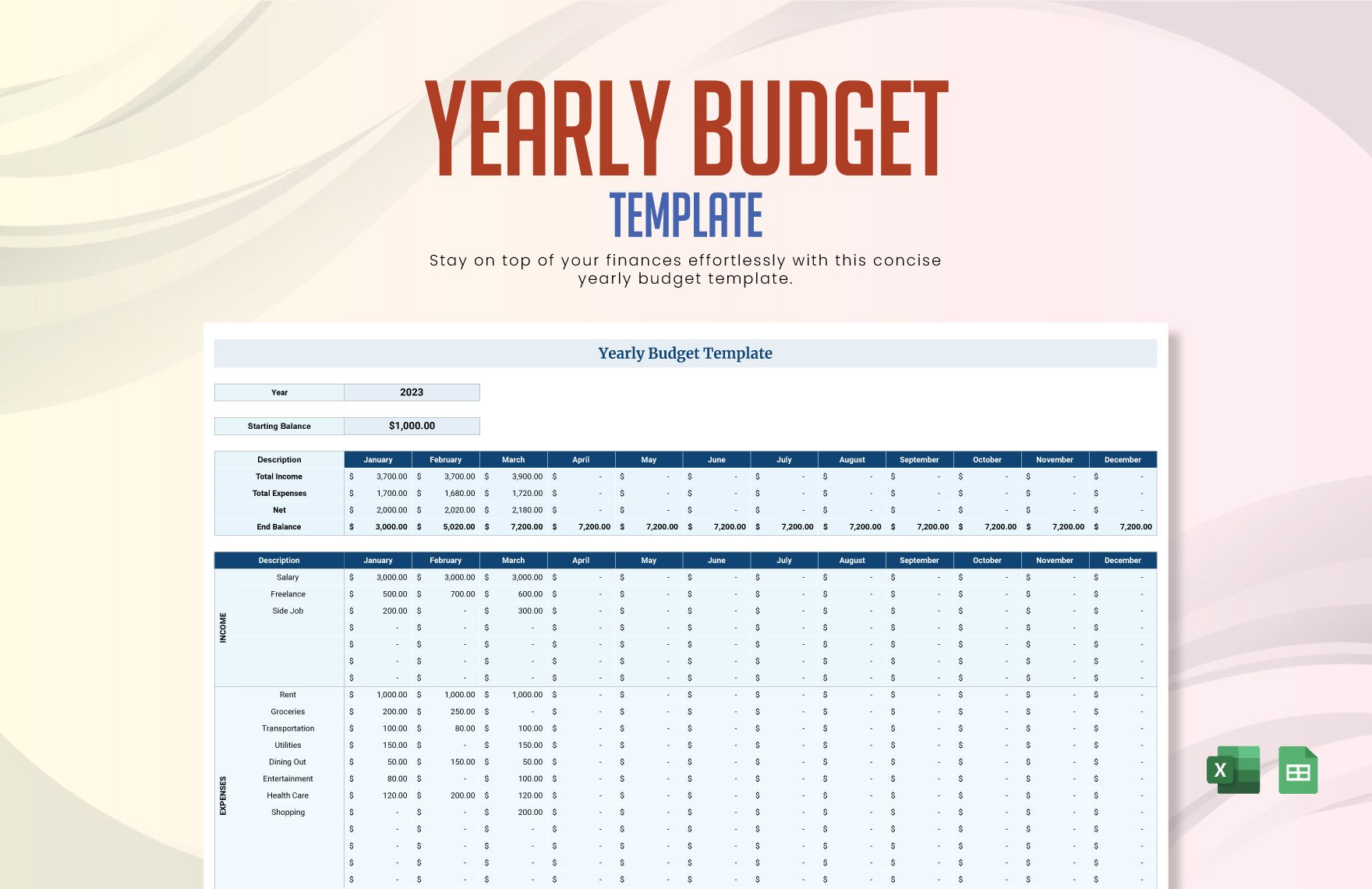

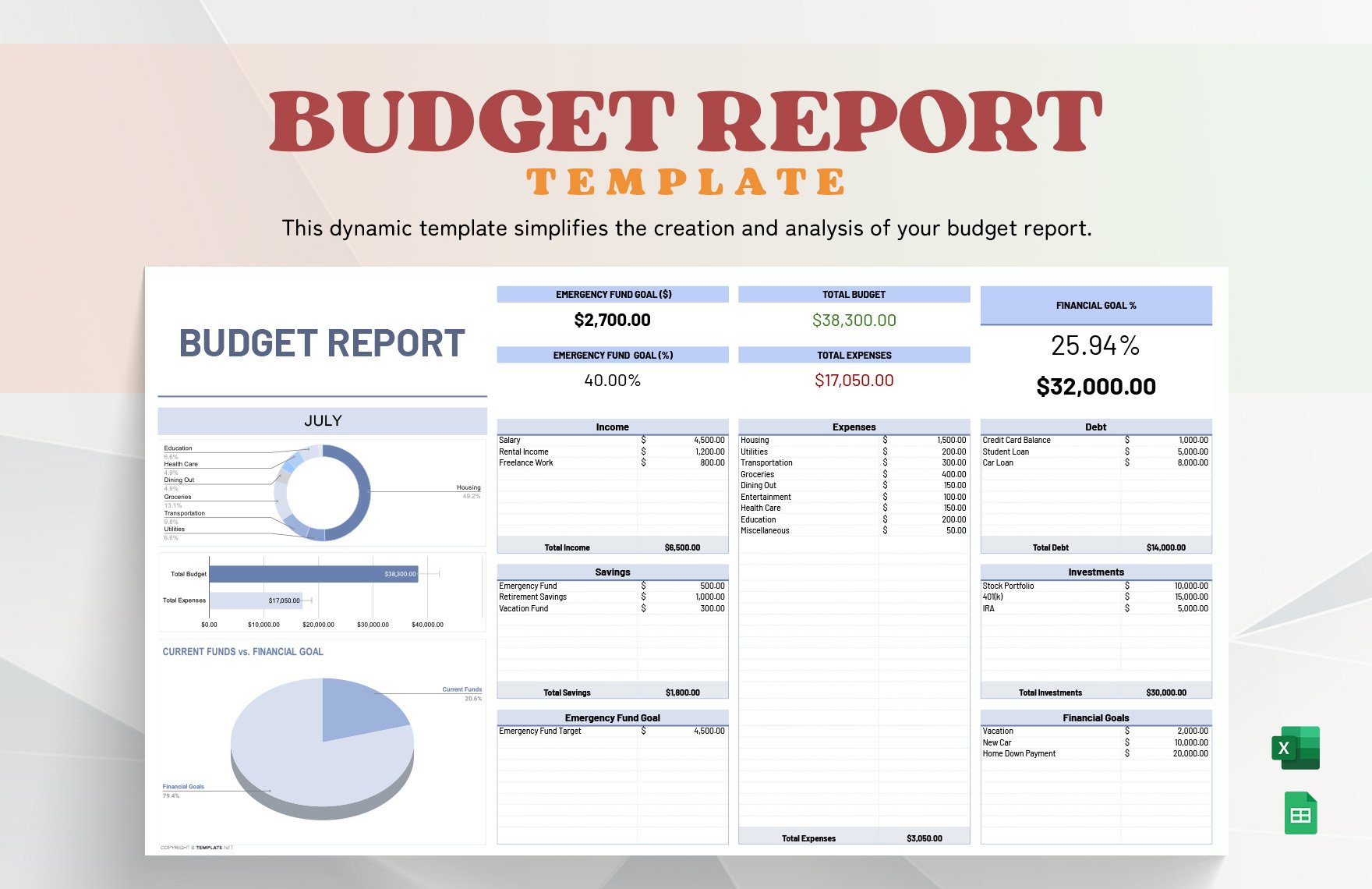

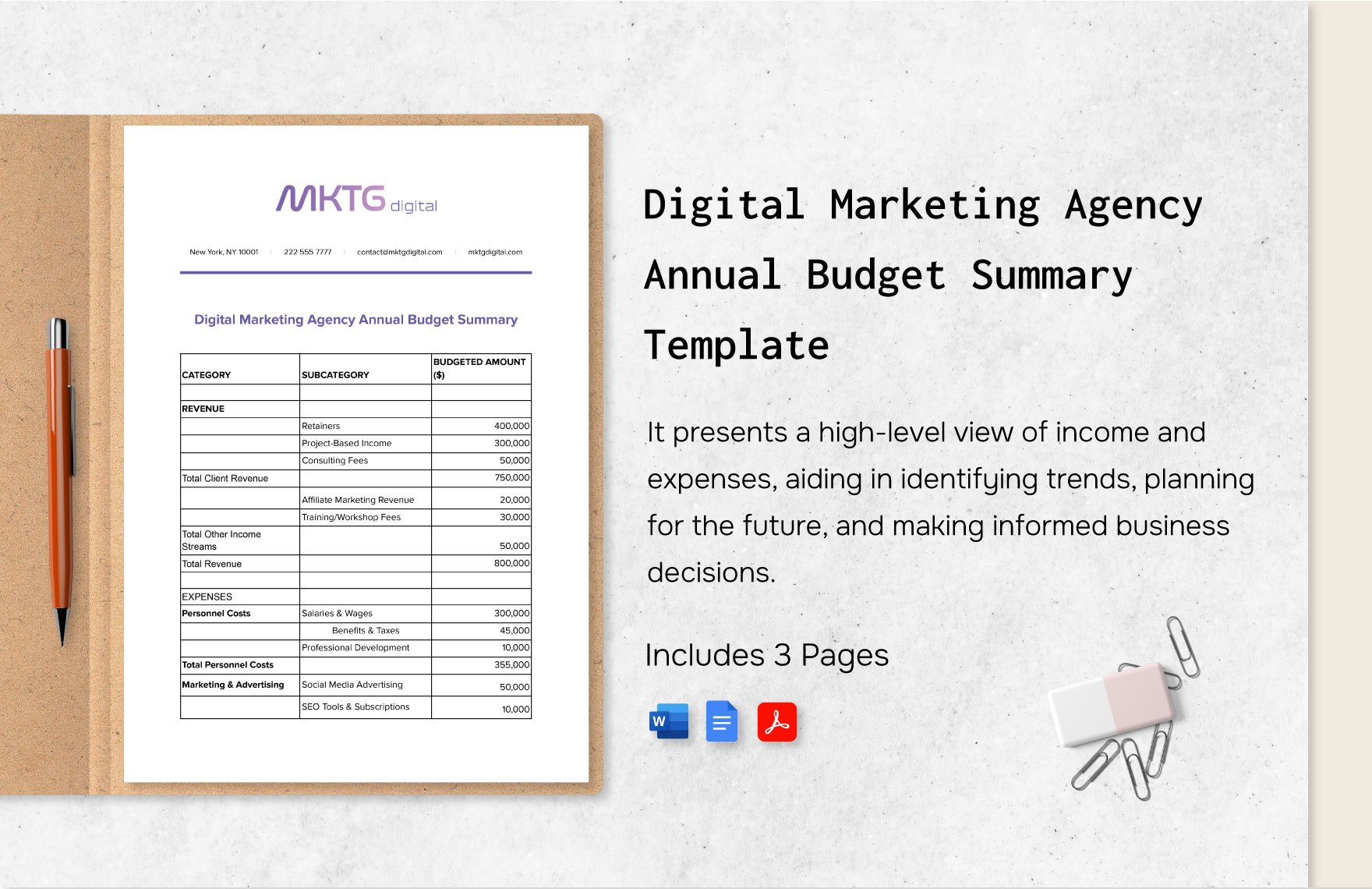

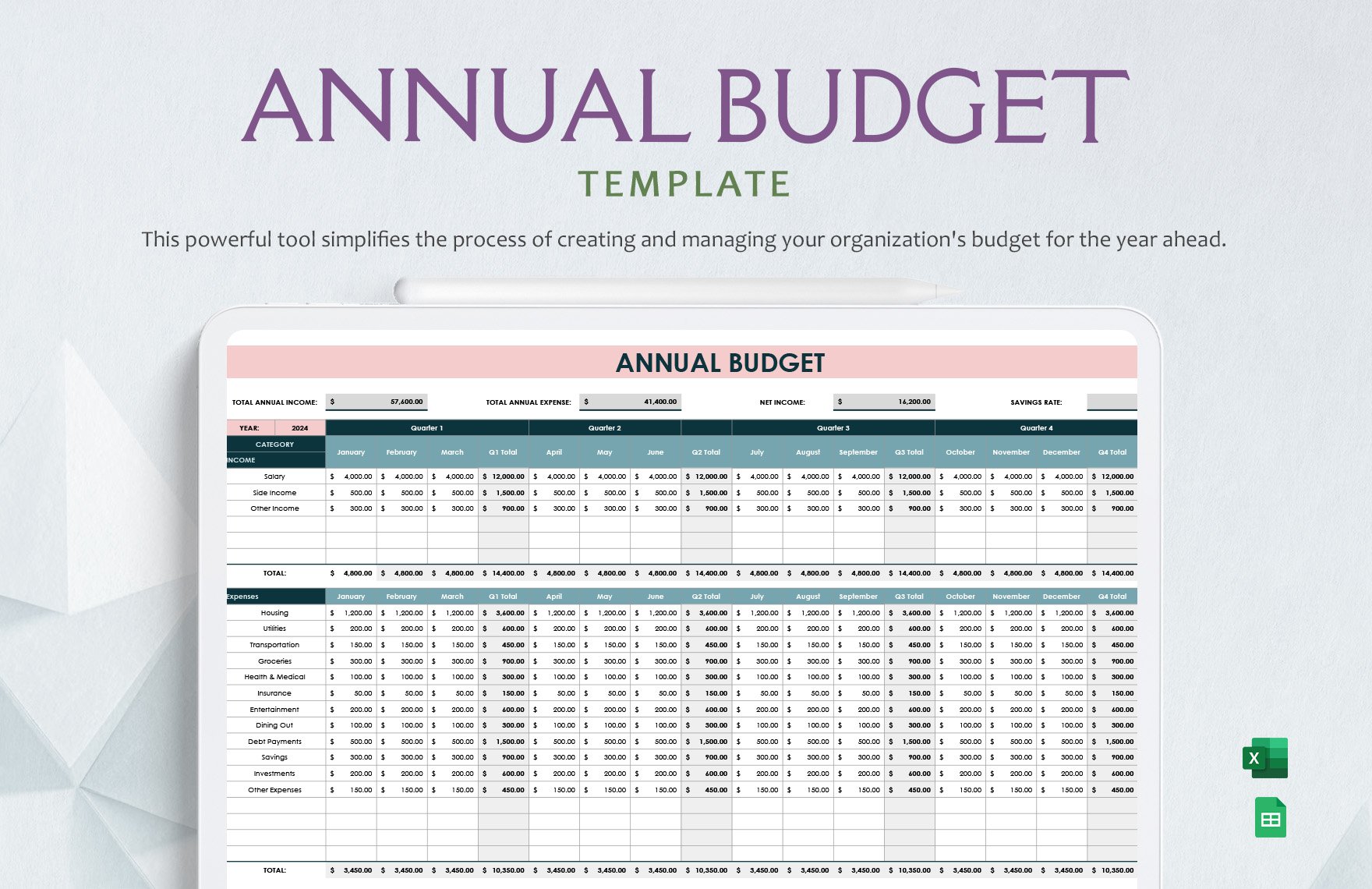

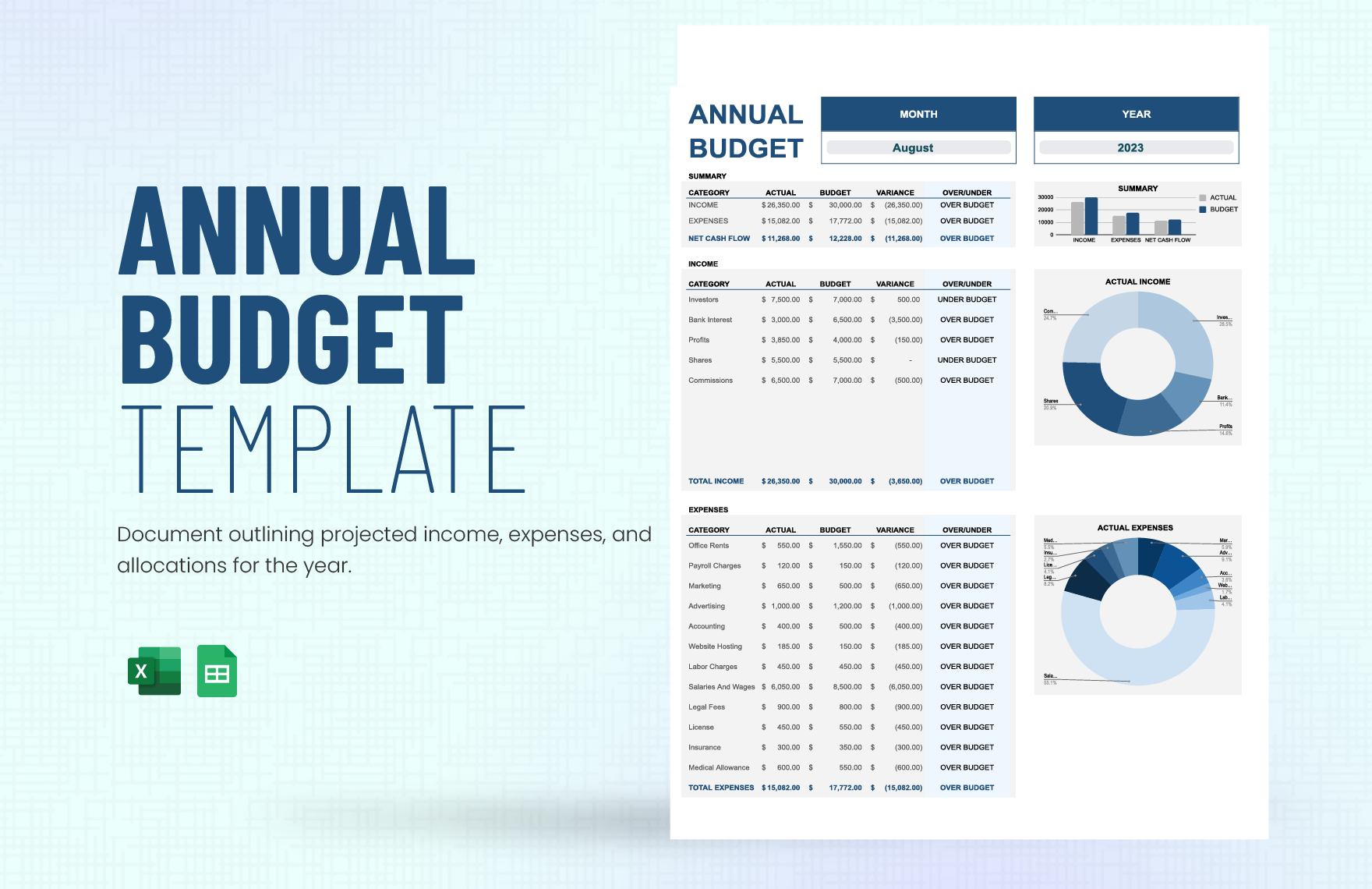

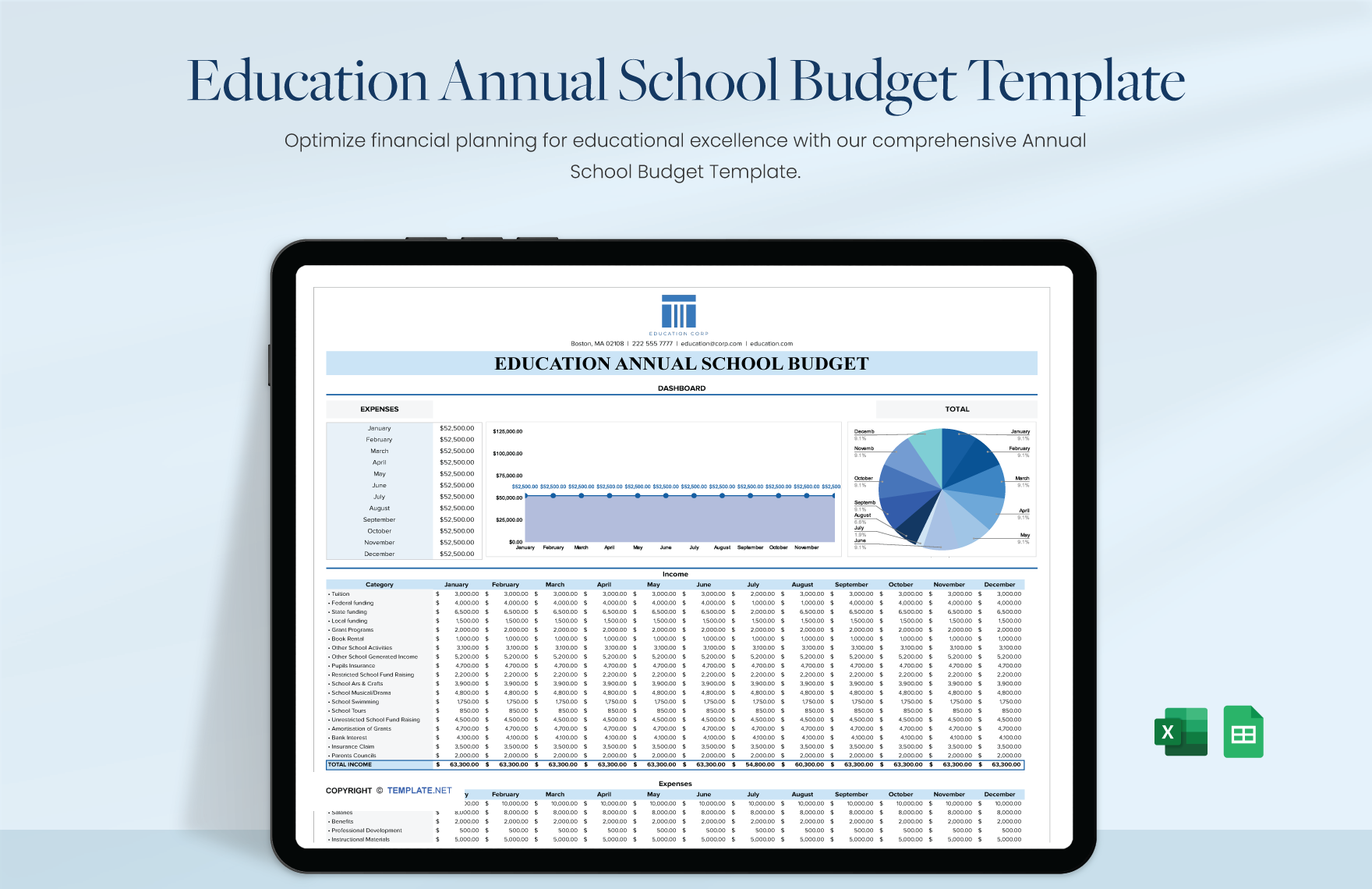

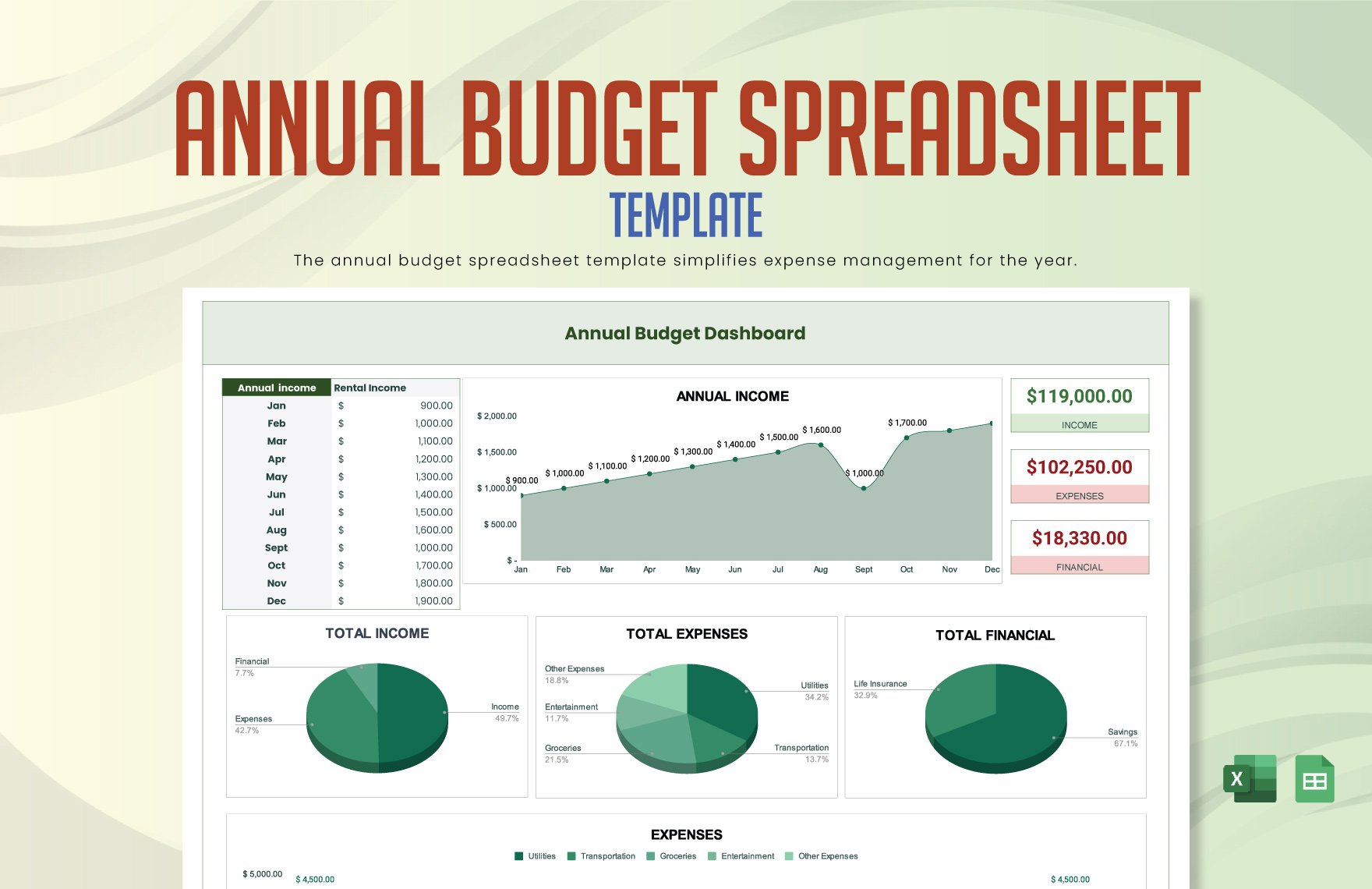

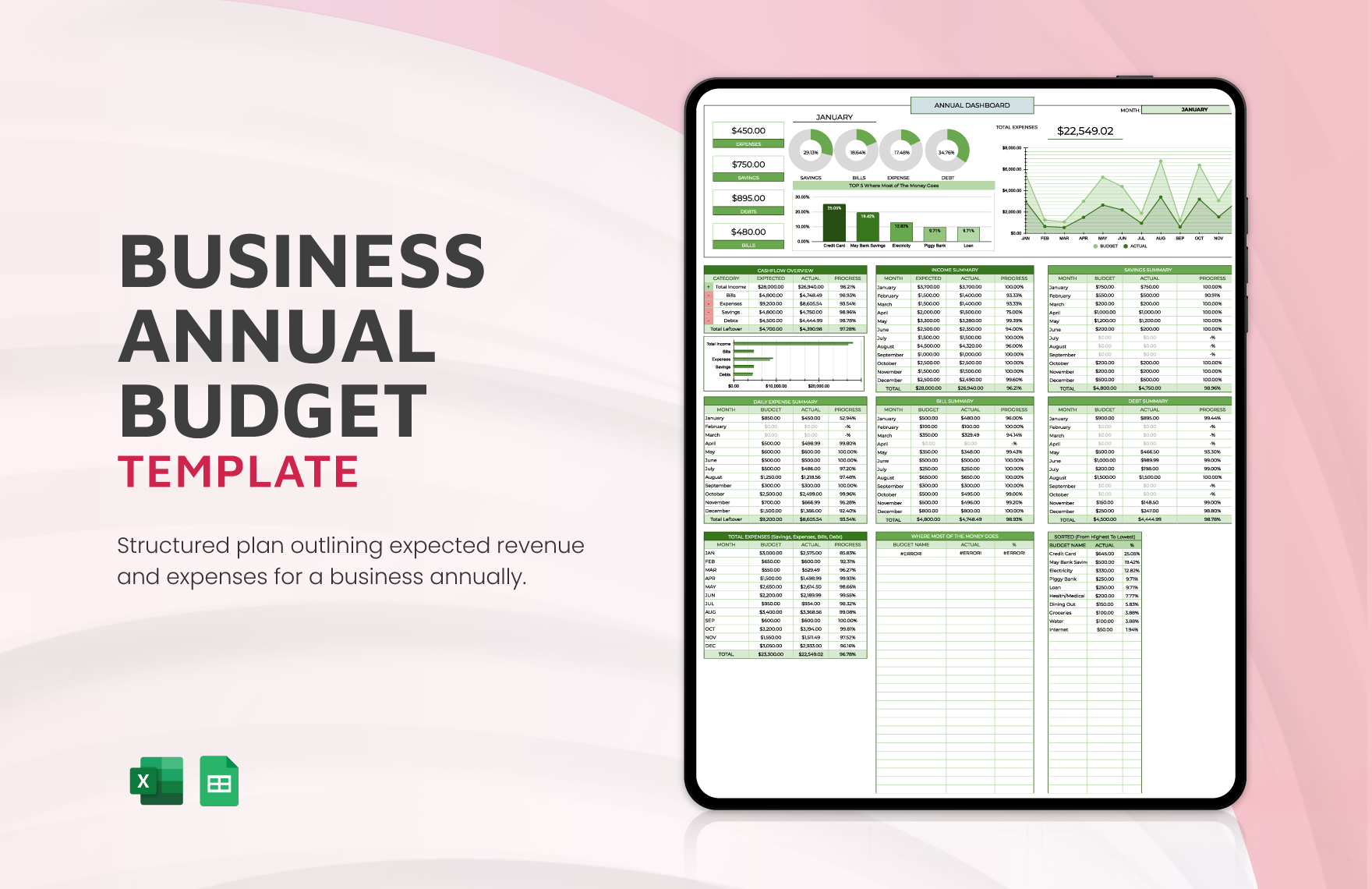

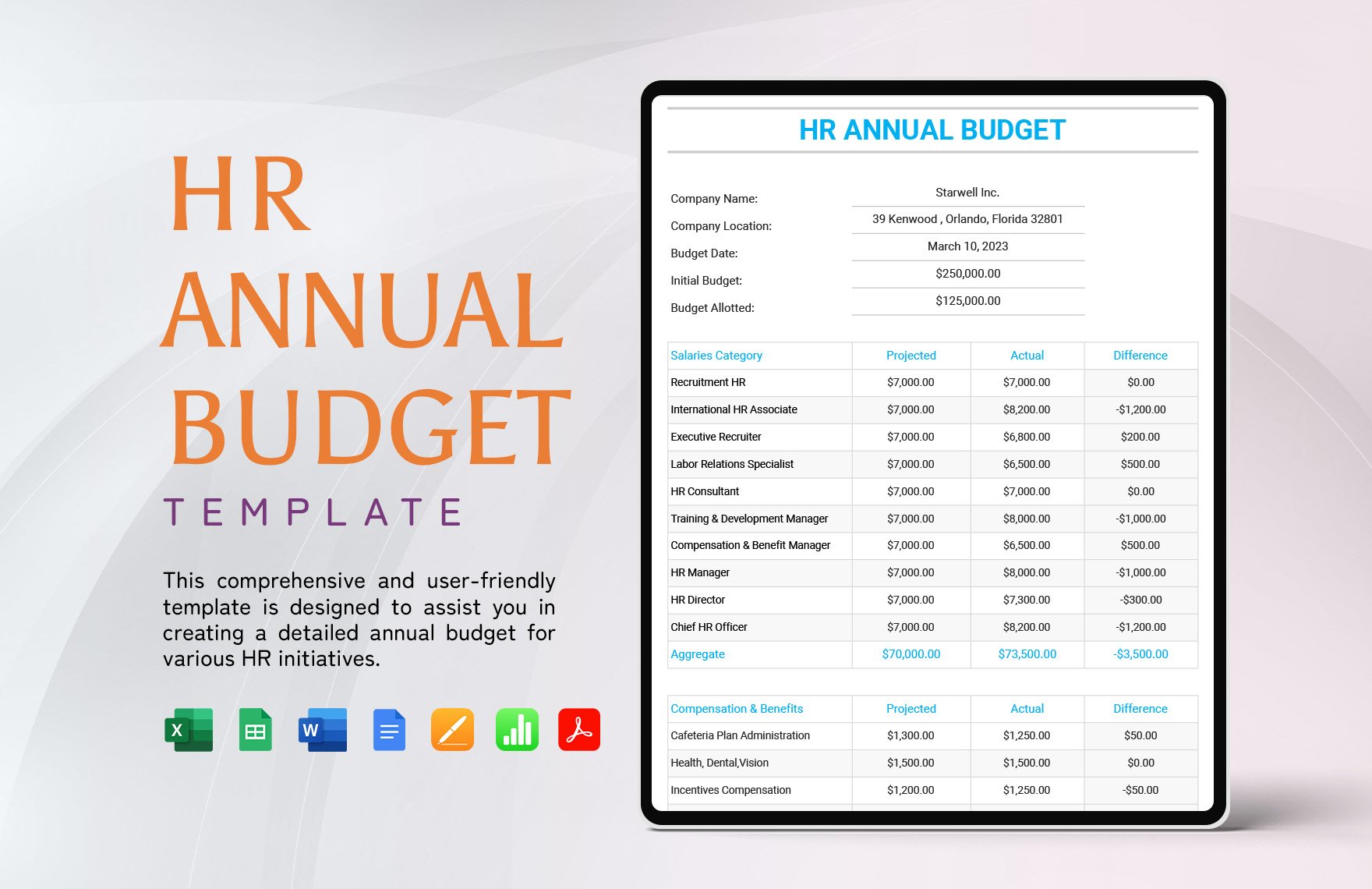

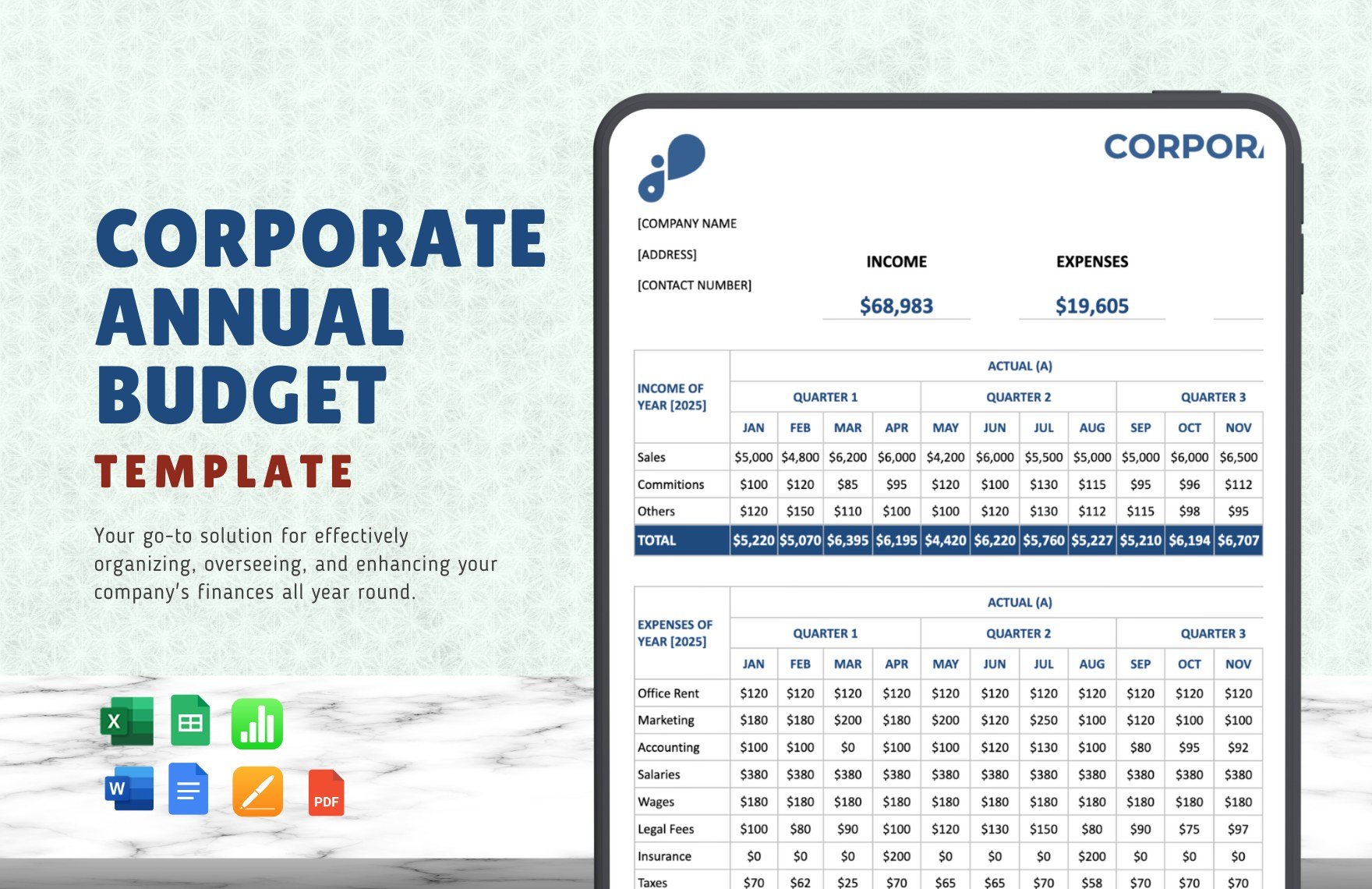

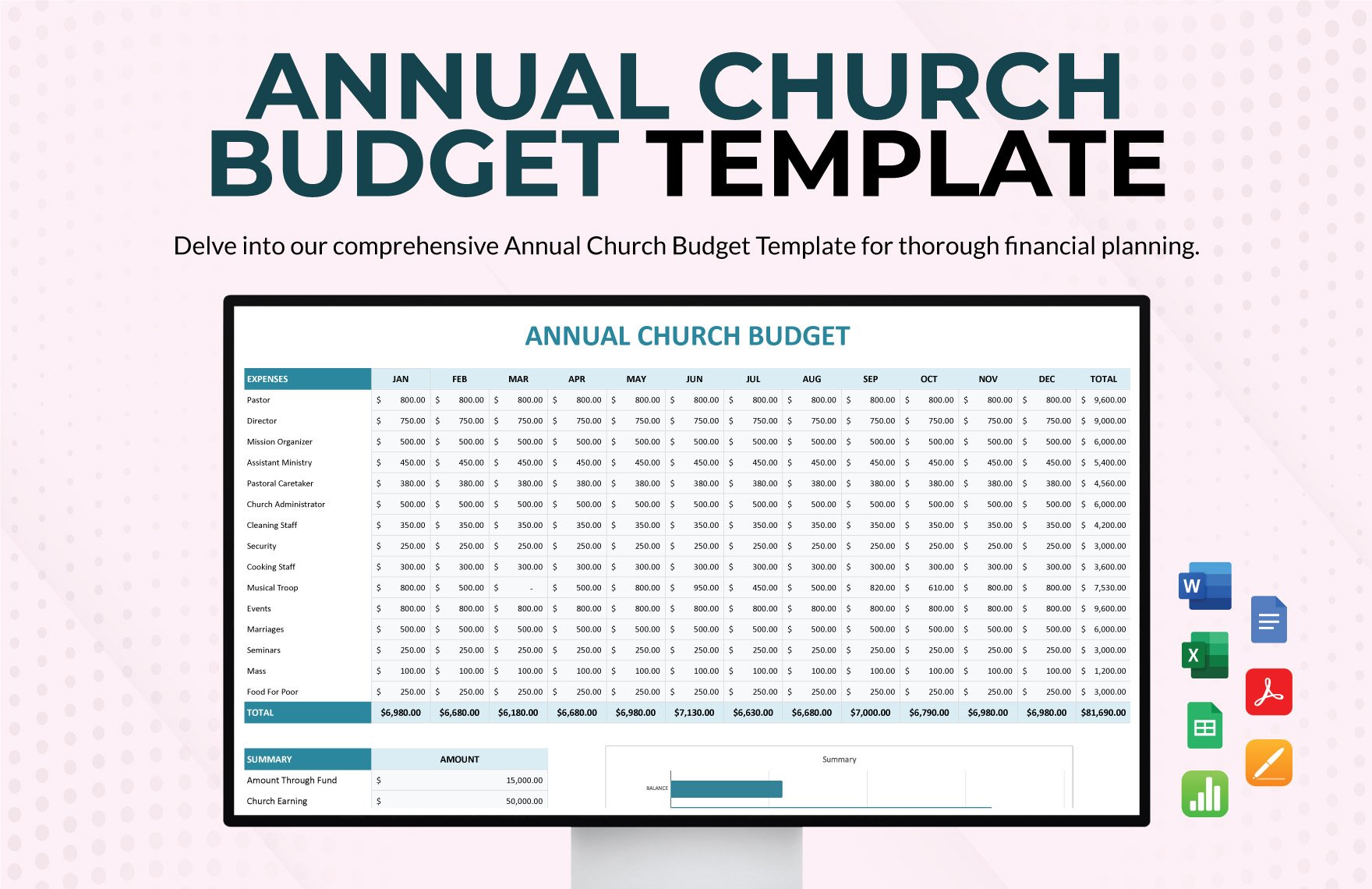

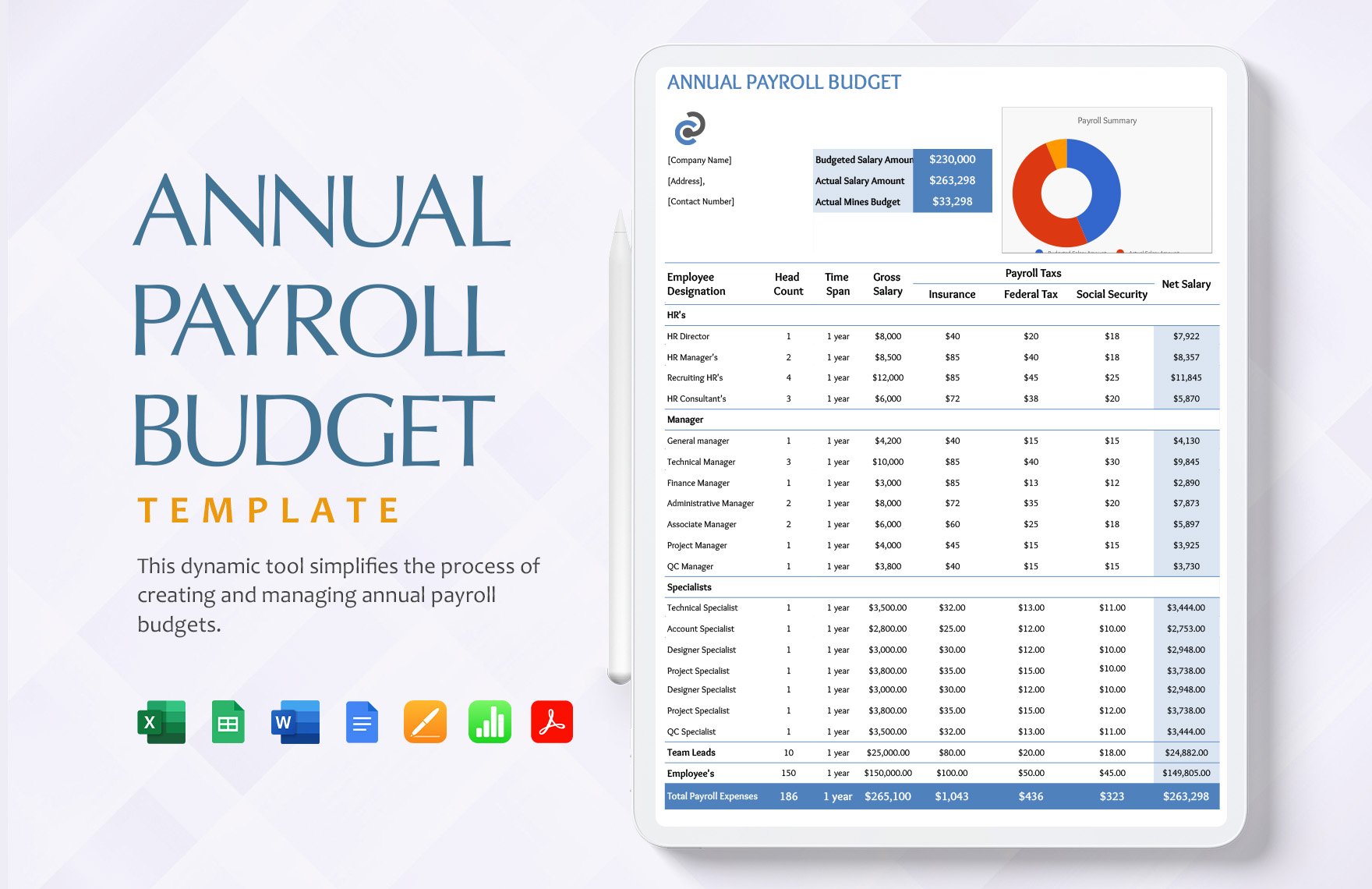

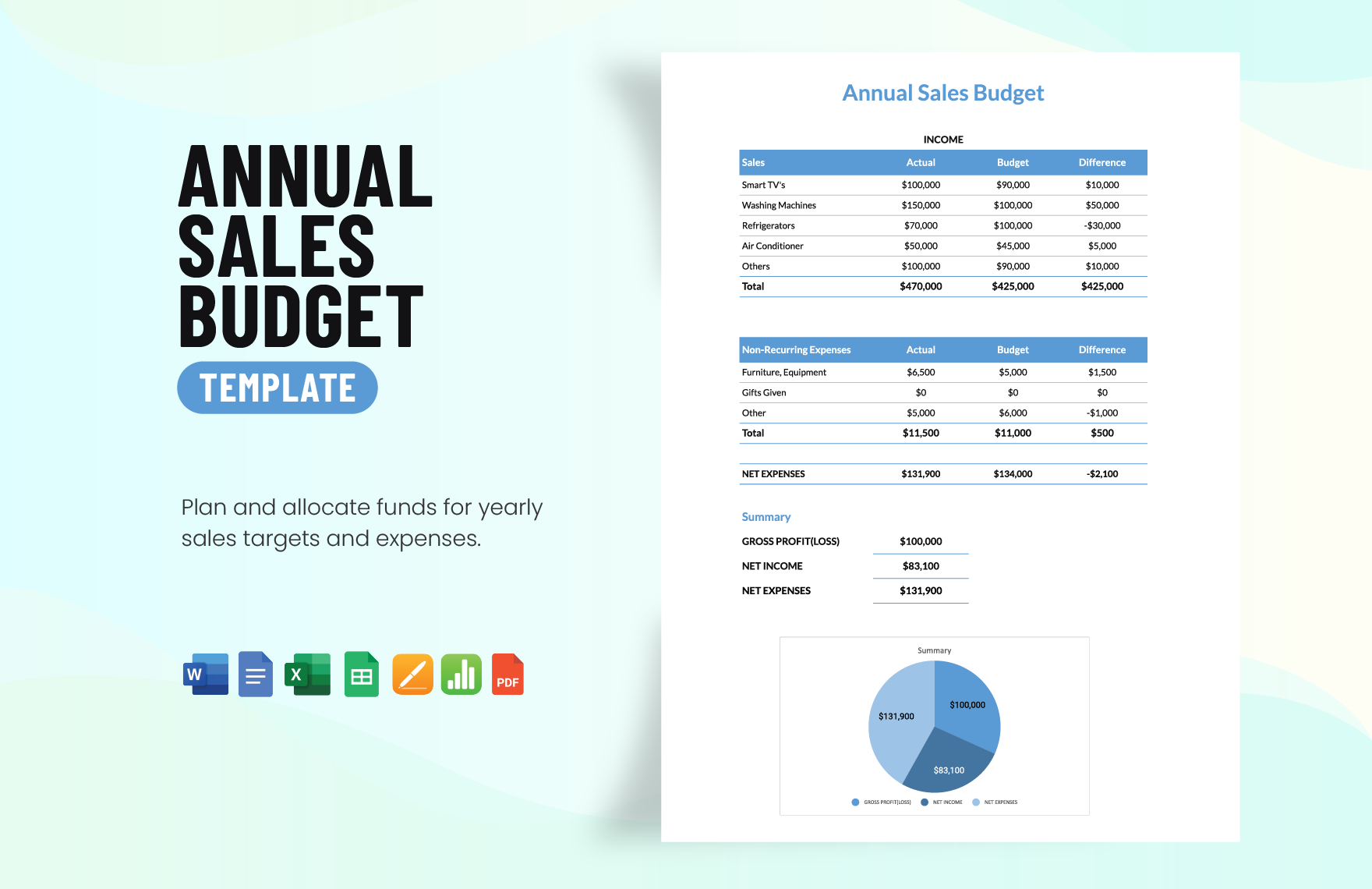

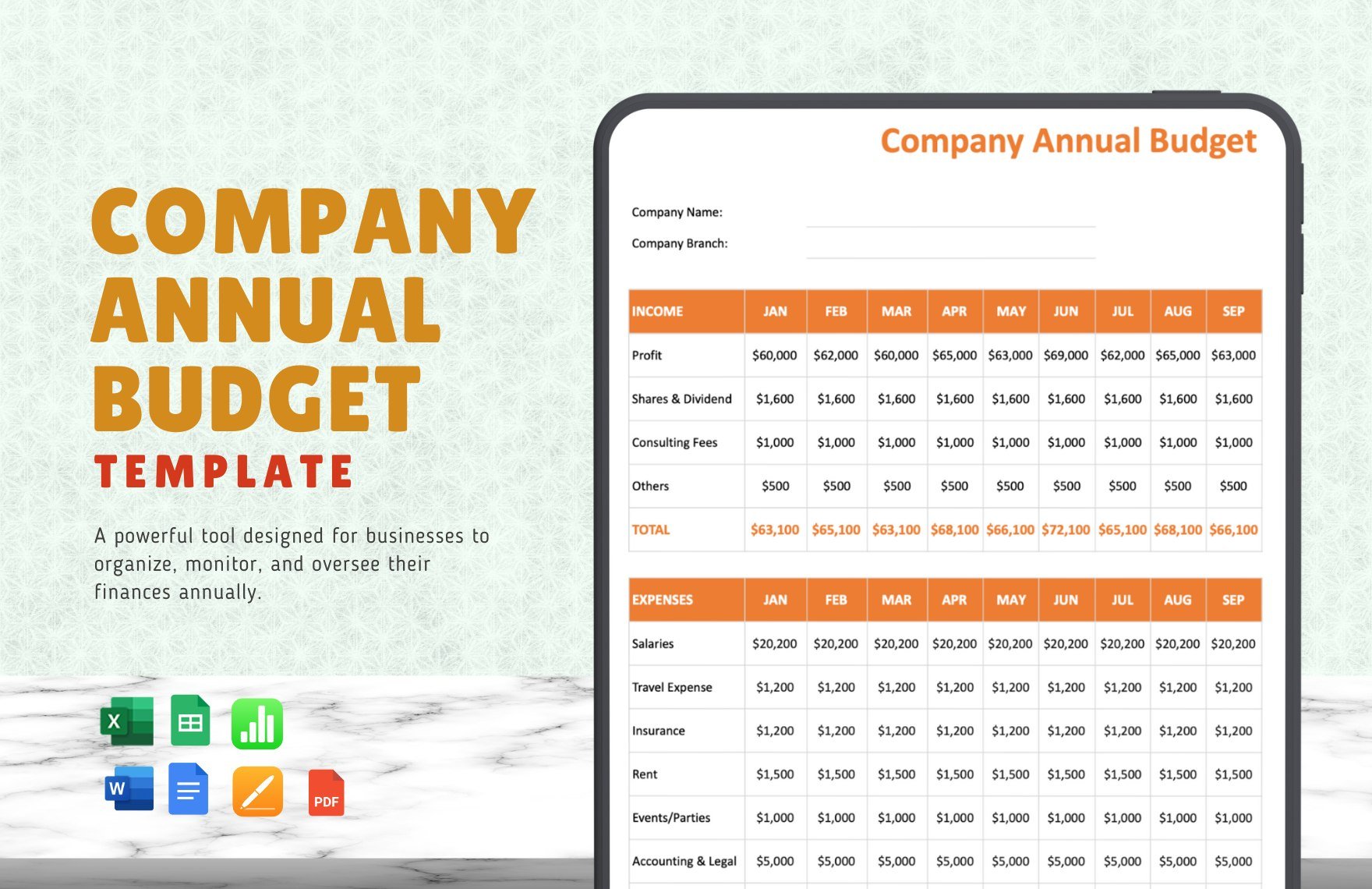

Keep your financial goals on track, streamline your expense management, and make informed decisions all year round with the Annual Budget Templates from Template.net. Designed for both individuals and businesses seeking financial clarity and efficiency, these templates allow you to meticulously plan your annual finances with ease. Whether you're planning to promote financial literacy through workshops or aim to invite team members to review an annual financial roadmap, these templates are your go-to solution. Each template includes essential fields for income, expenses, and projections, all structured in a user-friendly format. No advanced accounting skills are required, as the professional-grade design offers intuitive layouts suitable for any level of expertise. Plus, these templates are easily customizable, ensuring that your budget plan fits seamlessly into your financial strategy, whether printed or shared digitally.

Discover the many budget templates we have on hand, tailored to meet a variety of financial planning needs. Begin by selecting a template that best suits your financial landscape and swap in your specific data with ease. Tweak colors and fonts to match your brand identity or personal style, elevating the visual appeal of your budget documents. Add advanced touches with drag-and-drop icons, and enhance your presentation with animated effects if desired. The possibilities are endless, ensuring a process that is as fun as it is functional. With regularly updated templates on offer, you'll always find fresh design options to keep your budgeting up to date. When you're finished, easily download your template or share it via email or print for a comprehensive financial overview ideal for multiple channels and collaborative planning in real time.