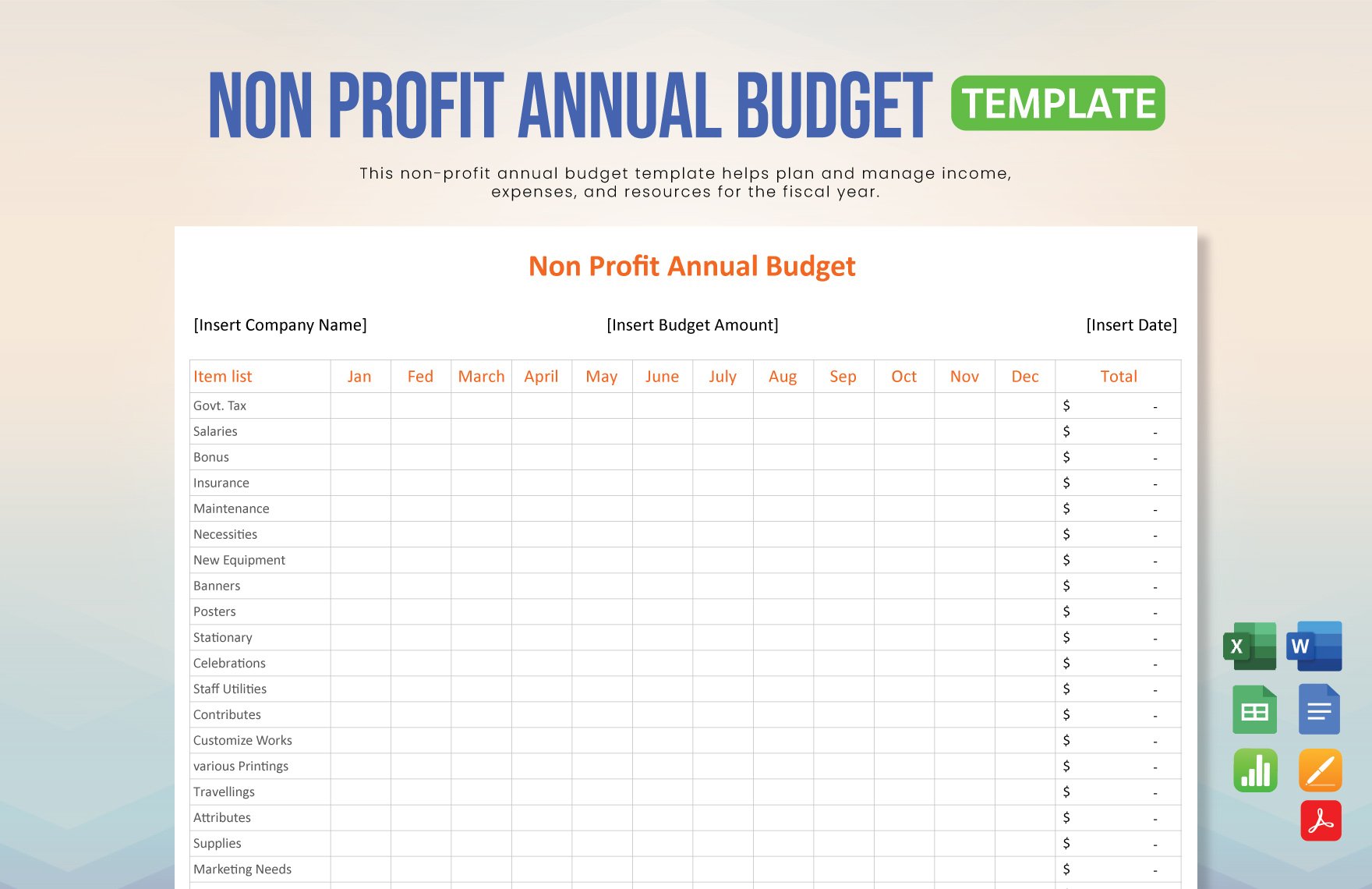

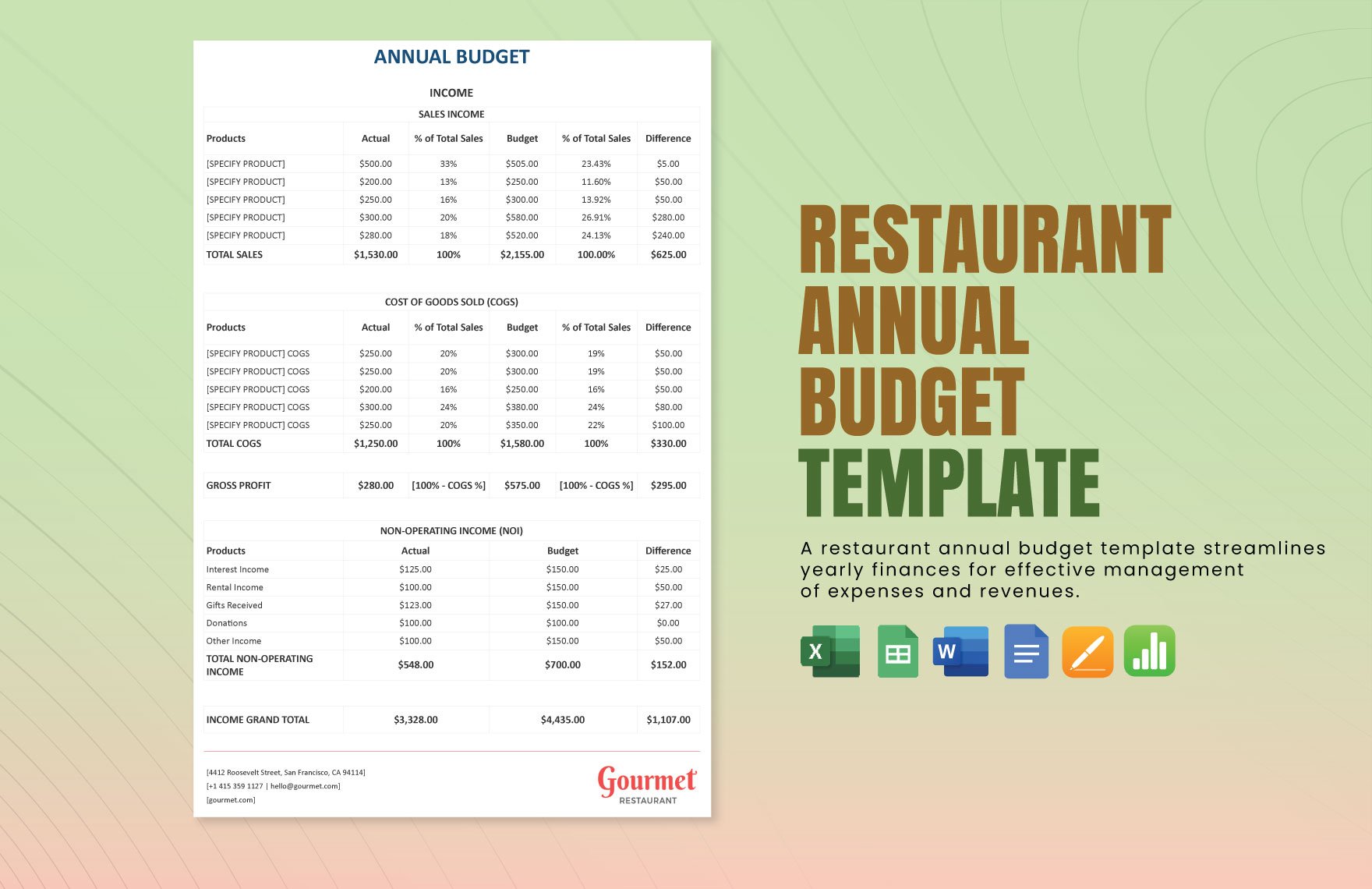

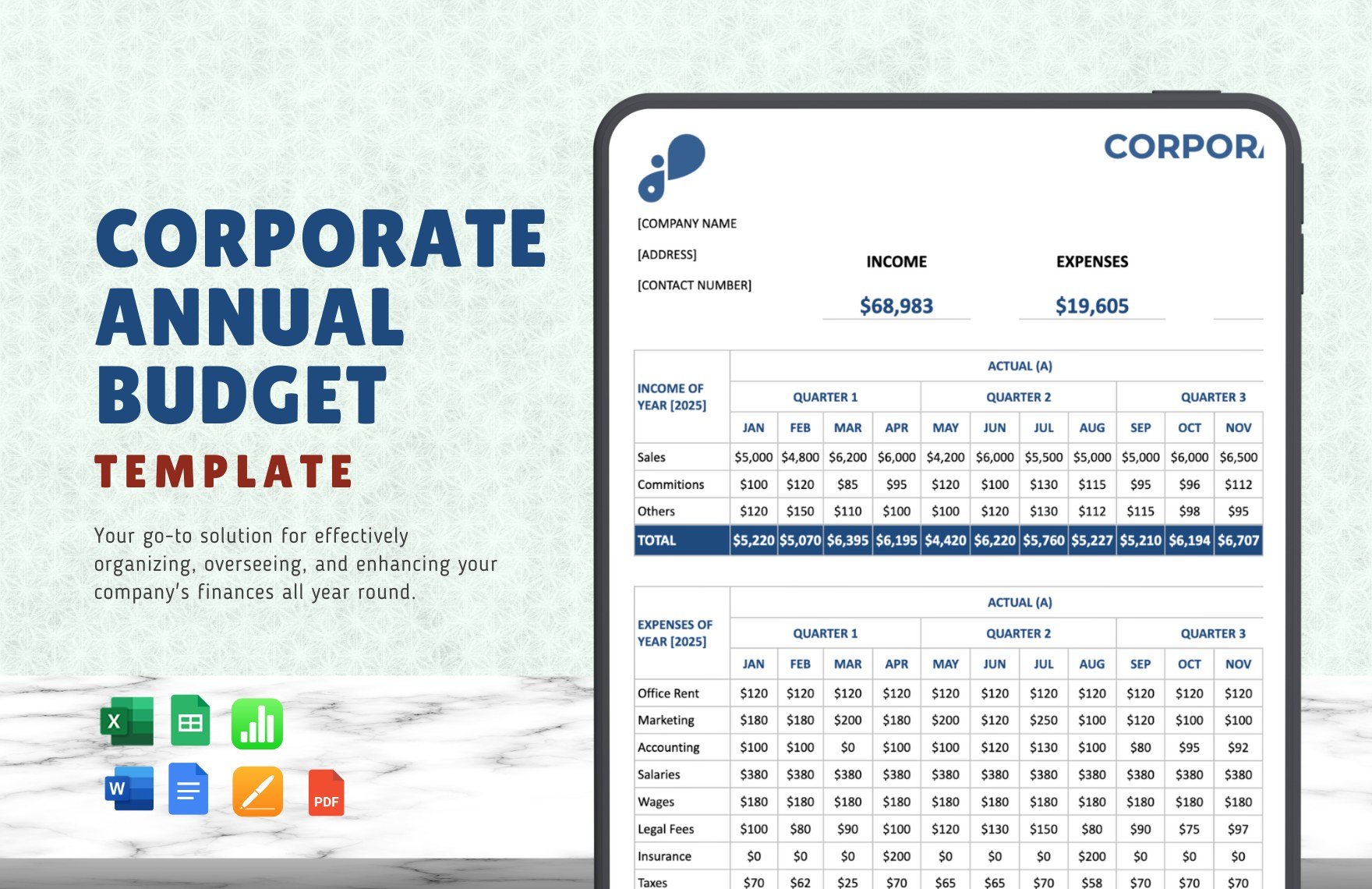

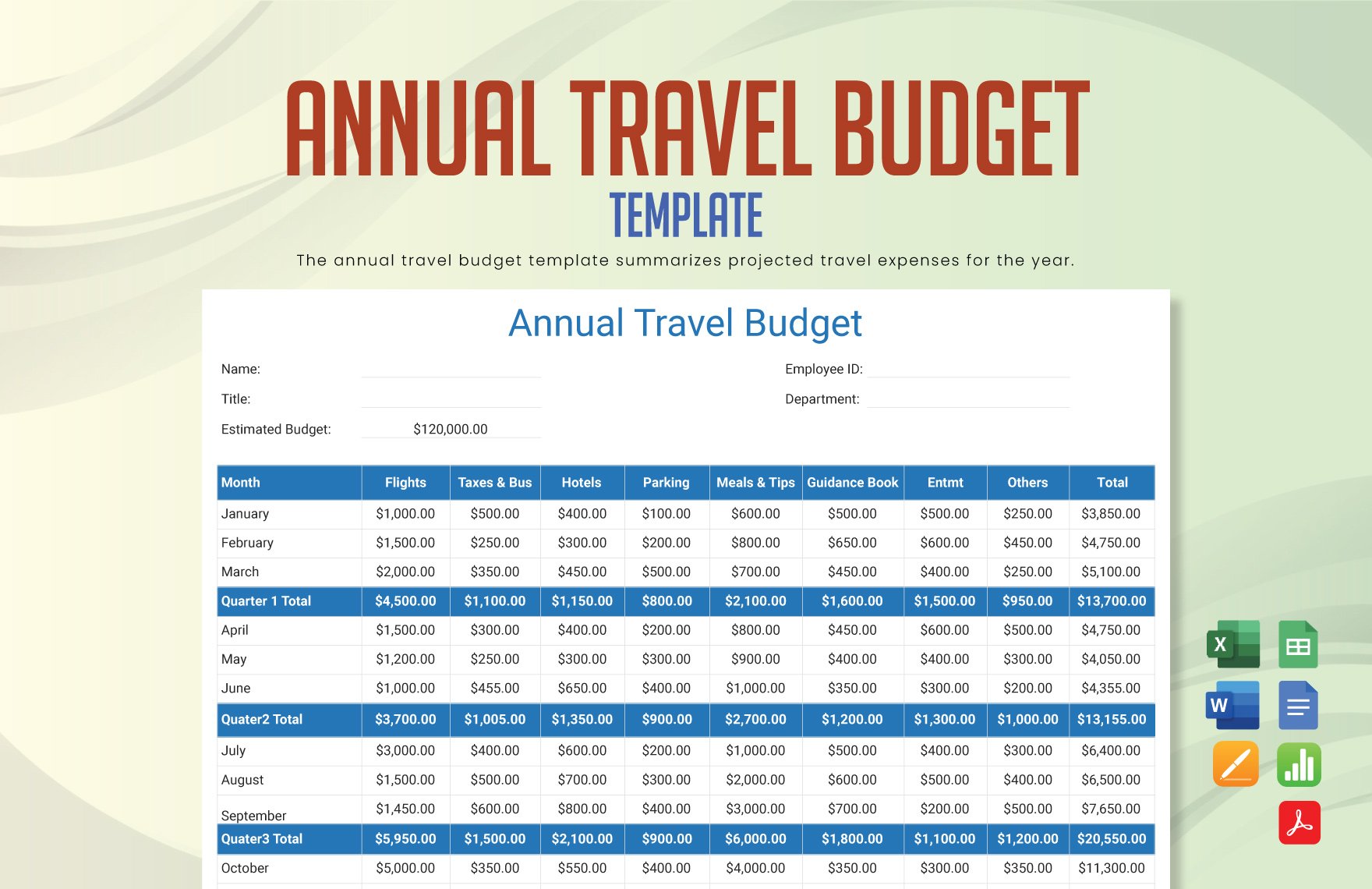

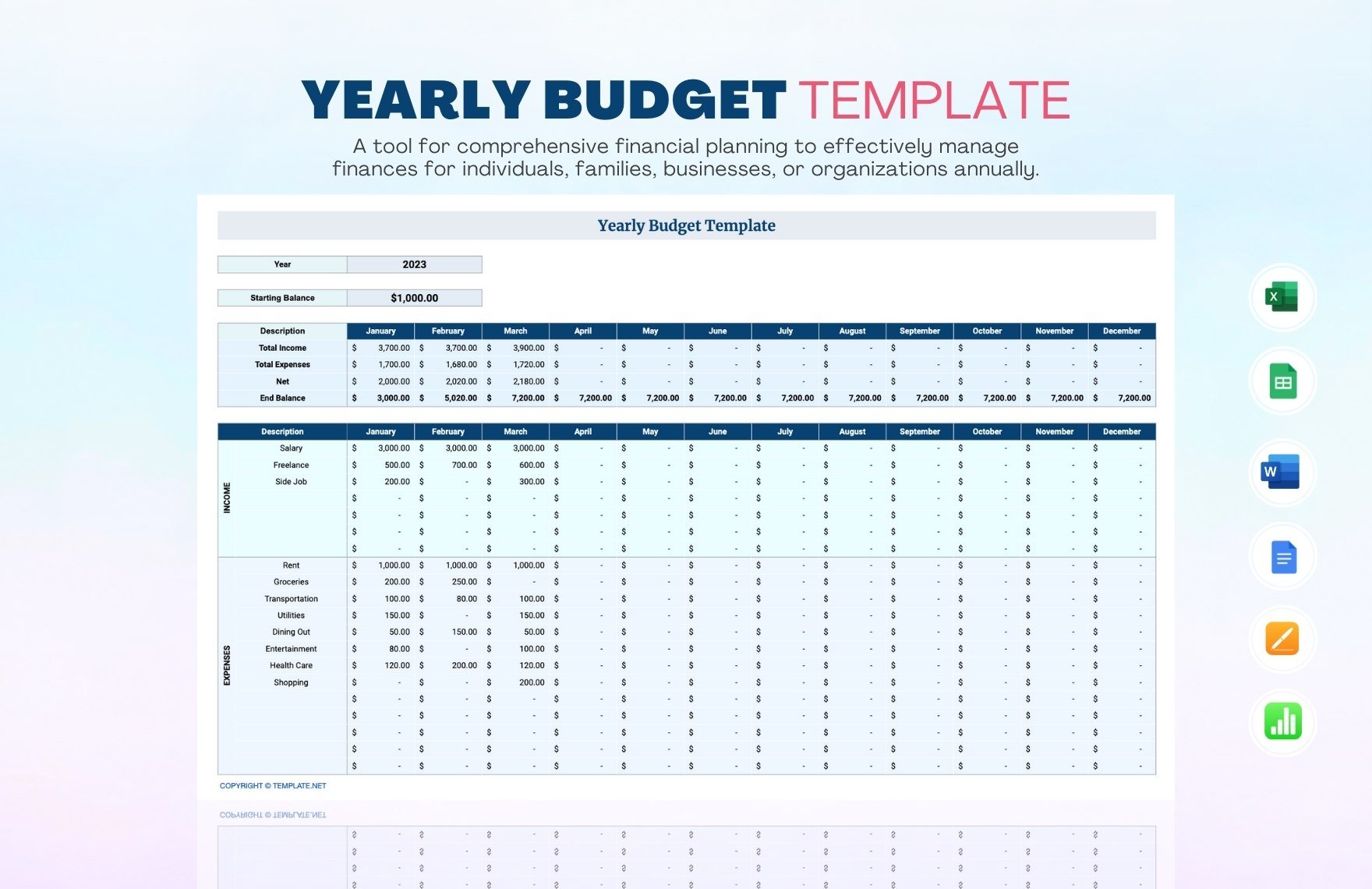

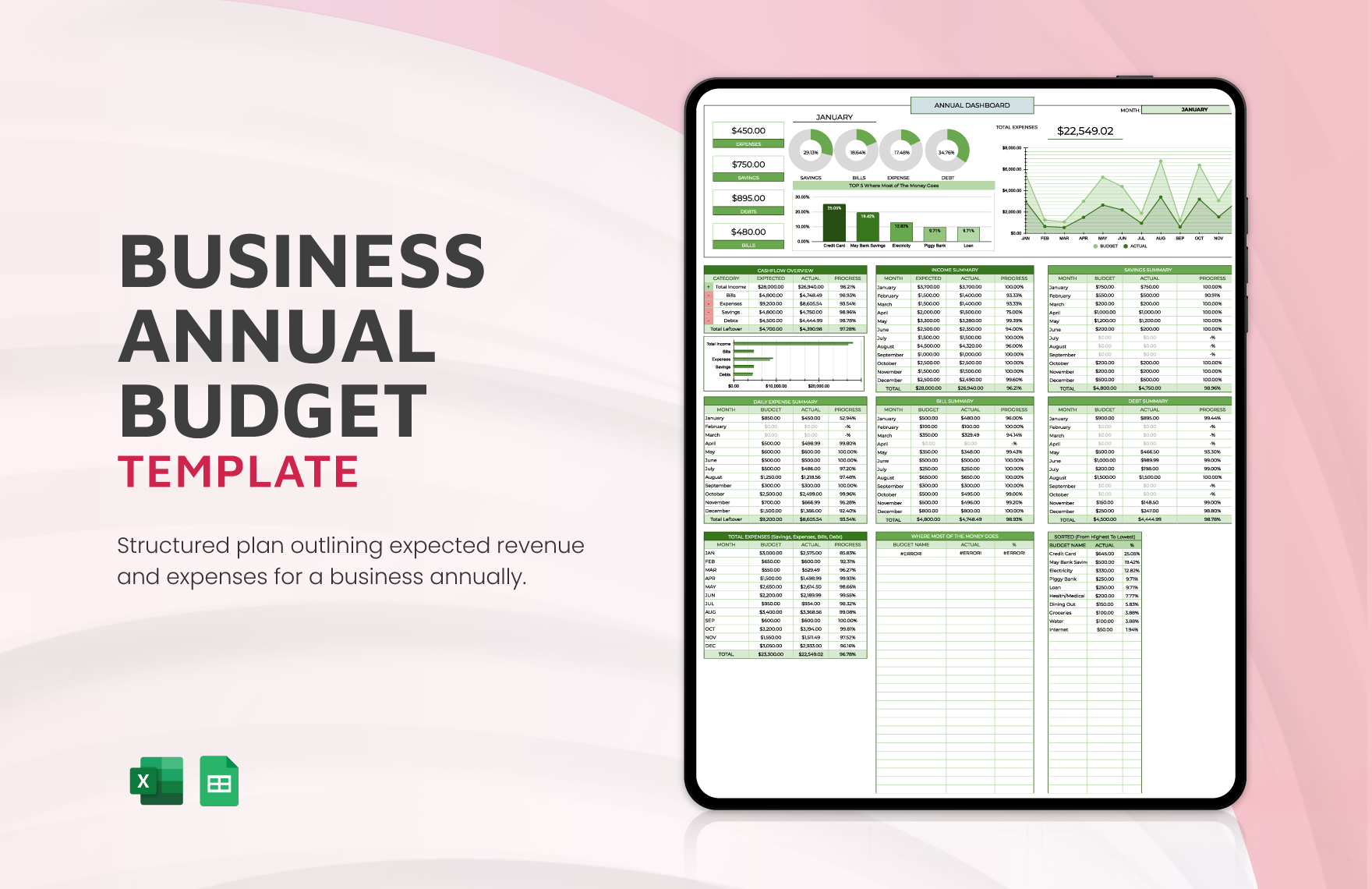

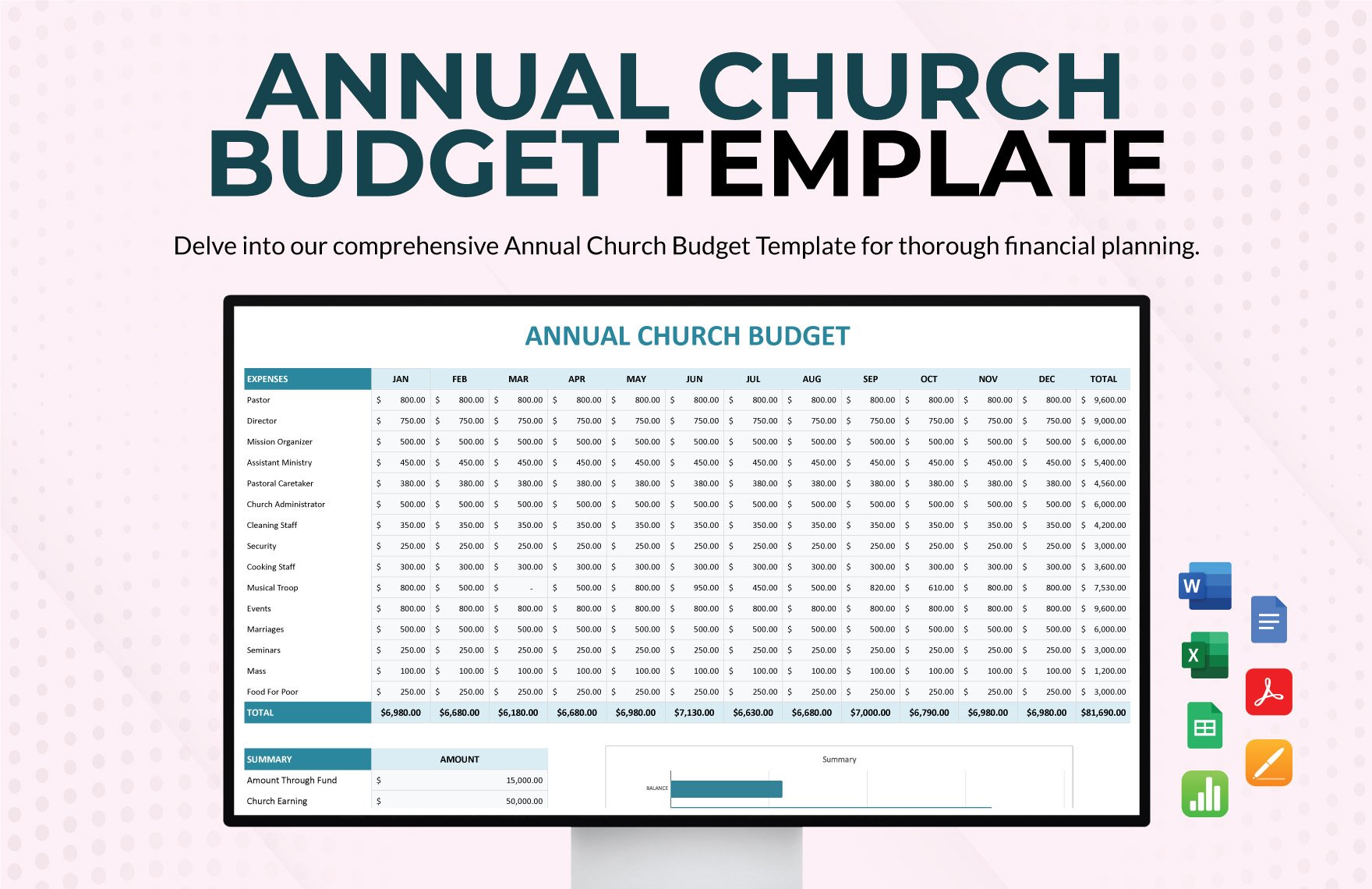

Establishing a budget proves to be essential in our daily lives. Family members plan such things to ensure proper expenses monthly when paying the bills, school tuition, and buying groceries. Small business establishments even utilize Excel sheets to calculate their costs annually to avoid possible shortages in their business. If you plan on creating a personal, nonprofit budget summary plan for your business or own well being, then we got something for you to get you started on that process. We ask you to try our ready-made Annual Budget Templates, for they are 100% customizable, easily editable, printable, and professionally made so that you won't have any hassle creating one from scratch. Download our ready-made templates today!

How to Create an Annual Budget in Excel

Organizing your expenses requires a lot of factors depending on the daily situation you deal with yourself or the activities your business is going through over the months. Statistics revealed in the Debt website about Personal Finance Statistics show that 69% of our budget expenses go to health care costs and insurance. That is only one factor out of the many that we are covering for our budget expenses, whether it be daily, weekly, monthly, or annually. With that said, we will give you these steps in creating an annual budget that can help strategize when utilizing your expenses. Now, let's begin.

1. Come Up With A Plan

When establishing your costs for your sample budget plan, you need to think of the factors necessary in your daily life. Think of the things you spend daily or the payments your business requires you to pay so you can set your standards, ensuring you or your company don't go compulsive, which may result in complications such as financial shortages. Always think ahead of time so you won't run short in cash daily, weekly, monthly, and annually.

2. List Down The Factors

Once you have come up with an action plan to help you secure a proper budget, it's time to list down the factors you utilize for your expenses. Include everything necessary since this is an annual budget plan. You may prioritize those factors and put the most important one on top and list the others below, depending on your costs and expenses.

3. Budget With Accuracy

After registering everything necessary for your simple budget plan, the next step is to establish an accurate exact for those factors listed down. Doing this will help you secure everything you need so you can carefully budget your money for expenses. It will also help you to not overspend on anything unnecessary for your budget plans so you won't run into sorts of complications on a daily, weekly, and monthly basis. Never be a compulsive spender, because money today doesn't come in as easy as you think.

4. Total It Up

After pricing the costs, you have spent for your particular factors listed down your personal budget, its time to sum it all up and see how much you have spent over a year. It is essential to understand, determine, and ponder on your expenses. The primary reason for this will allow you to think about how it came up to that particular amount and if you can find other ways to spend not as much so you can have something left for your savings to grow in the future. If you feel like you could have done better, then do it as soon as possible.

5. Proofread For Clarifications

Once you have finished your budget plan in all of its factors, its time to proofread everything for clarifications and any necessary revisions if you feel like you missed out on something. However, if all is good, then you finally have an annual budget plan that can help you in spending the right amount and not have an empty wallet in the process.