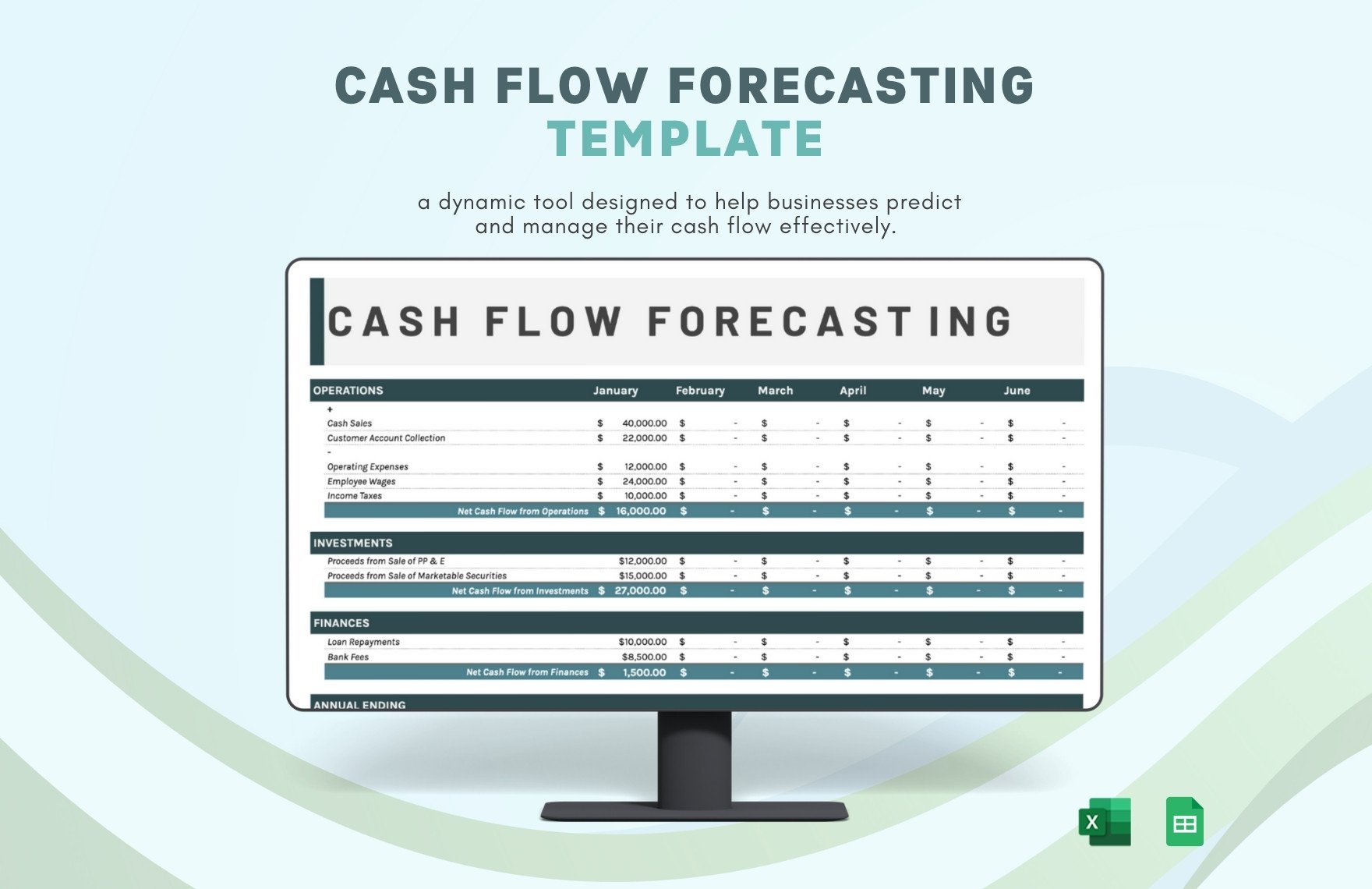

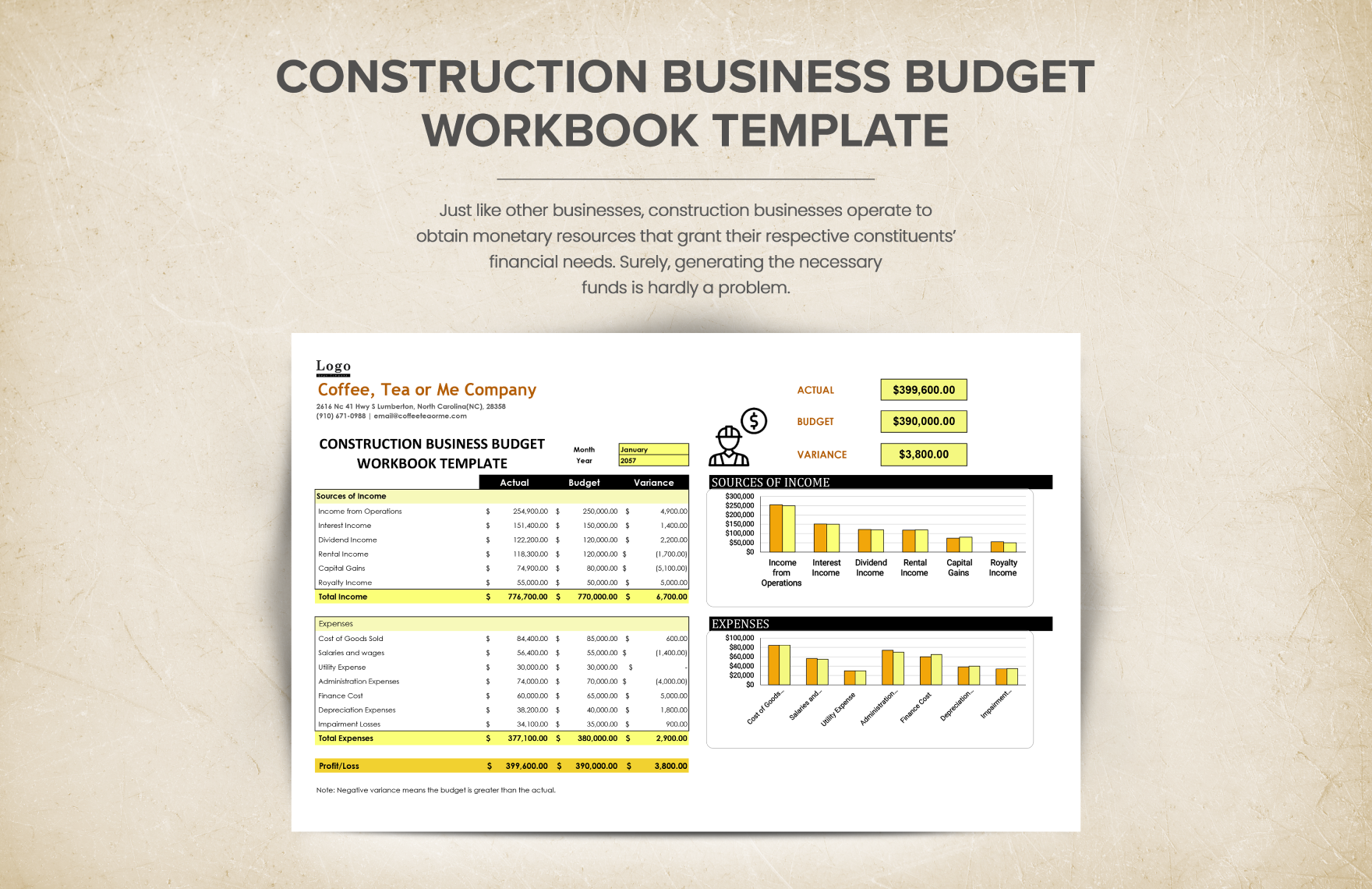

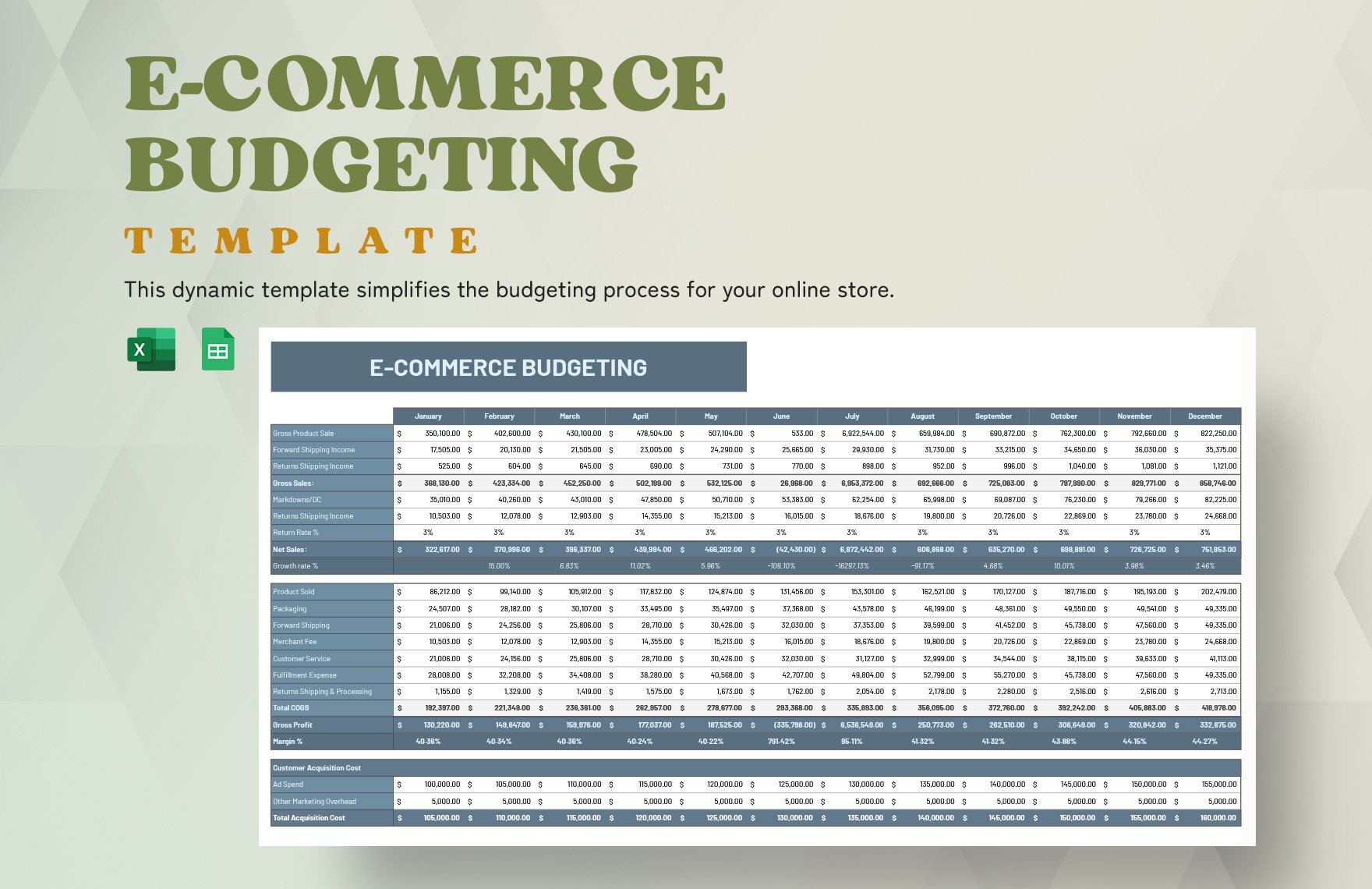

Bring Your Financial Planning to Life with Business Budget Templates from Template.net

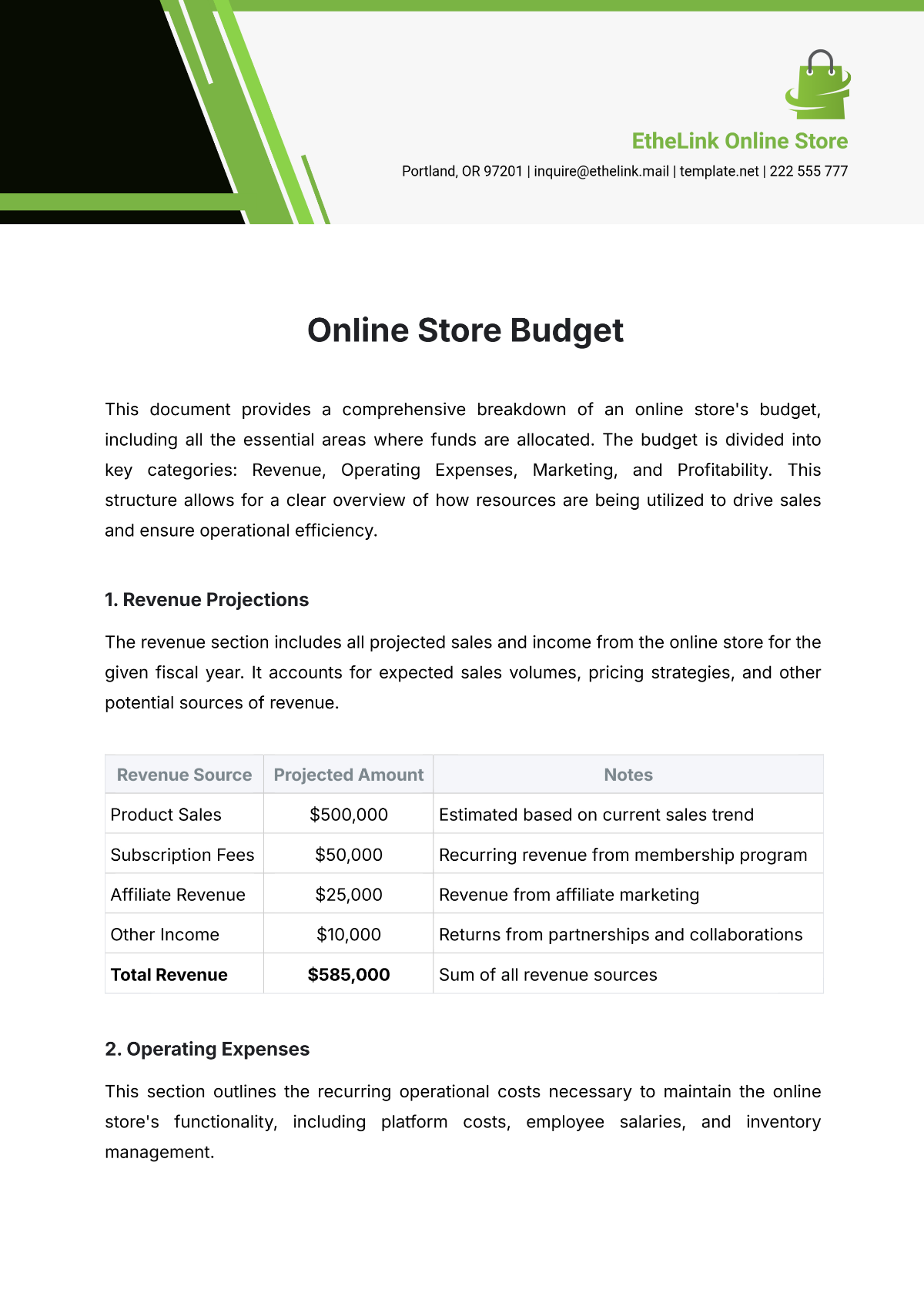

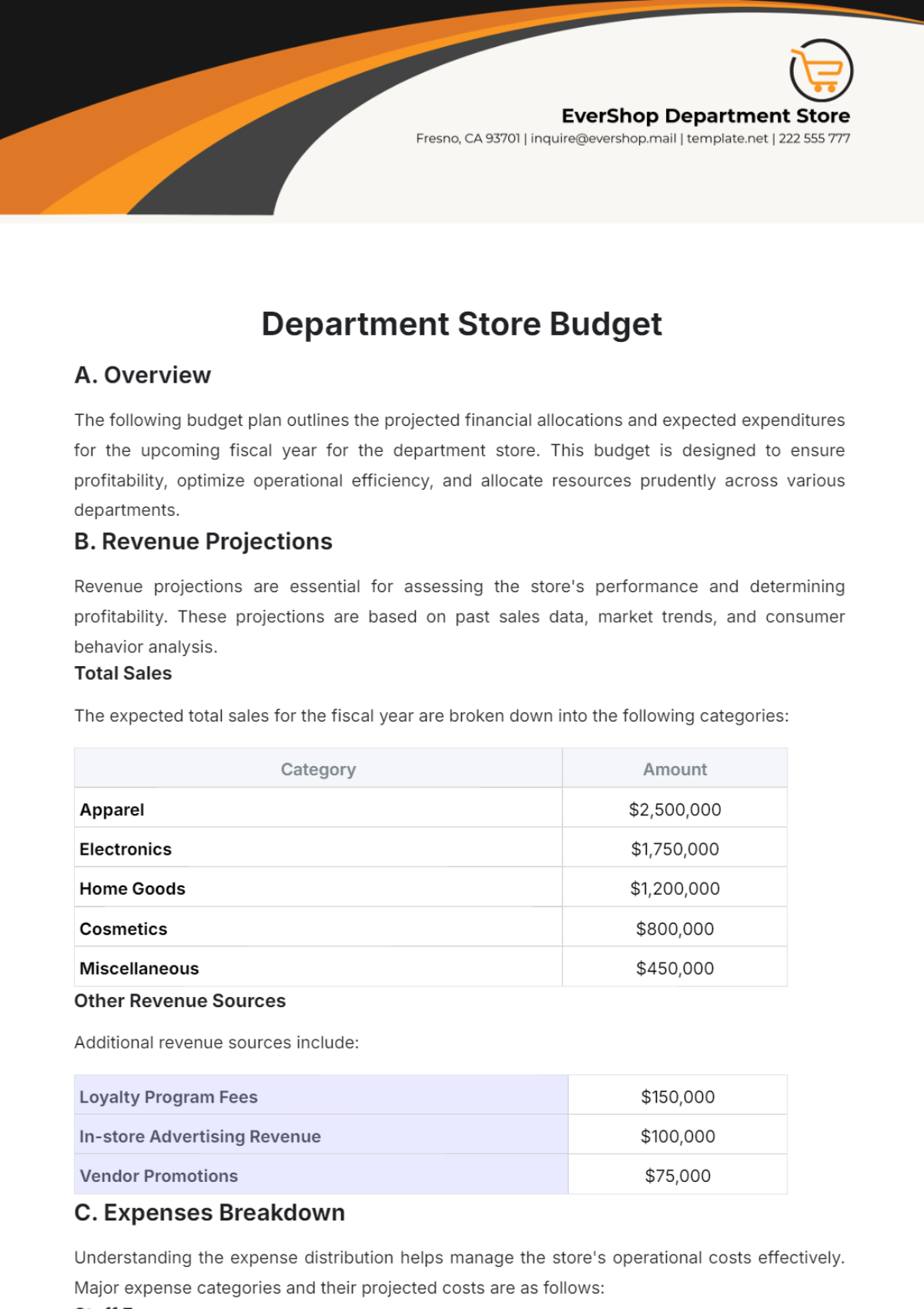

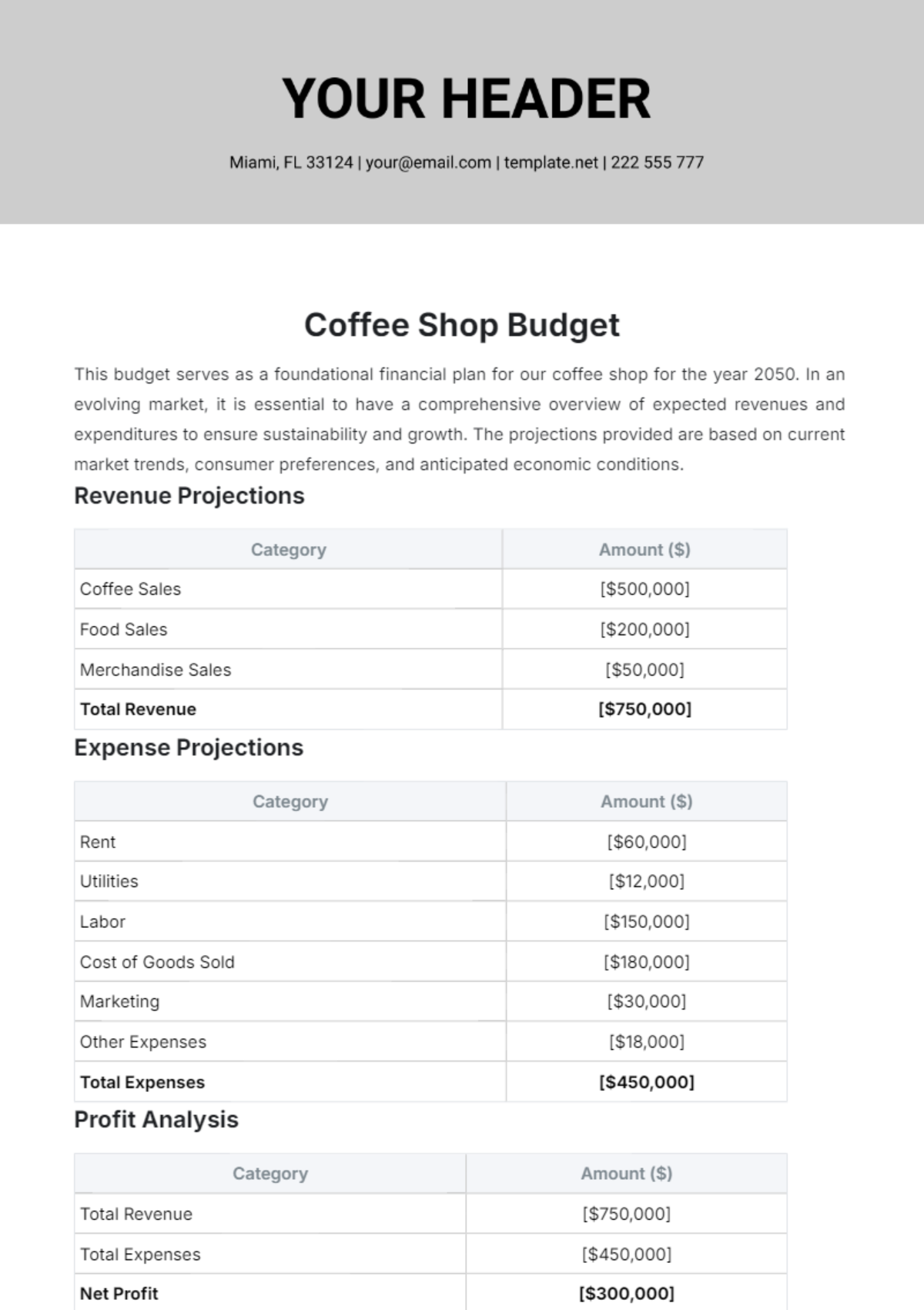

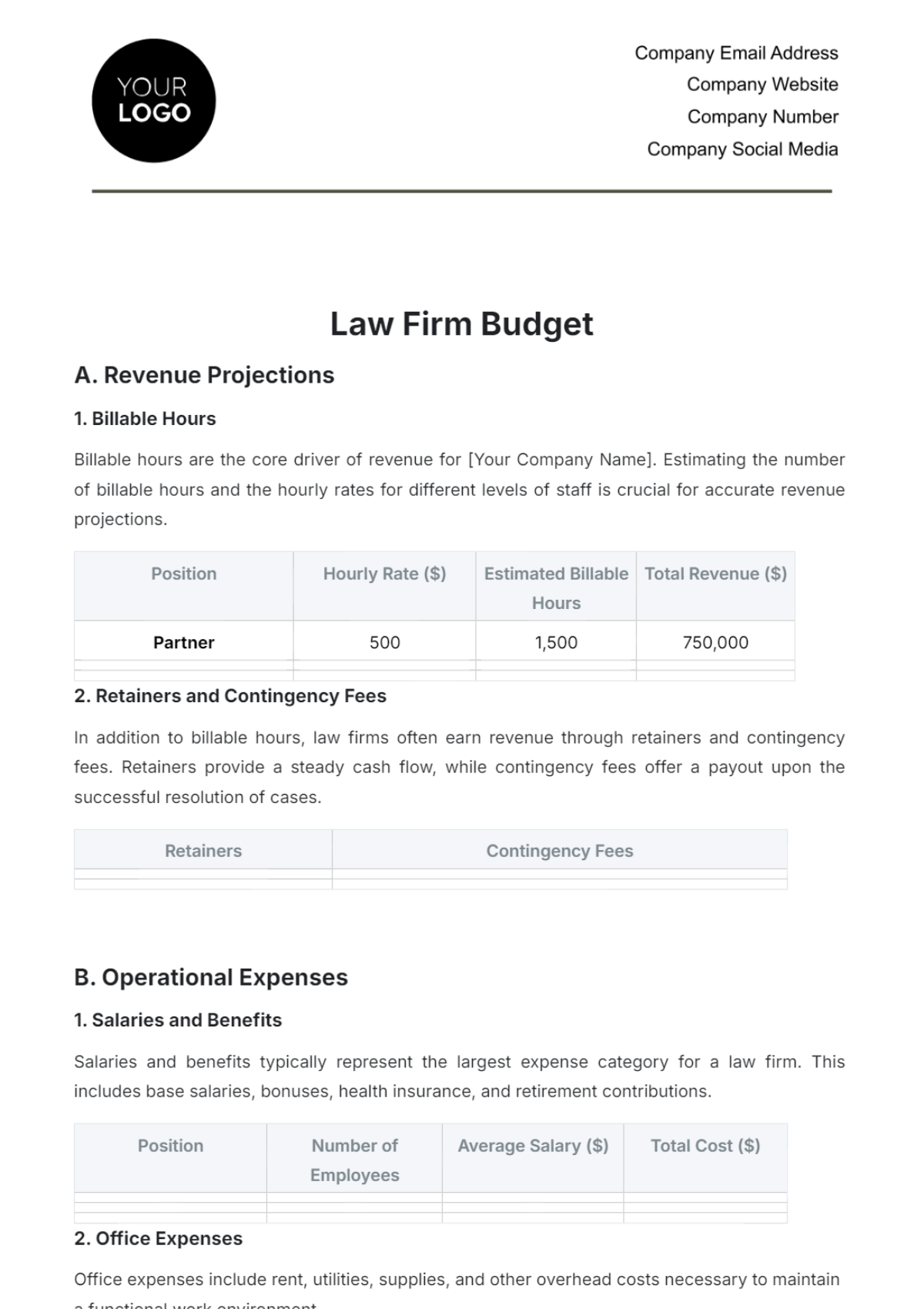

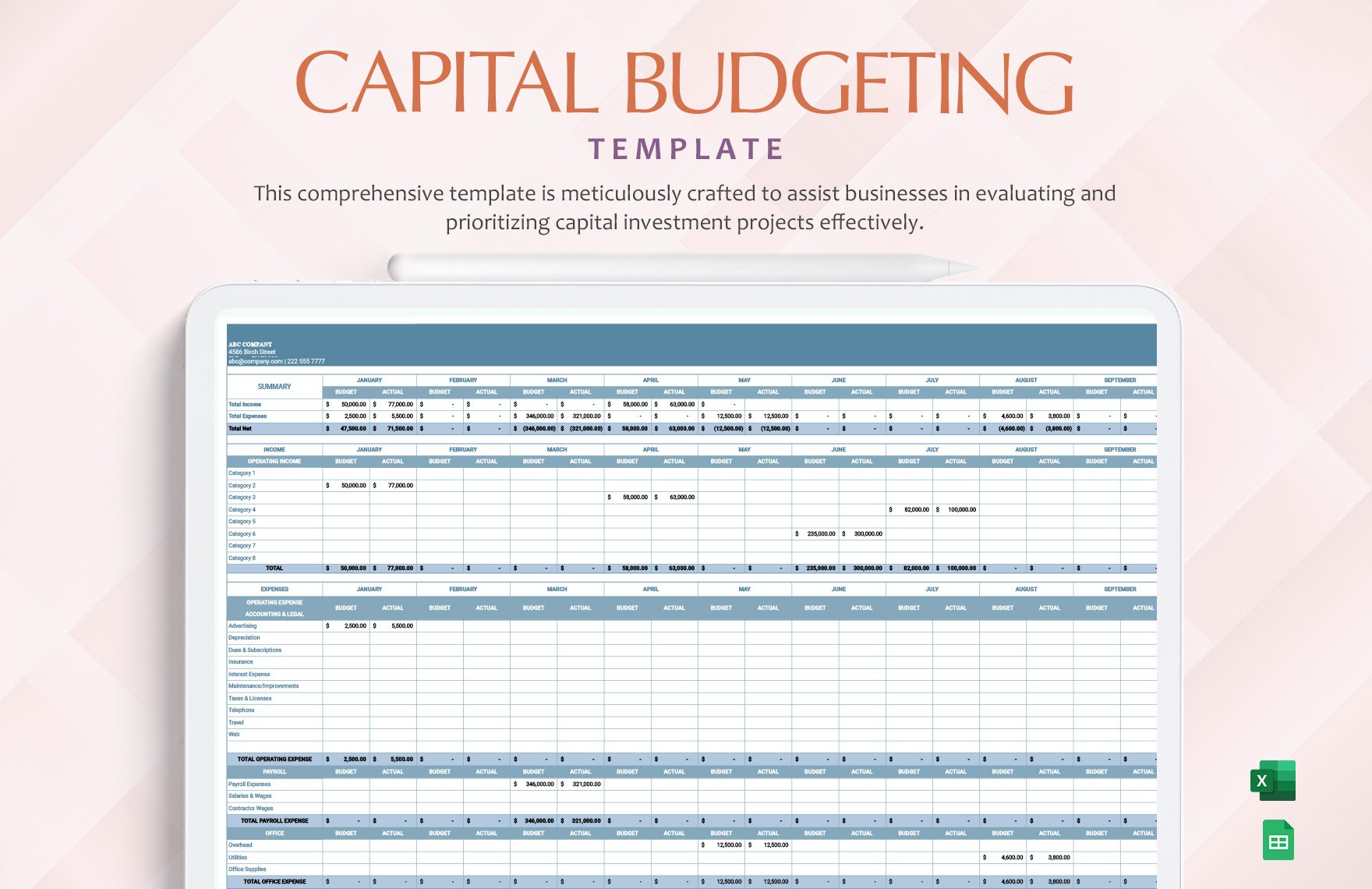

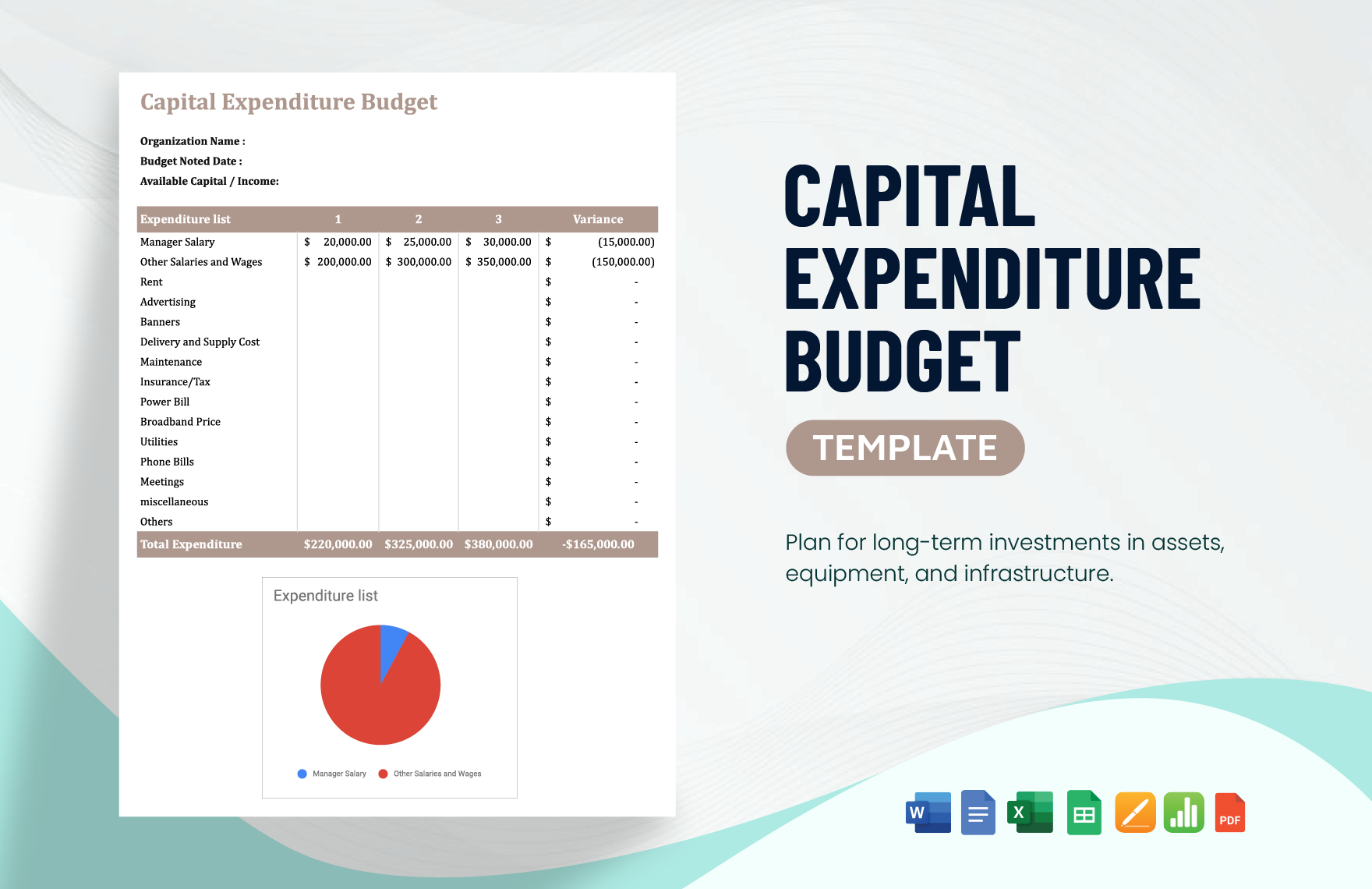

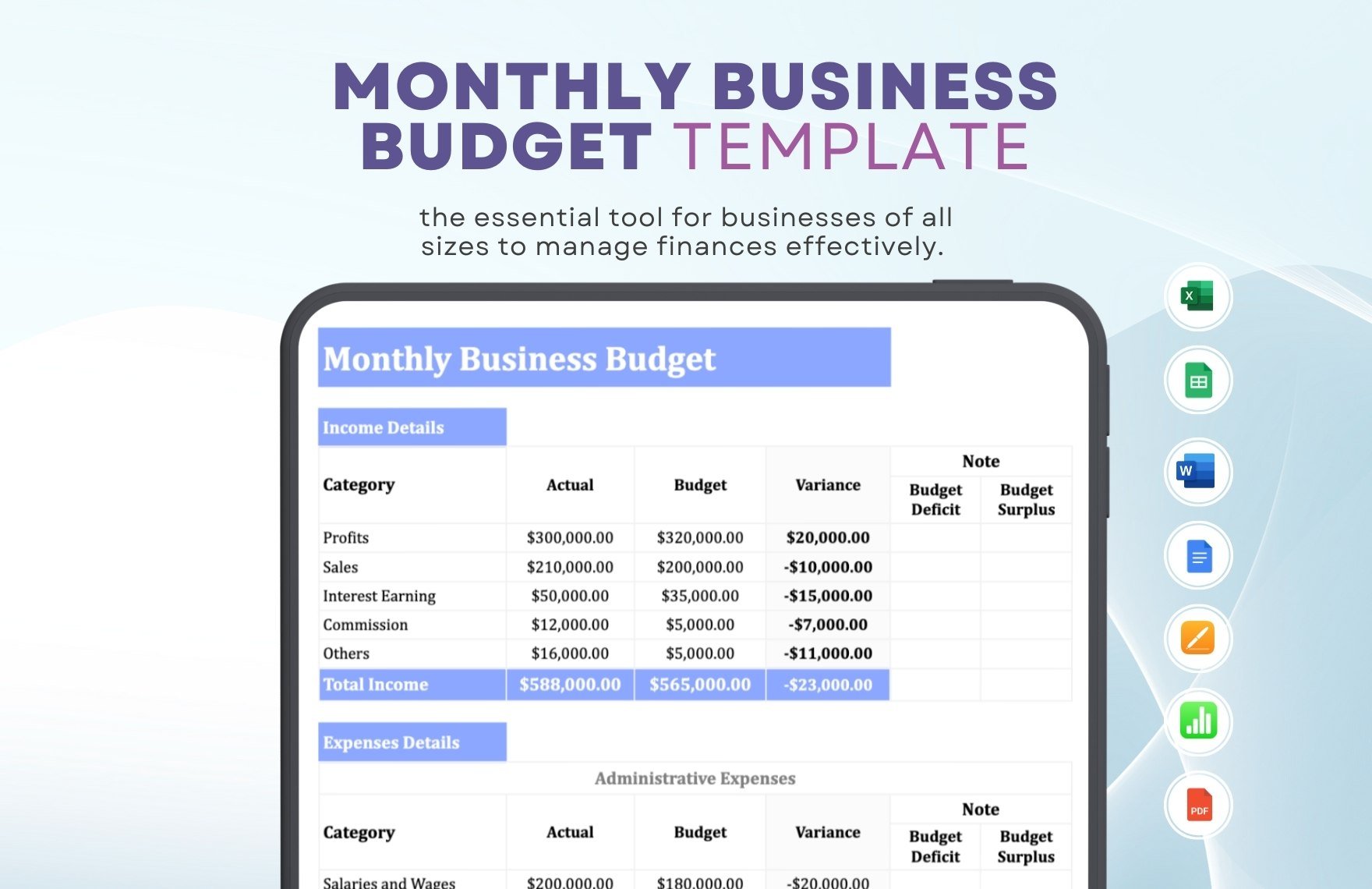

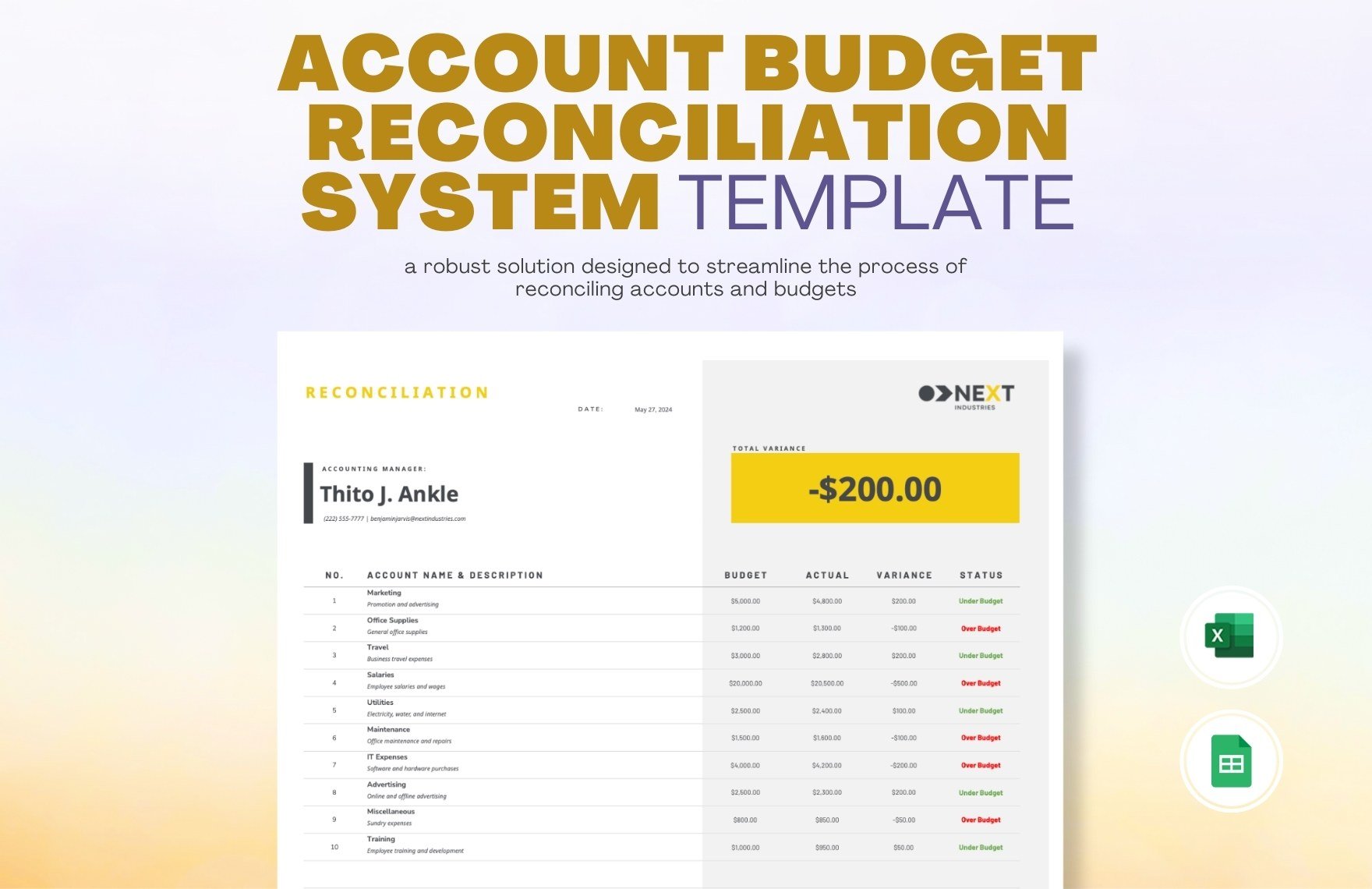

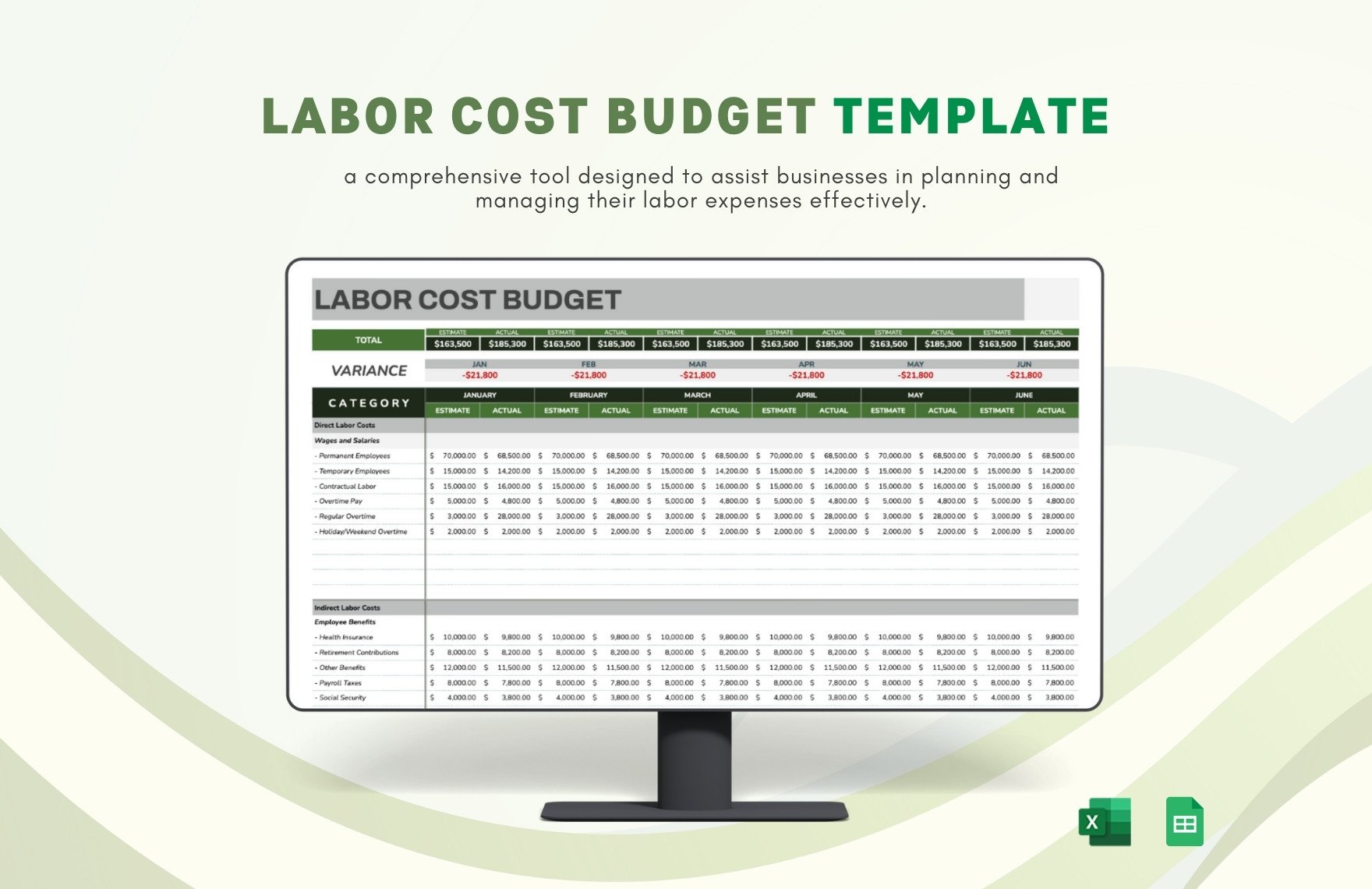

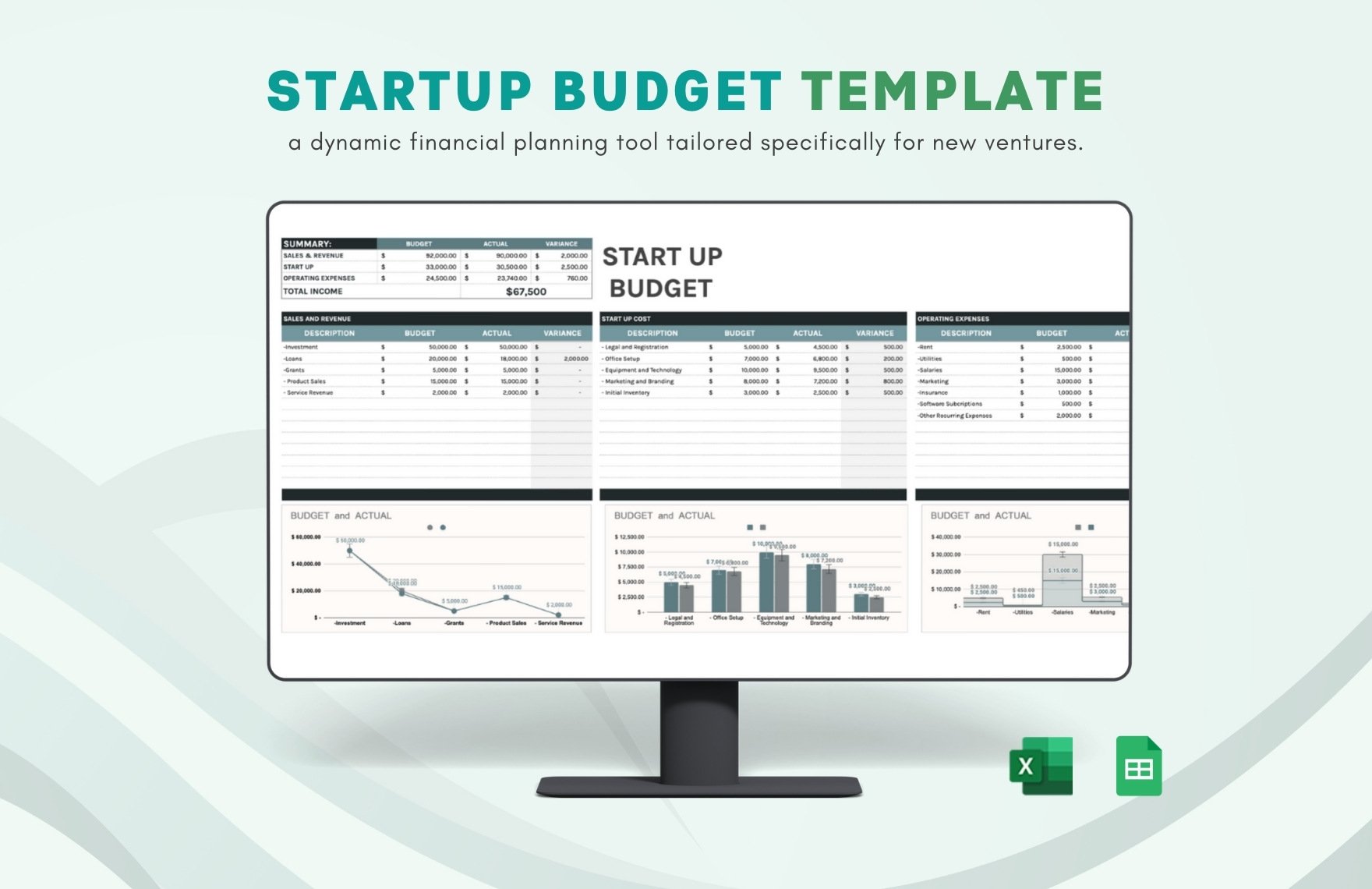

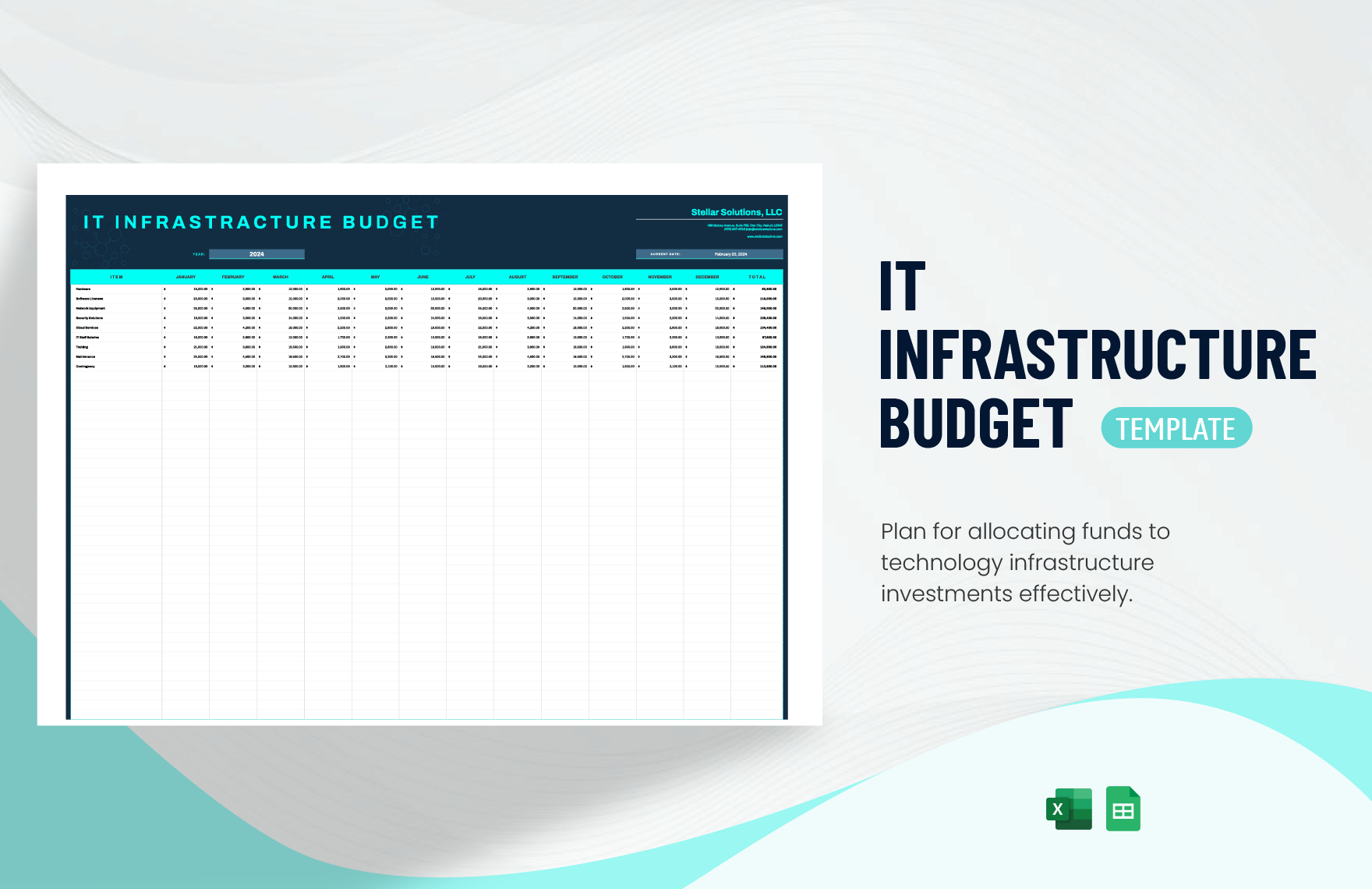

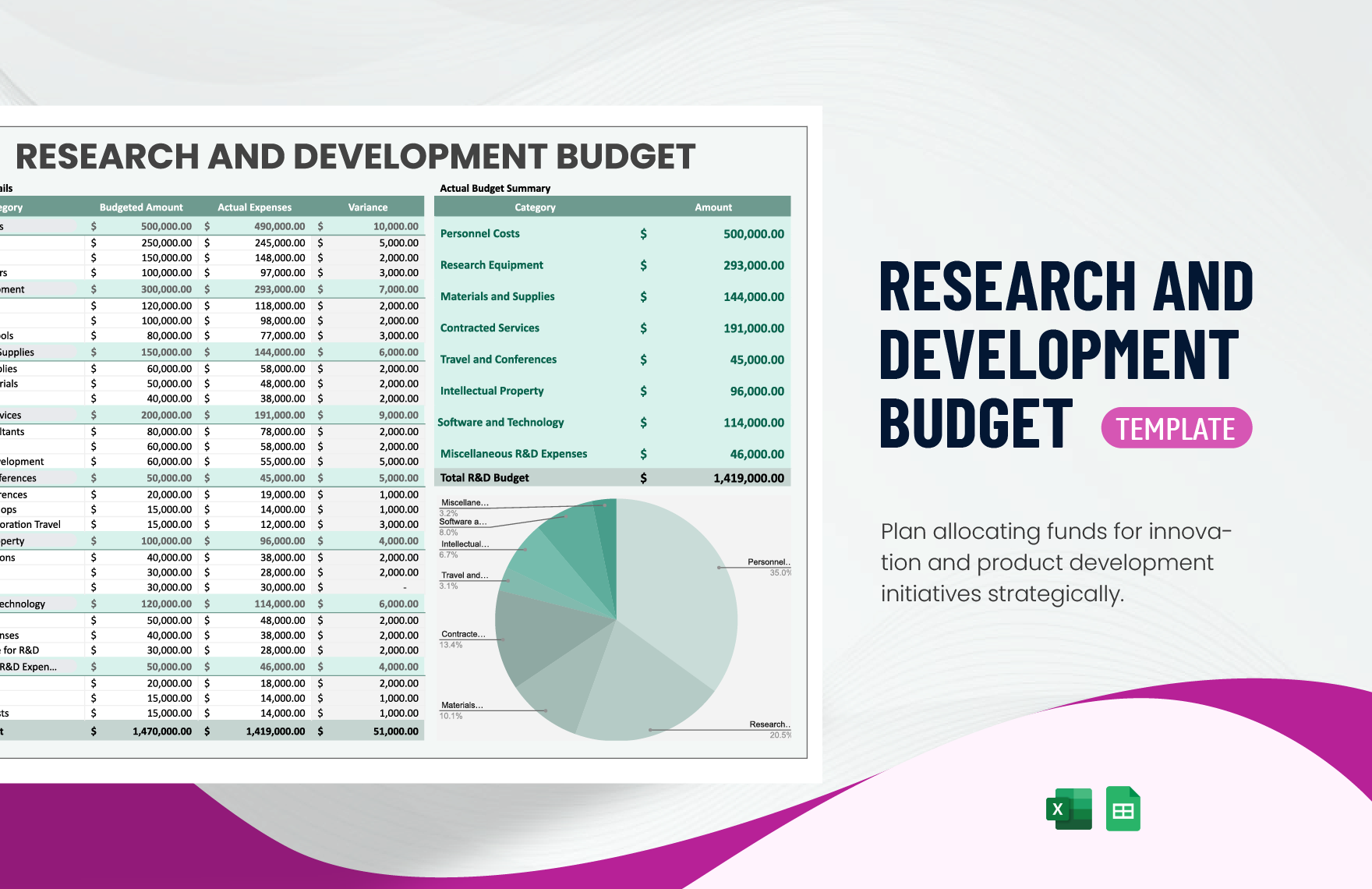

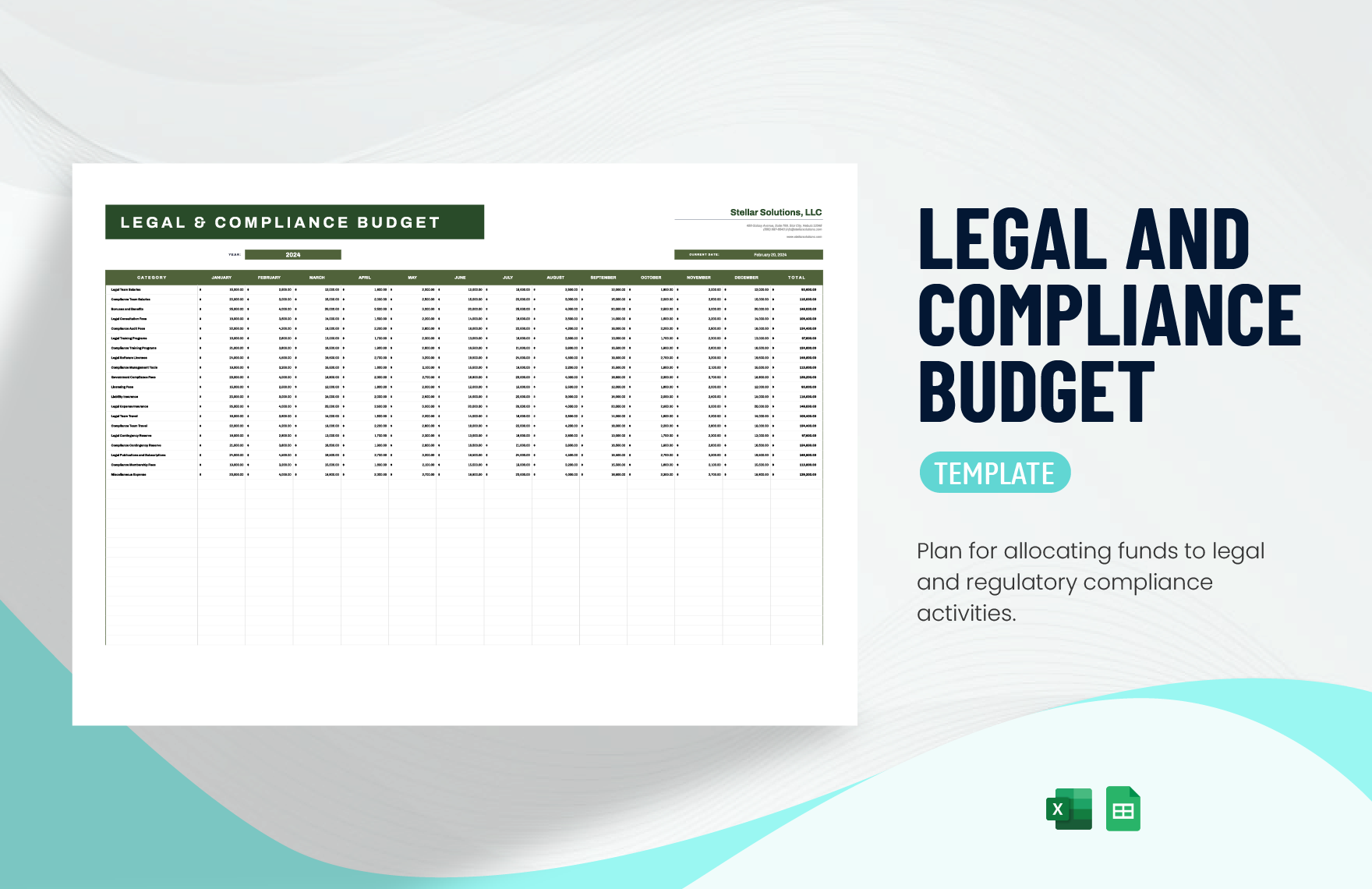

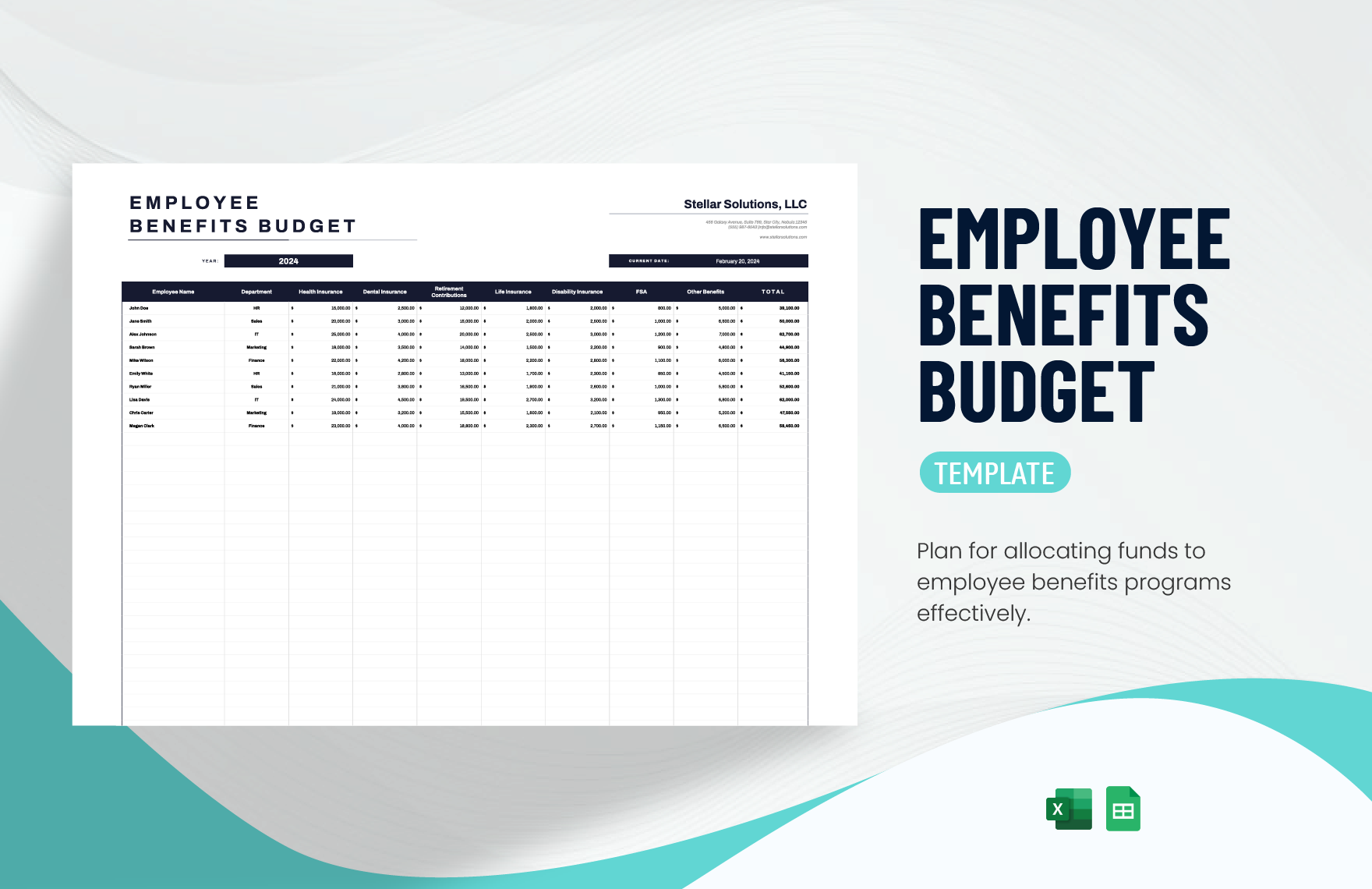

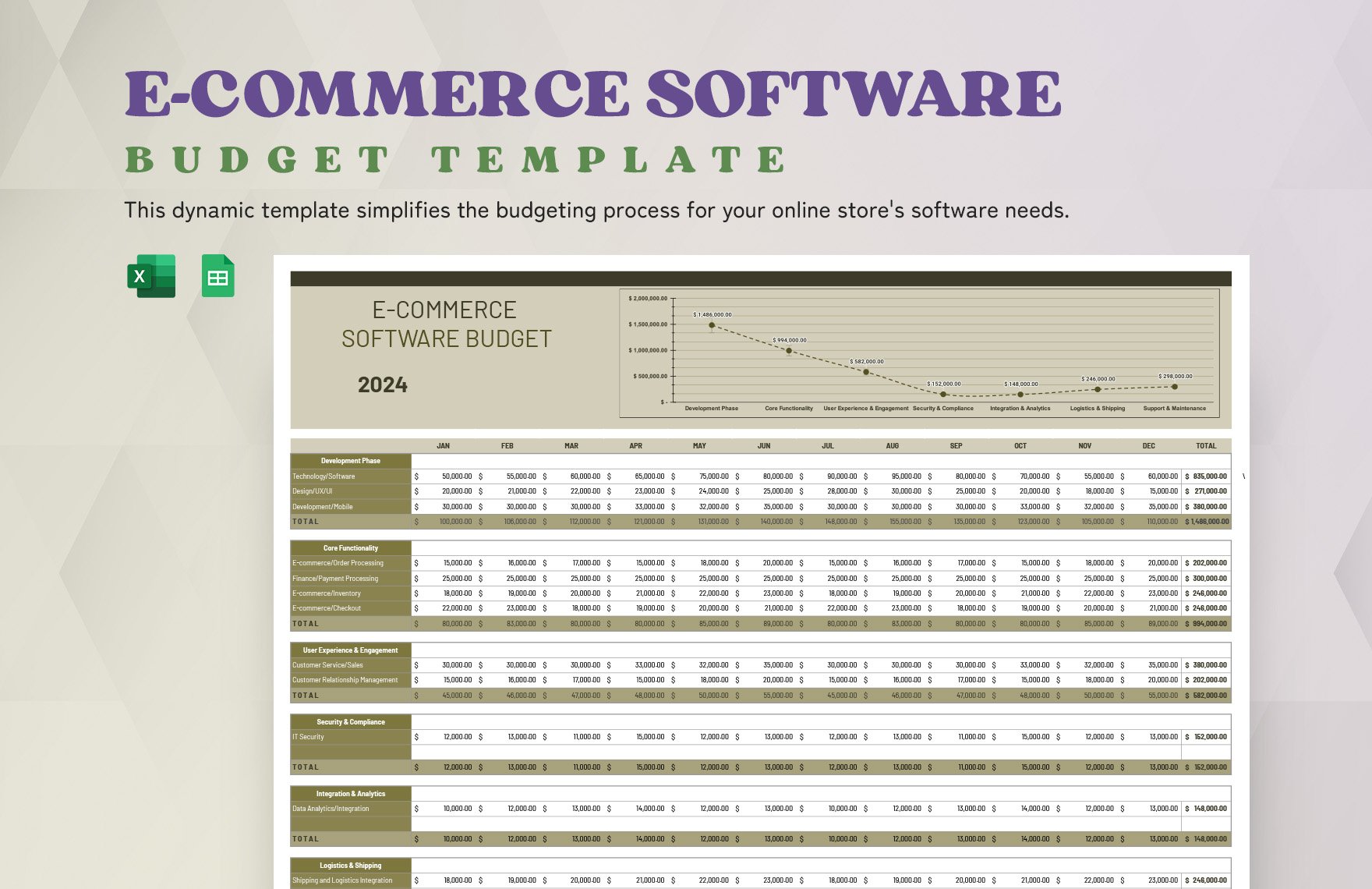

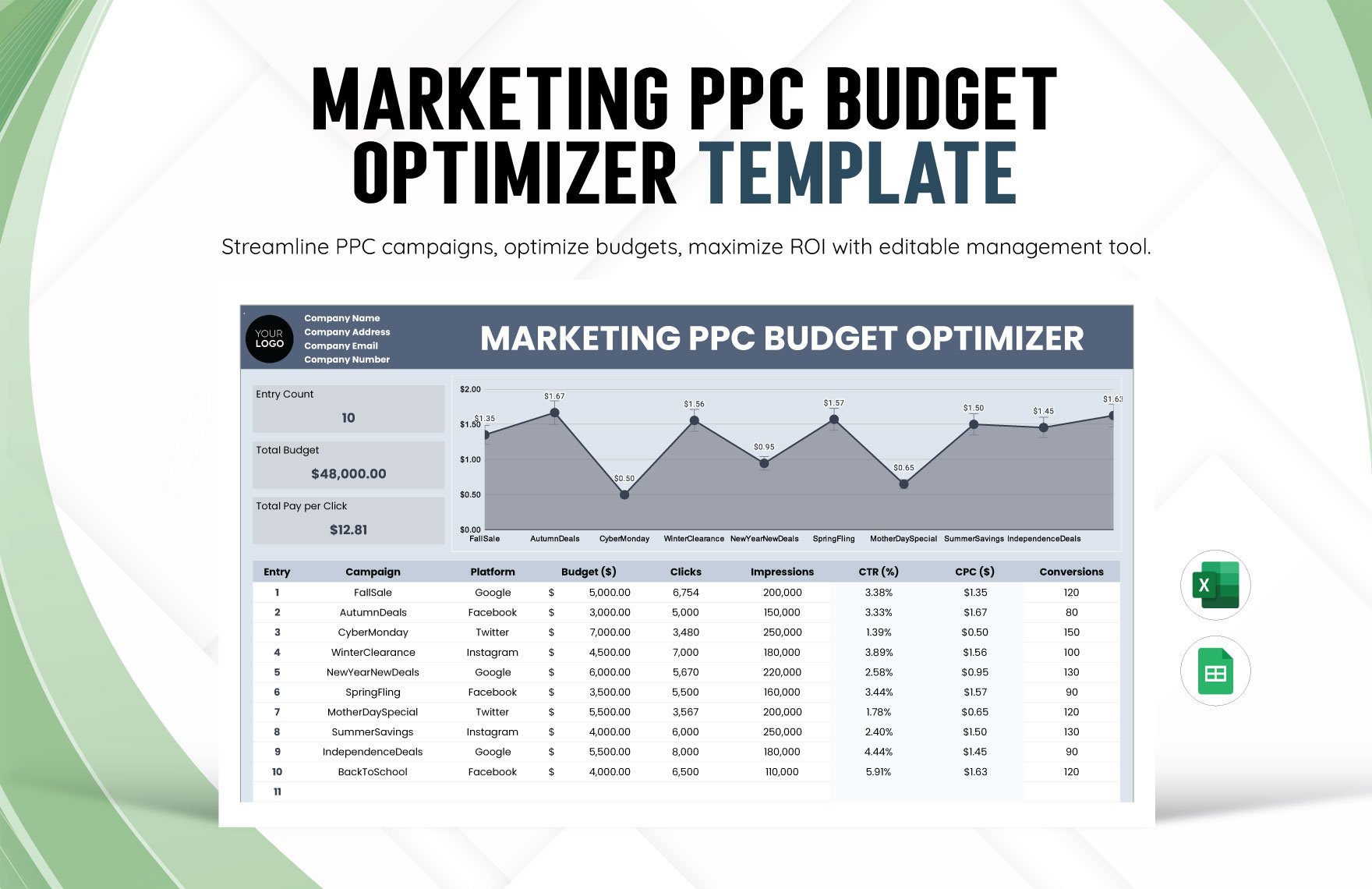

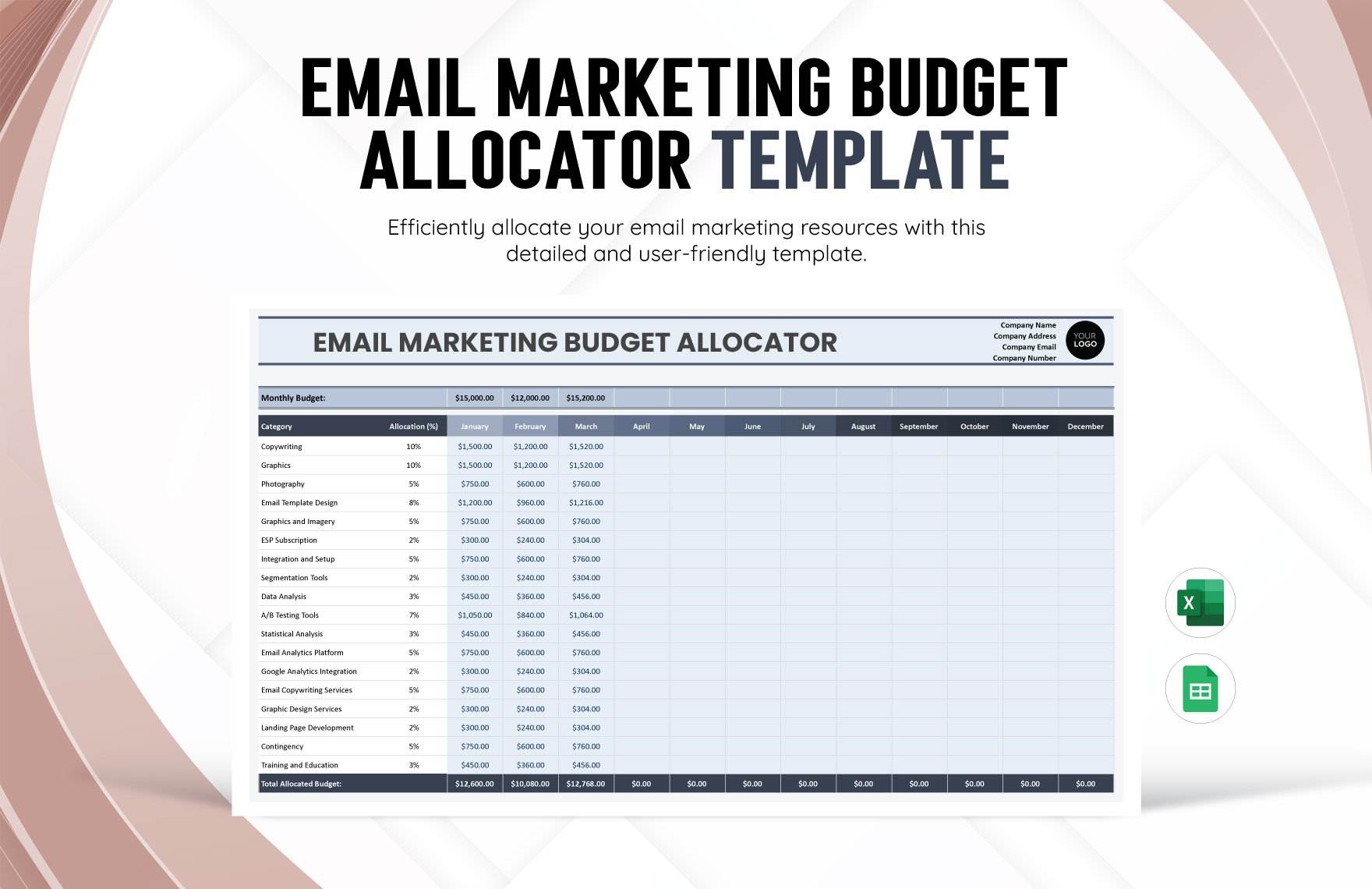

Keep your finance team engaged, streamline your budget formulation, and enhance financial transparency with Business Budget Templates from Template.net. Designed for small business owners, financial managers, and entrepreneurs, these templates allow you to create comprehensive and professional budgets with ease. Whether you're planning for a new fiscal year or managing a startup's financial resources, these templates are ideal tools. Include key financial figures such as income, expenses, and cash flow projections in your budget plans without the need for advanced spreadsheet skills. With options for both print and digital distribution, and professional-grade designs, these templates make financial planning easier and more efficient.

Discover the many budget templates we have on hand, tailored to meet diverse financial needs. Start by selecting a template that suits your business requirements, and easily swap in your financial data while customizing colors and fonts to match your company's brand. Add advanced touches like dragging-and-dropping graphics or leveraging AI-powered tools for text adjustments. Explore endless possibilities and create skillfully crafted budgets without any special expertise. With new designs added regularly, you'll always have access to the latest layouts. When you’re finished, download your budget plan or share it effortlessly via email, print, or export to various platforms.