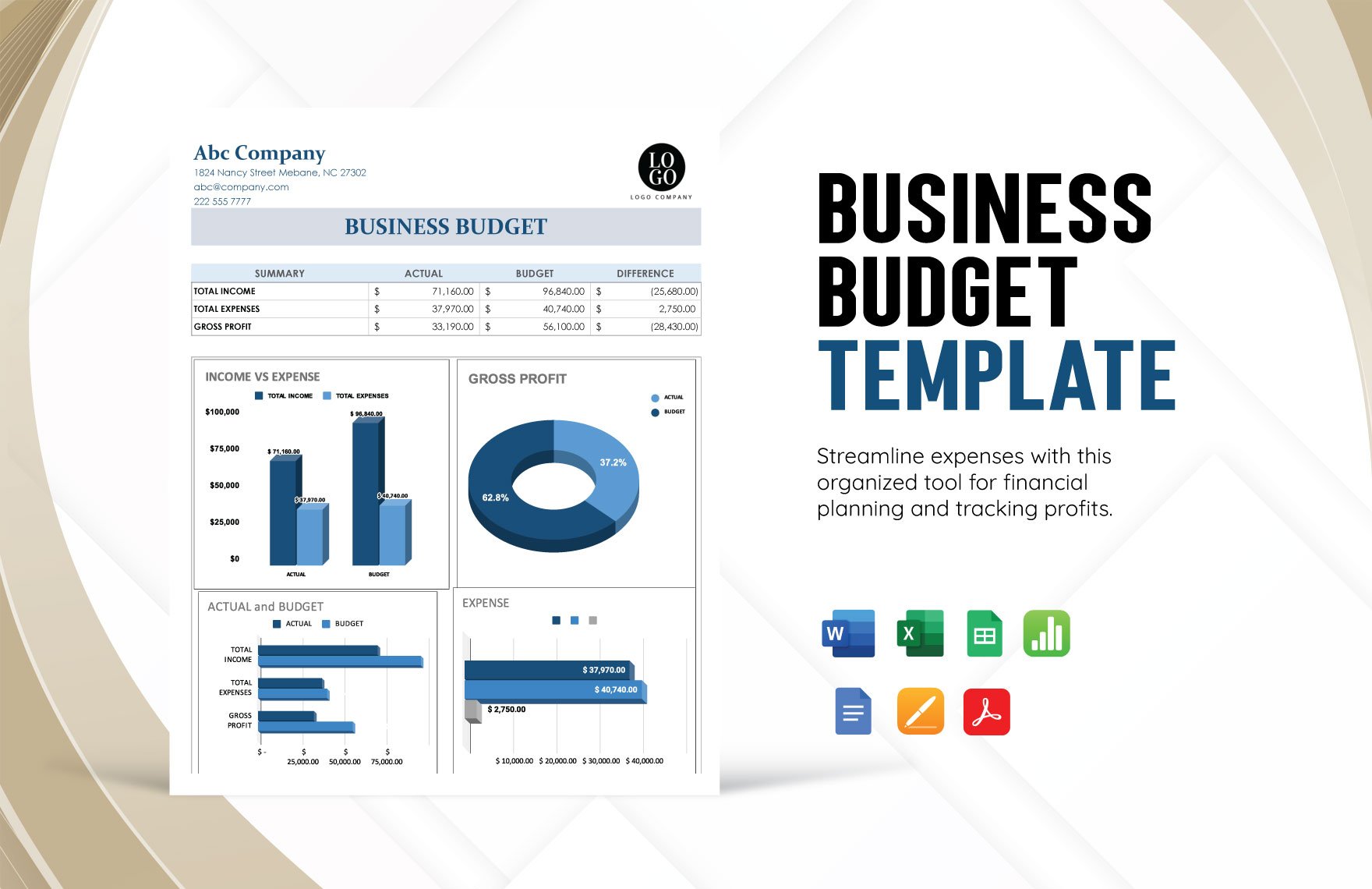

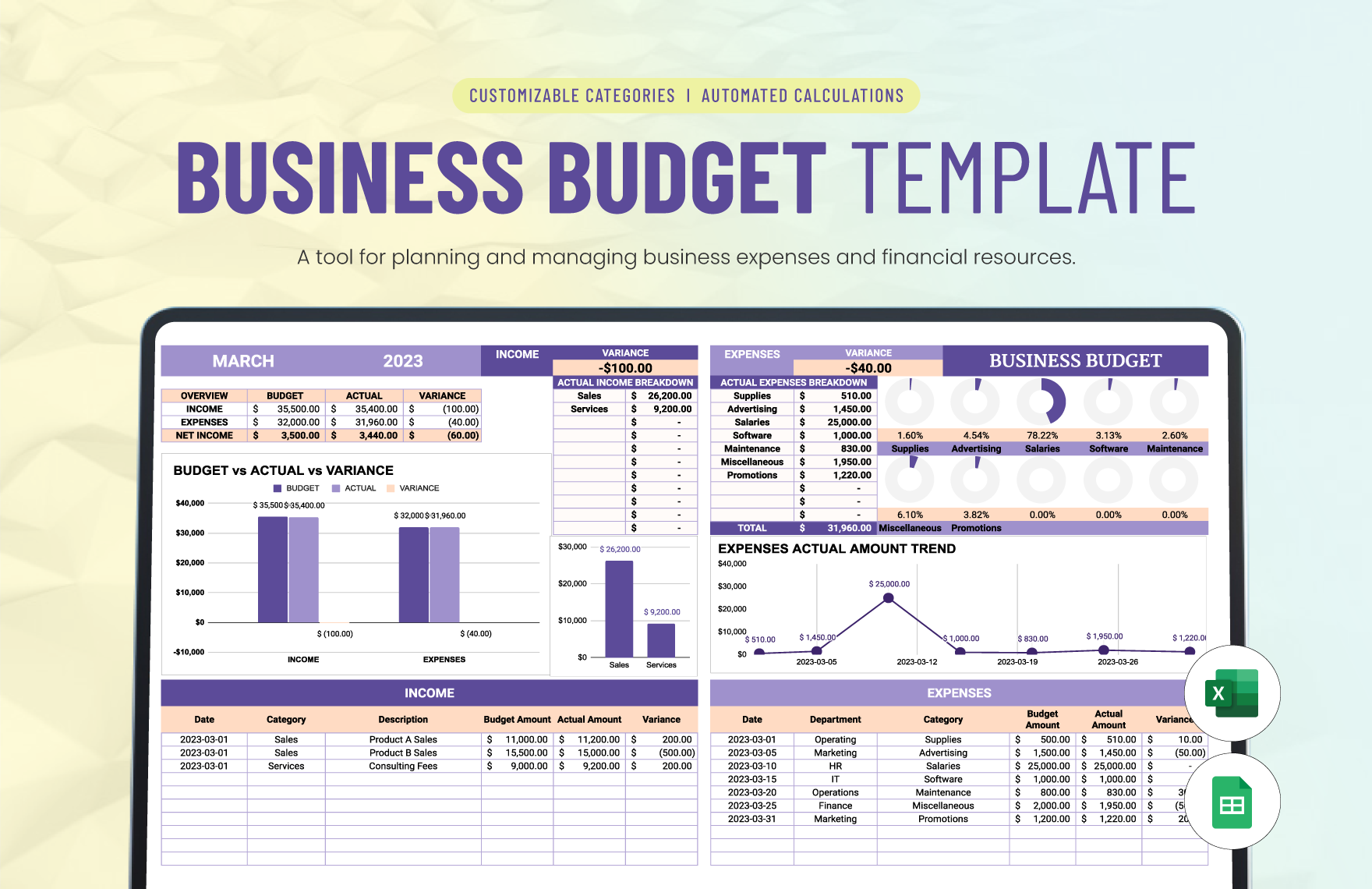

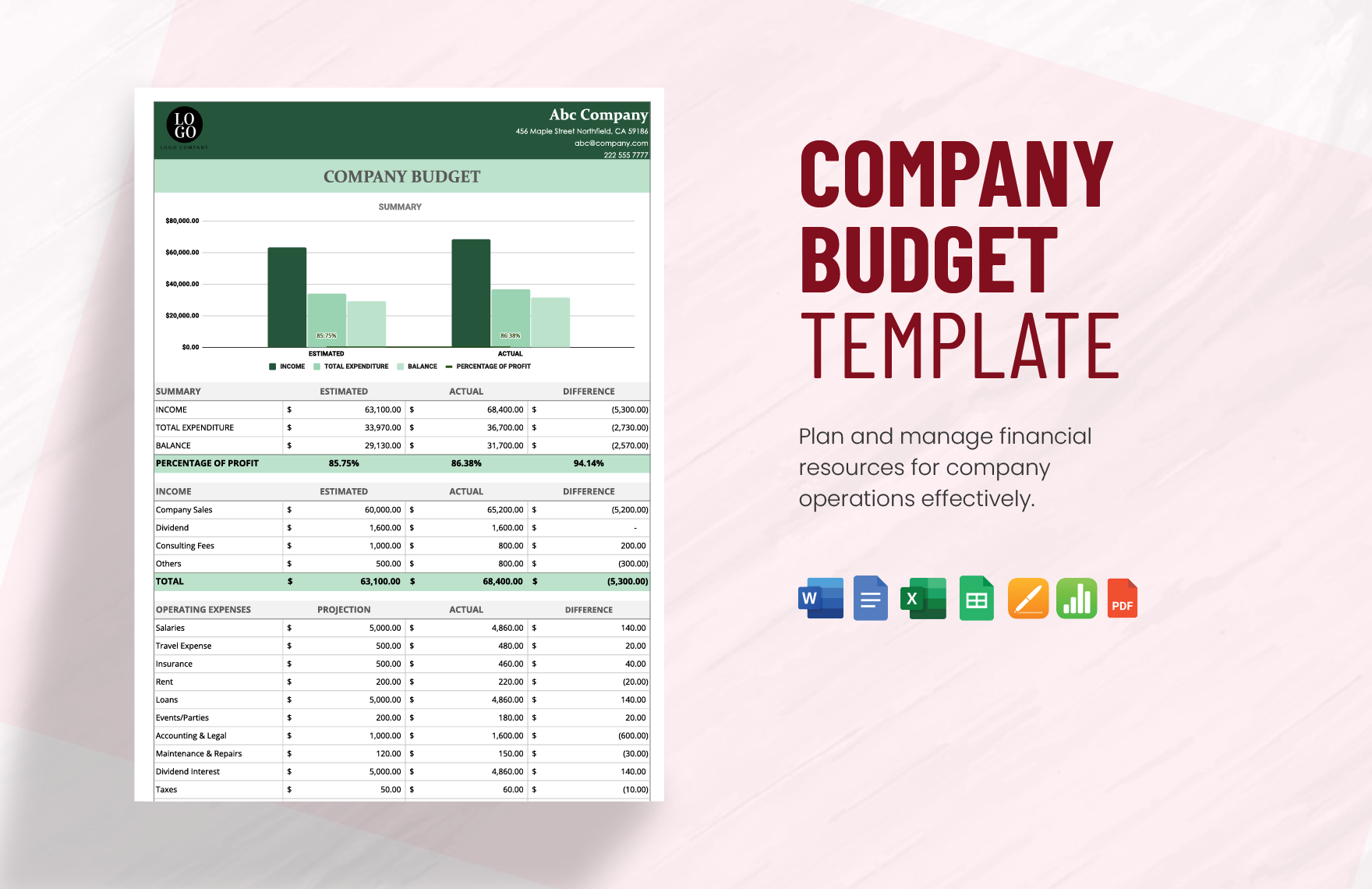

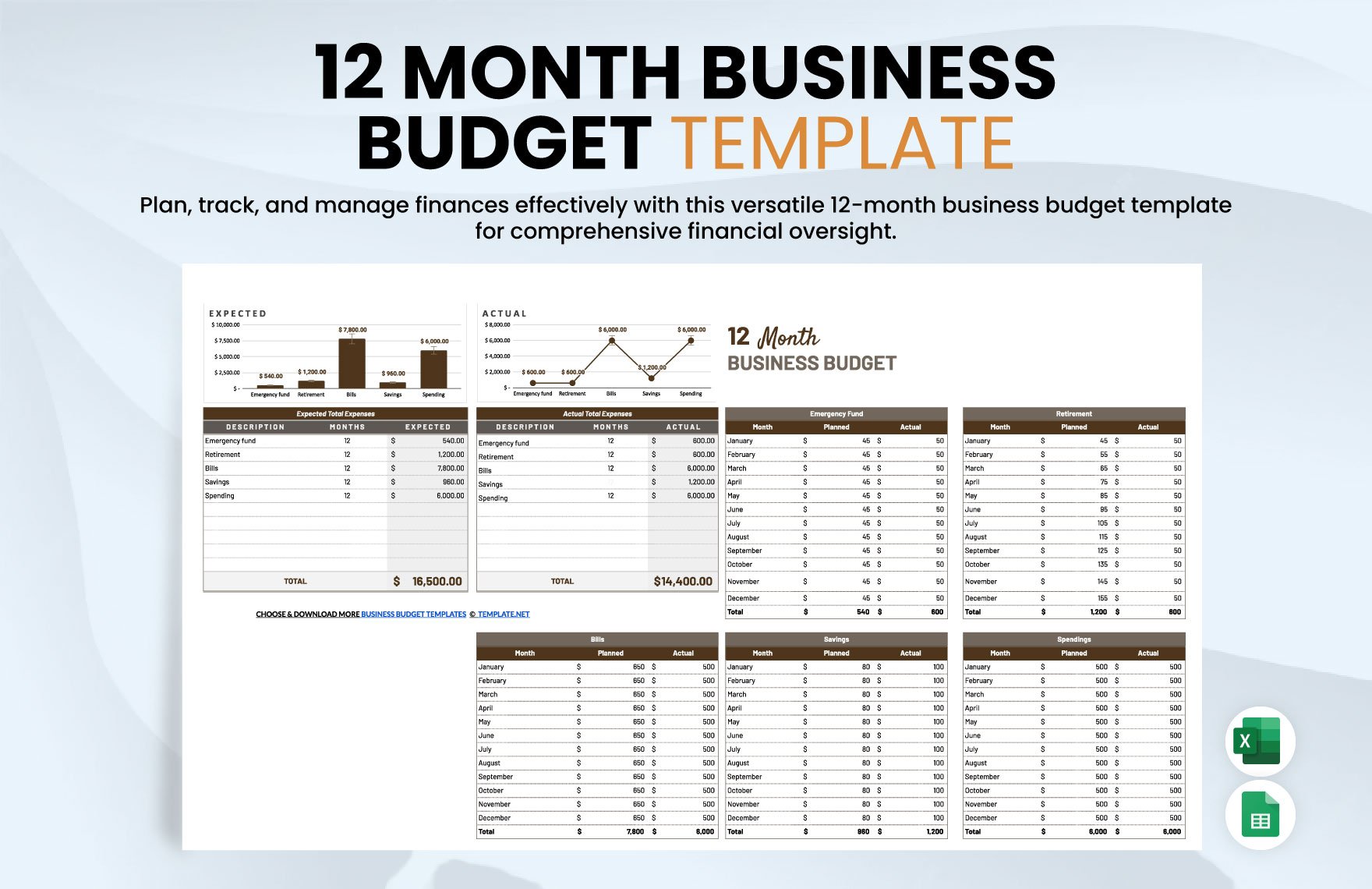

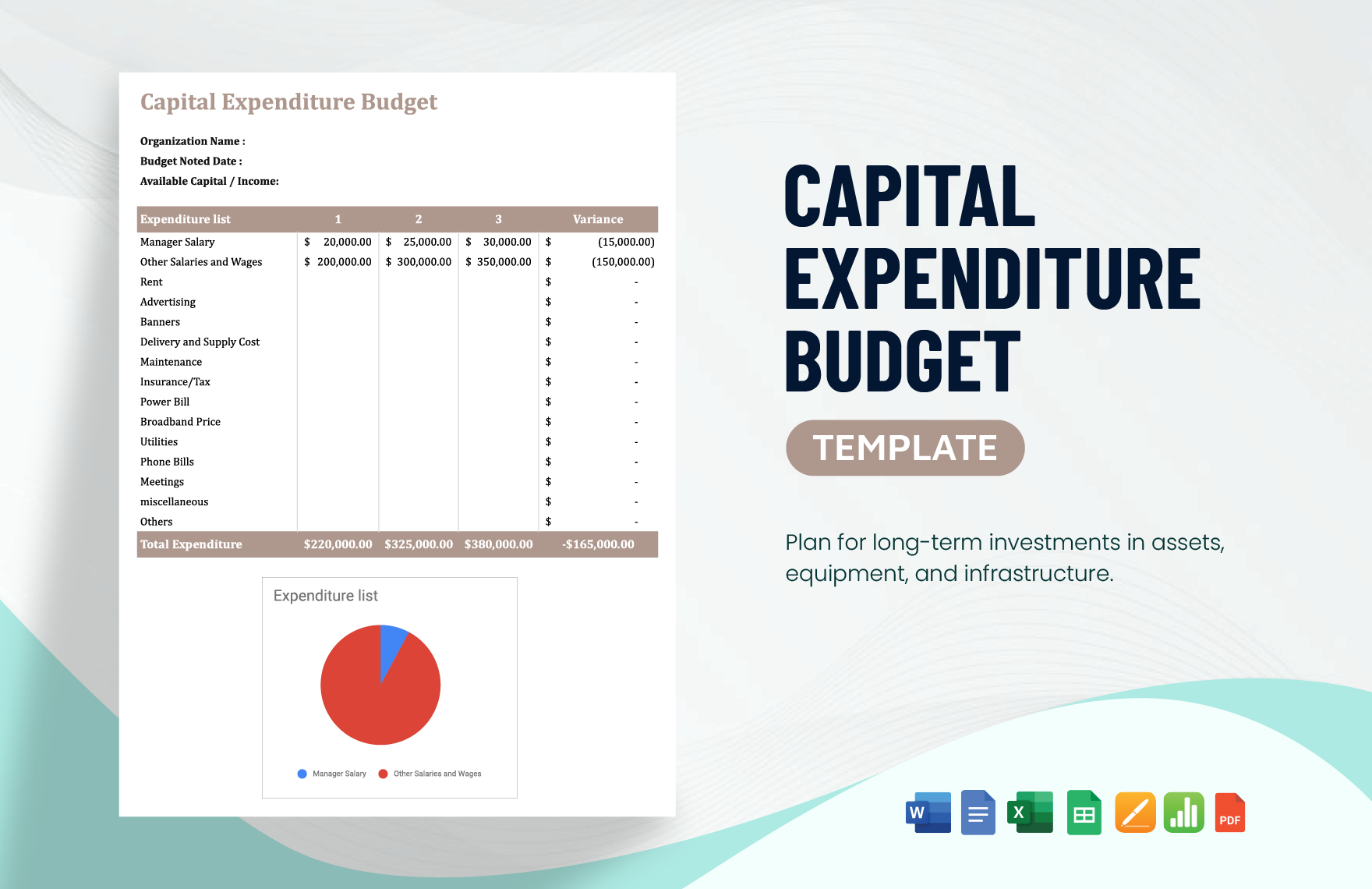

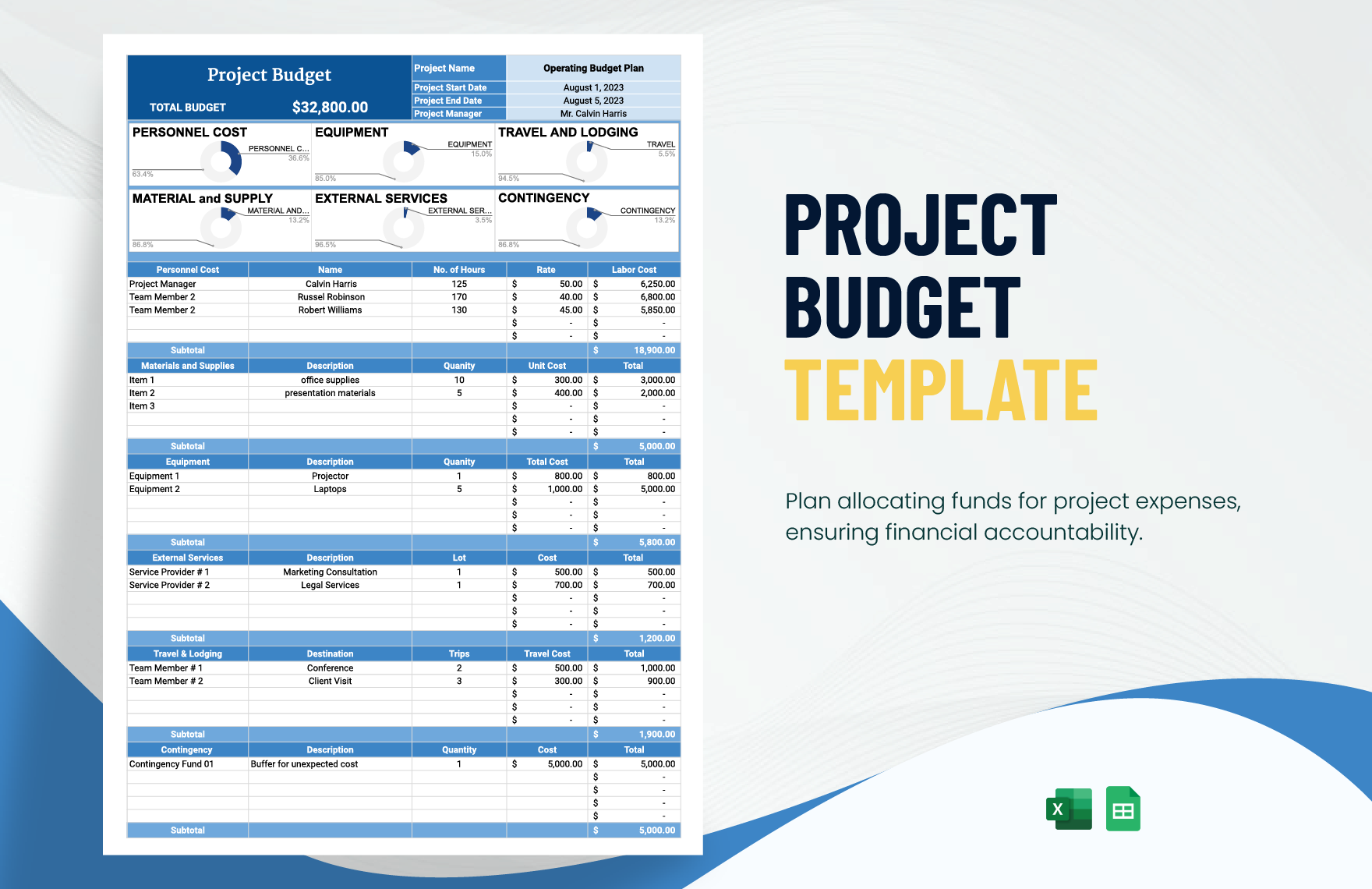

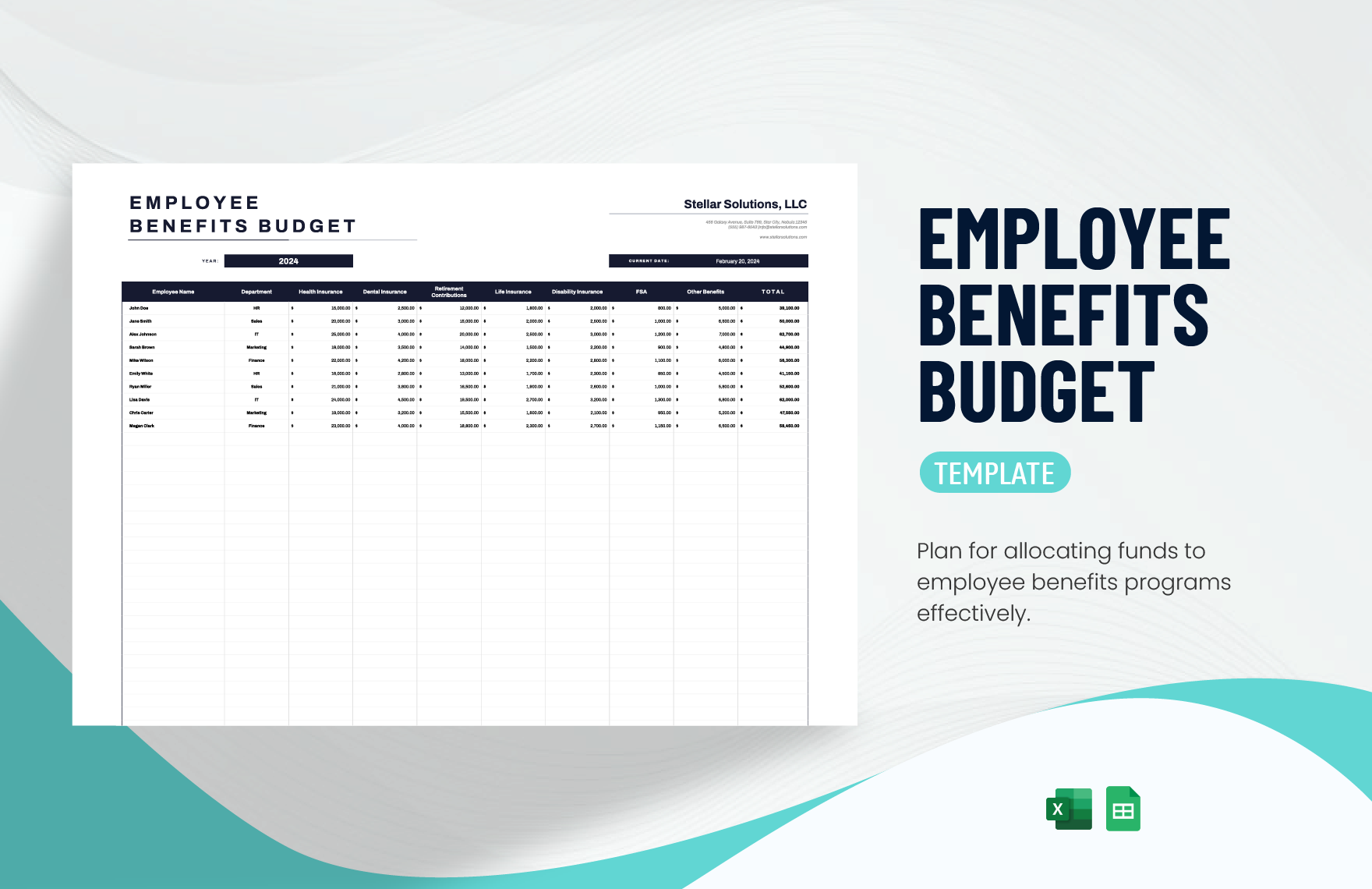

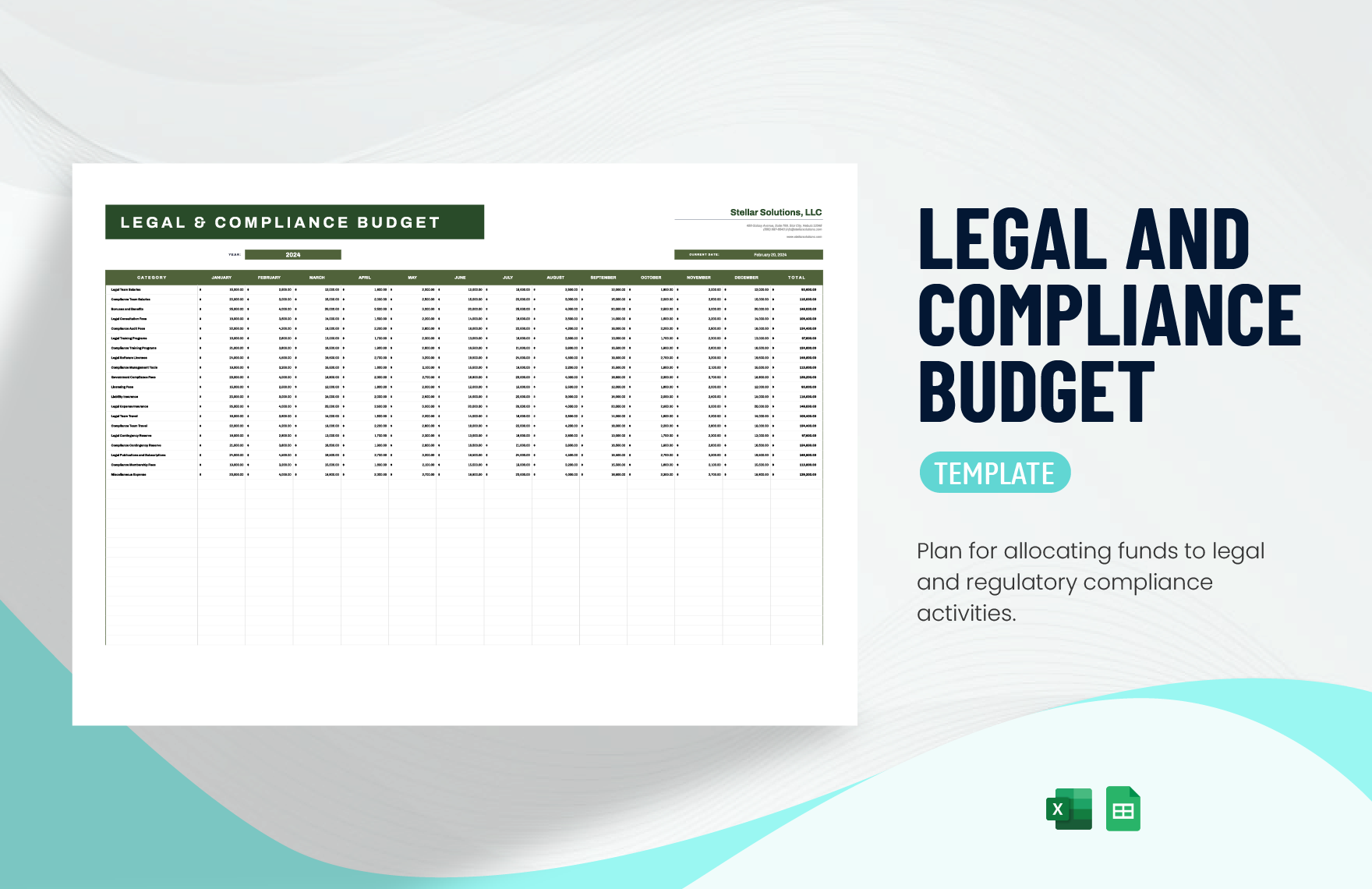

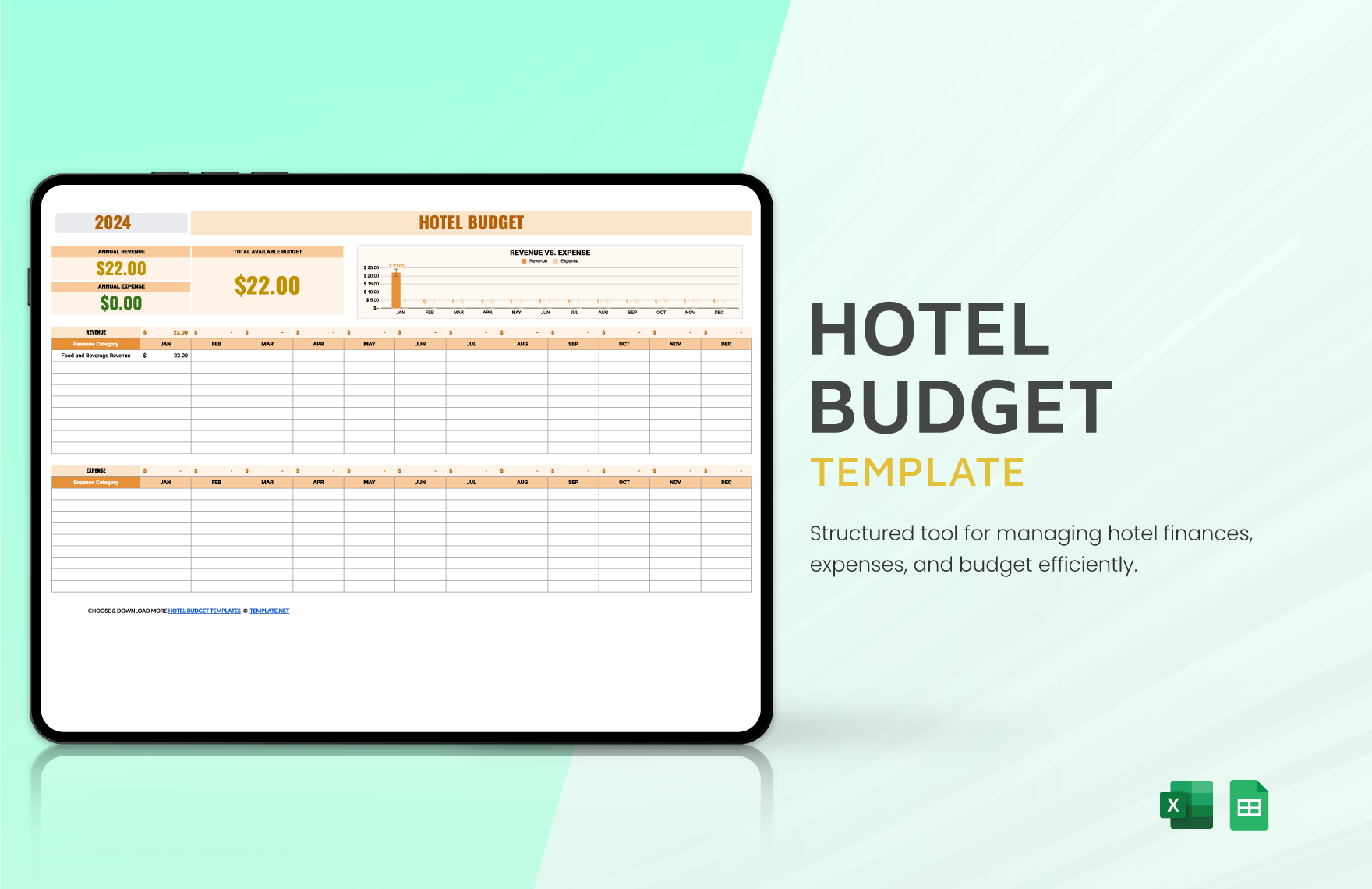

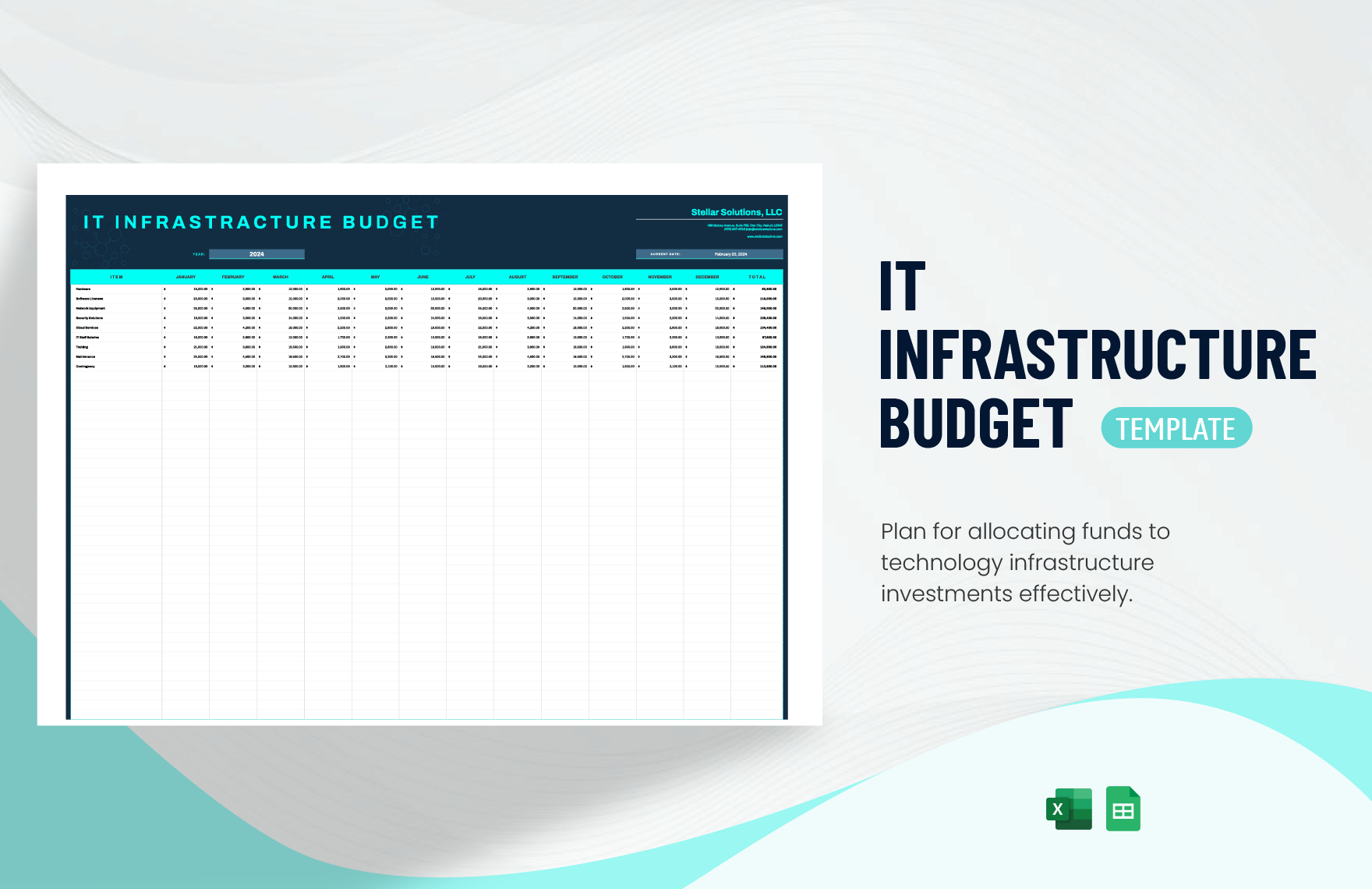

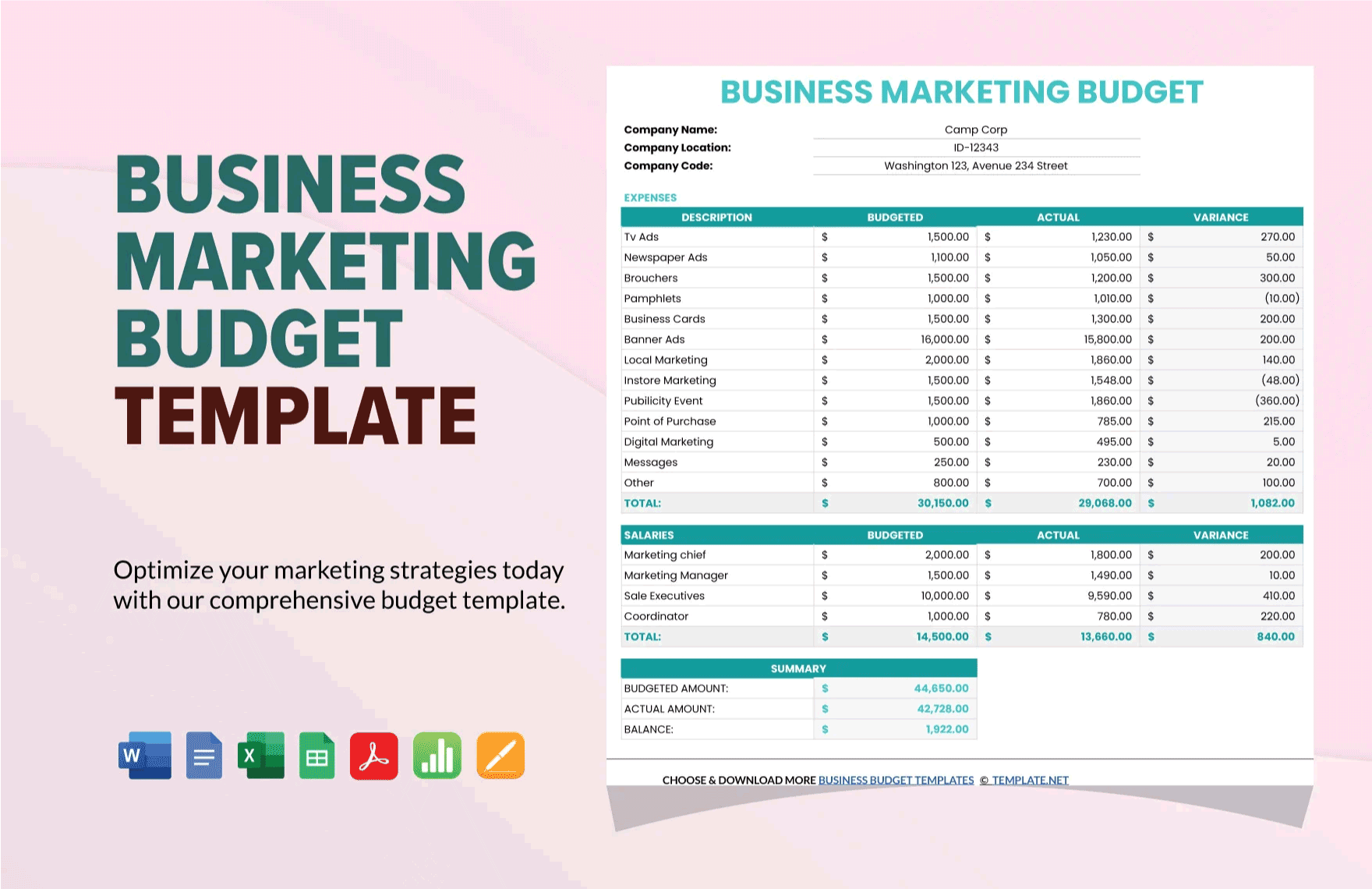

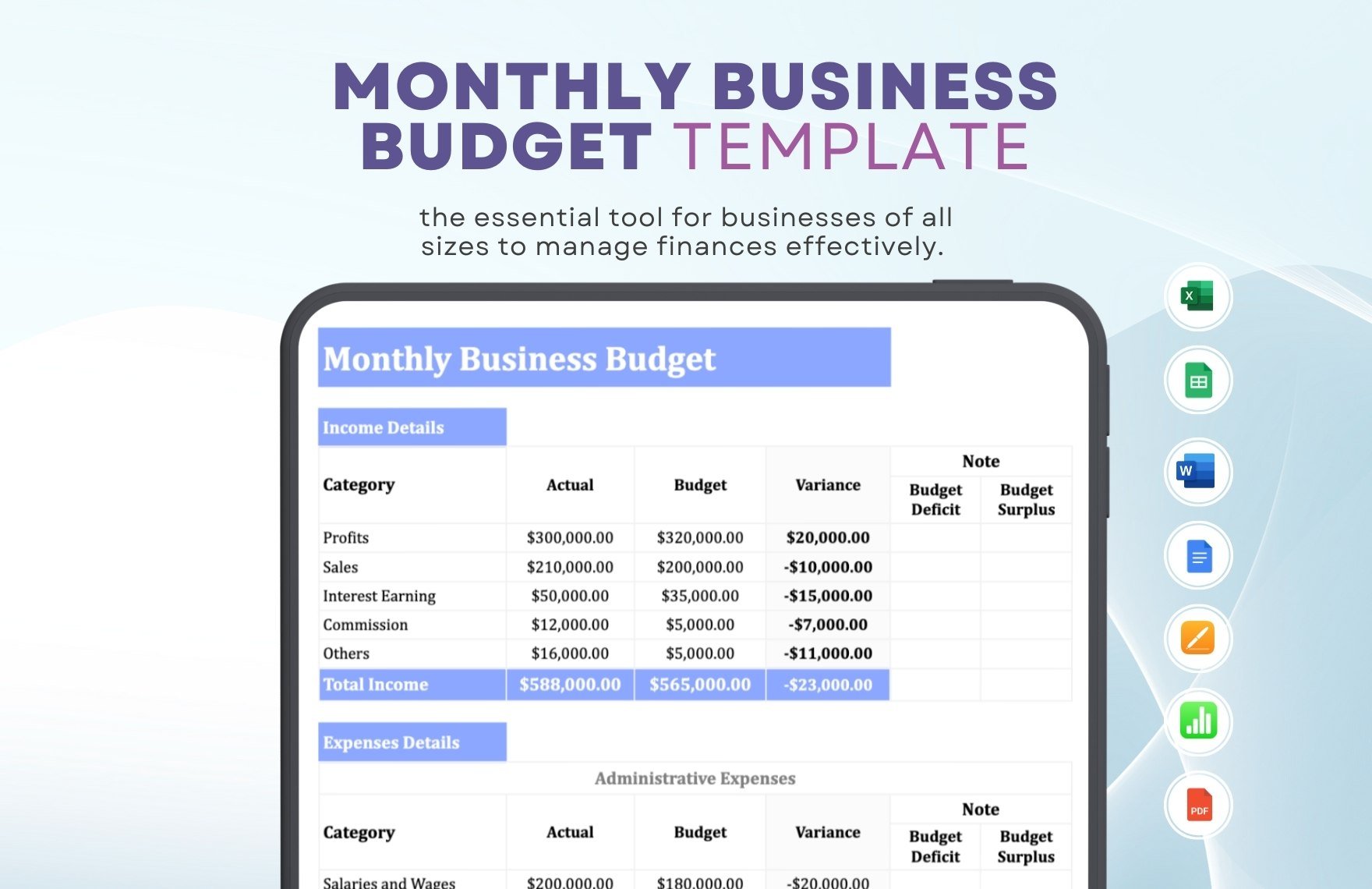

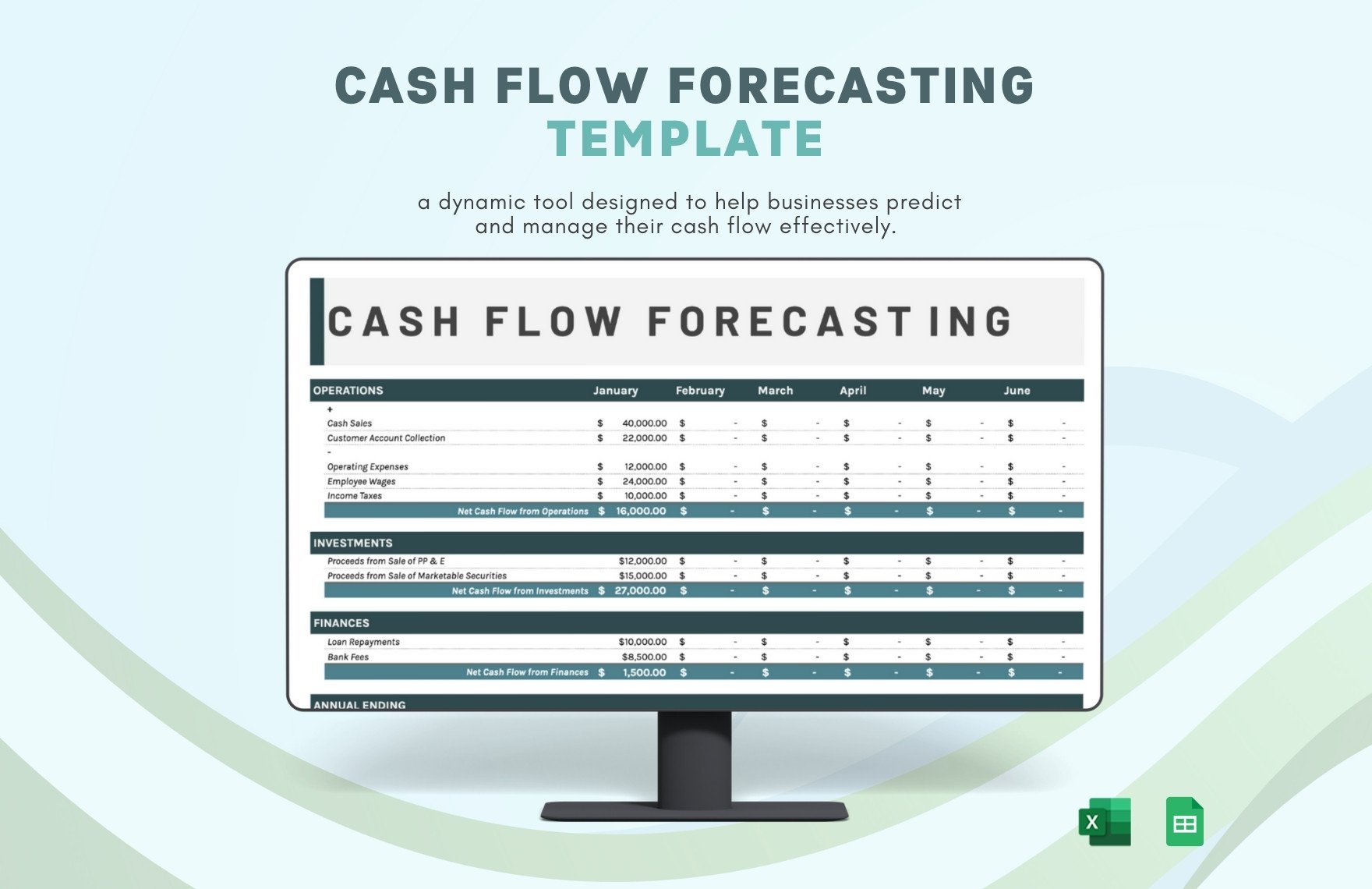

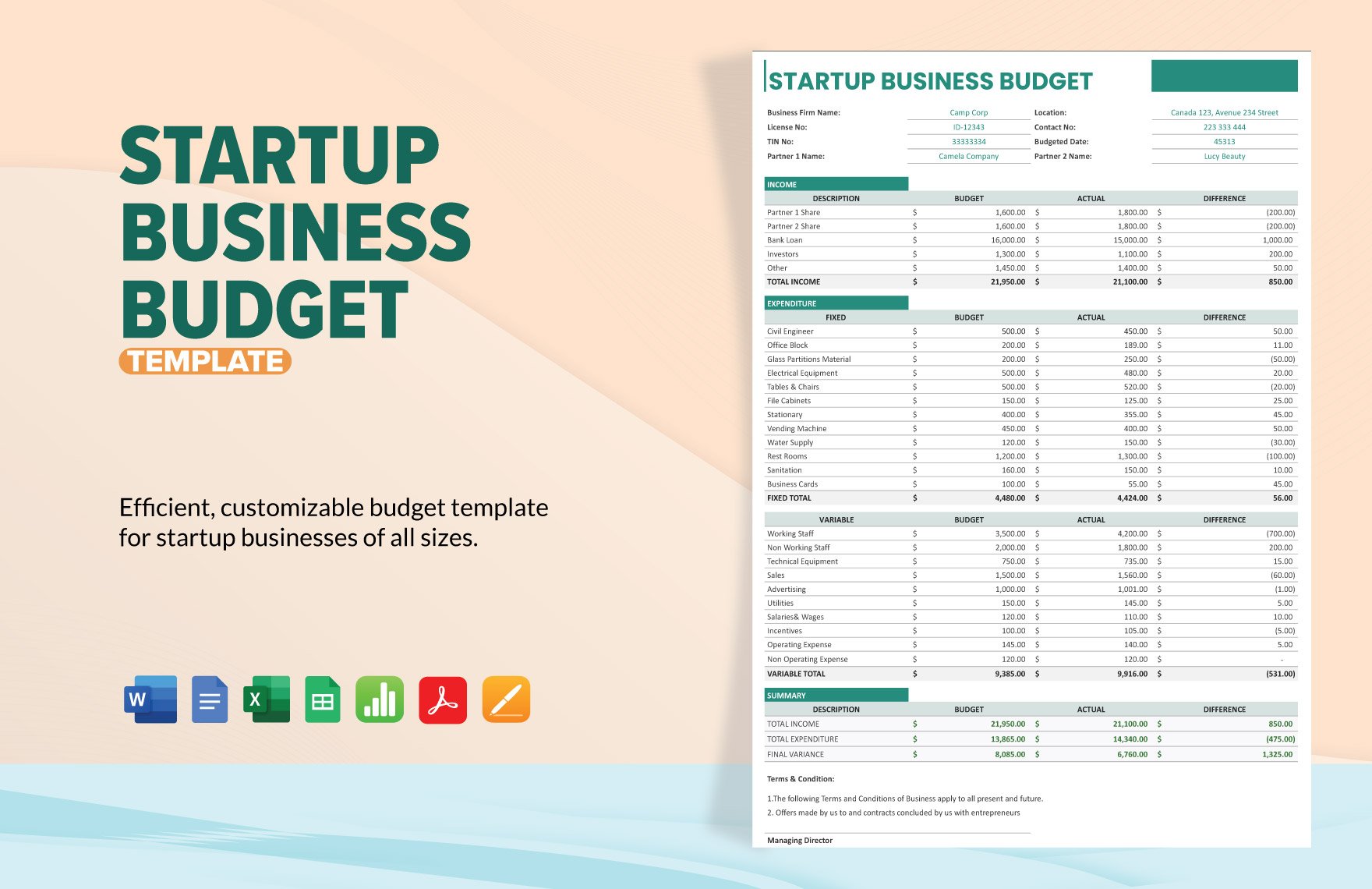

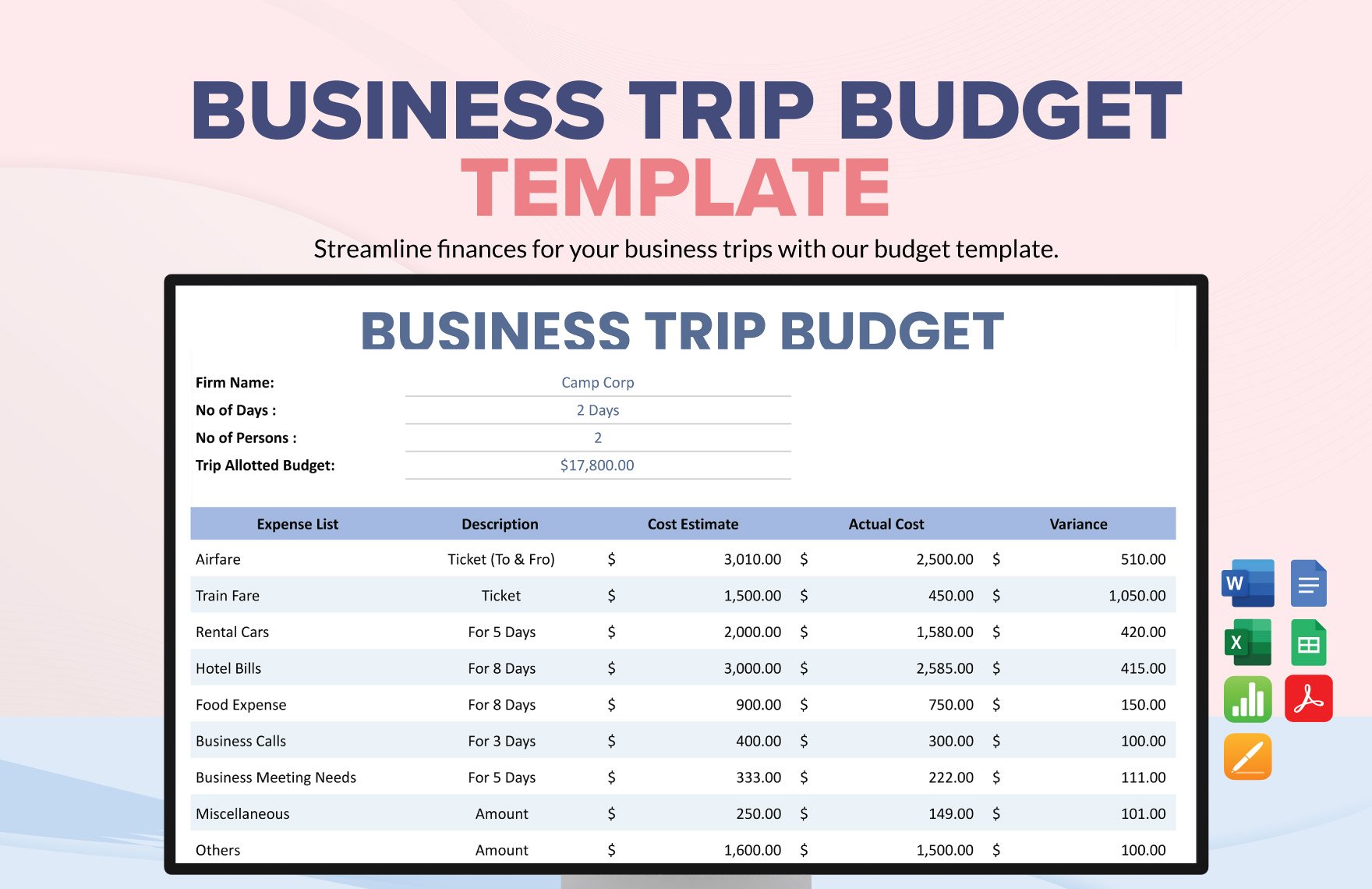

Bring your financial planning to life with pre-designed Business Budget Templates in Google Sheets by Template.net

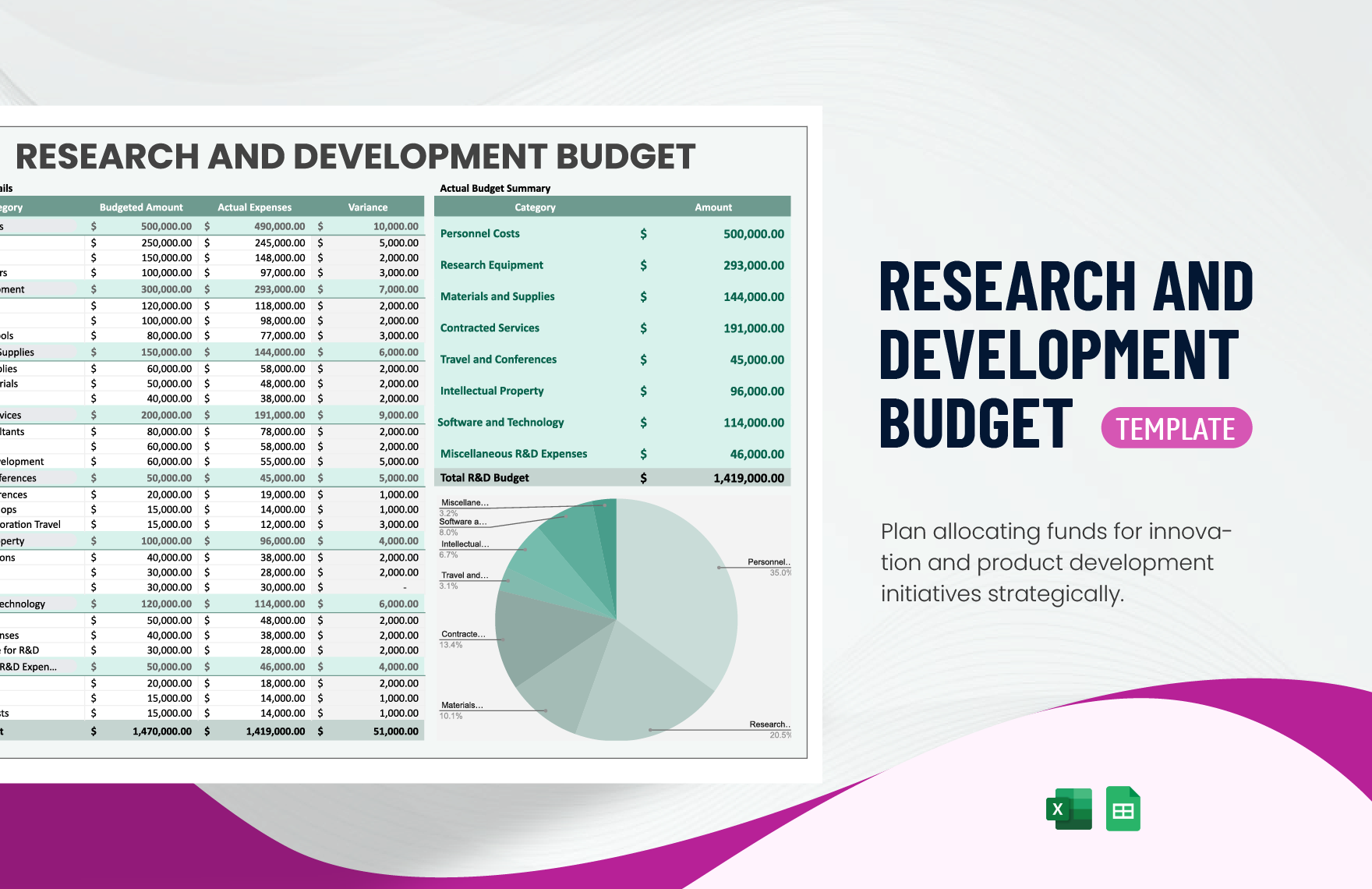

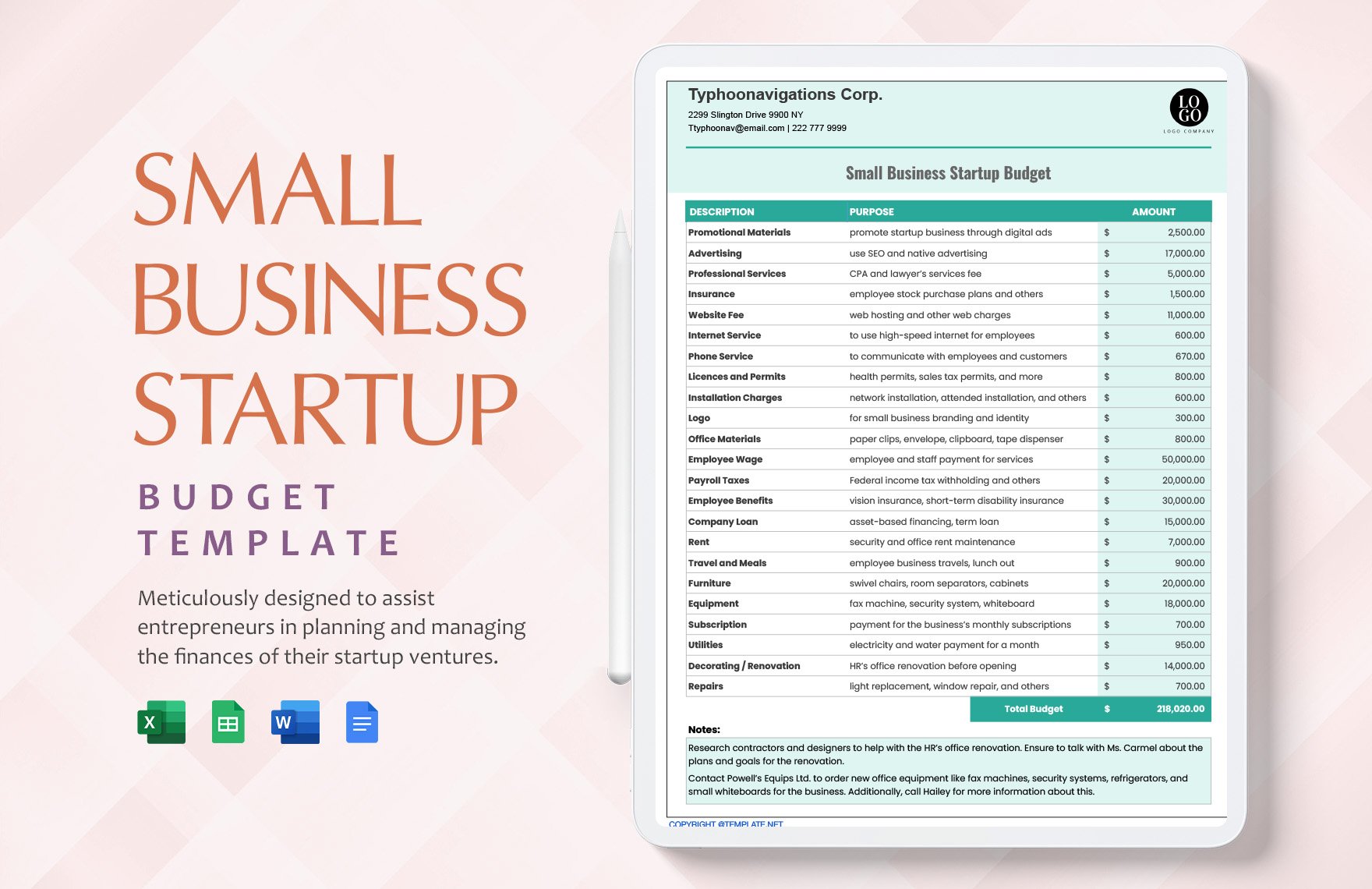

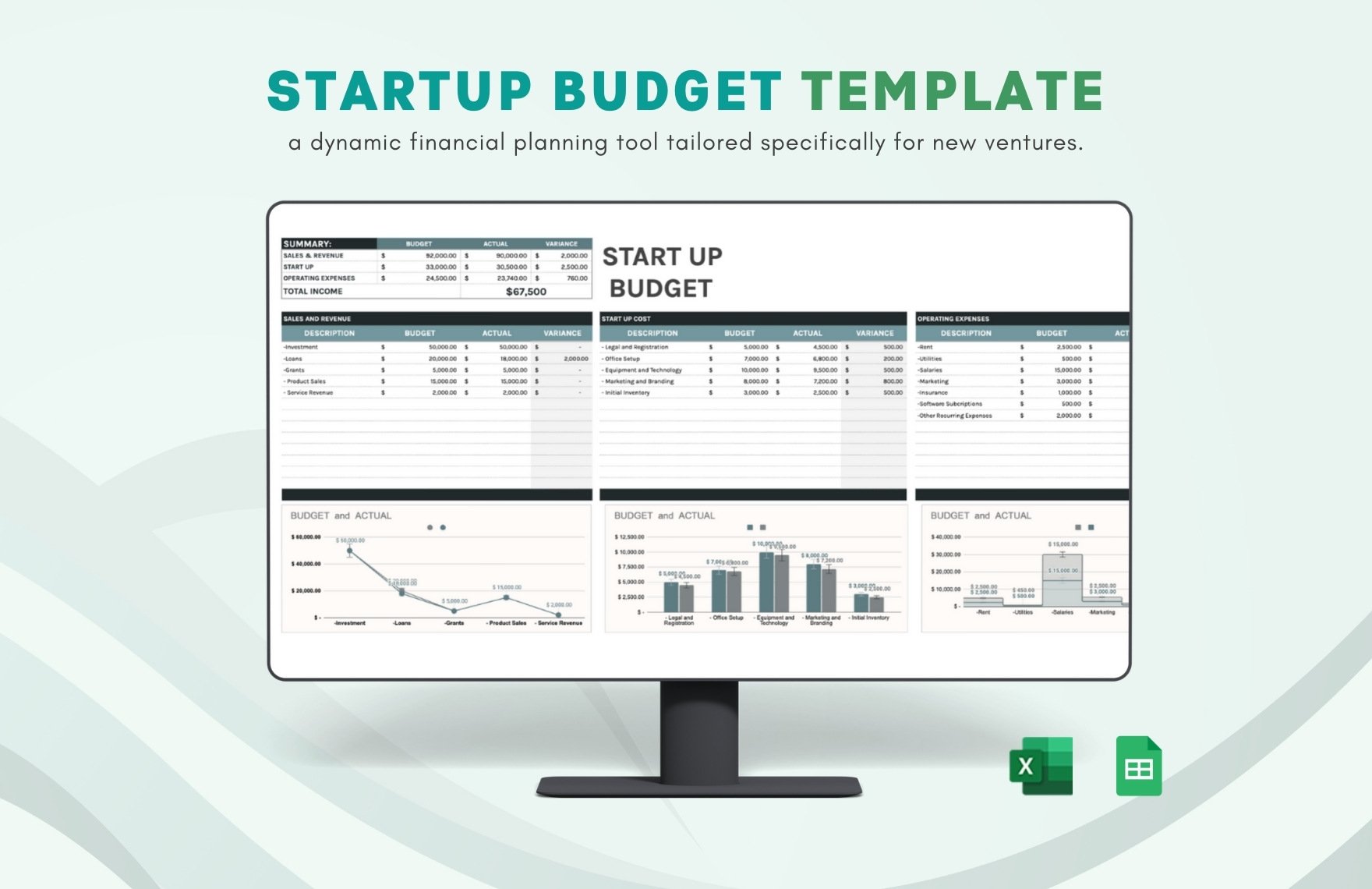

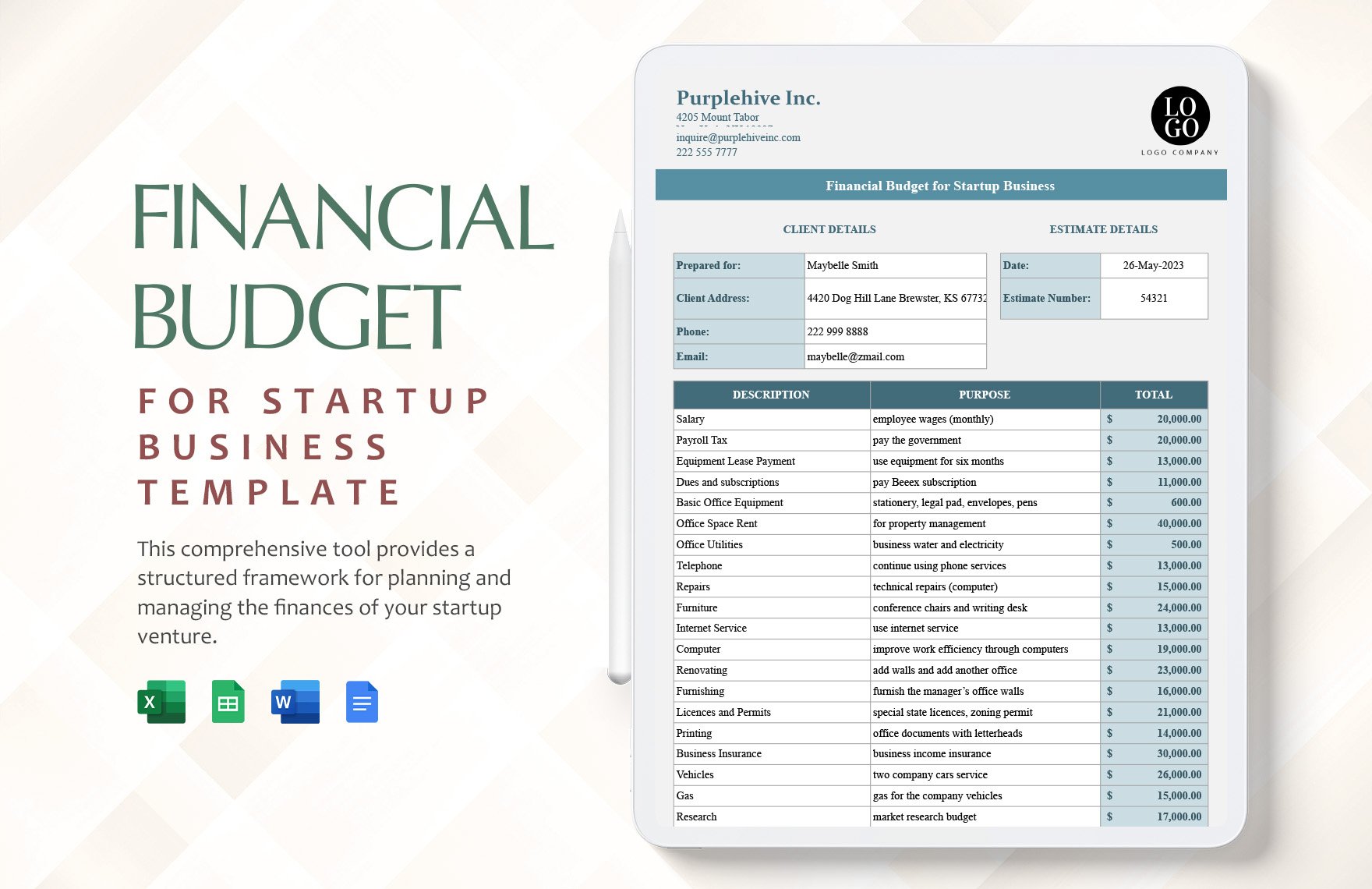

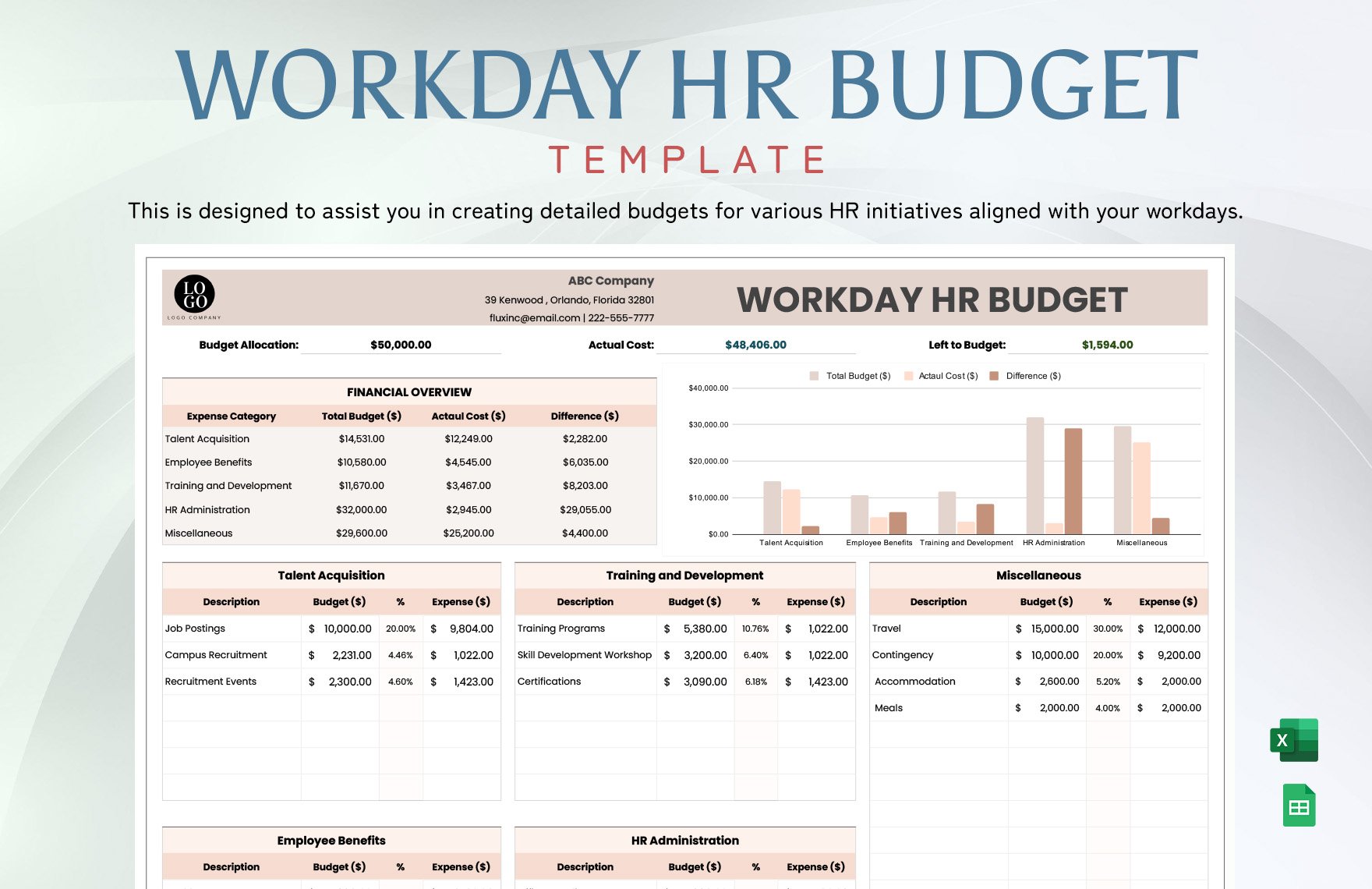

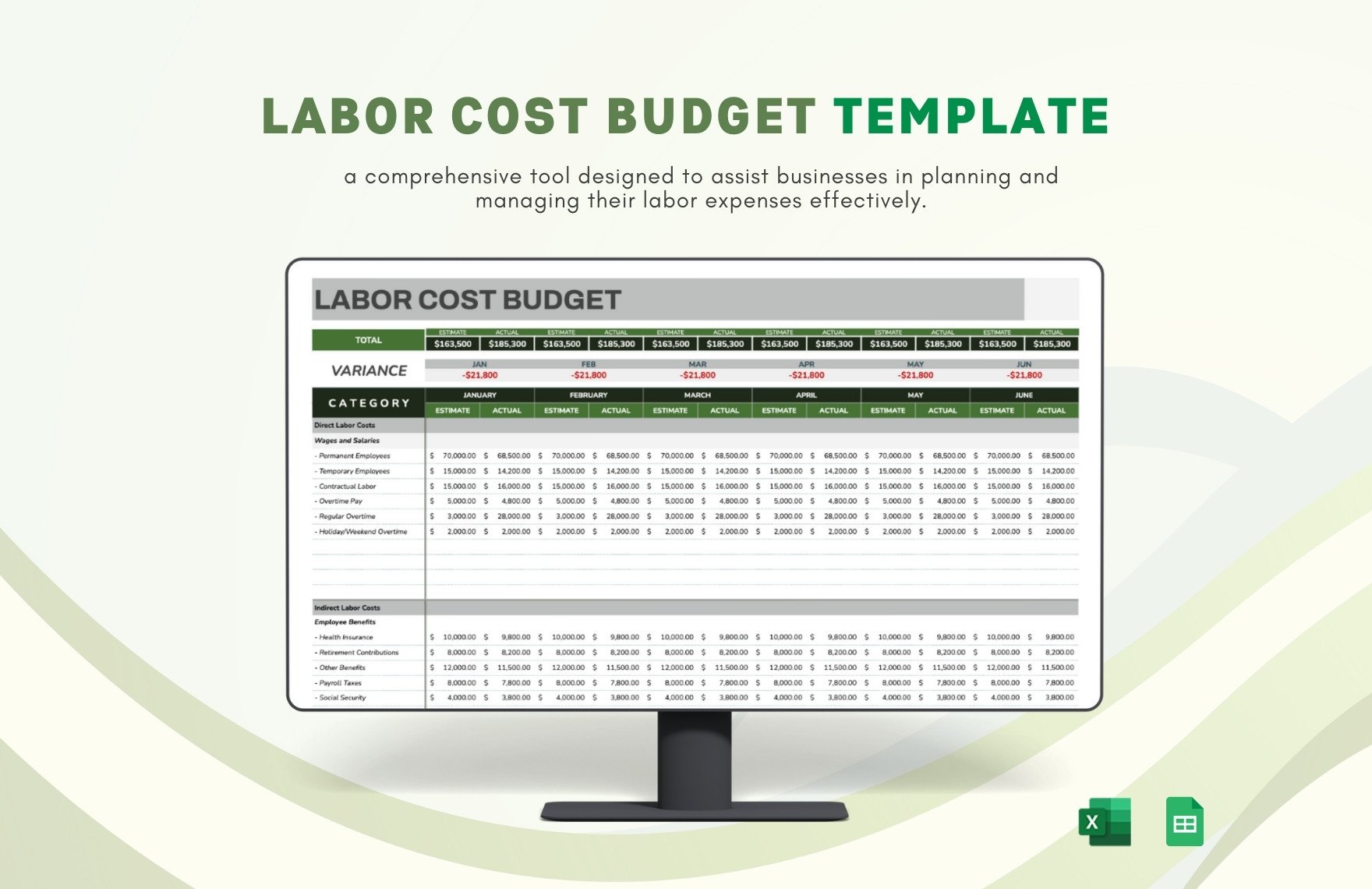

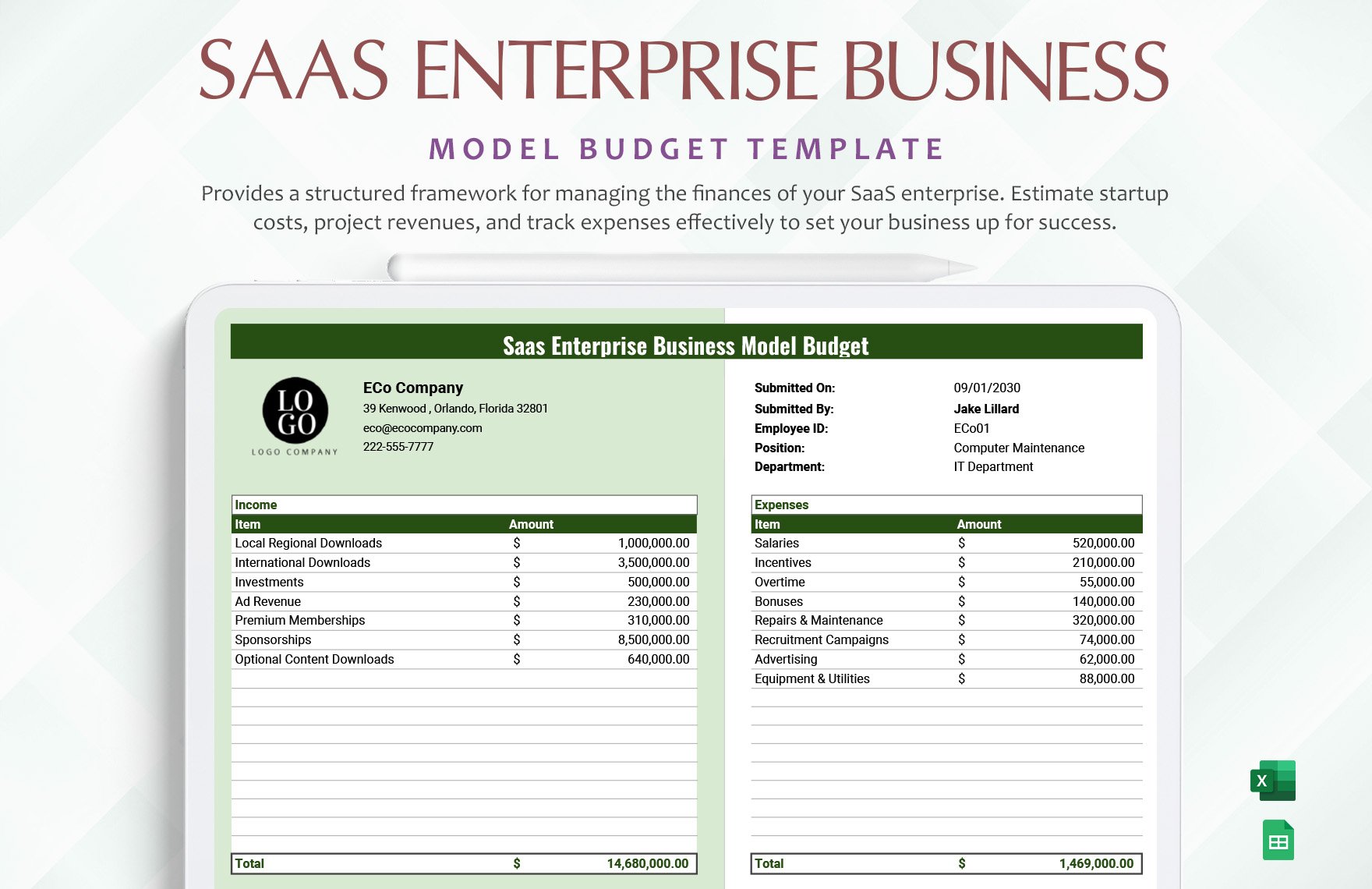

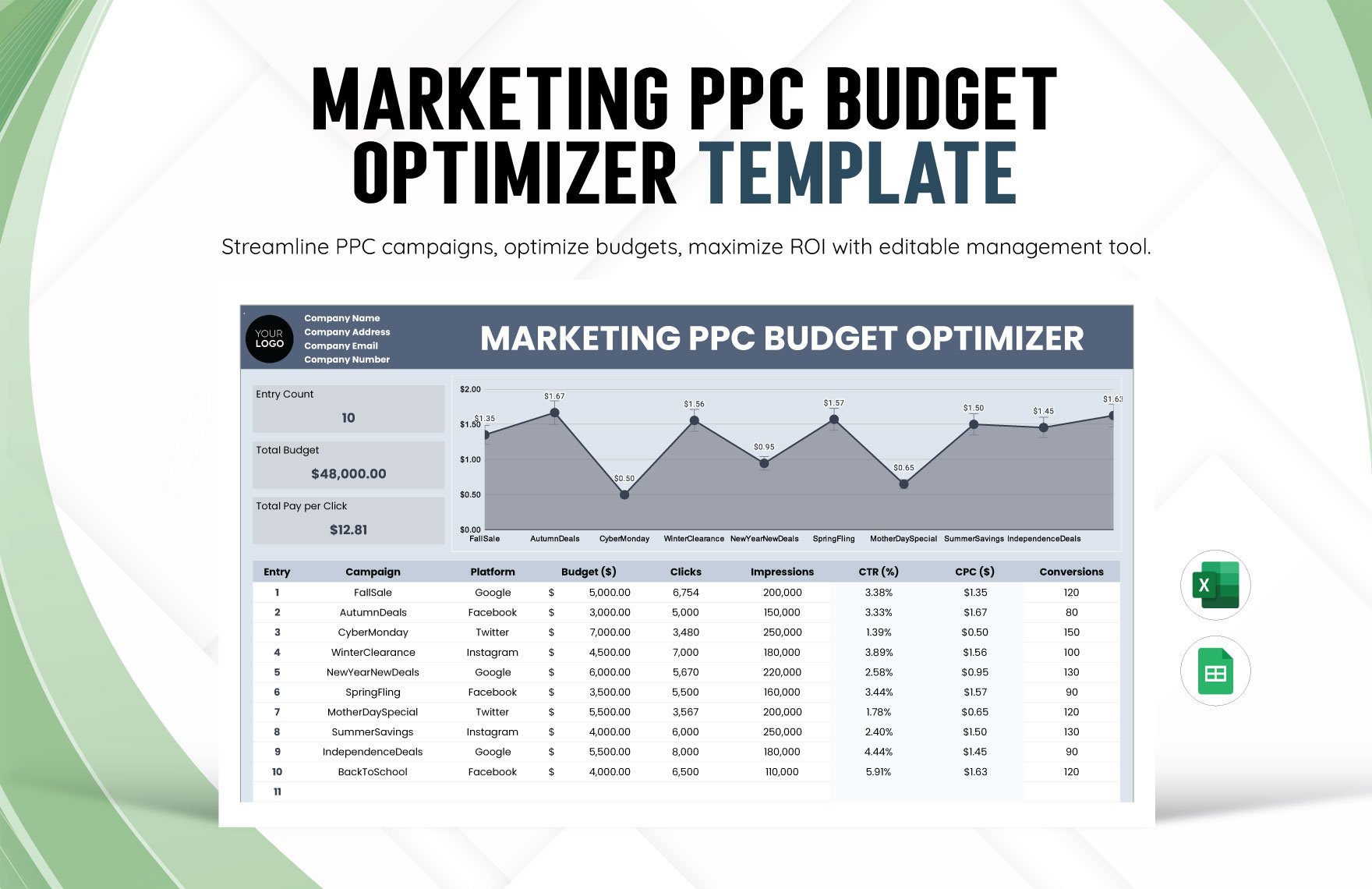

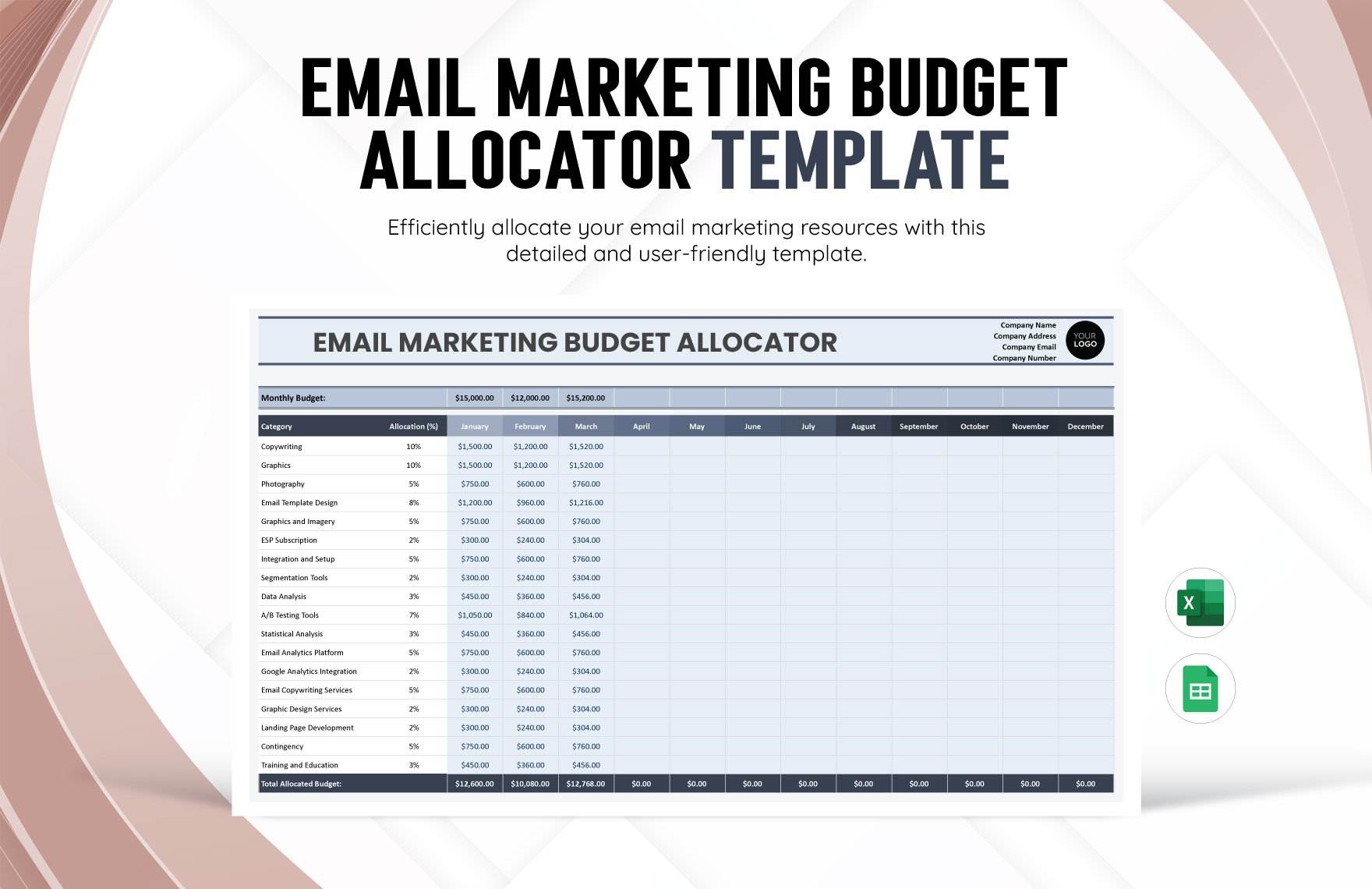

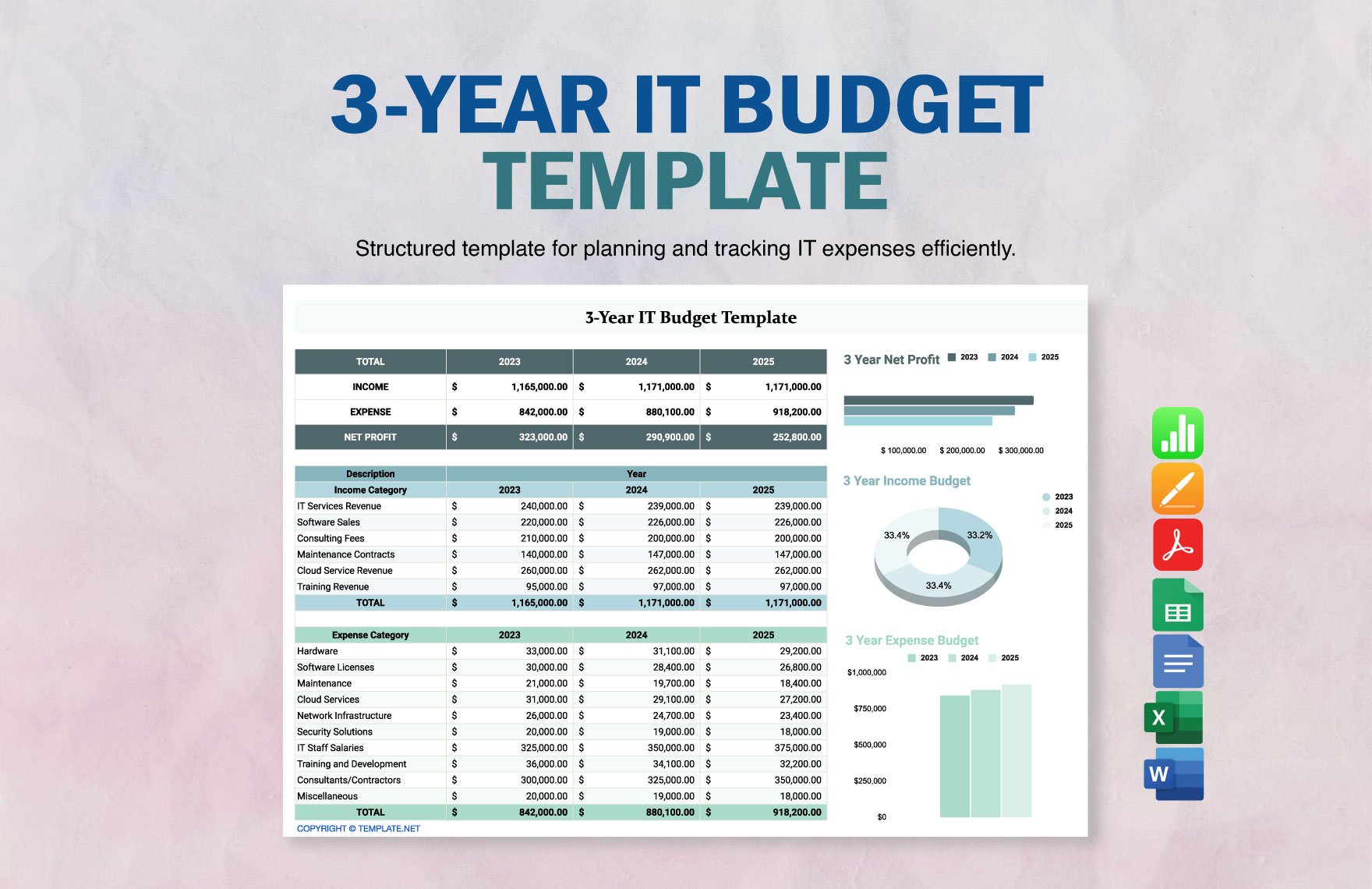

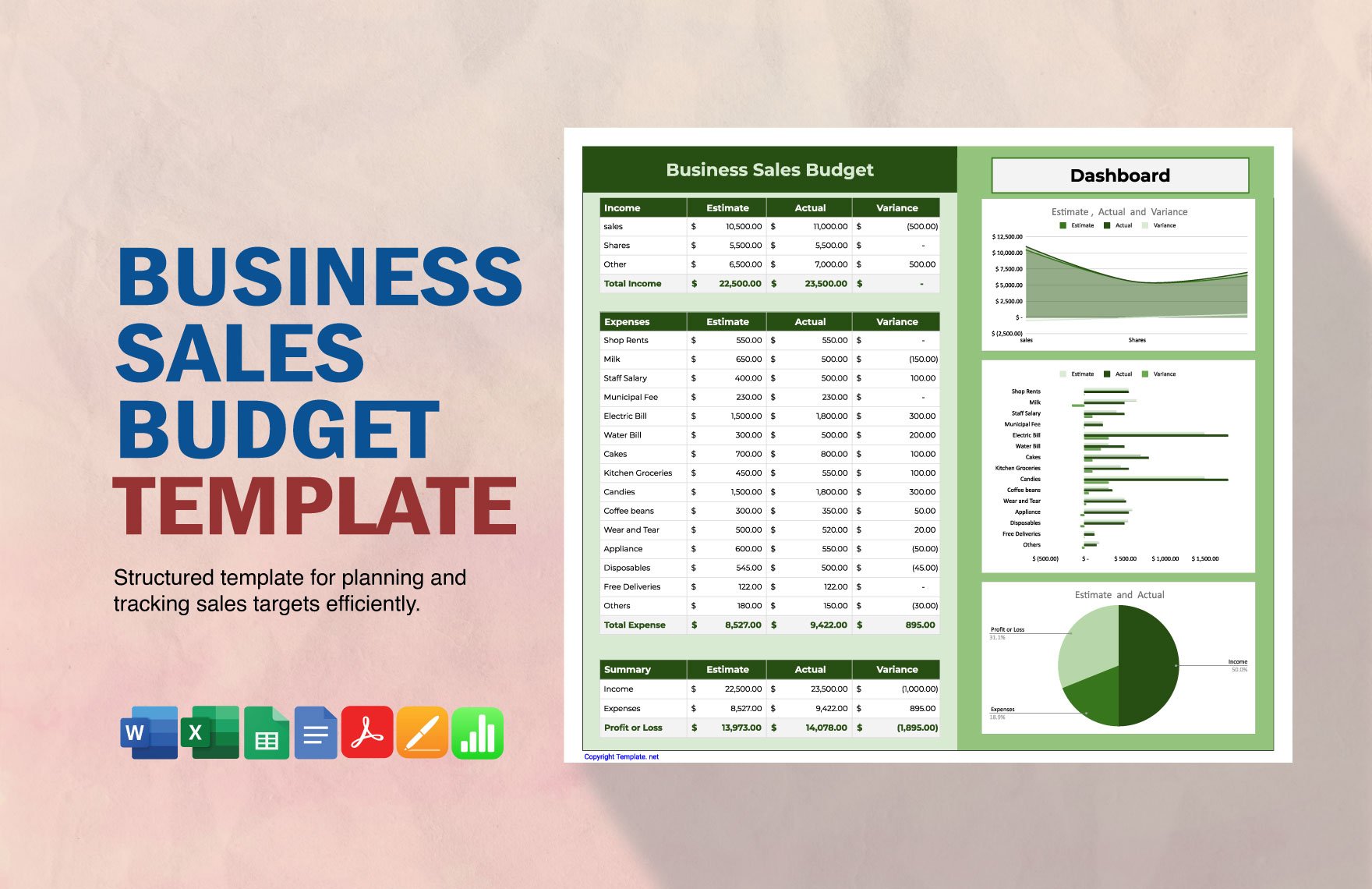

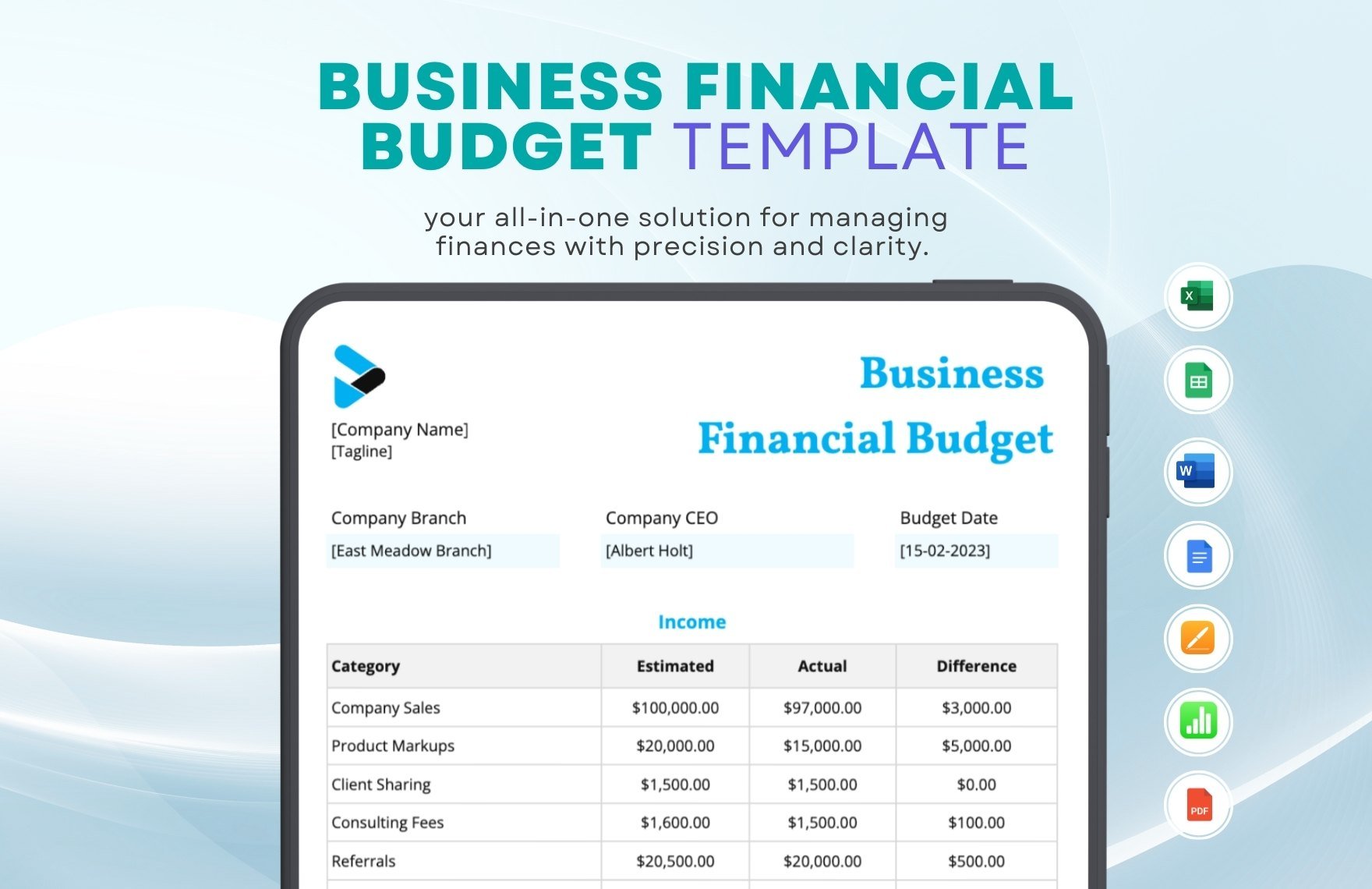

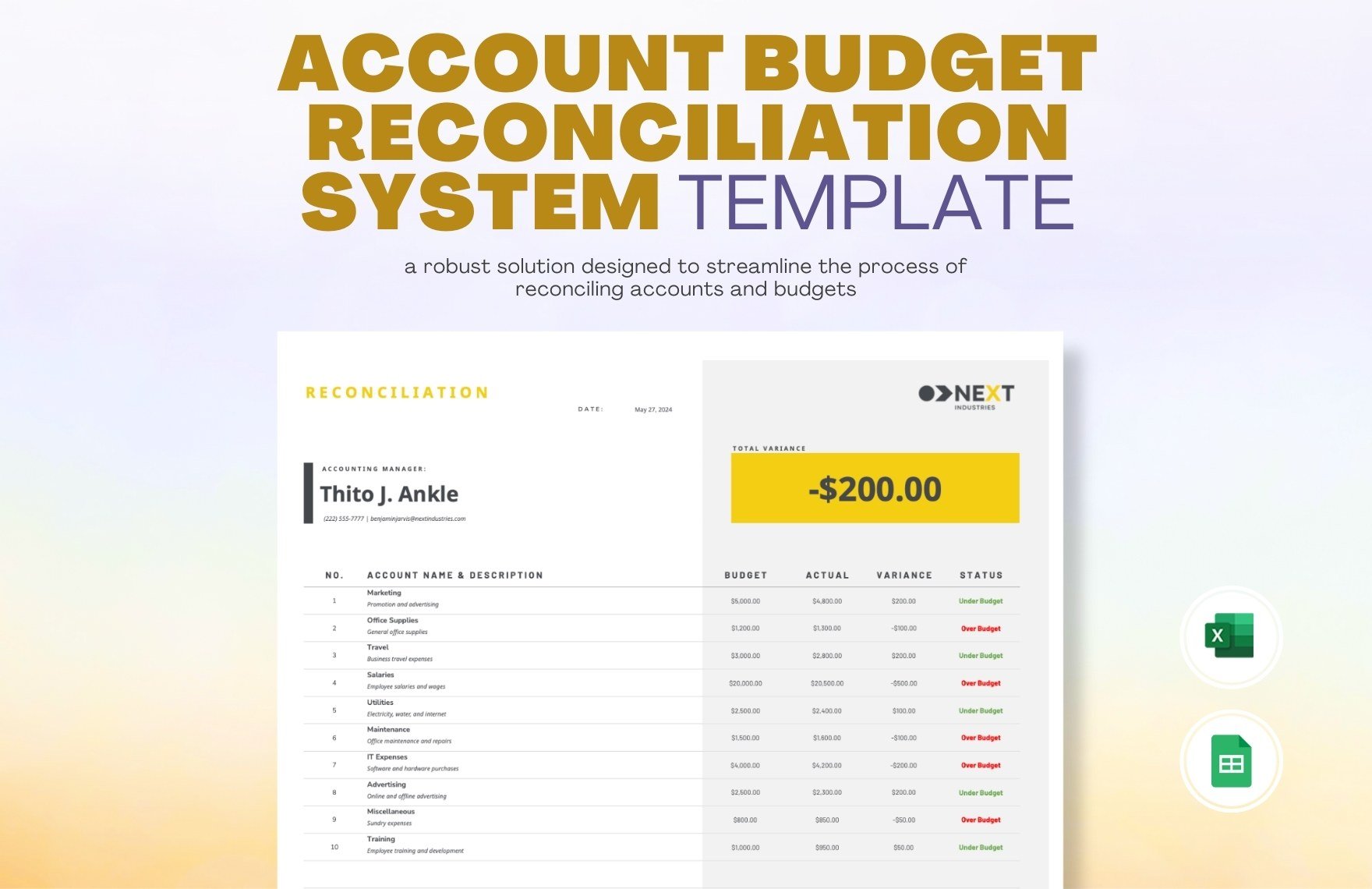

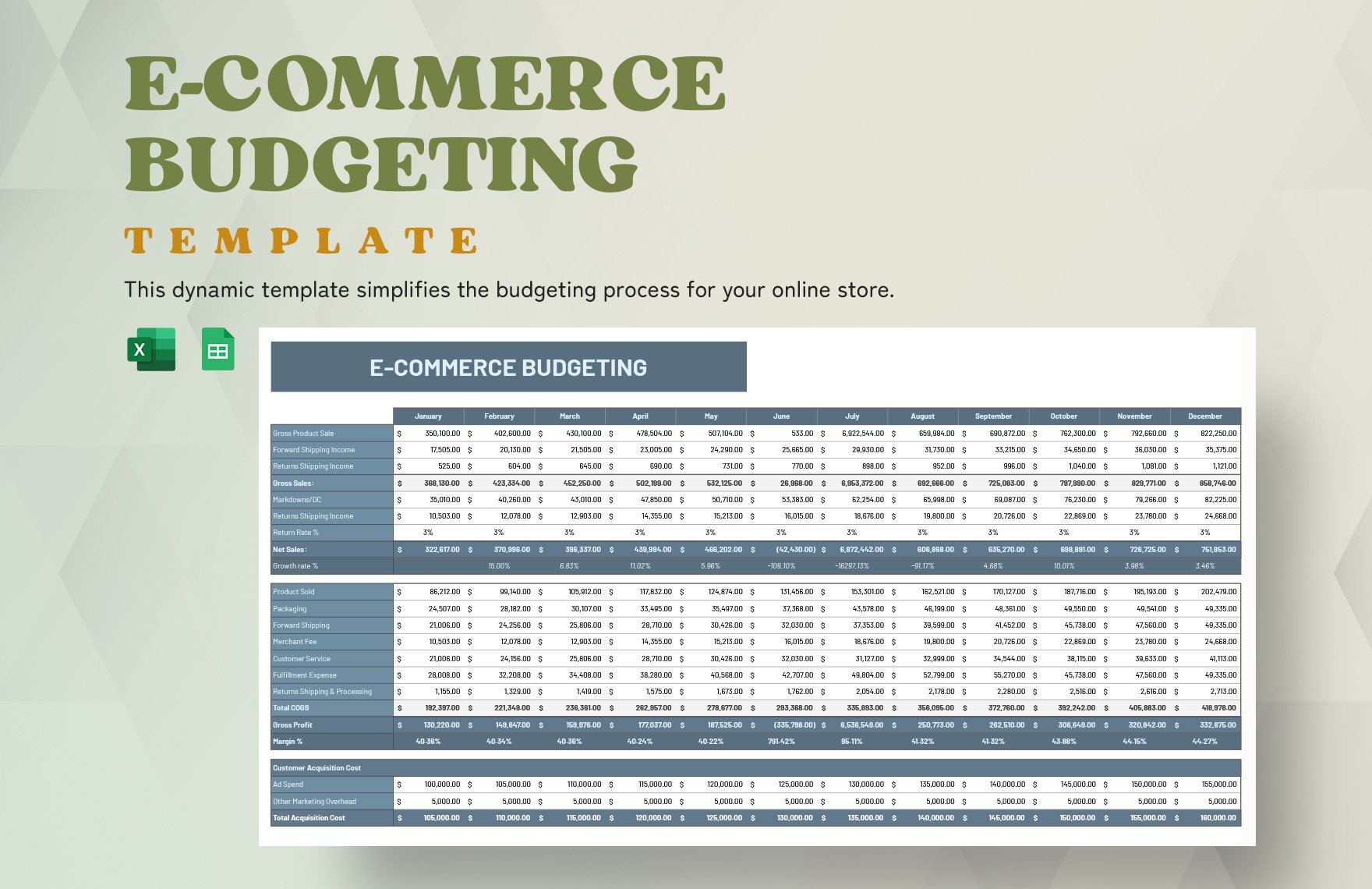

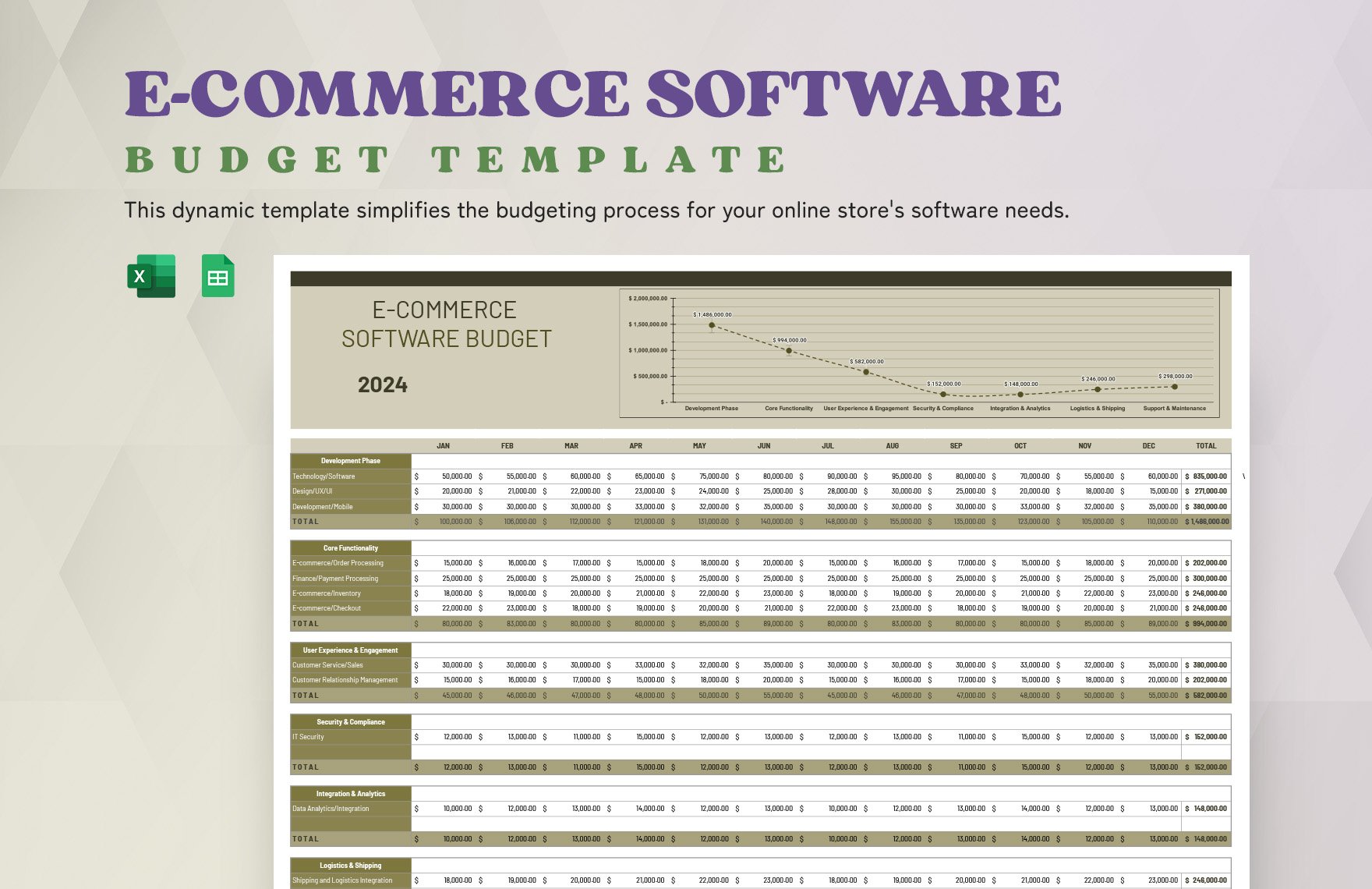

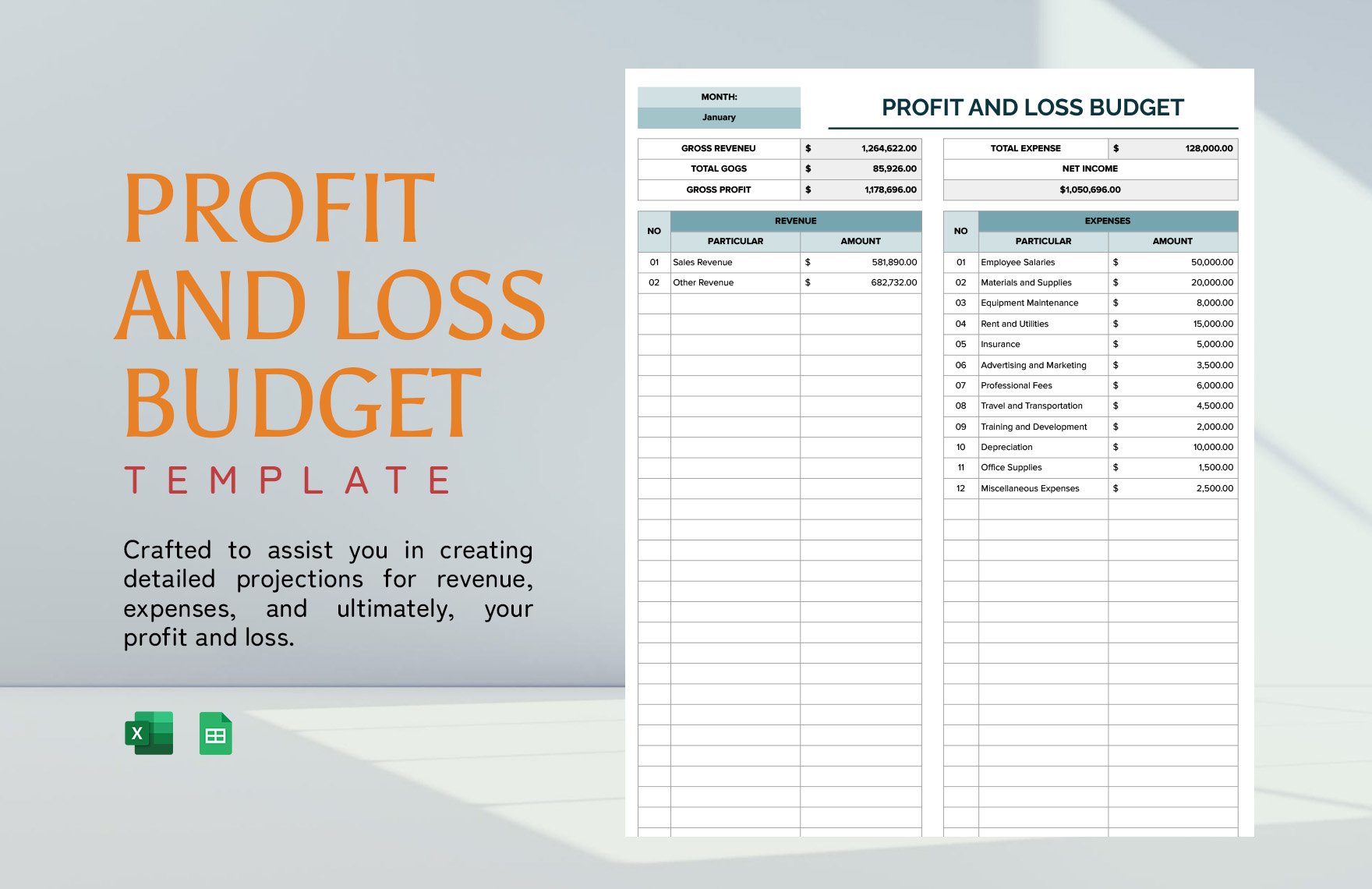

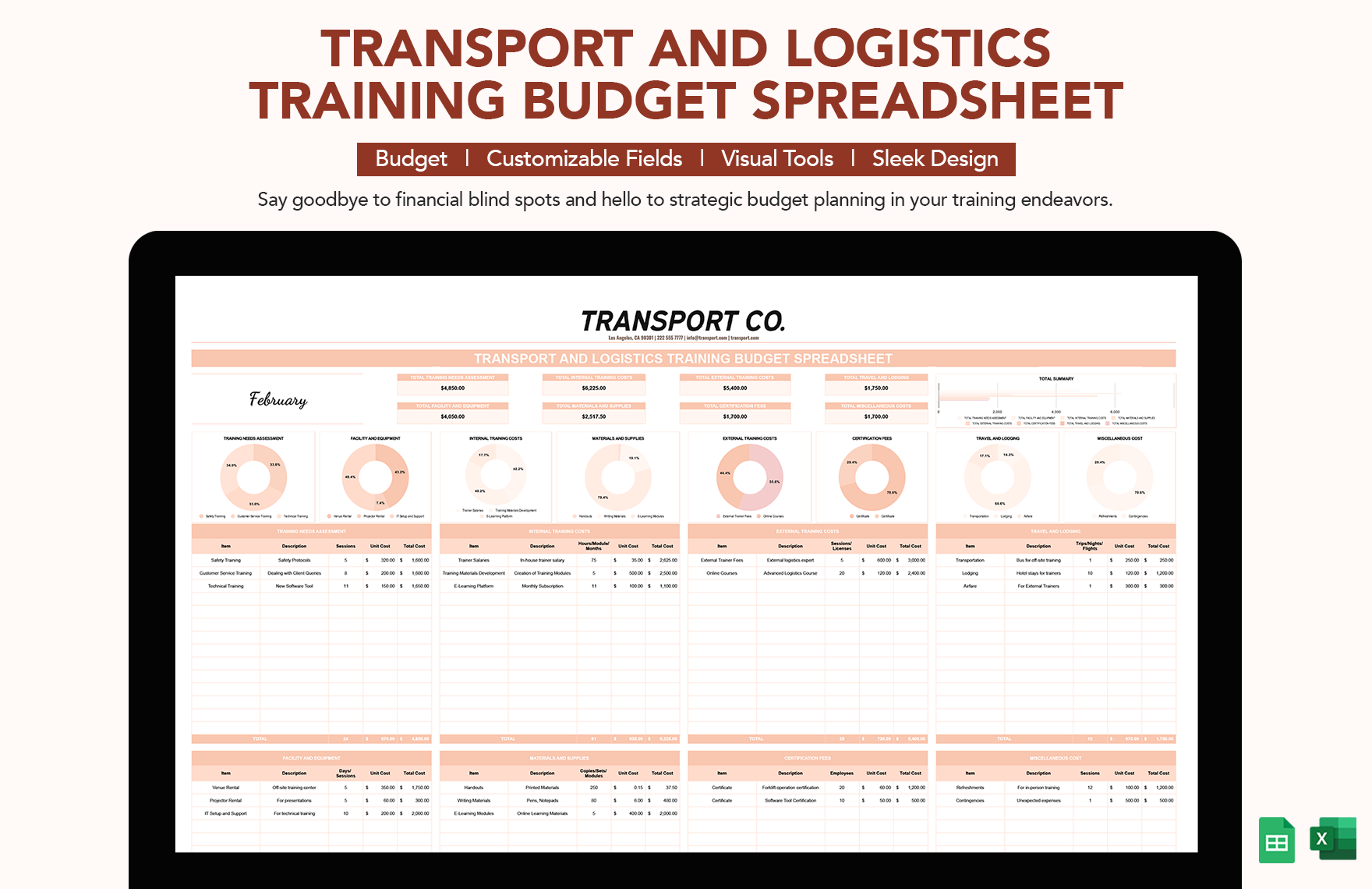

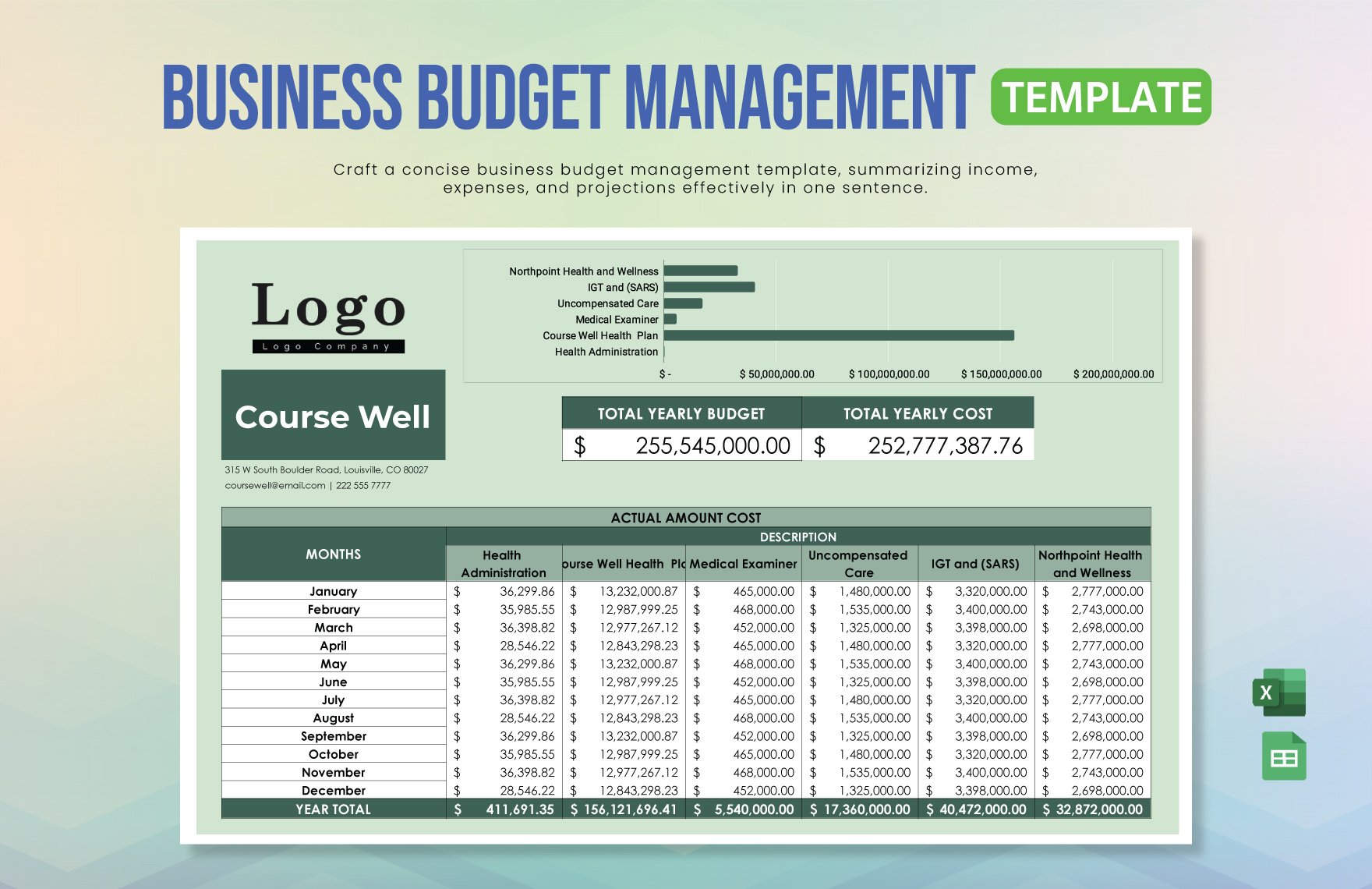

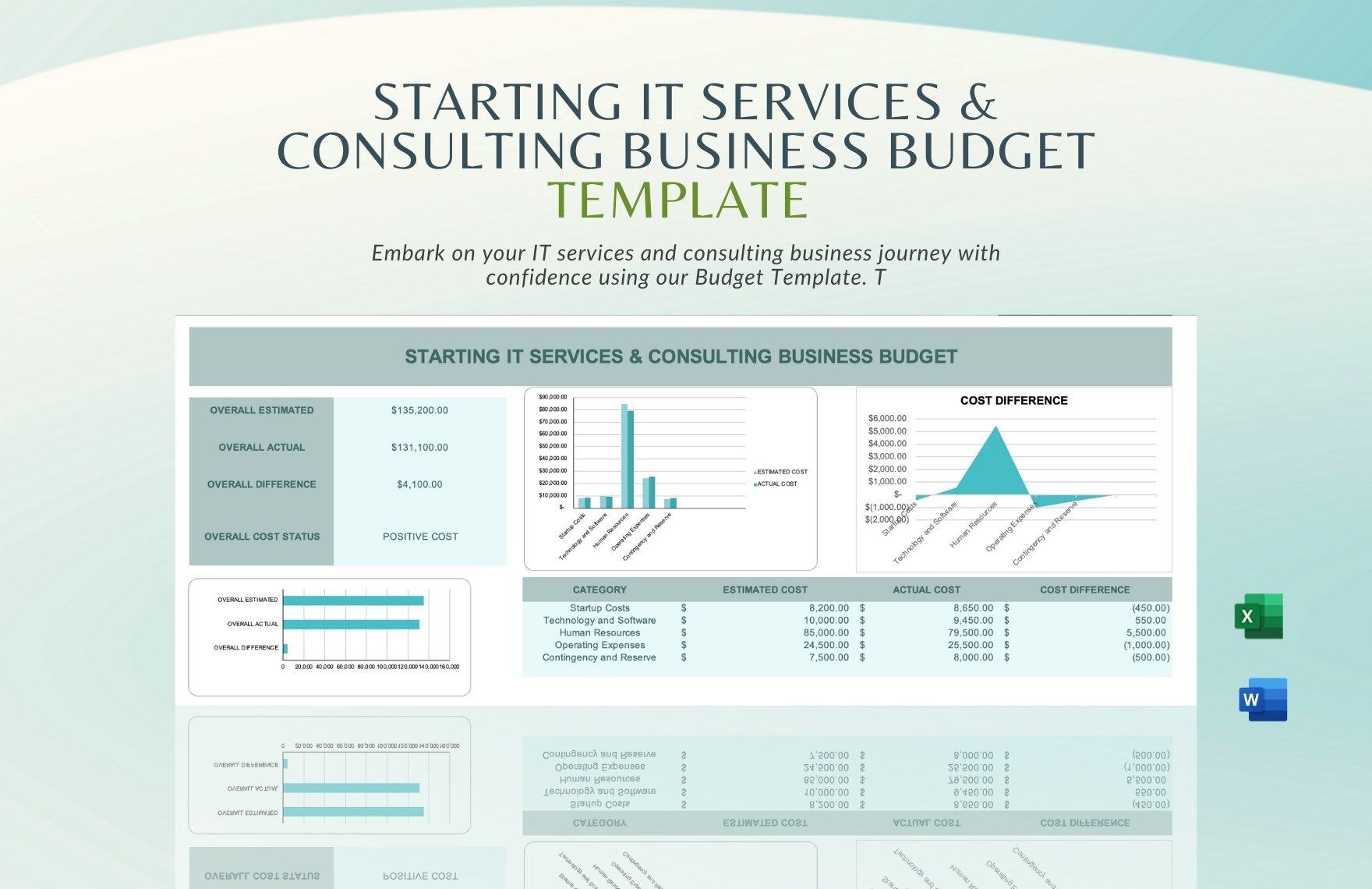

Business Budget Templates by Template.net empower business owners and financial analysts to create professional-grade budgets quickly and easily with no design experience. Whether you're looking to manage a business expansion or fine-tune your monthly expenditure, our pre-designed templates are here to assist. You can use these templates to promote financial clarity, helping you make informed decisions or showcase budget allocations during stakeholder meetings. With a collection of free templates that are both downloadable and printable in Google Sheets format, Template.net offers beautiful pre-designed templates that ensure ease of use. Enjoy customizable layouts for both print and digital distribution, saving both time and resources.

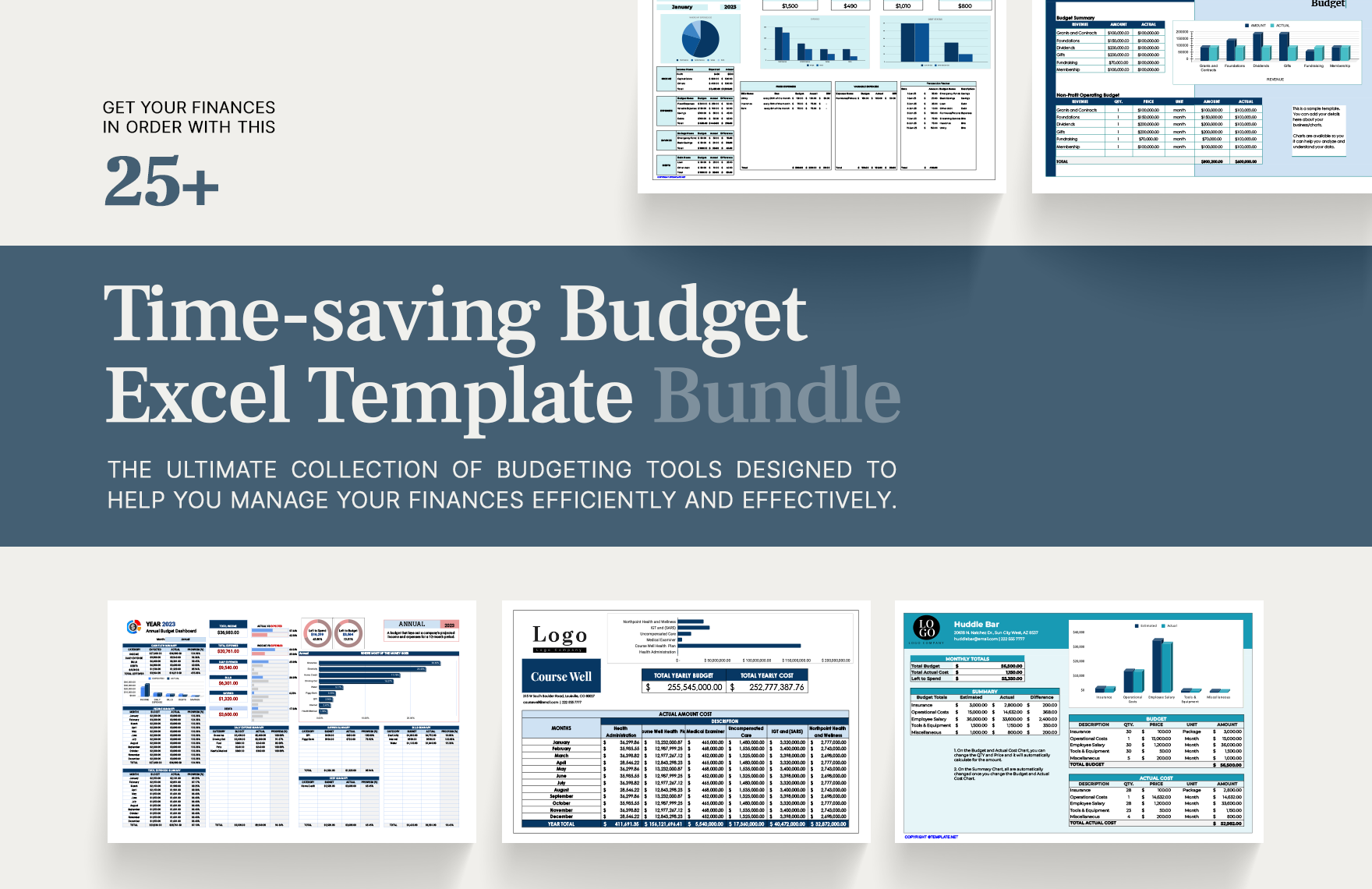

Explore more beautiful premium pre-designed templates in Google Sheets, designed to provide flexibility and style to your financial presentations. Template.net consistently updates its library with new and innovative designs to inspire your financial planning efforts. Whether you choose to download or share them via print, email, or export options, these templates increase the reach of your budget plans. Embrace the diversity of both free and premium options available for maximum flexibility. Try different styles and formats for a tailored approach to your financial documentation and planning.