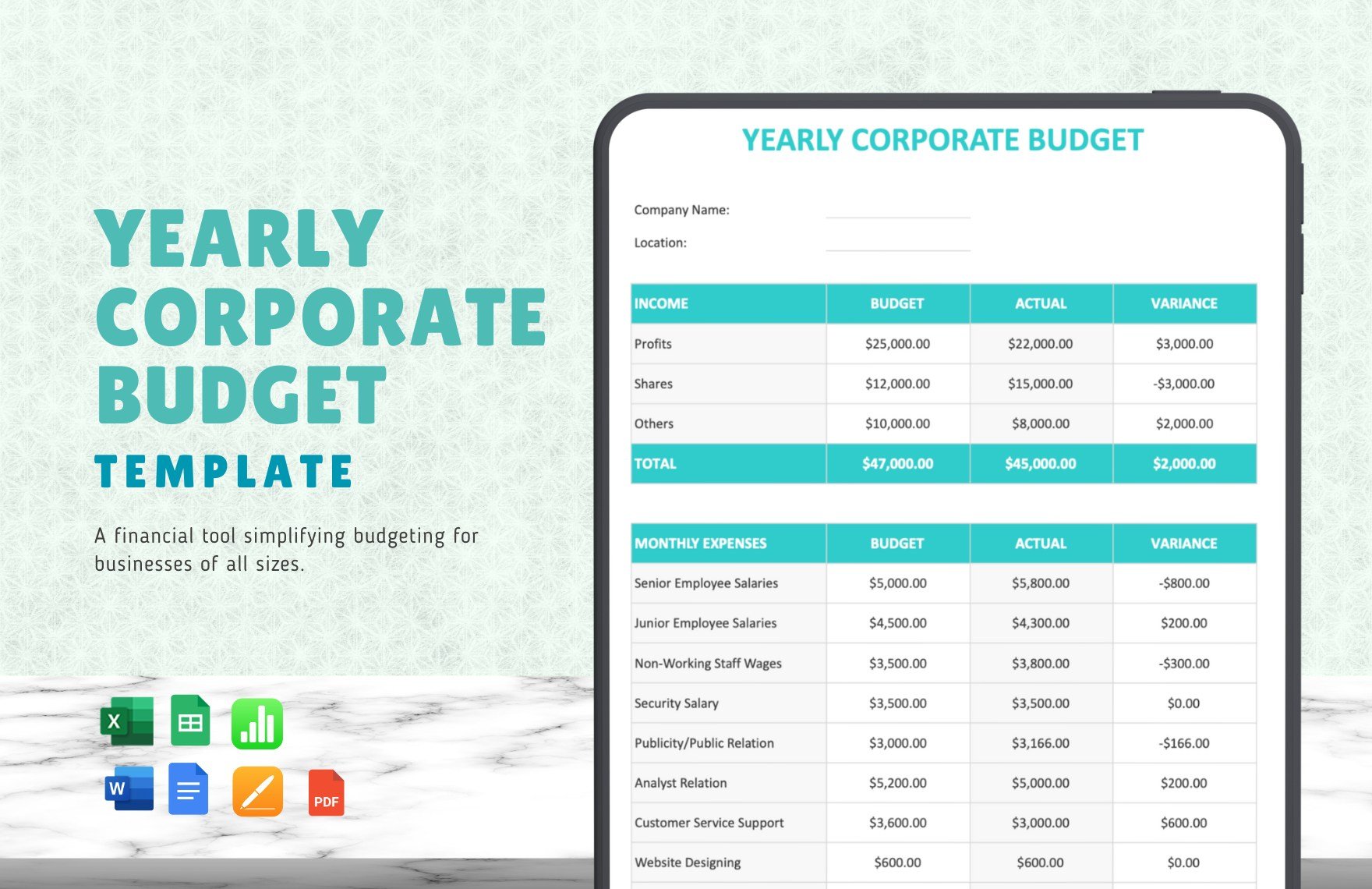

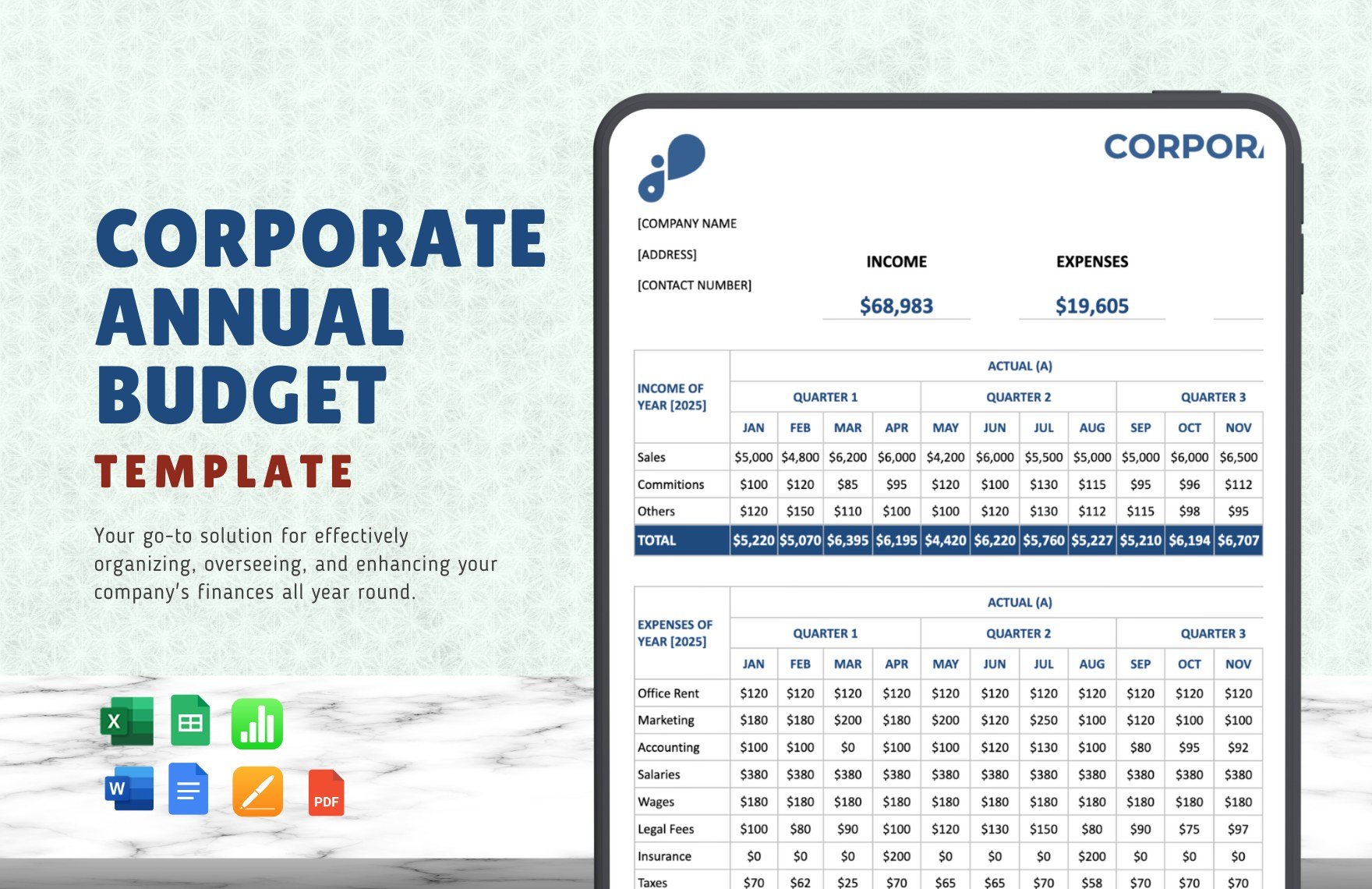

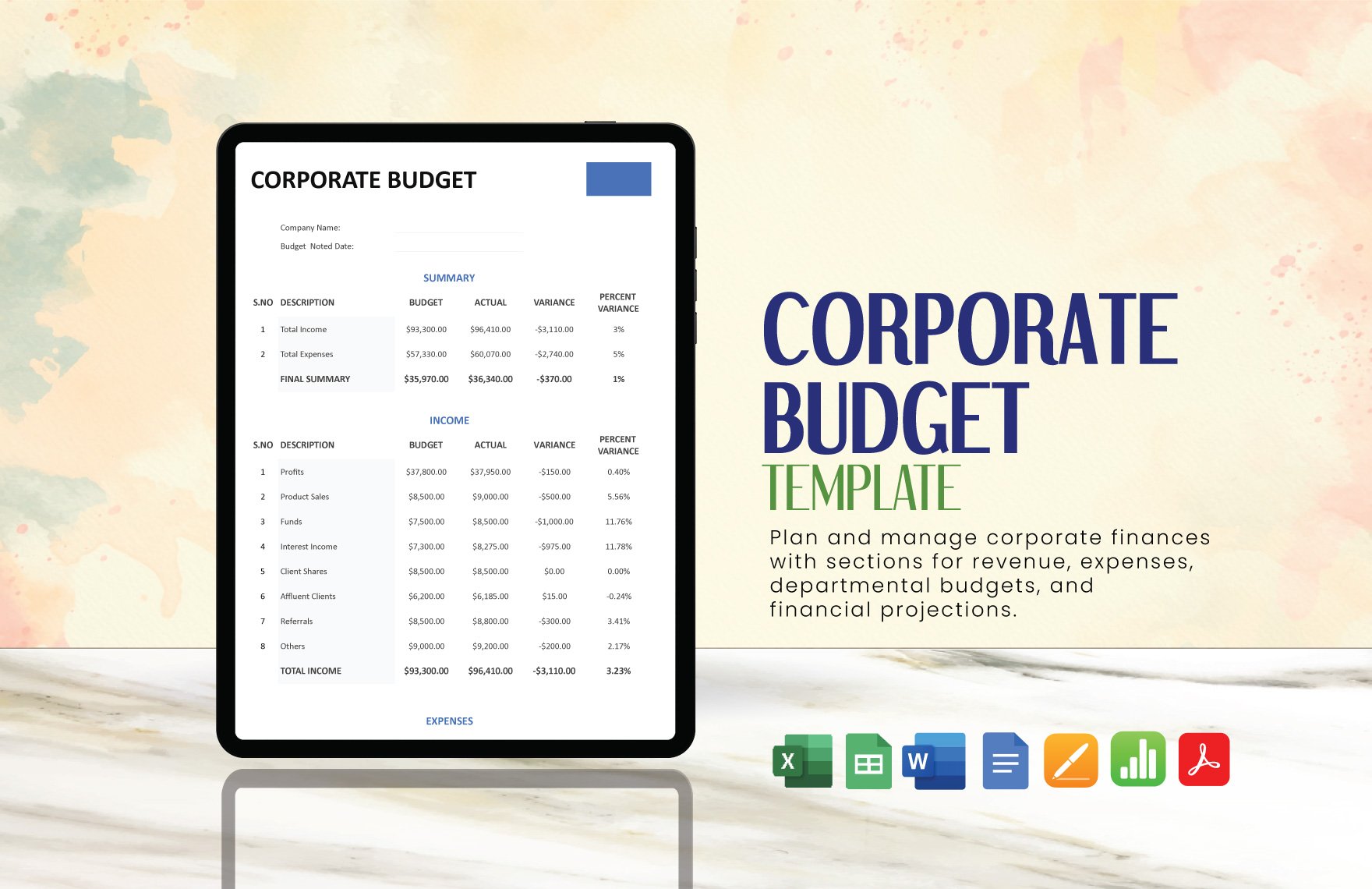

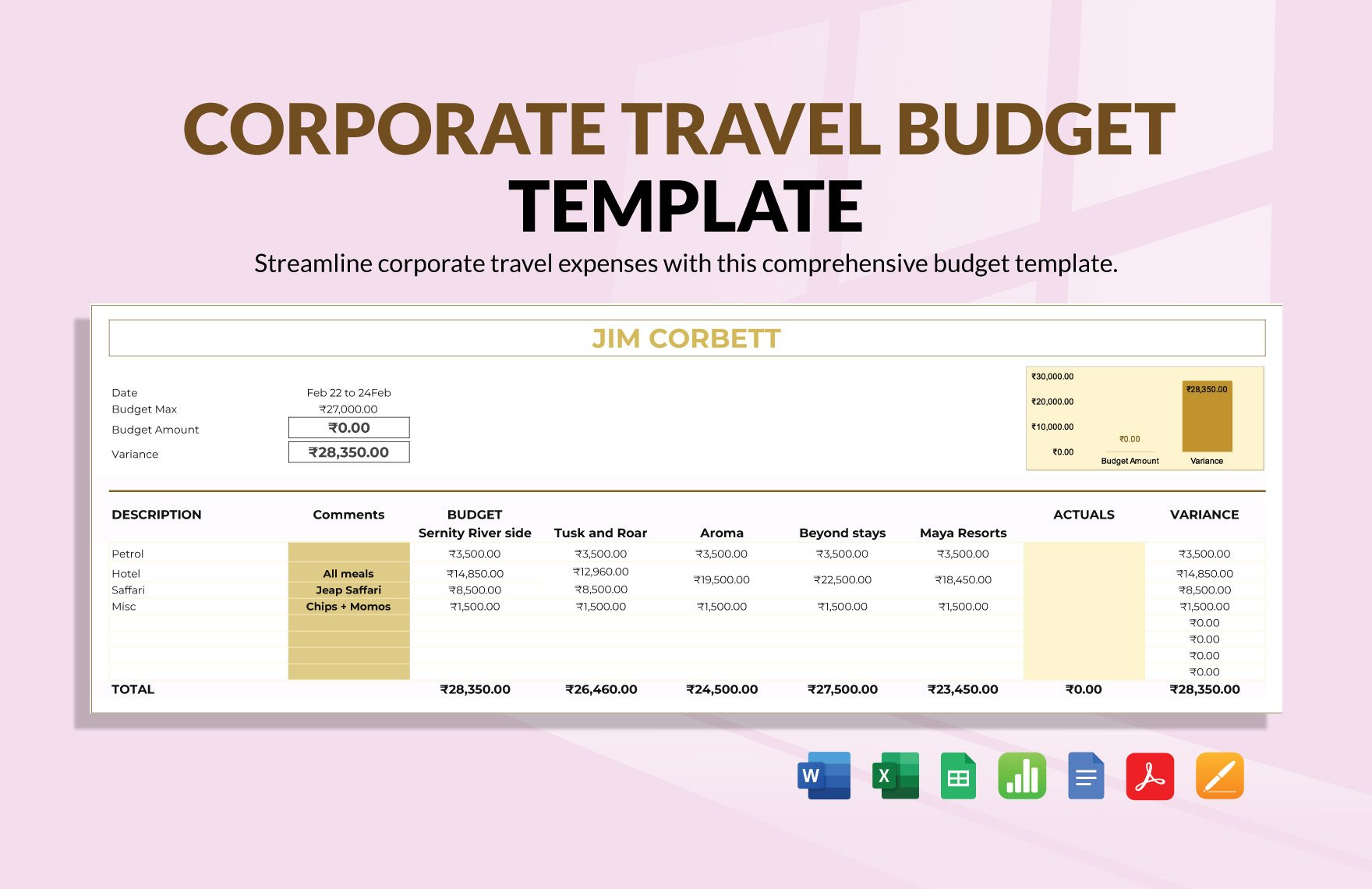

Bring Your Financial Plans to Life with Corporate Budget Templates from Template.net

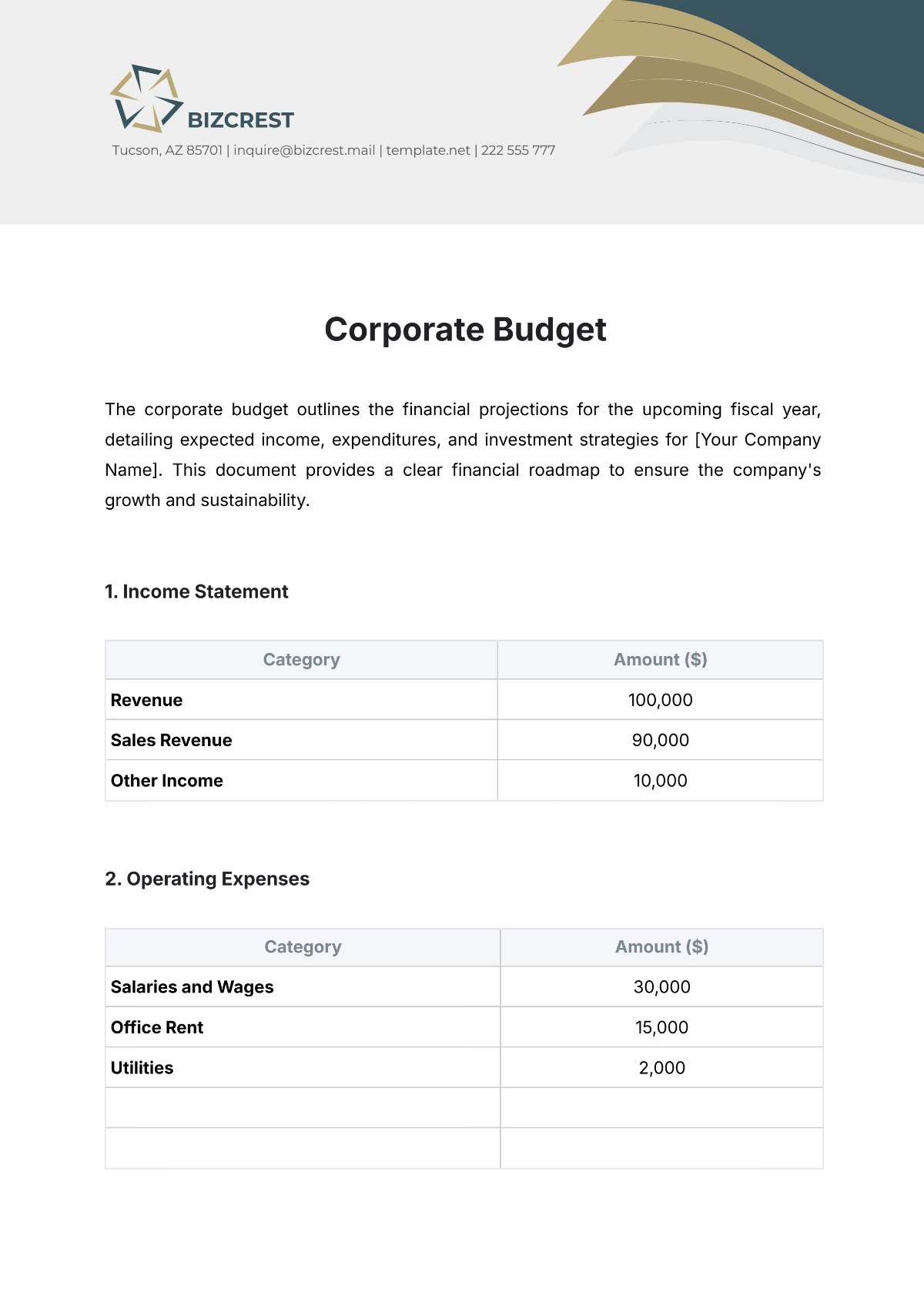

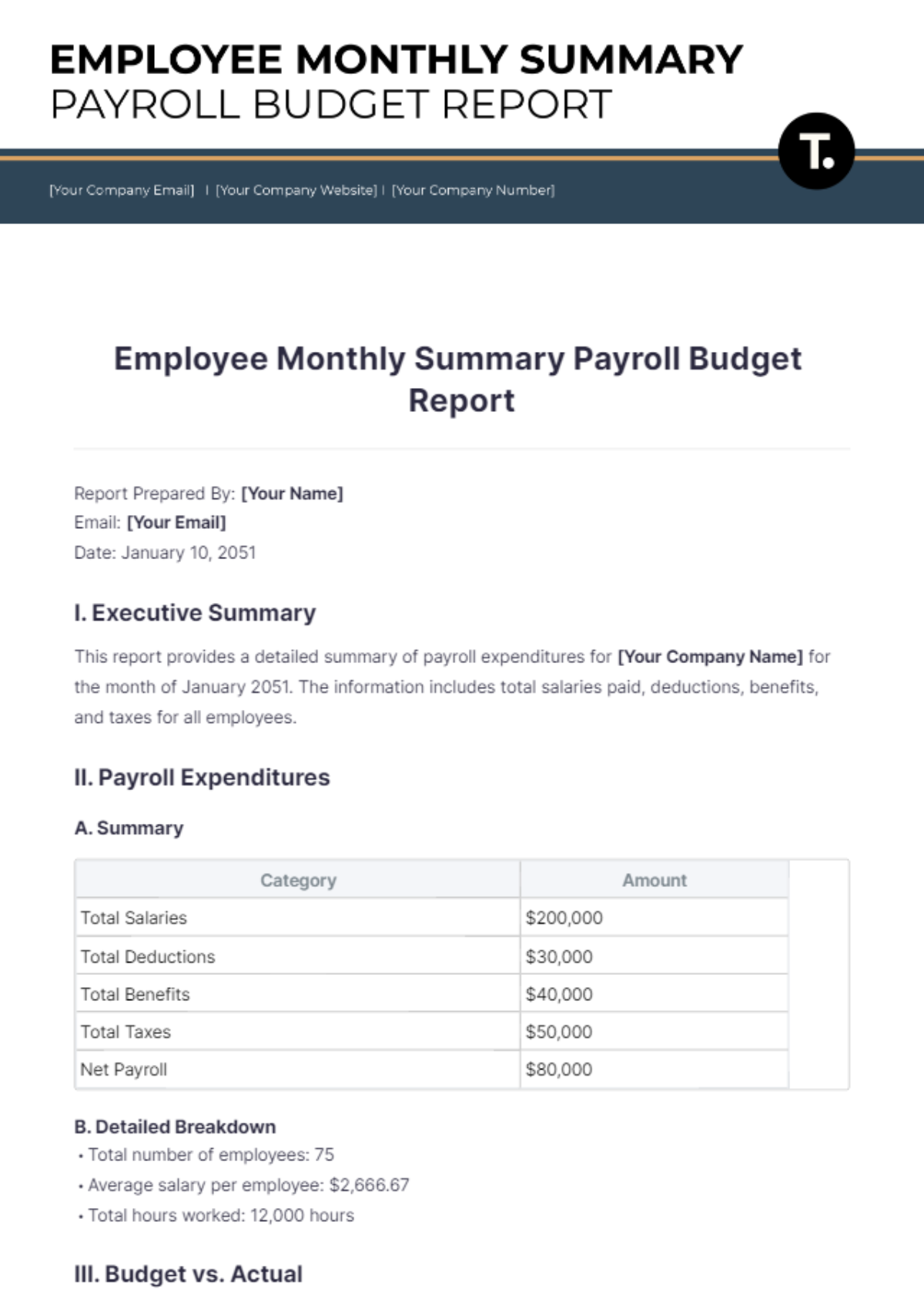

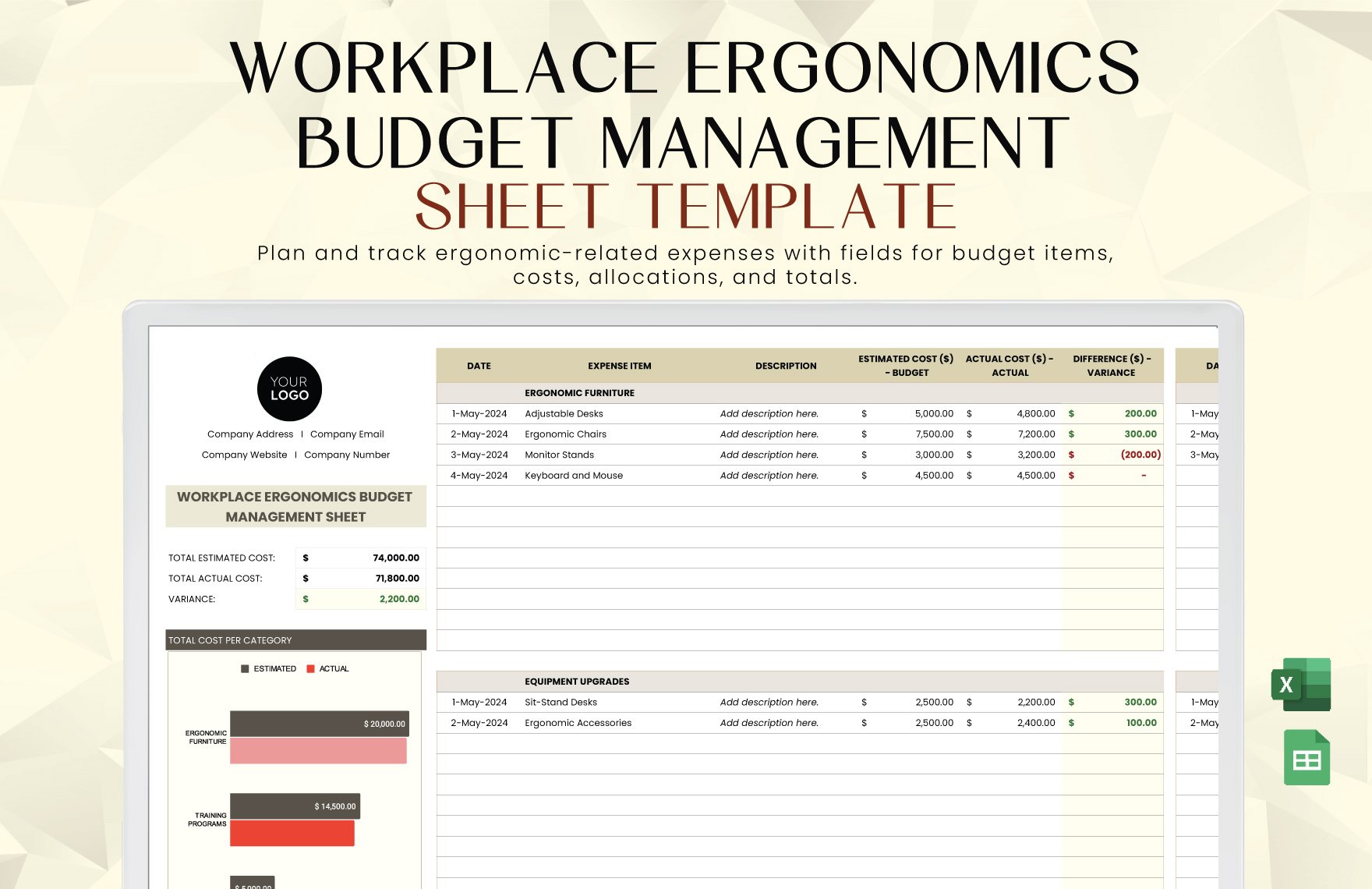

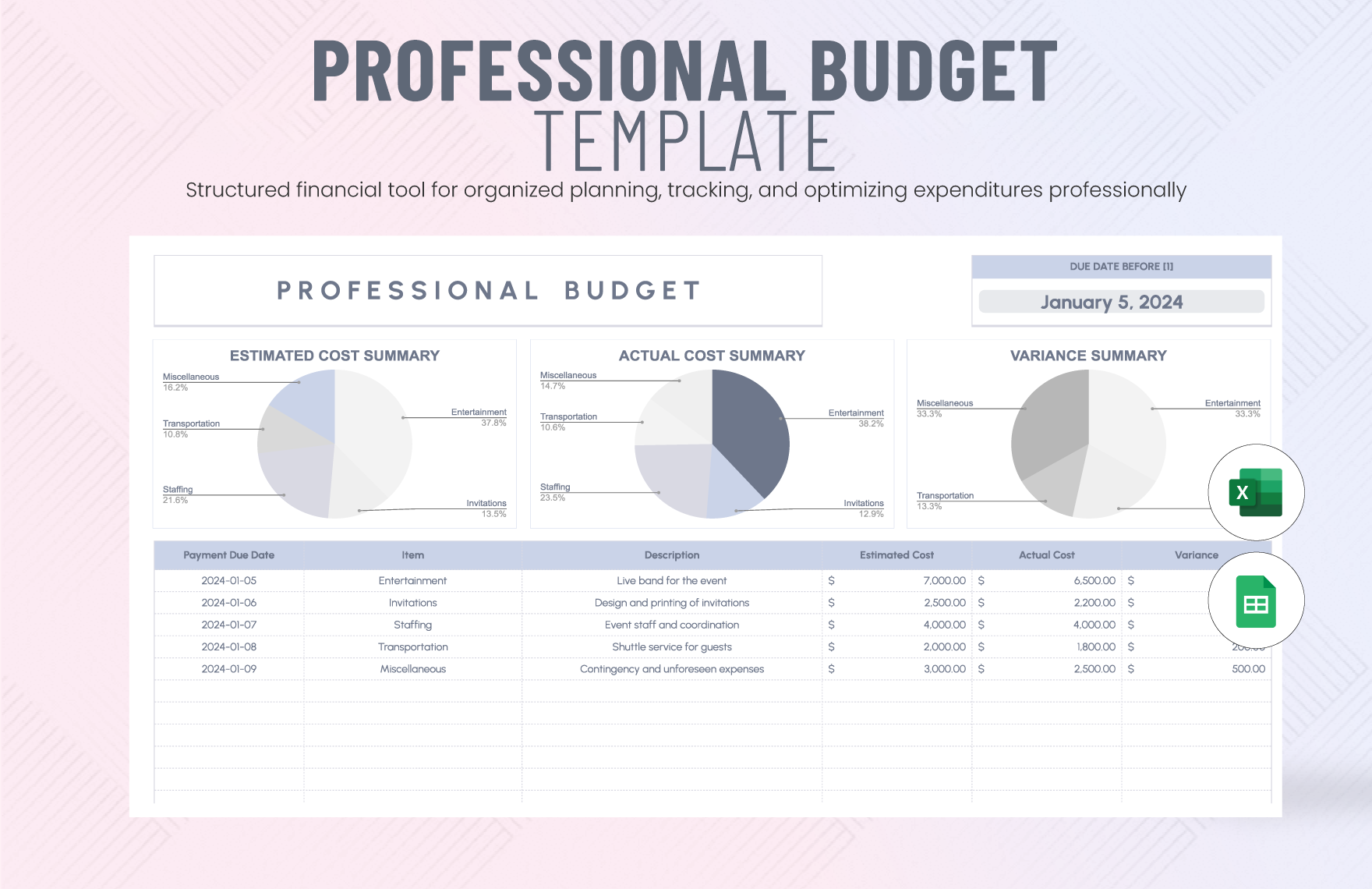

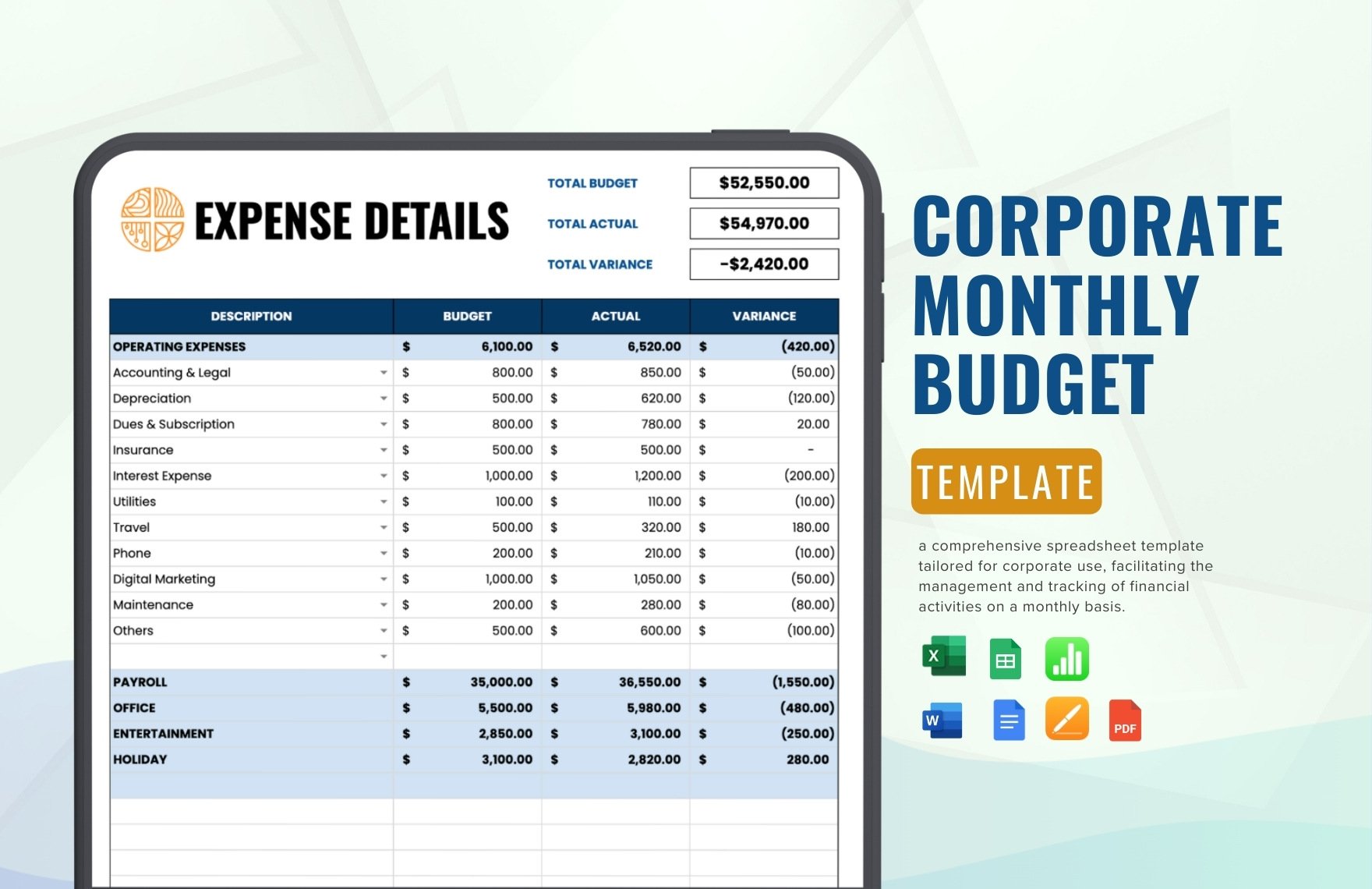

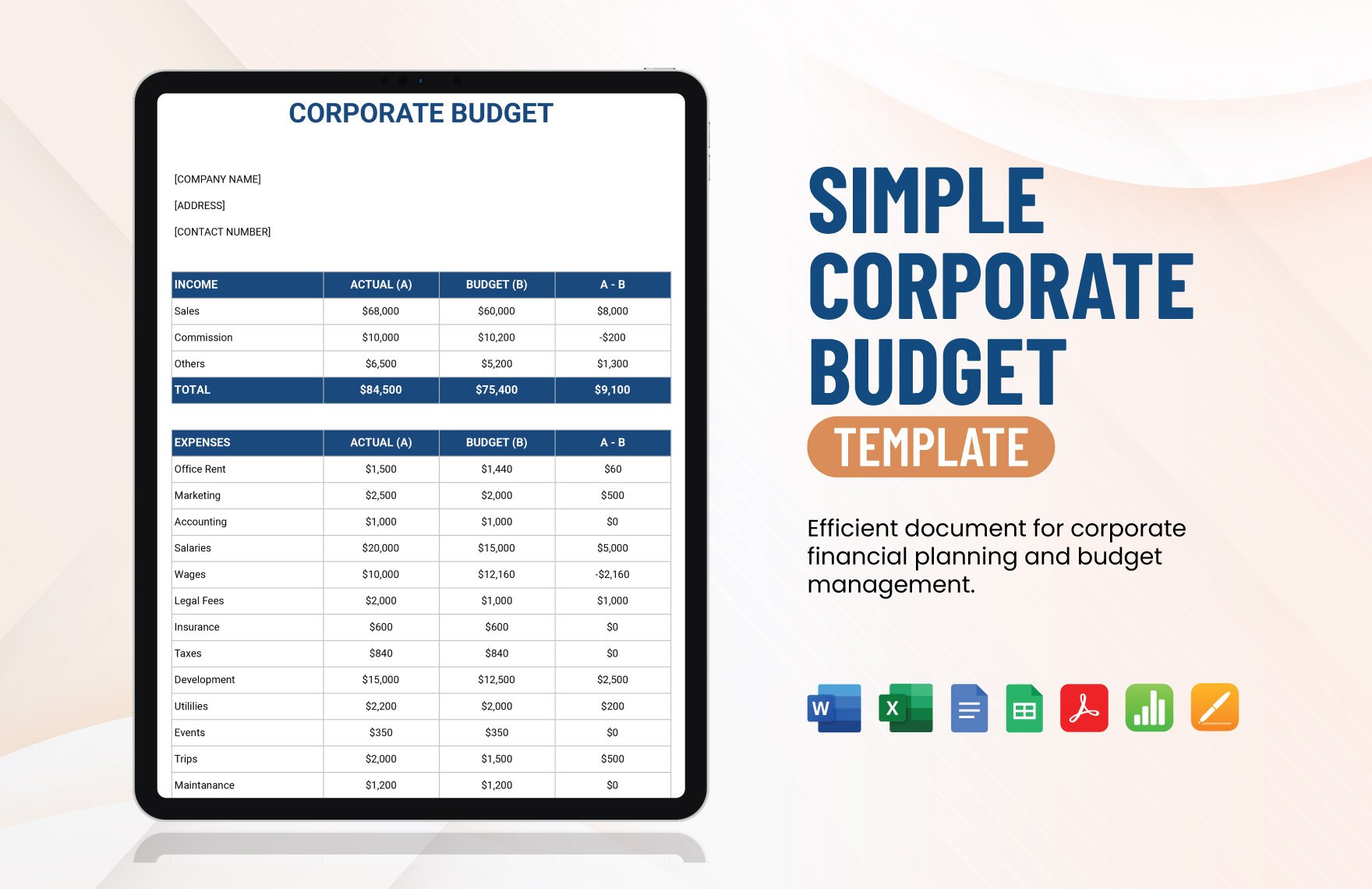

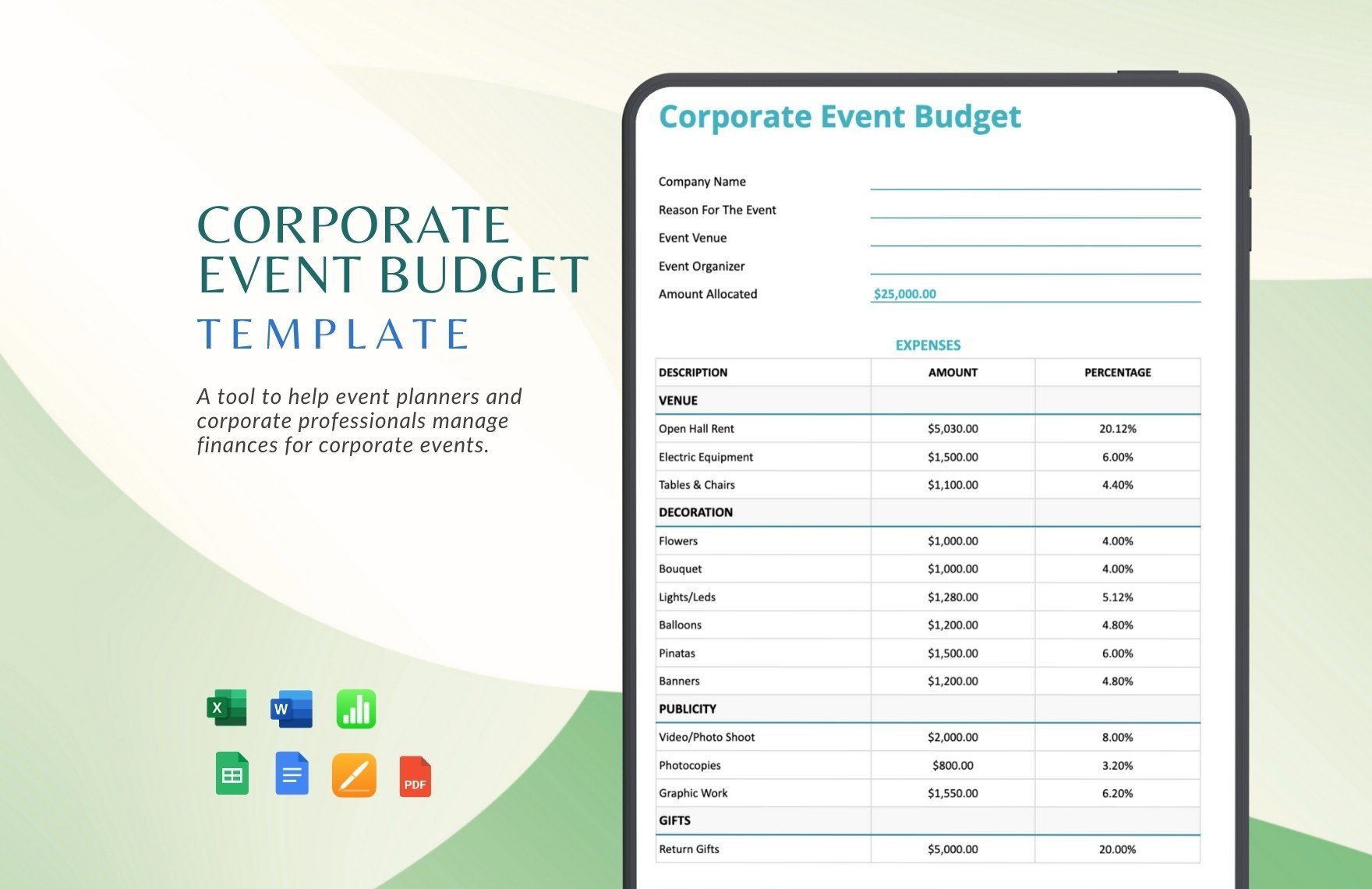

Keep your financial team engaged, streamline your budgeting process, and ensure accuracy with Corporate Budget Templates by Template.net. Designed specifically for finance and accounting professionals, these templates can help you effectively manage company expenses and forecast financial performance. Whether you are looking to plan a department's annual budget or track operational expenses for an upcoming project, these templates have got you covered. Available in easy-to-edit formats, such as Excel and Google Sheets, you can integrate specific data points and financial metrics seamlessly. Rest assured, no technical expertise is required, and enjoy the benefit of professional-grade design to communicate financial goals effortlessly.

Discover the many Corporate Budget Templates we have on hand to suit every business need. Start by selecting a template that aligns with your requirements, then easily swap in your financial data and tweak colors or fonts to match your brand's identity. Utilize drag-and-drop features for icons or graphics that add a polished touch, and employ AI-powered text tools for precise annotations. The possibilities are endless as you bring depth and clarity to your financial projections without any hassle. With regularly updated templates, you'll always have access to fresh designs that match the latest industry standards. When you're finished, download or share your budget summaries effortlessly, whether it's for internal review or stakeholder presentations.