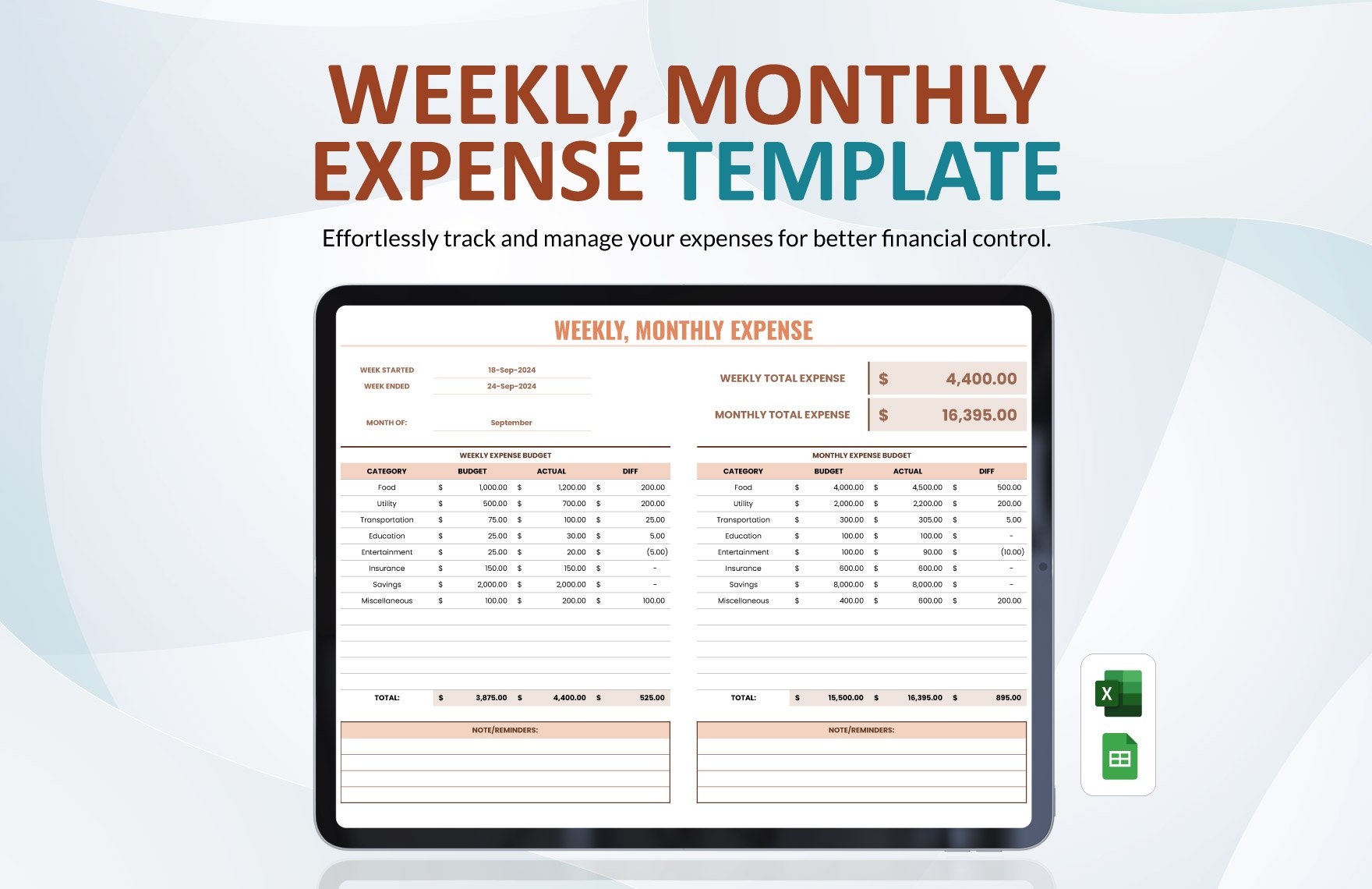

An expense or expenditure budget aids companies in keeping track of purchases and keeping running expenses to a minimum. Managers should align expenses with tax plans and cash flows with proper preparation and analysis. Managers run the risk of excessive spending and reducing or eliminating profit margins if they don't have spending budgets.

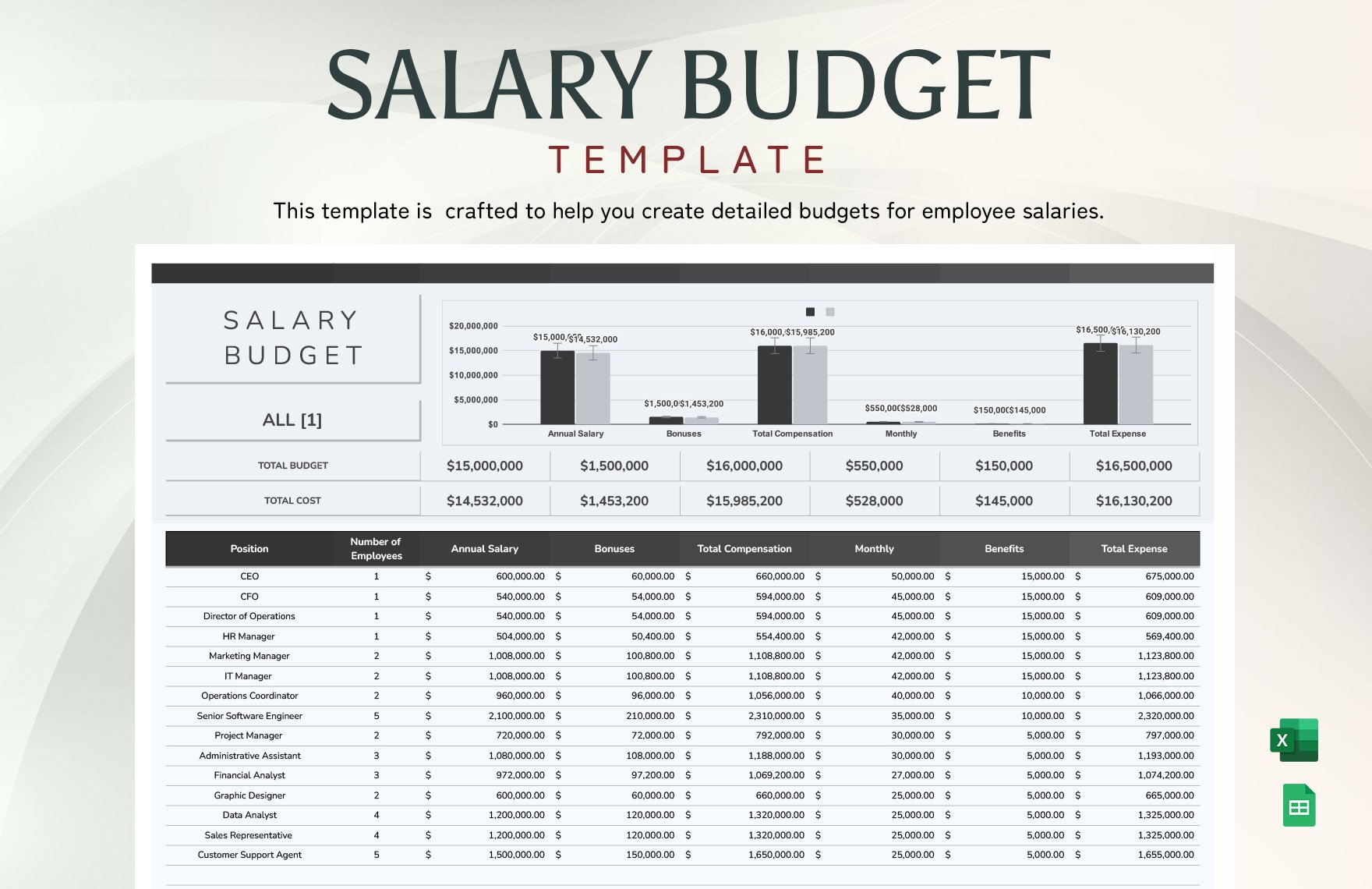

Capital assets or cash outlays for production machines and other revenue-generating equipment, are critical investments for organizations. Since manufacturing equipment is more costly than office supplies or monthly expenditures, financing is often needed to acquire capital assets. Generally, expenditure budgets include capital asset acquisitions and measure their effect on working capital and potential cash flows. Businesses will not be able to achieve their operational goals without well-planned capital expenditures. Direct labor is one of the most expensive operating costs in a manufacturing plant. Wages and benefits are charged to employees, which have an effect on the overall cost of doing business. Leaders must budget money to meet wage standards while also avoiding excessive overtime costs and lowering profit margins. Labor spending decisions are influenced by seasonal variations in demand and economic conditions. Raw materials are a significant cost that is factored into expenditure budgets. Supplier partnerships are reviewed on a regular basis to aid in budgeting, and changes in the global supply chain necessitate recalculating possible cash outflows. Taxes are a significant recurring cost that must be factored into an expenditure budget. Failure to pay the government will result in fines and other consequences, so proper tax budgeting is essential.

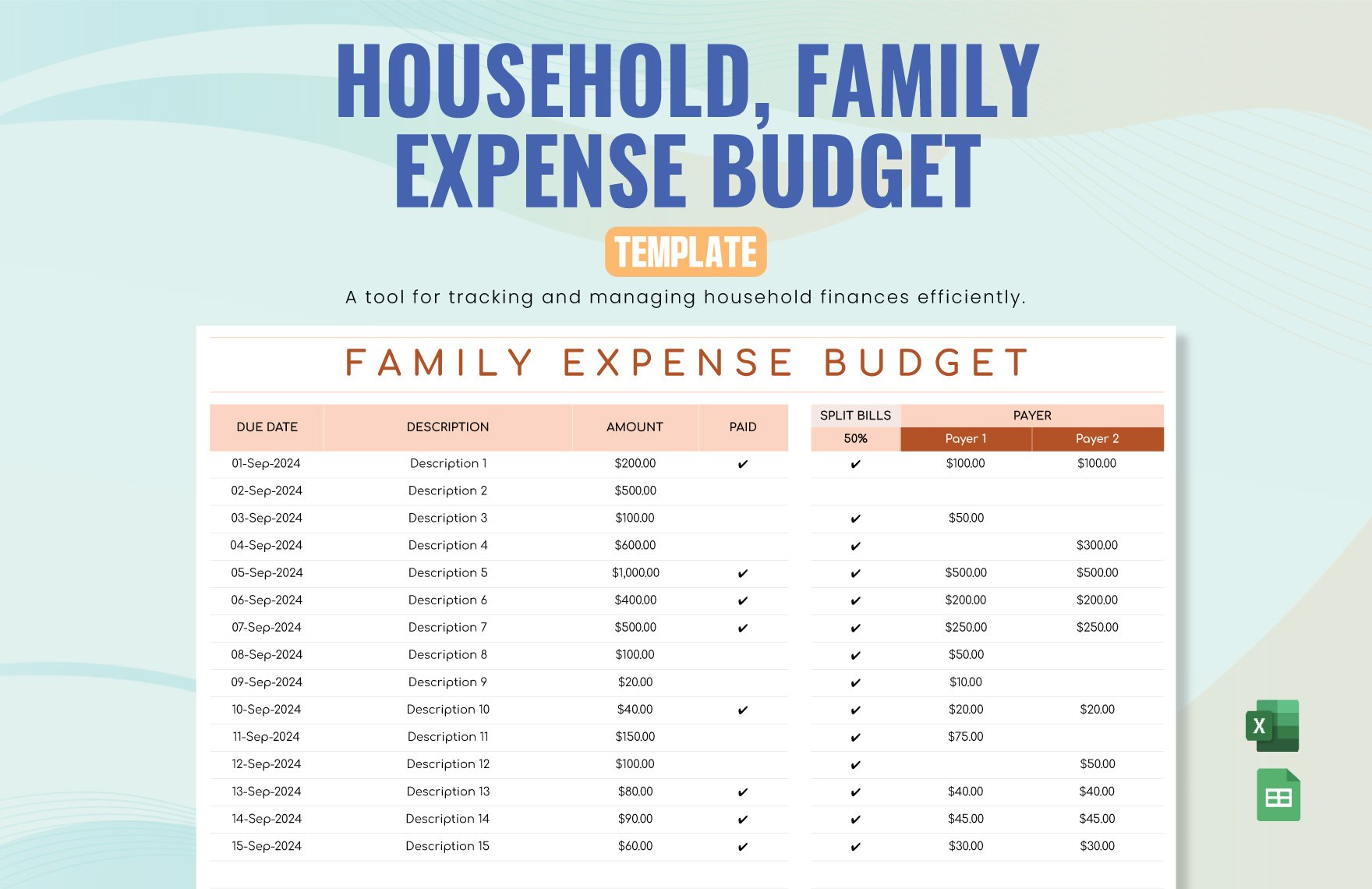

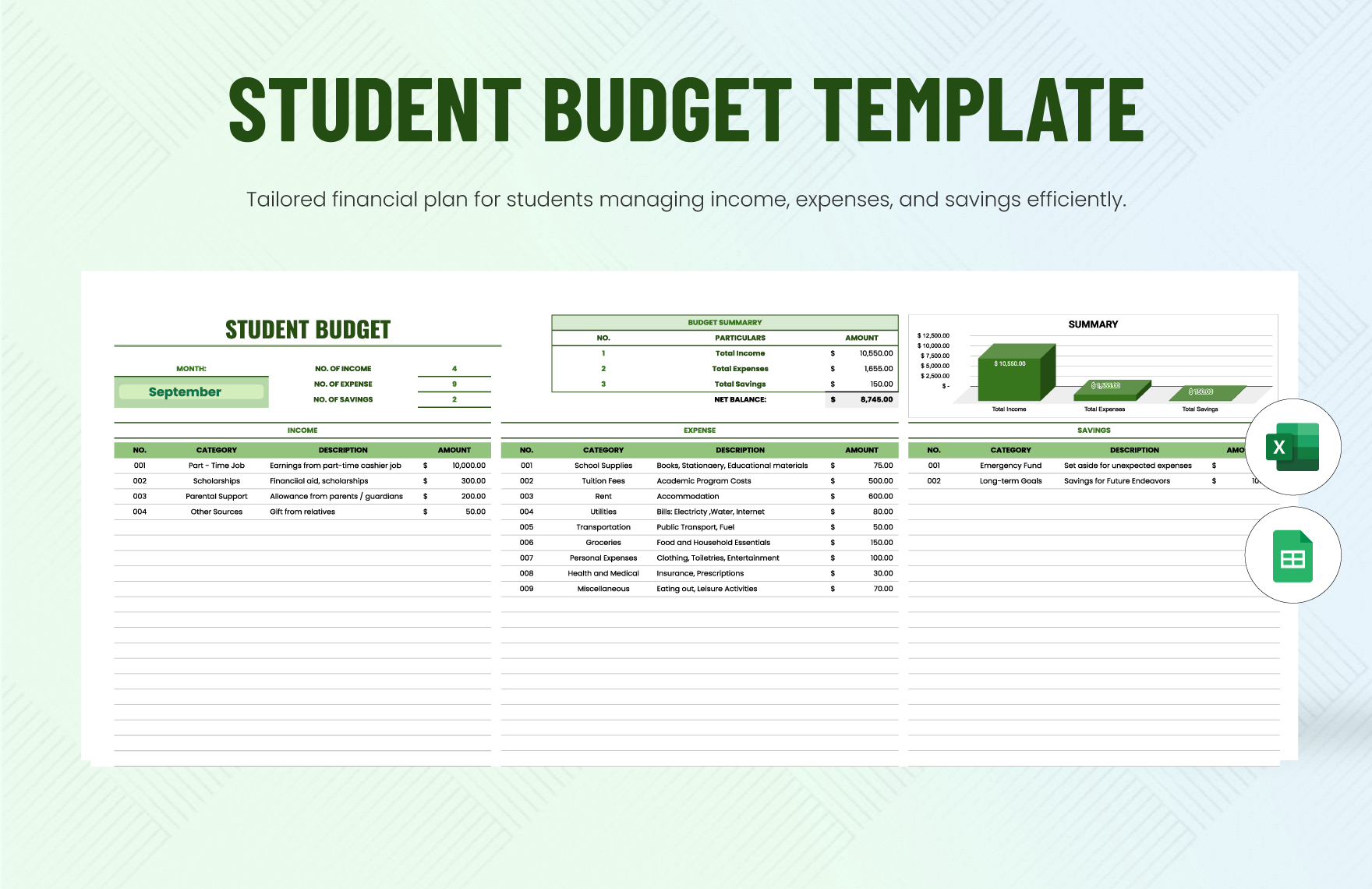

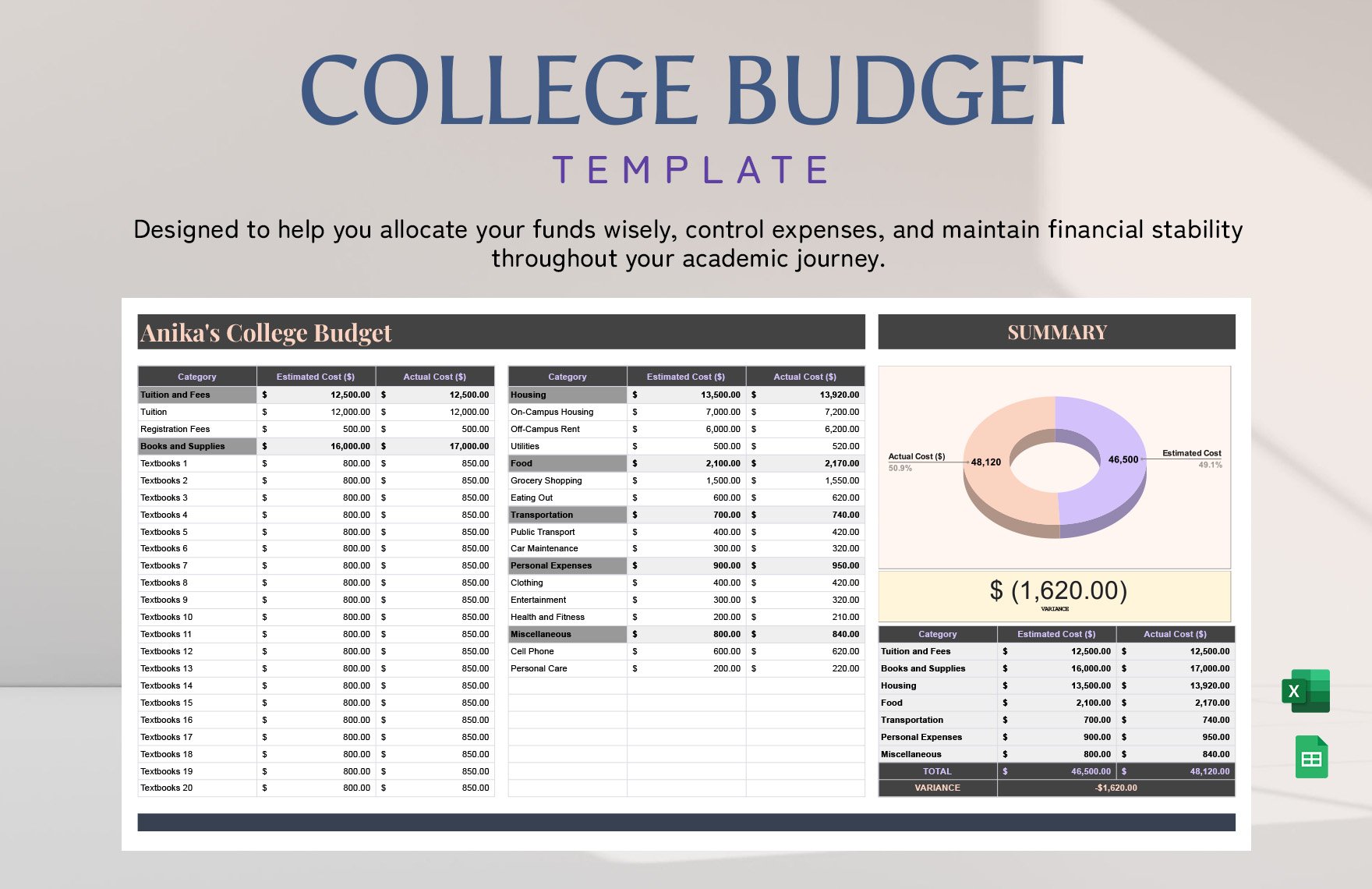

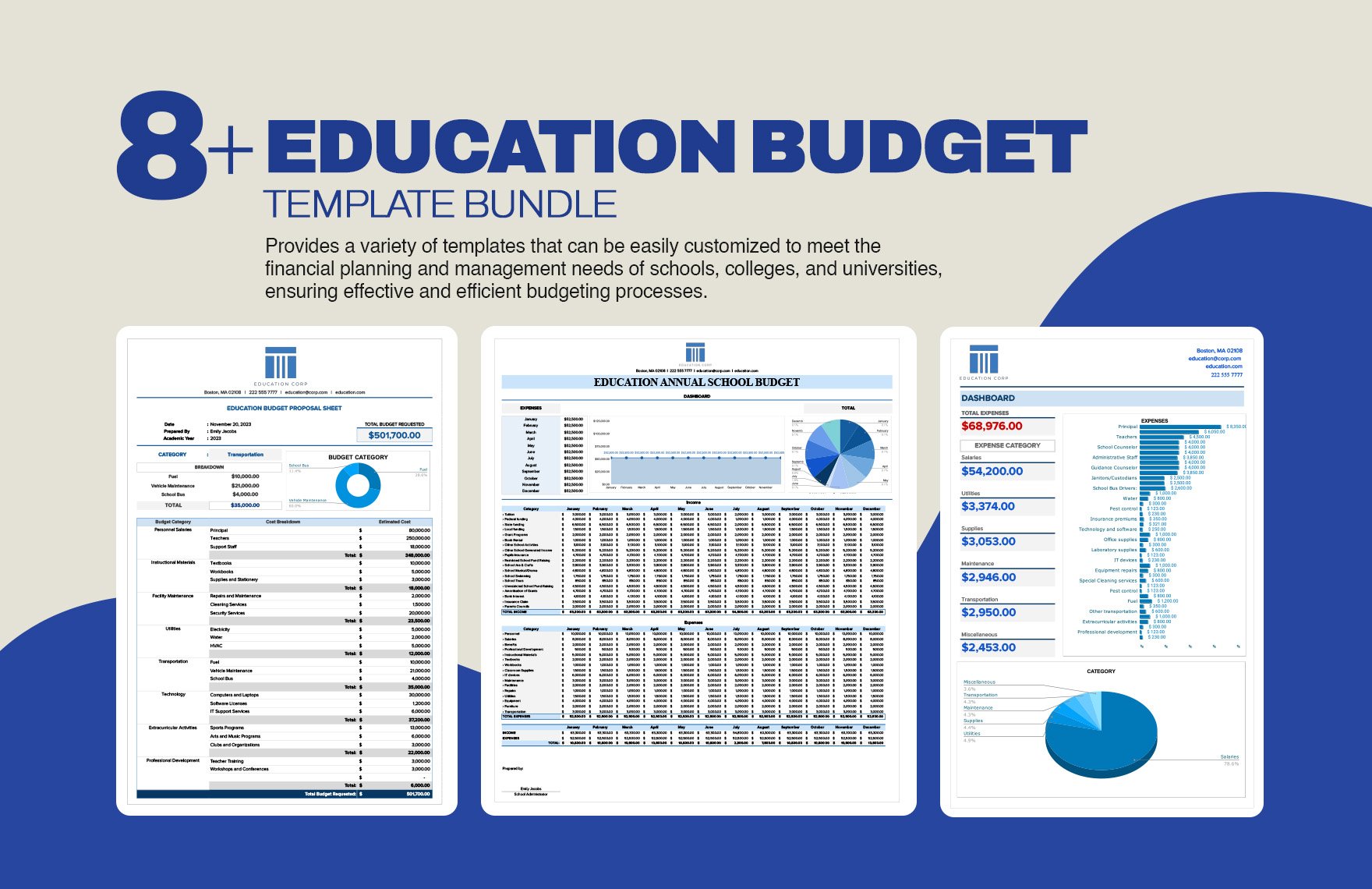

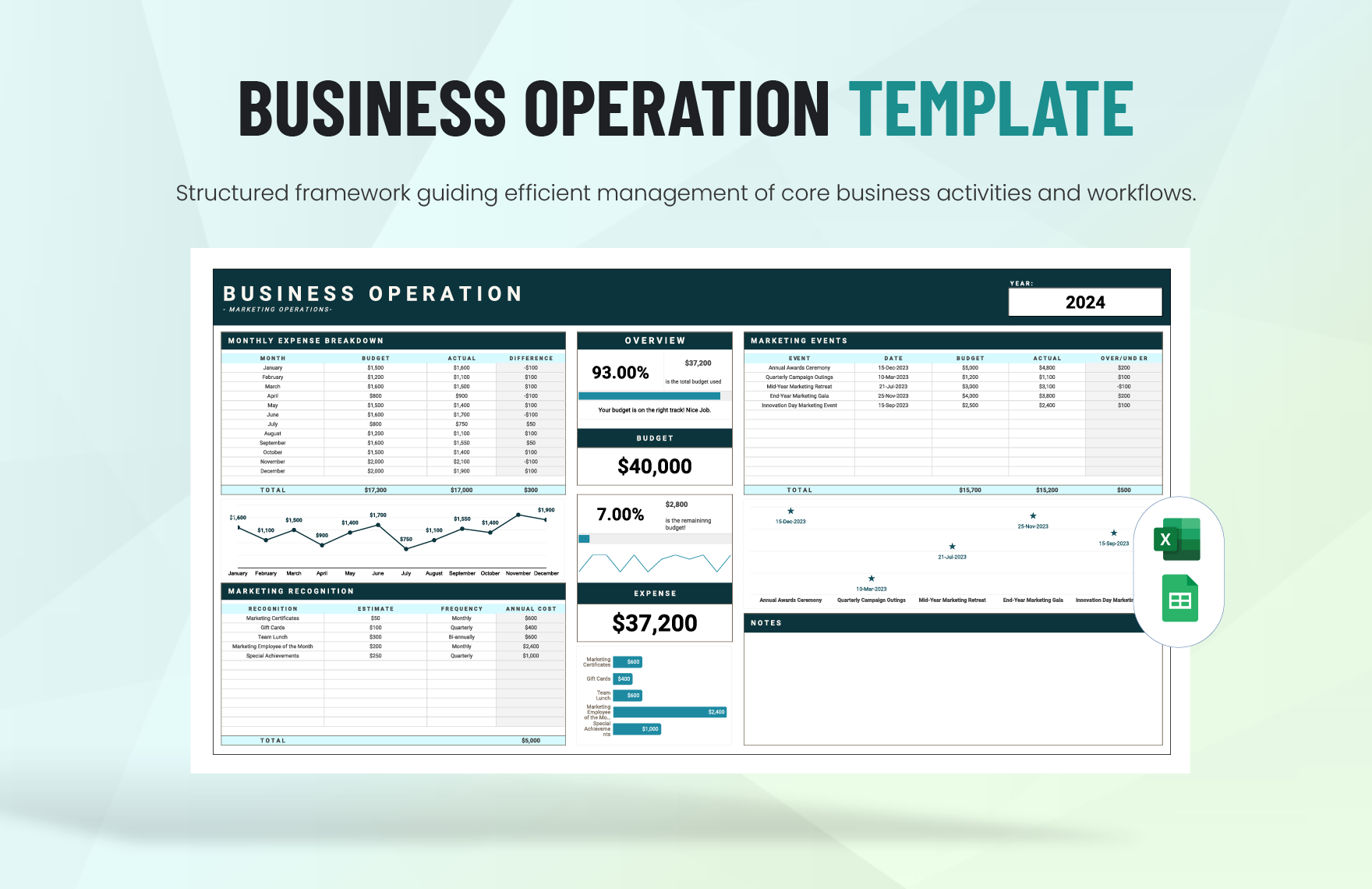

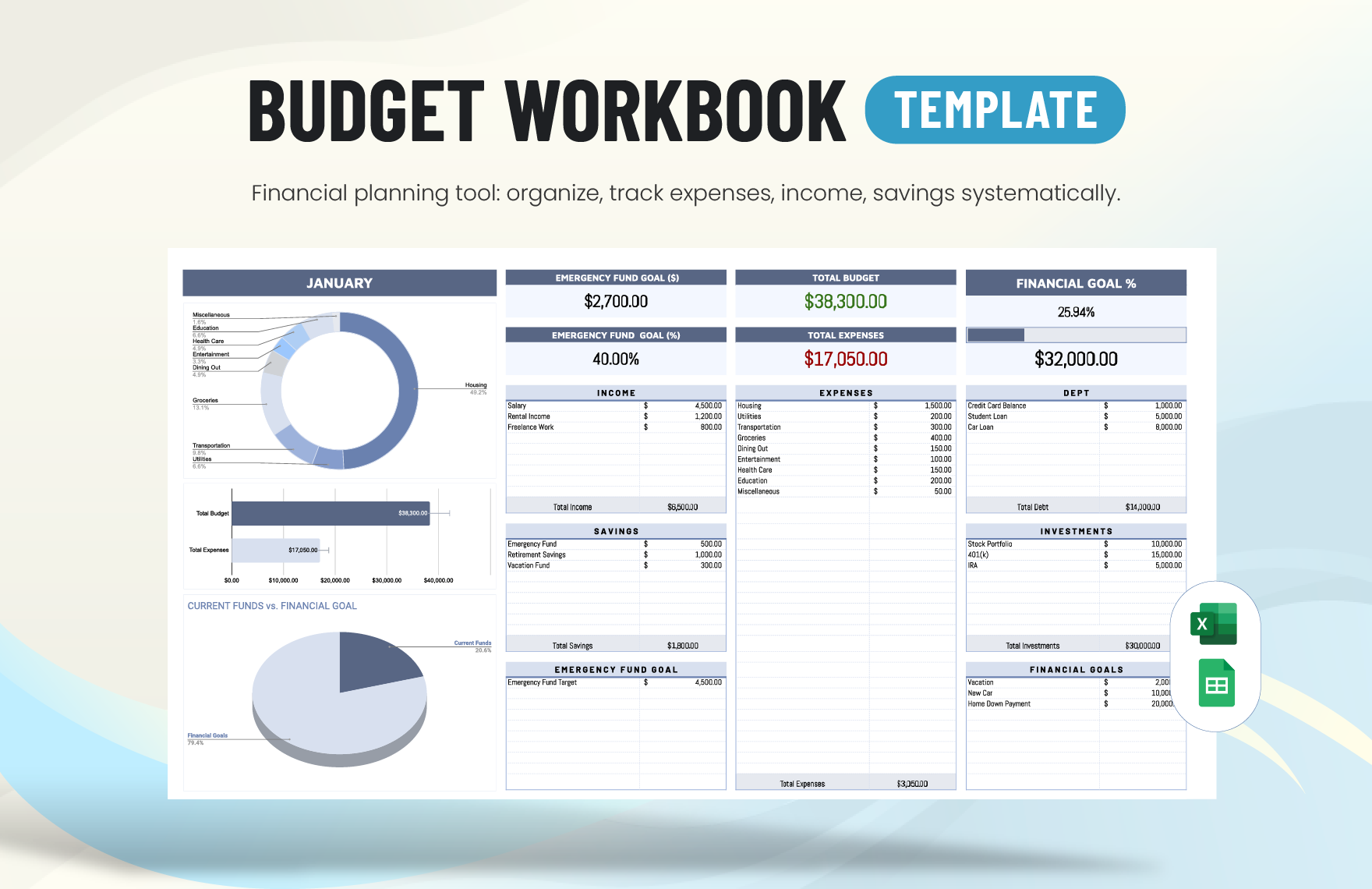

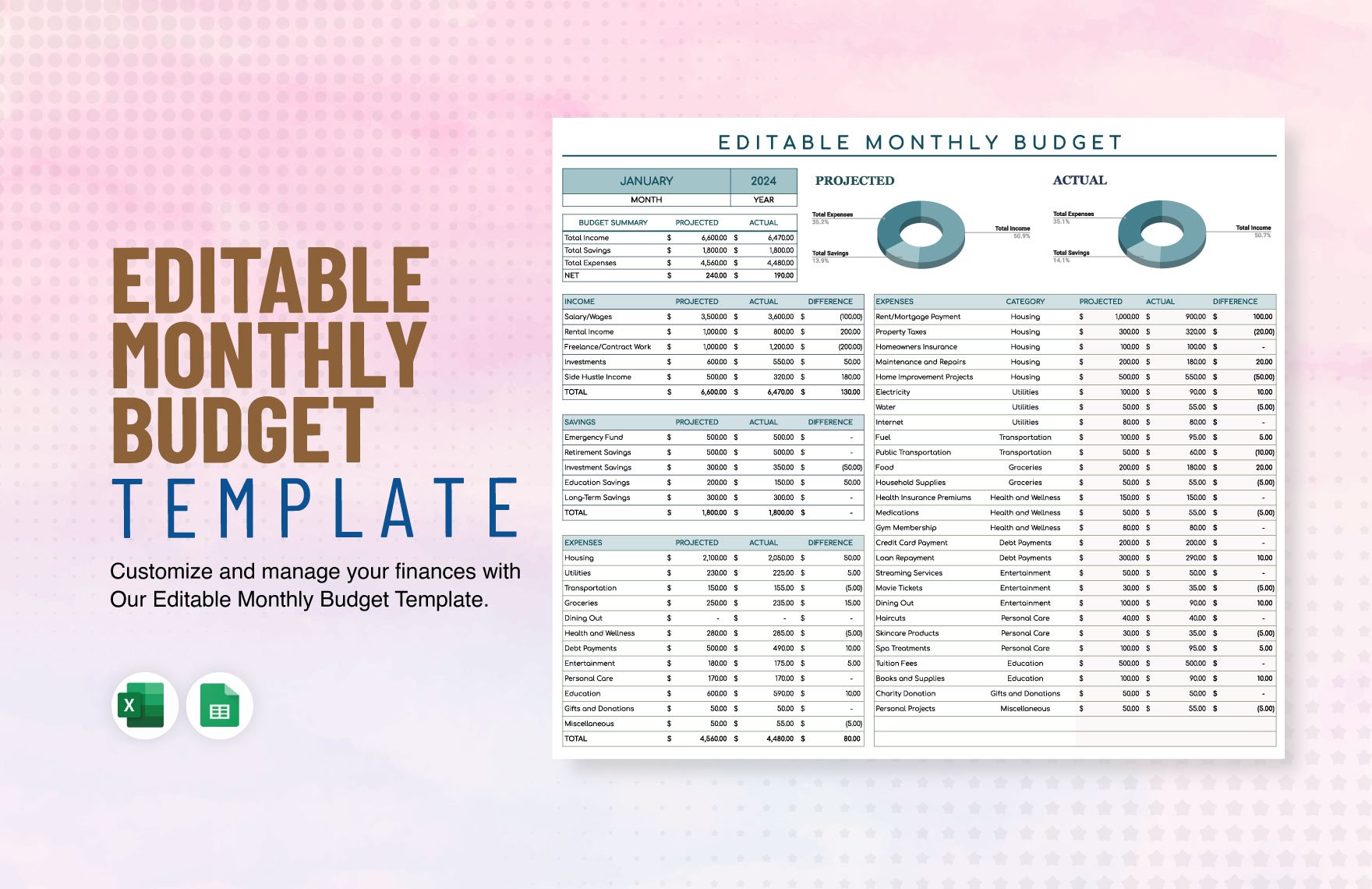

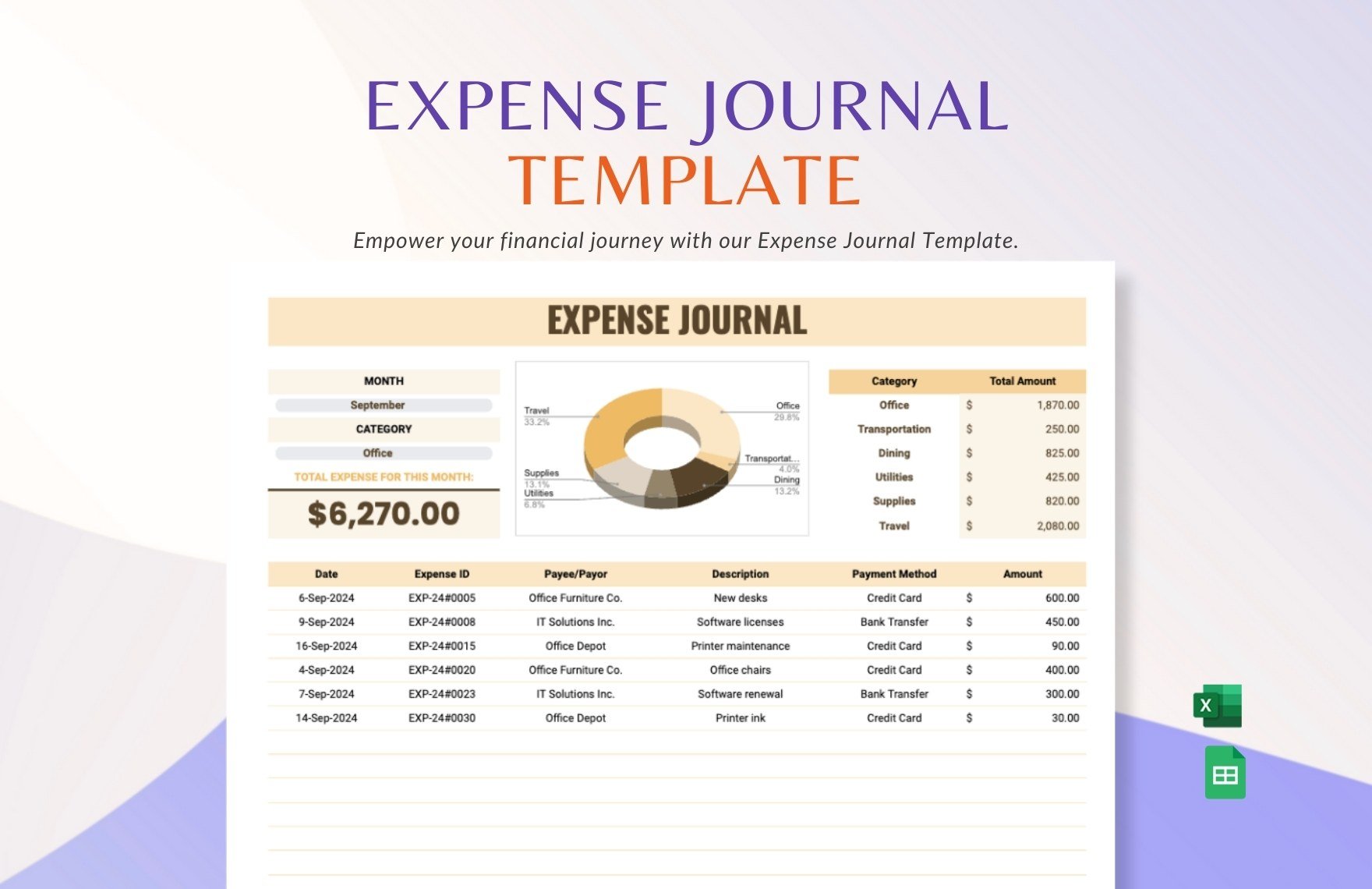

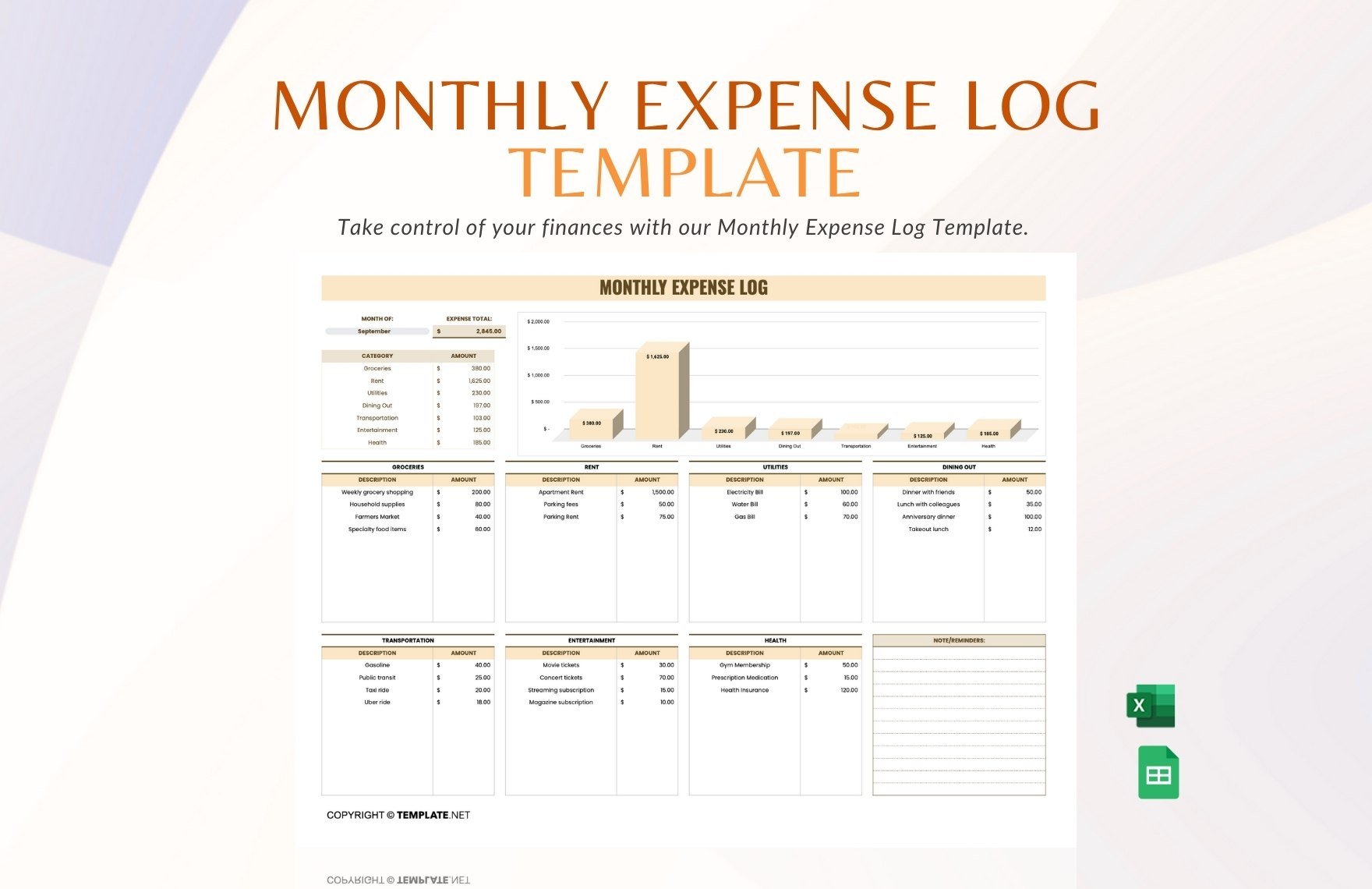

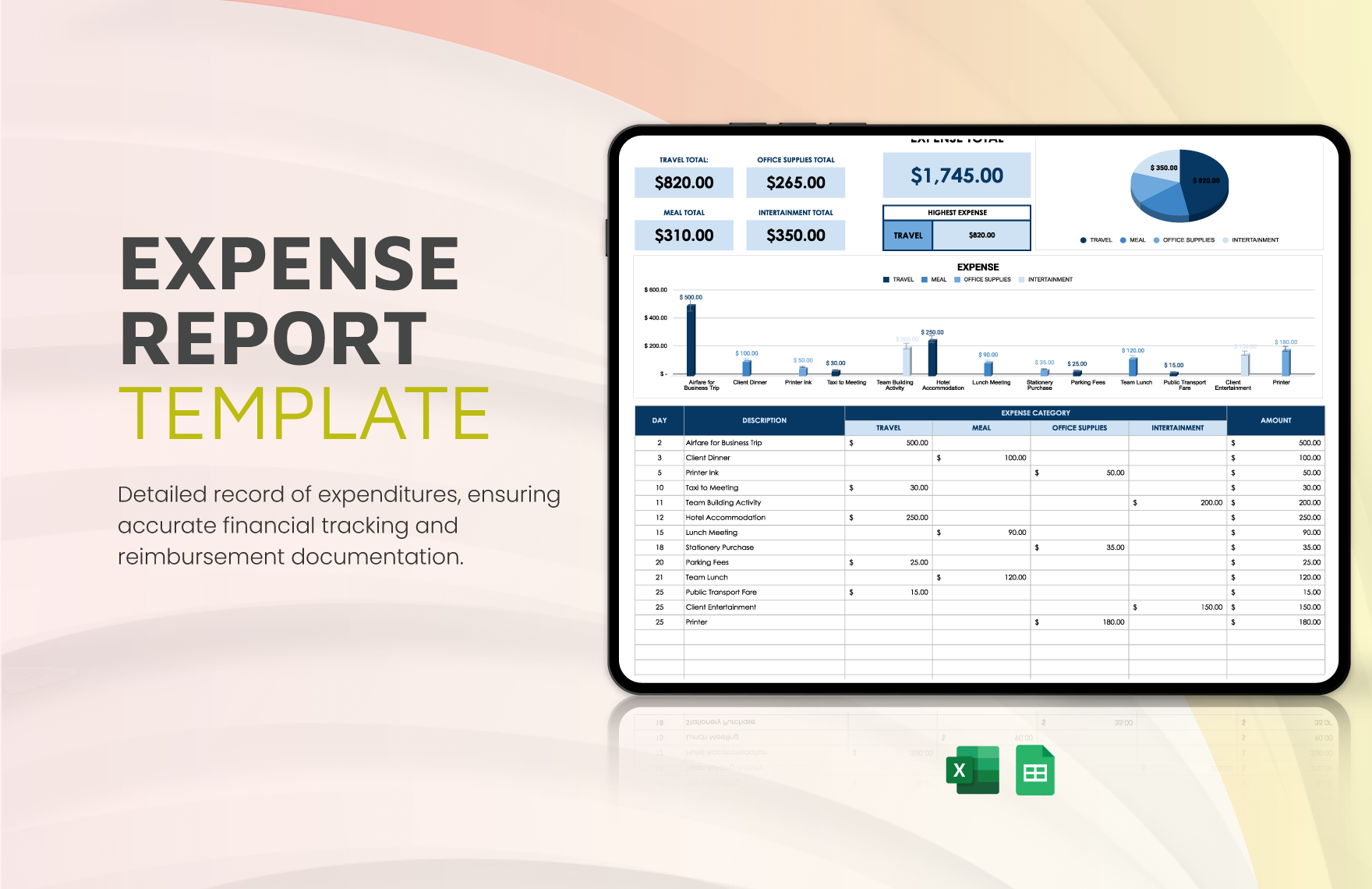

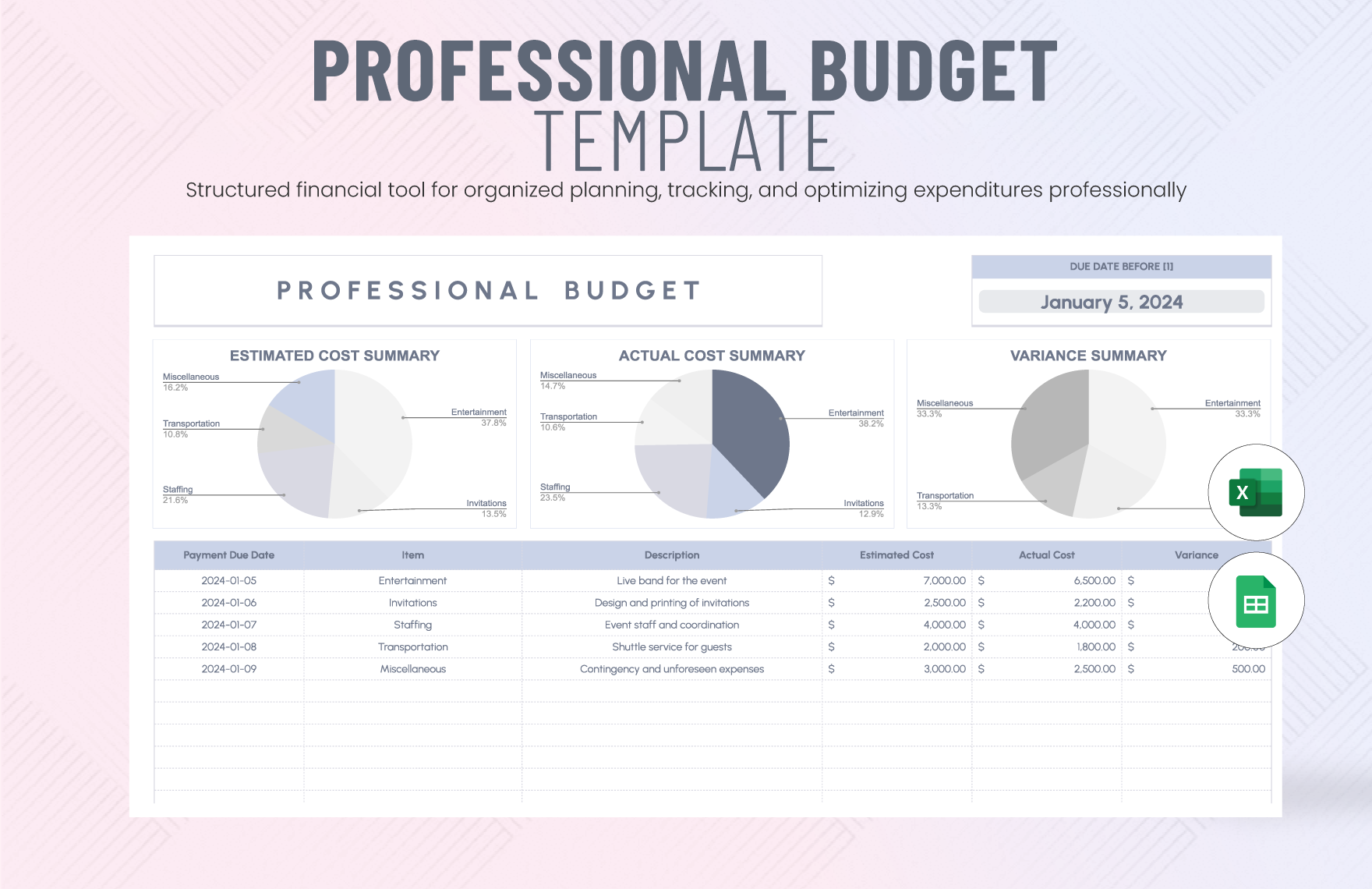

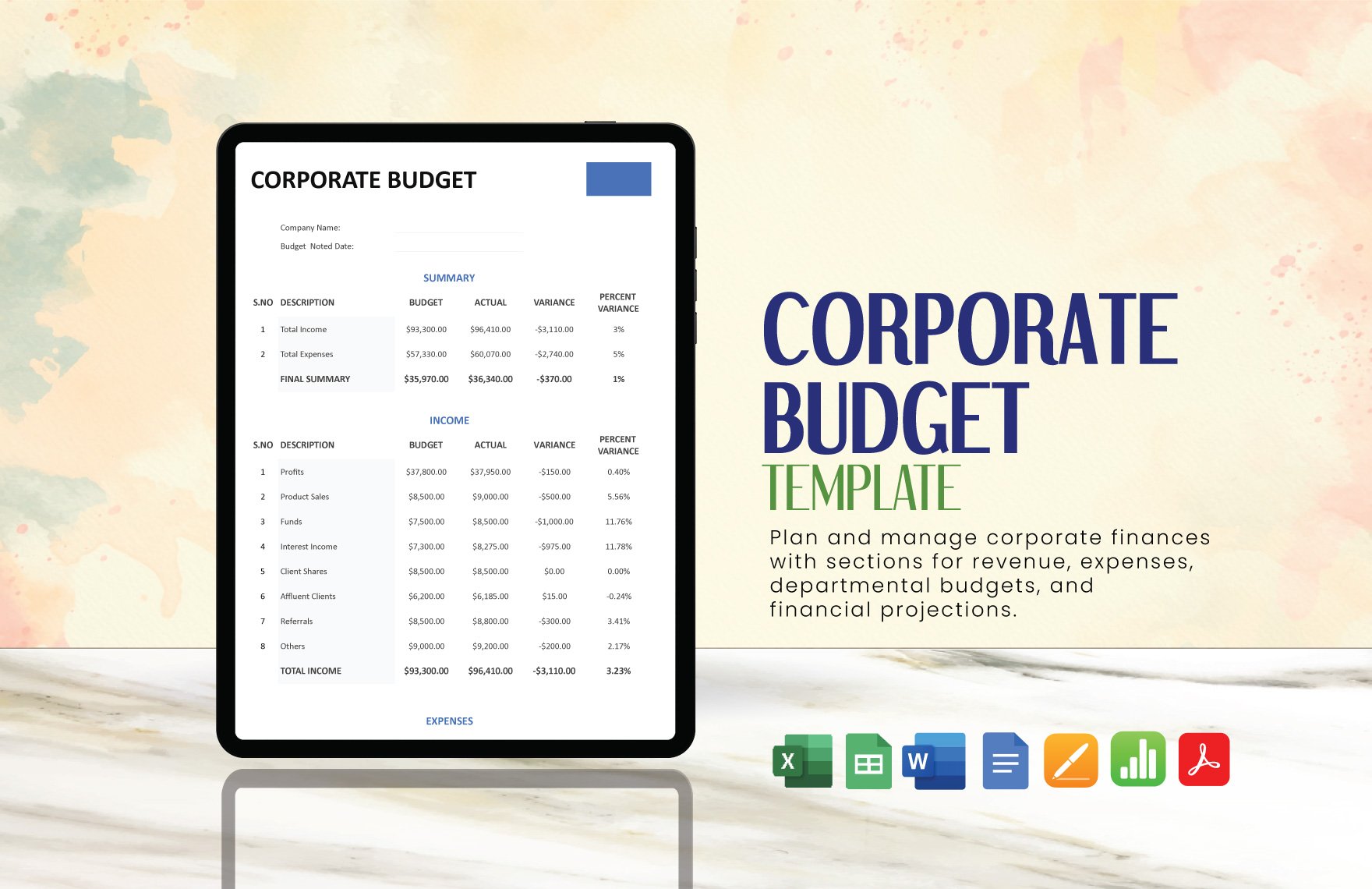

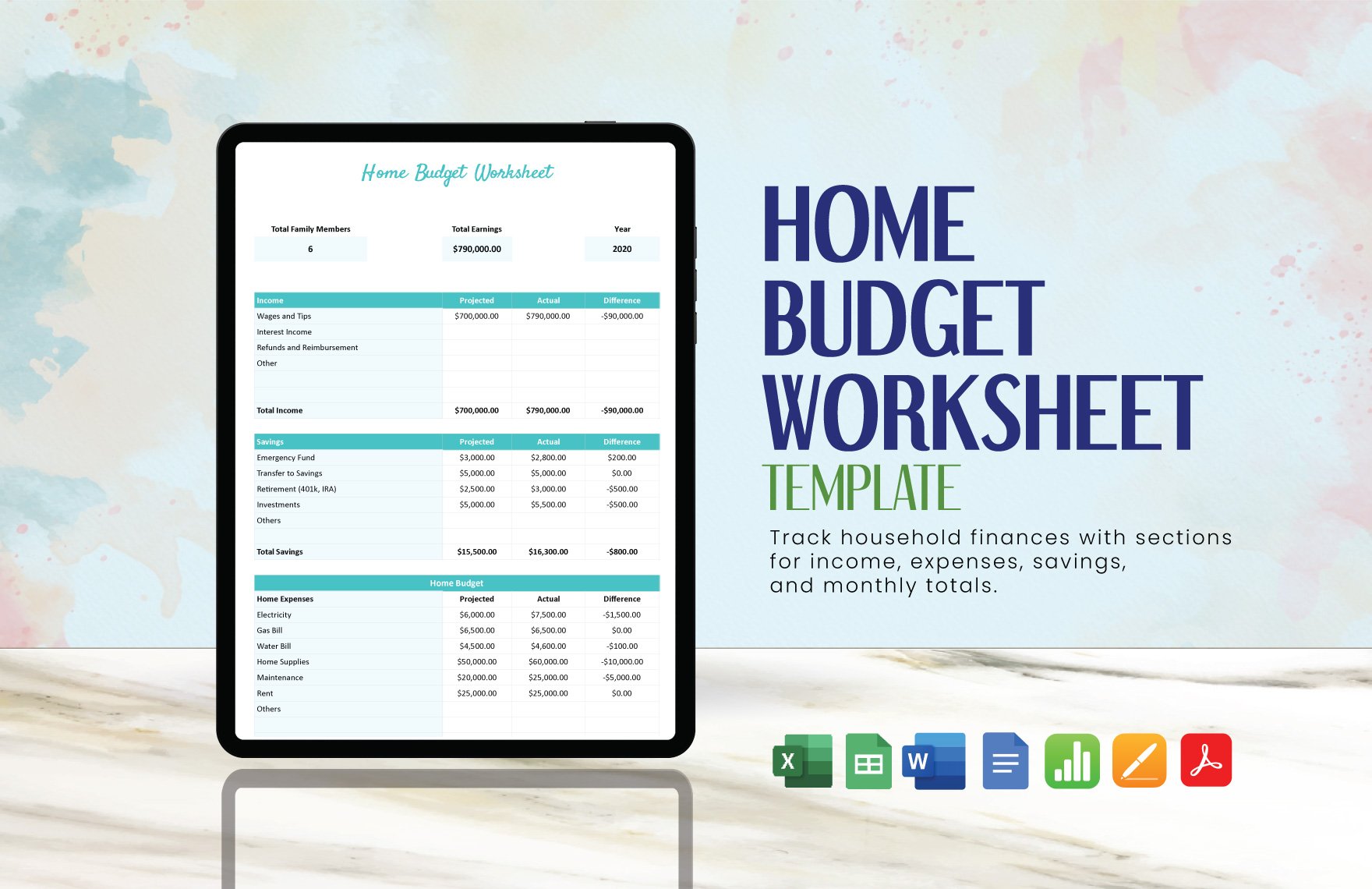

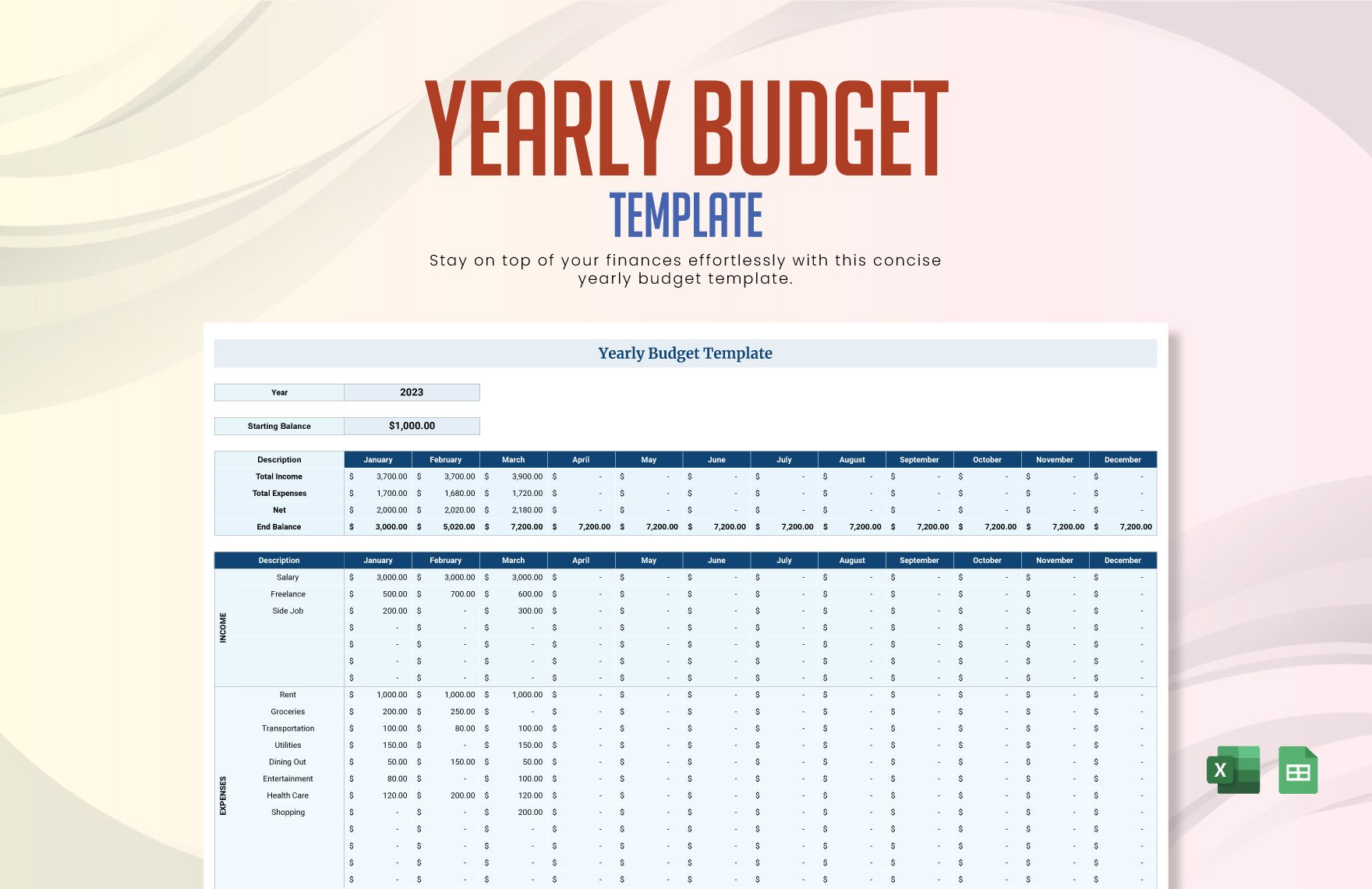

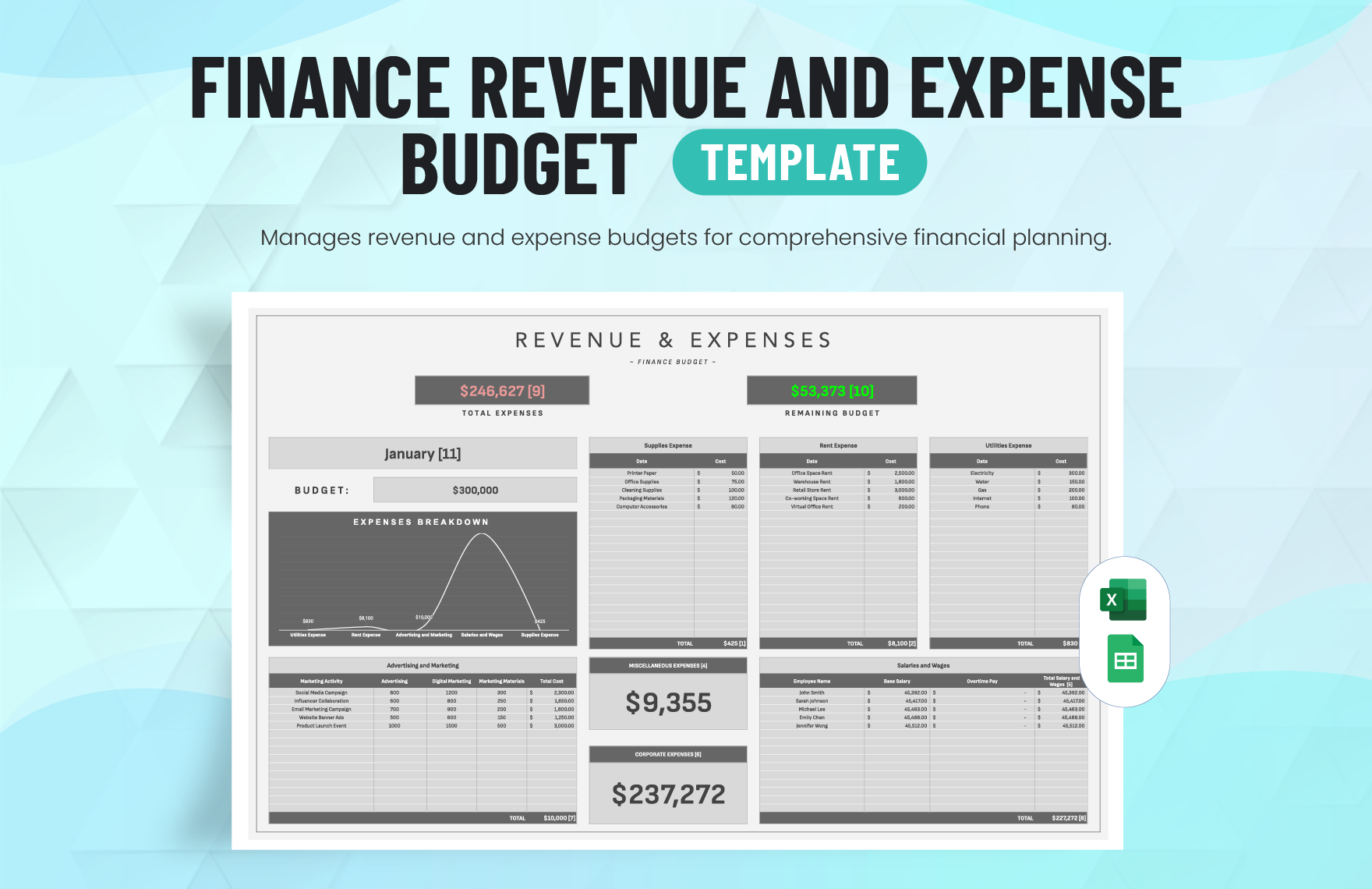

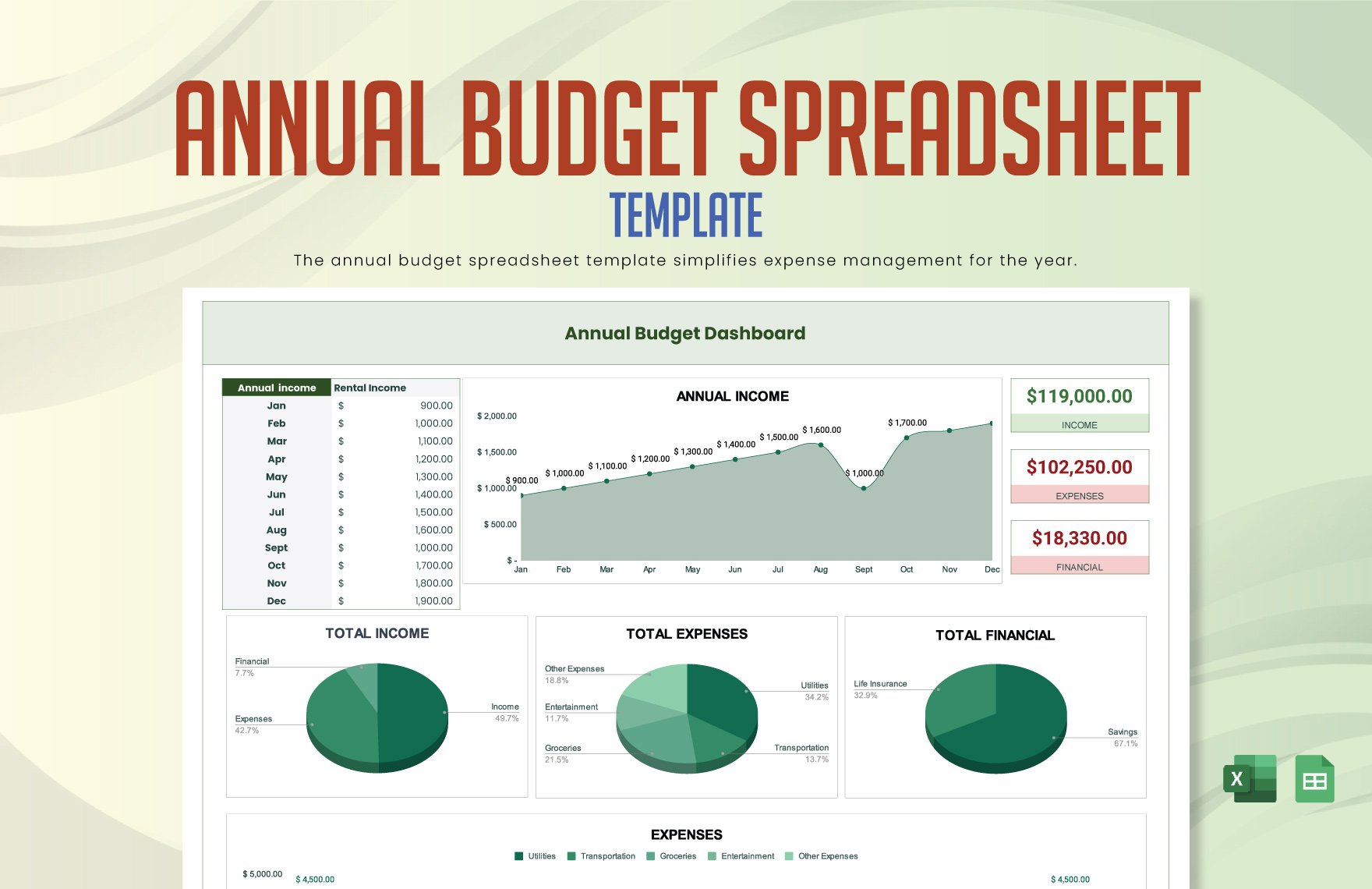

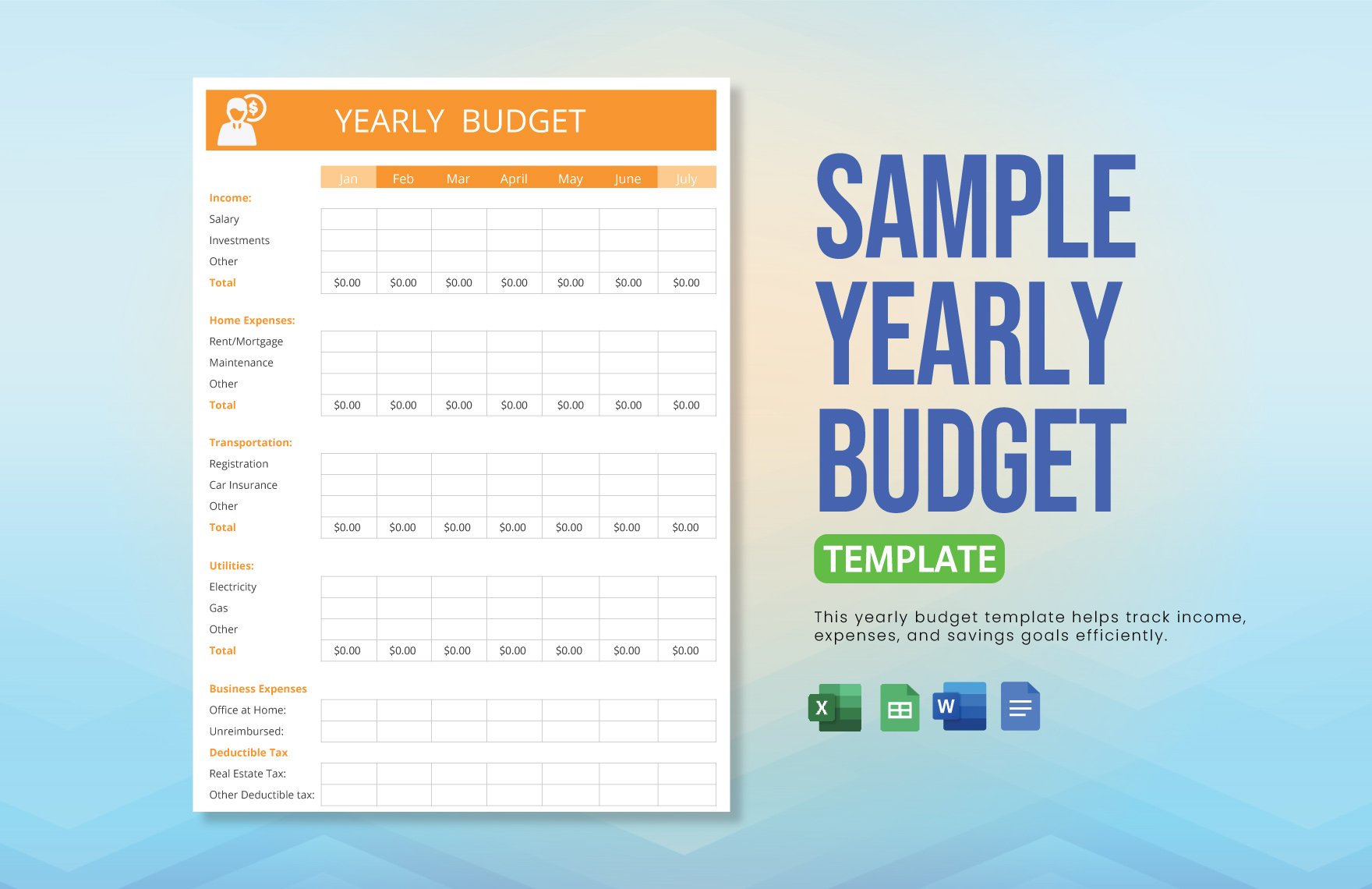

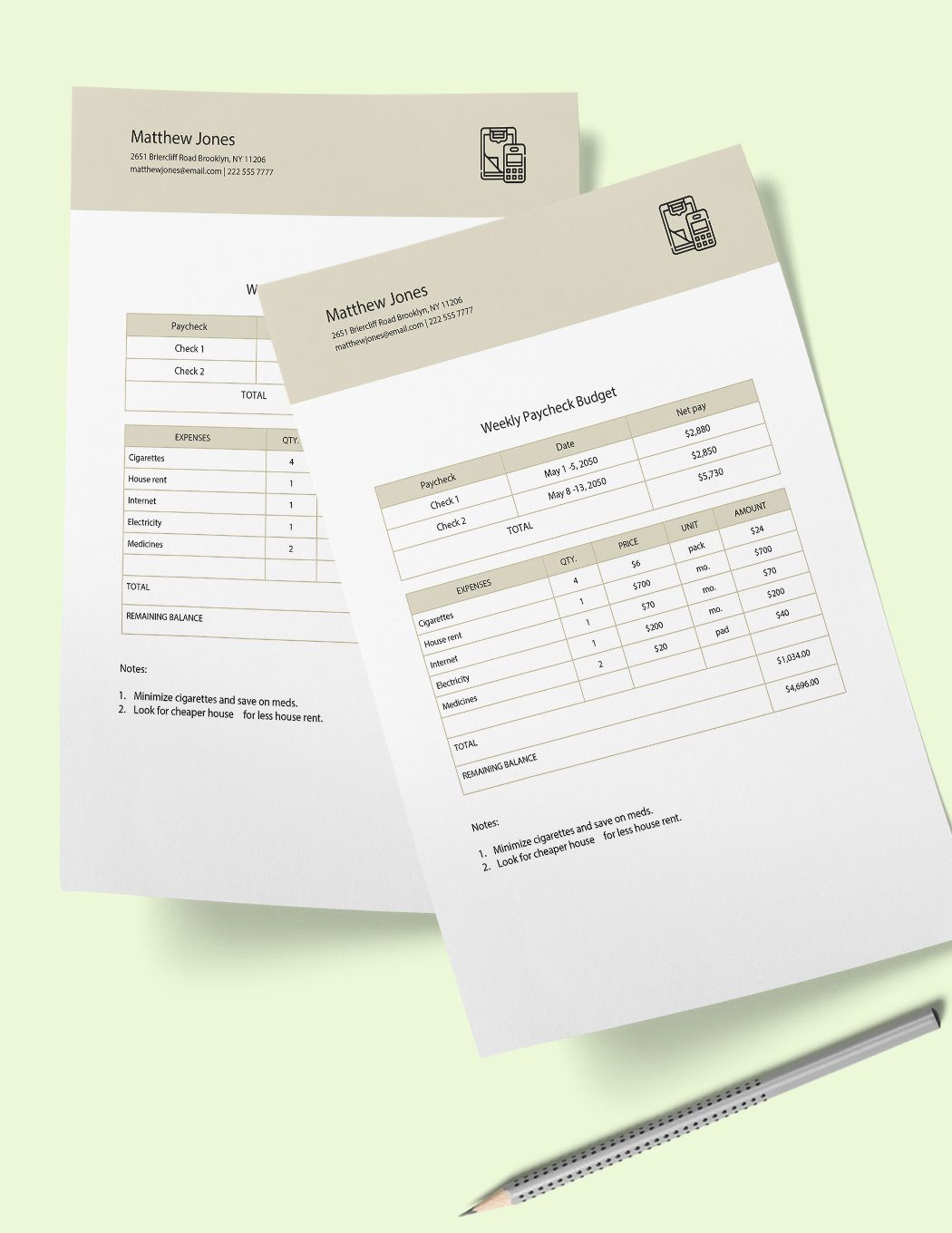

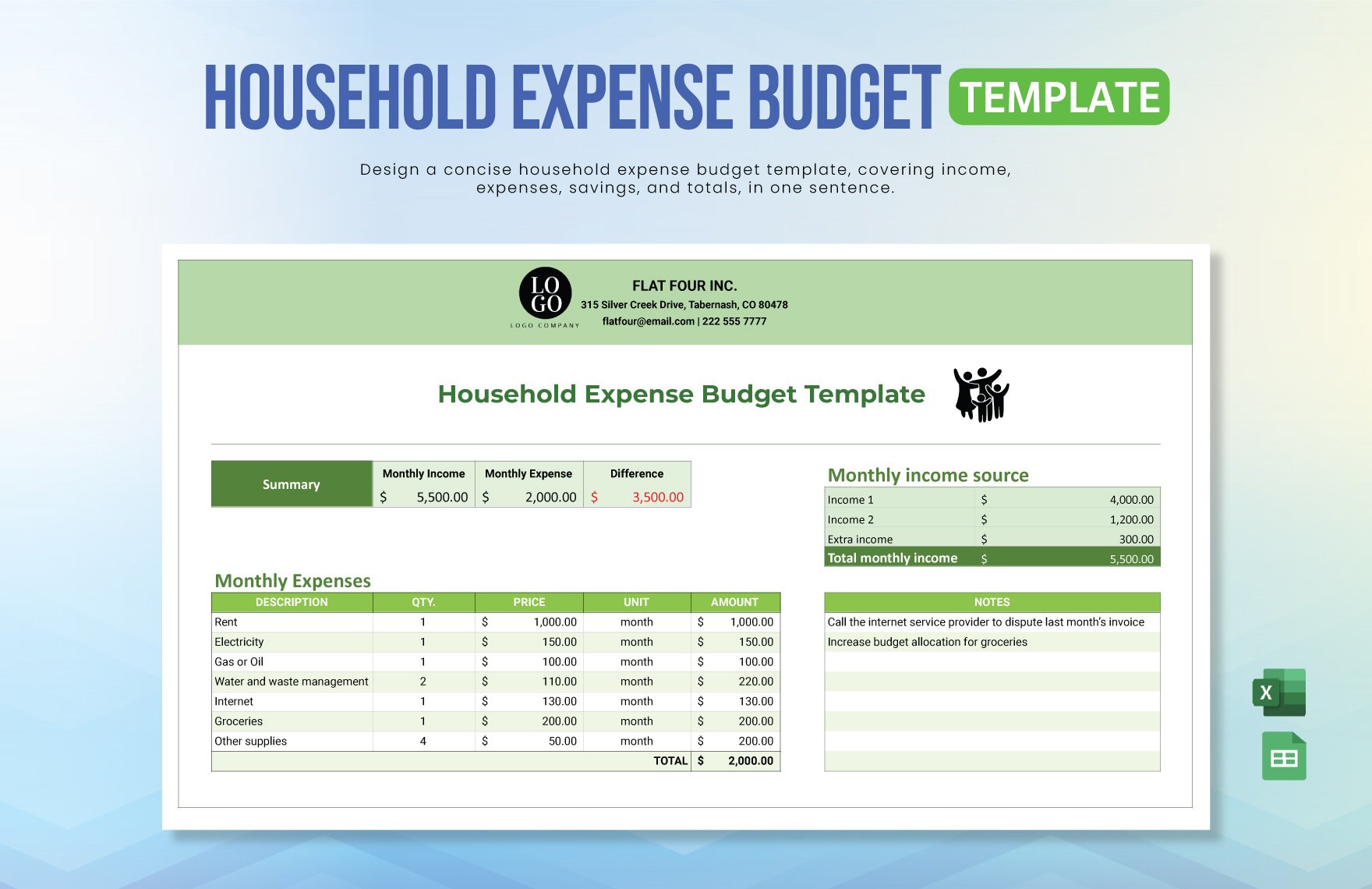

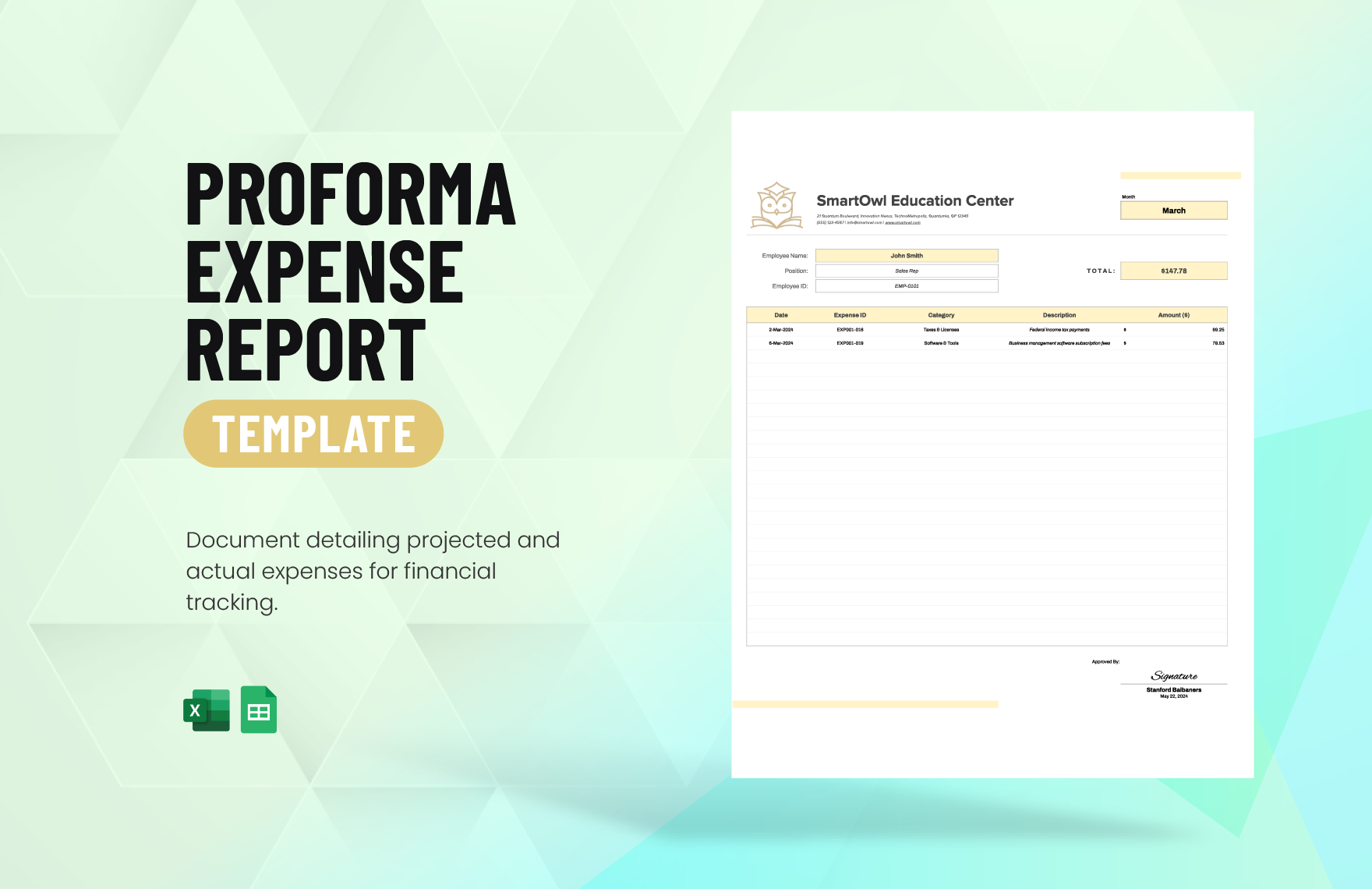

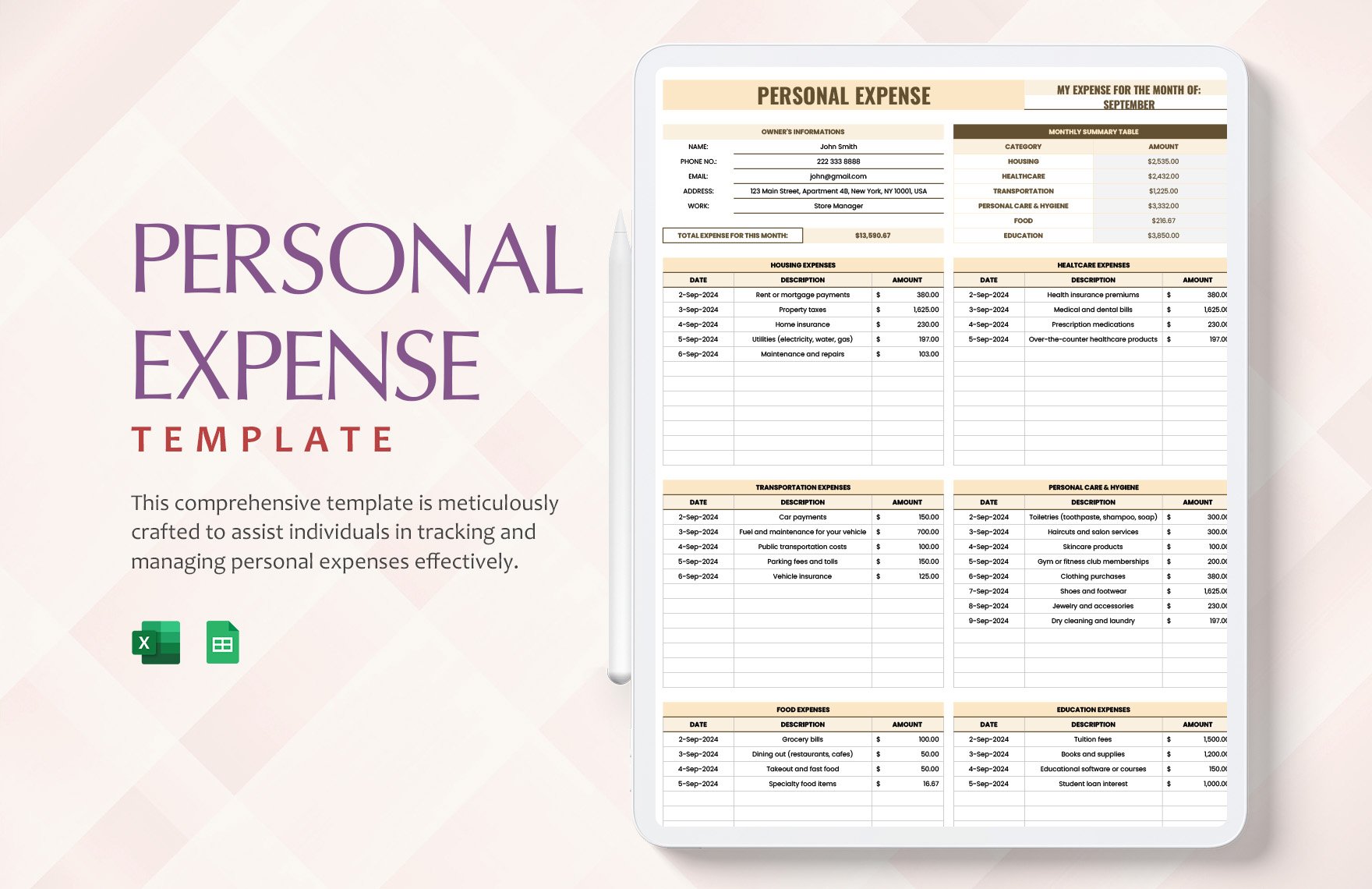

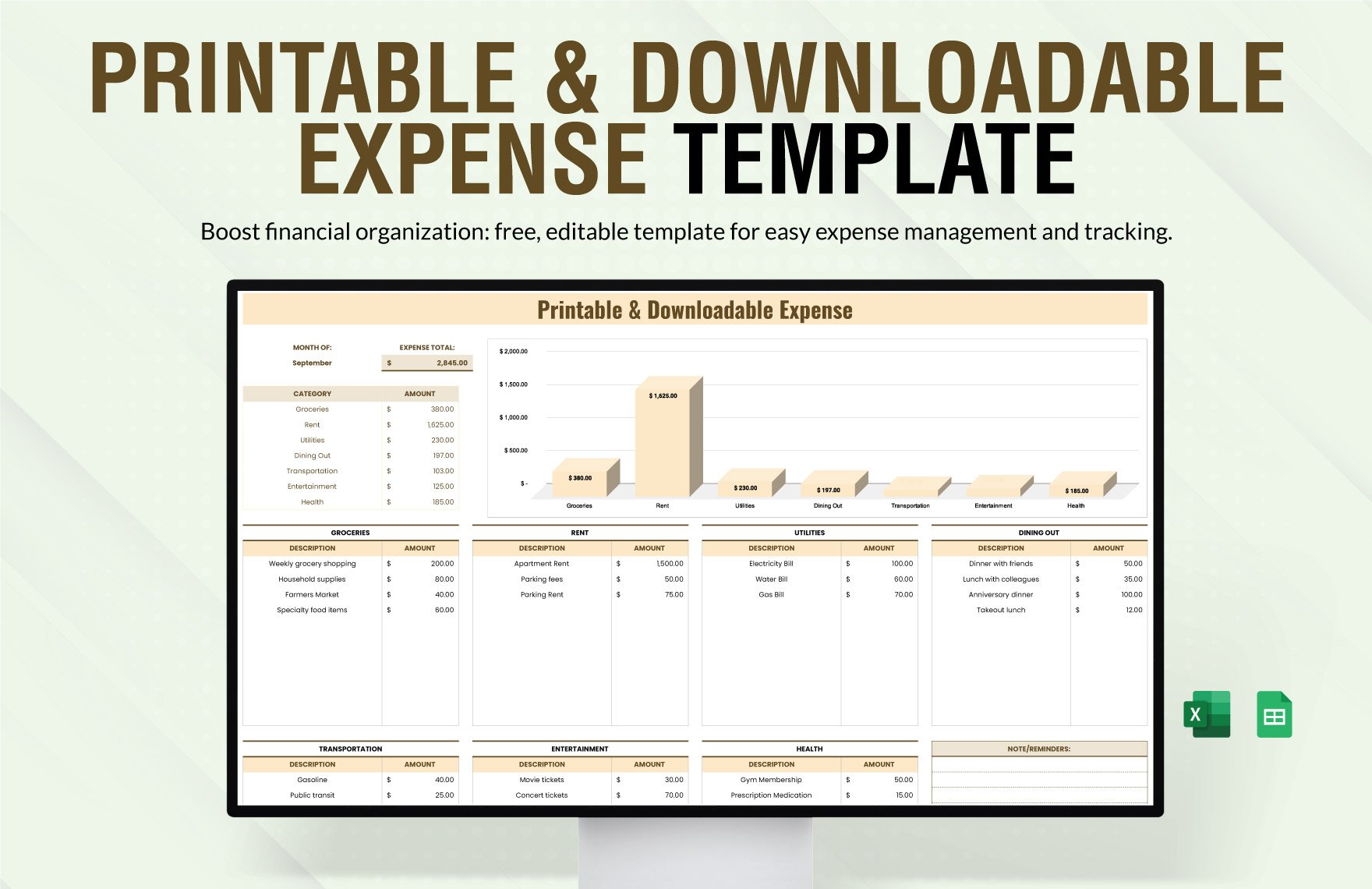

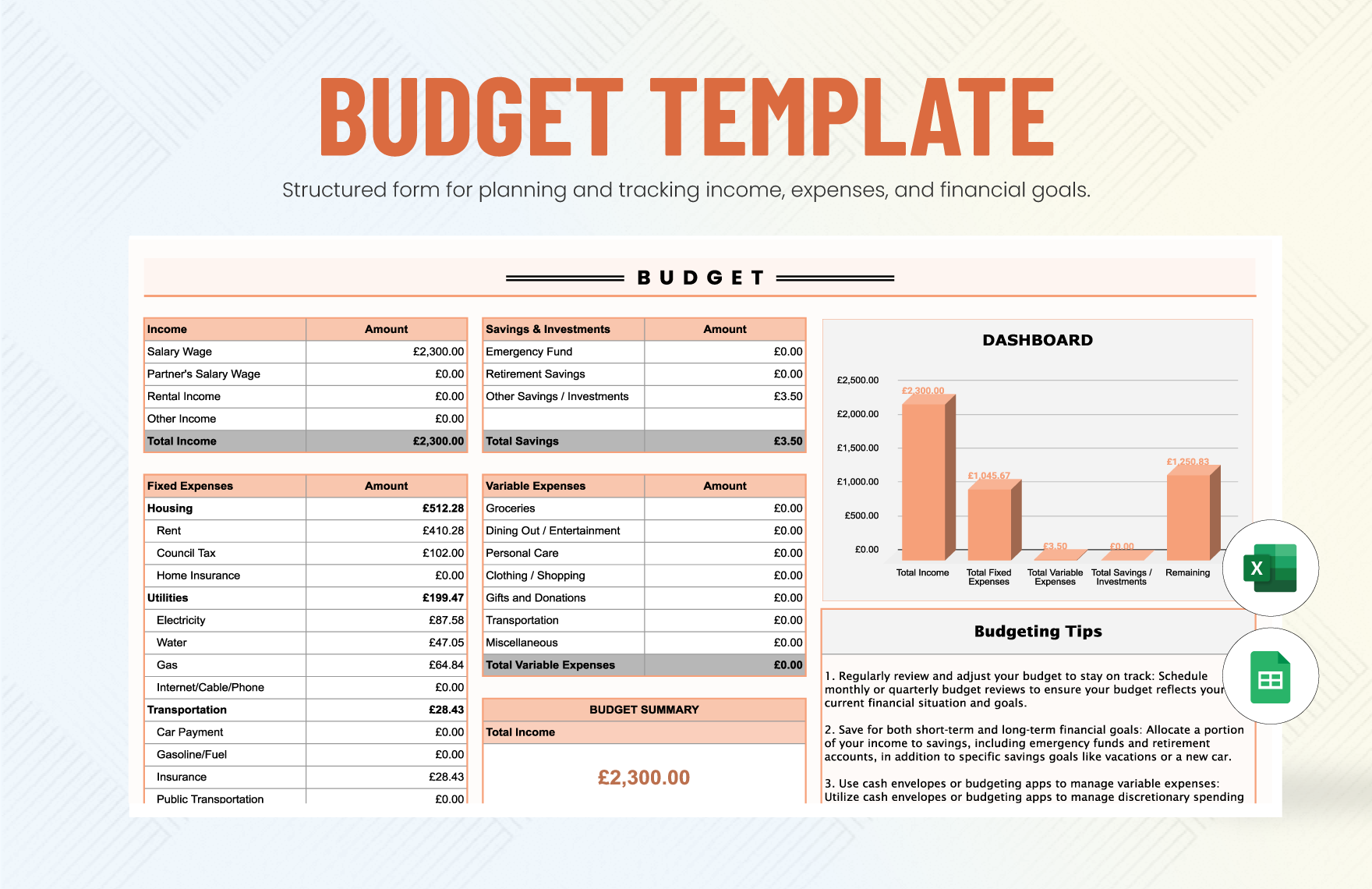

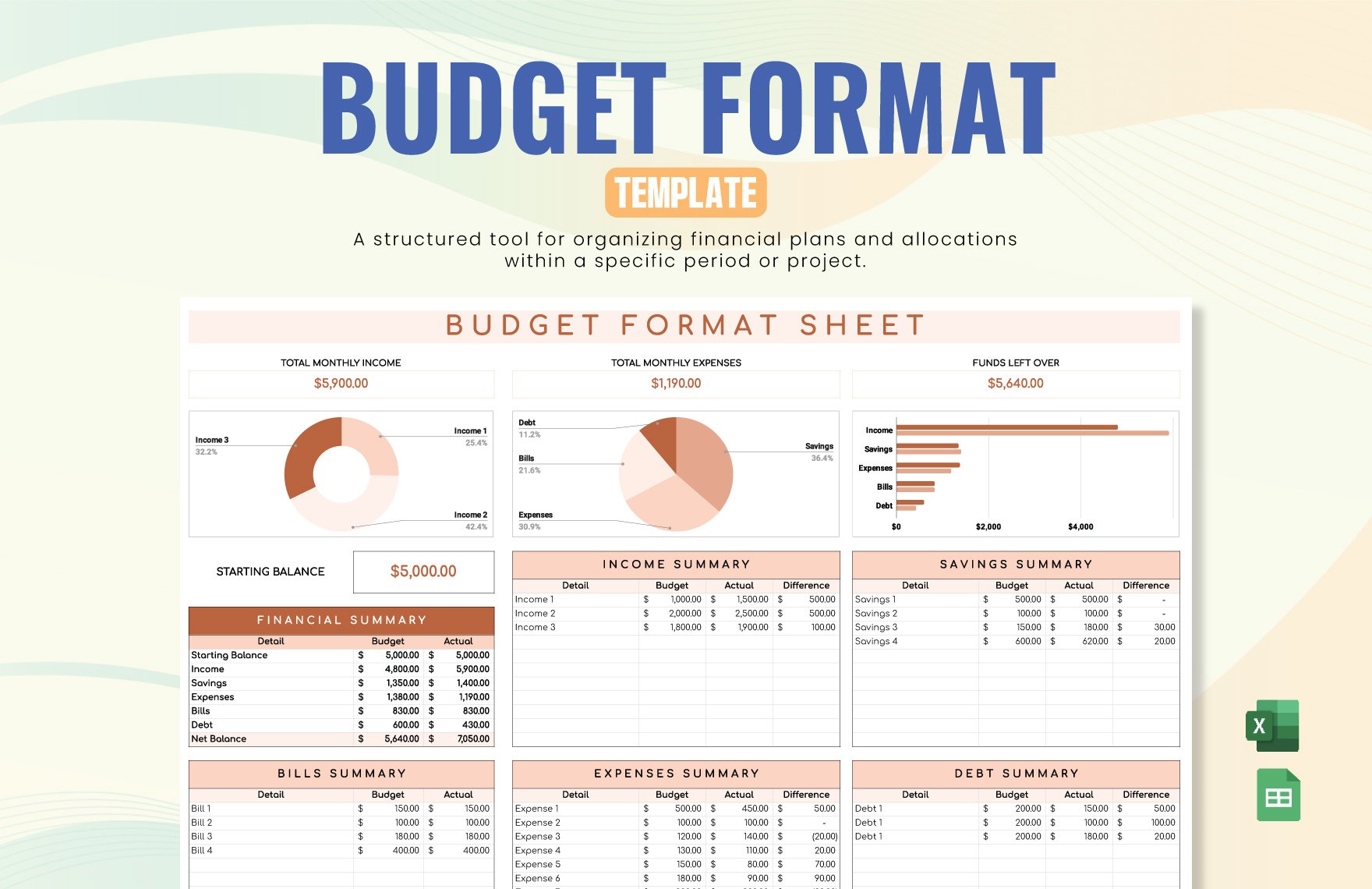

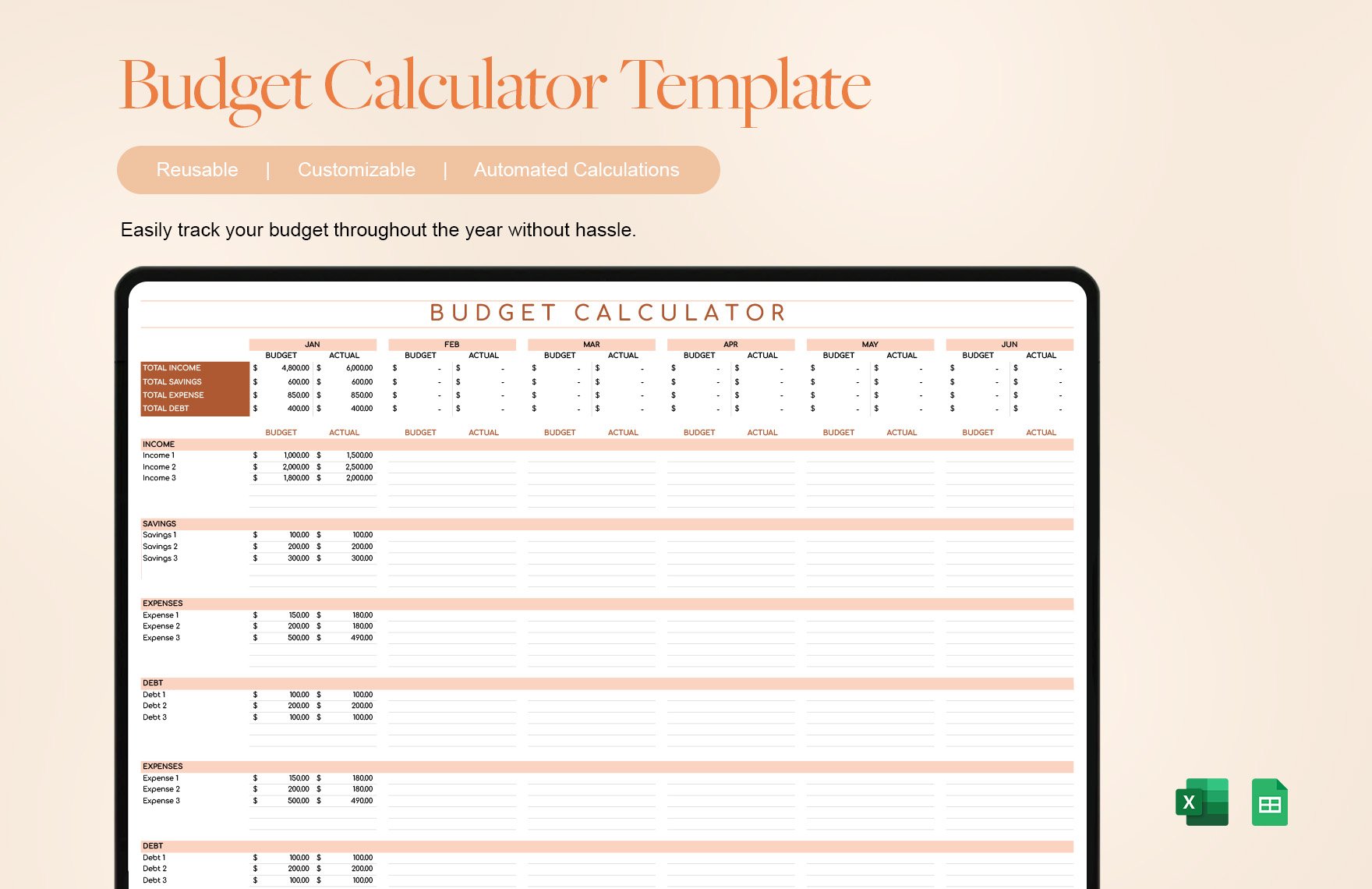

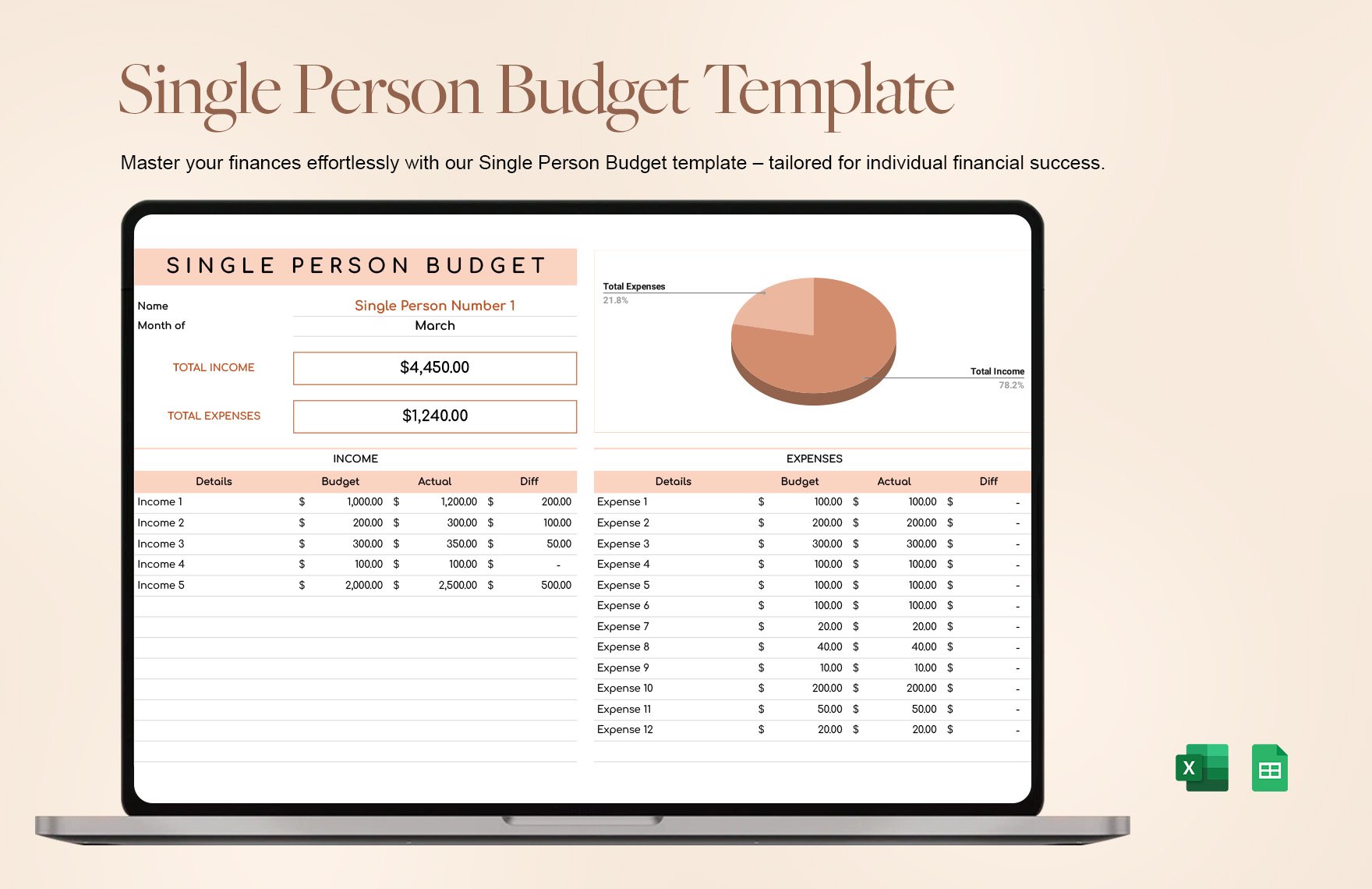

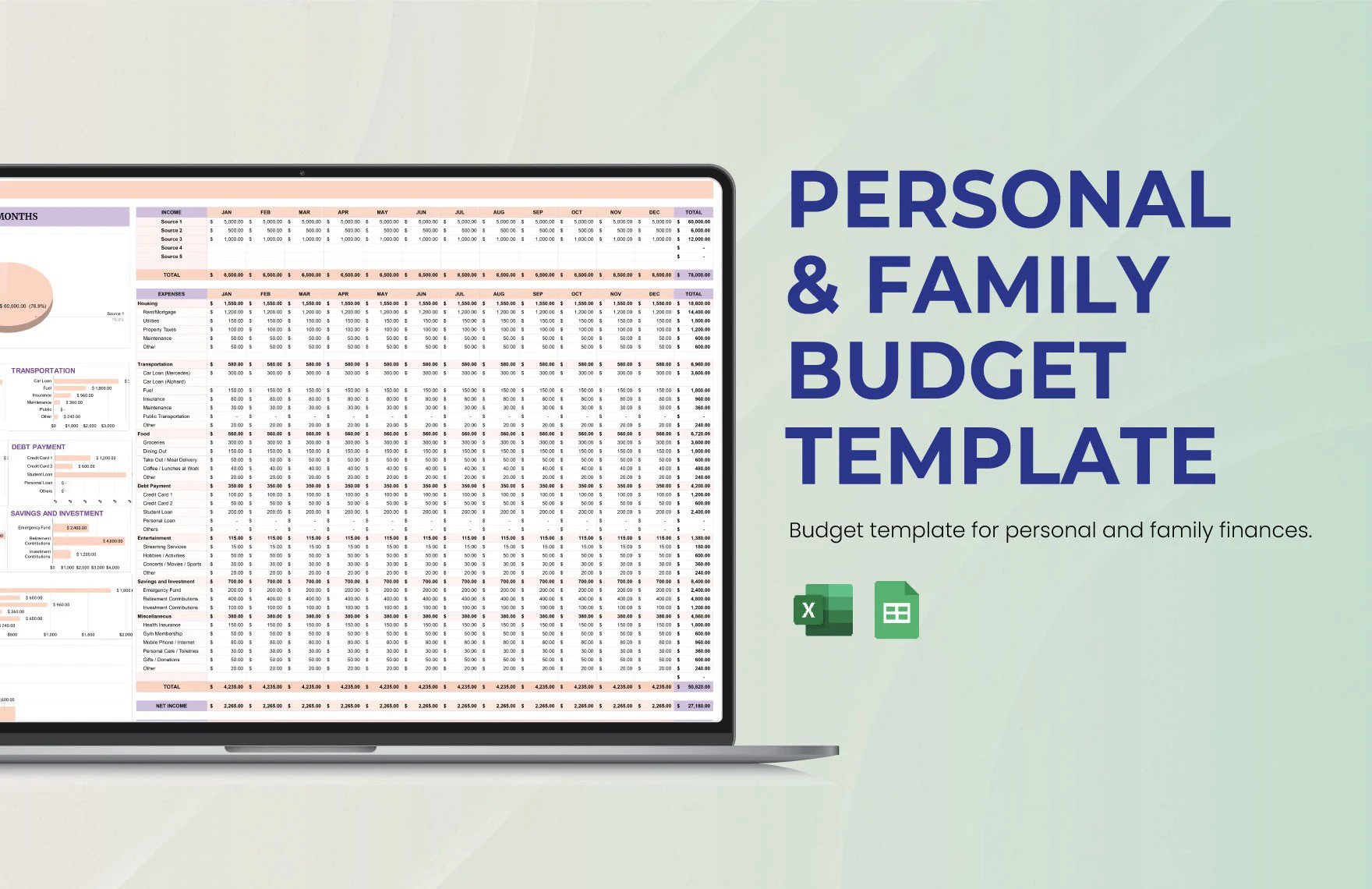

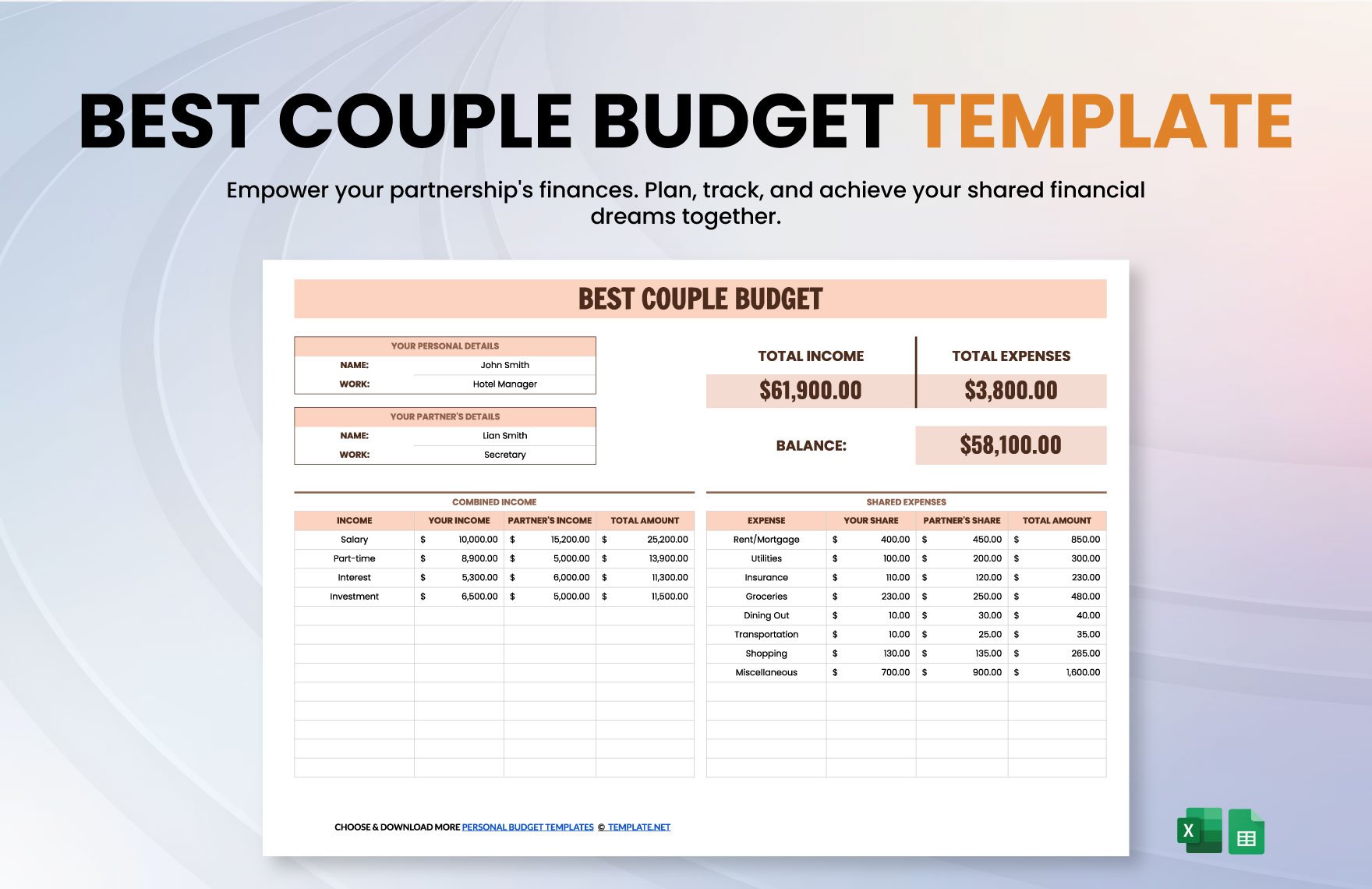

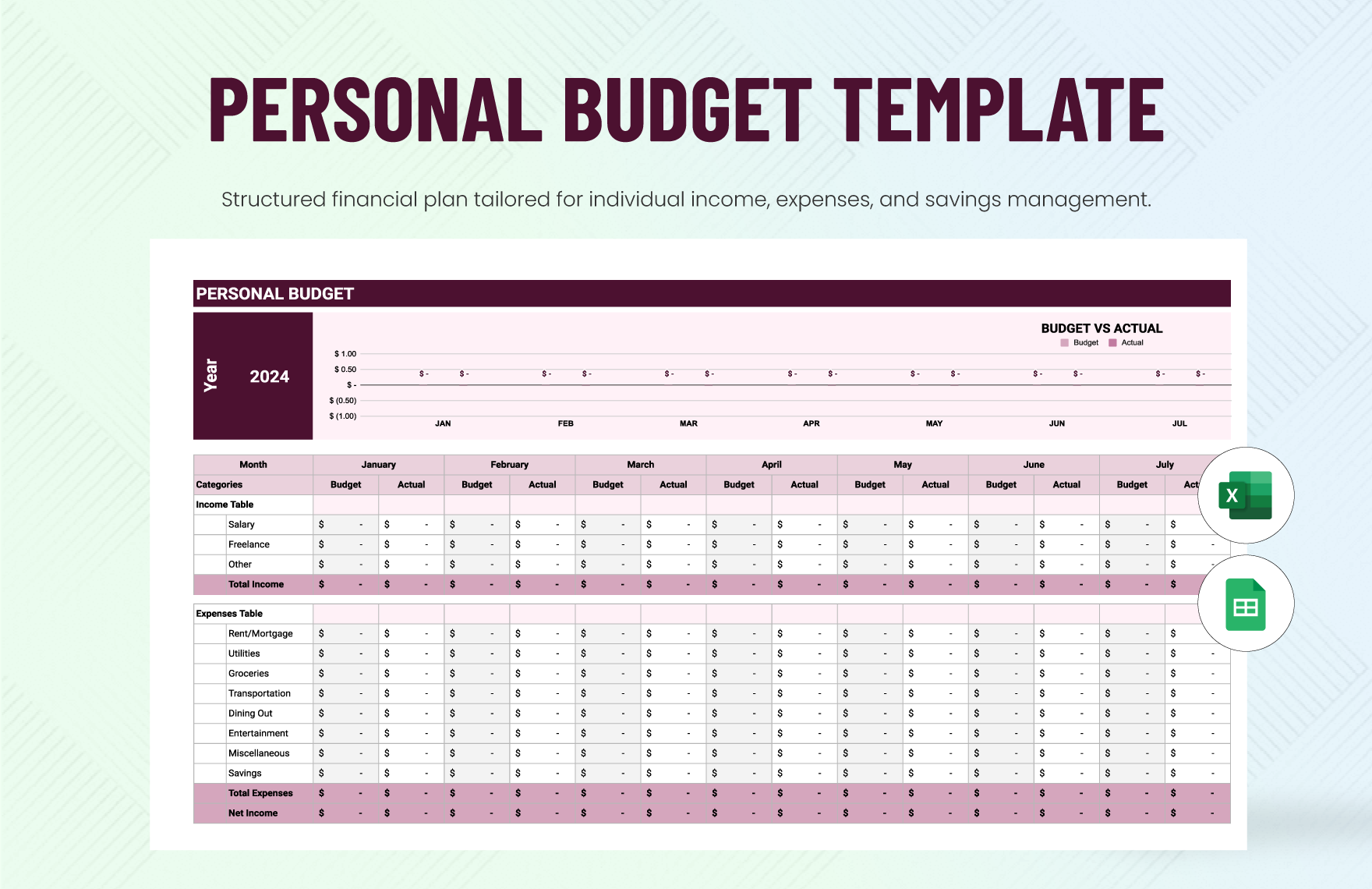

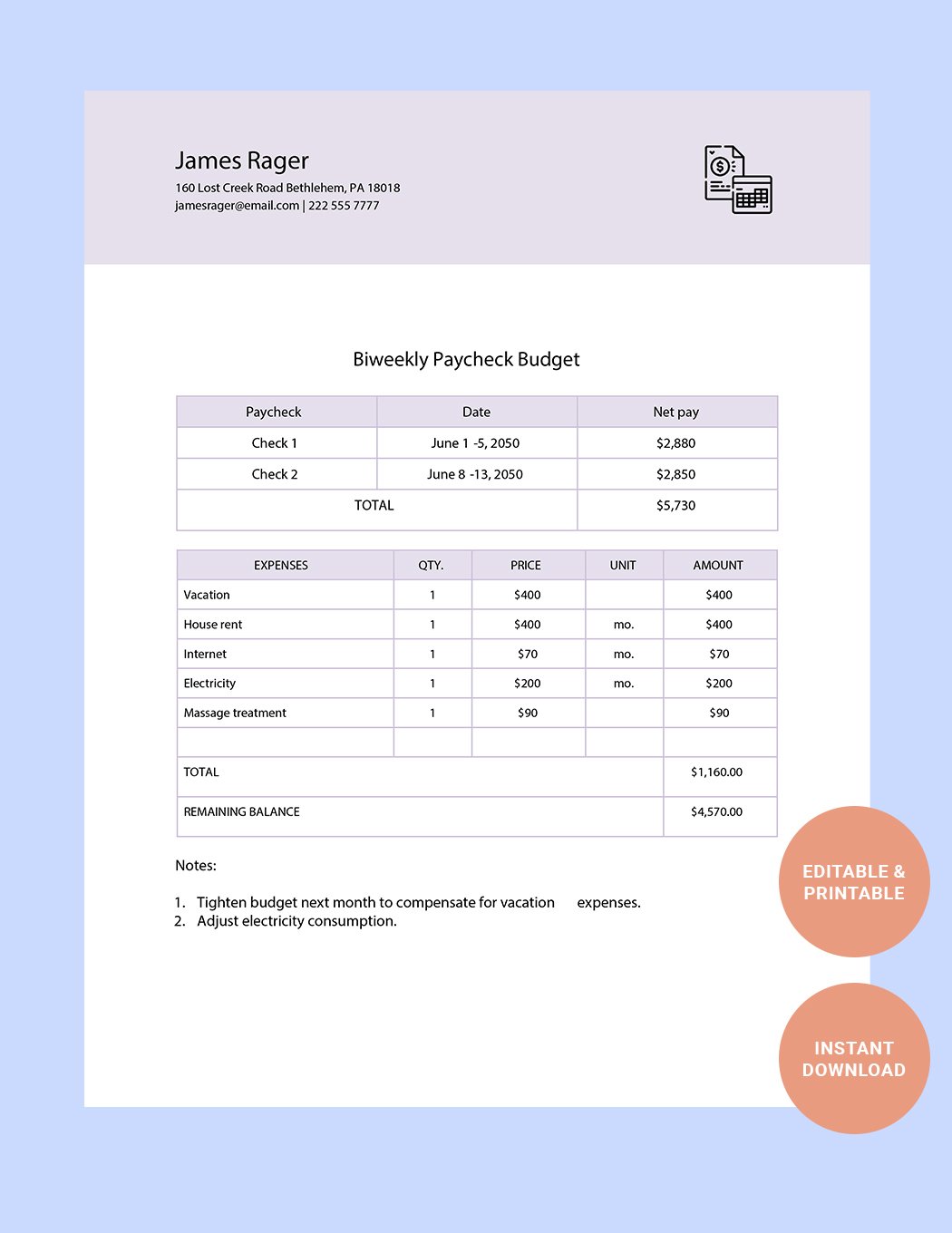

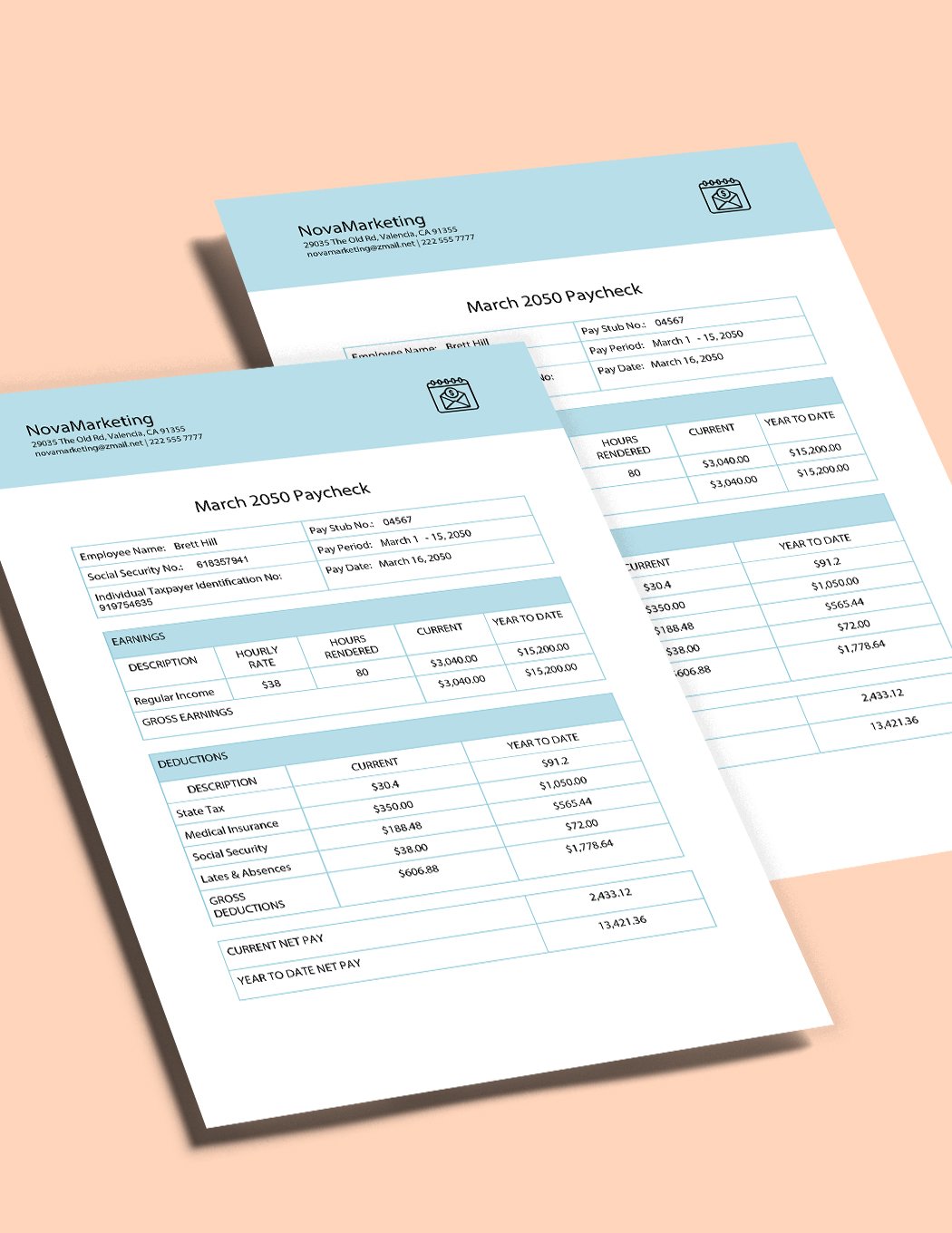

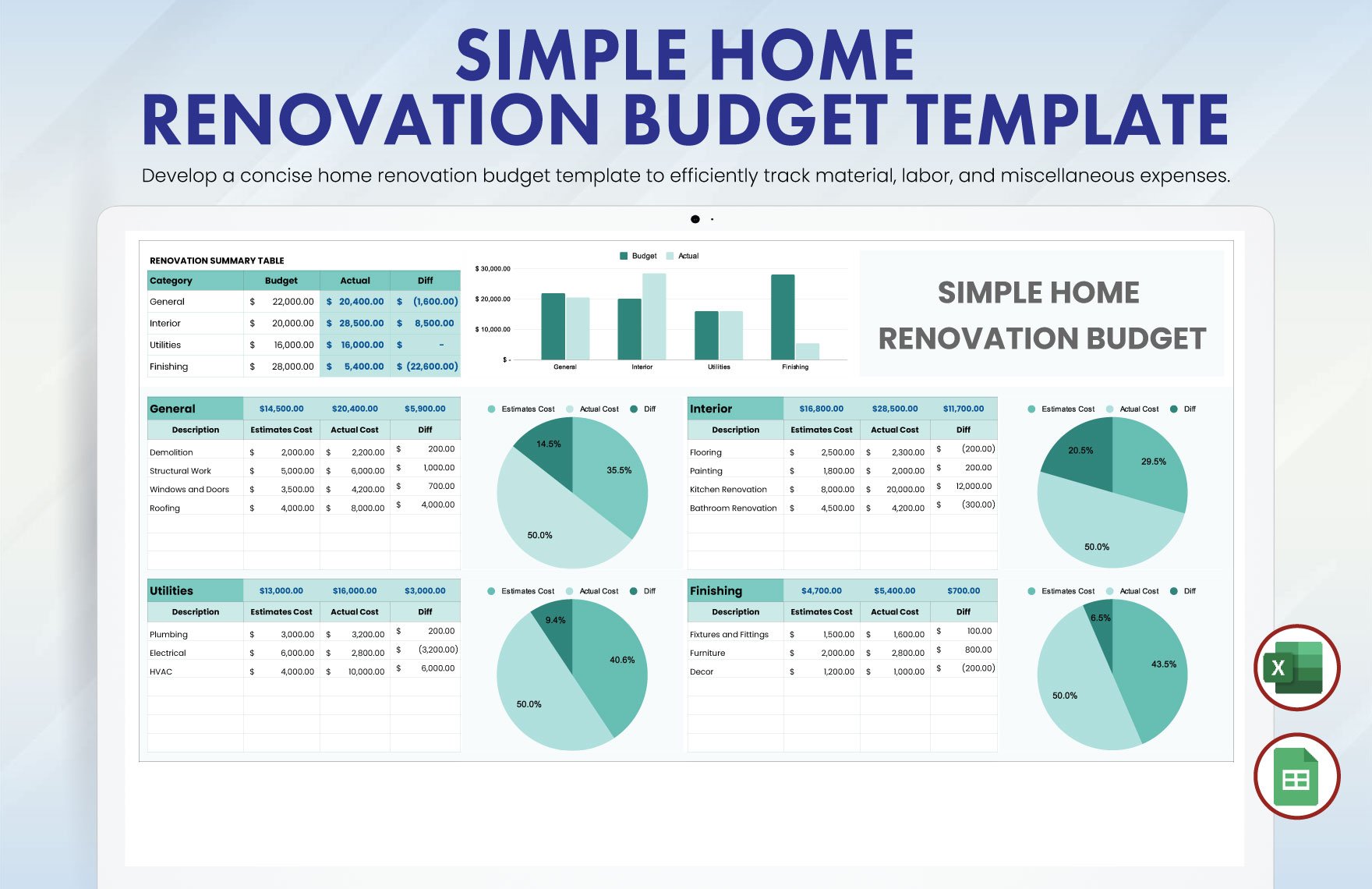

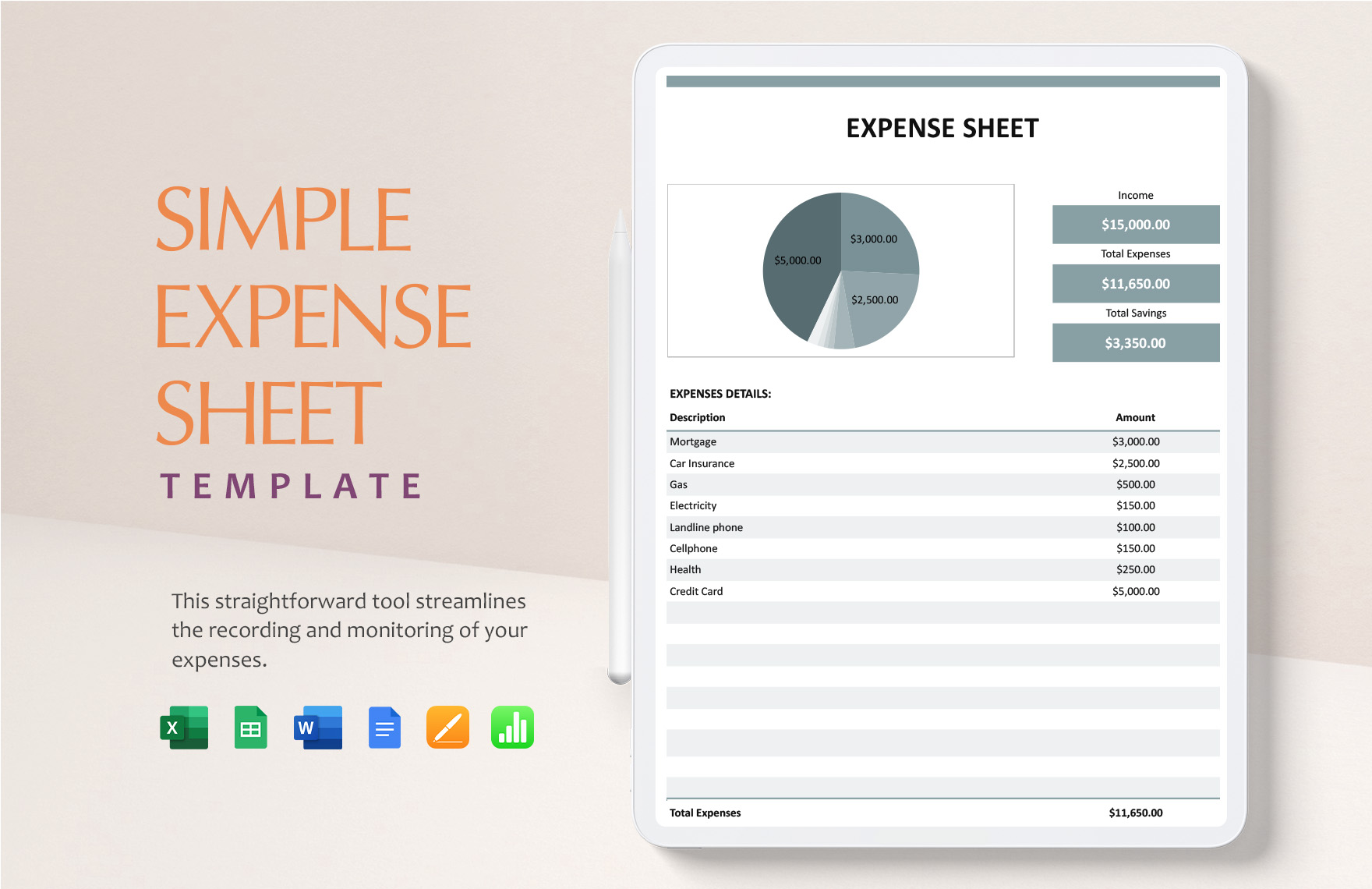

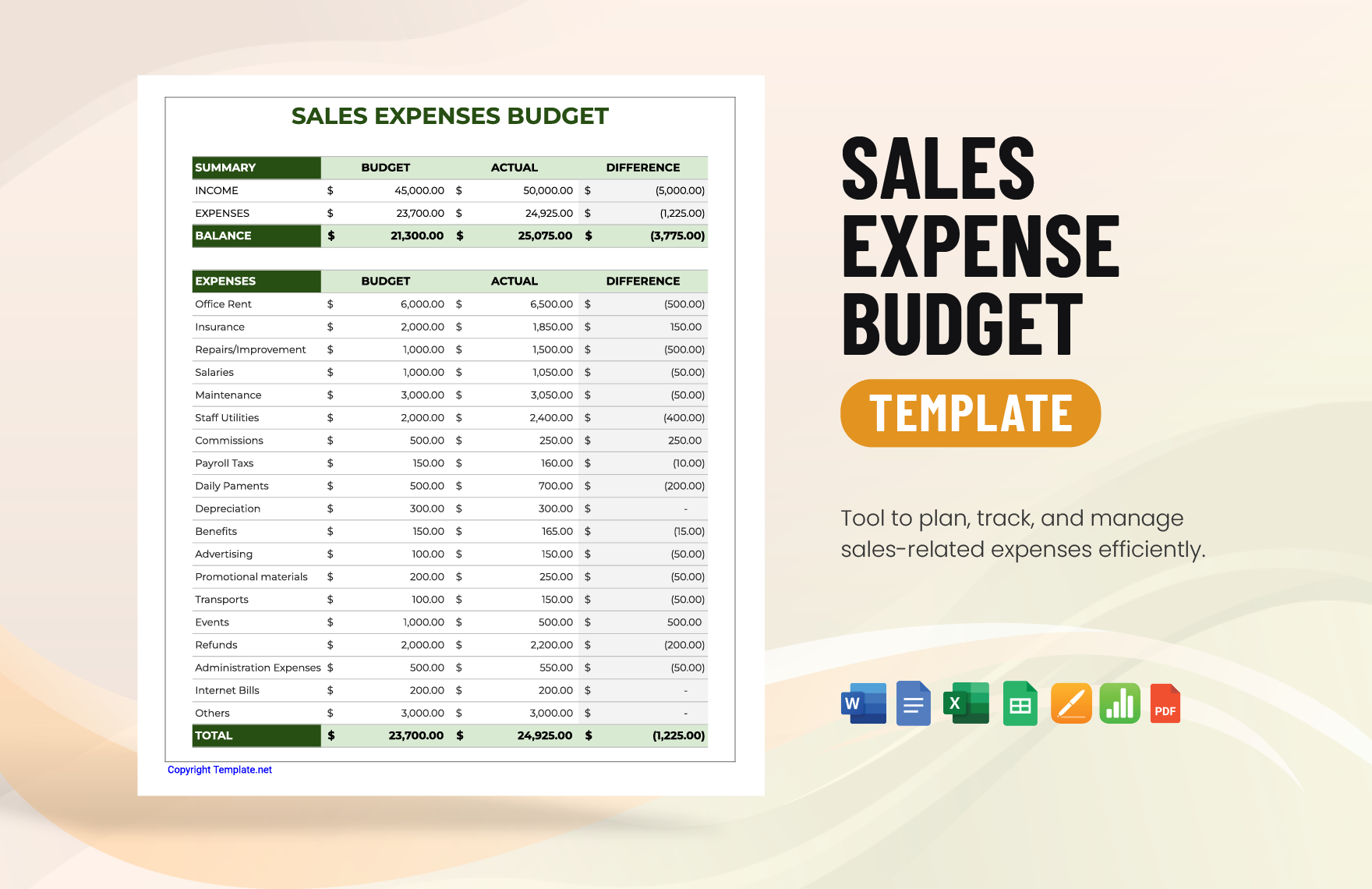

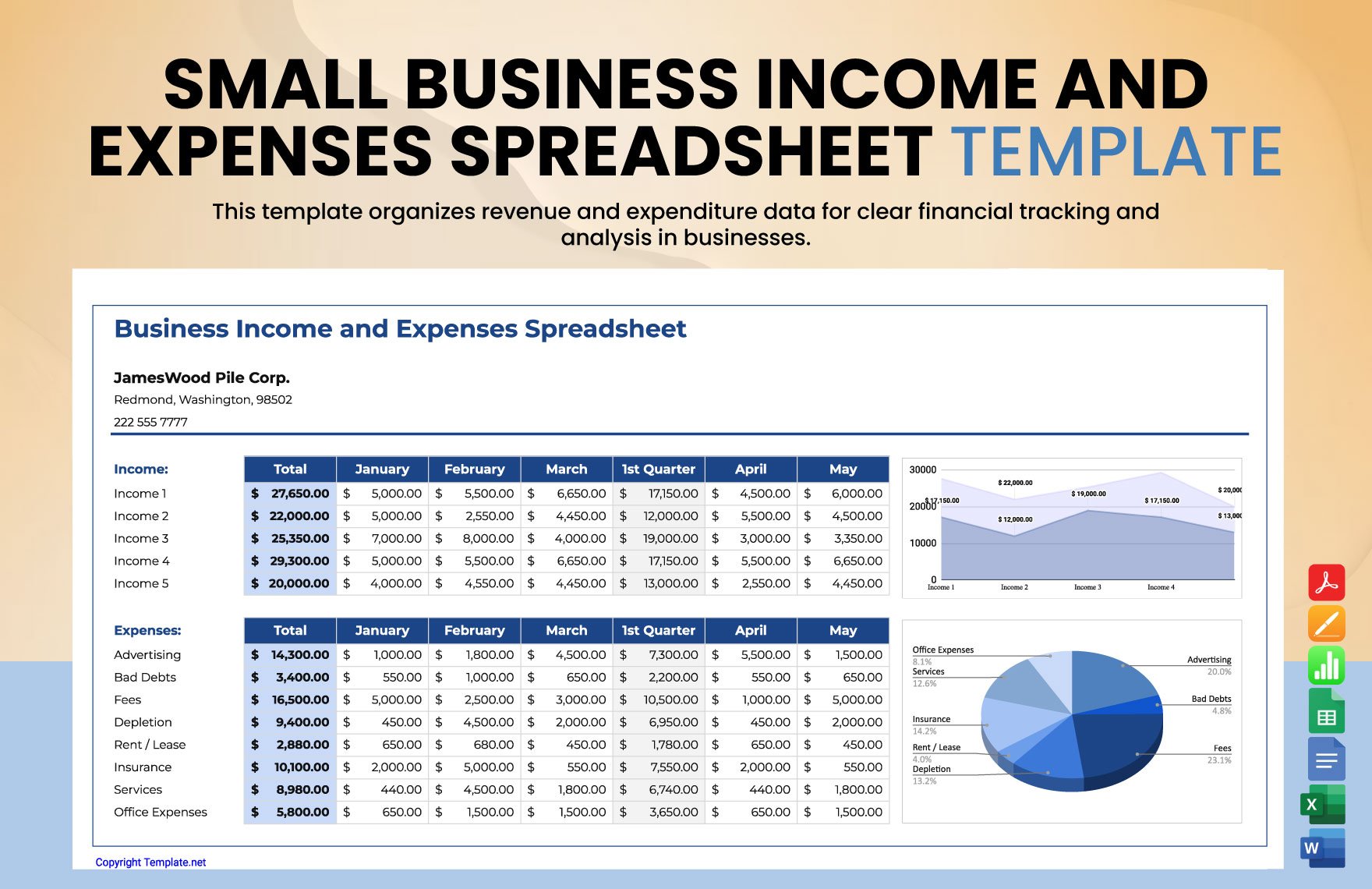

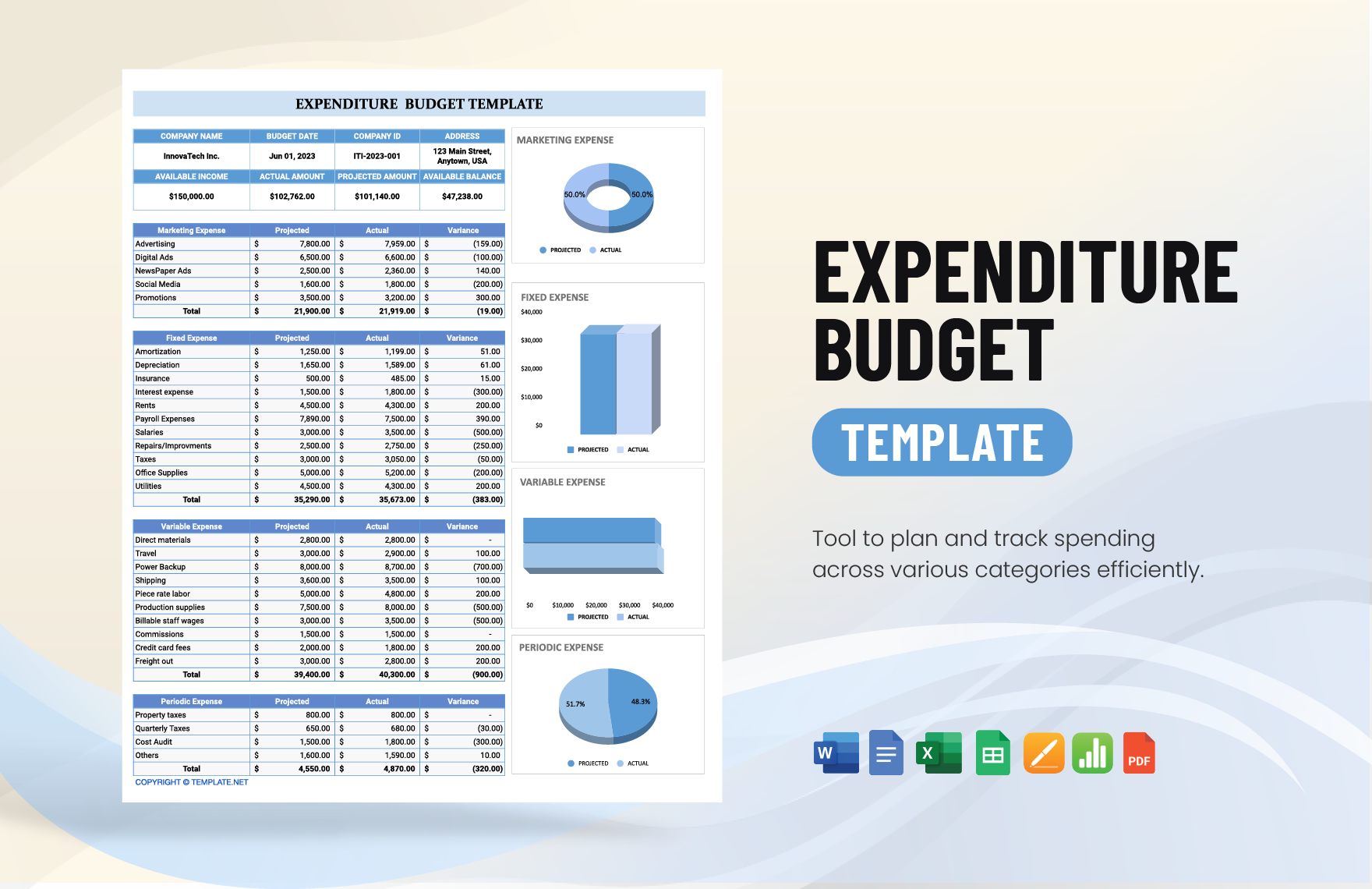

Browse through a sample collection of professional Expense Budget Templates that have been curated just for you.