Make Your Financial Management to Life with Freelancer Budget Templates from Template.net

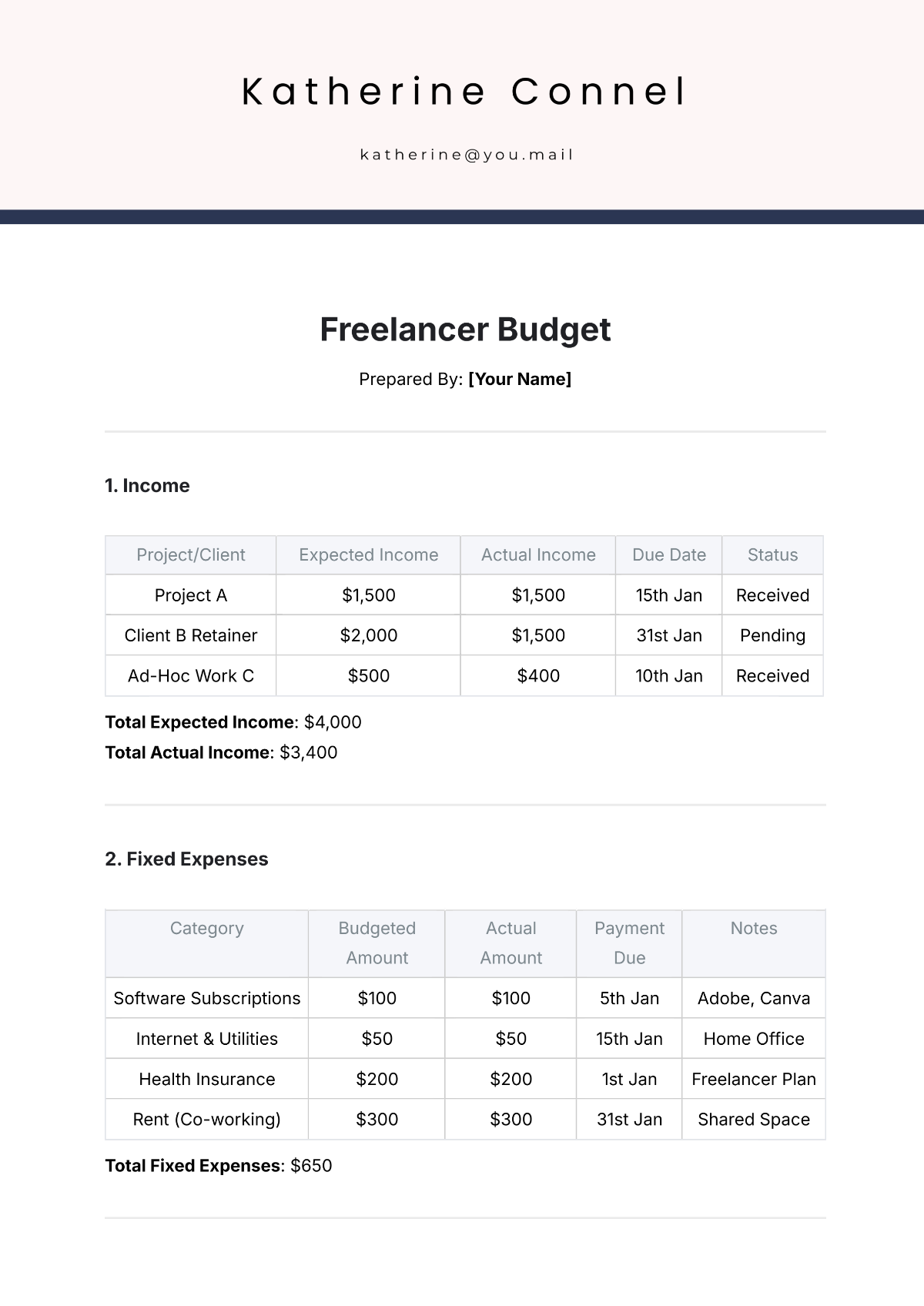

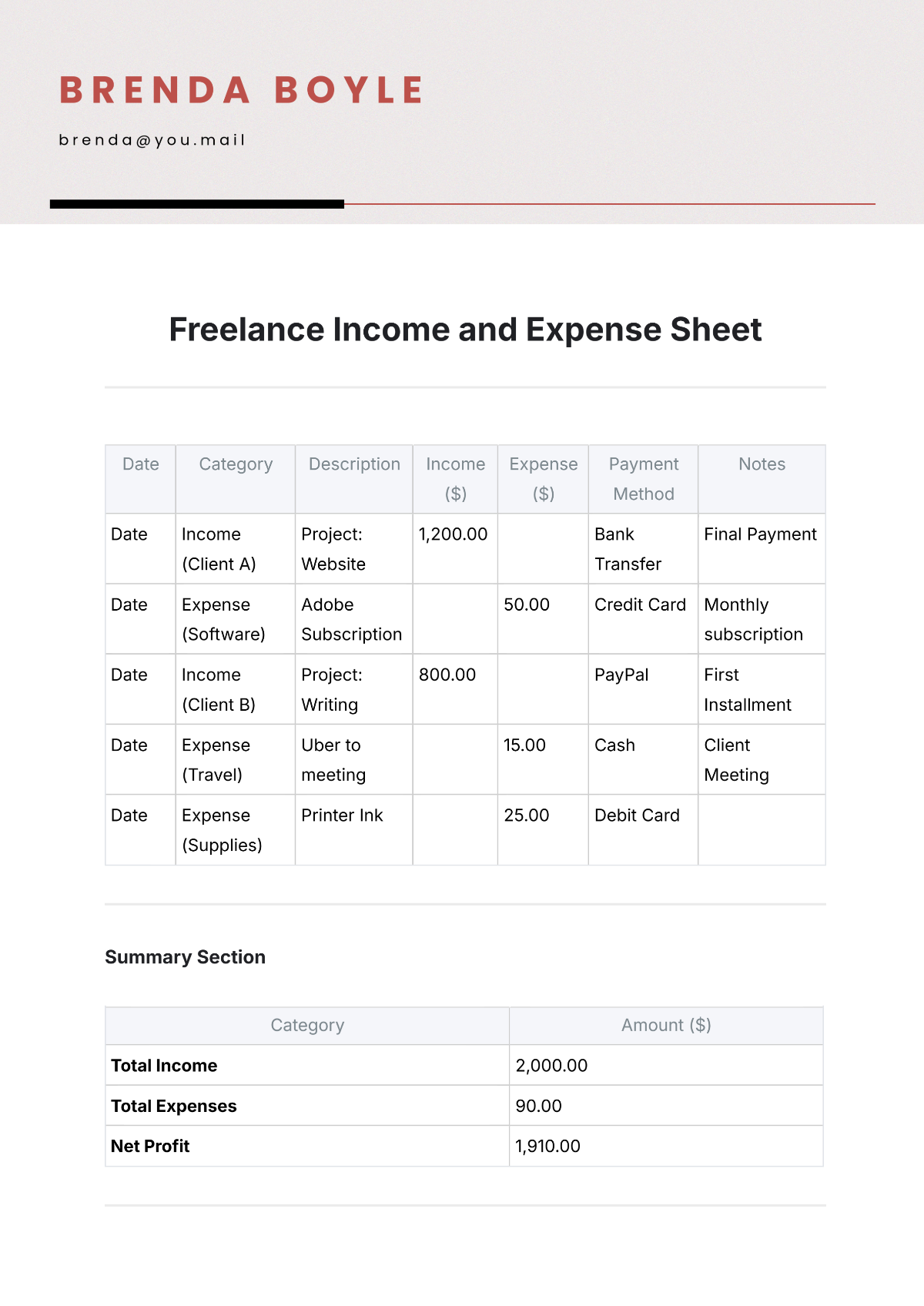

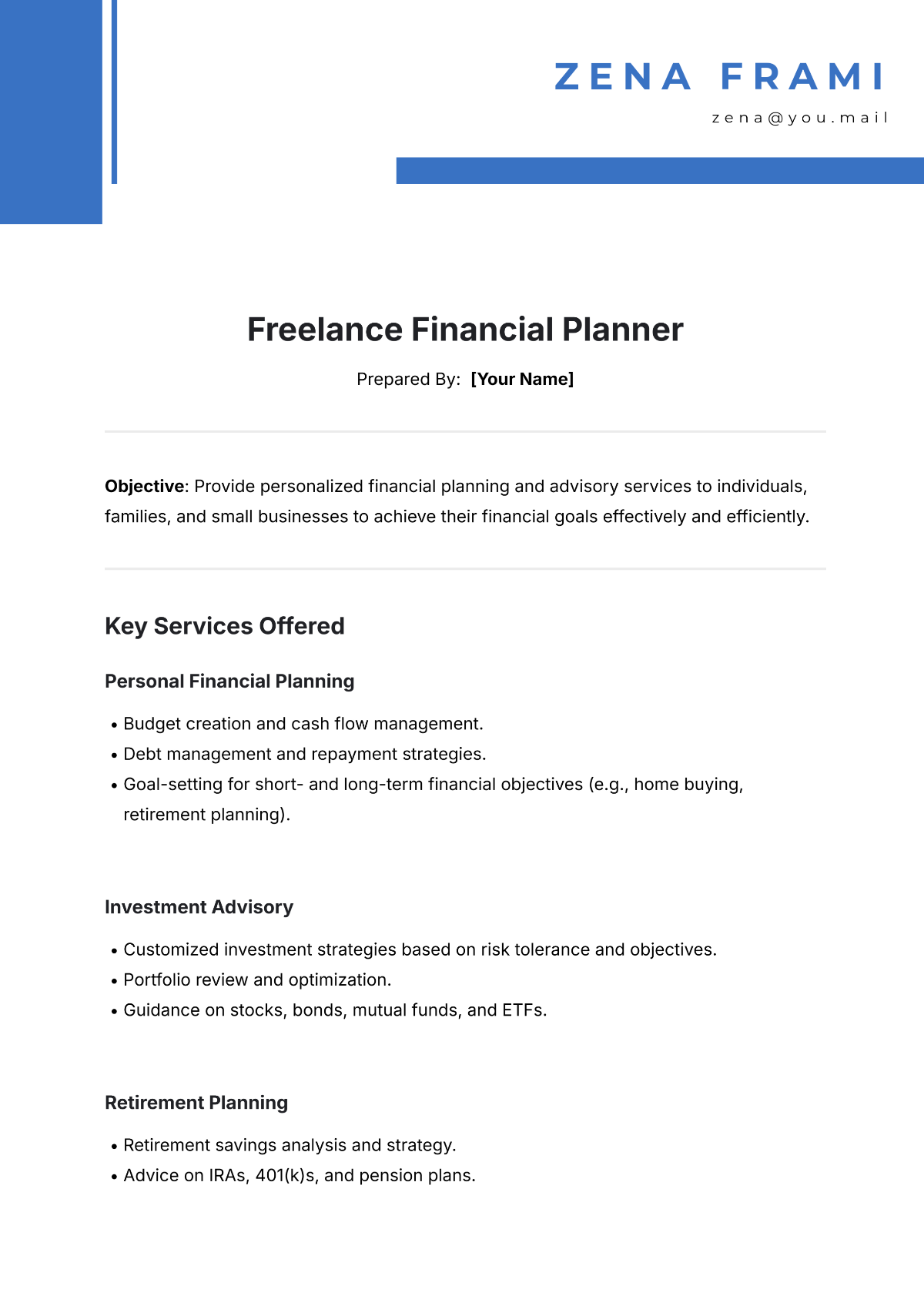

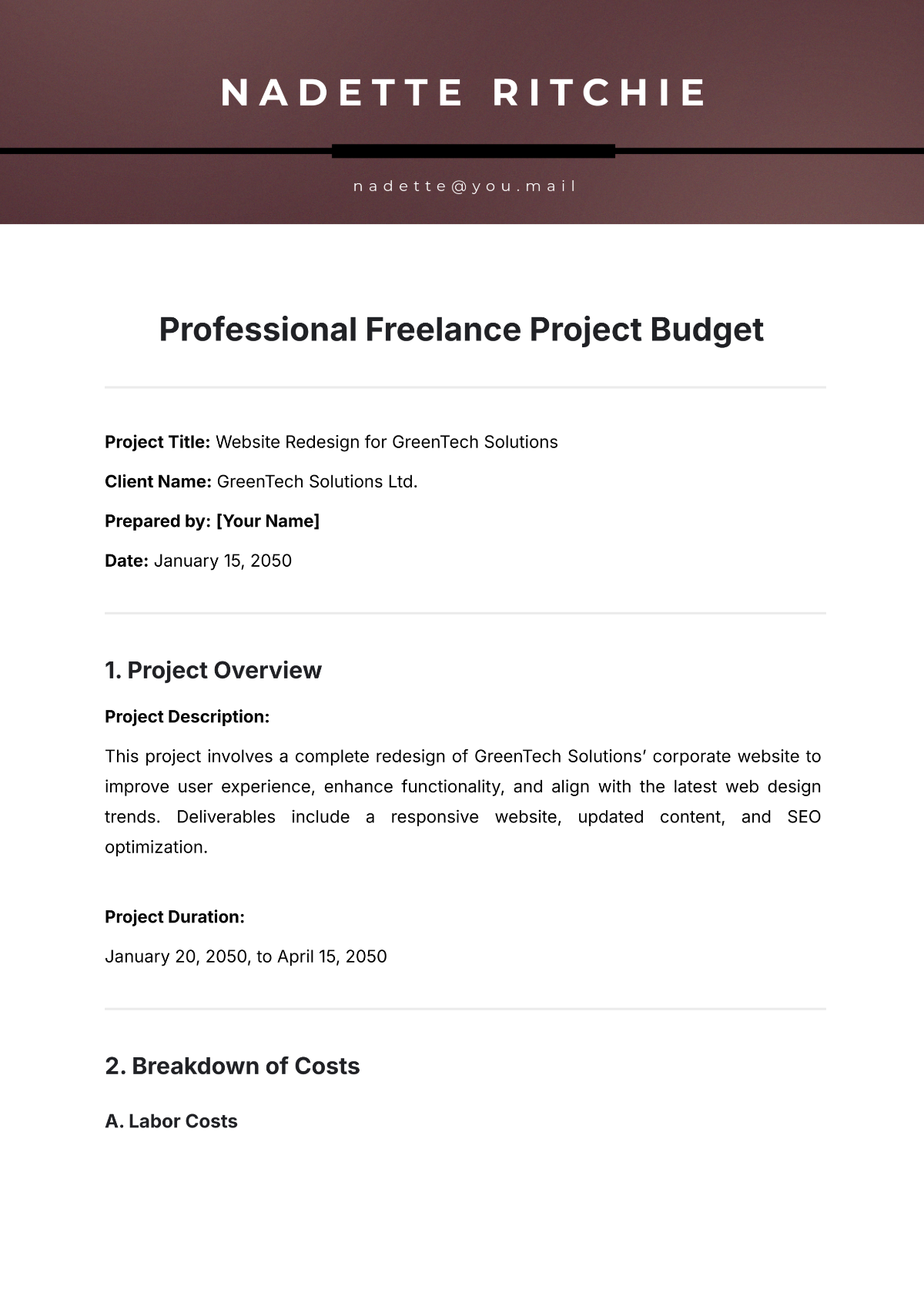

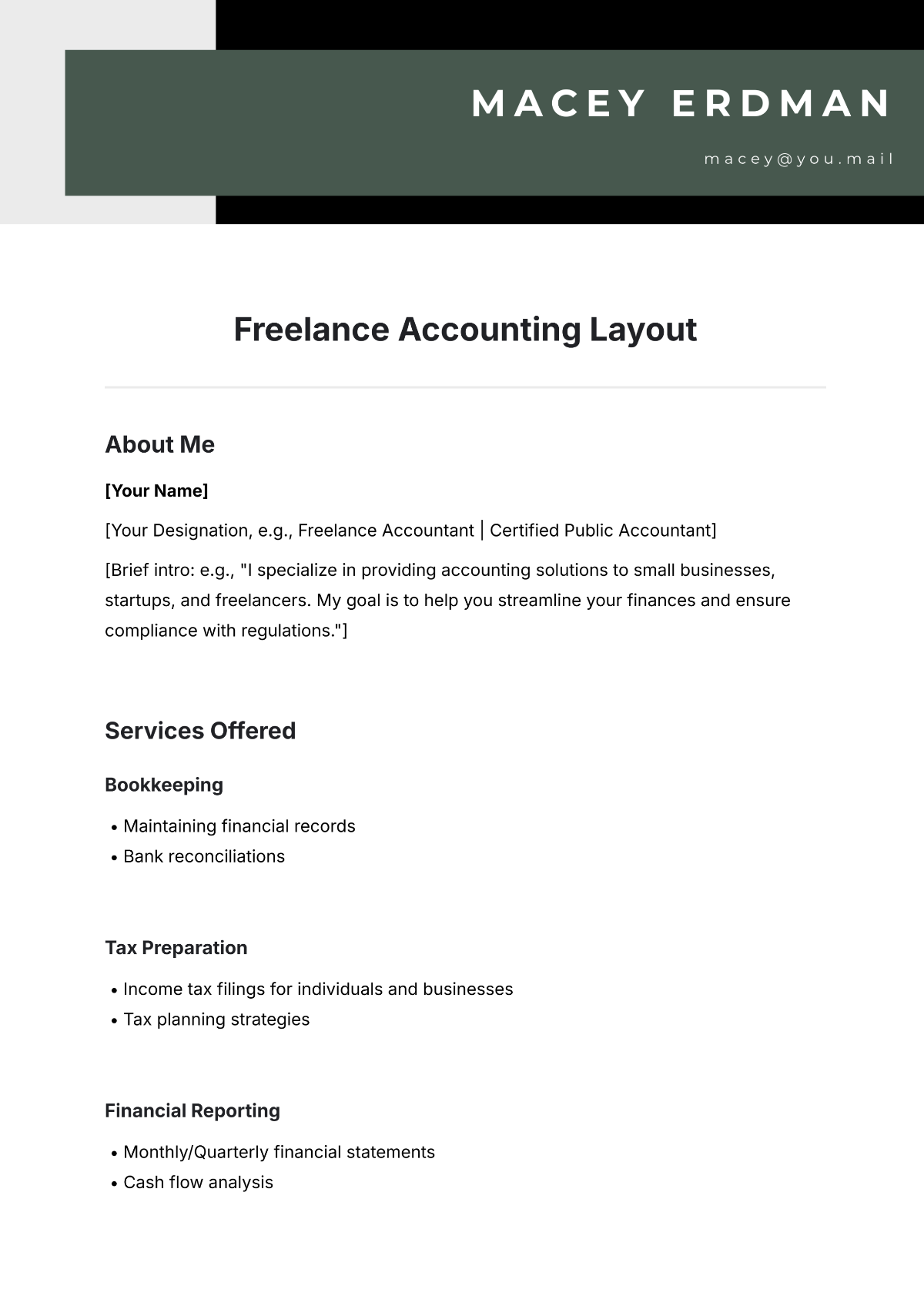

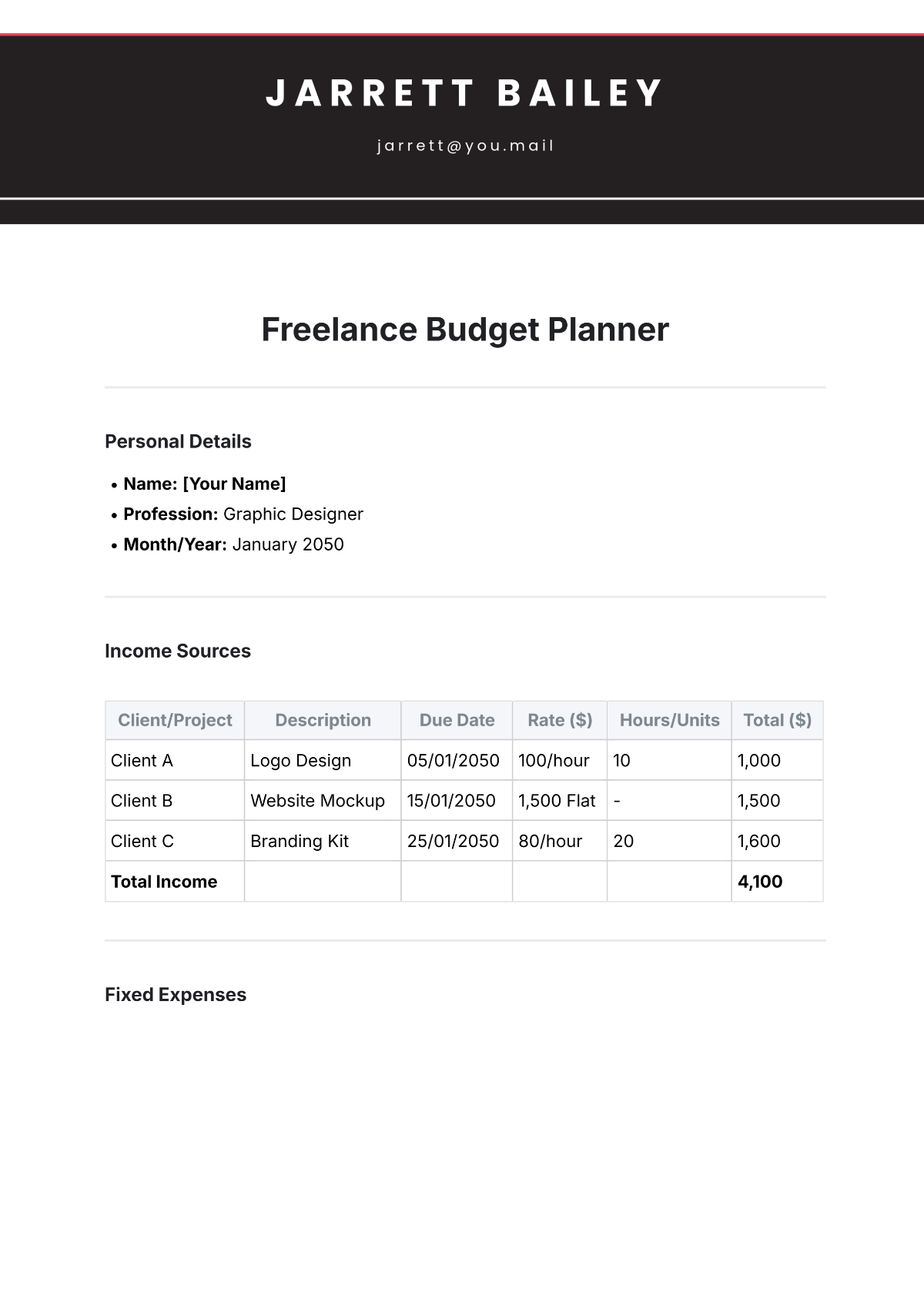

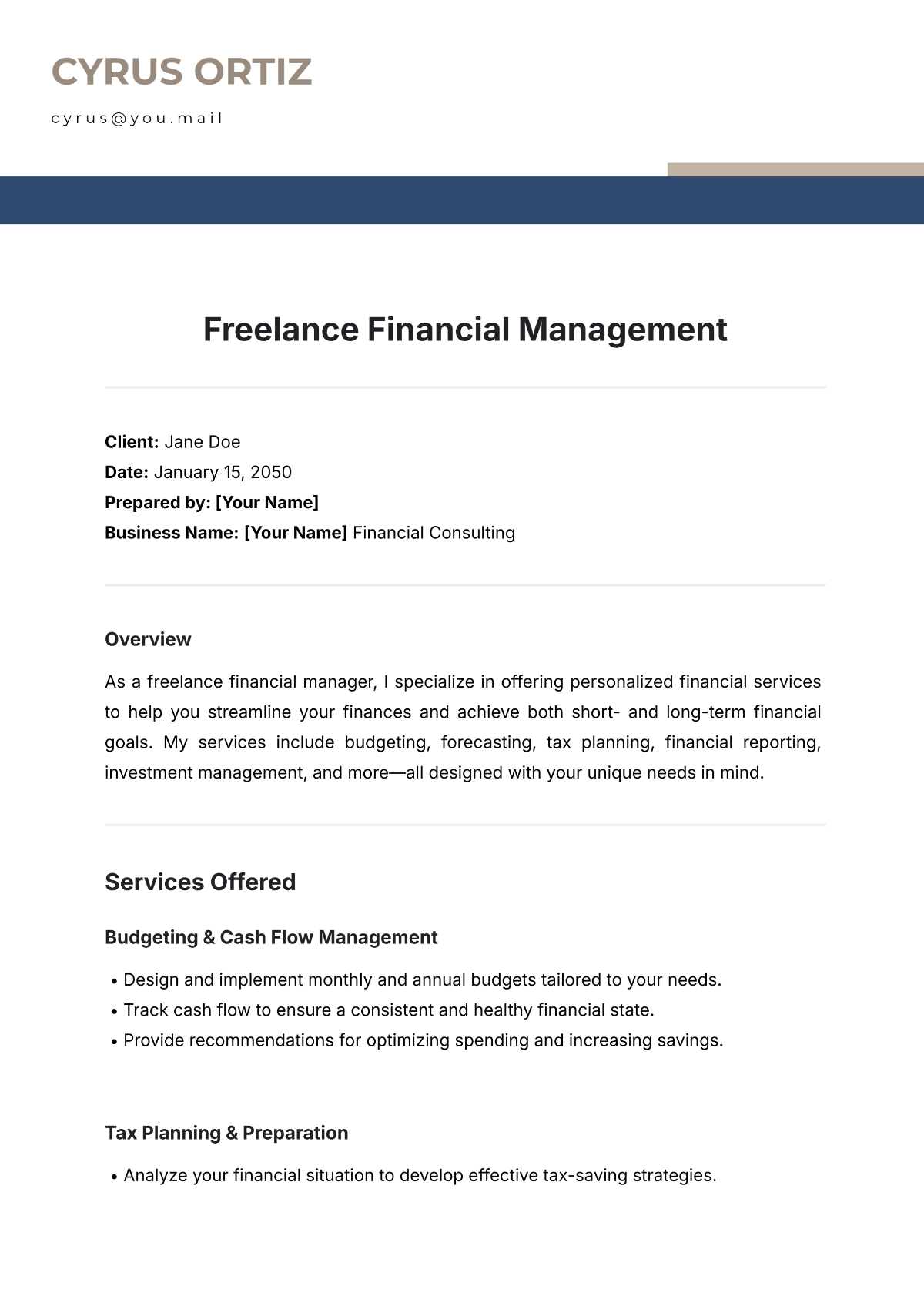

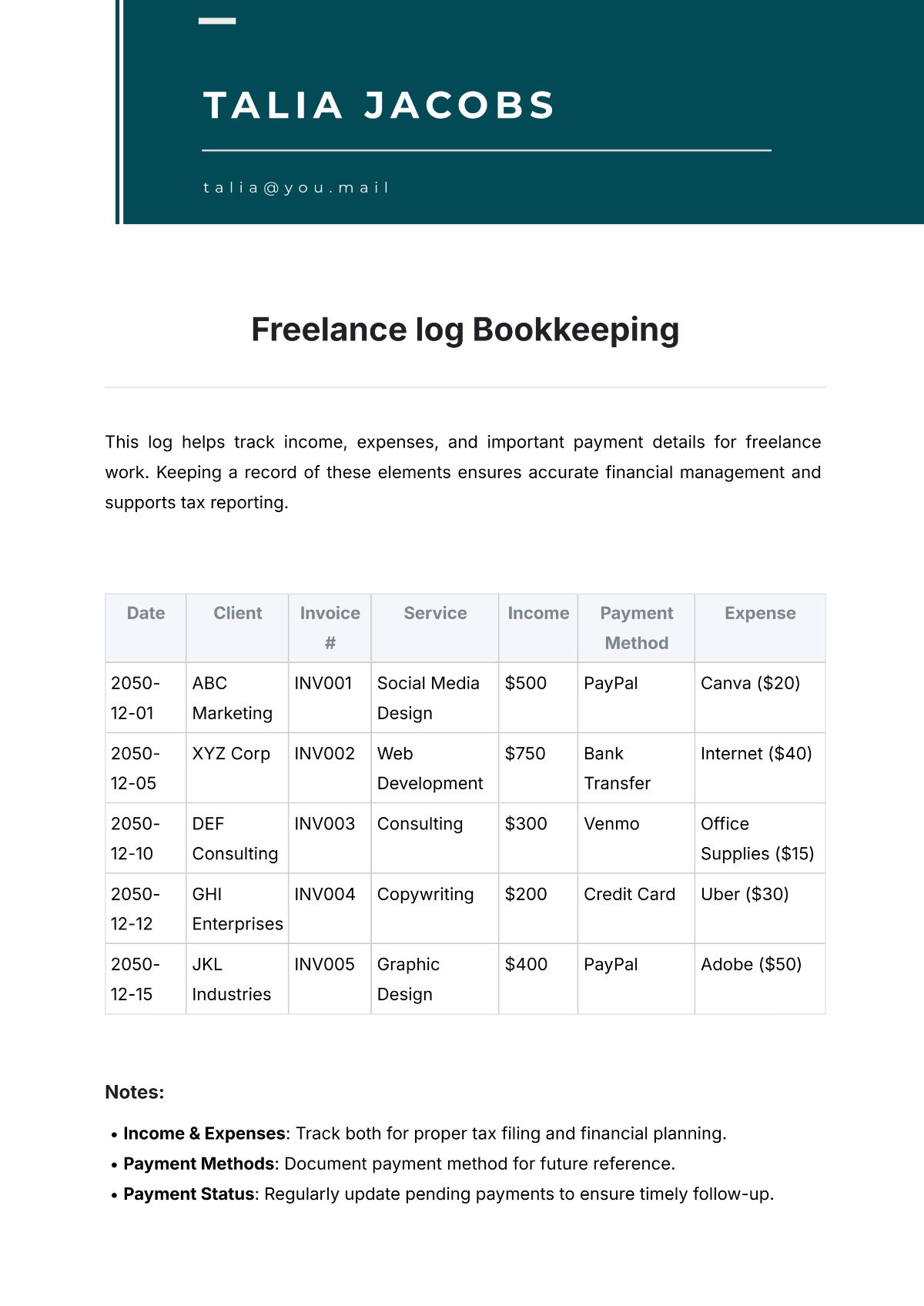

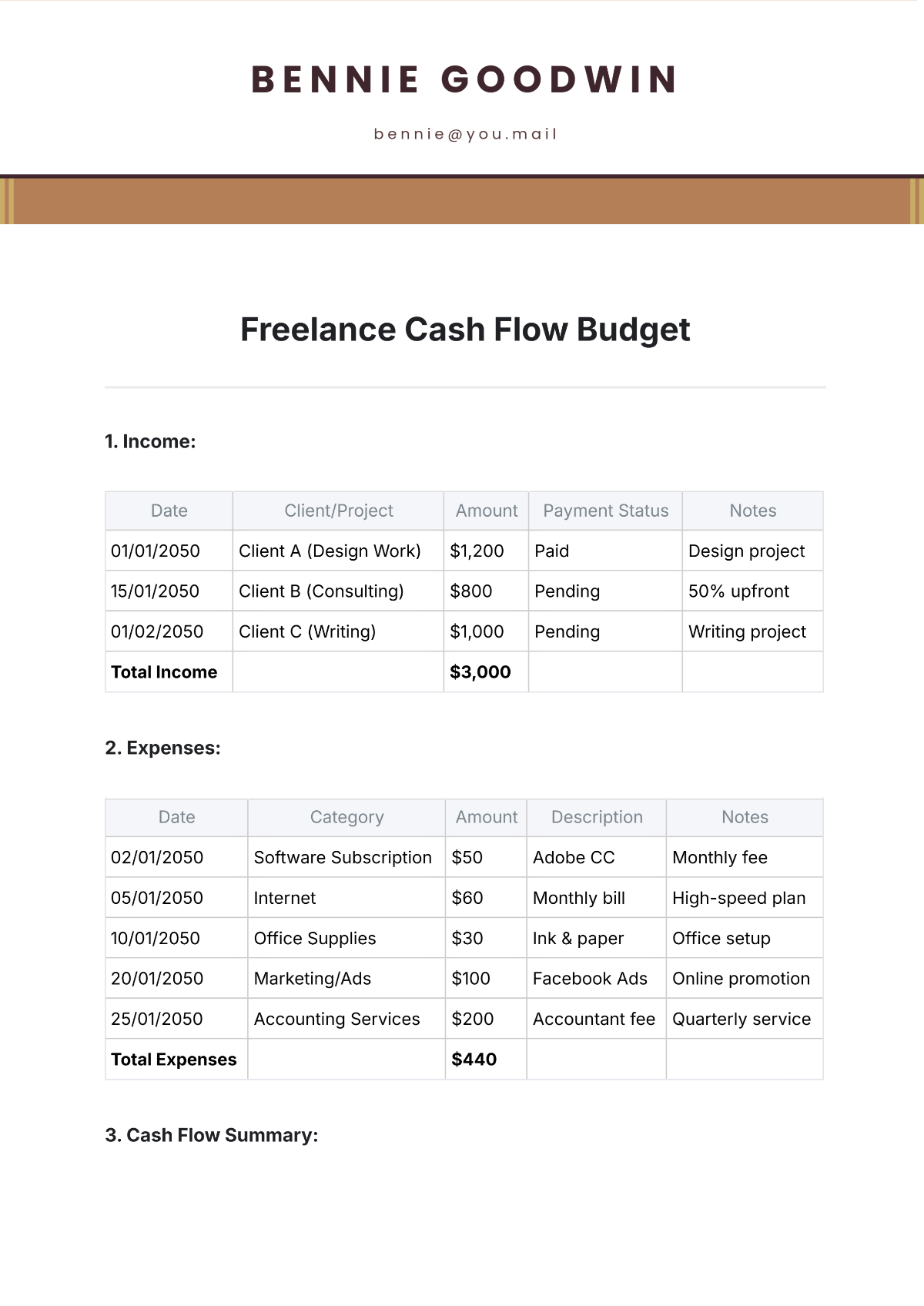

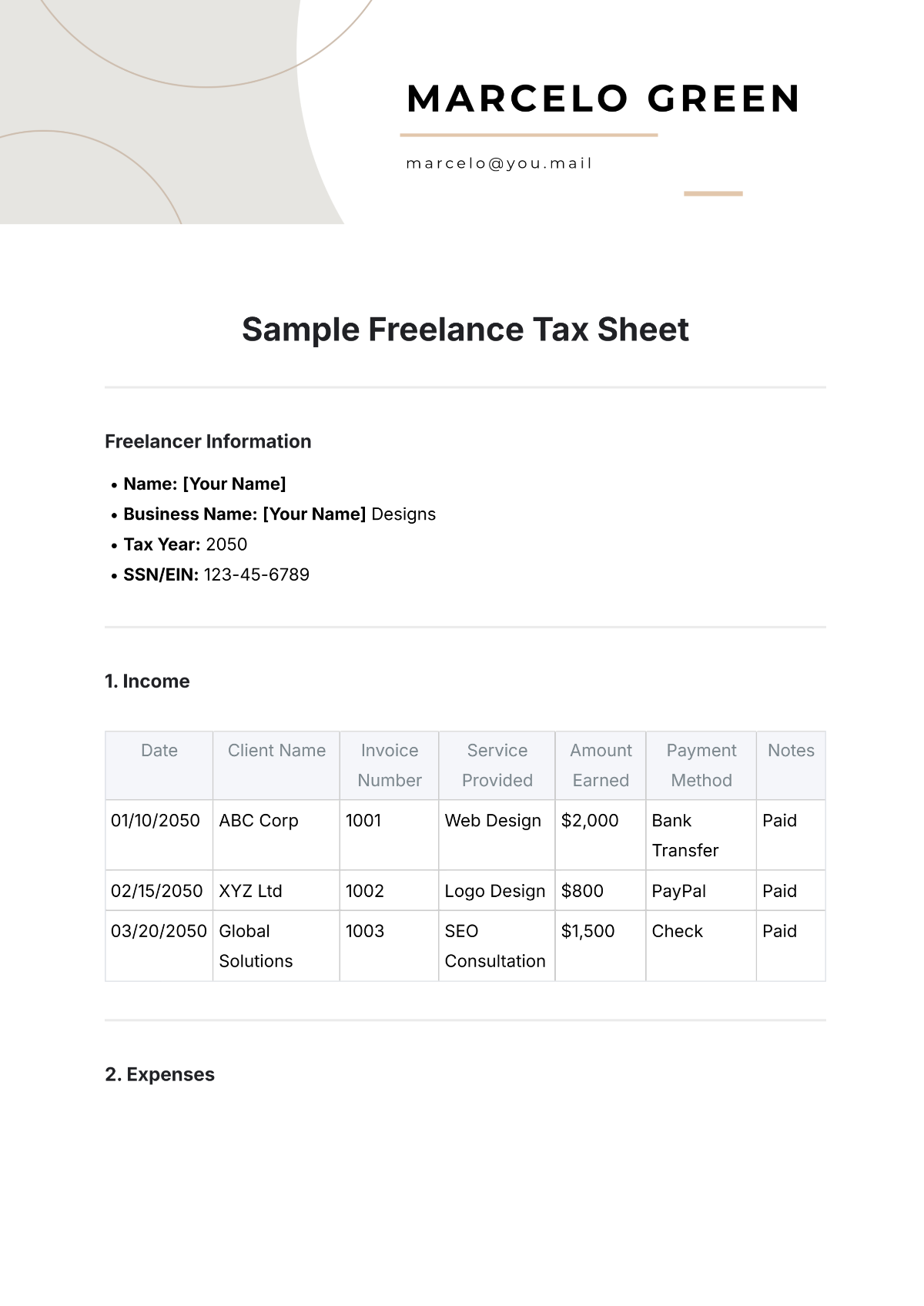

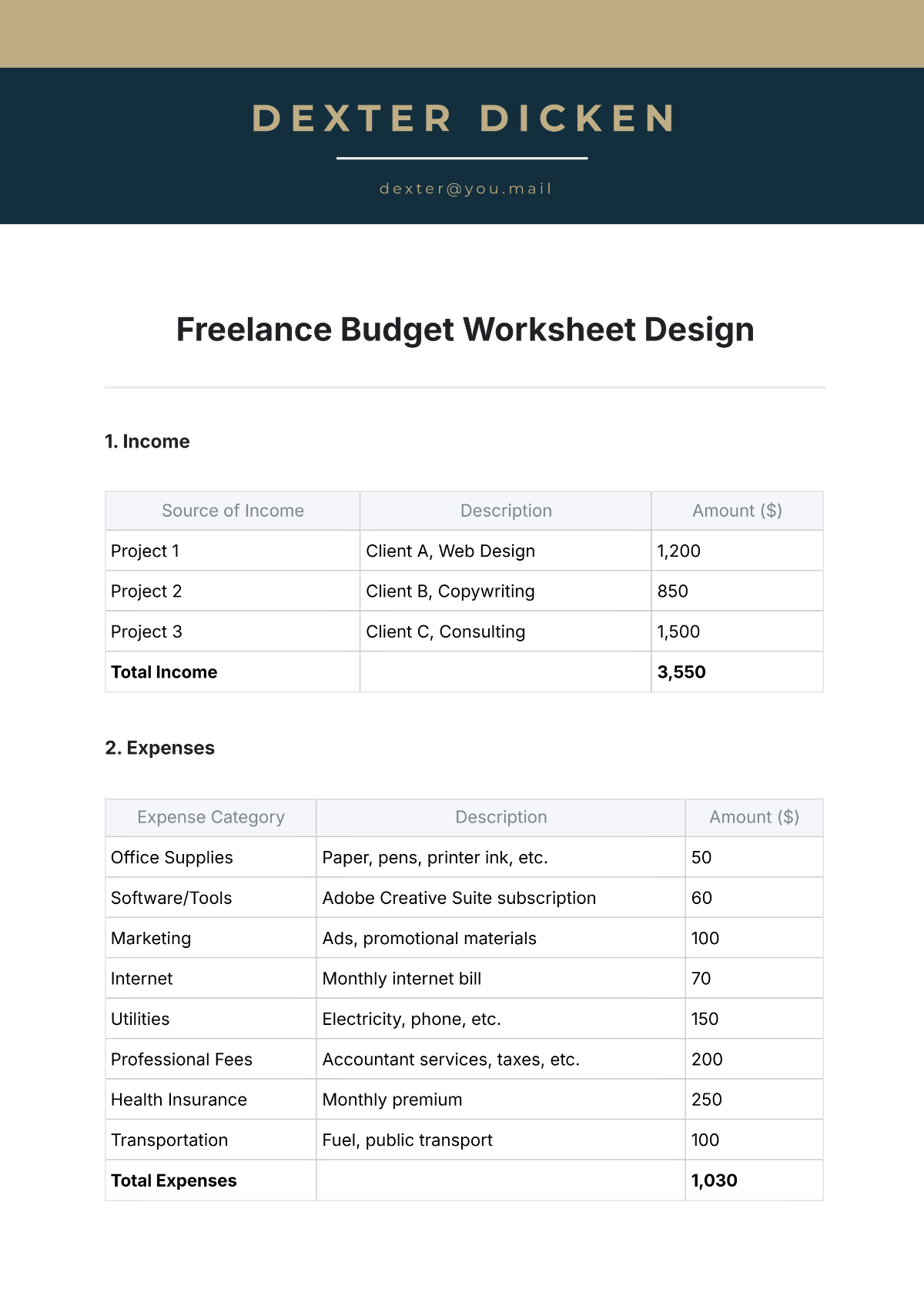

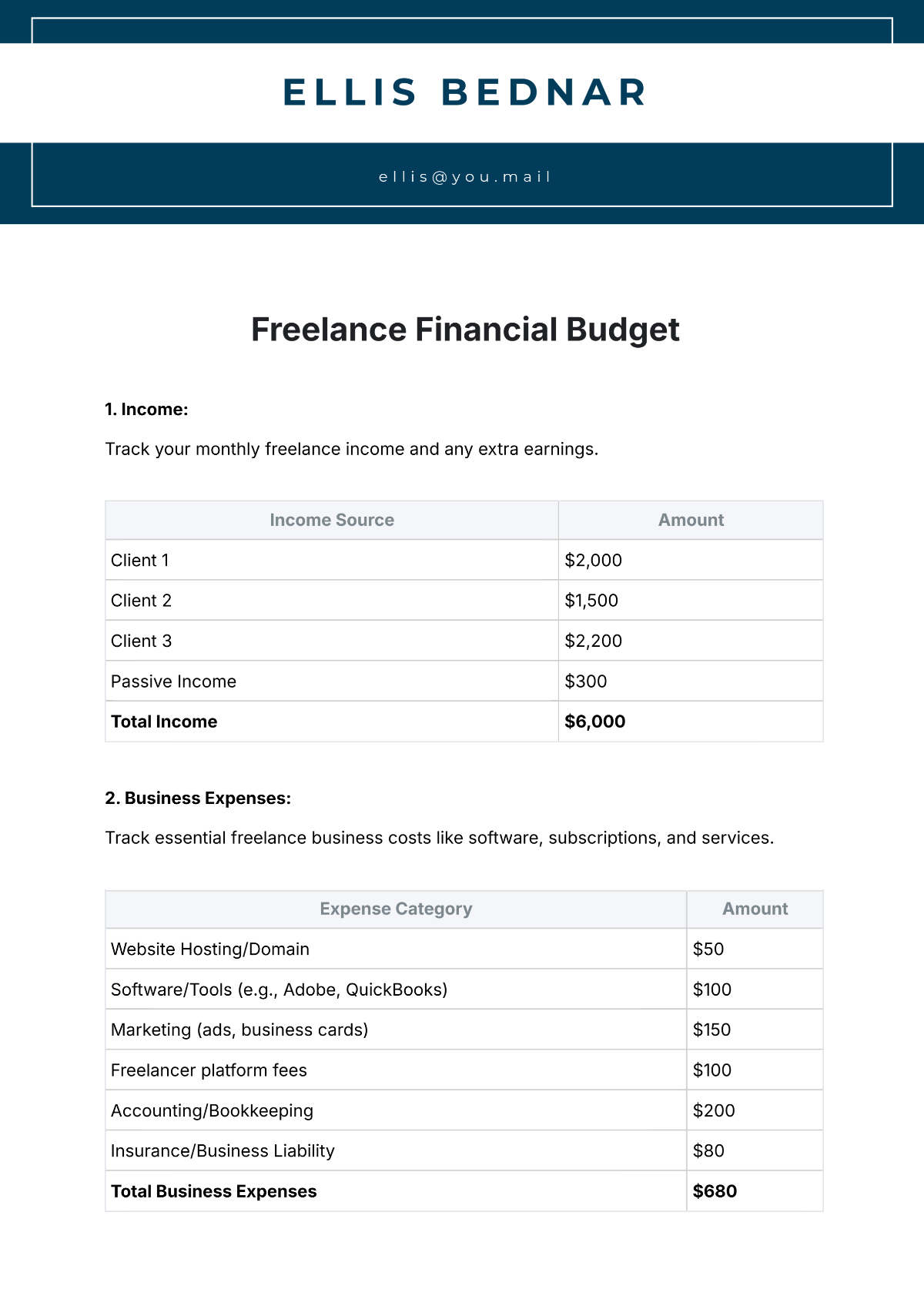

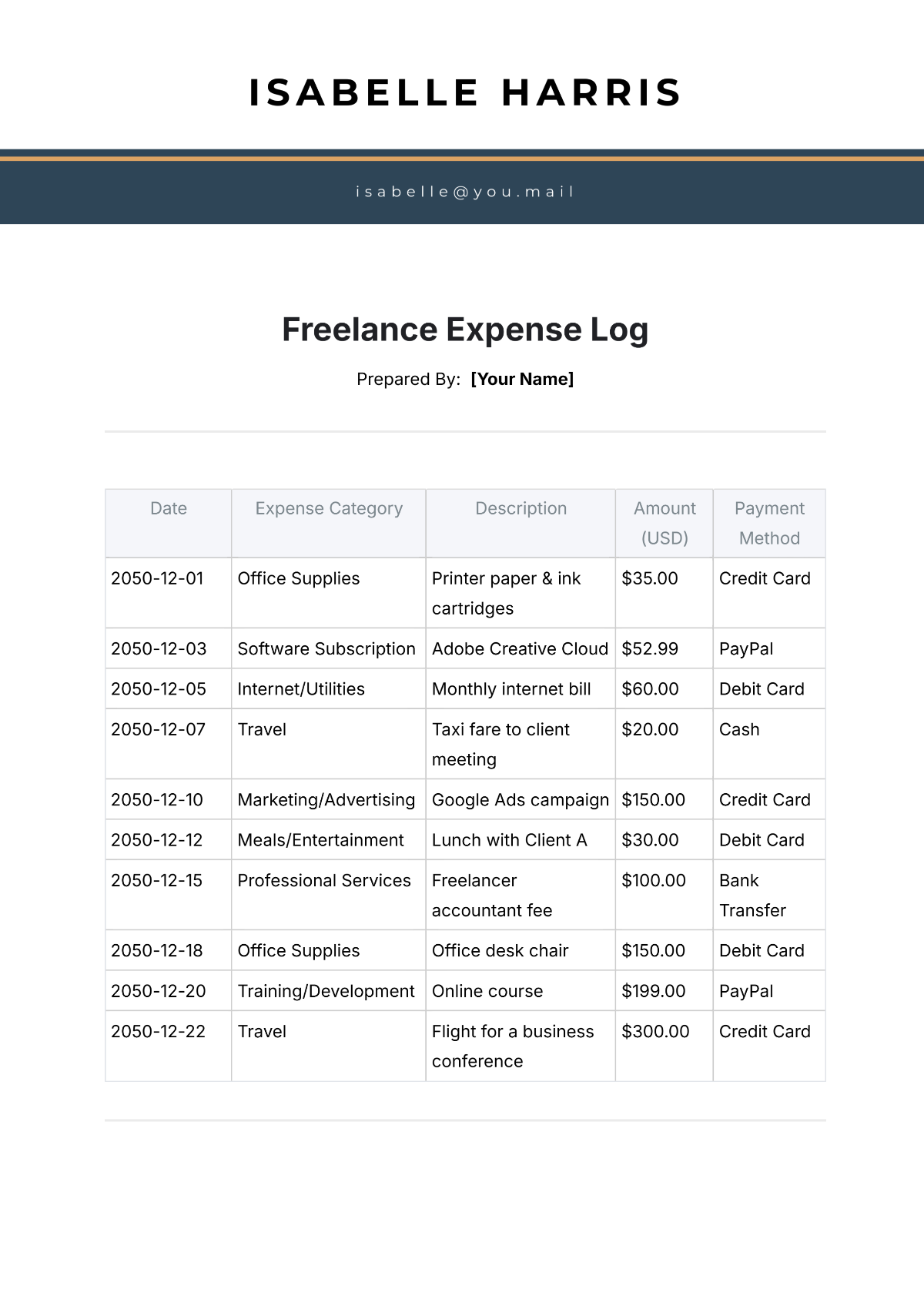

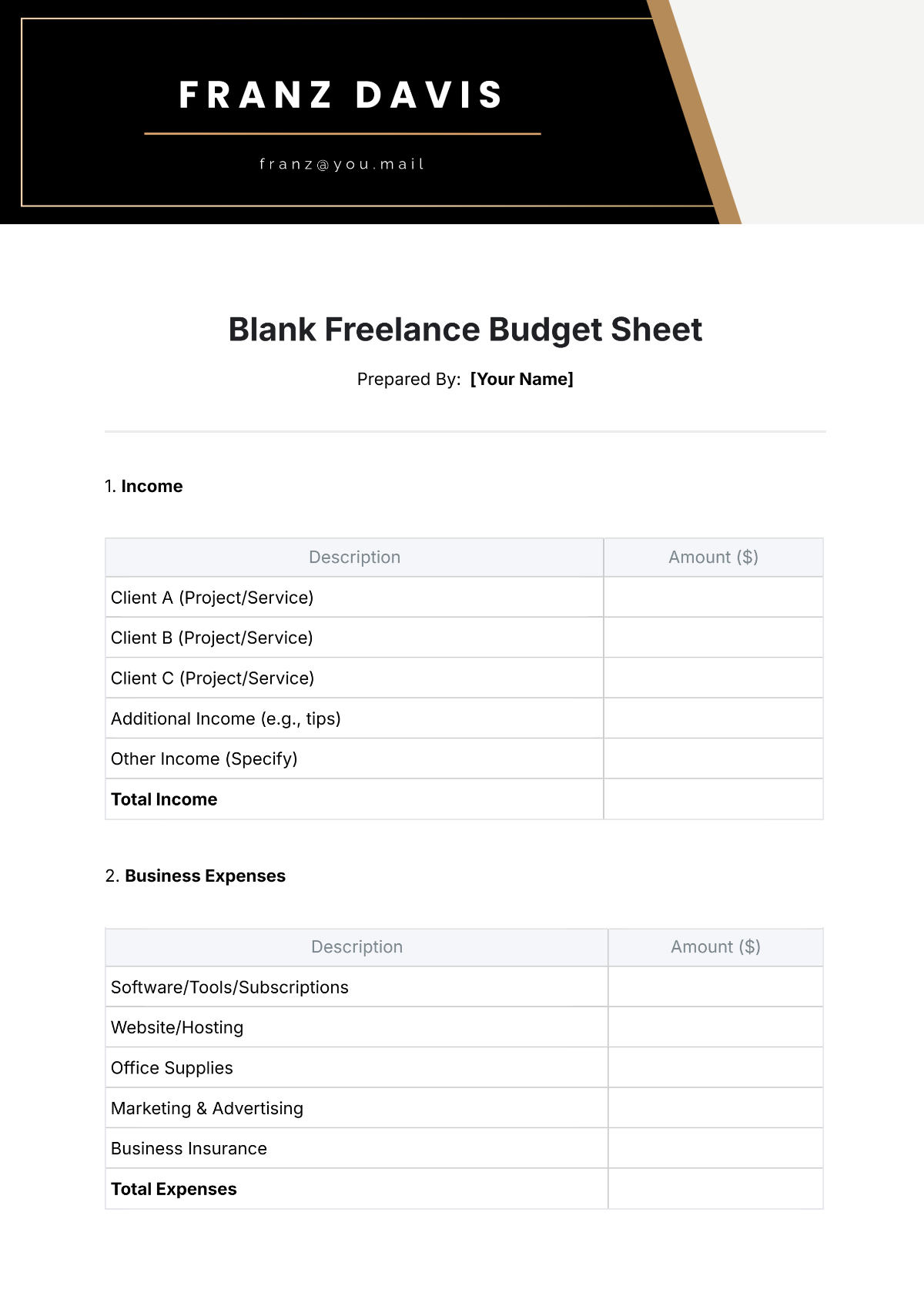

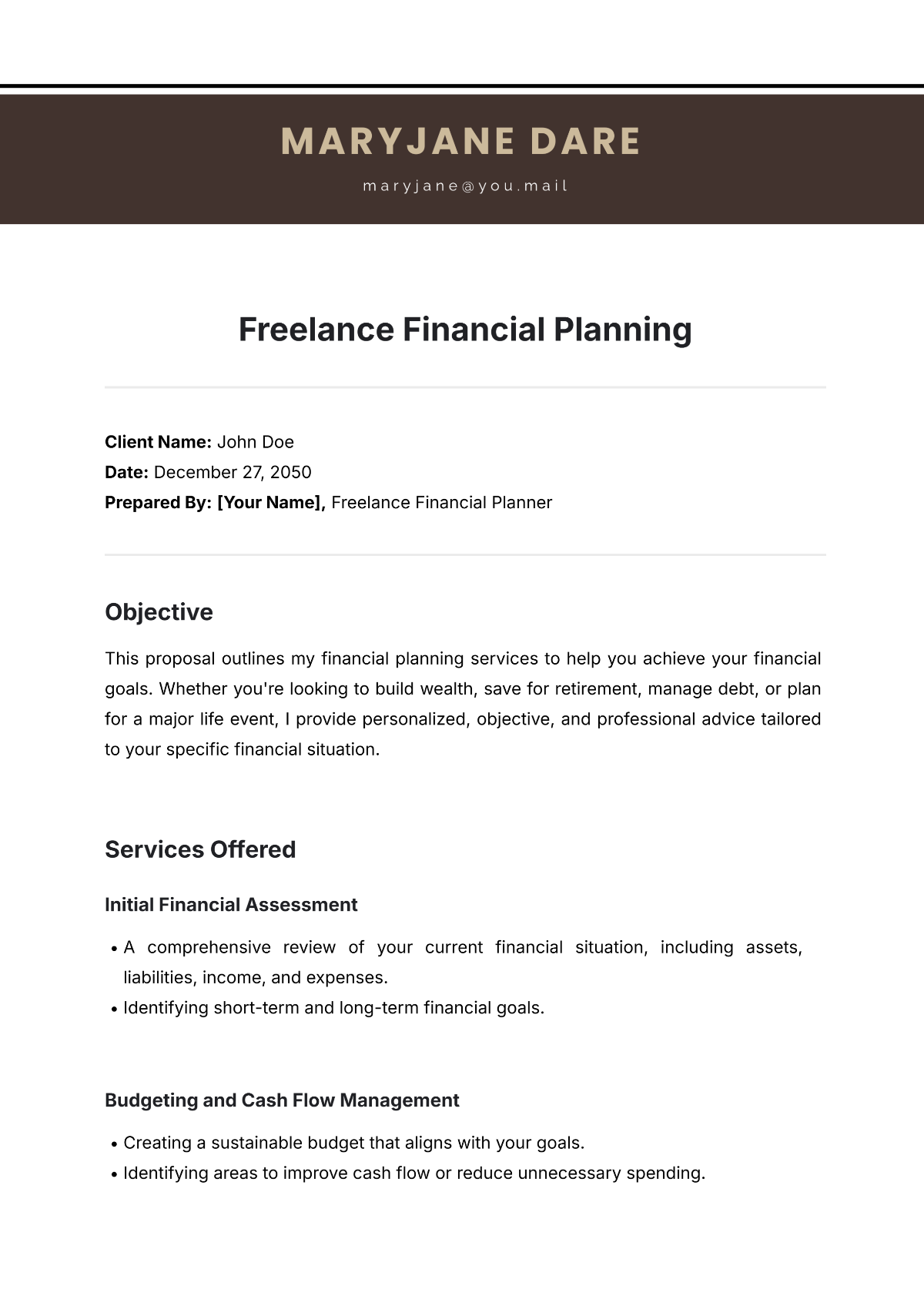

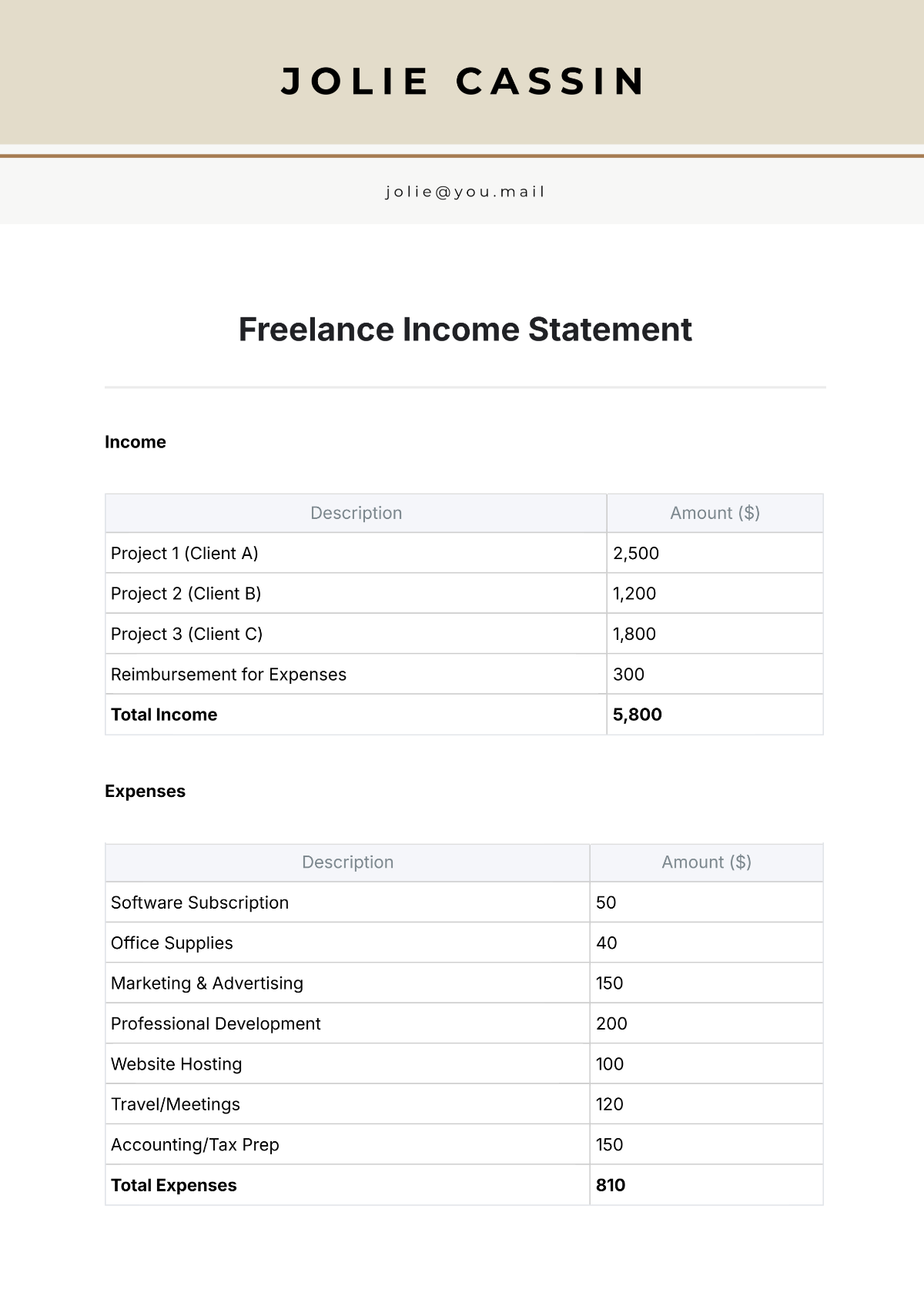

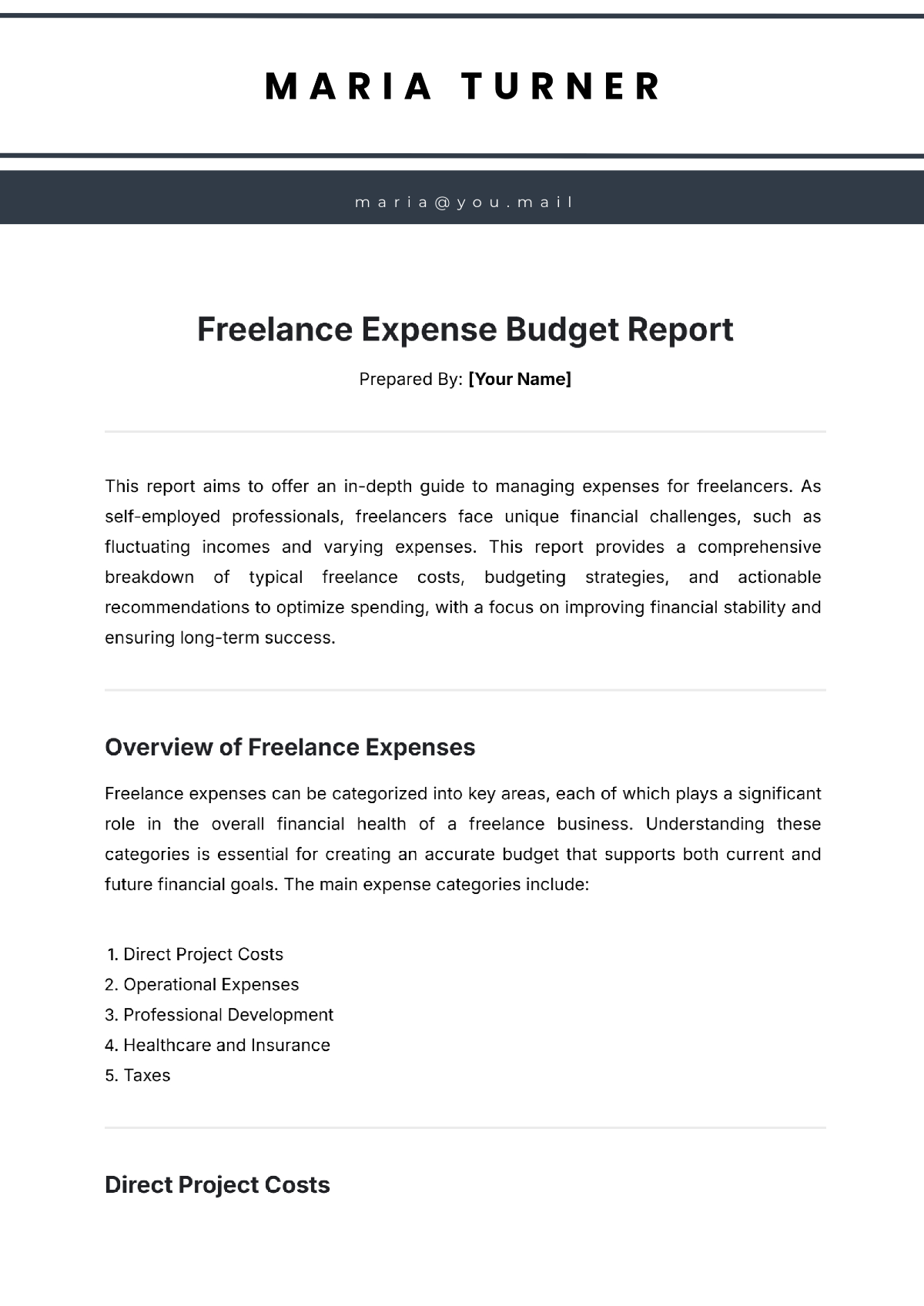

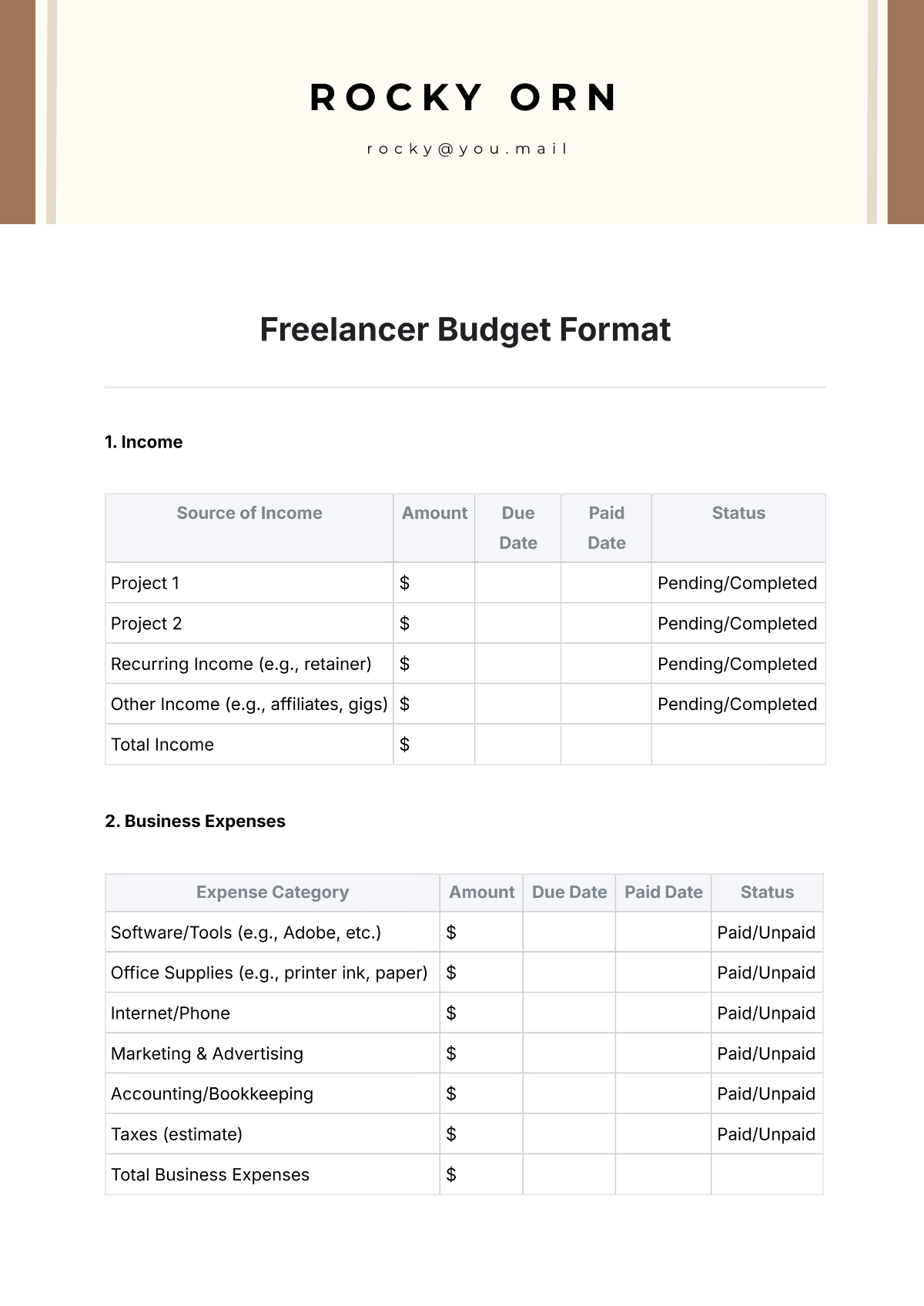

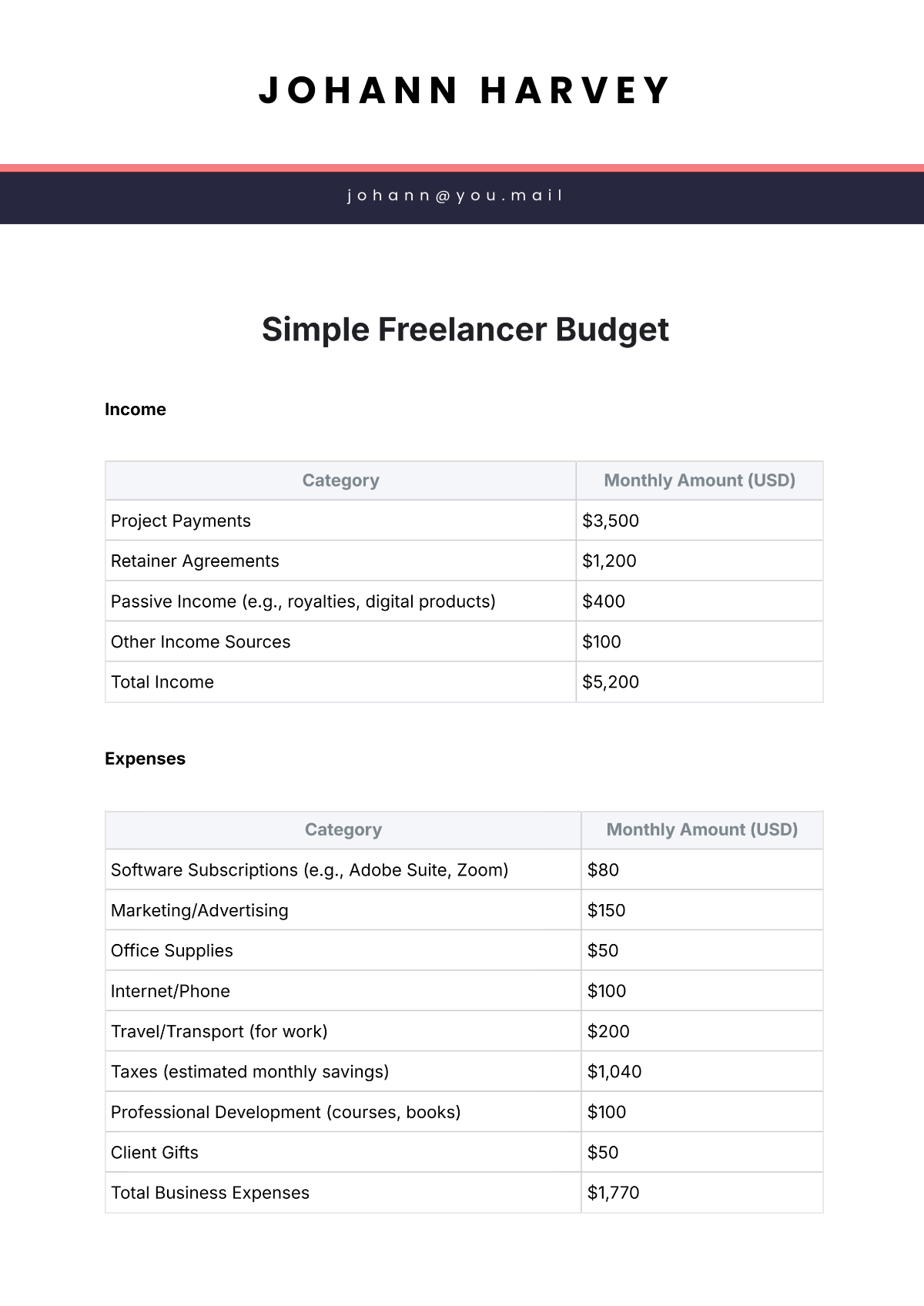

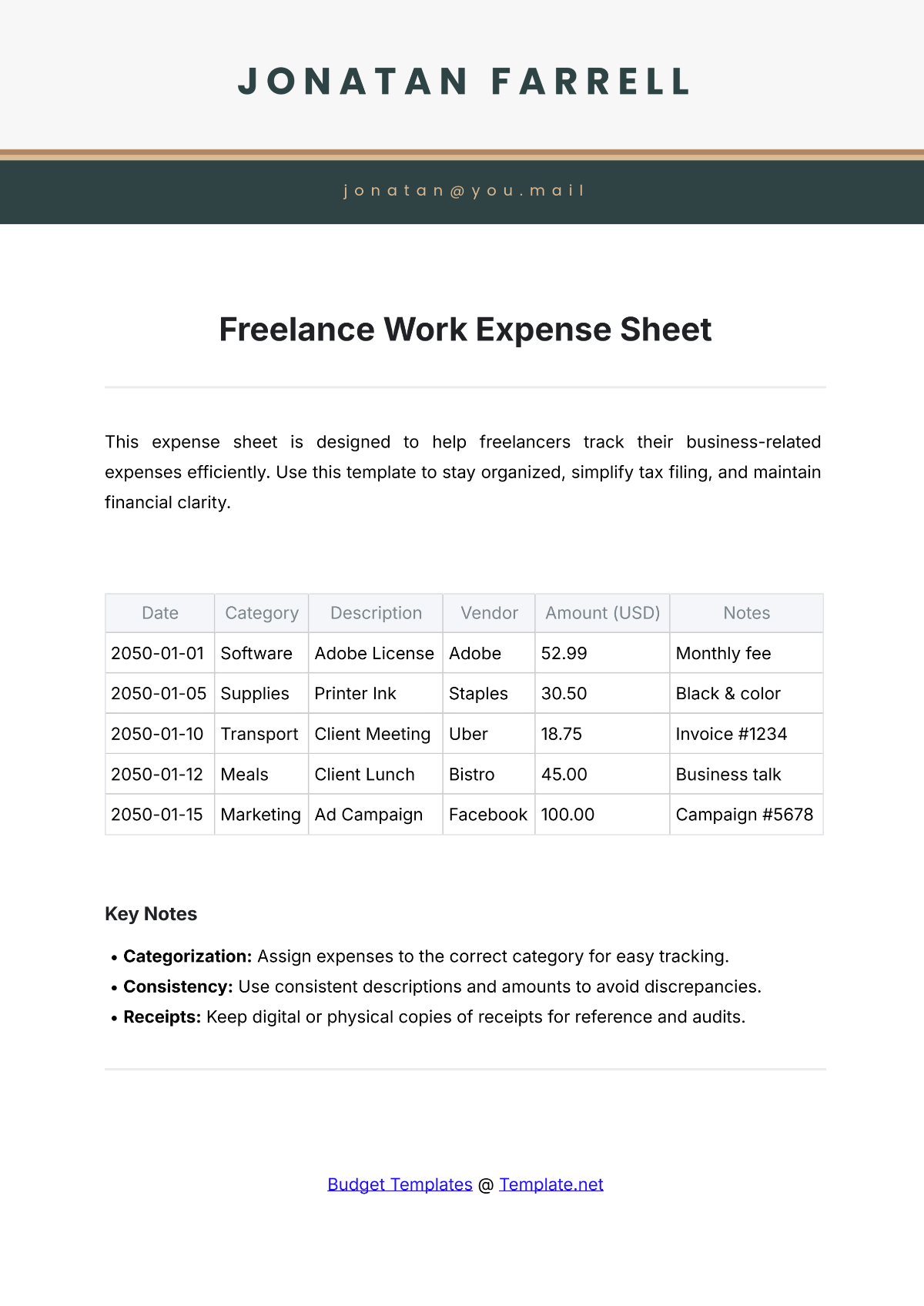

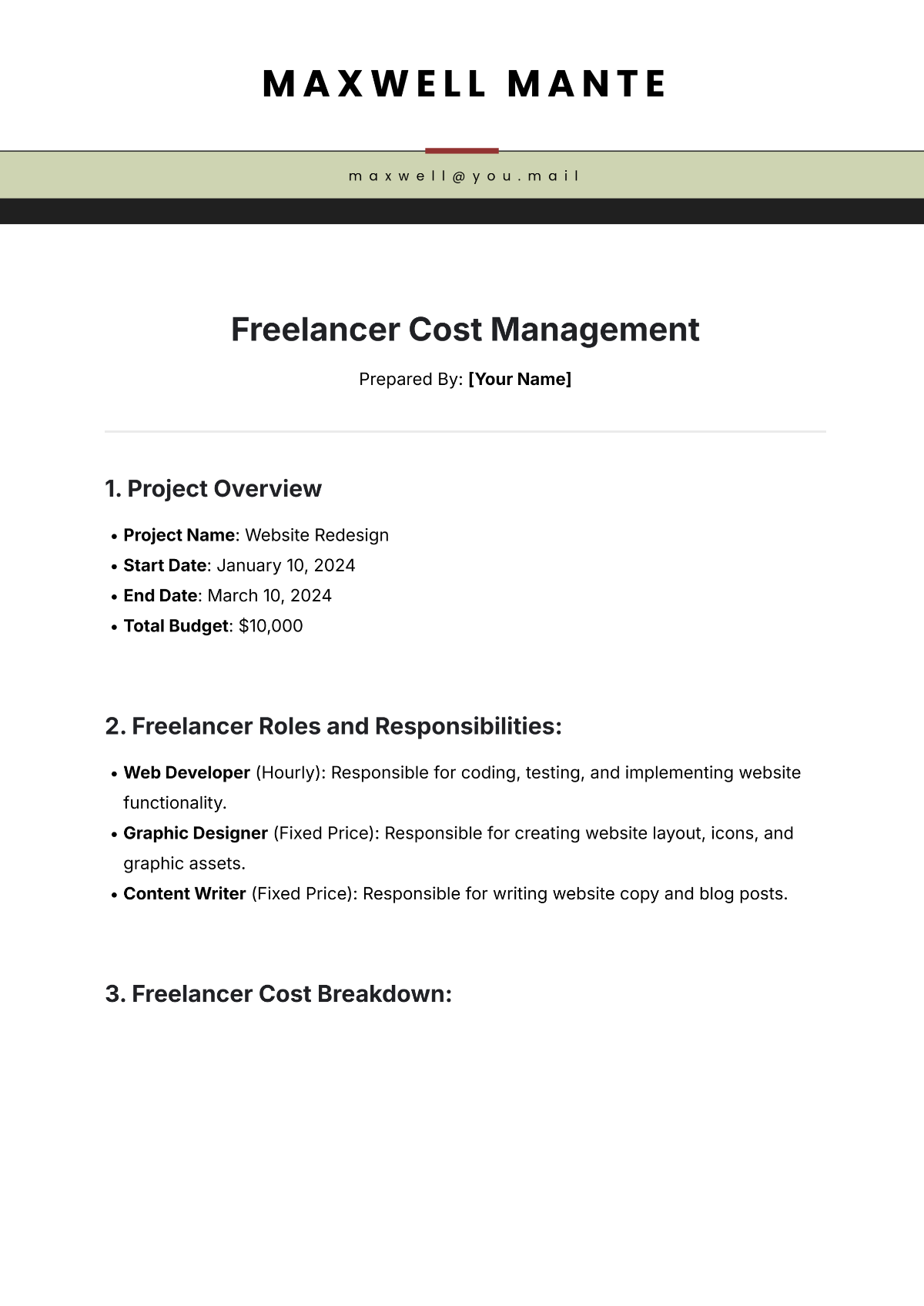

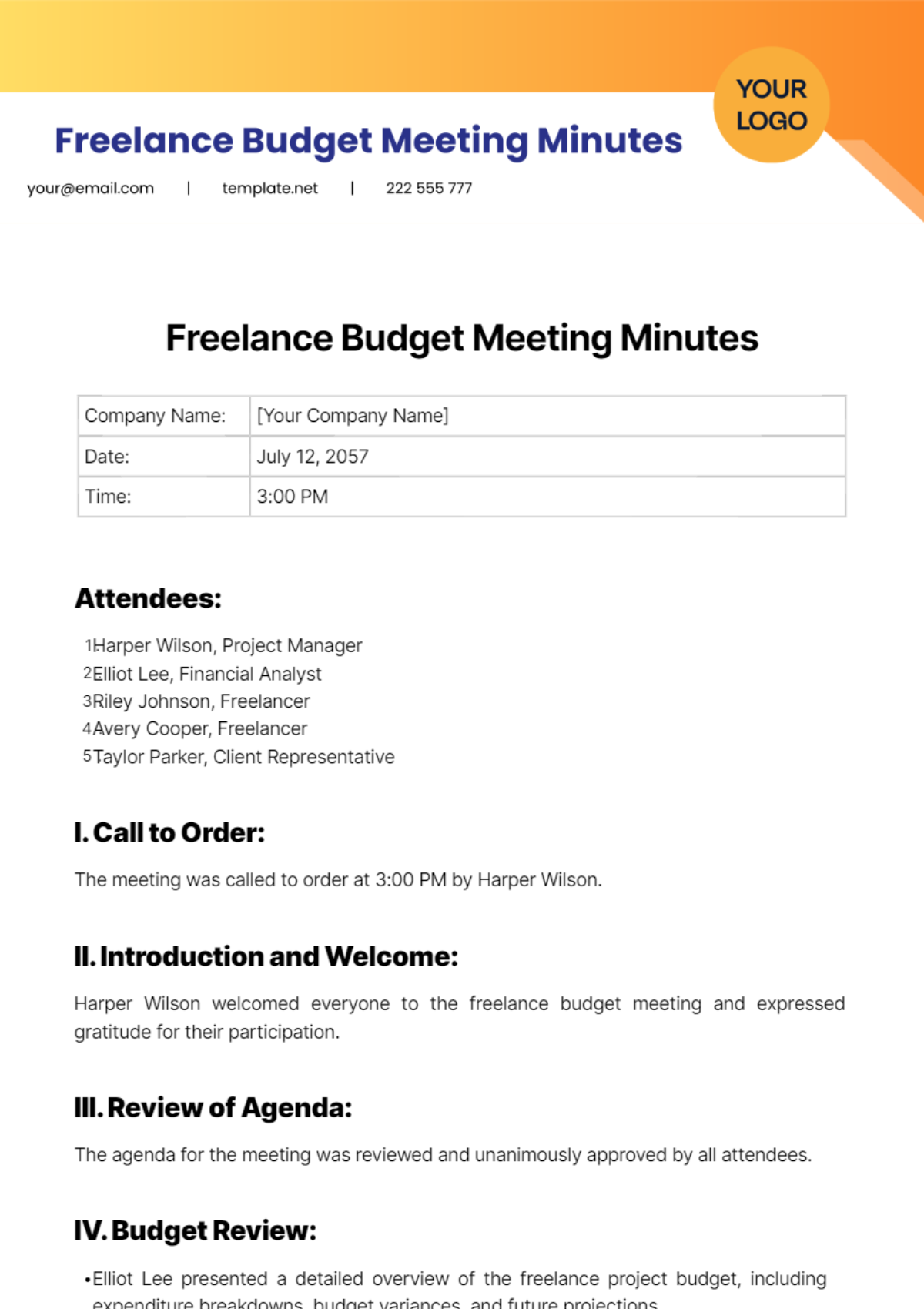

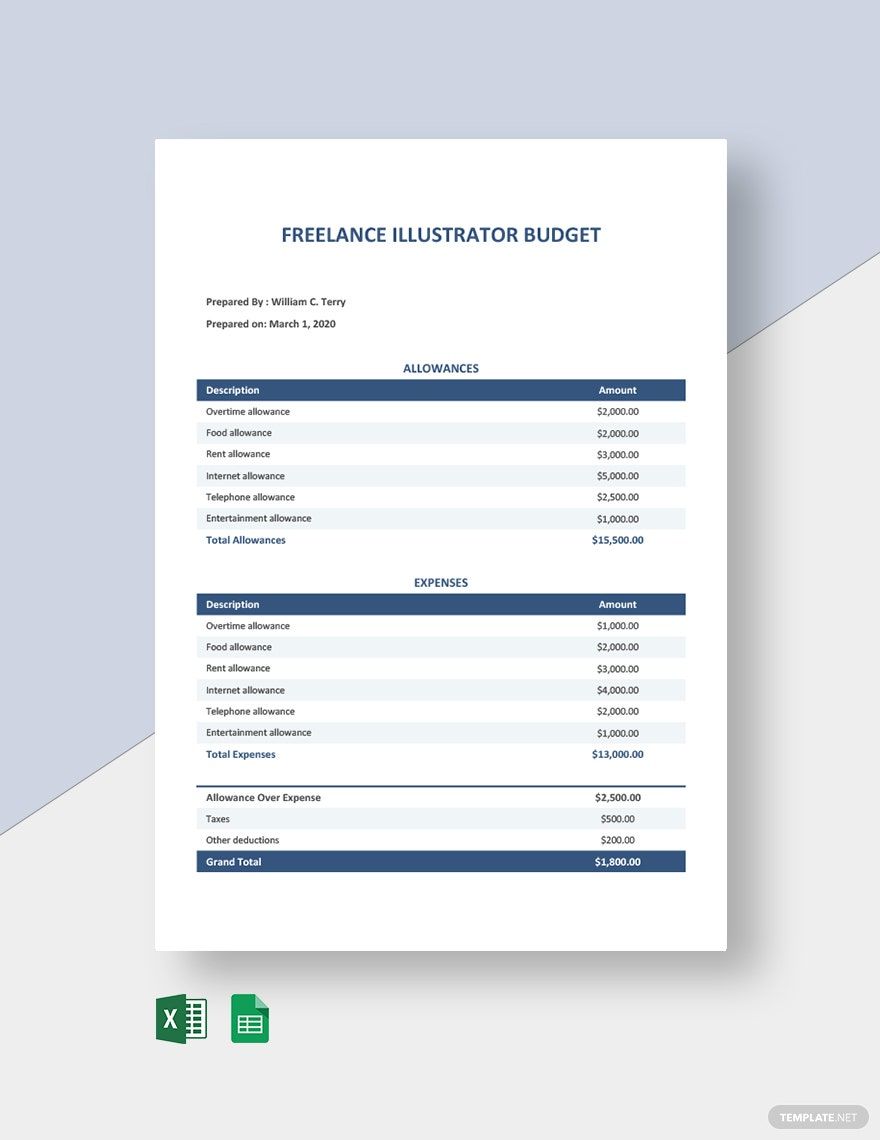

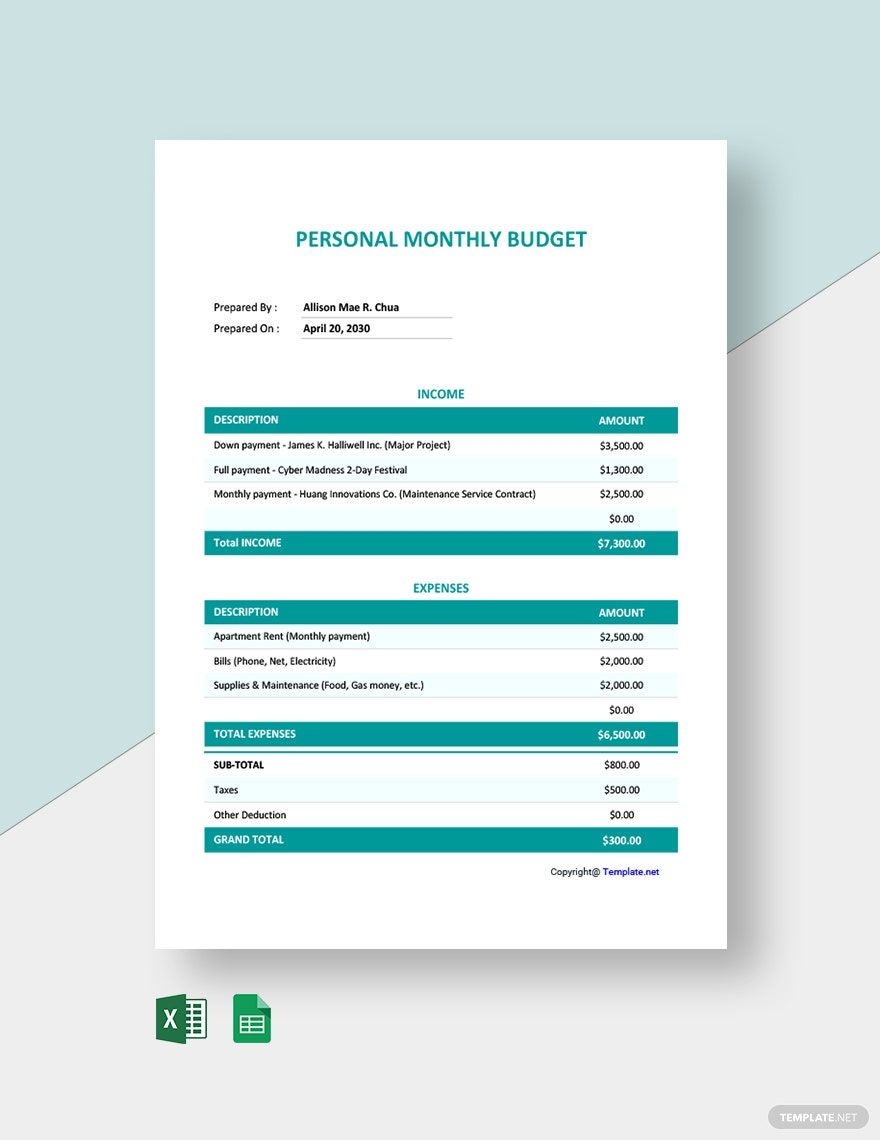

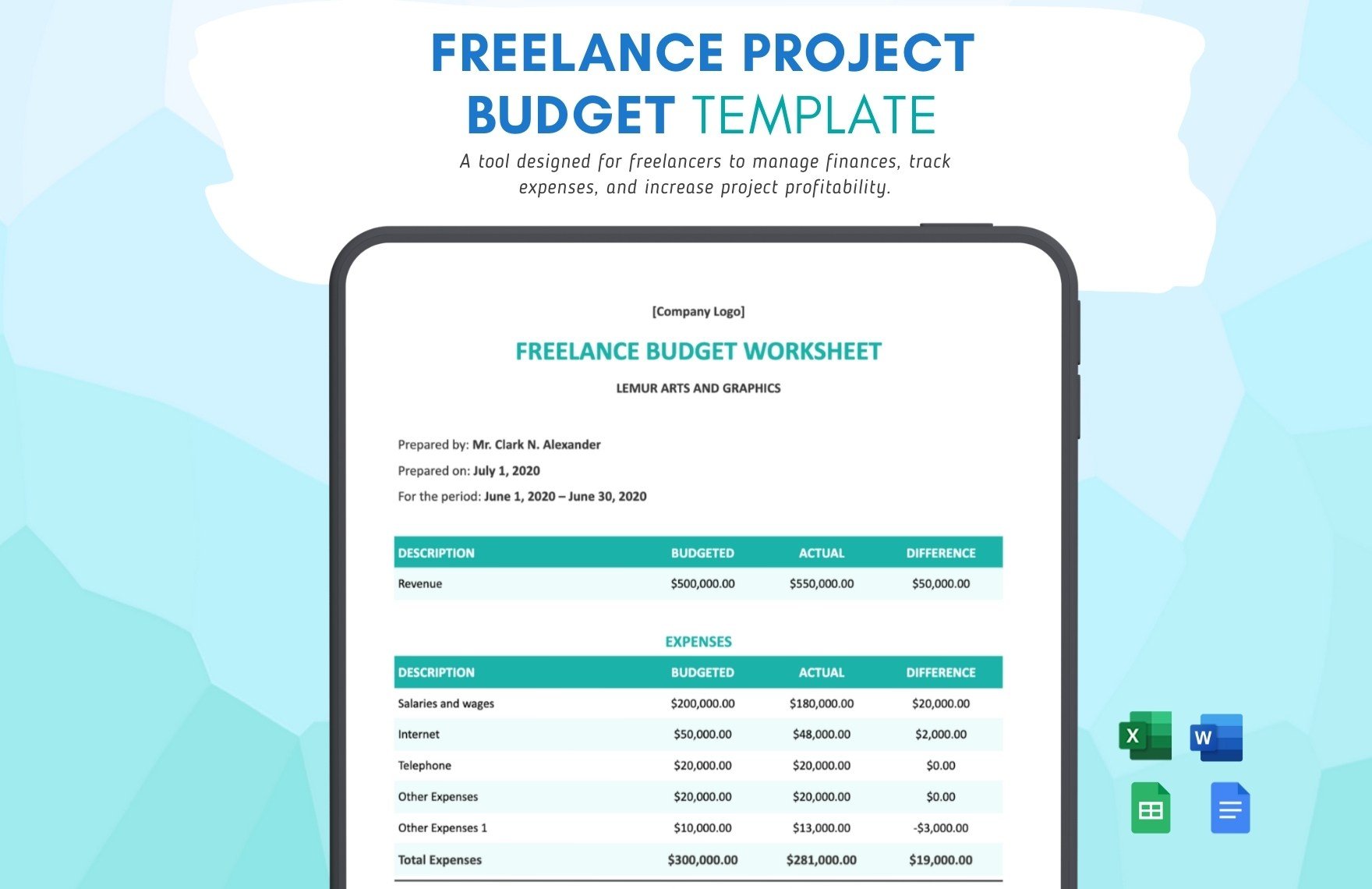

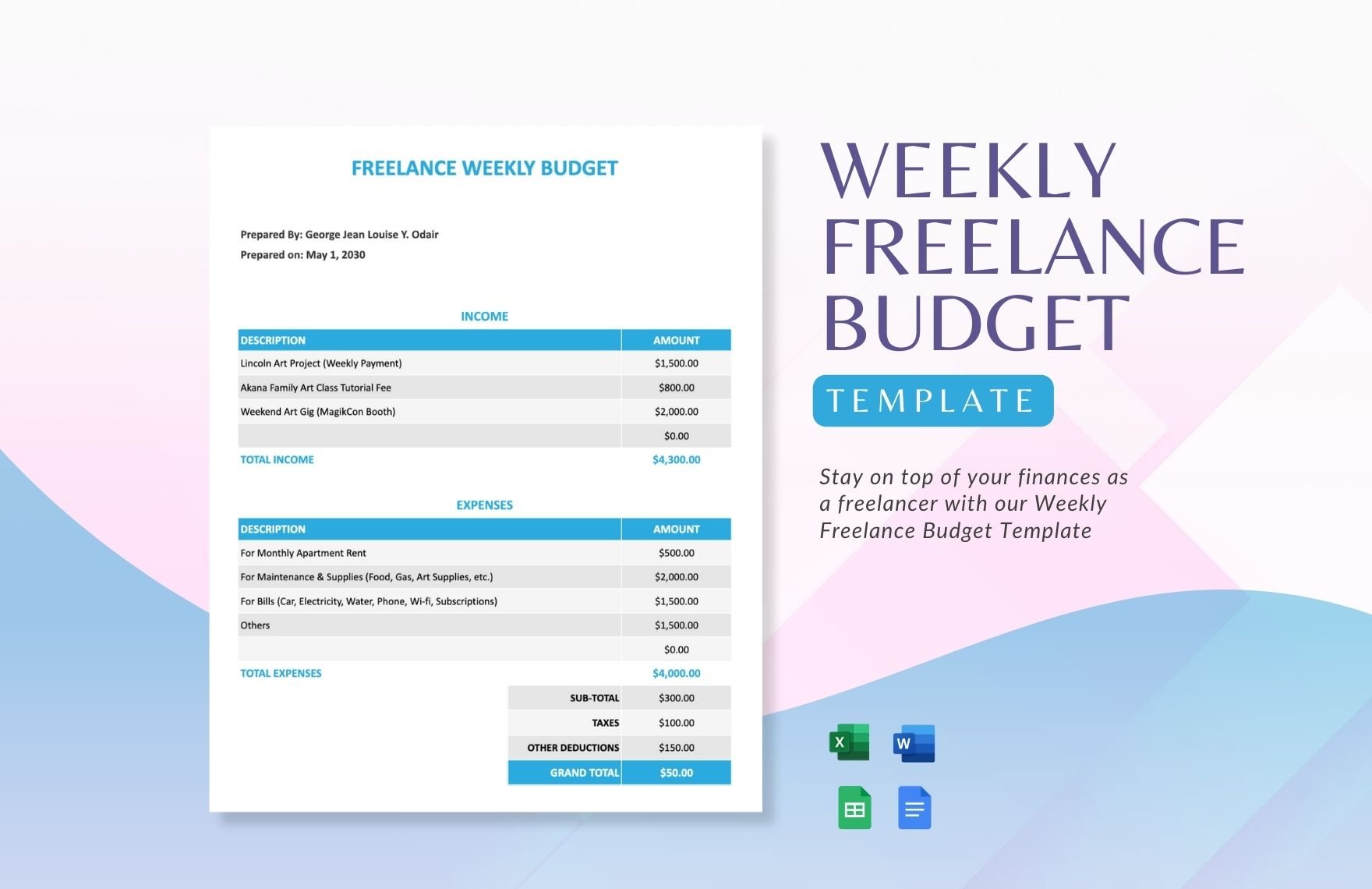

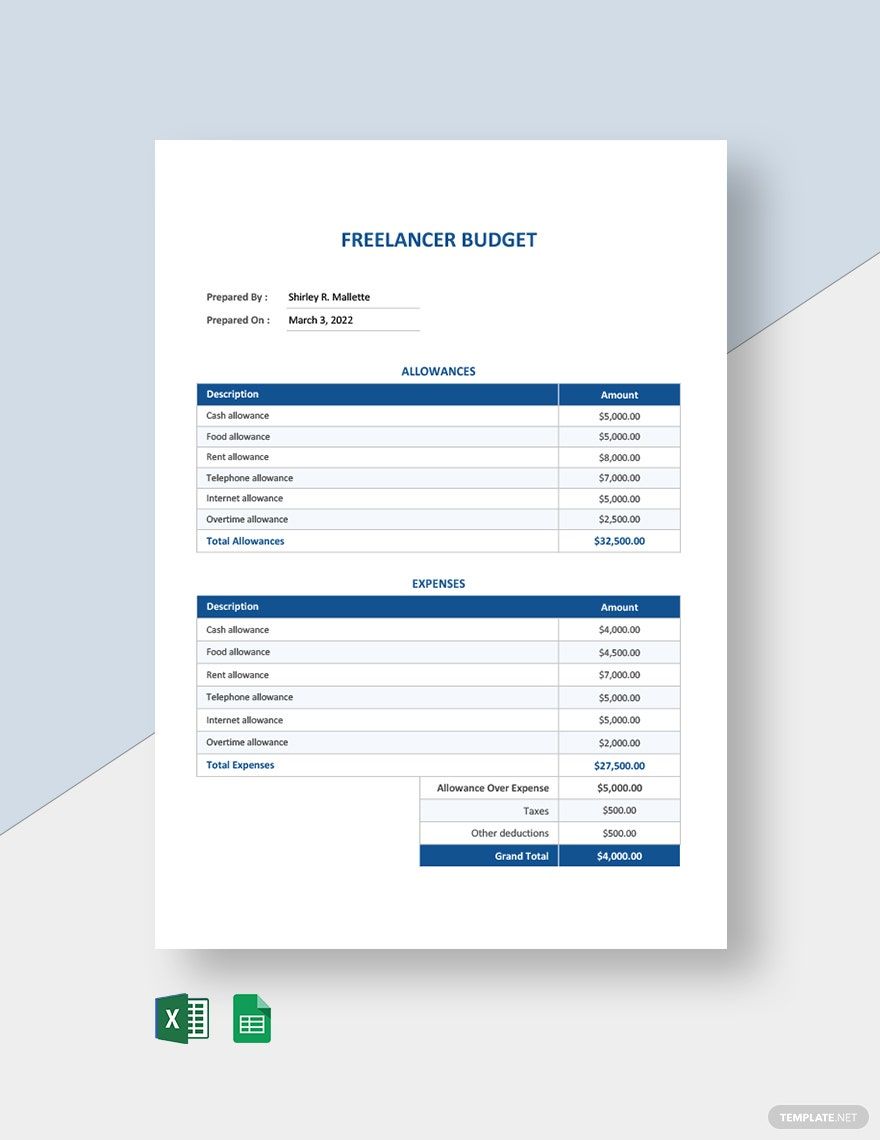

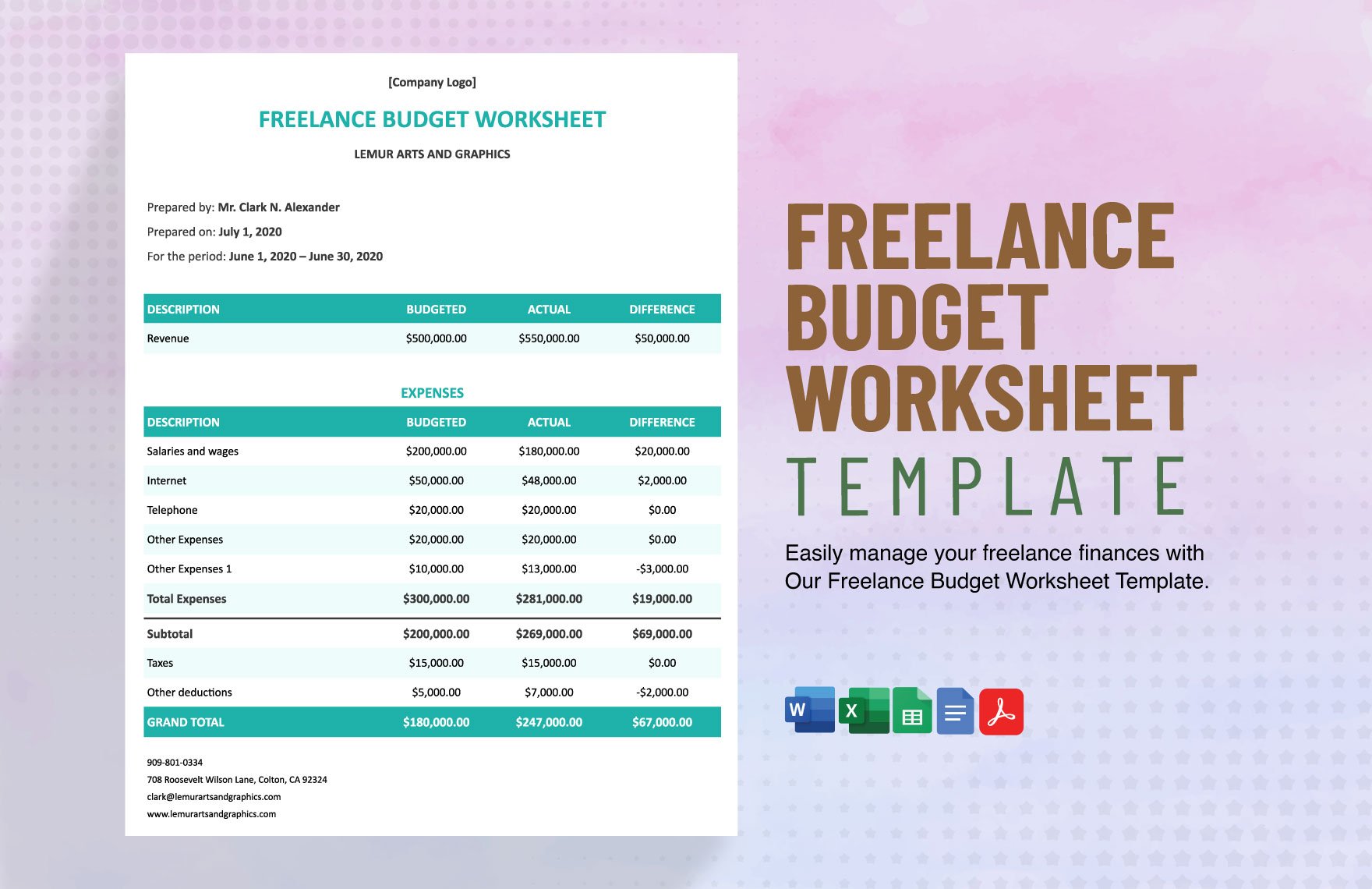

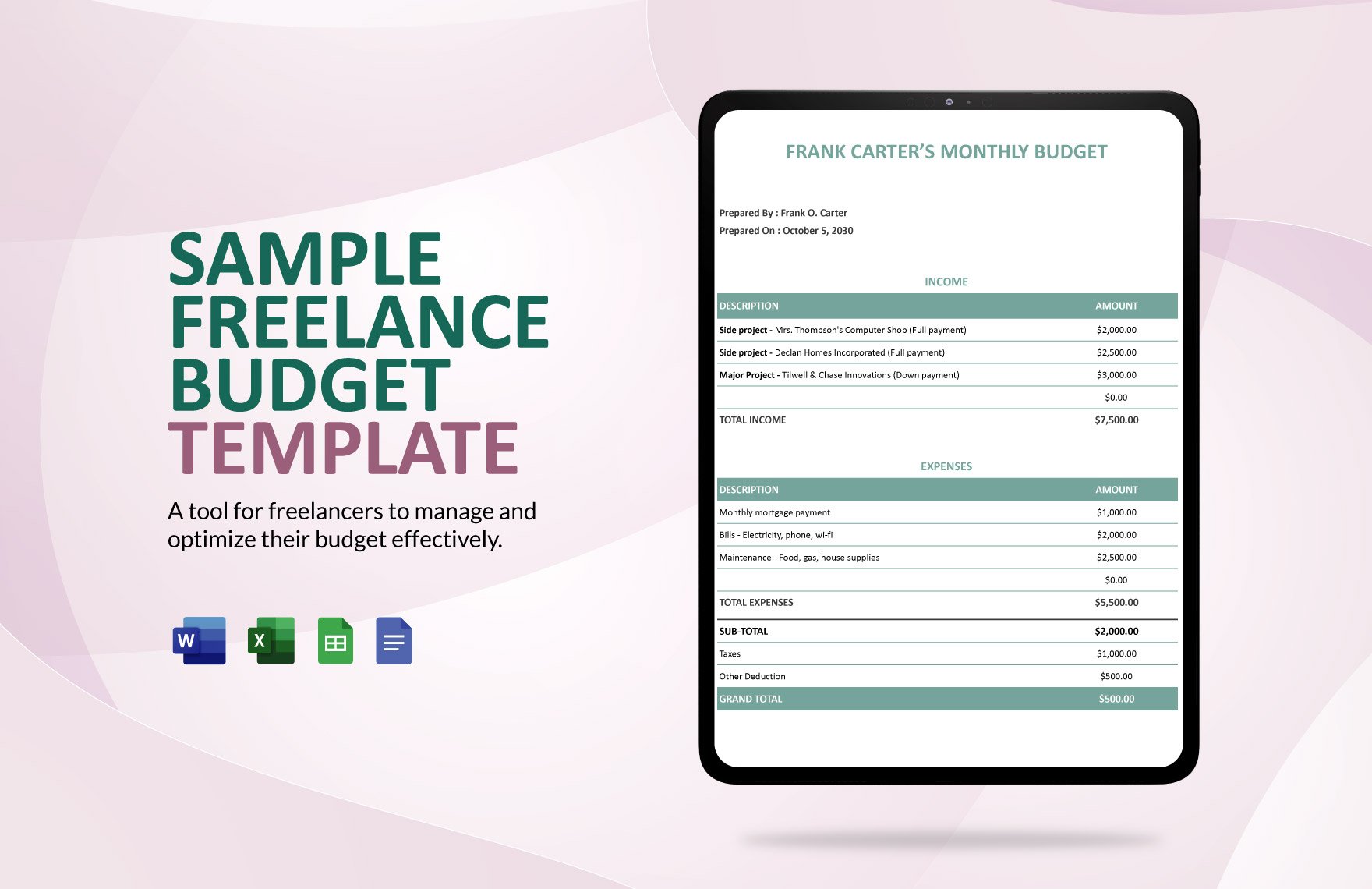

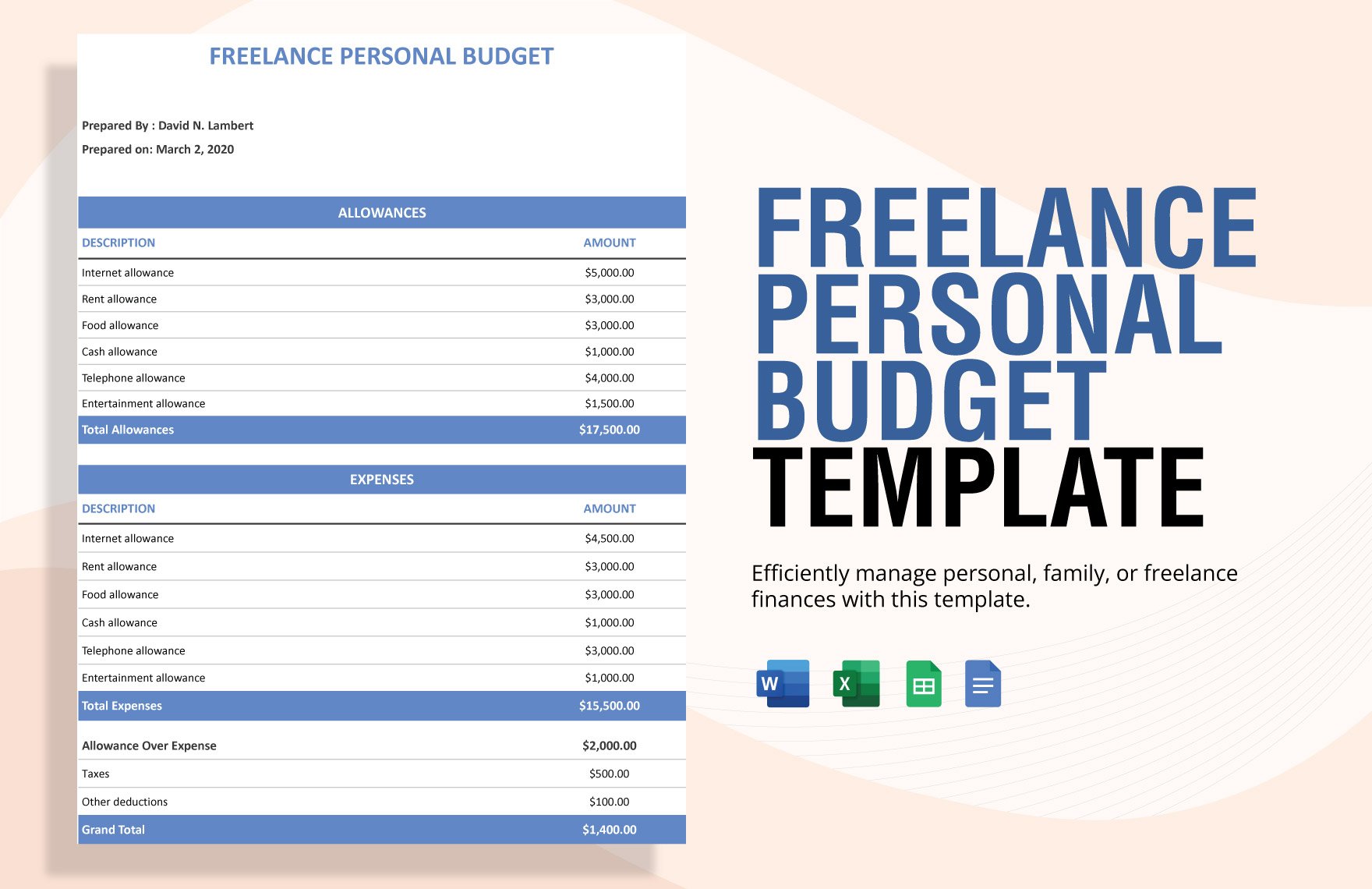

Bring your financial management to life with Freelancer Budget Templates from Template.net. These templates are perfect for freelancers who want to keep their finances organized, plan their monthly expenses, and ensure they are meeting their savings goals. Whether you’re looking to quickly layout your upcoming project budgets or track your freelance earnings and expenses, our templates have got you covered. Include all the essential details like project names, due dates, amounts, and client contact info without the hassle. Our templates feature professional-grade design with no advanced accounting skills required, making them accessible and easy to use for everyone. They offer customizable layouts that can easily be adapted for both print and digital formats, ensuring you have the flexibility you need.

Discover the many budget templates we have on hand to streamline your freelance business. Start by selecting a template that suits your project, then simply swap in your financial data, and tweak colors and fonts to match your branding. Add advanced touches by dragging and dropping graphics to highlight key areas, incorporating animated visual aids, or using AI-powered text tools to enhance readability. The possibilities are endless, allowing you to enjoy the creative process without any technical barriers. With regularly updated templates, you’ll always have fresh designs to choose from. When you’re finished, download or share your budget directly via email or export it for presentation. Our templates are ideal for multiple channels, and you can easily collaborate in real time to make sure your financial plans are seamless and professional.