Make Your Financial Planning Seamless with Household Budget Templates from Template.net

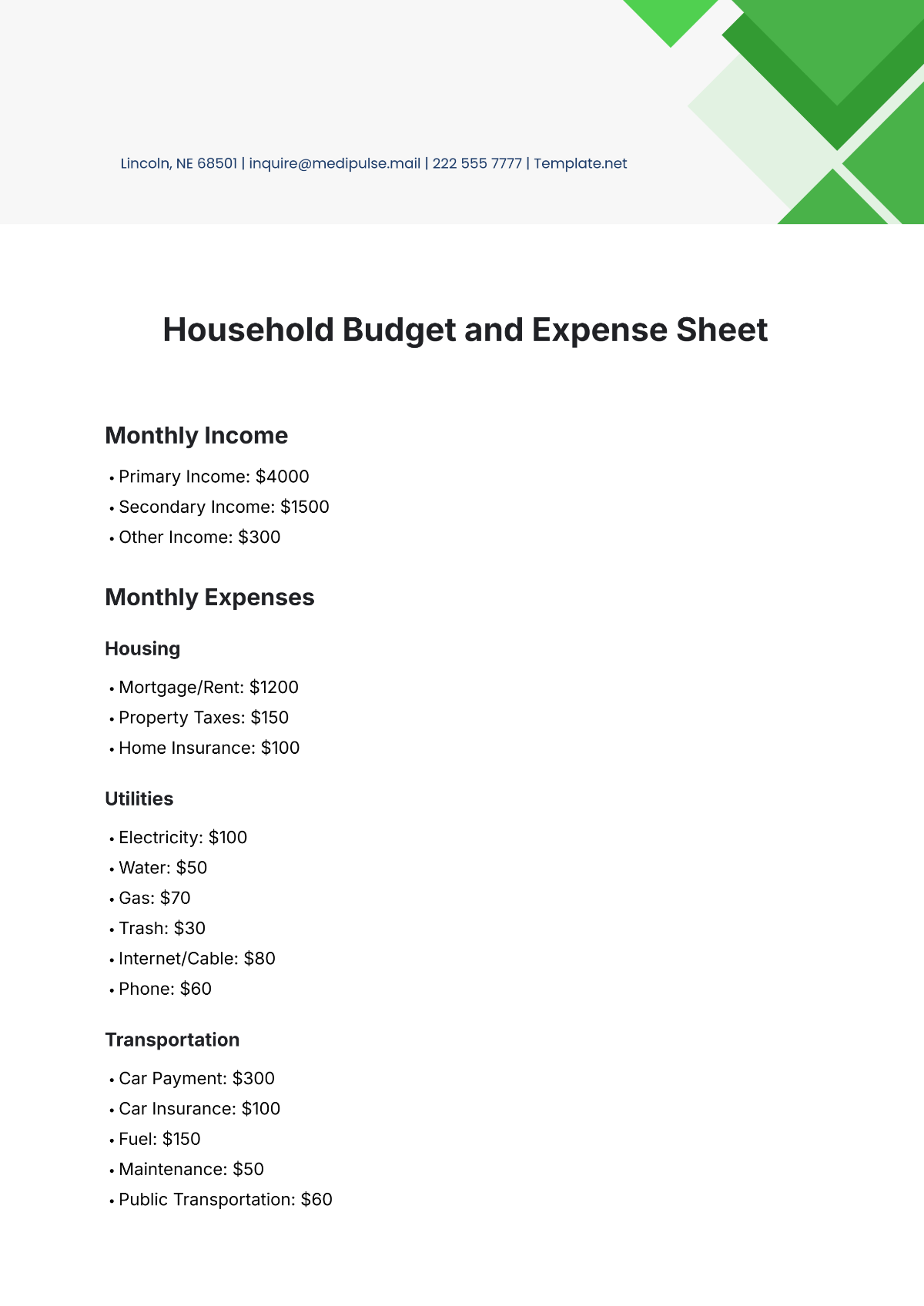

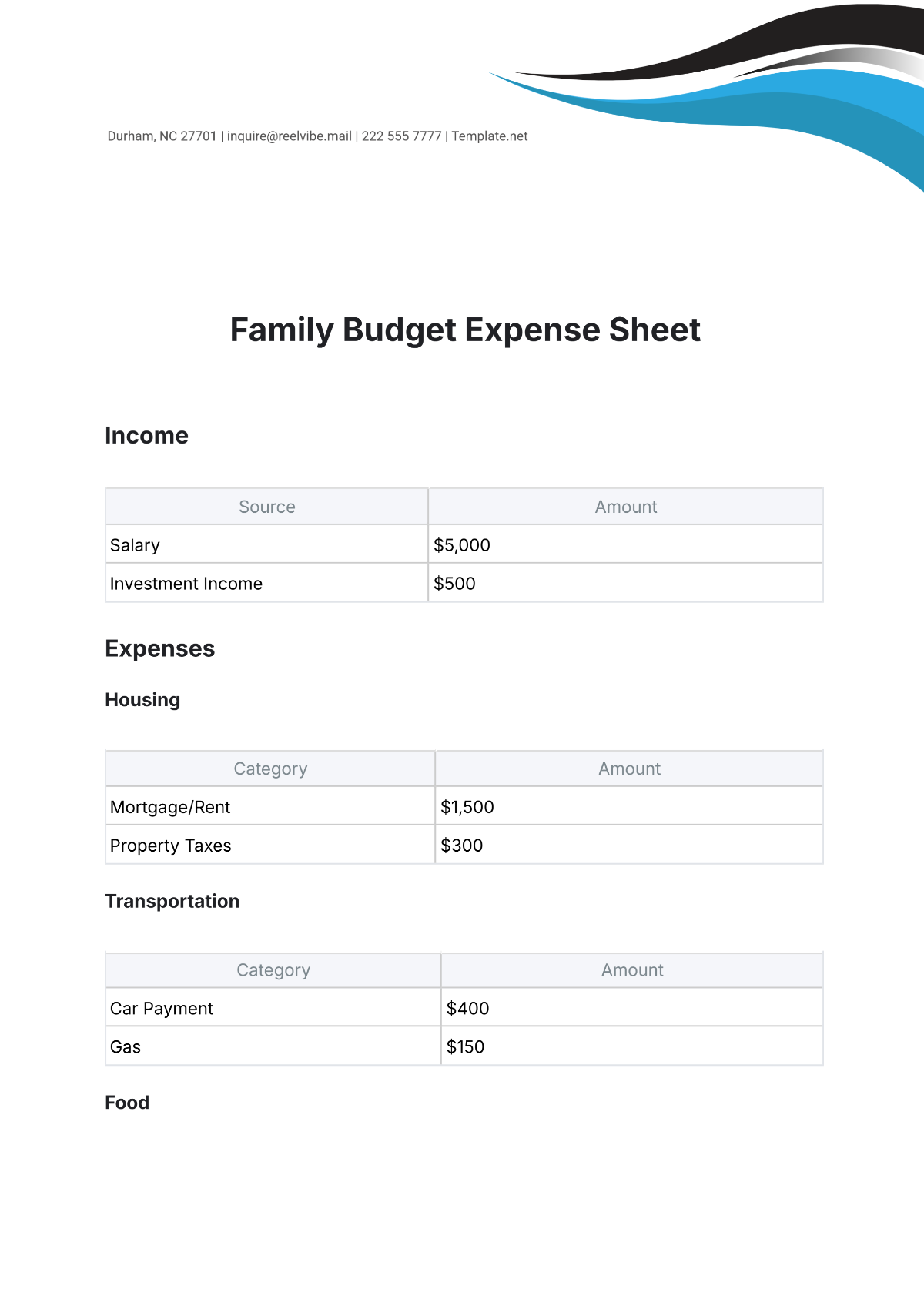

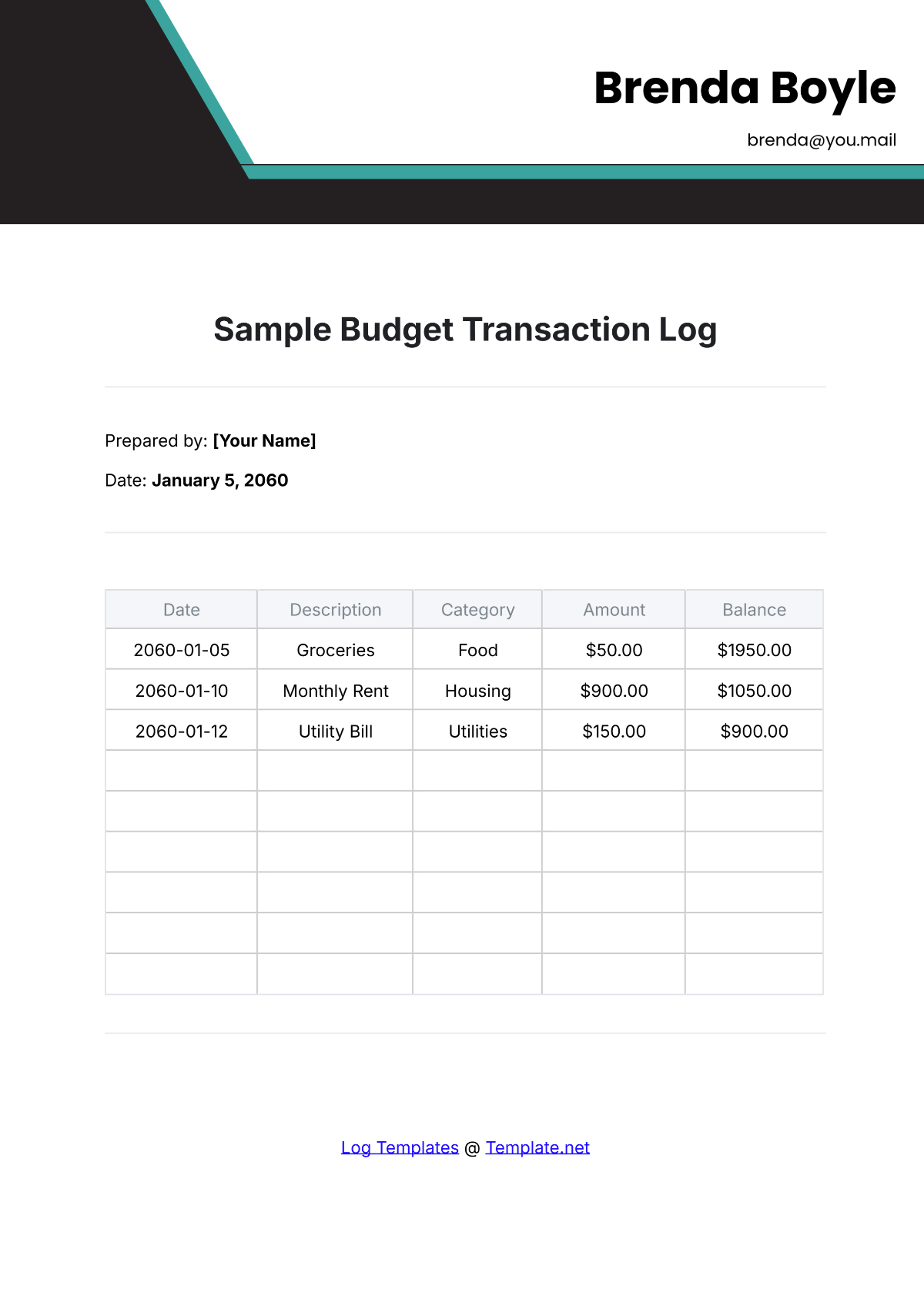

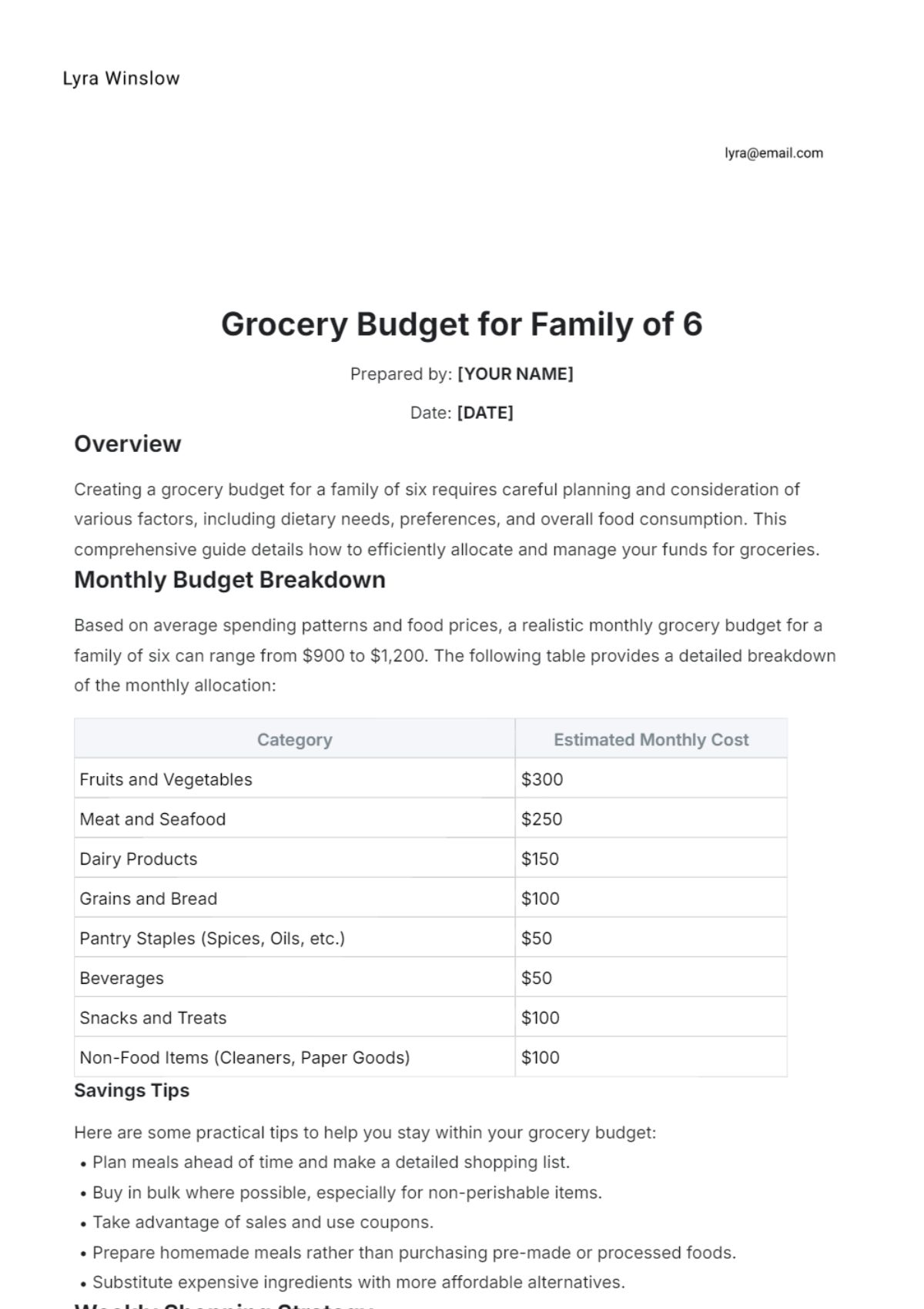

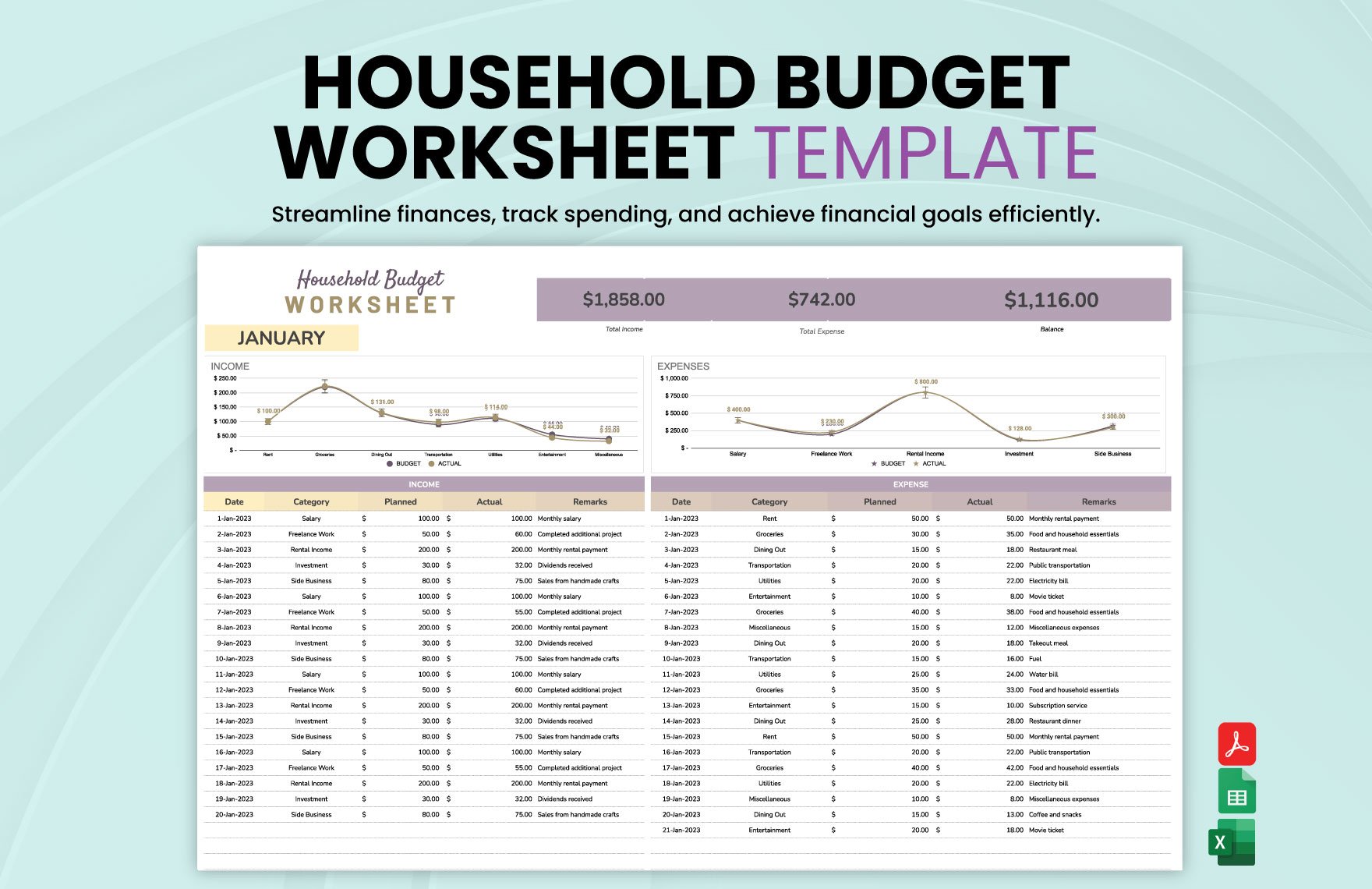

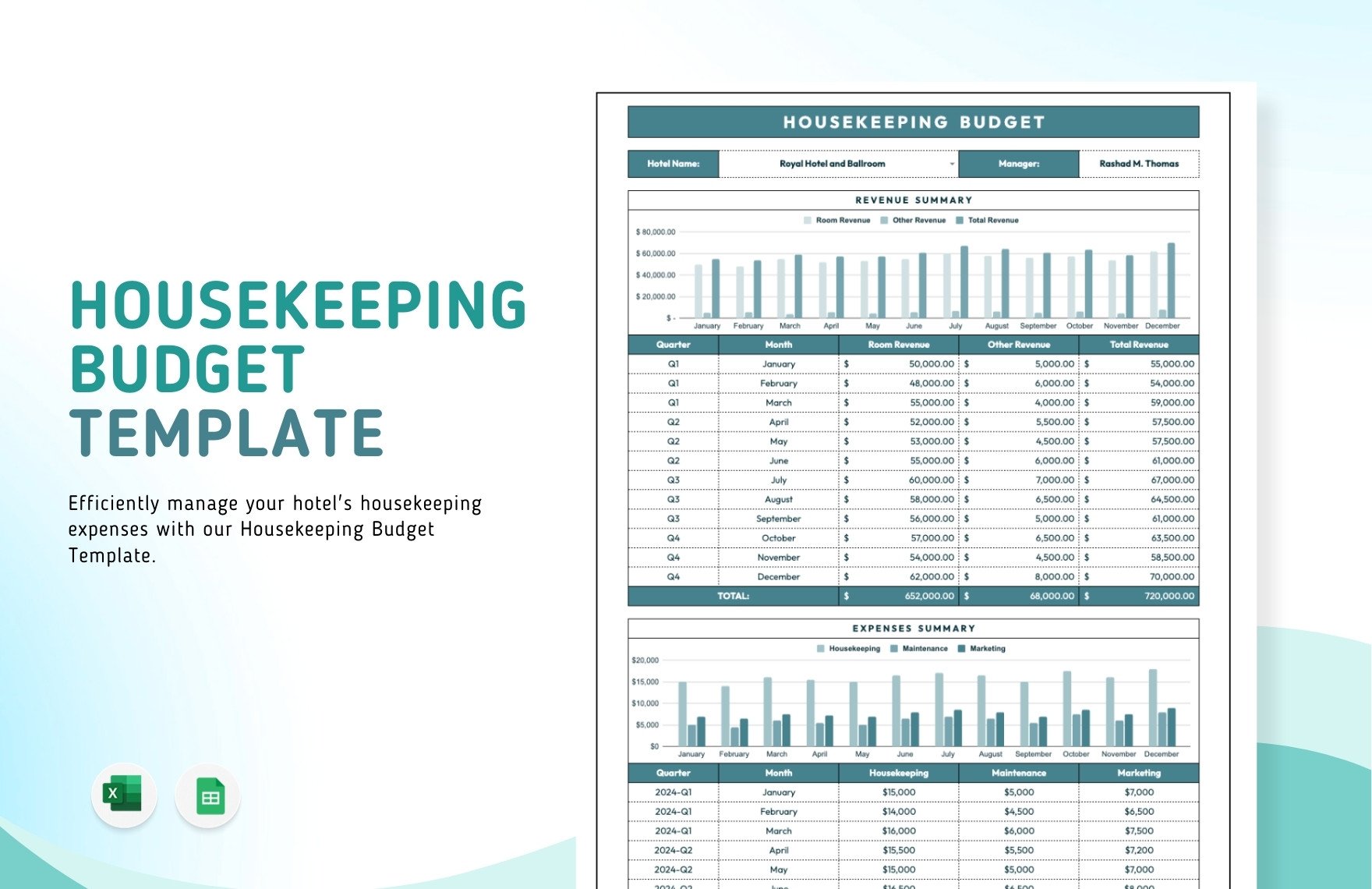

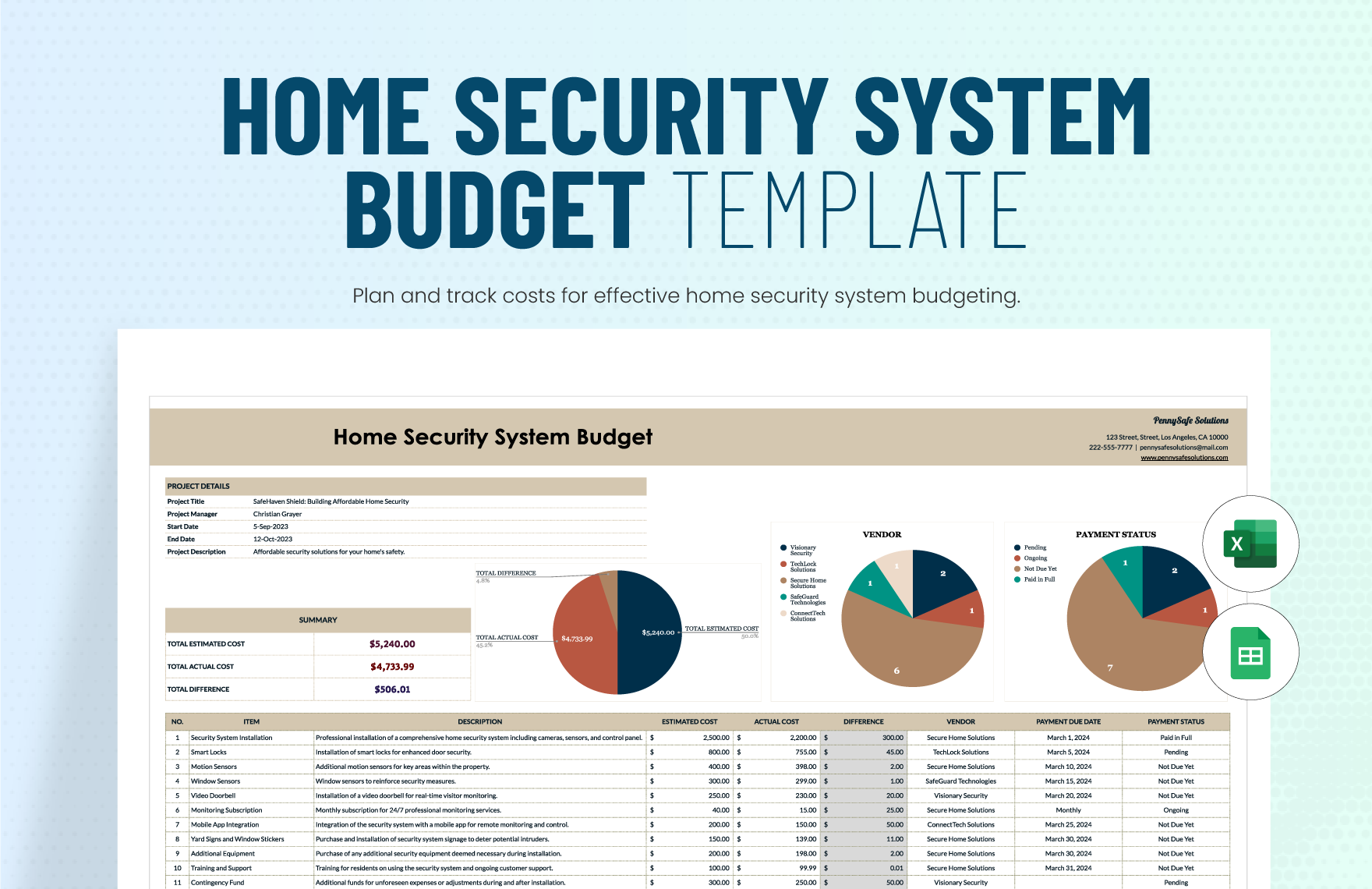

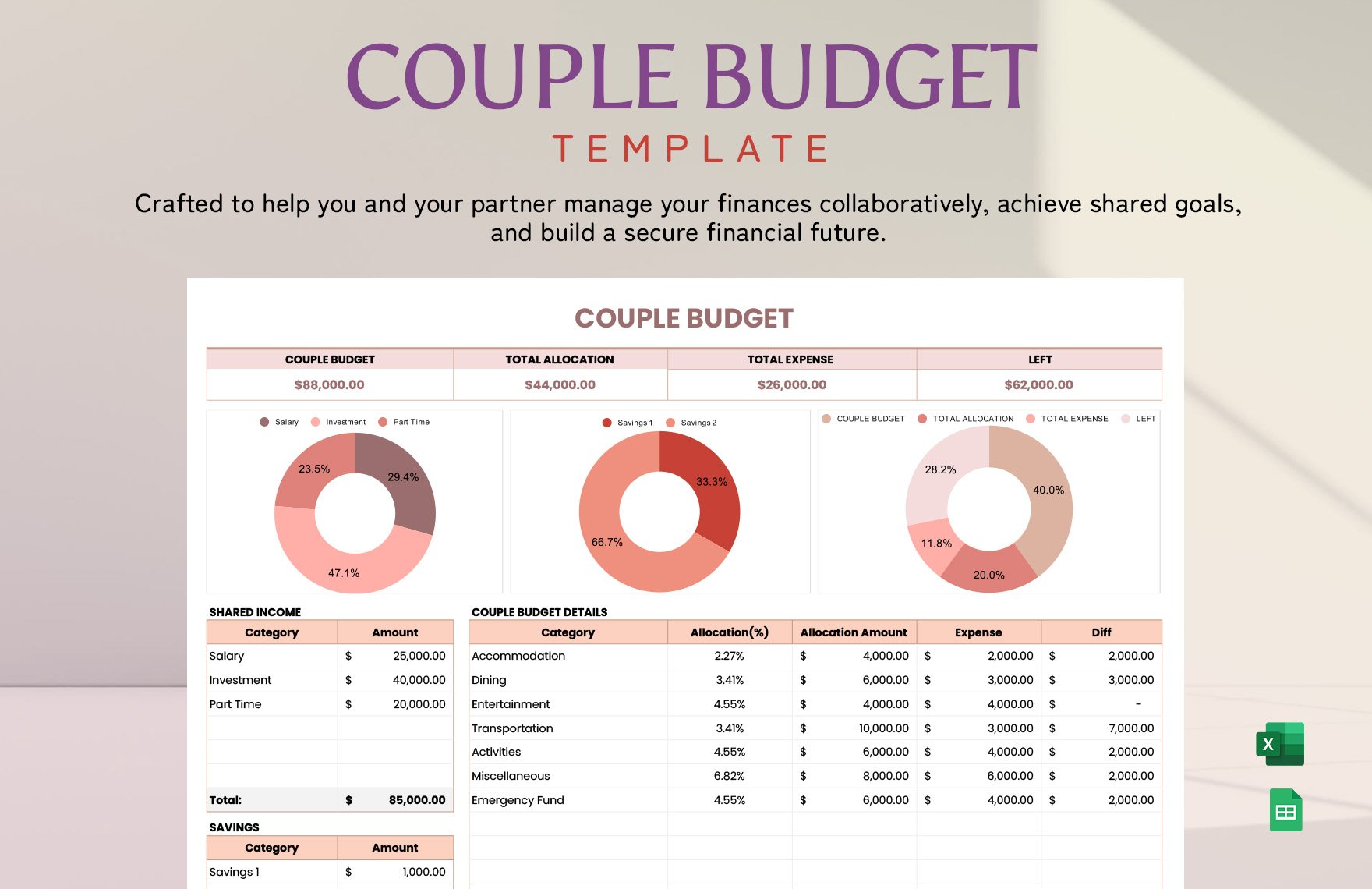

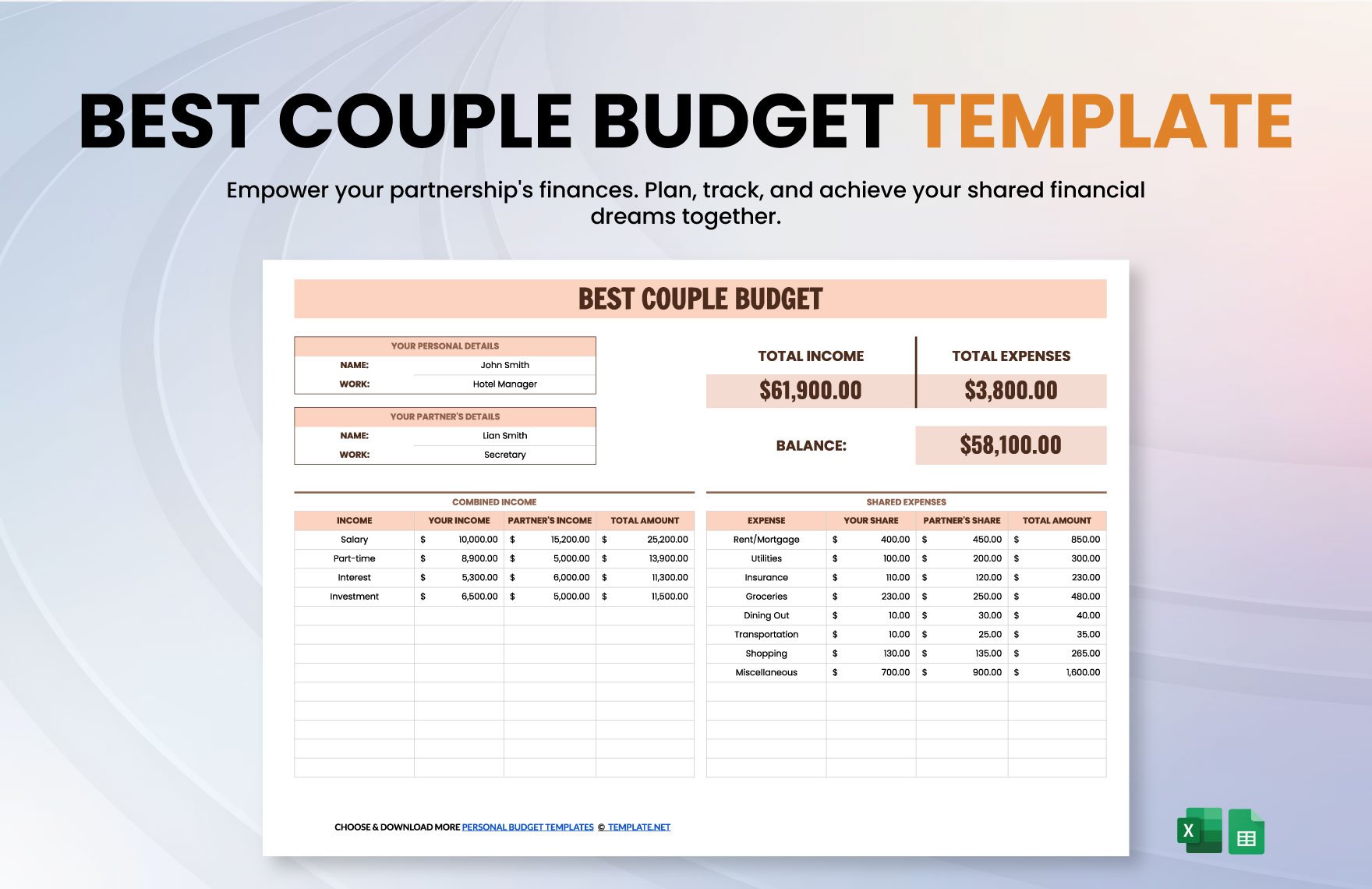

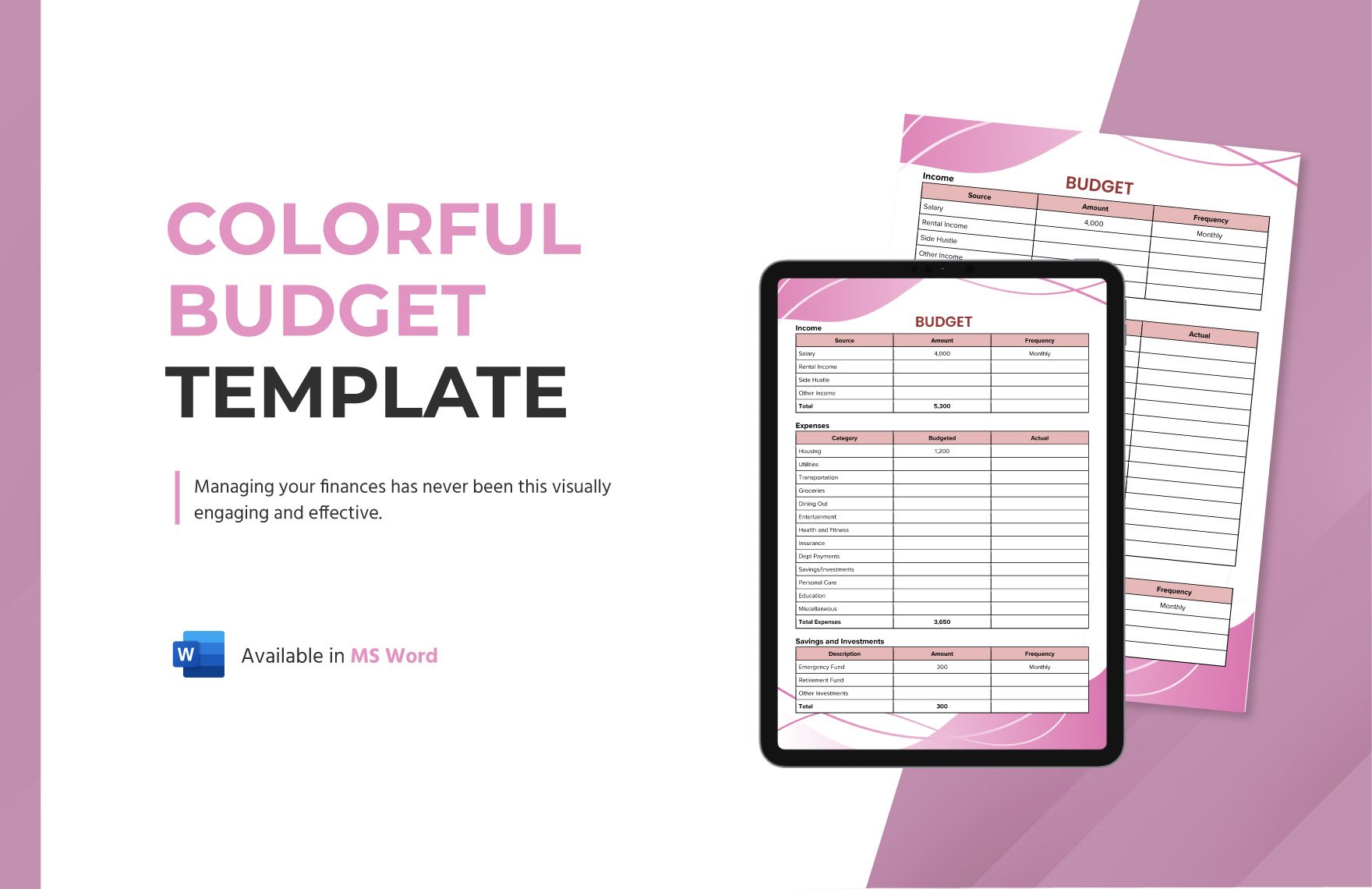

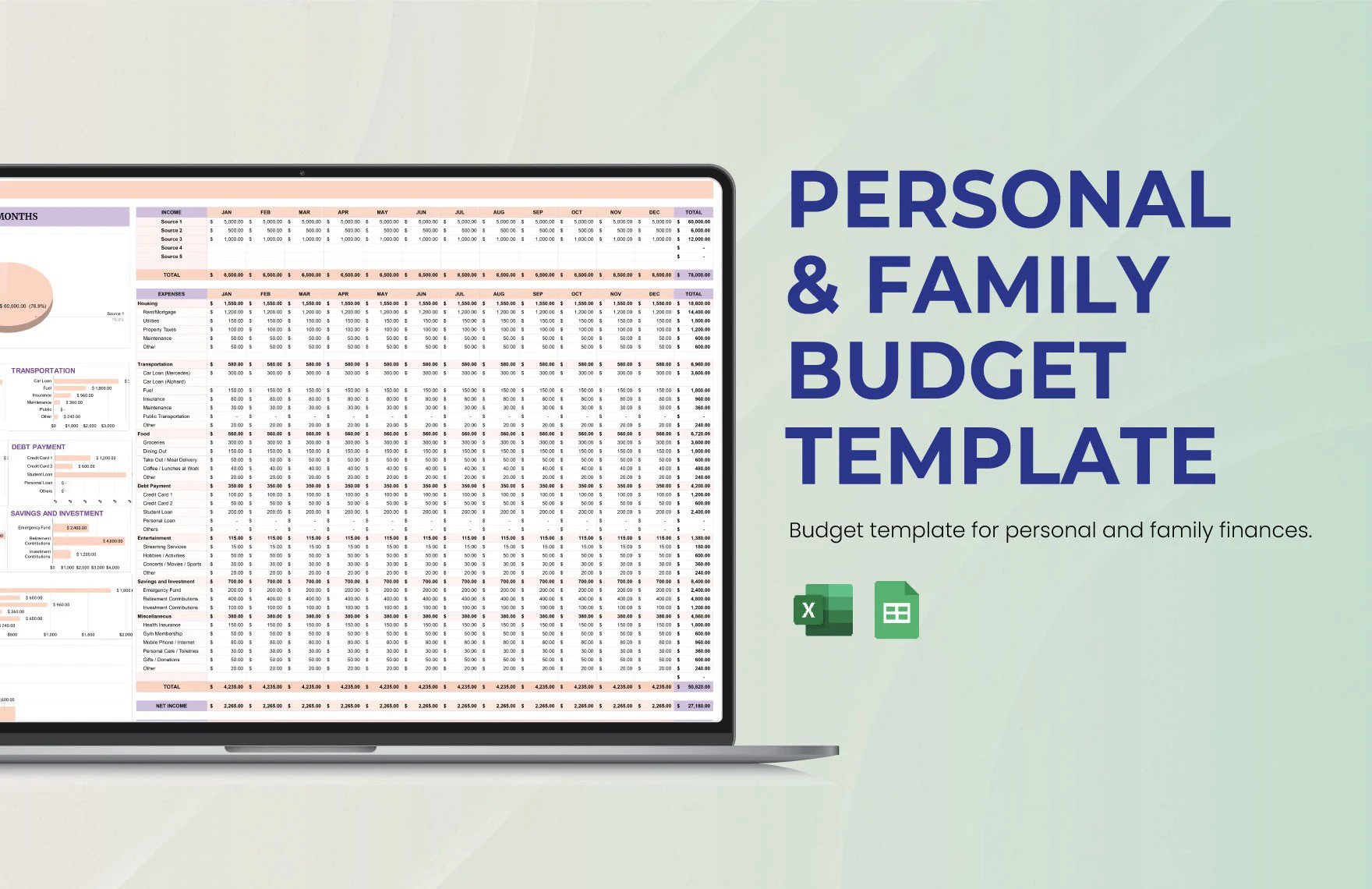

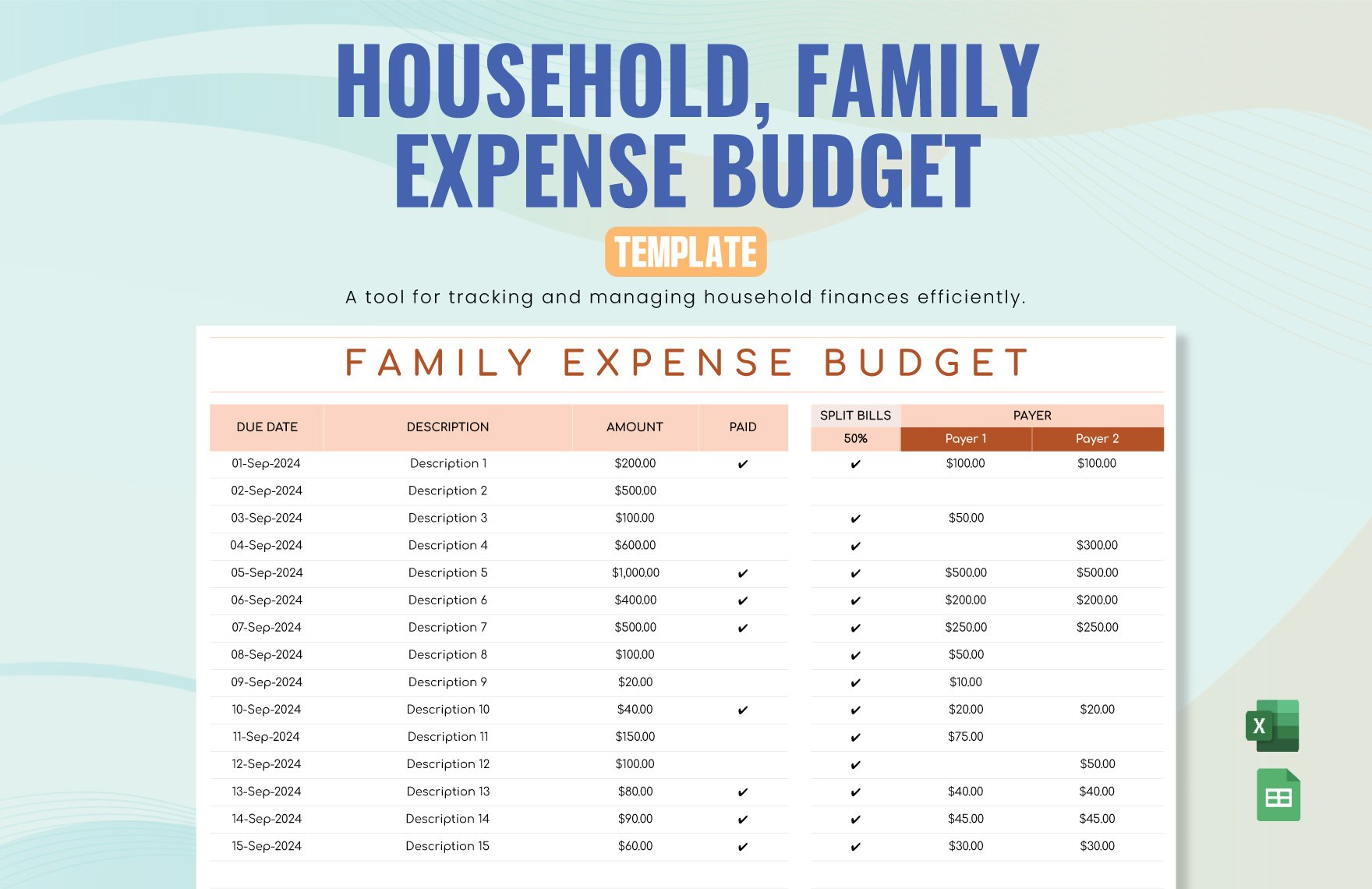

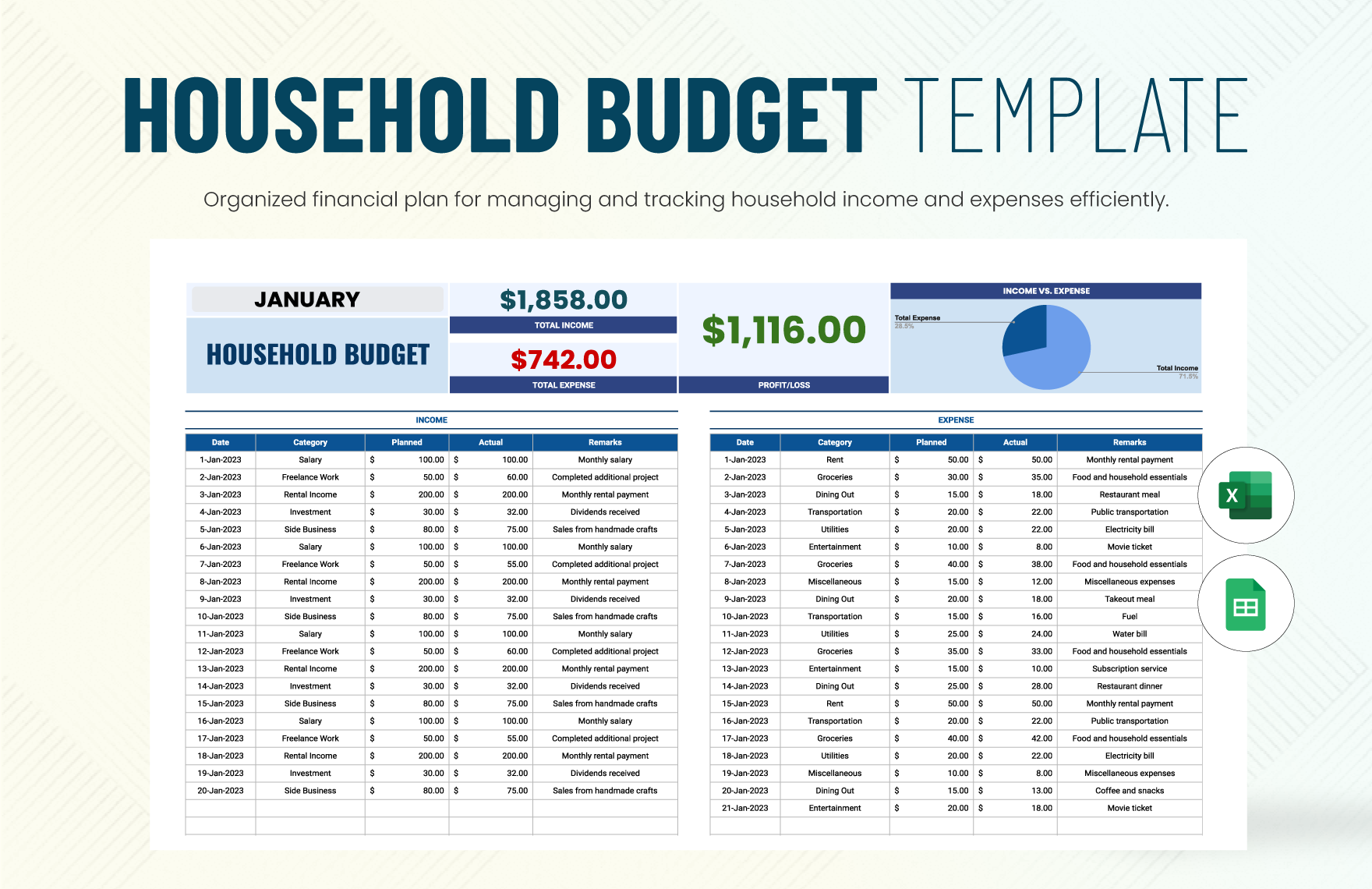

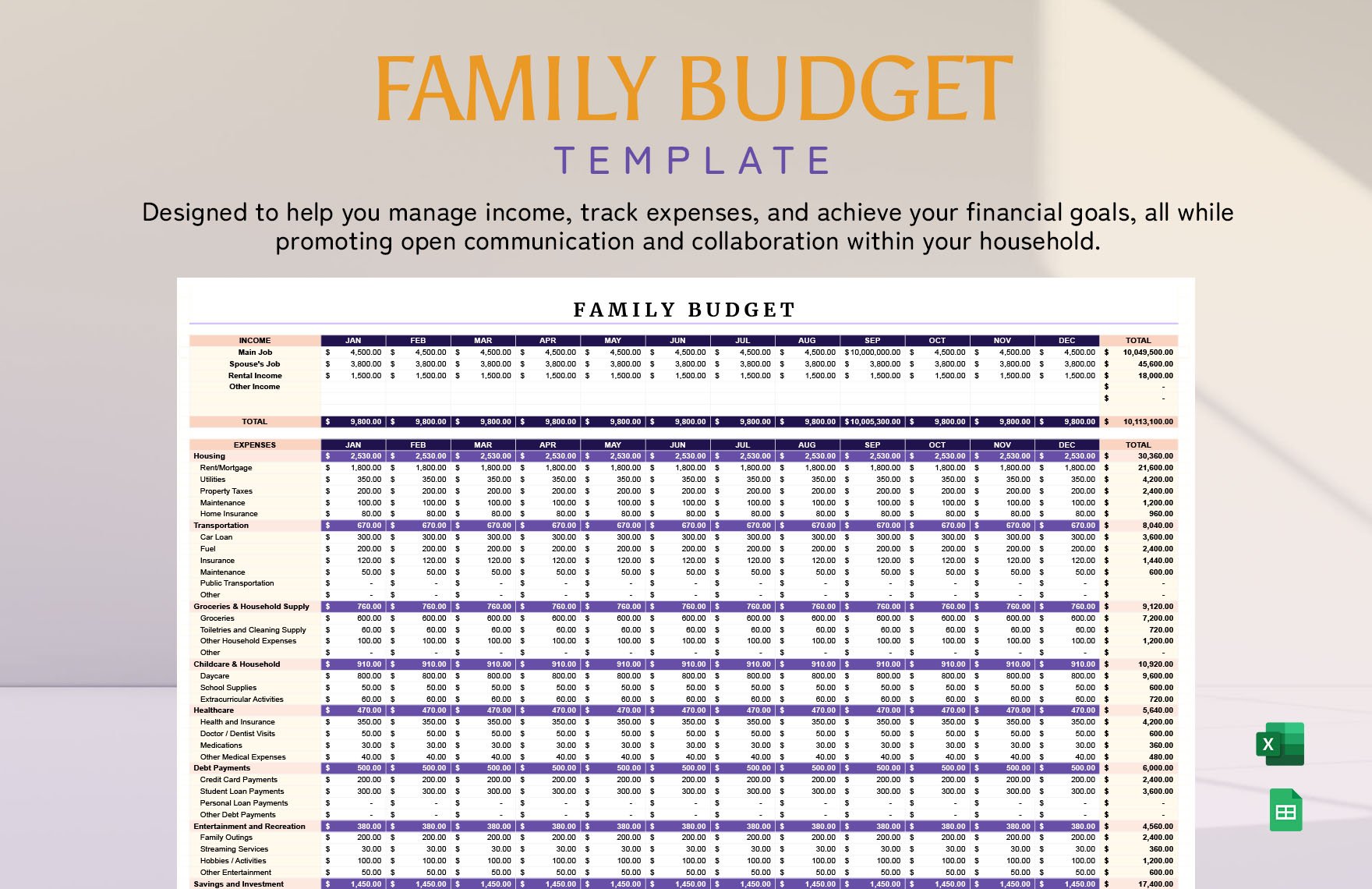

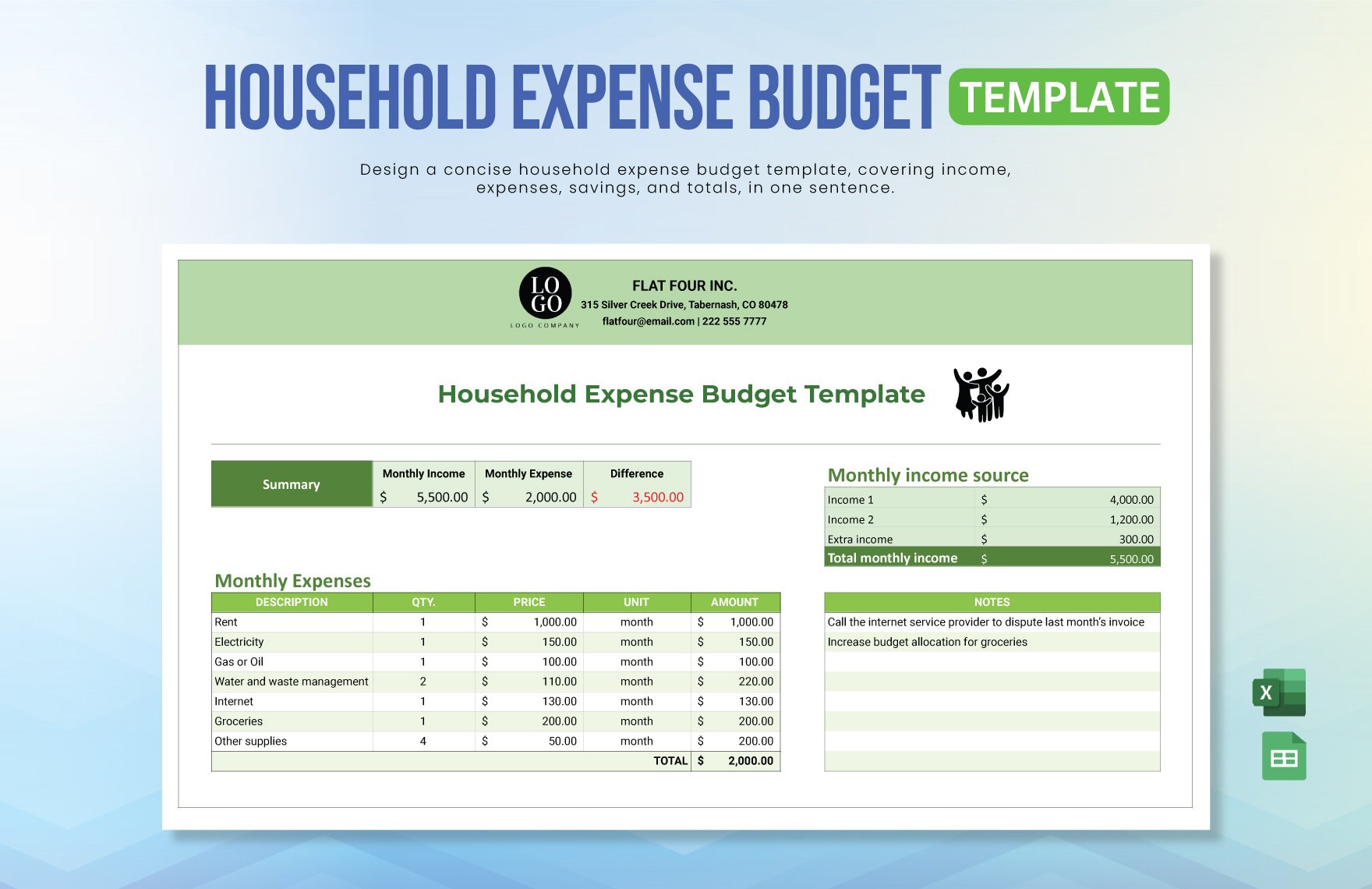

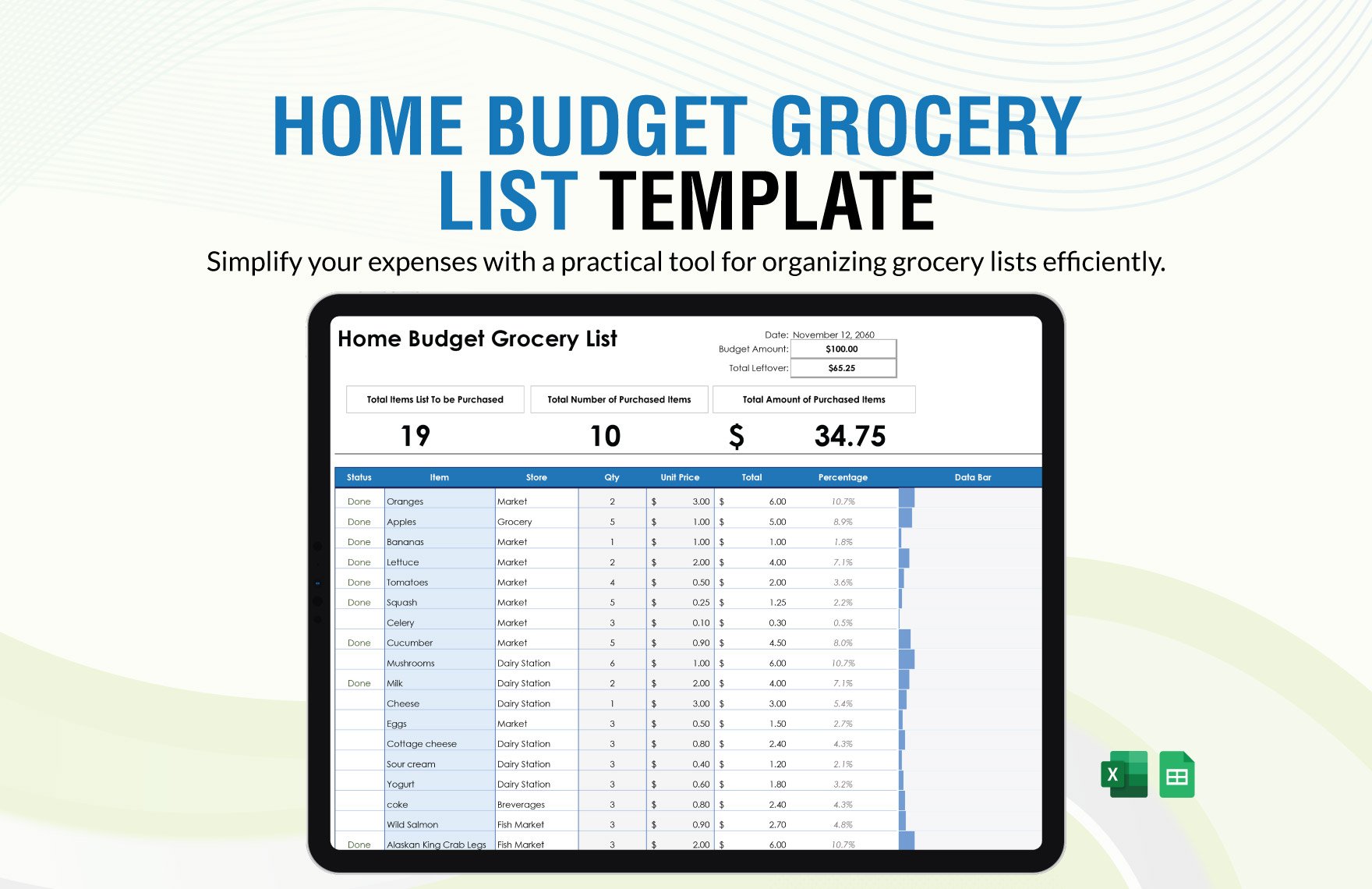

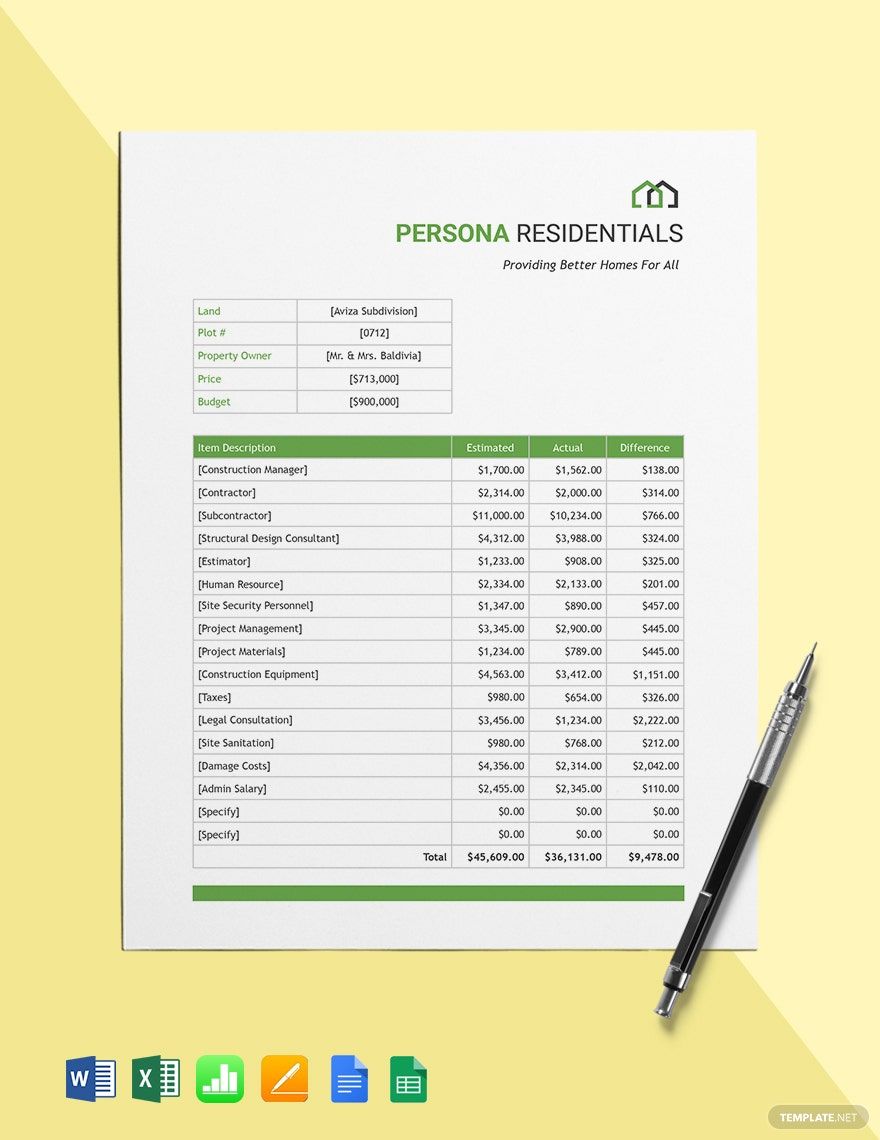

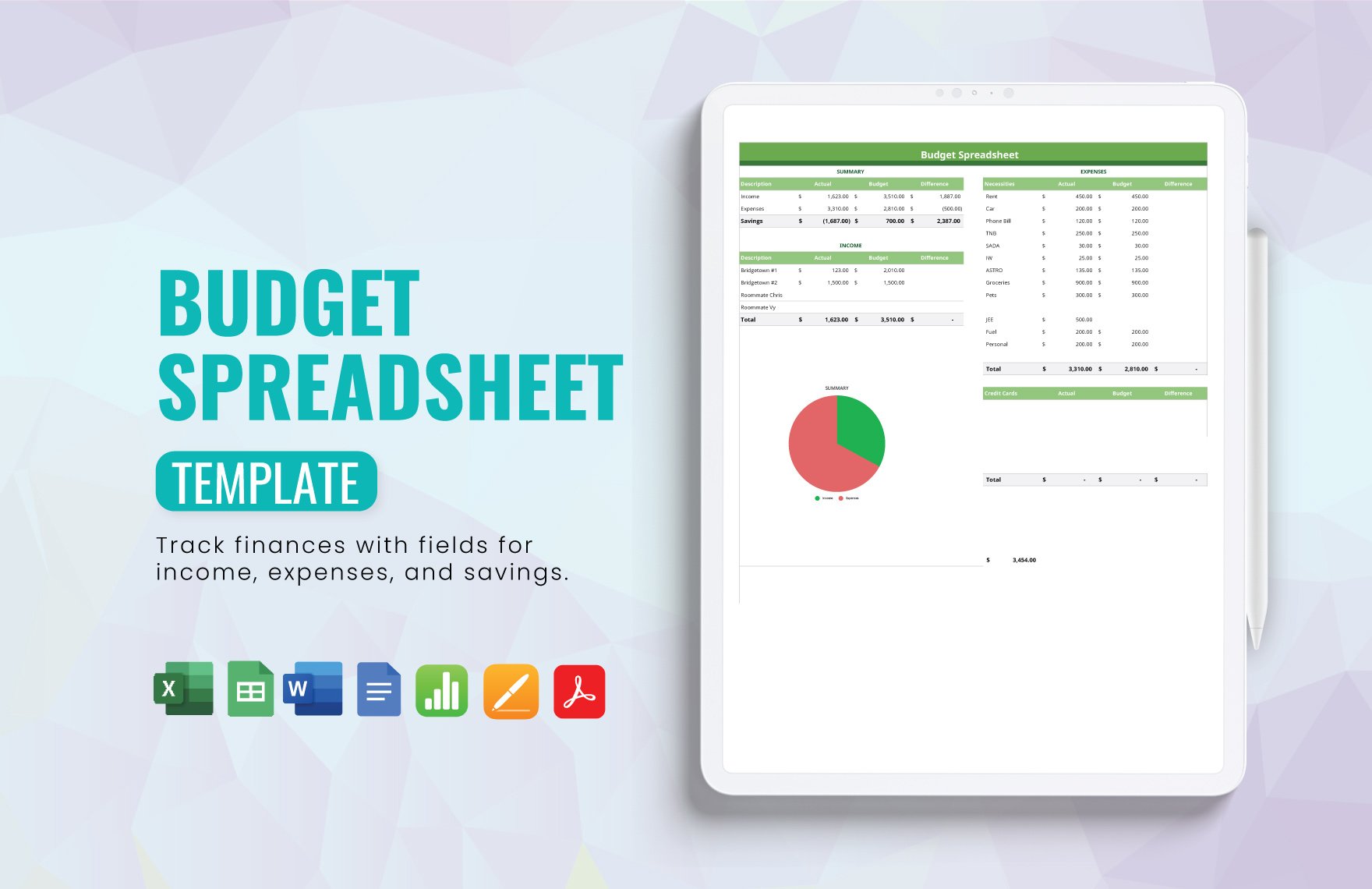

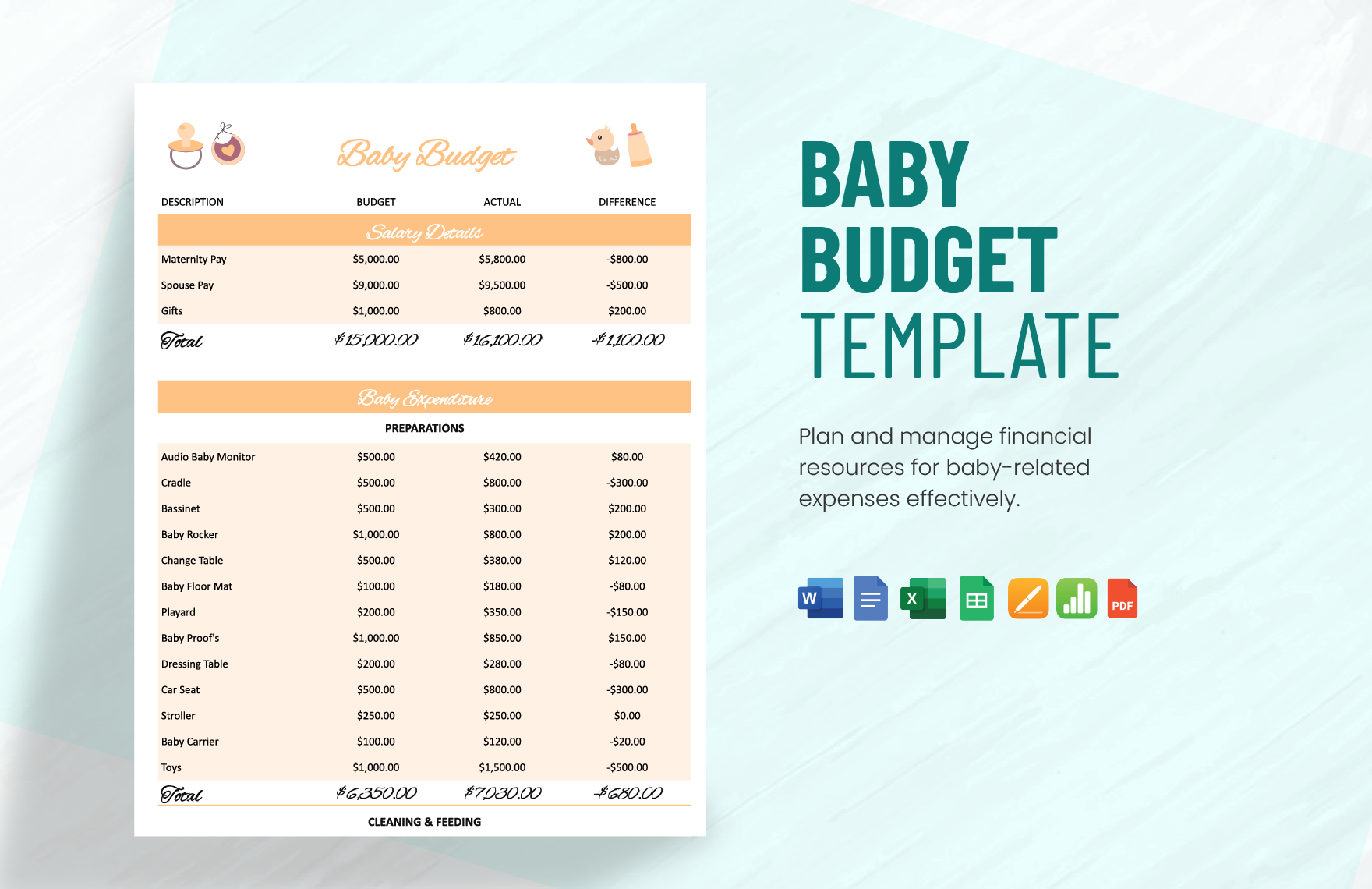

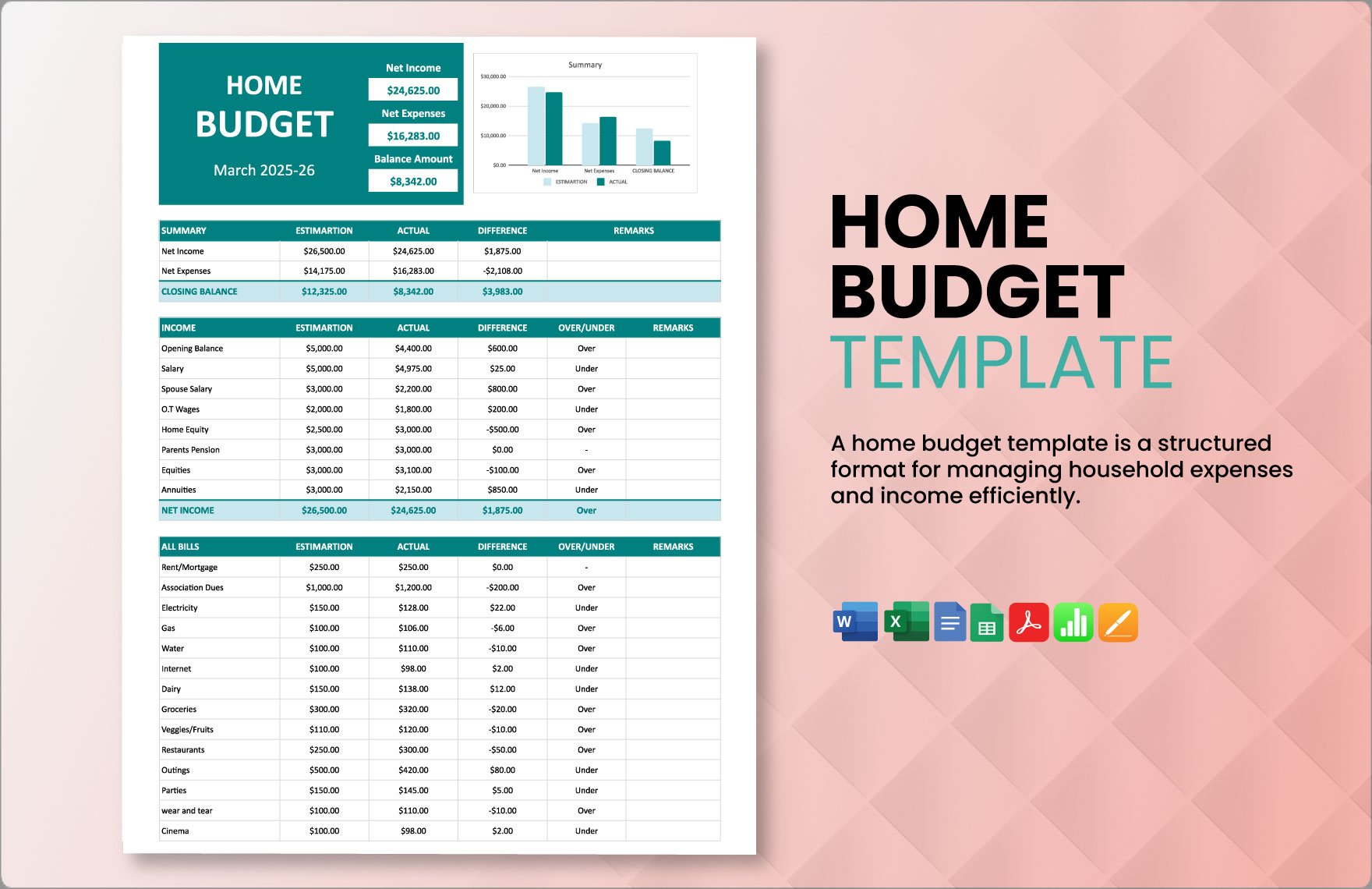

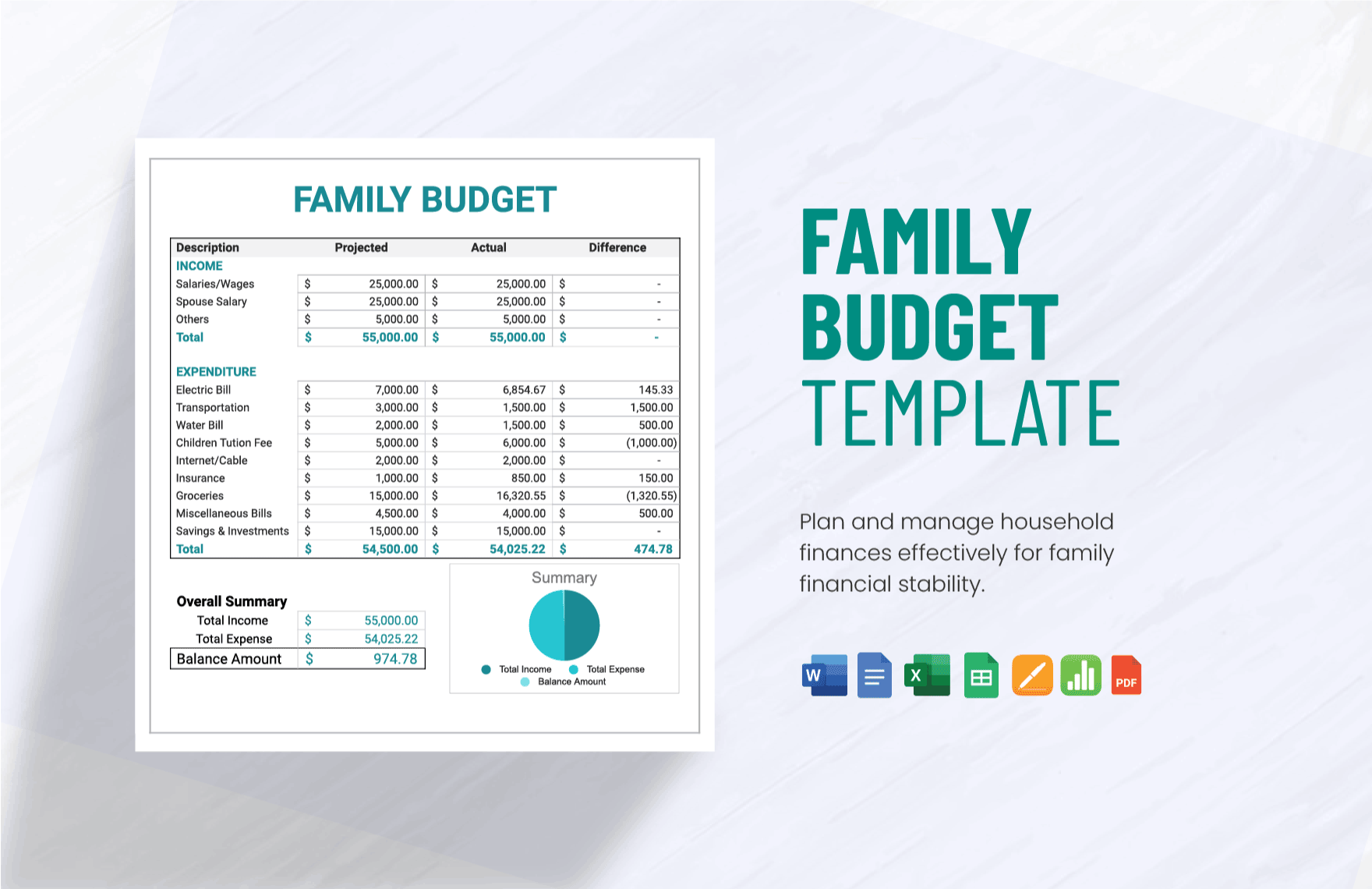

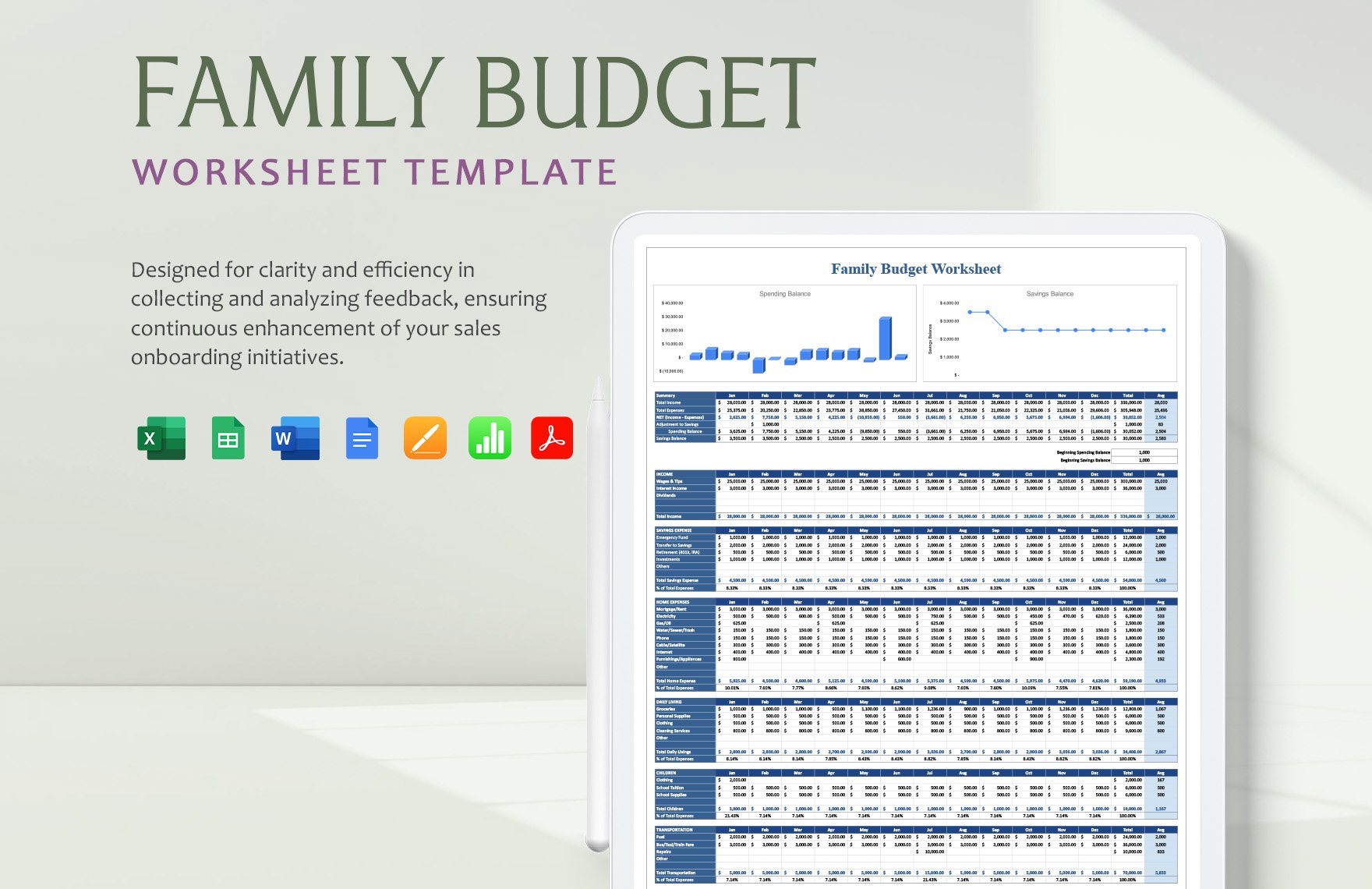

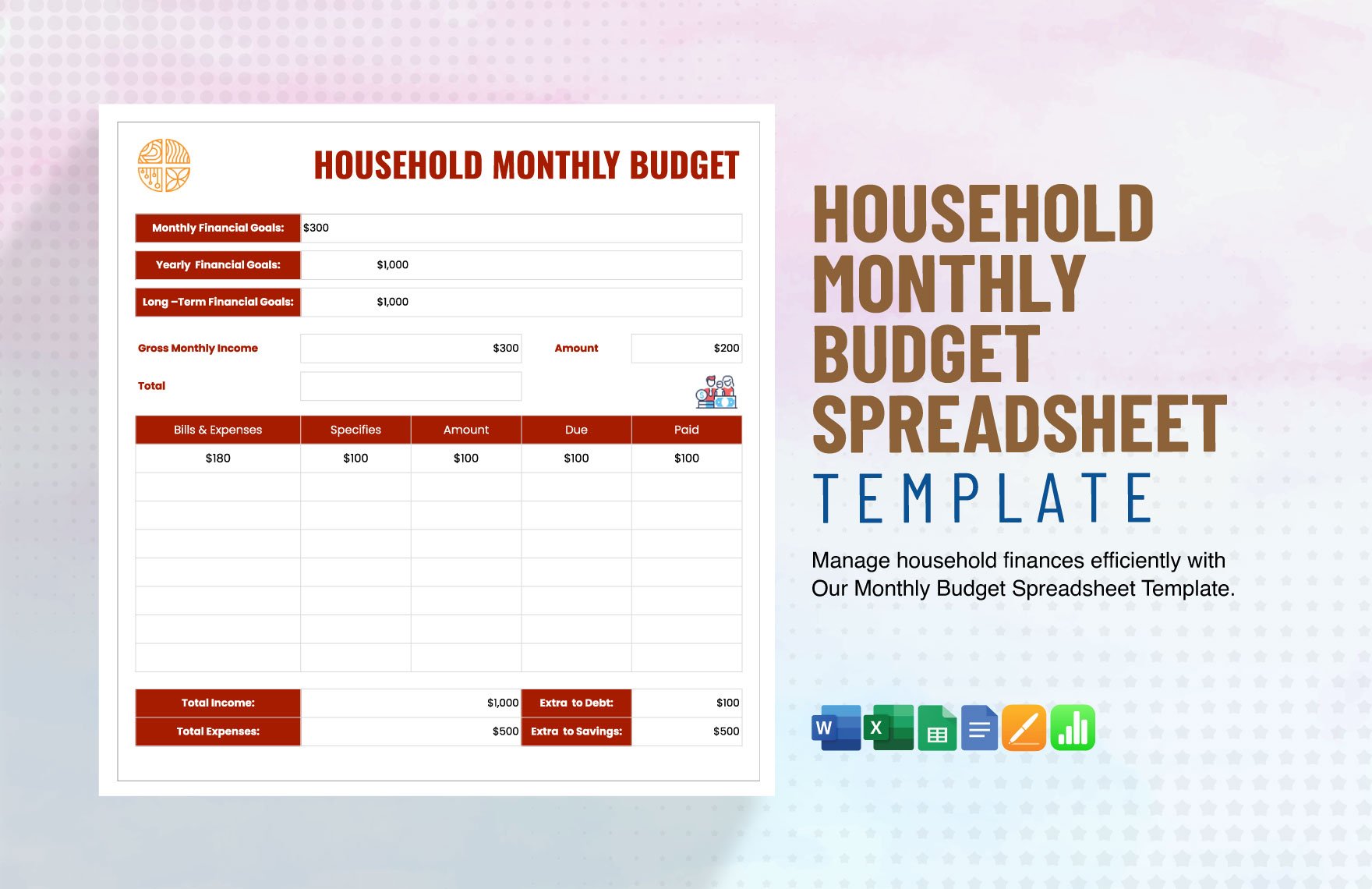

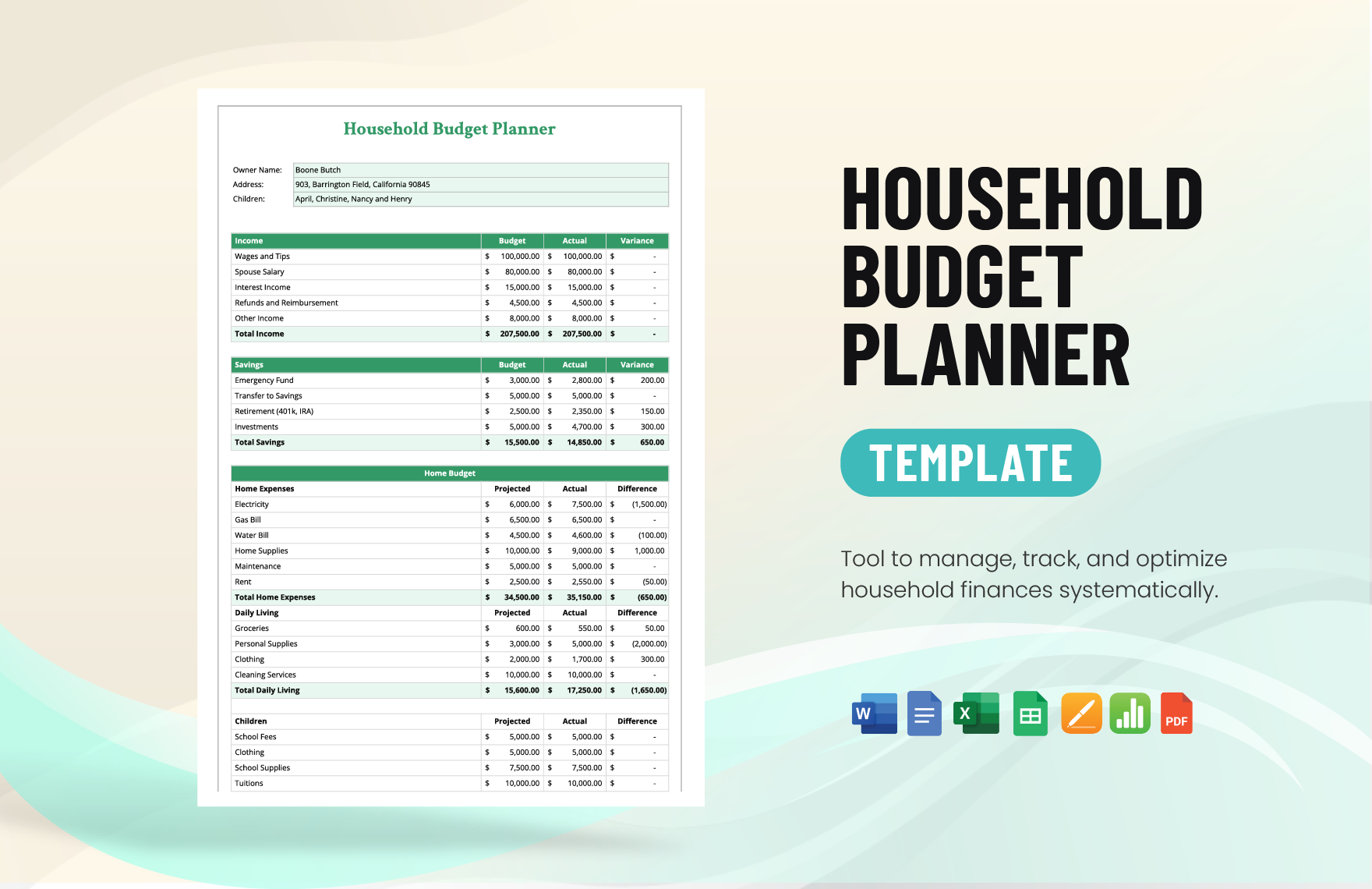

Keep your finances in check, streamline your expenses, and achieve your savings goals with Household Budget Templates from Template.net. Designed for individuals and families looking to maintain control over their financial health, these templates help you stay organized, track spending efficiently, and work towards financial security. Whether you need a budget plan for a family vacation or want to monitor household expenses month over month, these templates offer the perfect starting point. Each template comes with essential elements like income sources, expense categories, and savings goals, ensuring no vital detail is overlooked. And with no financial planning expertise required, you can enjoy professional-grade design and functionality that saves both time and effort, be it for print or digital use.

Discover the many Household Budget Templates we have on hand—easily customizable to fit your specific needs. Start by selecting a template, then effortlessly swap in your unique financial data, and tweak colors and fonts to match your personal style. Add advanced touches, like dragging and dropping icons or graphics for a visual overview, or incorporating AI-powered text tools for insightful financial advice. With limitless possibilities, you can create a budgeting system that not only works but is also enjoyable to maintain, all without any specialized skills. The collection boasts regularly updated templates, ensuring you always have fresh designs at your fingertips. When you're finished, download your budget plan or share it conveniently via email, print, or export to keep your financial plans within easy reach.