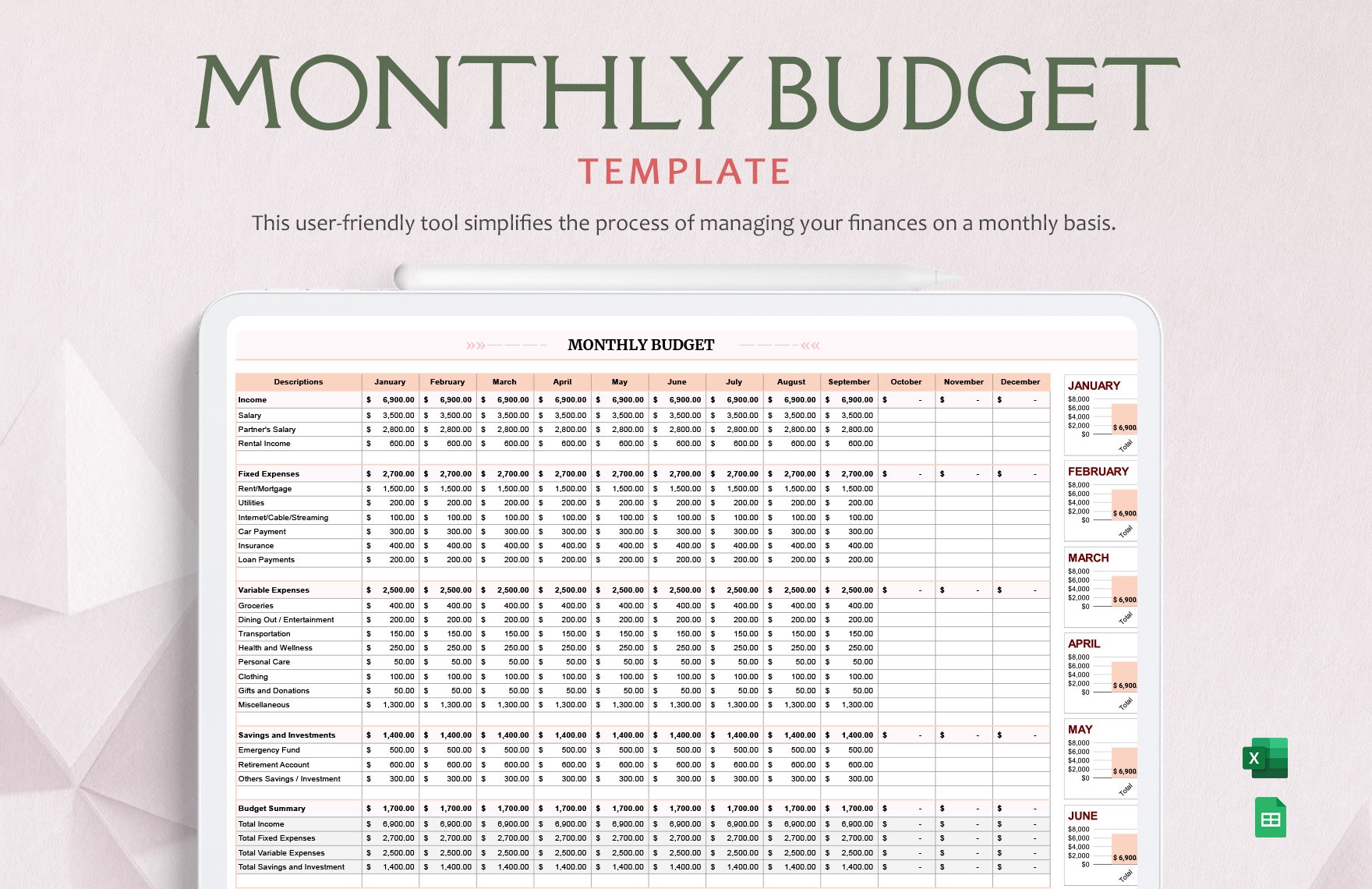

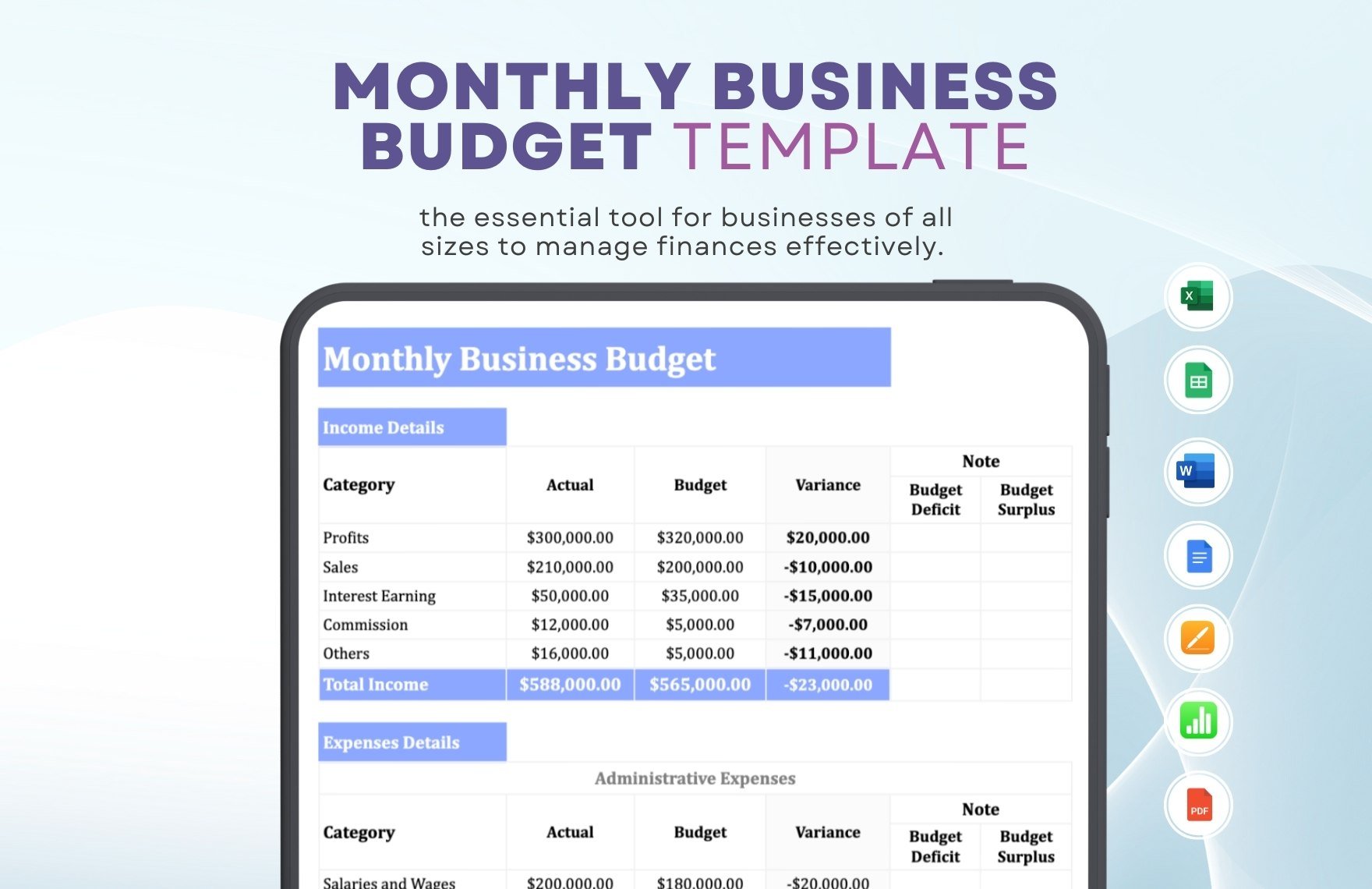

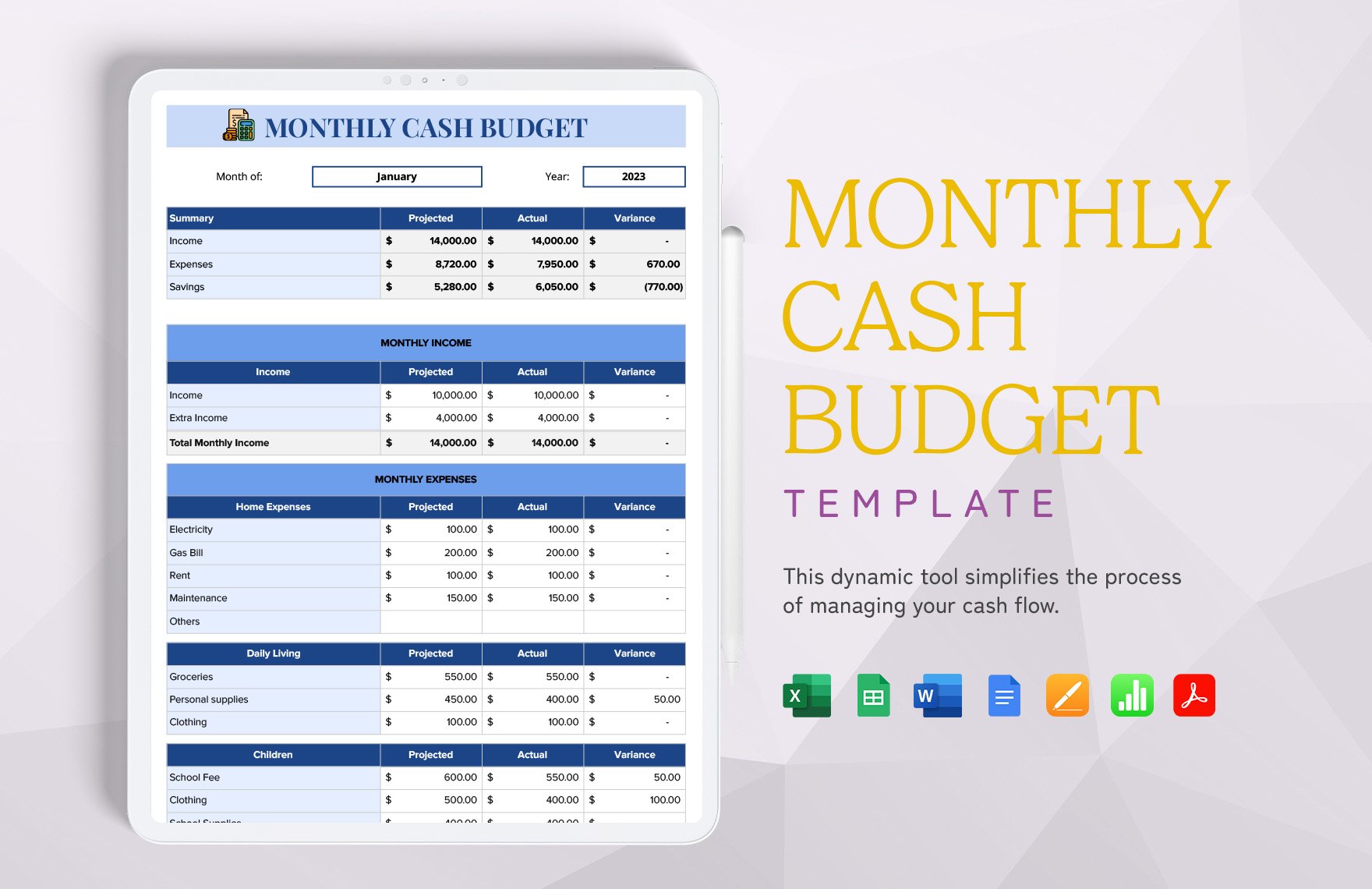

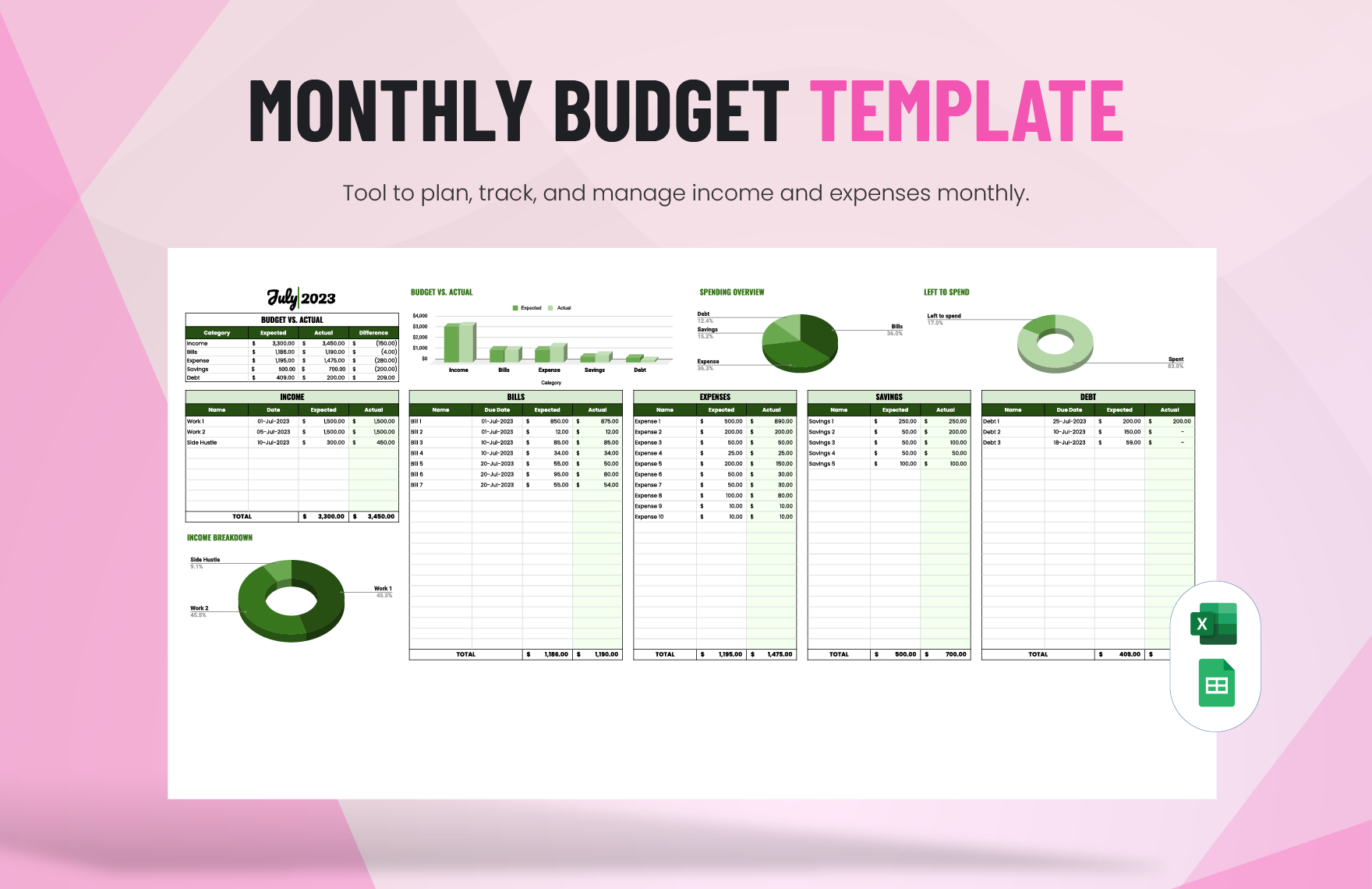

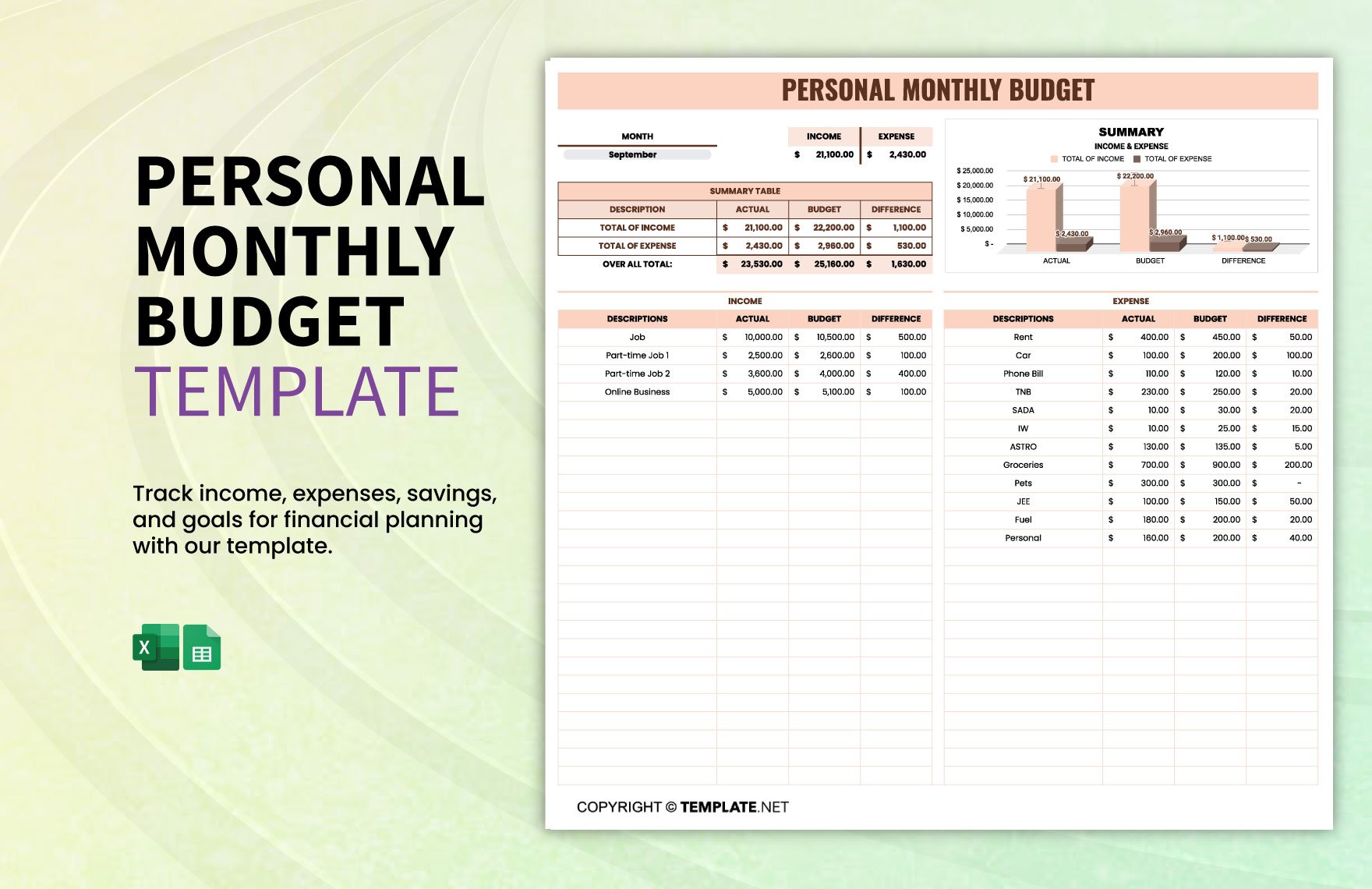

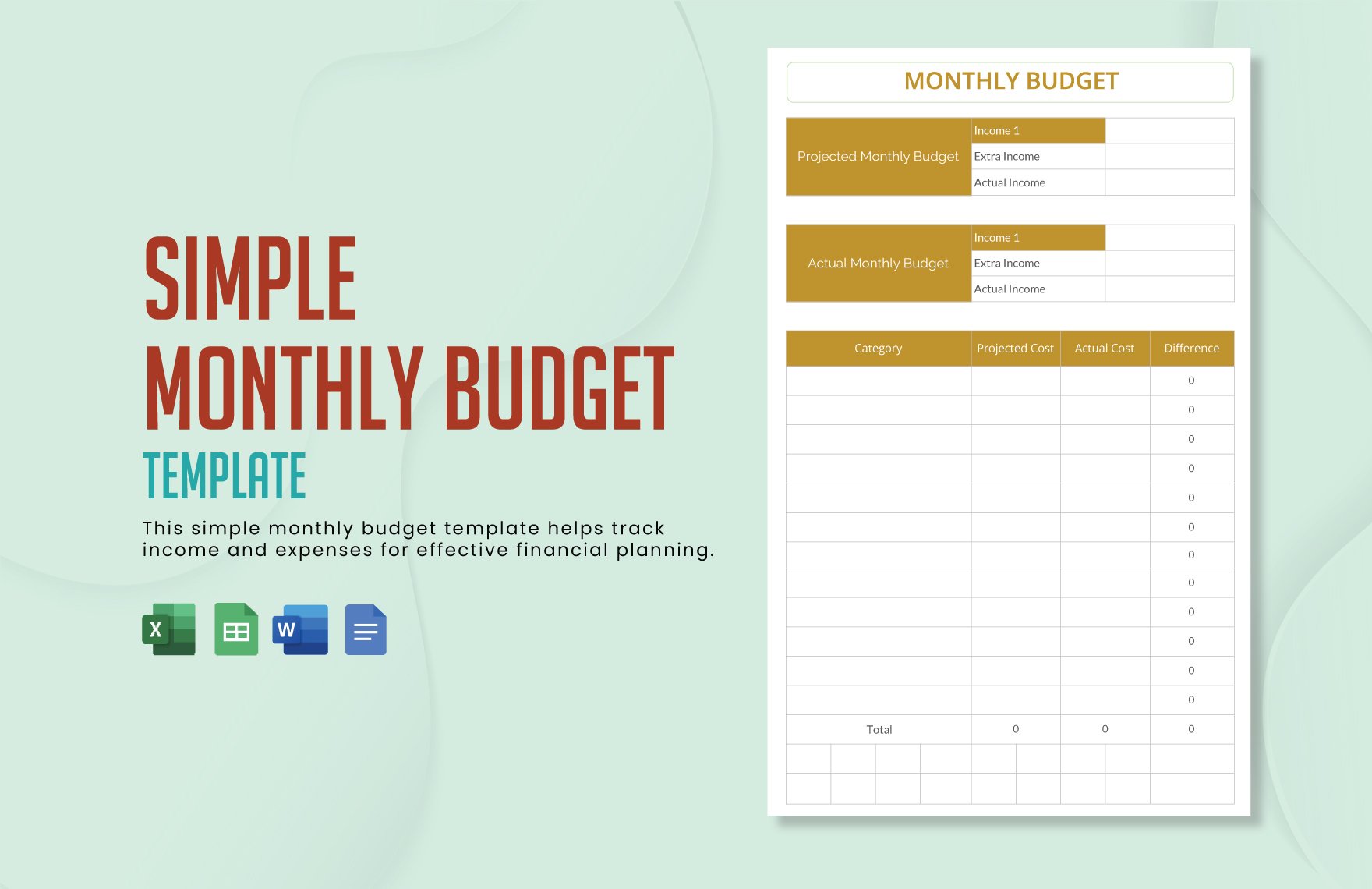

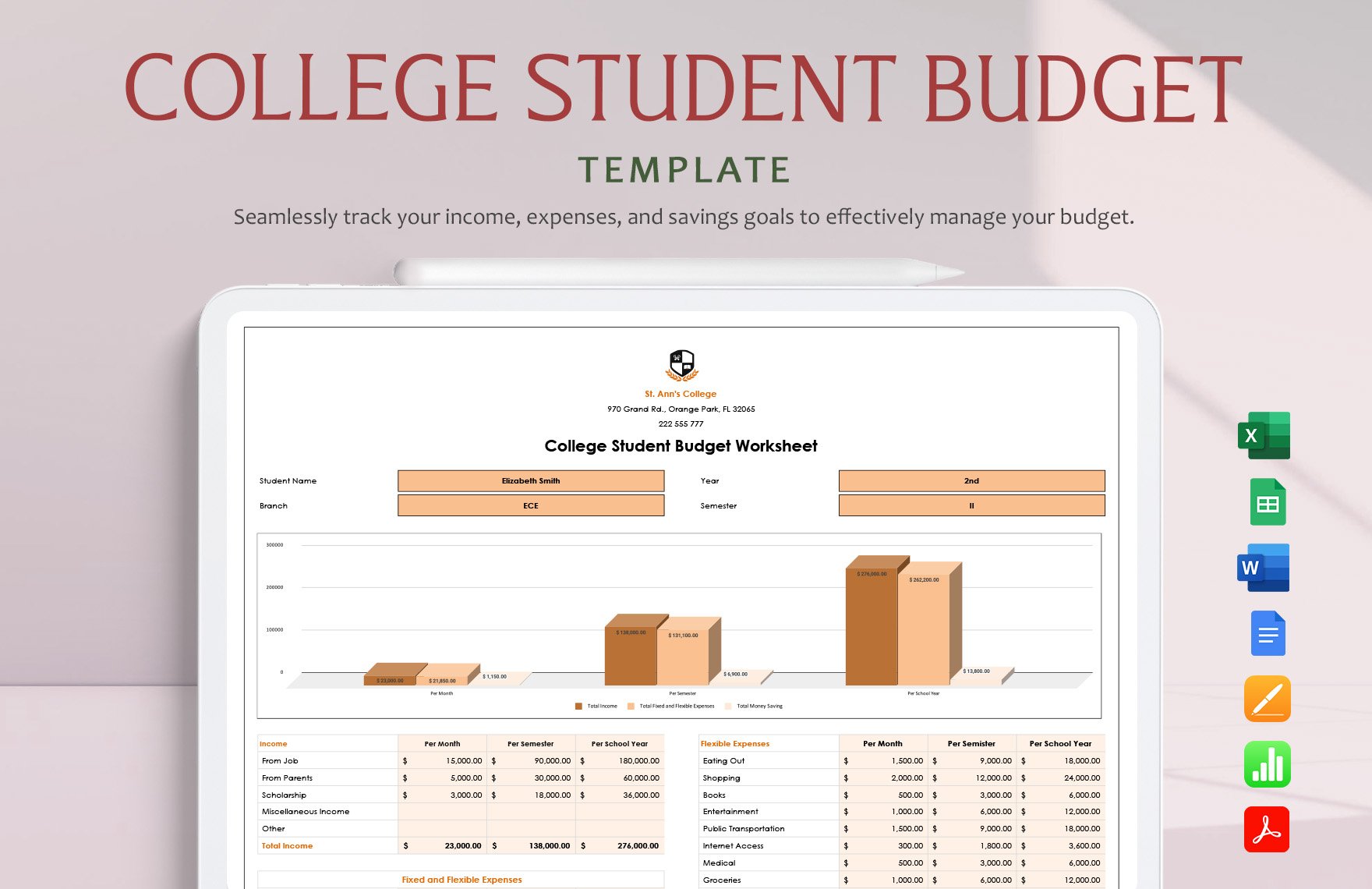

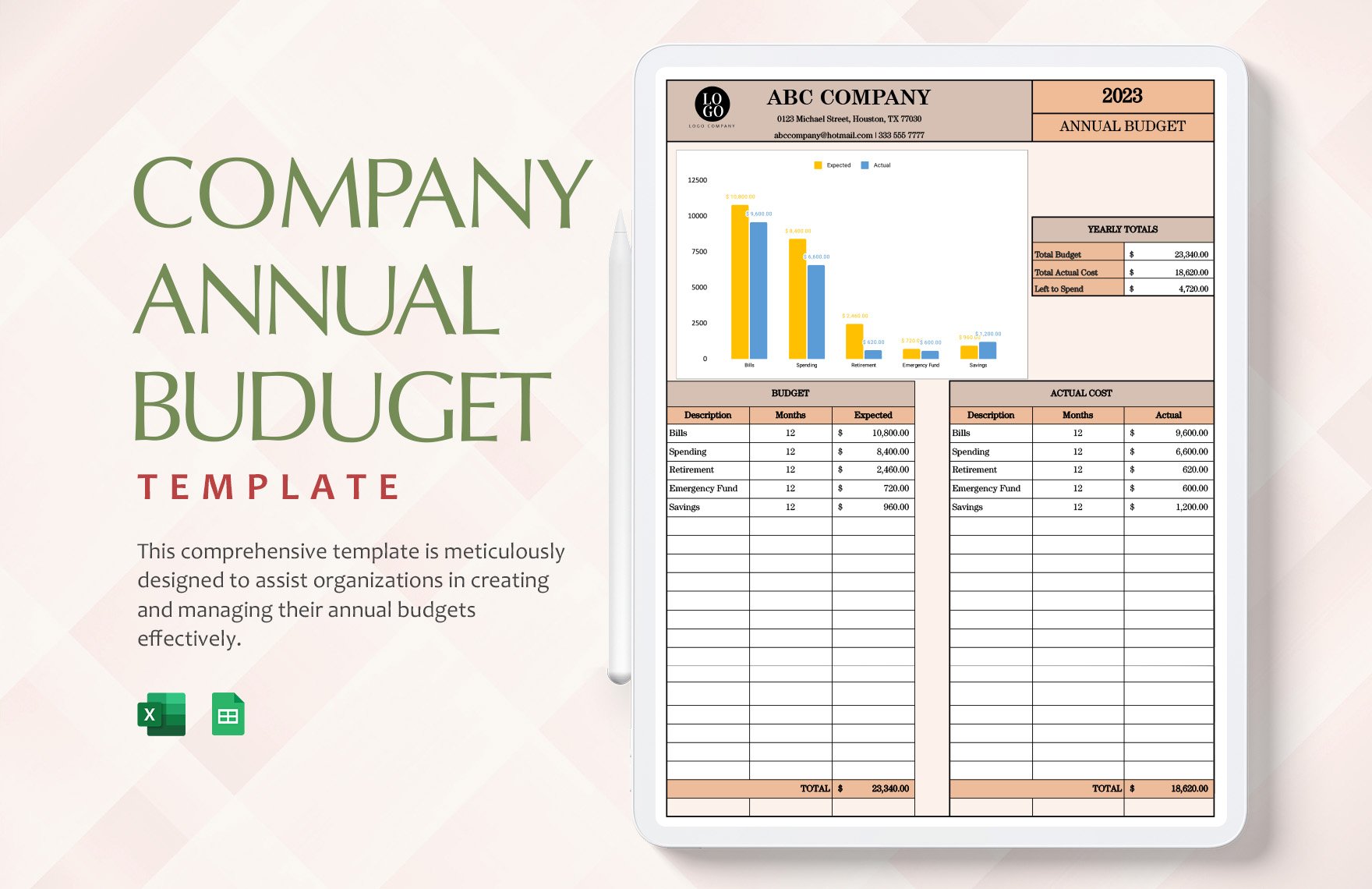

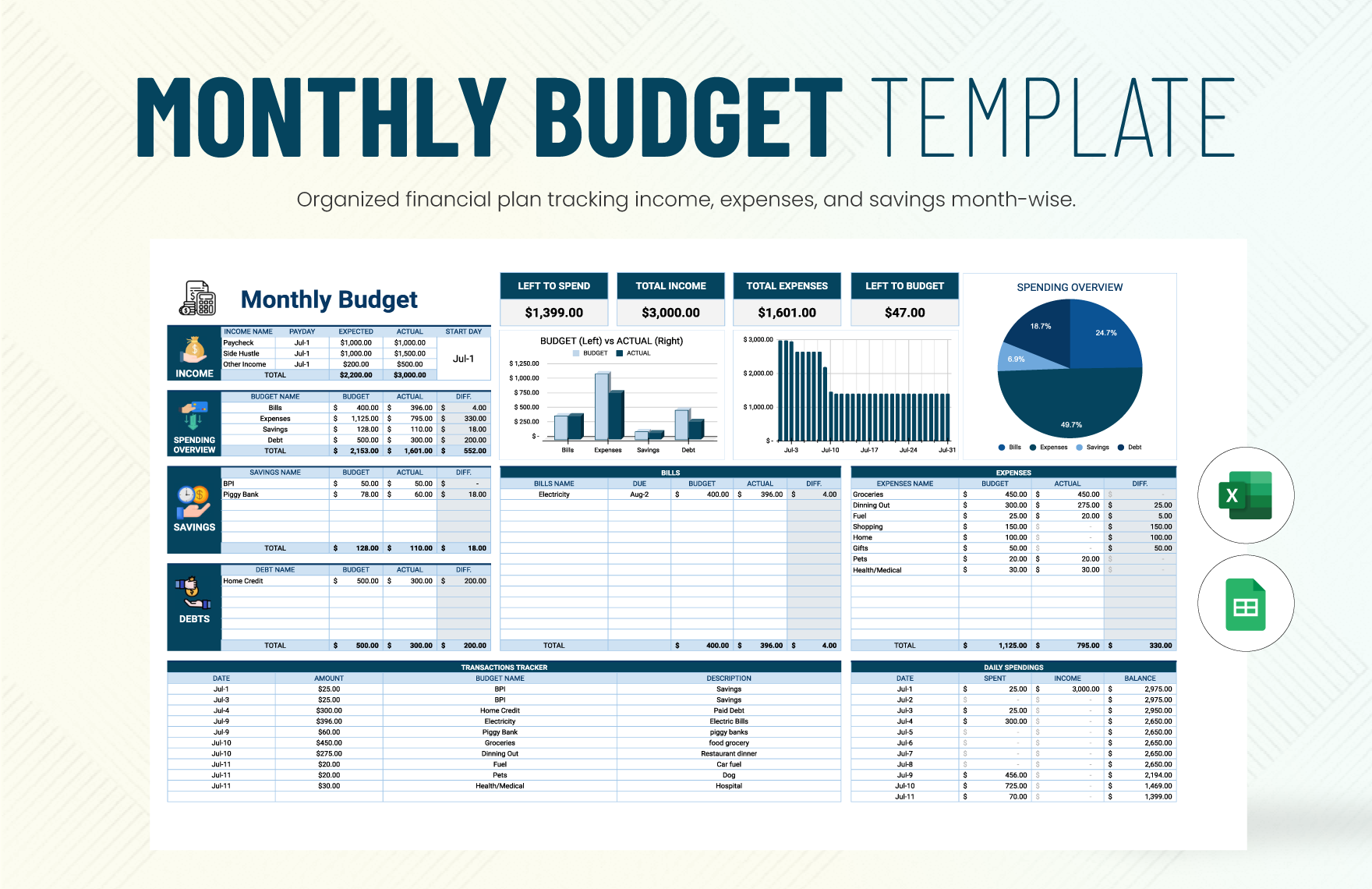

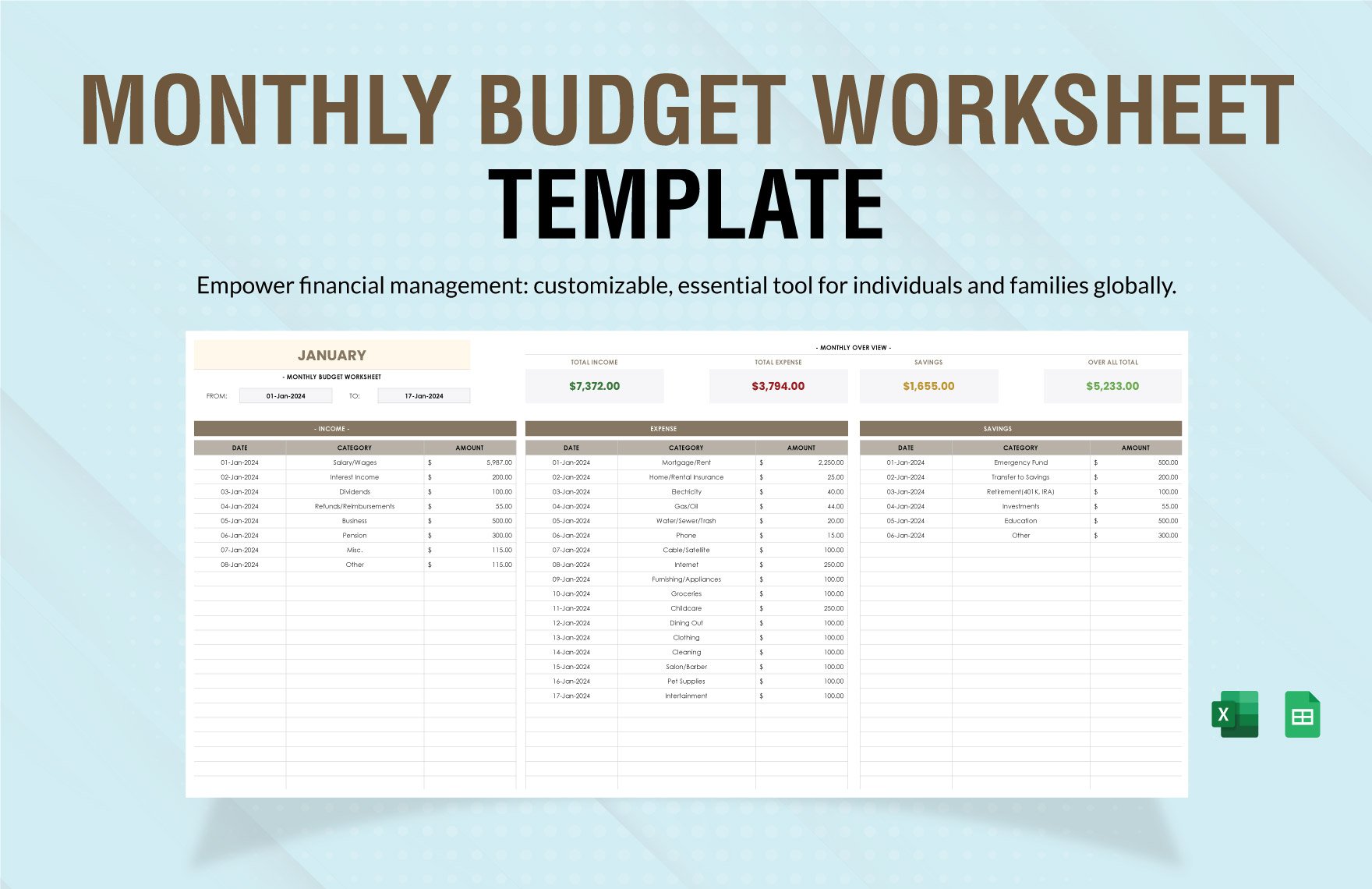

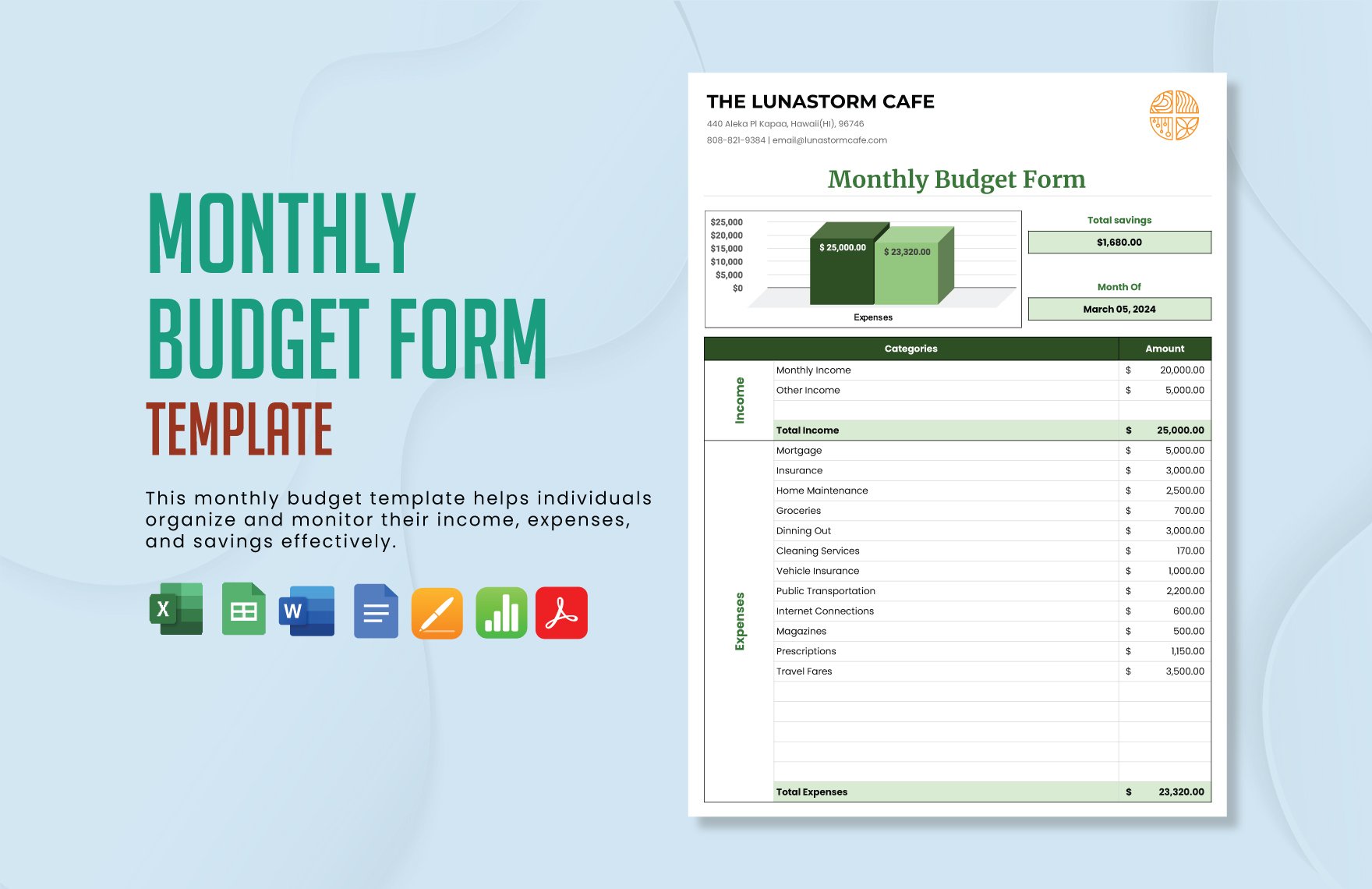

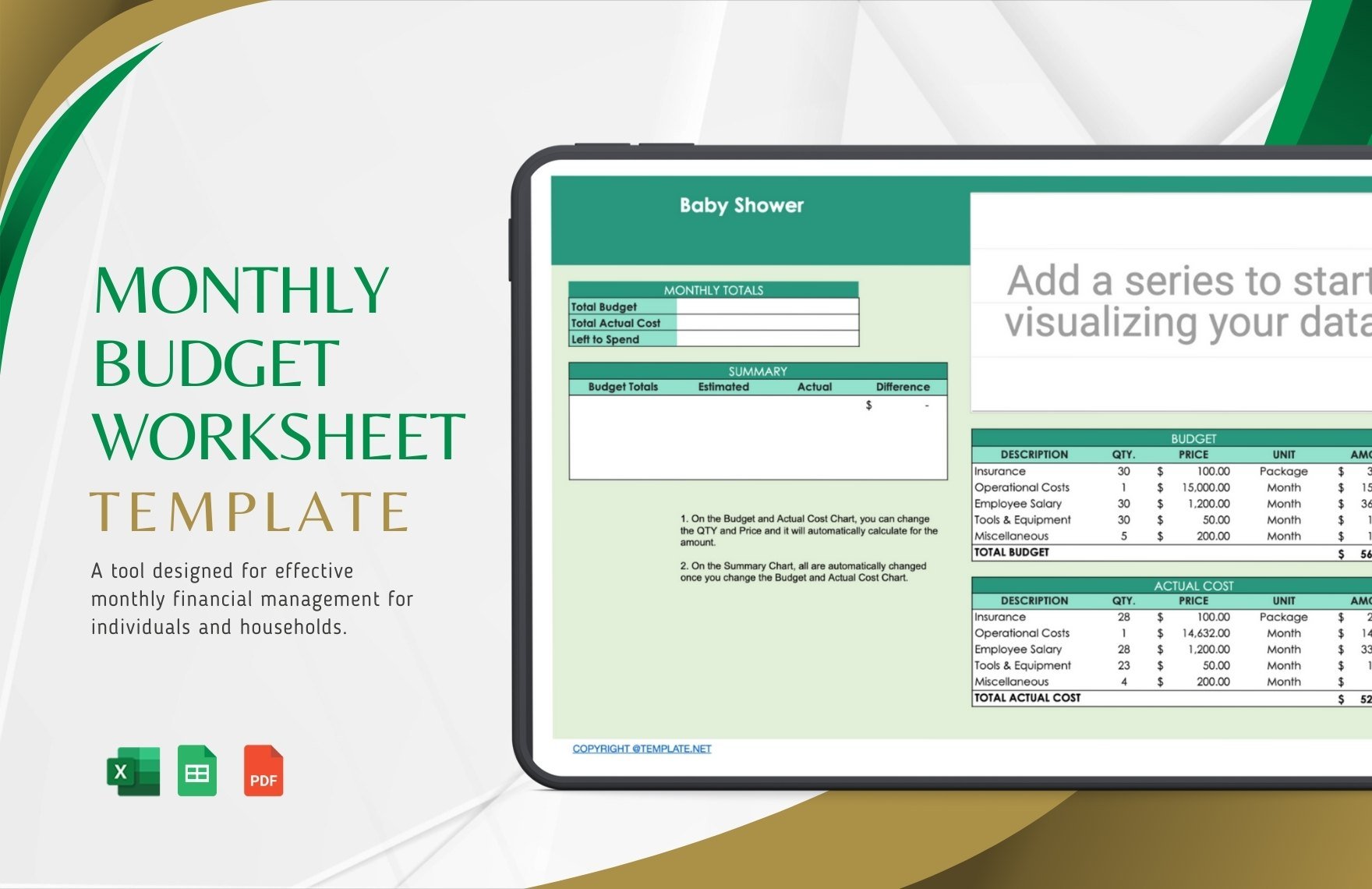

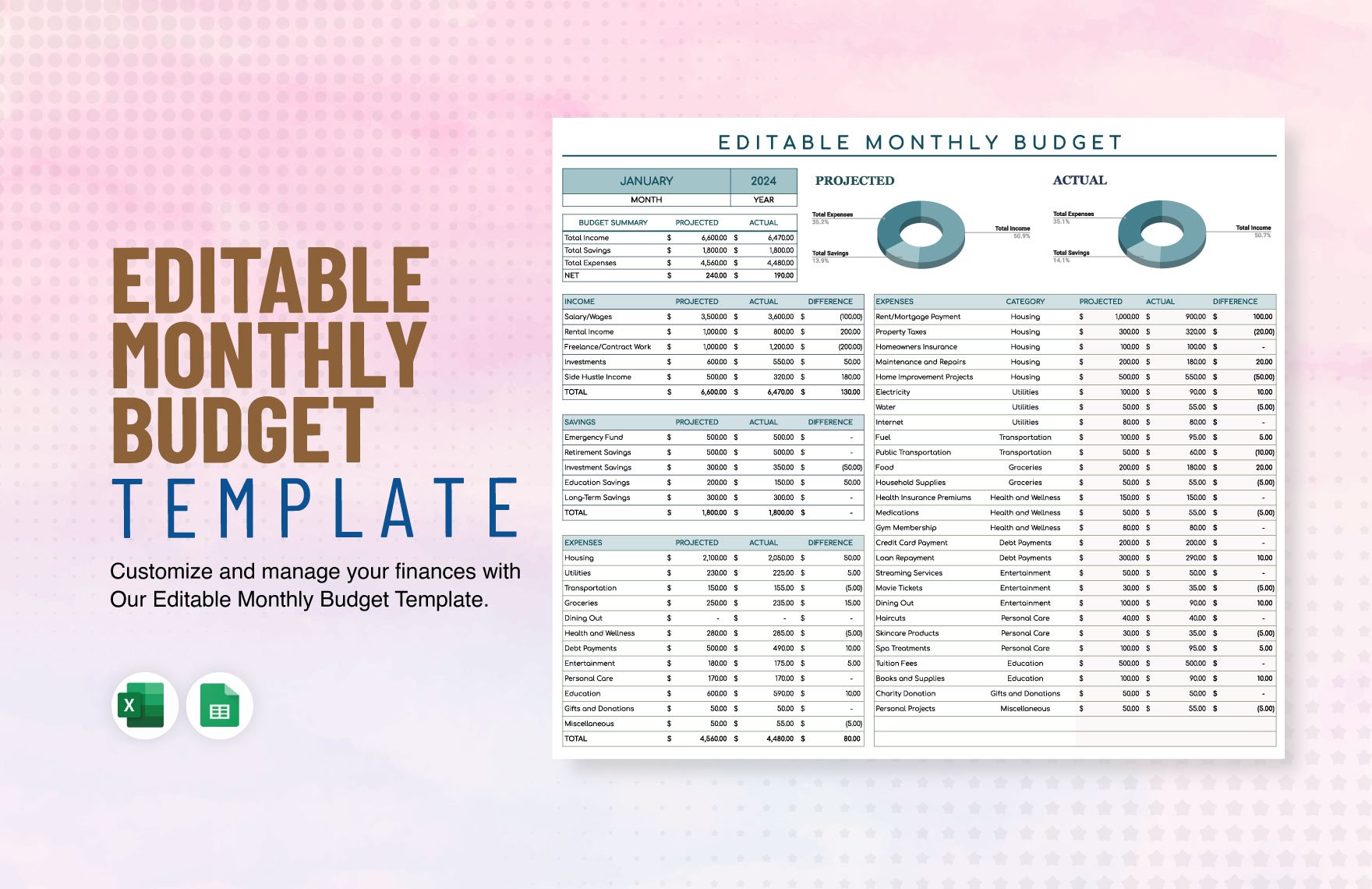

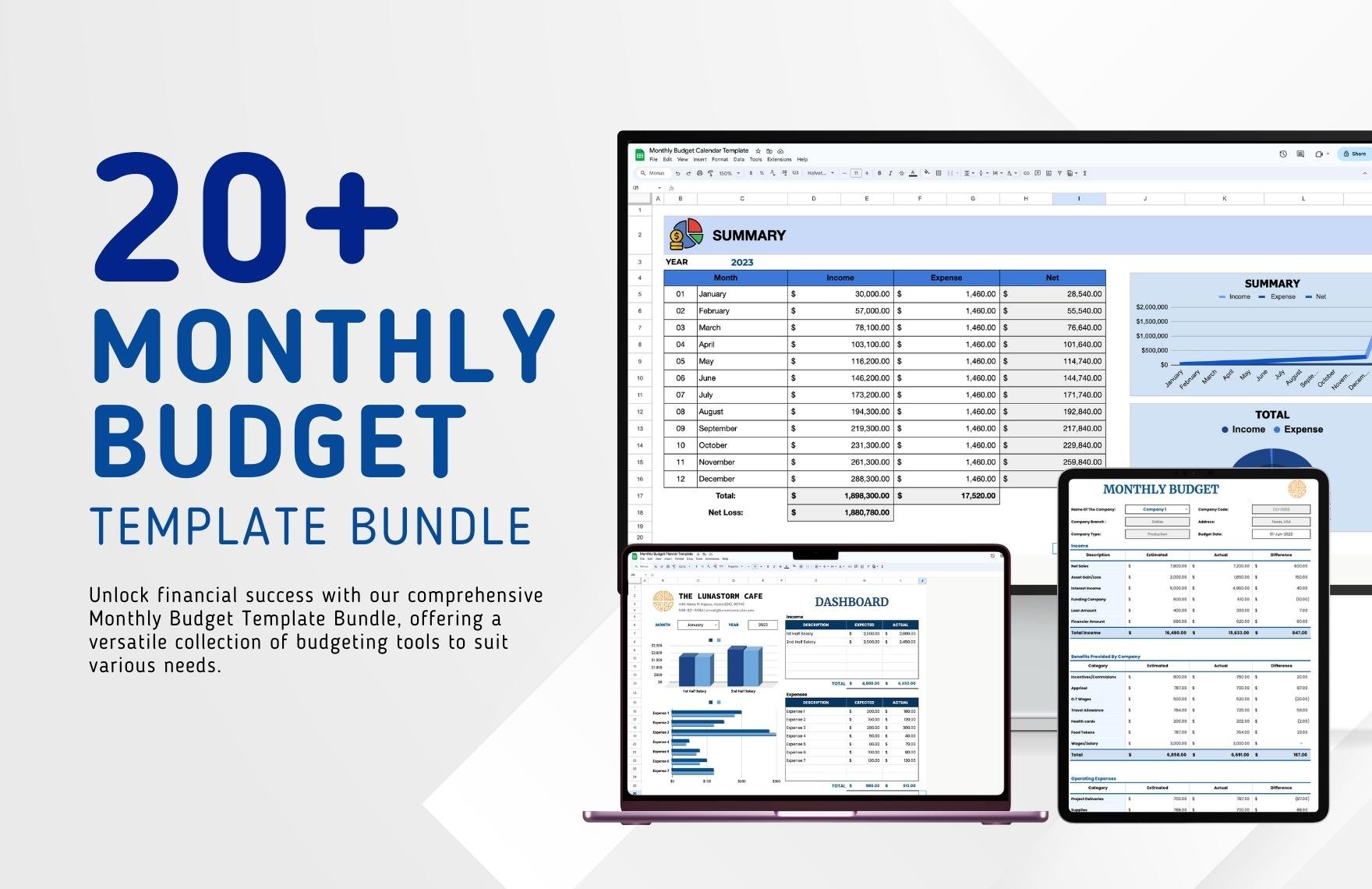

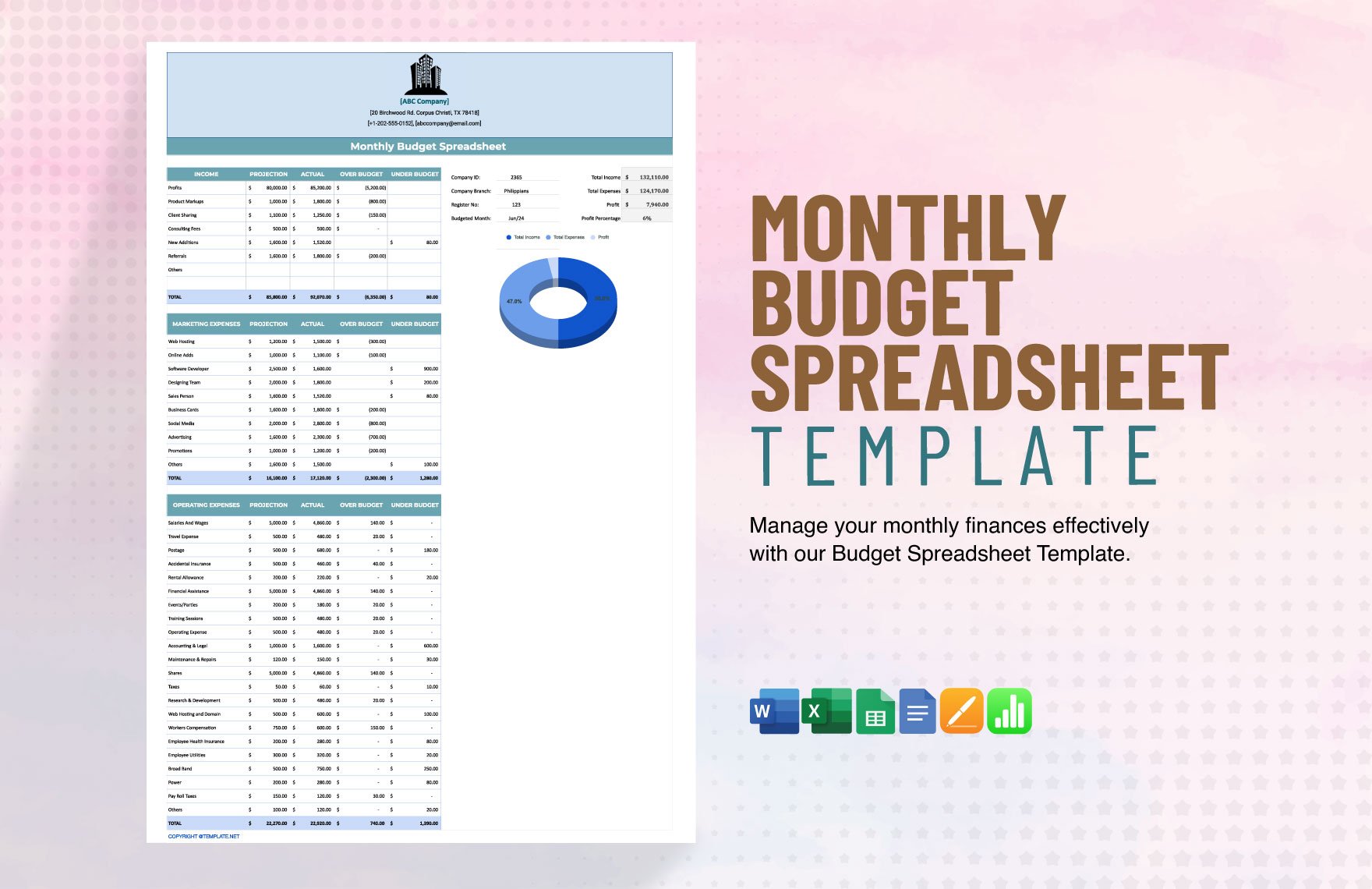

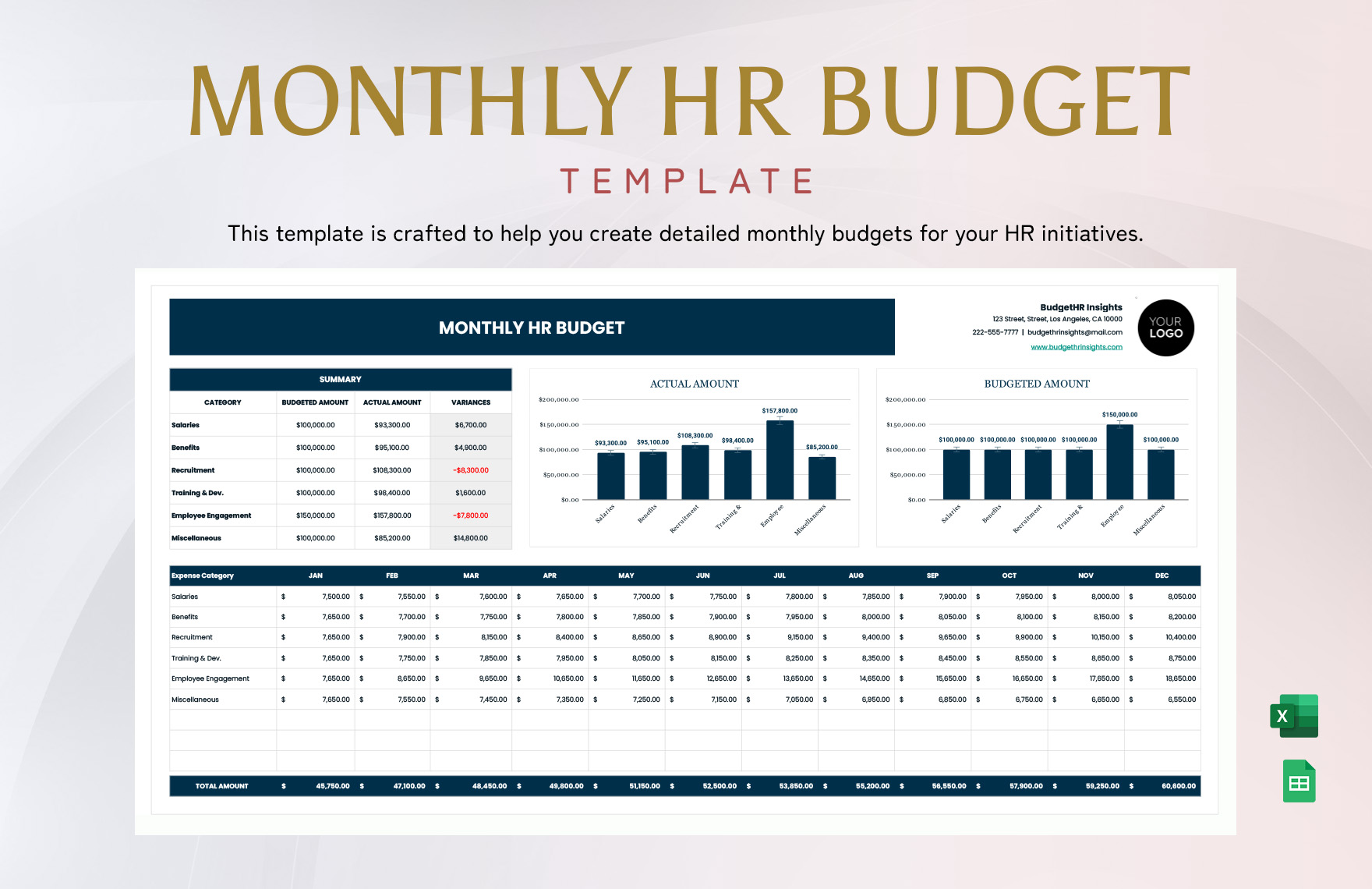

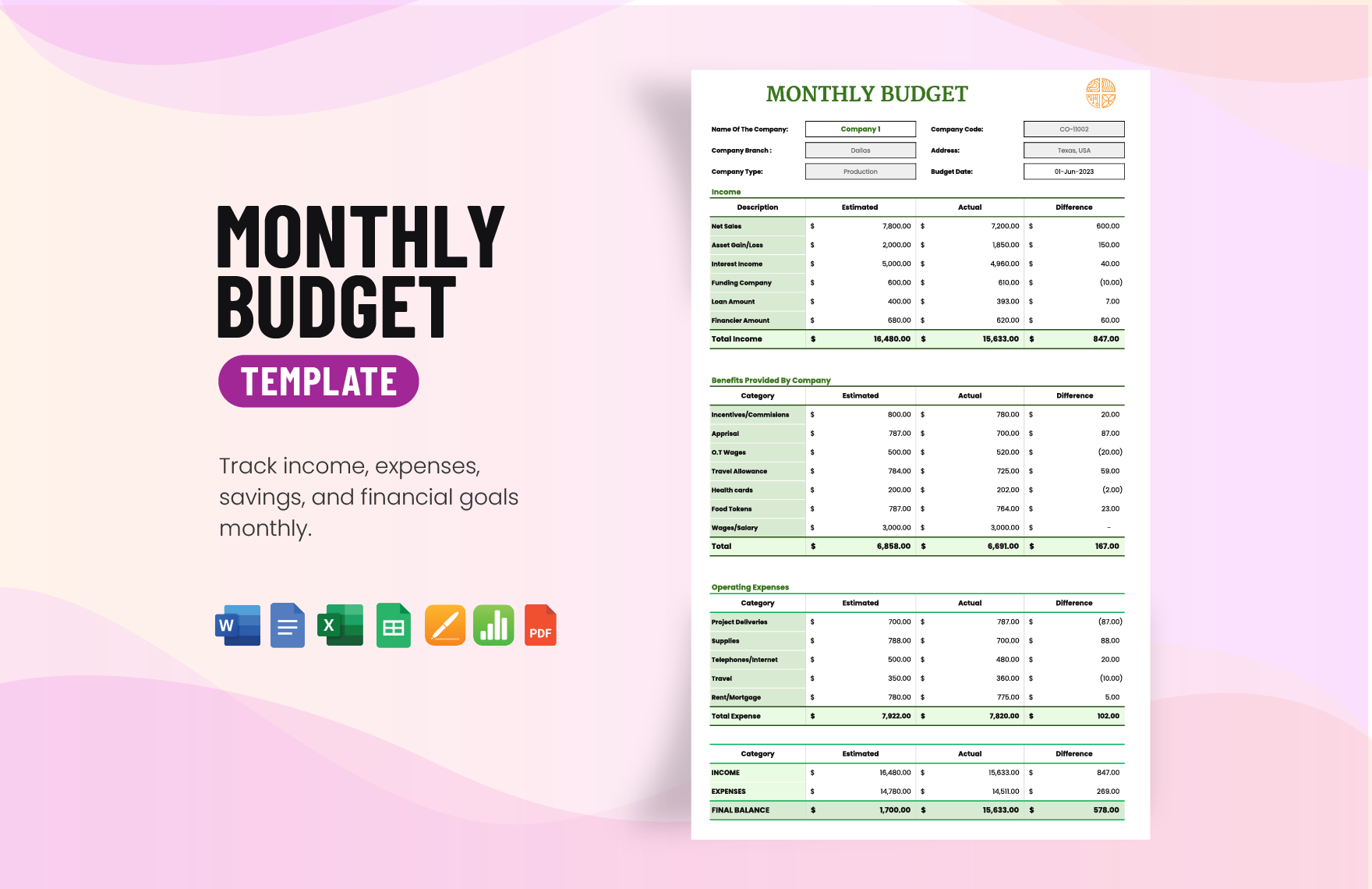

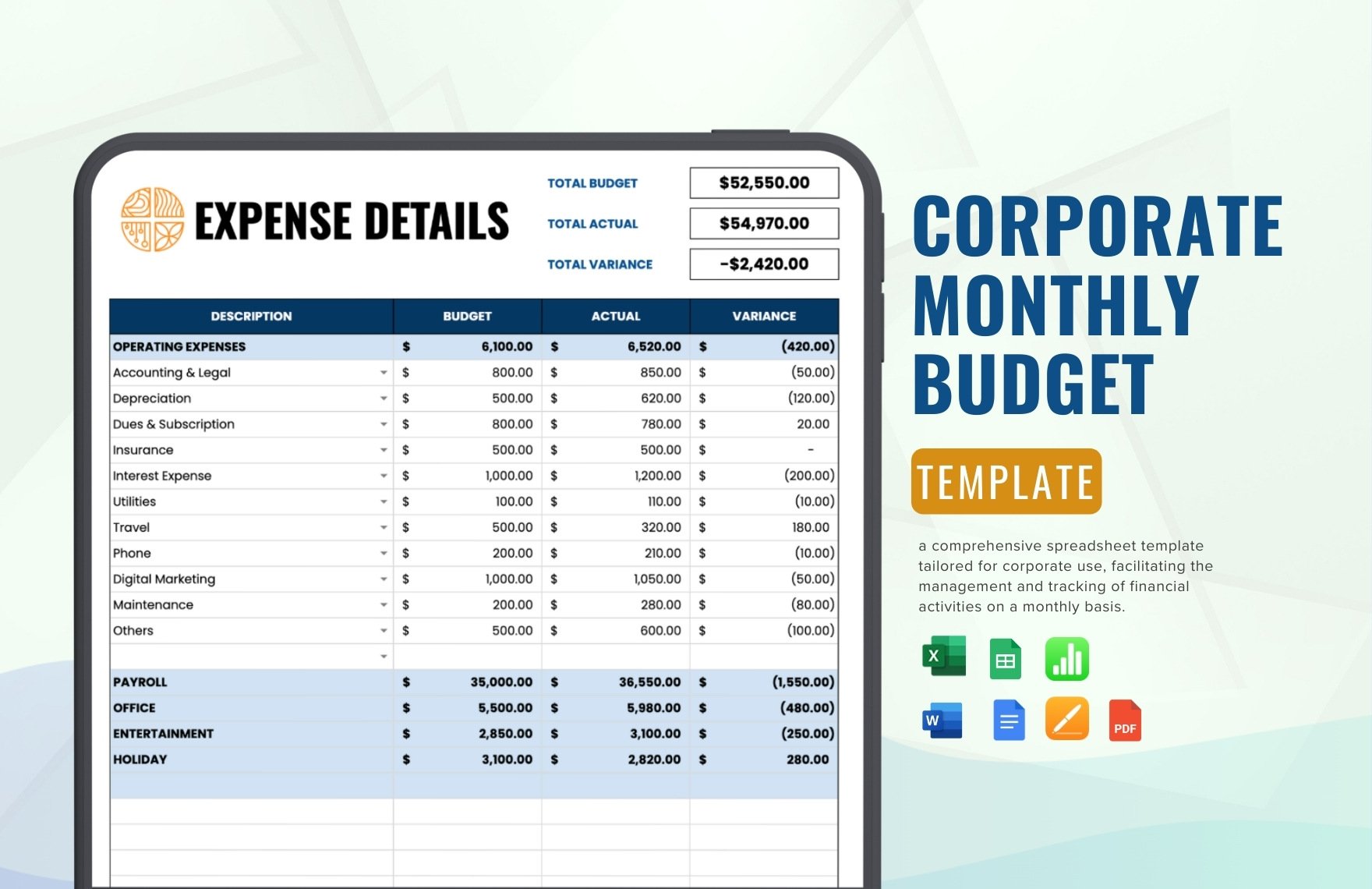

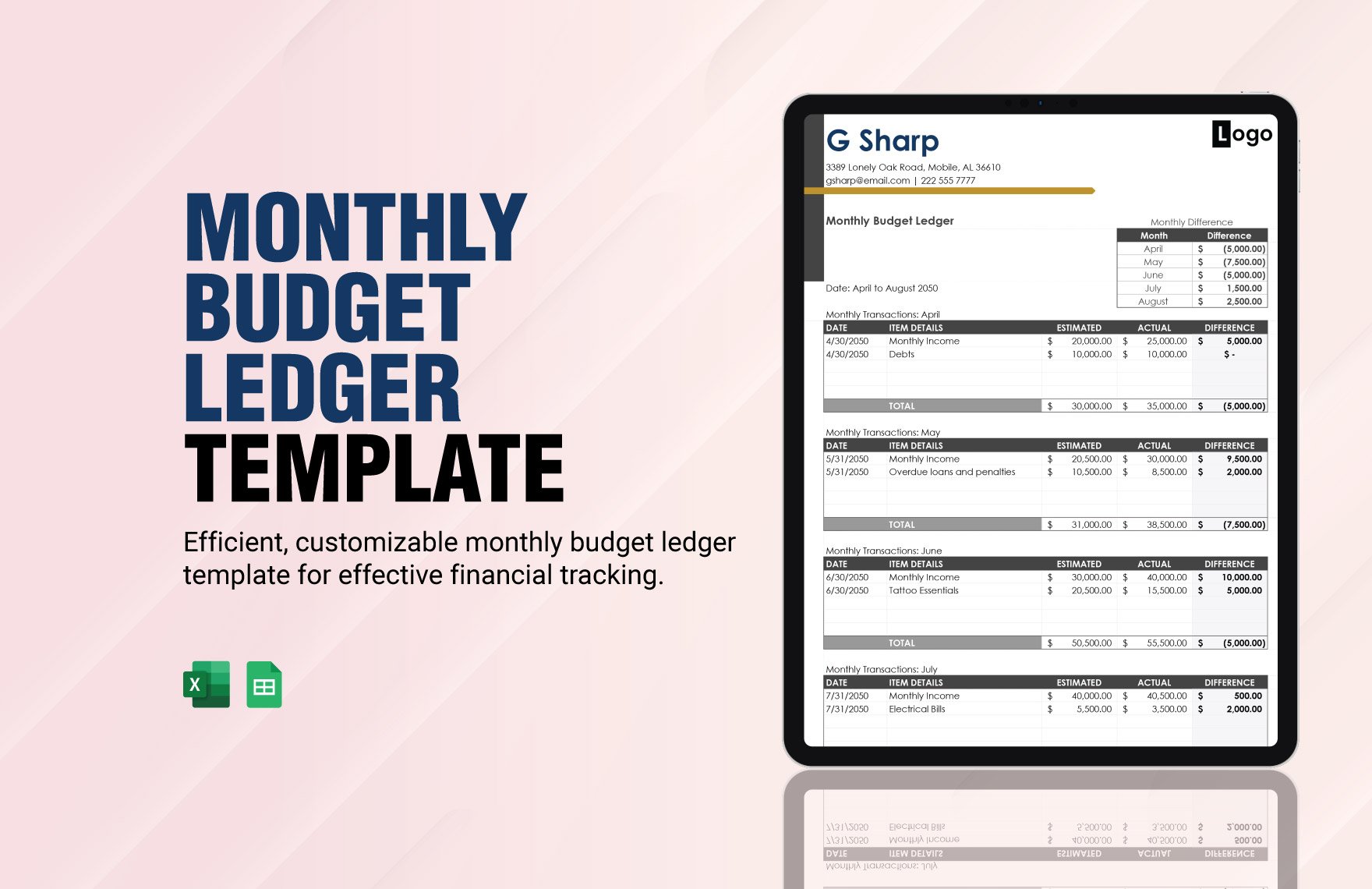

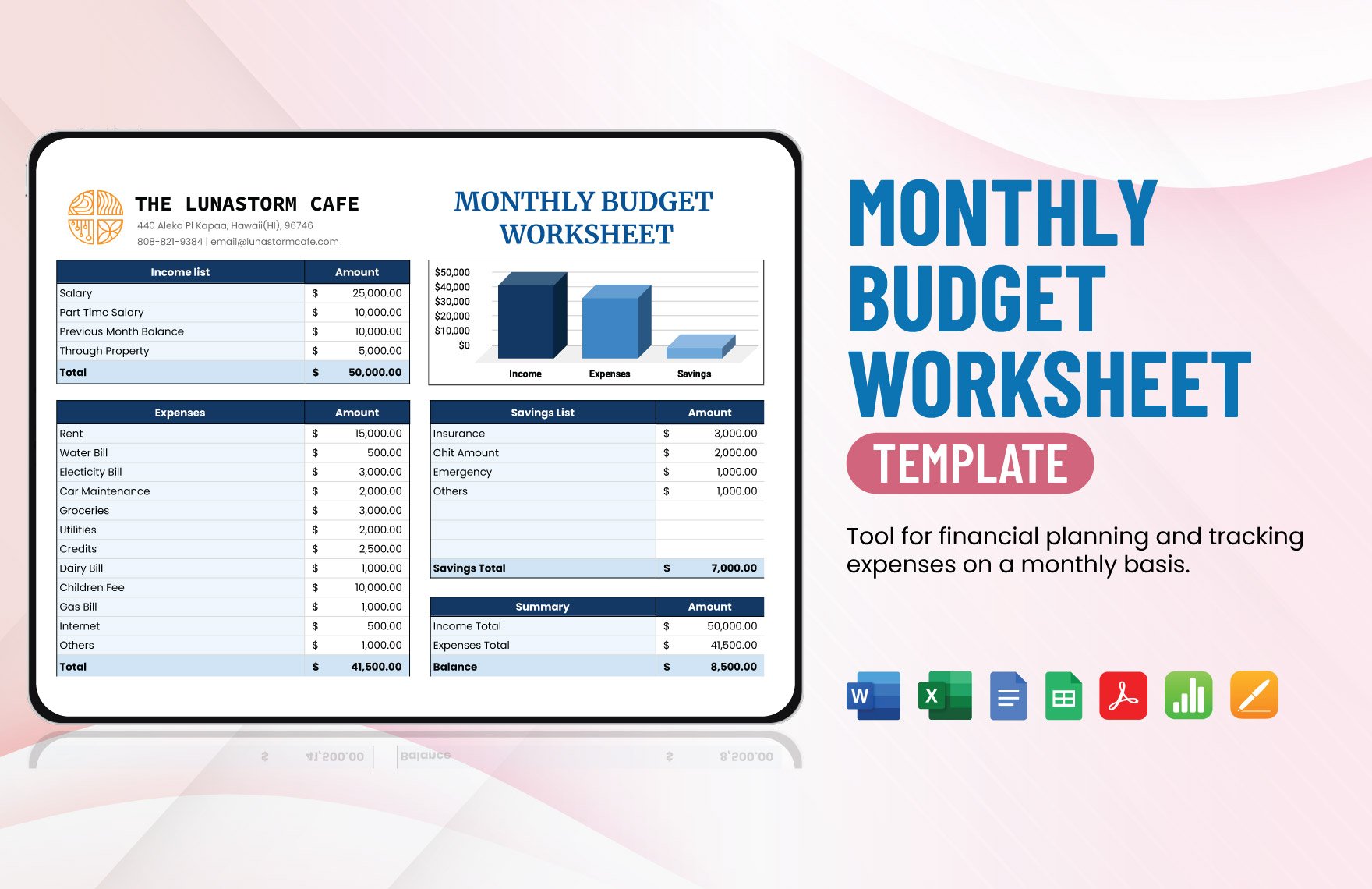

Establishing a monthly budget is essential as you live your everyday life. It will help you handle payments connected to your household for your family and your other bills for personal purposes. If you plan on creating a simple budget plan so you can get yourself strategizing in the months to come, then we got something for you to get you started in that process. Please try our ready-made Monthly Budget Templates, which are 100% customizable, easy to edit, printable, and professionally made so that you won't have a hassle creating one in Excel from scratch. Get your blank spreadsheet ready and download our ready-made templates from scratch.

How to Create a Monthly Budget in Excel

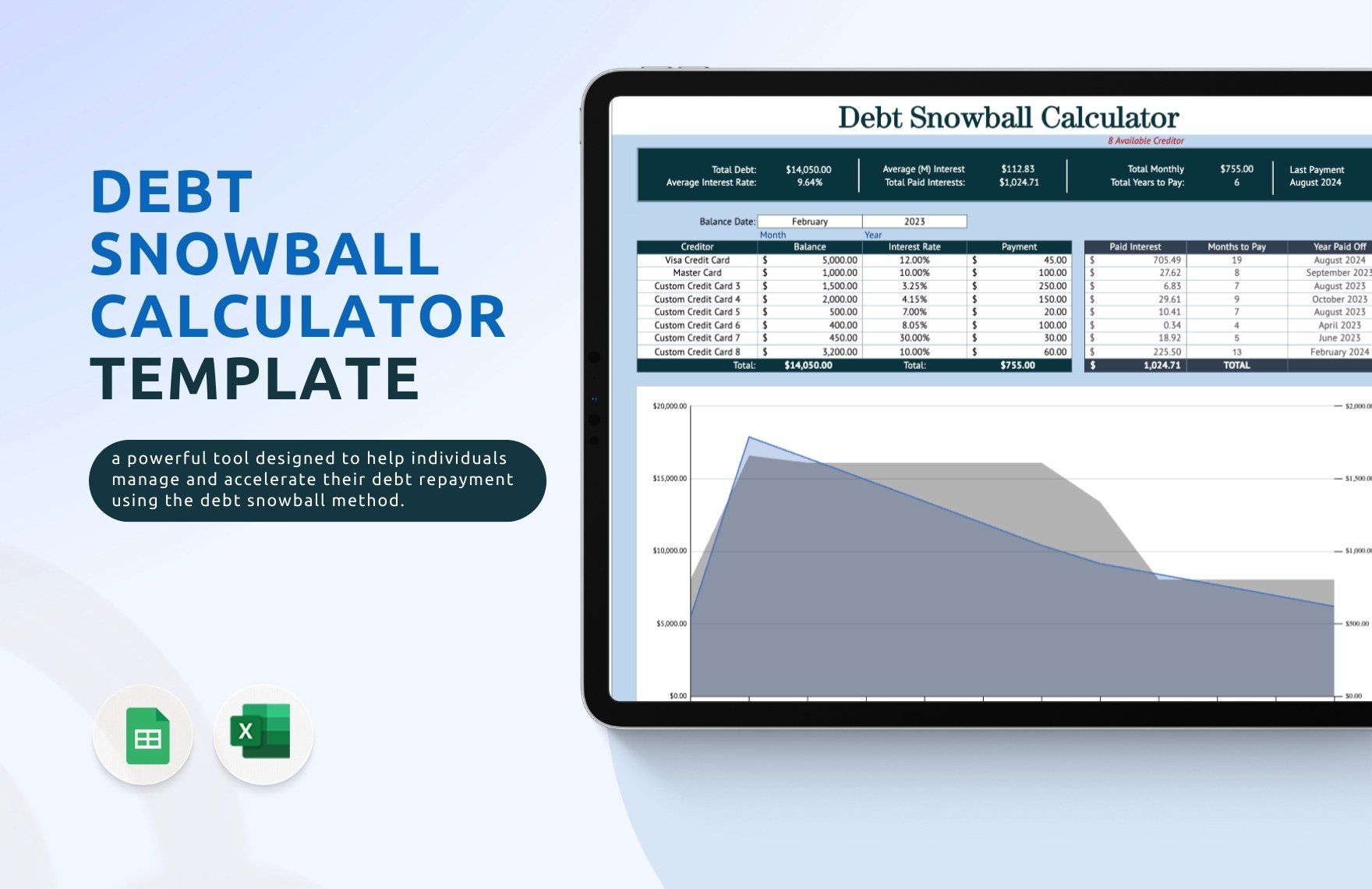

Creating your sample budget plan consists of a variety of payments, depending on the things you owe daily or weekly. You don't have to go all cute and stingy with your budget. We want you to learn about budgeting your hard-earned money properly so you can have something left for yourself and place it all in your savings account for future purposes. Statistics revealed from the Debt website about personal finance statistics show that most people today use 68% of their payments through the use of a credit card. Credit cards prove to be essential when utilized smartly. However, if you use it compulsively, then you'll probably have some big problems in the months to come. With that said, we will give you these steps in creating a monthly budget that can help you in saving more of your earnings in the process.

1. How Do You Want To Save

When creating a budget plan, we want you to think about how you want to save as part of your budgeting strategy. It is important to establish goals when budgeting the money you earned at your job and how you should utilize your budget for the better not just for yourself, but to your family as well in the process.

2. Breakdown Your Expenses

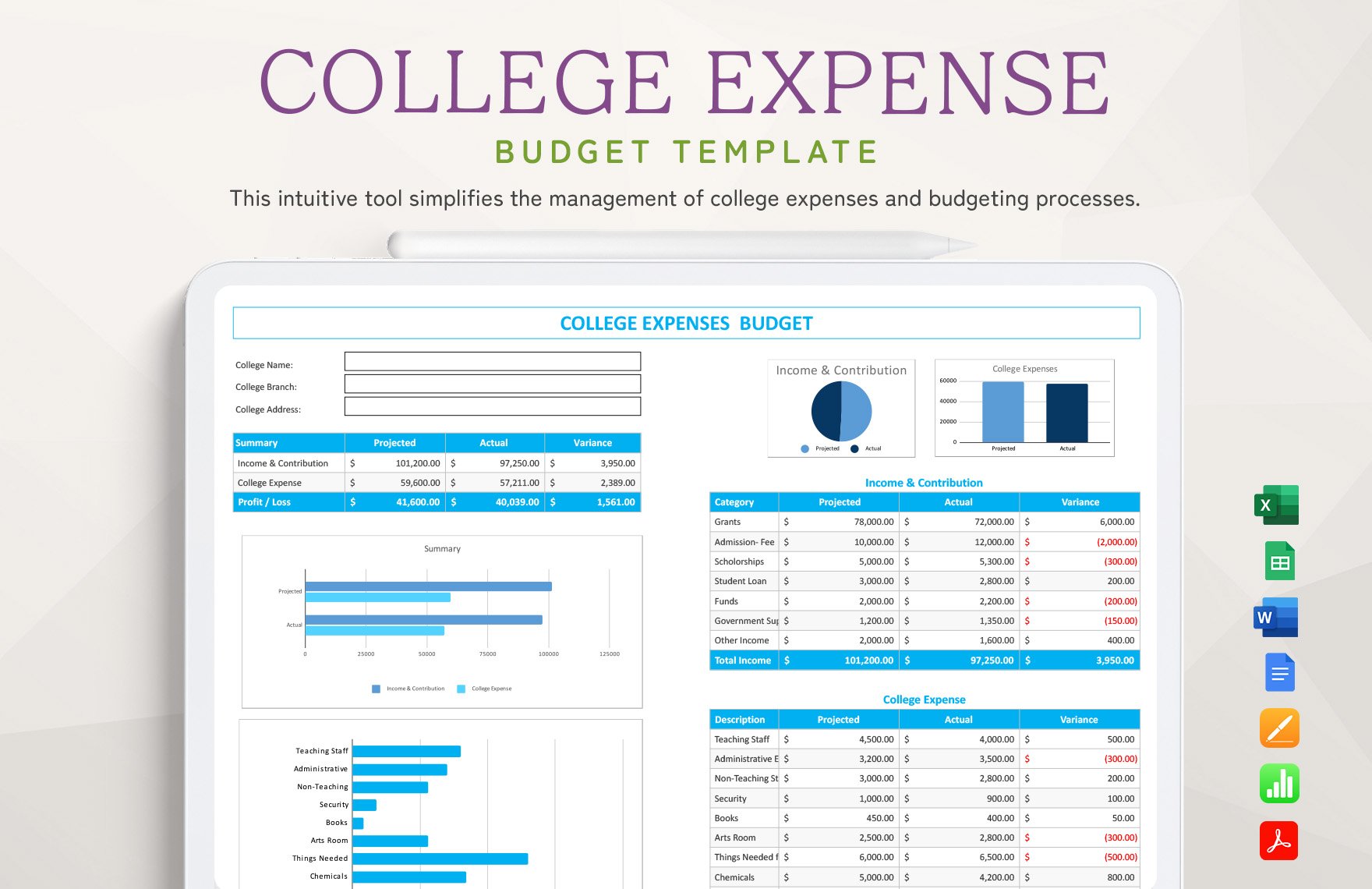

The next step after establishing how you want to budget your savings is to break down the expenses you spend on a daily to weekly basis. Having a weekly budget plan may come in handy, so you micro-manage your budget from time to time. Enumerate the following, depending on the things you are responsible for budgeting, not only for yourself but for your family. Unless if you're single, then you wouldn't be spending as much, and it will make things a lot easier for you as you save and budget your expenses.

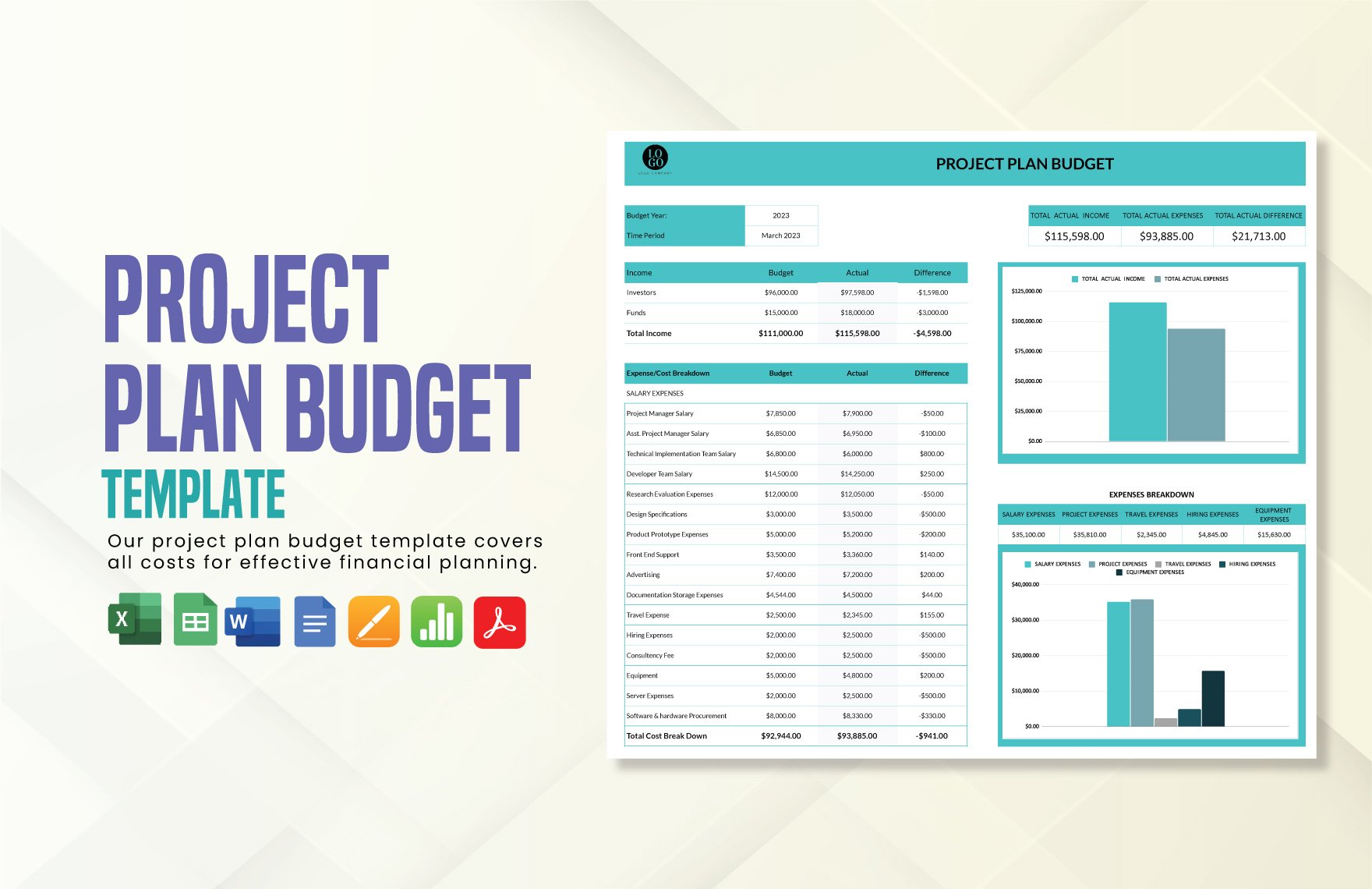

3. Budget Accurately

After breaking down the categories particular to your simple budget plan, it's time for you to estimate your earnings. You may divide them separately, depending on your bill's rate for that particular expense. Budget wisely and accurately to make you didn't miss out on something, which may result in you getting short in cash in the process. Never get compulsive as well, unless you need that particular thing you wish on purchasing.

4. Start Recording

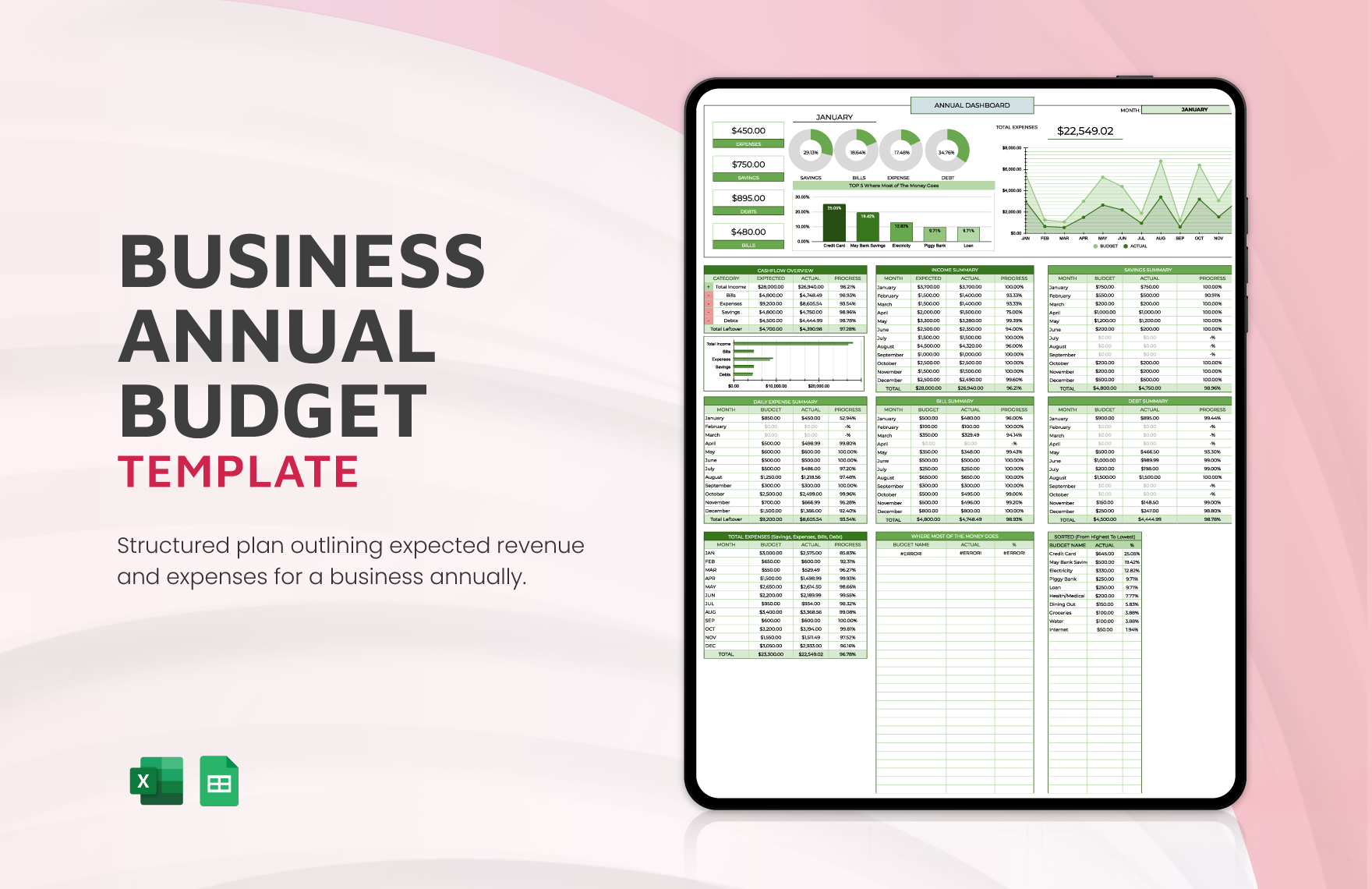

After budgeting everything required for your strategic plan to come into place, it's time to record and observe how much you have left after dividing your expenses for your monthly budget. Doing this will help you utilize the remaining money left wisely before your next payday. You may budget a portion of what you have left for your savings account. It would all depend on you since it's your money.

5. Review and Maintain

Before putting your printable budget into action, we ask you to read your work for finalization thoroughly. In case you missed out on something minor or essential, you can always set revisions when necessary. If you feel that it's good enough for you to utilize, then you may print it out and make it a priority to maintain this habit for the betterment of yourself in days, weeks, months, and years to come.