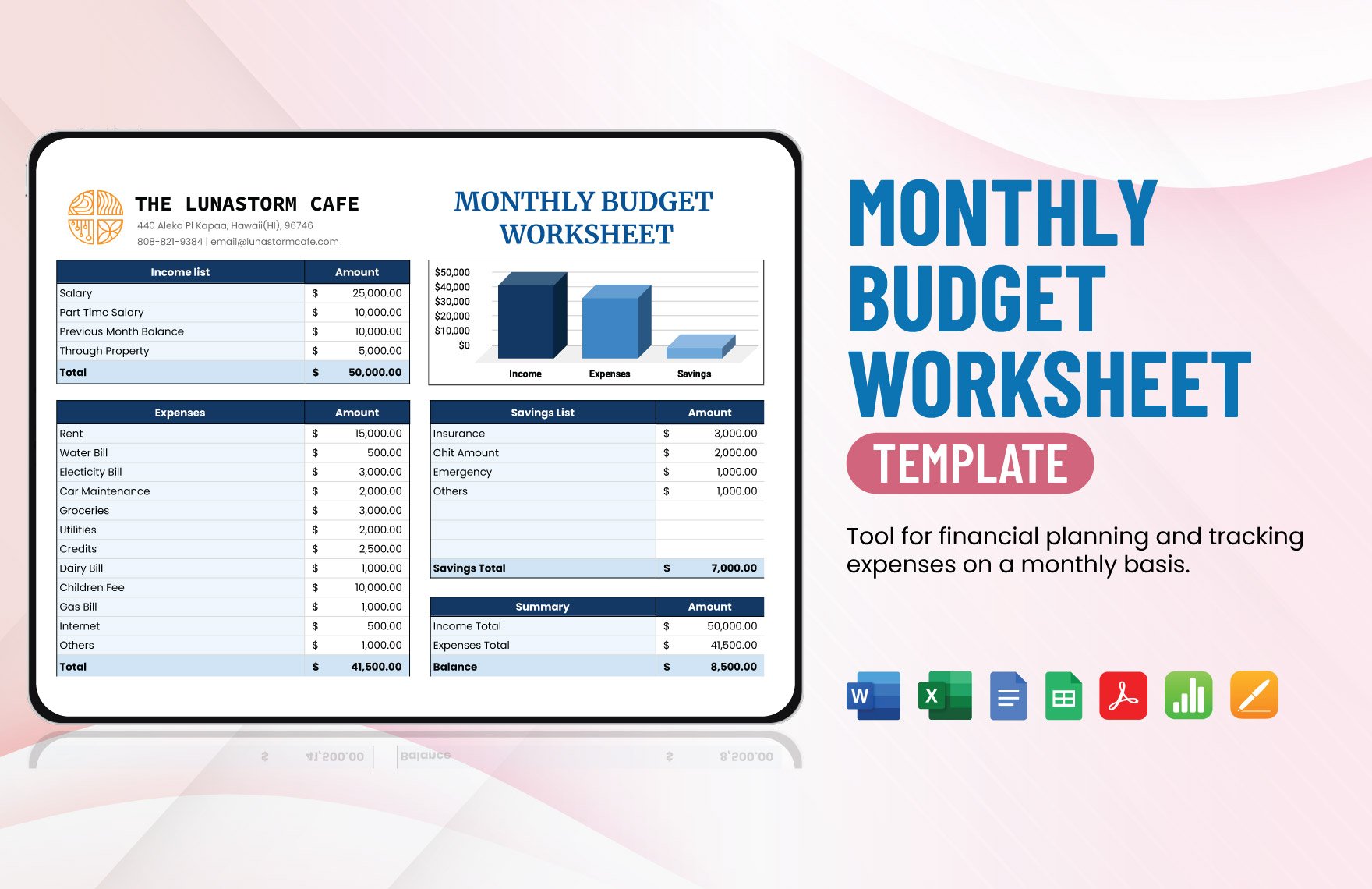

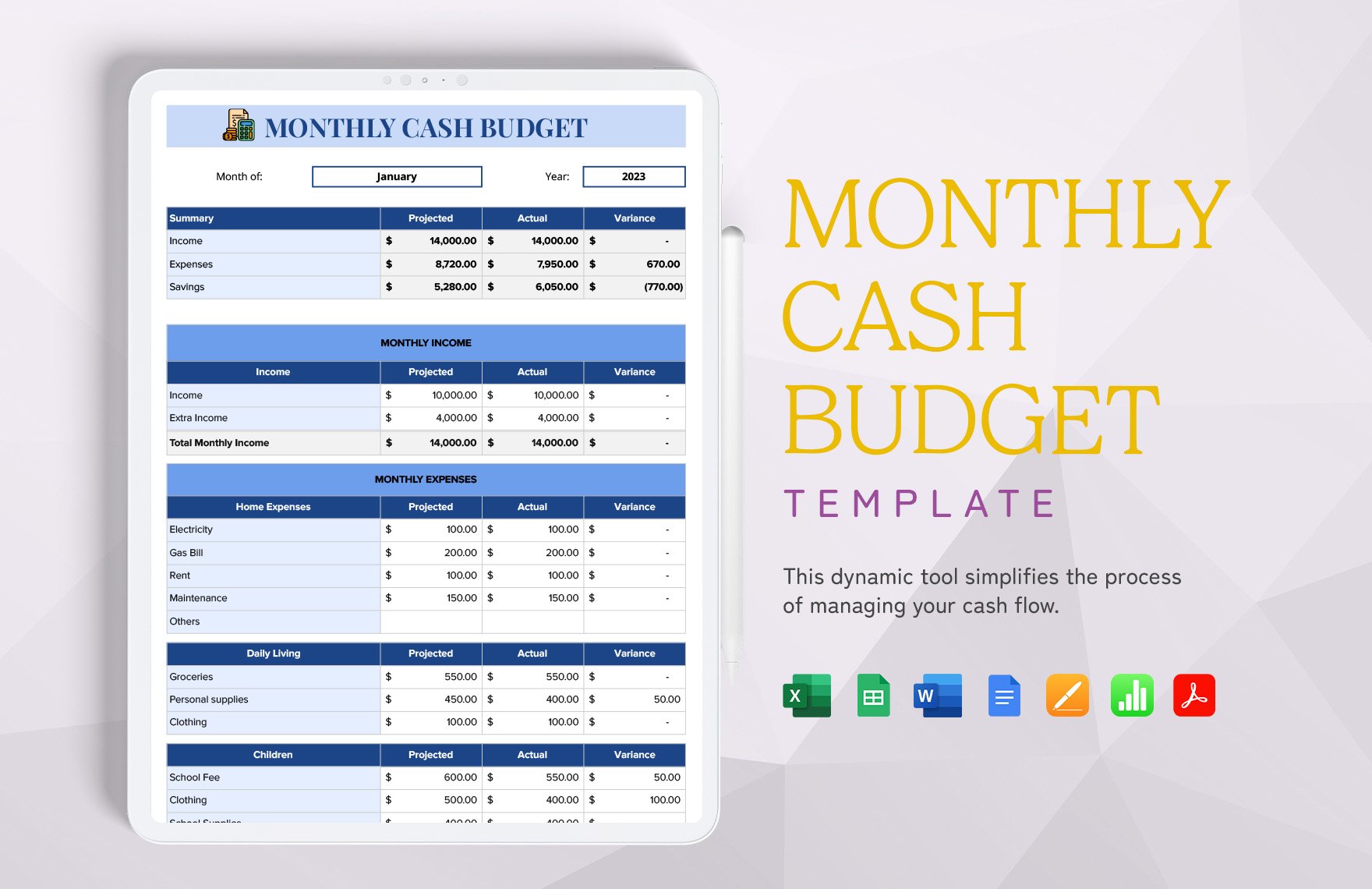

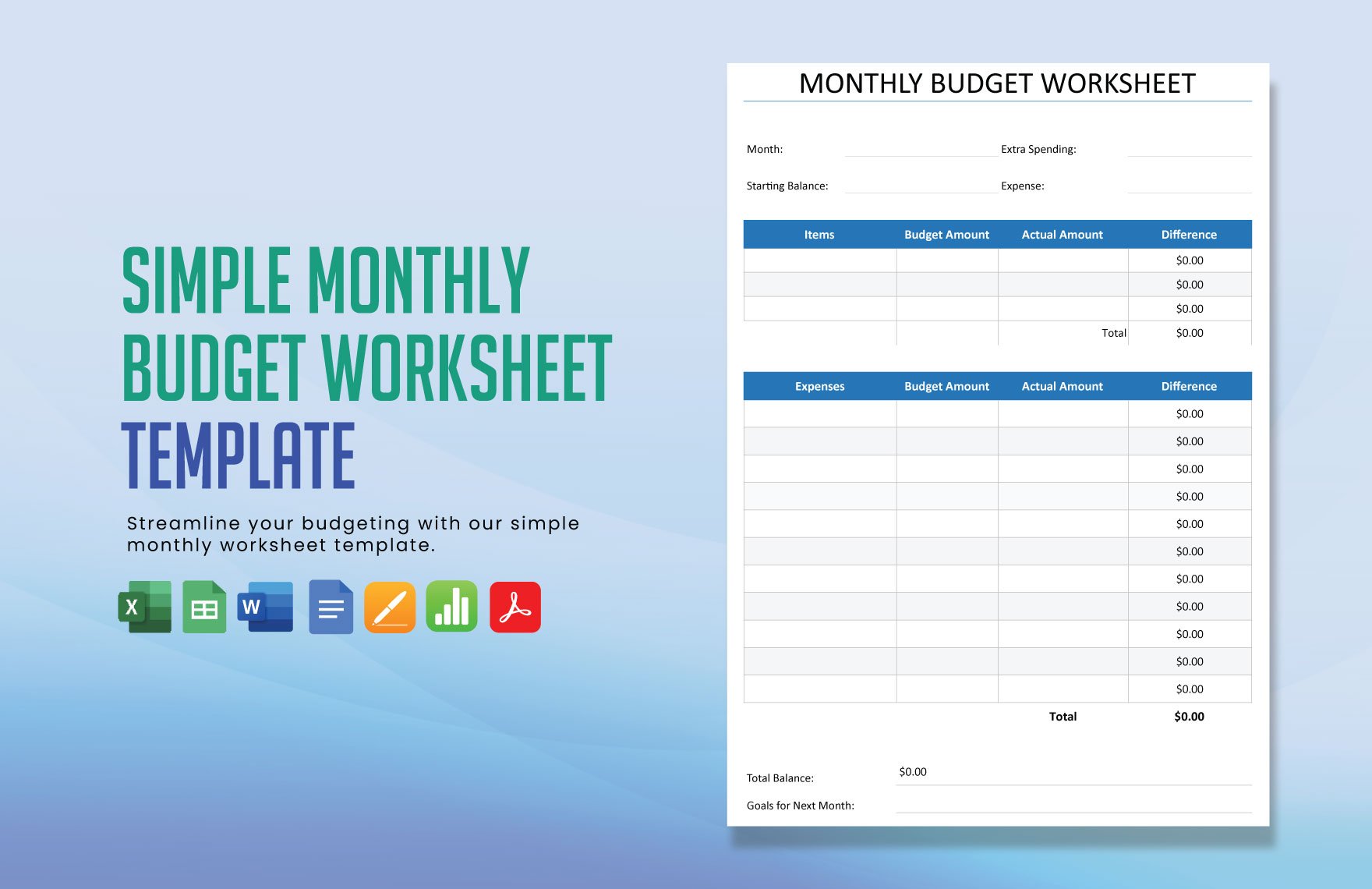

Every month, you receive your monthly income after working hard. However, you need to pay bunch of things so you can survive the upcoming months. You could be paying for your family and everything around your household, or you could be paying for other things for personal purposes. If you plan on creating a simple budget plan without having the trouble to create one on a blank spreadsheet in Excel from scratch, then we got something for you to get started. Try our ready-made Monthly Budget Templates, which are 100% customizable, easy to edit, printable, and professionally made so you won't have a problem creating one from start to finish. Download our ready-made templates today!

How to Create a Monthly Budget in Pages

Creating your personal budget plan requires a lot of dedication if you wish to succeed in the years to come. You don't want to overspend what you receive at the end of the month. You have bills to pay, groceries to buy, and other essential things required for you to live and survive in the upcoming months. It's the current cycle of life, and that's how most people these days live to get by. Statistics revealed on the Debt website show that most Americans who apply budgeting on their daily lives might save up to $75,000 for an entire year. With that said, let us give you these essential steps in making your monthly budget plan.

1. Receiving Your Income

When payday comes, people usually celebrate after a long month of working. They go out, party, have a beer, and do some crazy stuff in that single night. However, they would usually struggle as the new month begins because of careless spending, and we don't want you to end up like those people. Have a solid budget plan once you receive your monthly income. Take the time to study your income and budget wisely for the essential things in life. You may end up saving a bit or more at the end of it should you succeed.

2. Breaking It All Down

After receiving and analyzing your income carefully, list the essential factors on where a portion of your money will go. Enumerate everything from the most important down to the least. Doing this will help you strategize your sample budget better without running short in cash during the process.

3. Spending Wisely

After enumerating all the necessities you need to pay for the upcoming month, it's time to get spending. However, don't overspend for unnecessary things unless you need it for a particular purpose. We are not saying that you should go all cute and minimal with your expenses; just spend wisely on essential things in your daily life. Apply this to your strategic plan to improve your chances of saving more at the end of the month.

4. Saving What's Left

After utilizing your simple budget for all the necessities required for the month, it's time to use the remaining amount for your savings. Of course, you could use a portion for your other daily needs such as food and transport. We suggest that as soon as your next payday arrives, place the current savings you have in the bank and keep repeating that so you can save more in the future.

5. Making It A Habit

The last step to completing your budget sheet is by making saving a habit. Save and enjoy the luxuries of your savings as you get older. You don't want to work forever. We always have that plan on settling down someday, and if you want that to happen, start saving while you're still working. You won't regret this decision when that day comes.