Bring Your Financial Goals to Life with Personal Budget Templates from Template.net

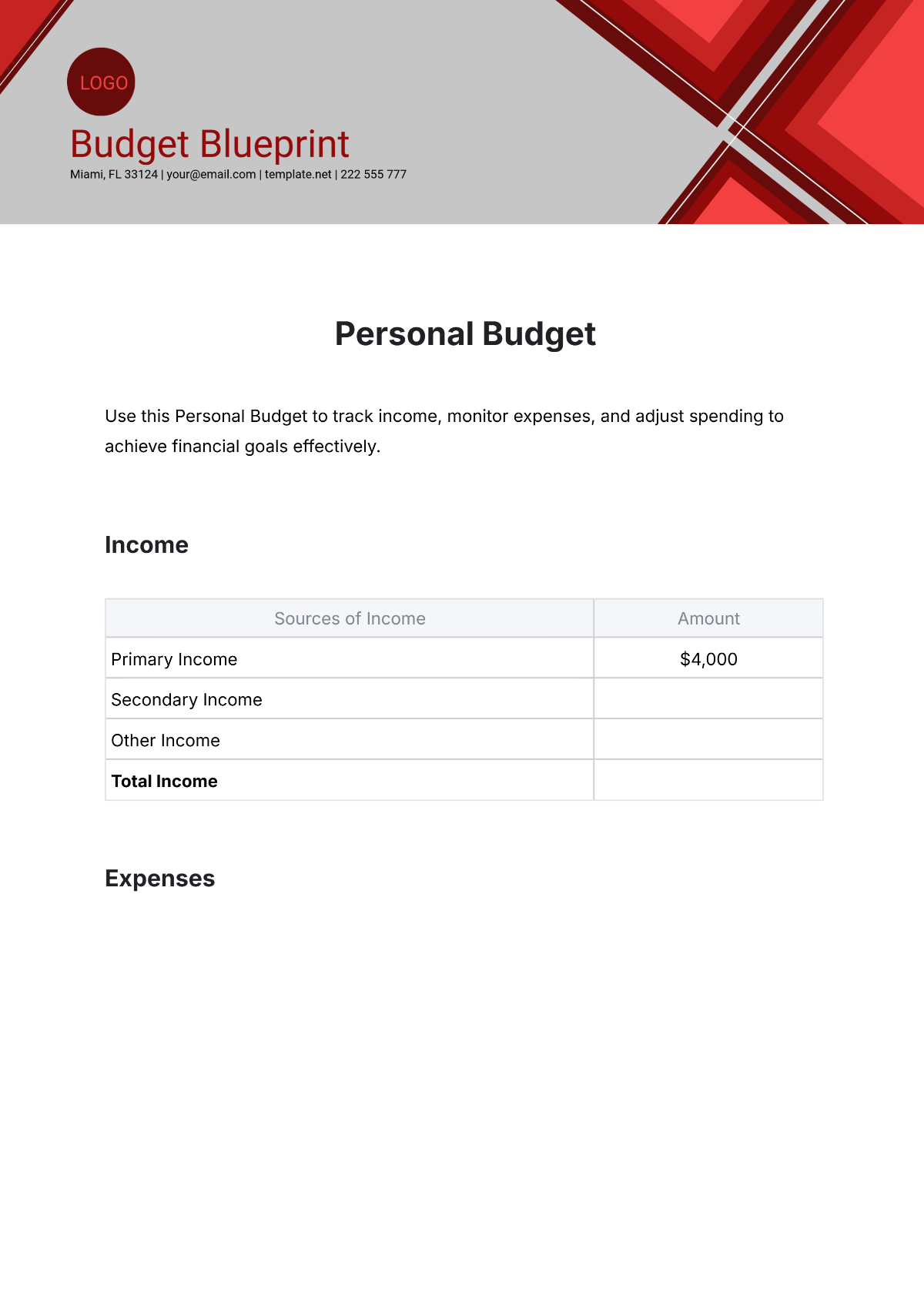

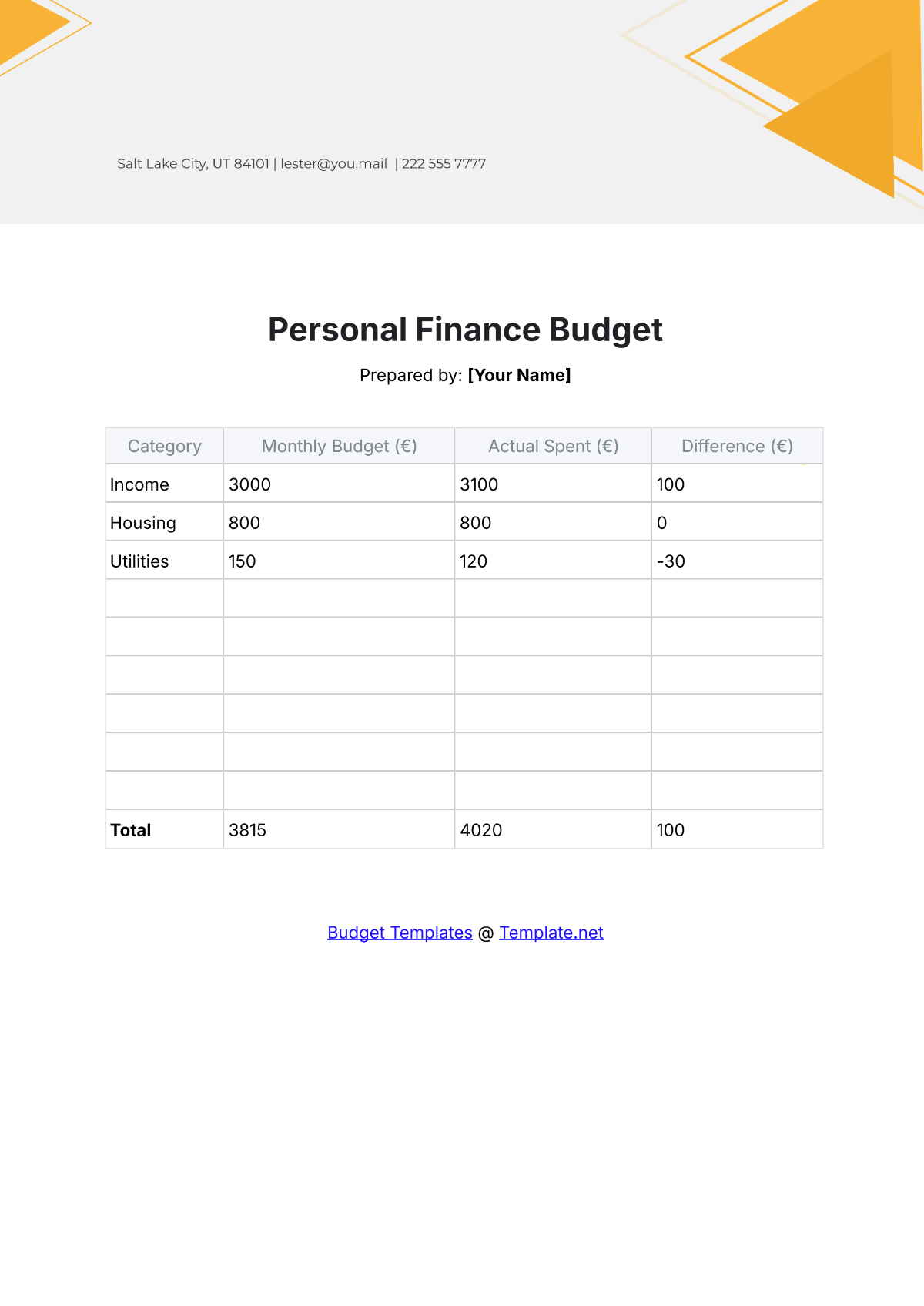

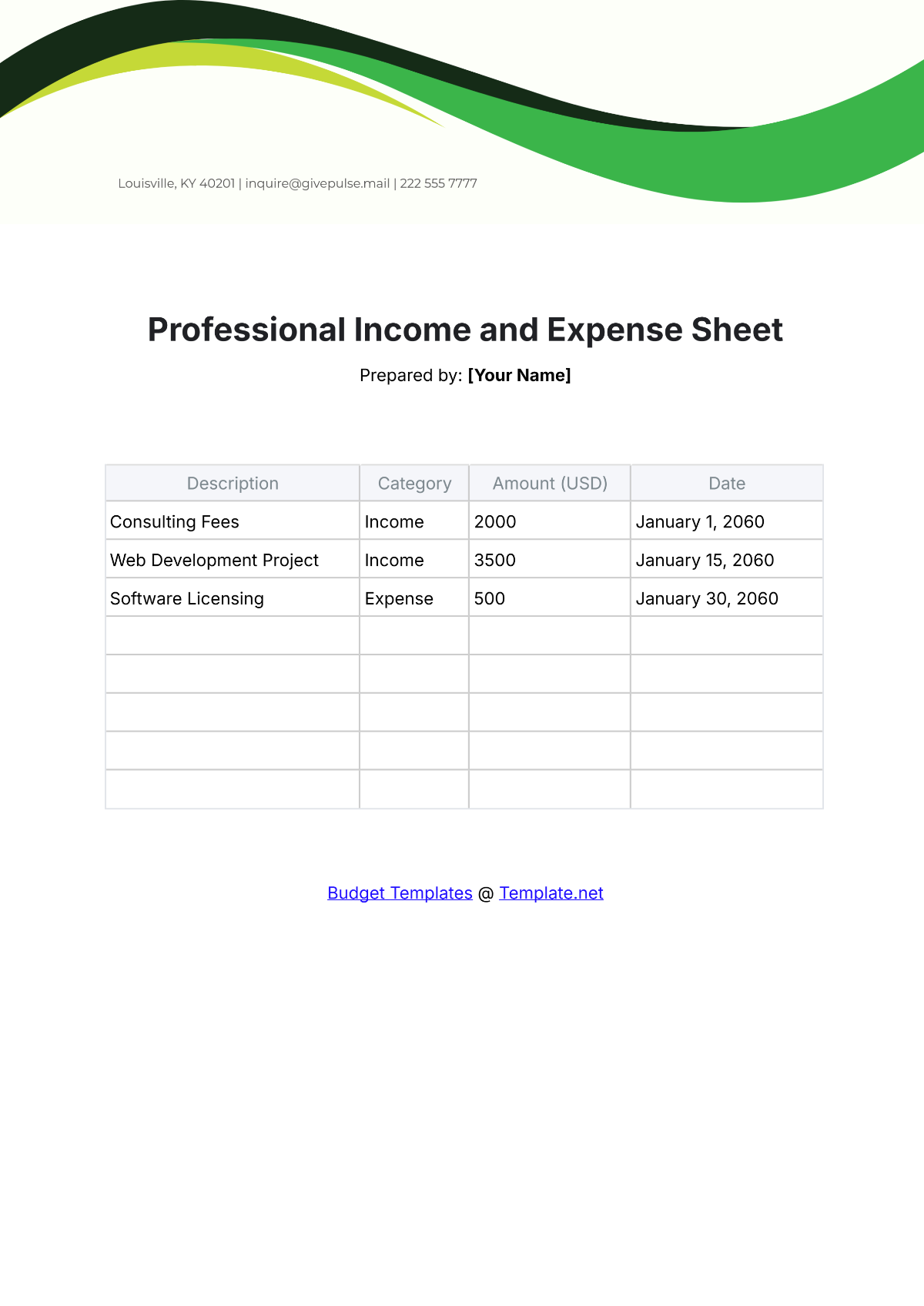

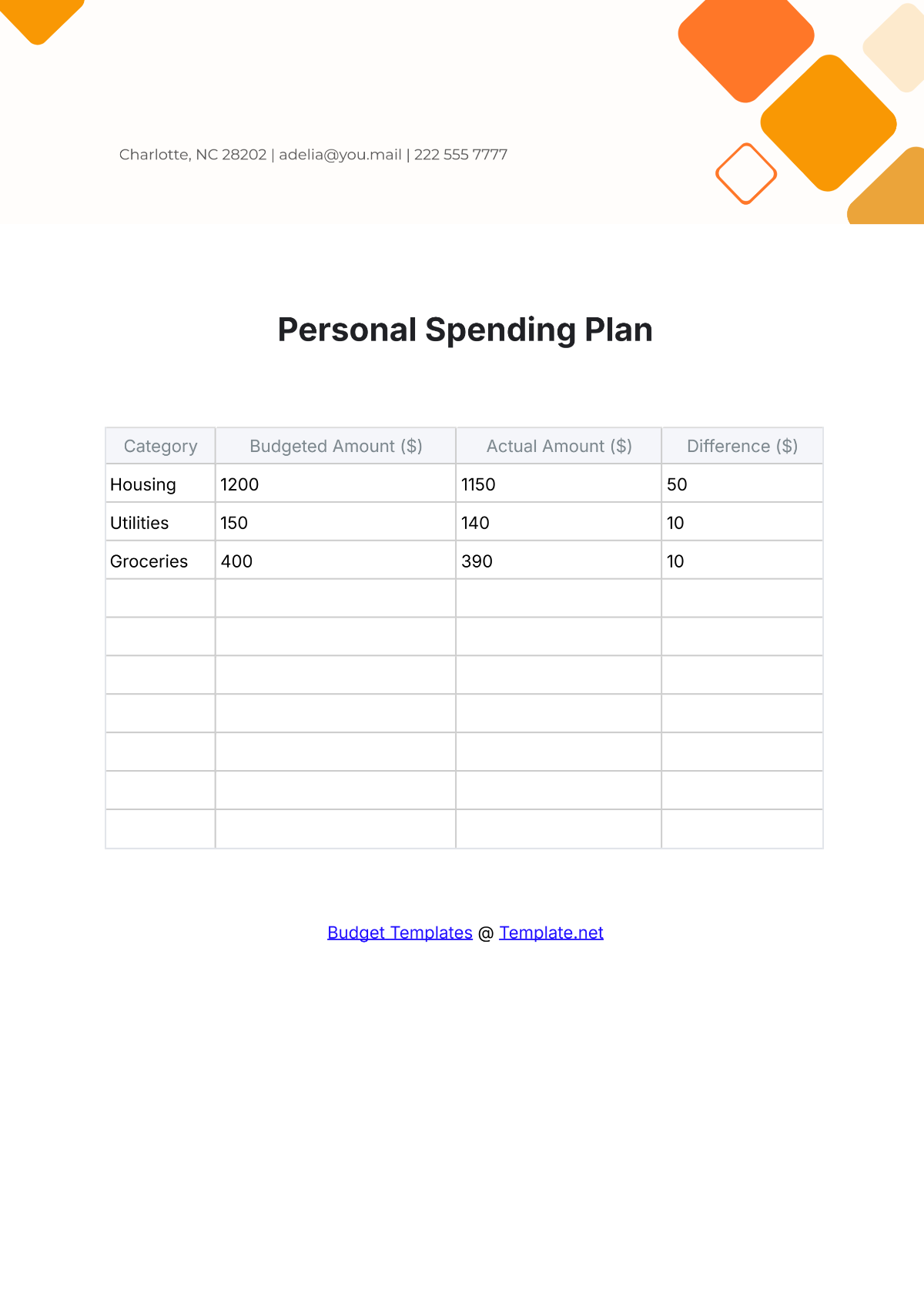

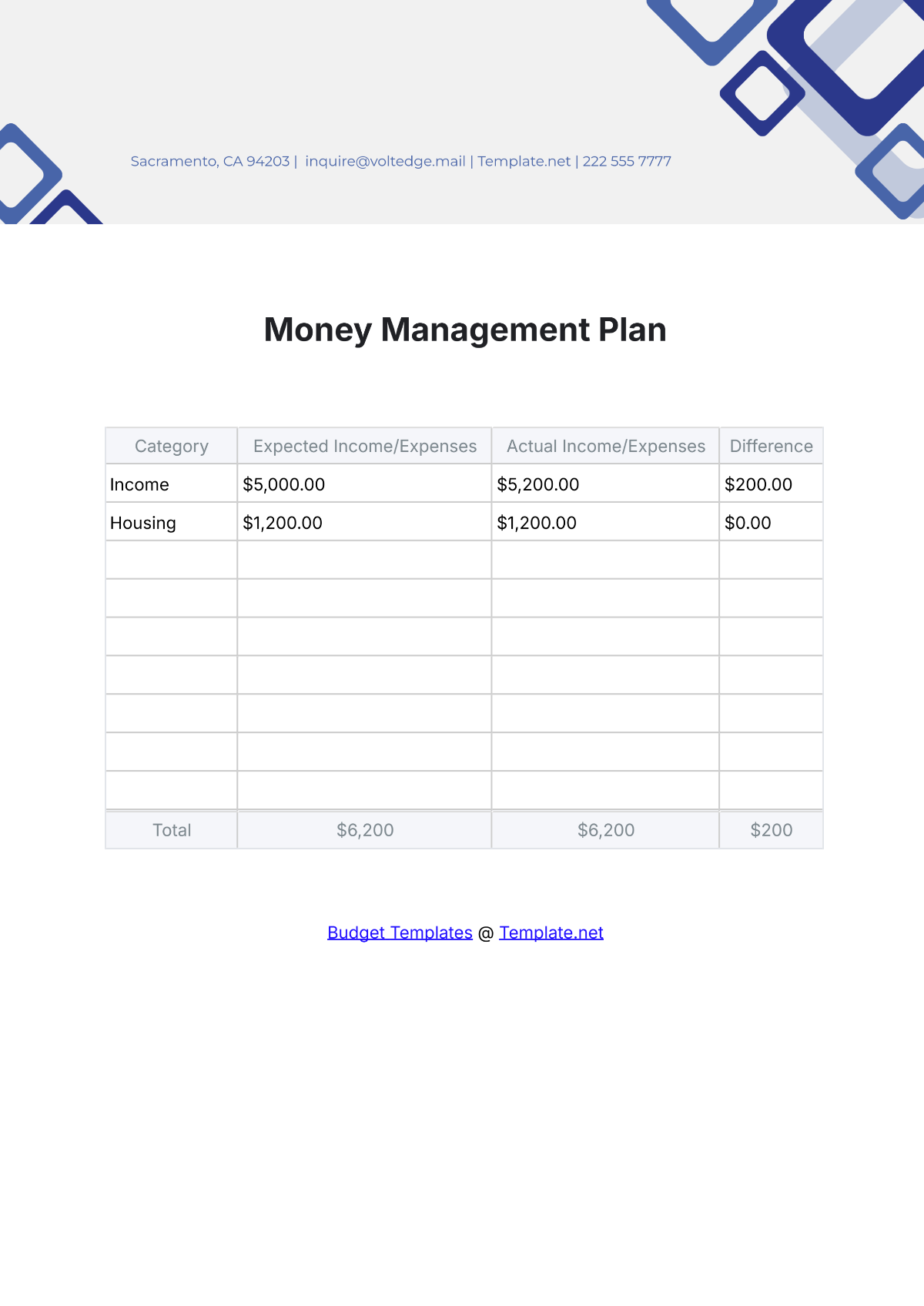

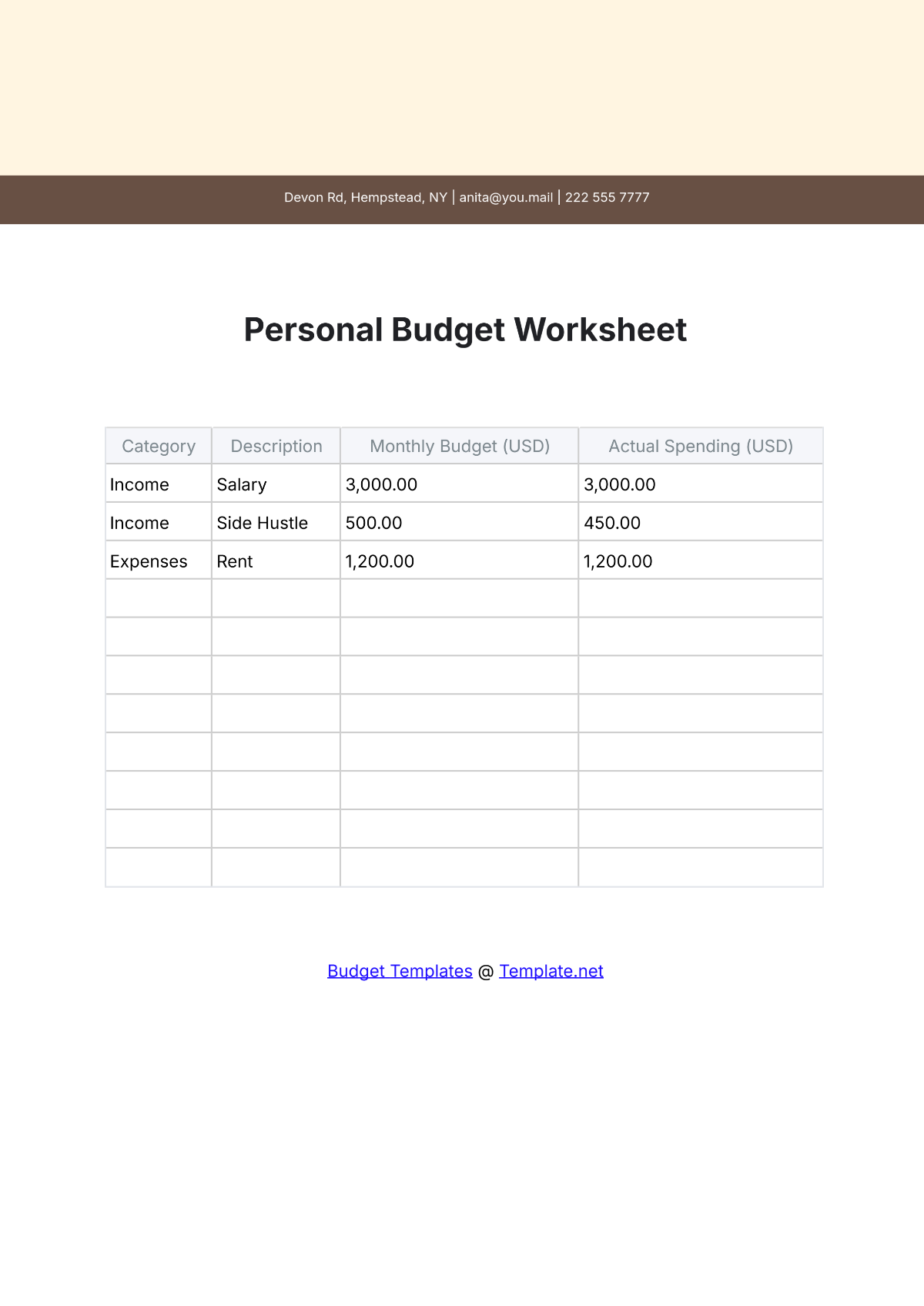

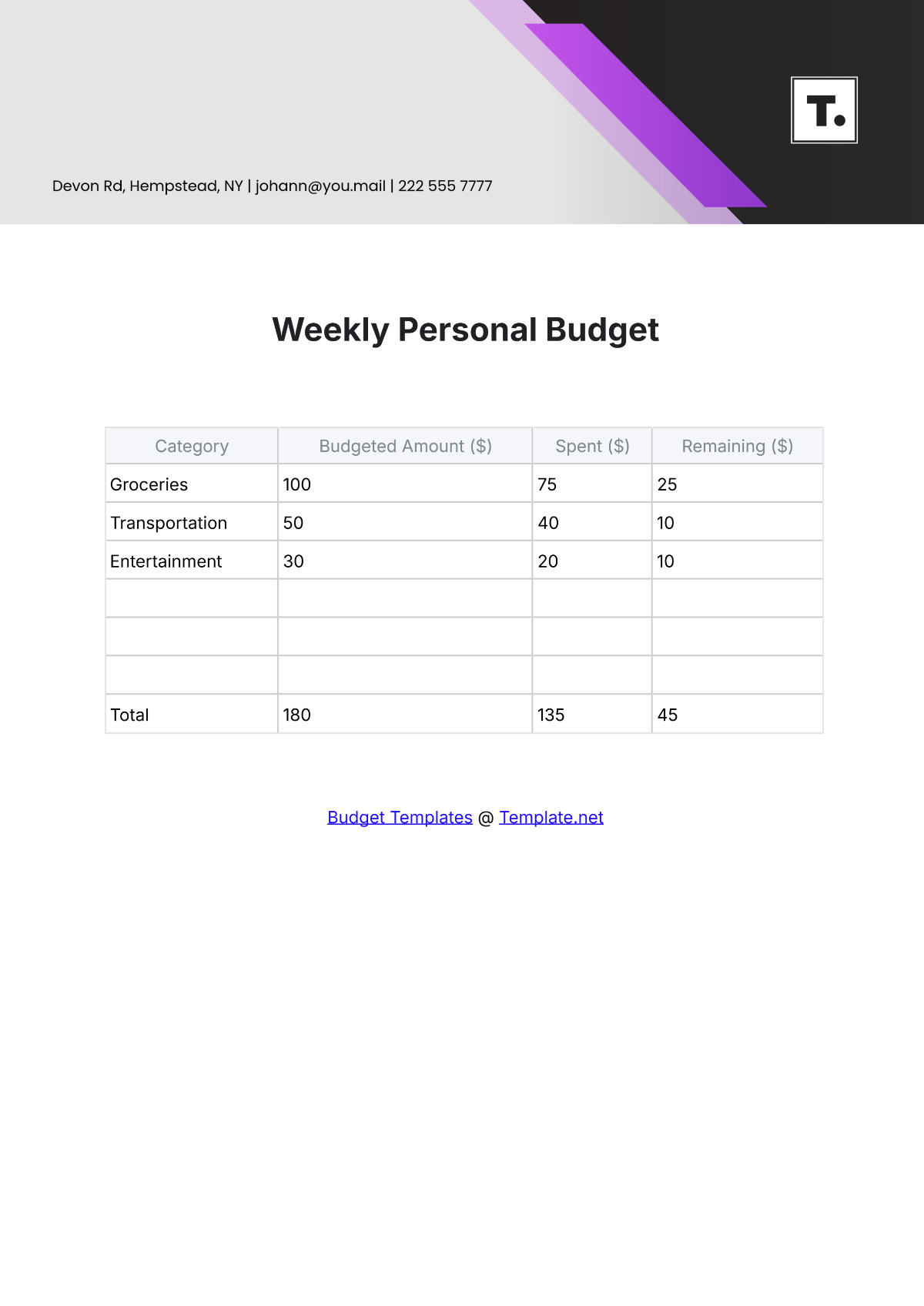

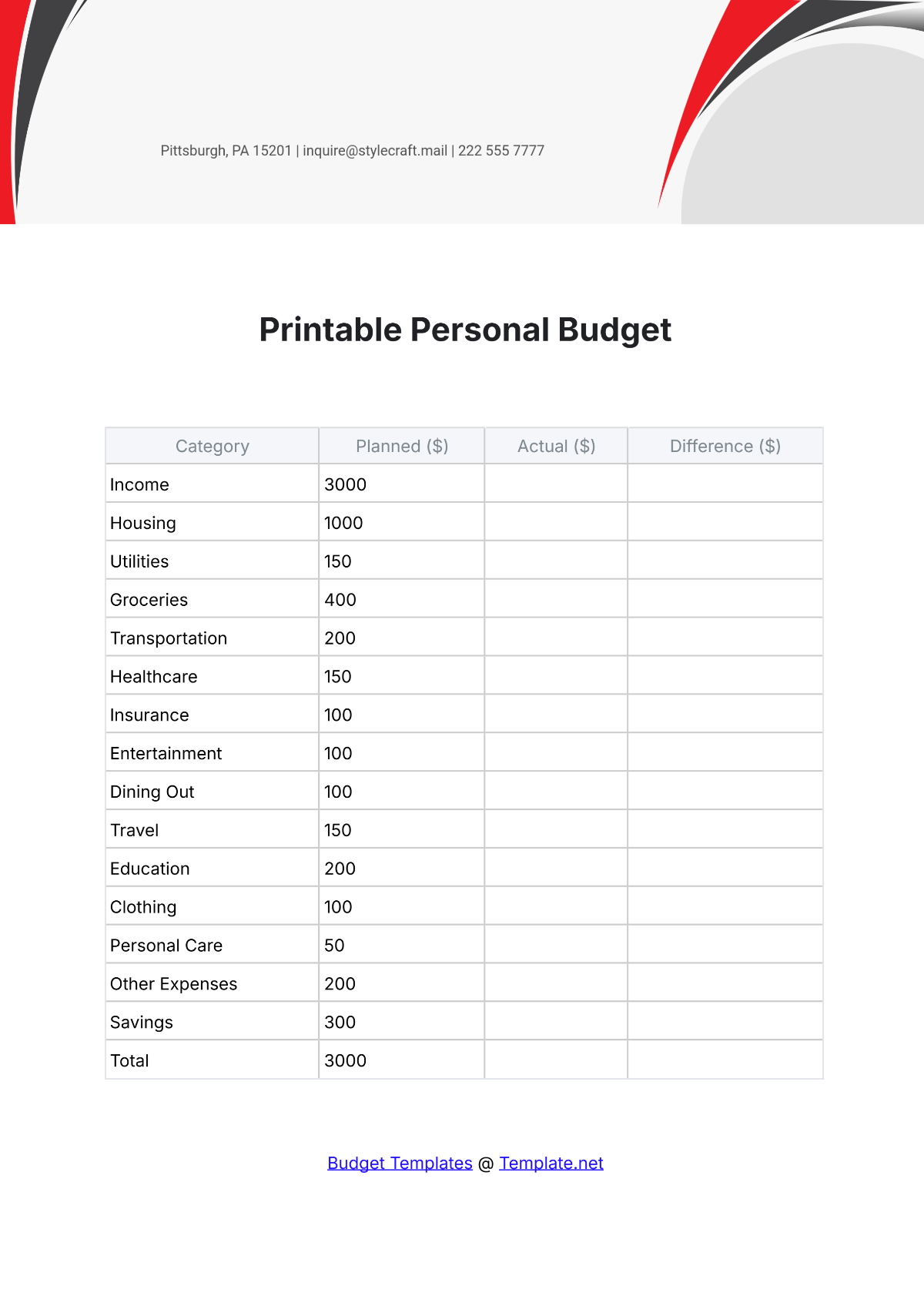

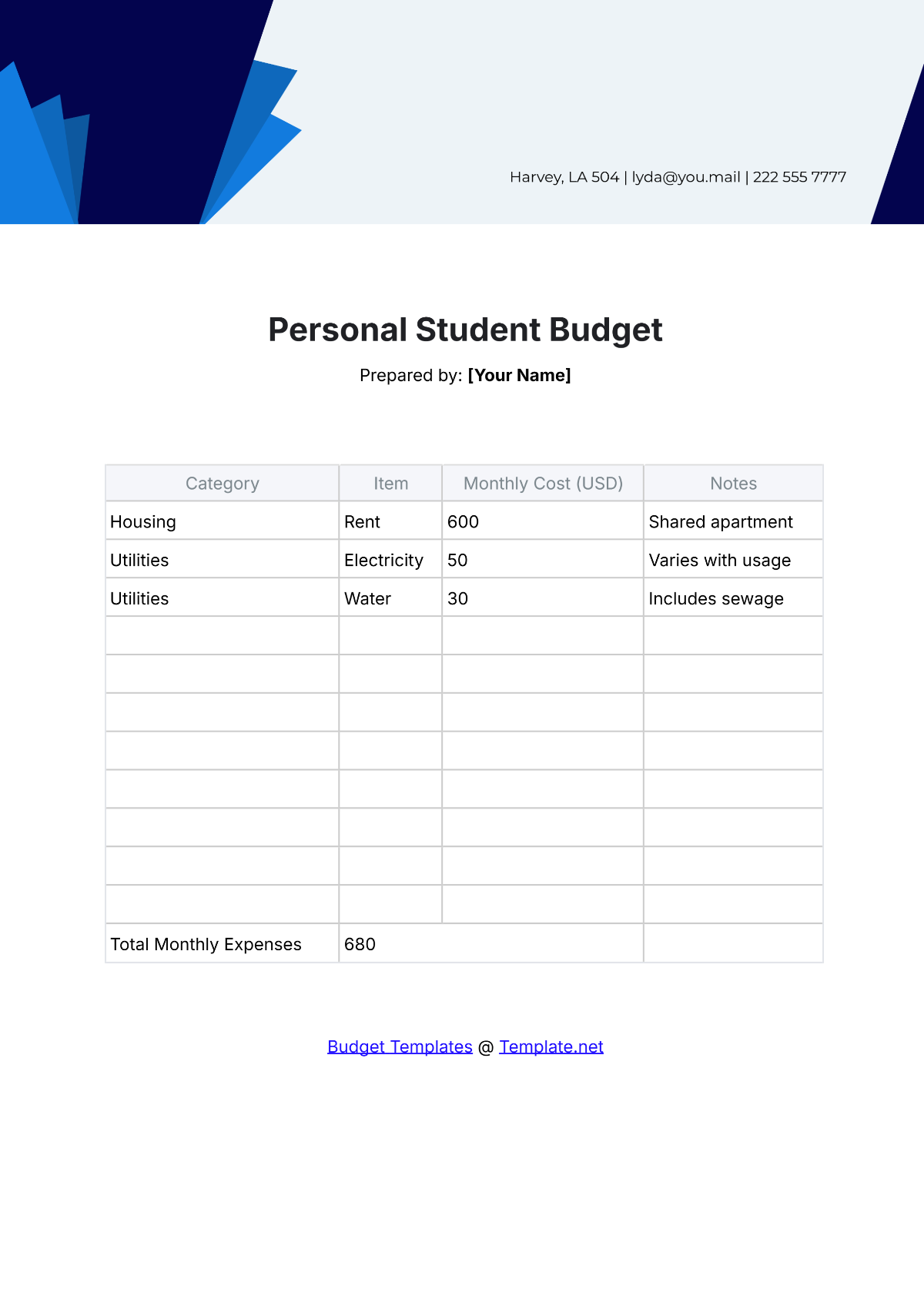

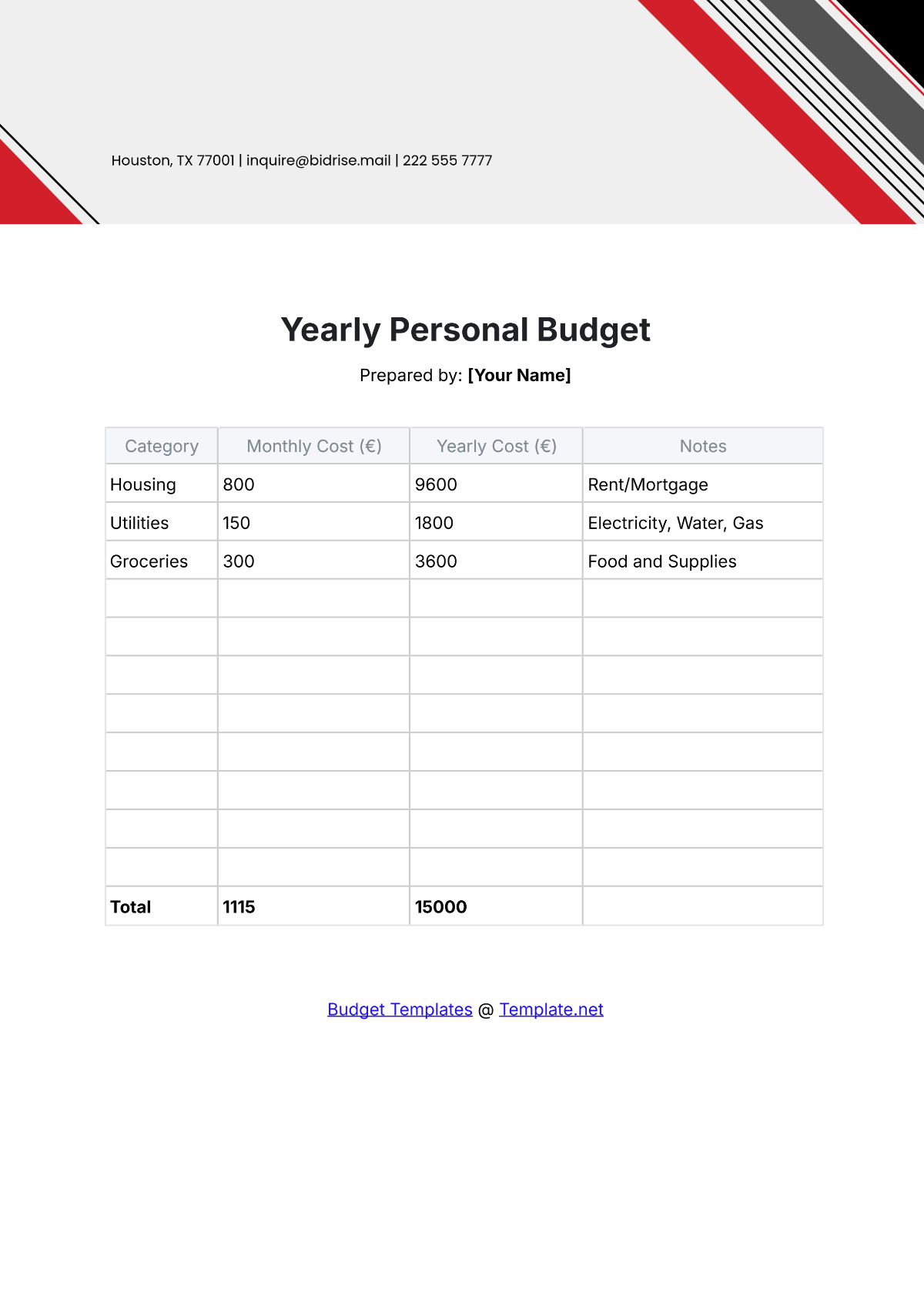

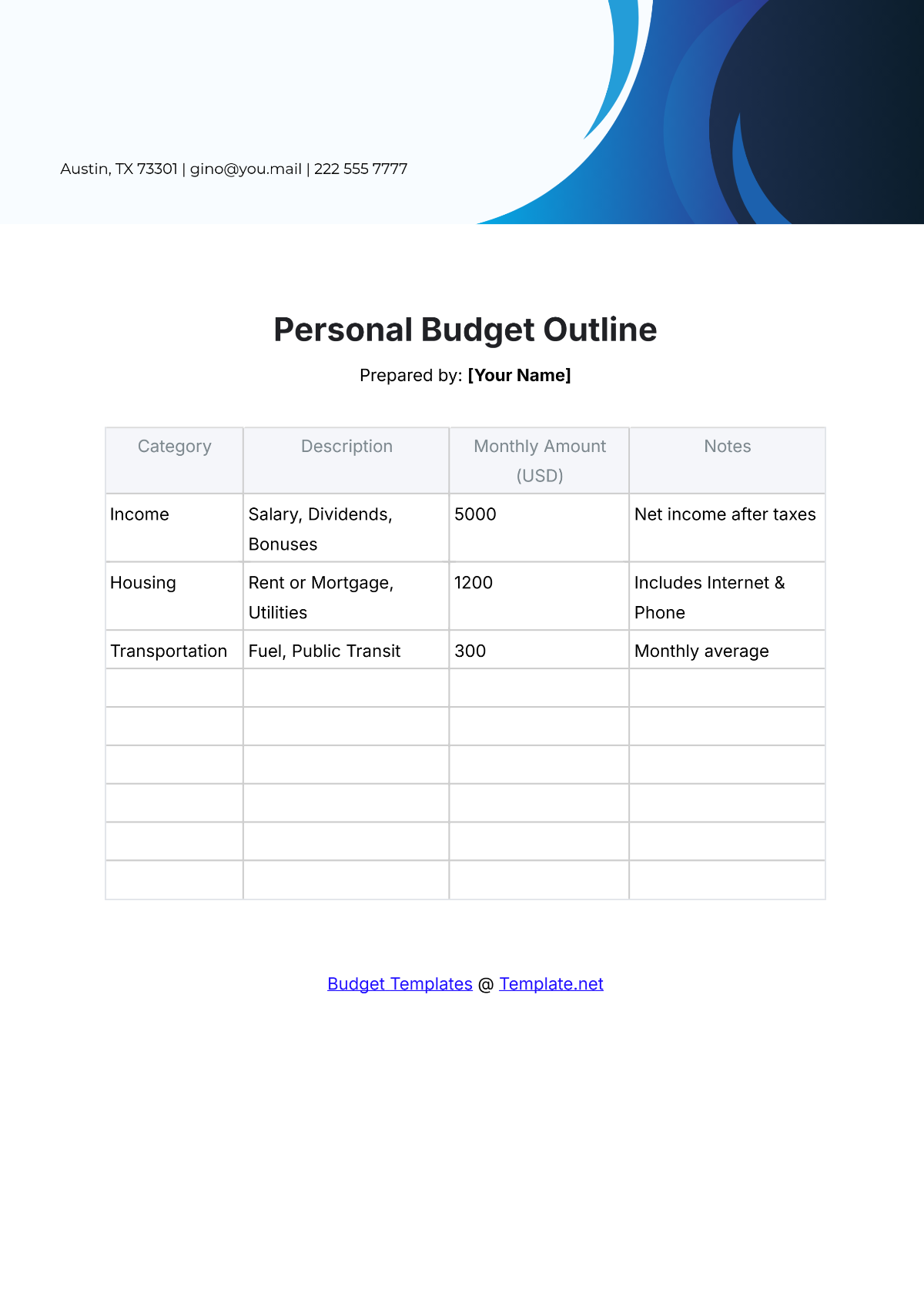

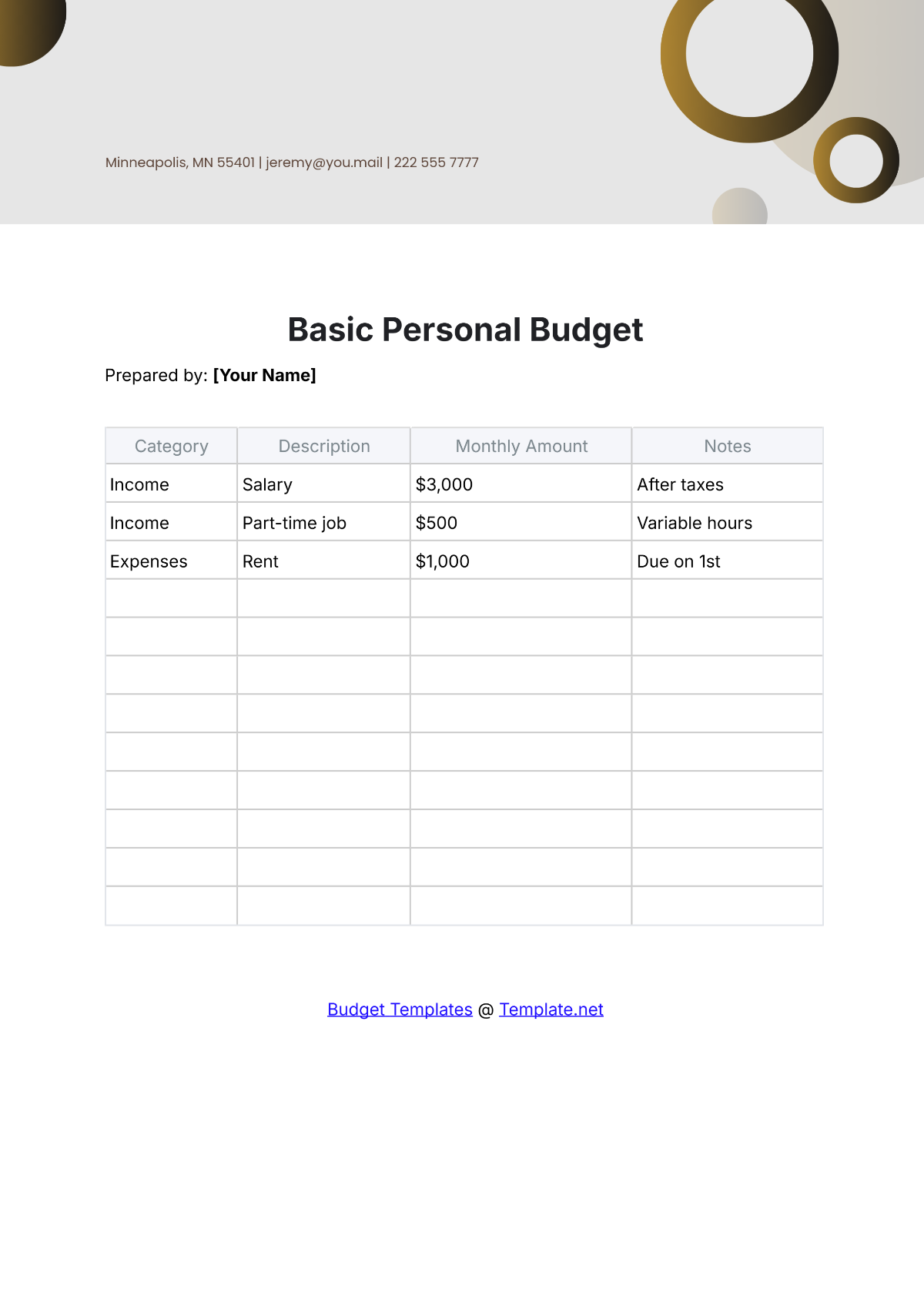

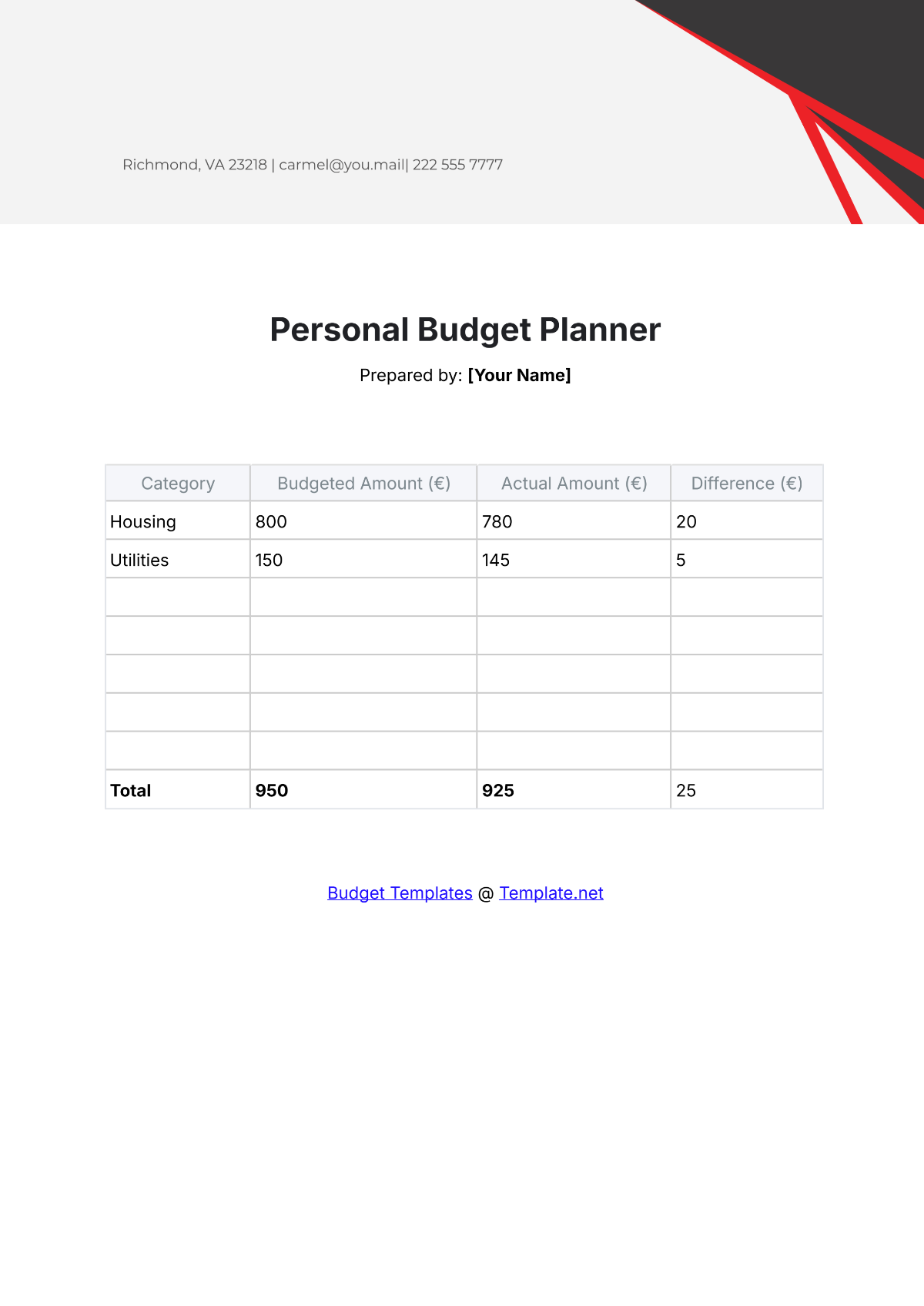

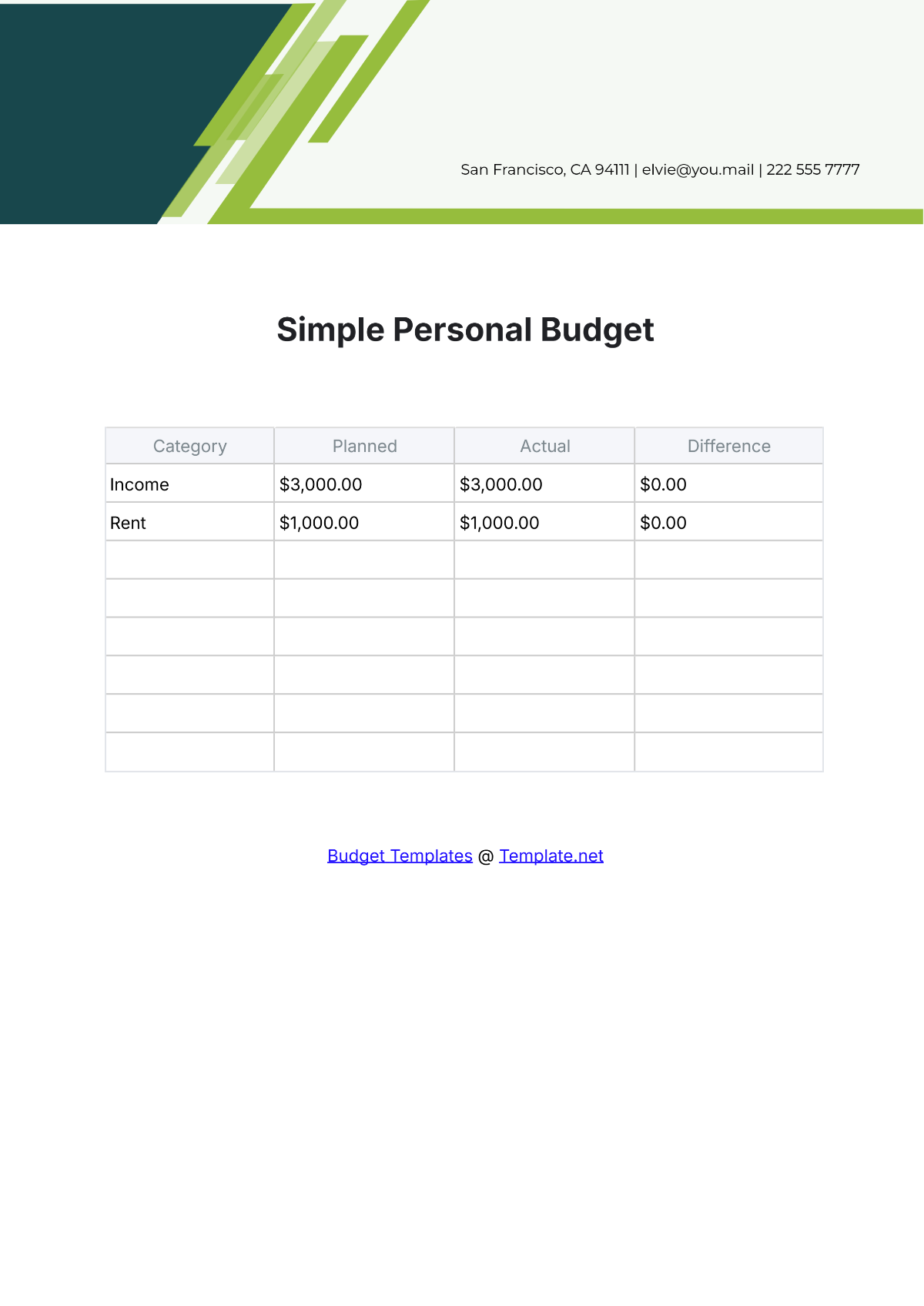

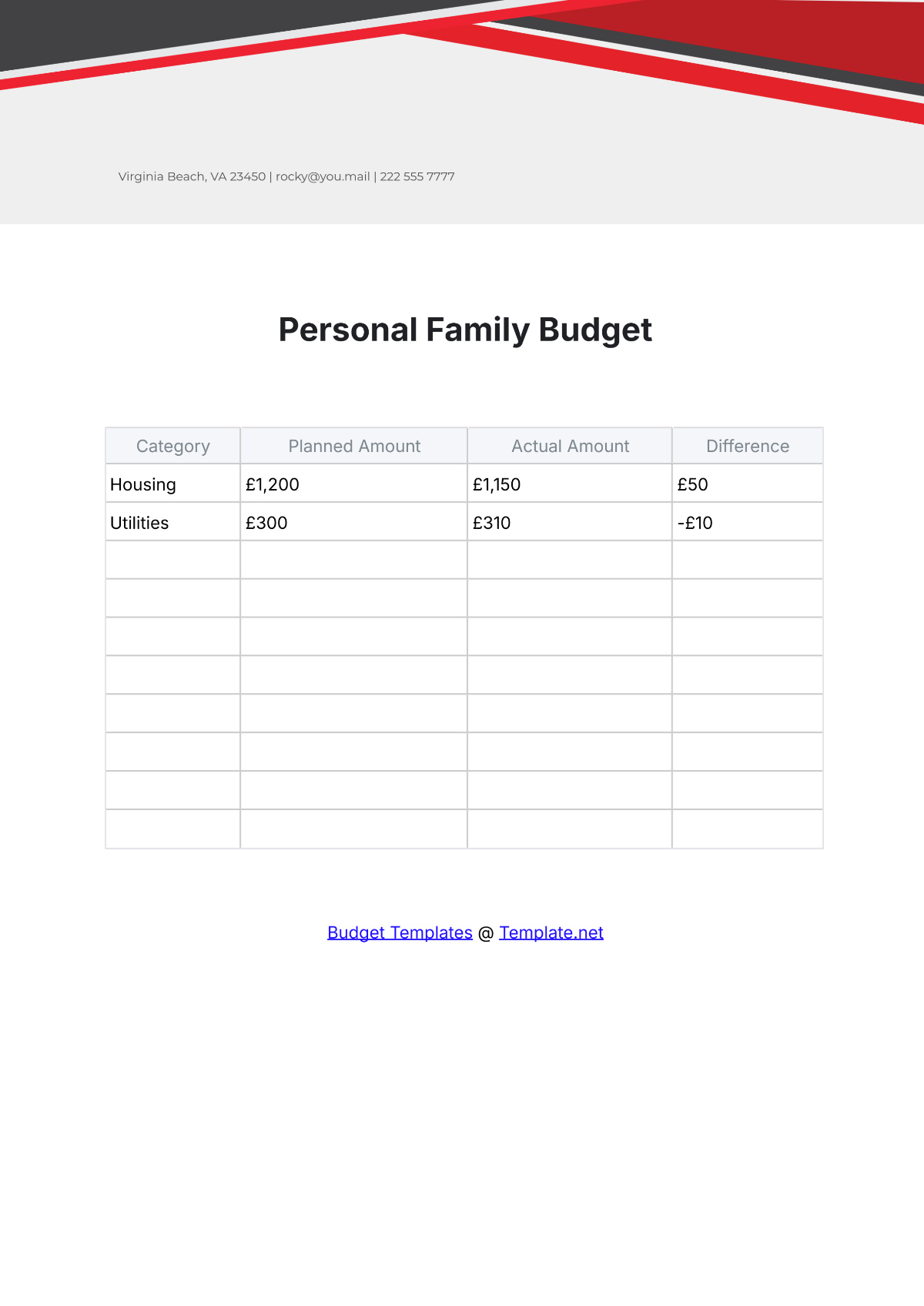

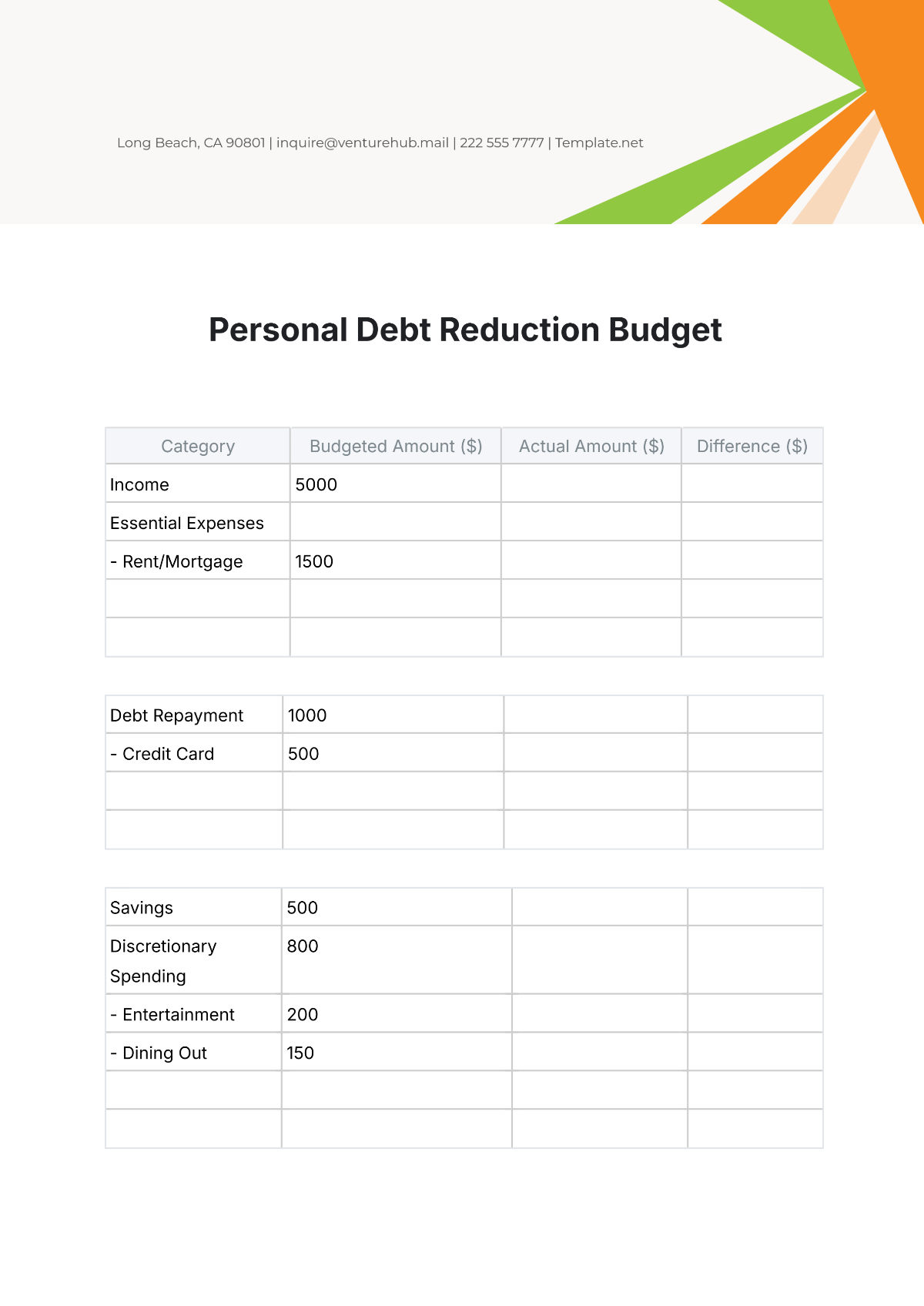

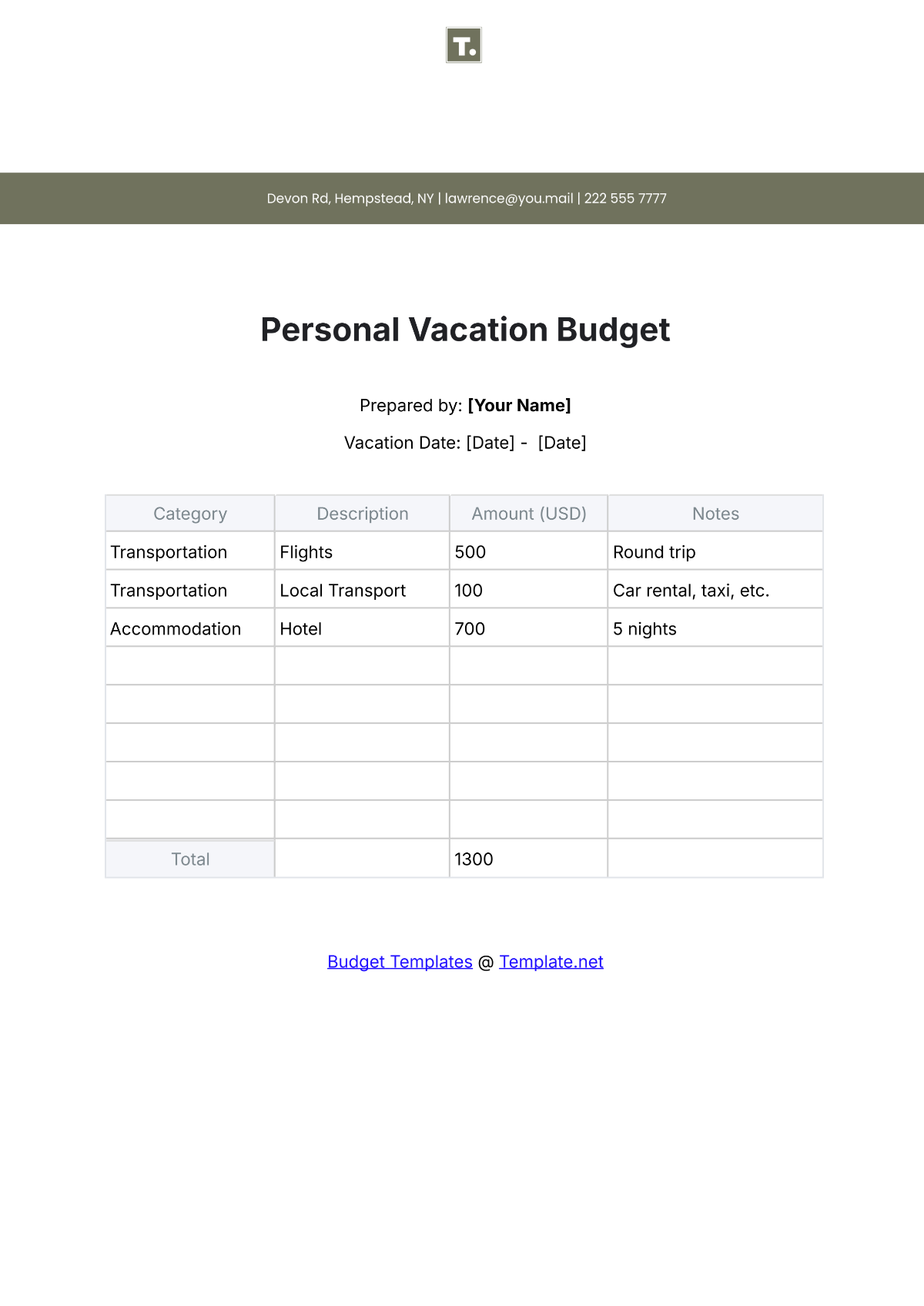

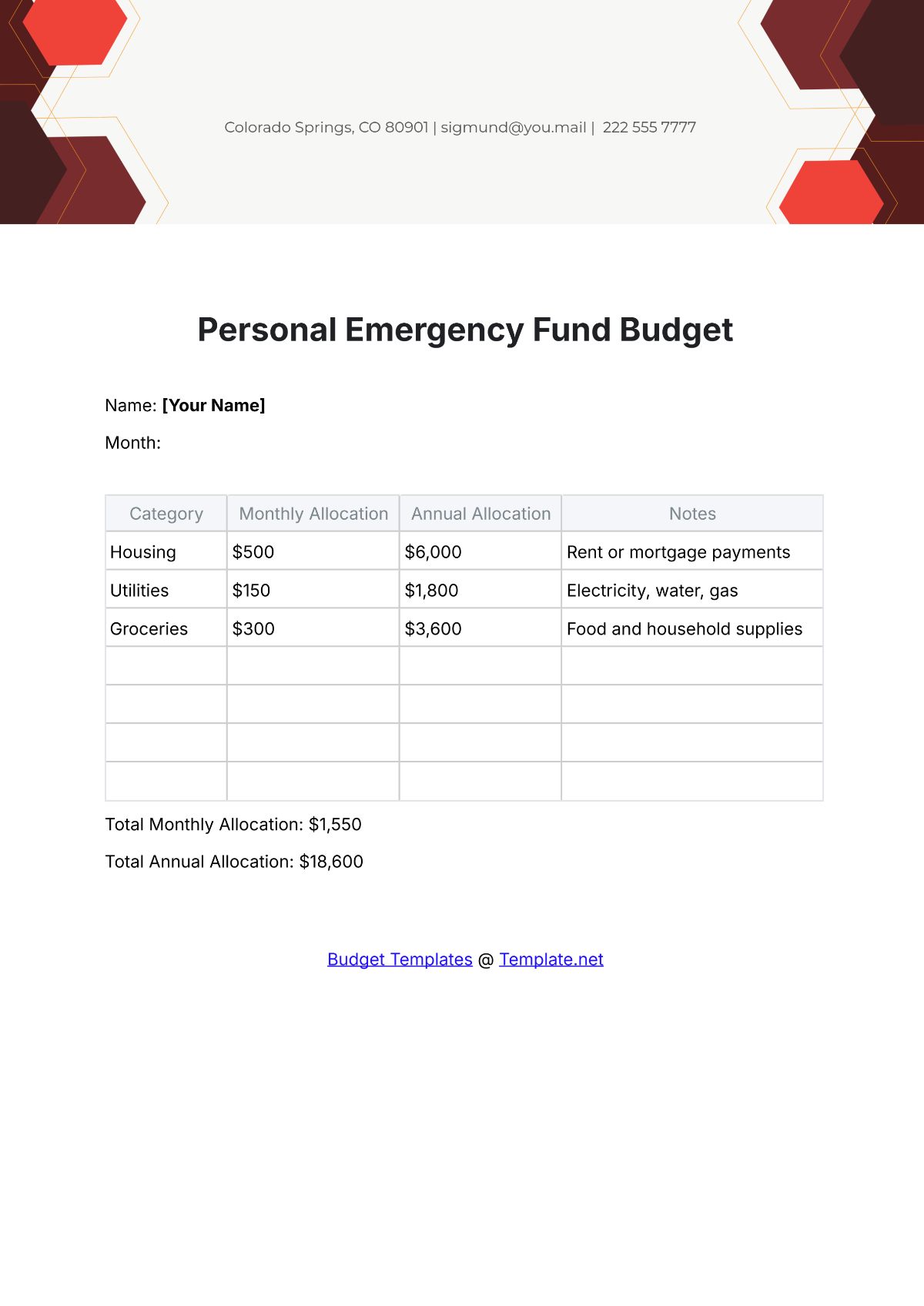

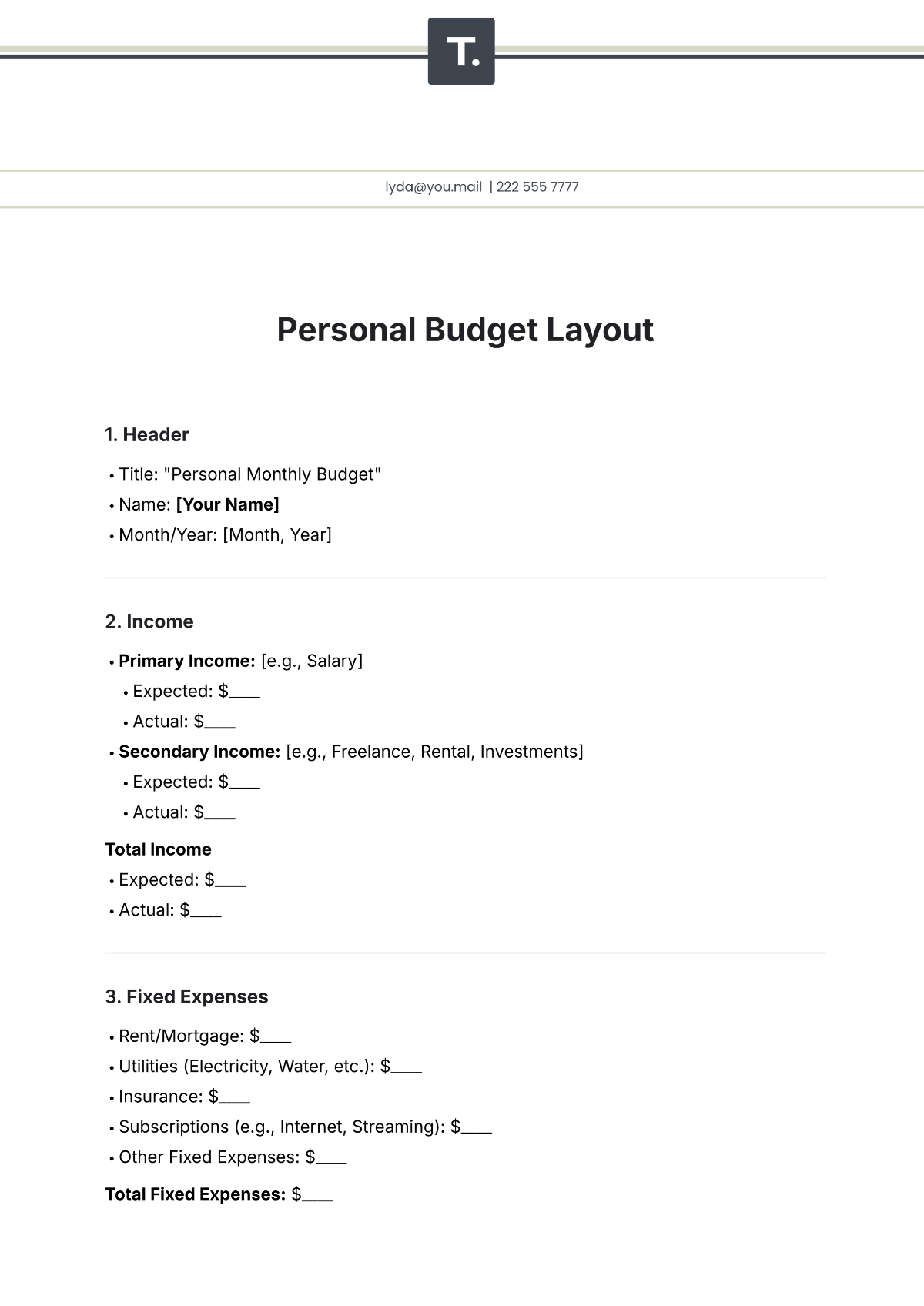

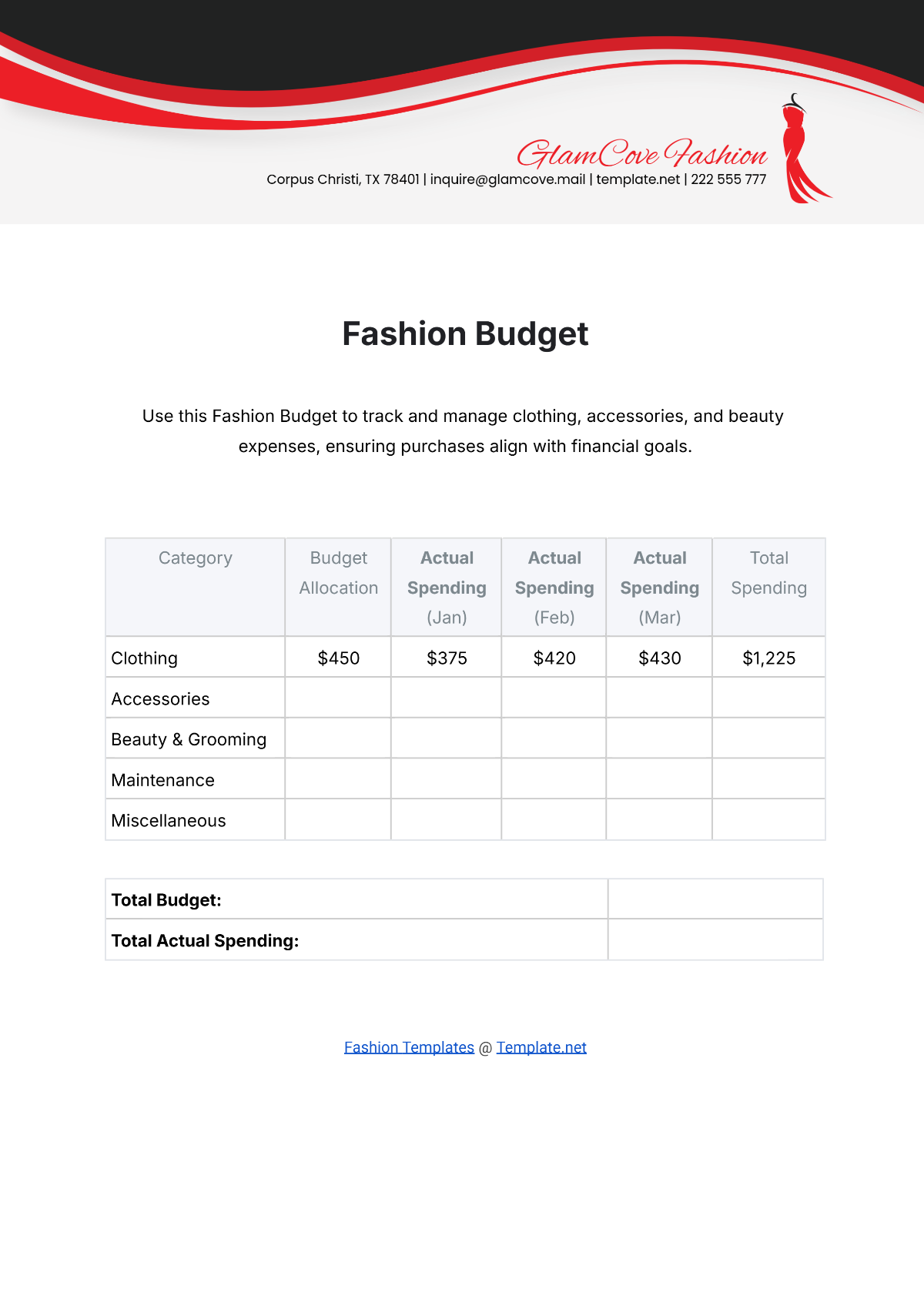

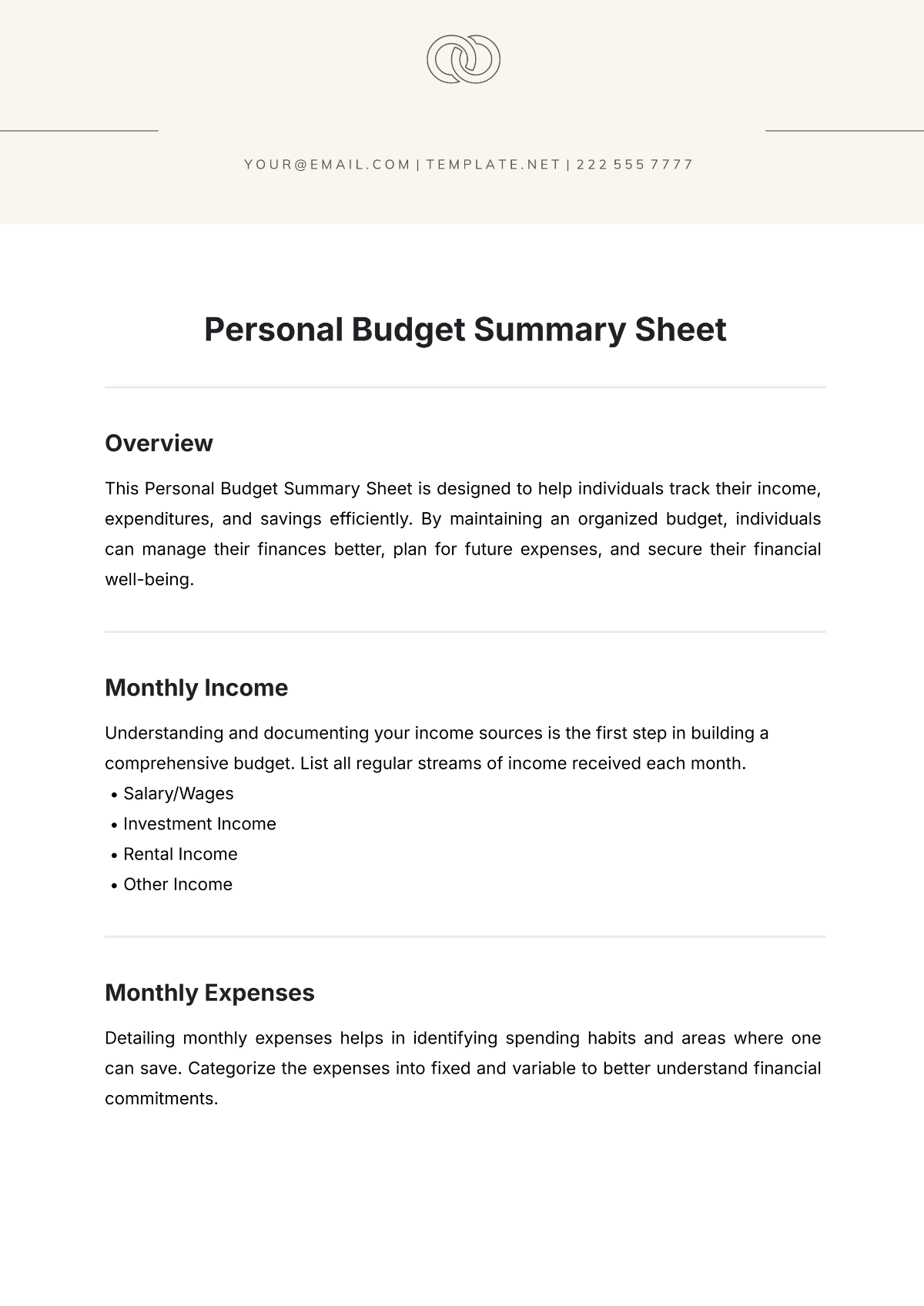

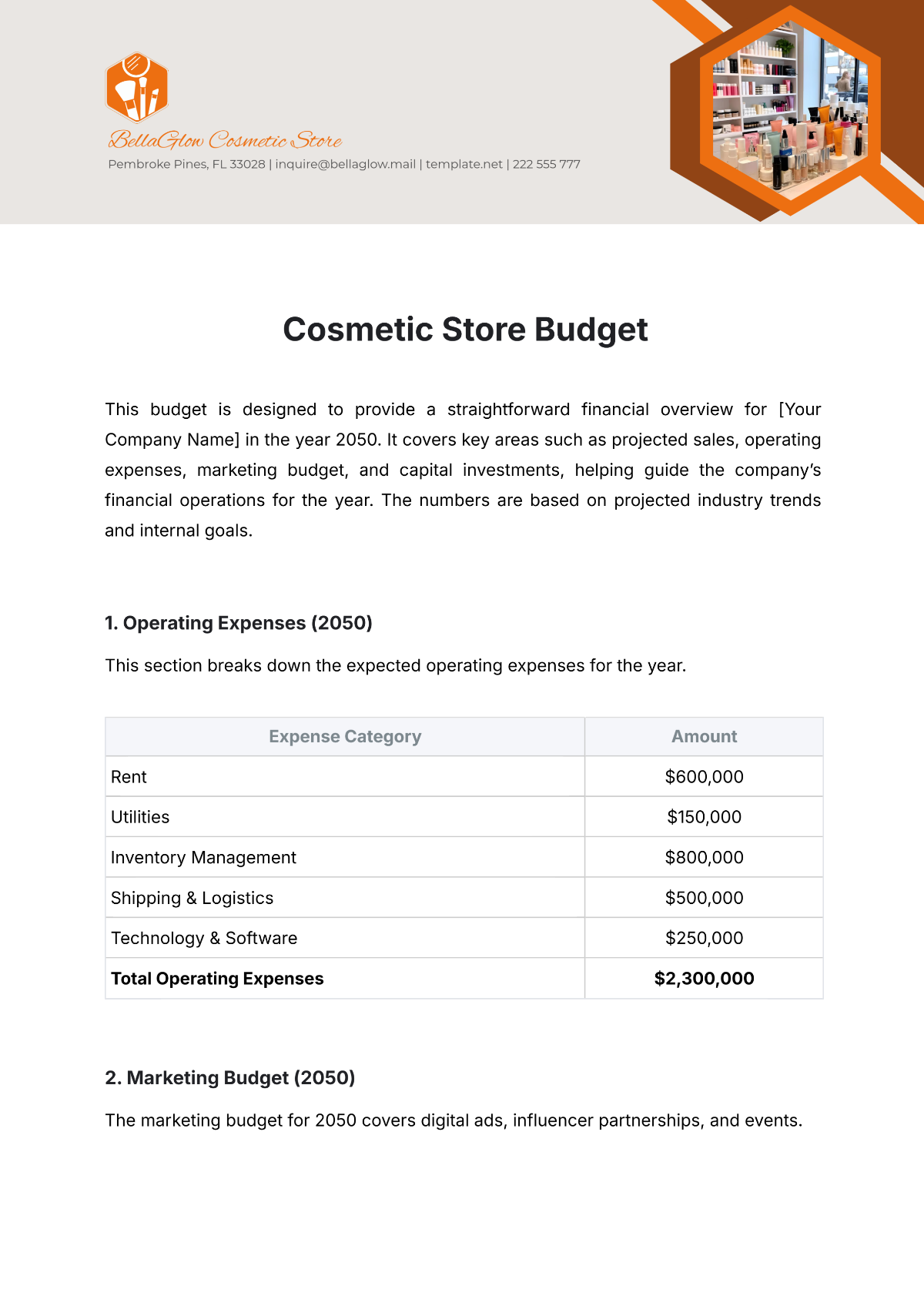

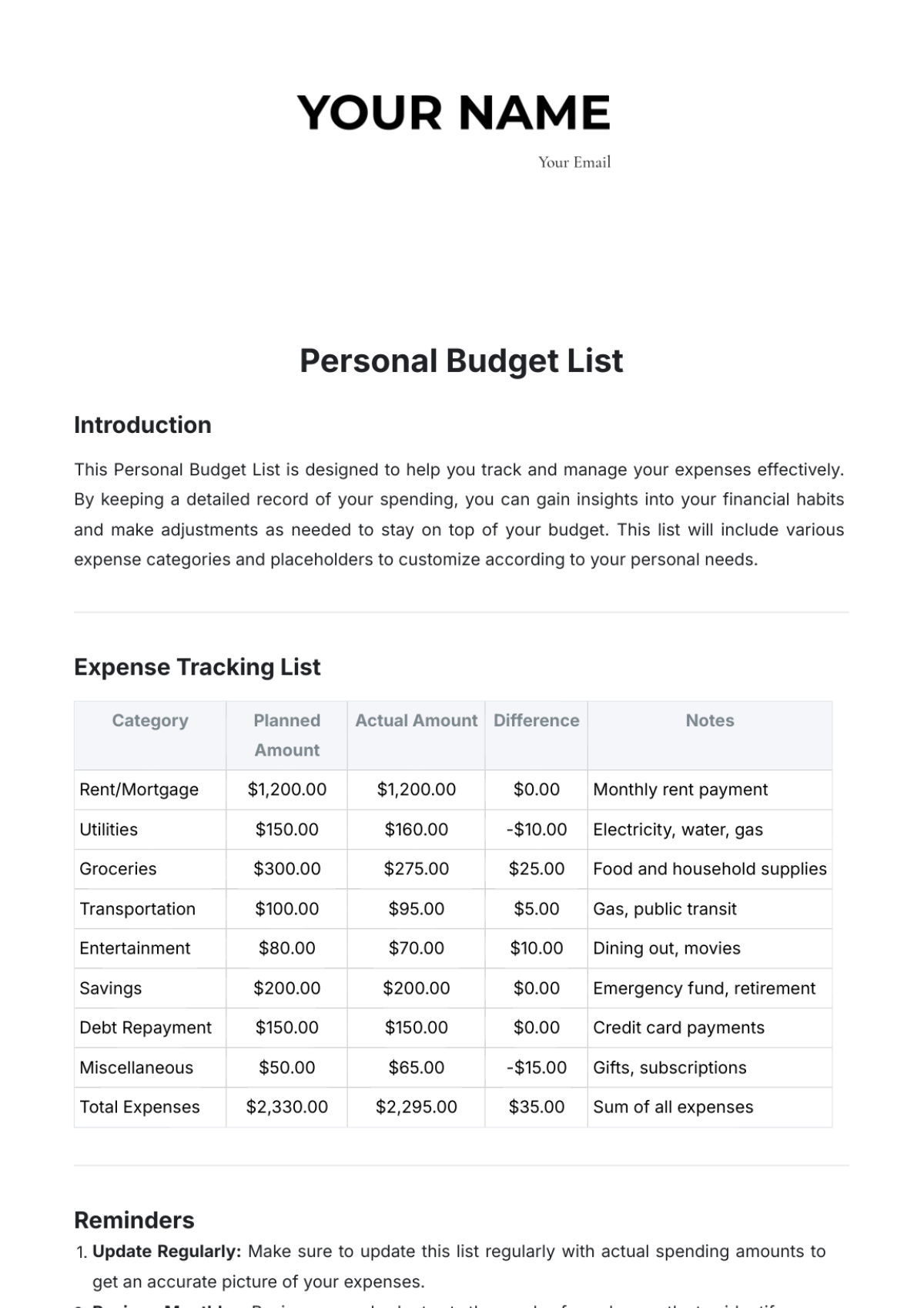

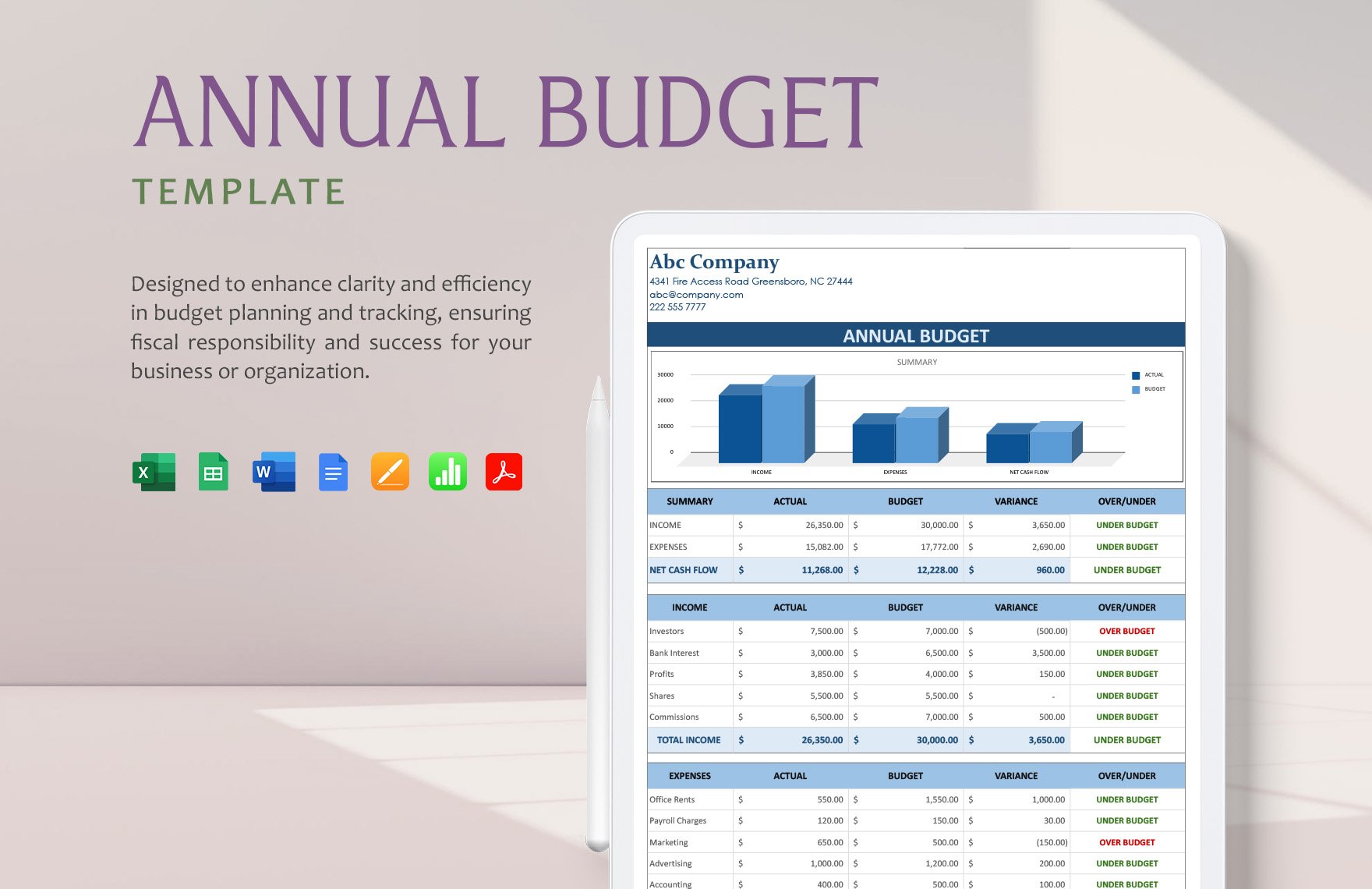

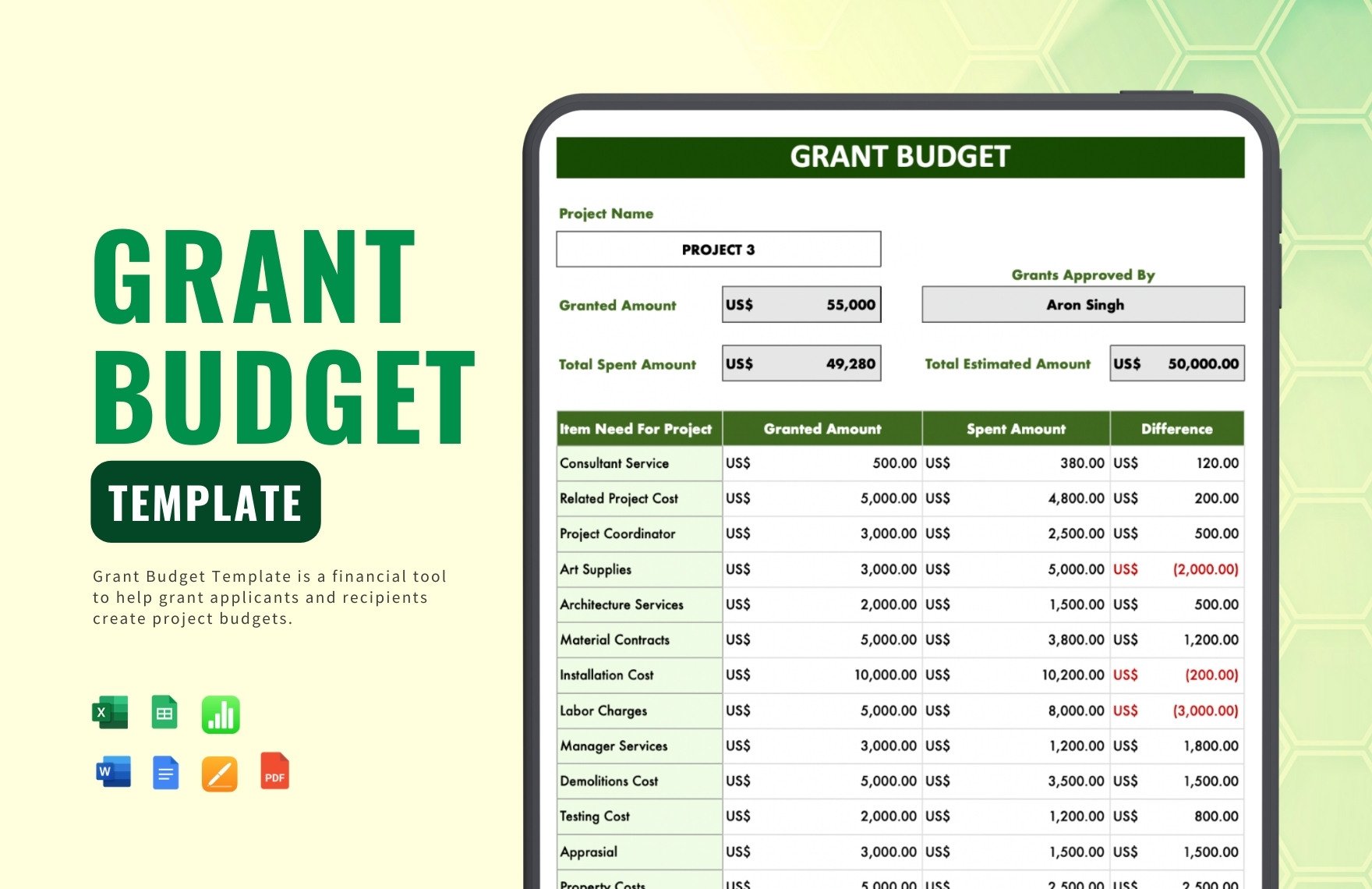

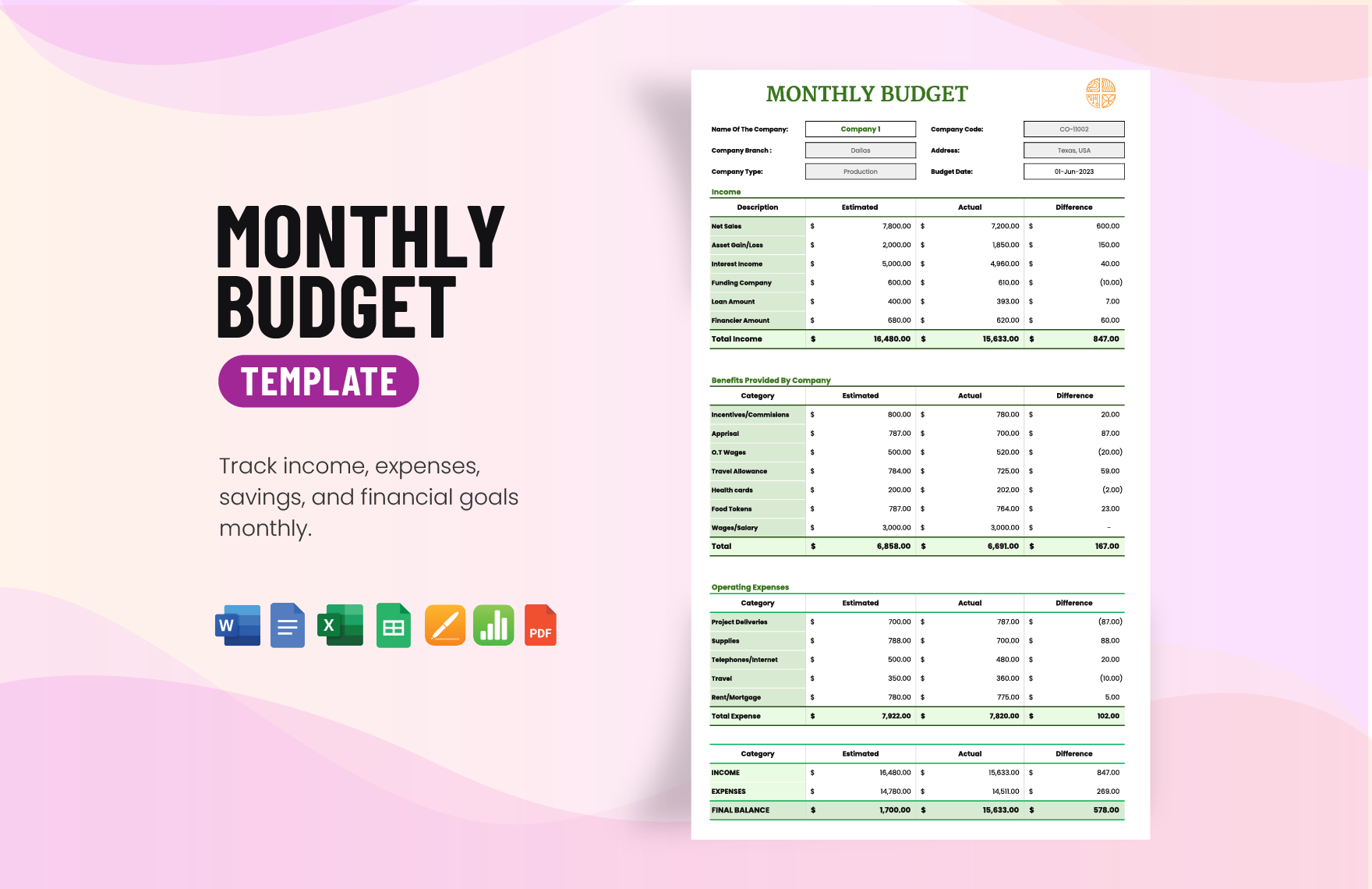

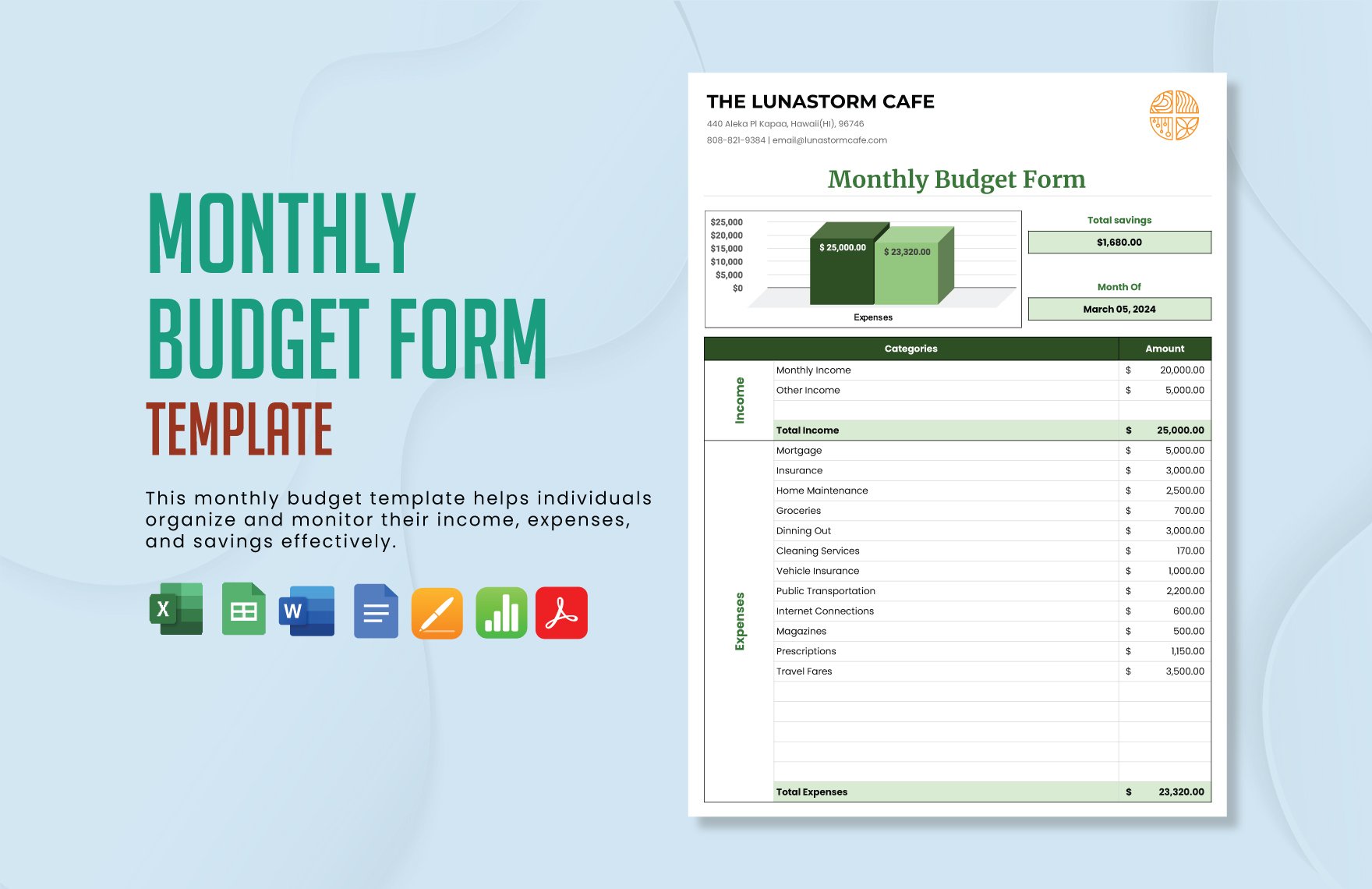

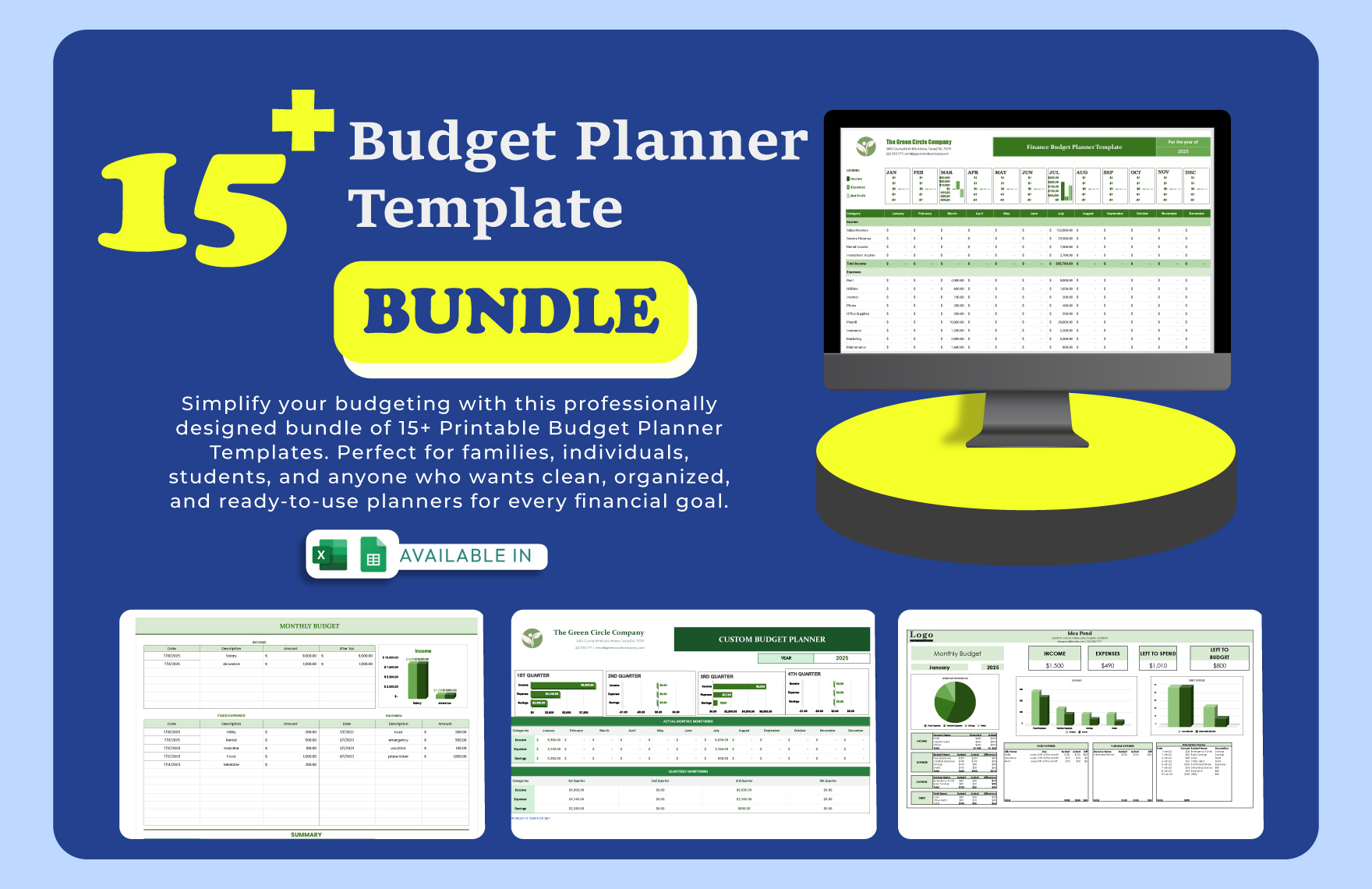

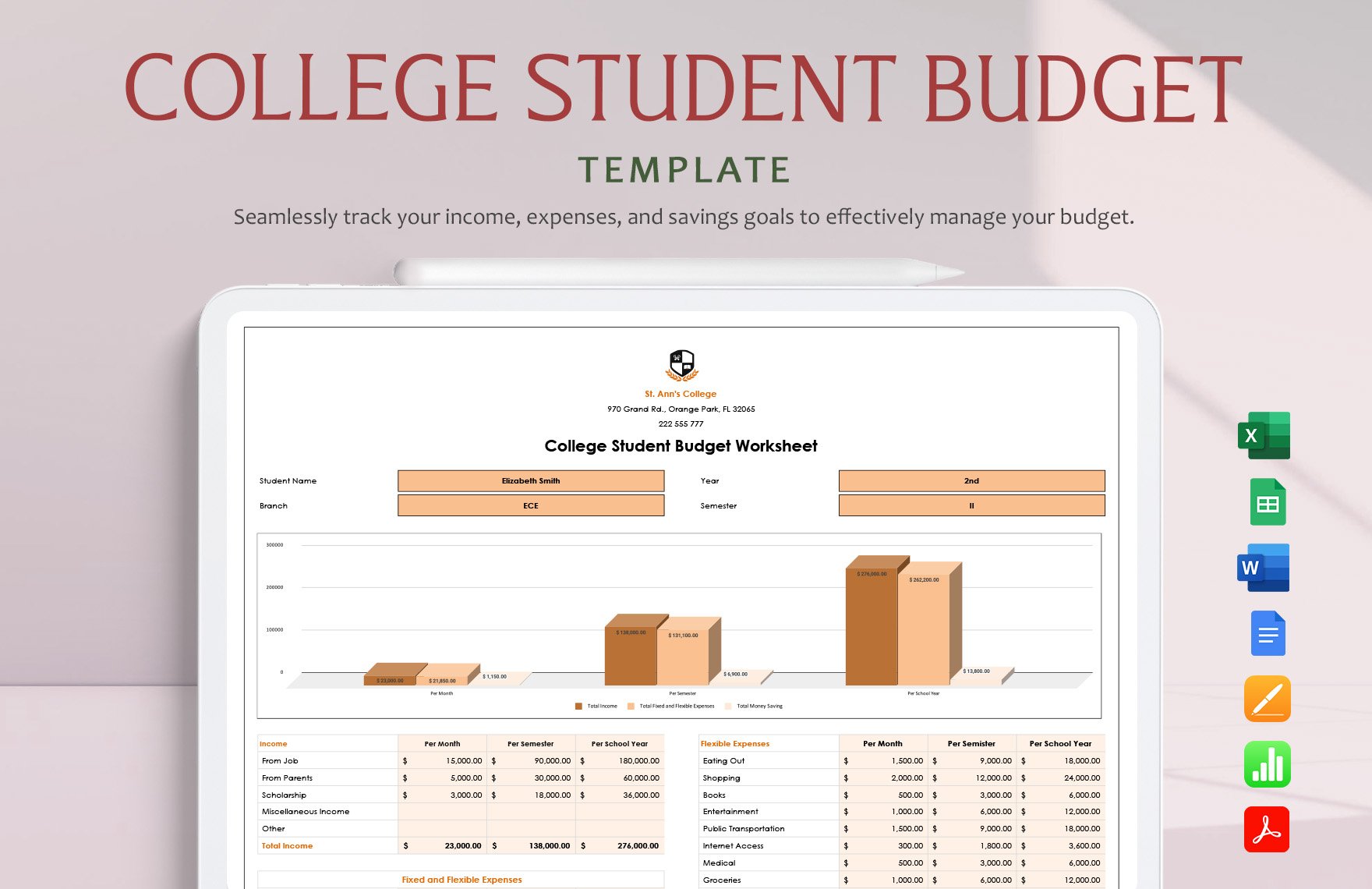

Keep your finances on track and make informed decisions with Personal Budget Templates from Template.net. Perfectly suited for individuals and families alike, these templates allow you to manage expenses efficiently, plan for future goals, and stay financially organized. Whether you're looking to save for a big purchase, pay off debt, or simply keep track of your daily expenses, our comprehensive templates cater to a wide range of budgeting needs. With easy-to-use layouts, these templates come with essential features like date-tracking fields and categorized expense sections, ensuring no detail is overlooked. Best of all, you don't need any financial expertise to get started—our templates are designed with user-friendliness in mind and offer free, professional-grade budgeting tools that can be printed or used digitally.

Discover the many budget templates we have on hand, ready to transform your financial management experience. Simply choose a template that fits your style, input your financial data, and adjust colors and fonts to match your personal preference. For an advanced touch, drag and drop additional icons and graphics, or utilize our AI-powered text tools to create detailed budget notes. The possibilities are endless and the process is skill-free, making the task of budgeting a fun and engaging activity. With regularly updated templates and new designs added weekly, you can always find fresh inspiration. When you're finished, download or share your budget plan via print or email, ensuring your financial goals are accessible whenever and wherever you need them.