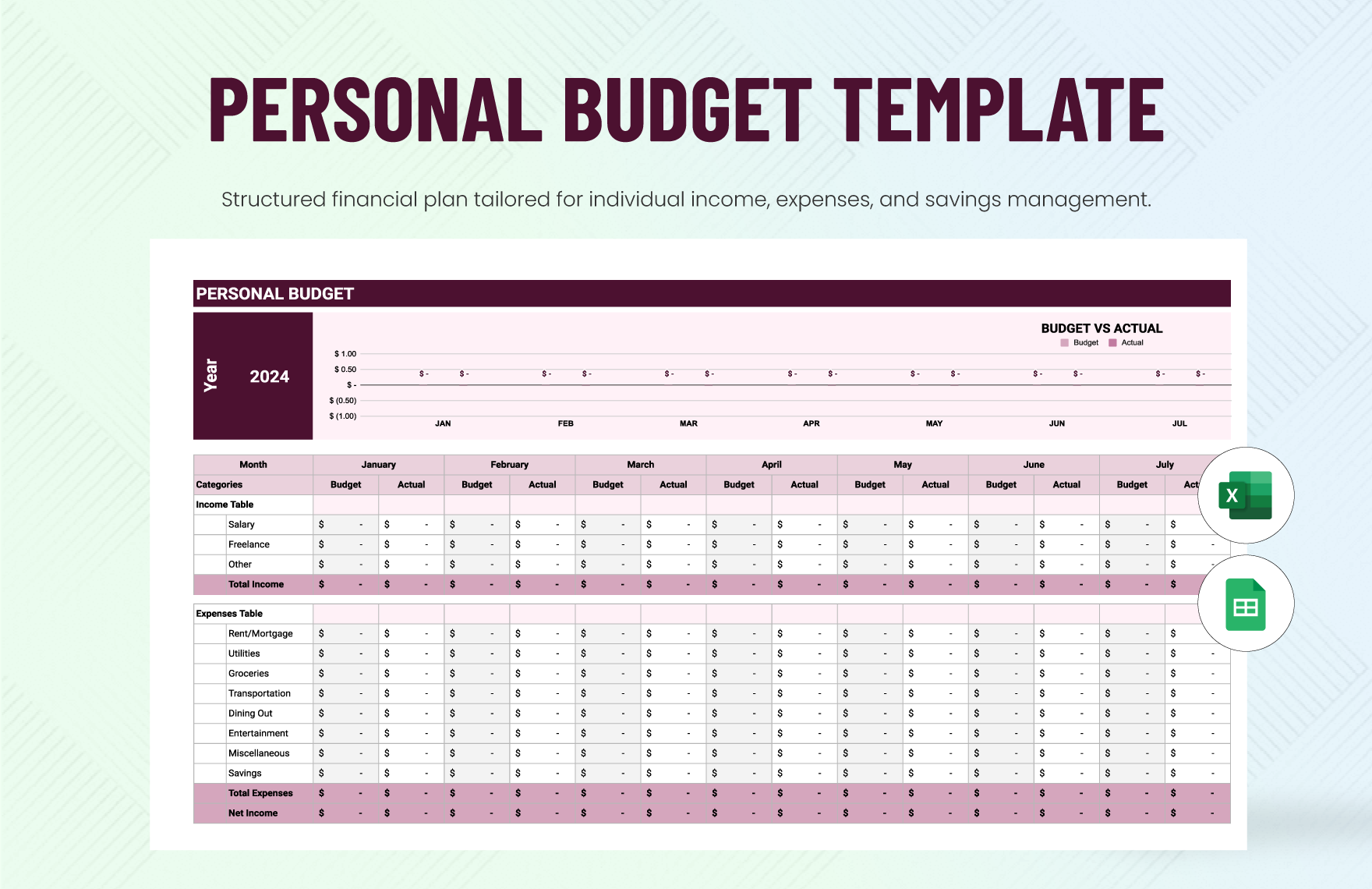

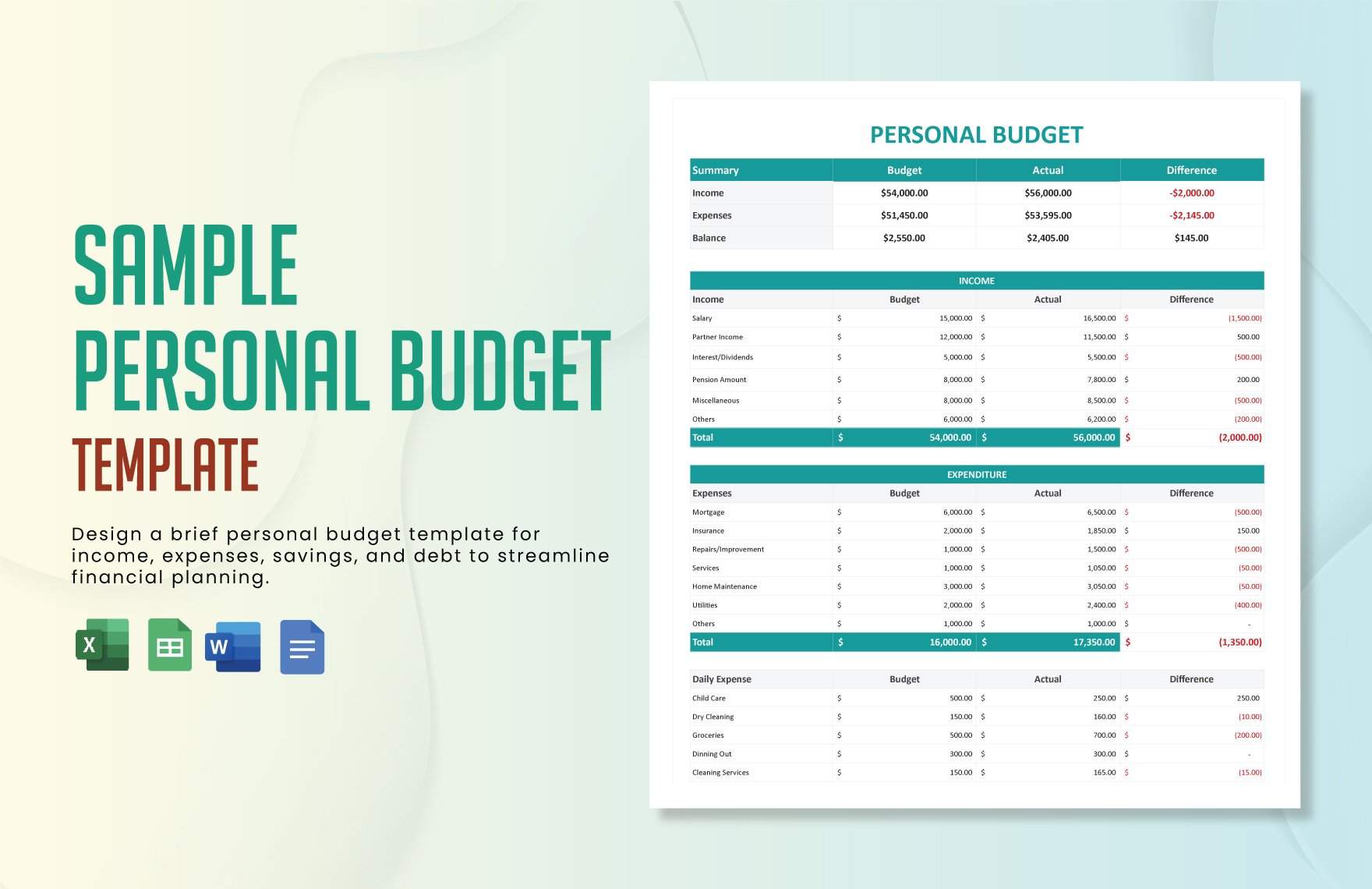

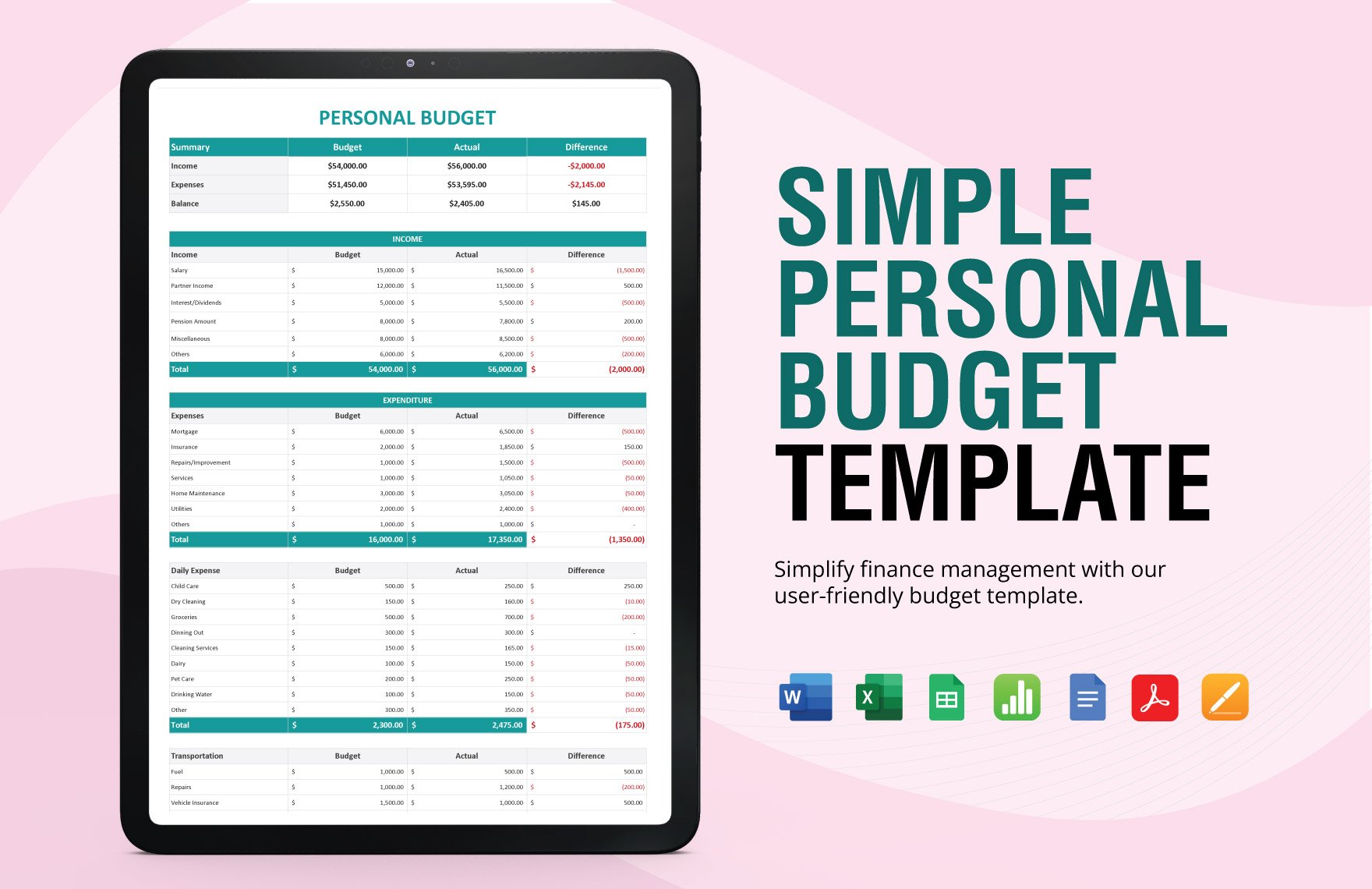

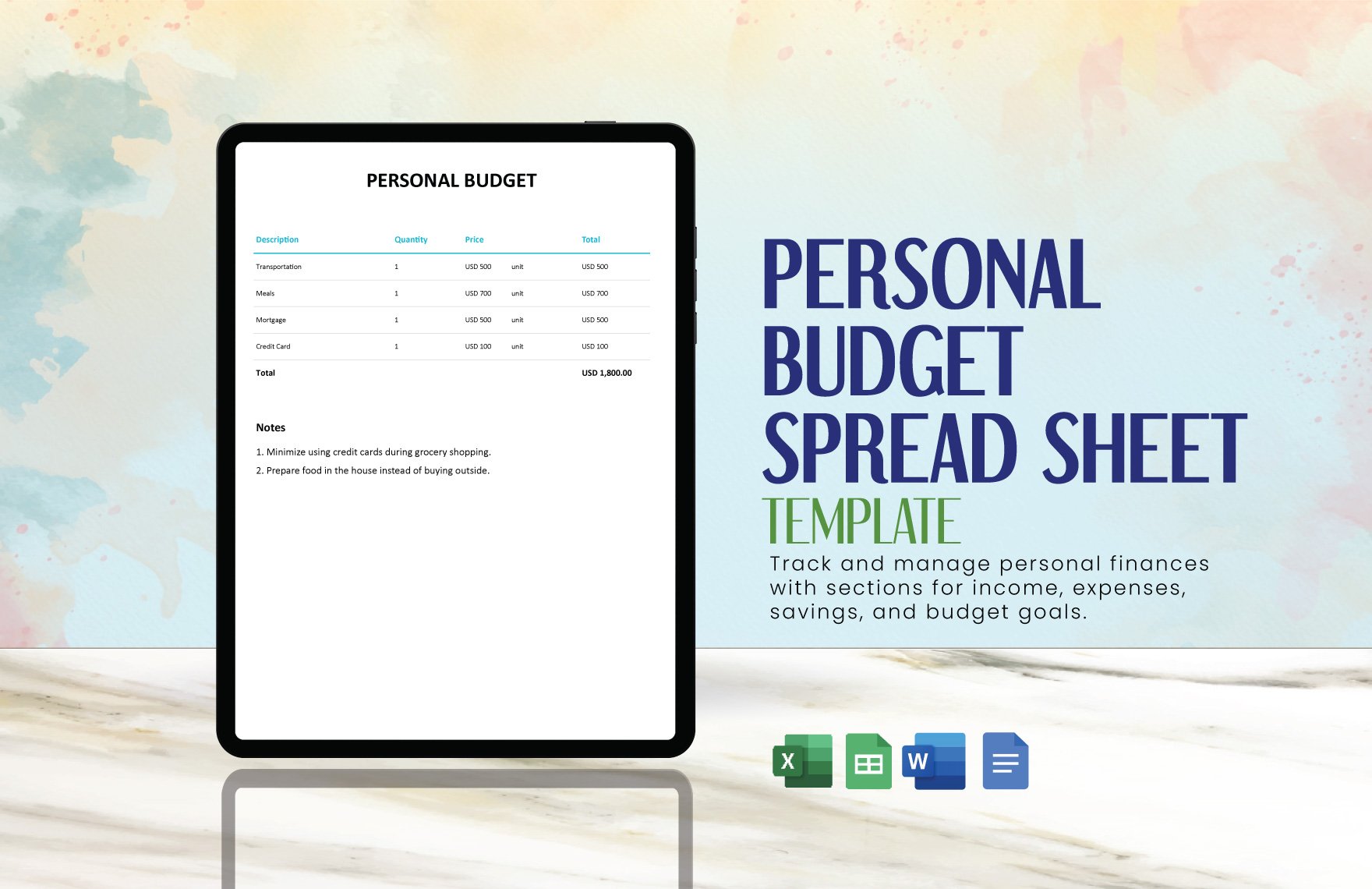

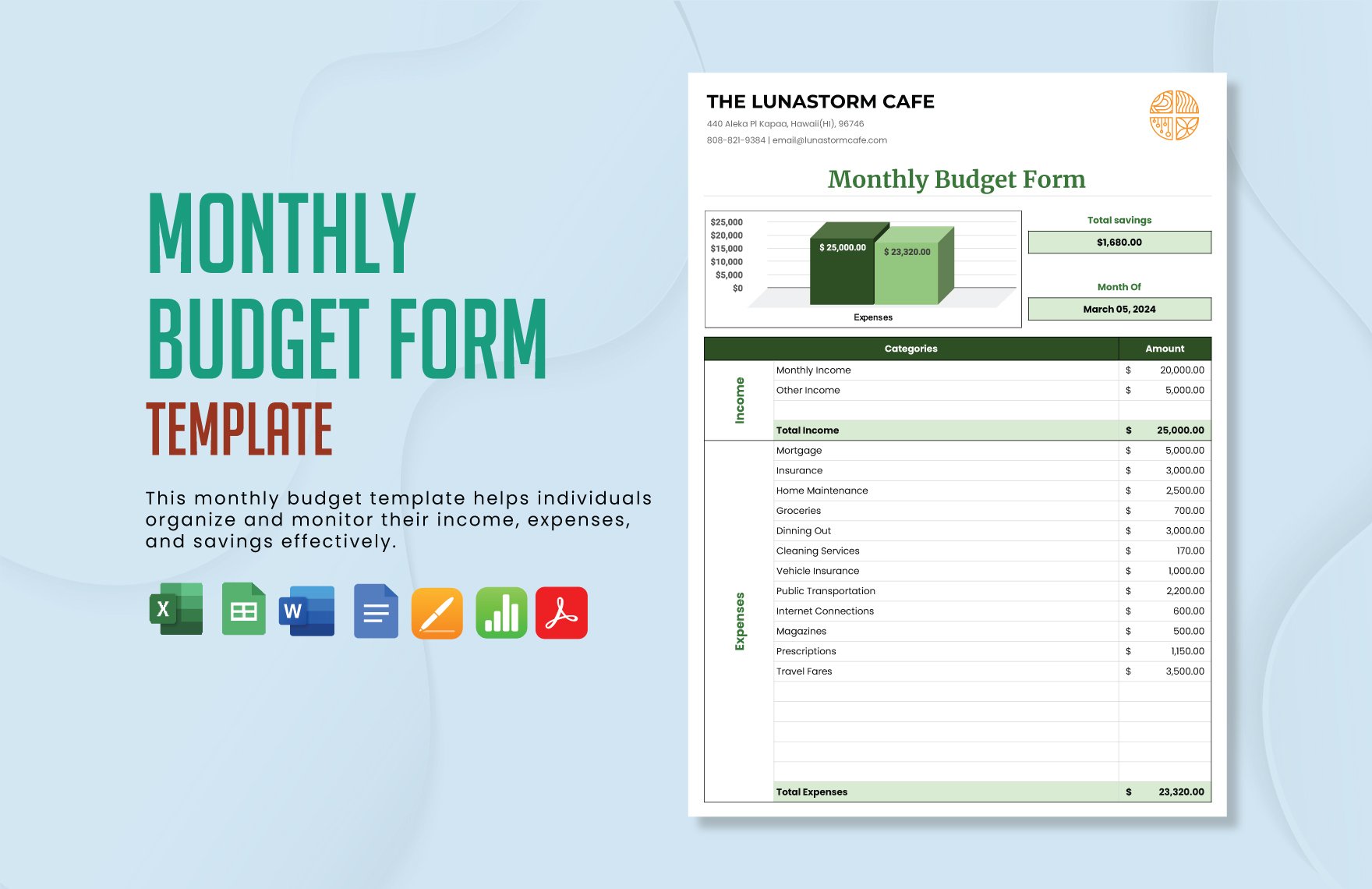

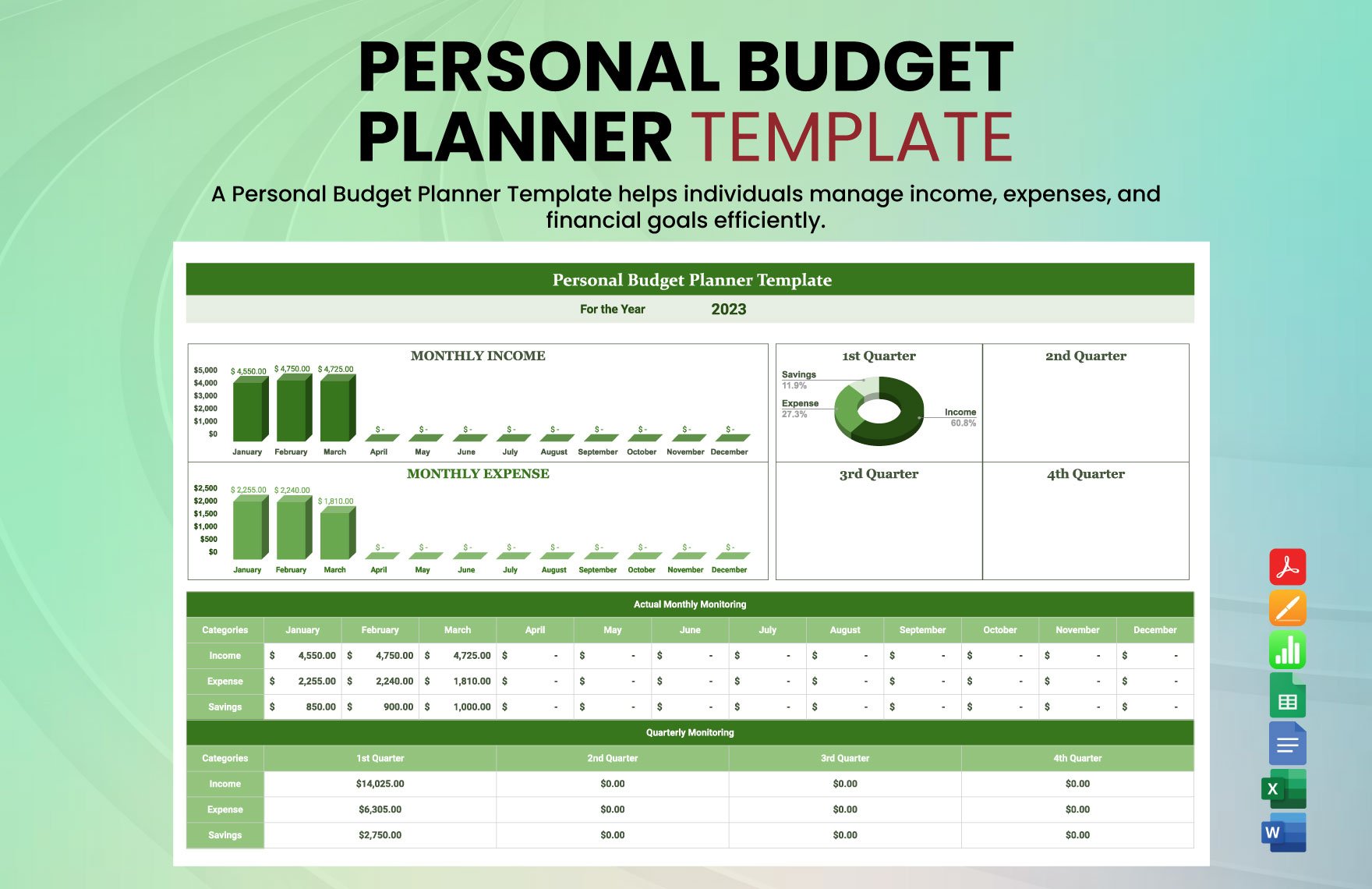

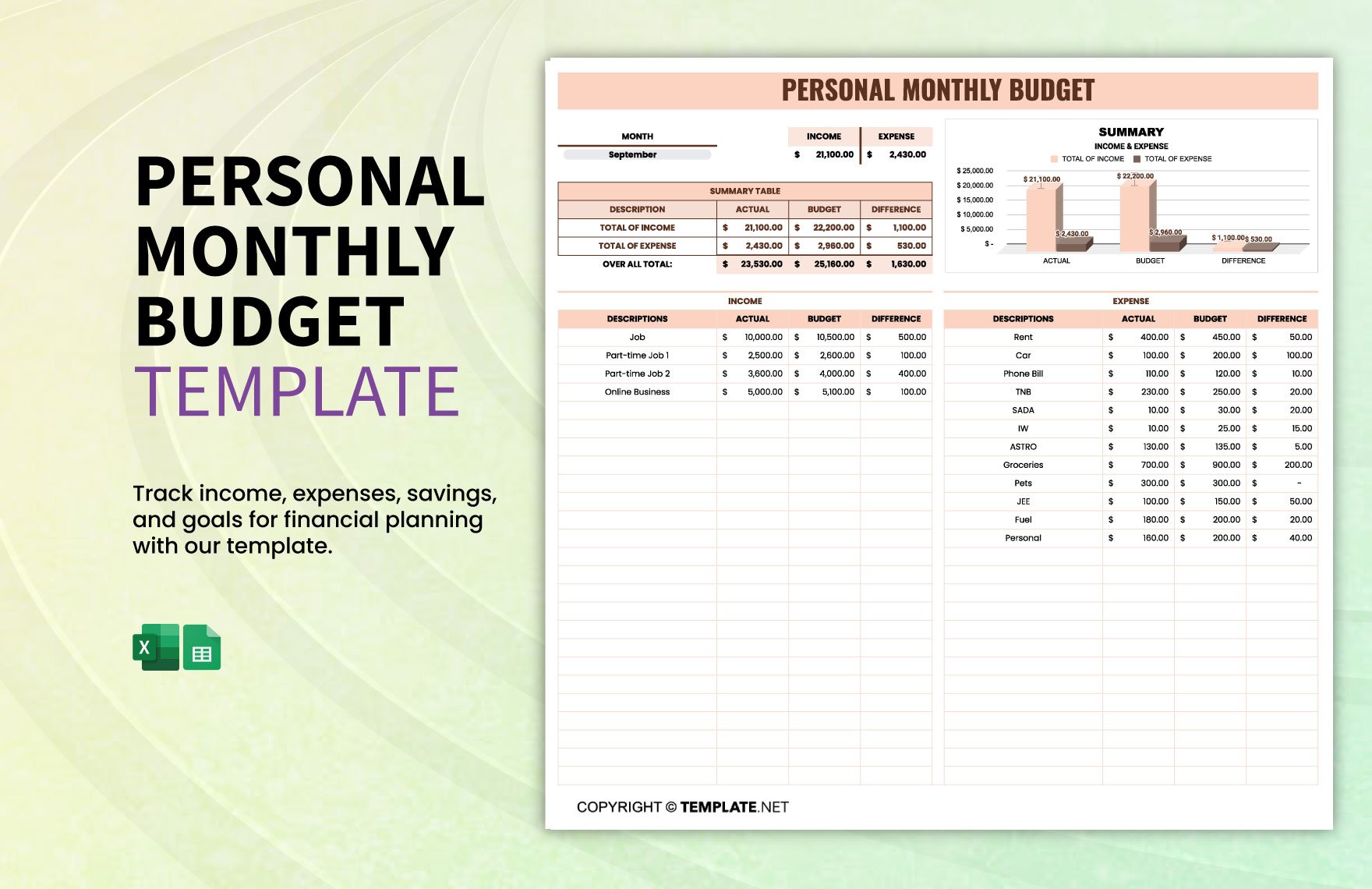

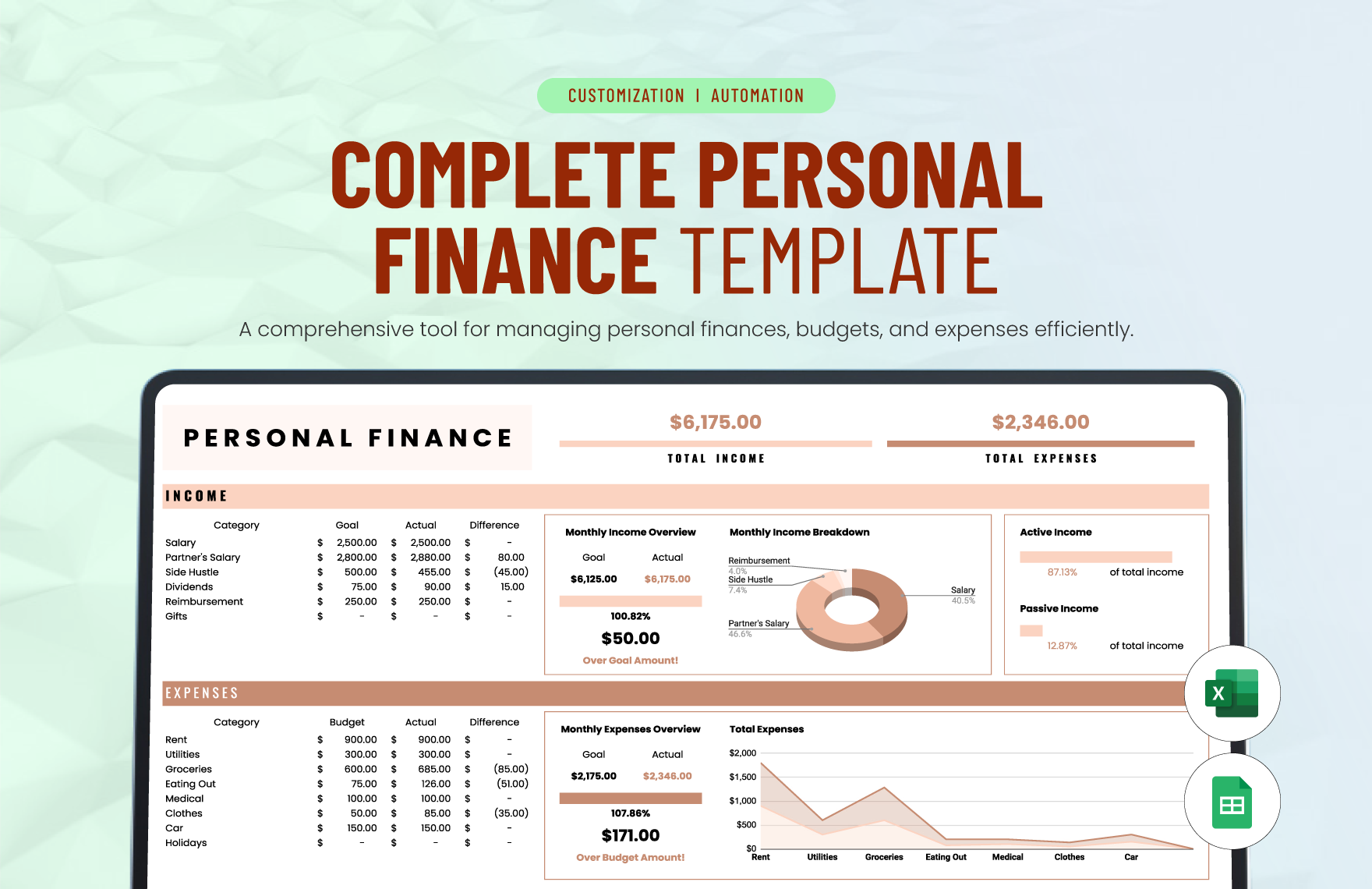

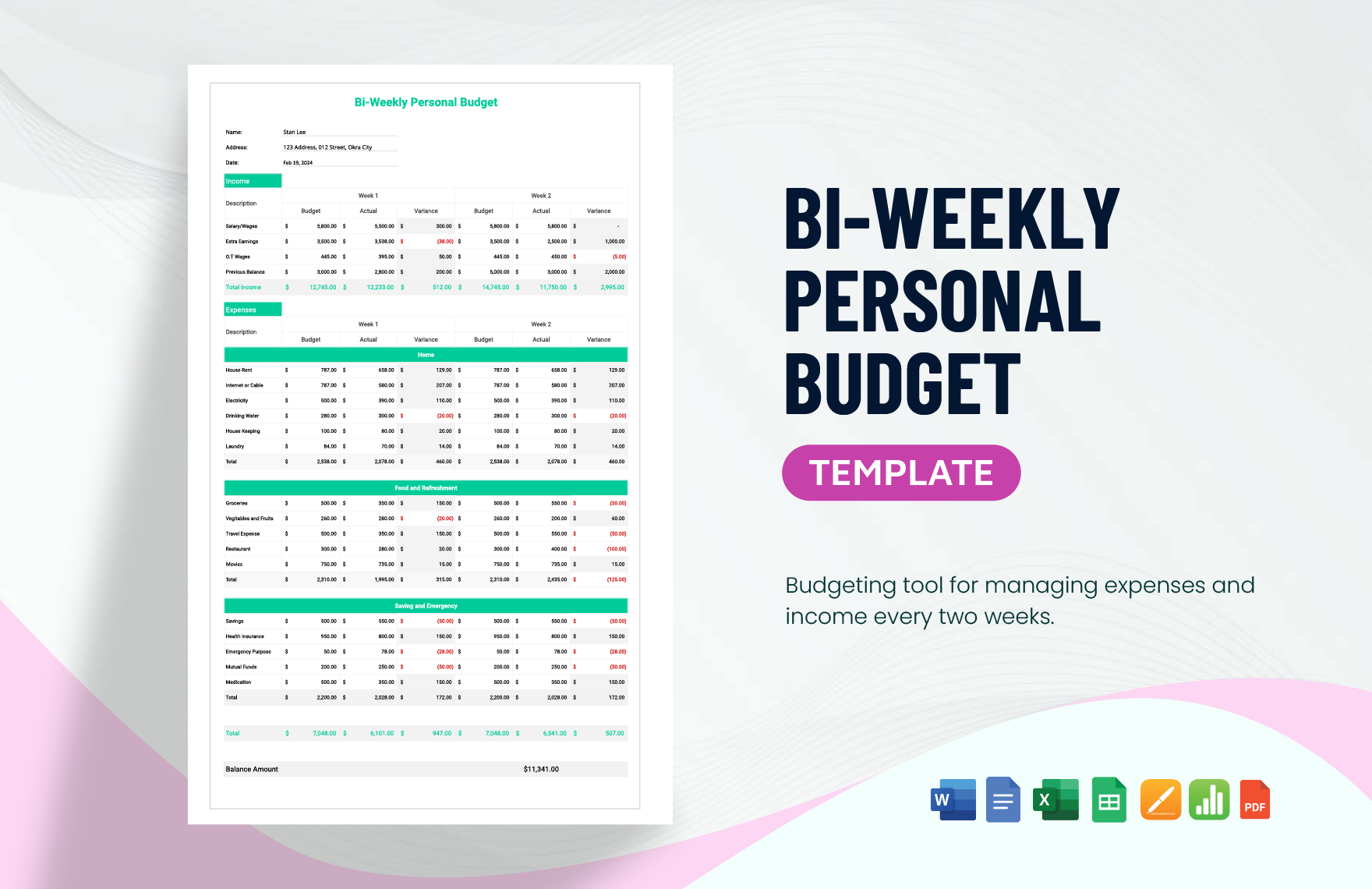

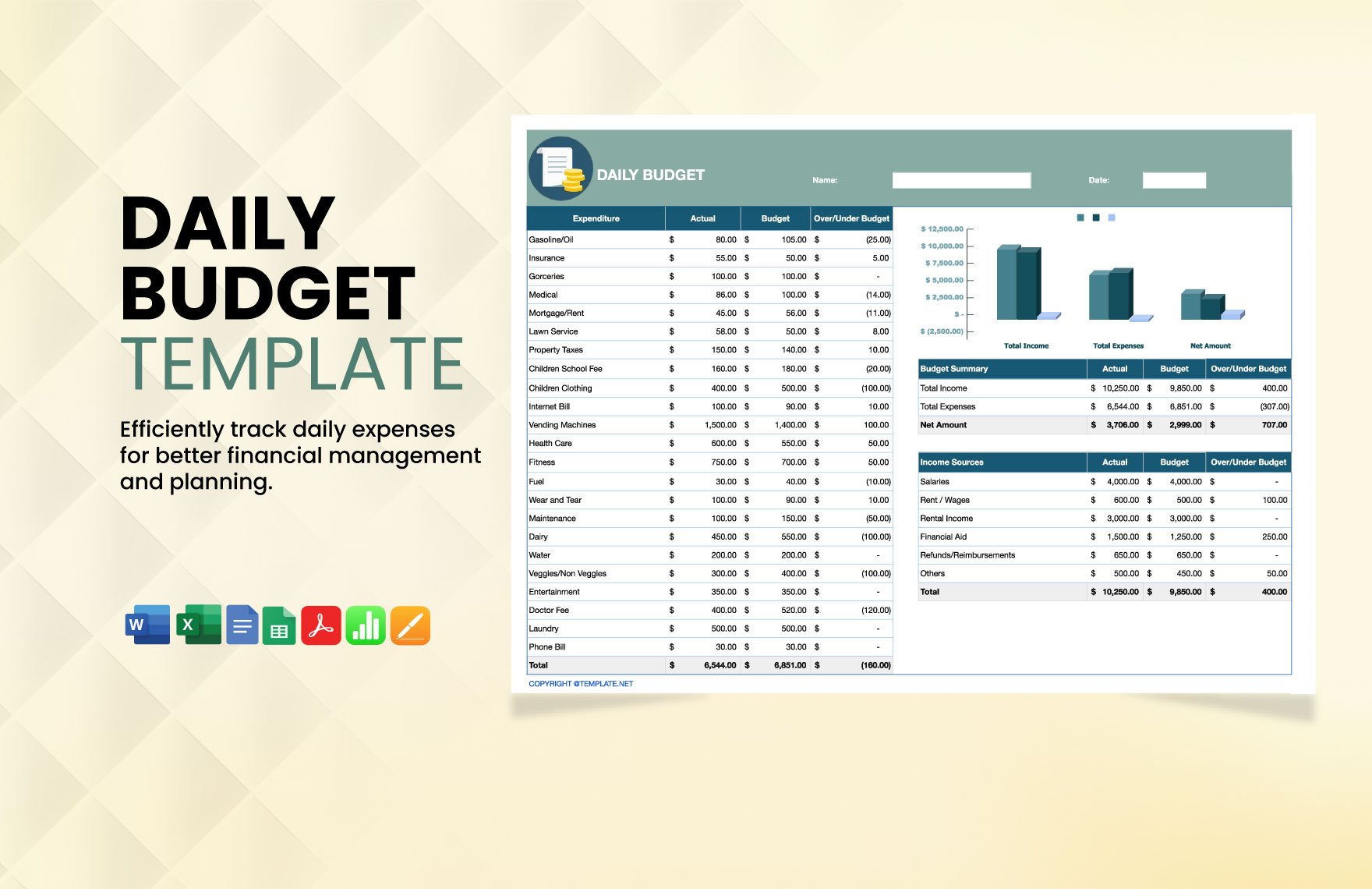

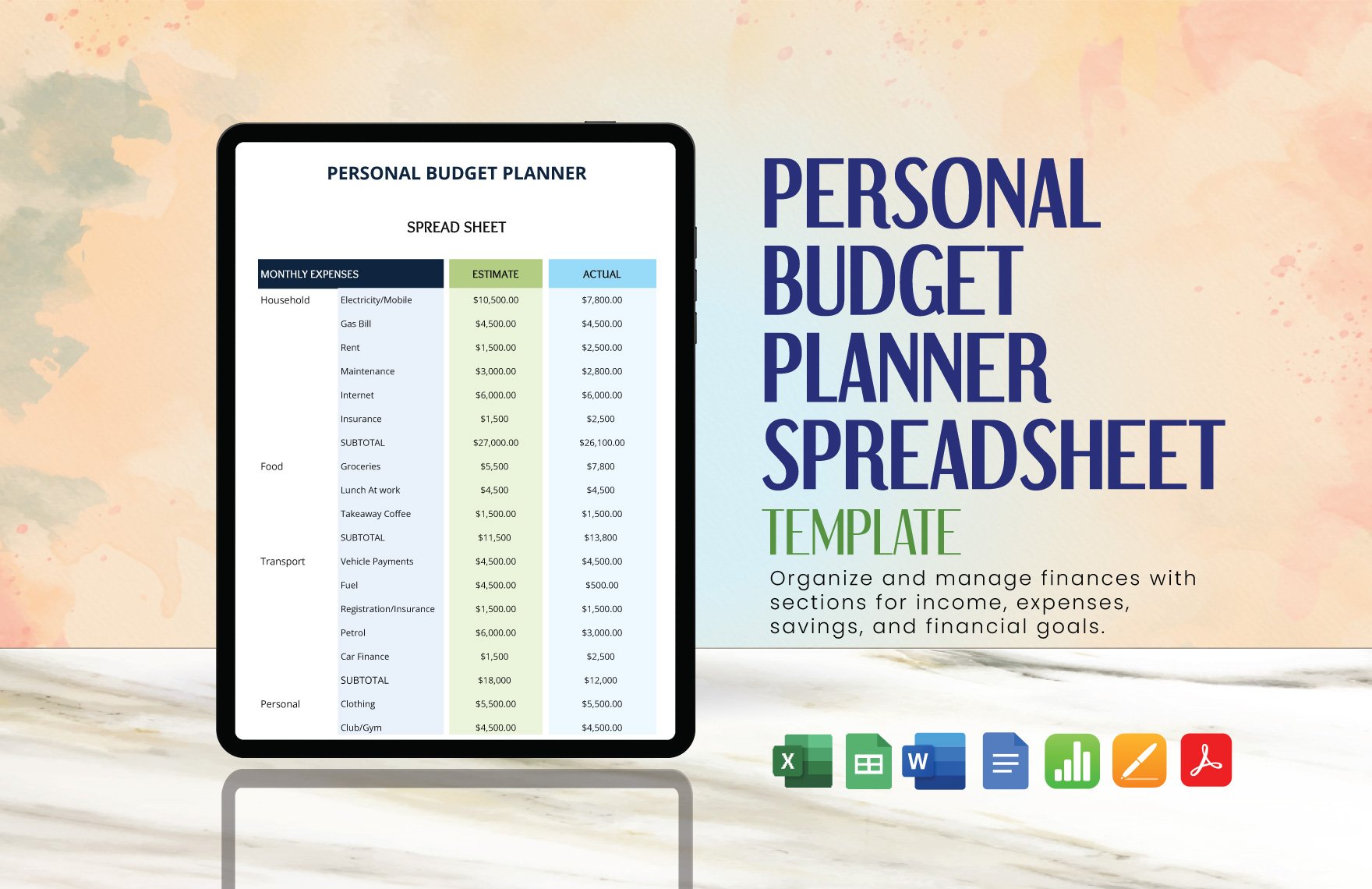

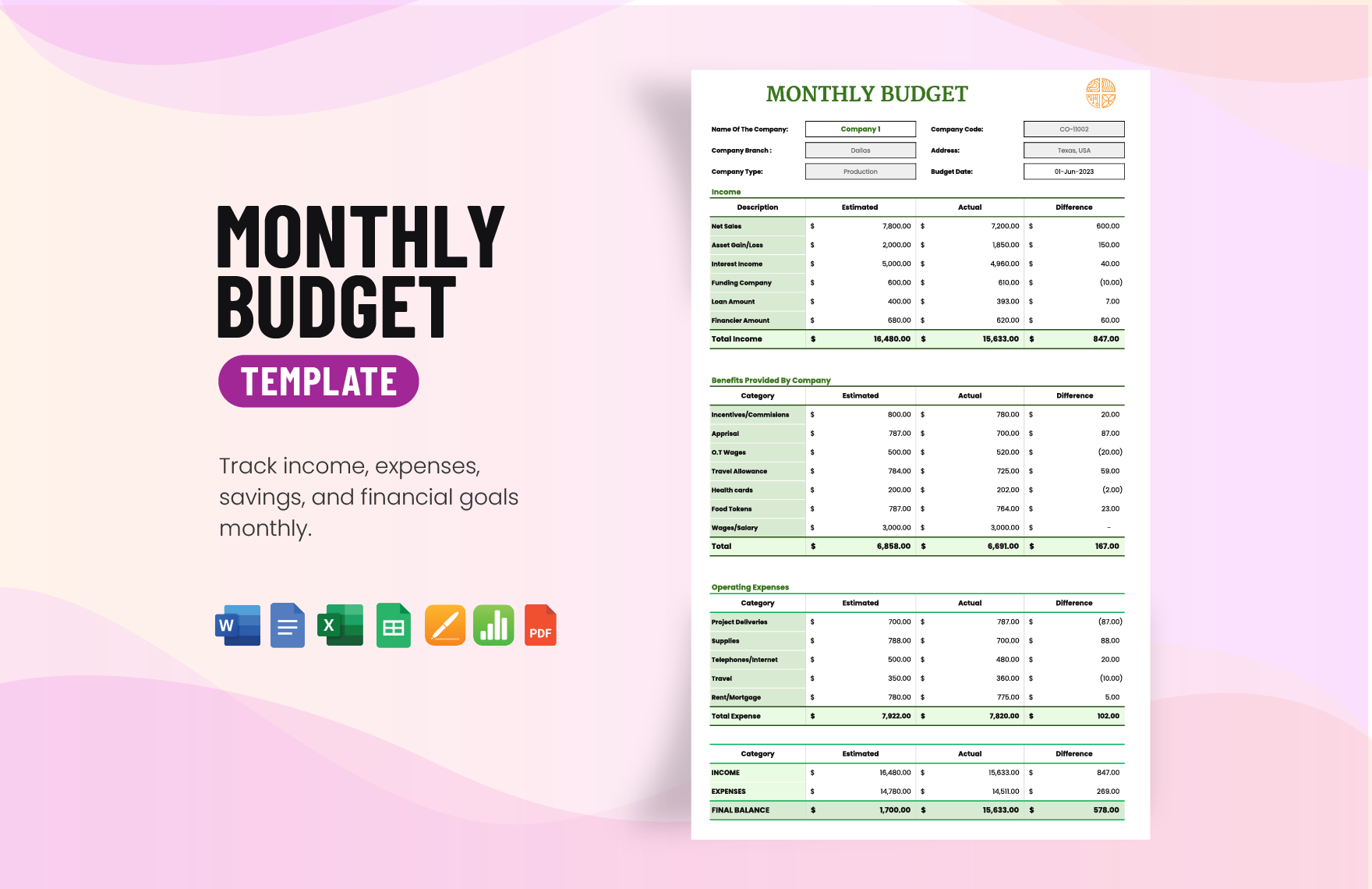

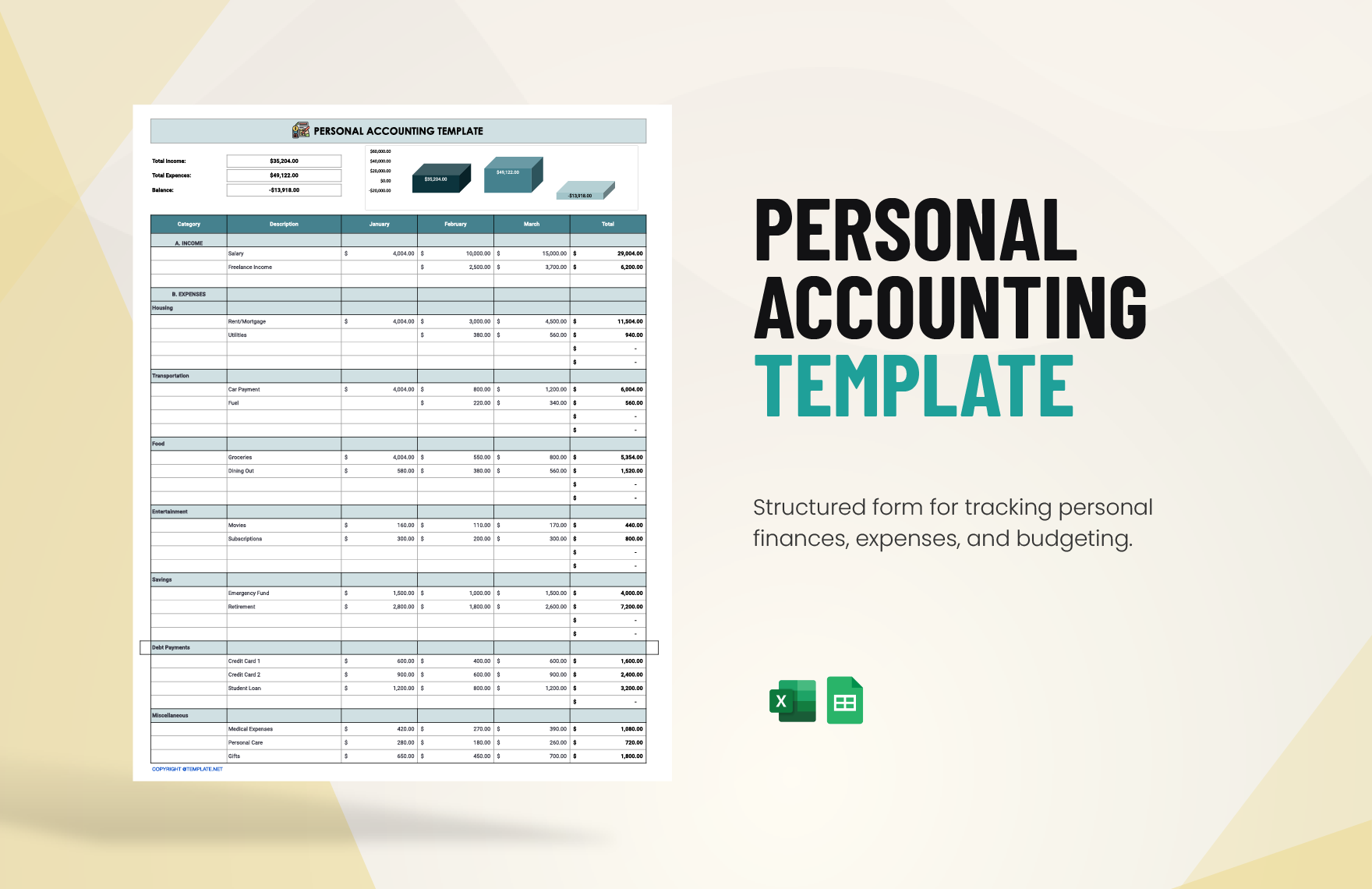

Imagine how much money you will make over the years if you collect all the penny you found on the street. That's why you should not neglect little expenses because it could go a long way. Some might not consider tracking their expenses because it is obvious. But if you want to be clear with your spendings, here is a Personal Budget Template straight from our collection. With this template, tracking your money will be as easy as never before. If you want more 100% customizable, easily editable, professionally made, high-quality, and printable template, subscribe to any of our subscription plans.

How to Make a Personal Budget in Excel

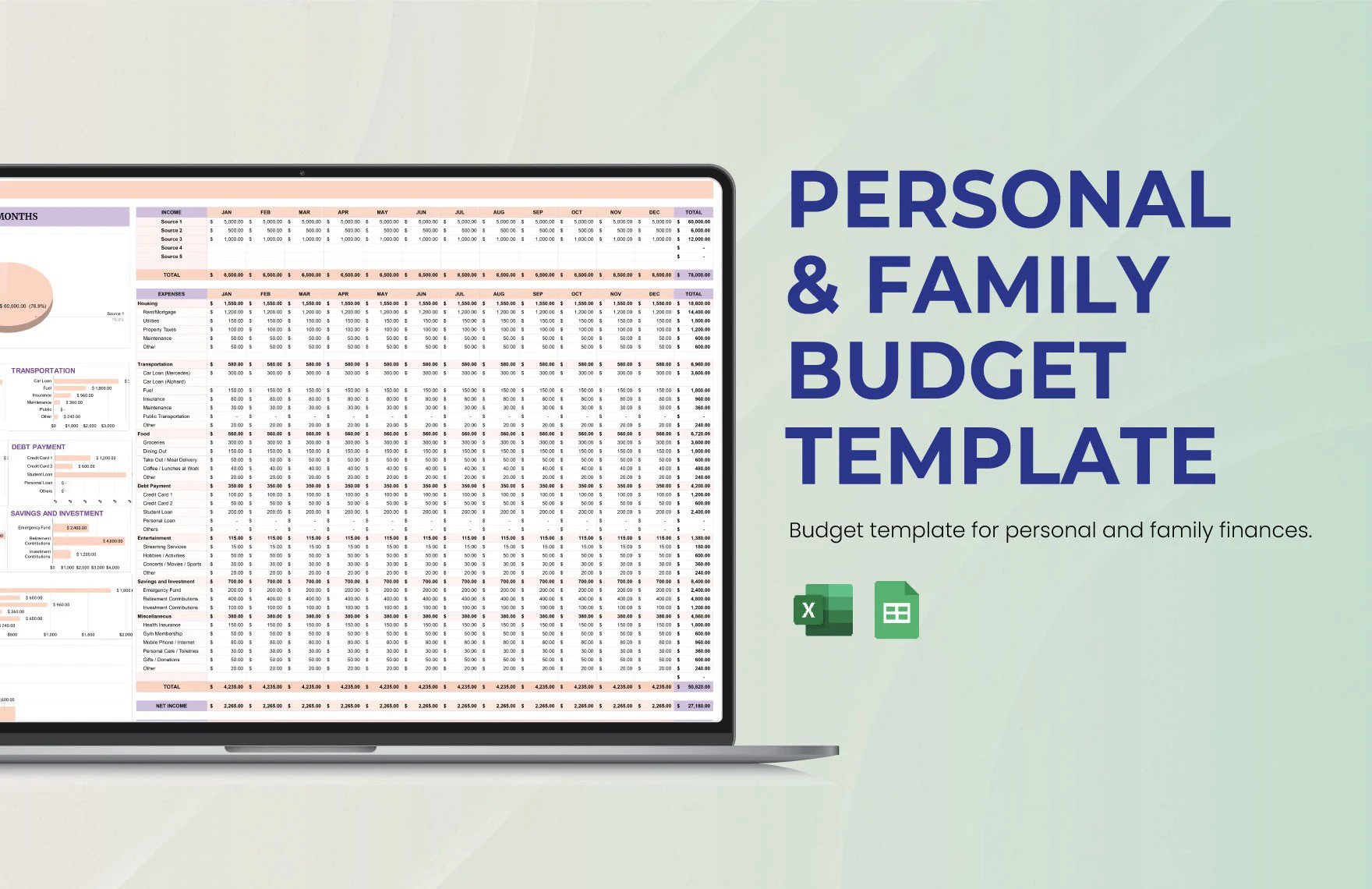

When it comes to personal finance, the meaning of savings is preserving money for future spendings. However, the saving rate still relies on the economic environment. Based on the data reported by Statista in 2019, 7.6 percent of the Americans preserve their capital for the future, which amounted to 1,289.8 billion U.S. dollars. If you want to set aside money, putting it under the mattress is not the solution. You need to make a personal budget plan. Below are tips in making a personal budget in Microsoft Office Excel.

1. Determine Expenses

If you want to start a budget plan, the first thing you should do is to find out how much you are spending for a specific time frame. Then, add up everything and divide the sum by the amount of time. With this result, you can project the amount you are willing to budget.

2. Know Your Income

Since you know how much money you need to retain, the next thing you will do is to know your actual income. Your income can be deducted with unexpected payment. With that, you have to consider your actual income as the remaining money on your hand.

3. Set Goals

The main reason why you have a budget is to track money and see where it flows. Having a budget can prevent extra spending since you already allot your resources for certain things. With this, your goal should be keeping track of your budget. Though you can break the budget, make sure you get right back at it on time.

4. Record Progress

For sure, you want to keep an eye on your budget. To do that, document all your spending and income. These records will motivate you to meet your savings goals.

5. Be Realistic

Let's be real. It's hard to stick with your budget plan sometimes. However, reaching your financial goal is the most satisfying. So, as much as possible, do not break your budget.