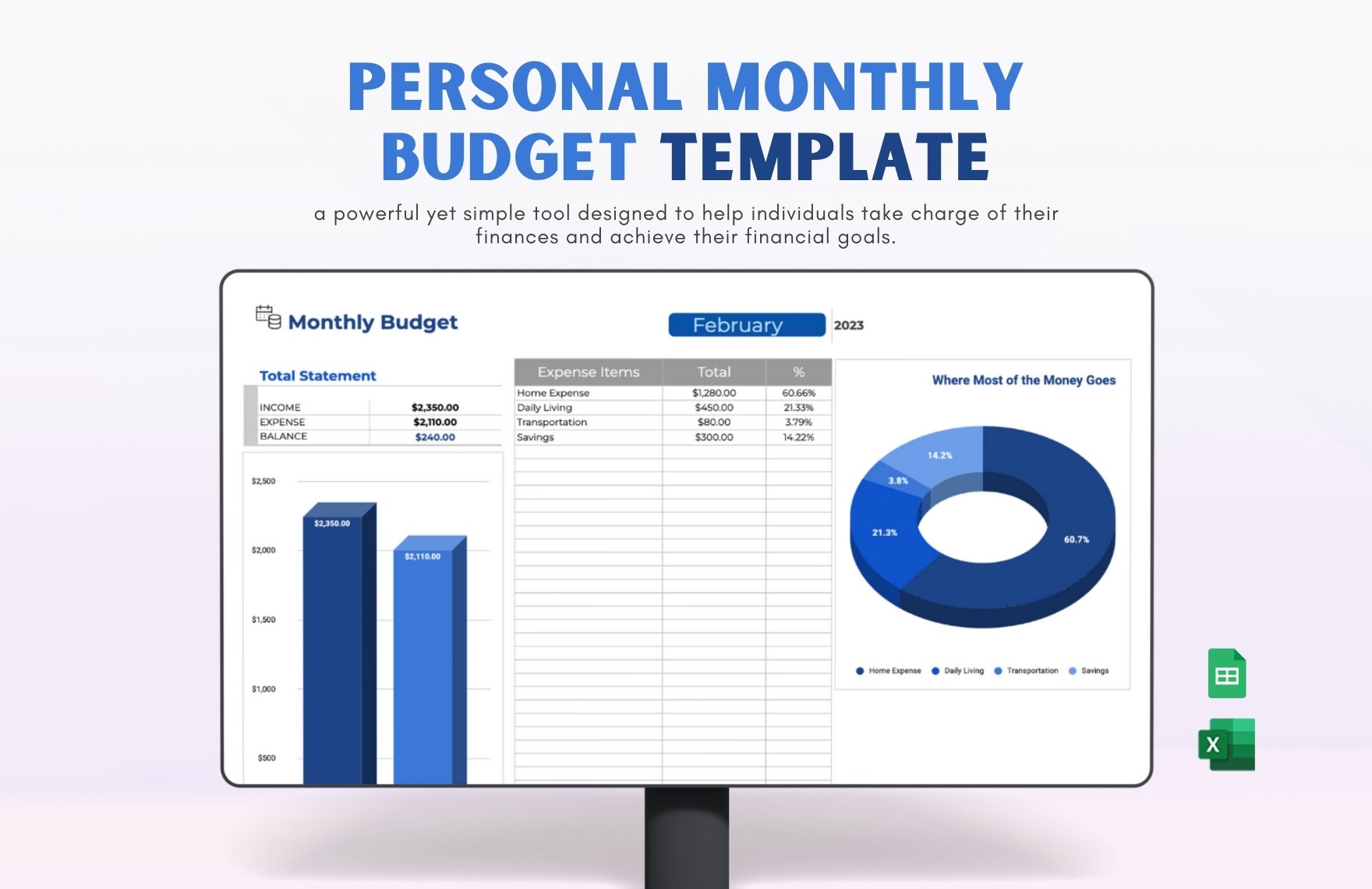

Manage Your Finances Effectively with Pre-designed Personal Budget Templates in Google Sheets by Template.net

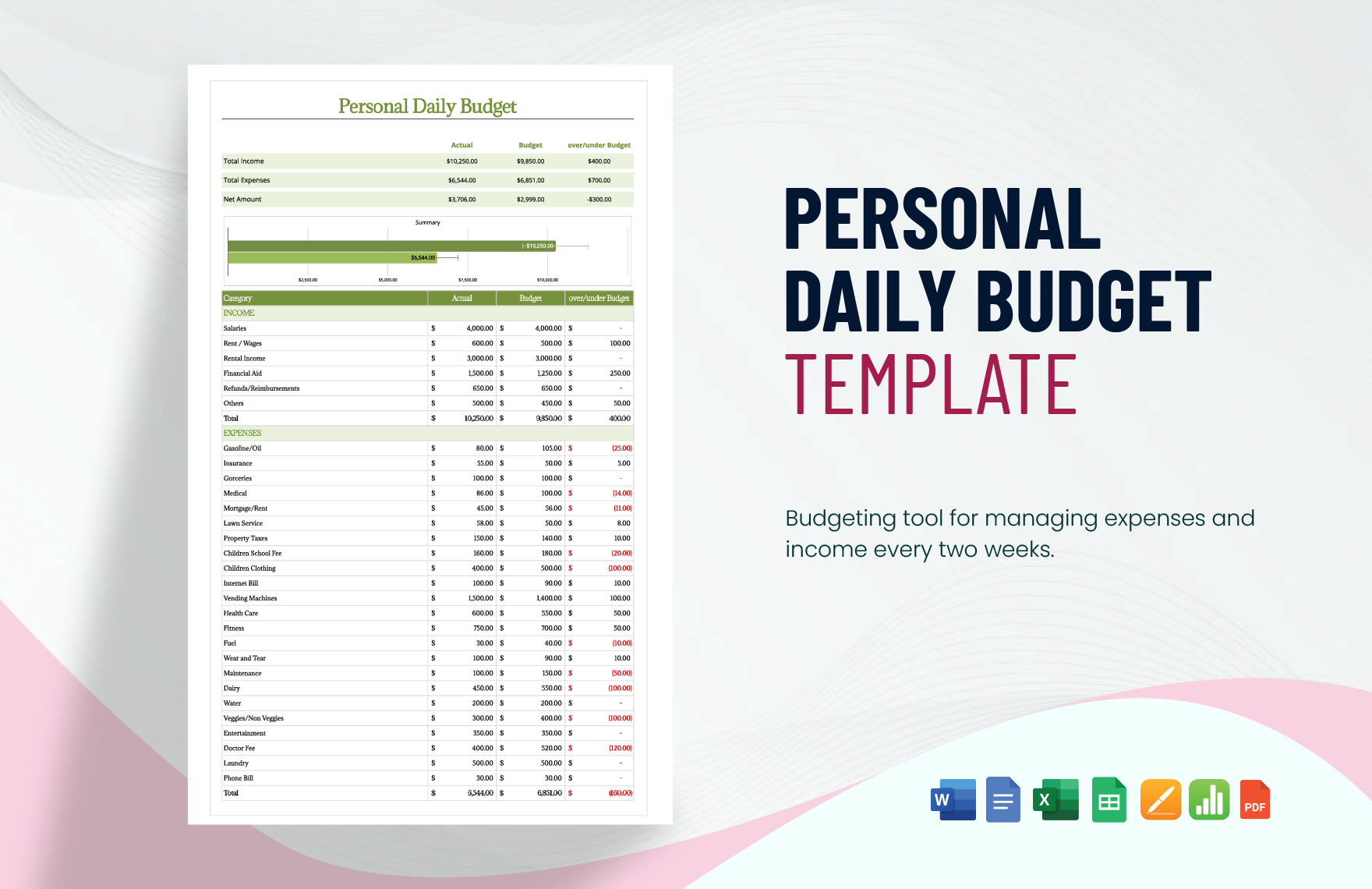

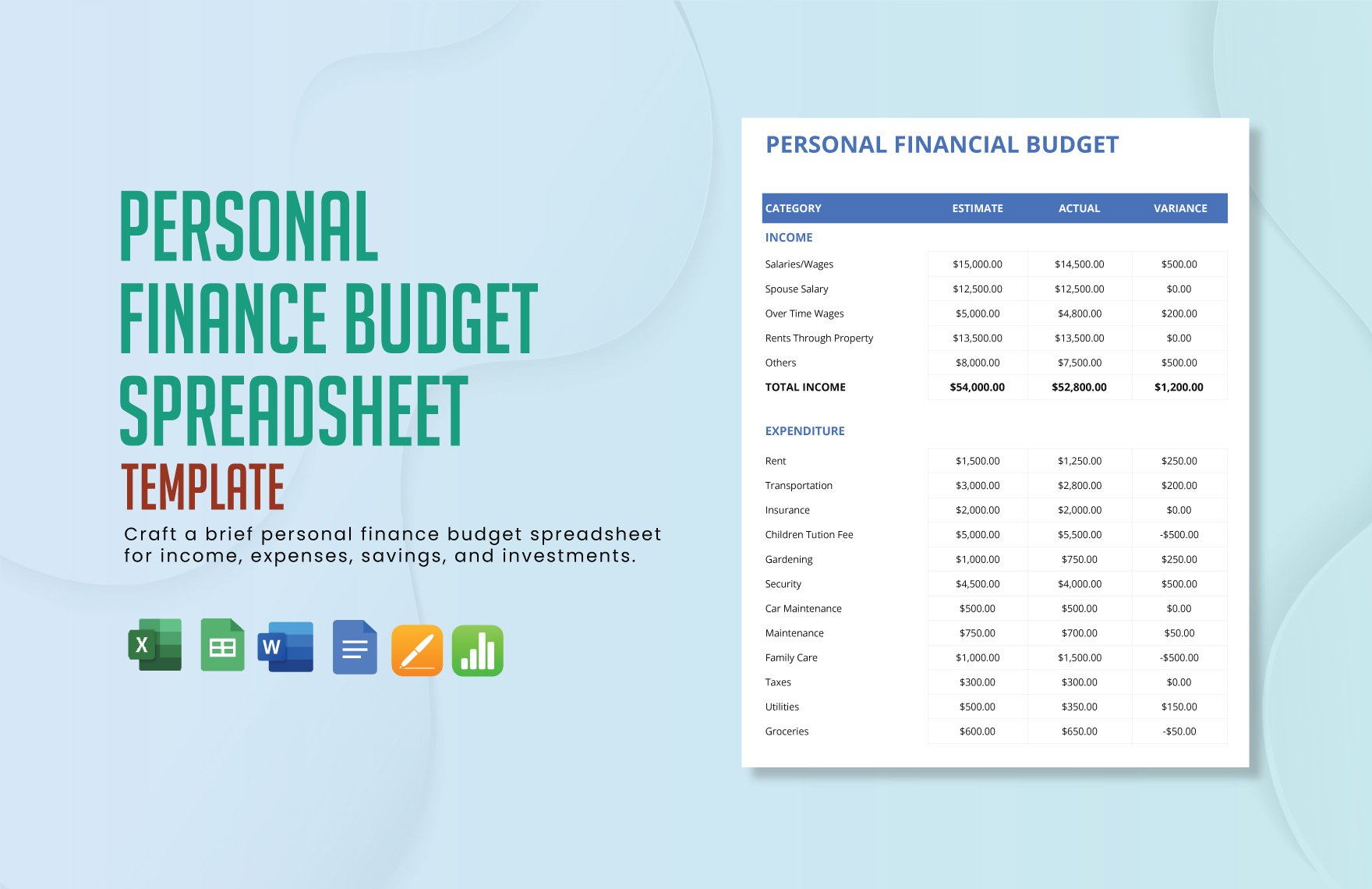

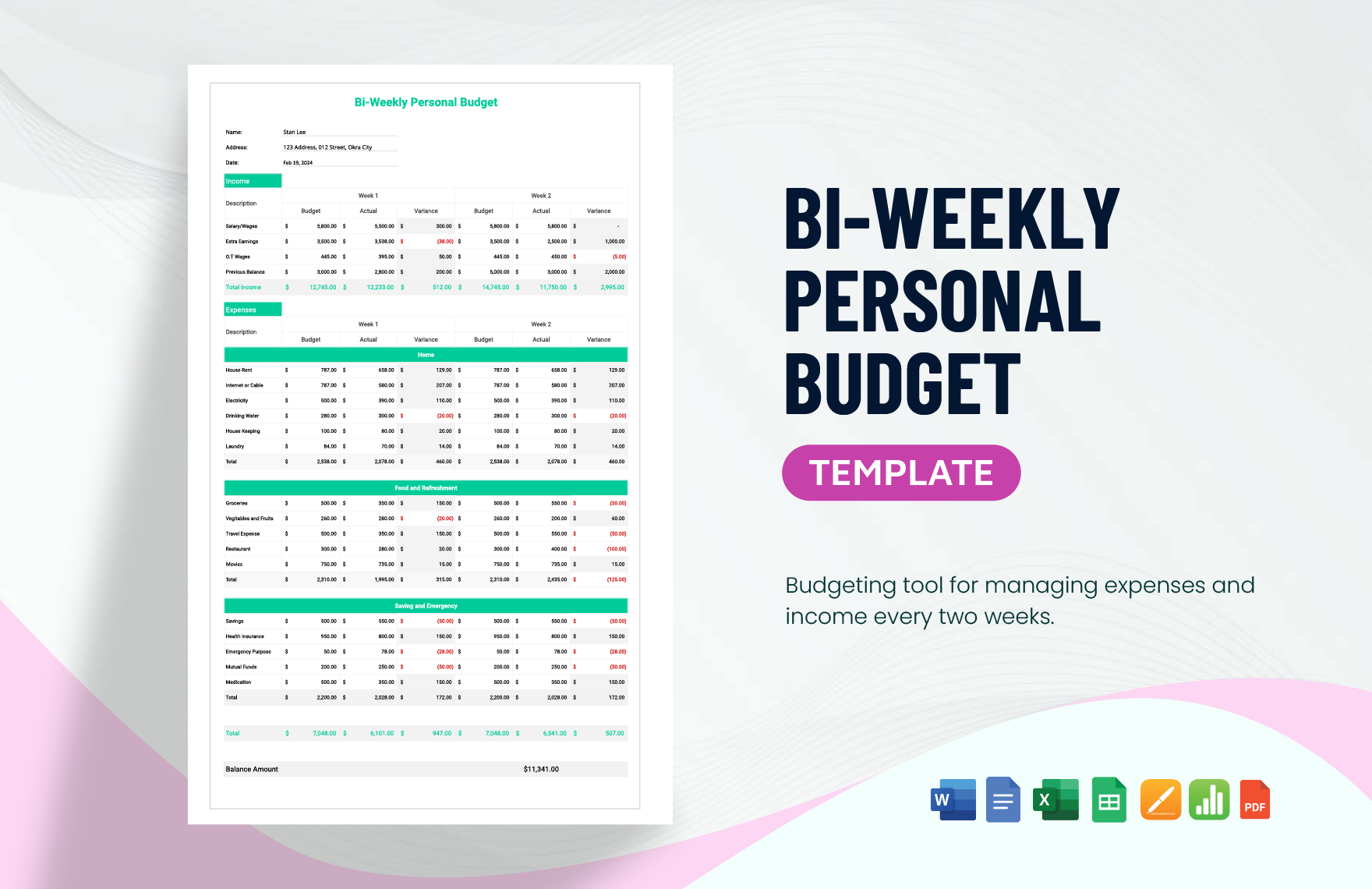

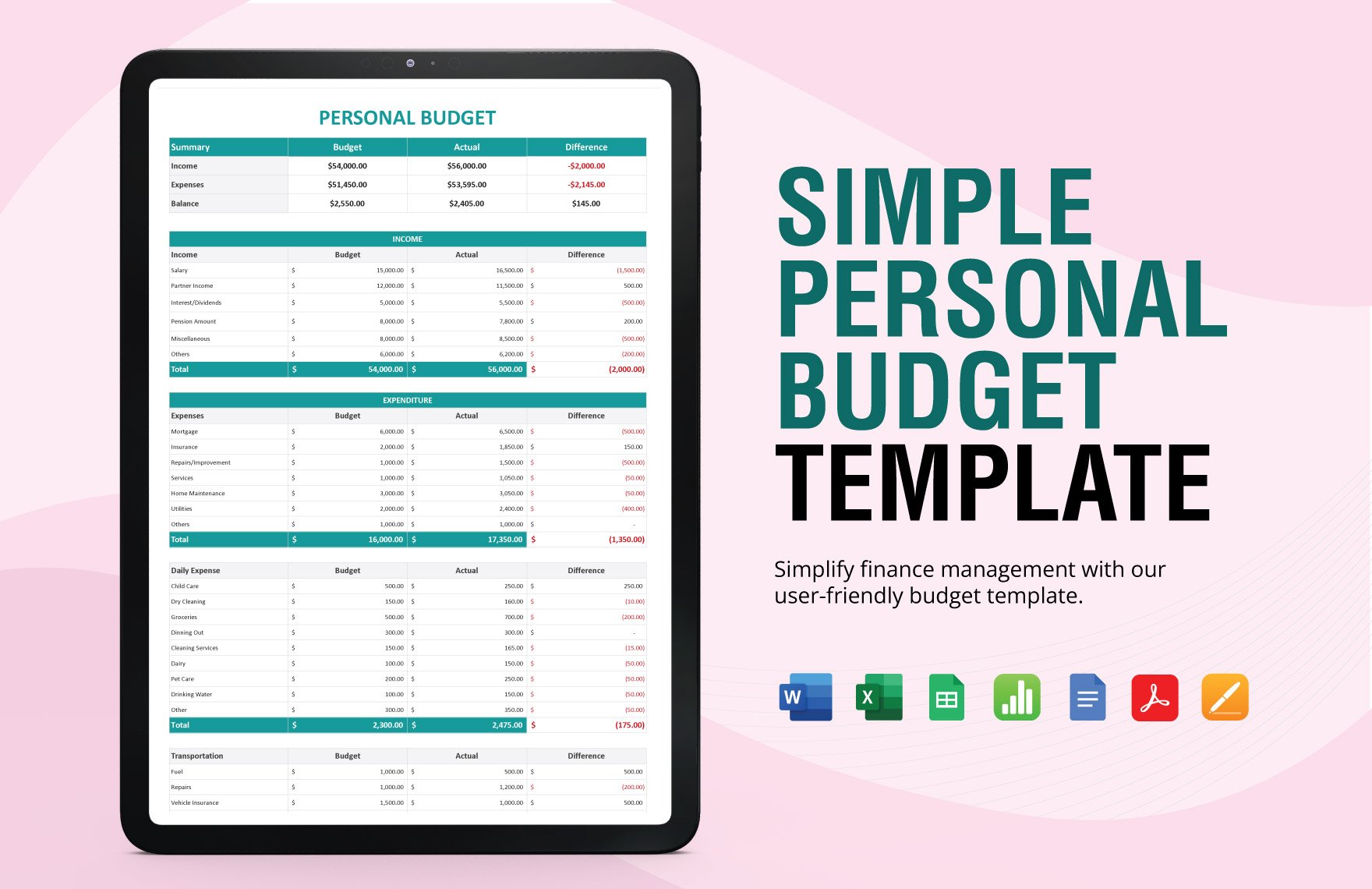

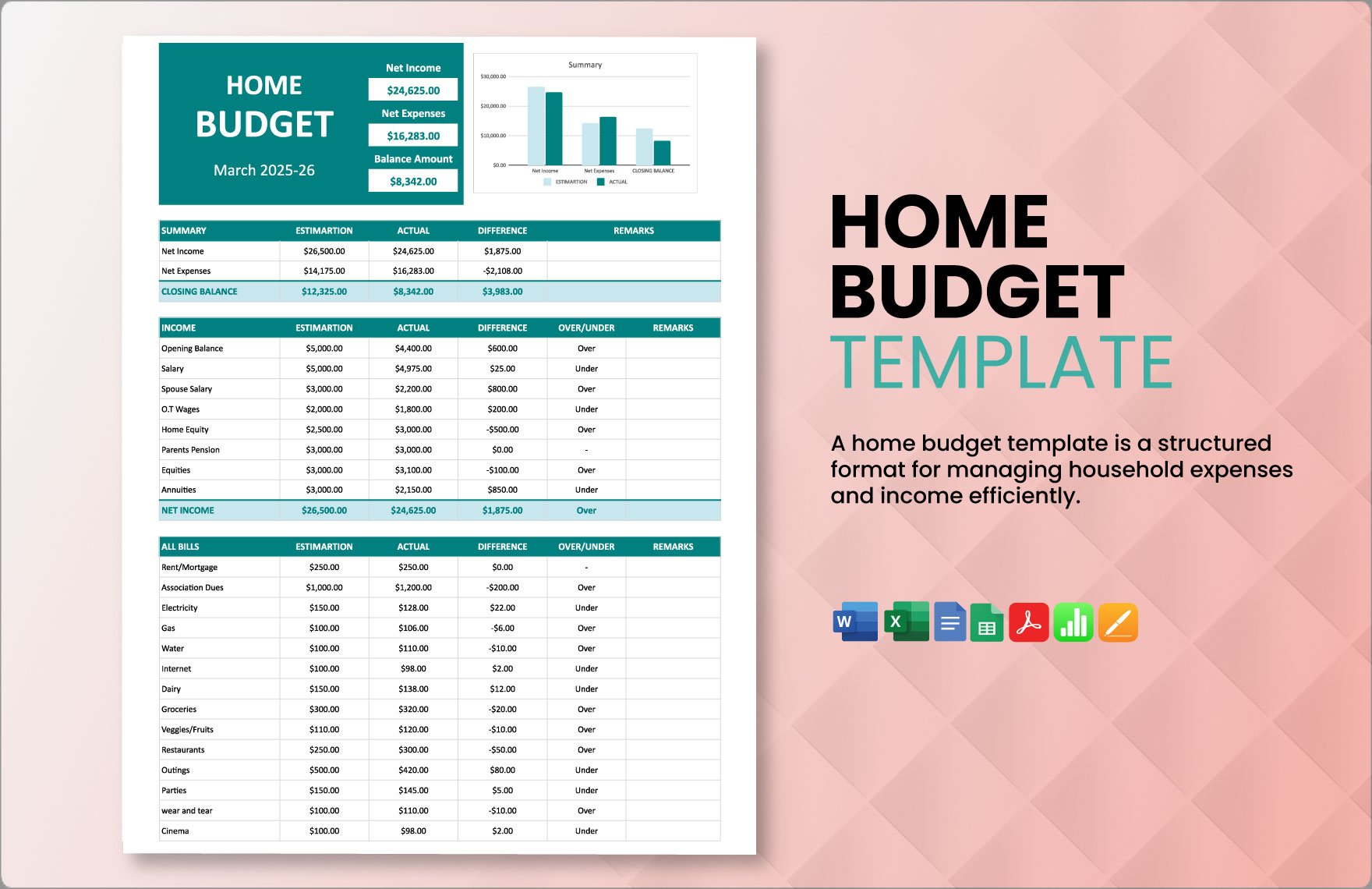

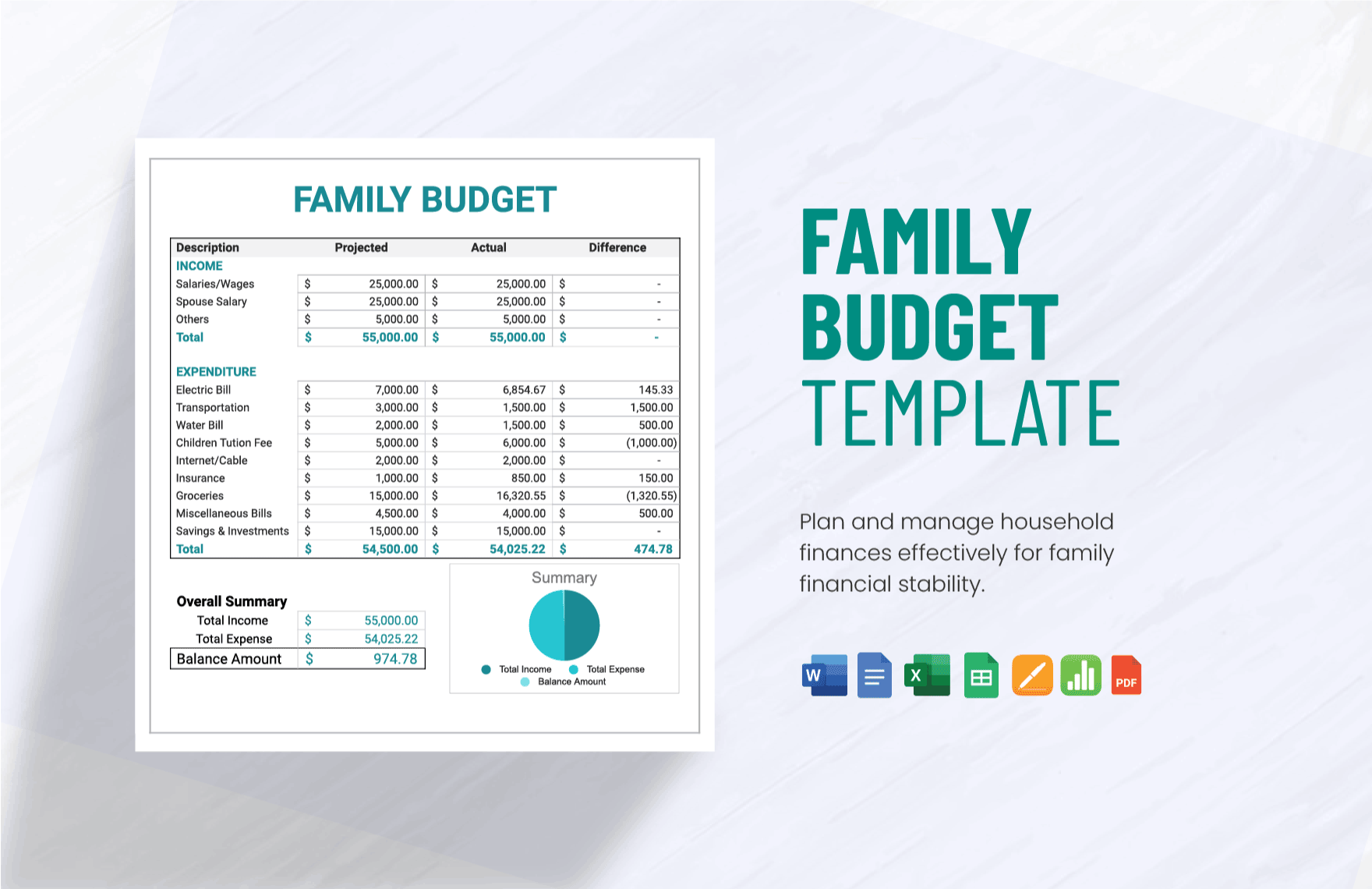

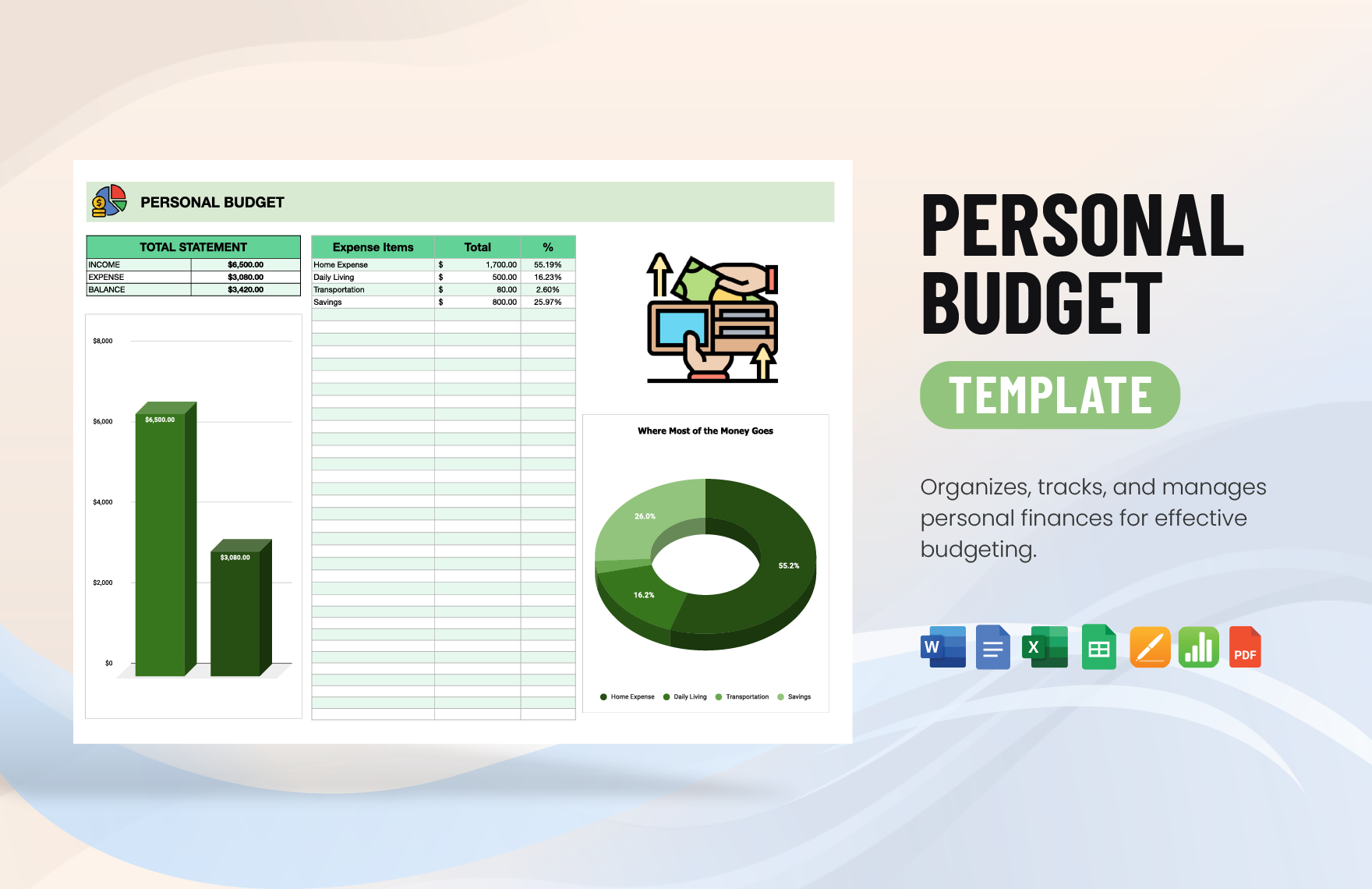

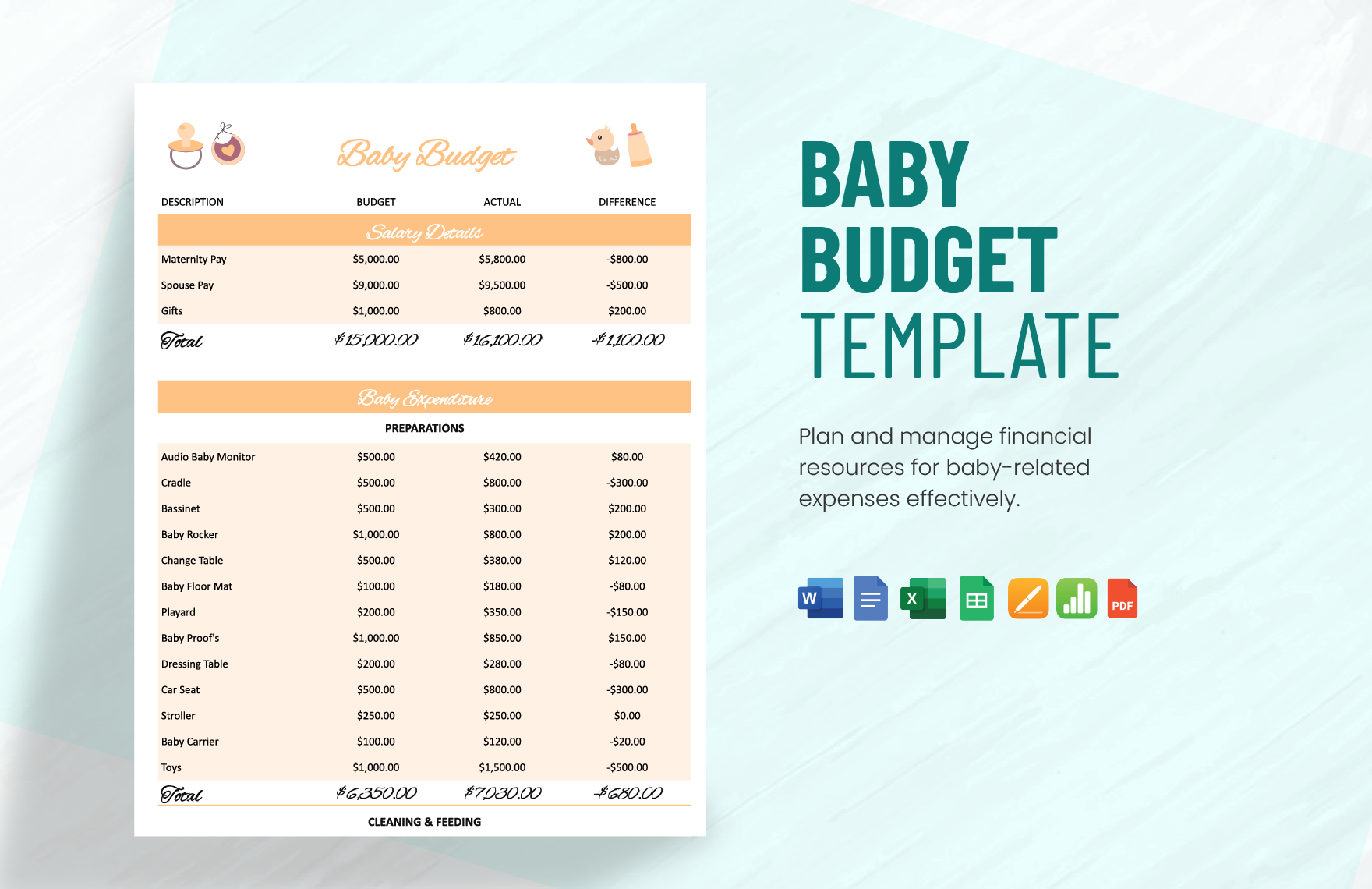

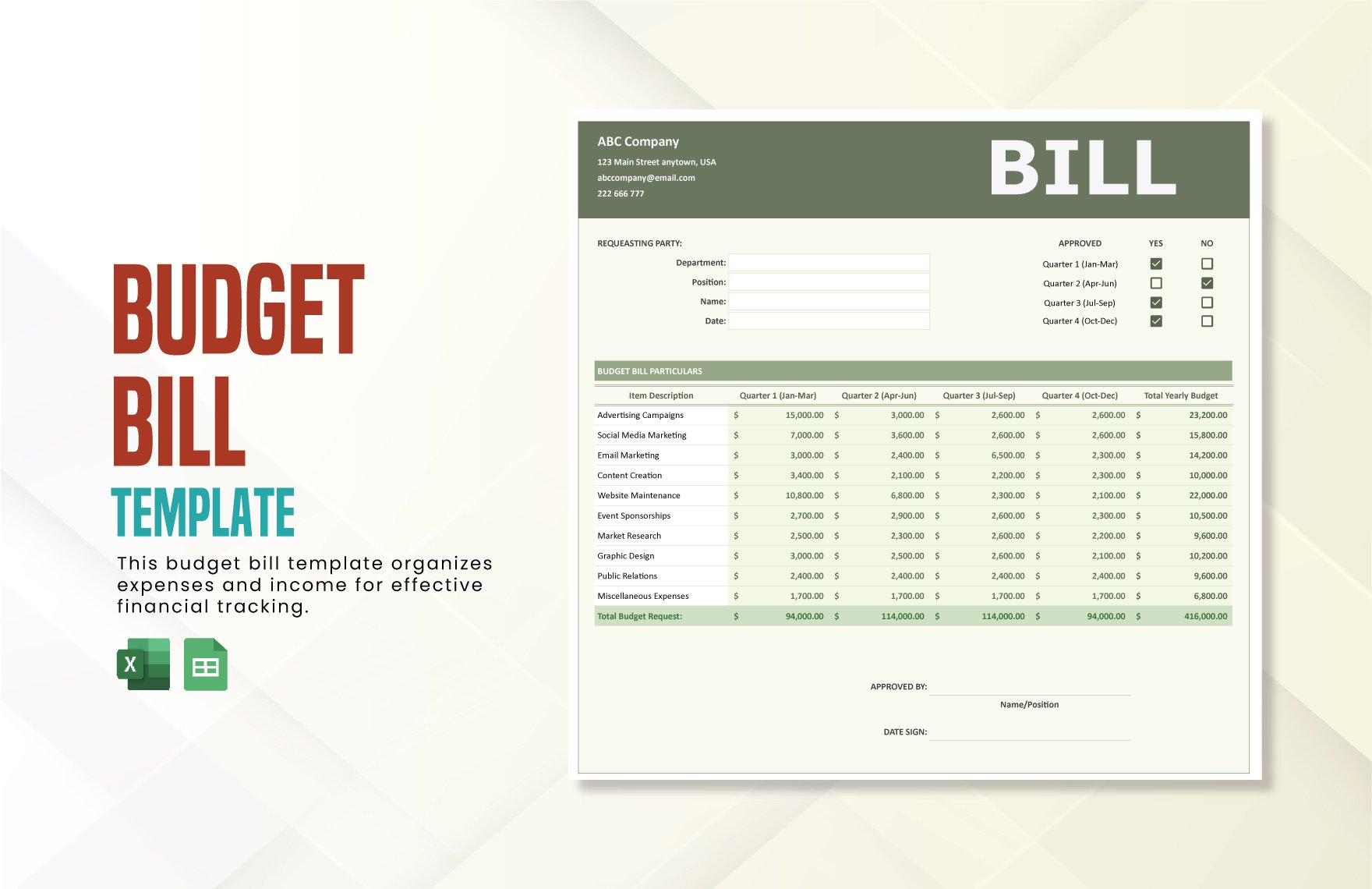

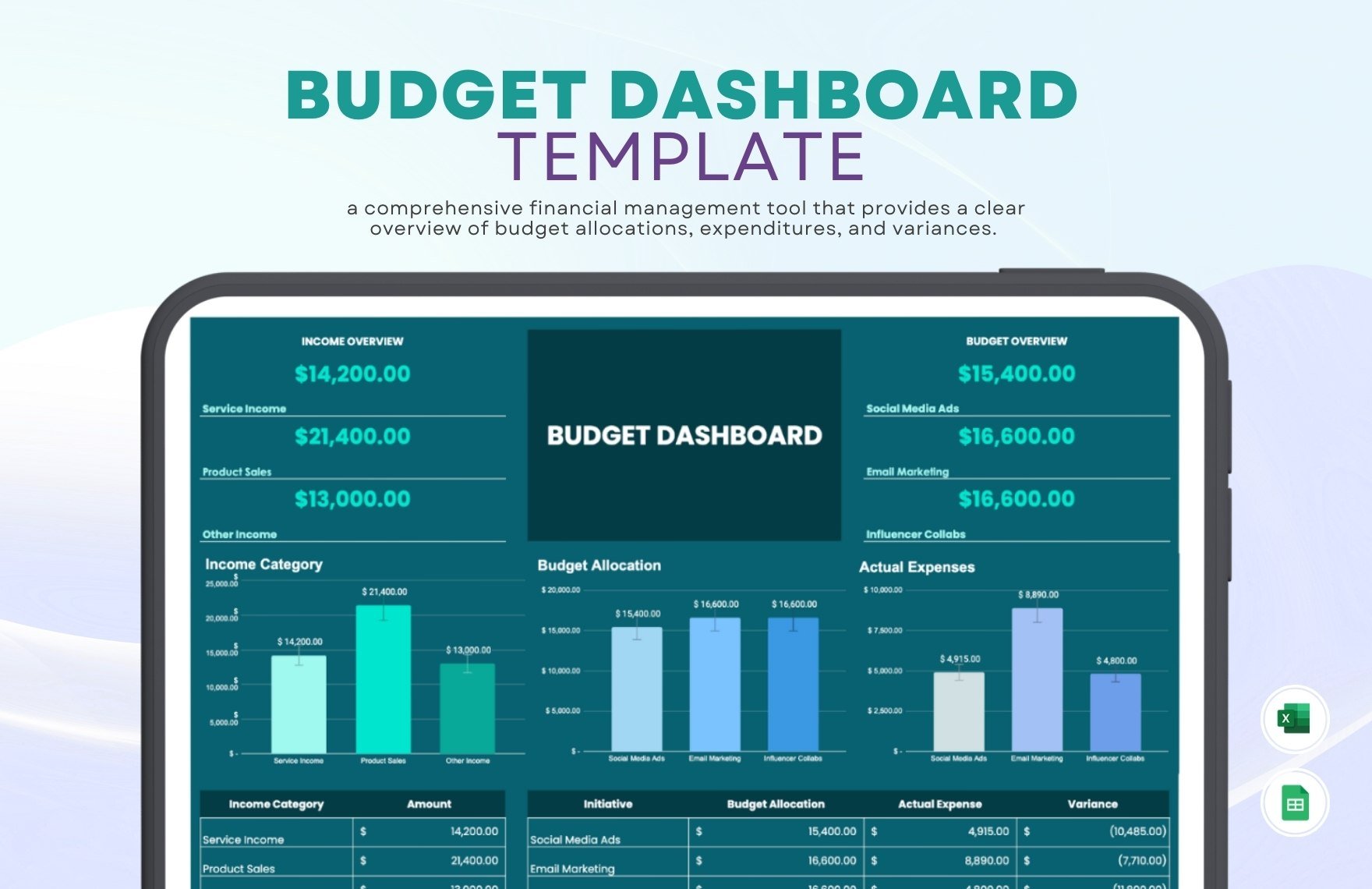

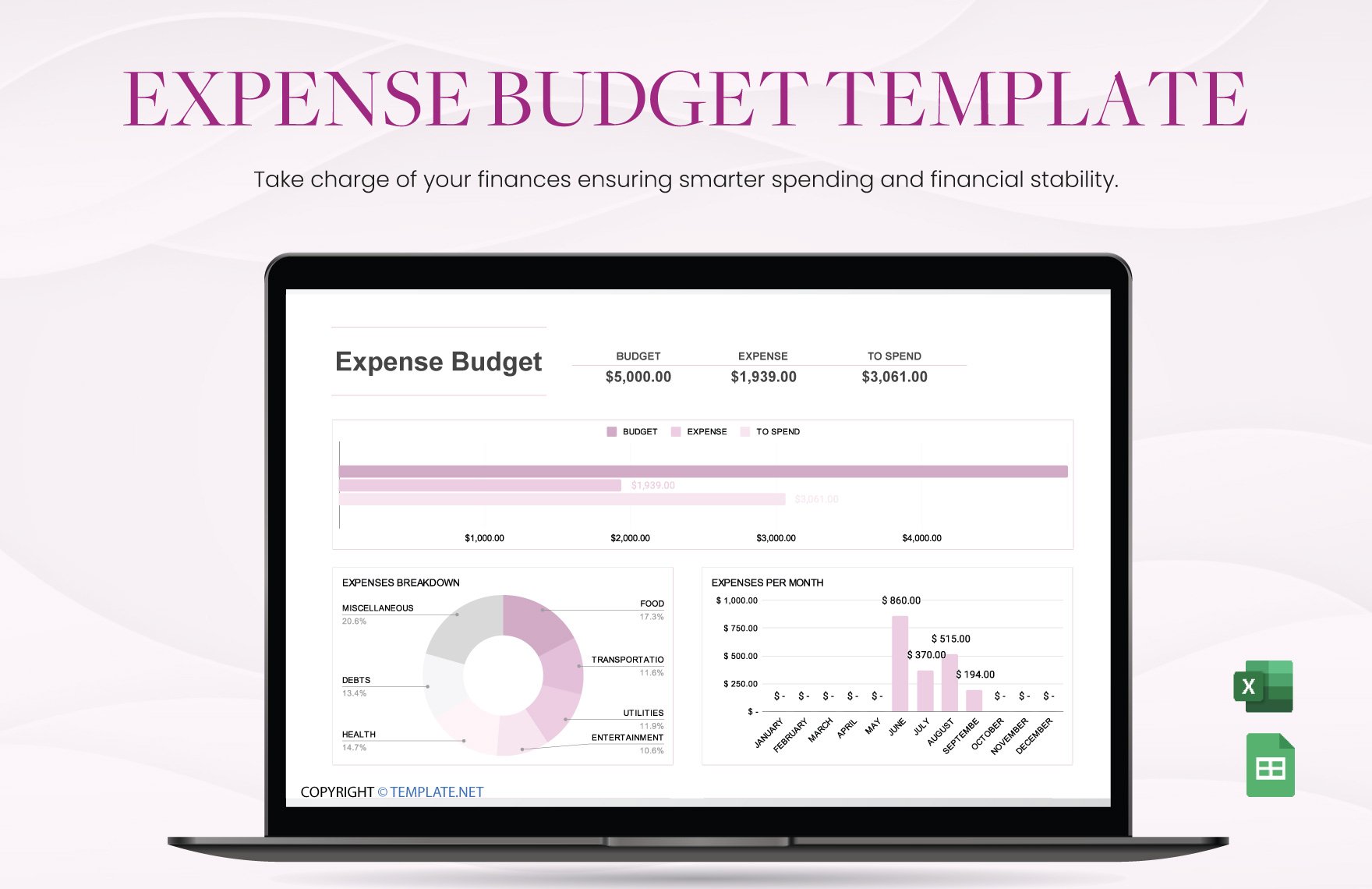

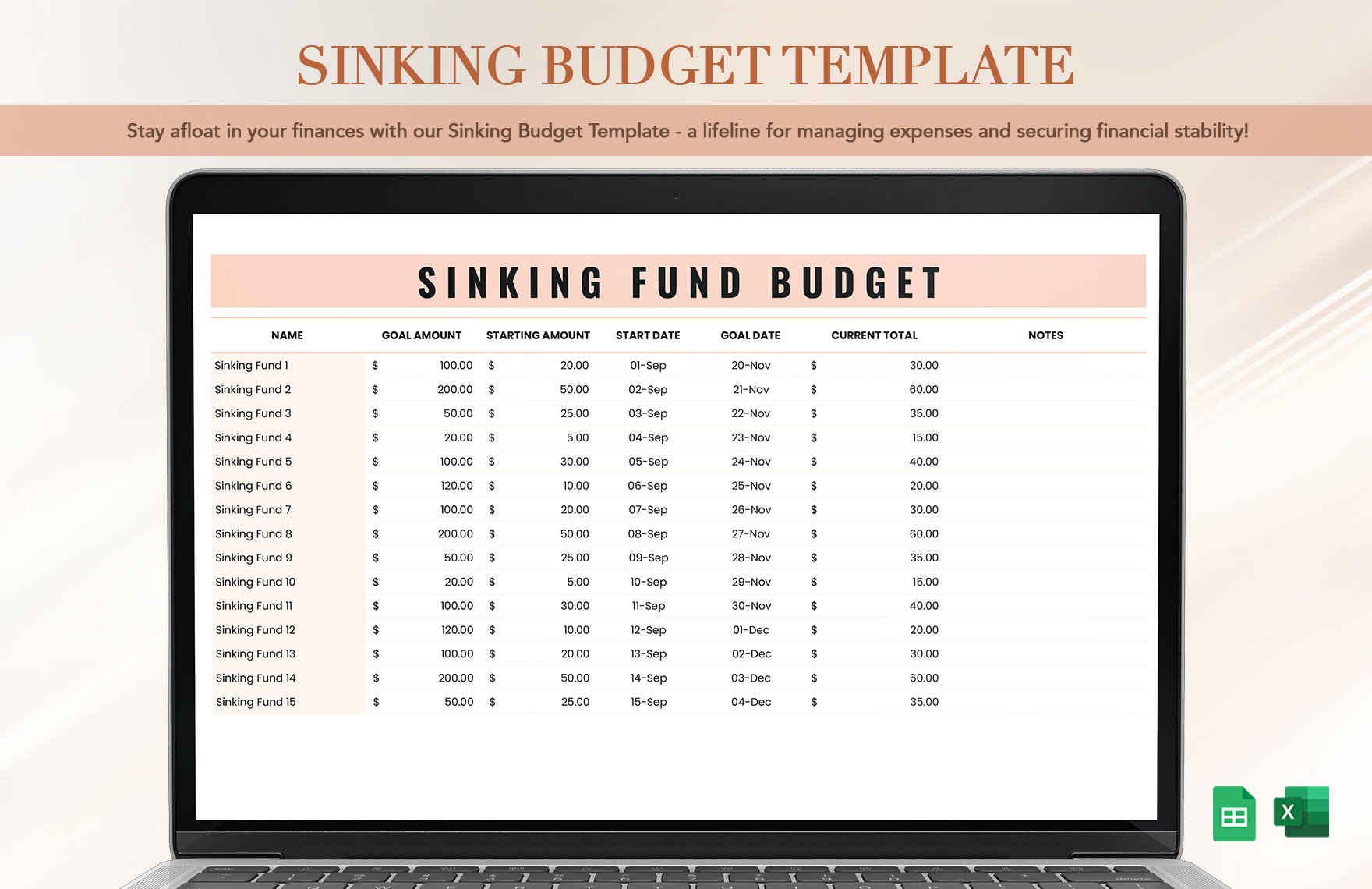

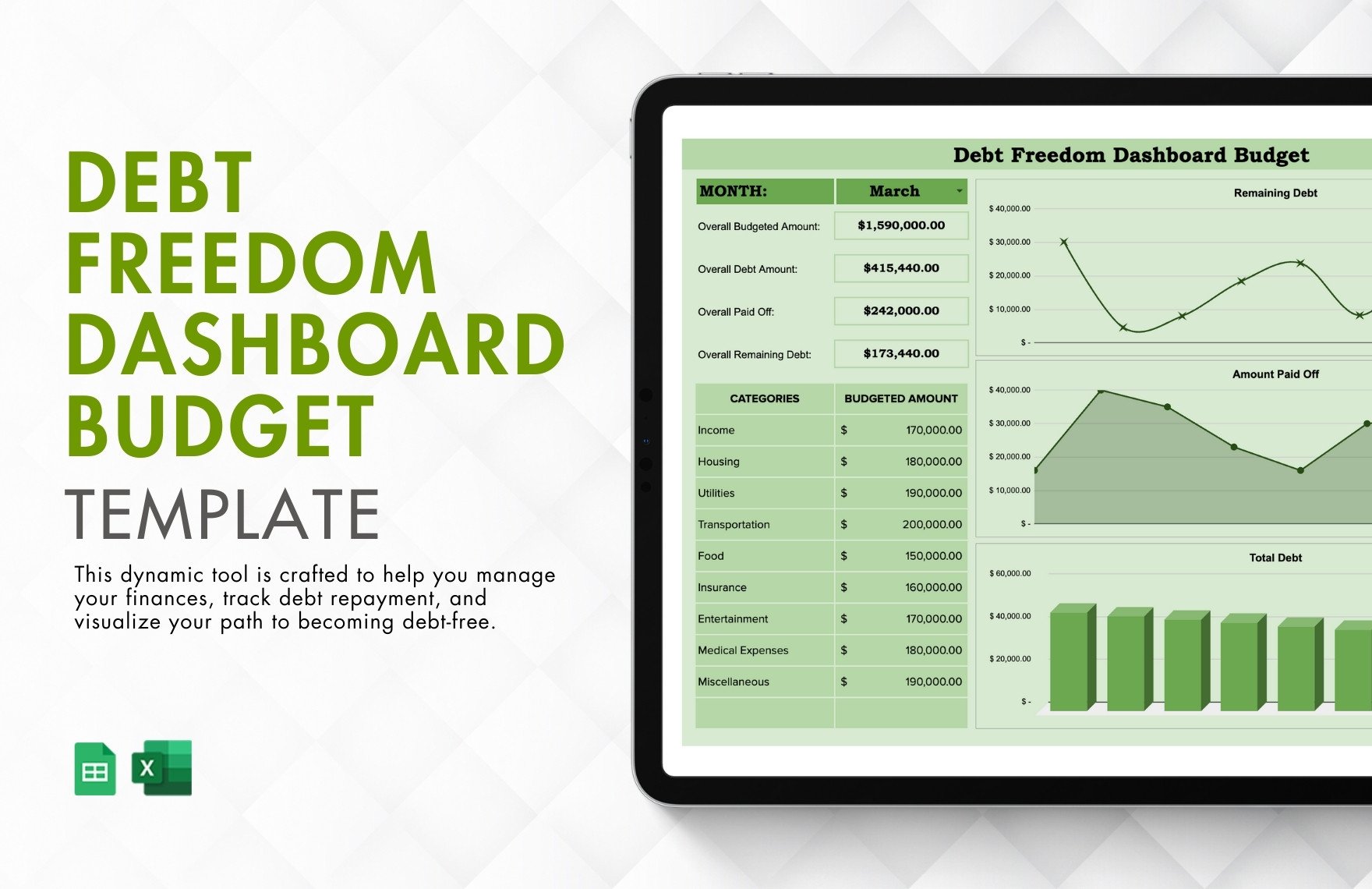

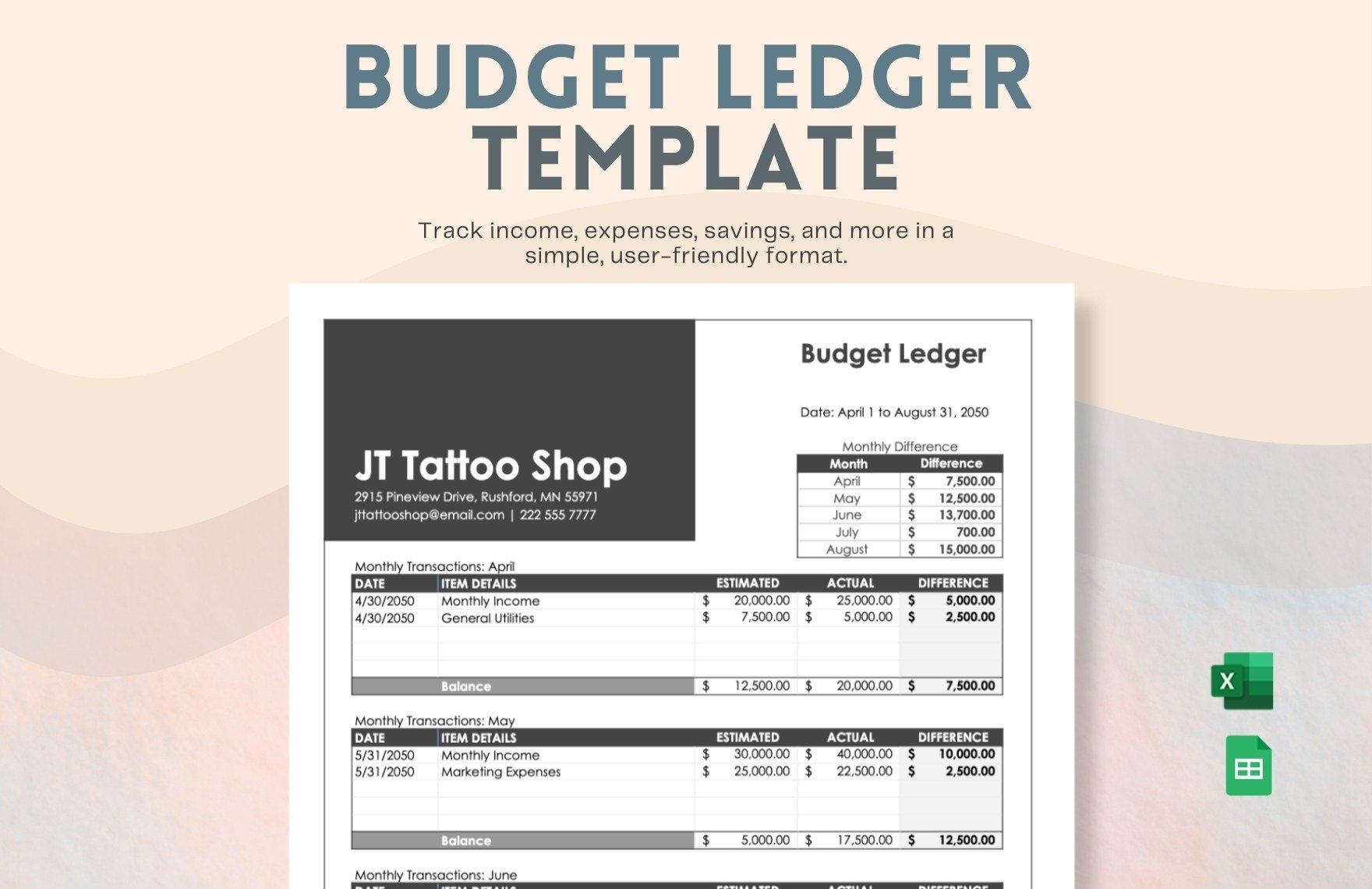

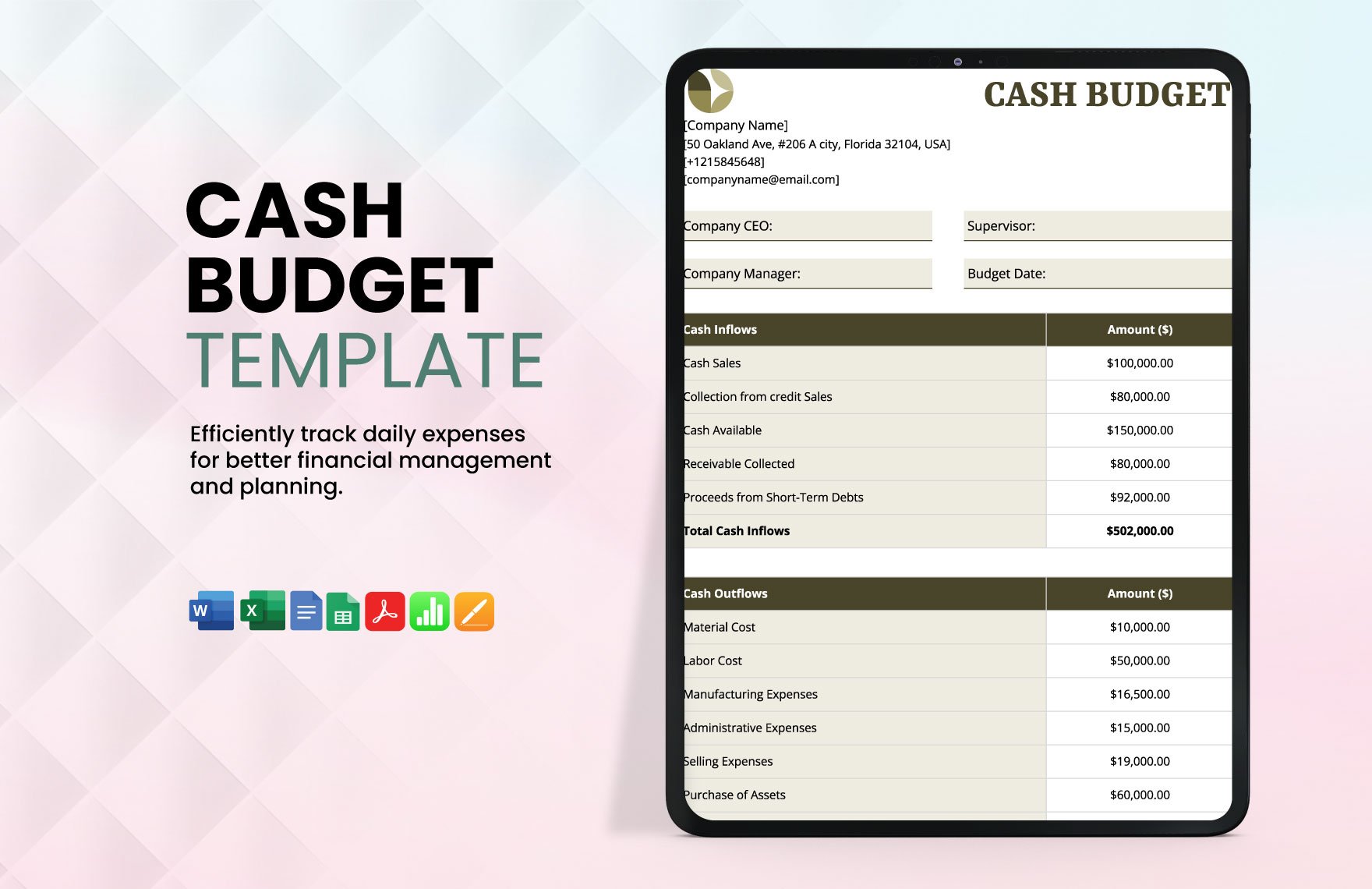

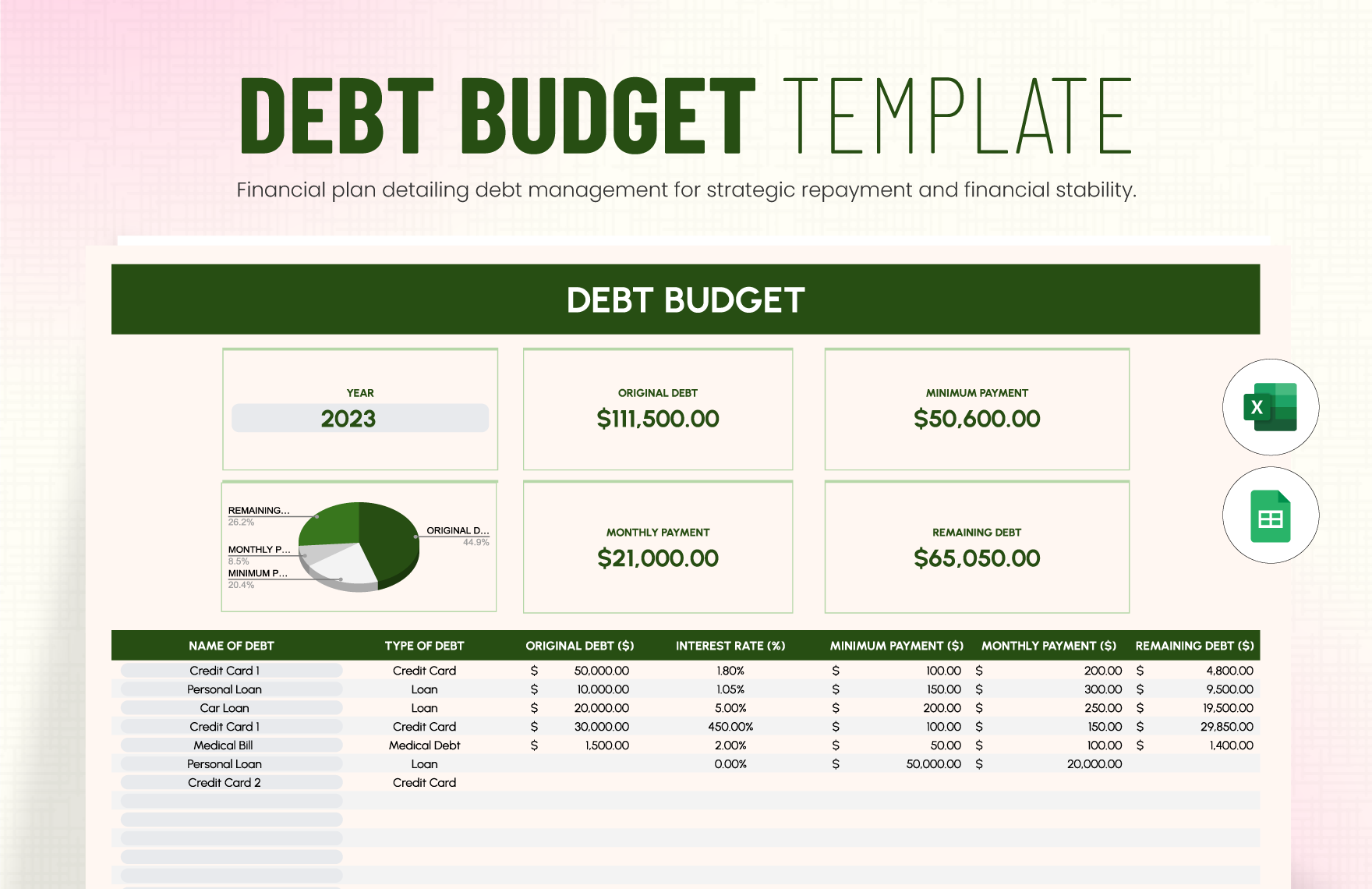

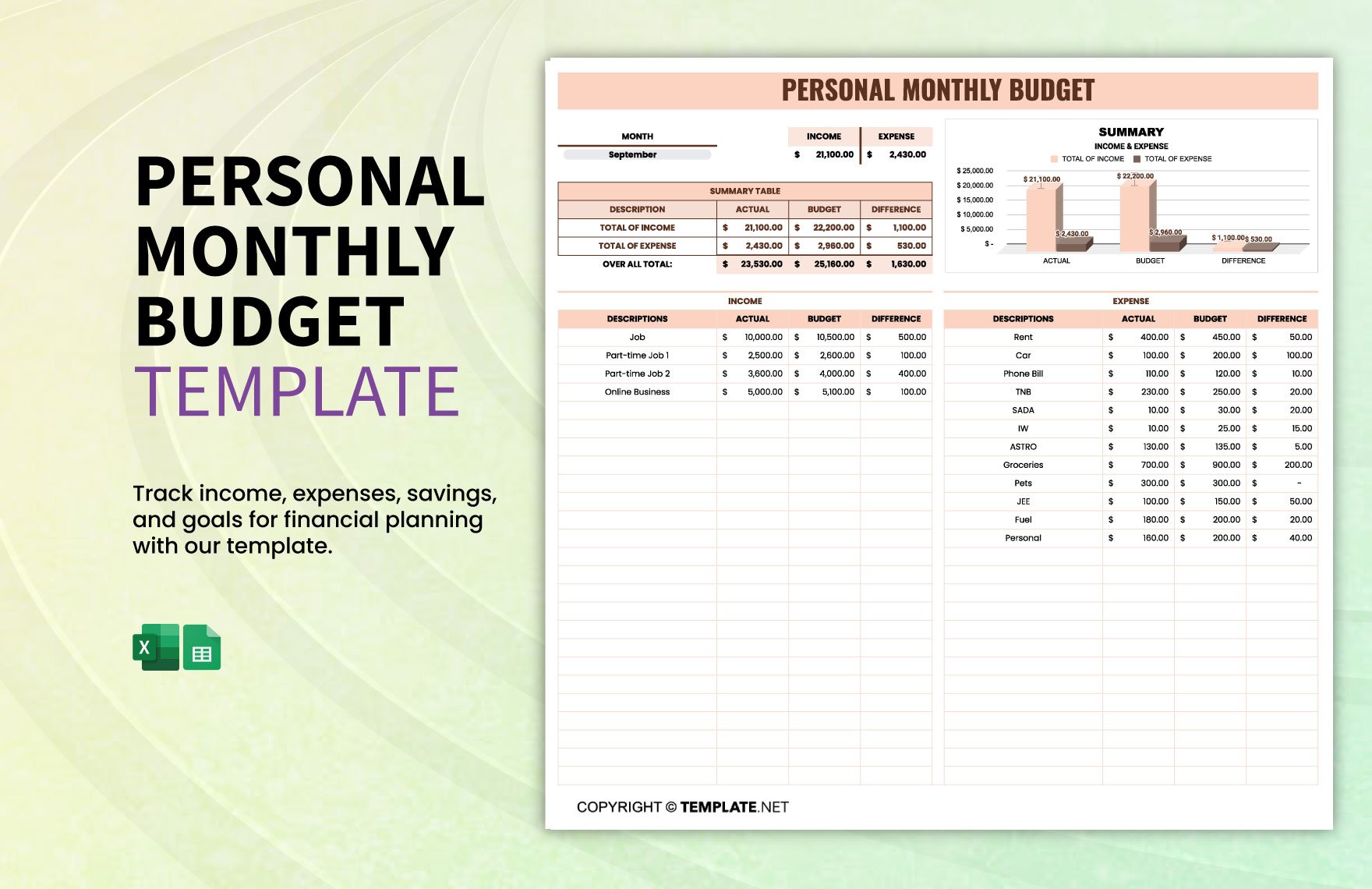

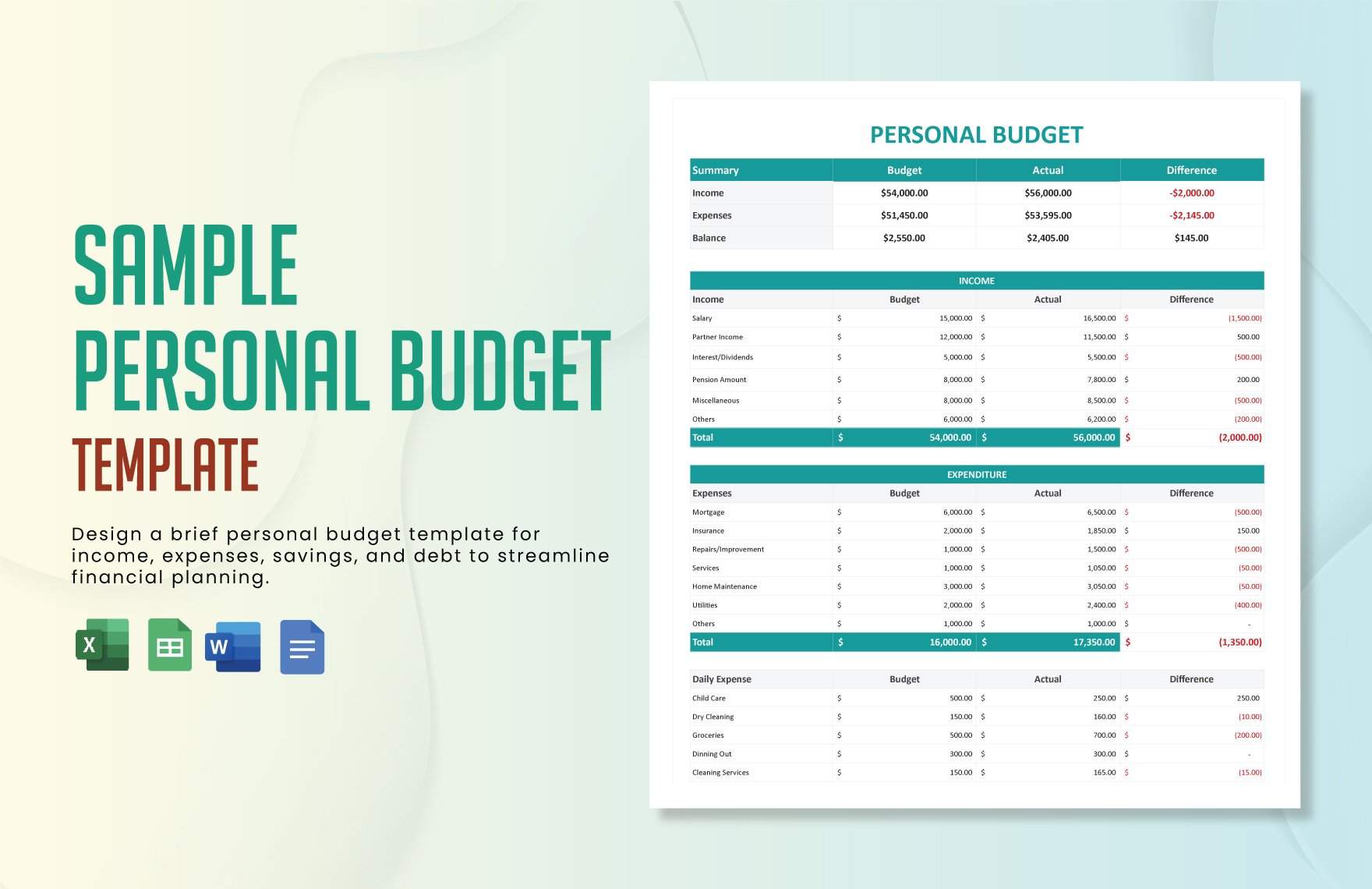

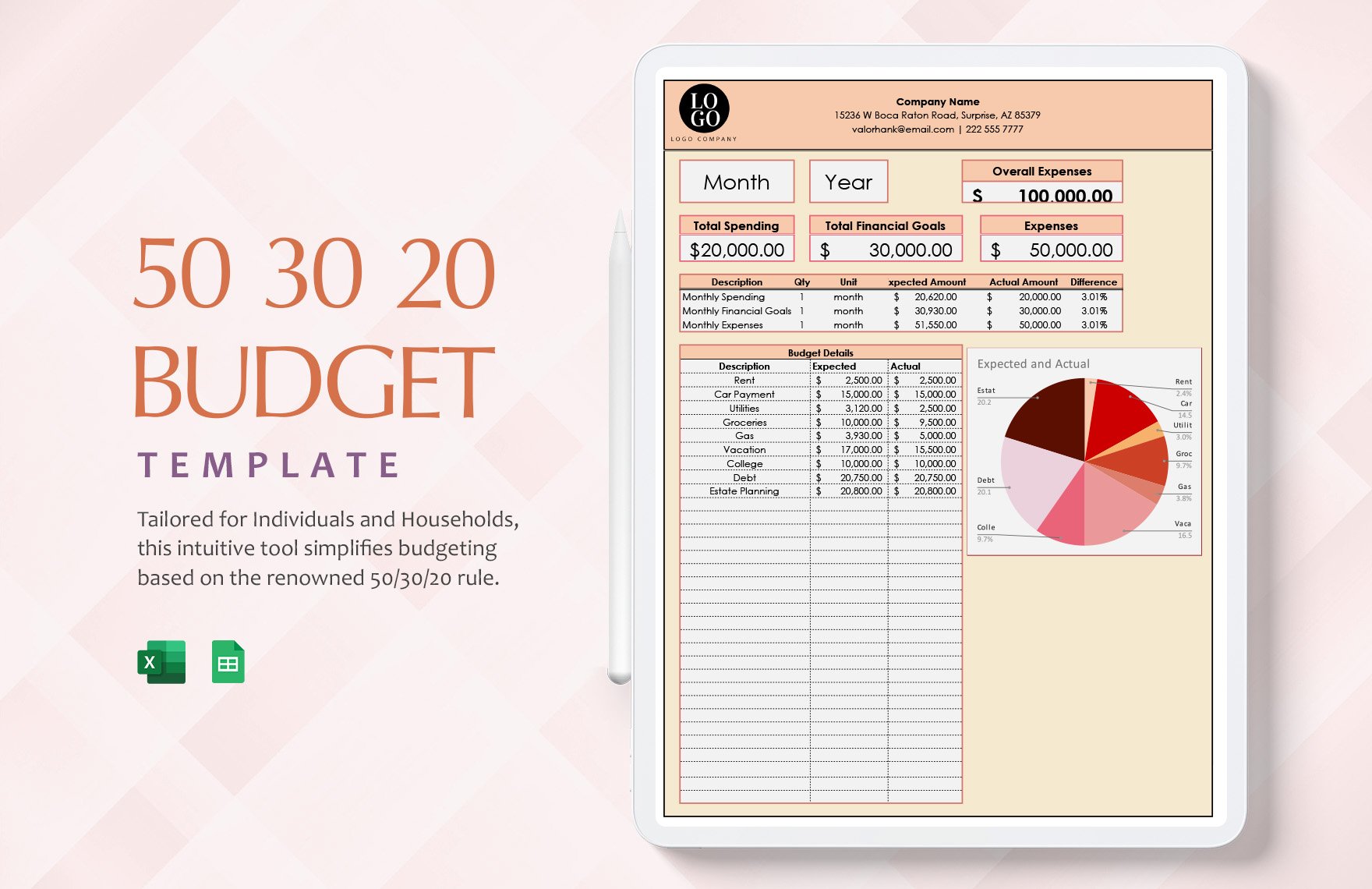

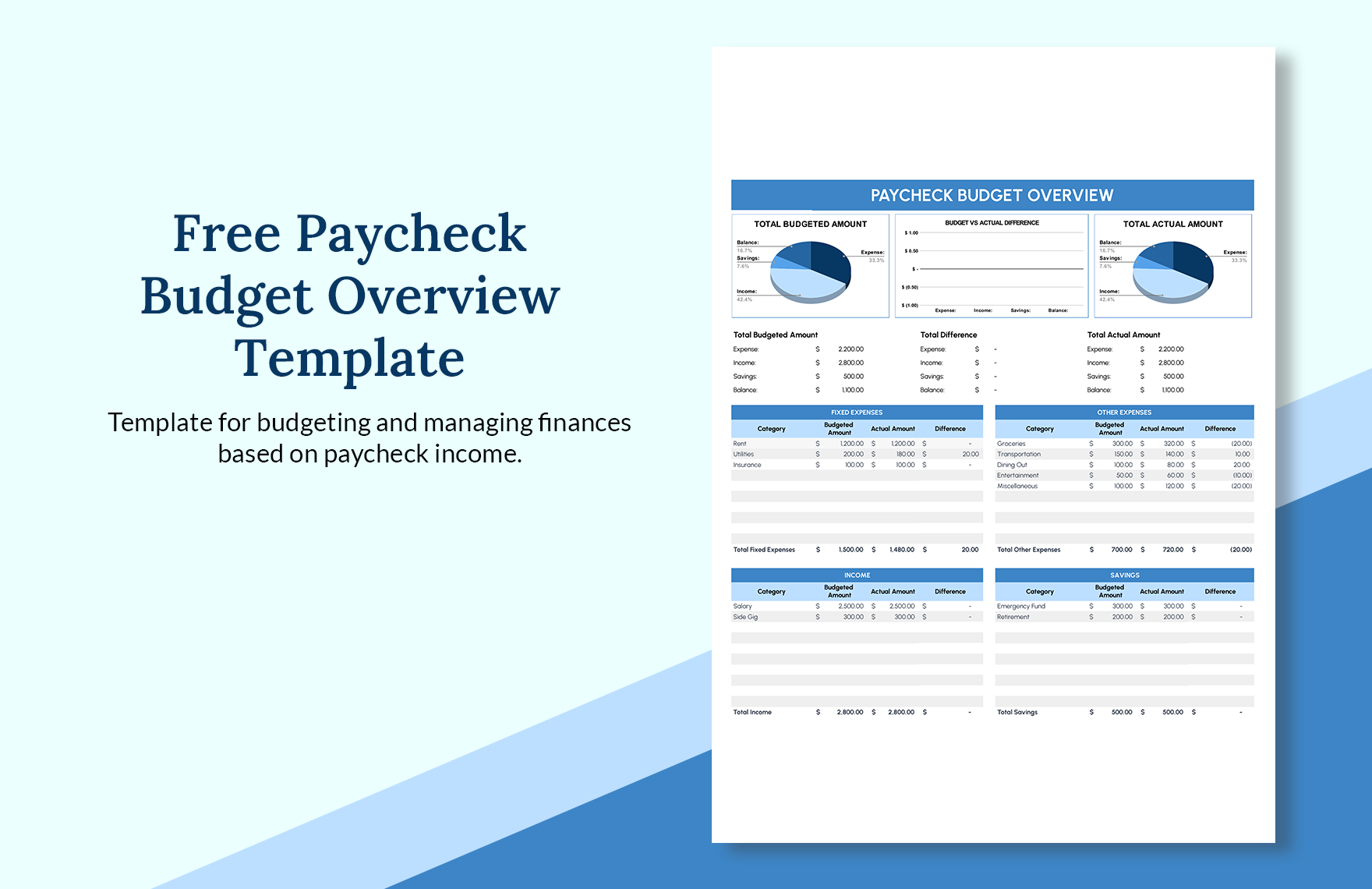

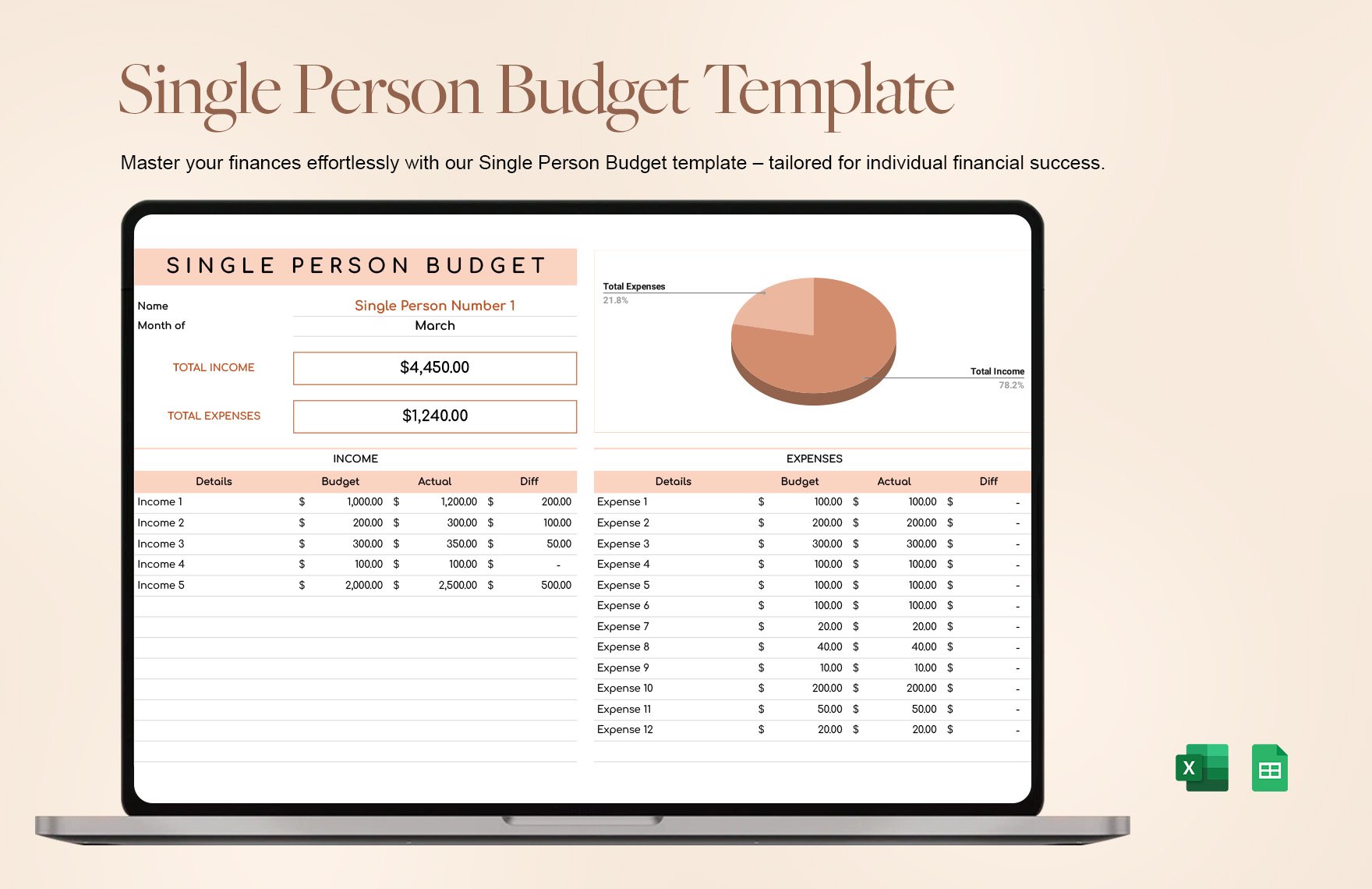

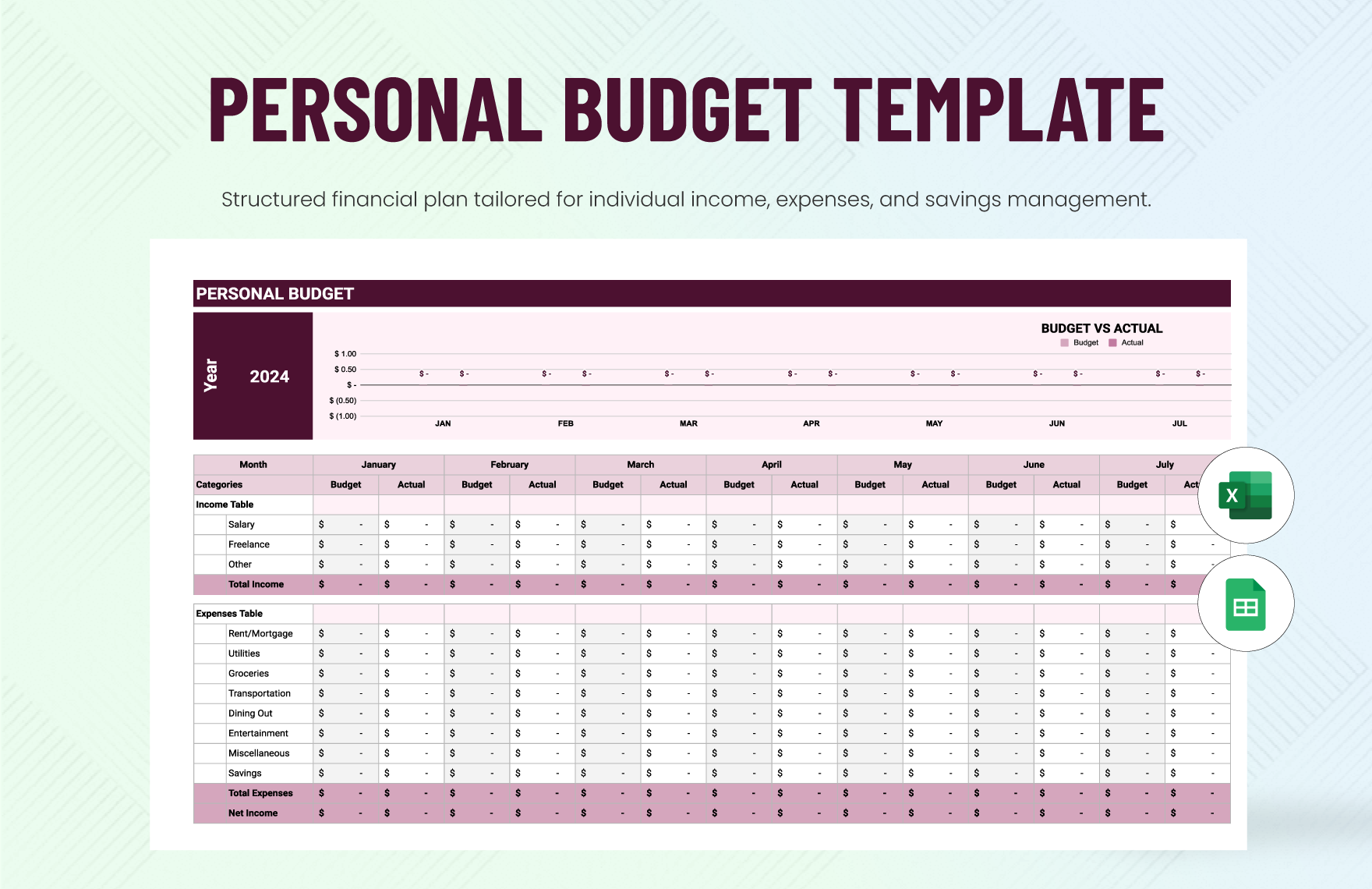

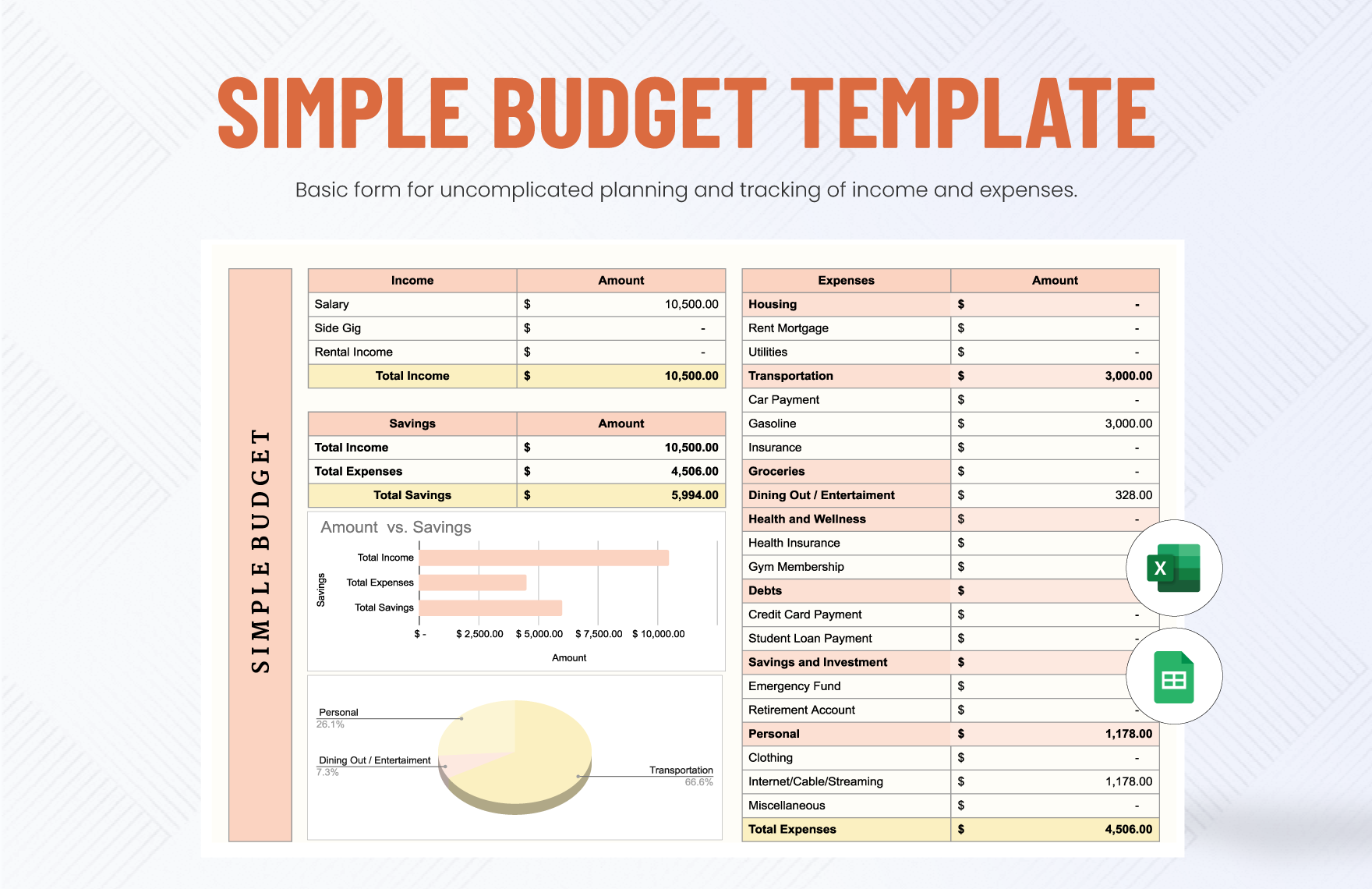

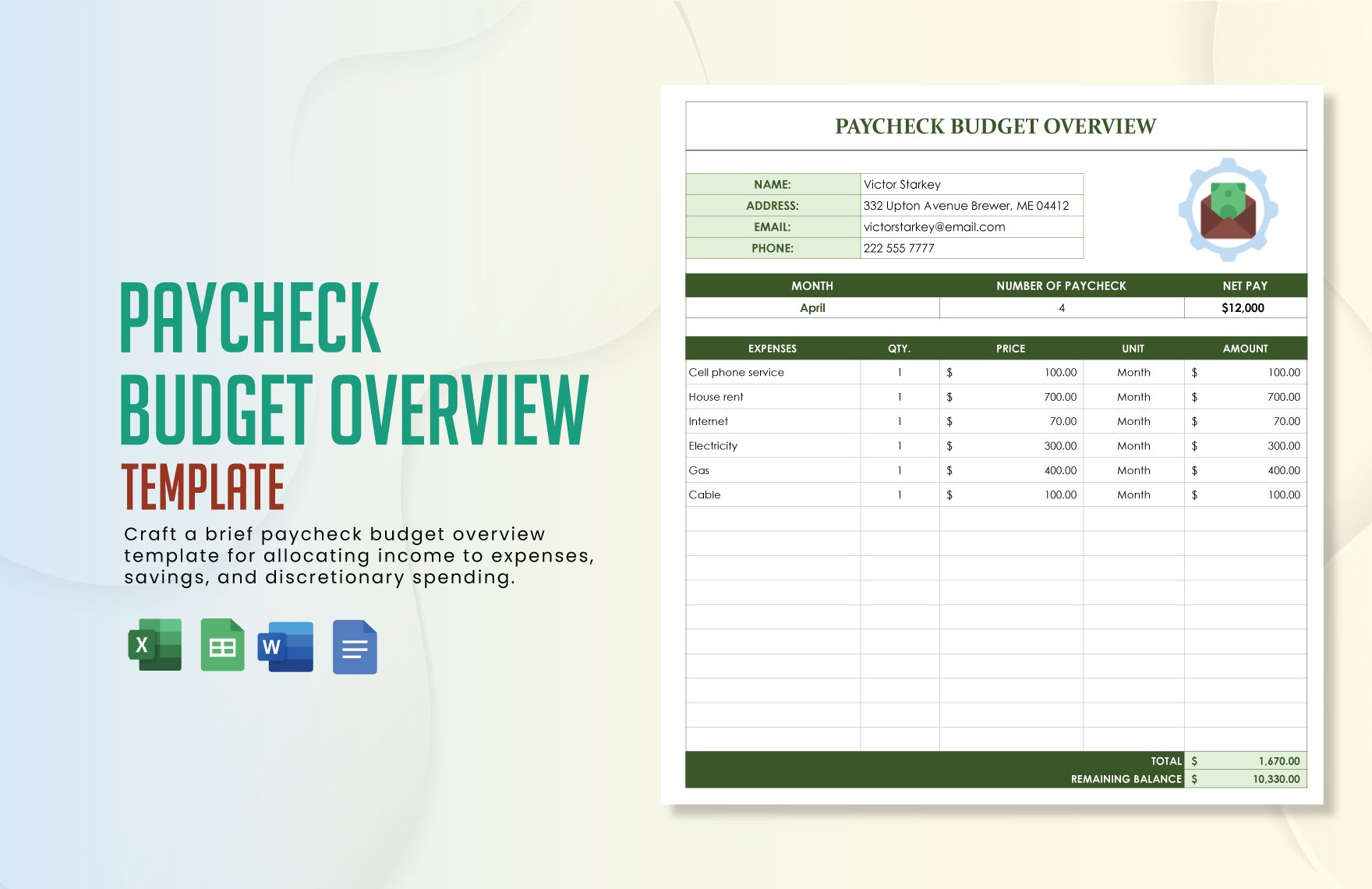

Create professional-grade budgets quickly and easily with no design experience needed. Whether you're budgeting for your household expenses or planning your savings goals, these Personal Budget Templates offer a streamlined and intuitive solution. Use them to track monthly expenditures or set financial goals for a holiday. With free pre-designed templates, Template.net provides downloadable and printable files in Google Sheets, ensuring that you have both the digital access and the hard copies you need for any financial planning scenario. Enjoy the simplicity and efficiency of beautiful pre-designed templates with no need for advanced design skills, allowing you to focus on what truly matters—smart financial management.

Explore a diverse range of Personal Budget Templates available in Google Sheets, designed to cater to various financial planning needs. With new designs and updated templates released regularly, Template.net ensures your budgeting tools stay fresh and relevant. Easily download or share your budget plans through links, print them for manual tracking, or export them for professional presentations. Leverage both free and premium templates to customize your budget templates to your specific situations, offering flexibility in handling your finances. Take advantage of expert tips and strategies provided with each template to enhance your budgeting skills further.