Budgeting is not only for businesses but also for personal use as well. This allows individuals to save up for future expenses such as getting married, buying a new house, and starting a family. Since budgeting requires extensive discipline, it's important to keep track of how much money you're earning, spending, and saving. To deal with these efficiently, you can create a personal budget and keep these recorded. Here, we have a collection of Personal Budget Templates in Apple Numbers to get you started. They're 100% customizable and created by professionals. Start managing your personal finances by downloading any of our templates now.

Personal Budget Templates in Apple Numbers

Create your own professional-quality personal budget templates in Apple Numbers. Free, customizable, and printable. Download now.

Get Access to All Budget Template Templates

Transform Your Financial Management with Personal Budget Templates in Apple Numbers by Template.net

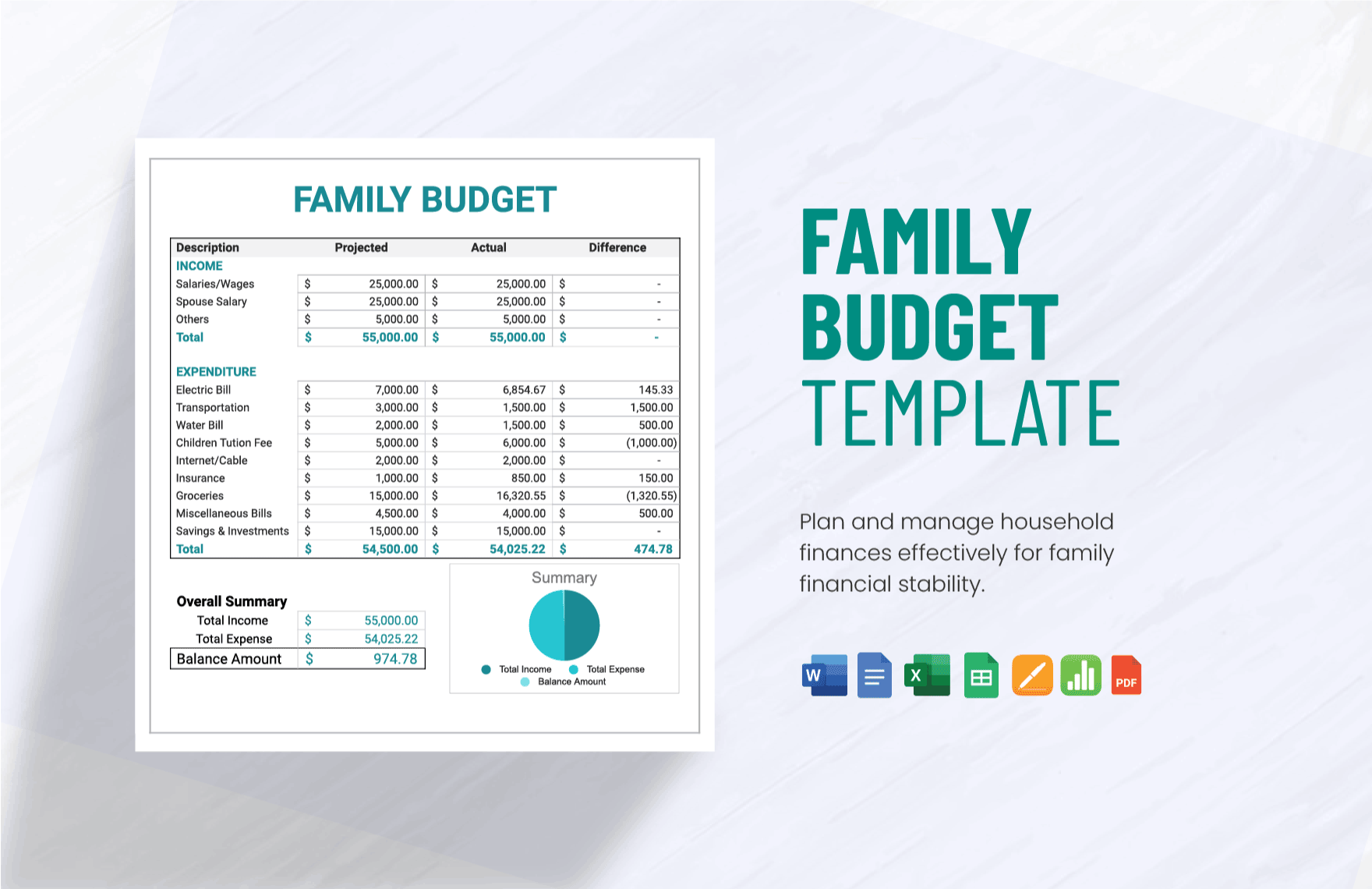

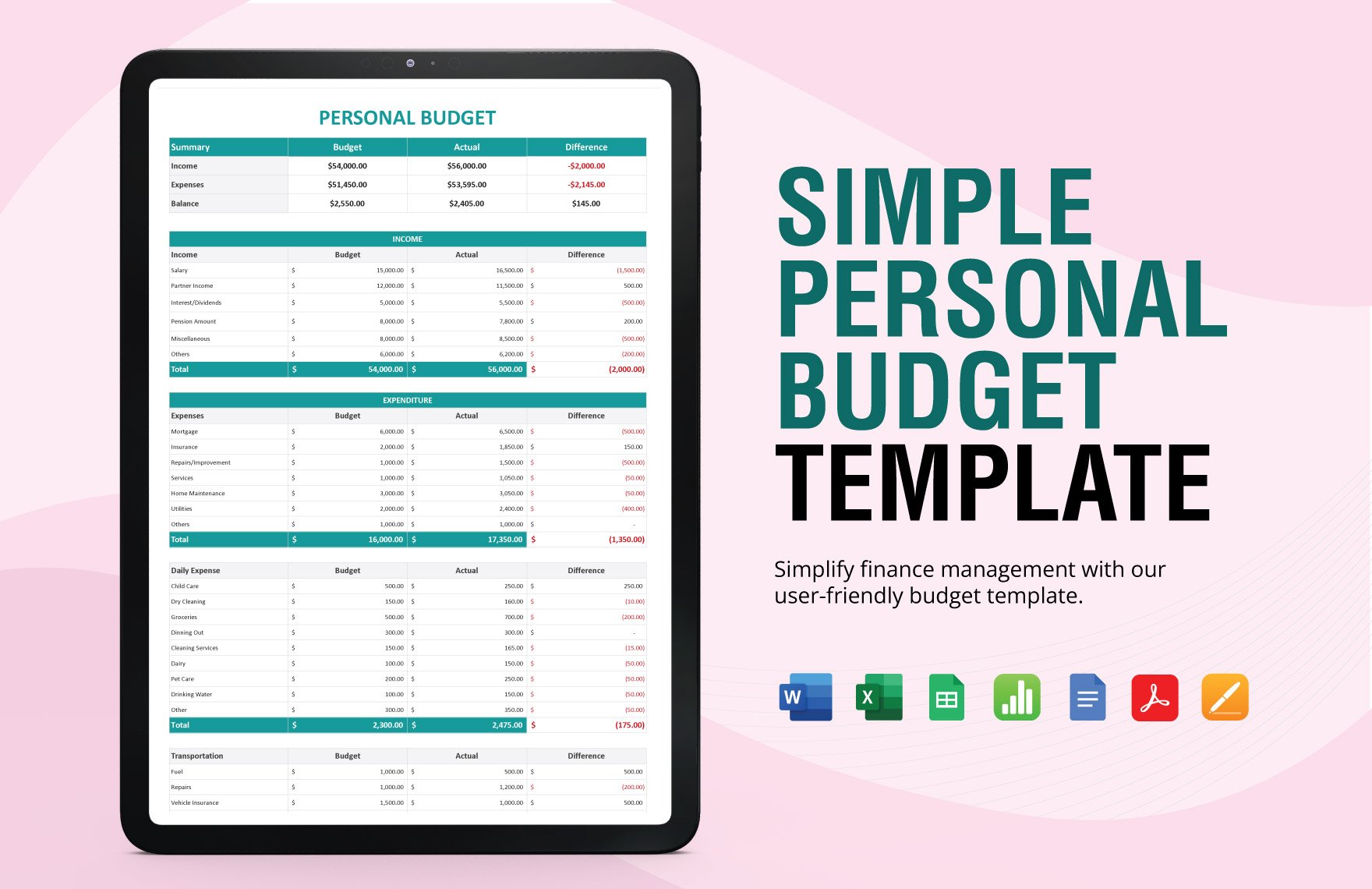

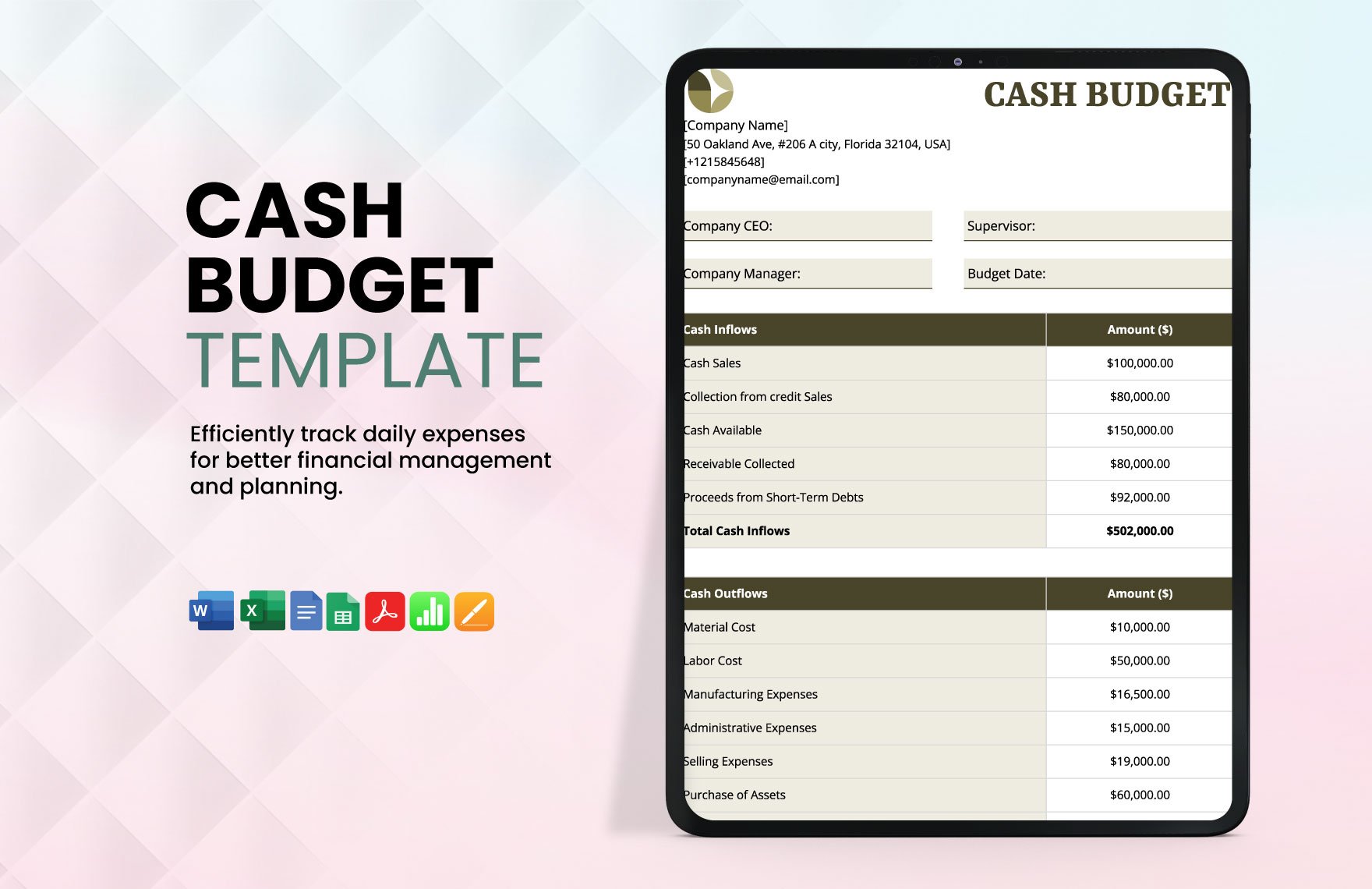

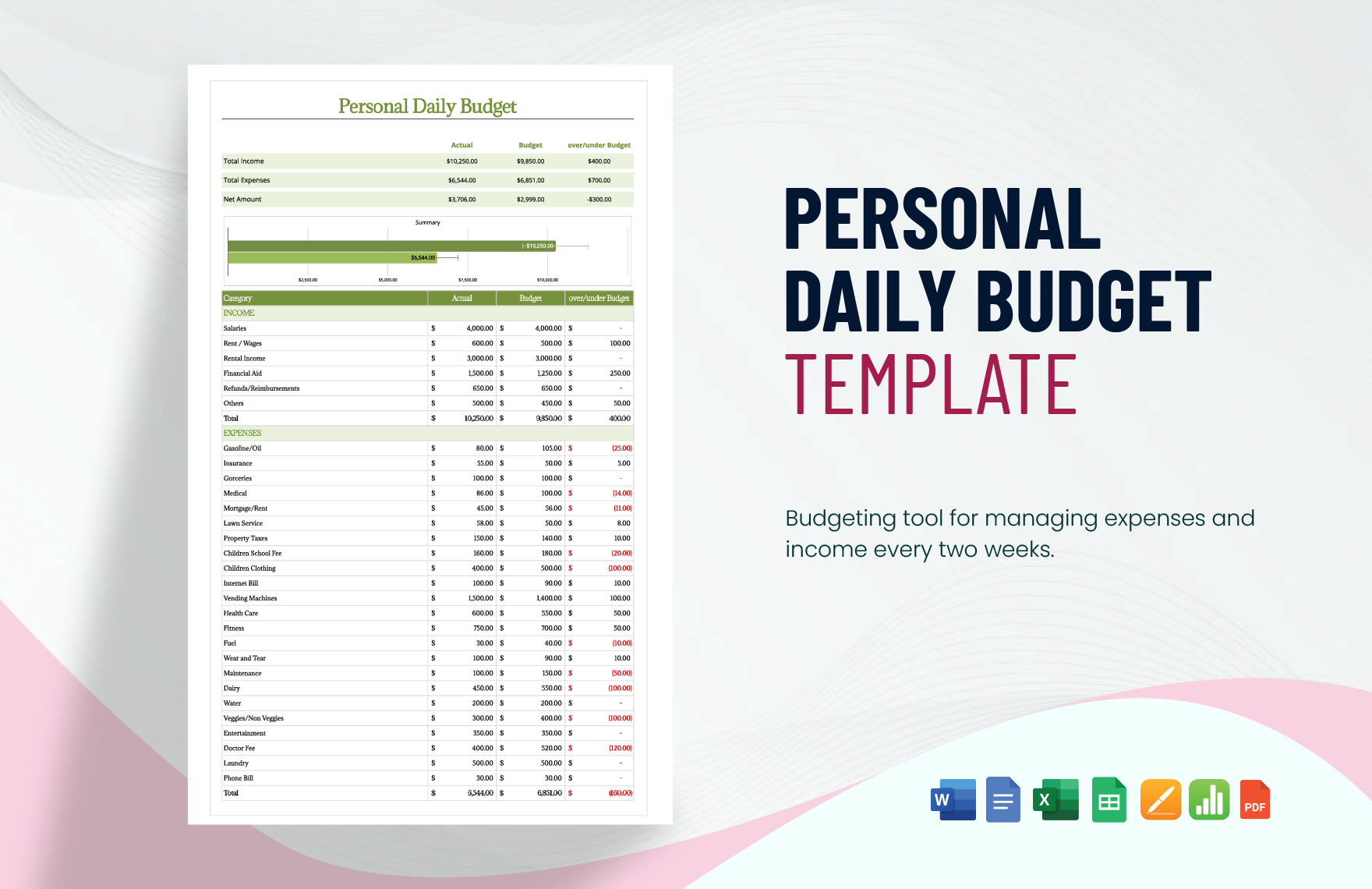

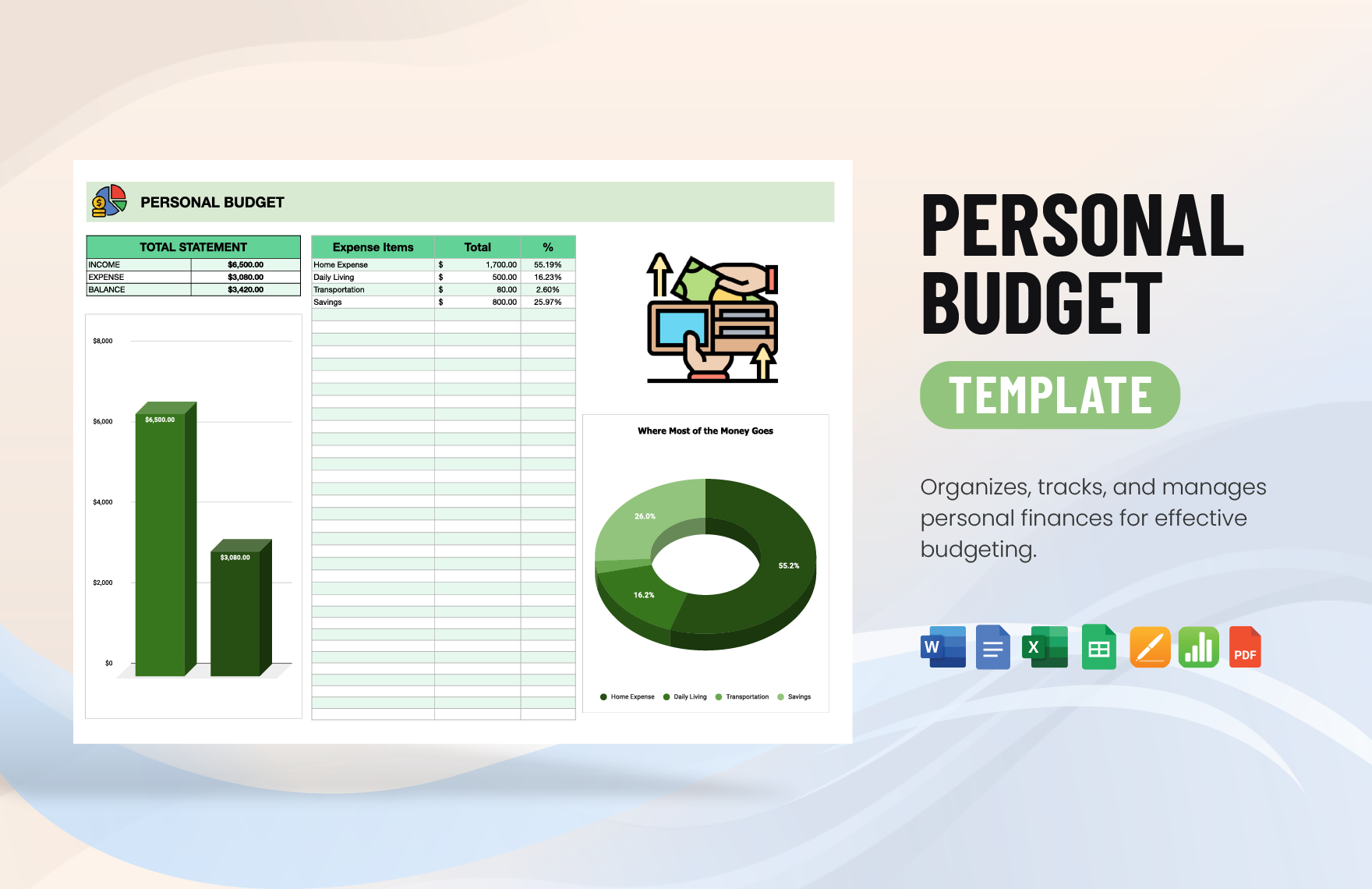

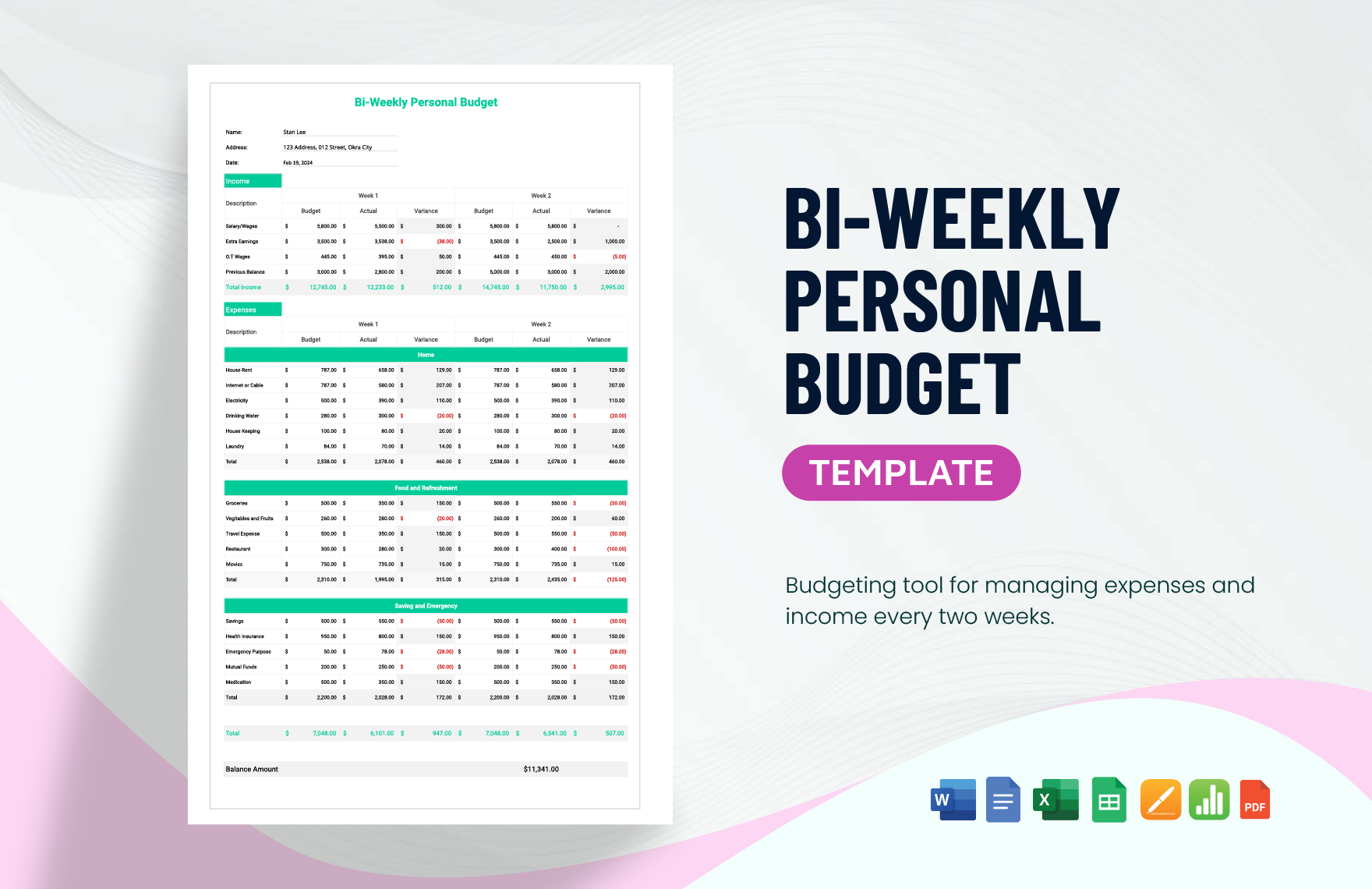

Easily gain control of your finances with free pre-designed Personal Budget Templates in Apple Numbers by Template.net. Designed for anyone looking to enhance their financial planning, these templates enable you to create professional-grade budgets quickly without the need for design experience. Whether you're looking to organize your monthly expenses or plan a yearly financial schedule, these templates are your perfect solution. With customizable layouts ideal for both print and digital distribution, you'll find it easy to manage your funds effectively. Each template comes with downloadable and printable files in Apple Numbers, offering ease of use and saving you time with their beautiful pre-designed structures. Best of all, a selection of these resources is available for free, ensuring that everyone can access the tools they need to succeed financially.

Explore a wide array of Personal Budget Templates in Apple Numbers designed to meet all your budgeting needs. With Template.net's library, you can access regularly updated and newly designed templates, ensuring you stay on top of your financial goals efficiently. Choose from a range of free and premium templates for maximum flexibility, helping you customize and expand your budgeting plans. Whether you need a simple monthly tracker or a comprehensive financial overview, there's something to suit every requirement. Once you've tailored your template to perfection, you can download, share, or print them for increased reach, making financial management more accessible and effective than ever before.

Frequently Asked Questions

What Is the 20% Saving Rule?

The saving rule is about allocating 20% of your income for personal savings. For the remaining 80%, it will be divided among the essential and non-essential expenses, more of which are allocated to the former. Specifically, 50% of the your total income is for essential matters such as bills and groceries, and only 30% will be for the wants. Other people refer to this as the 50-30-20 budget rule.

What Are Examples of Monthly Needs?

Listed below are examples of needs and should never be confused with your wants:

- Food

- Housing

- Water

- Electricity

- Transportation

How Important Is Having a Personal Budget?

Personal budgeting is crucial as it allows you to develop yourself by providing avenues to grow and buy the things you want. Having a personal budget will also ensure you of having enough money for other expenses after taking care of the liabilities.

Is 15% of Monthly Savings Enough?

It all depends on your budget plan. Some say it is enough as long as the needs or essential expenses are already paid. But ideally, you should allocate 20% of your income for your savings.

How Much Should I Spend on Rent?

According to the 50-30-20 rule, you should only spend 30% of your gross income on rent. Paying more than that may have an effect on your overall budget plan.