Empower Your Financial Planning with Pre-Designed Personal Budget Templates in Apple Pages by Template.net

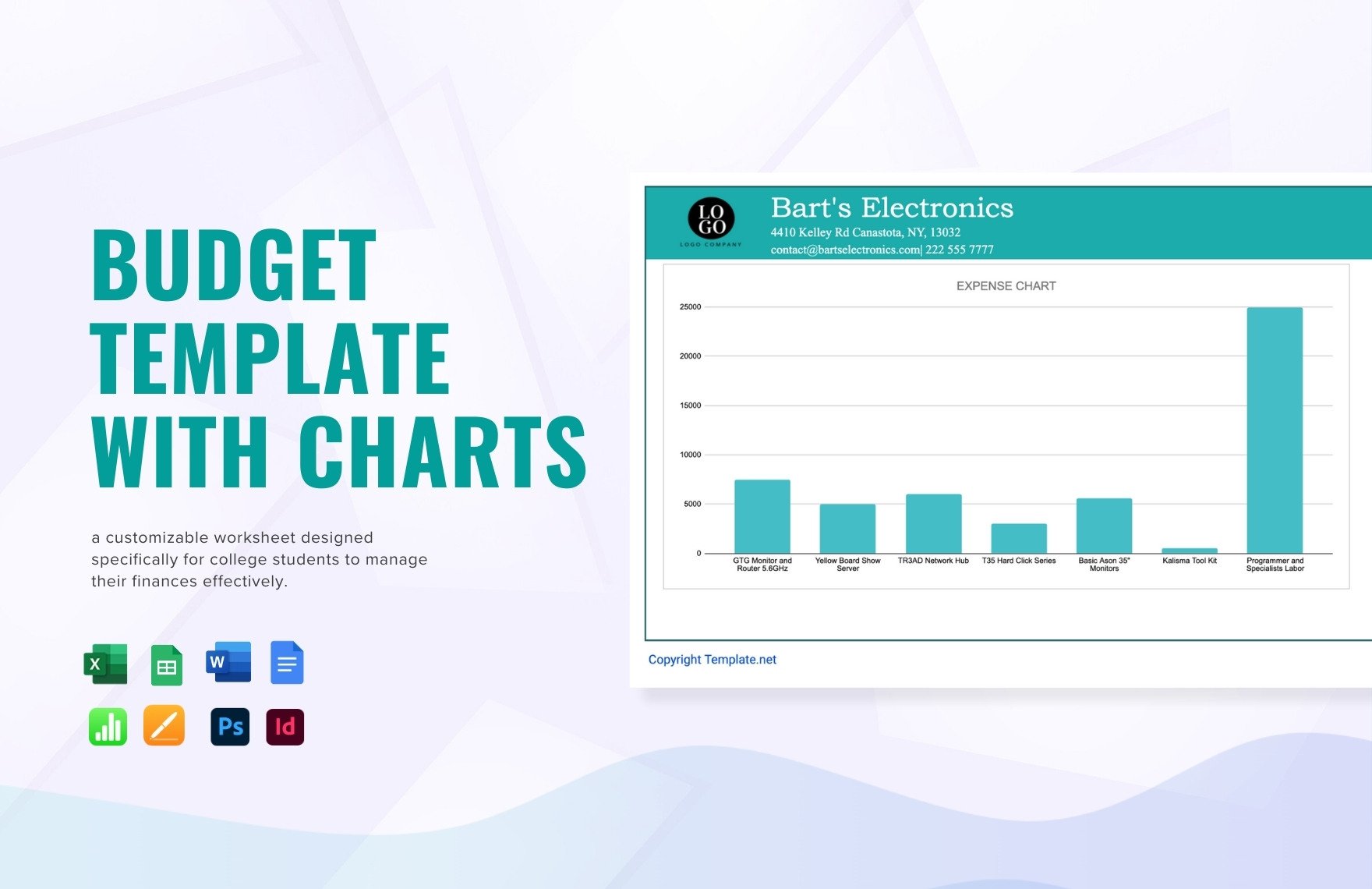

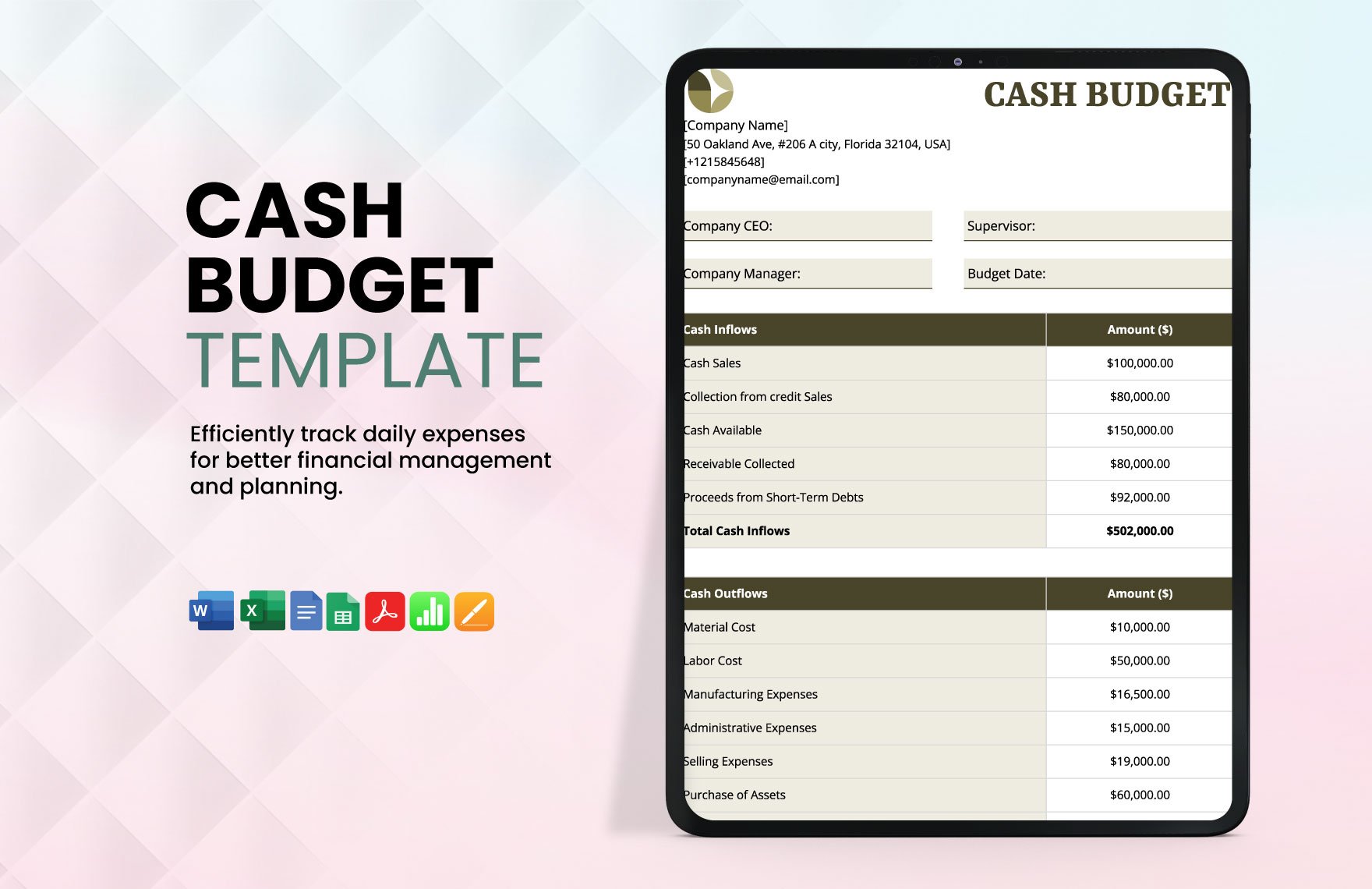

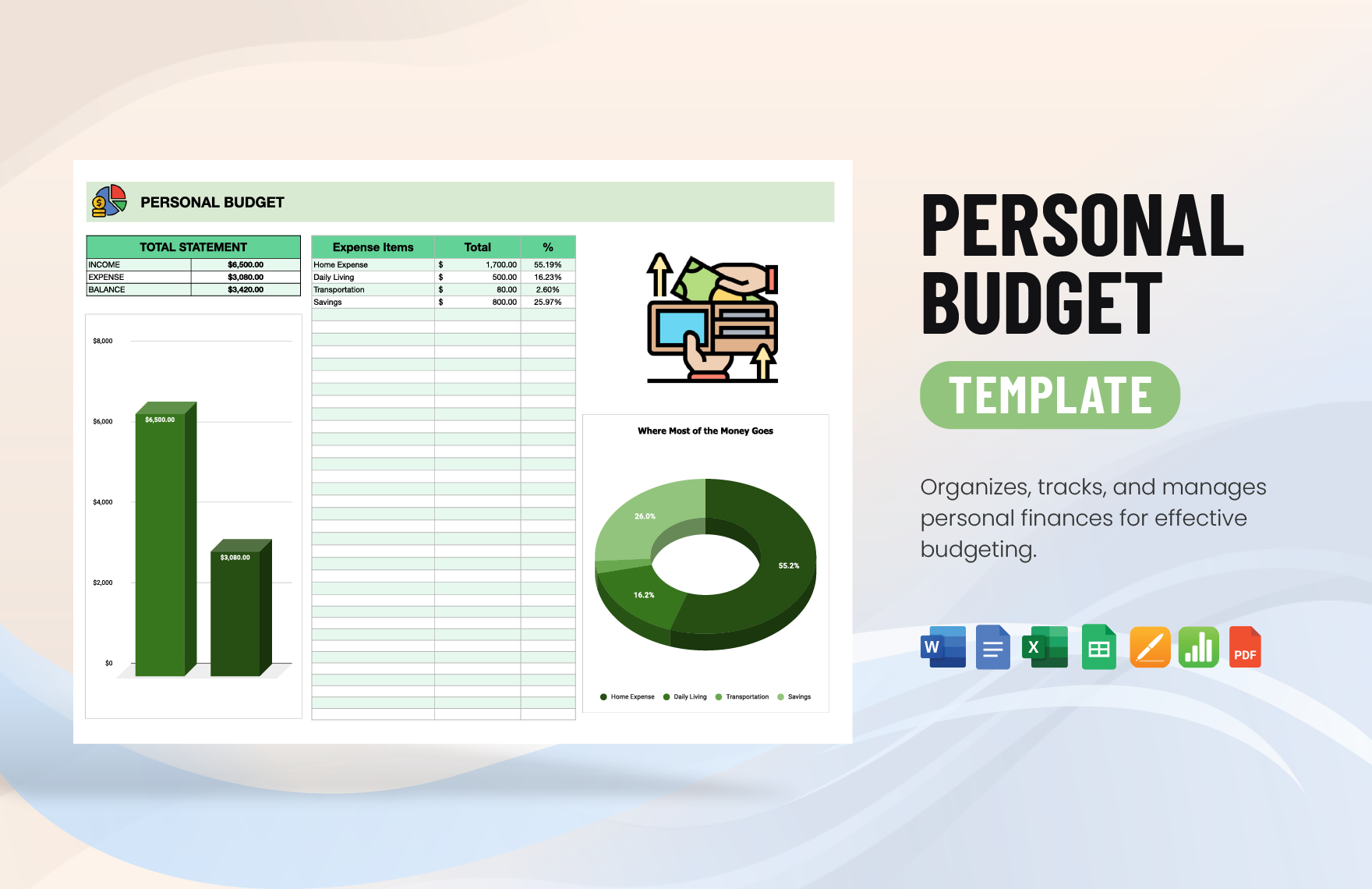

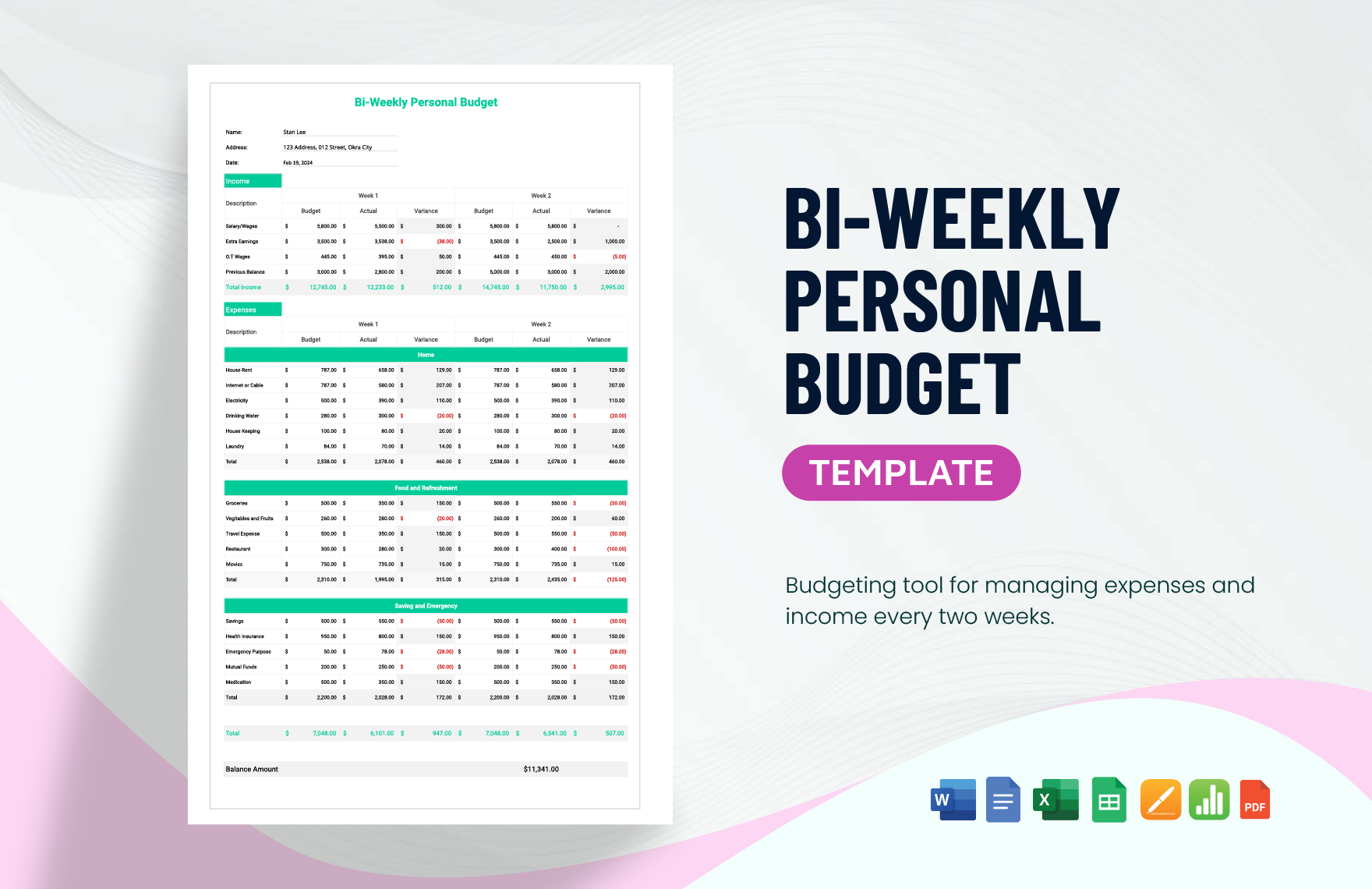

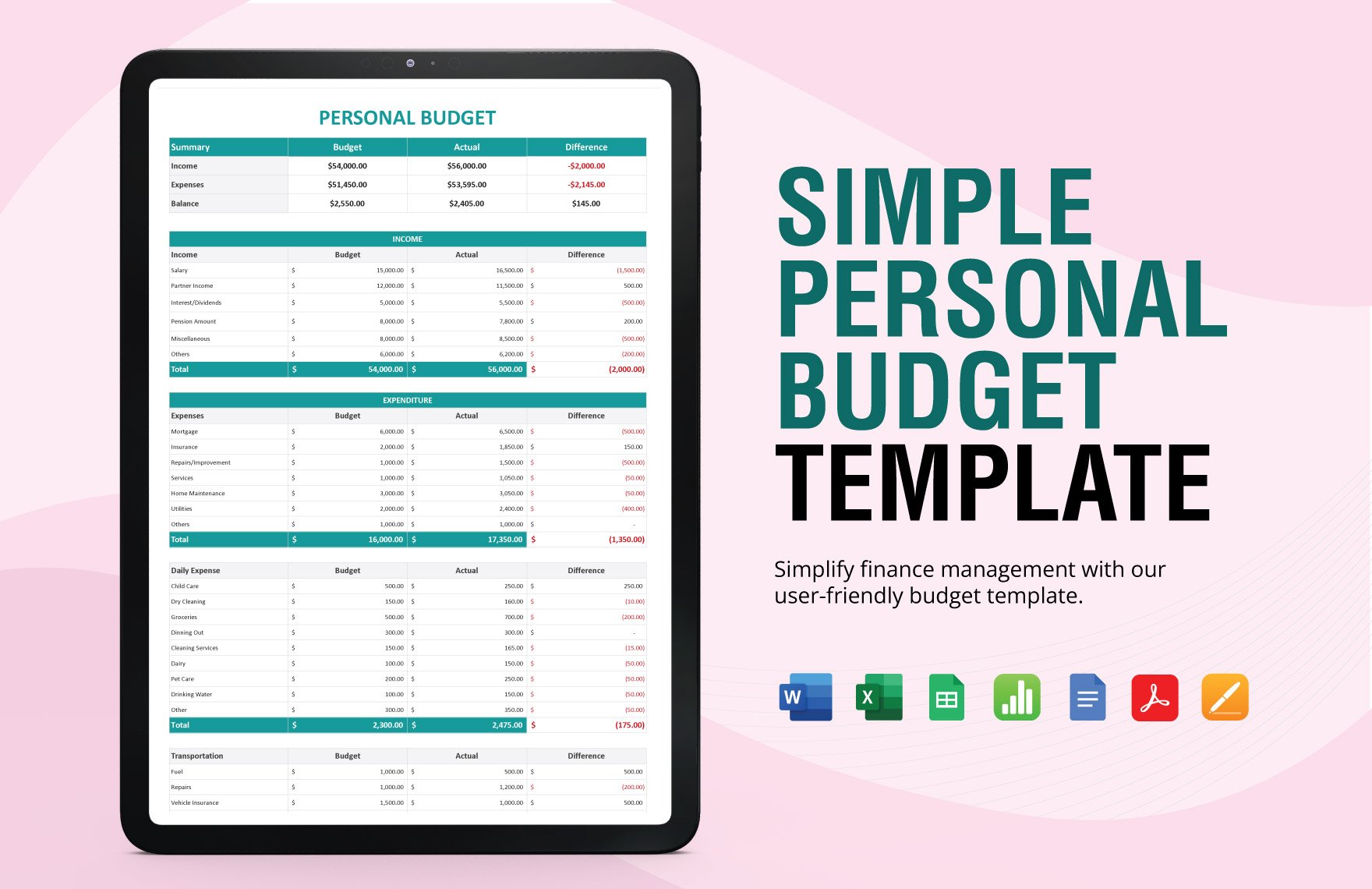

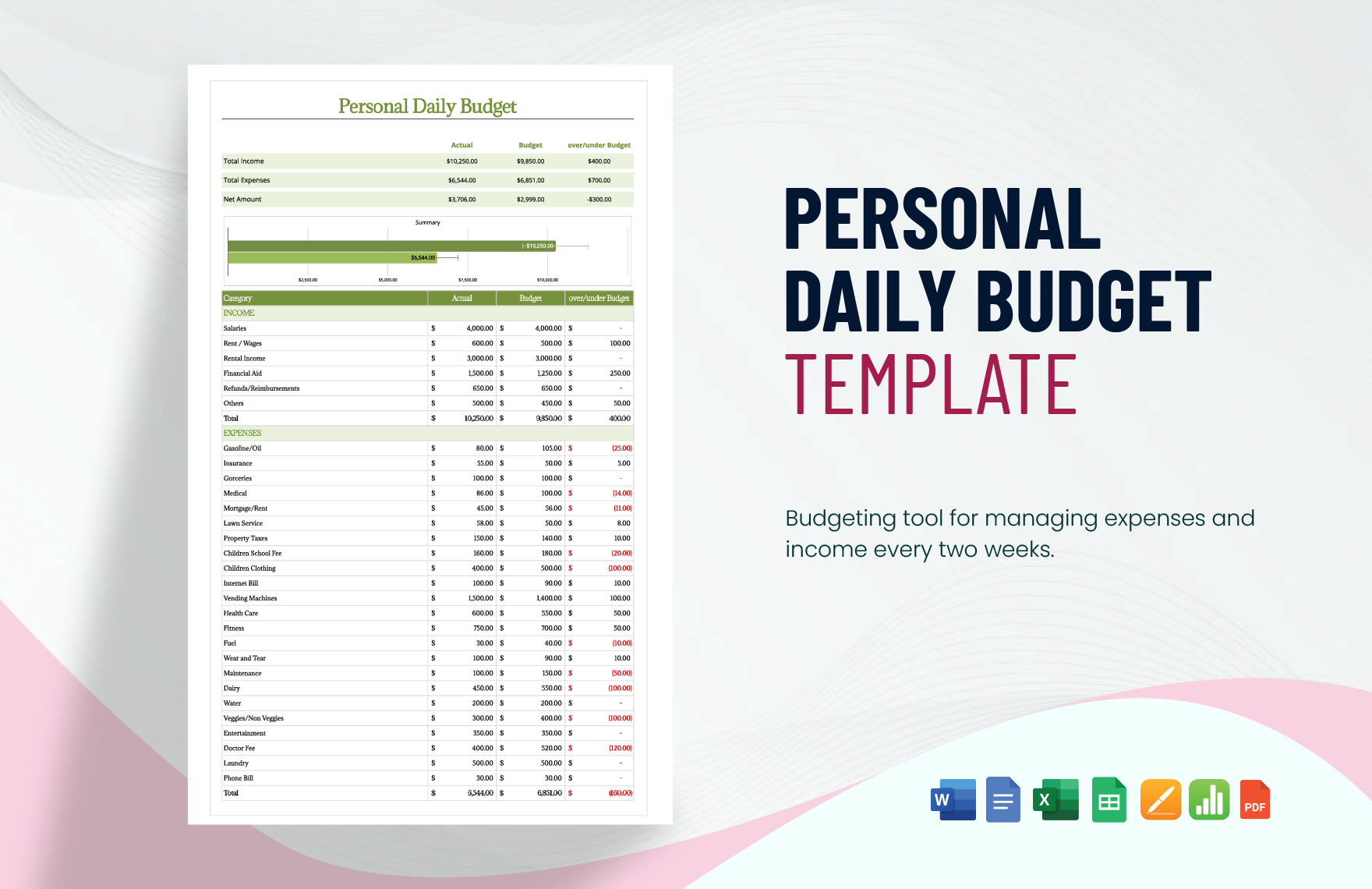

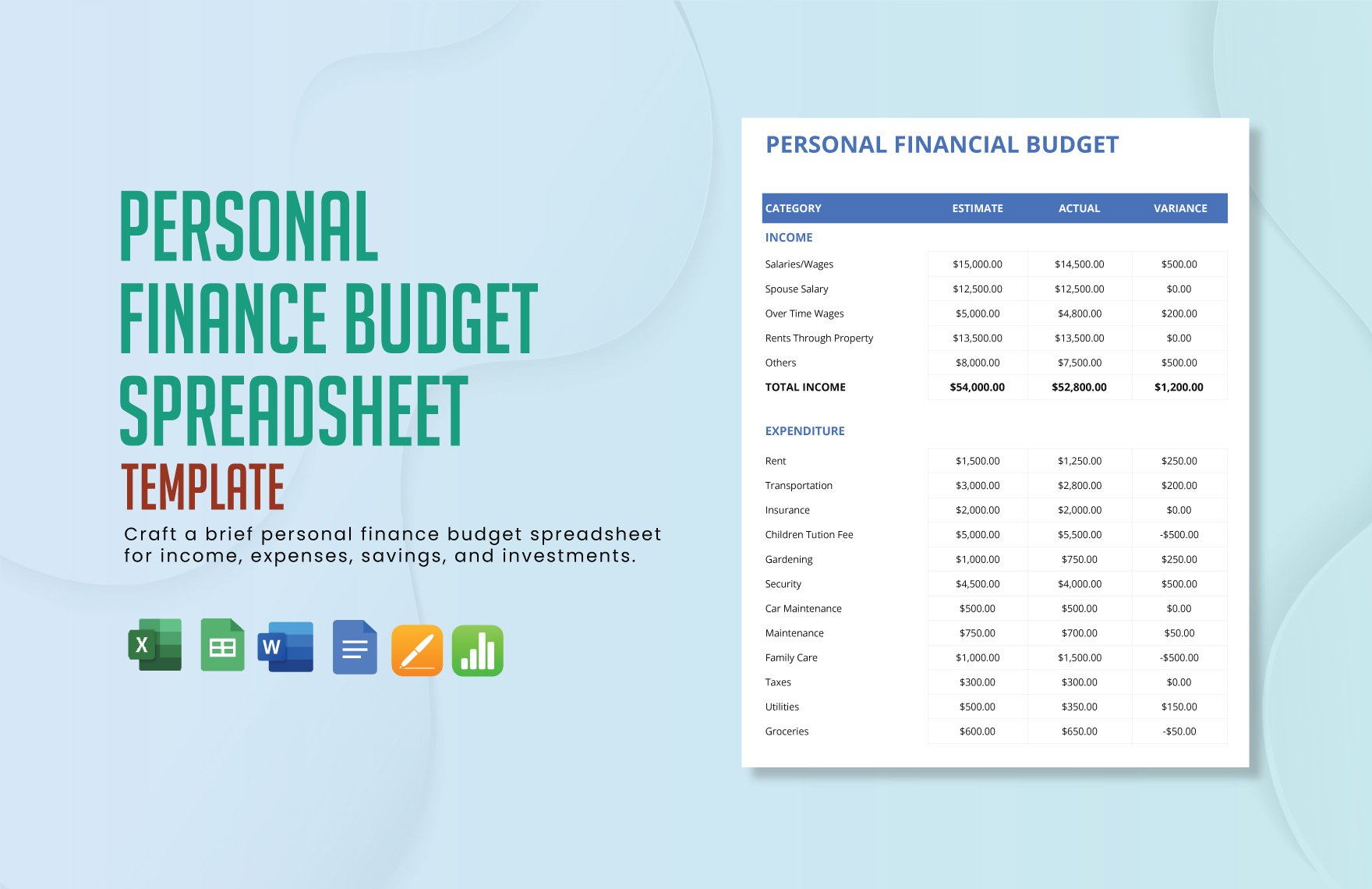

Free pre-designed templates by Template.net are the key to creating seamless budget plans, tailored perfectly for your financial goals. These templates are designed for individuals and businesses seeking to streamline their budgeting process without the hassle of starting from scratch. Create professional-grade budget plans quickly and easily with no prior experience, whether you're planning a personal monthly budget or managing financial details for a small enterprise. With the ability to download and print files in Apple Pages, you can conveniently manage your finances both online and offline. The inclusion of beautiful pre-designed templates ensures that no design skills are needed, providing a free and efficient solution for financial planning while saving time and reducing stress, making financial management accessible for everyone.

Embark on your journey to financial savvy by exploring an impressive variety of premium pre-designed templates in Apple Pages. With regularly updated options and new designs added frequently, there are plenty of opportunities to keep your budget planning fresh and exciting. You can easily download your chosen template or share it via a link, email, or print to amplify its reach and share your financial plans with others. Consider using both free and premium templates for added flexibility and tailored features, ensuring your specific budgeting needs are fully met. With helpful tips and user-friendly features, managing your budget has never been easier or more stylish.