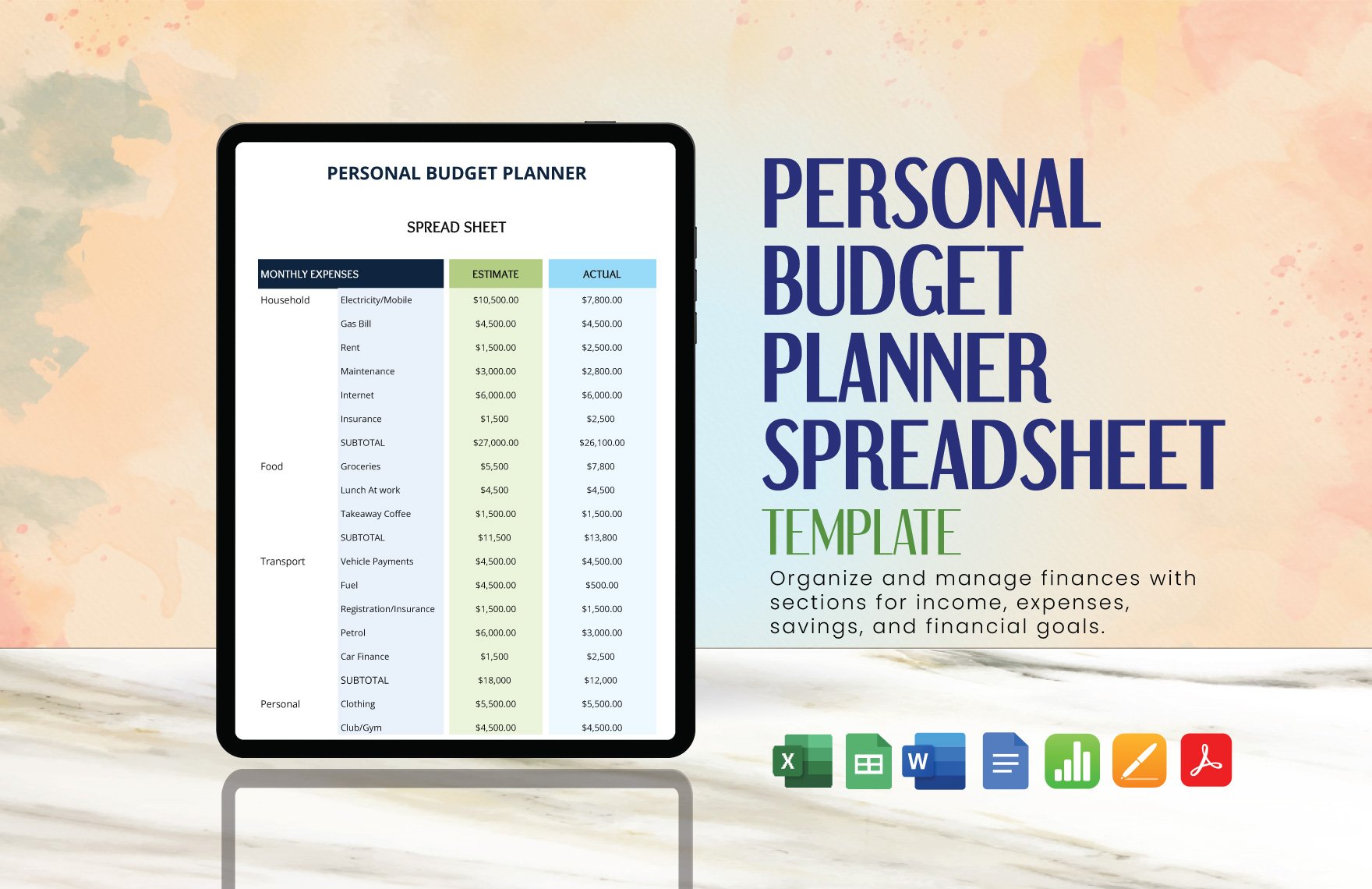

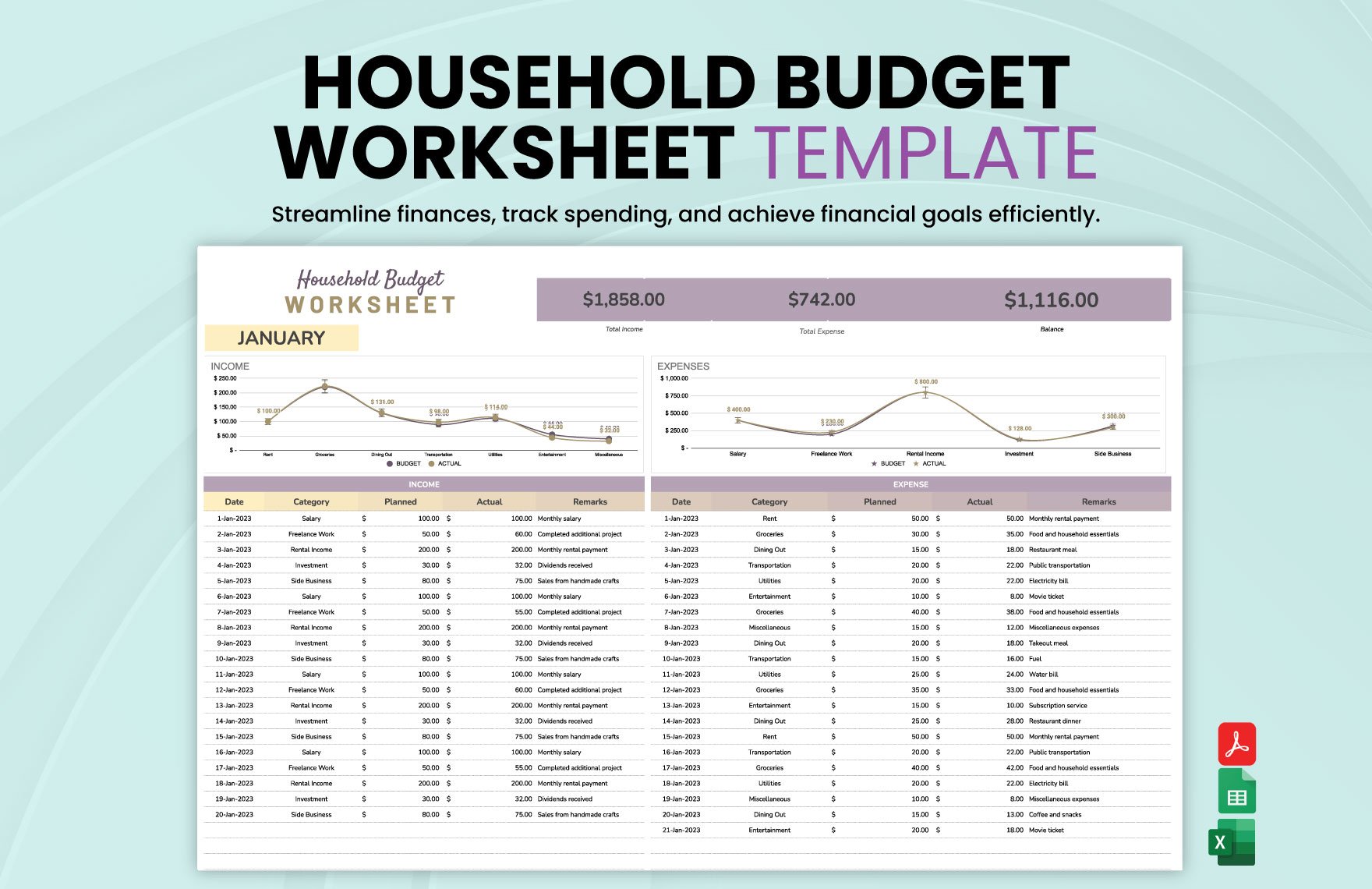

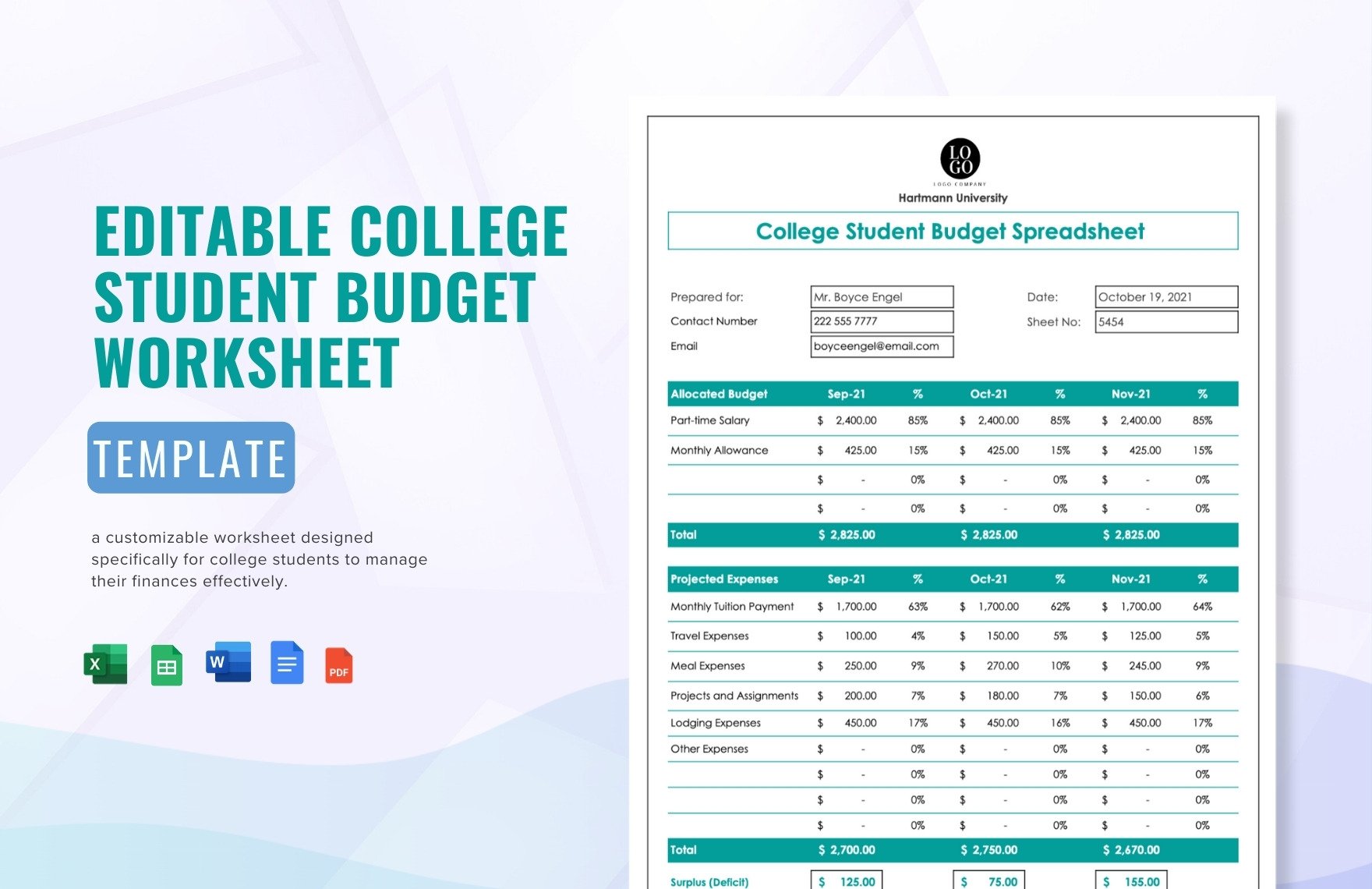

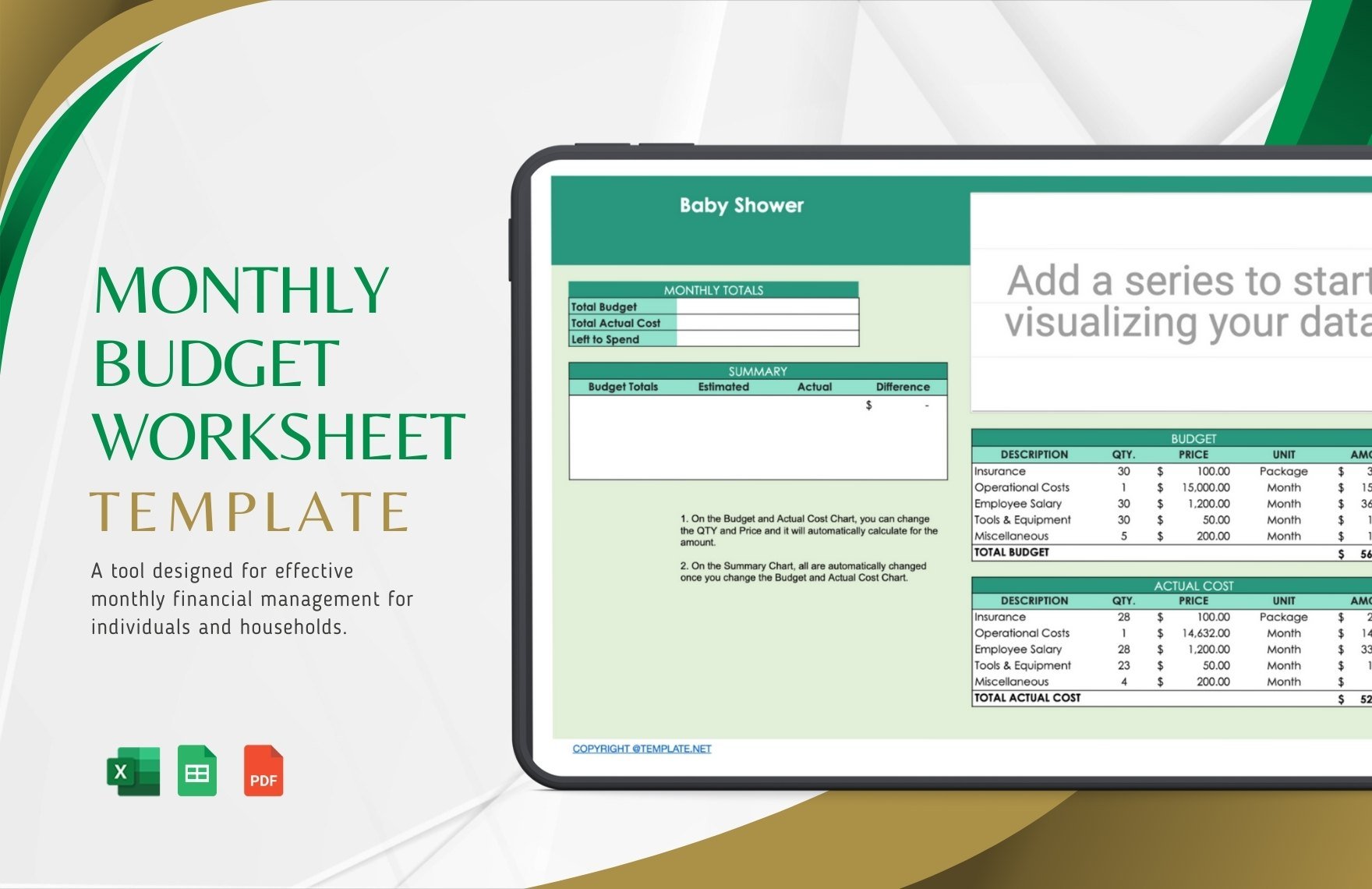

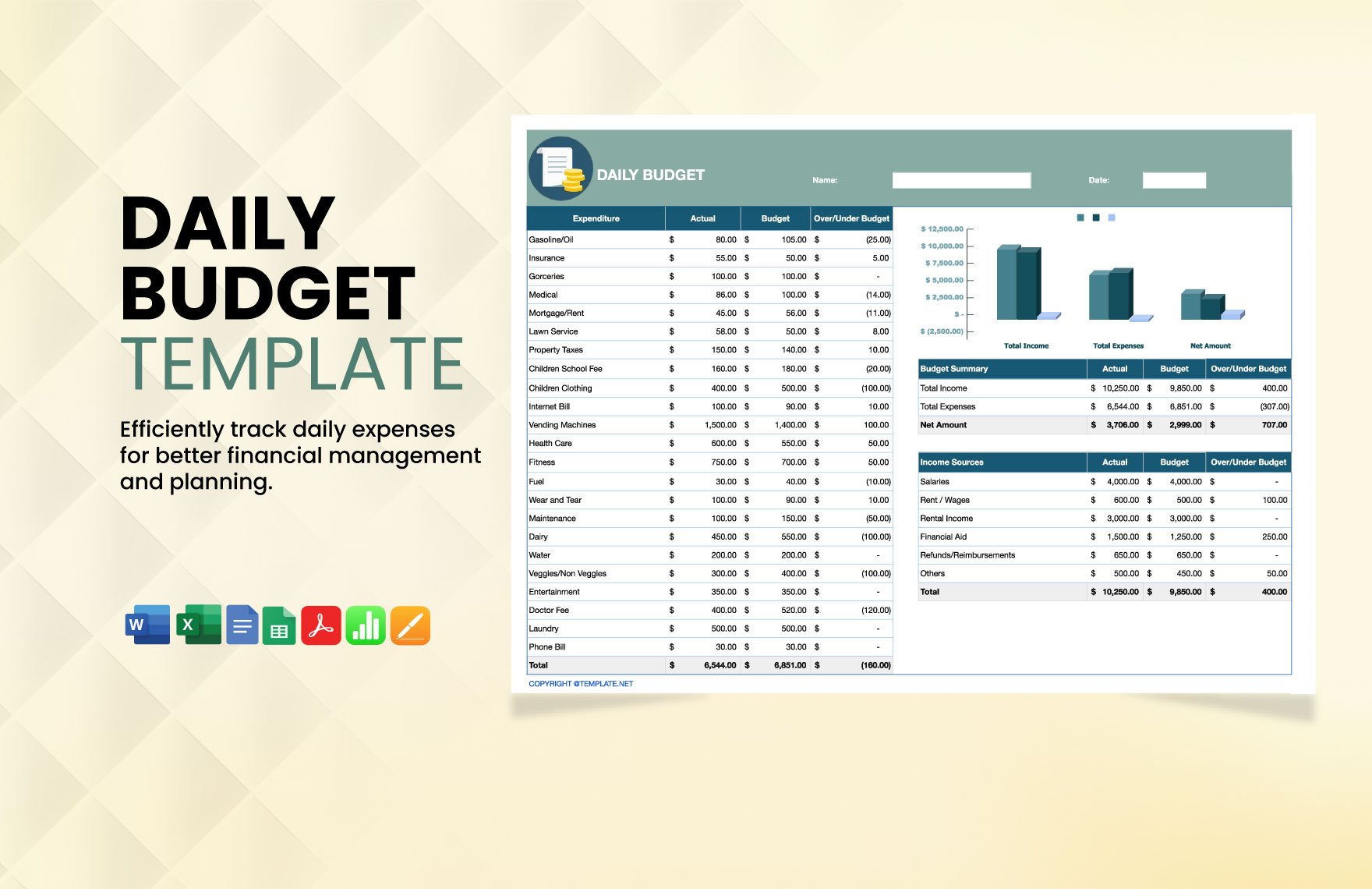

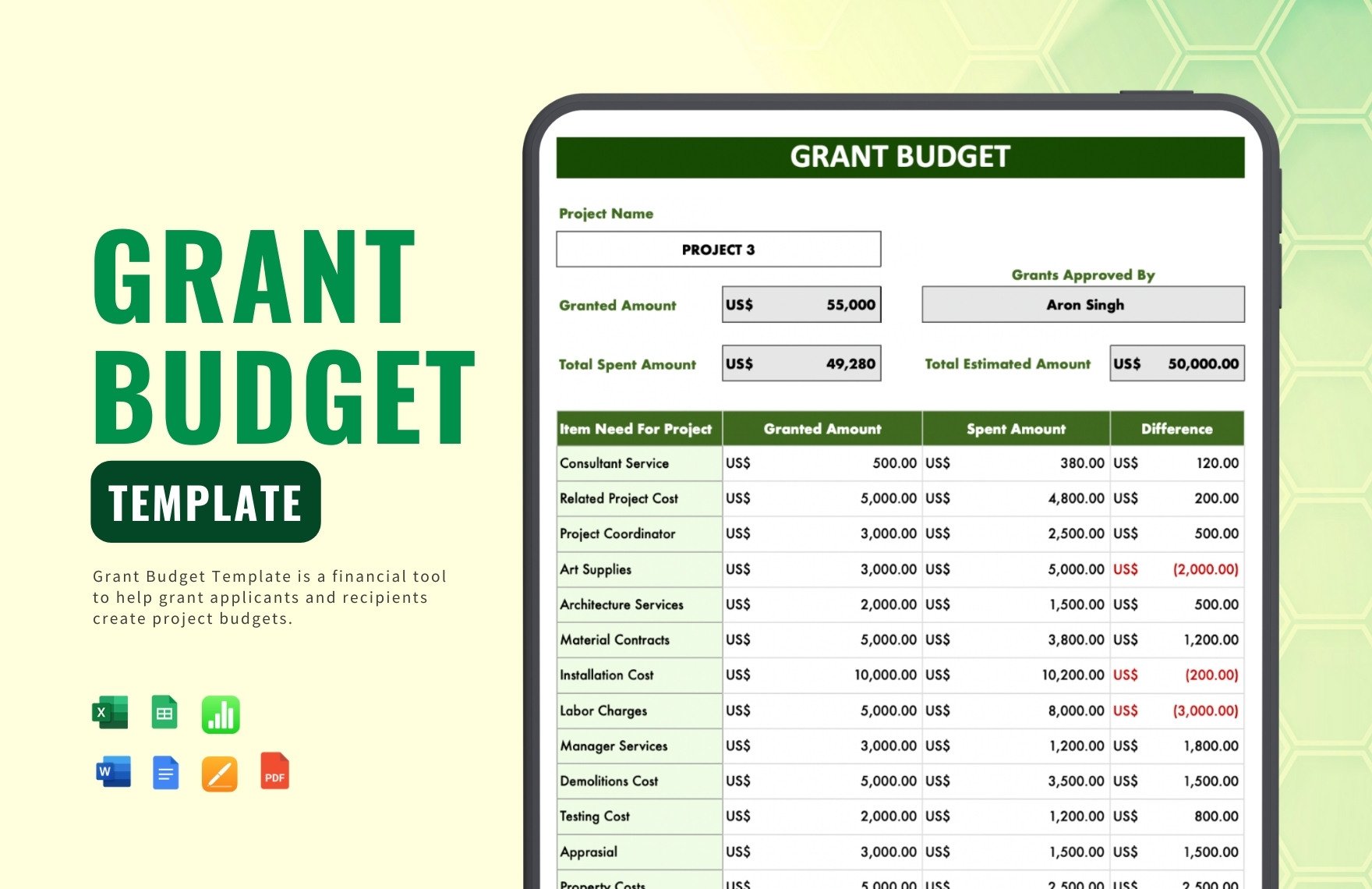

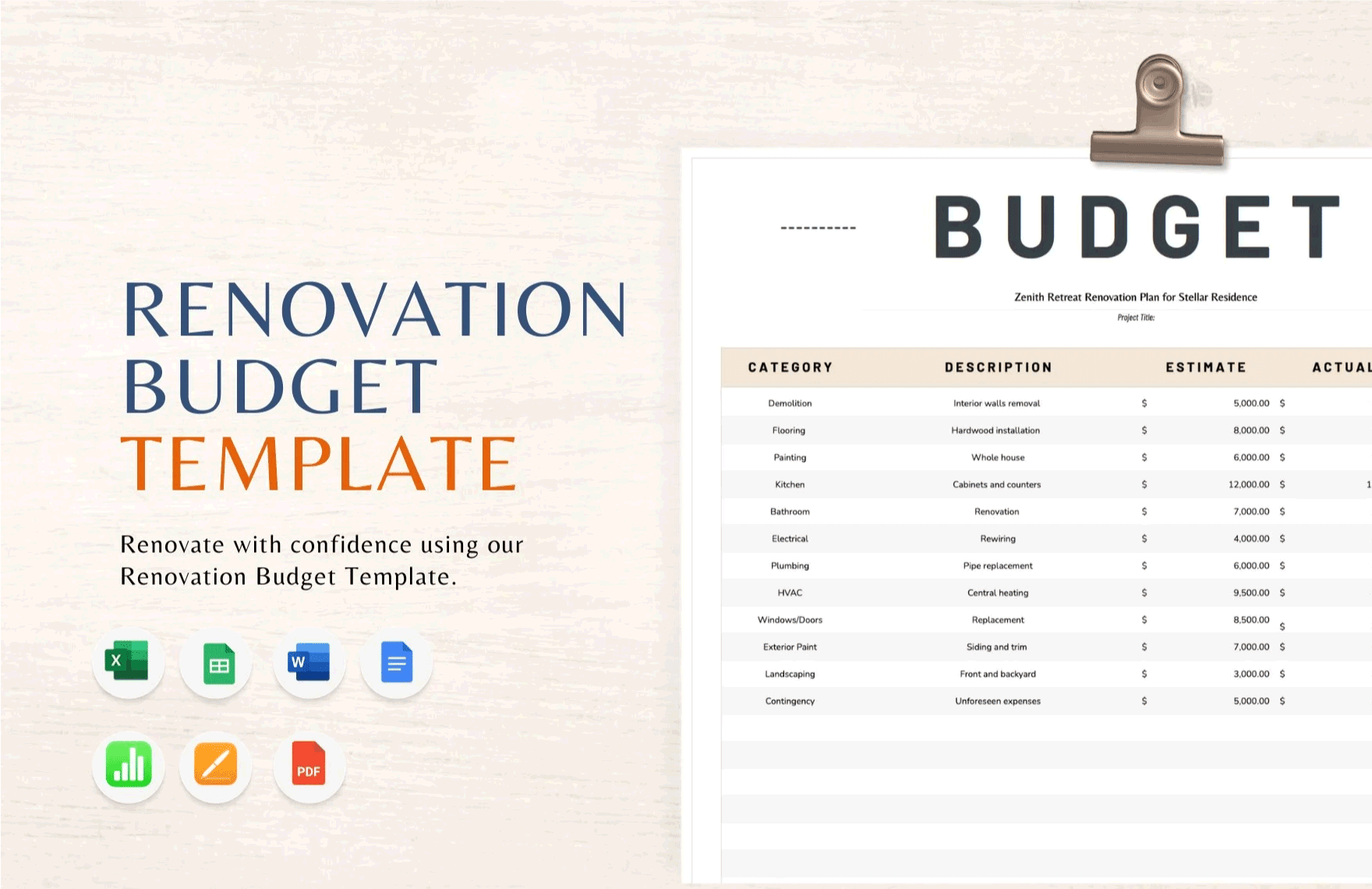

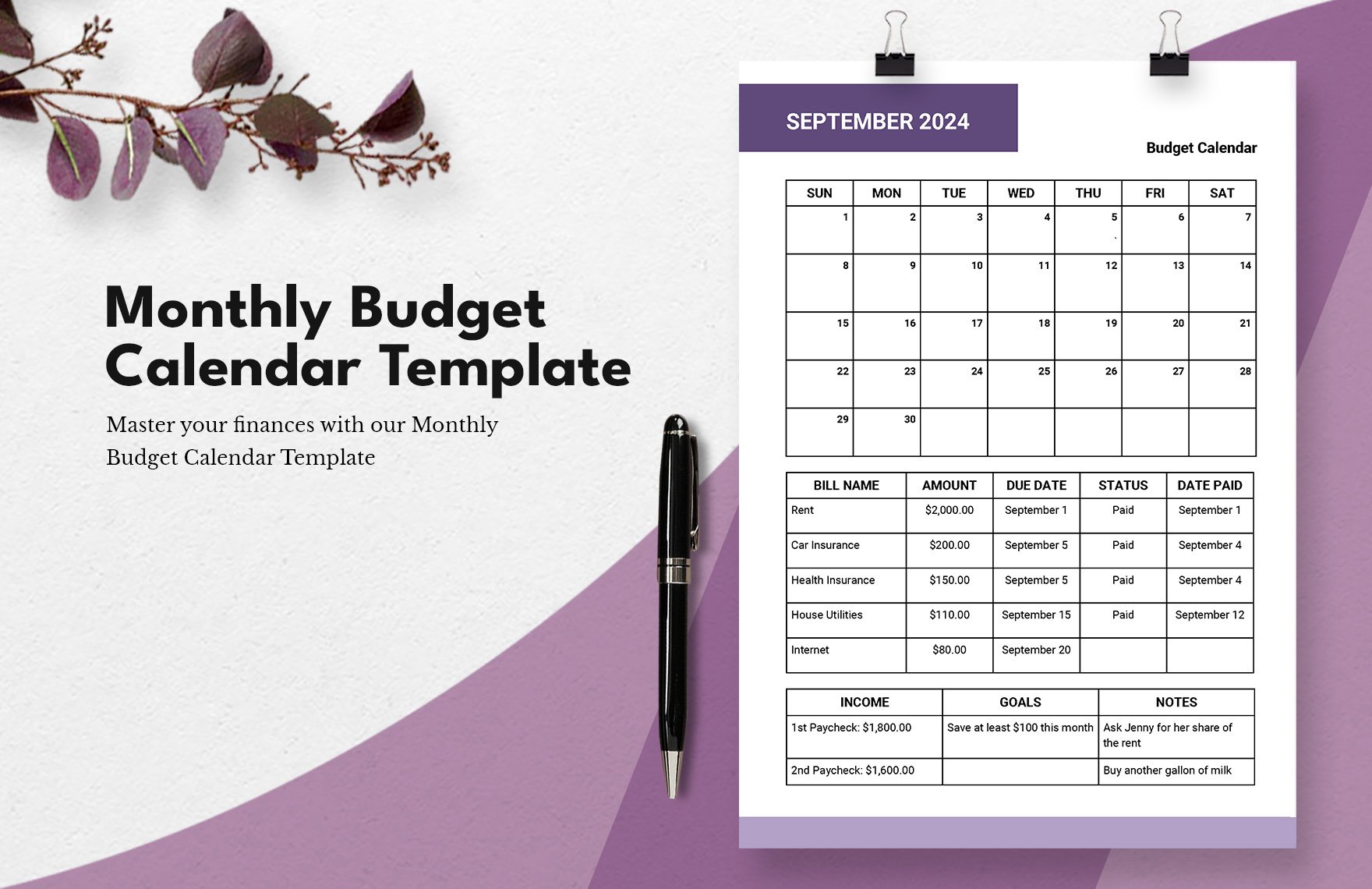

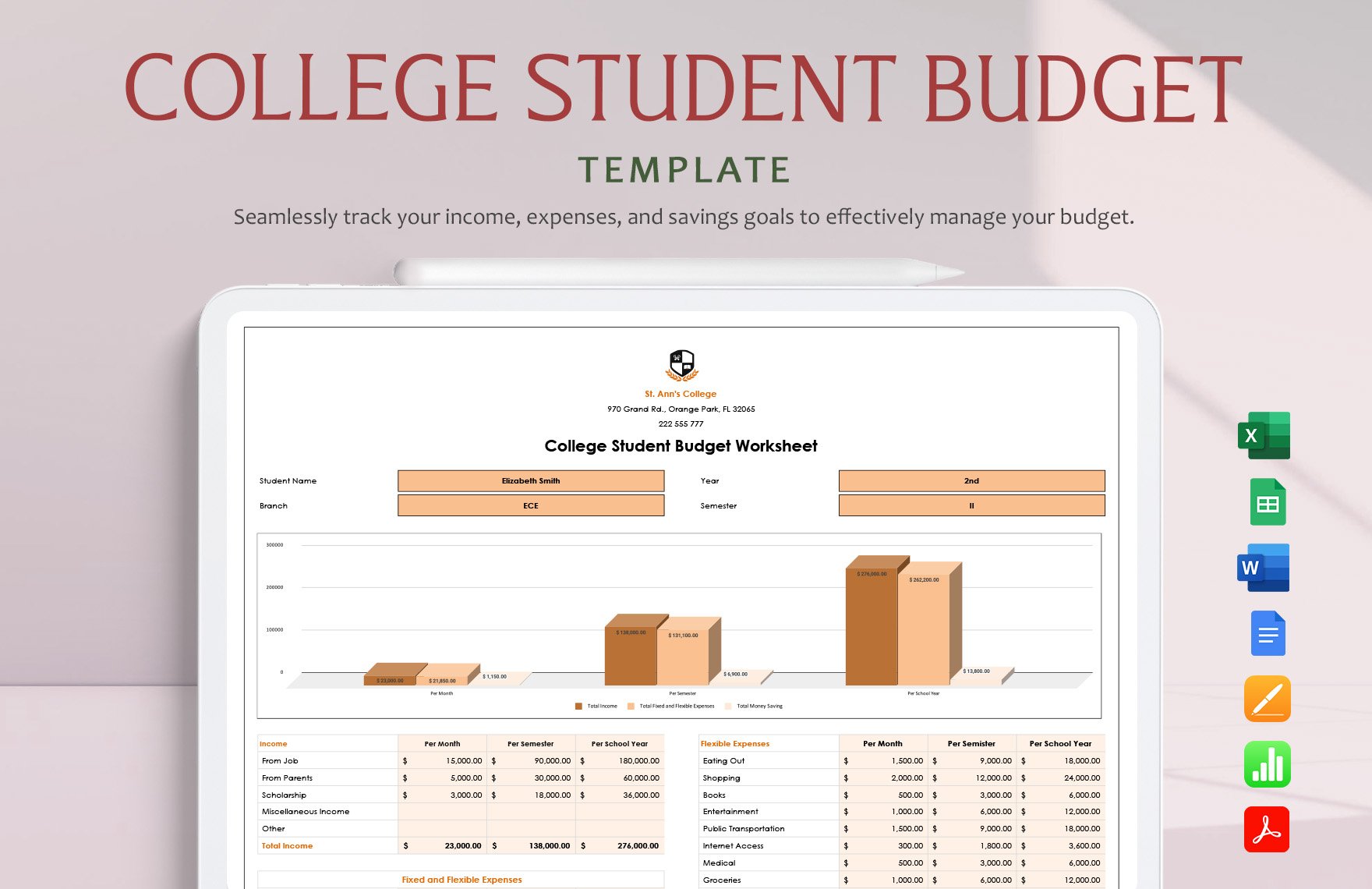

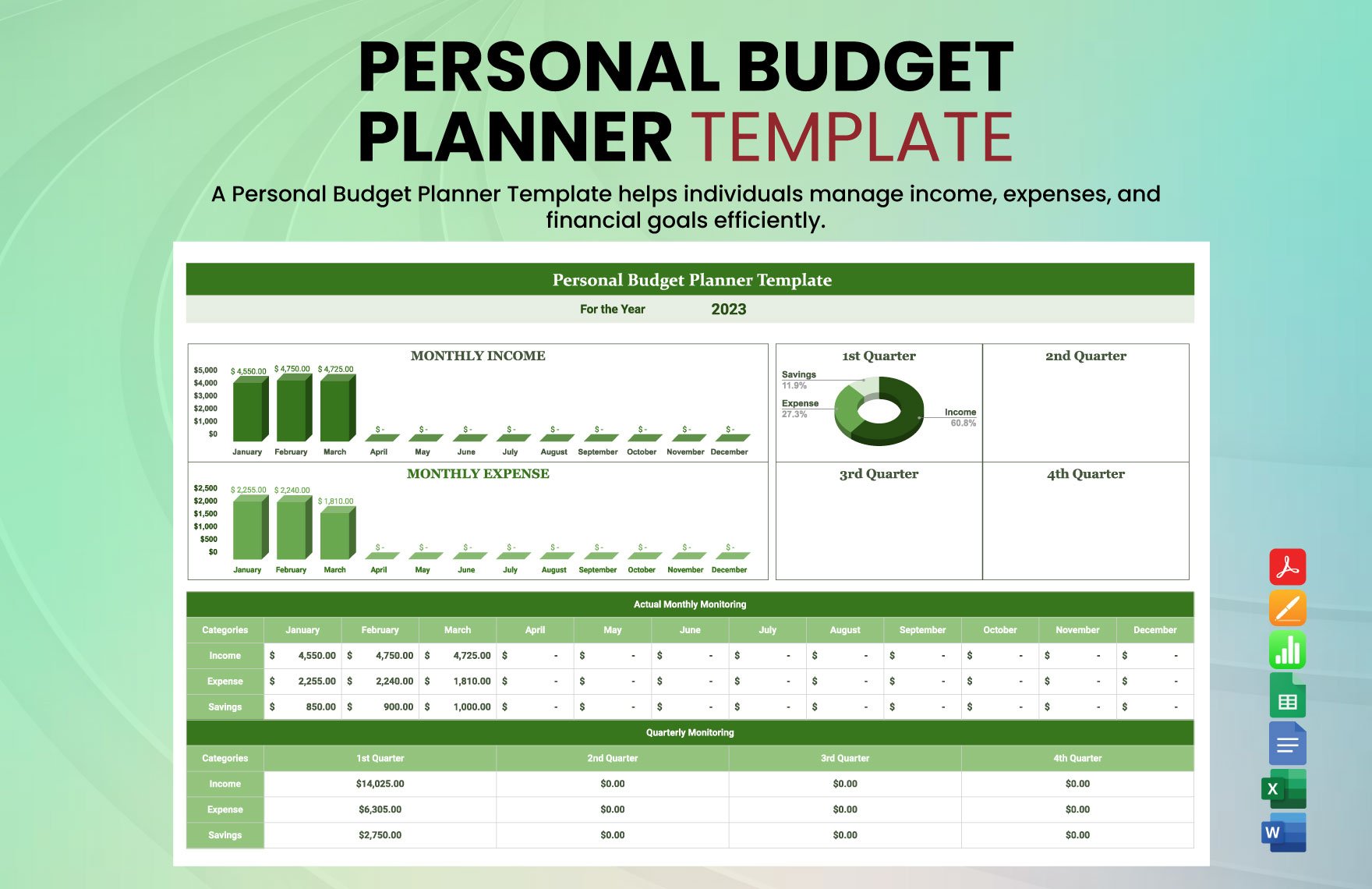

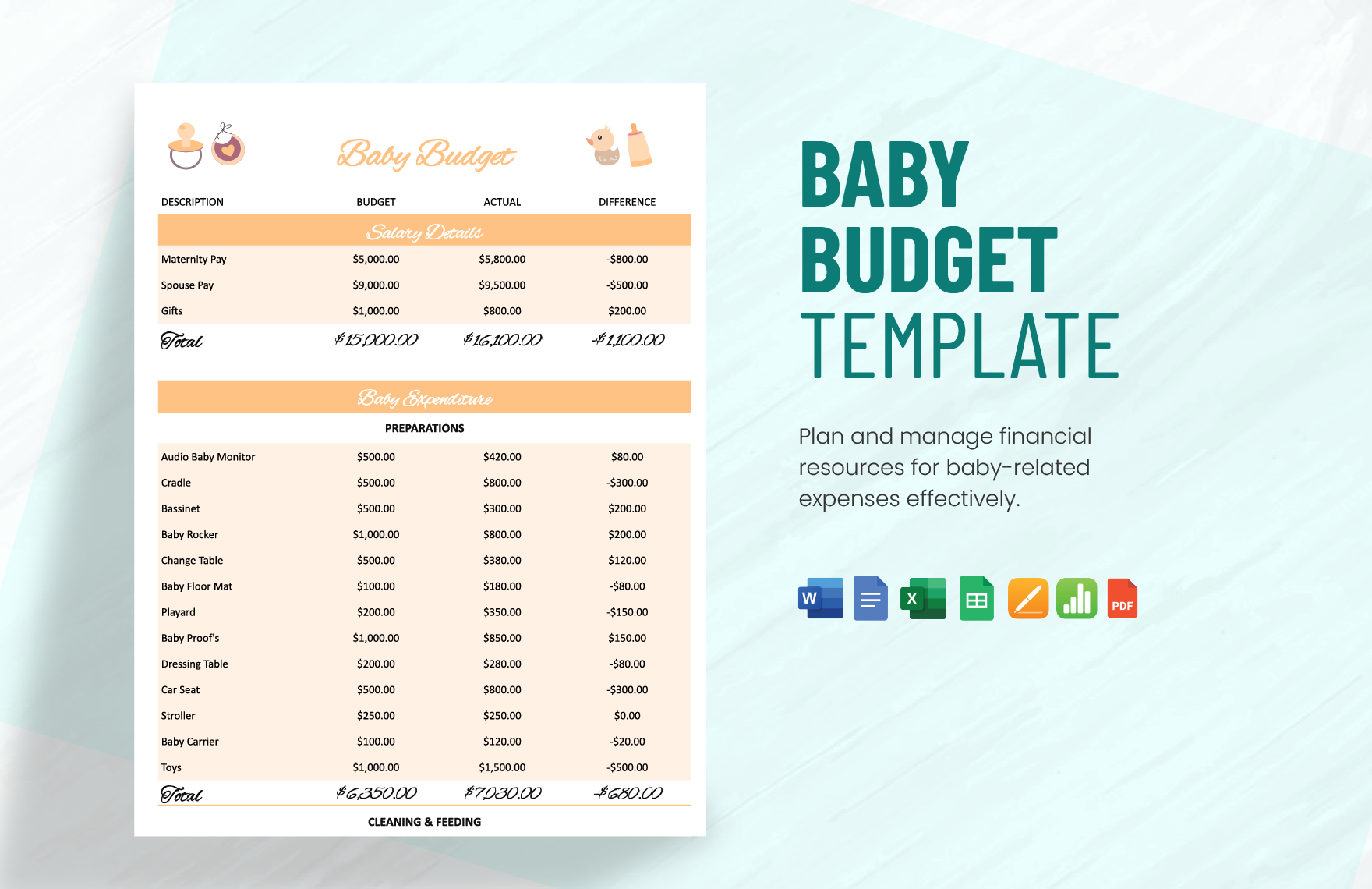

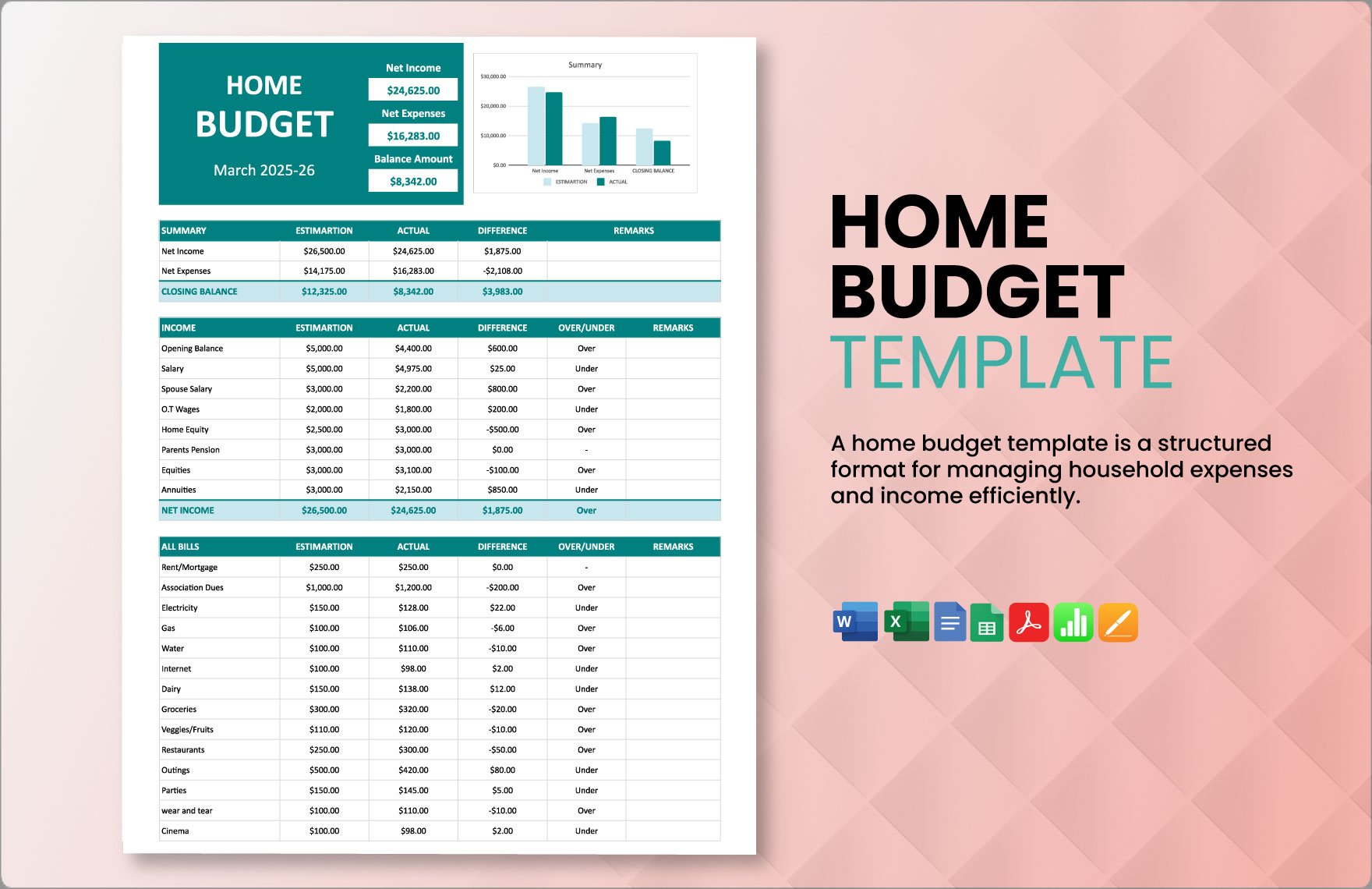

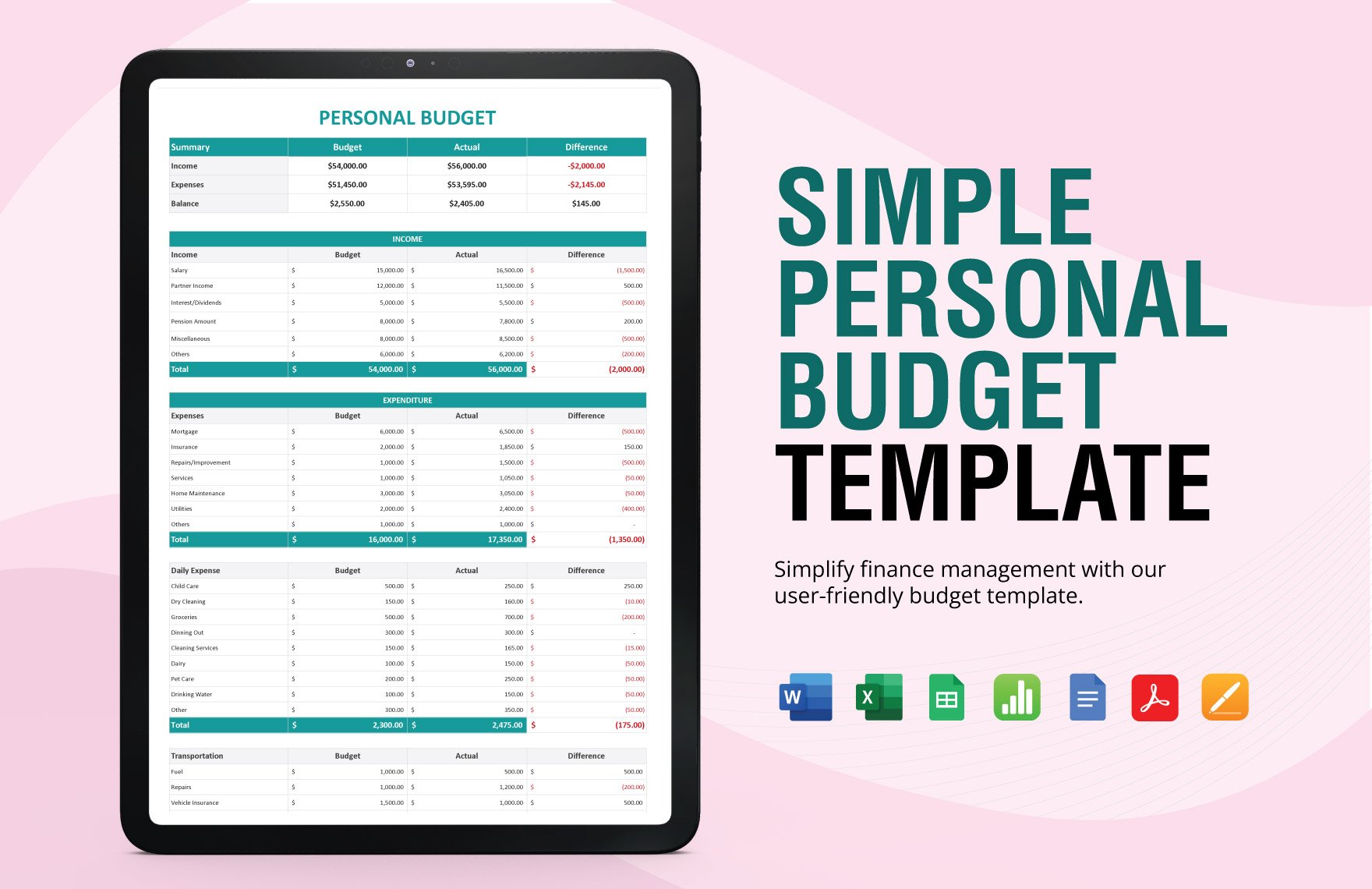

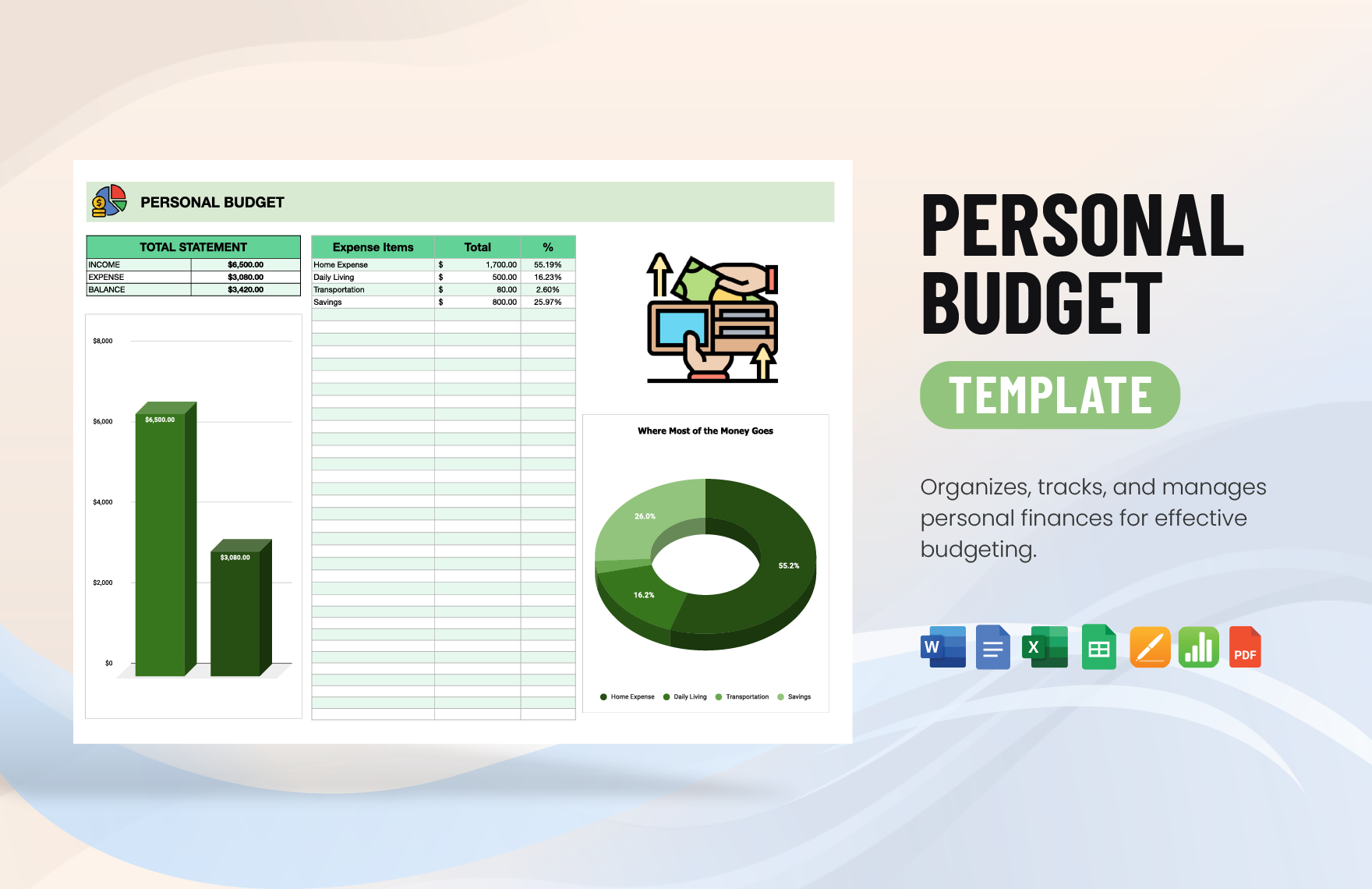

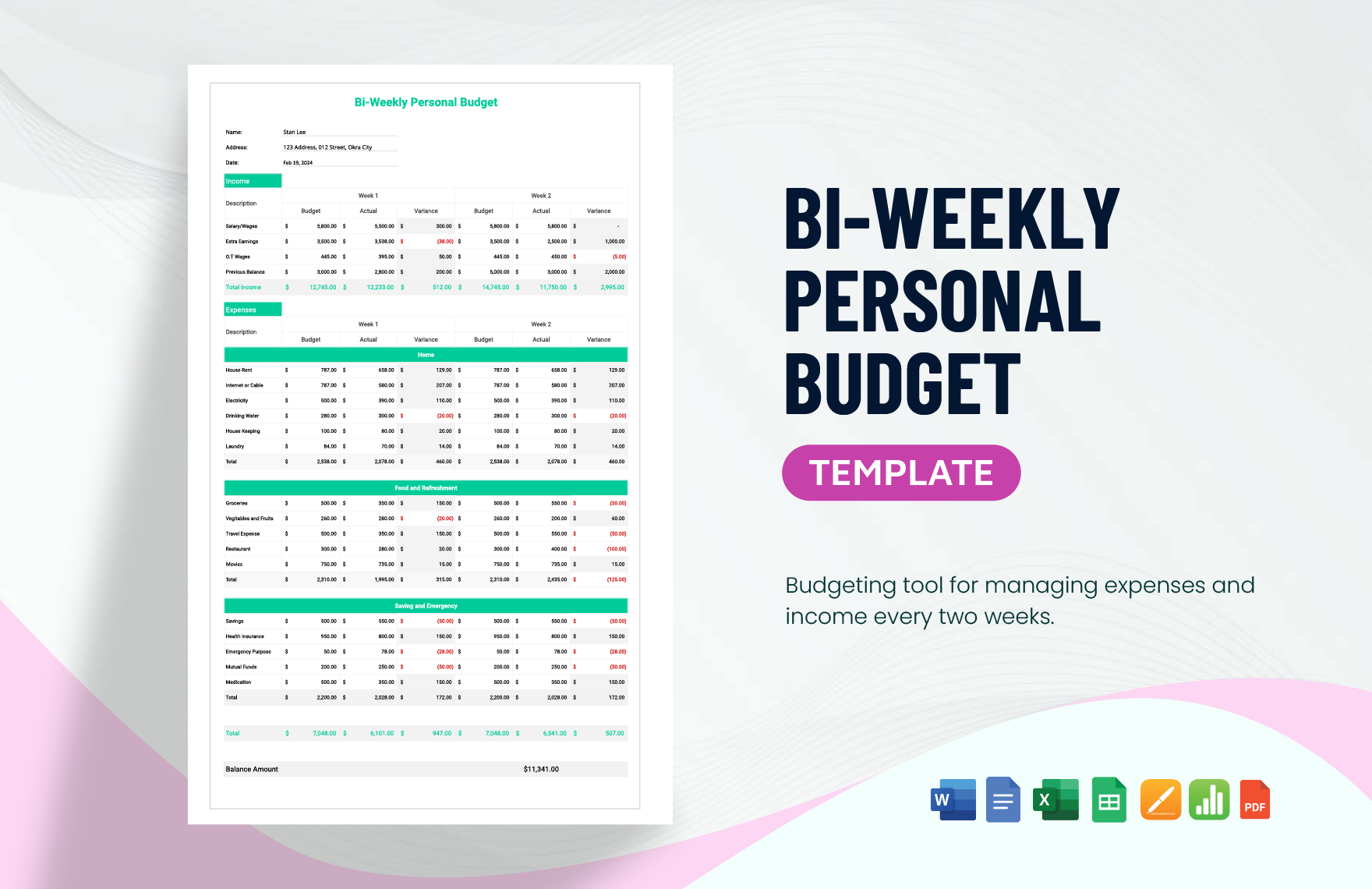

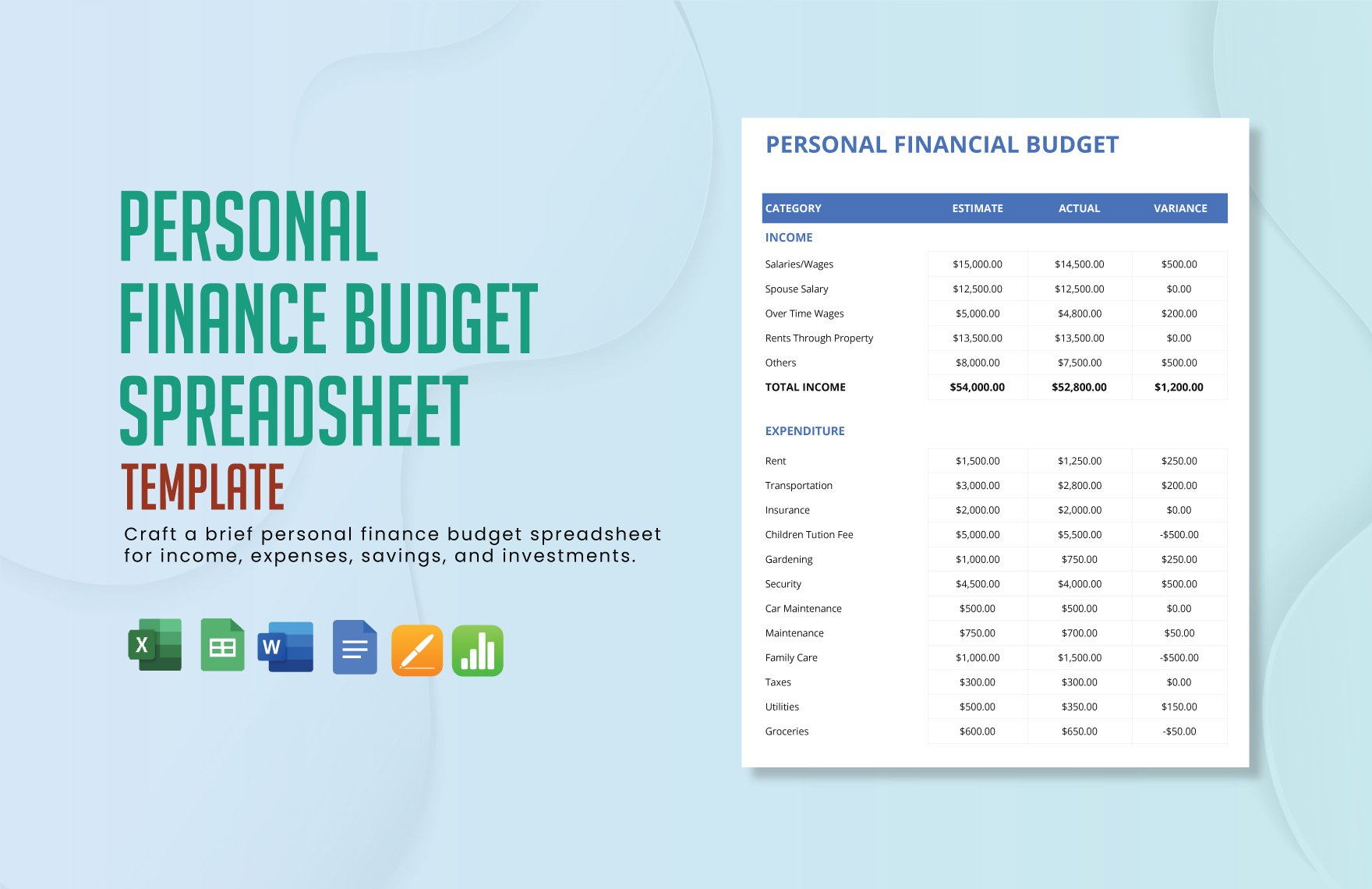

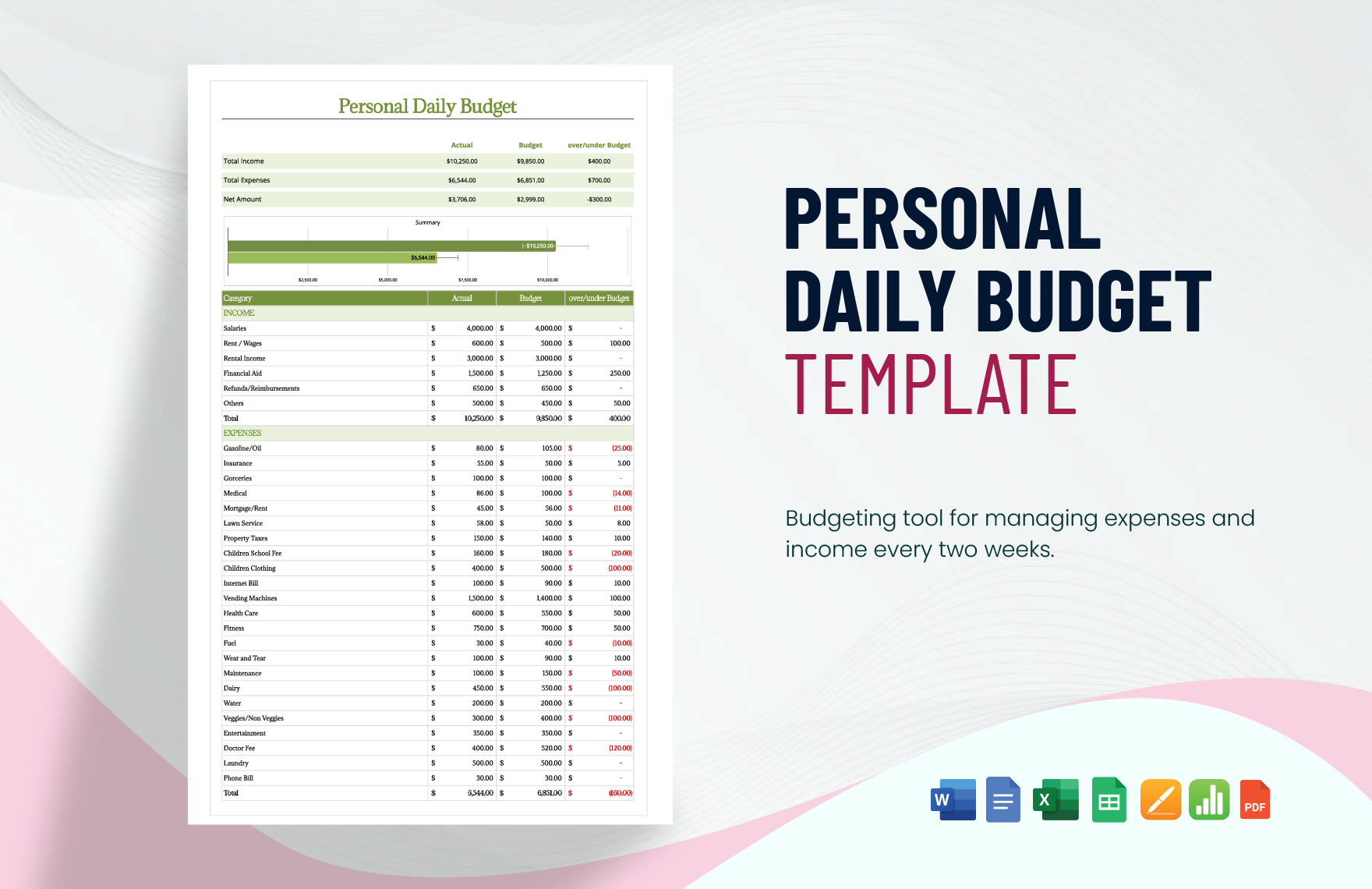

Supporting a family can be difficult, especially if your salary rate is lower than most. You'll need to consider costs for things like school, rent, and personal amenities. While it is hard, that doesn't mean there isn't a solution. What you can do is explore our selections of Ready-Made and Customizable Personal Budget Templates. You can edit these templates using PDF programs to ensure that you can change their content to suit your personal needs and preferences.. Download any of them now and you'll be able to experience the joy of knowing that you'll always have a way to keep track of your personal budget.

How to Create a Personal Budget in PDF

Whether you're on your own or have a family, it's important that you always have a budget. Data released by the Hamilton Project states that low-income households spend the majority of their budgets on basic needs alone—particularly housing, food, and transportation. Even if you're part of the middle or upper class of society, it's still worth budgeting your finances. That's why the steps below will help you make a personal budget that's sure to tell you where your money is going.

1. Determine Your Expenses

Always start with the basics, meaning that you'll have to outline all of your financial priorities. Typically, this involves expenses that cover rent, utility, food, electricity, water, and quite possibly, tuition fees. Knowing what your expenses are will make it easier for you to budget your finances.

2. Break the Expenses

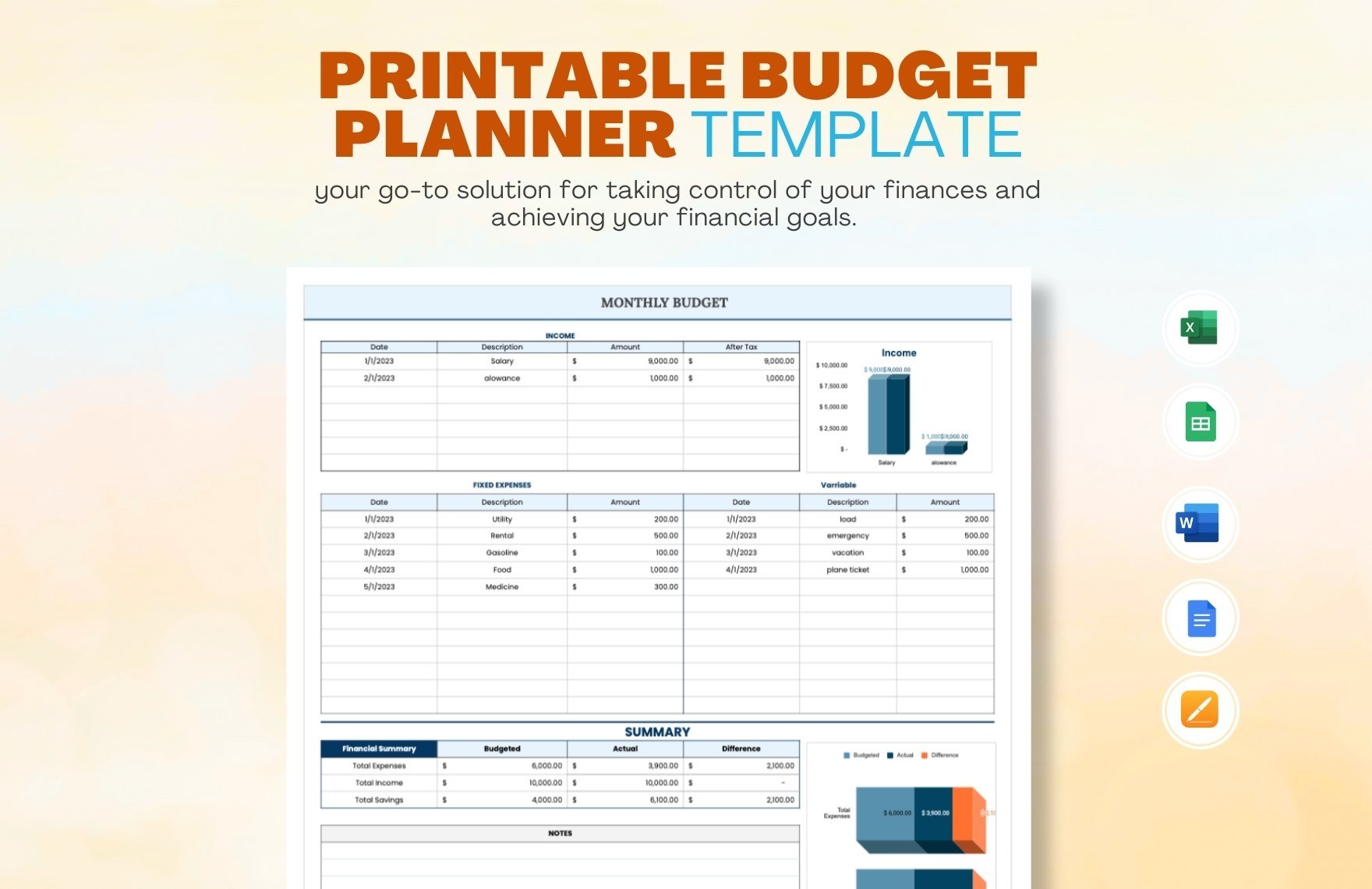

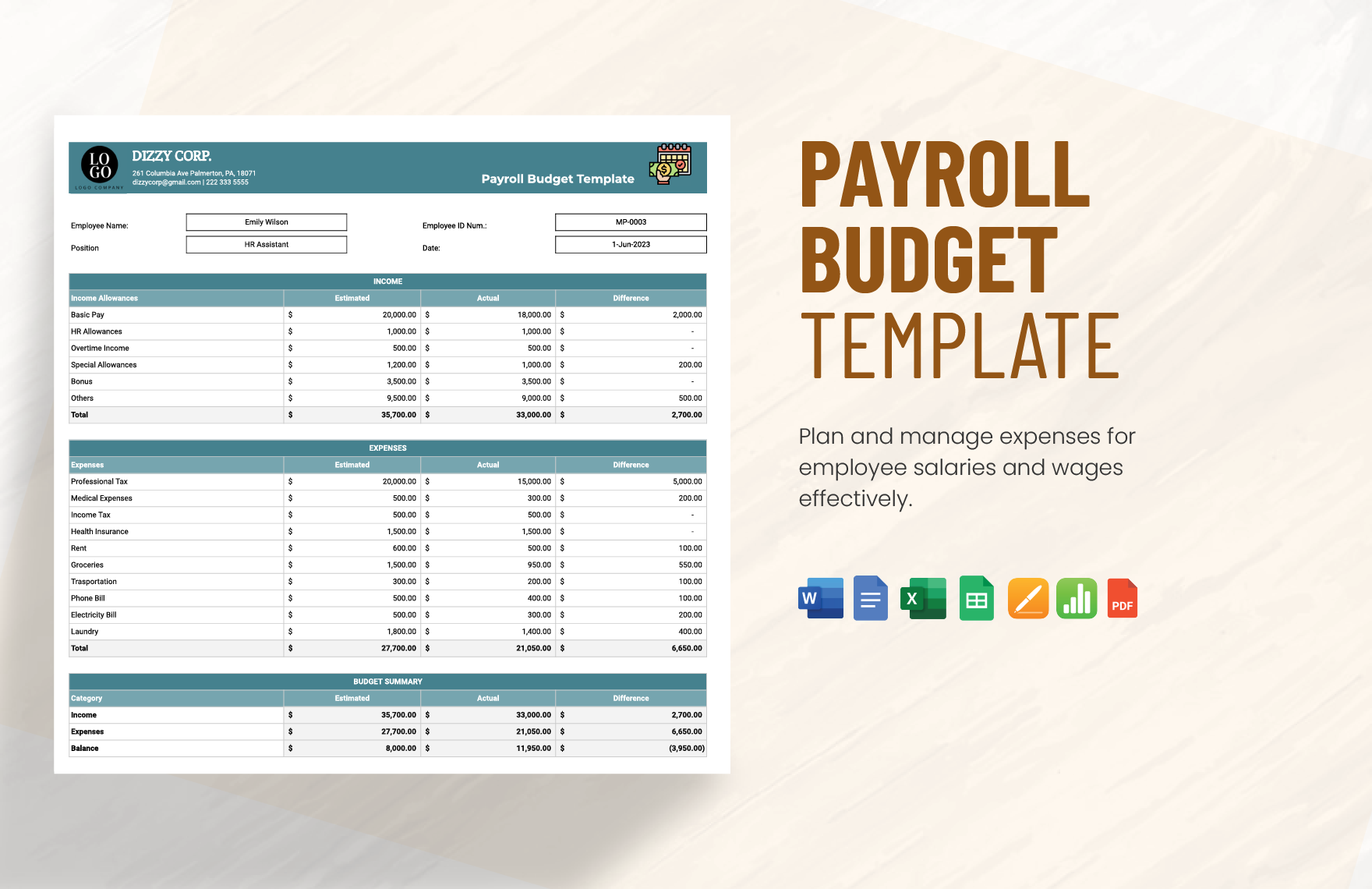

Next, break down each expense by supplying the exact amount for each. Do this by figuring out which ones are fixed and which ones can change quantity. Take note that you'll also have to cover both permanent and temporary expenses in your budget plan.

3. Construct a Table

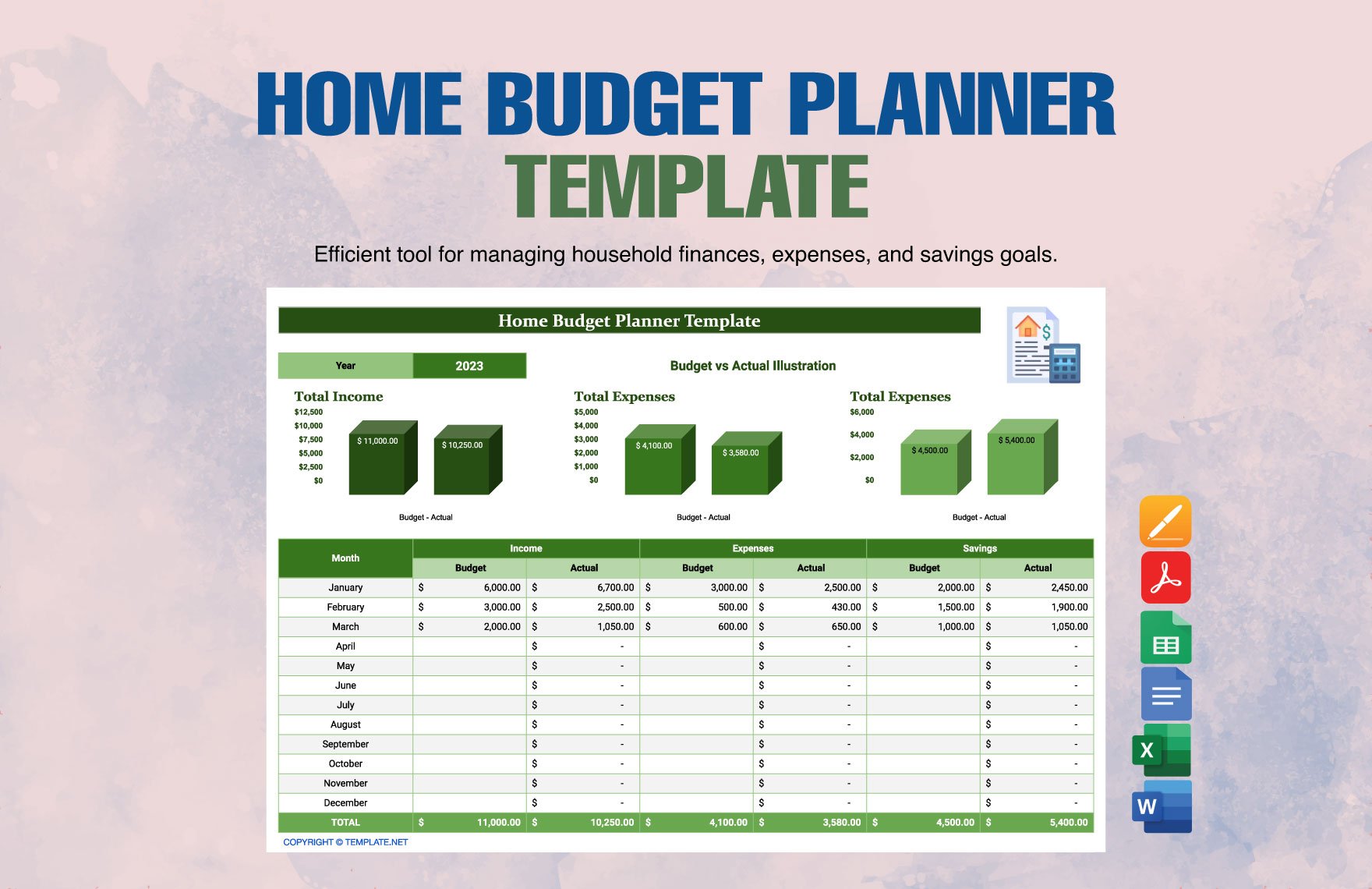

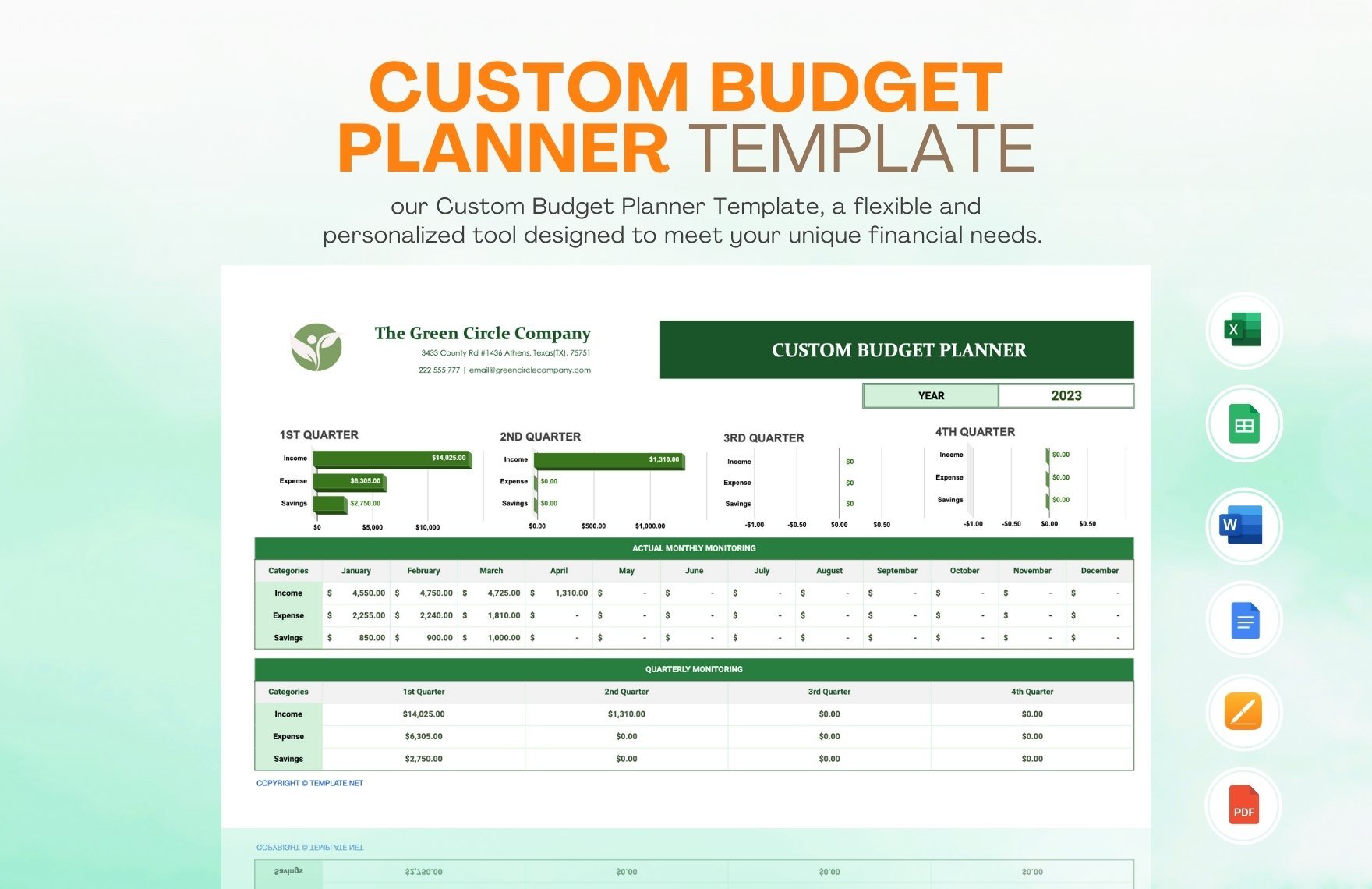

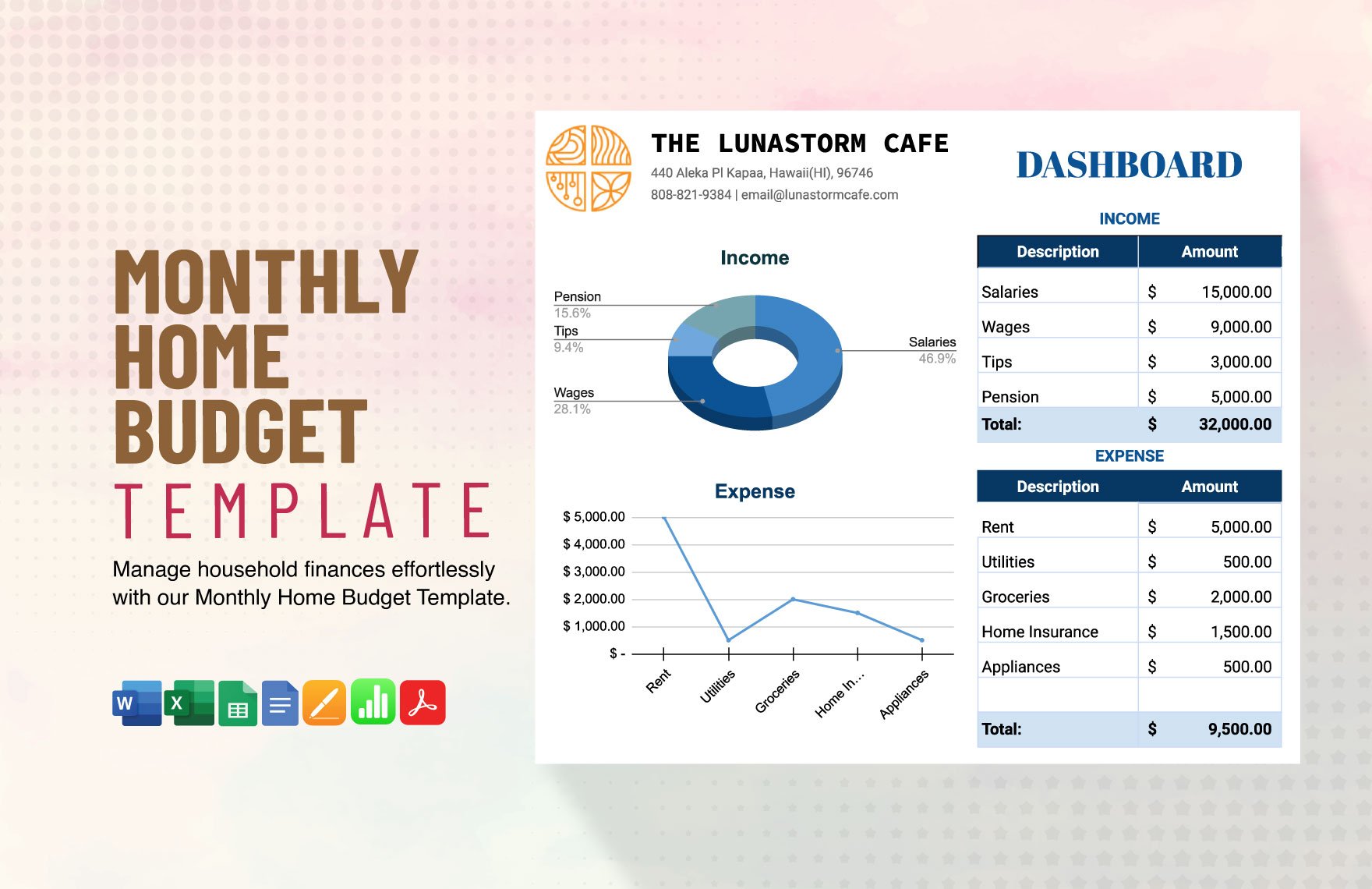

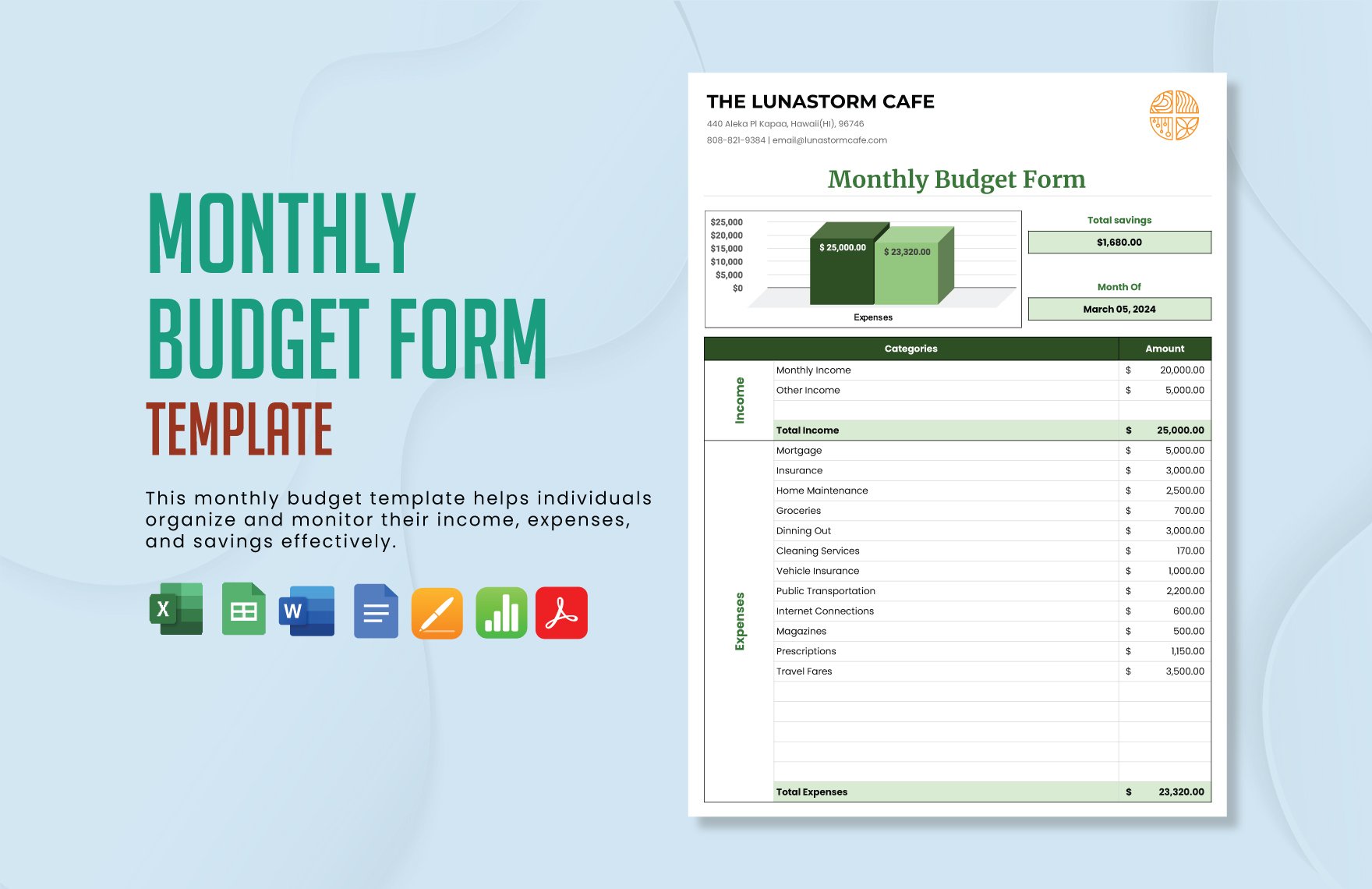

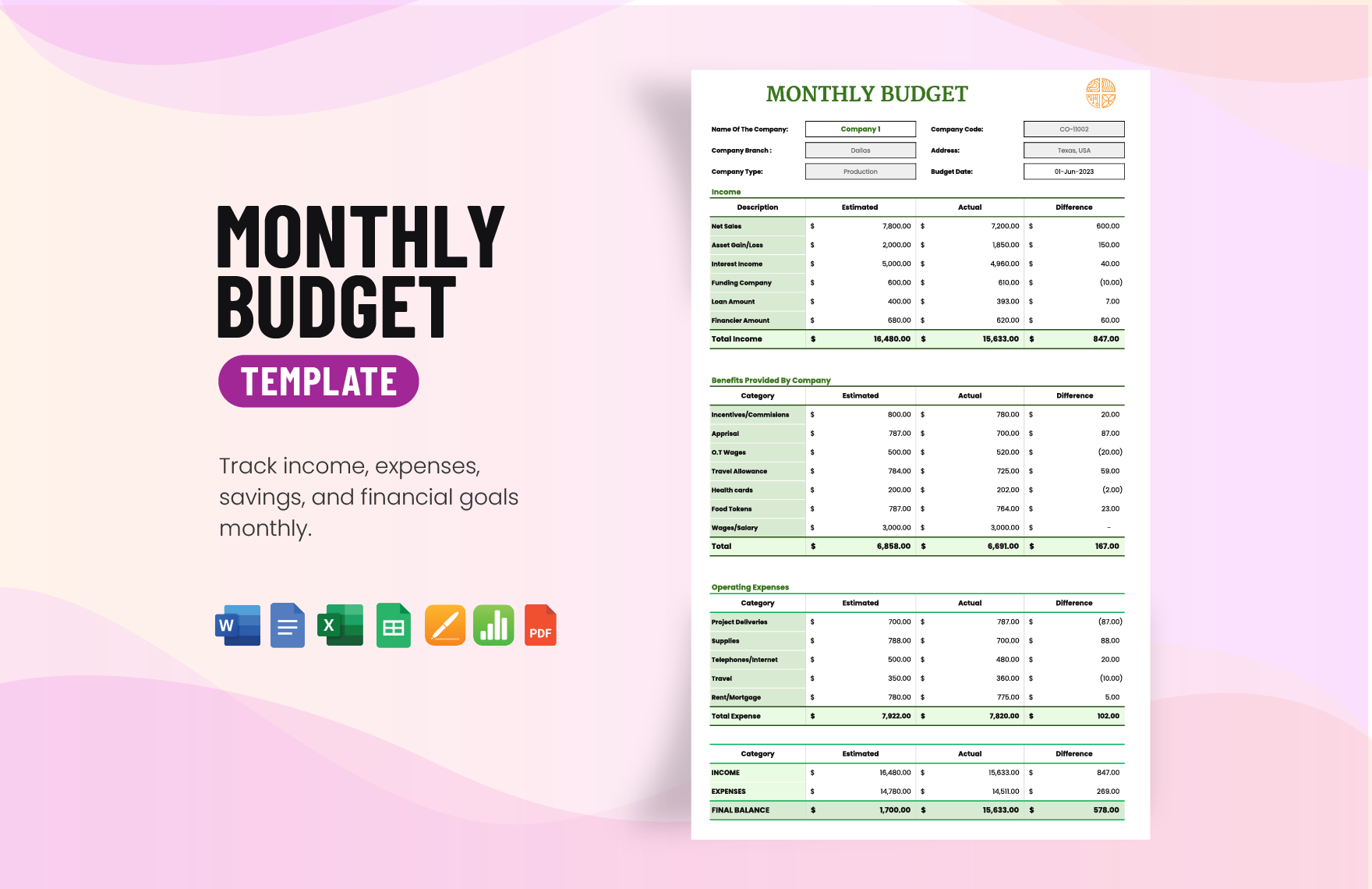

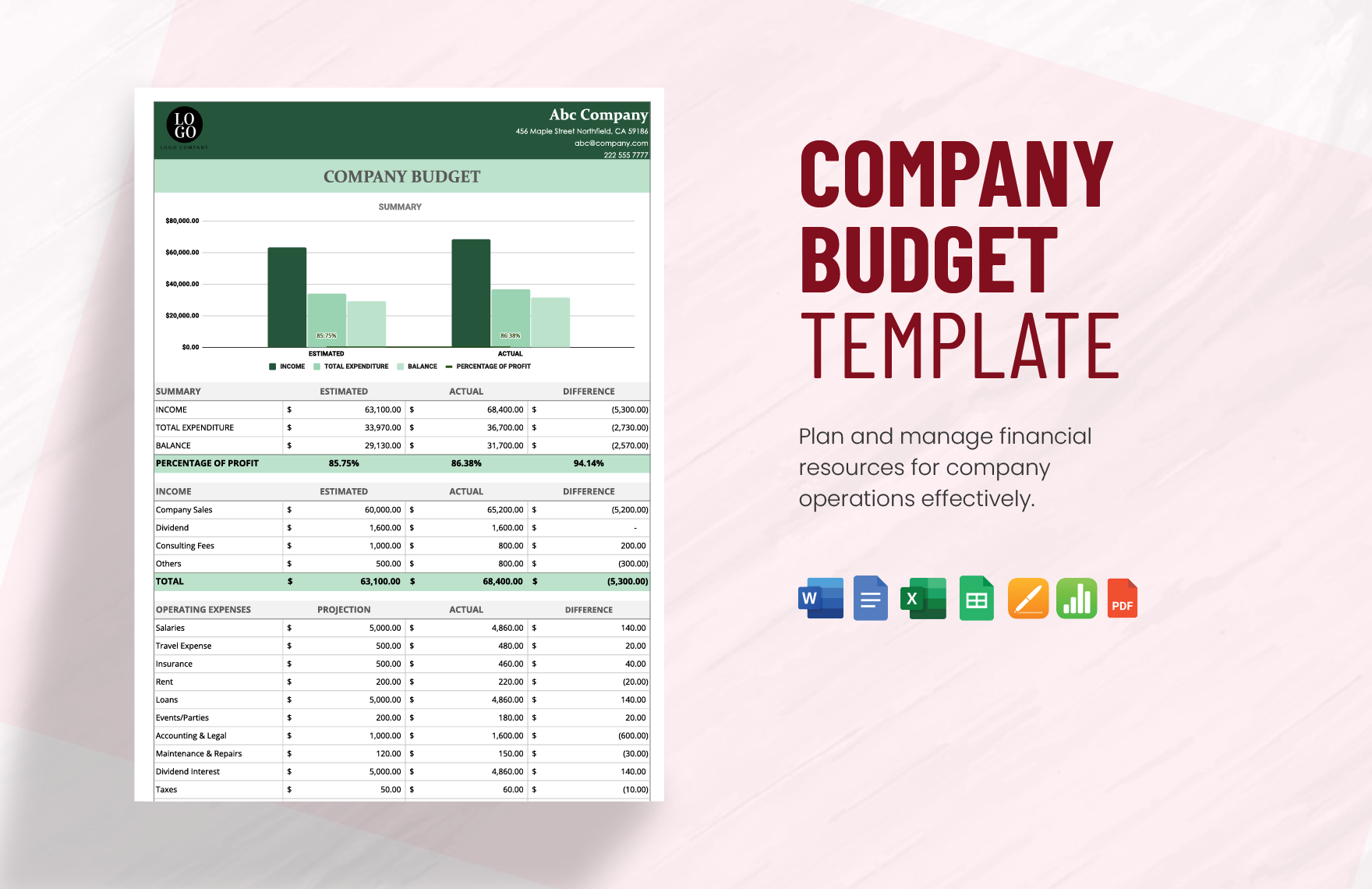

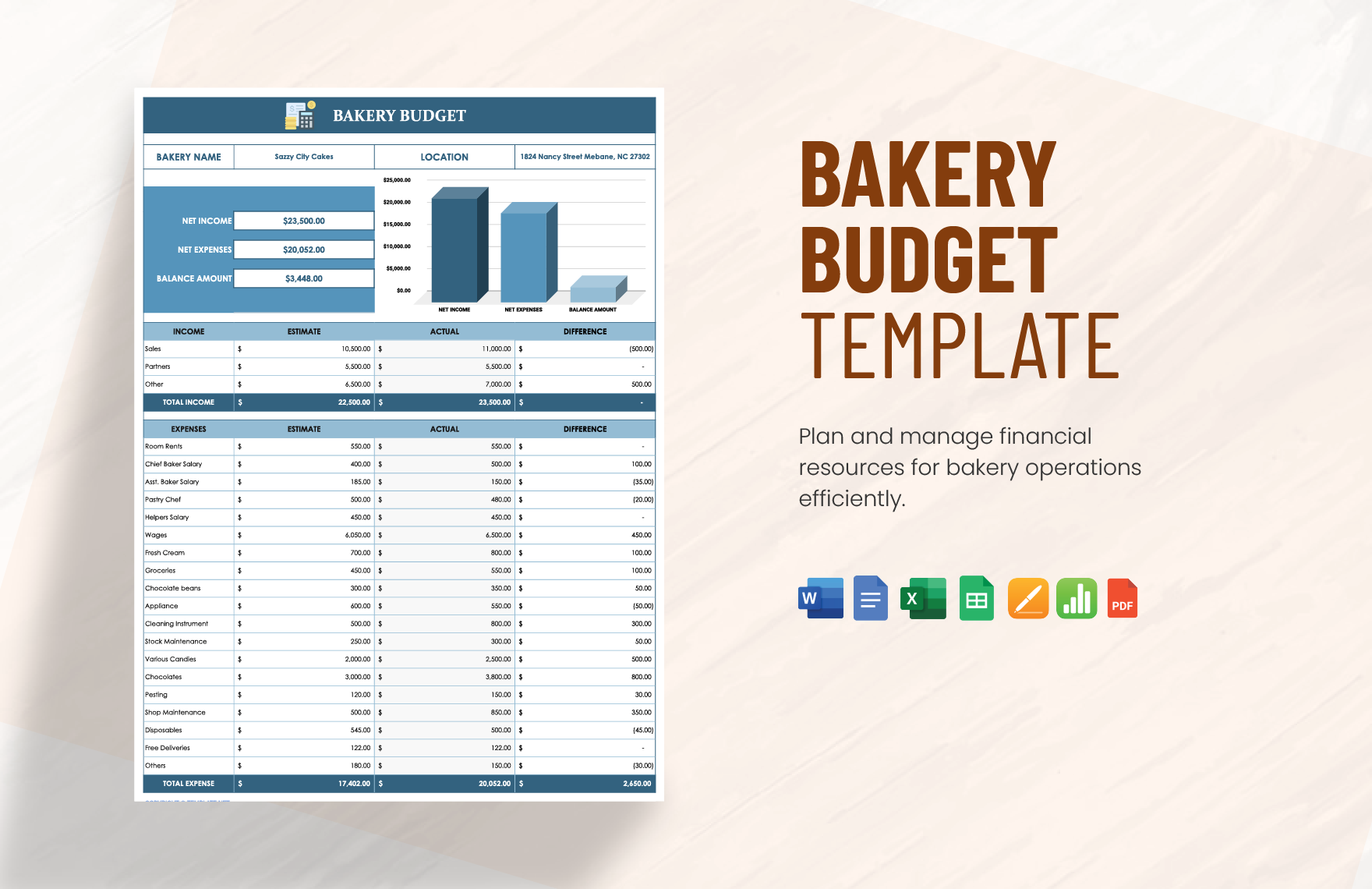

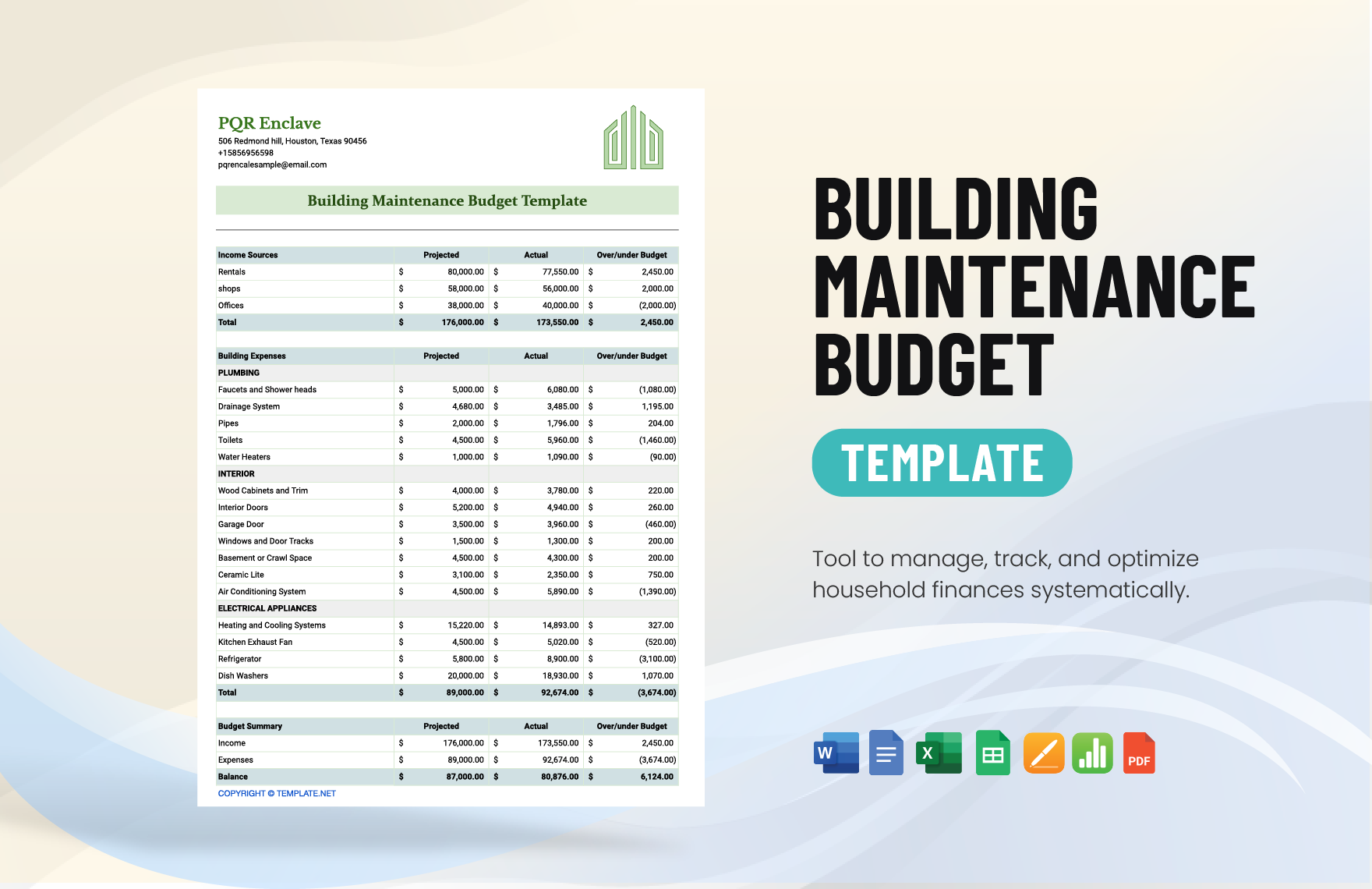

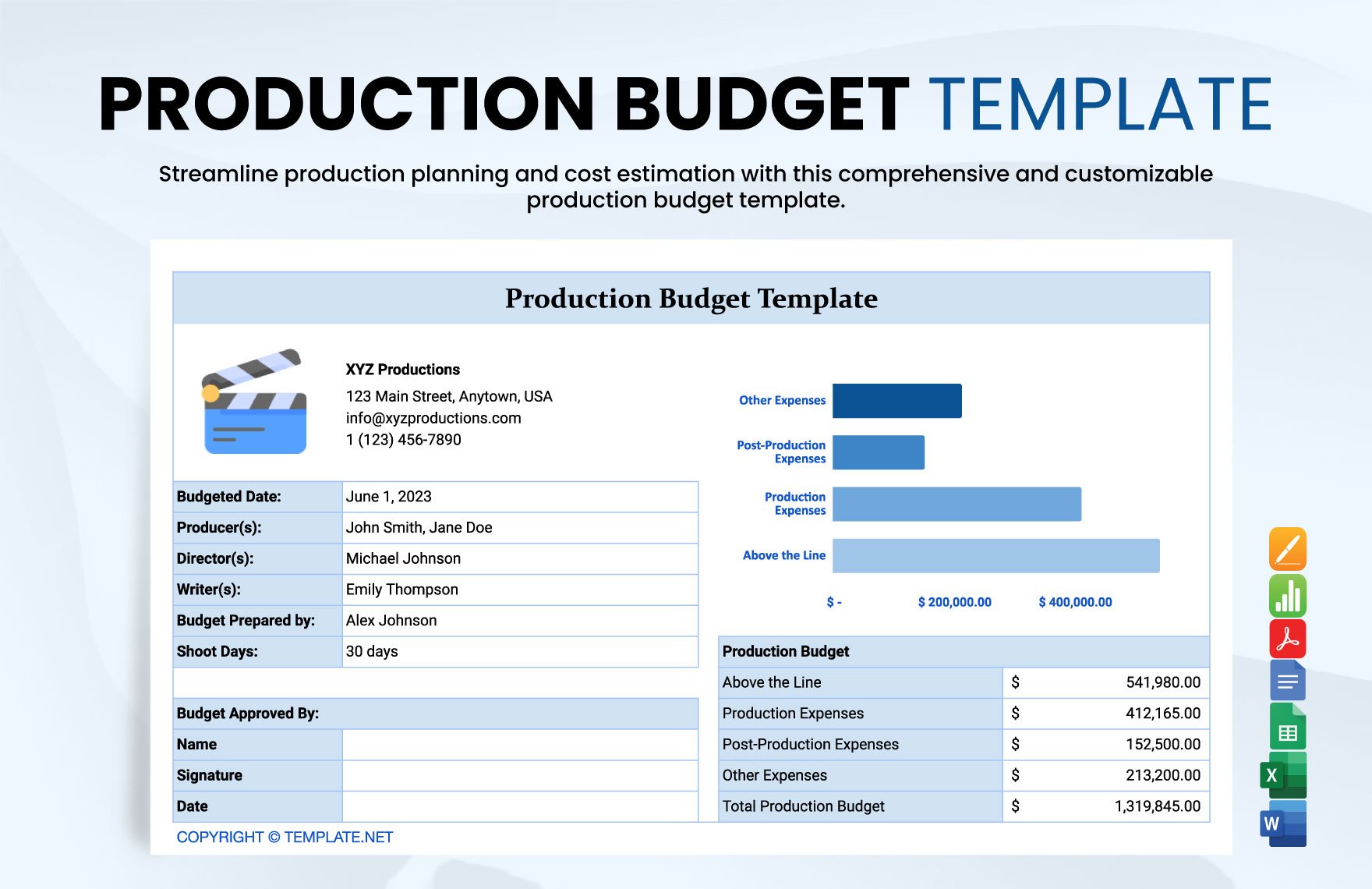

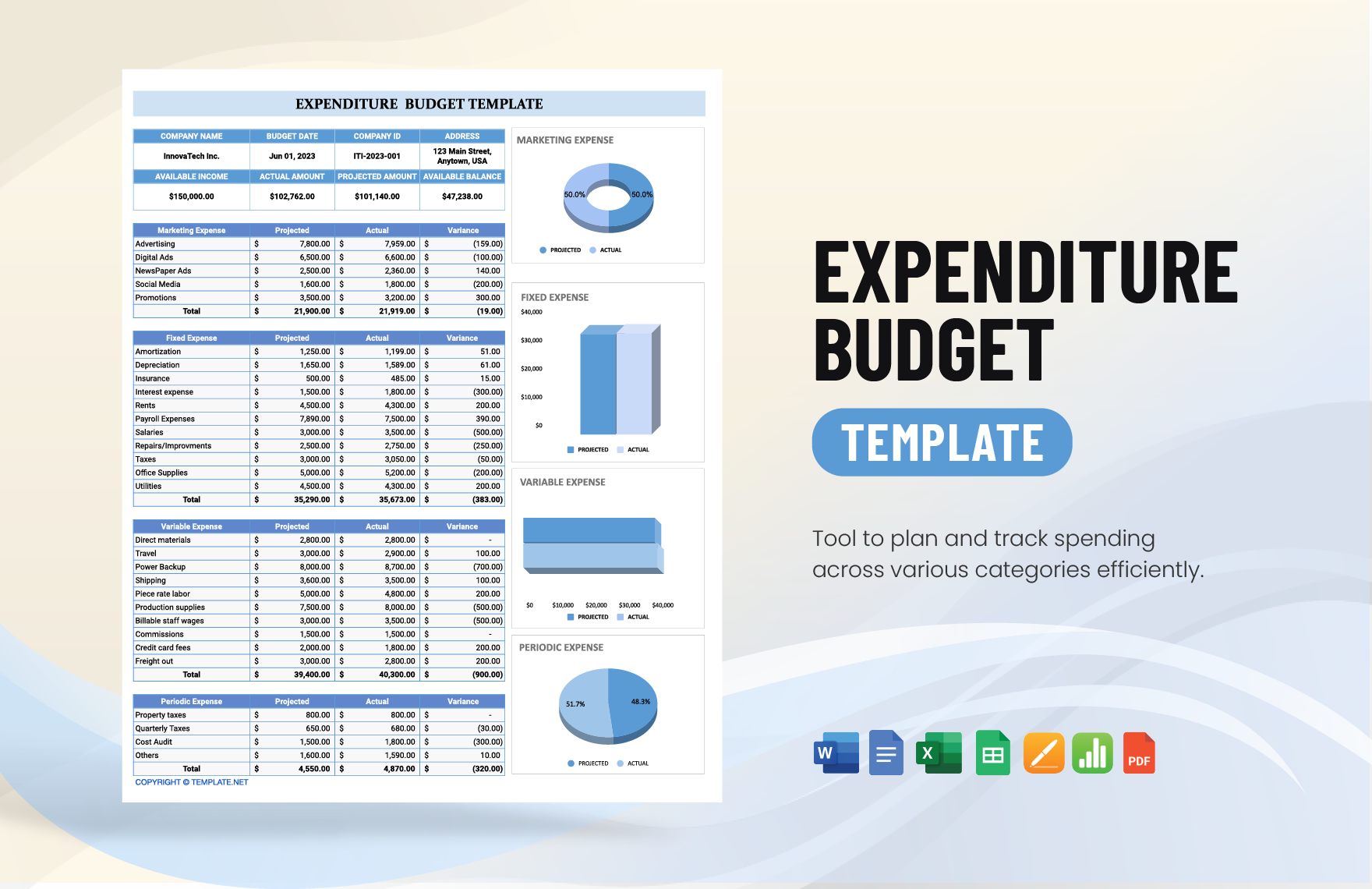

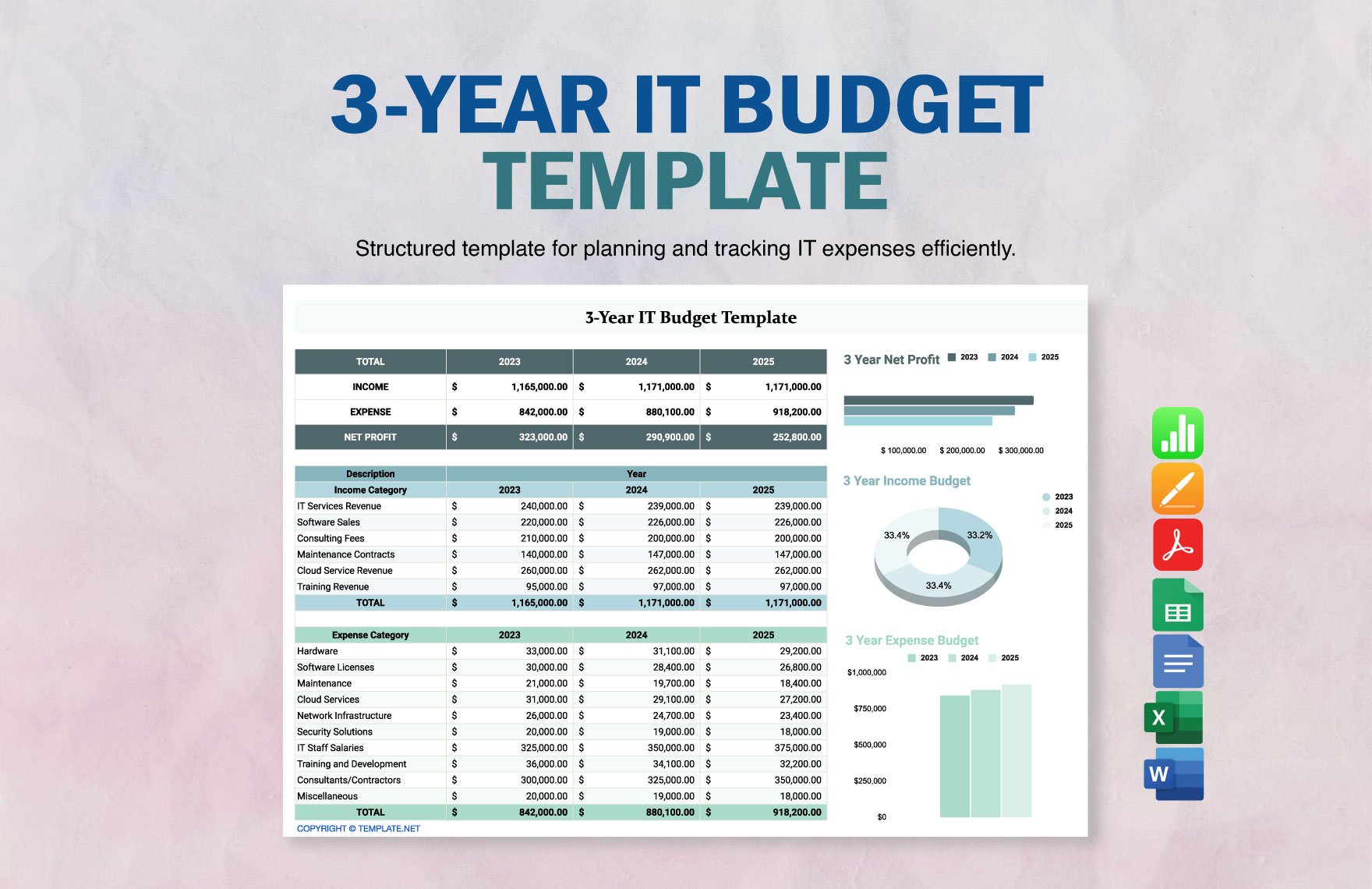

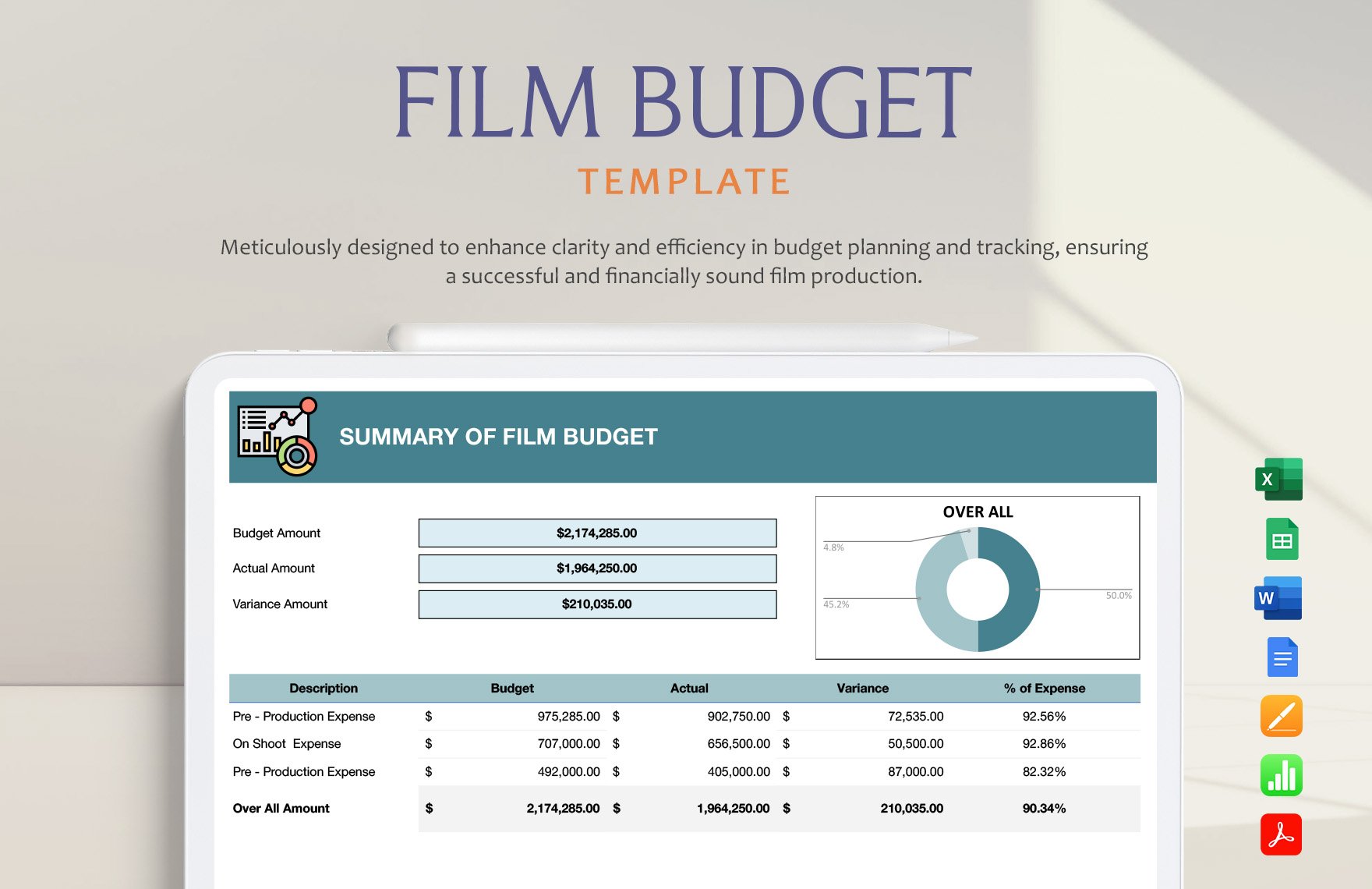

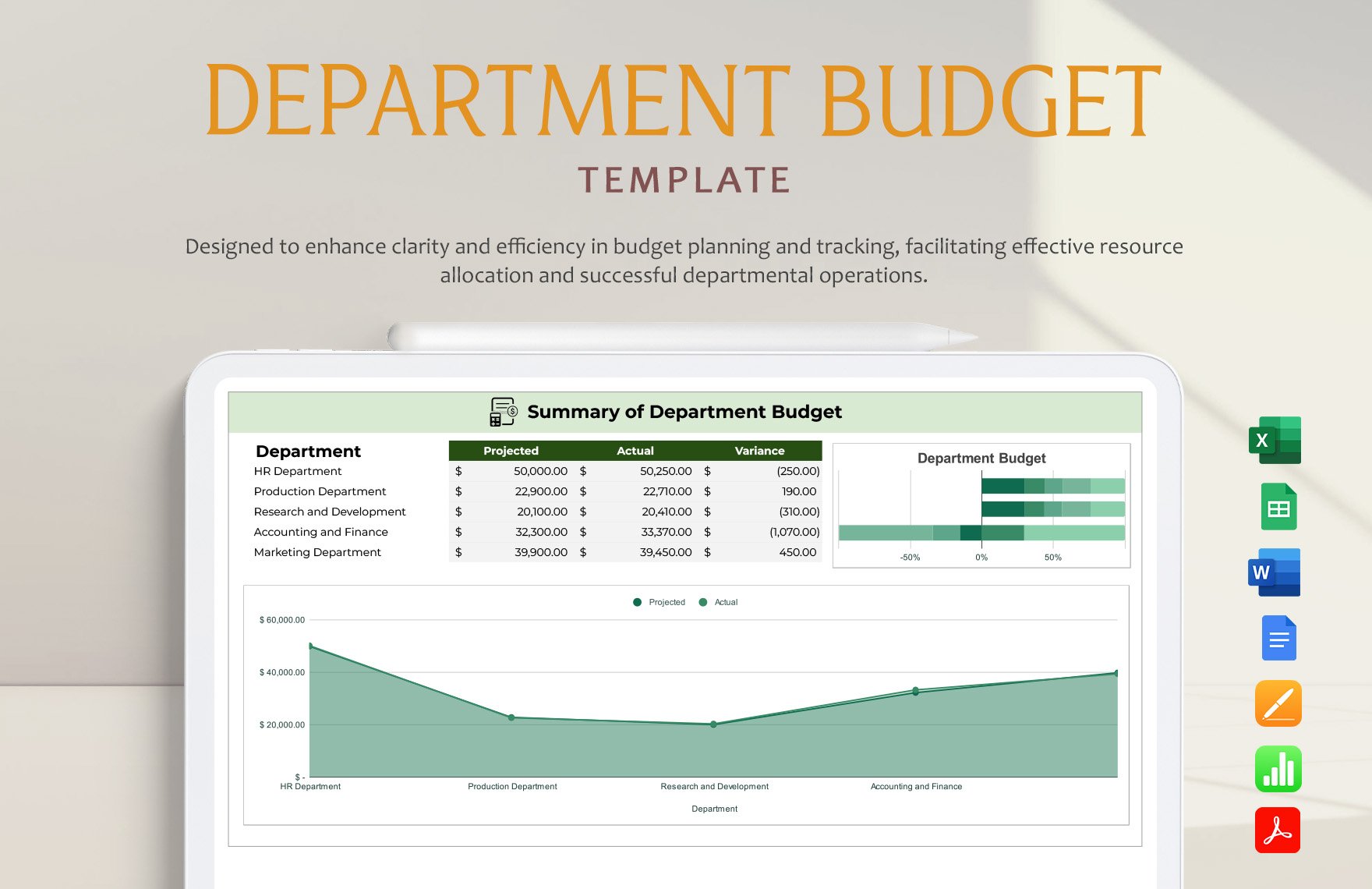

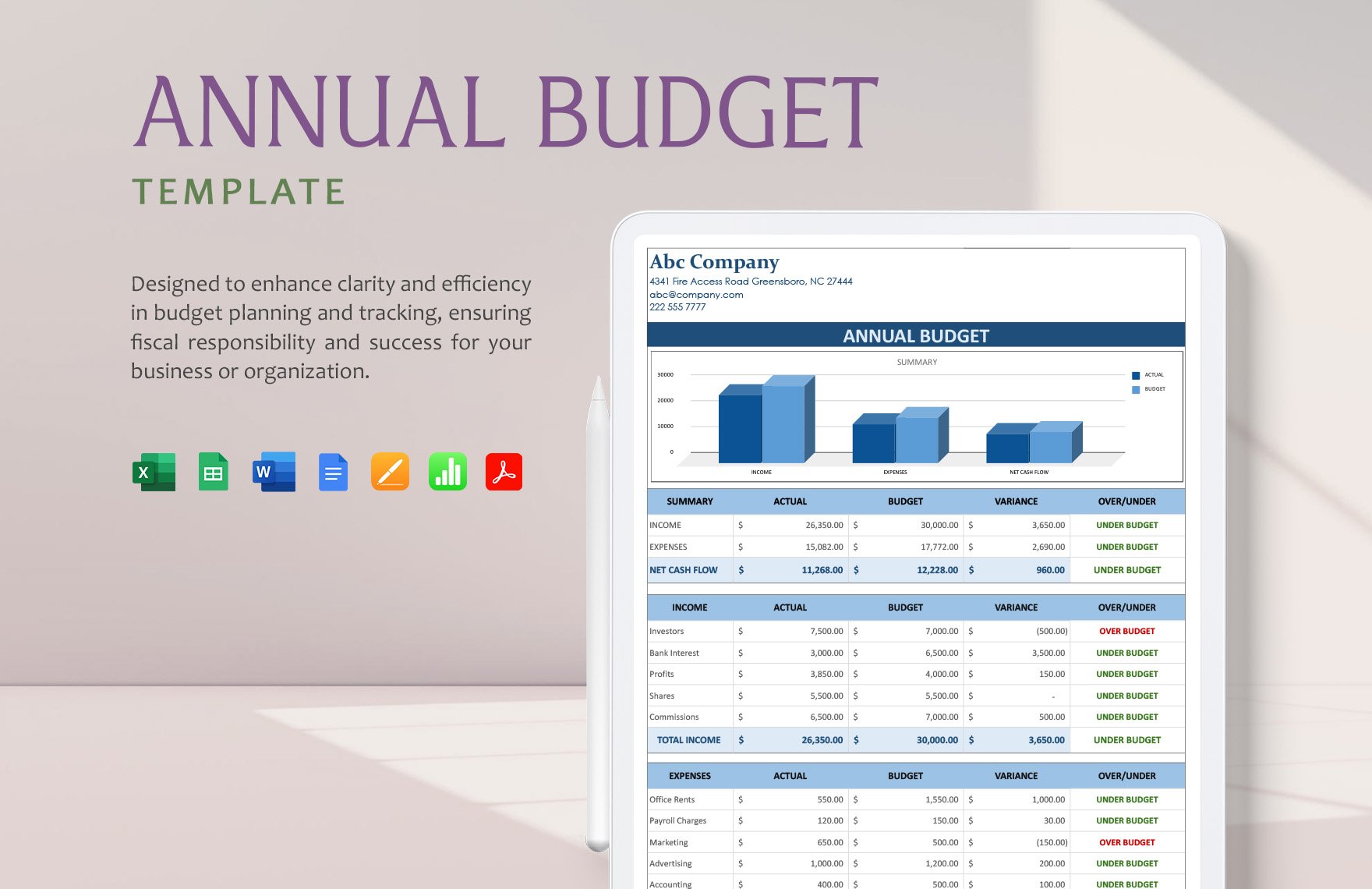

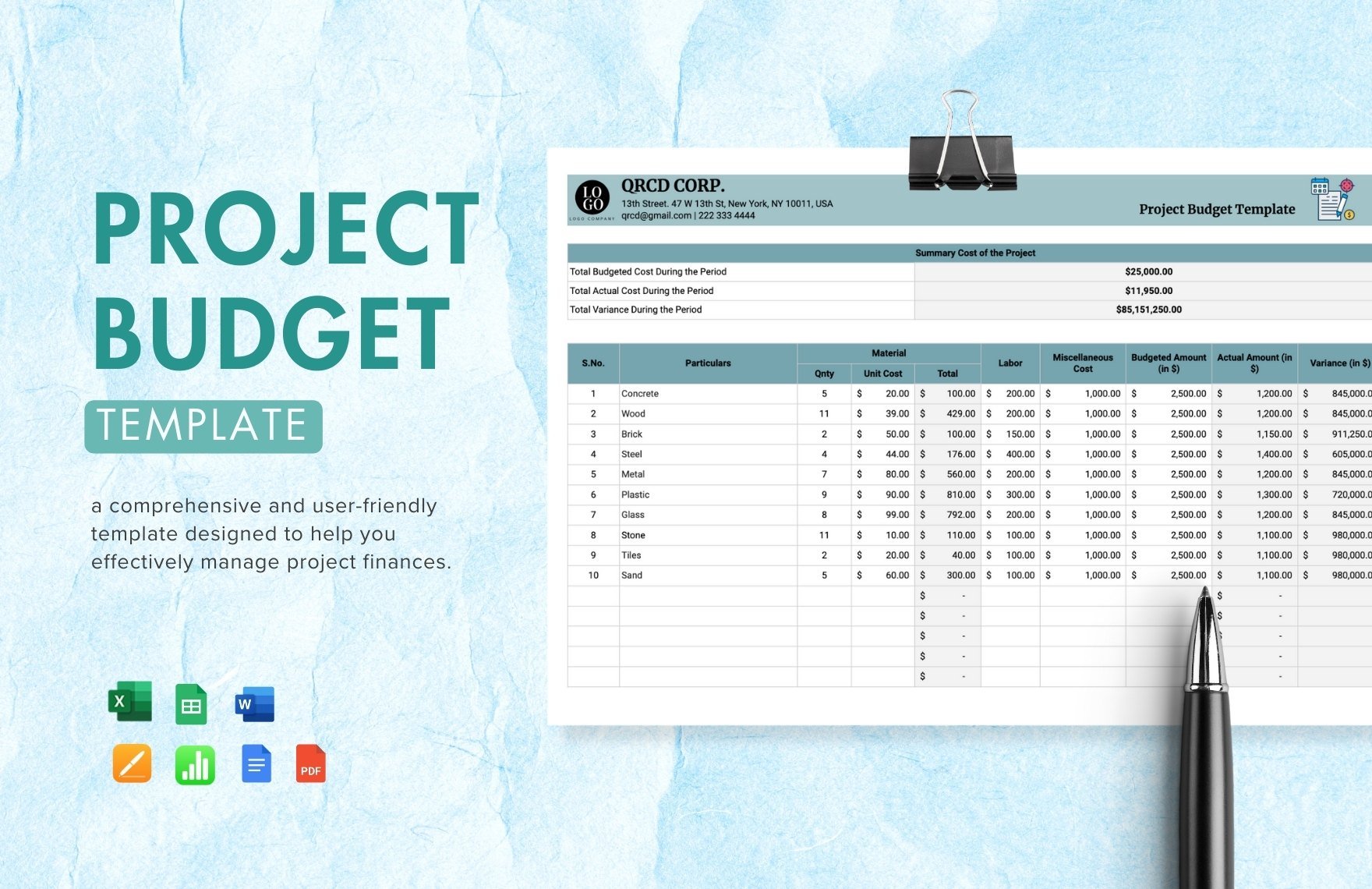

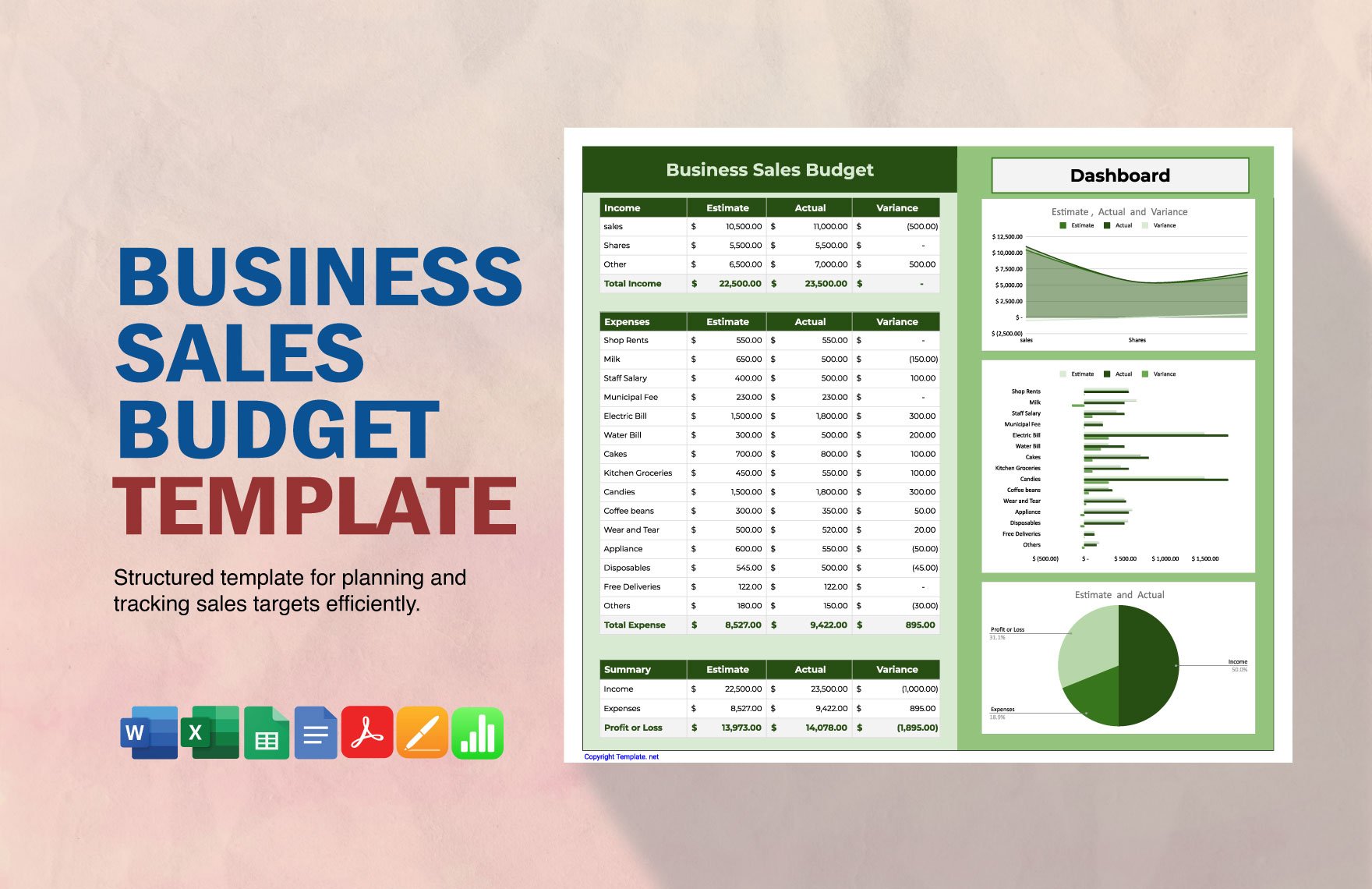

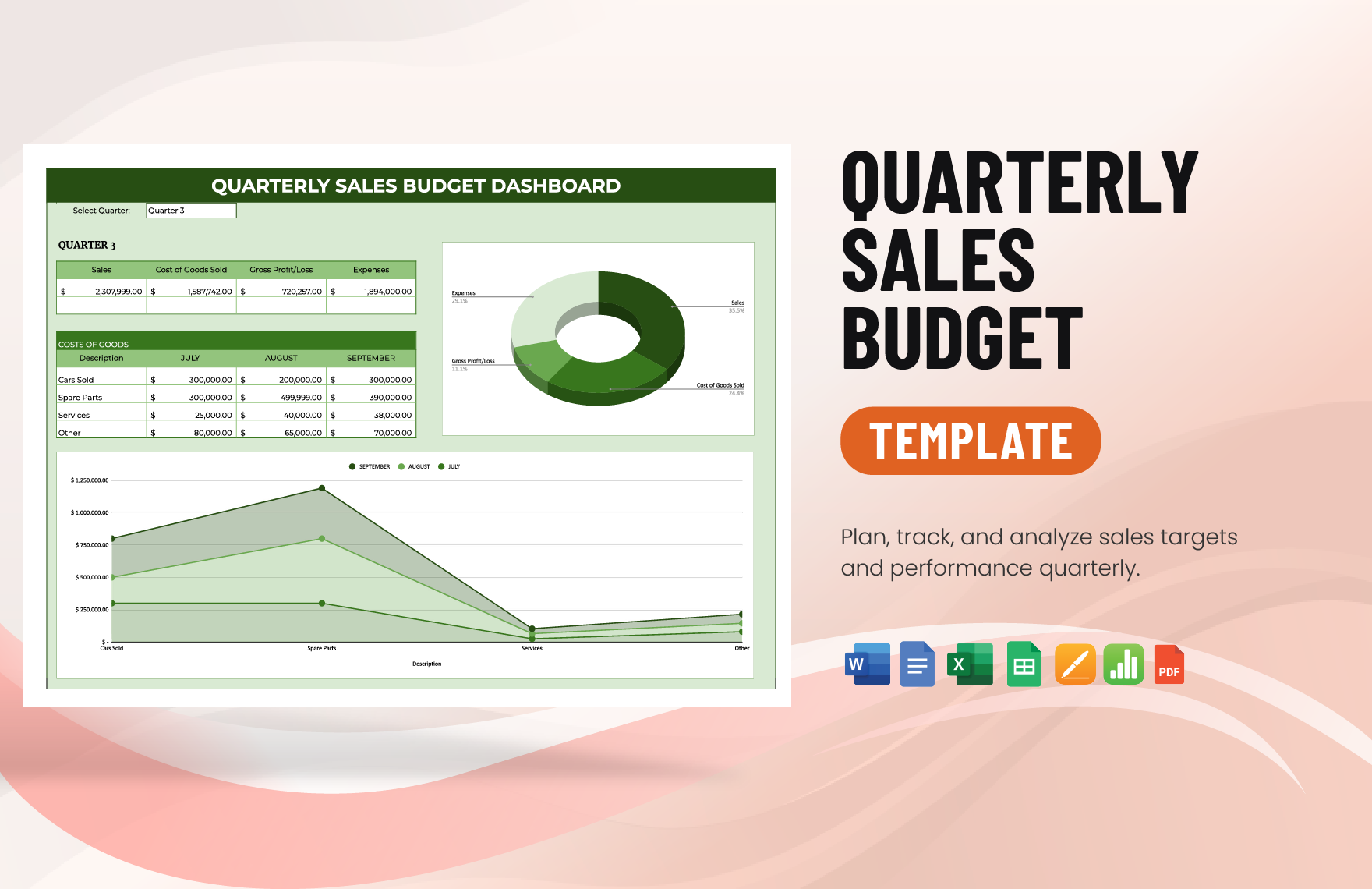

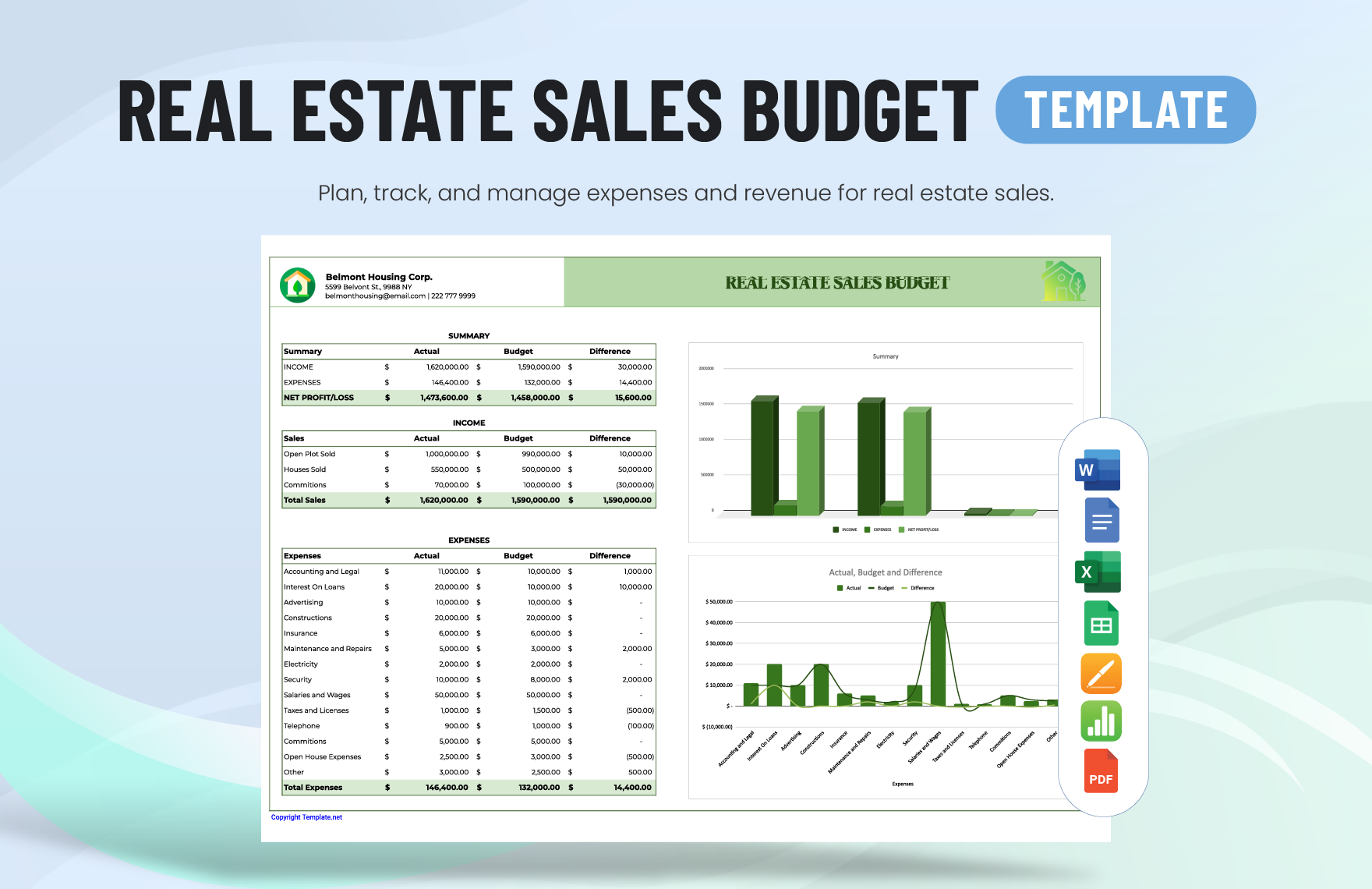

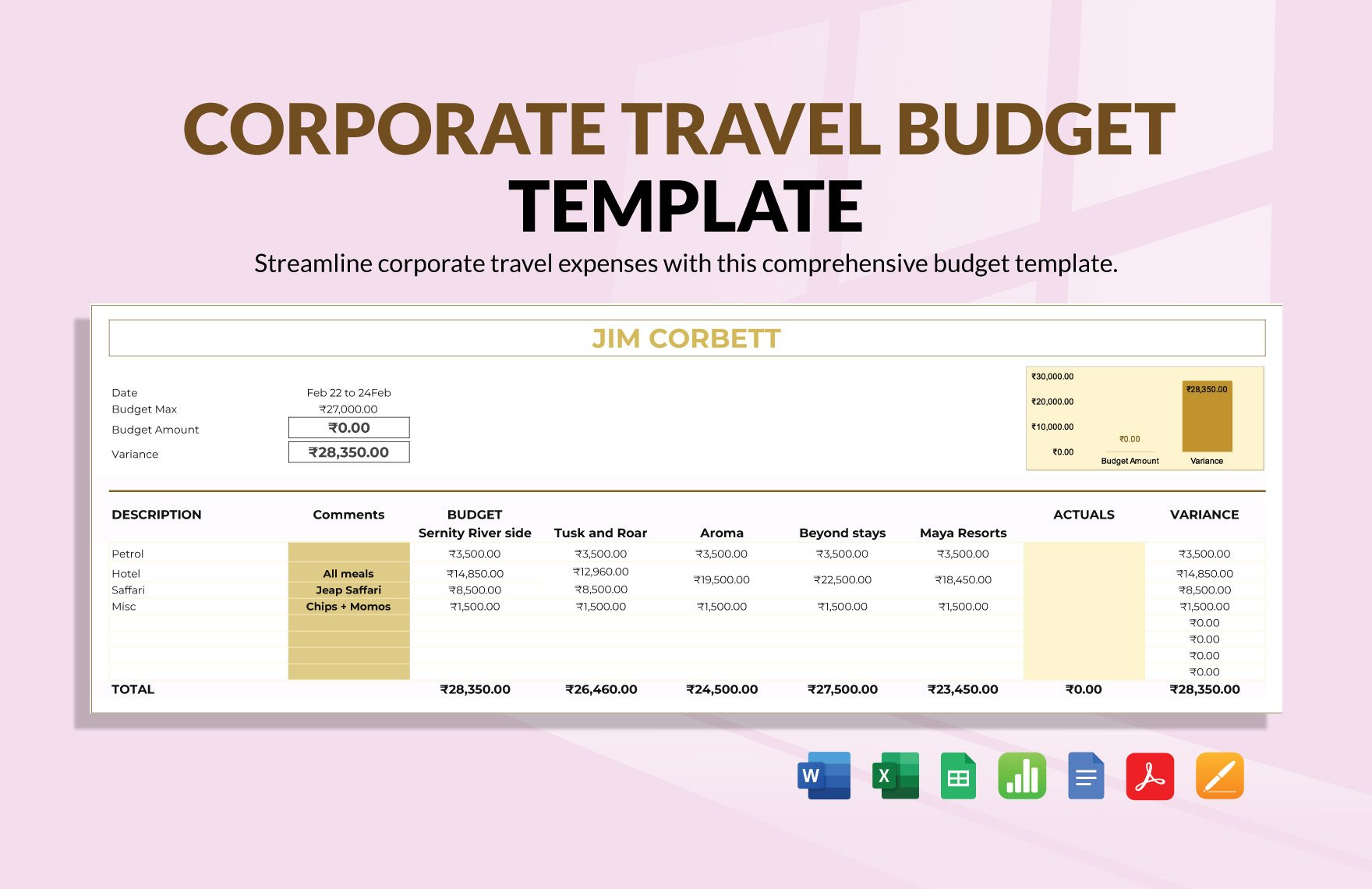

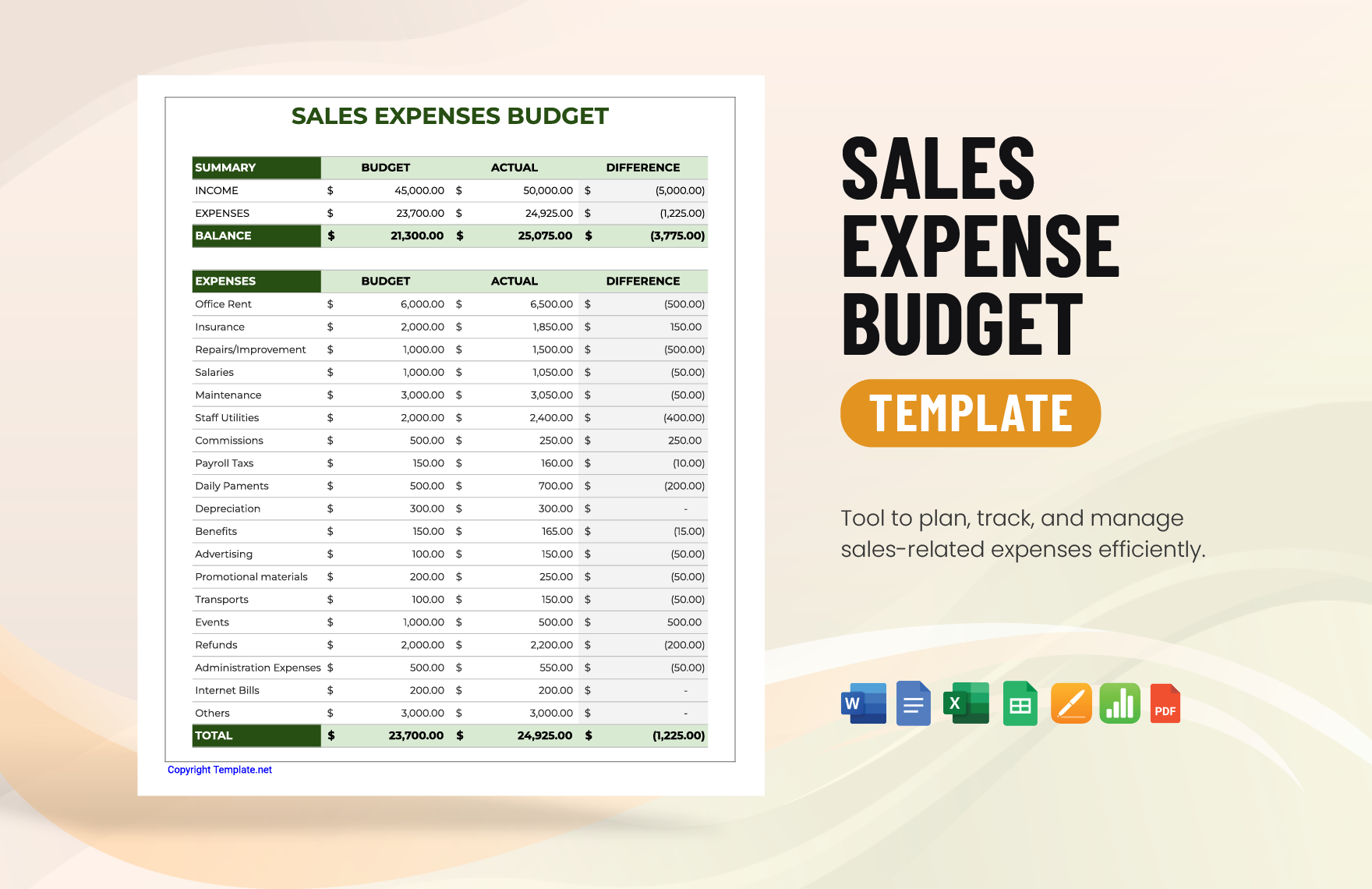

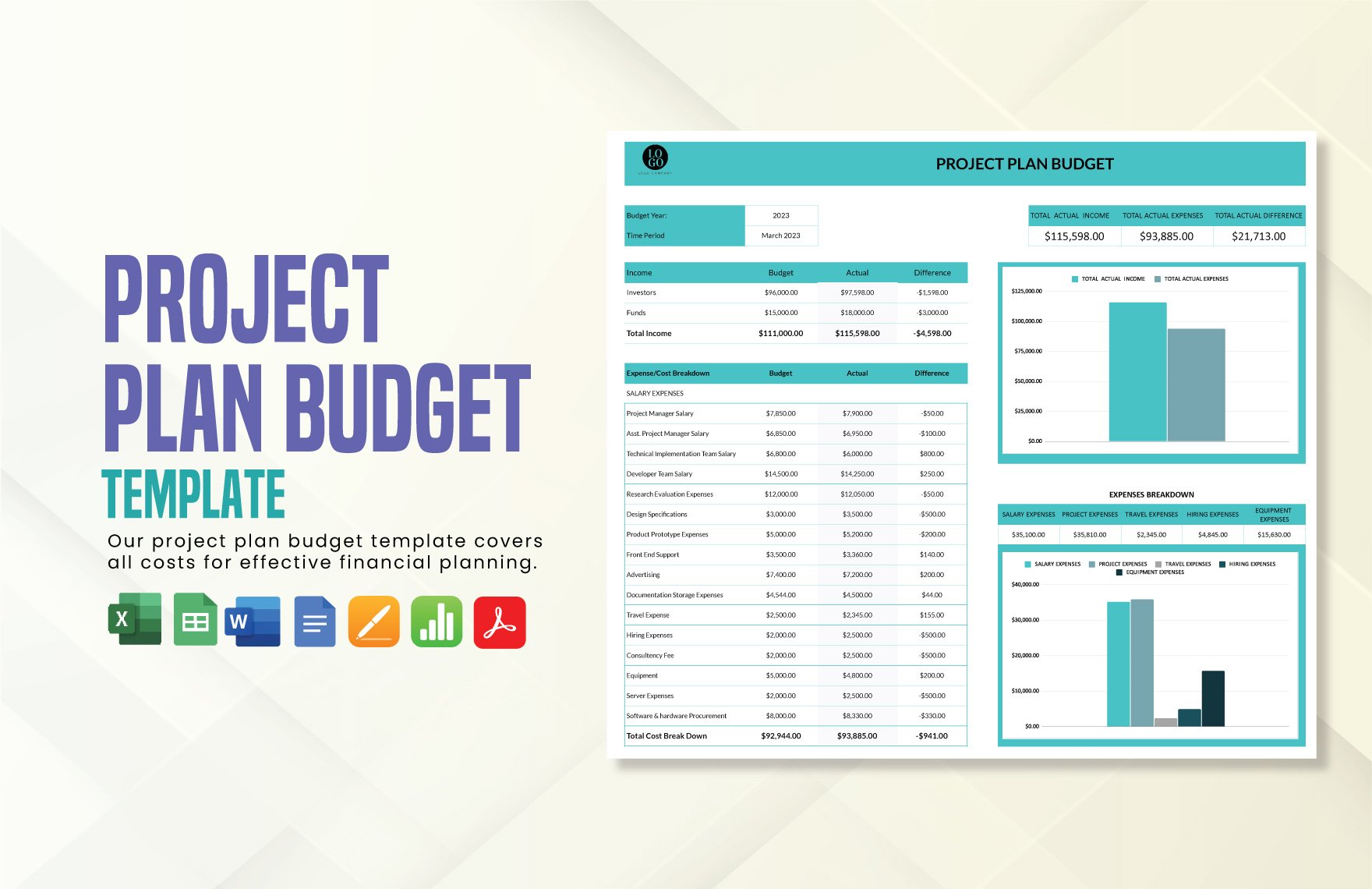

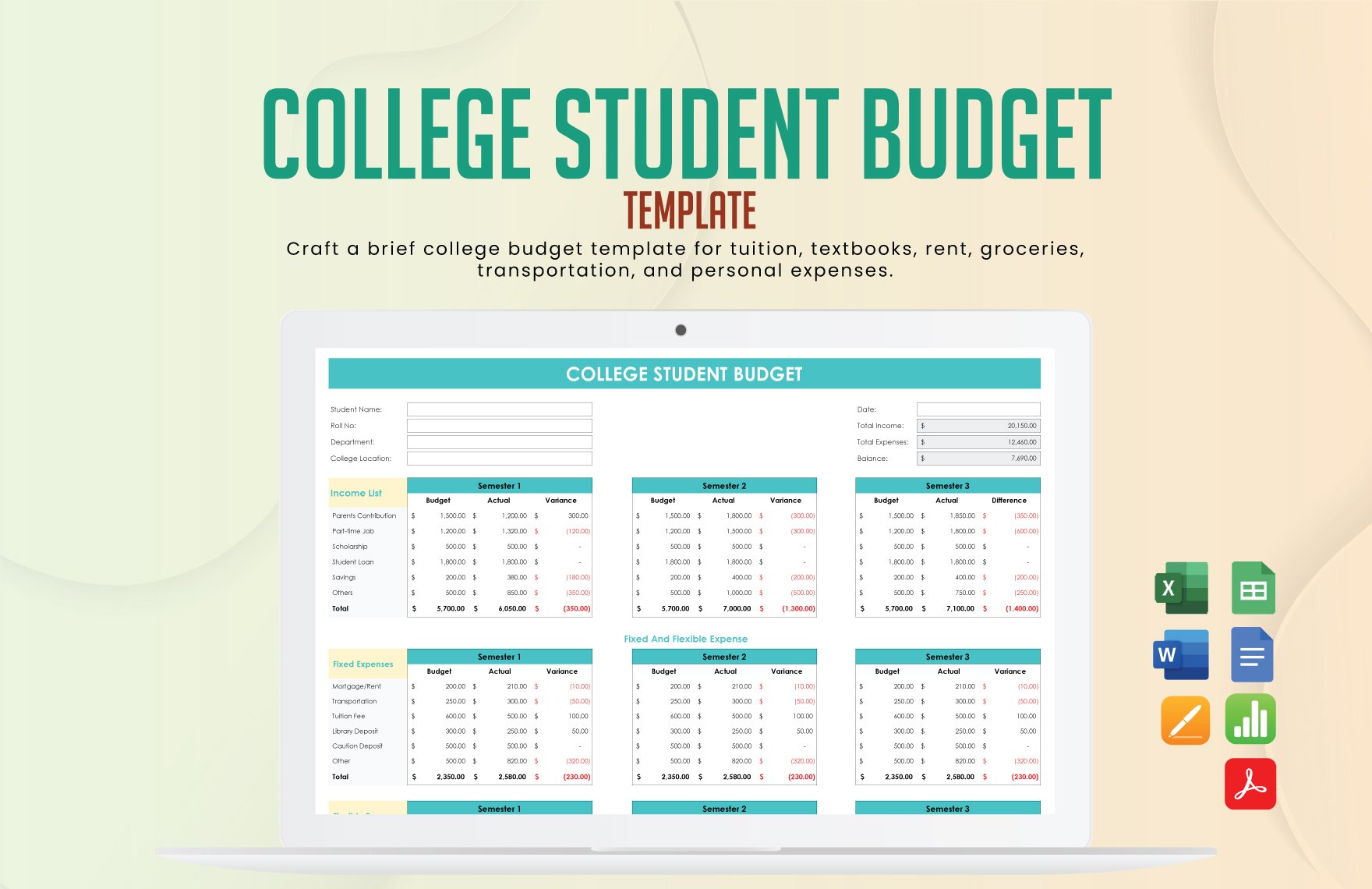

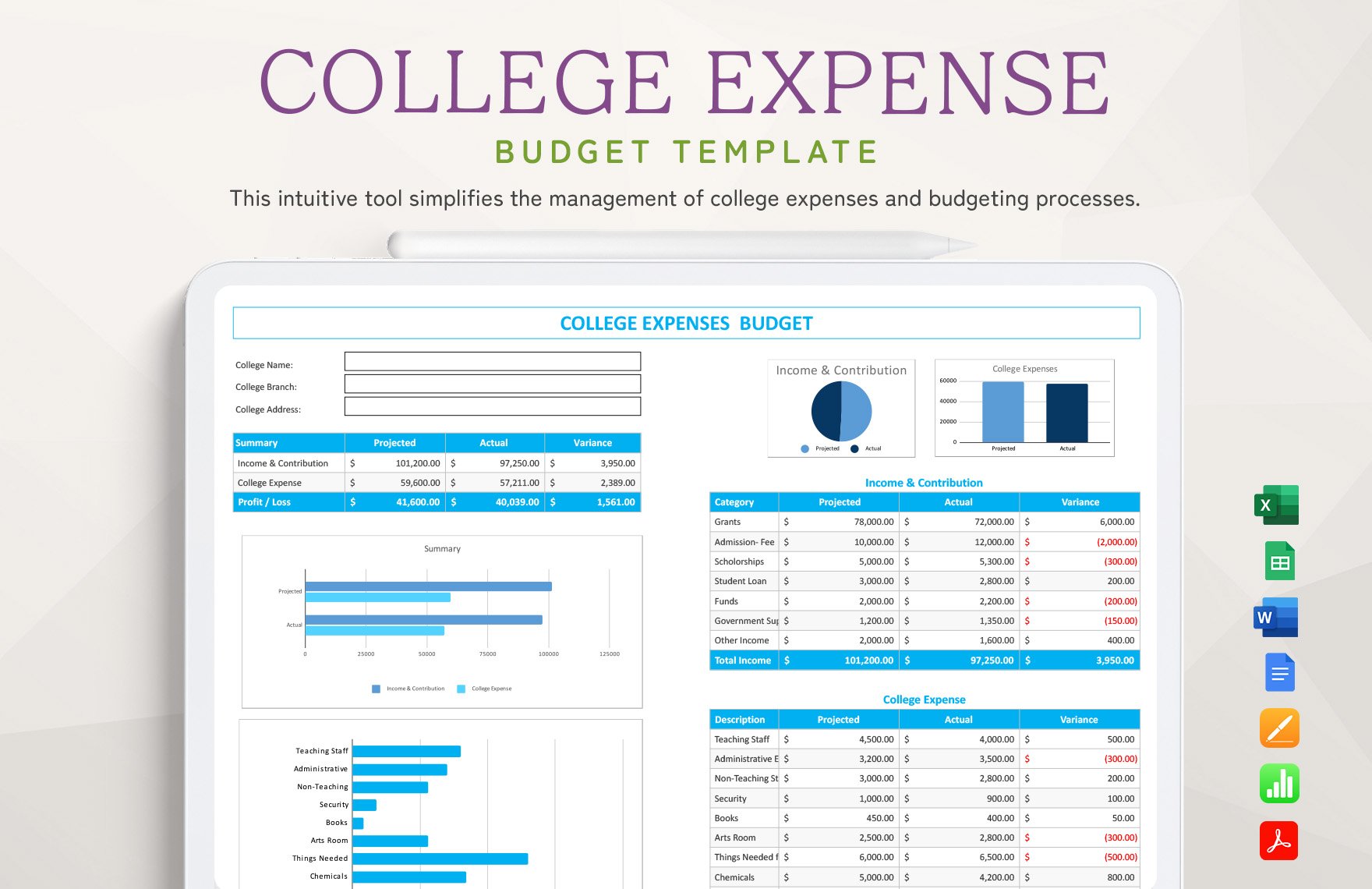

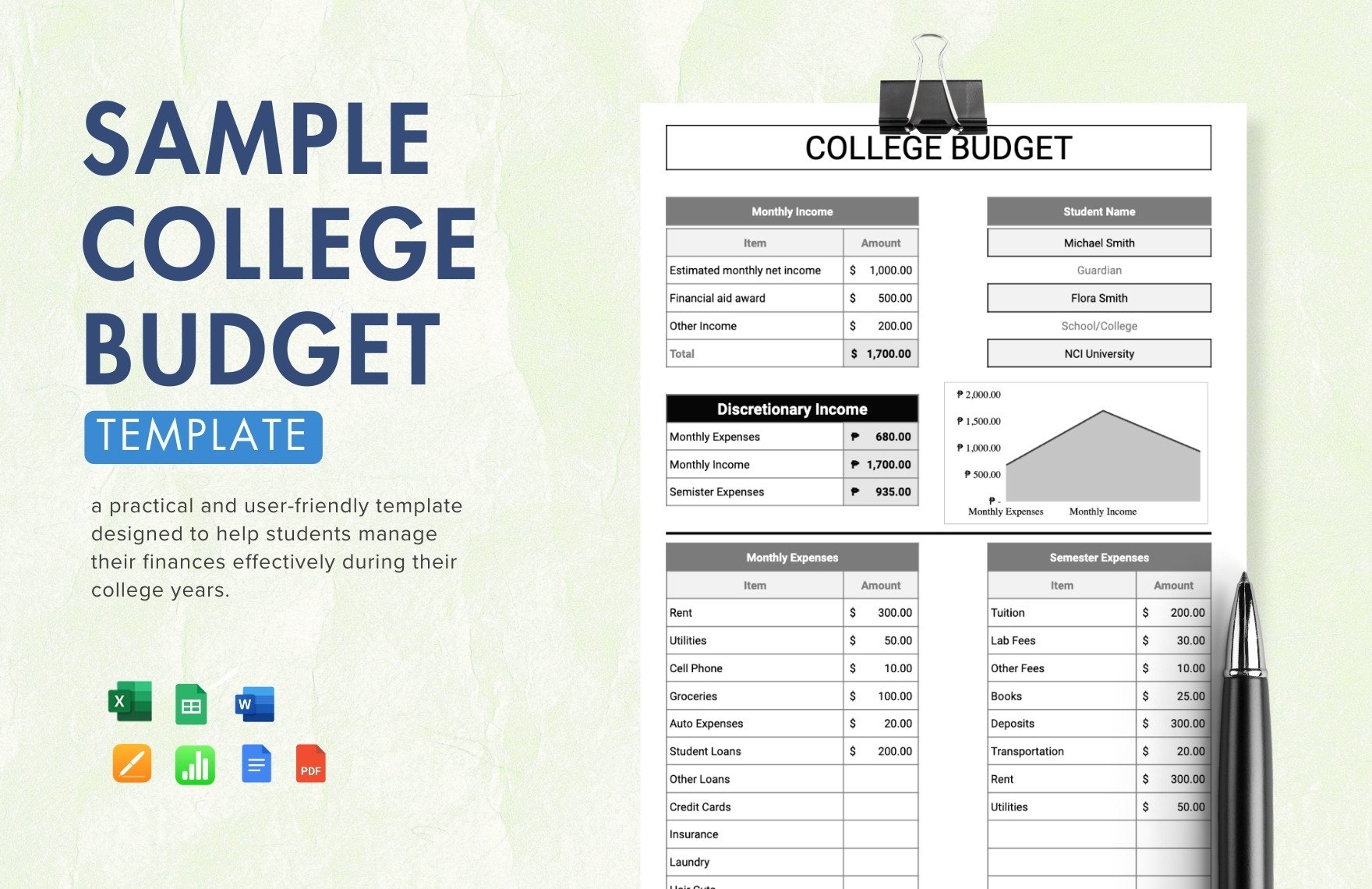

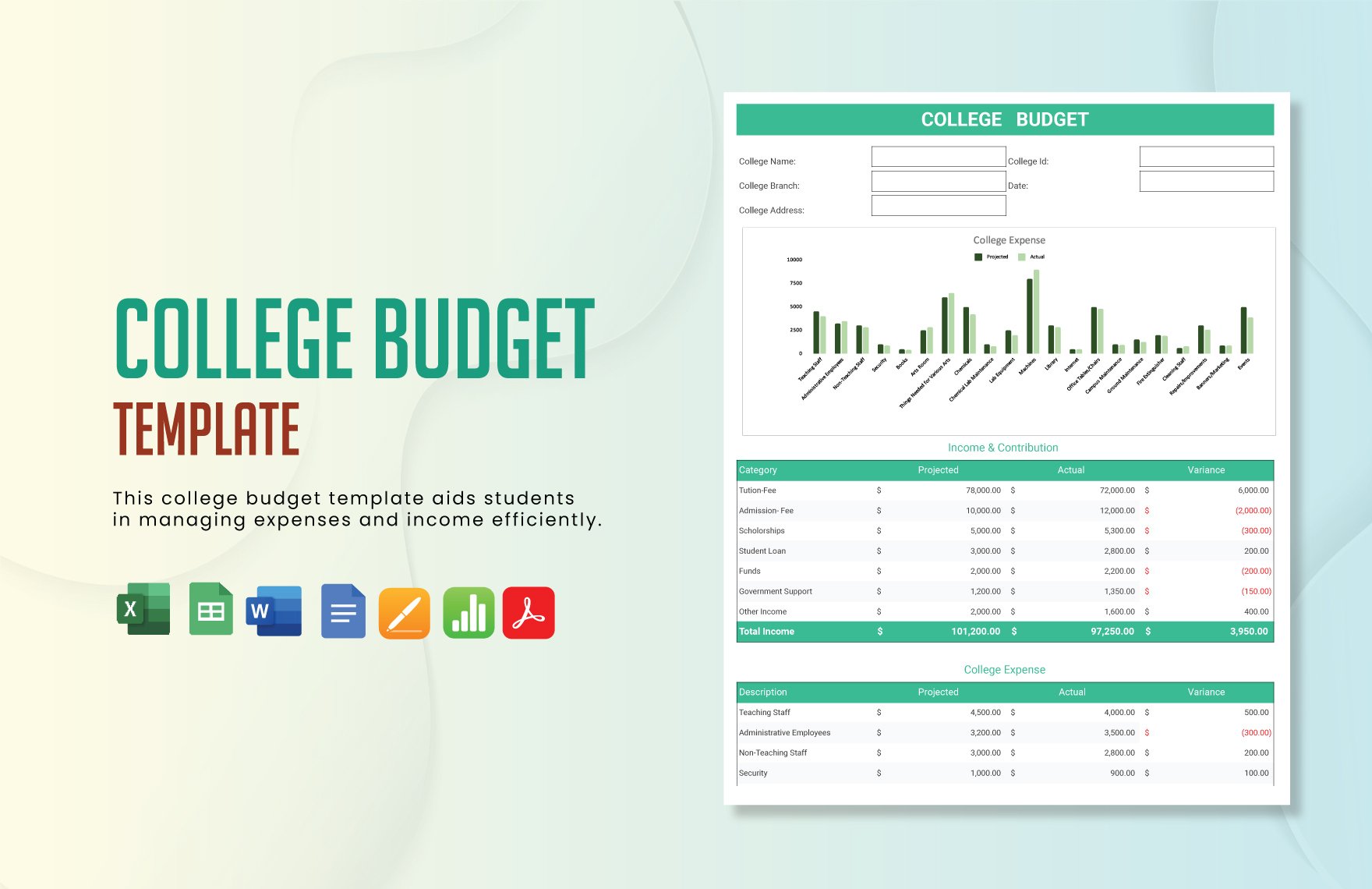

Next is for you to create a table where you can place all your expenses. To do this, you can either start from scratch or look for a pre-made budget template. Our website has a variety of Ready-Made Personal Budget Templates that you can use. Check to see if there are any that meet your personal preferences.

4. Supply the Details

Now, continue by inputting your monthly or annual income. If you have any other sources of income other than what you receive from your job, then be sure to include those as well. Then, place all of your expenses into the table. Make sure your document labels each item appropriately as either an income or expense. Now, calculate the result to see if you go over or under your budget.

5. Check and Implement

Lastly, check to see that you've gotten everything right. If you're supporting a family, then ask them to get involved as they may bring up expenses or sources of income that you never knew about. If all is well and good, then go ahead and print the document to commence your personal budget plan.