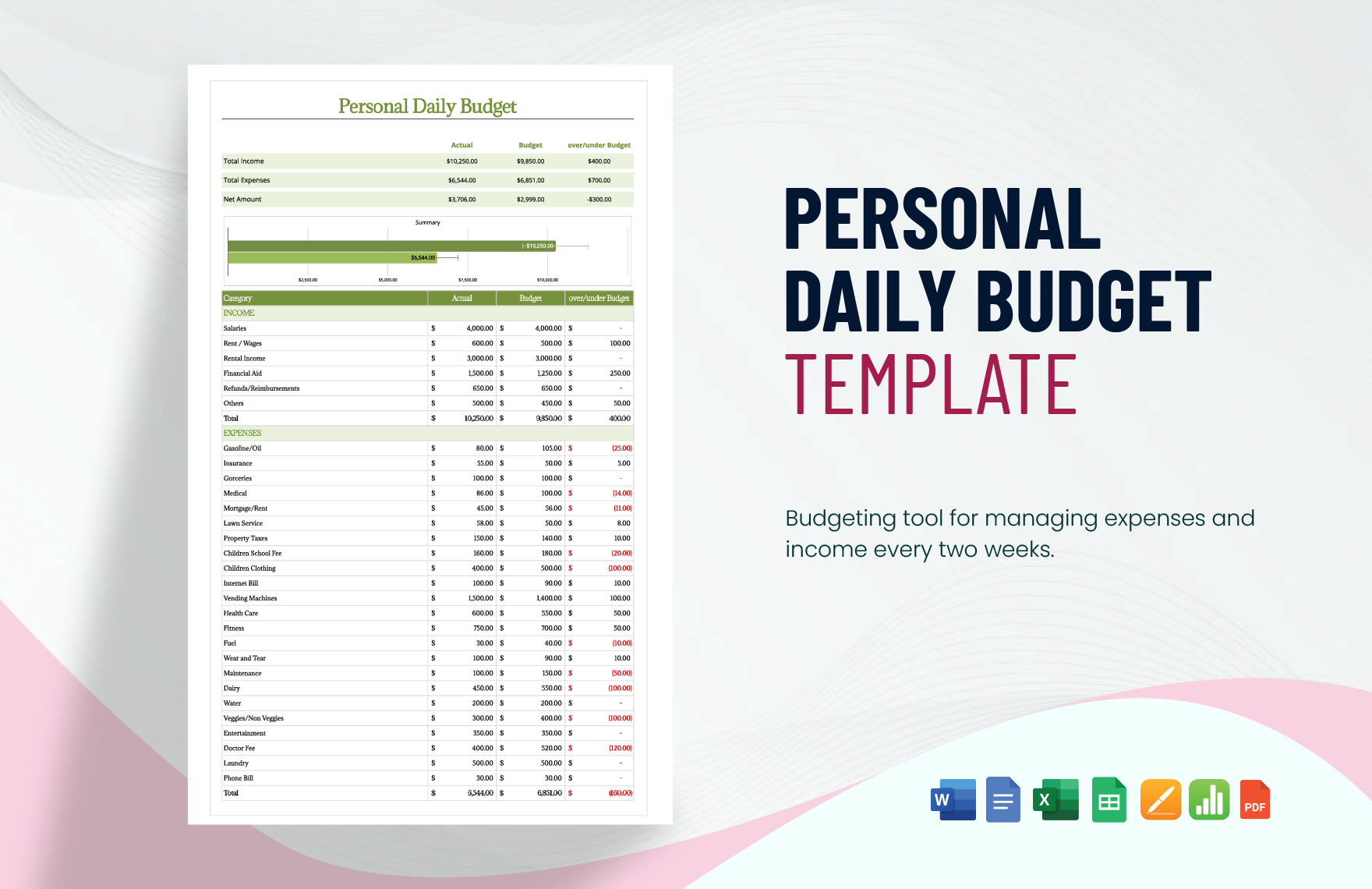

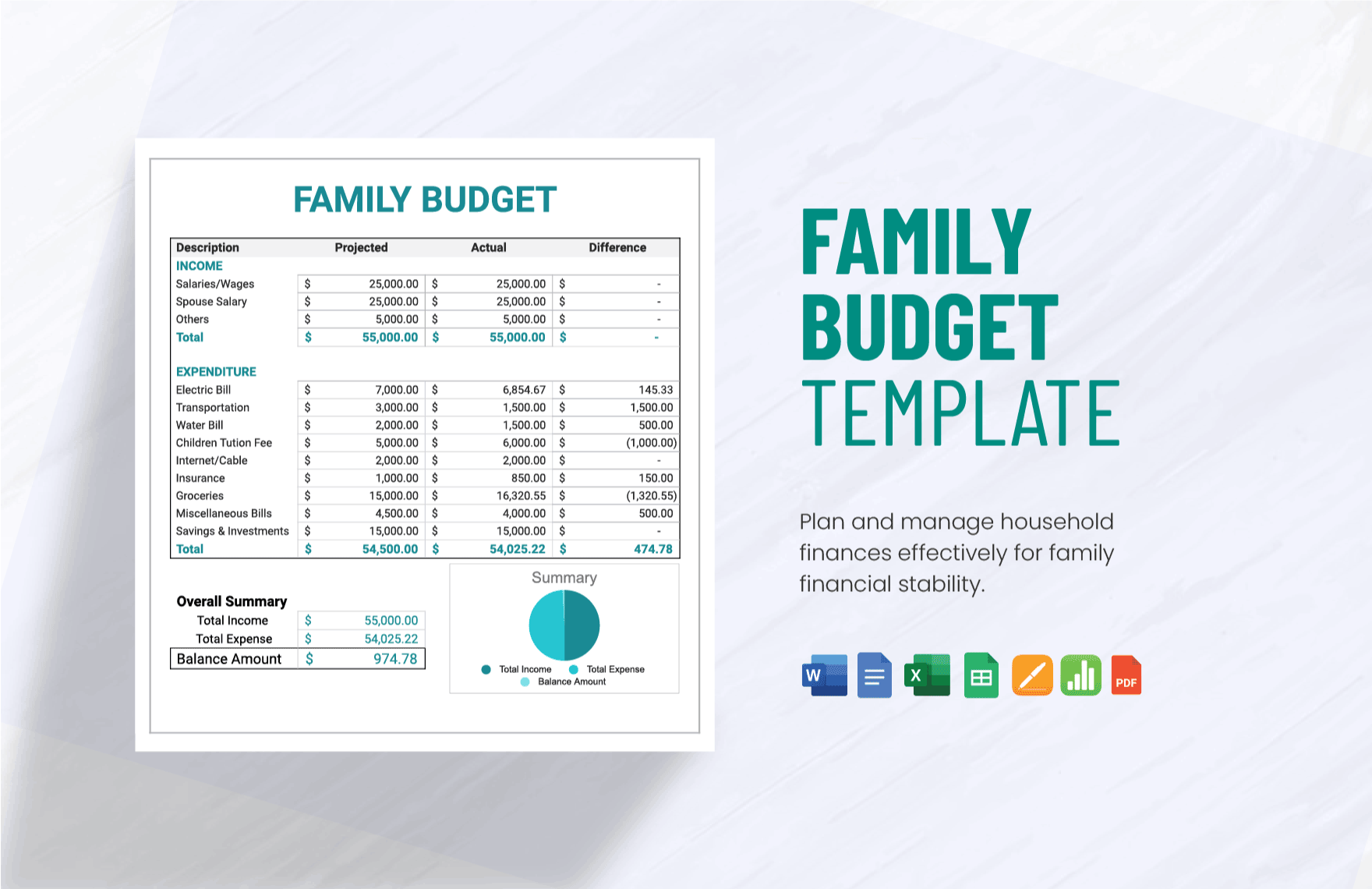

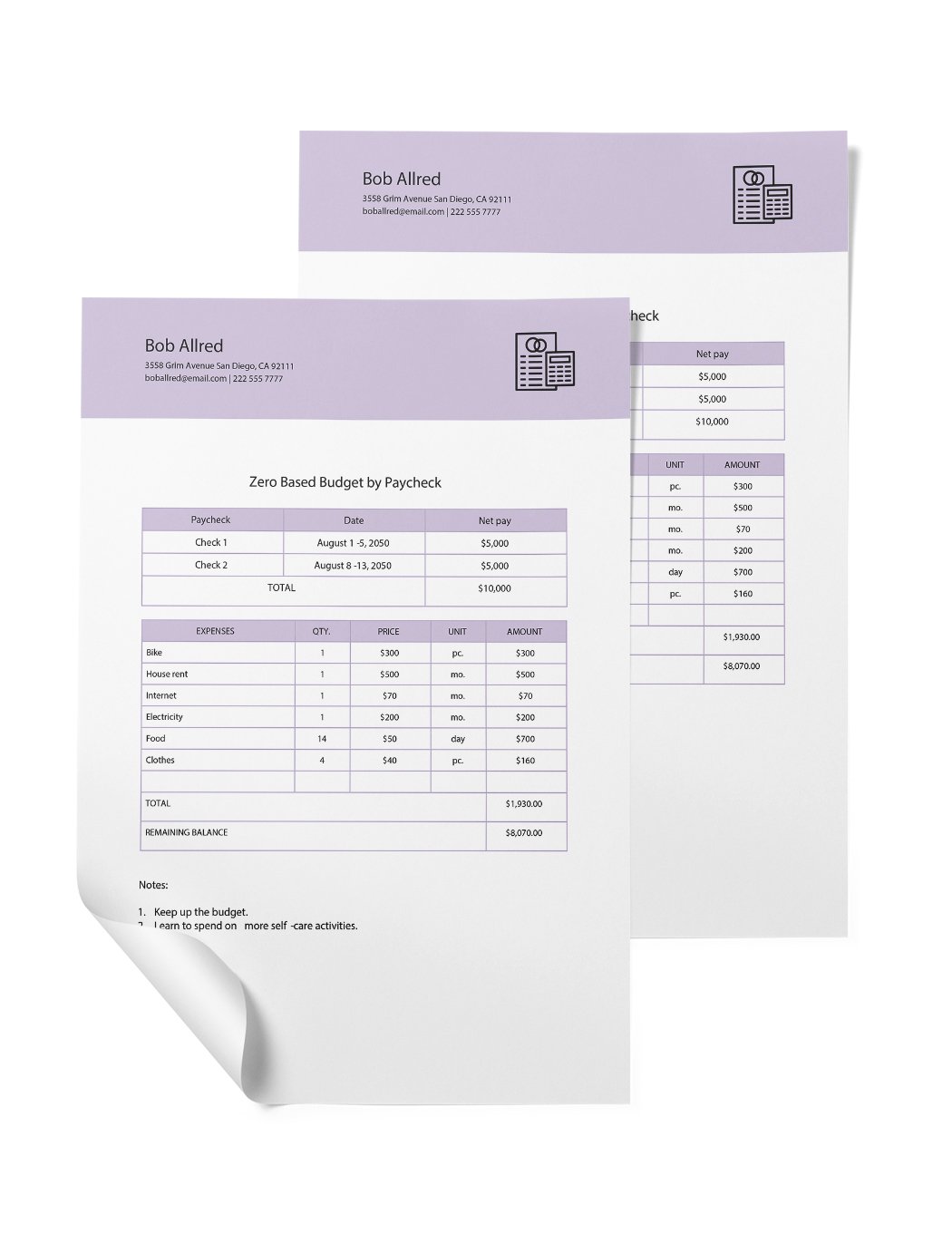

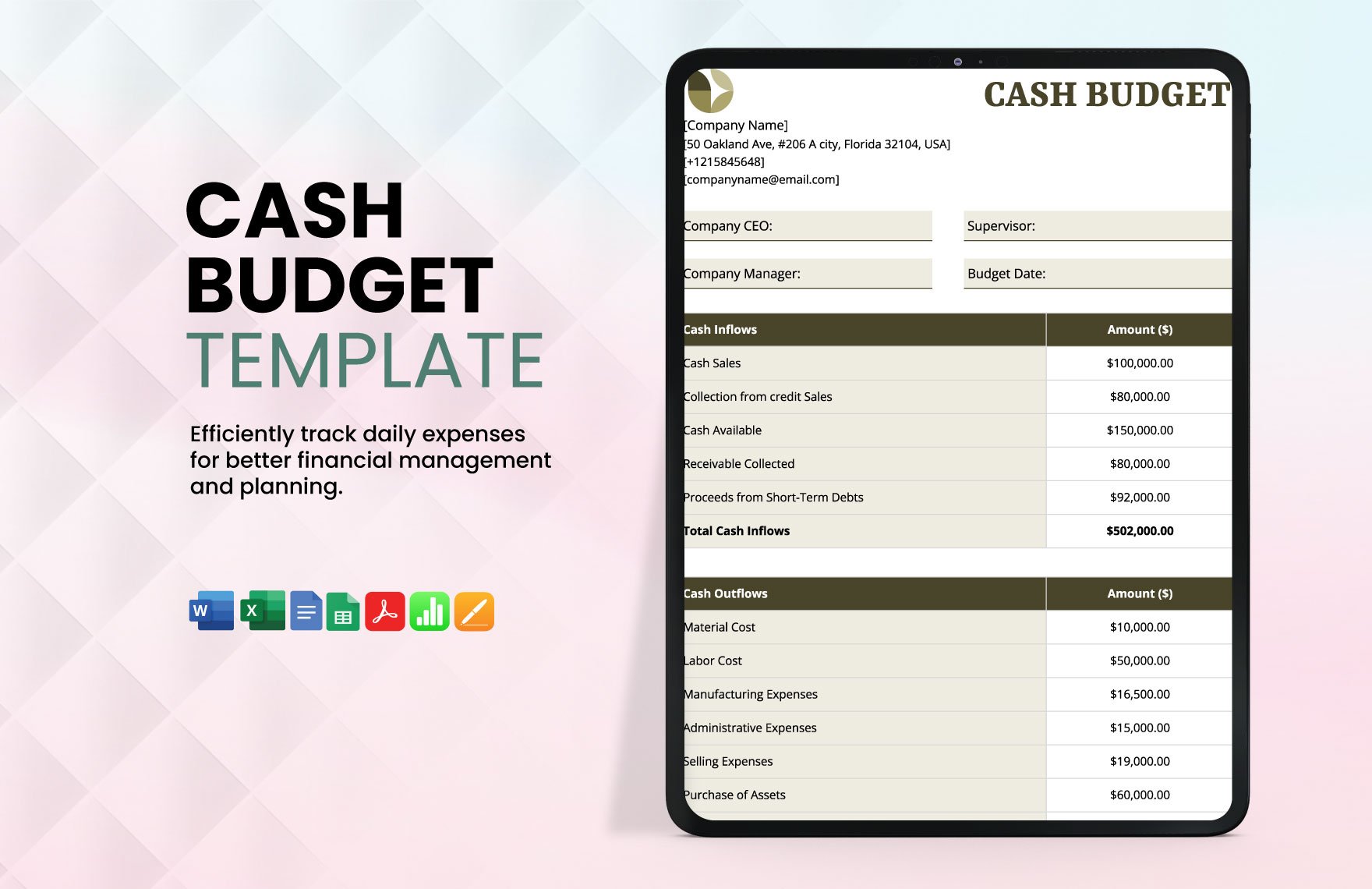

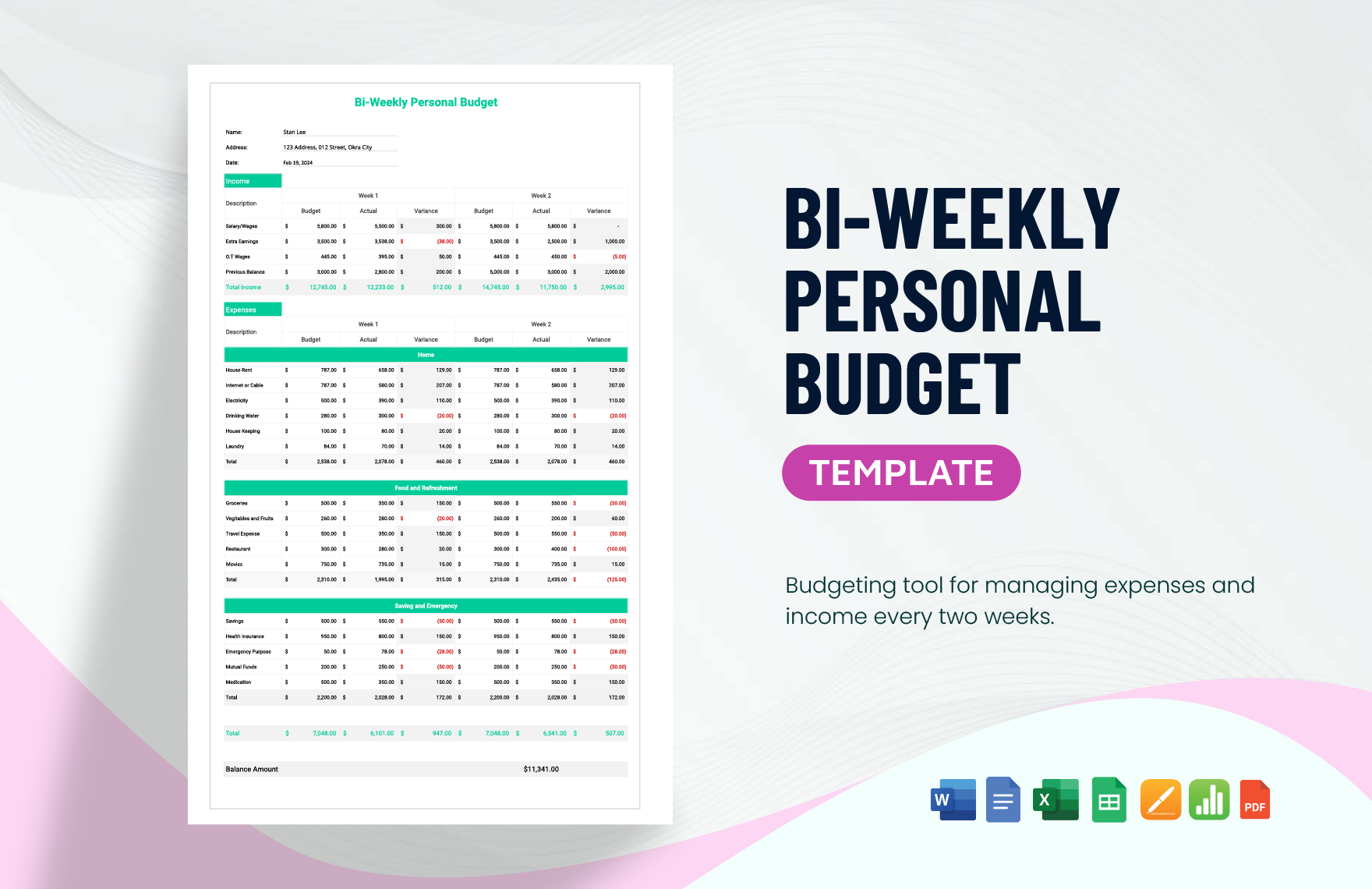

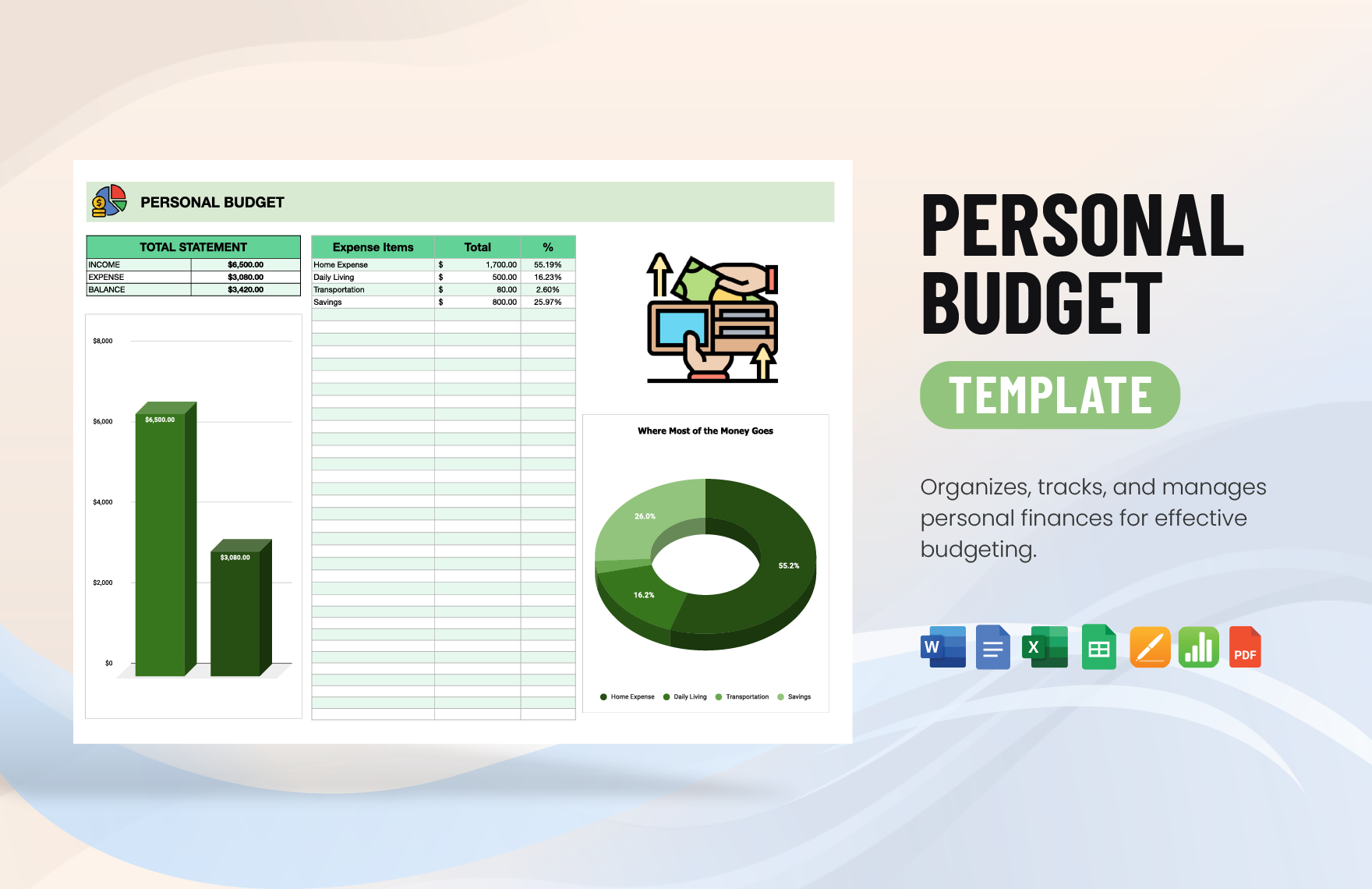

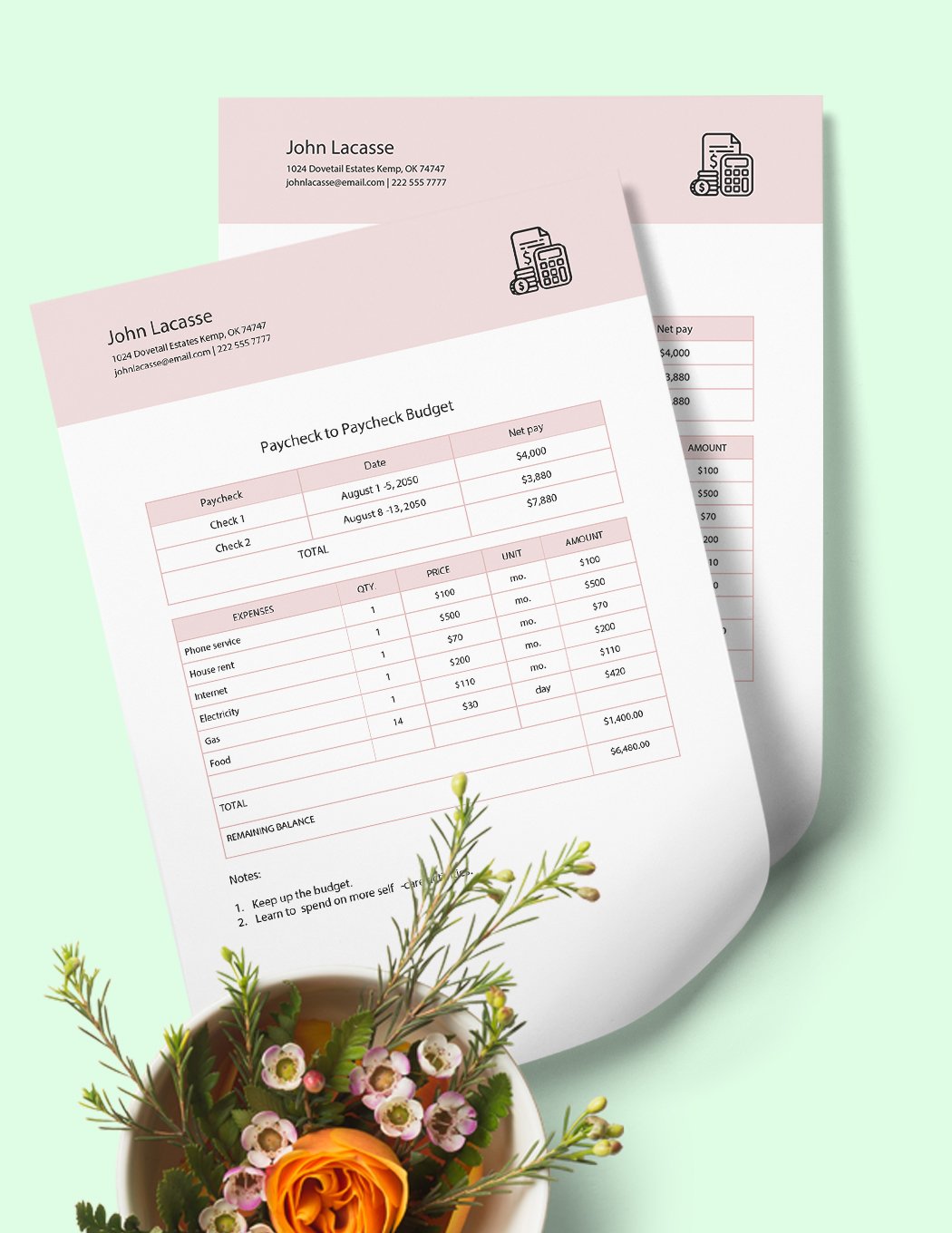

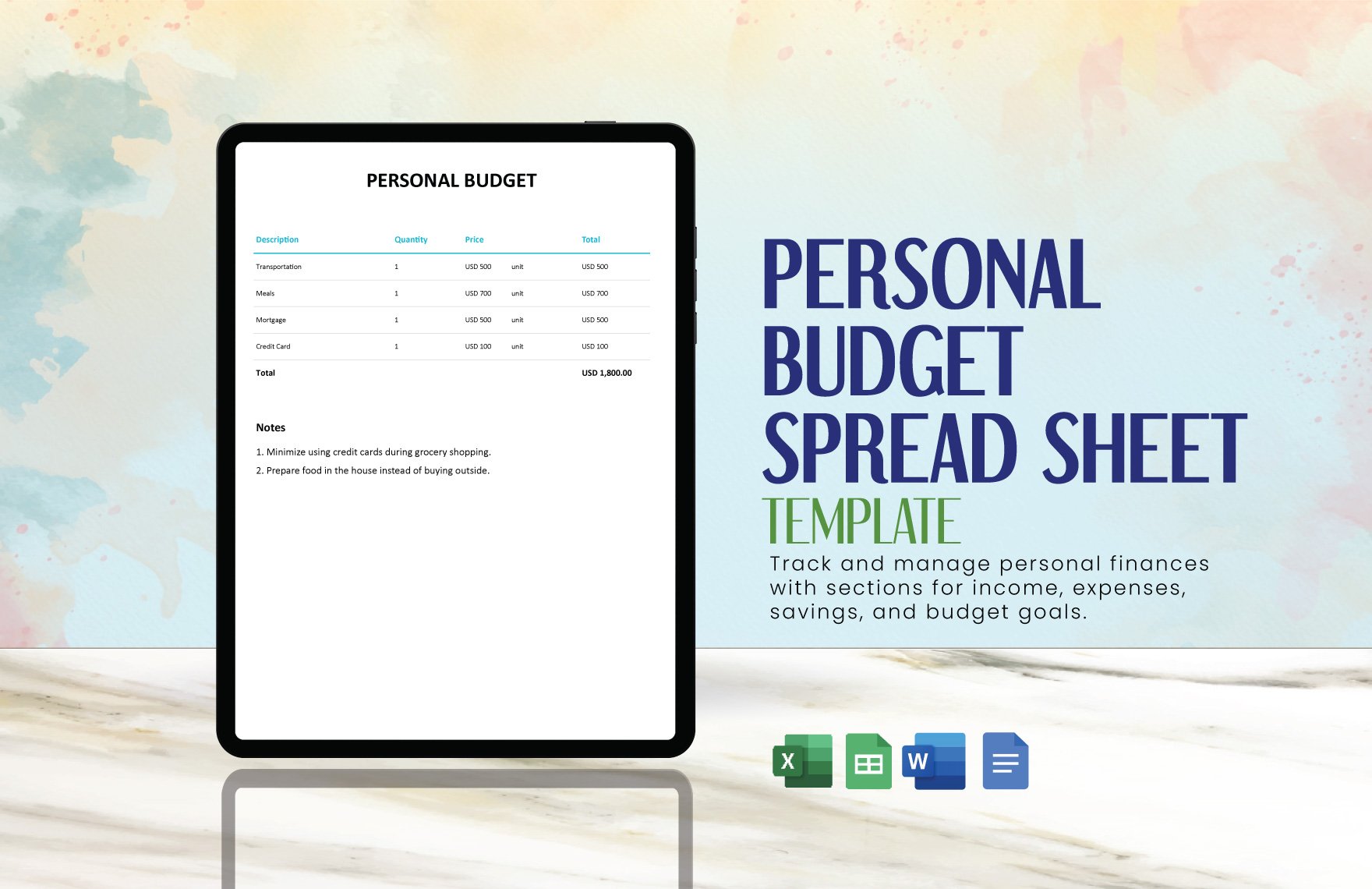

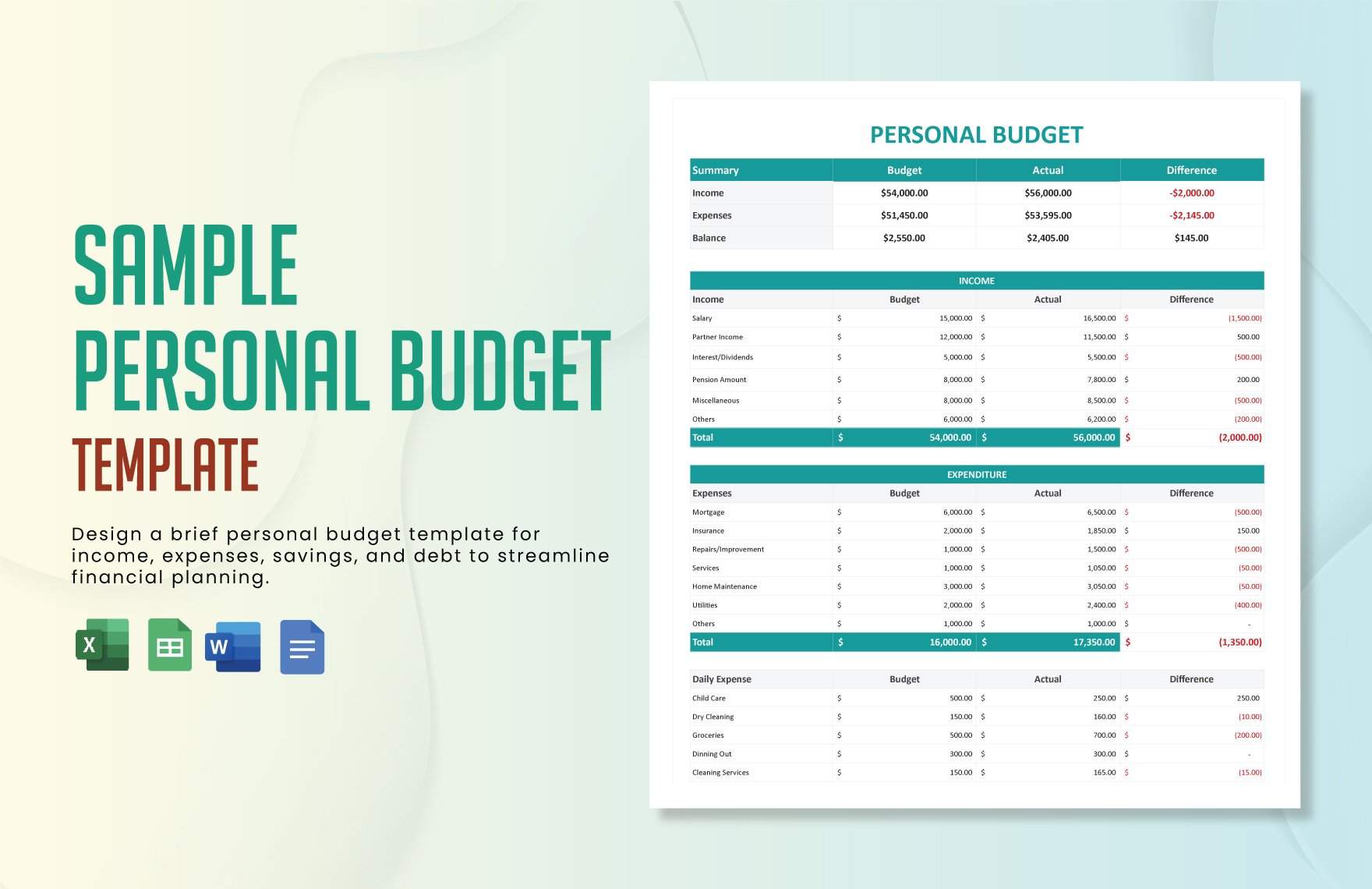

Either you're single, married, or have a family of your own, know that it's essential to implement proper budgeting. Applying it will help you eradicate unnecessary expenses and focus on spending your hard-earned money more responsibly. It might be hard at first, but it allows you to be wiser in terms of distinguishing your needs and wants. We can help you construct your budget plans by using our pre-made and downloadable Personal Budget Templates in Word. Since it was easy to edit, you can also customize it 100%. Our templates are printable and available in A4 & US. Download our templates today, which is also available in other file formats.

How to Create Personal Budget Templates in Word

CNBC stated that around 75% of U.S adults have responded that they are "living comfortably" and are doing "okay," according to a yearly Federal Reserve study on household well-being. It shows that there's a high number of American adults who are feeling secured in terms of the financial aspect. Regardless of how much money you have earned monthly or yearly, proper budget planning helps you avoid unnecessary expenses. To learn more about this method, we can help you in creating Personal Budget Templates using Word file version.

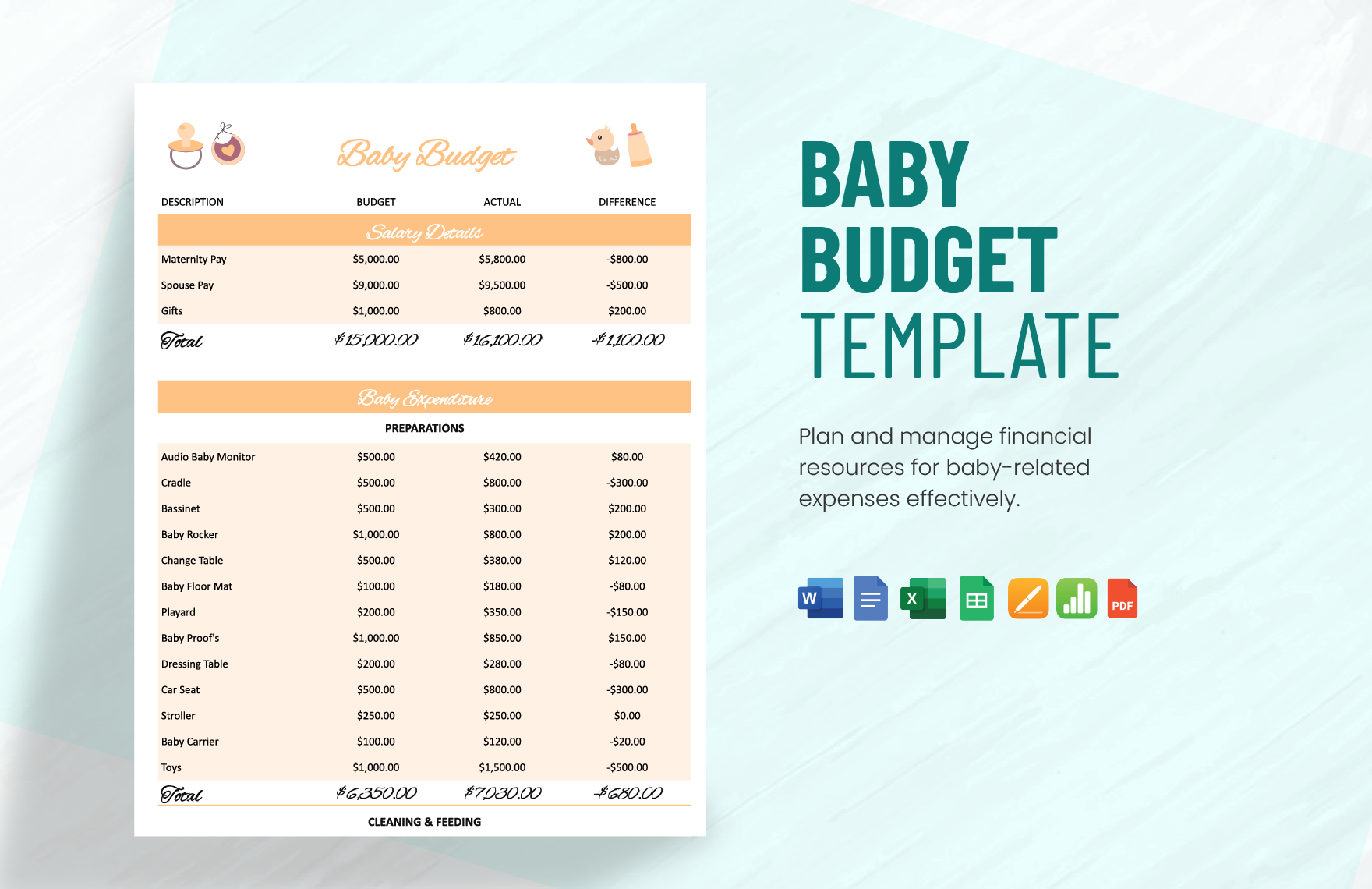

1. Know the Number of People Involved

When opting to make your budget planning, it's wise to determine how many people are involved. Know if it's suitable for a single person, 2 person, college student, or family cash budget. That way, you can control each expense accurately.

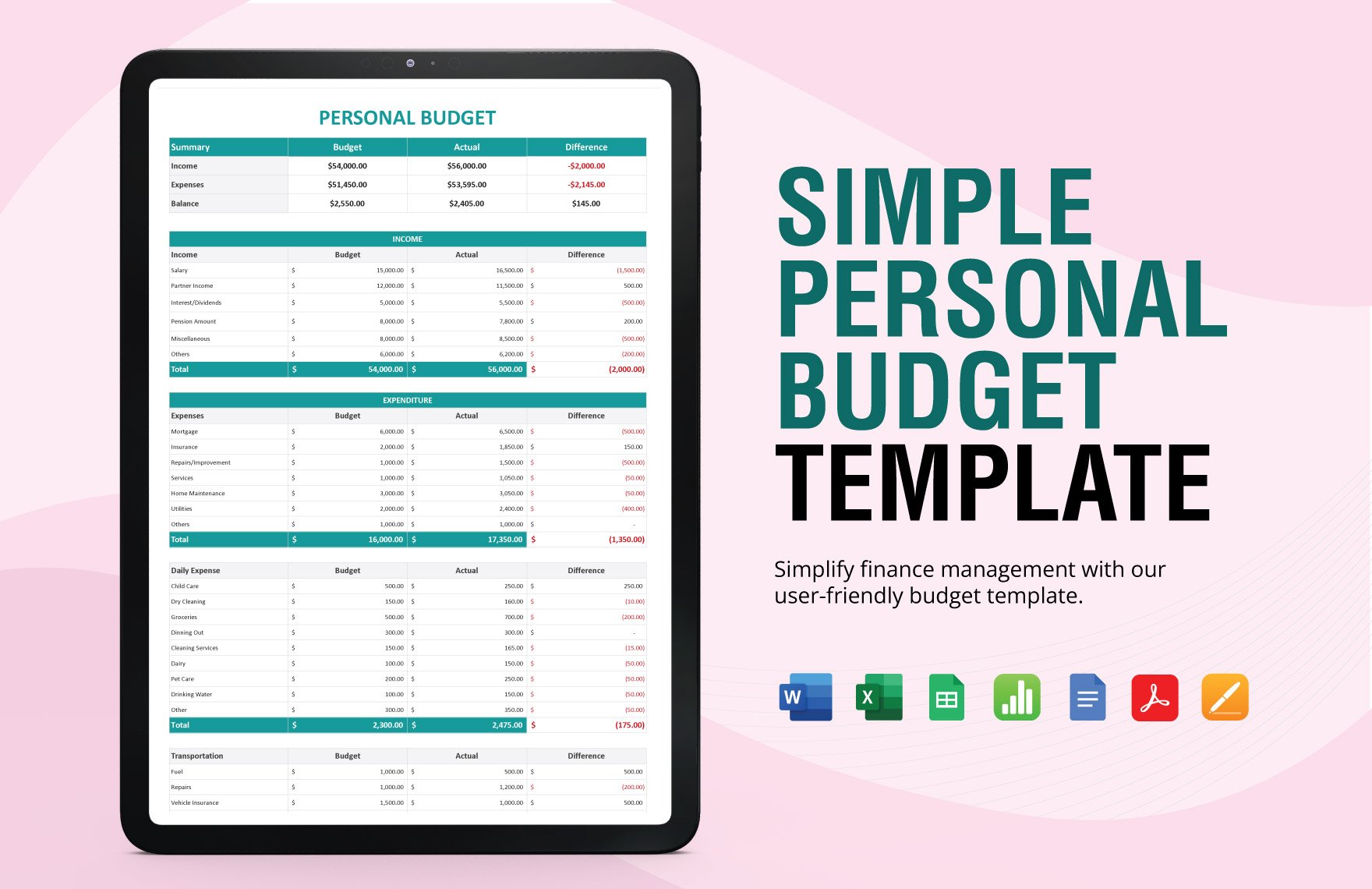

2. Specify the Exact Amount of Income

If you're a married person, you can merge both of you and your partner's income to specify the exact amount monthly. The focus of your budget must able to reach the goals and keep you from having any debts. By then, you will be in full control of managing and spending money wisely.

3. Breakdown Necessary Expenses

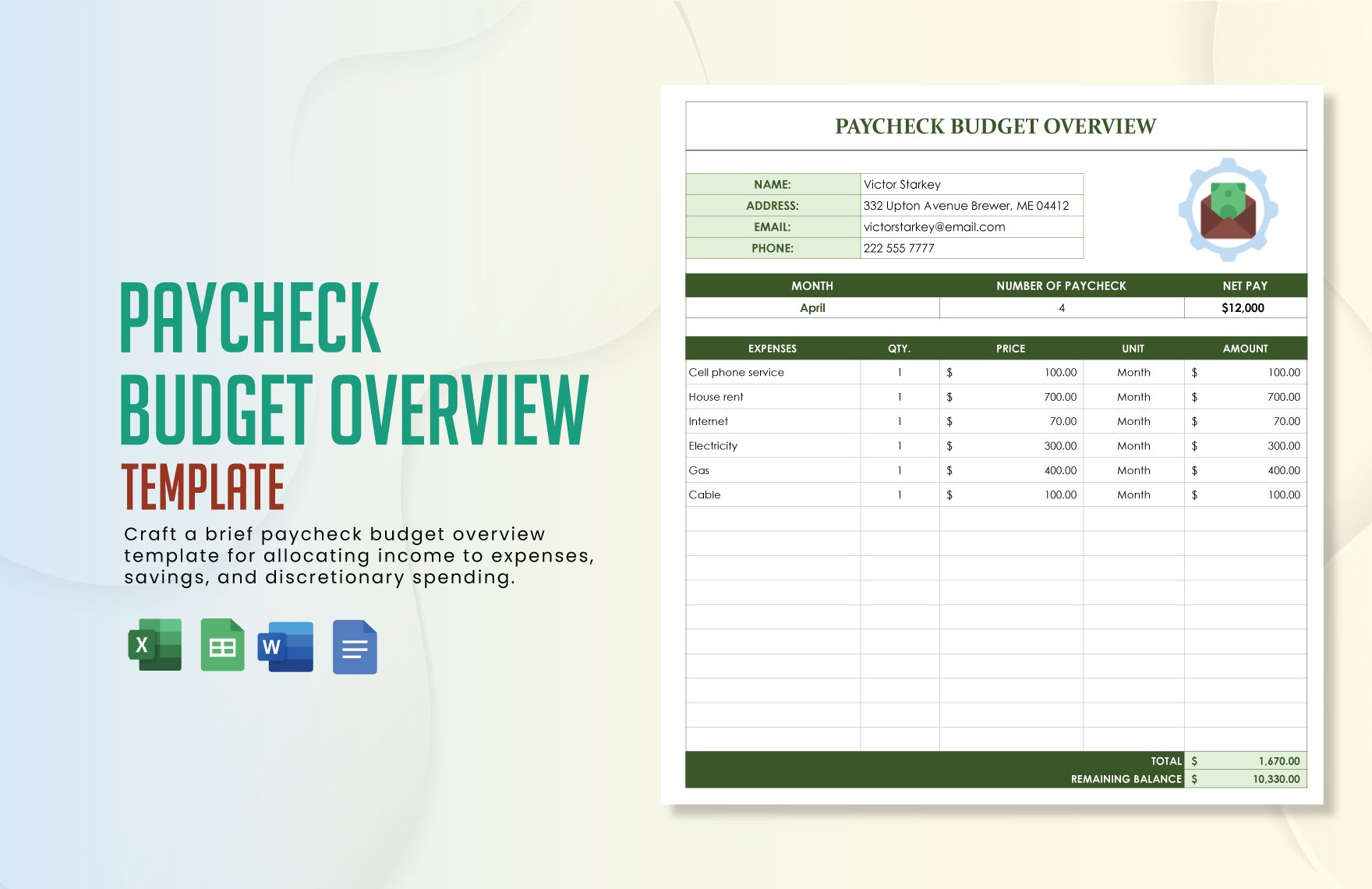

Tend to breakdown all your necessary expenses to keep track of everything all at once. You can have a budget planner, a simple budget worksheet, or anything that works for you. It will help you identify those things you must able to prioritize all the time.

4. Calculate the Total Expenditures

After inputting all those essential details, calculate the sum of your overall expenses within a month. It would be easier to determine the remaining amount you have and spend it on other things you were planning to get. Doing so will not lead you to any problems in terms of wanting to buy any stuff you like.

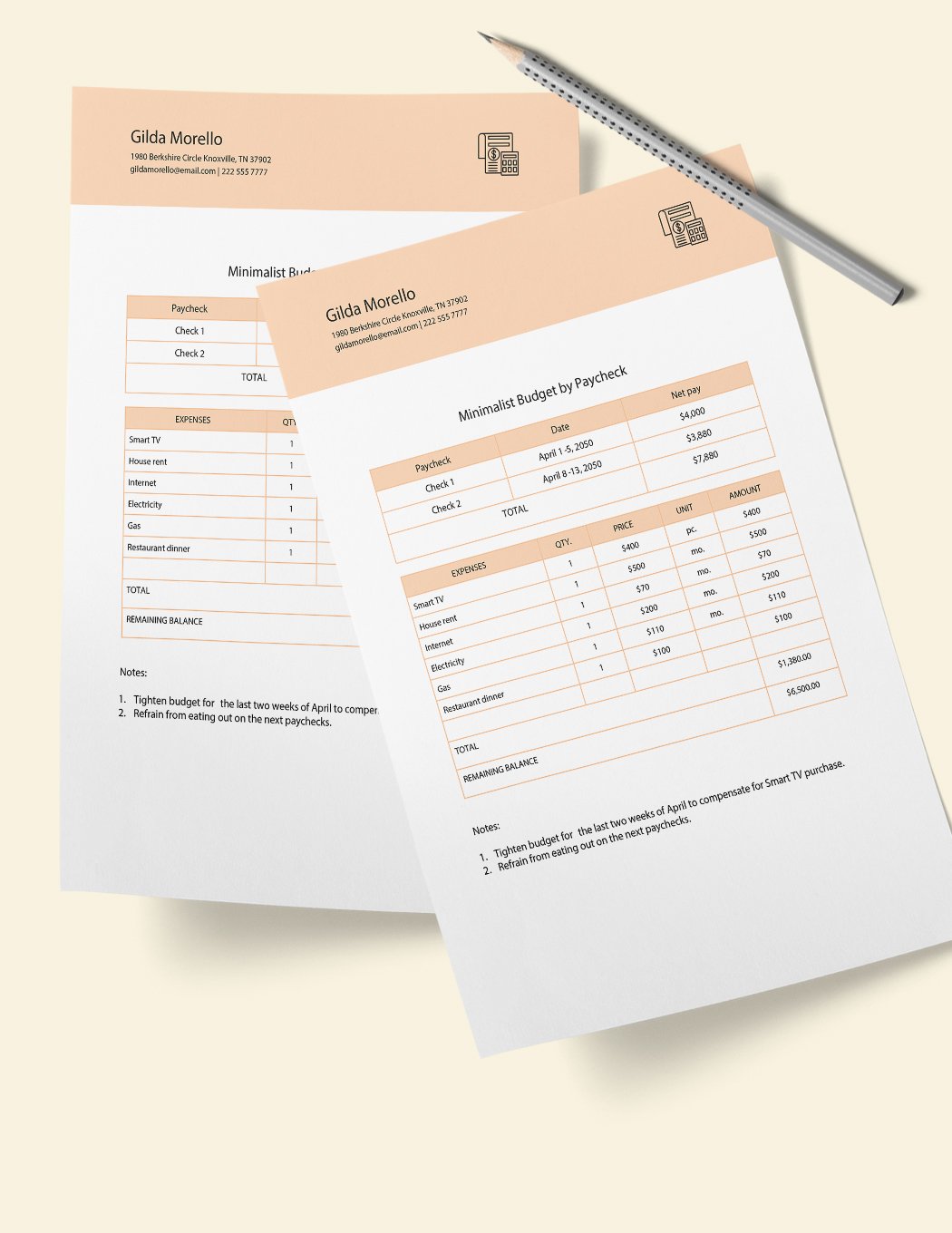

5. Monitor Your Budget

Keep your stance when monitoring your simple budget, especially if there are any changes to the expenses. A good sense of proper budgeting reminds you of the things worth prioritizing and be in full control. It's how the way you manage the money, and for you not to overspend it.