Make Your Financial Planning Goals to Life with Annual Budget Plan Templates from Template.net

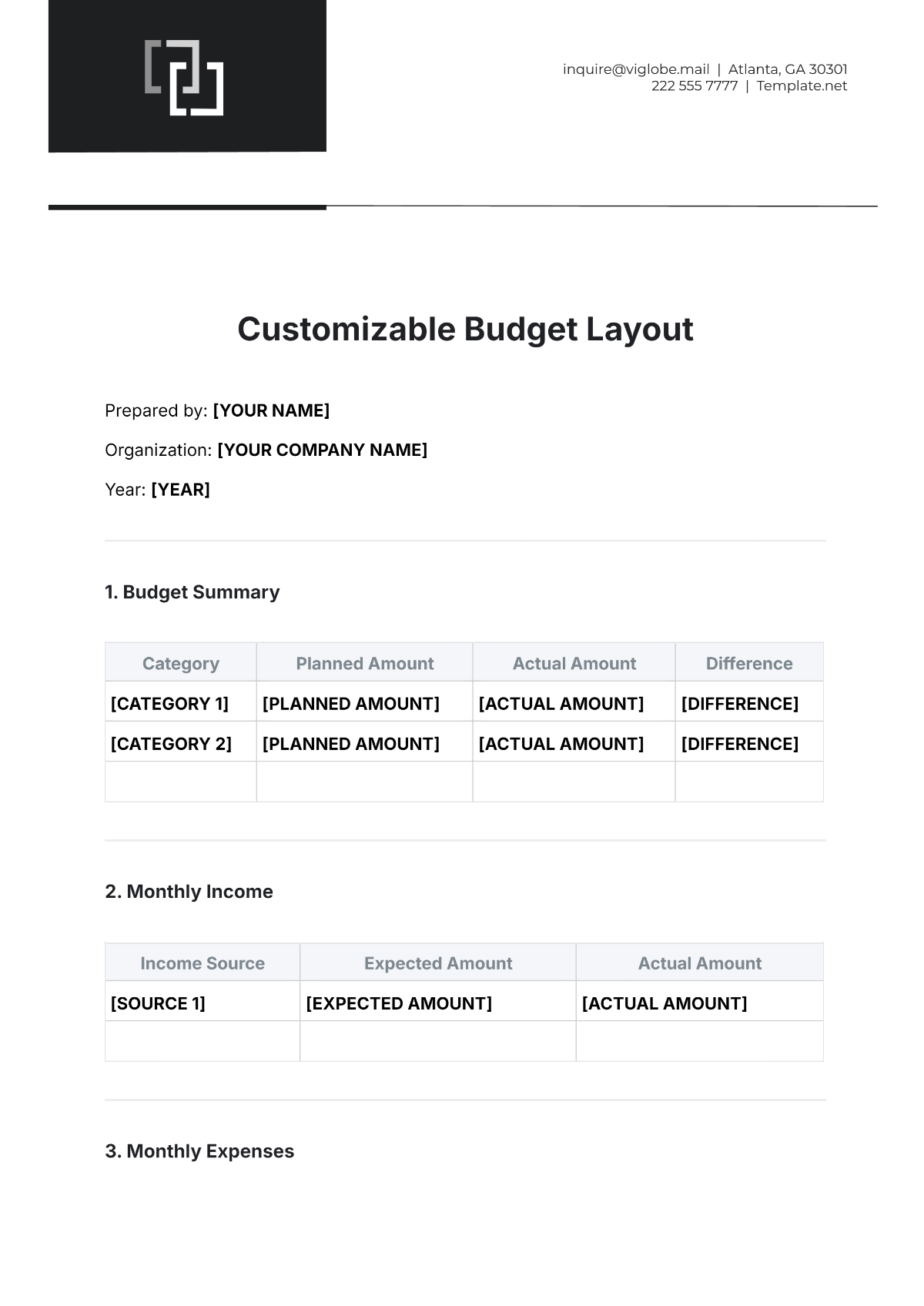

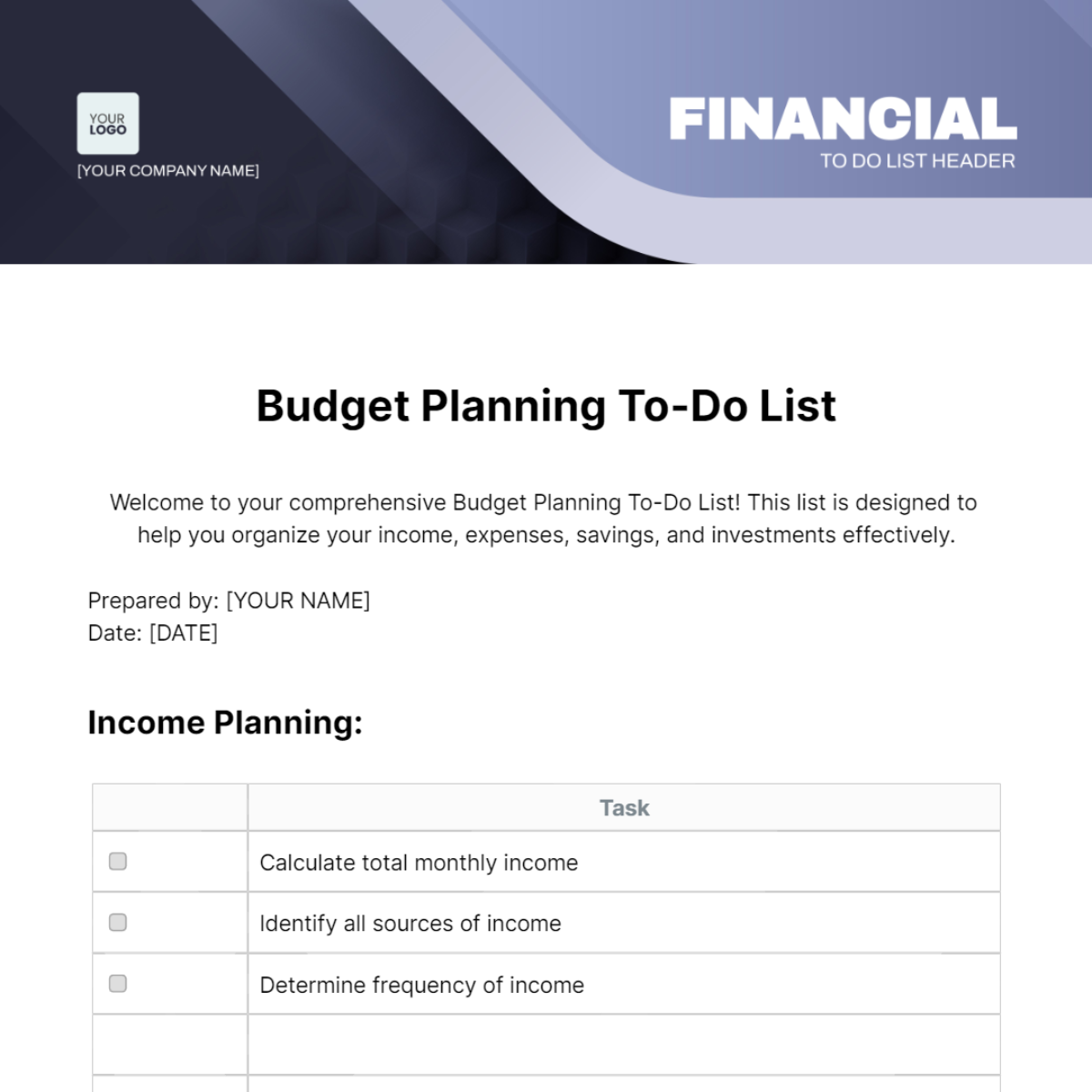

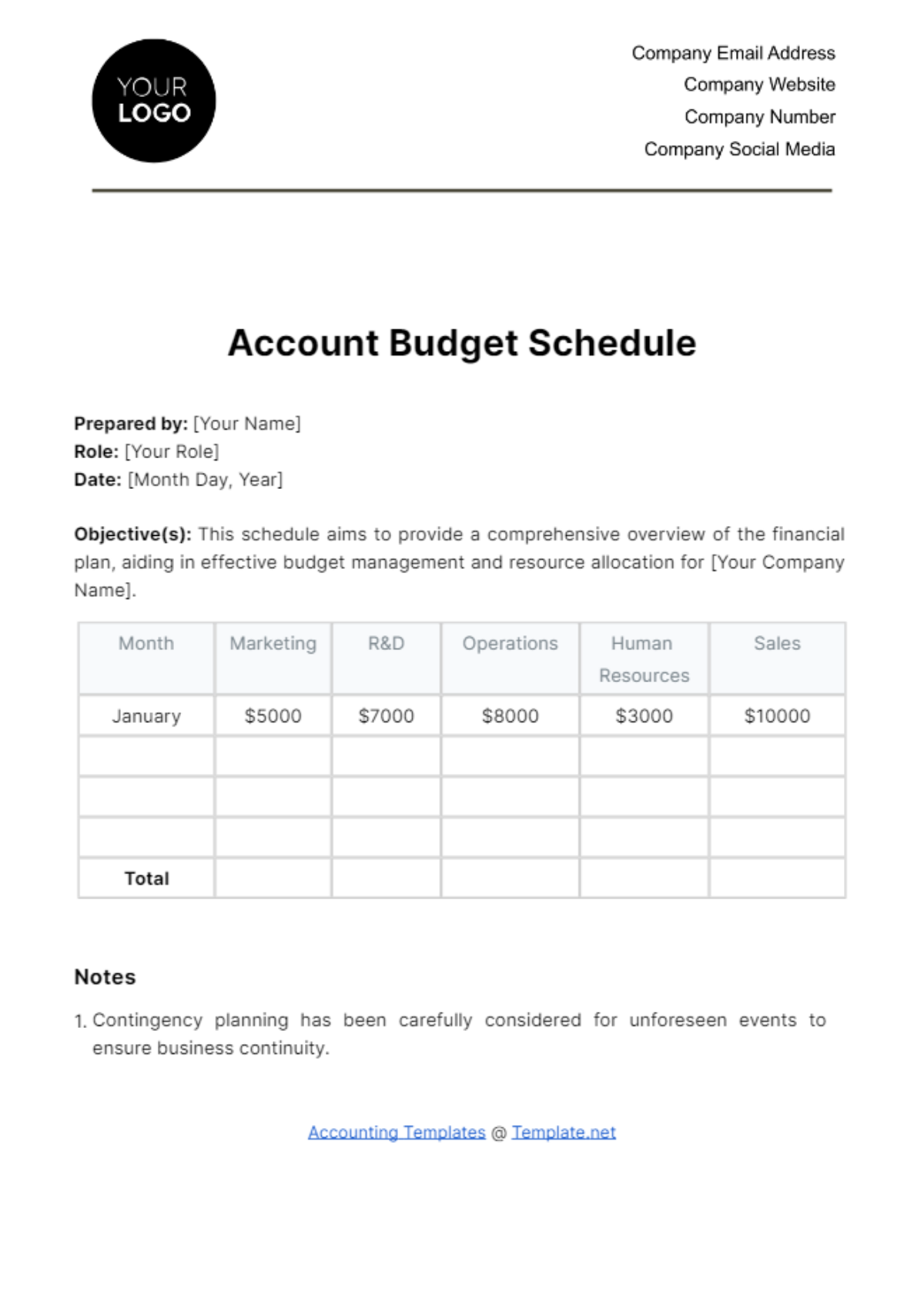

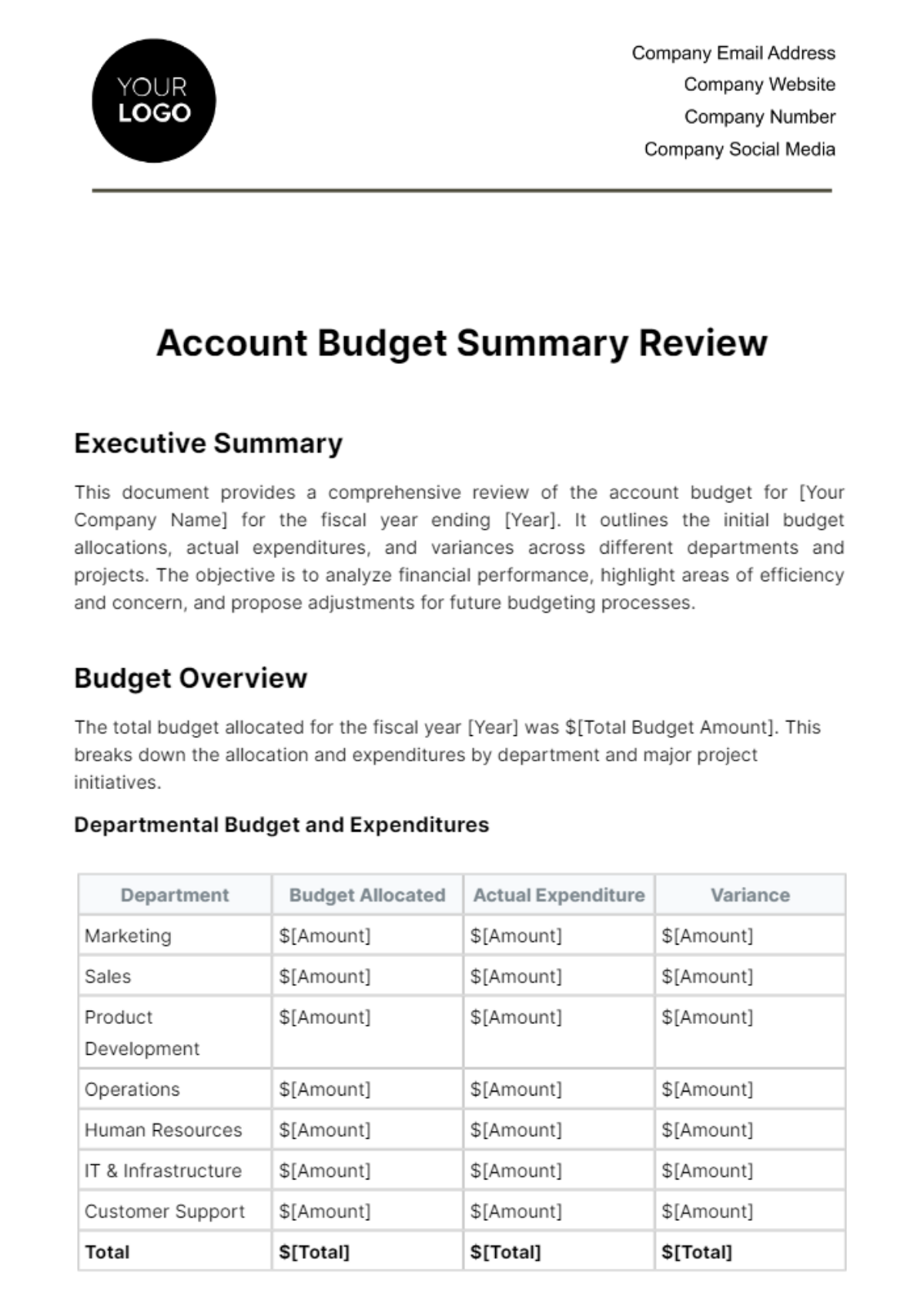

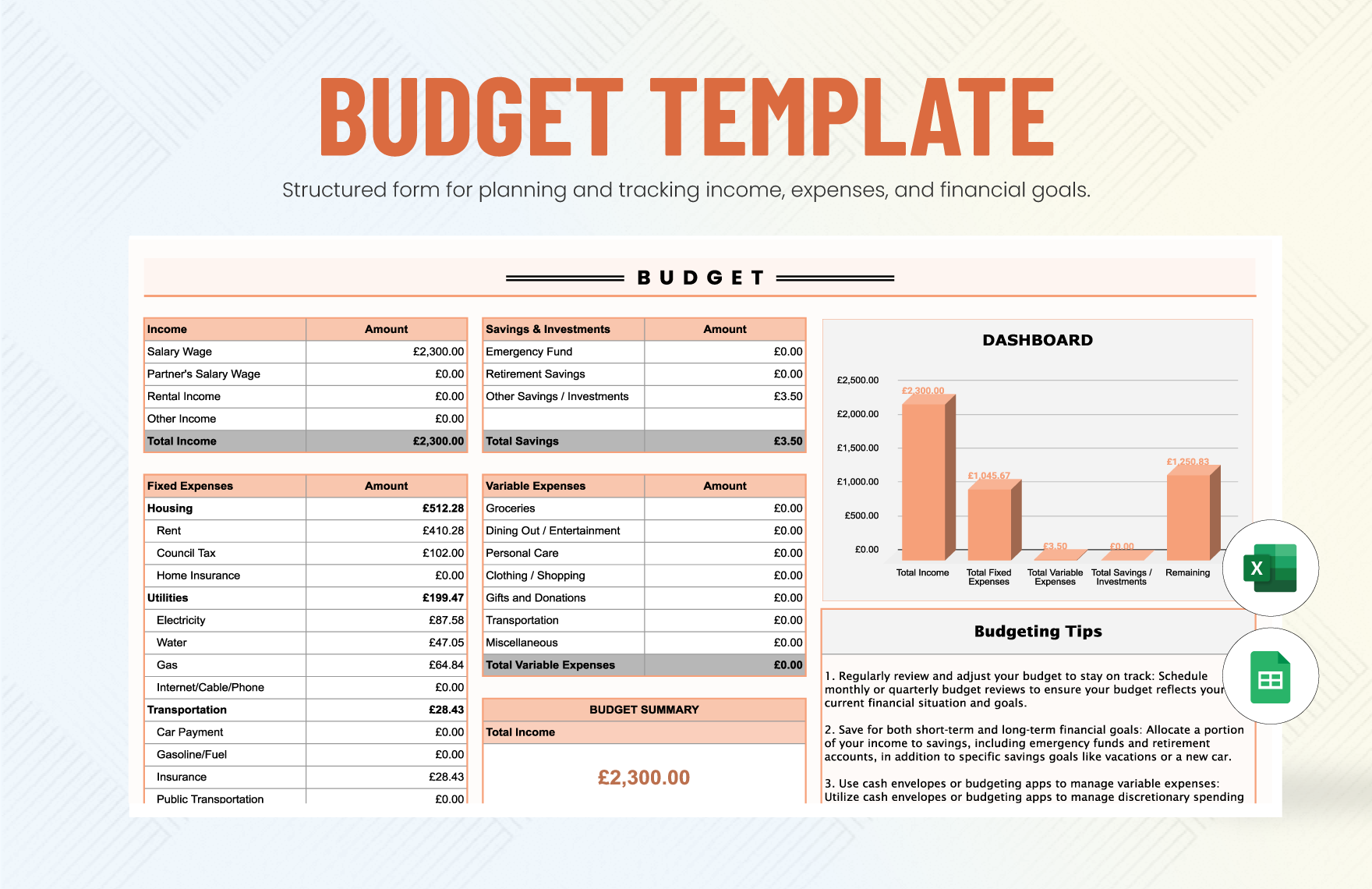

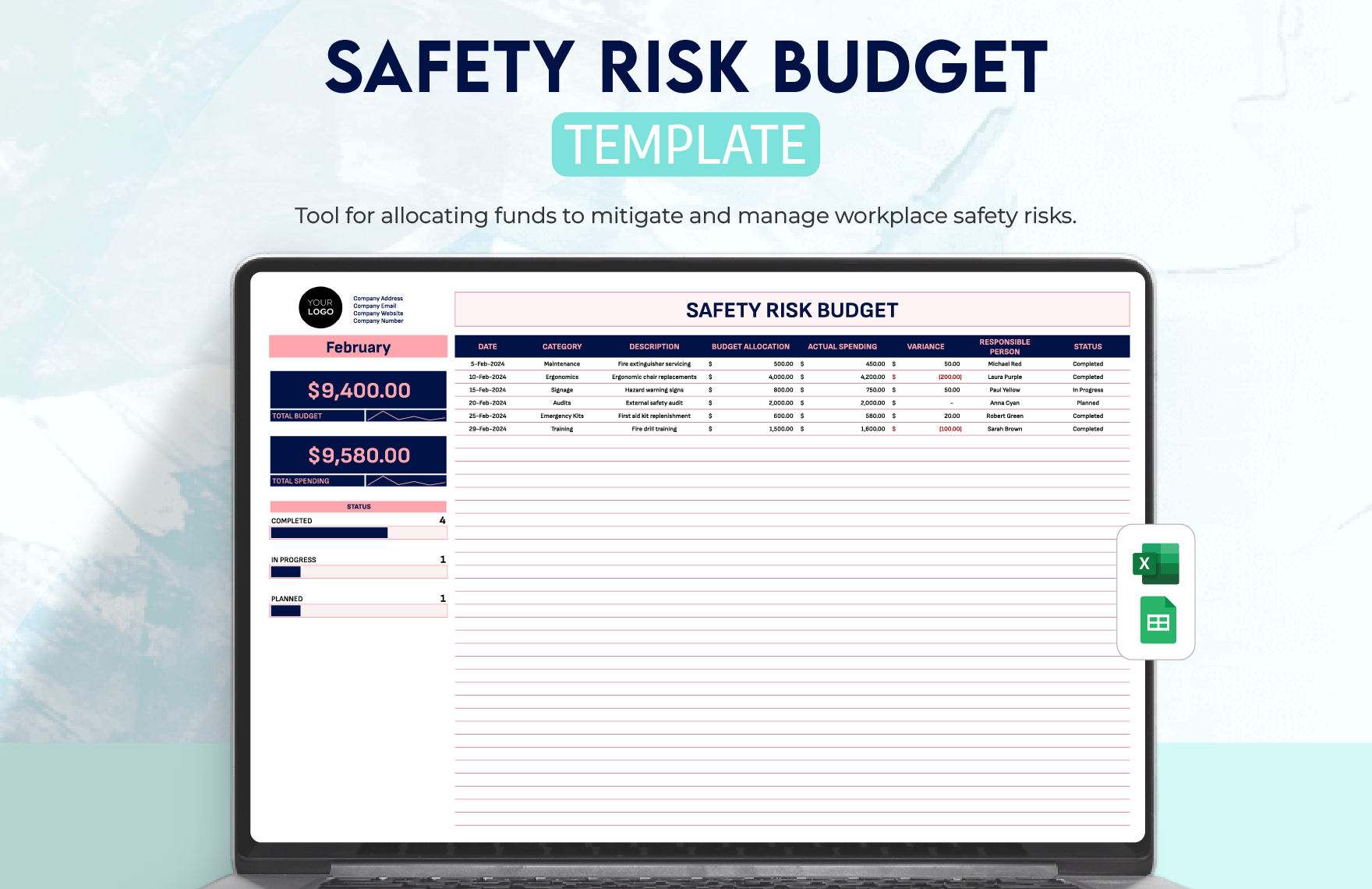

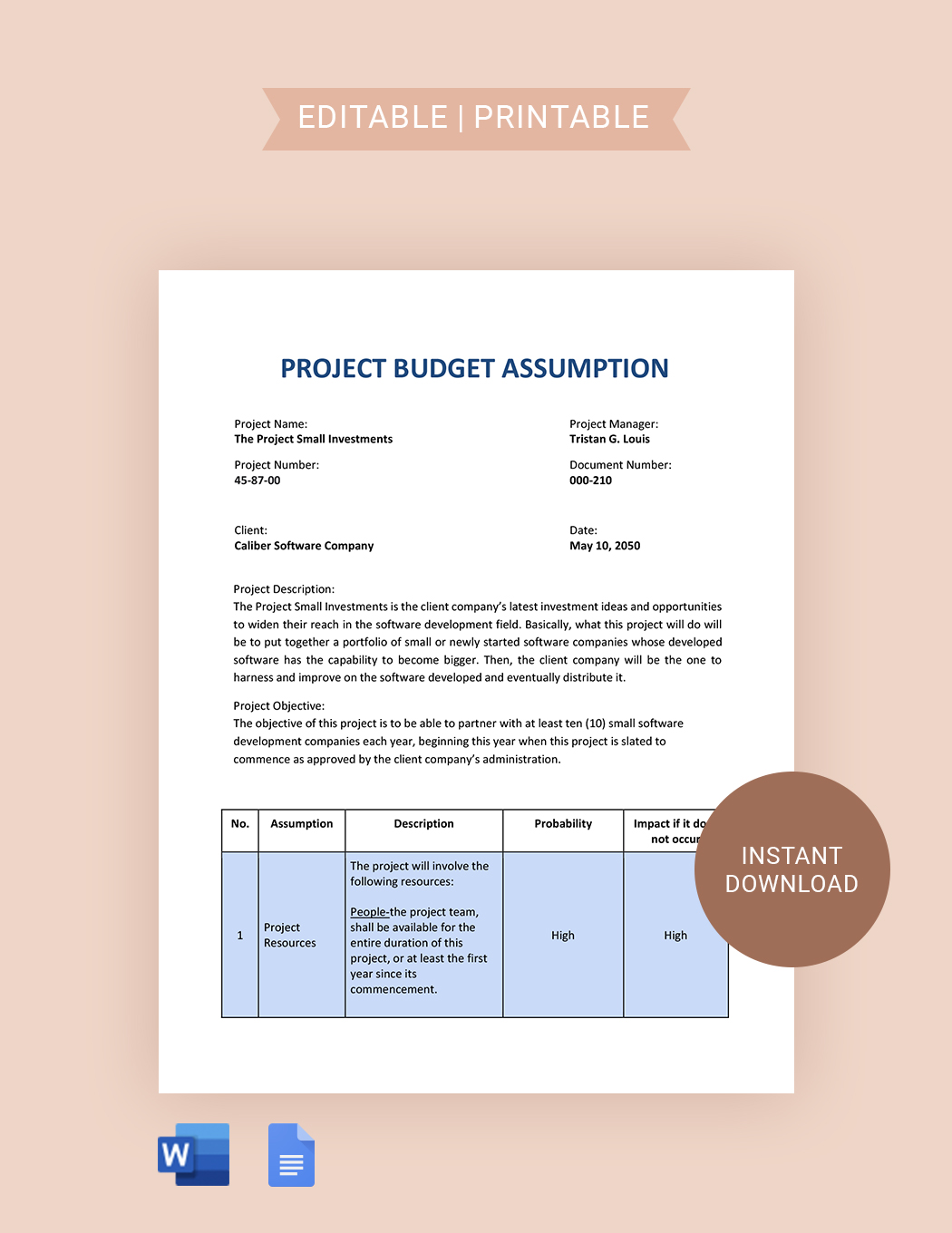

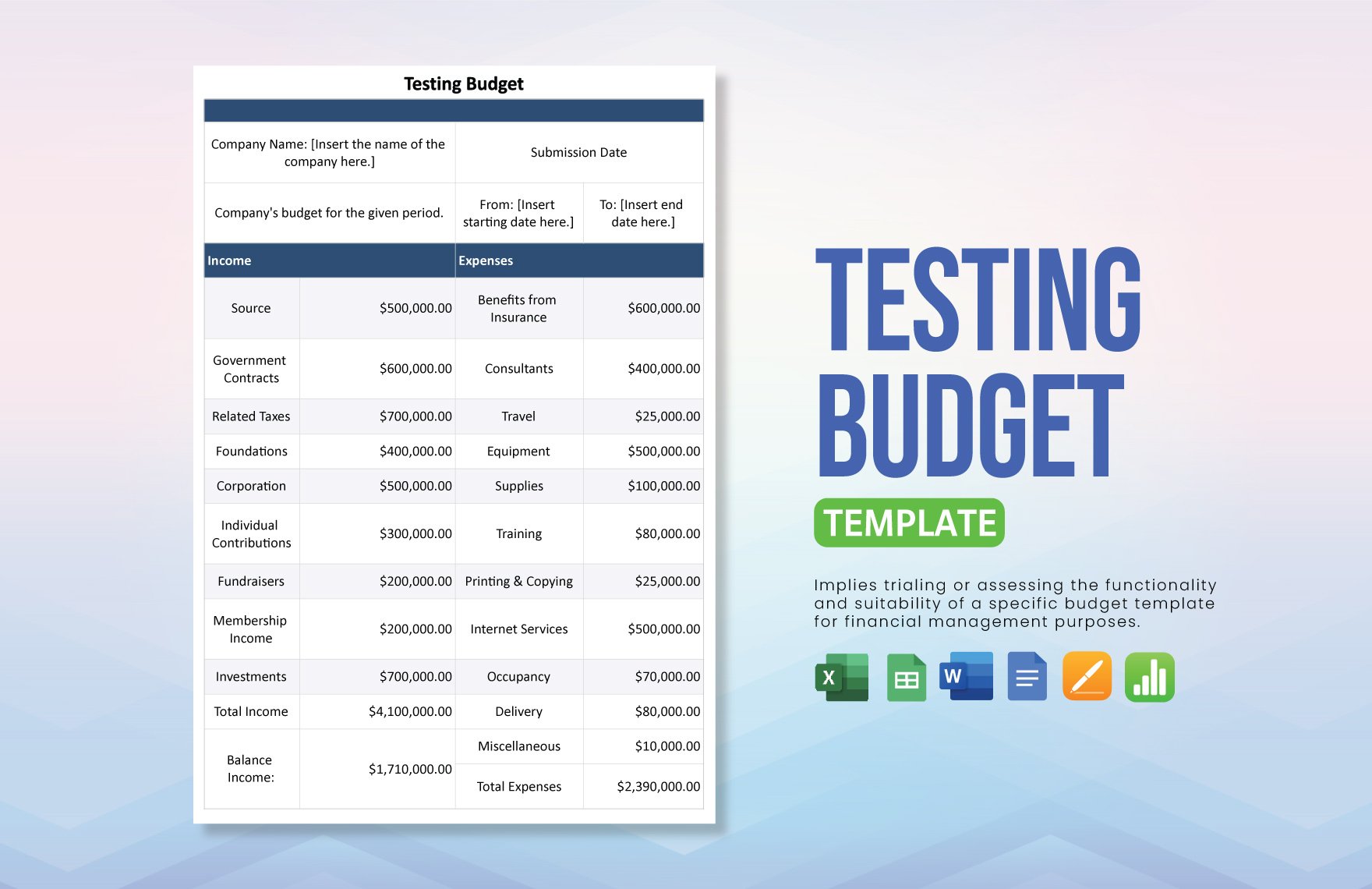

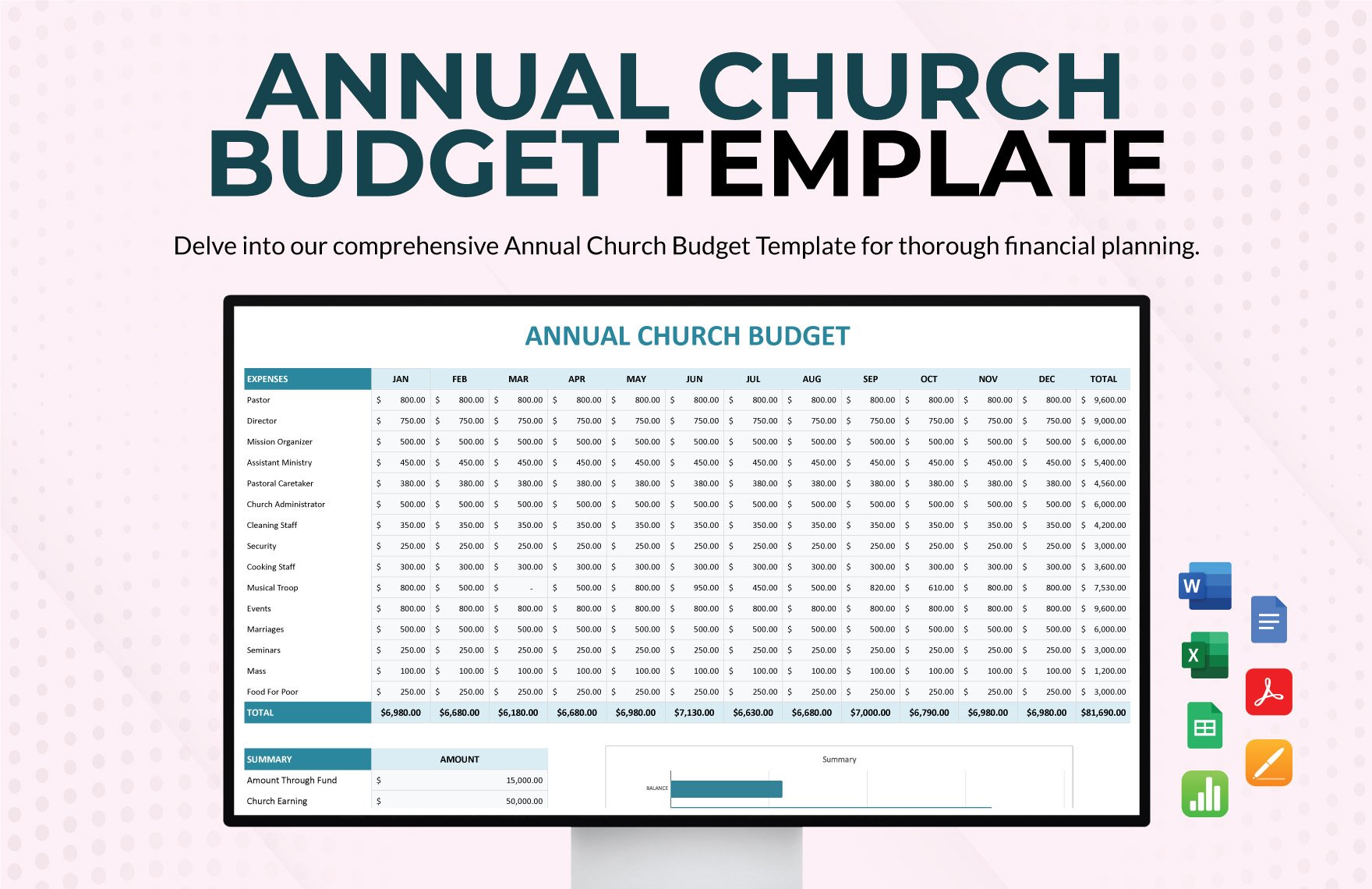

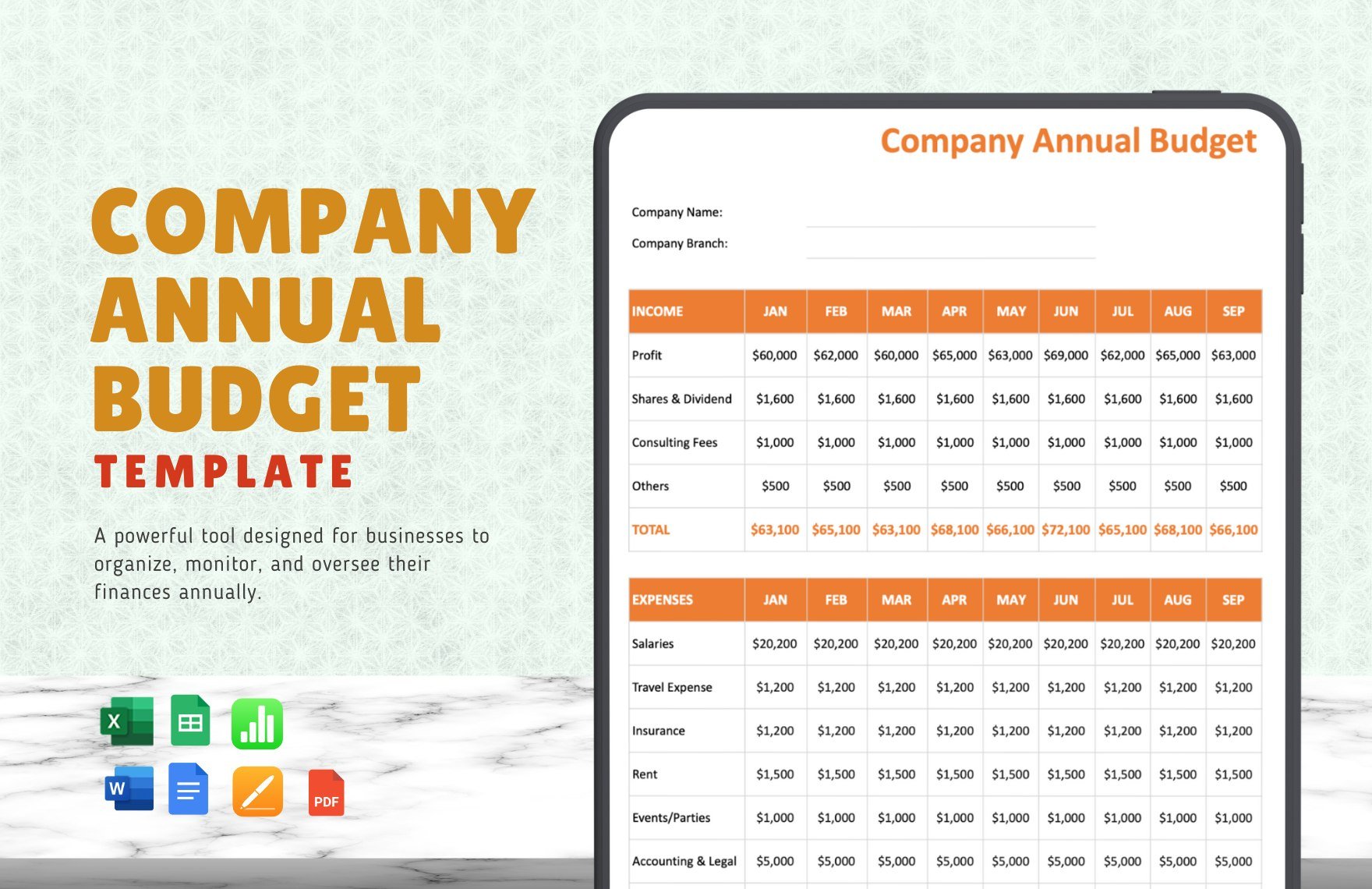

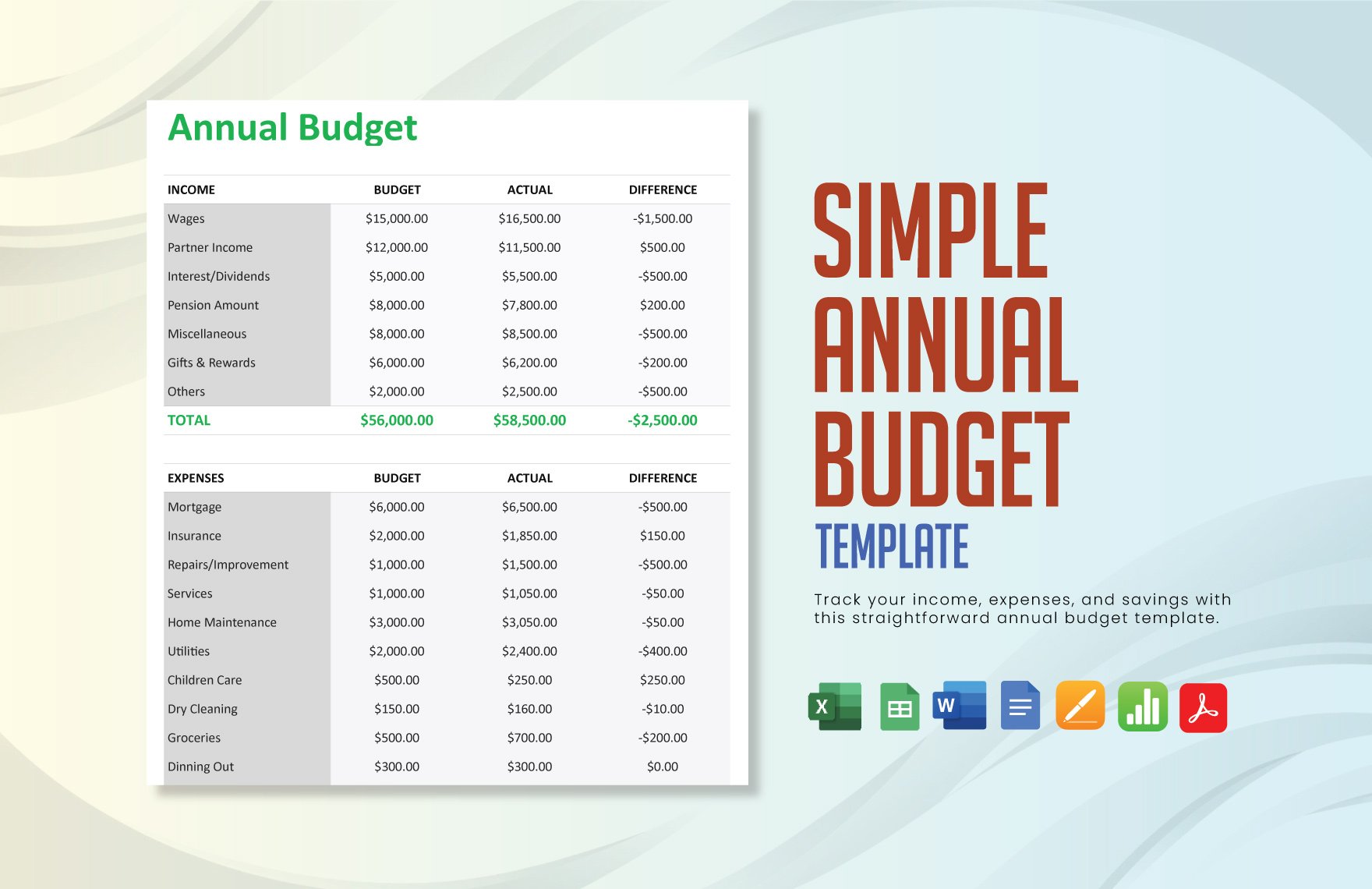

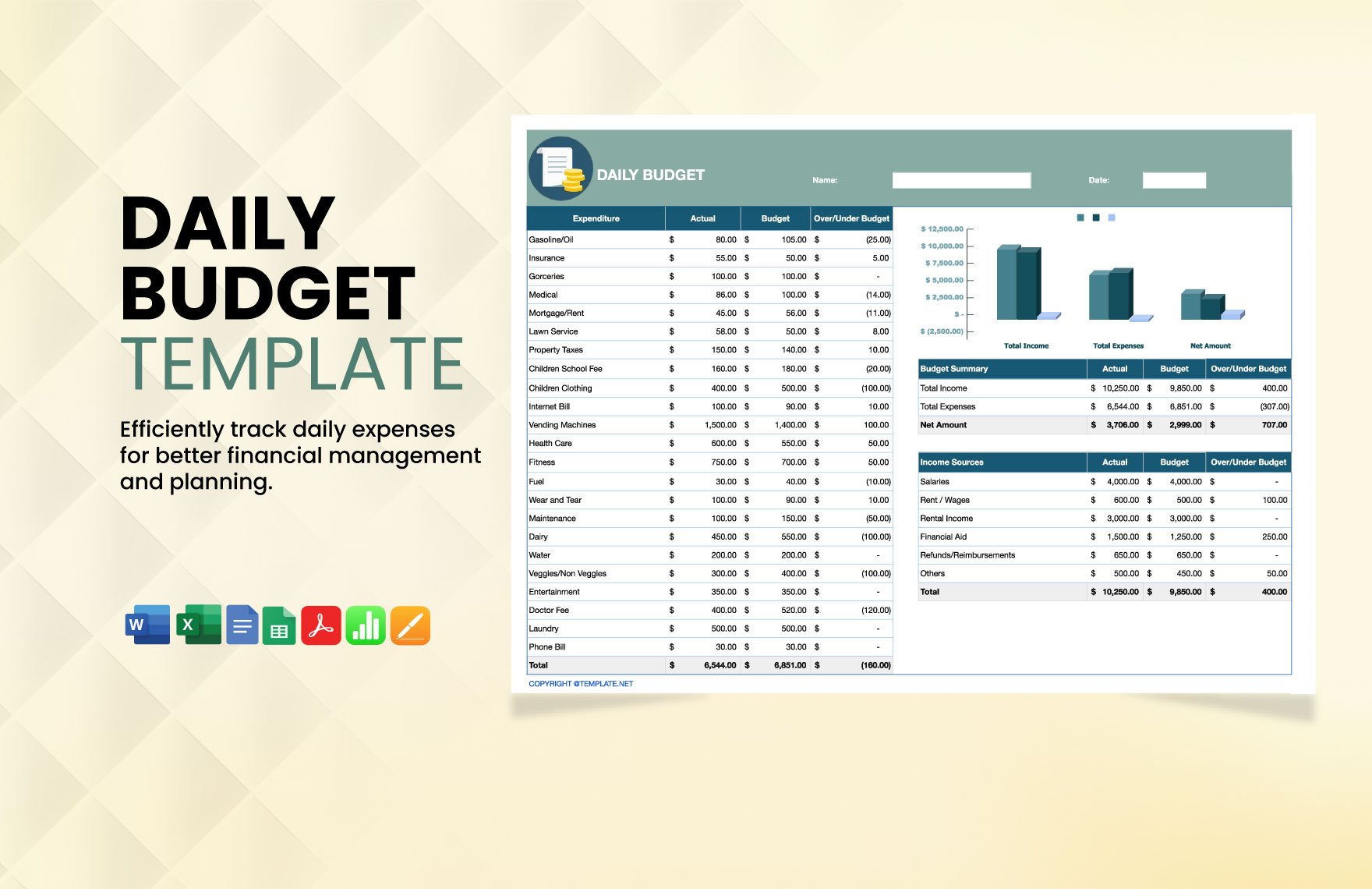

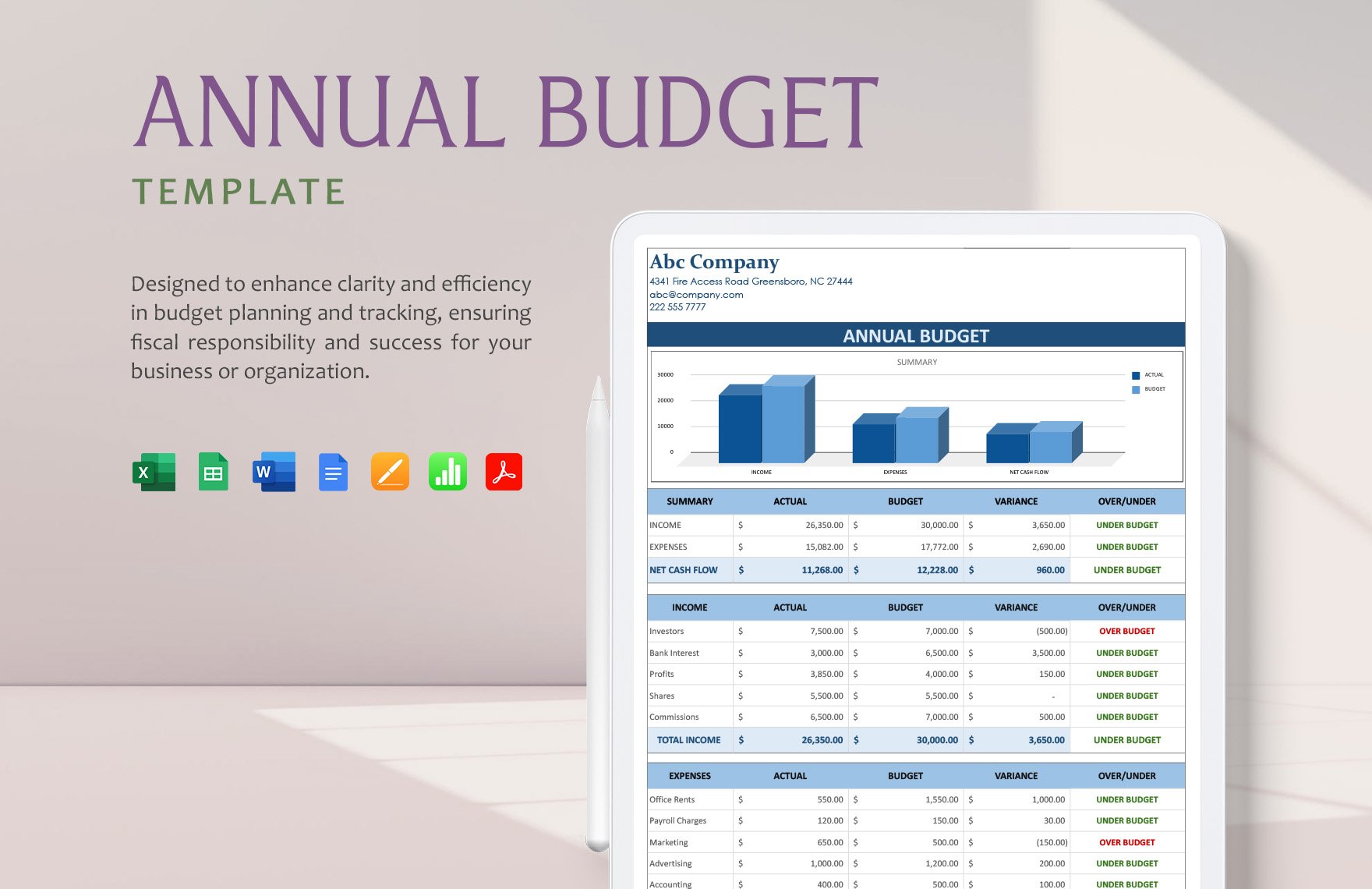

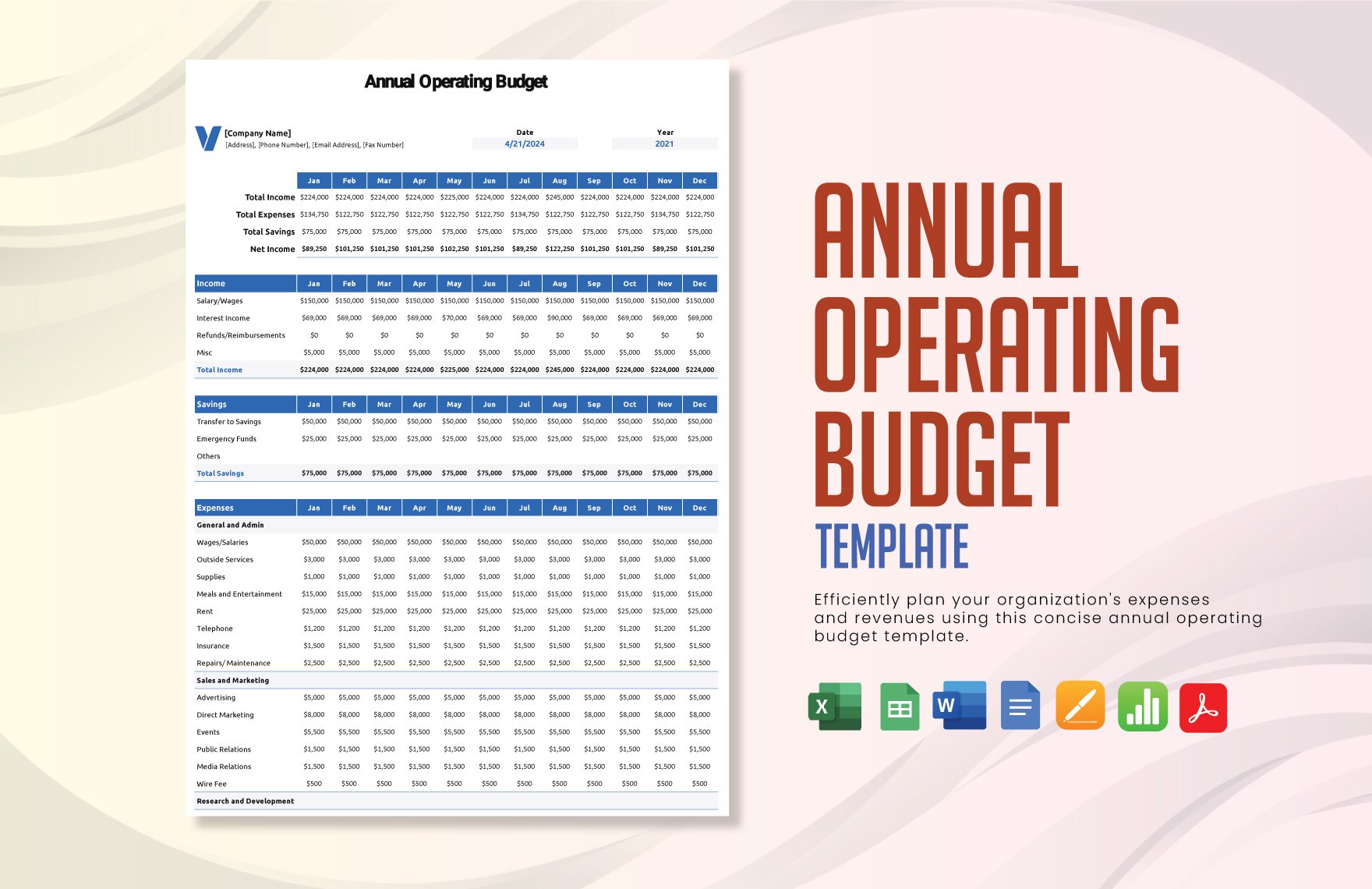

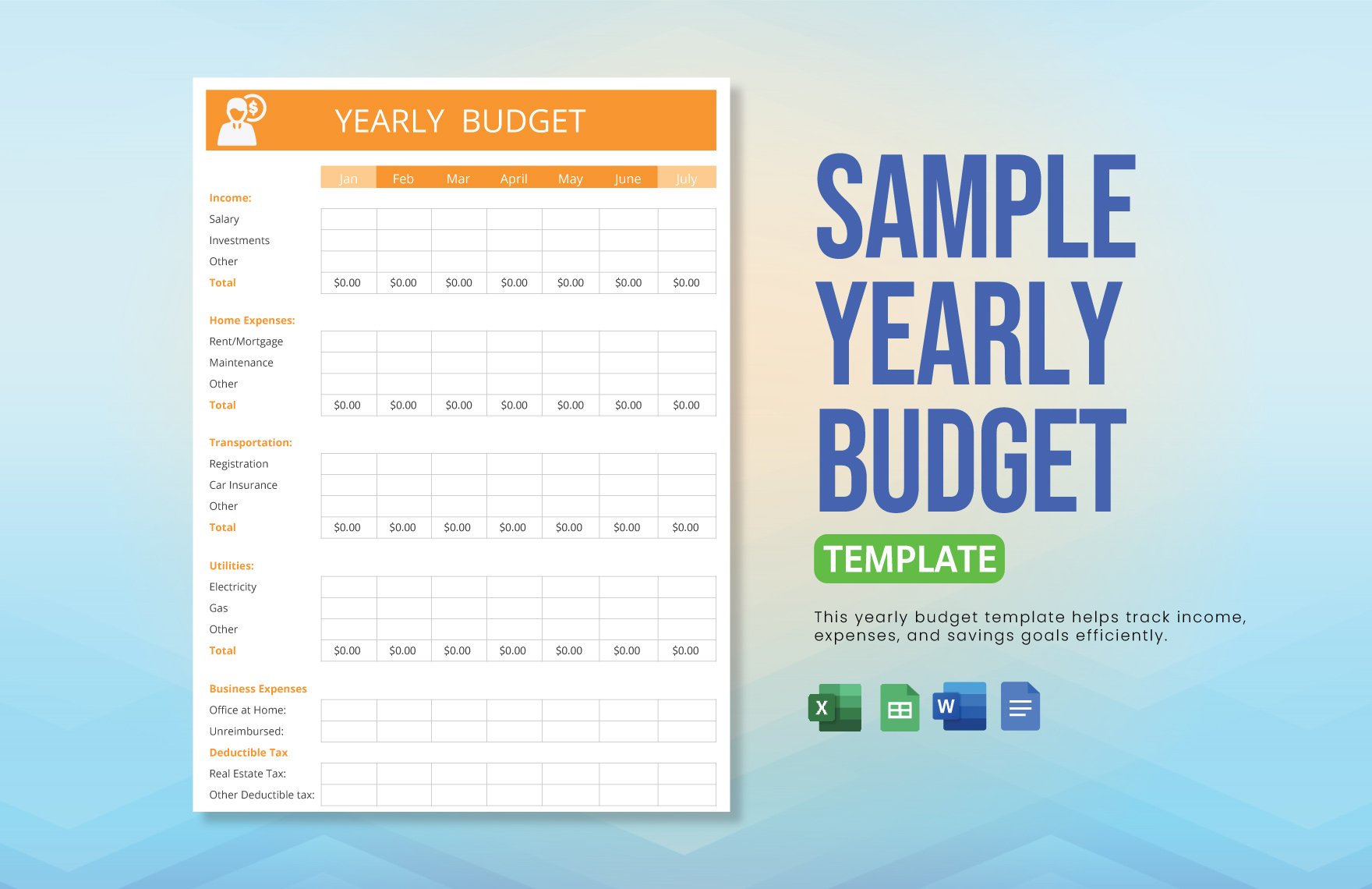

Get ready to streamline your financial strategies with the comprehensive Annual Budget Plan Templates by Template.net. Designed for individuals, small businesses, and large corporations alike, these templates empower users to create a clear financial roadmap. Keep your budget organized, enhance future financial forecasts, and track expenses with ease. Whether you're preparing a budget for a small business's quarterly review or crafting a detailed personal household budget, these templates are versatile enough to accommodate your needs. All templates include key elements like financial periods, expected income and expenditure, and crucial cash flow details. Best of all, these professional-grade designs make budget planning accessible for everyone, ensuring there are no skill barriers, and saving you both time and effort. You can customize these templates for print or digital distribution, fitting seamlessly within your workflow.

Discover the many Annual Budget Plan Templates we have on hand, each one carefully crafted to suit a variety of budgeting needs. Select from the numerous templates available, easily swap in your own financial data, and tweak colors or fonts to fit your brand or personal style. Add an advanced touch to your presentations by incorporating supportive graphics or icons, and explore the potential of AI-powered text tools to enhance your narrative. This process is fun and requires no prior experience, making it easy for anyone to Bring their budgeting to life. Our regularly updated library ensures you have access to fresh, innovative designs on a consistent basis. Once finalized, you can download, print, or effortlessly share your budget plans via link or email, making it ideal for collaboration and distribution across multiple channels.