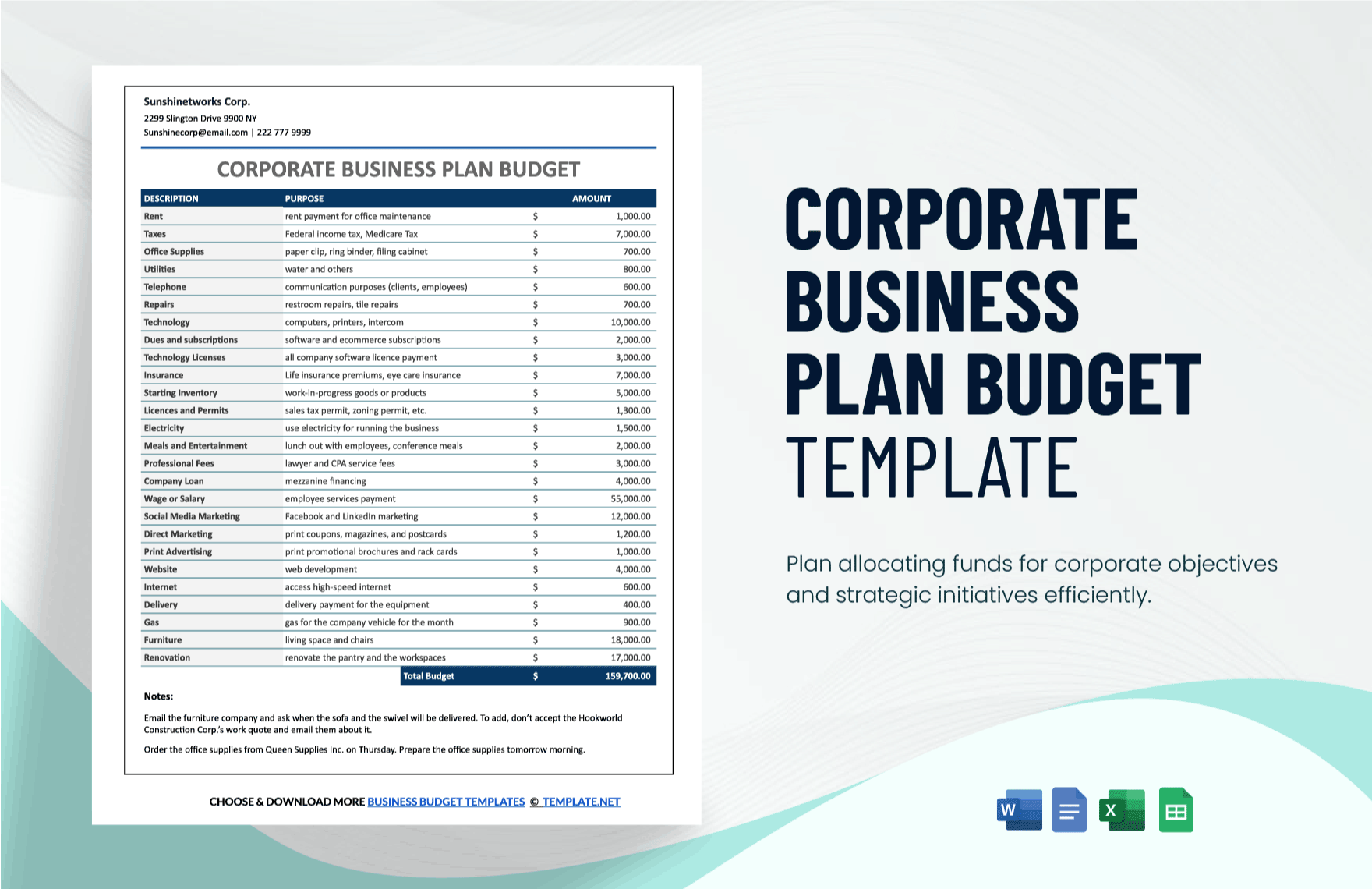

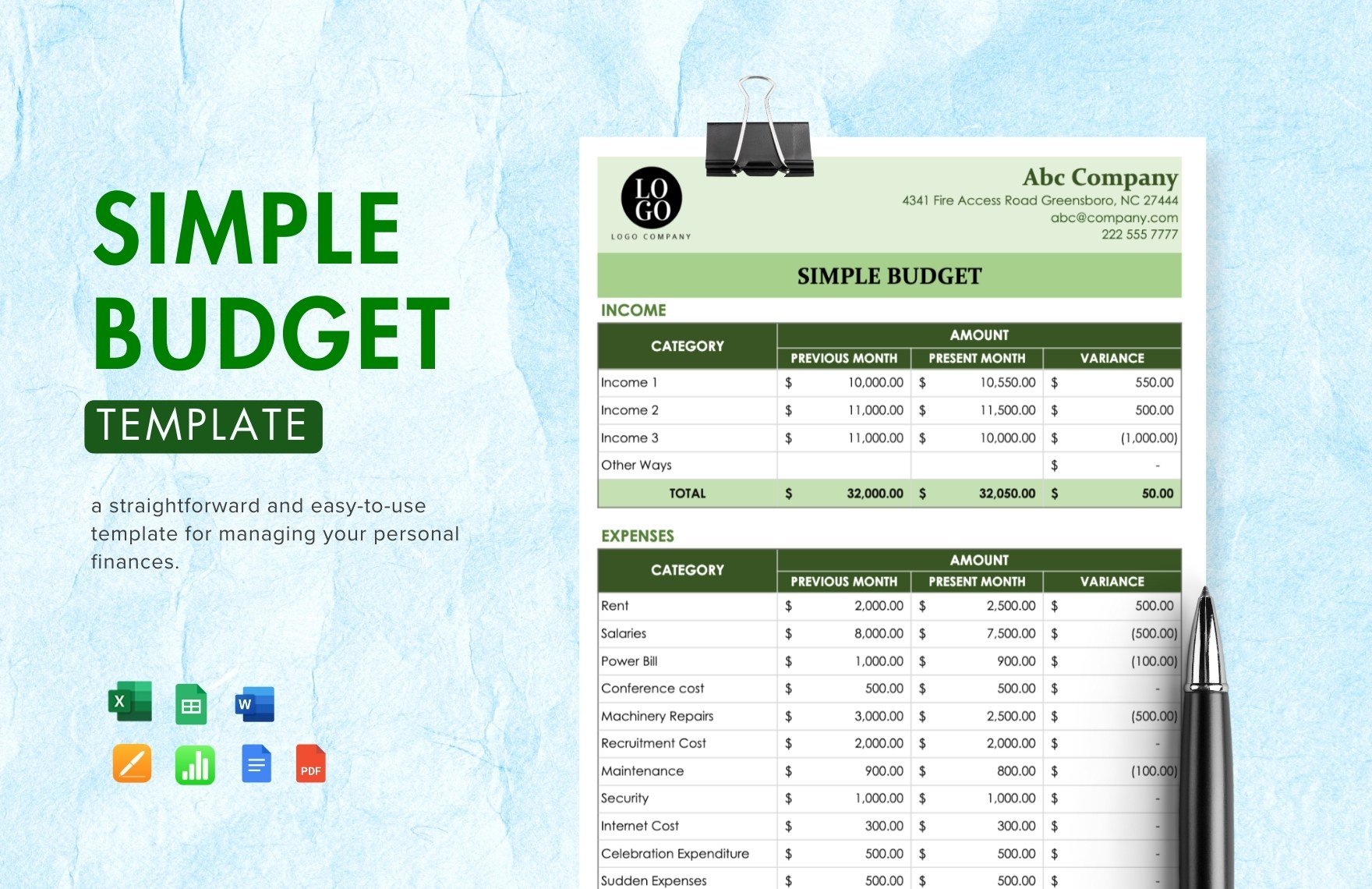

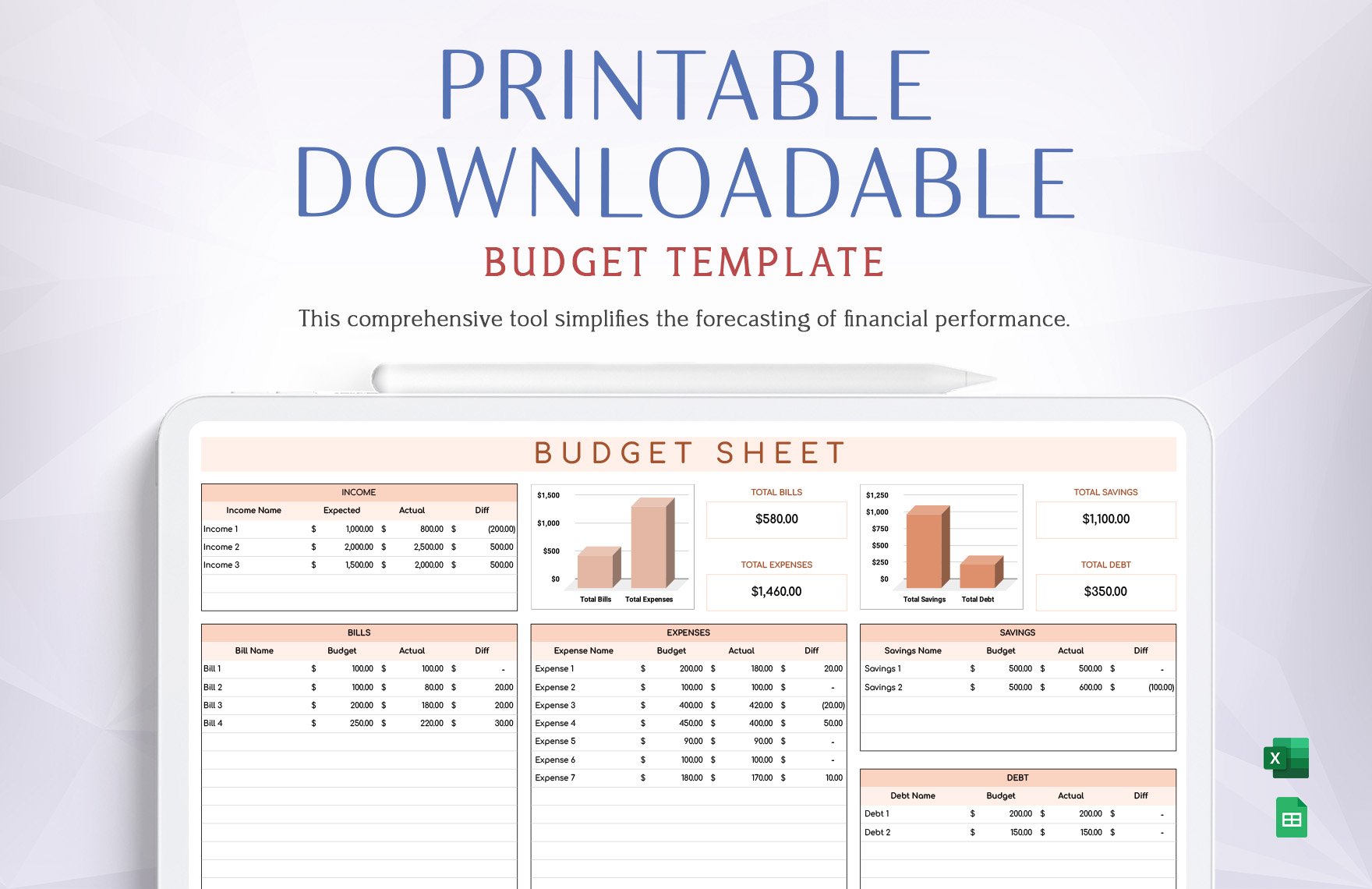

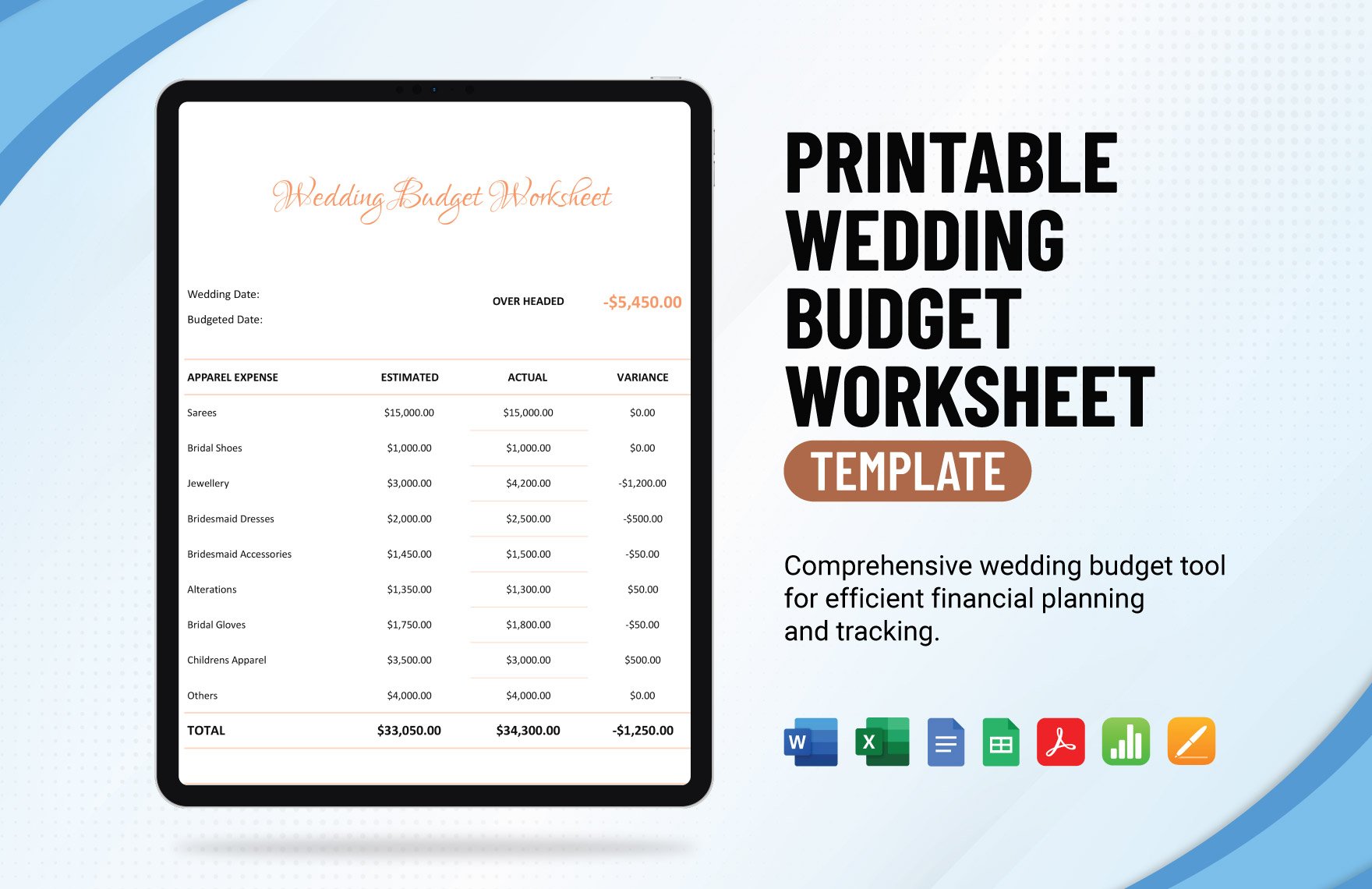

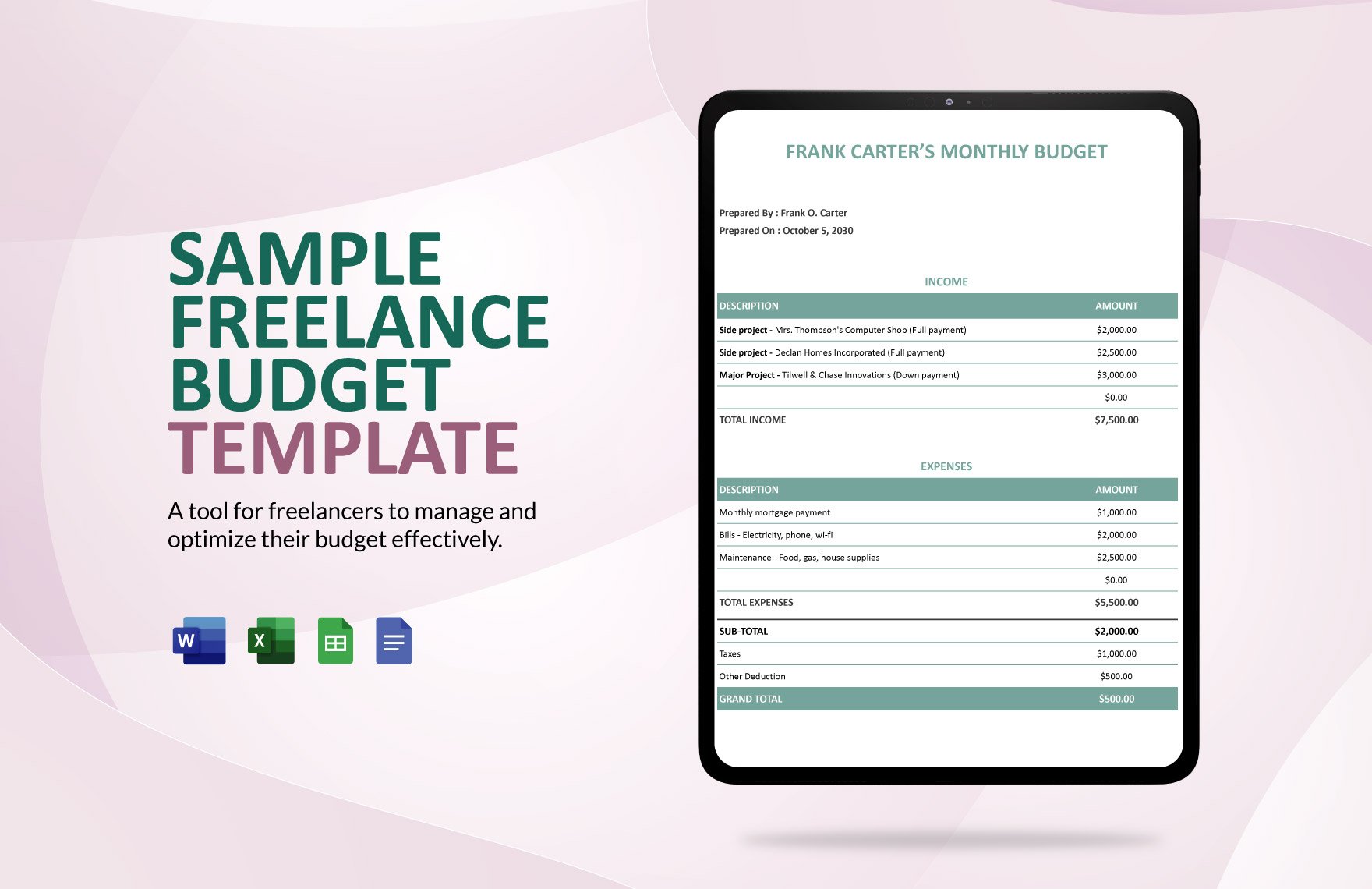

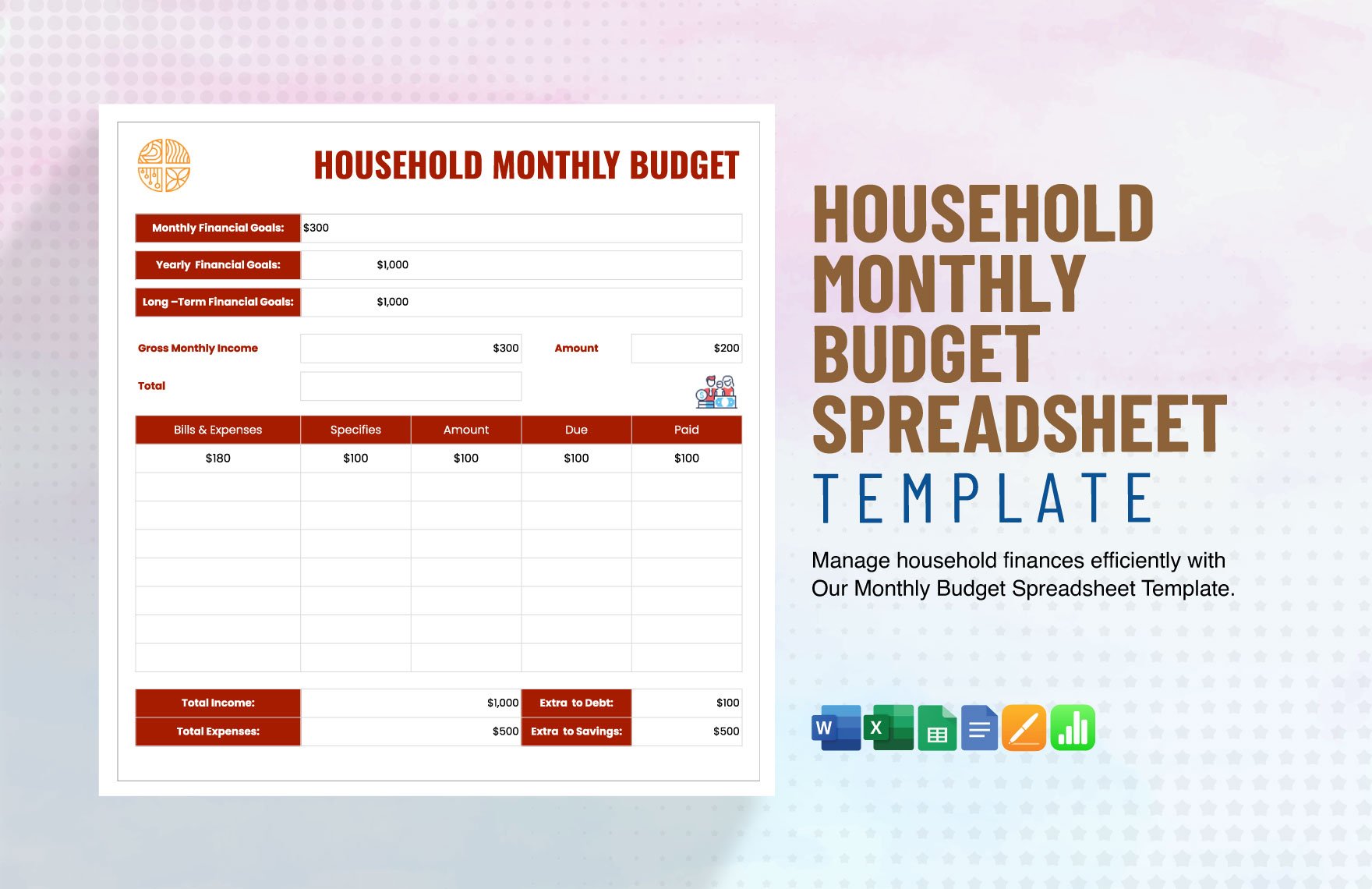

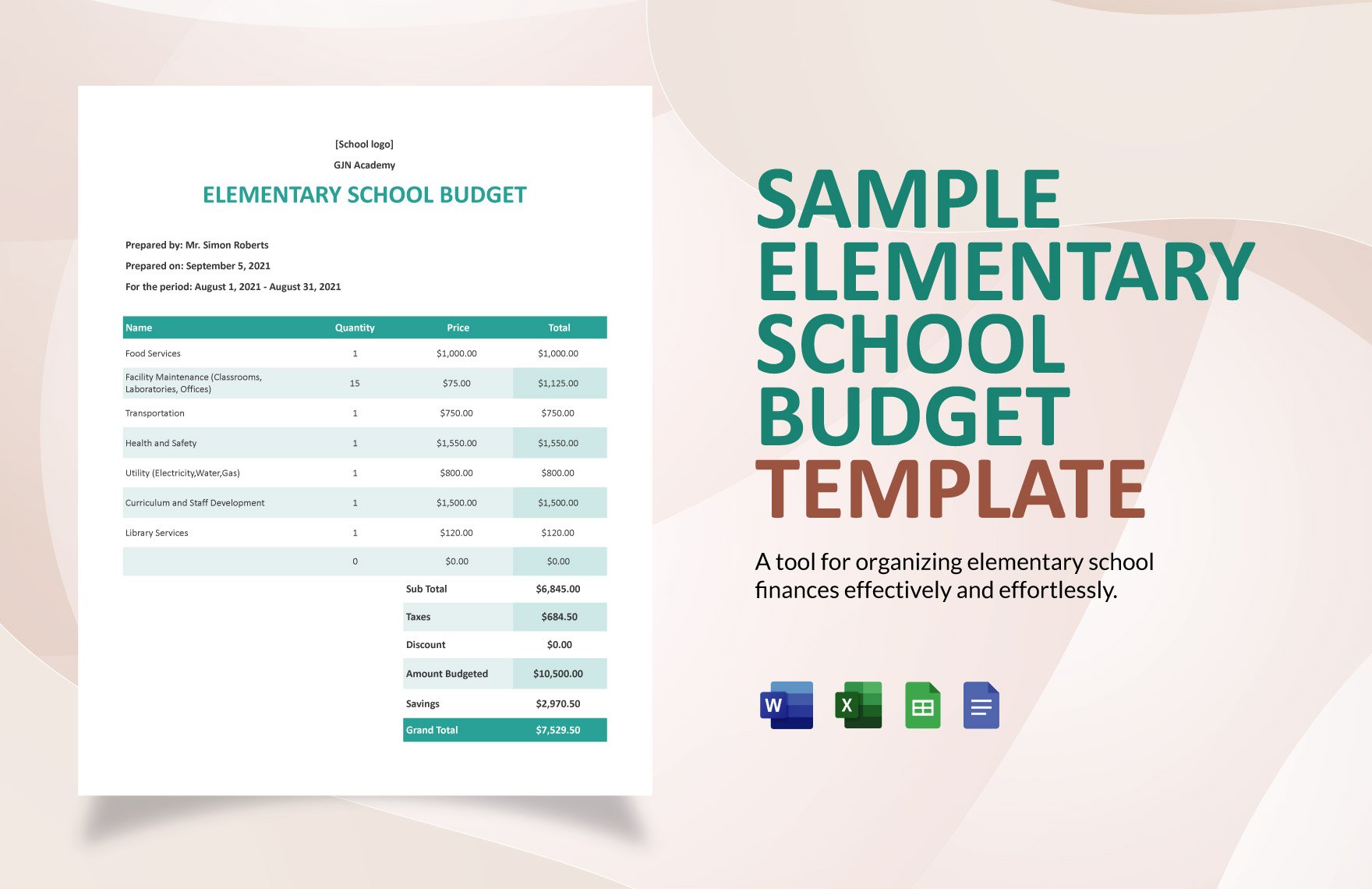

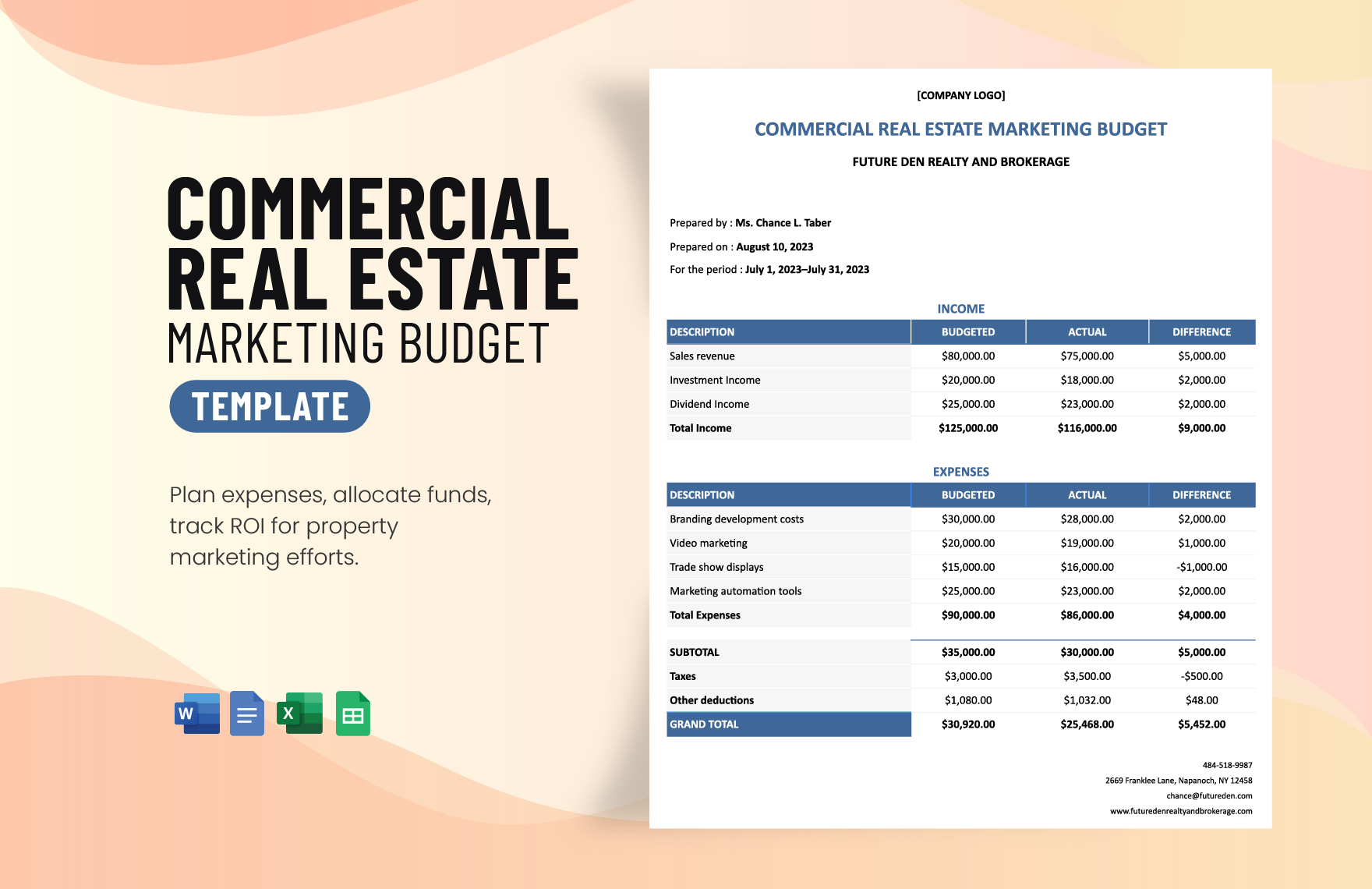

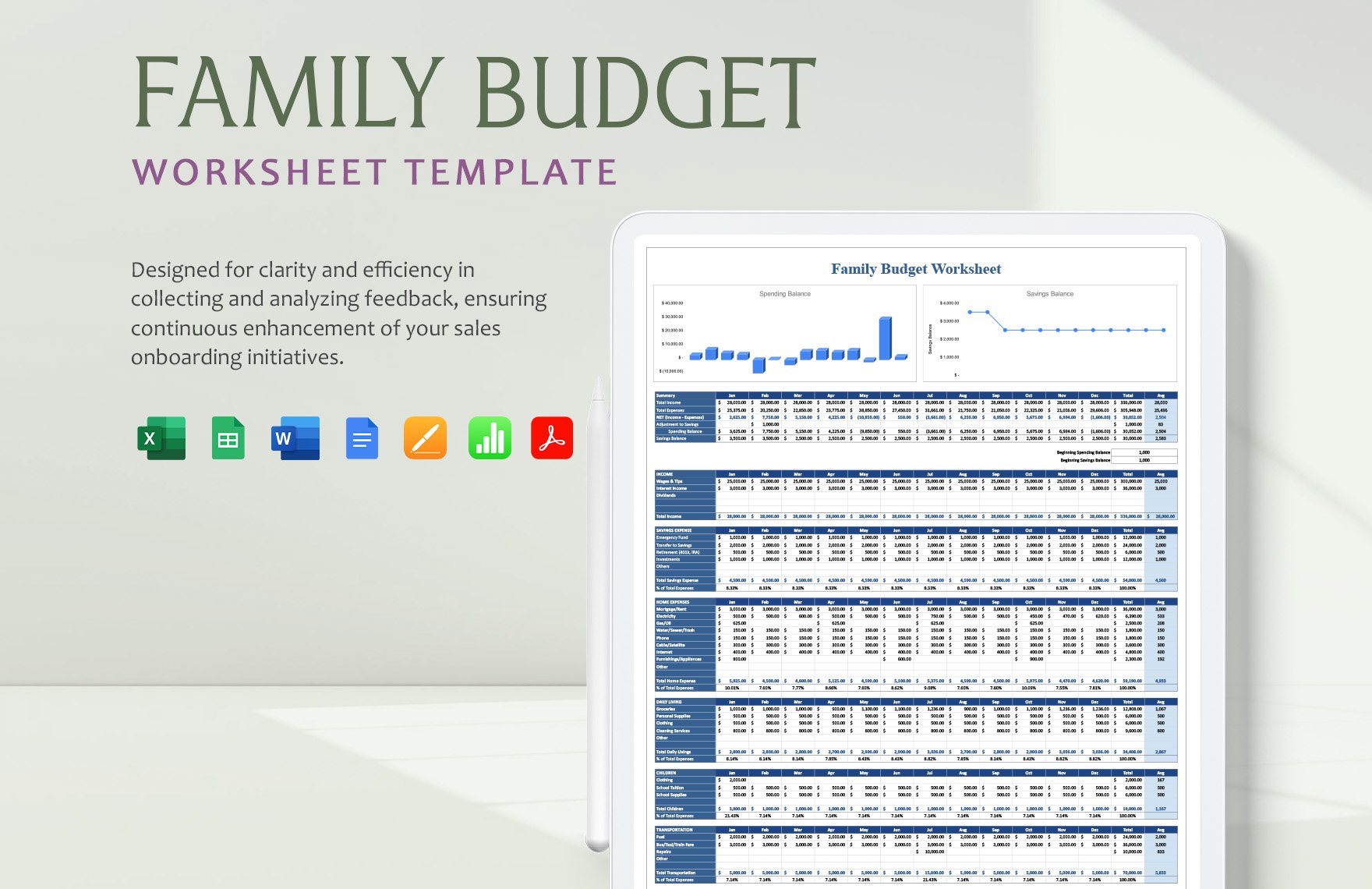

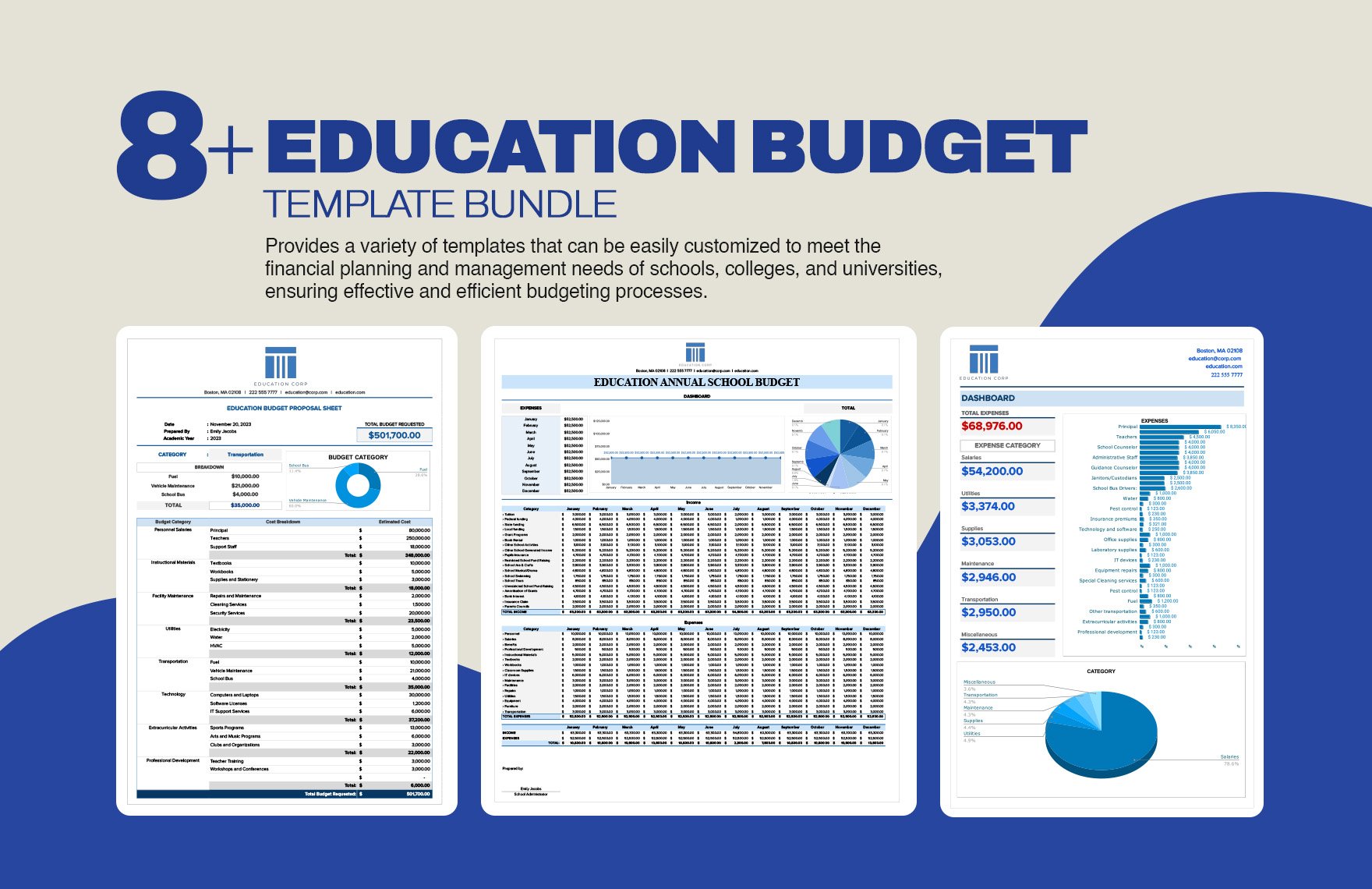

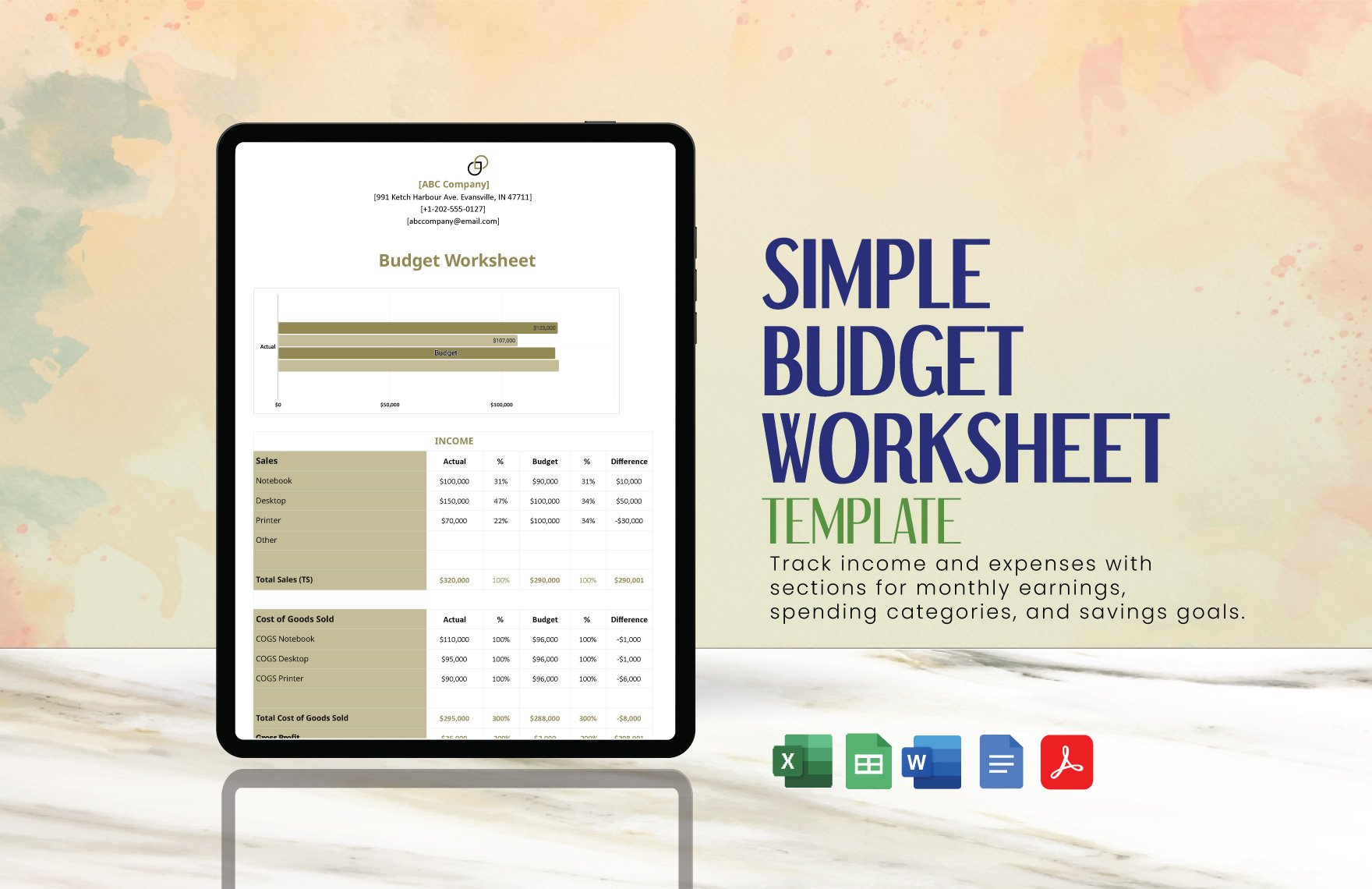

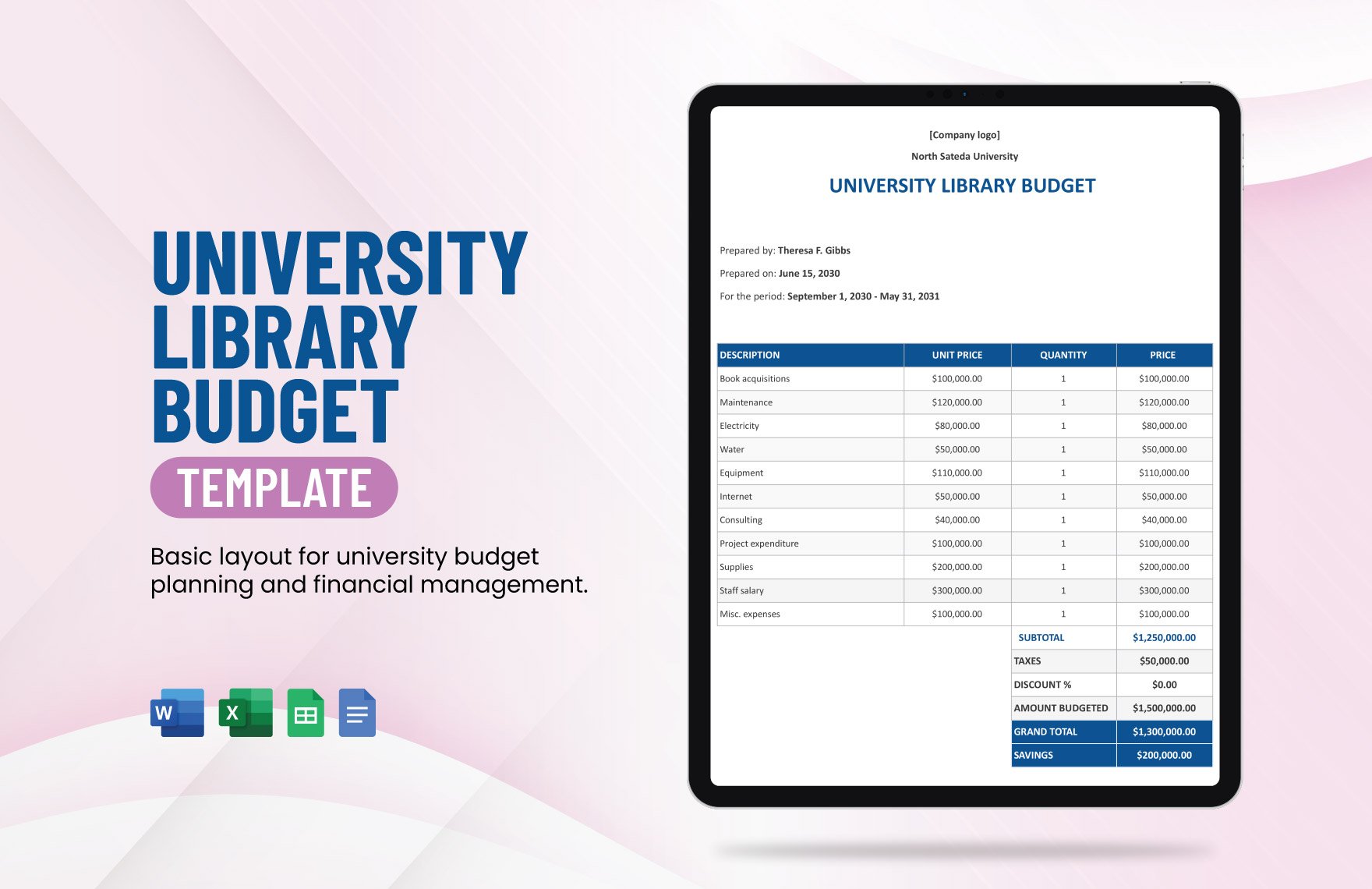

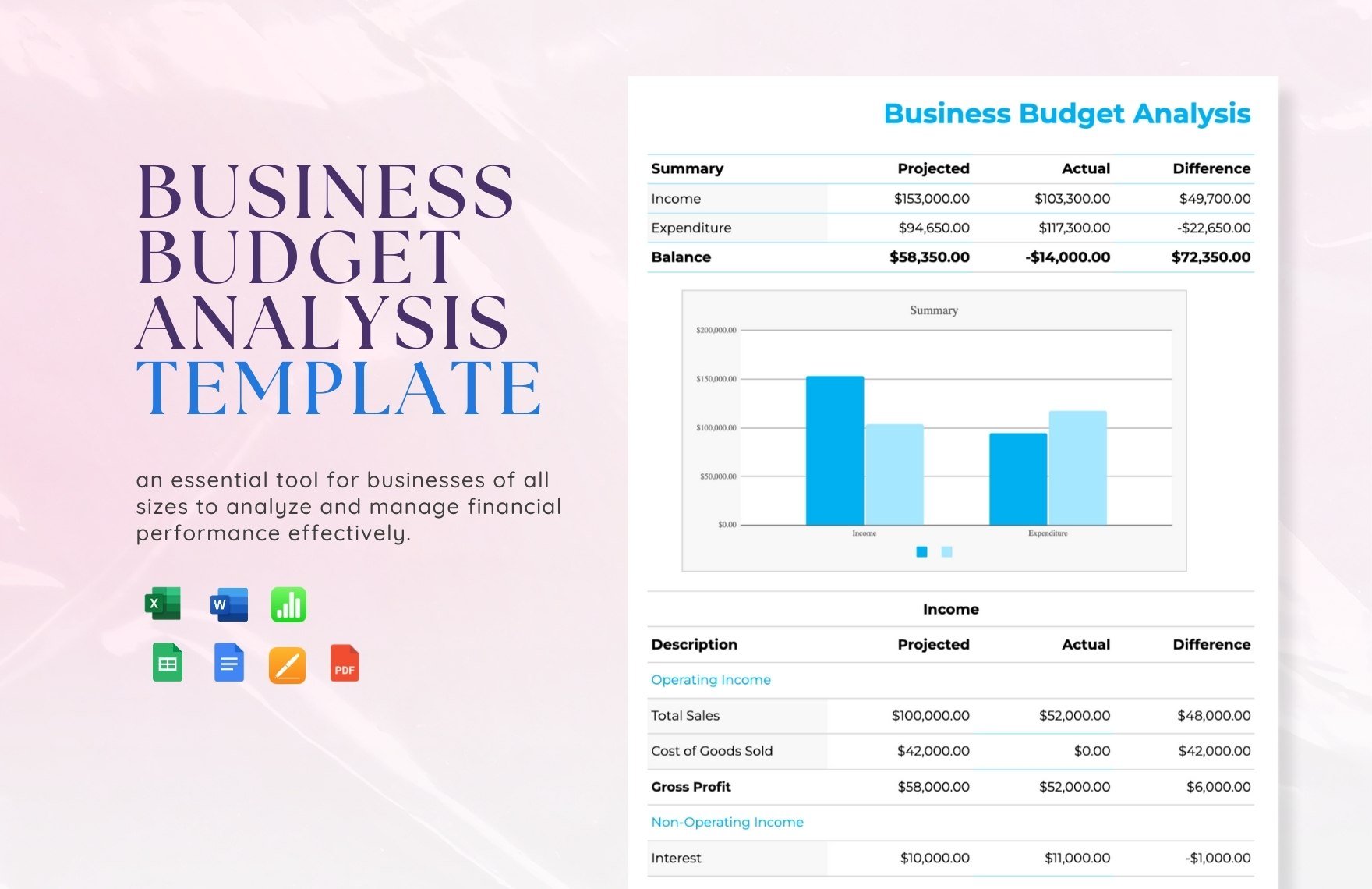

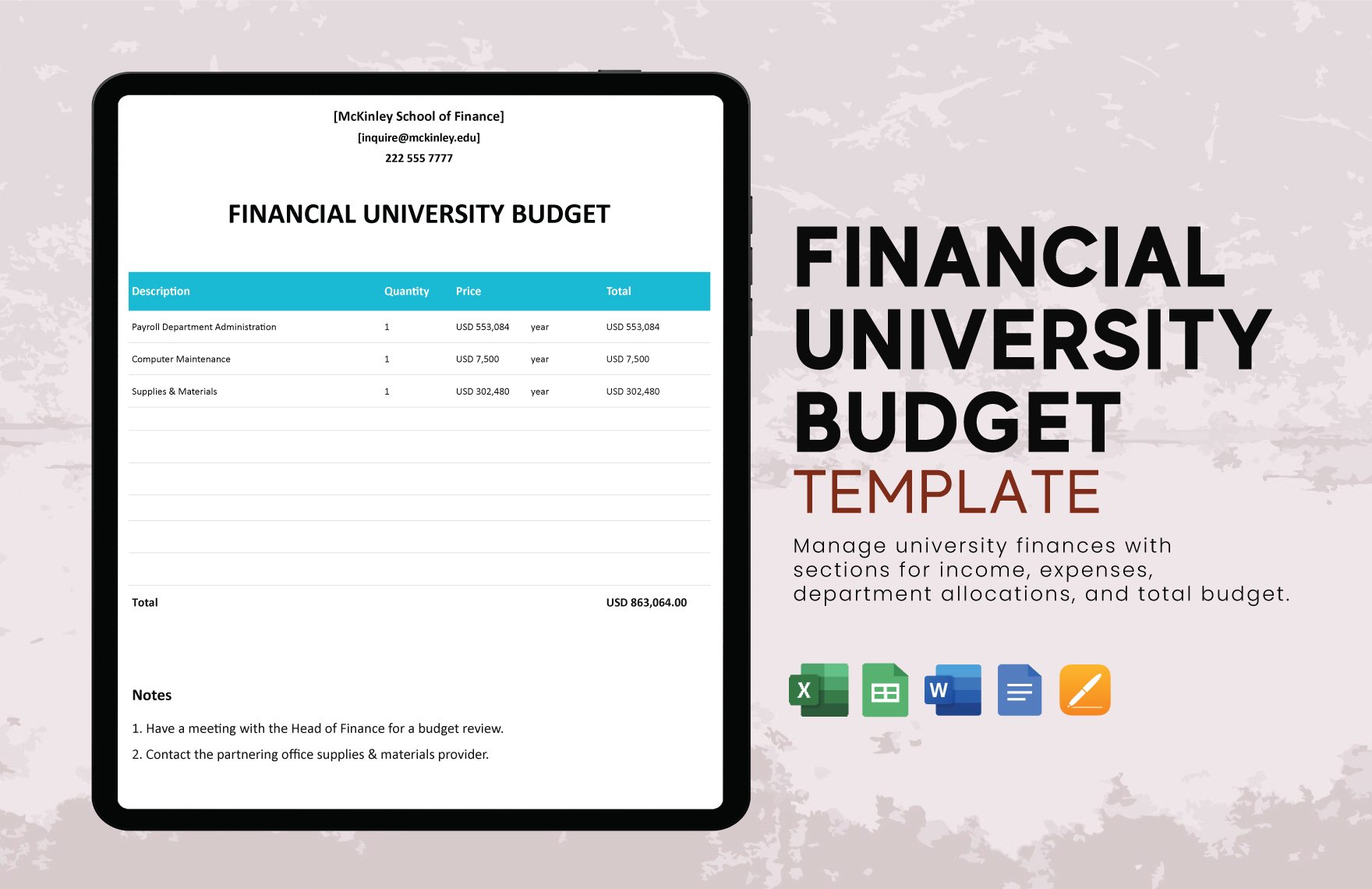

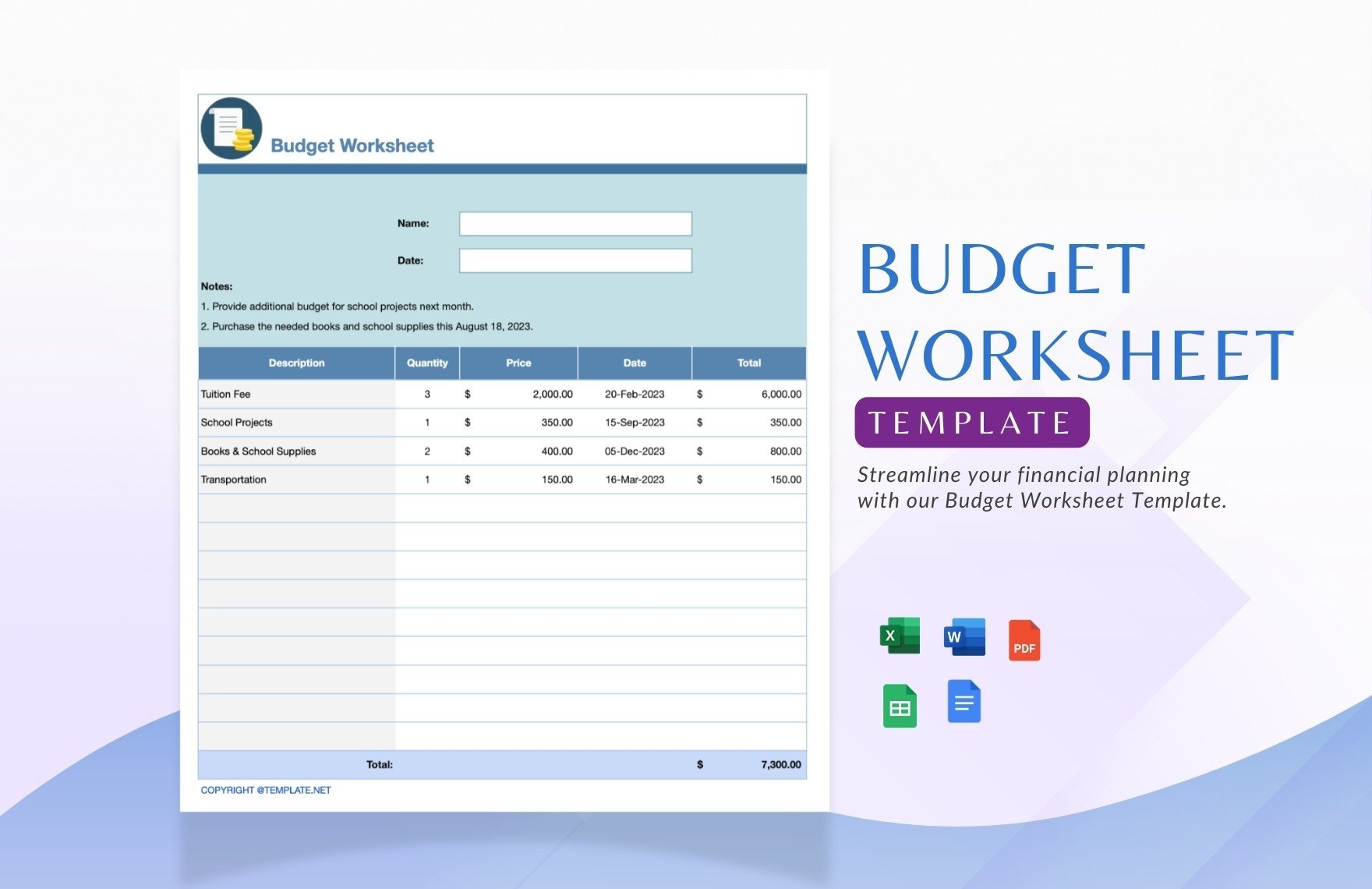

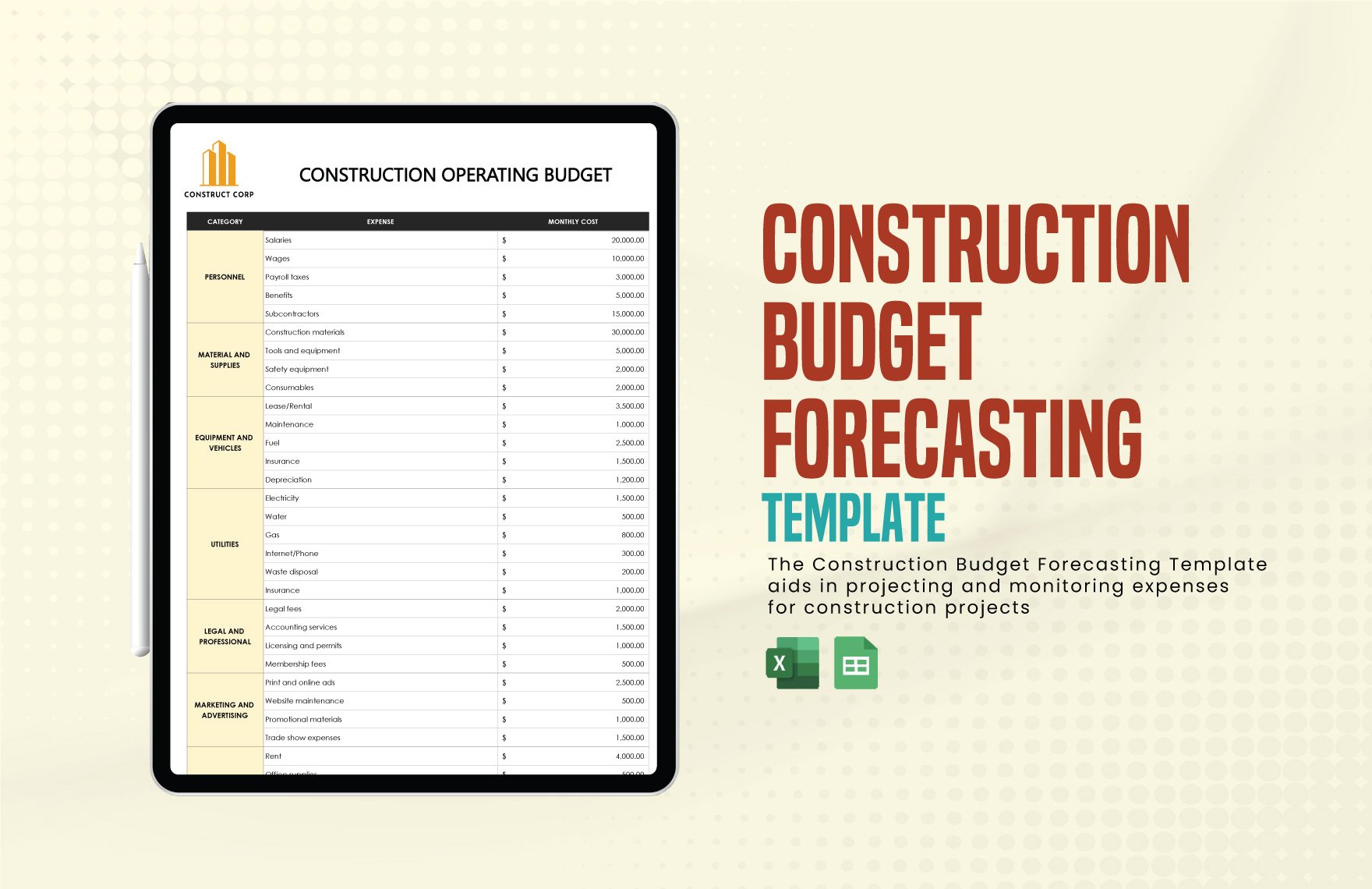

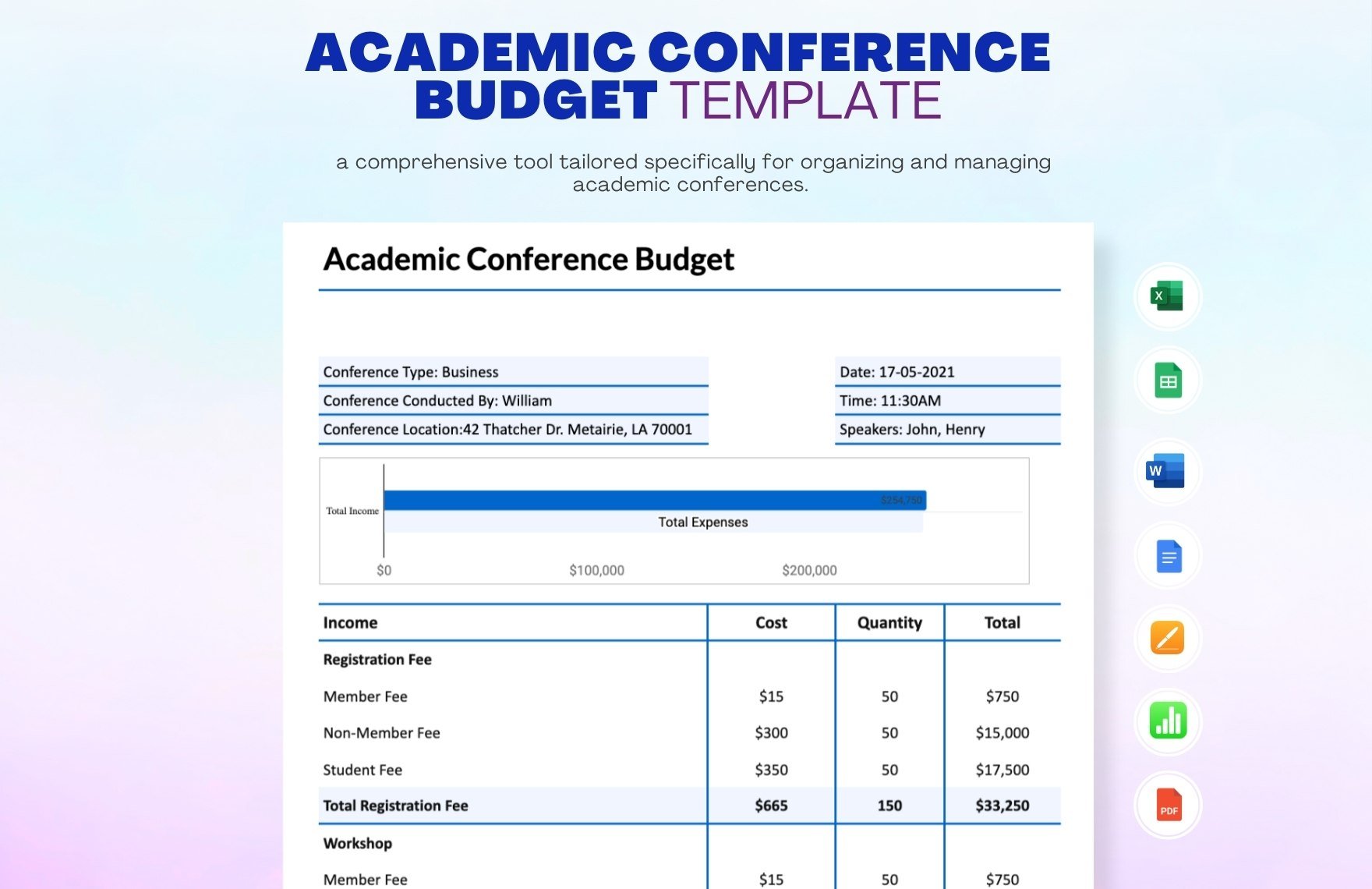

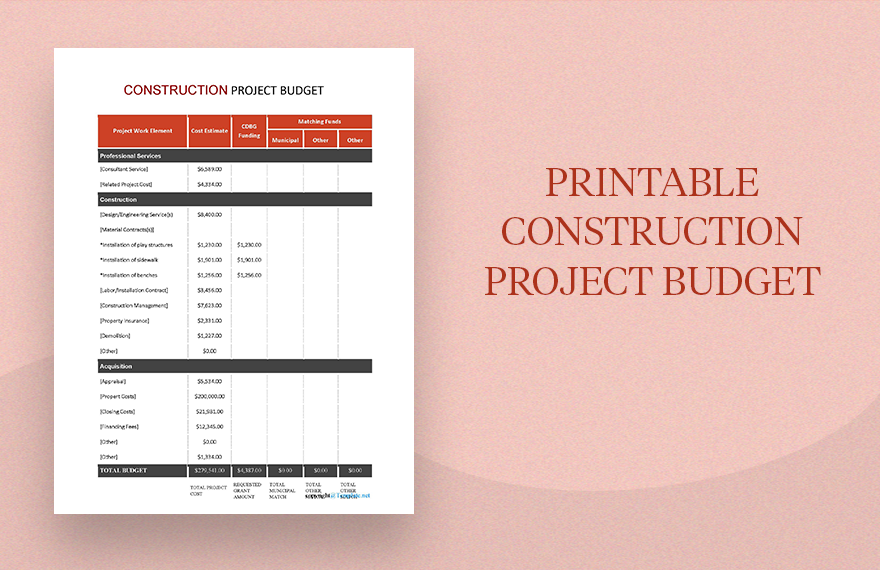

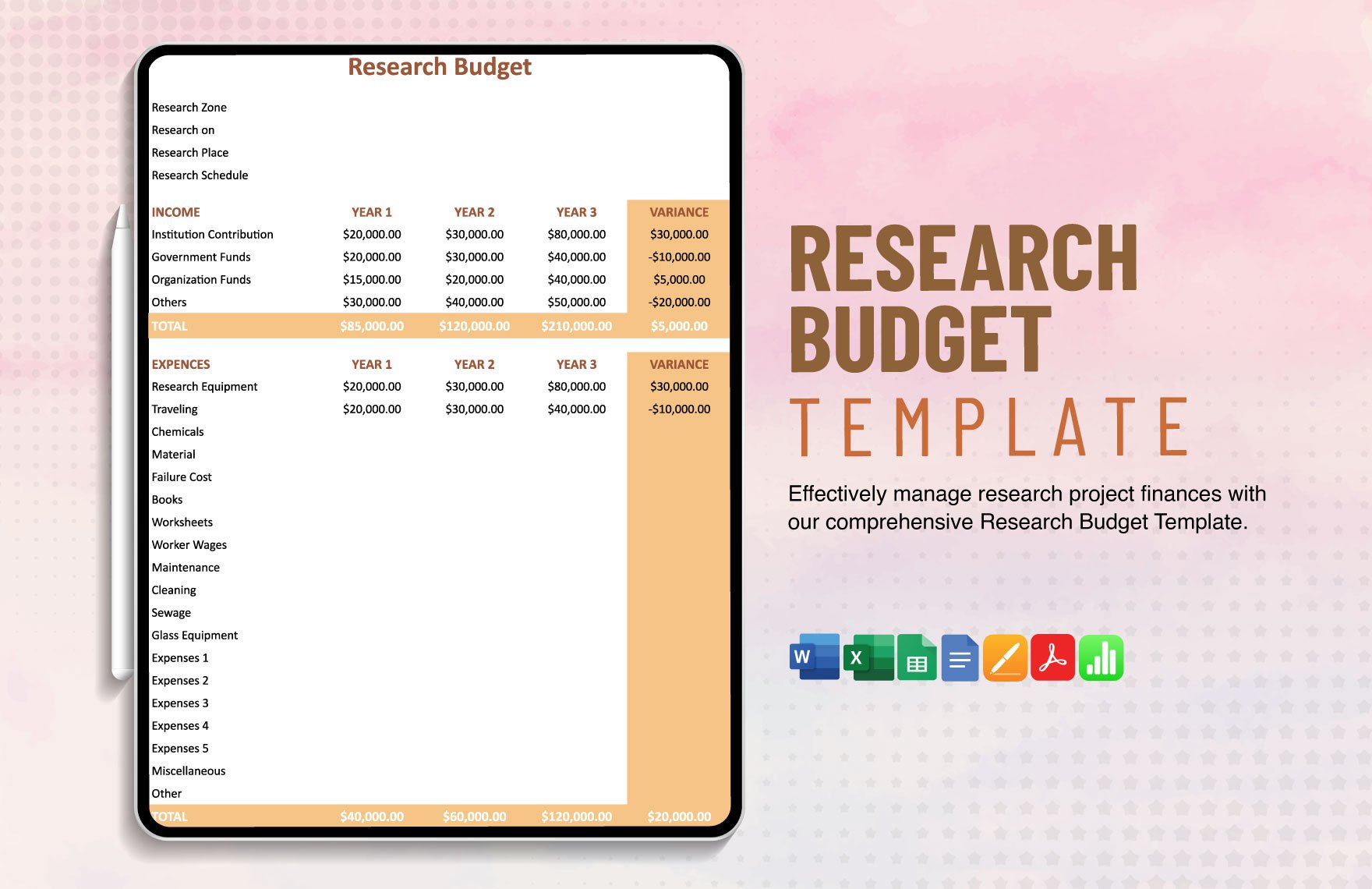

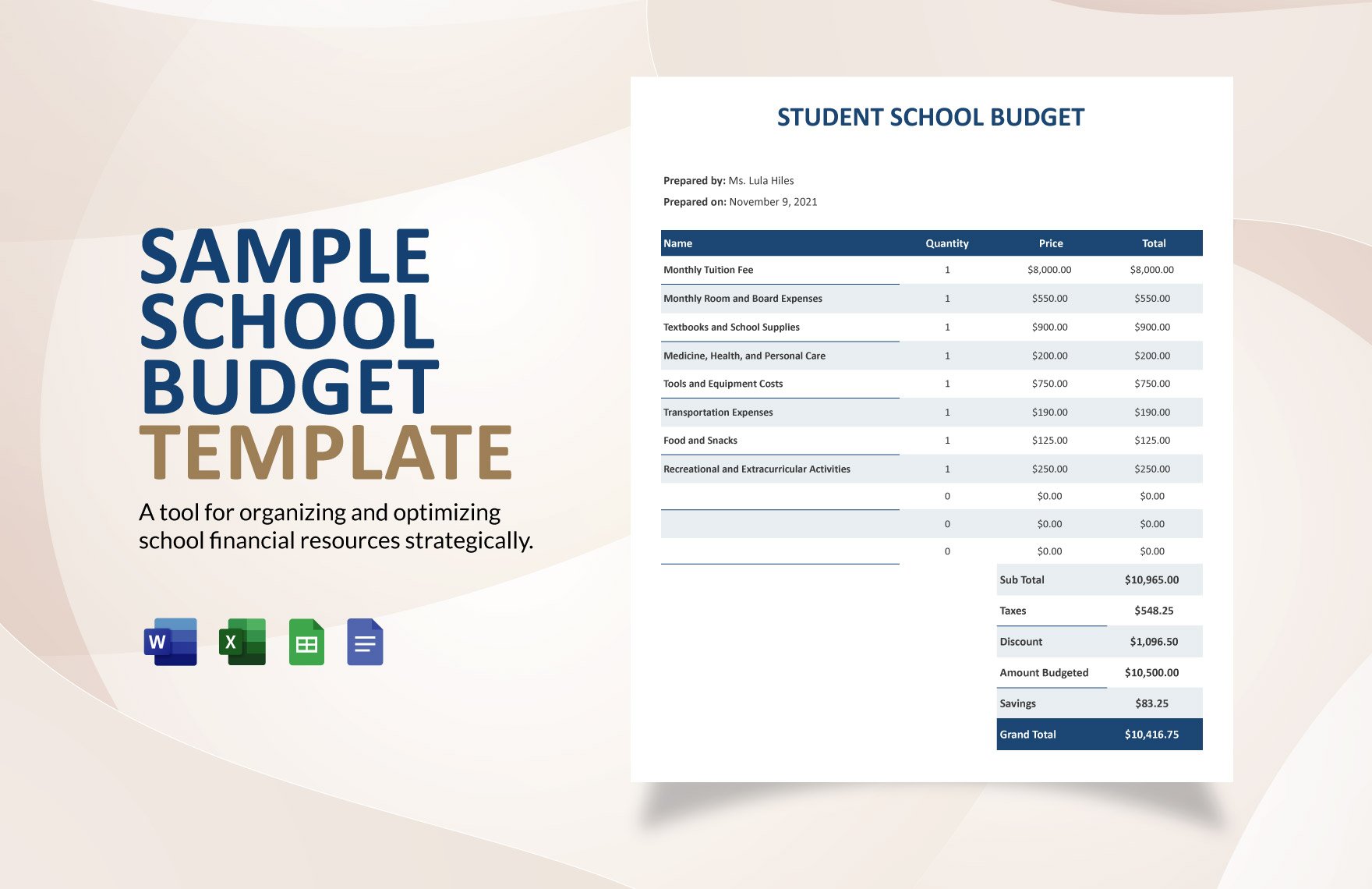

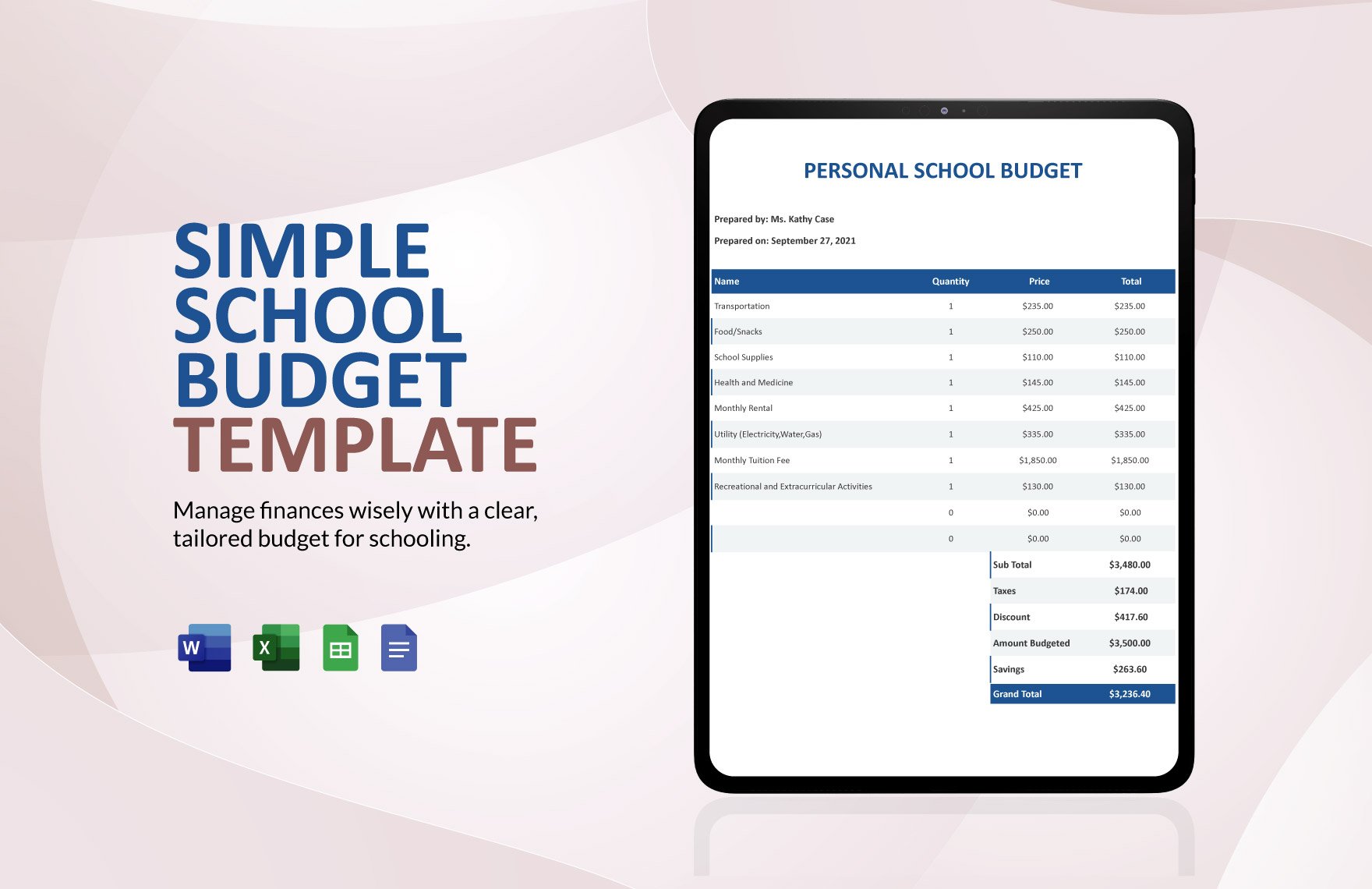

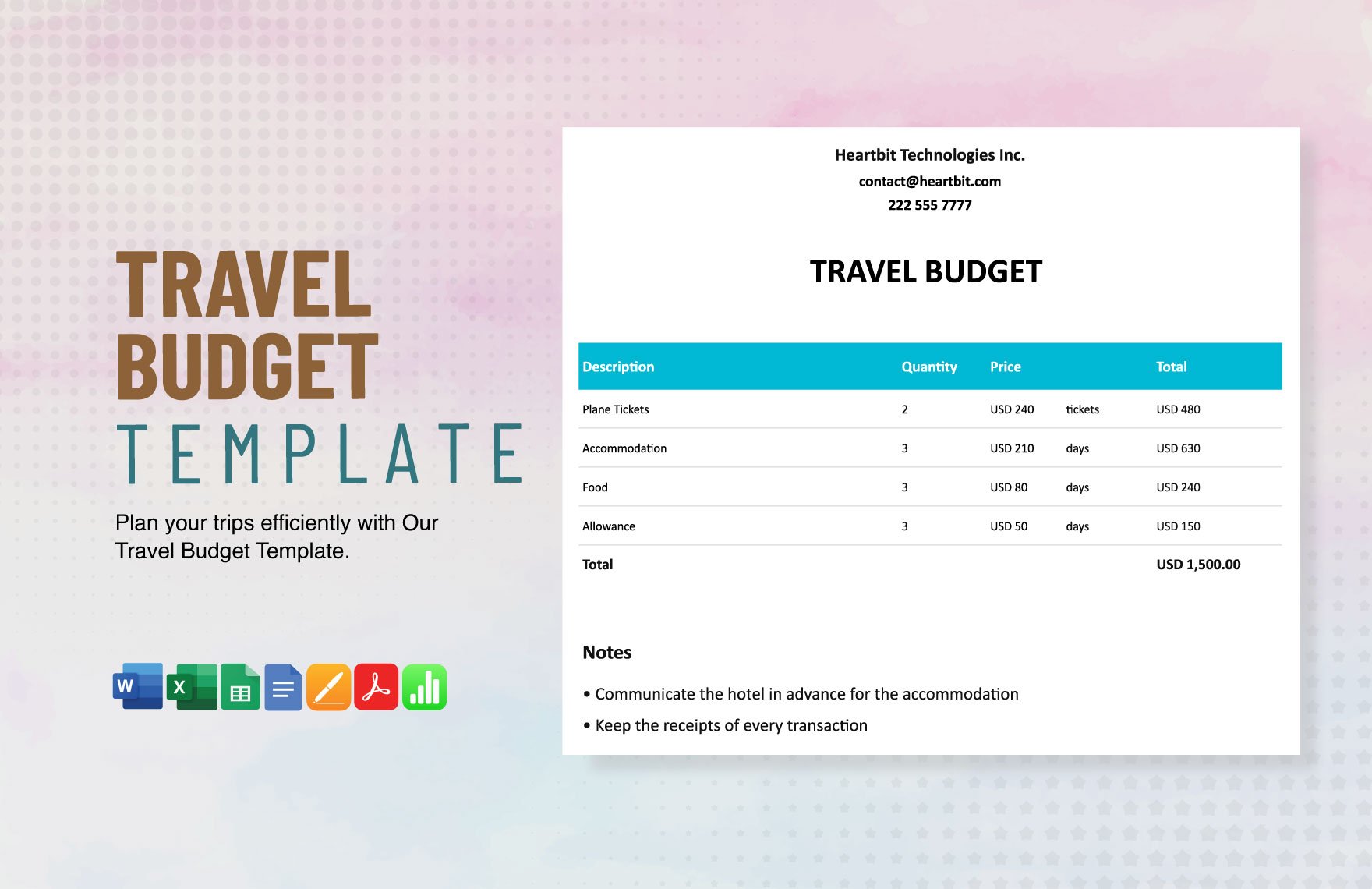

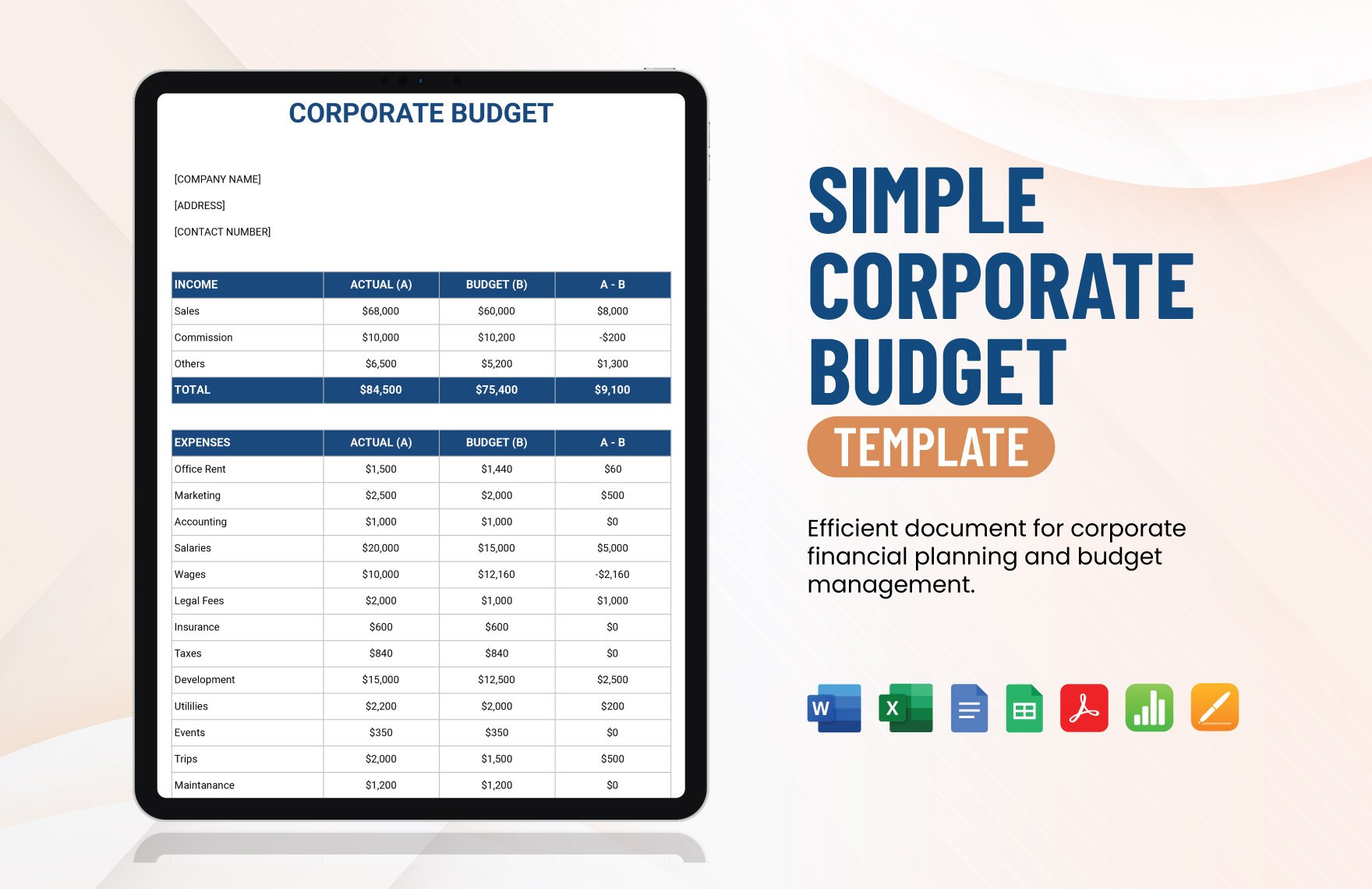

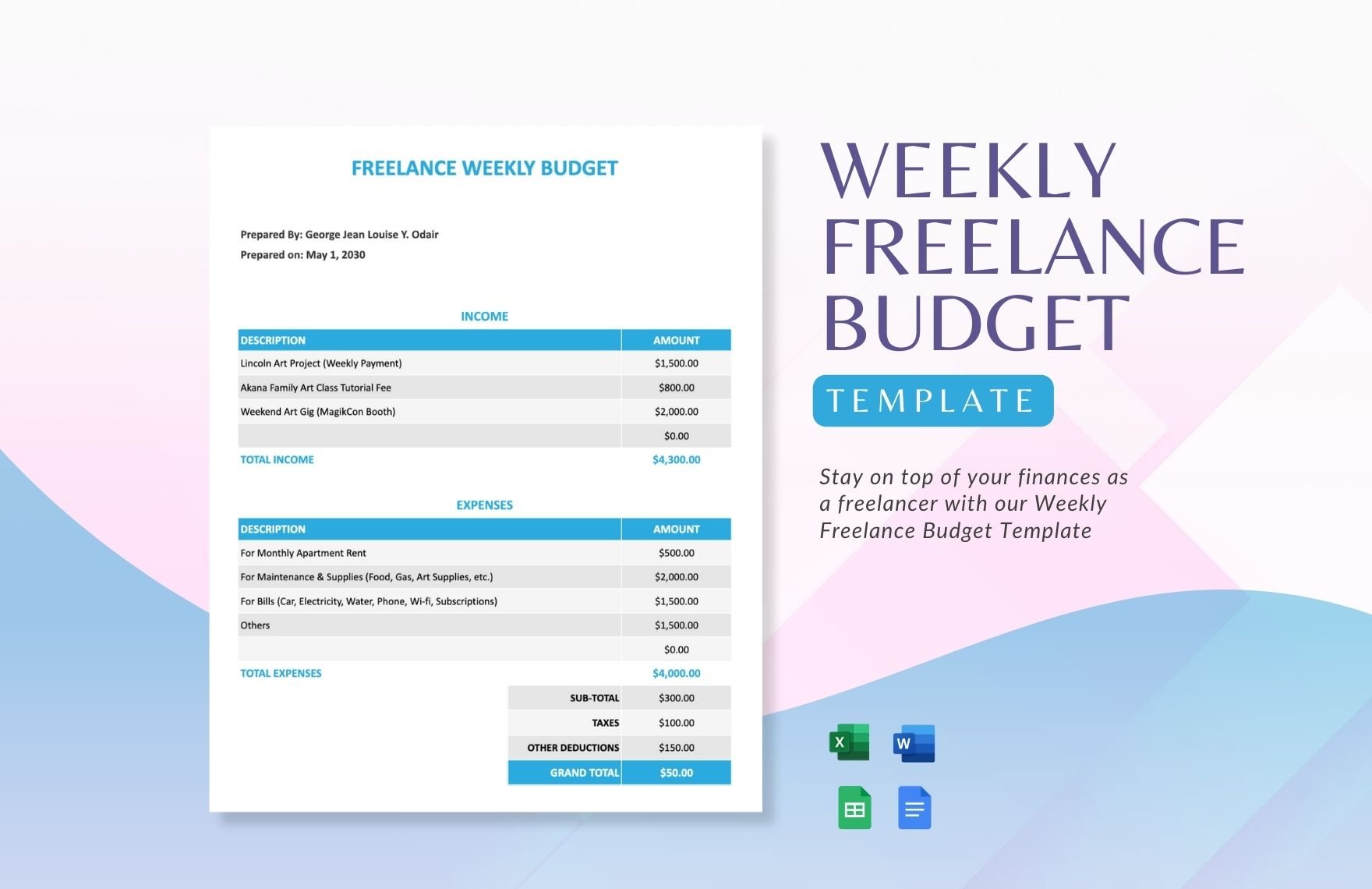

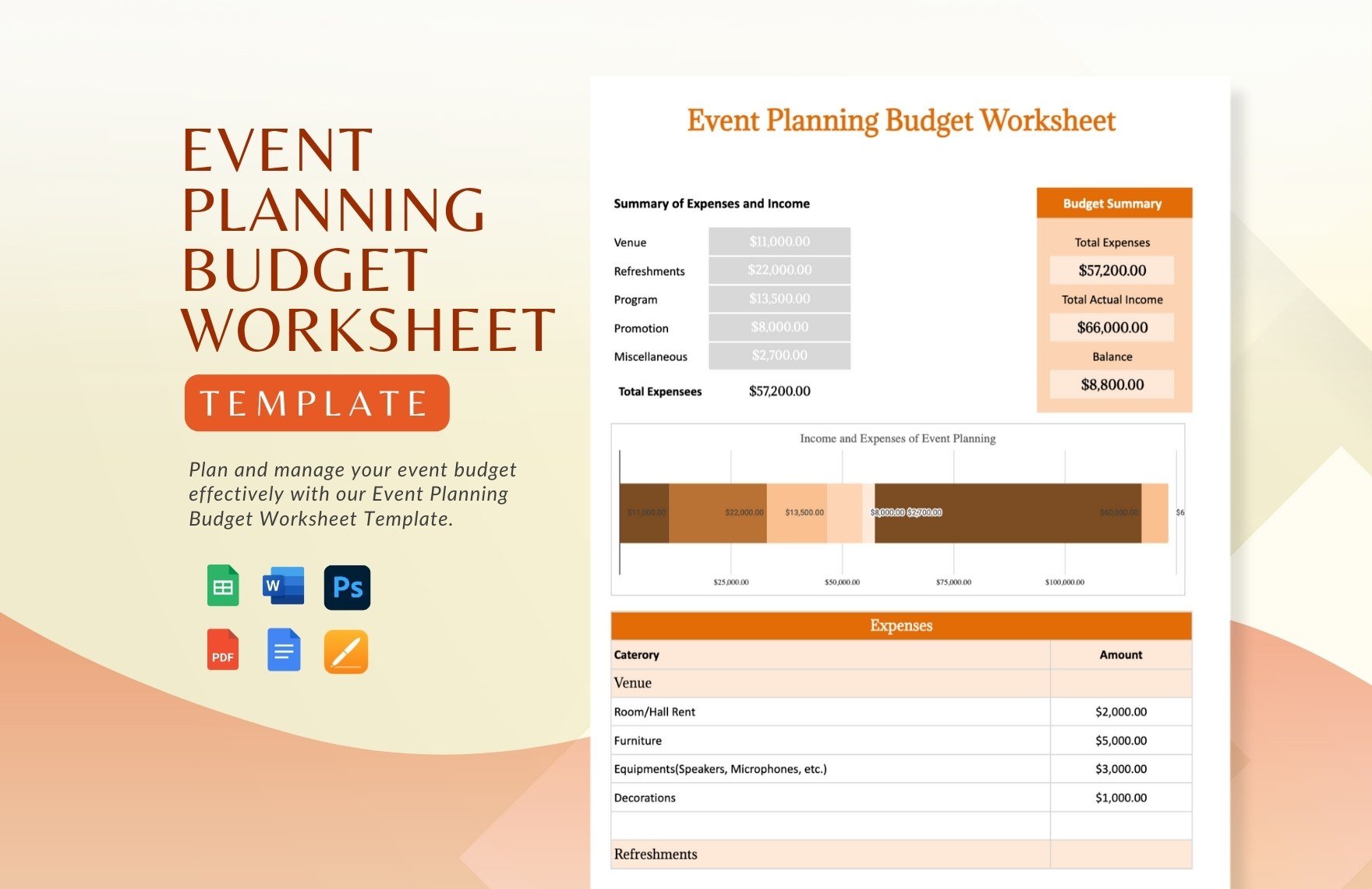

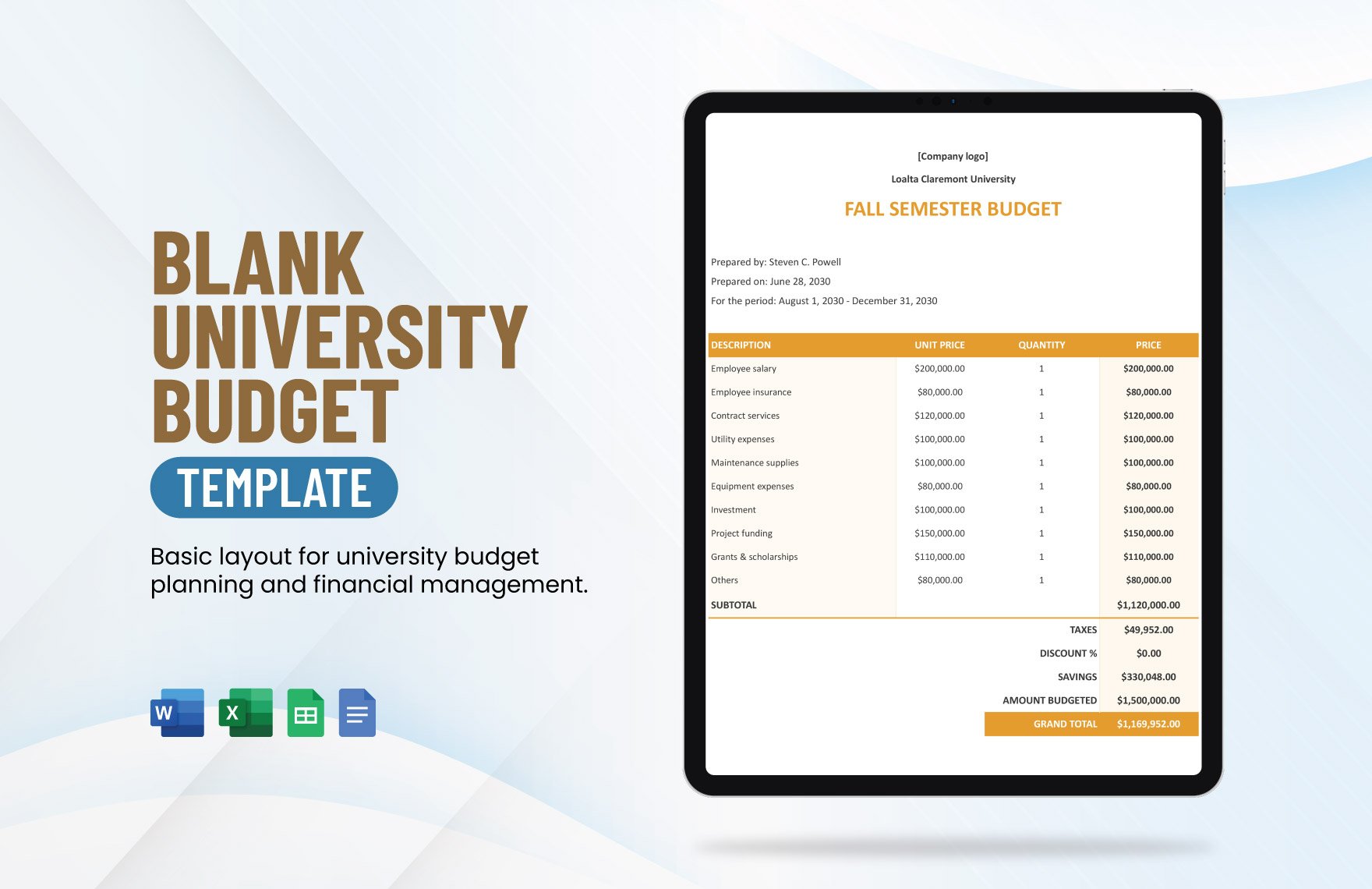

Keep your finances on track with the help of our high-quality Printable Budget Templates that are all 100% customizable in your favorite file formats. With these easily editable templates at your disposal, you can now quickly plan up a budget for any use whether it's for weddings, restaurant business, building constructions, or film productions cost. The best thing about these templates is that all of them are pre-formatted with easy-to-modify features to give you a hassle-free editing experience. Ace your next budget-making by downloading our premium templates today!

How To Make Printable Budget Templates?

A budget is an estimate of income and expenses specified for a set period of time and are usually compiled and re-evaluated periodically. In simpler terms, it is a plan on how would you spend your money and helps you keep track of the money that you earned and the things you want to buy with it.

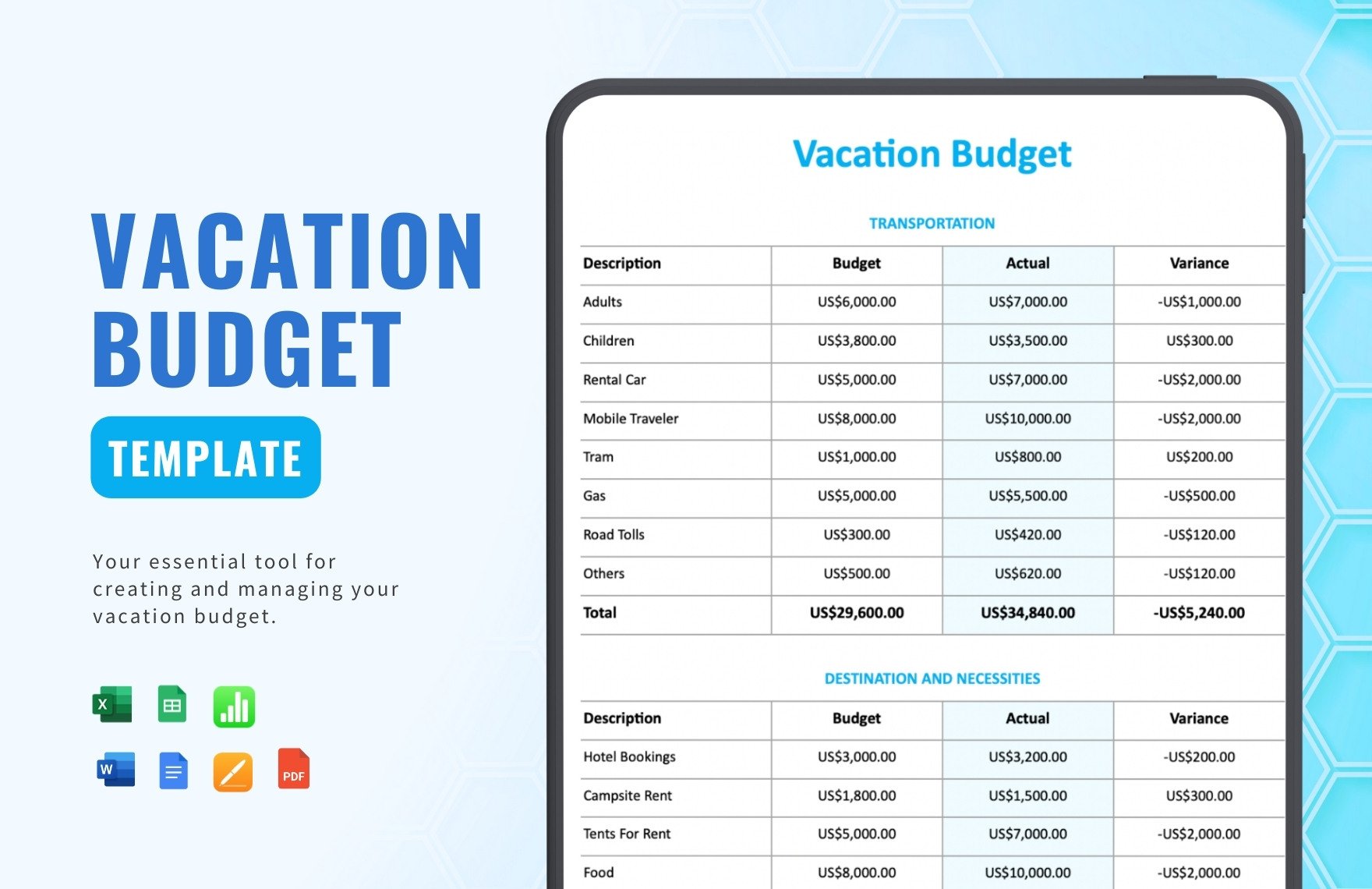

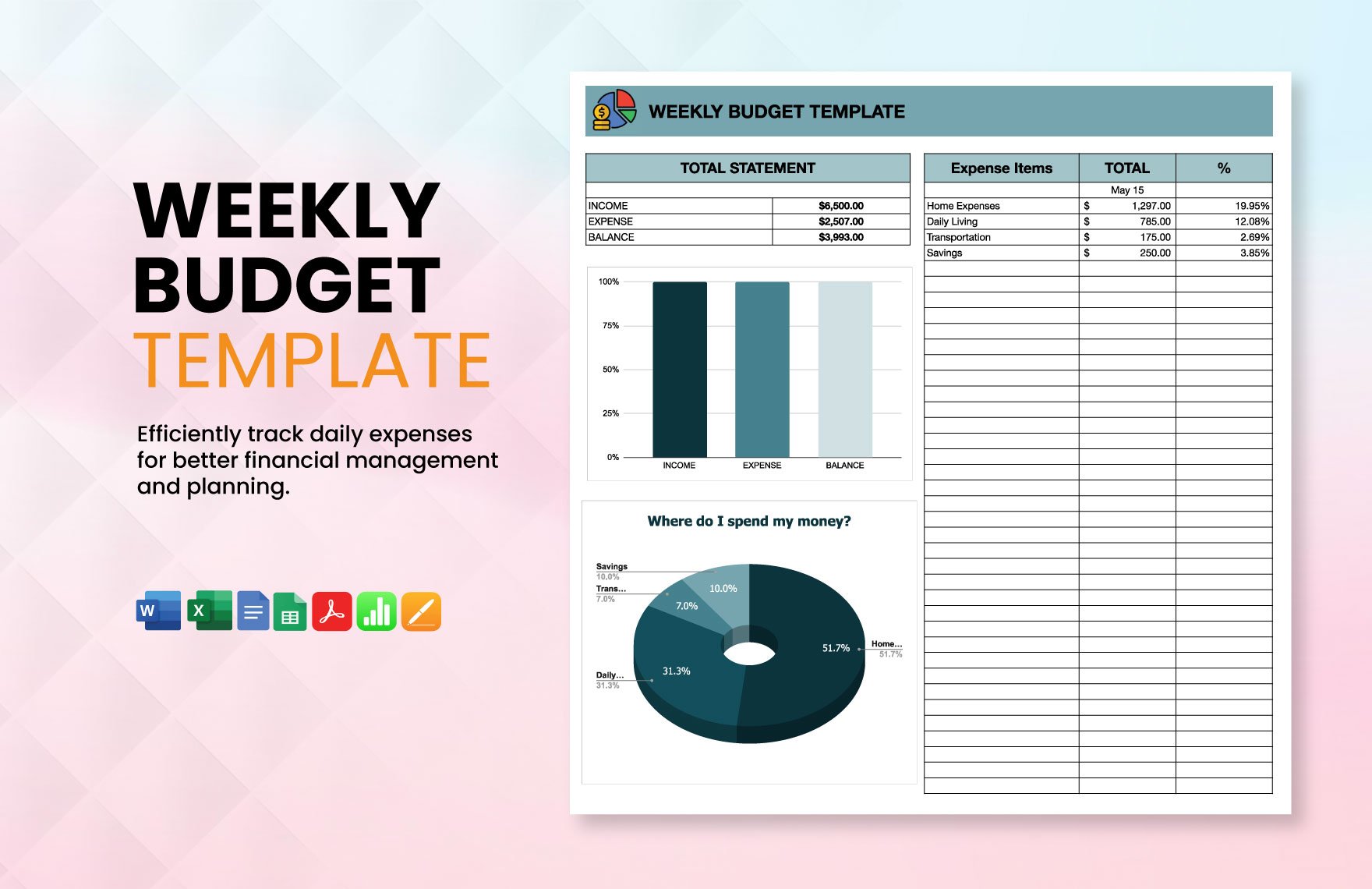

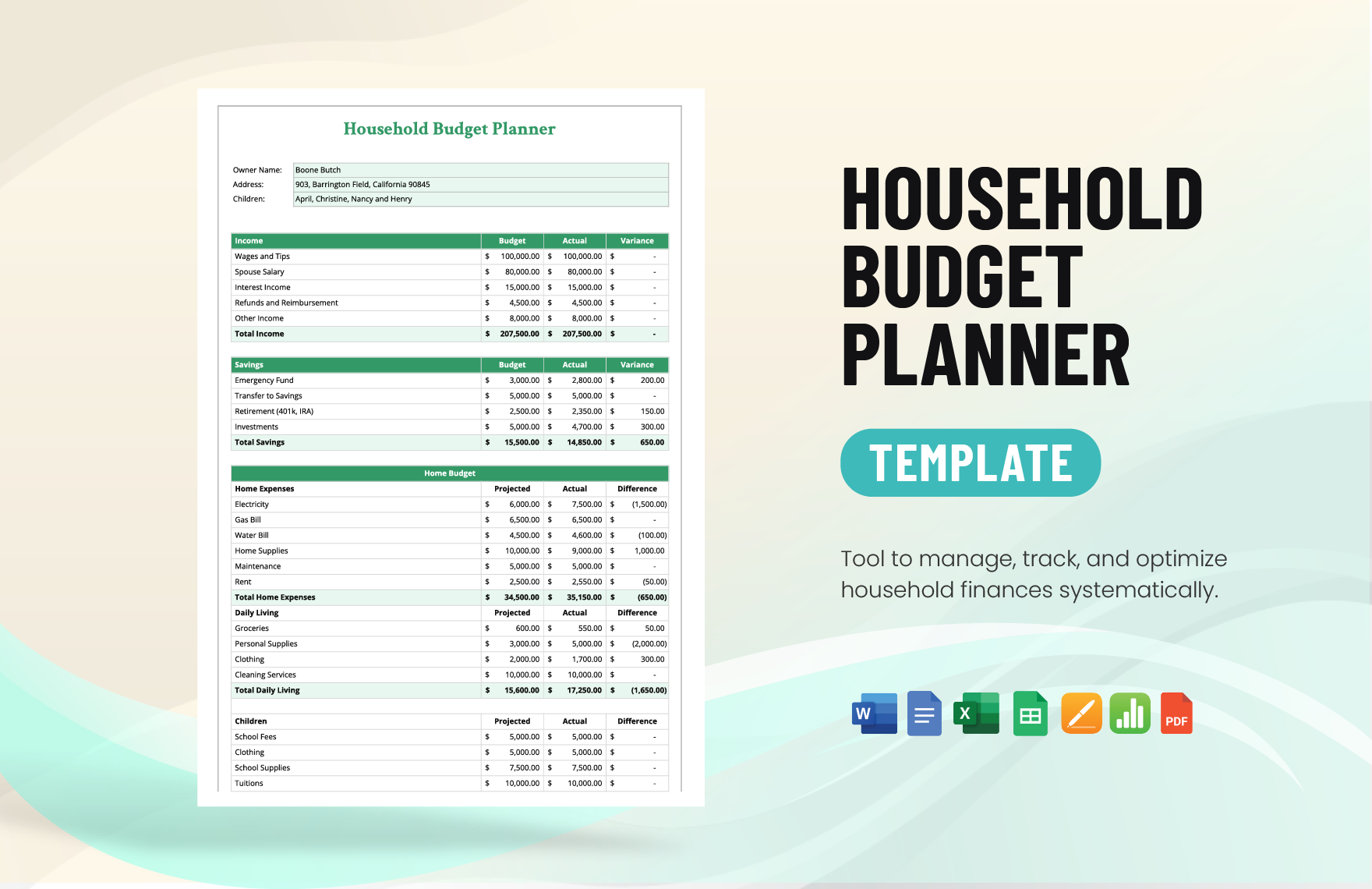

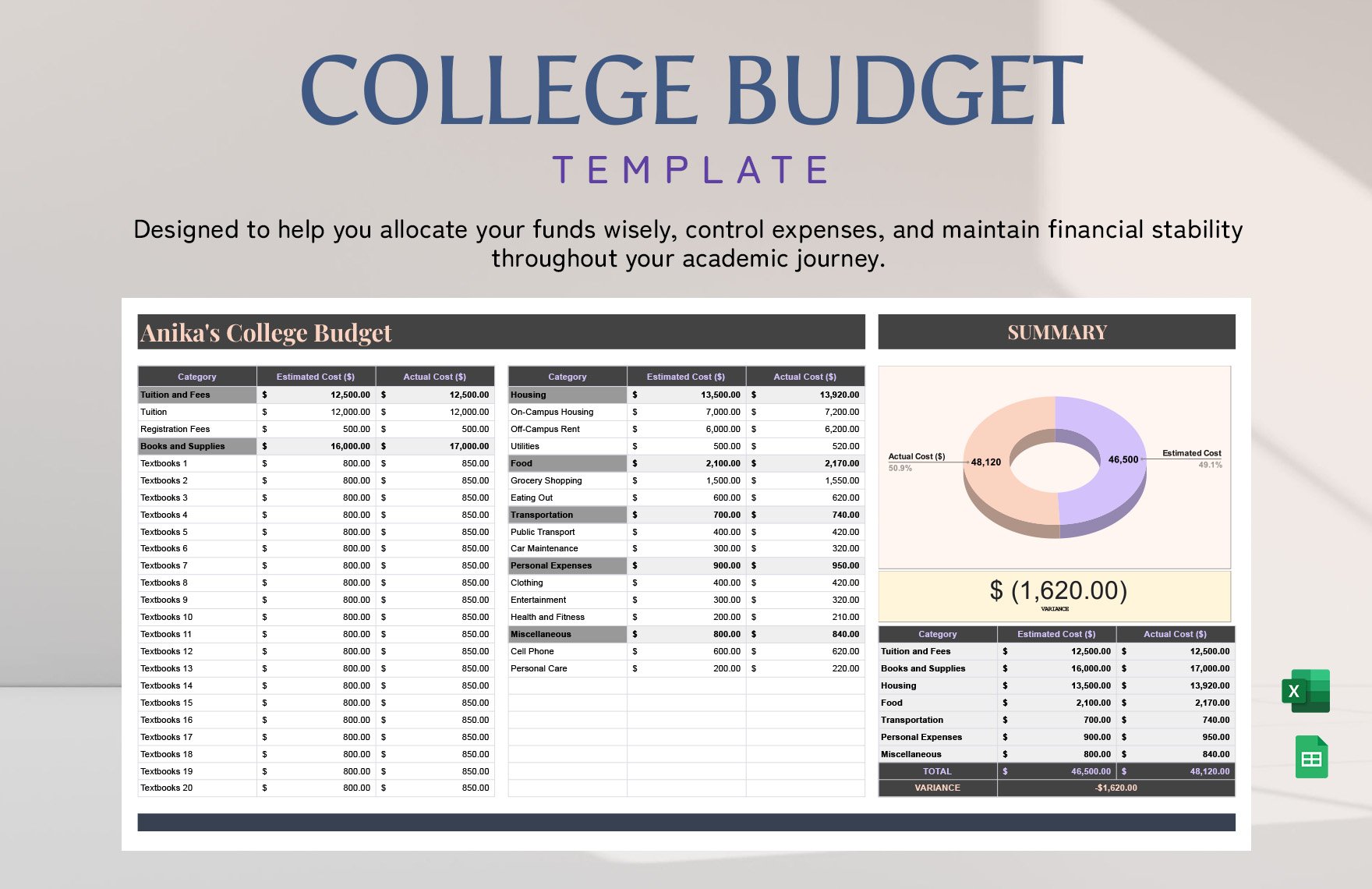

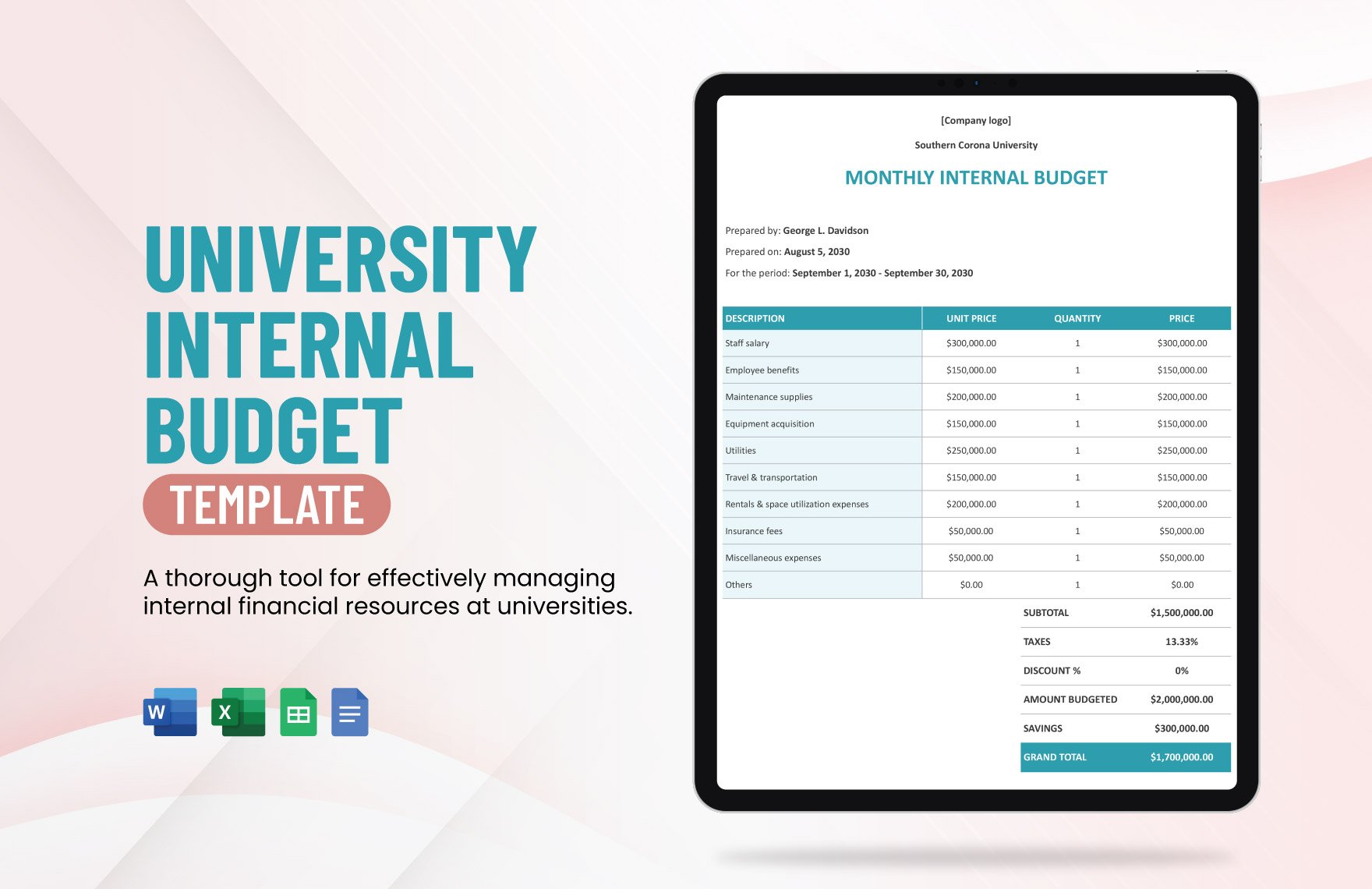

Printable budgets are the budget documents that you can use if you want to keep track of your daily, weekly, monthly, and annual financial expenses. This document shows you a thorough summarization of the overall computation from revenues to expenses as well as the breakdown percentage of the budget and where they are allocated. If your end game is to get away from debt, save for your kid's college fund, worry-free retirement, and investments—you need a budget. Learn how you can make a personal budget template with the help of some guide tips that we have provided below.

1. Record Your Net Income

The first step in creating a simple budget is to determine the amount of money you are expecting to receive on a daily or monthly basis. By doing so, you make it easier for you to overestimate what you can afford if you think of your total salary as what you have to spend. Make sure to record a net income that is subtracted already with deductions and taxes so that you can freely allocate it without worrying.

2. Track Your Expenses

Tracking your day to day expenses is very important in creating a budget, especially if you're a student because this will help you know where you can make adjustments. Doing so will help you identify where you are spending most of your money and what part of your expenses should you cut back more. Begin by listing down your fixed expenses, such as household rents or utilities, as well as the variable expenses, which include groceries and entertainment. And from there, decide what opportunities should you cut back to itemize your monthly budget planner well.

3. Set Your Goals

After tracing up your expenses, make a list of all the short and long term financial goals you want to achieve. If setting up a start-up budget for your desired business is one of them, make sure that you get to meet them within a specific period. Remember that your goals don't have to be set in stone, but identifying your priorities before you create an annual budget plan can be very helpful for you in so many ways.

4. Set Up A Plan

Now that you have already finalized your fixed and variable expenses, you'll now be able to get a sense of what to spend in the coming months. To do this, opt to make a budget sheet that will help you predict fairly and accurately how much you'll have to budget for. Make sure to break down your expenses thoroughly between the things you want and the things you need.

5. Review It Regularly

After successfully creating a budget, make sure to review it regularly to be sure you are staying on track. If you're creating an annual budget, comparing it to your previous ones will help you determine if your expenses have increased or you may have reached any goal. Whatever your reasons, make sure to always apply the tips mentioned above in your next budget-making.