Handling finances prove to be difficult for many. Time and time again, we fall into the traps of discounted bags and limited edition shoes. Contrary to popular belief, you don't have to be good in math to be able to come up with your own budget plan. Here at Template.net Pro, we provide you Sample Budget Templates that's perfect for your weekly, monthly, or yearly planning. We offer 100% customizable, printable, easily-editable, high quality, professional, quick, saves time, and professionally written templates. Available in A4 & US Letter sizes and in your favorite file formats. What are you waiting for? Download our templates now!

What Is a Sample Budget?

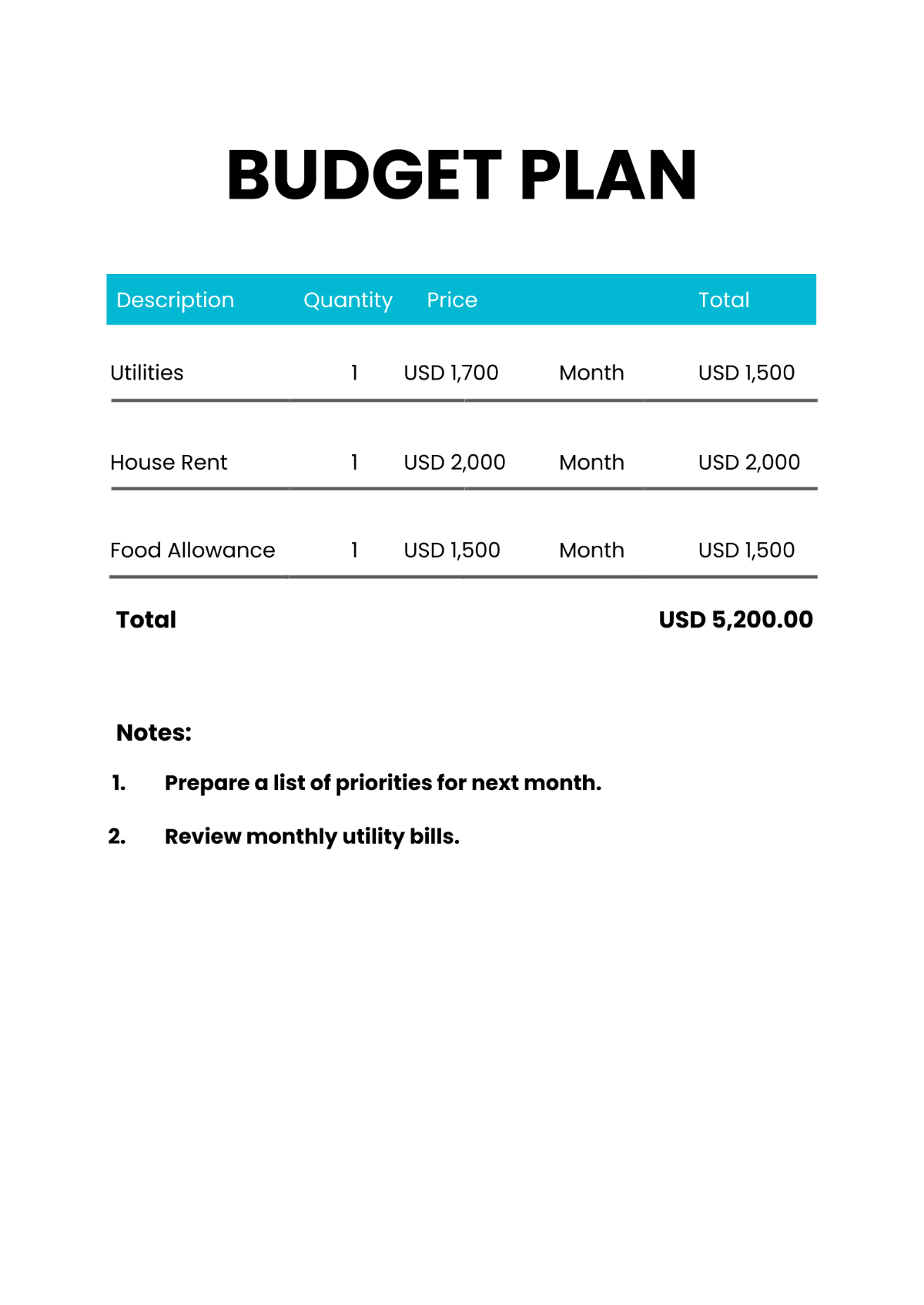

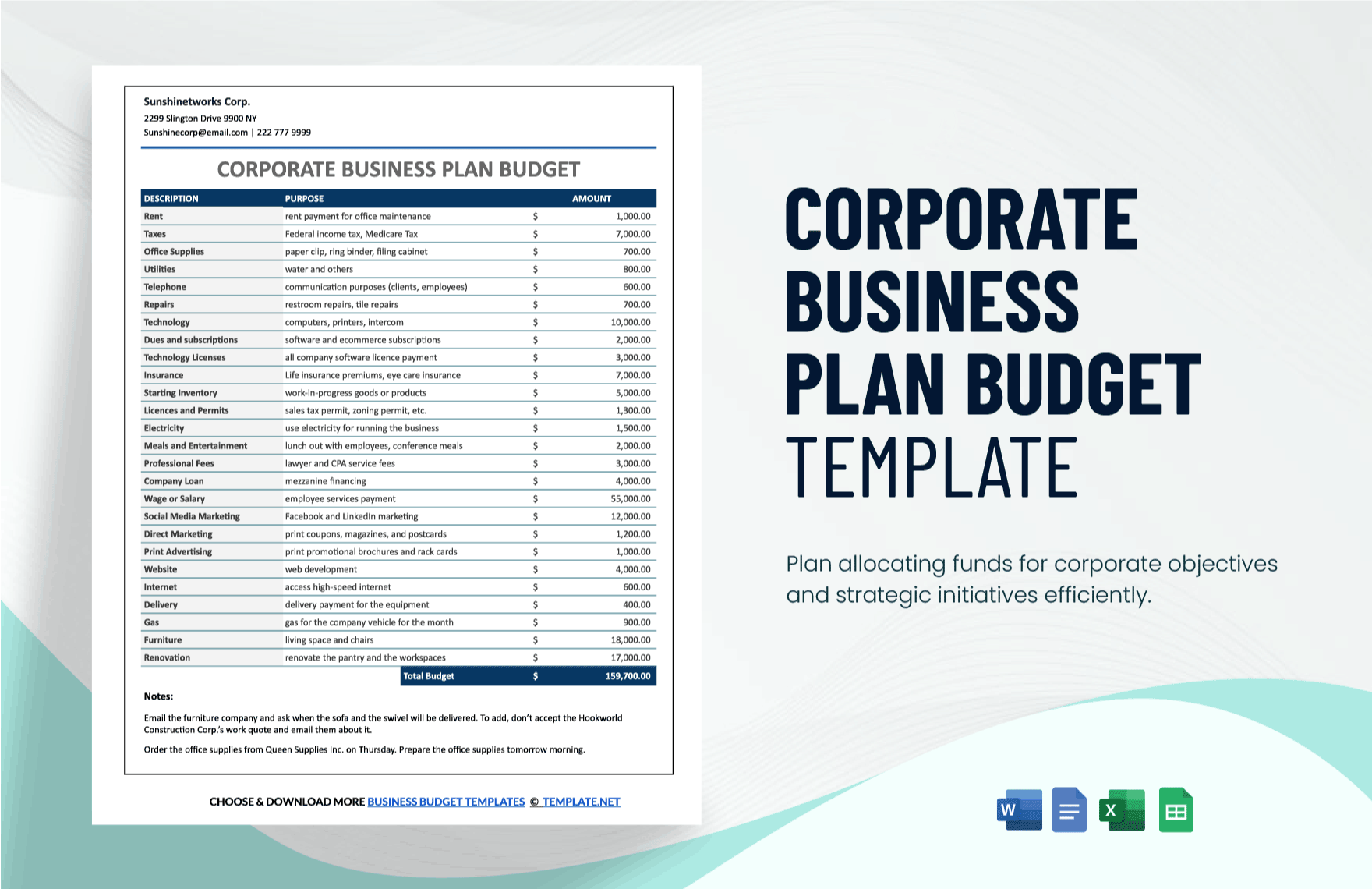

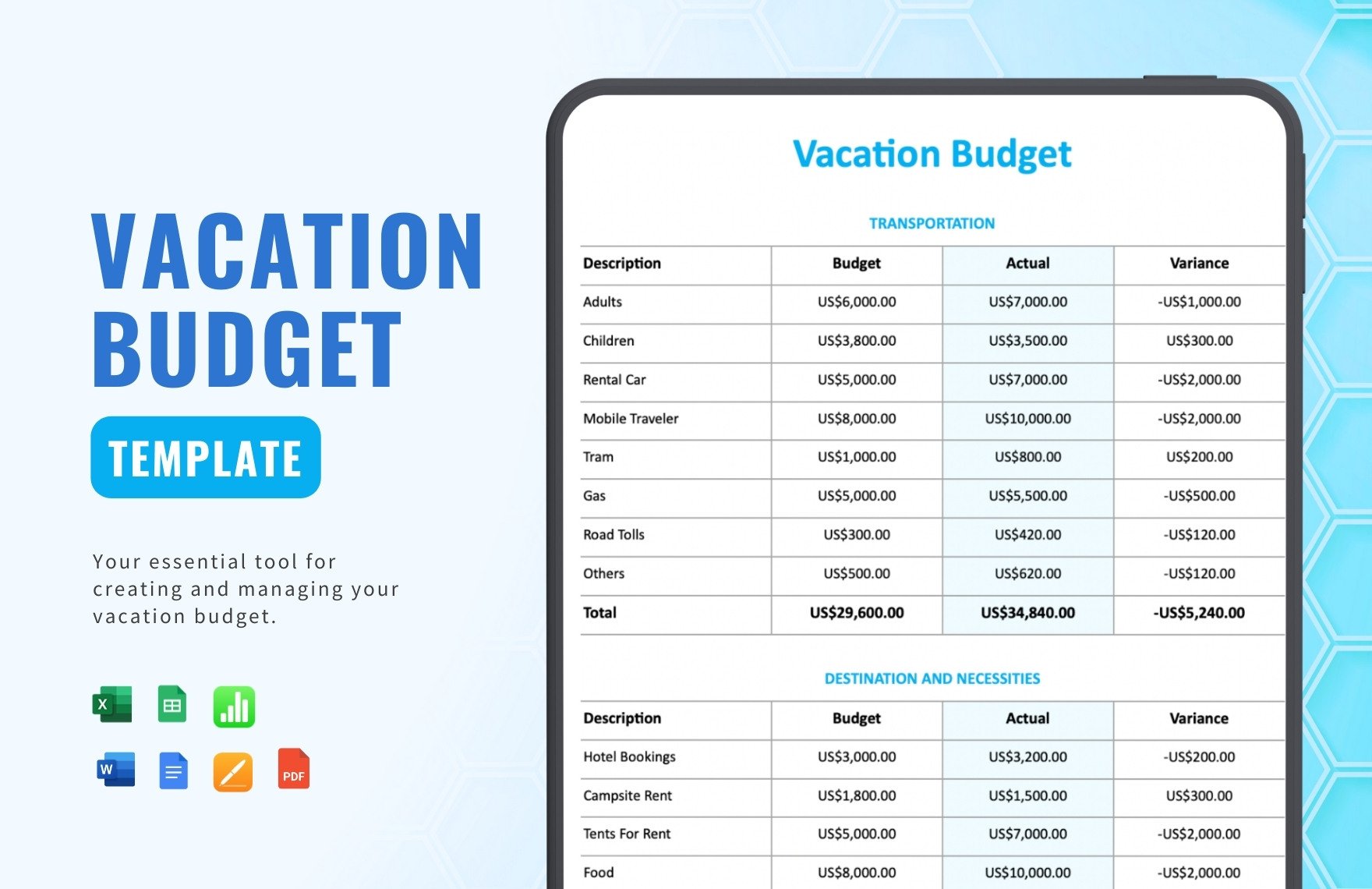

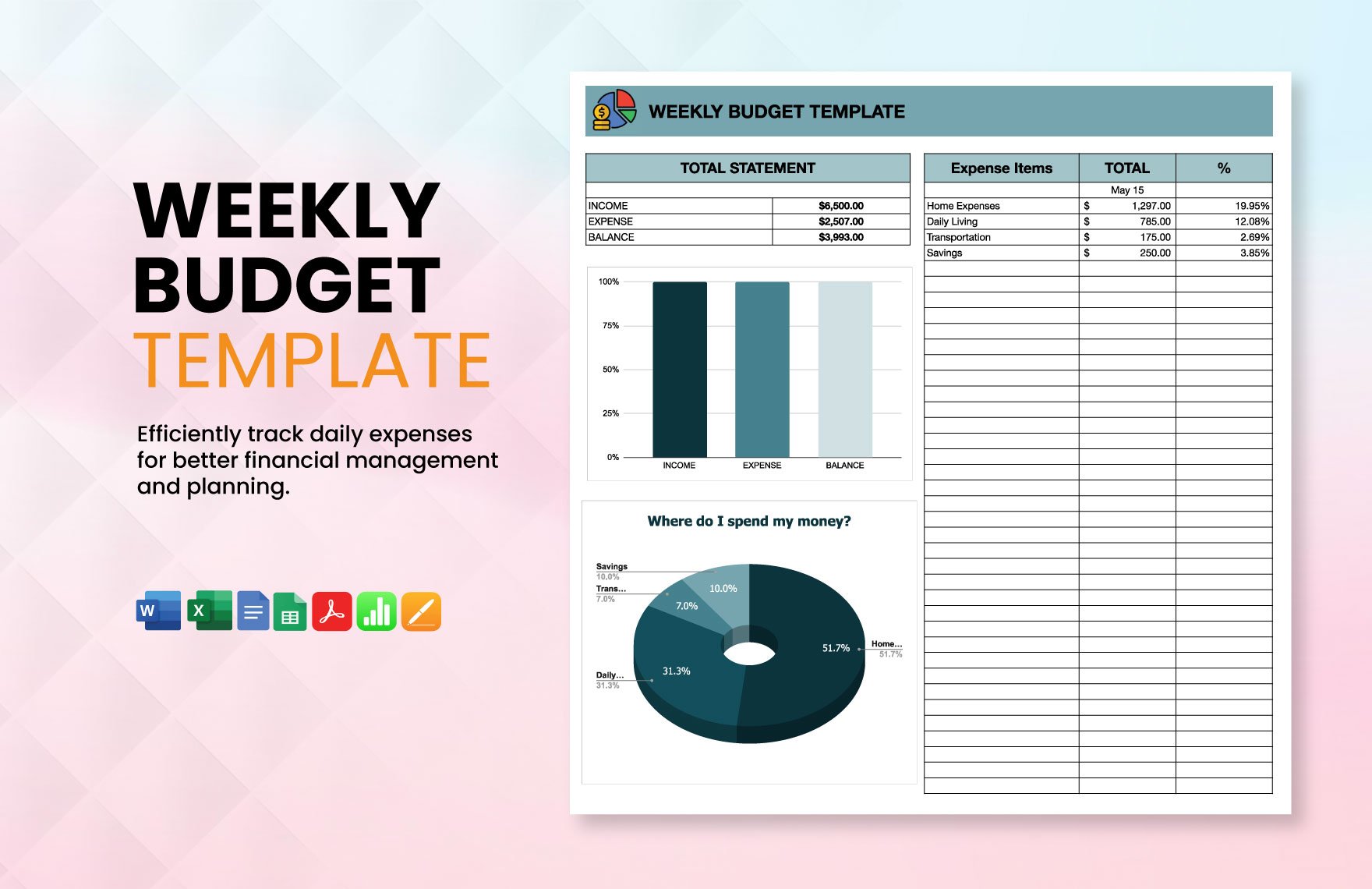

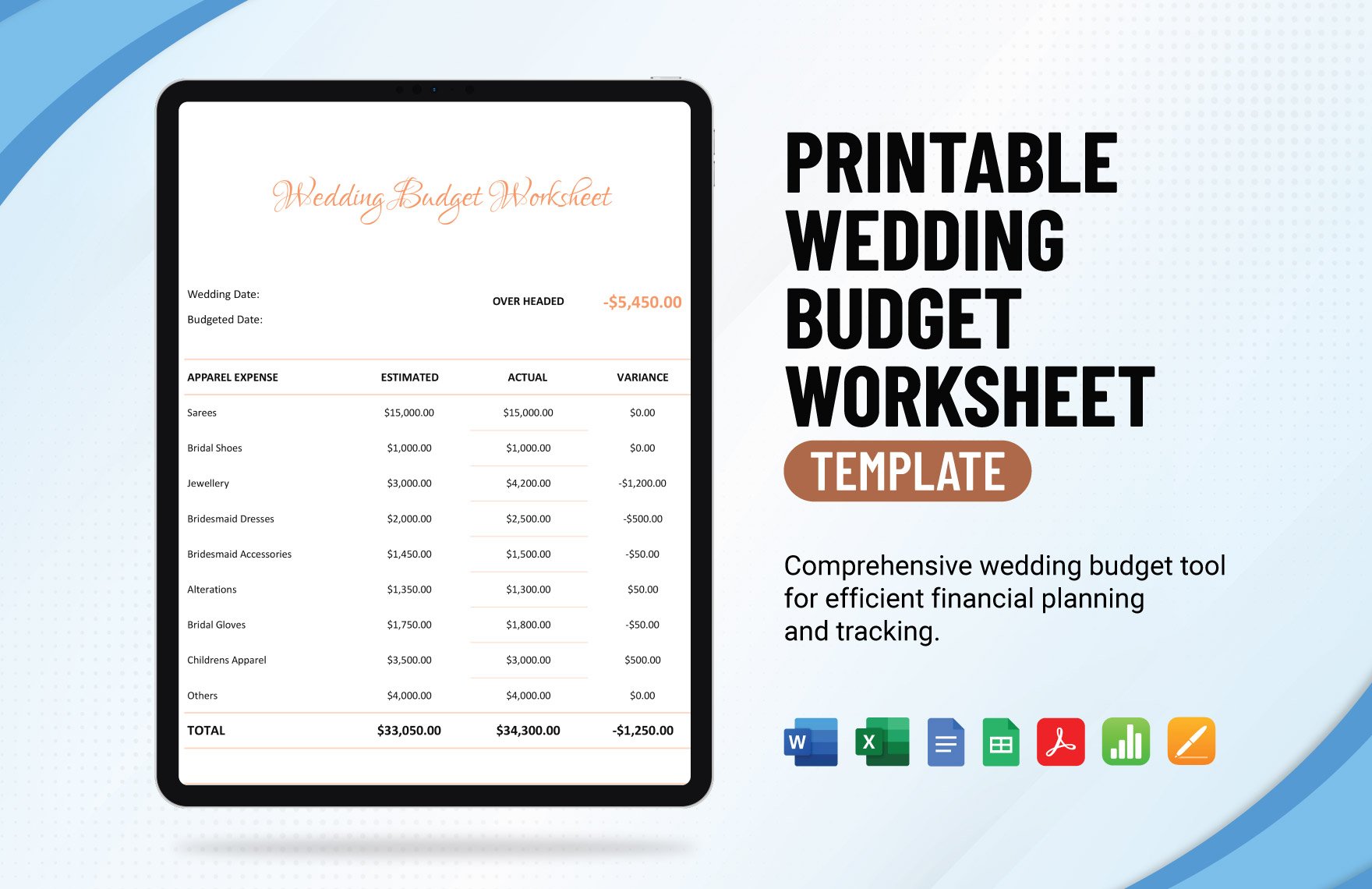

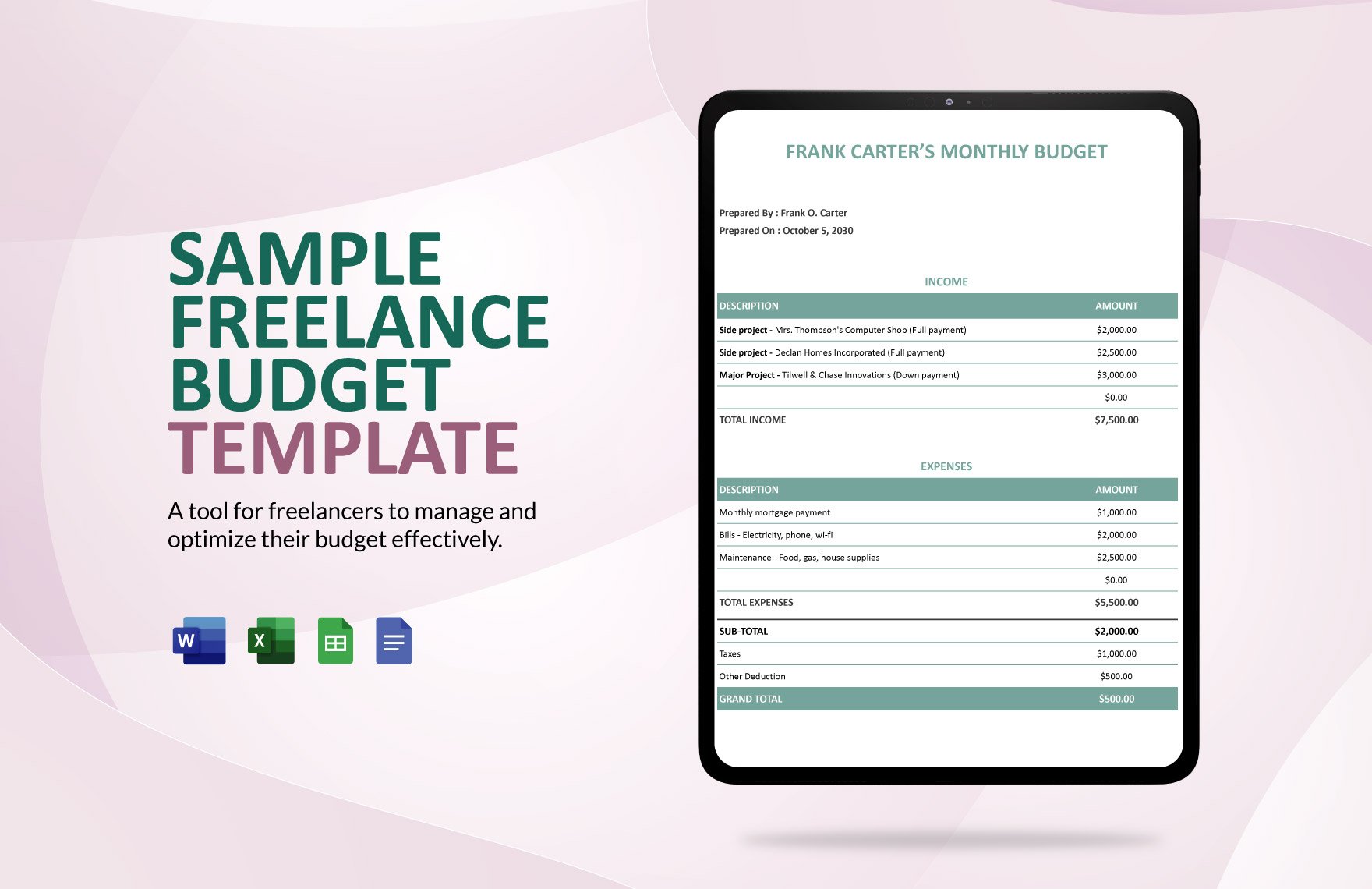

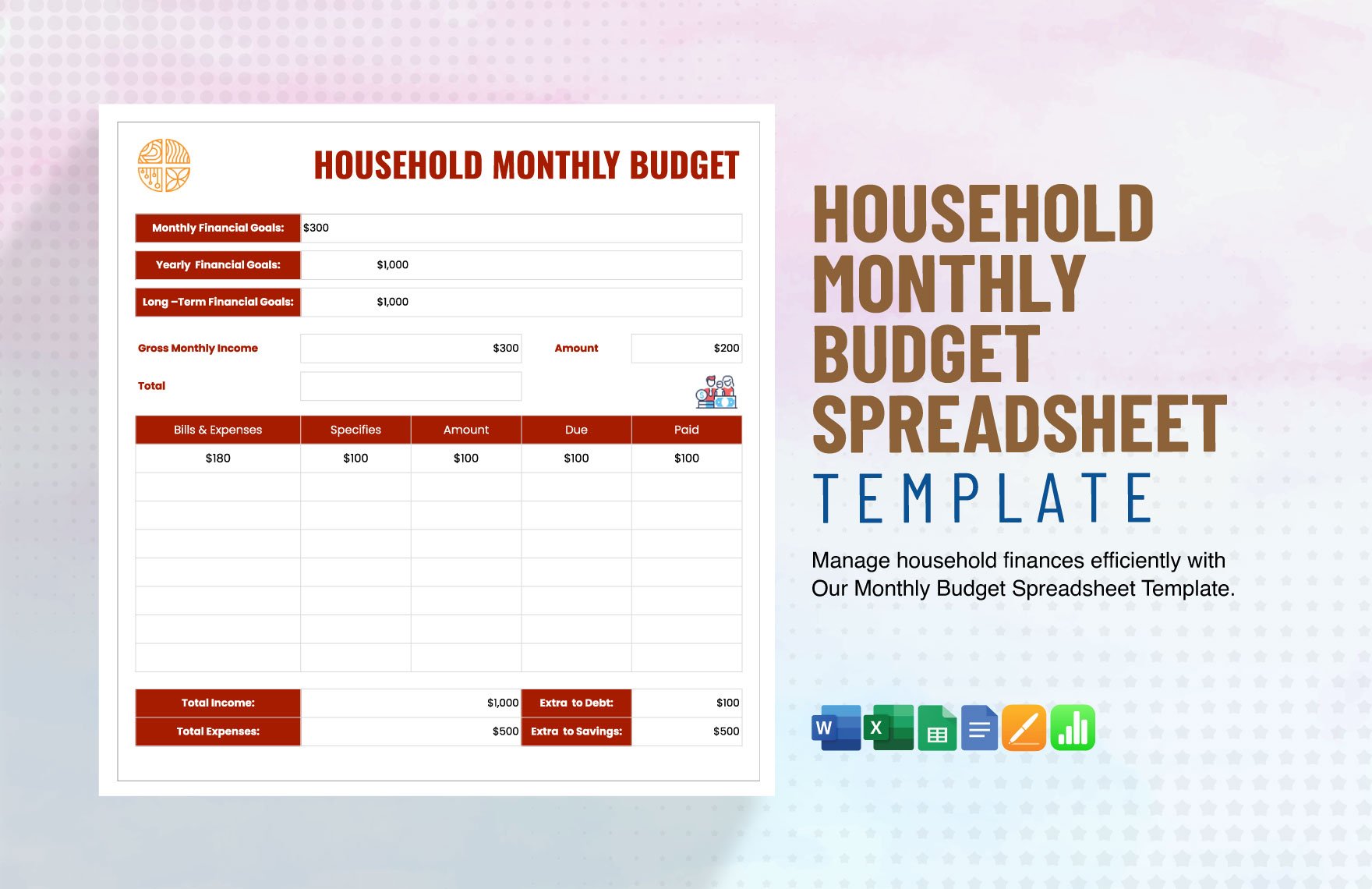

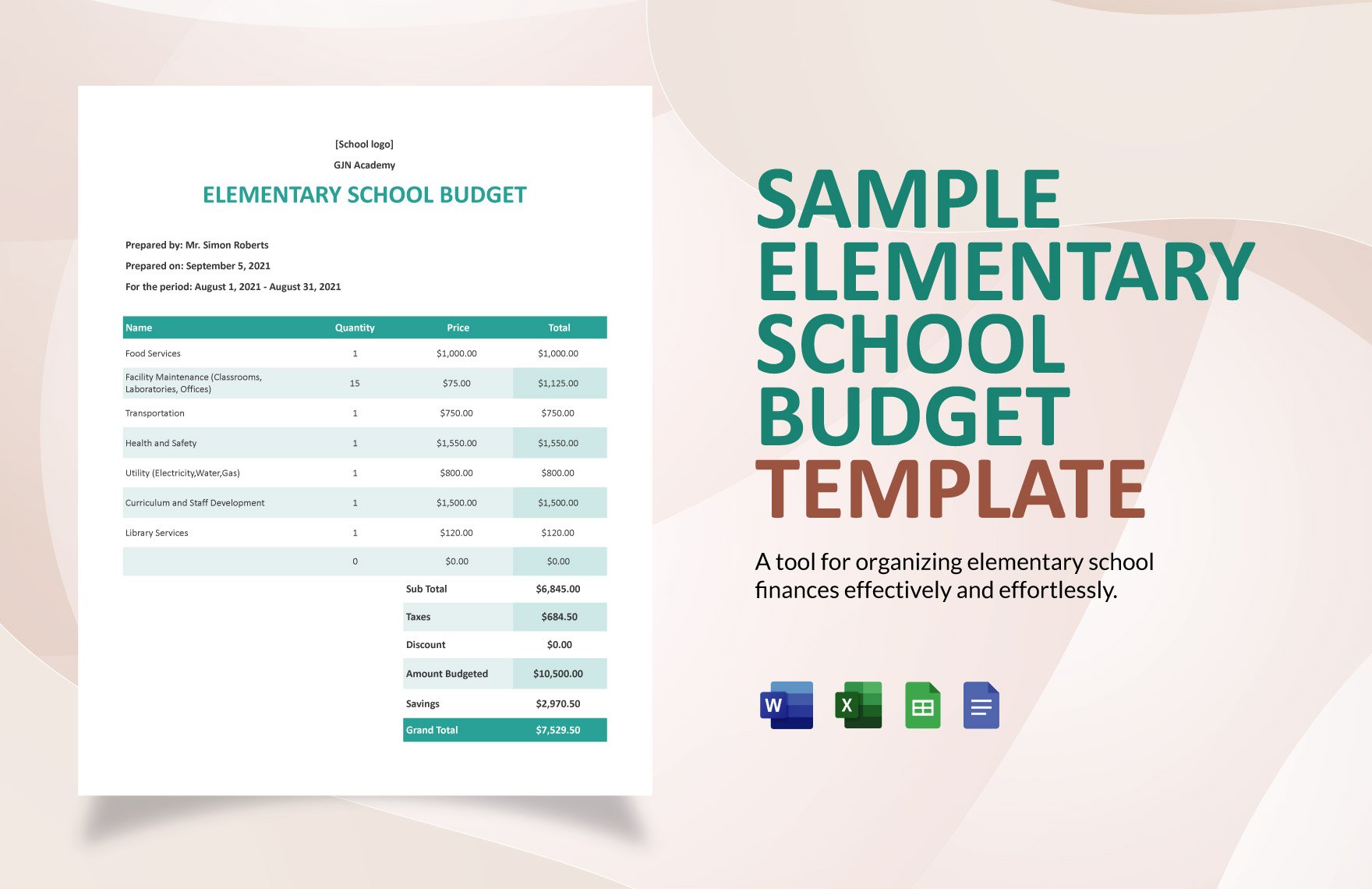

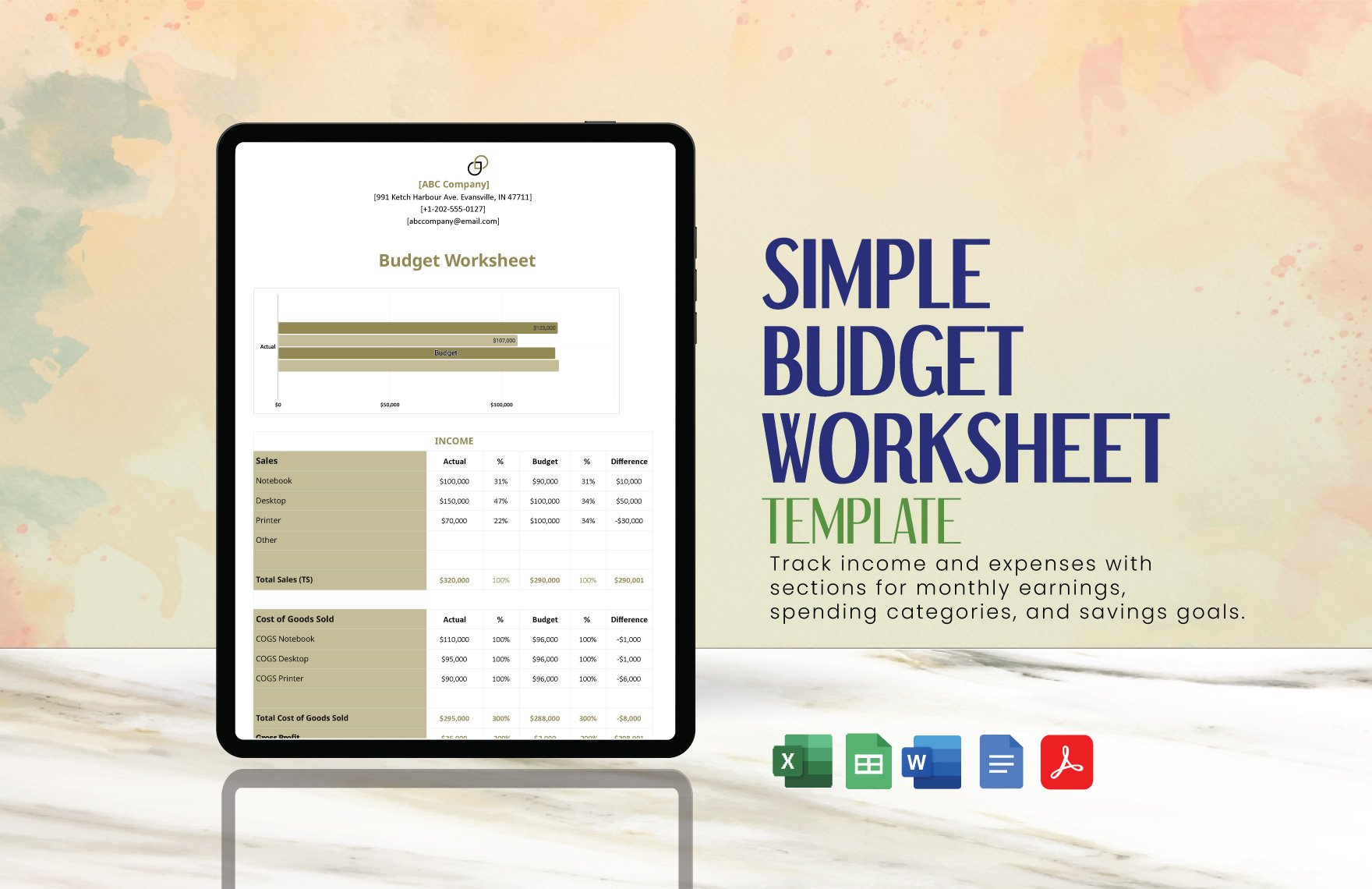

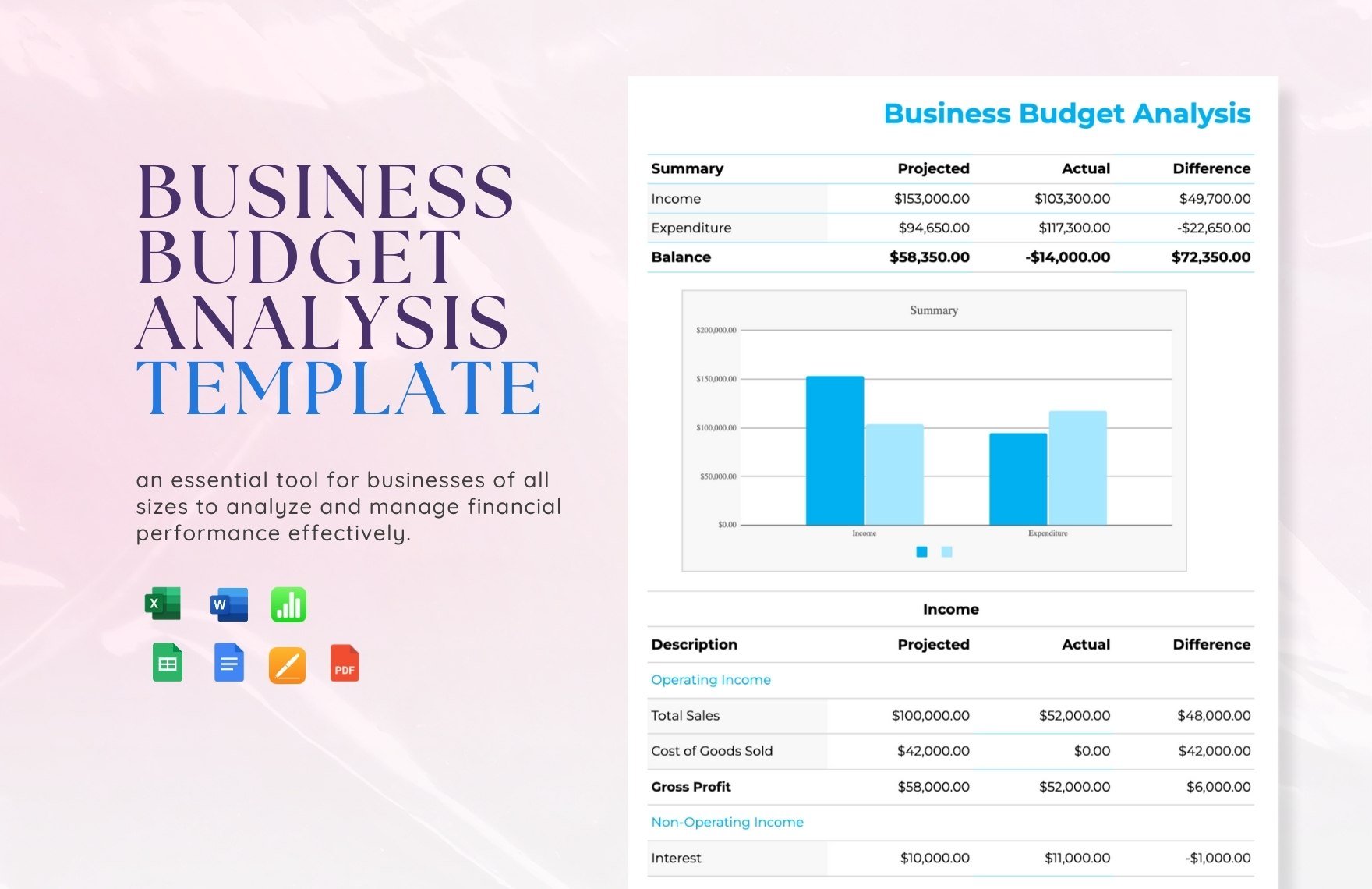

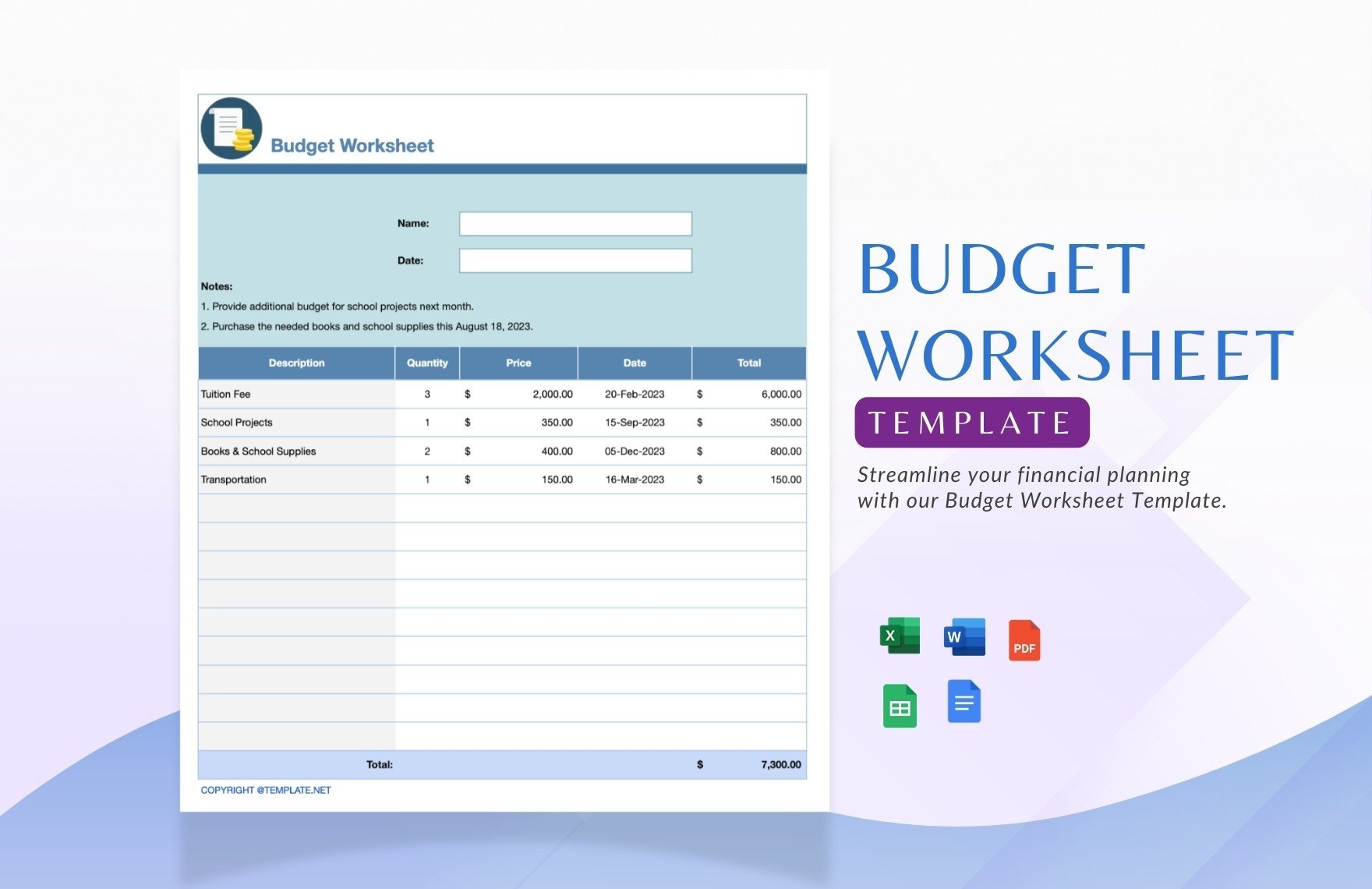

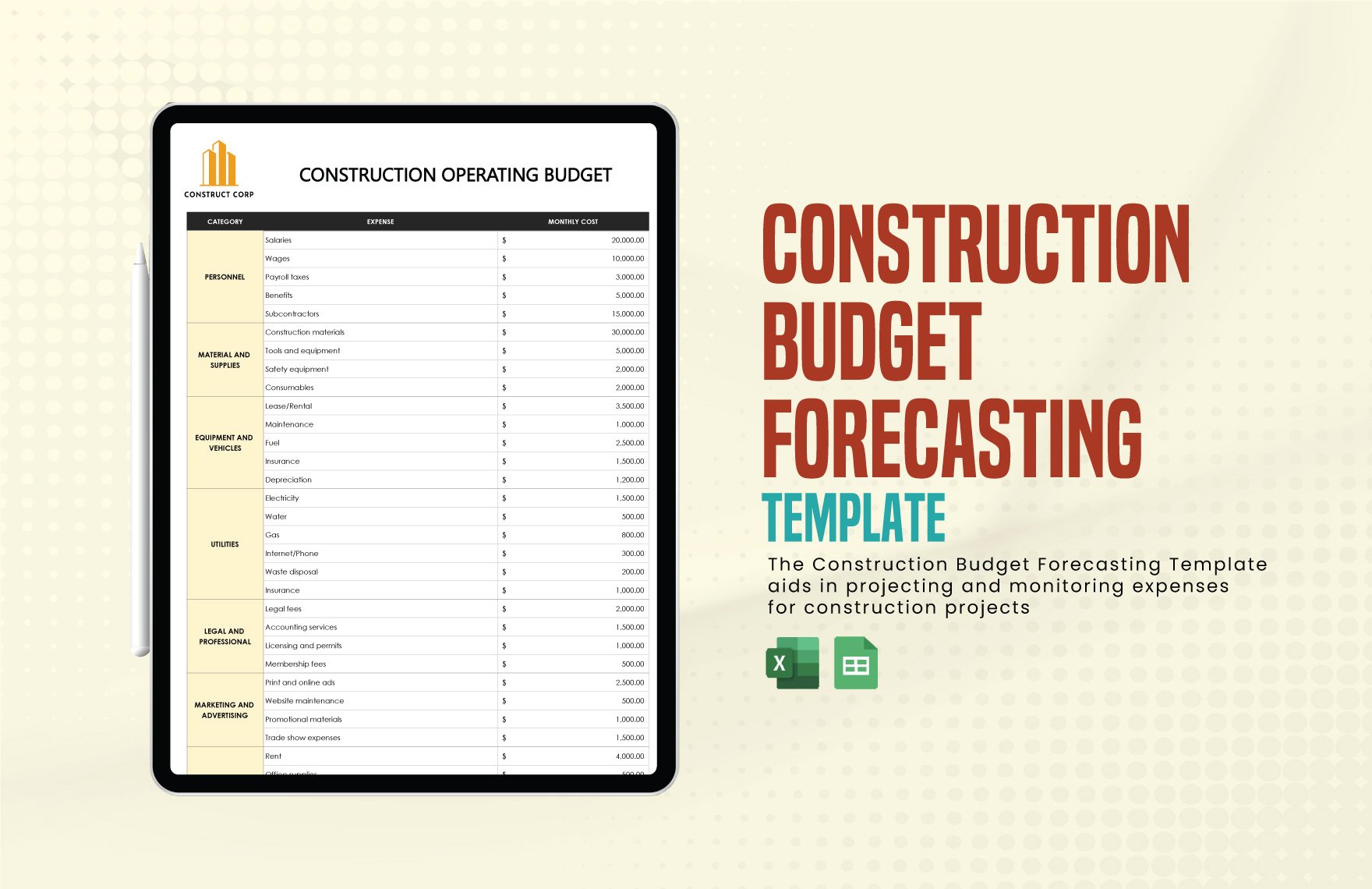

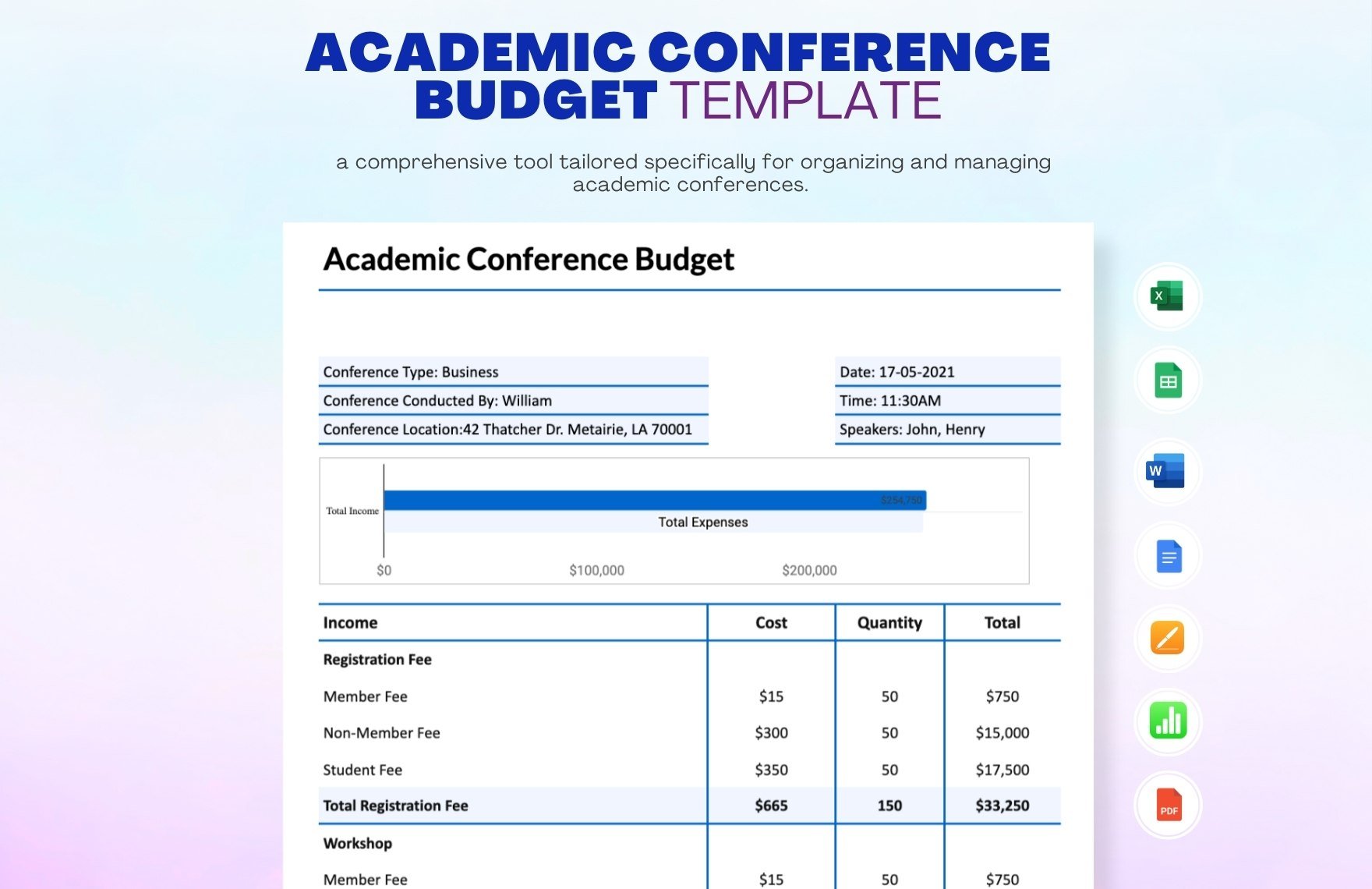

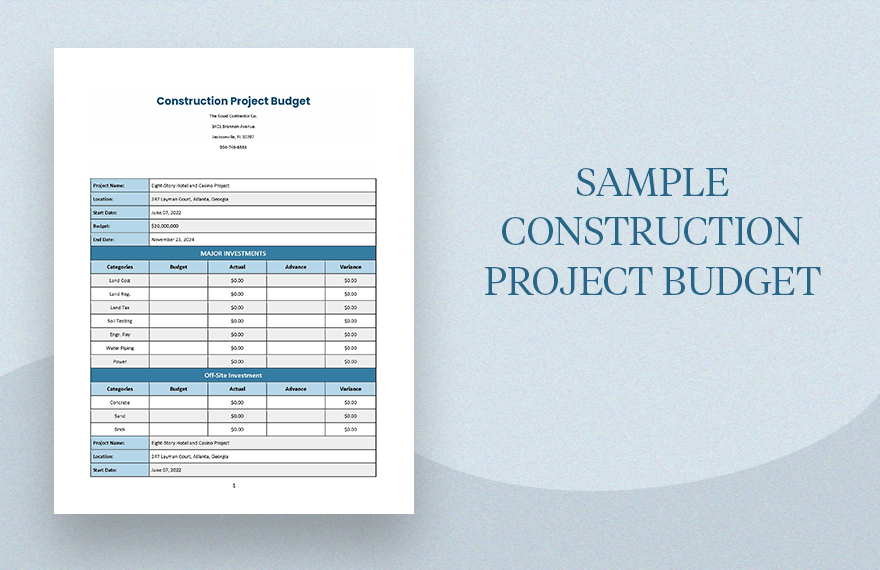

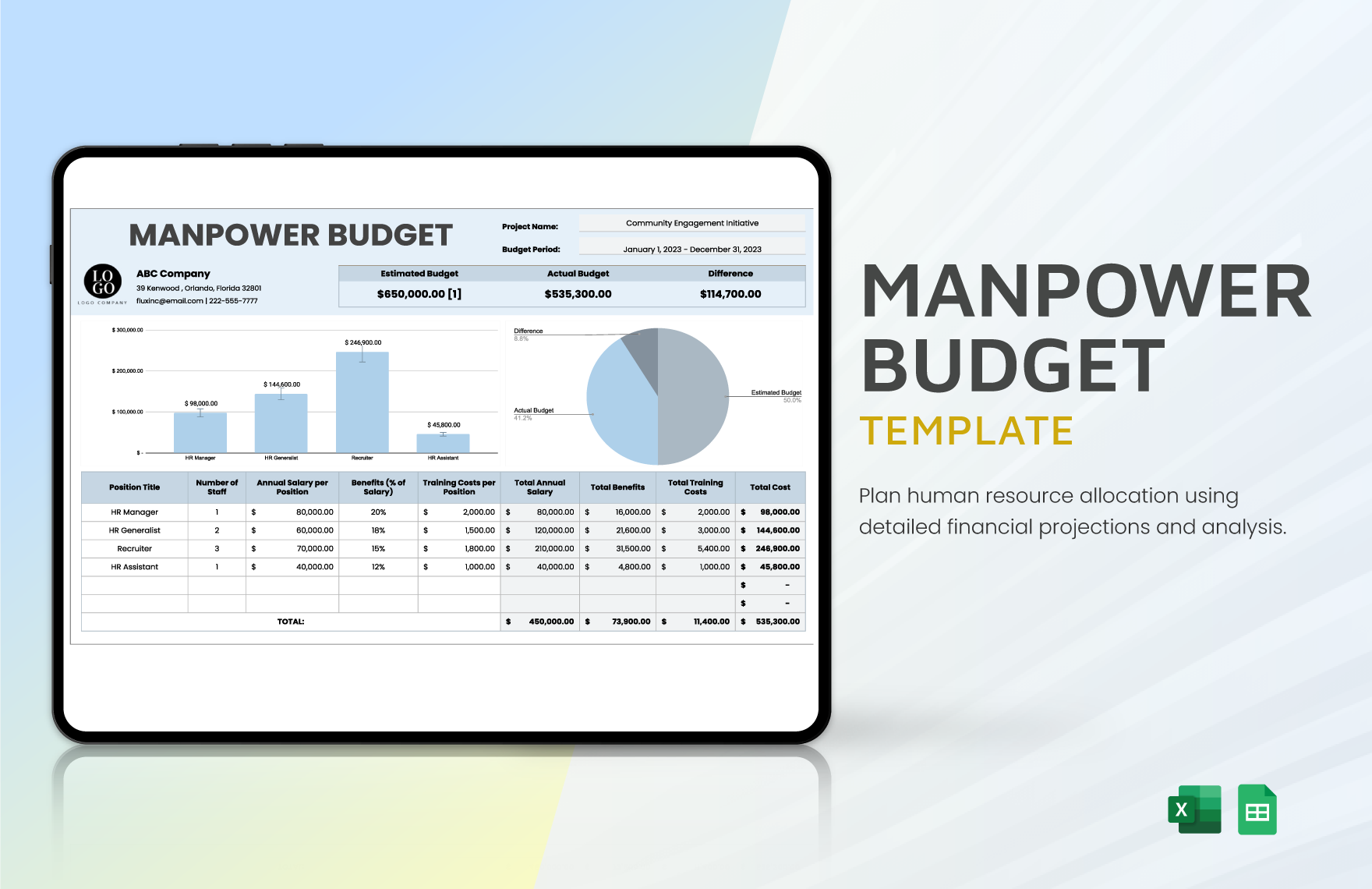

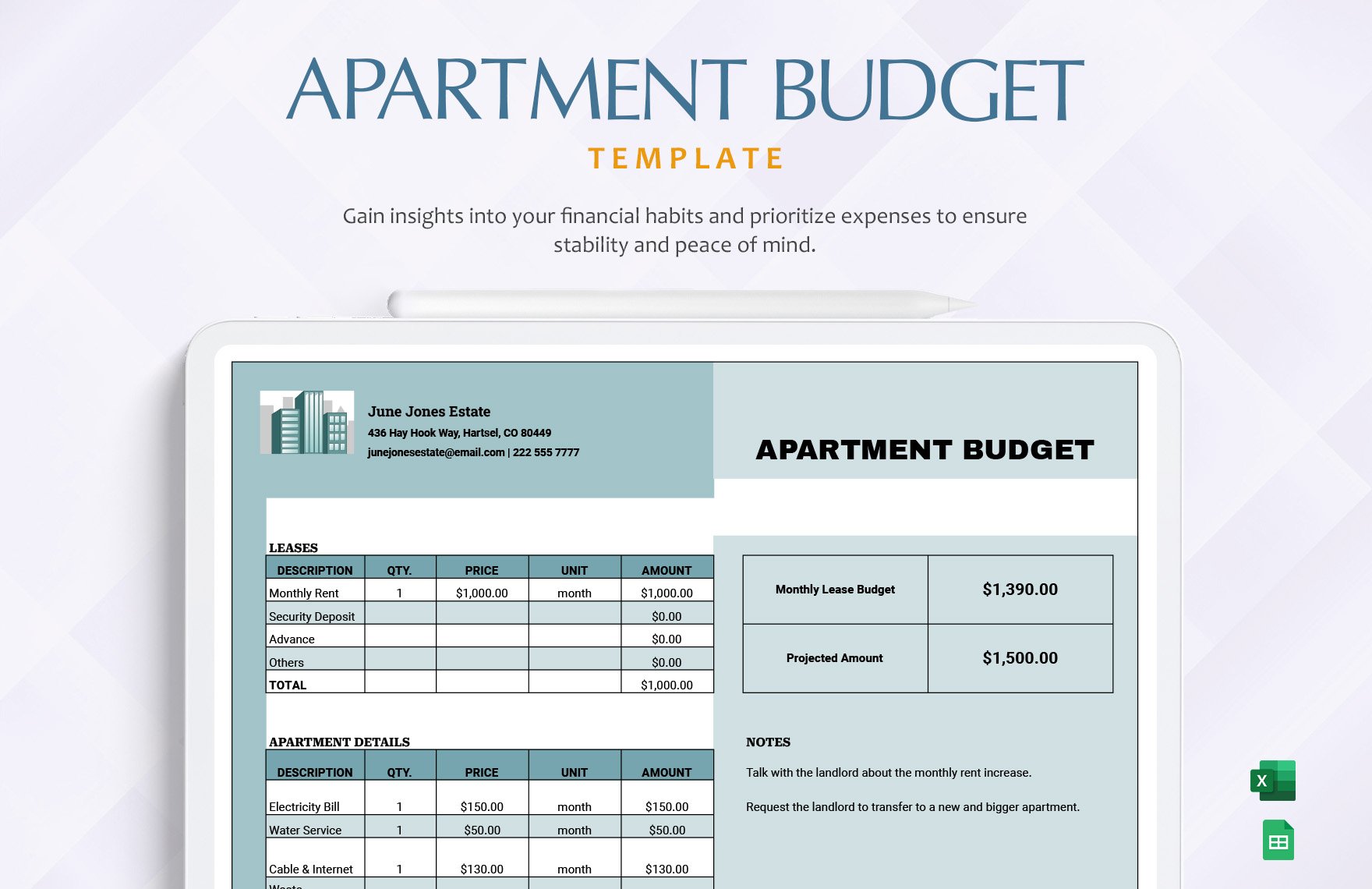

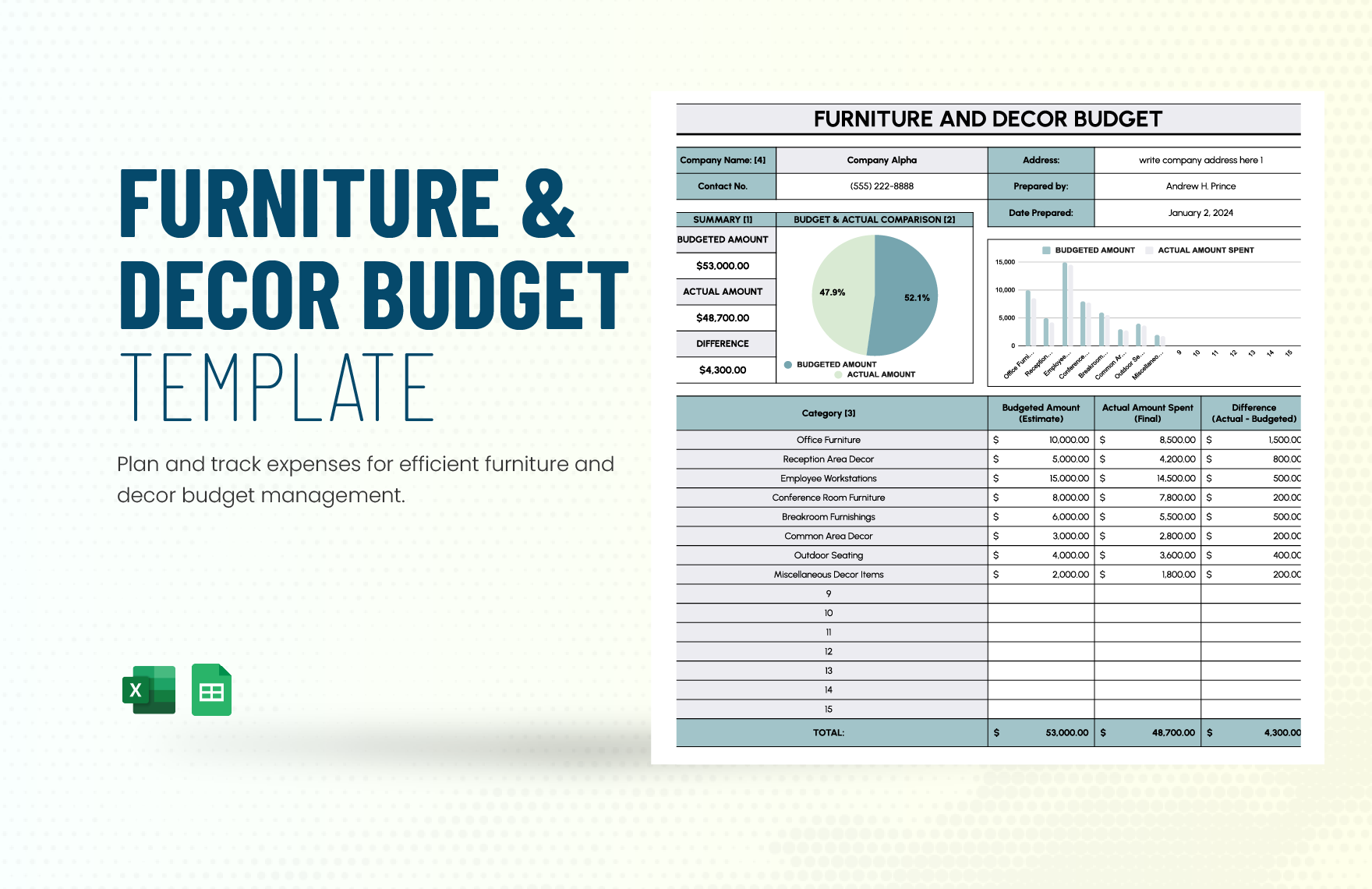

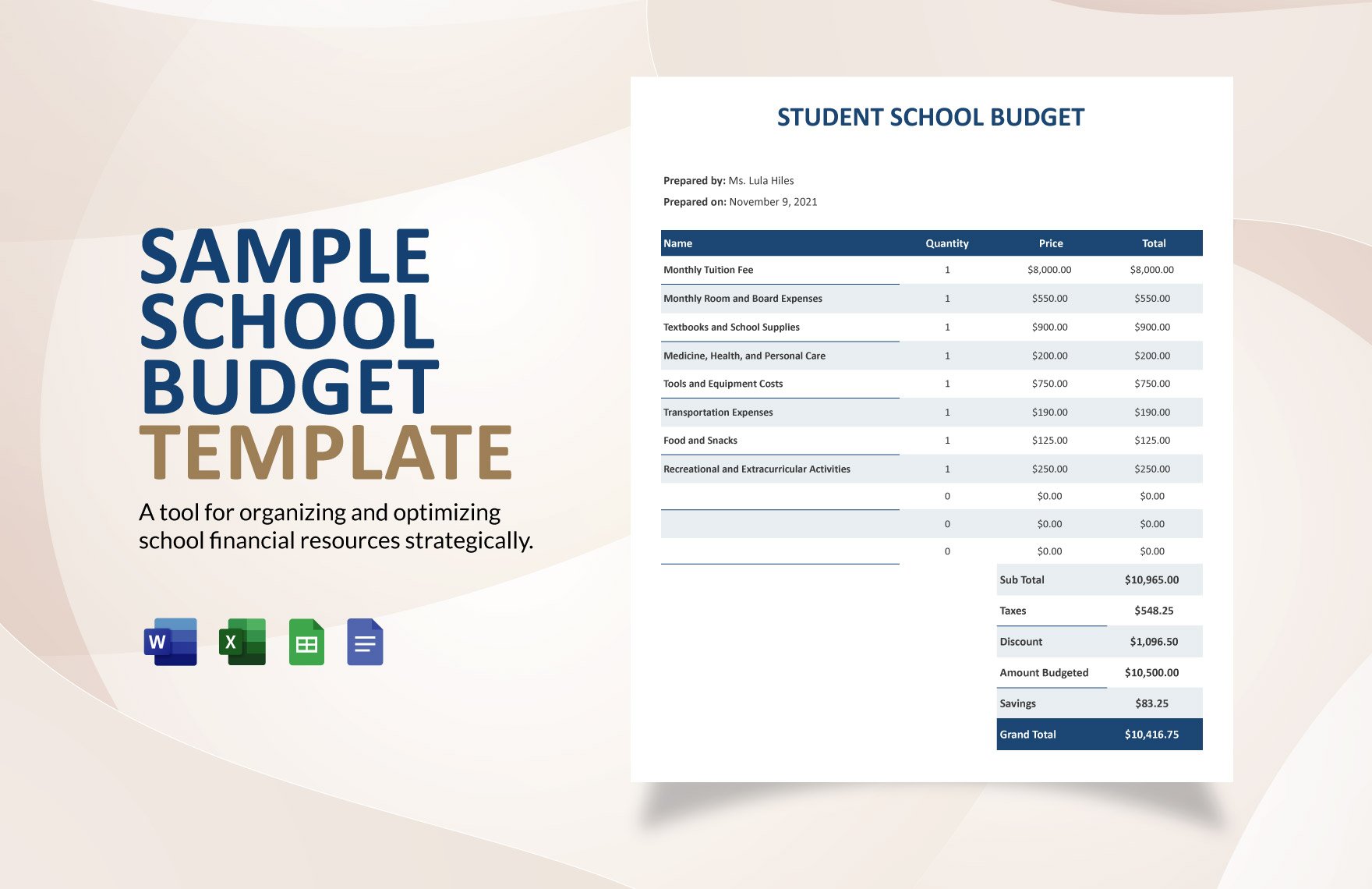

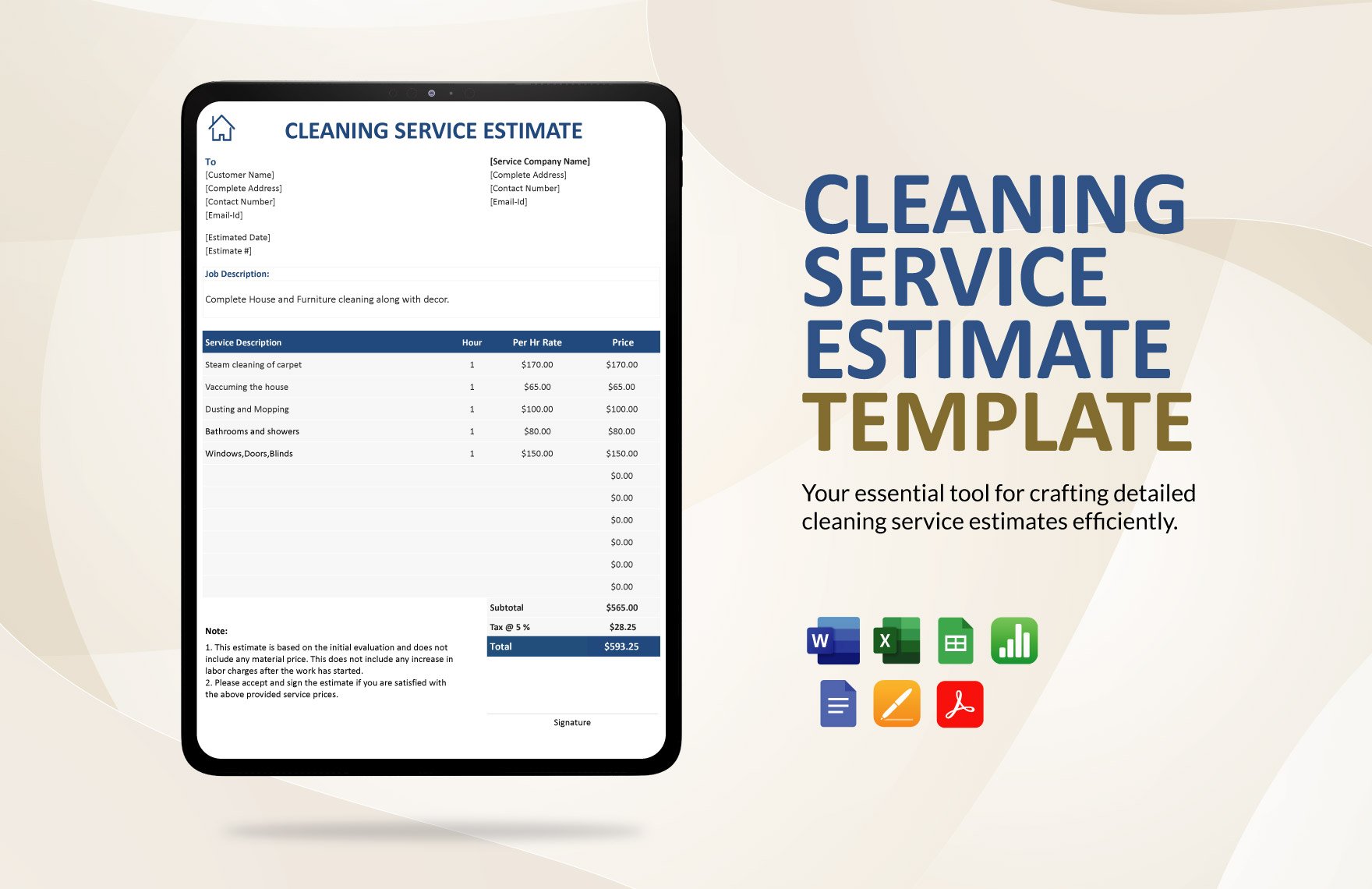

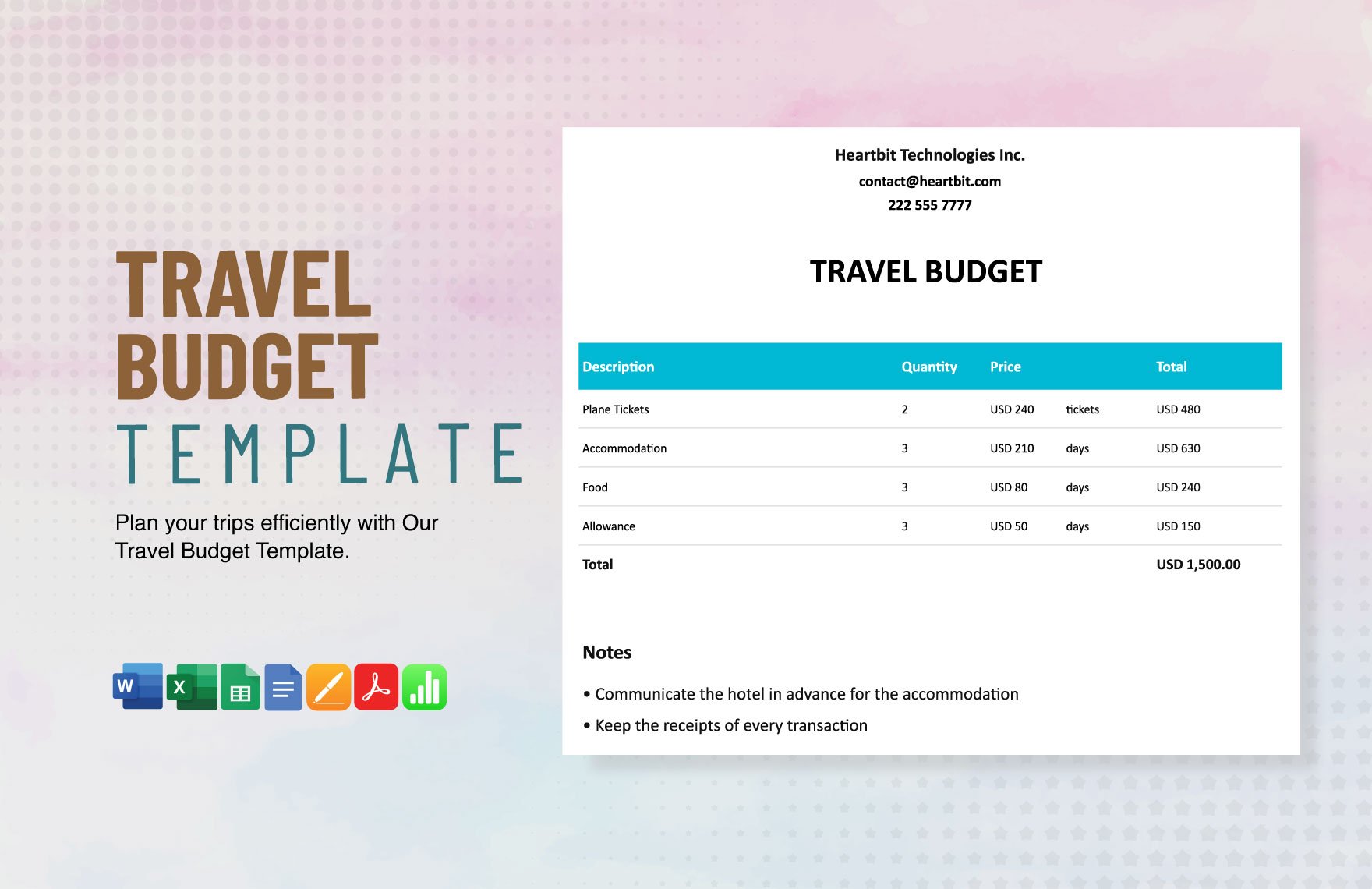

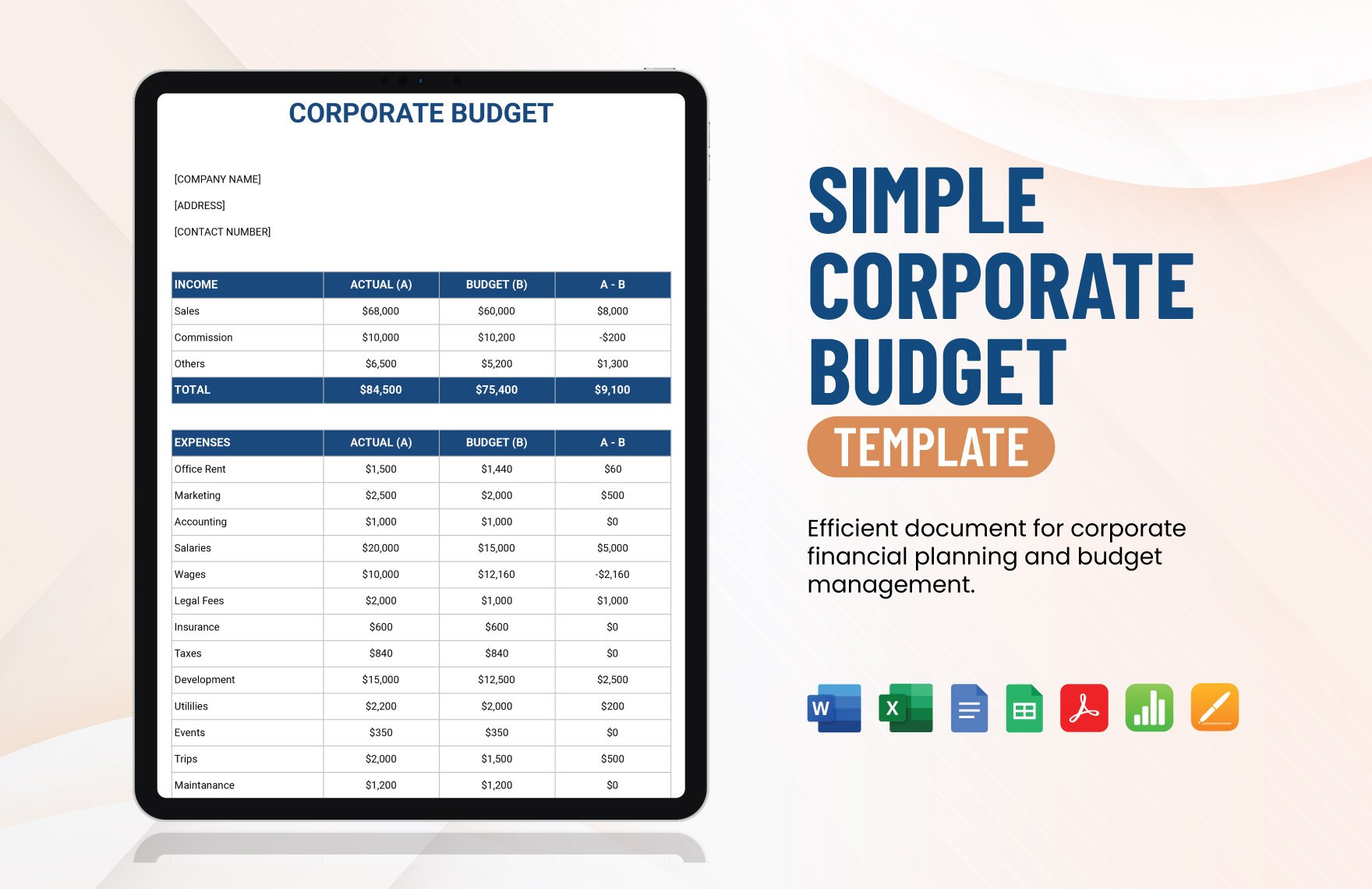

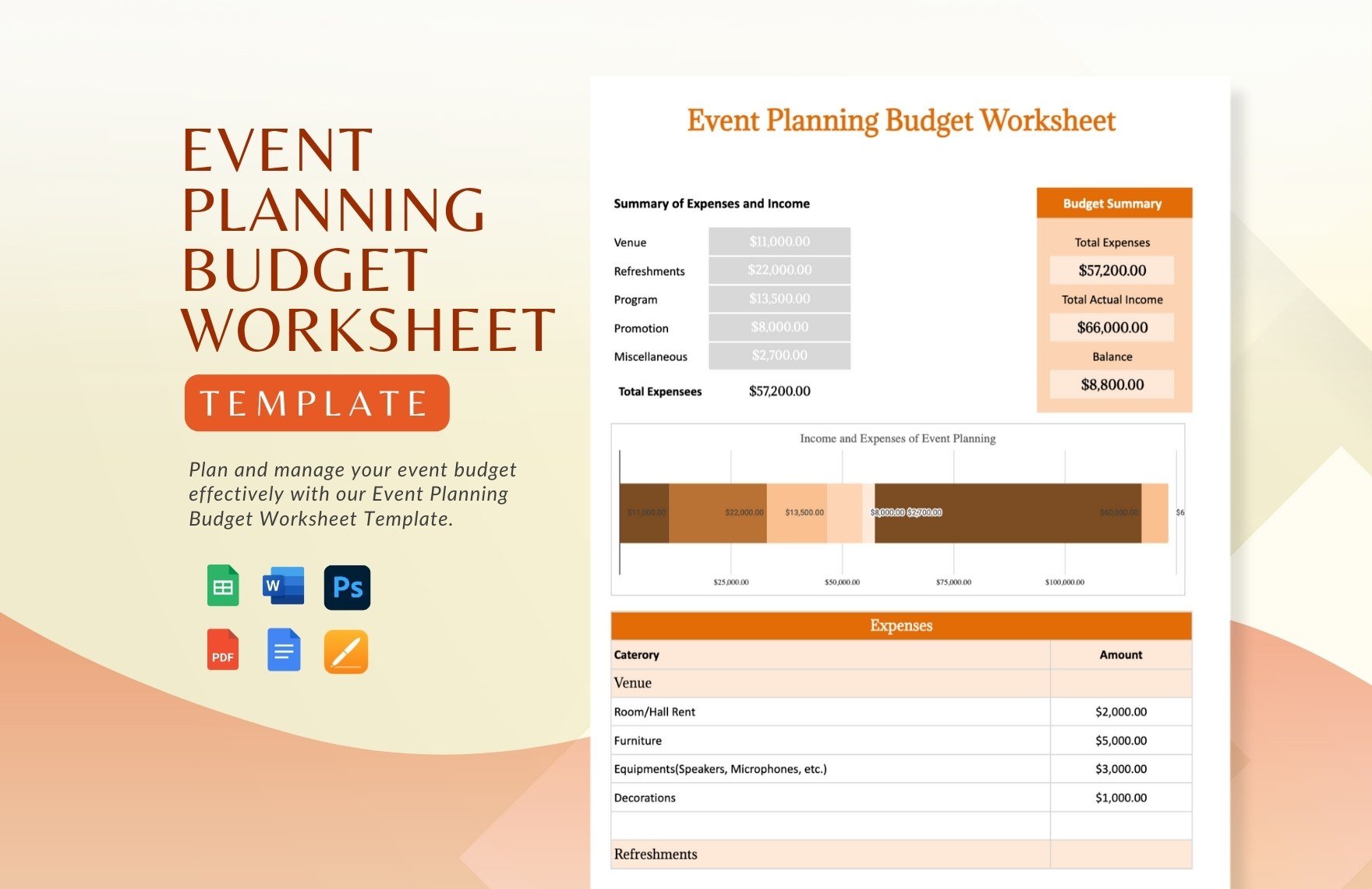

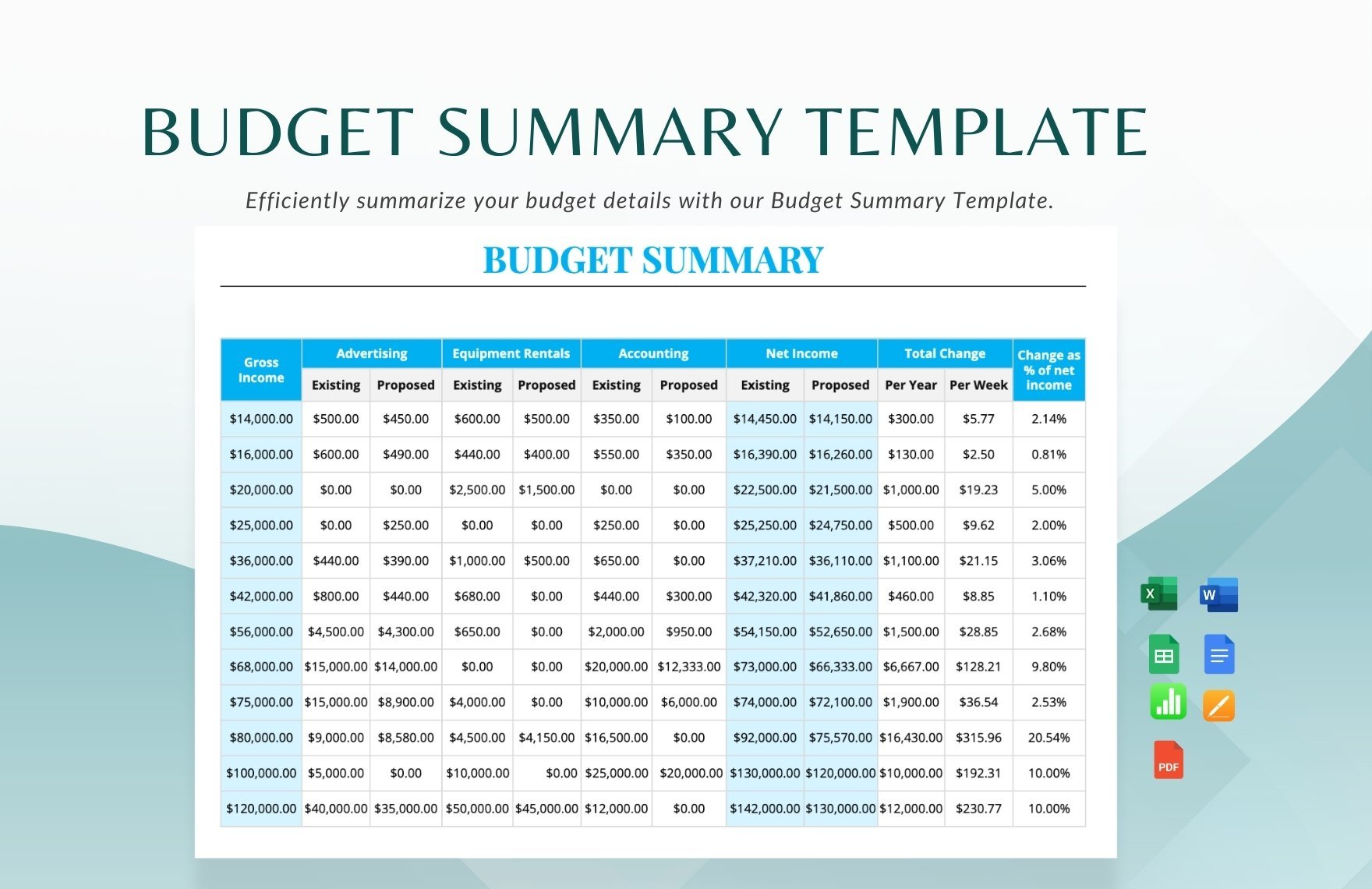

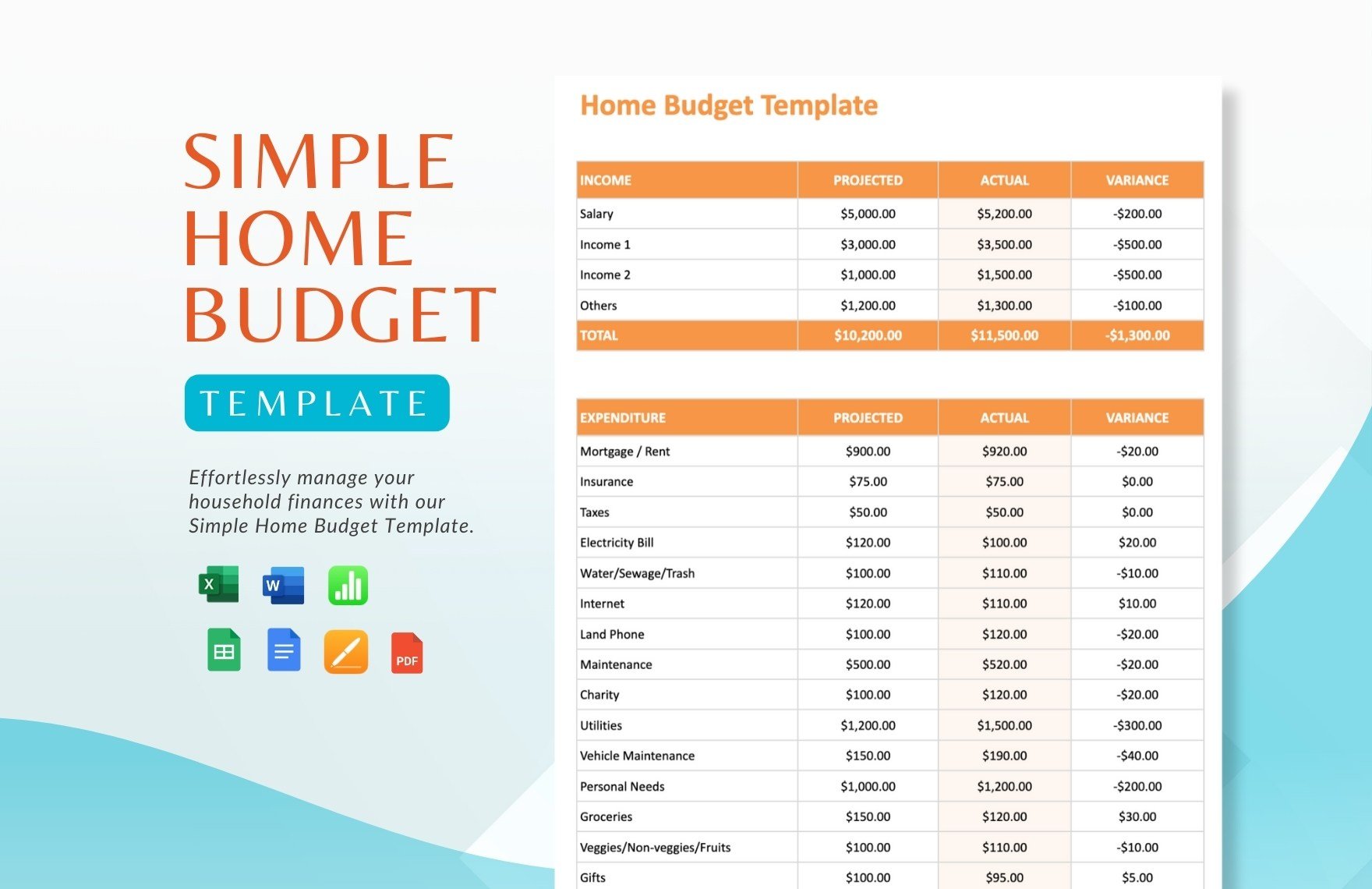

A Sample Budget is the periodic (weekly, monthly or yearly) planning of your finances. This is used to present the expected expenses (whether a company event or household). For business budget, this is initially submitted as a proposal or project to be approved by the senior management. For the latter, the budgeting is based on income.

One helpful factor to help you with your budgeting is to establish goals. Your goals can include graduate school, retirement, car purchase, and many more. Your budgeting will set a straight line towards your goals. Ask for help if you are having difficulties n budgeting.

Did you know that your educational attainment influences your habits of budgeting? 38% of college graduates practice the habit of budgeting whereas high school graduates or lower comprise only 26%.

How to Create a Sample Budget?

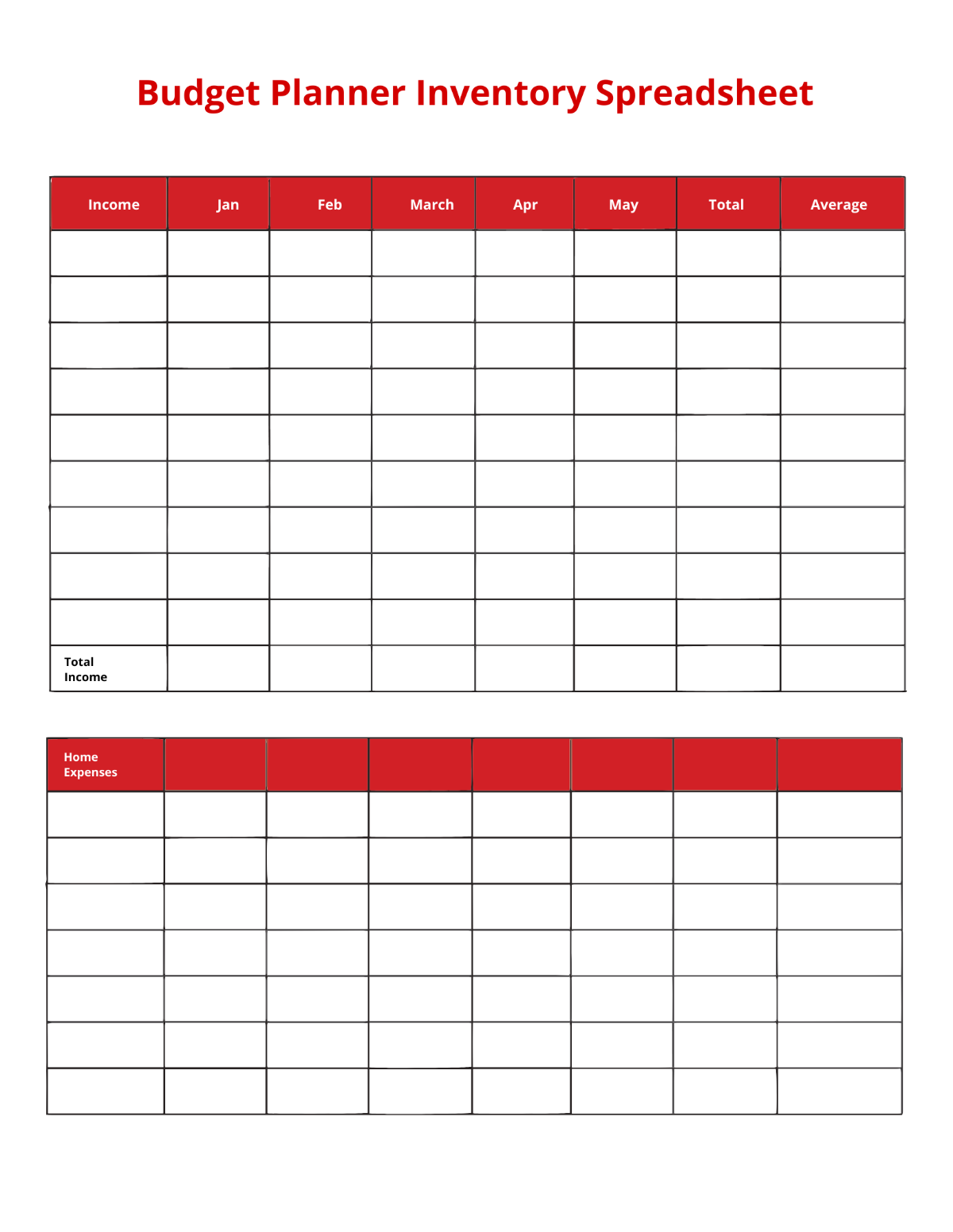

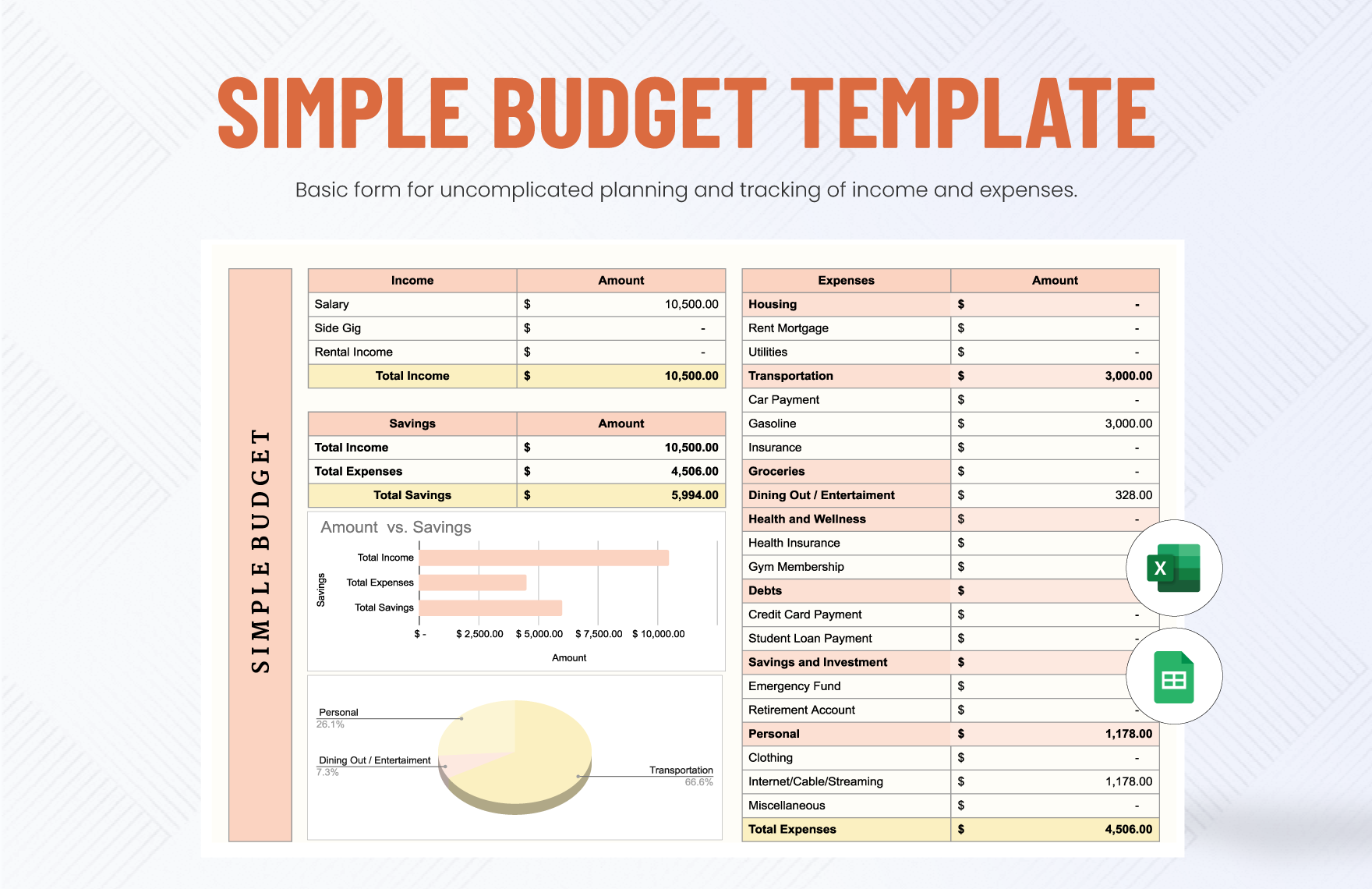

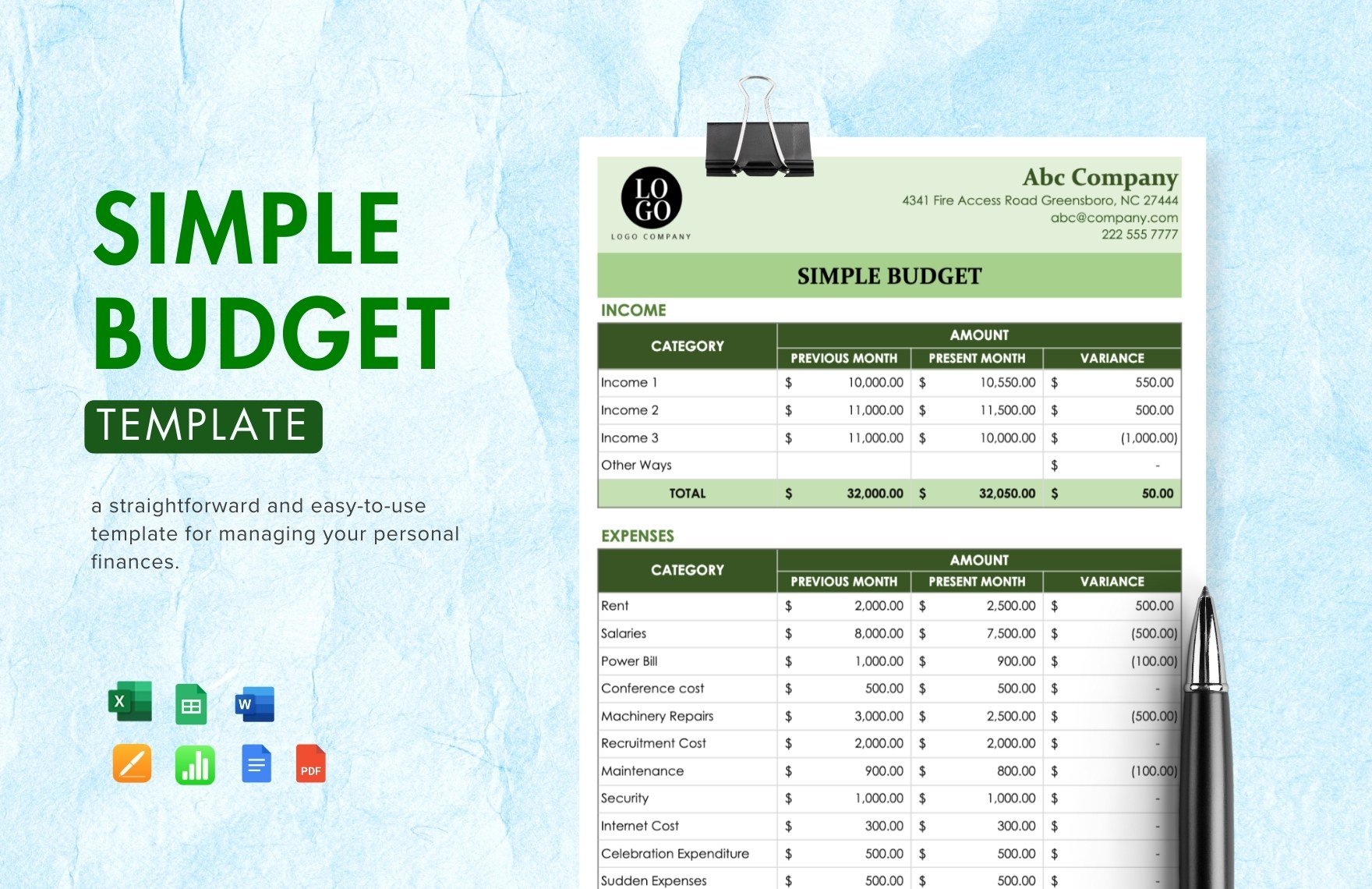

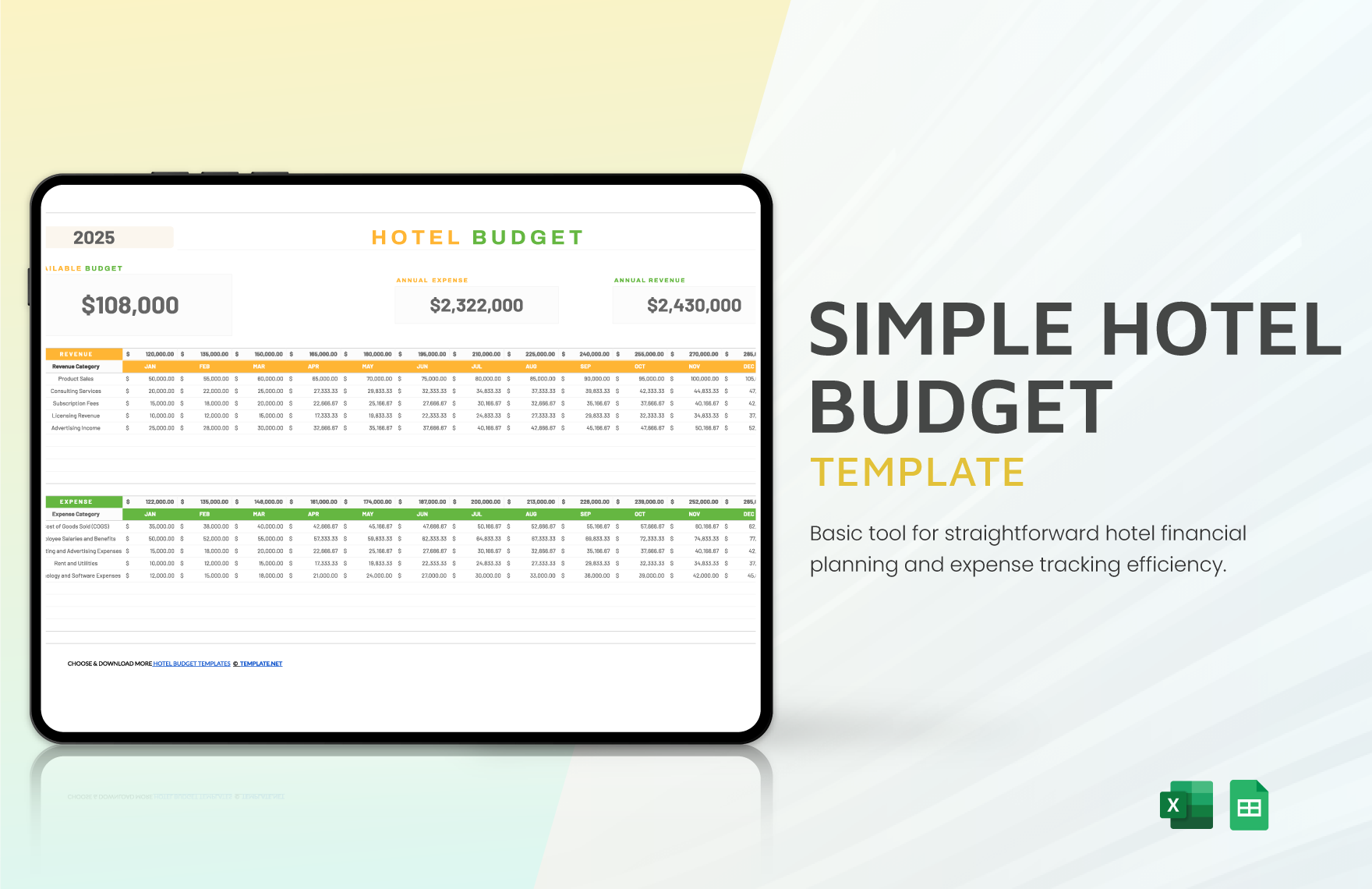

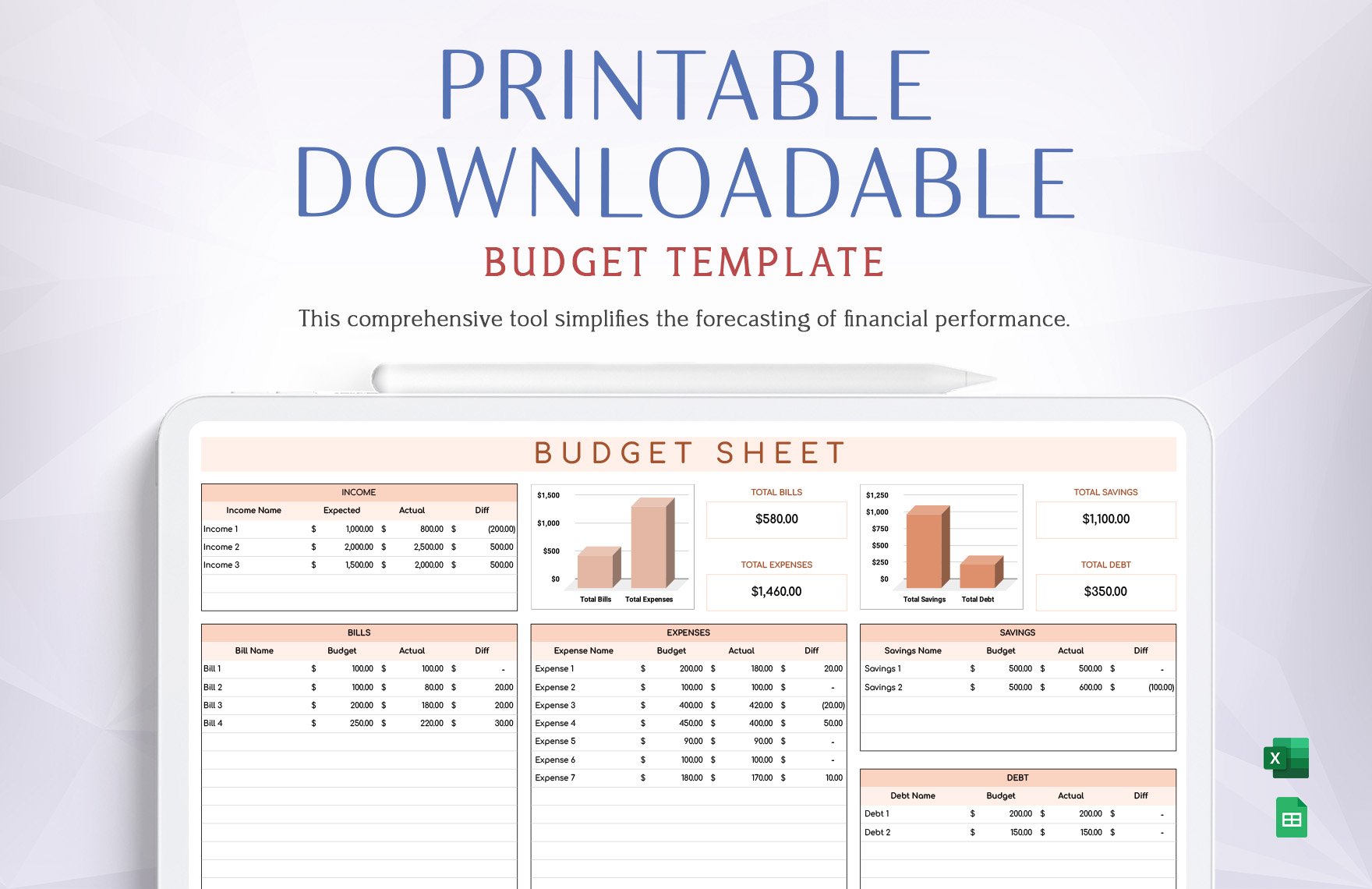

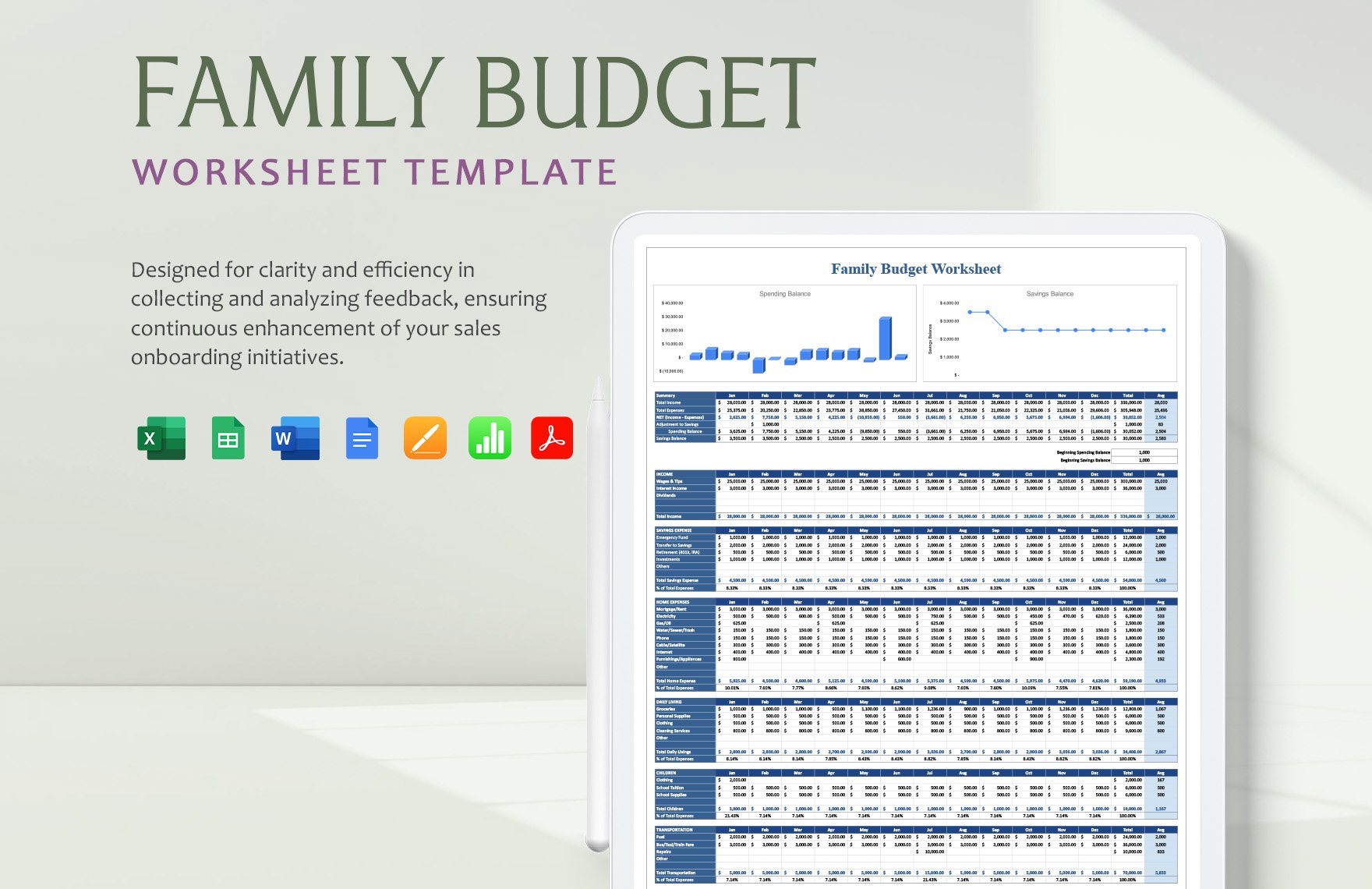

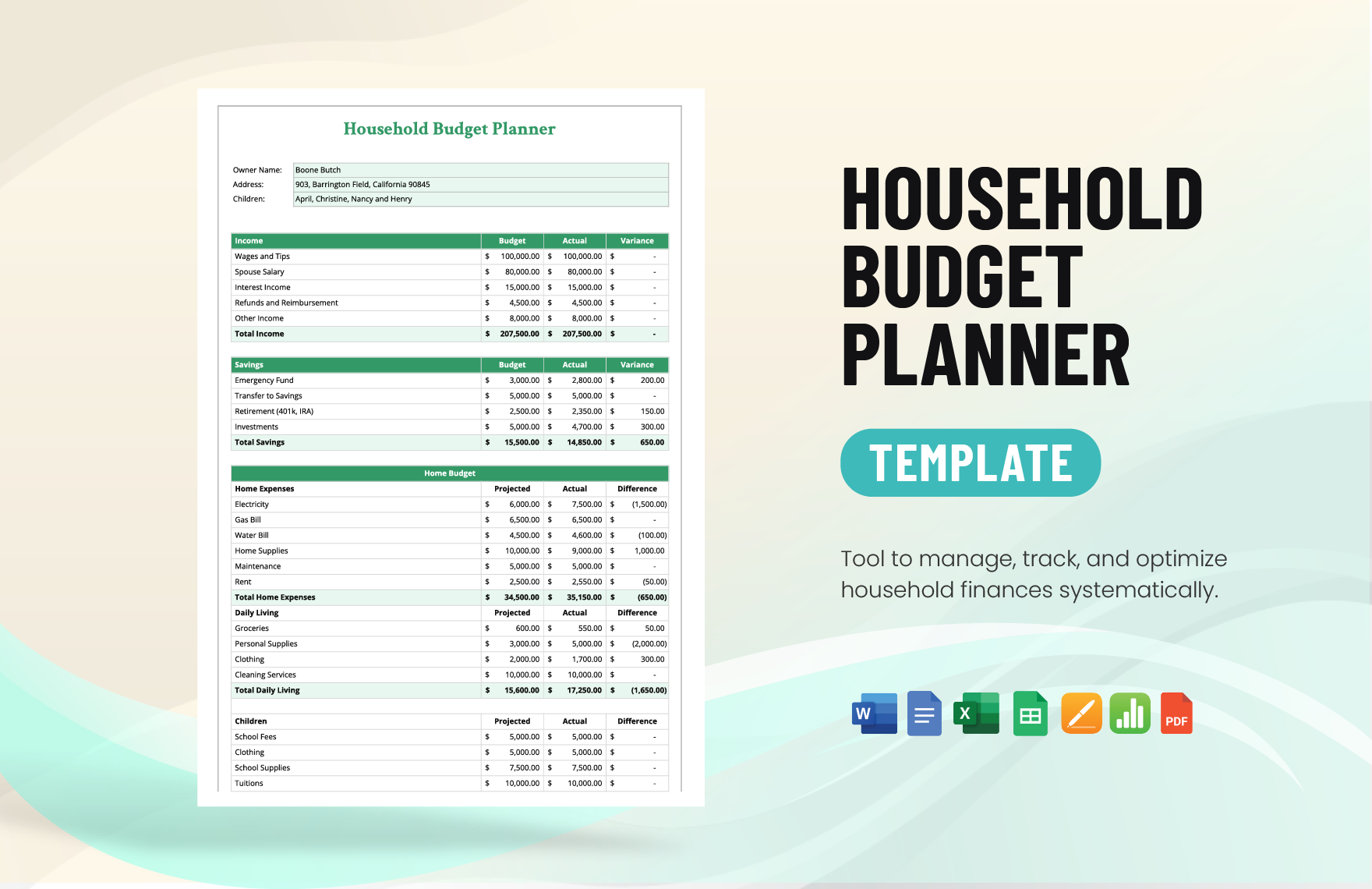

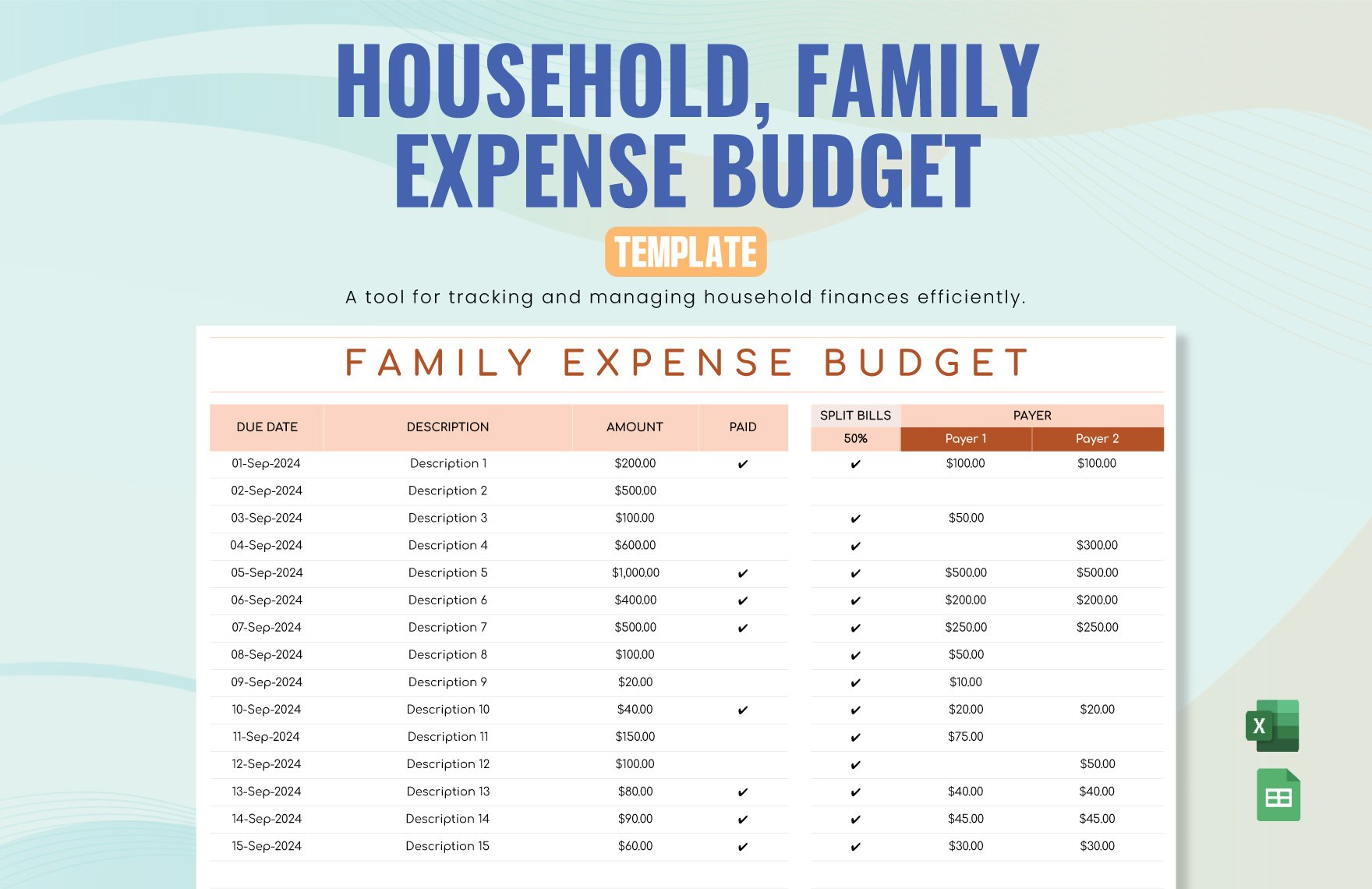

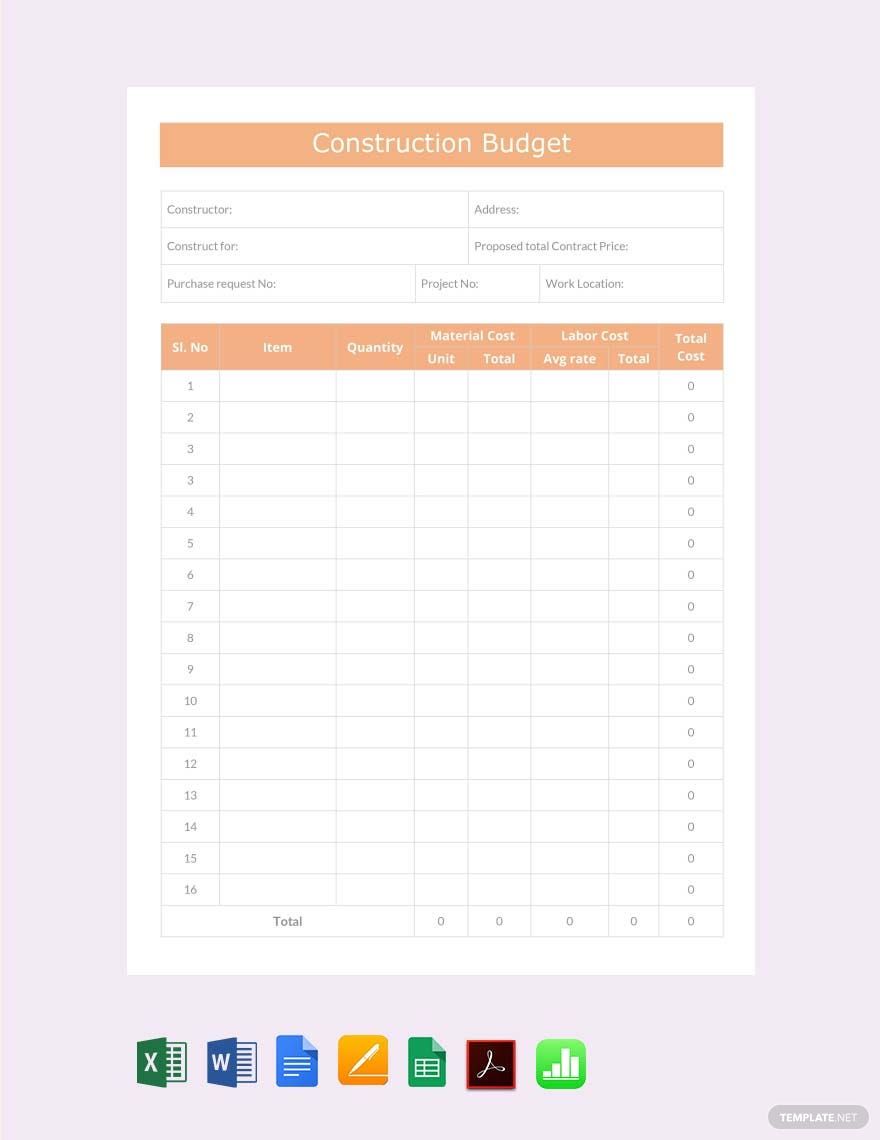

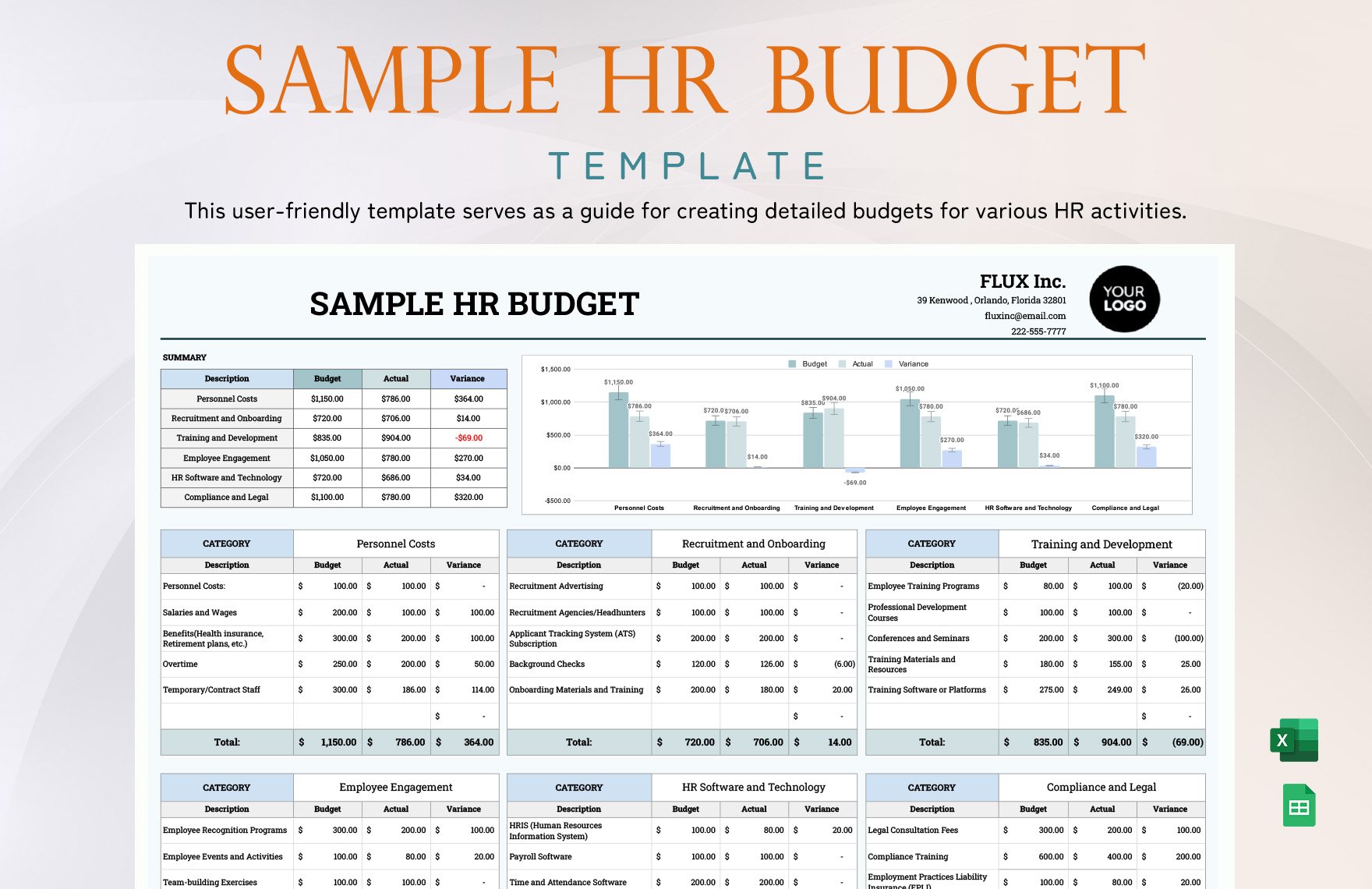

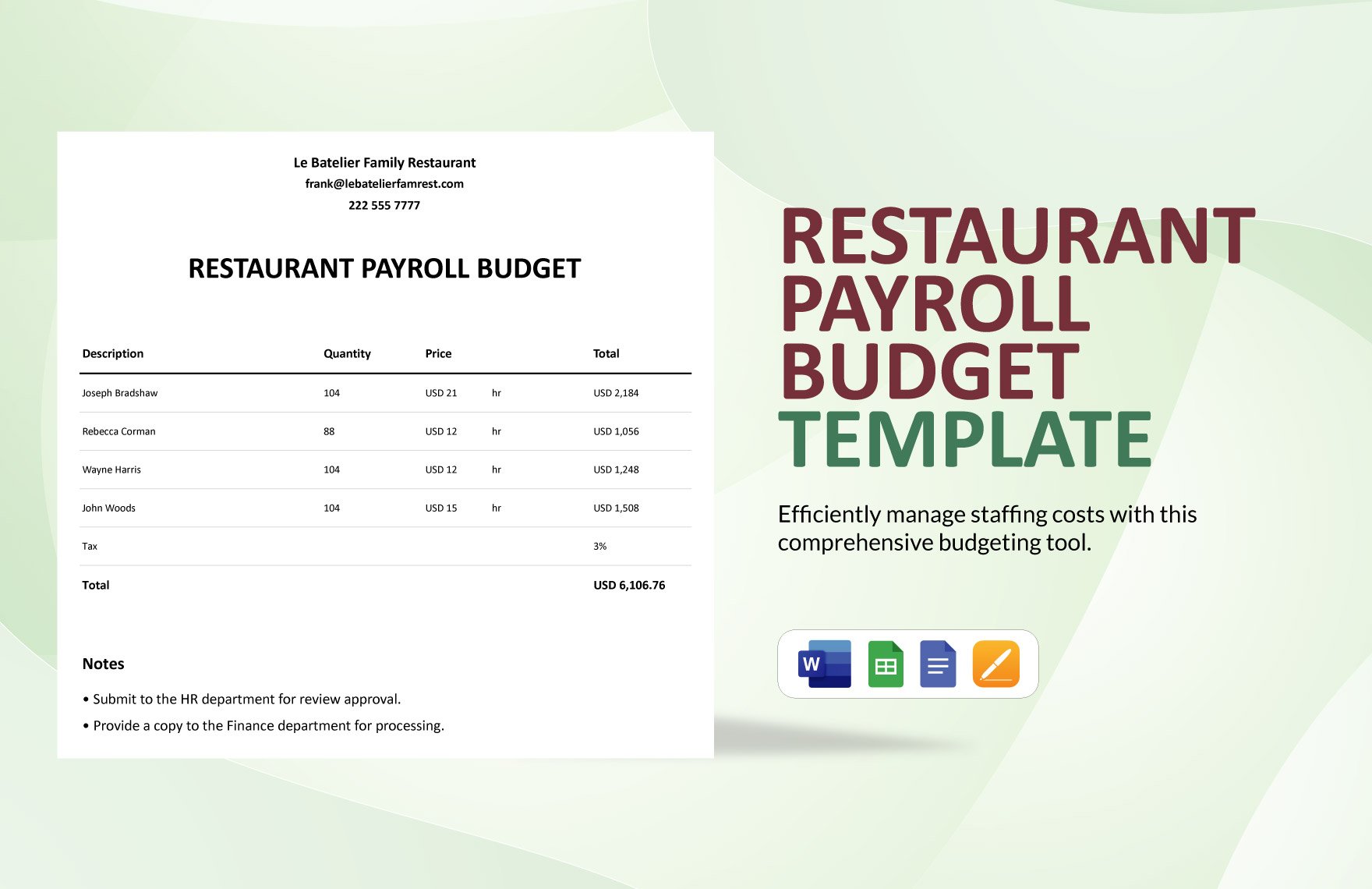

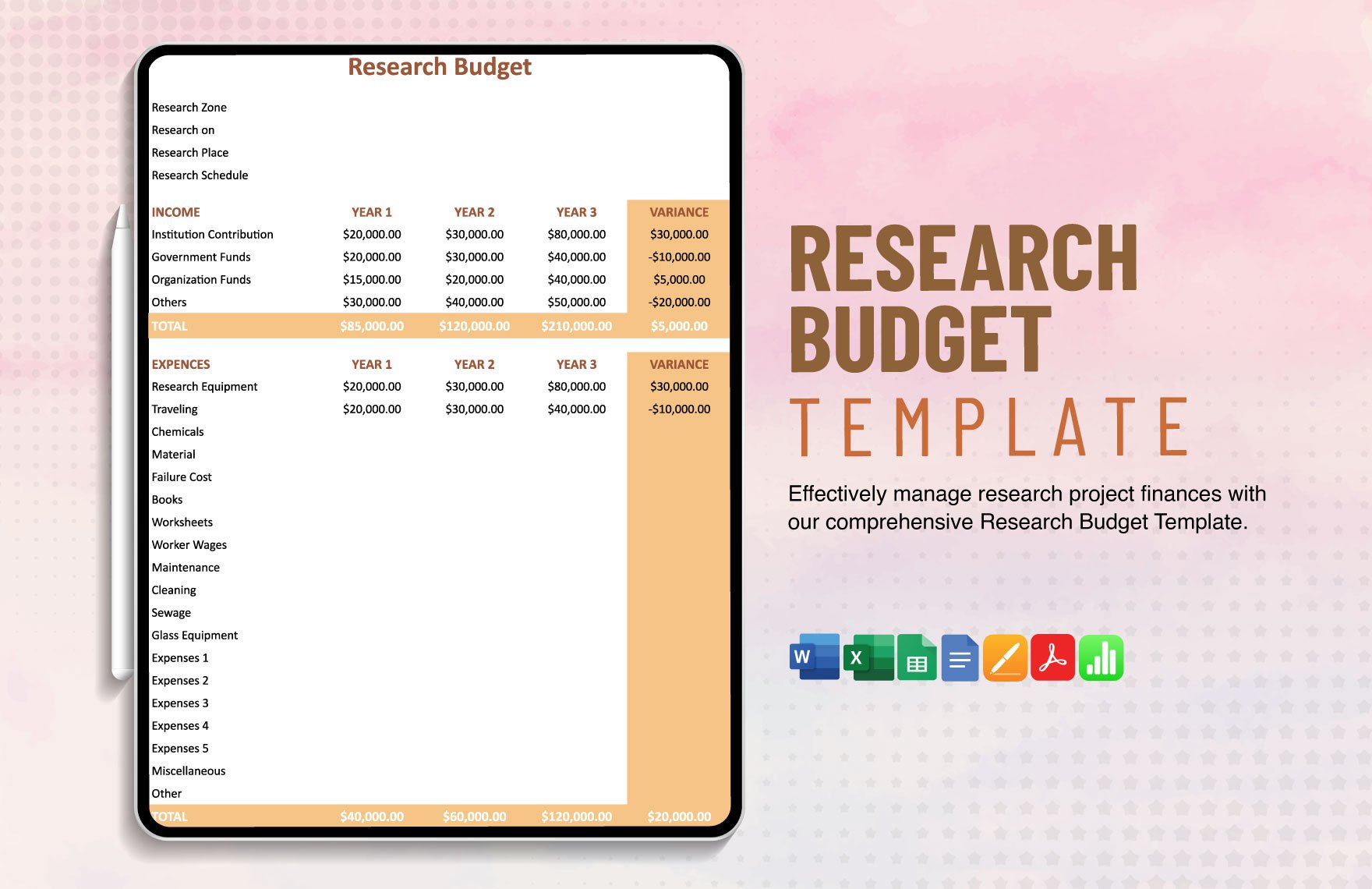

The easiest and most effective way of budgeting is by using a Spreadsheet (Google Sheets or Microsoft Excel). Its tabular format will make it easier for you to input your numerical data and group them into categories. Another alternative is downloading sample budget templates online which we currently offer. If you prefer to create your budget plan manually, we will provide you with tips below.

1. Enlighten Yourself

Financial Literacy is not something that everybody possesses. Take time to educate yourself about financial matters. You can ask for advice from friends who are good at handling money or you can mirror the actions of friends who are penny pinchers.

2. Have a Journal for Your Budgeting

Track your budgeting progress by writing them down in a journal (or encode them in an app for budgeting). This can help you lessen your expenses in the succeeding months. It's also convenient to group them into categories to know which category you need to cut some expenses in.

3. Sort Your Priorities

Needs over wants. One common mistake we commit is prioritizing the latter over the former. Pay your bills or debt first, buy your groceries, and etc. before splurging on temporary pleasures. You won't have problems with late payments this way.

4. Save, Save, Save

Save whatever money is left after paying the necessities. When unforeseen circumstances arise, you'll have a stash of money that can assist you. You can opt to place your savings in a savings account.

5. Get Rid of Your Credit Cards

Credit cards bring more debt and high-interest rates which could only cause damage in the long run. Since you're temporarily borrowing money, you're more enticed to spend and you're also risking yourself to credit card fraud. For safer transactions, use debit cards or cash.

6. If All Else Fails, Search for Another Stream of Income

If the preceding tips failed to ease your burden, search for another stream of income. You can either engage in part-time or freelance work and you also have the option of investing in stock markets and such.