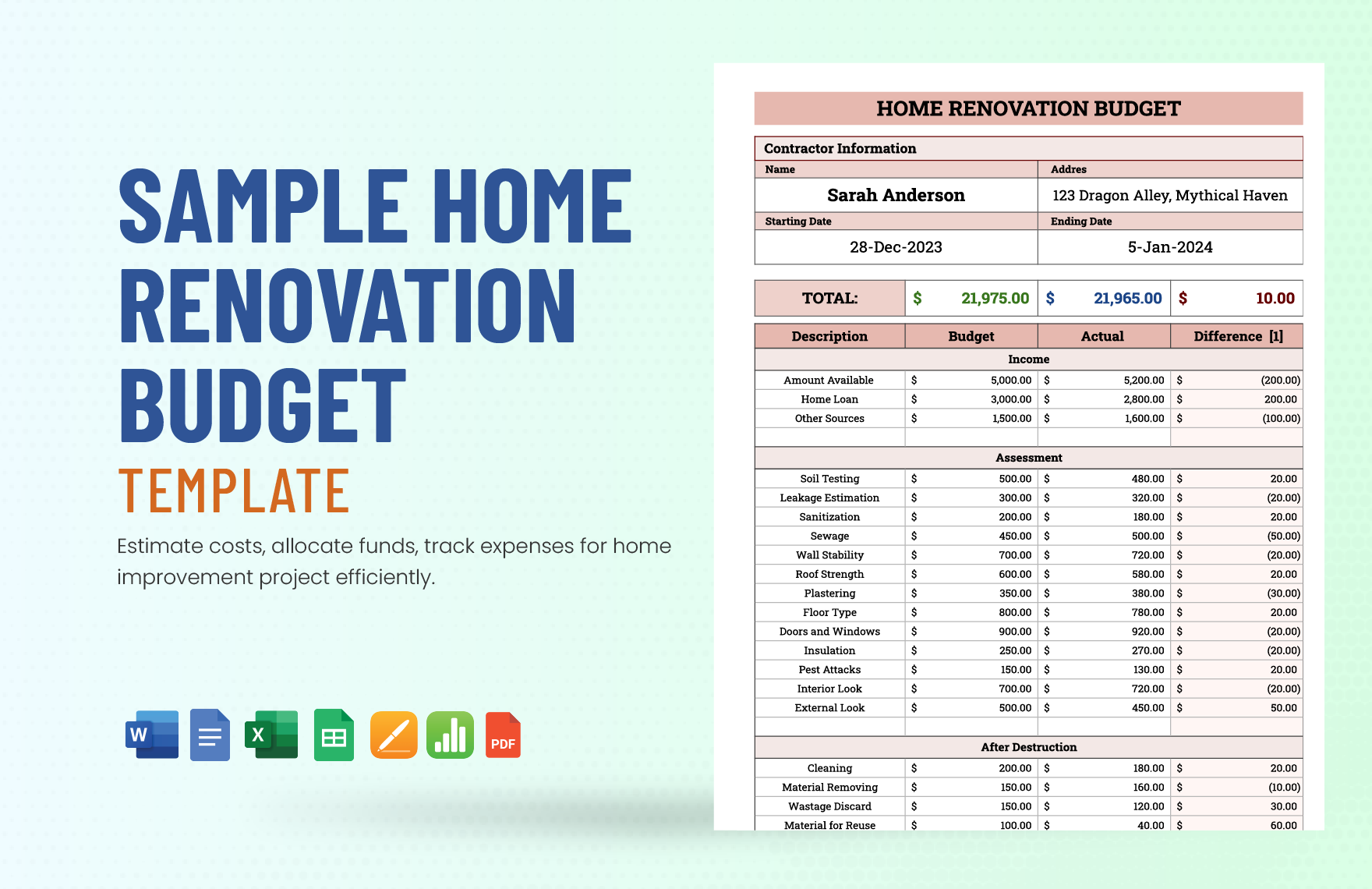

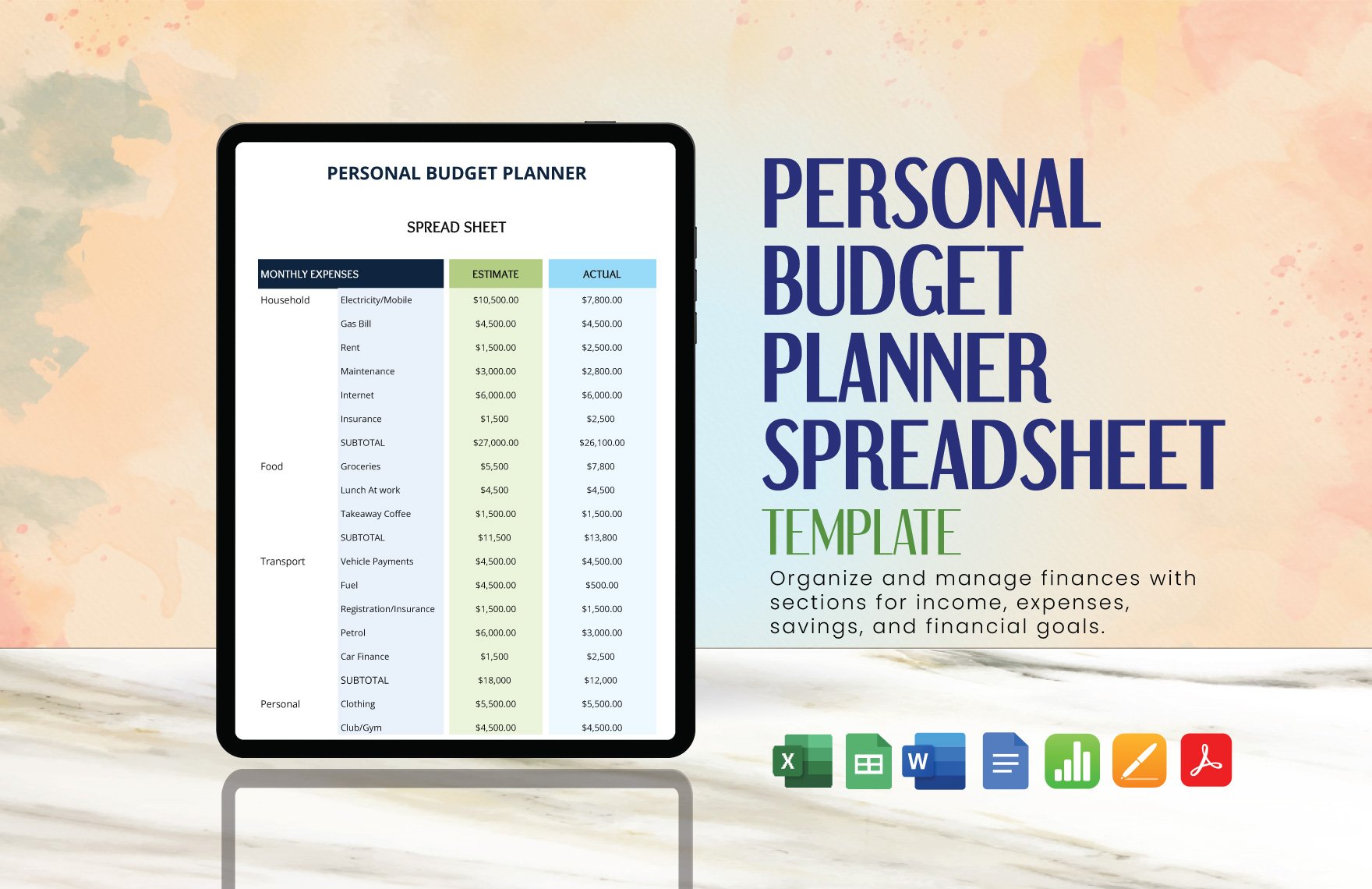

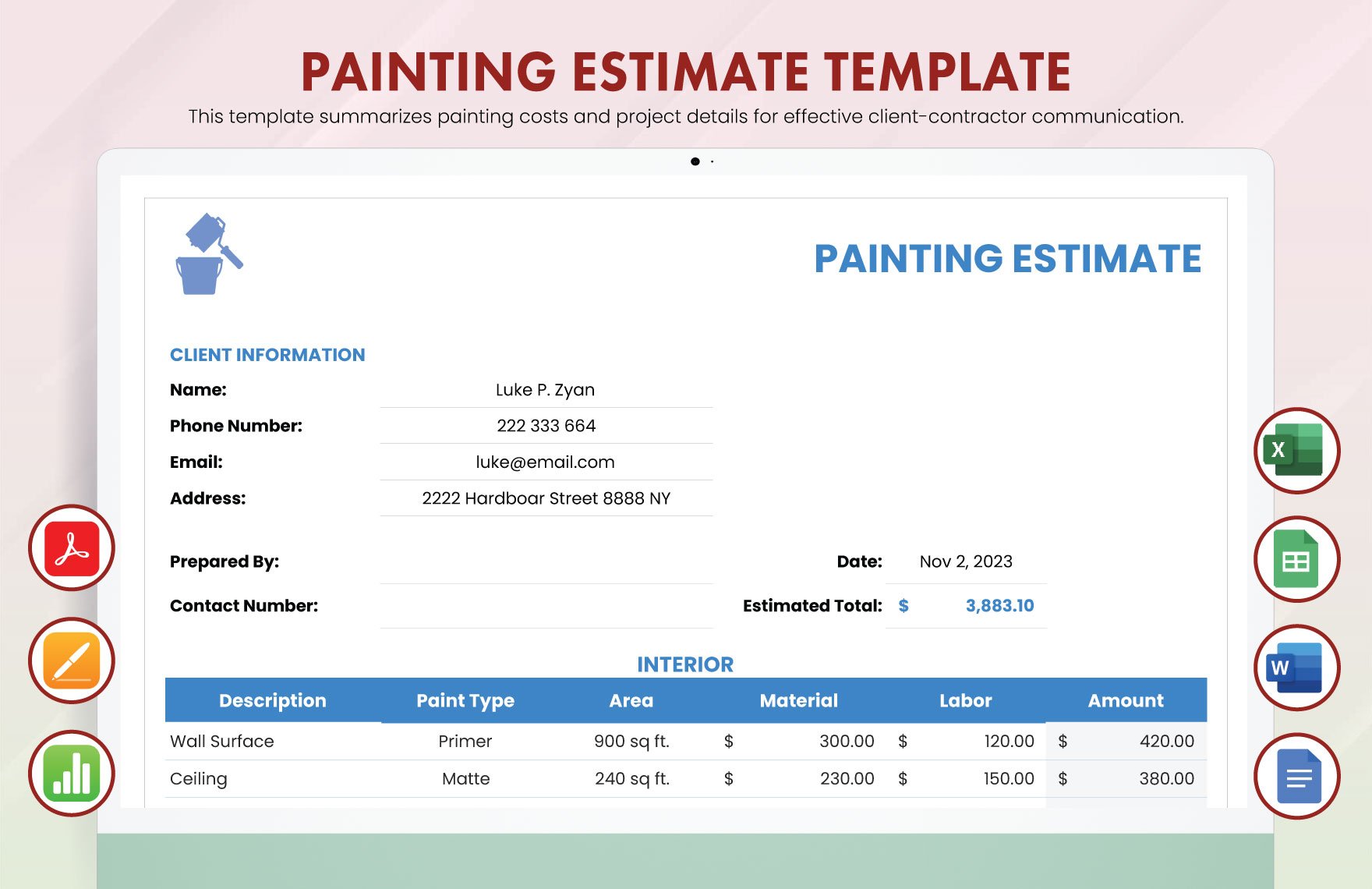

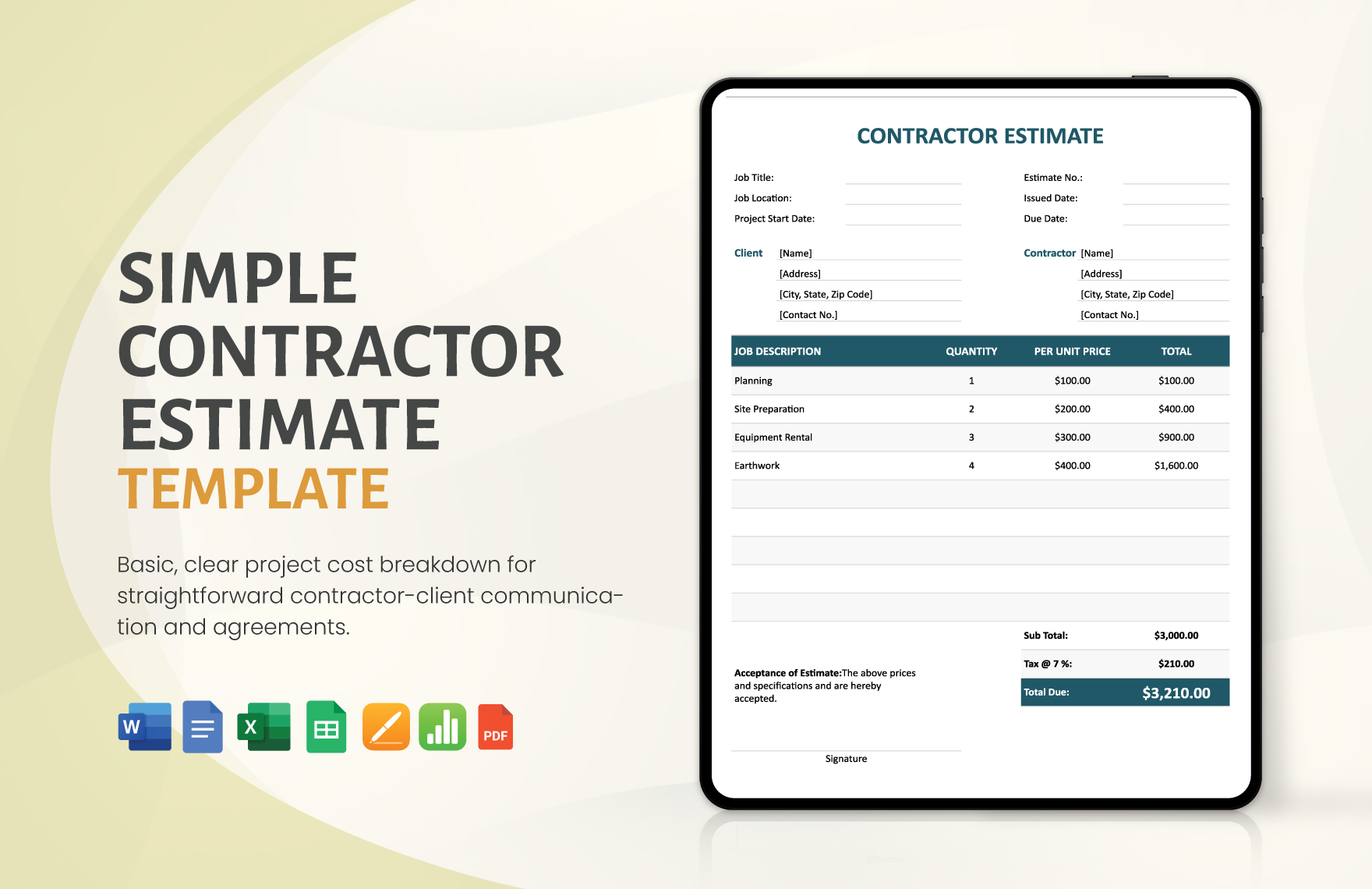

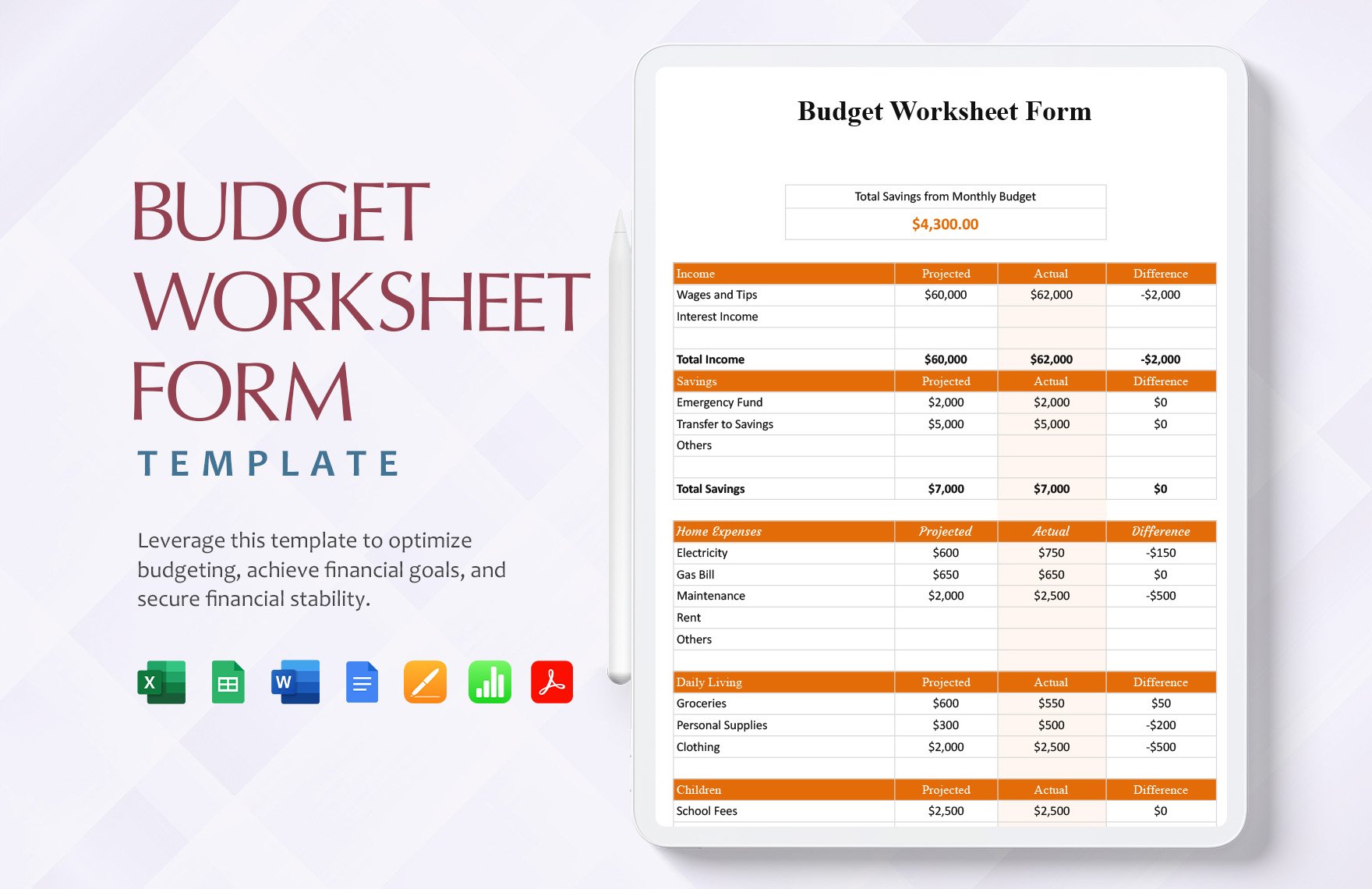

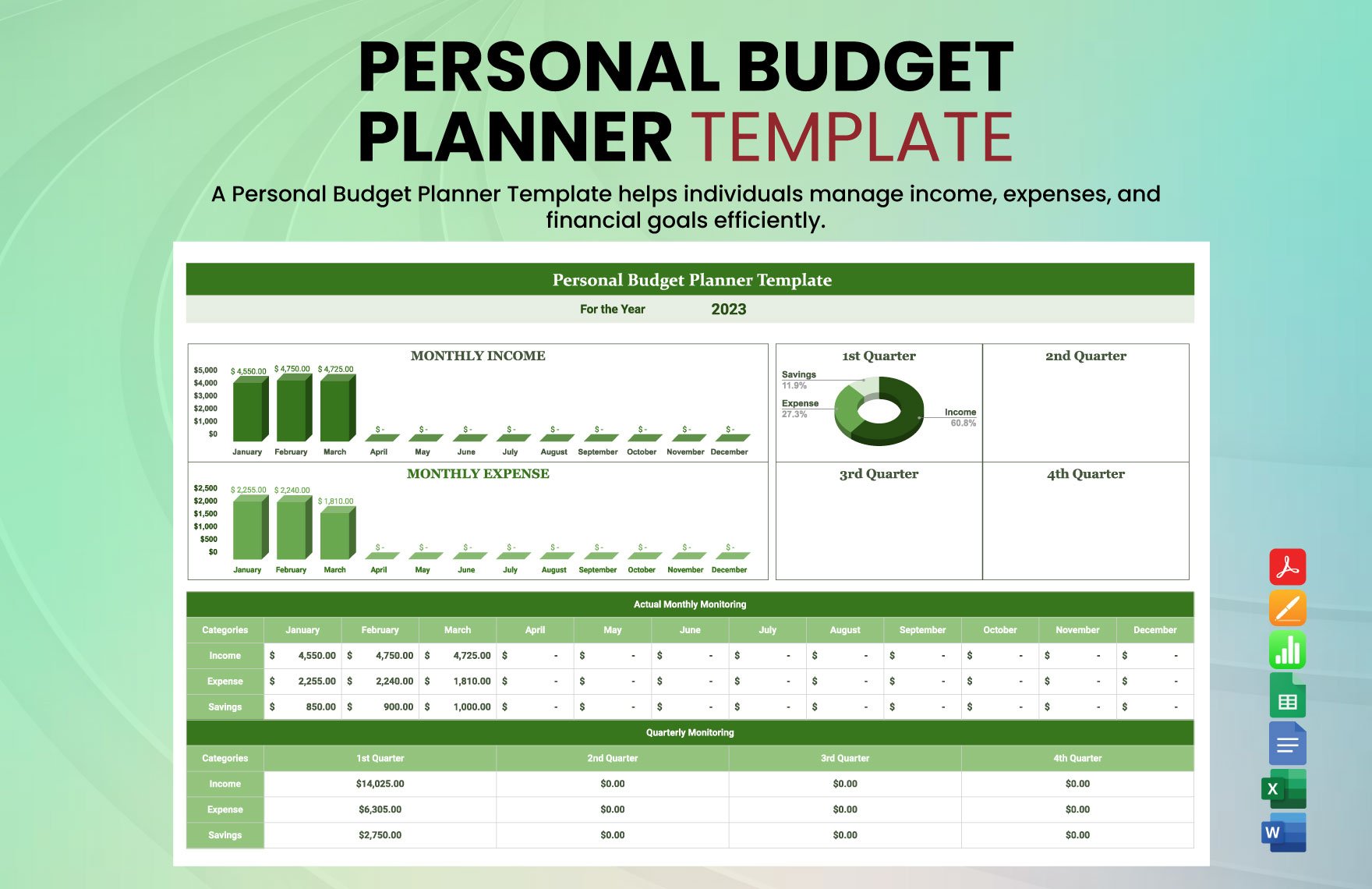

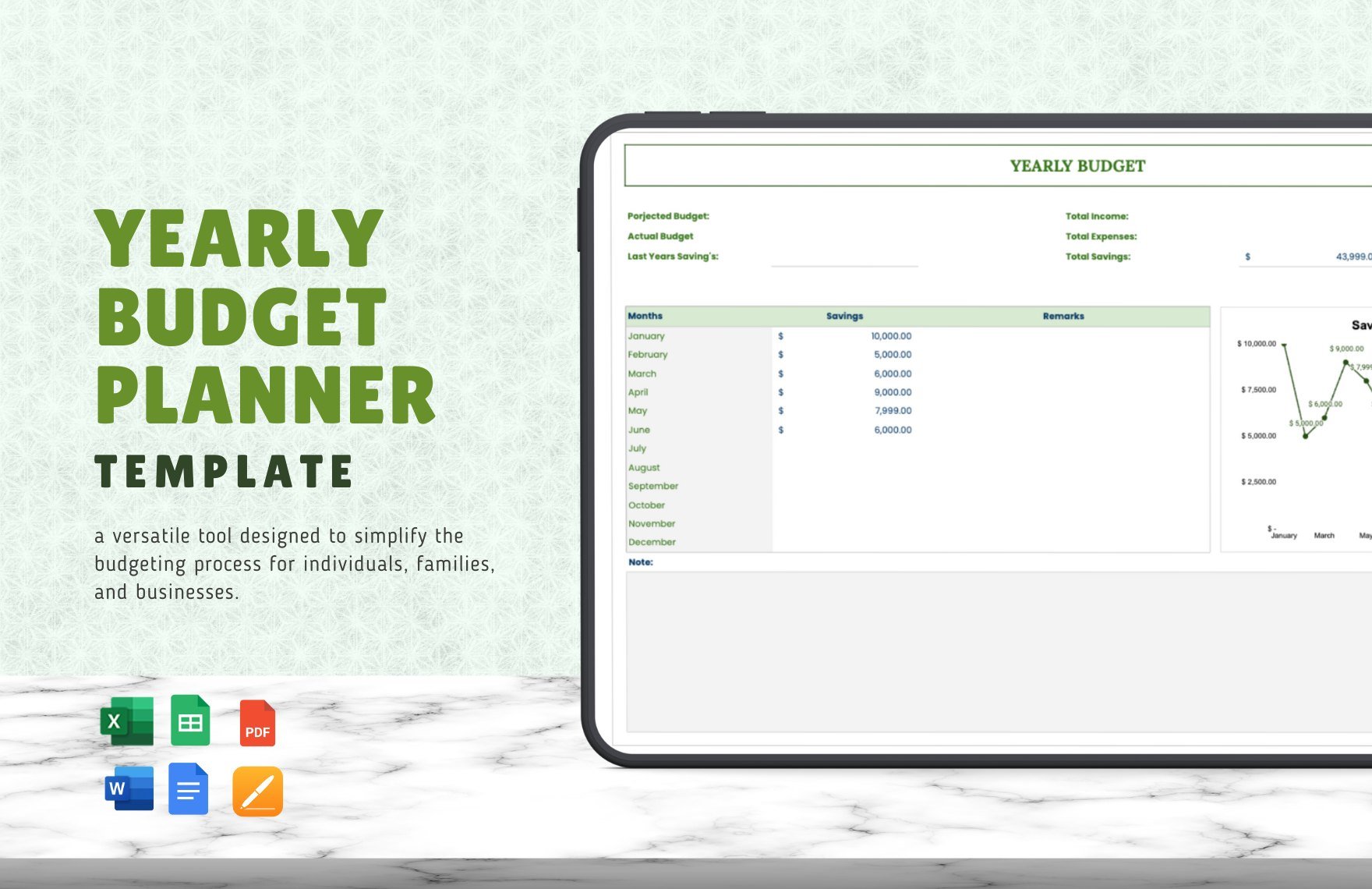

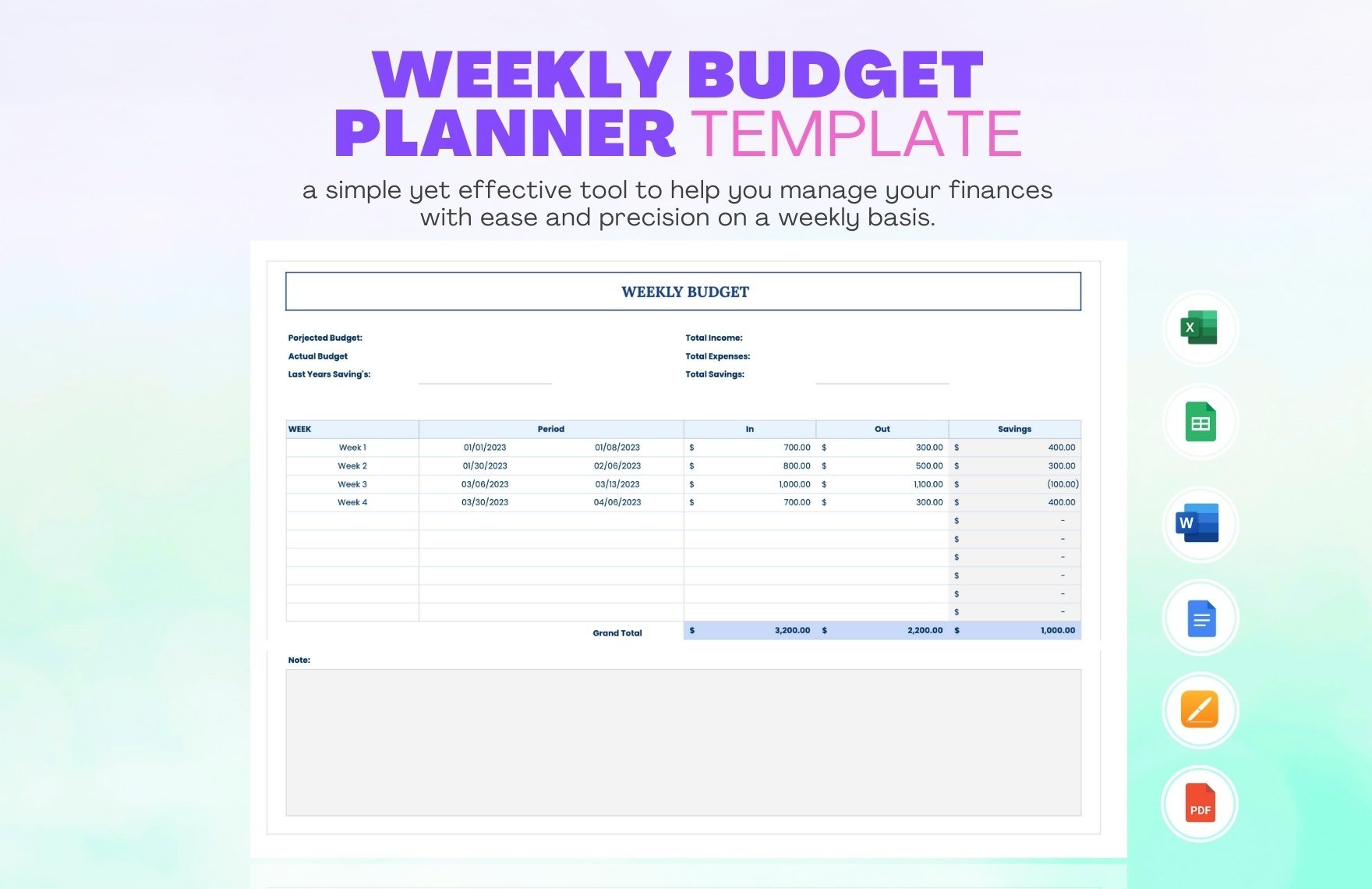

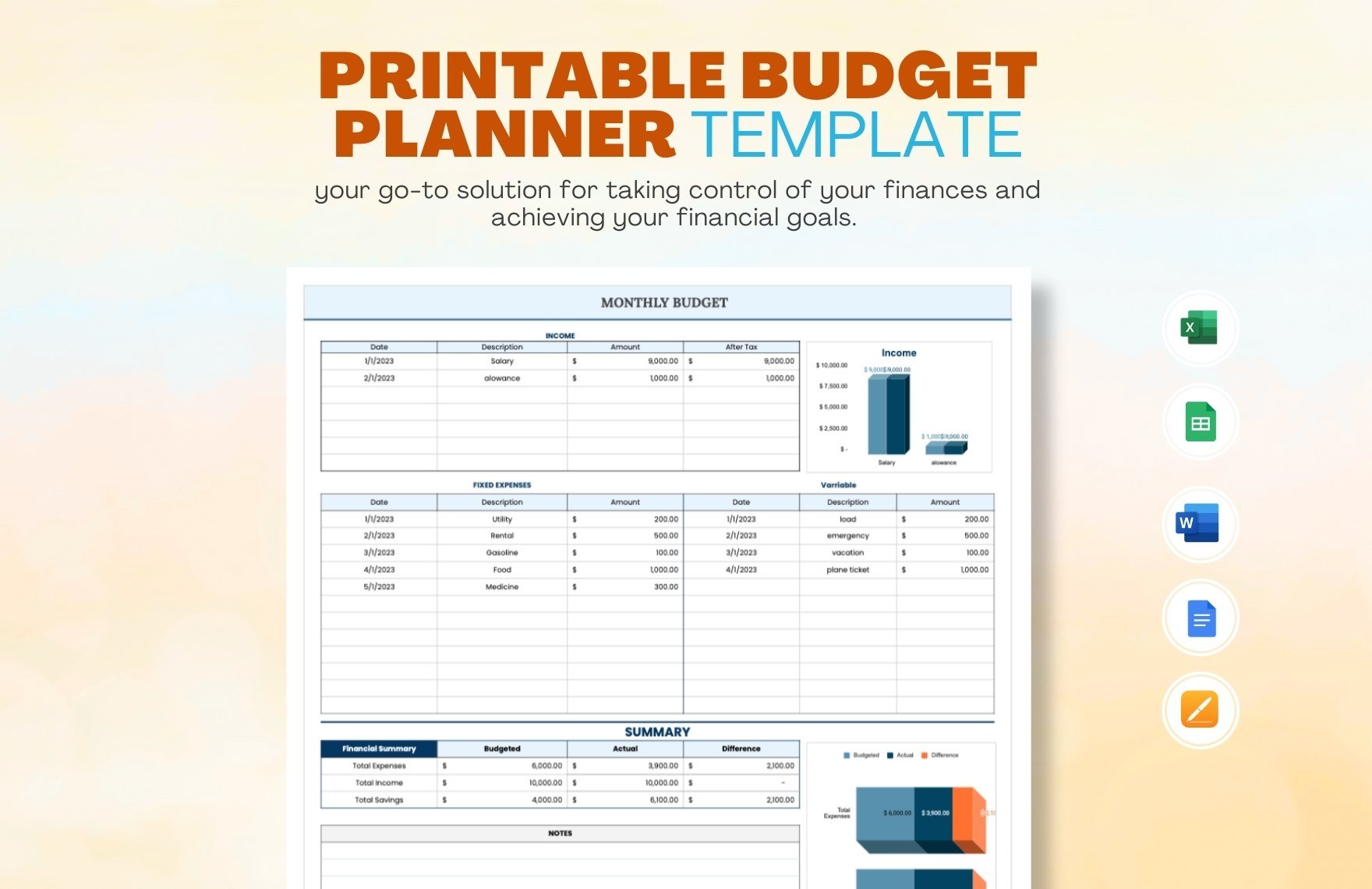

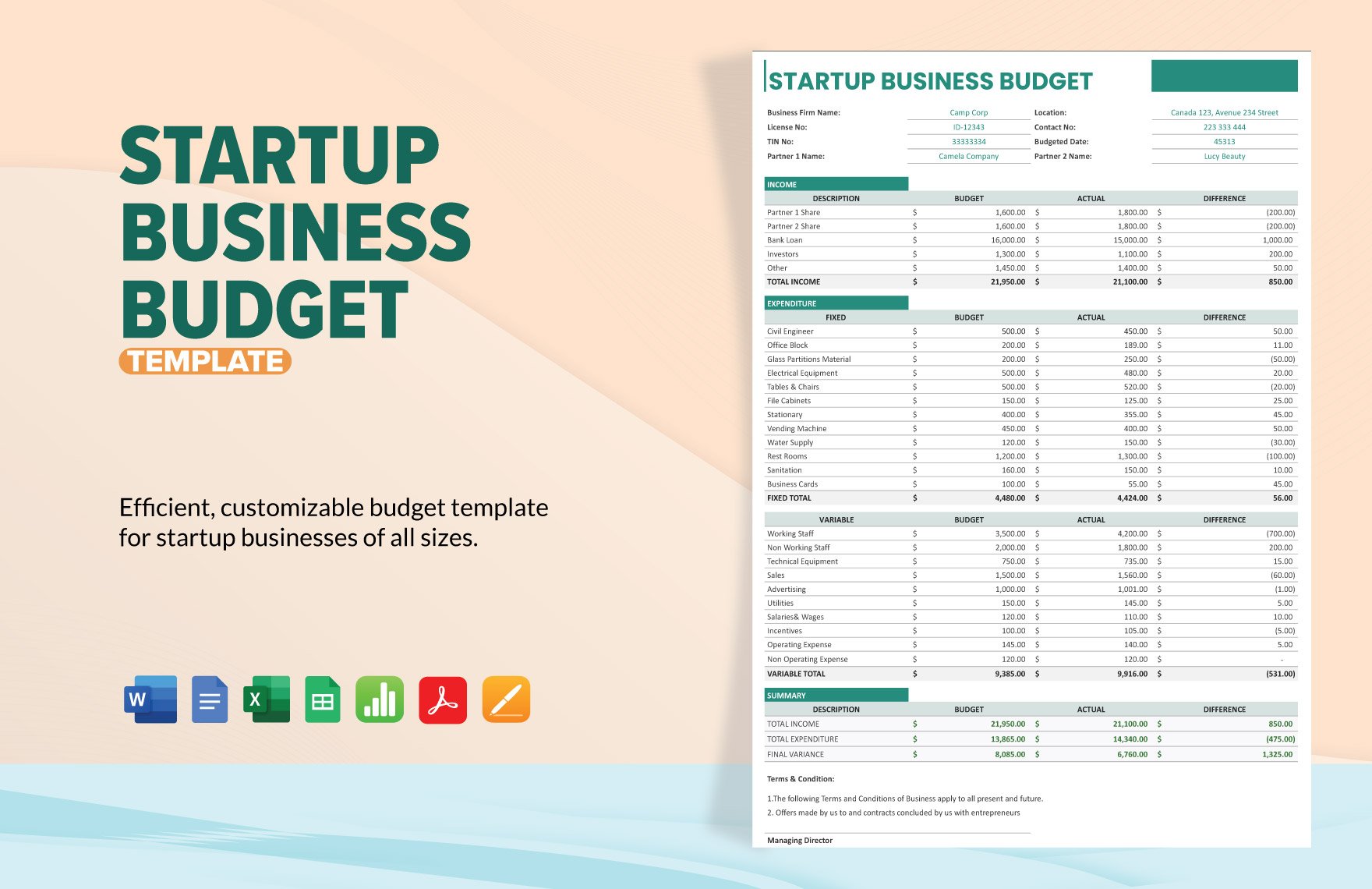

Having a budget can do so many things for a person. Budgeting can give you total control of your spending. It can help you organize how your money is spent. And also, it can help you achieve your money goals. With that said, you might be interested in downloading any of the ready-made Sample Budget Templates available below. Using these templates allows you to track your finances and expenditures easily and conveniently. These files come with original suggestive content that is fully customizable anytime through Adobe PDF file format. Gain control of your monthly budget when you utilize our premium and high-quality templates.

How to Make a Sample Budget in PDF

A budget is essential for a person, even for businesses. Carelessly spending money can lead to being in a bad financial status. No one would want to be in that situation. Budgeting is the most basic technique of managing the money you have in hand. To some, budgeting is about limitations when, in fact, it can give you a clear idea of how you allocate your money to save you from overspending and possible debts. Whatever your purpose is, here are some tips to help you in creating your sample budget from scratch in PDF.

1. Determine Money Goals

People tend to create a budget to attain their money goals. When making a sample budget, you will need to know why you are making this. Give your budget a purpose. Your purpose can be for student expenses budget, household budget, event budget, operating budget, biweekly budget, marketing budget, or vacation budget.

2. Break Down Expenses

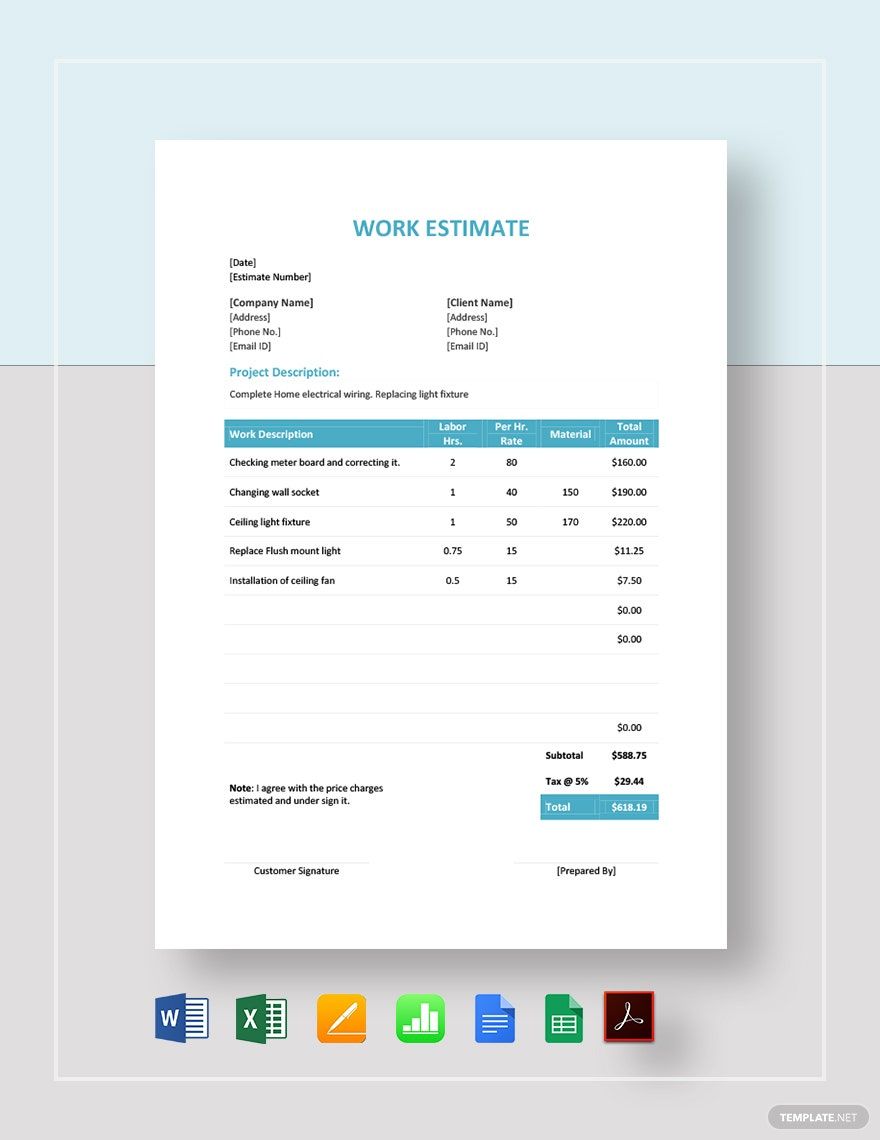

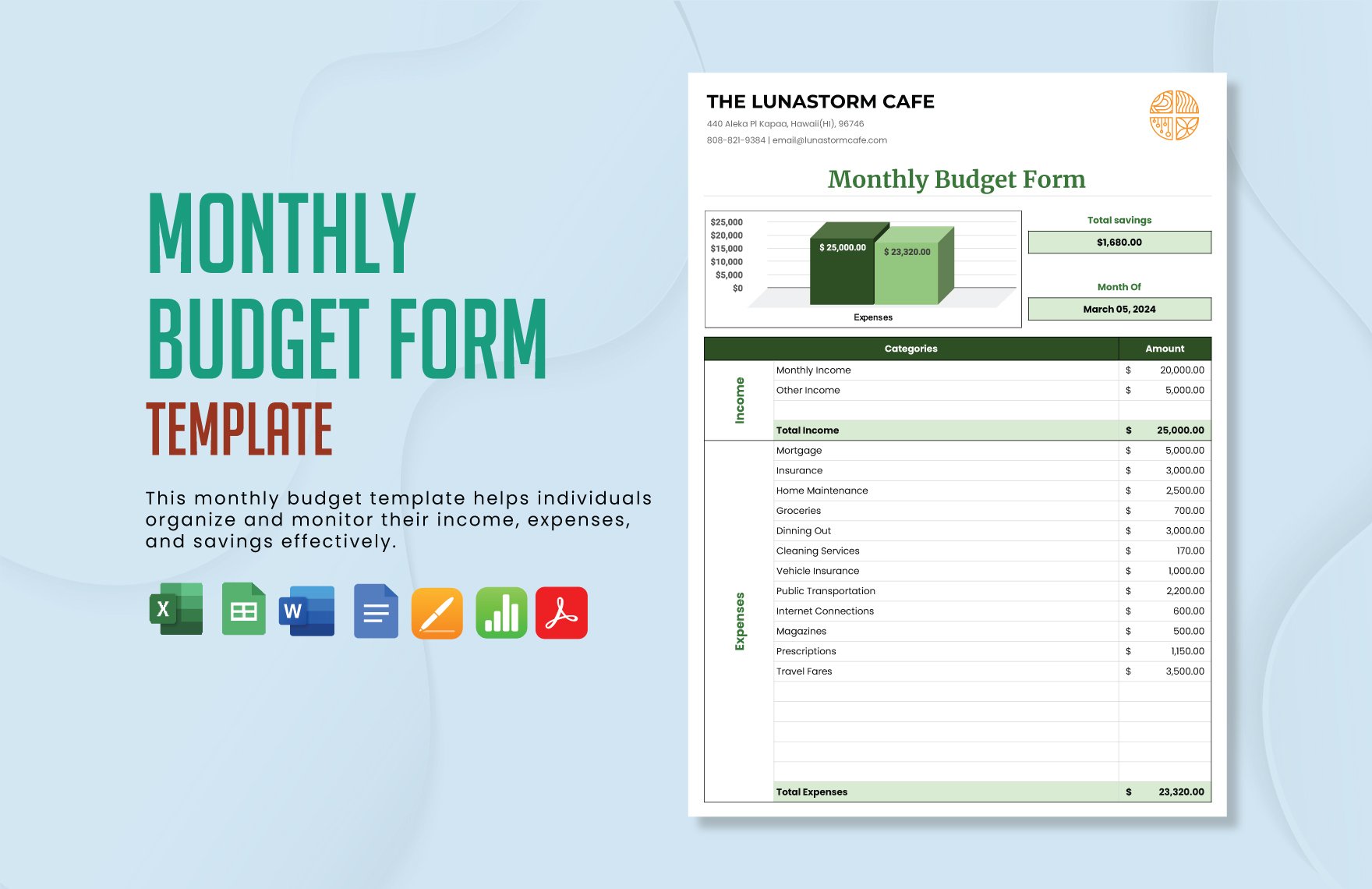

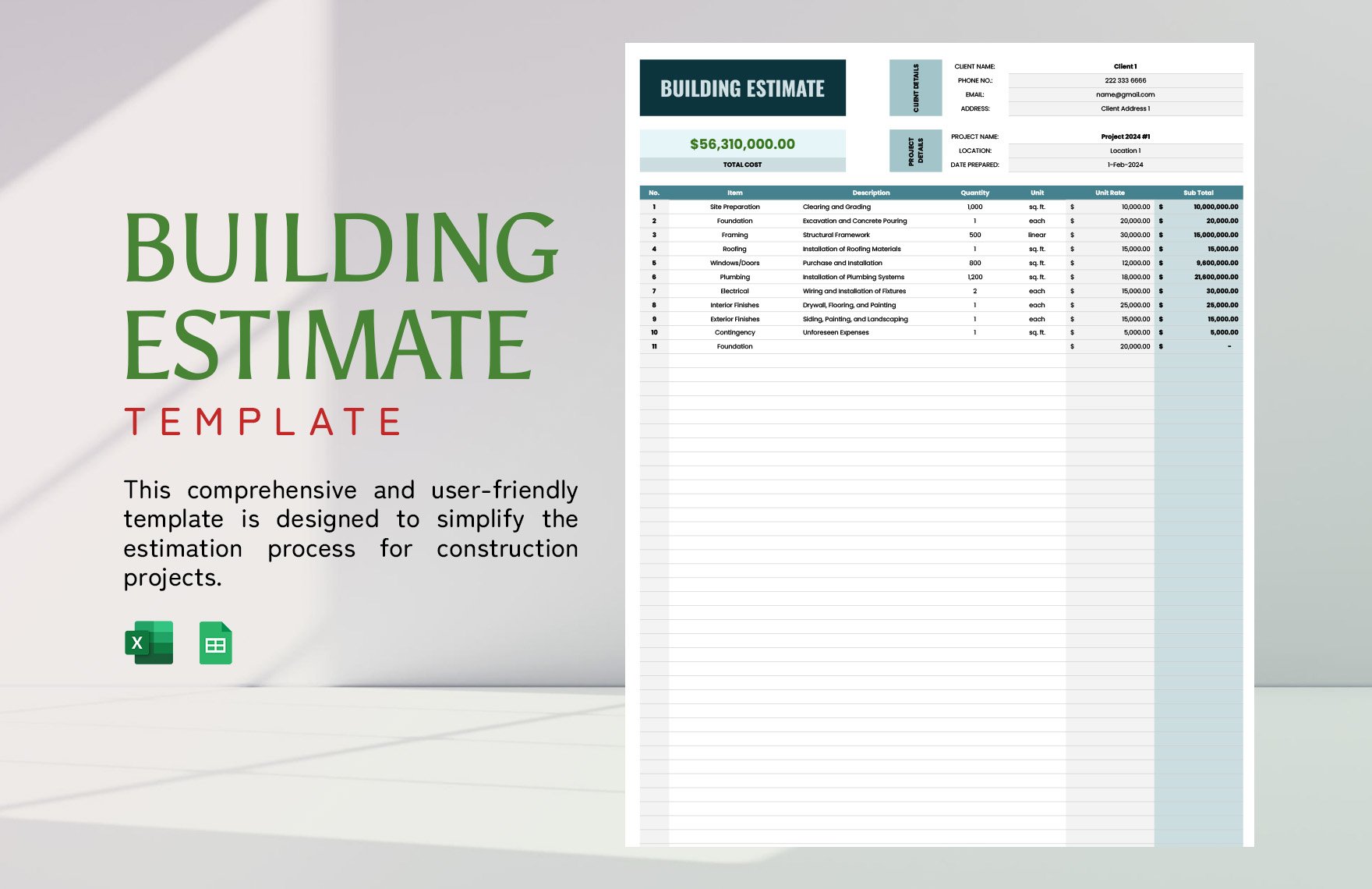

To begin your budget, you will need to gather your bills, receipts, and other financial records. When you plan your budget, it is necessary to base it on the number of your spending. Create a list of these expenses on the document. Get a clear picture of how much you are spending weekly, monthly, or irregularly. Also, identify as to what you are spending your money on. That being said, you'll be able to create a budget fit for your lifestyle.

3. Identify Income Sources

According to InCharge, 18% of Americans spend more than their income. When you overspend, your budget plan will fail. To avoid this, you have to know how much you are making. By identifying your income source and how much you are making, allocating your money to certain expenses can be a lot easier. You'll be able to allocate and adjust payments fitting for the particular costs. You'll be able to take full control of what goes out of your wallet.

4. Leave Extra Money

It will be beneficial if you leave some extra money on your budget plan, either weekly or monthly. You can have this as your savings, or you can use it when unexpected circumstances happen.