Make Your Financial Planning to Life with Budget Sheet Templates from Template.net

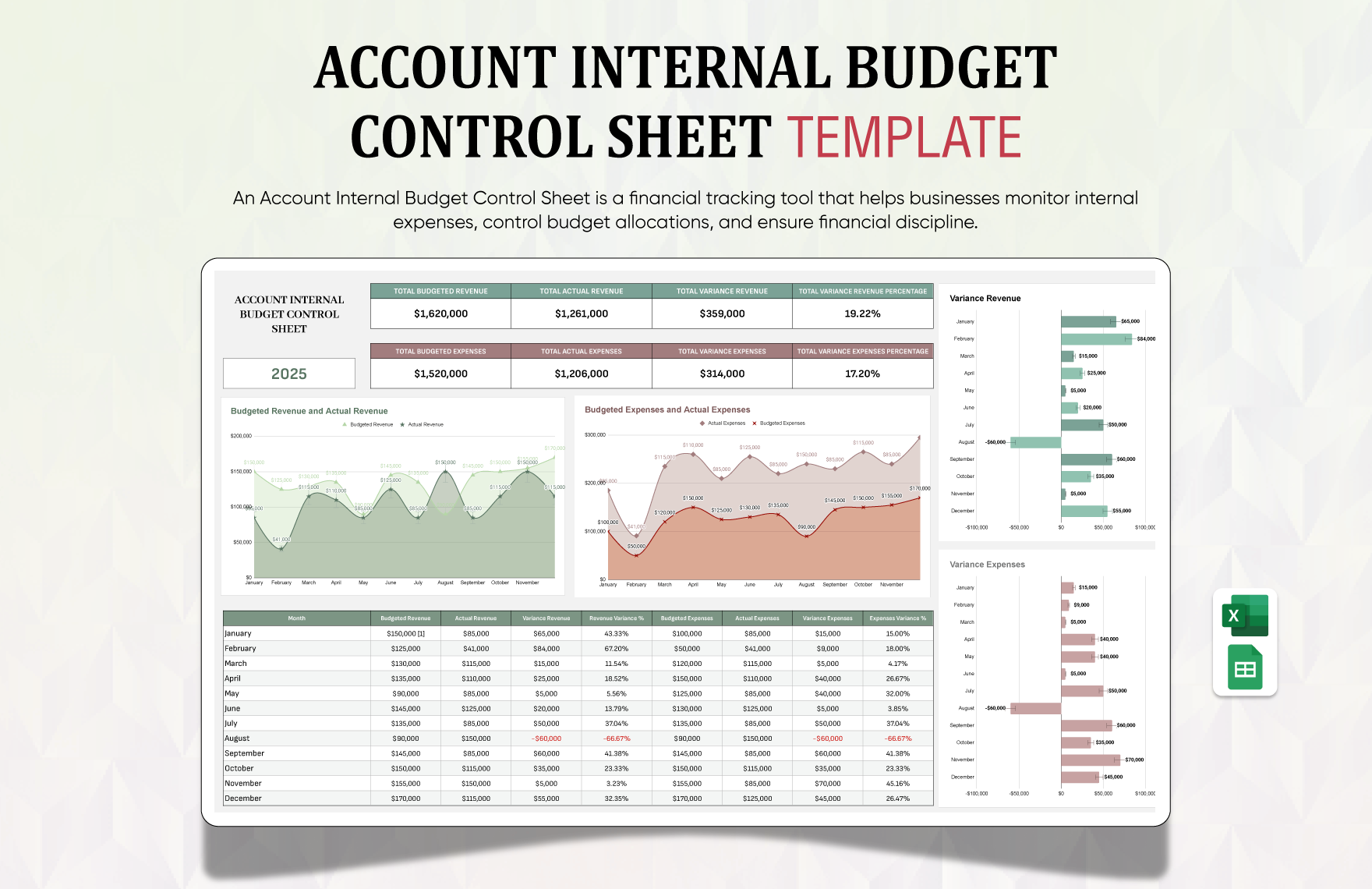

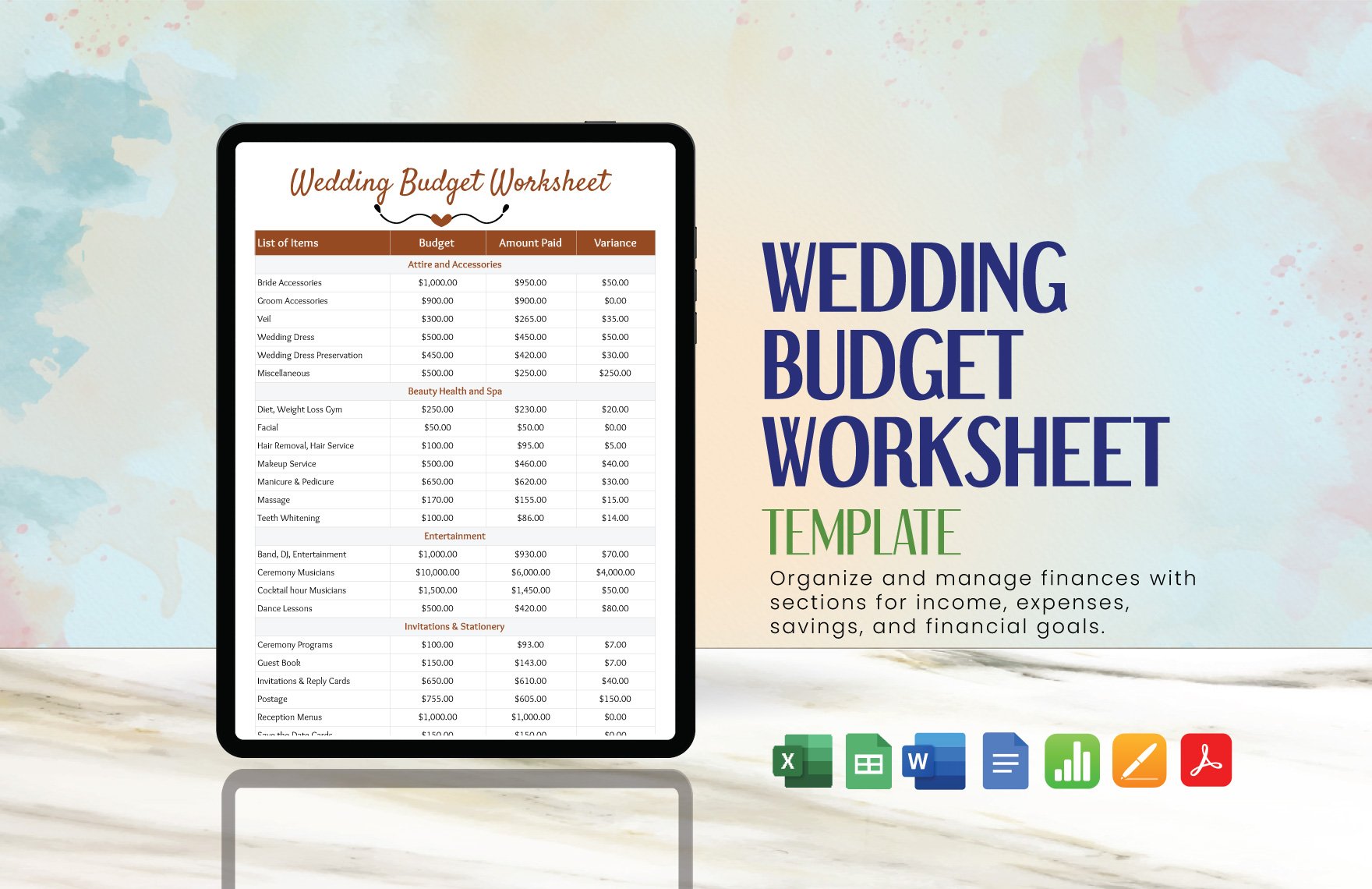

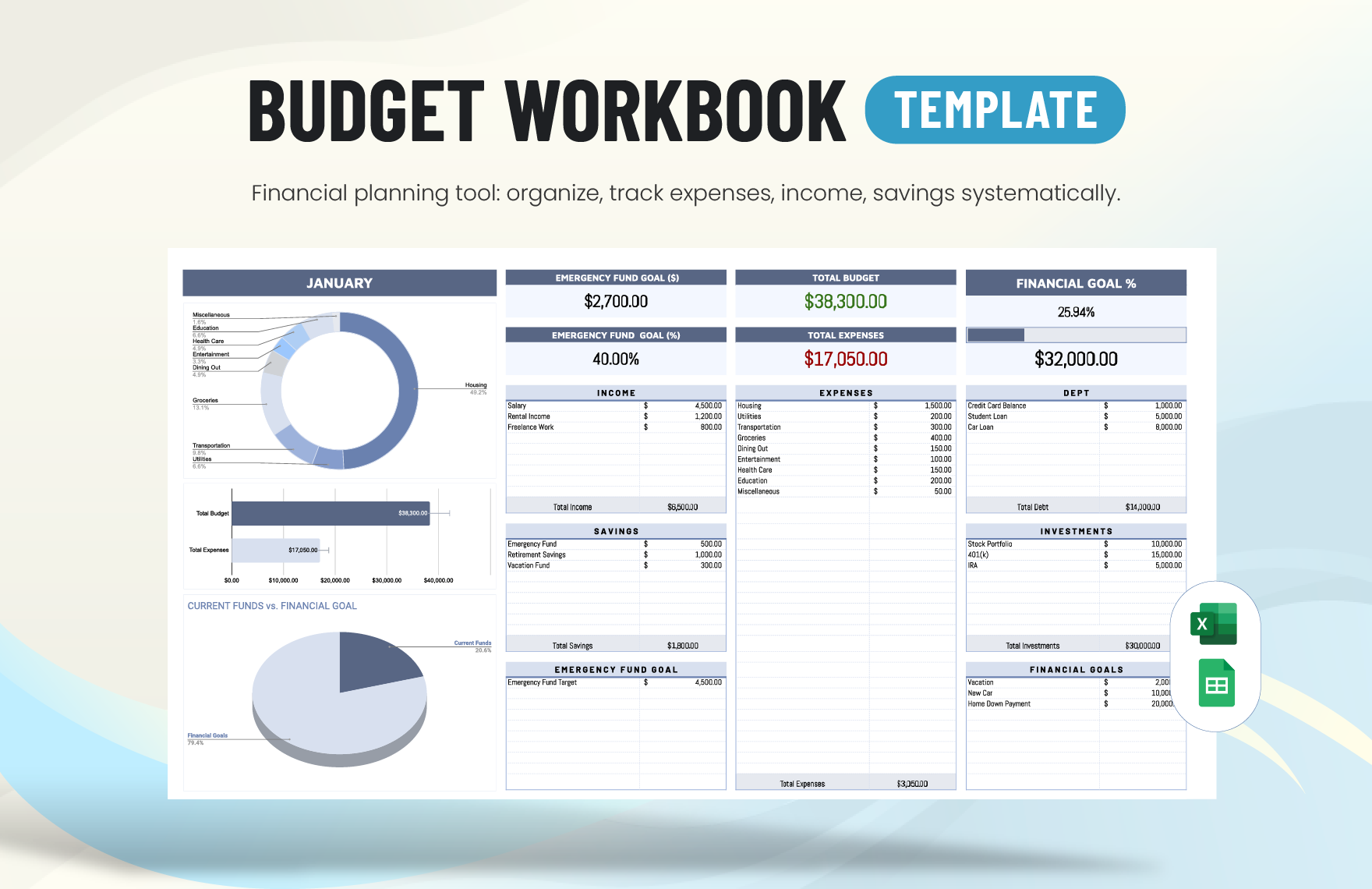

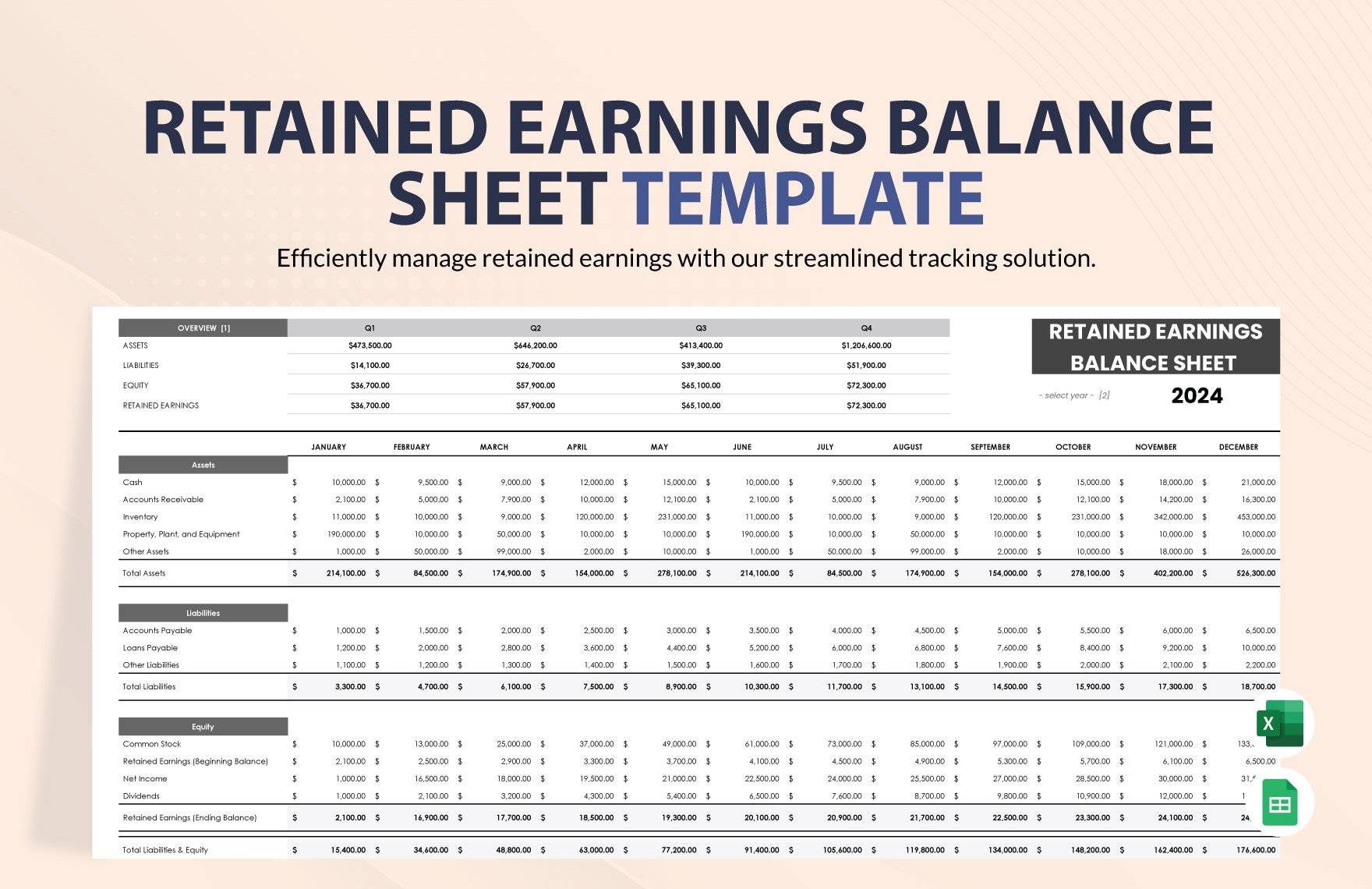

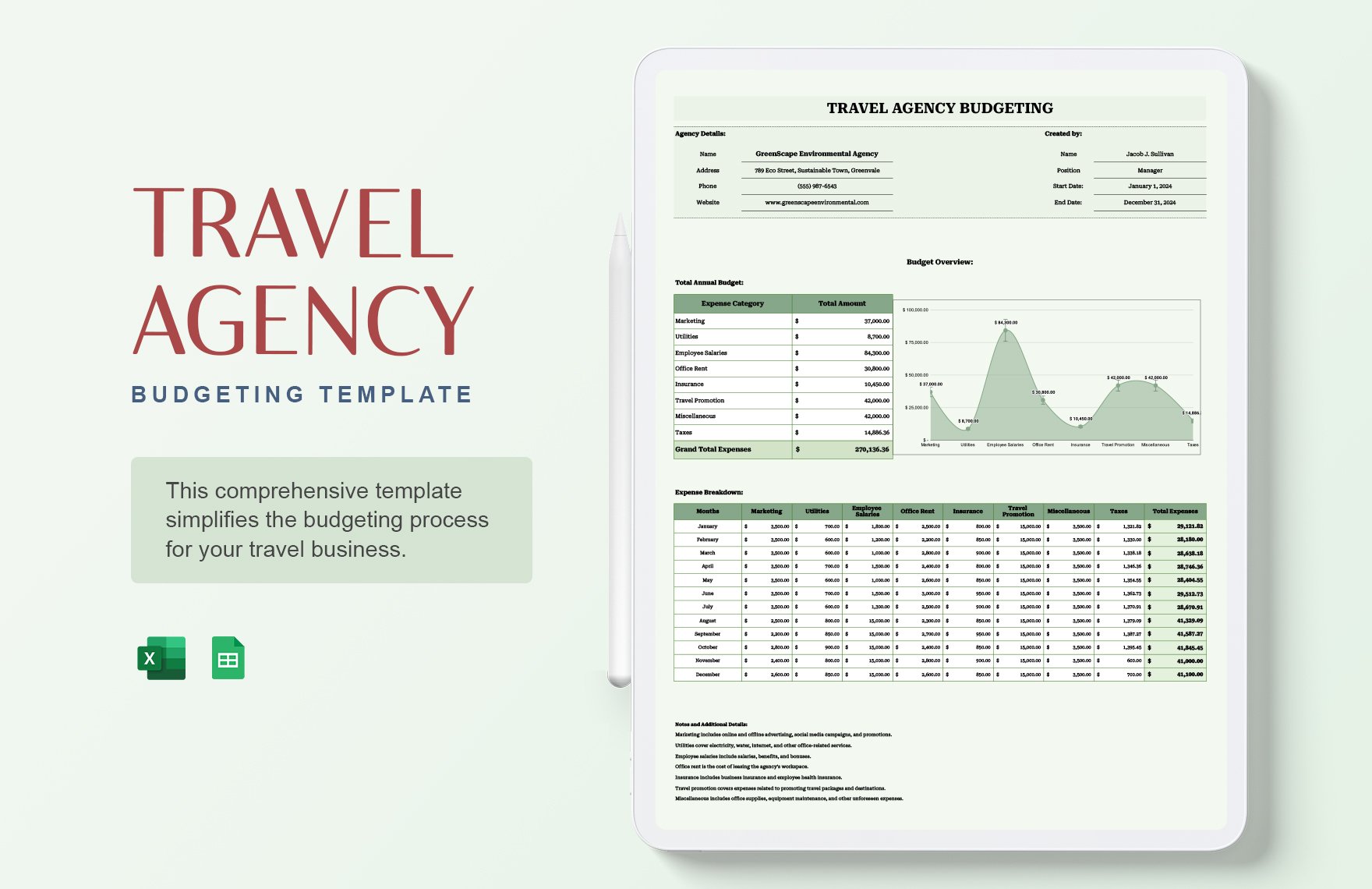

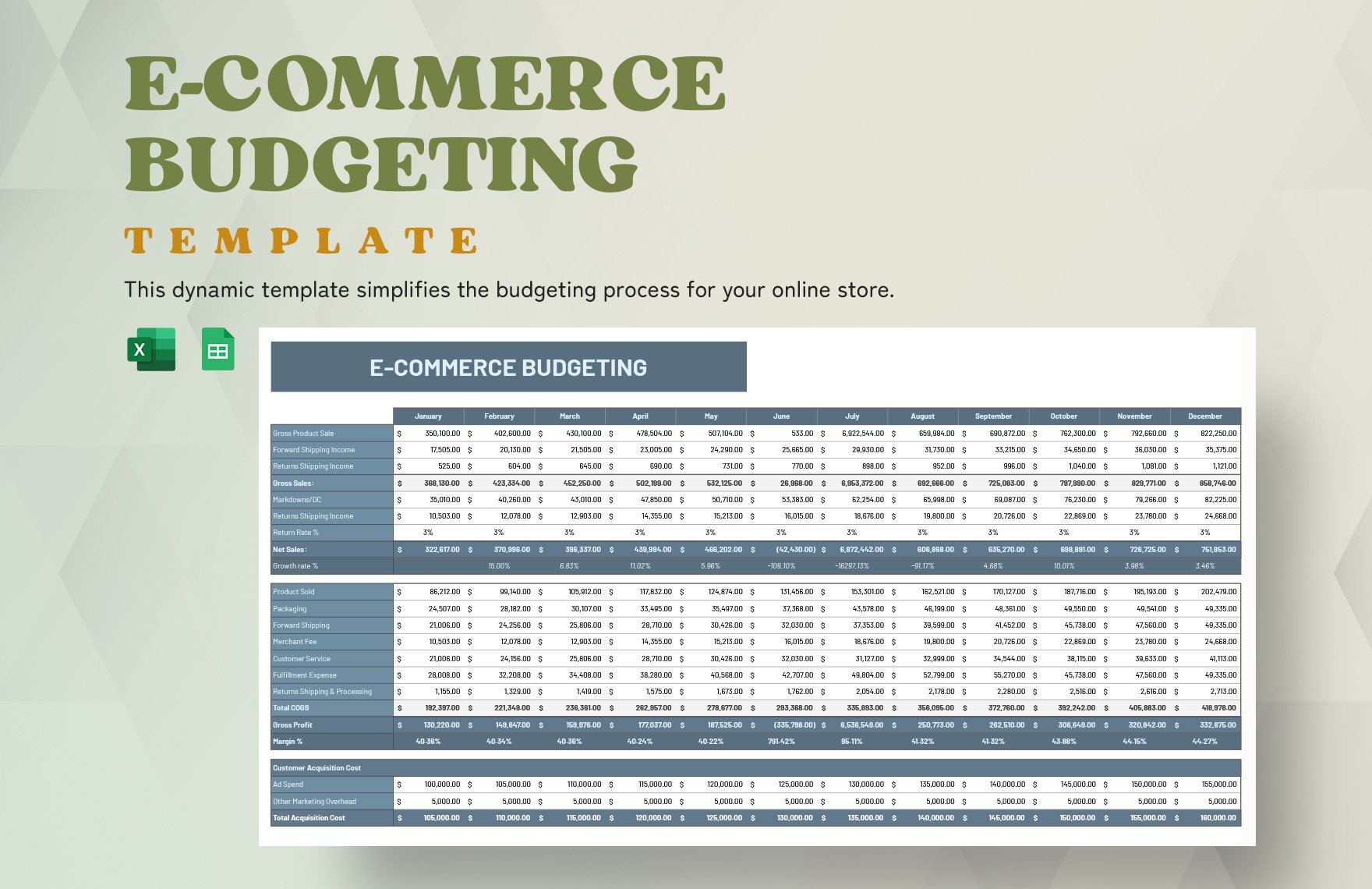

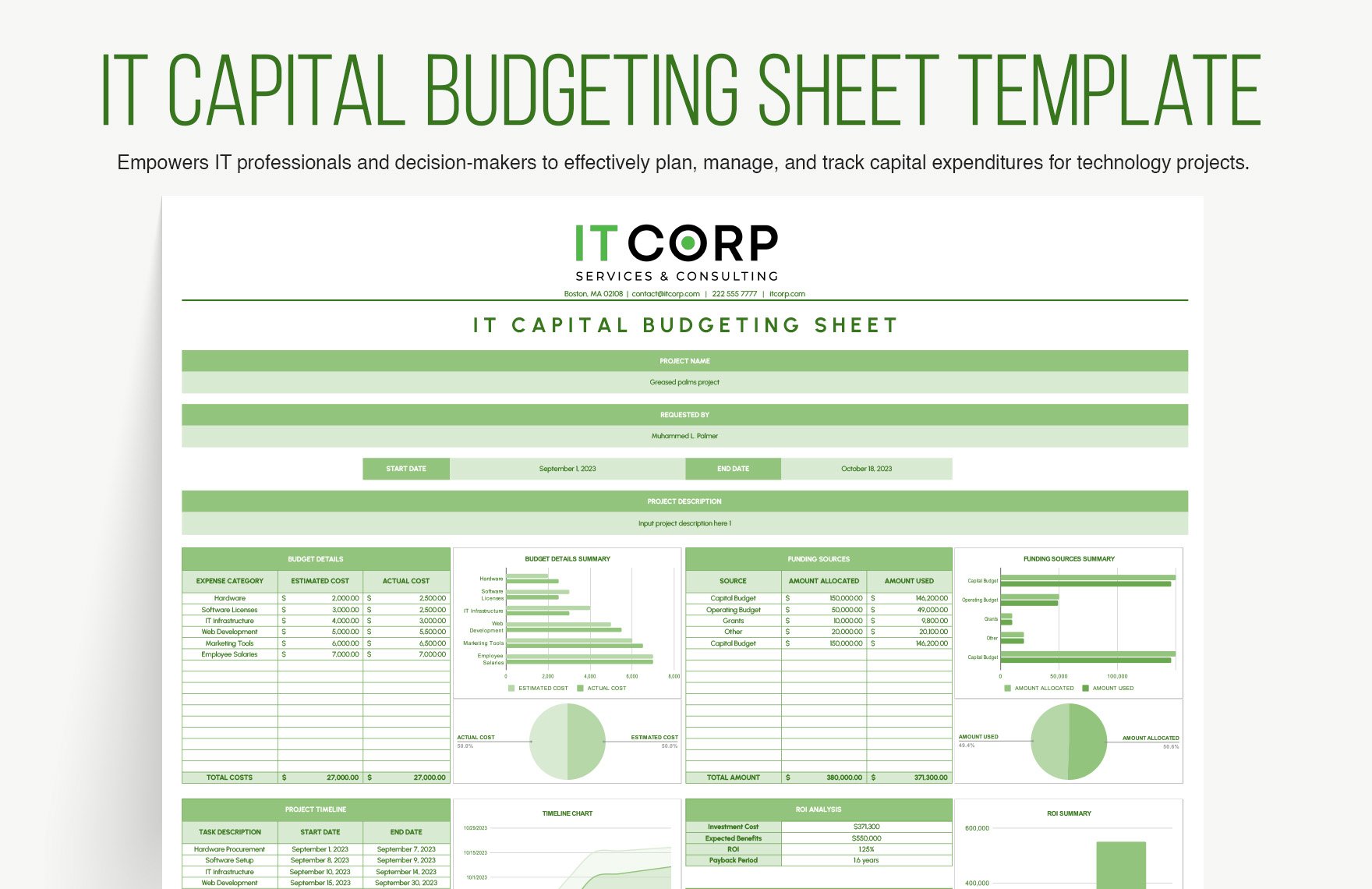

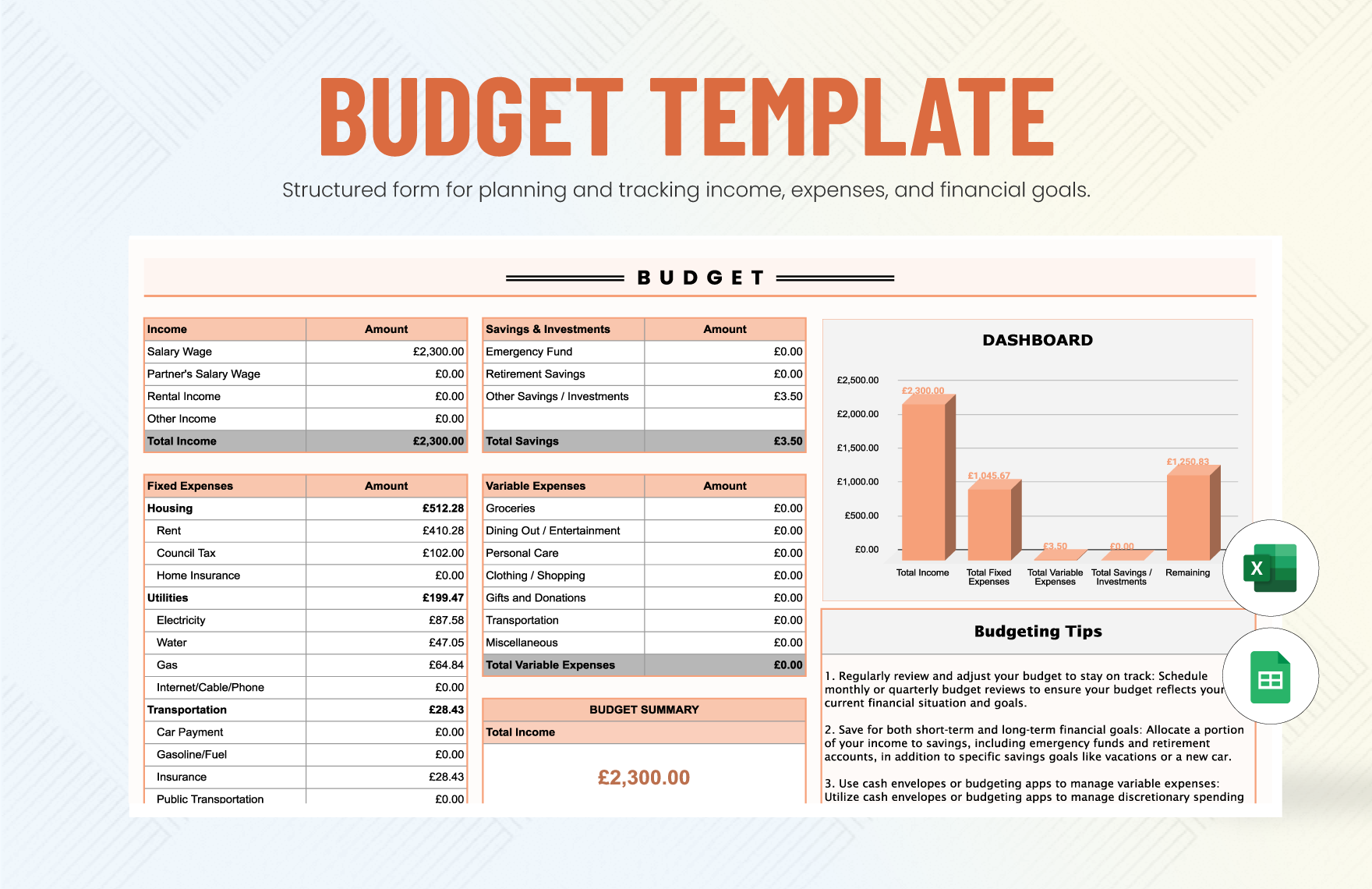

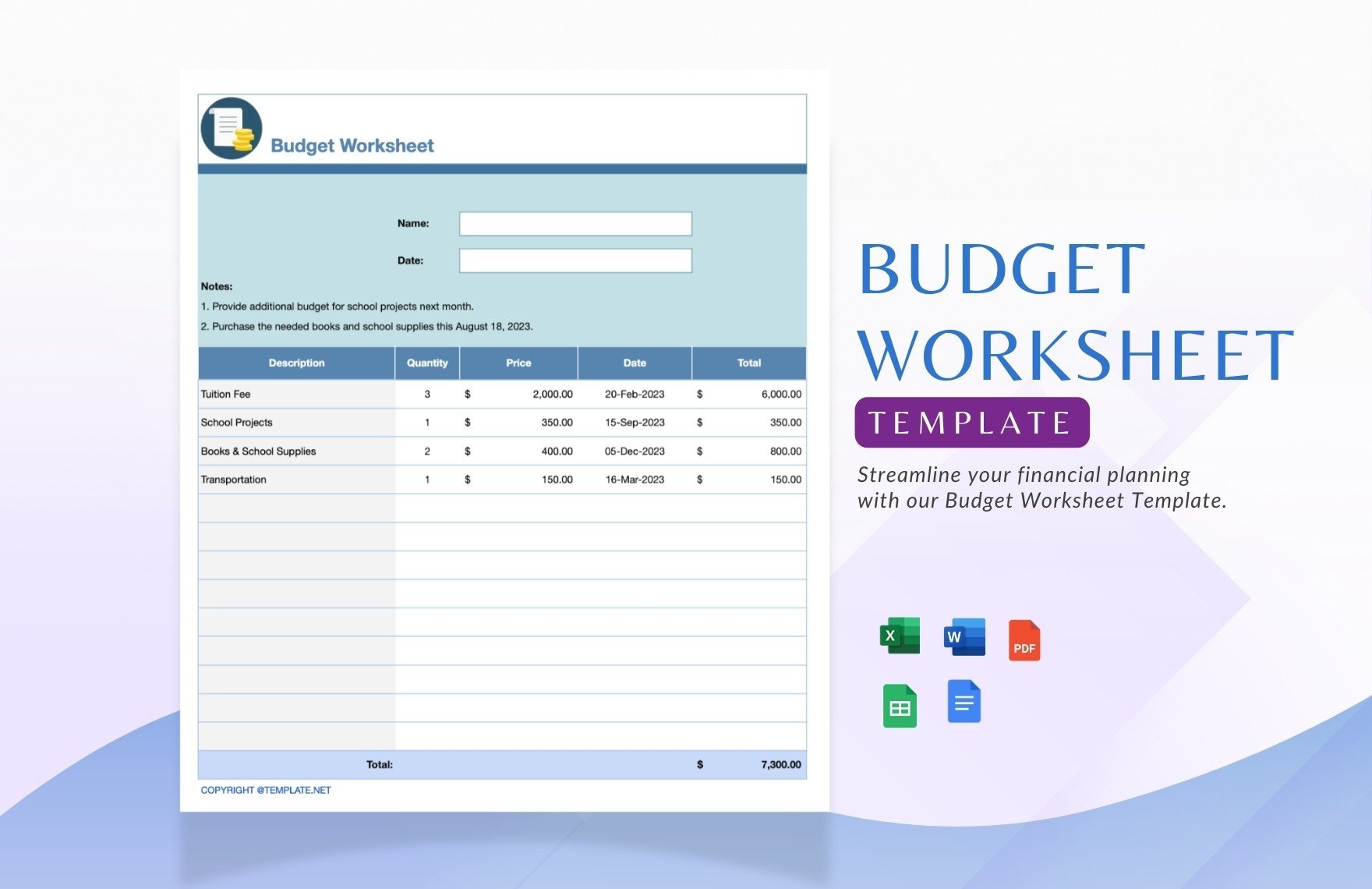

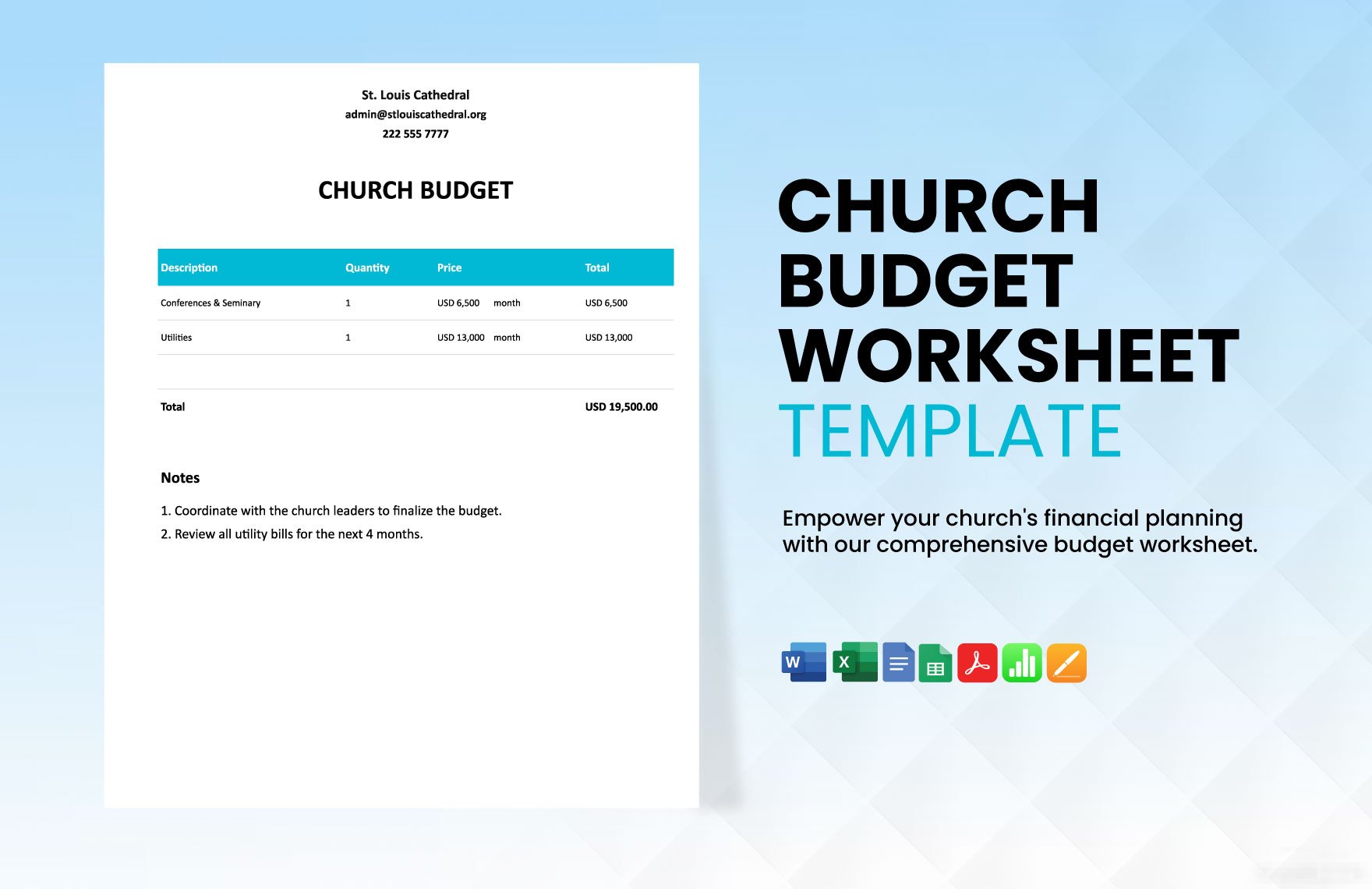

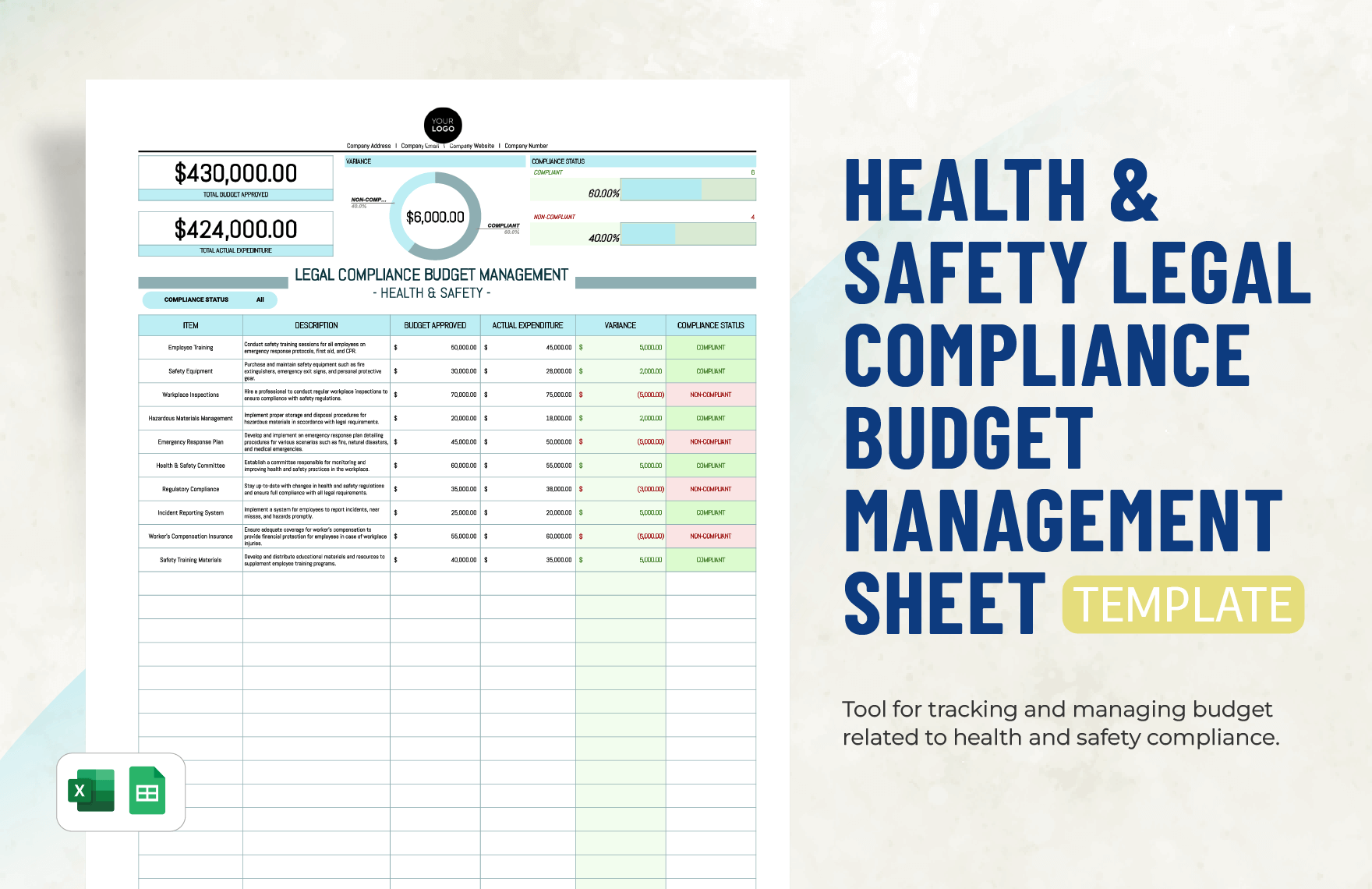

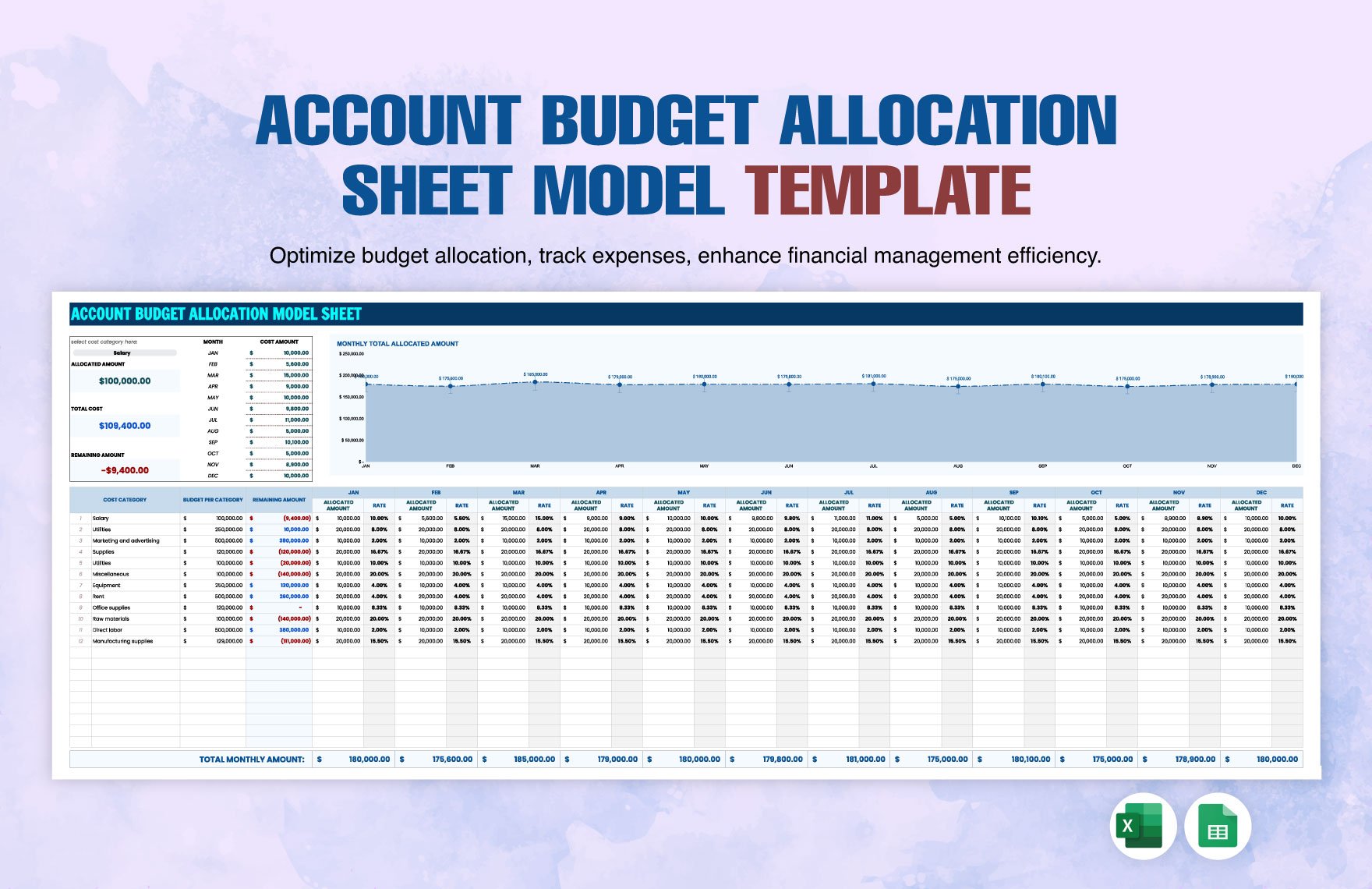

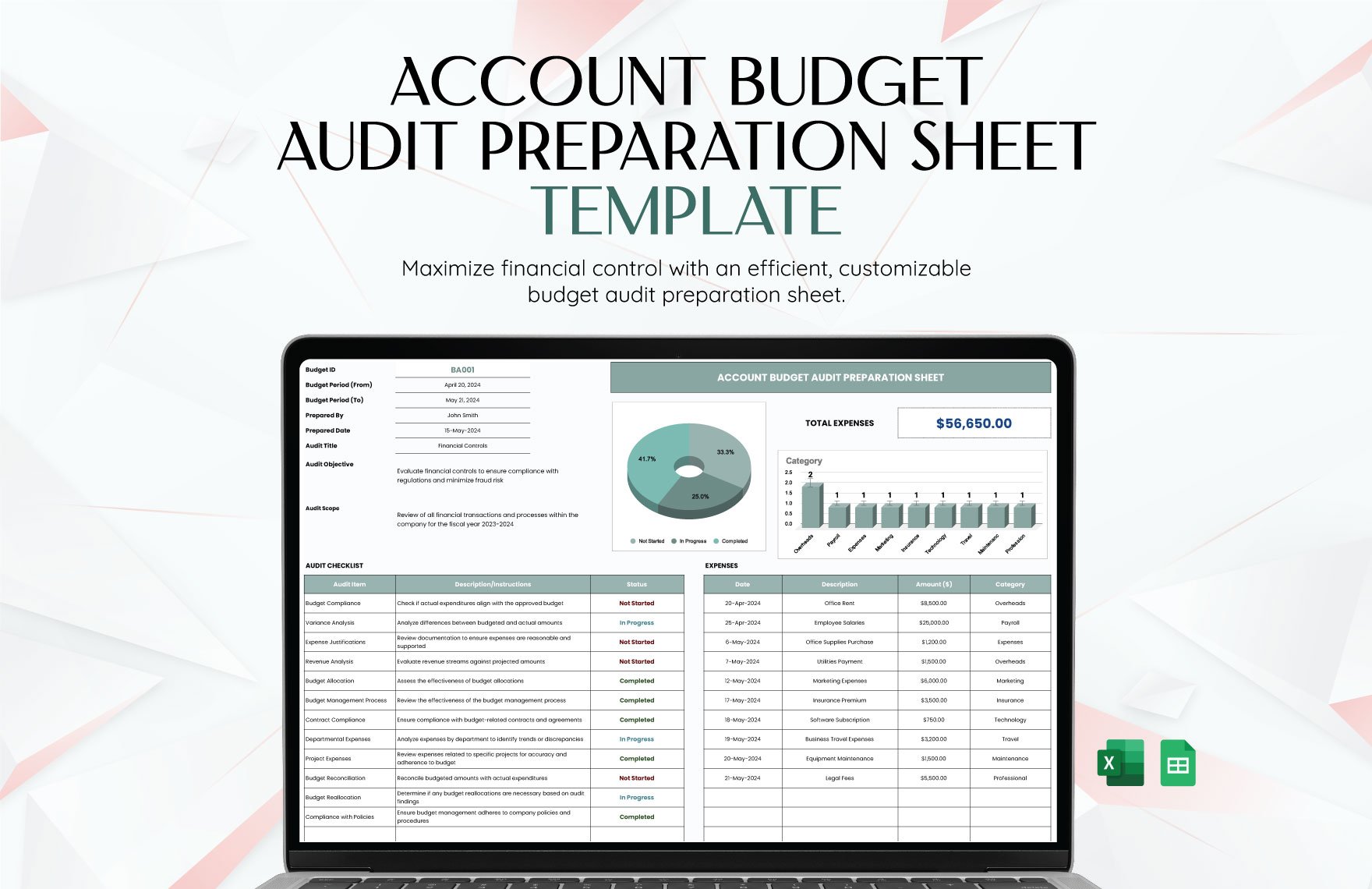

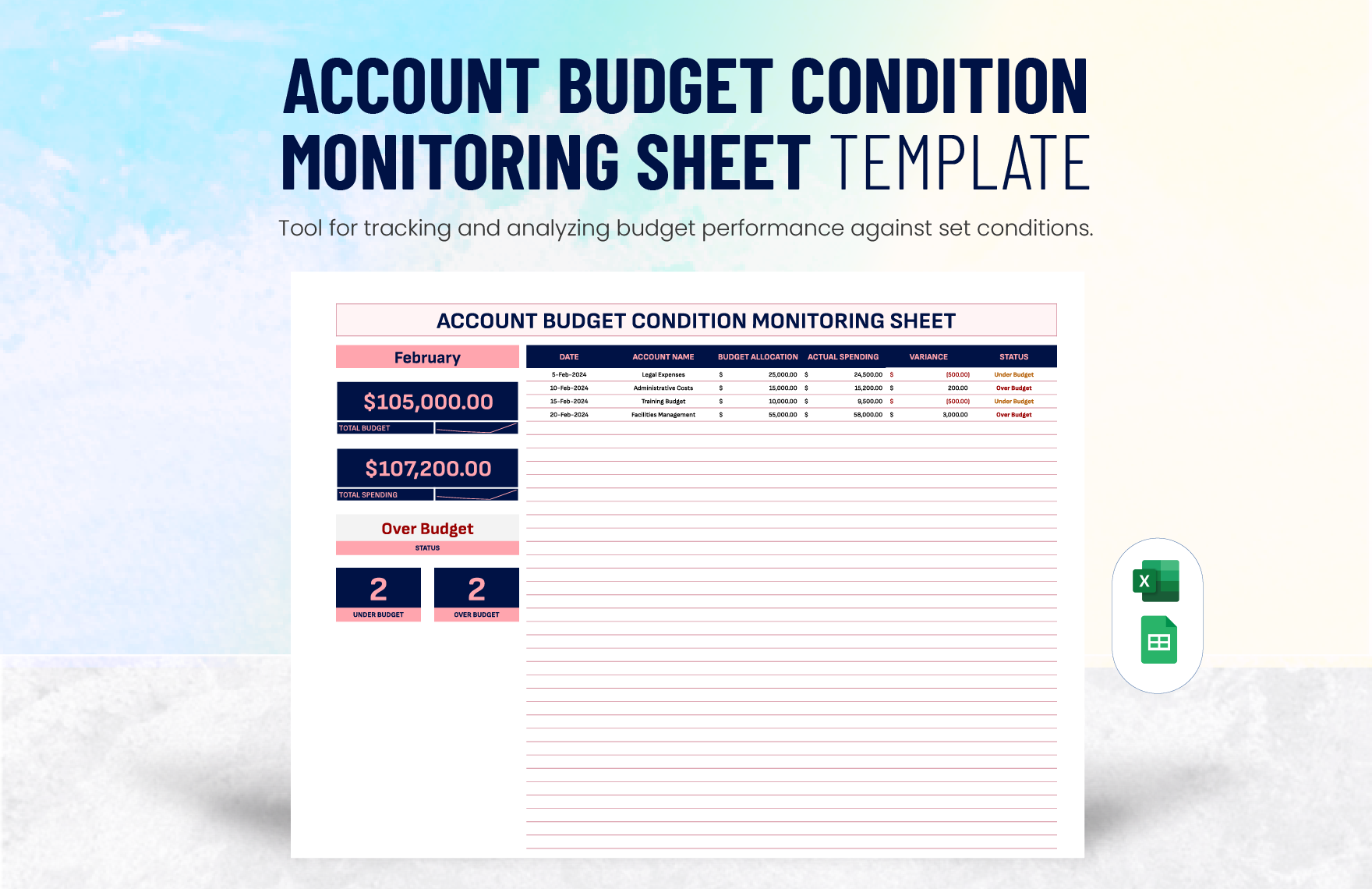

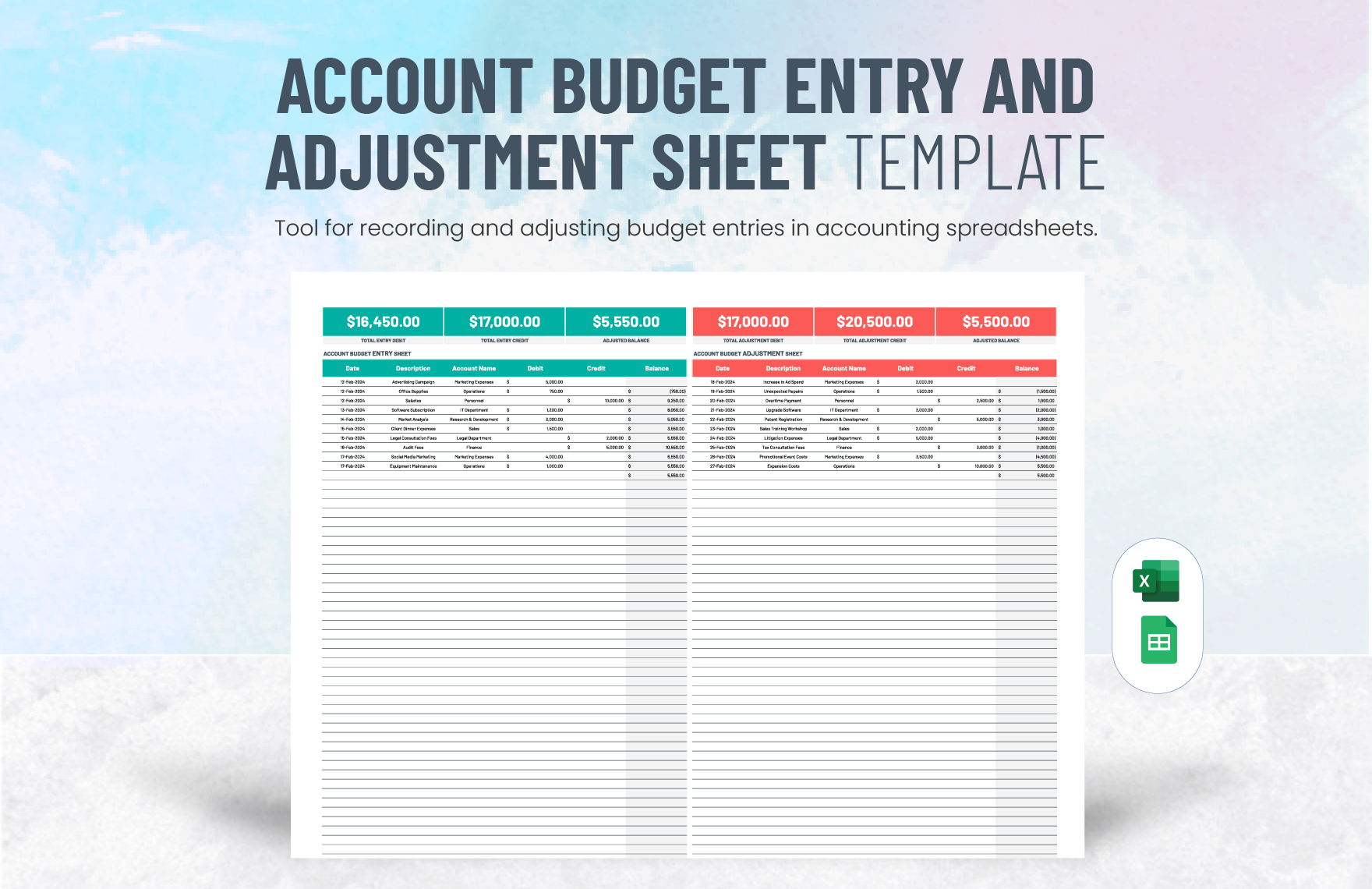

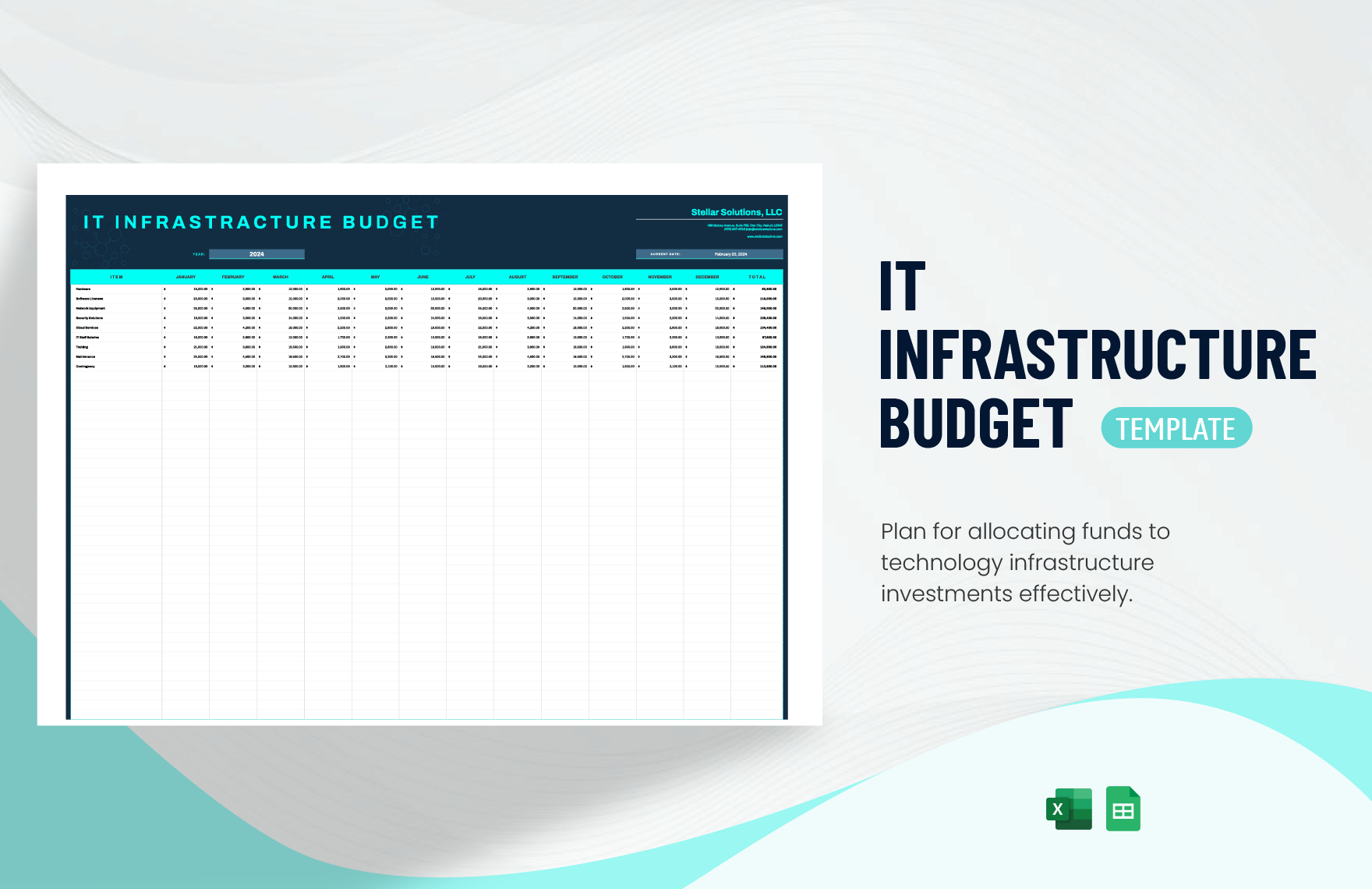

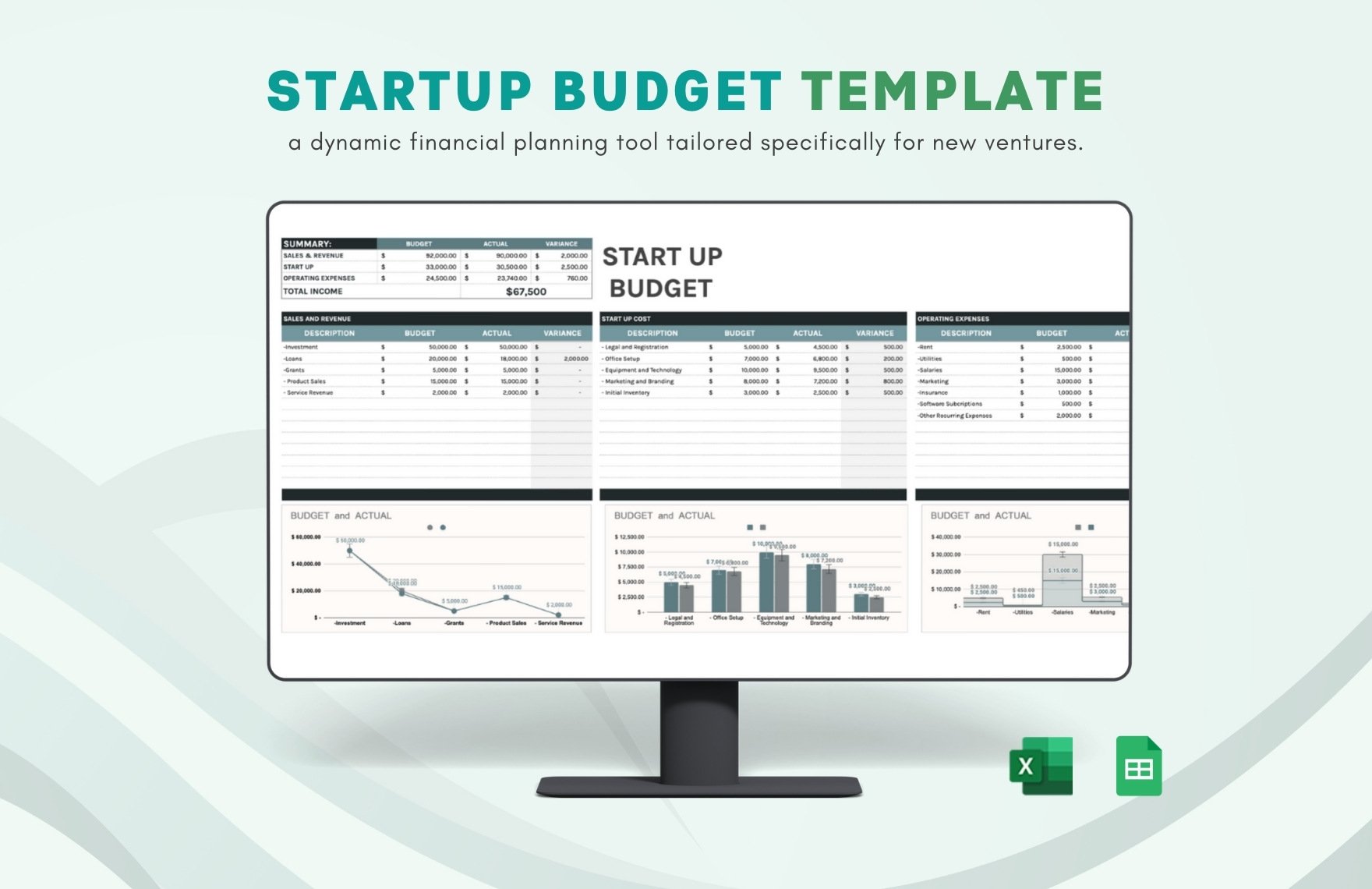

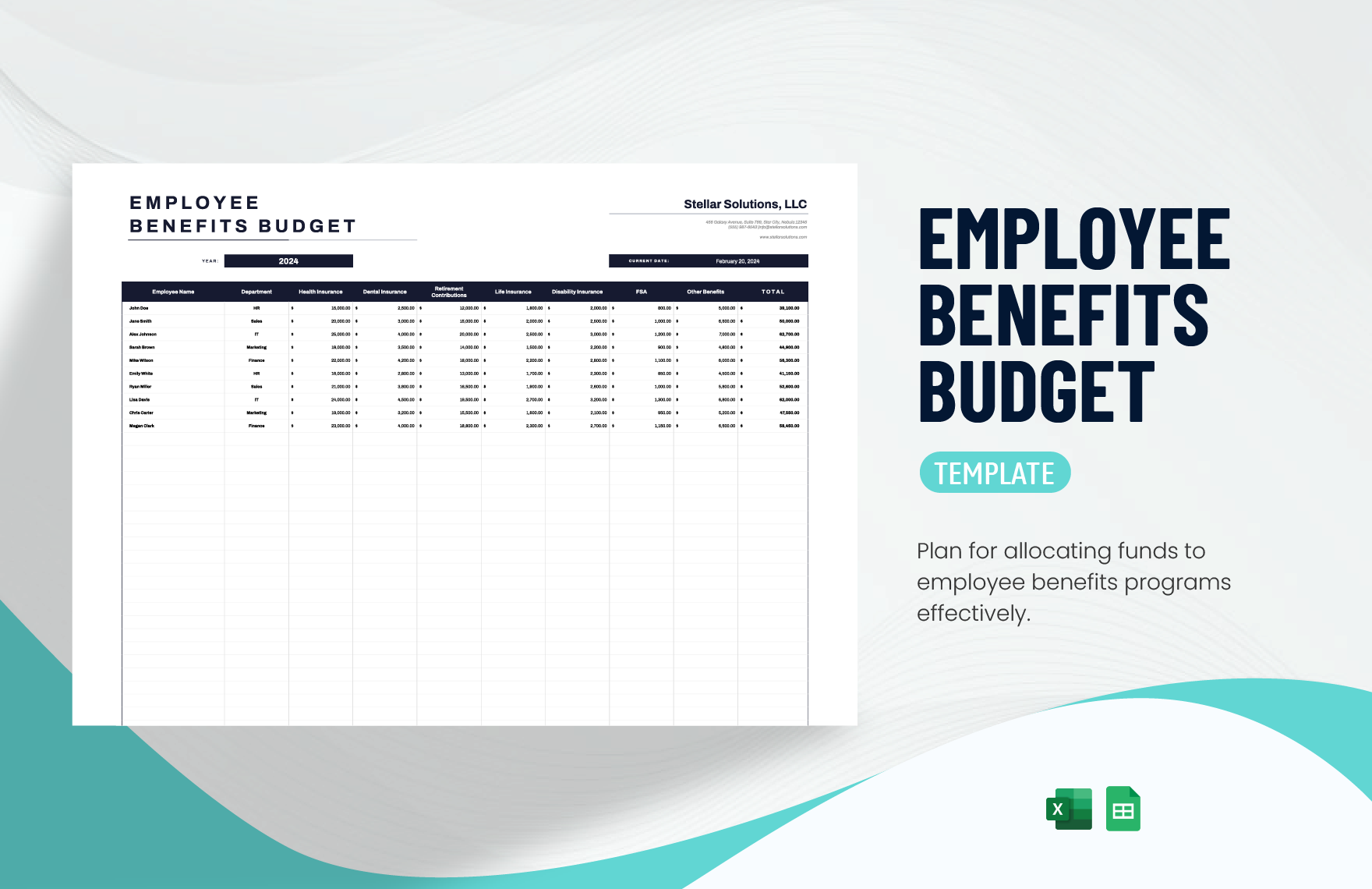

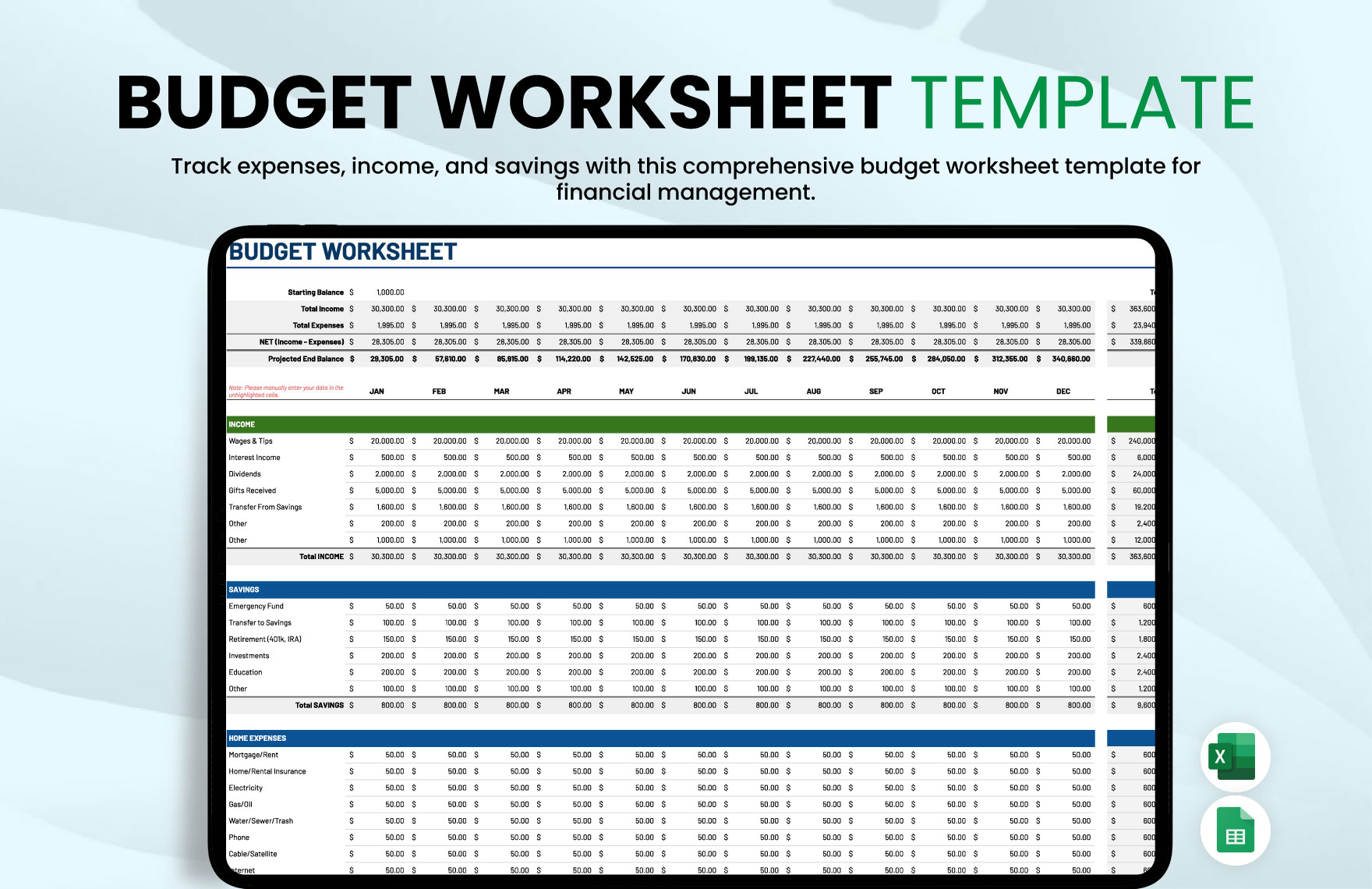

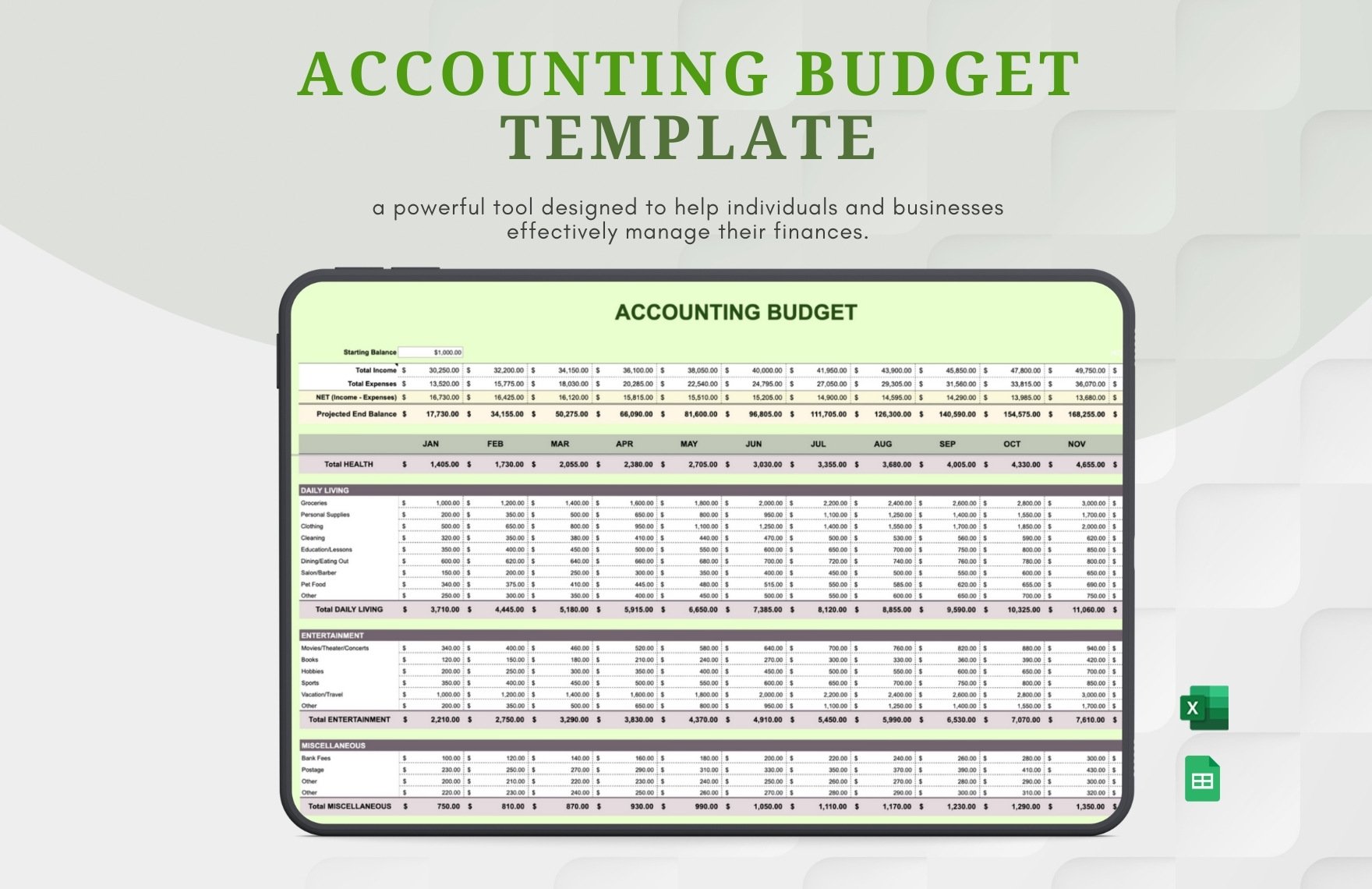

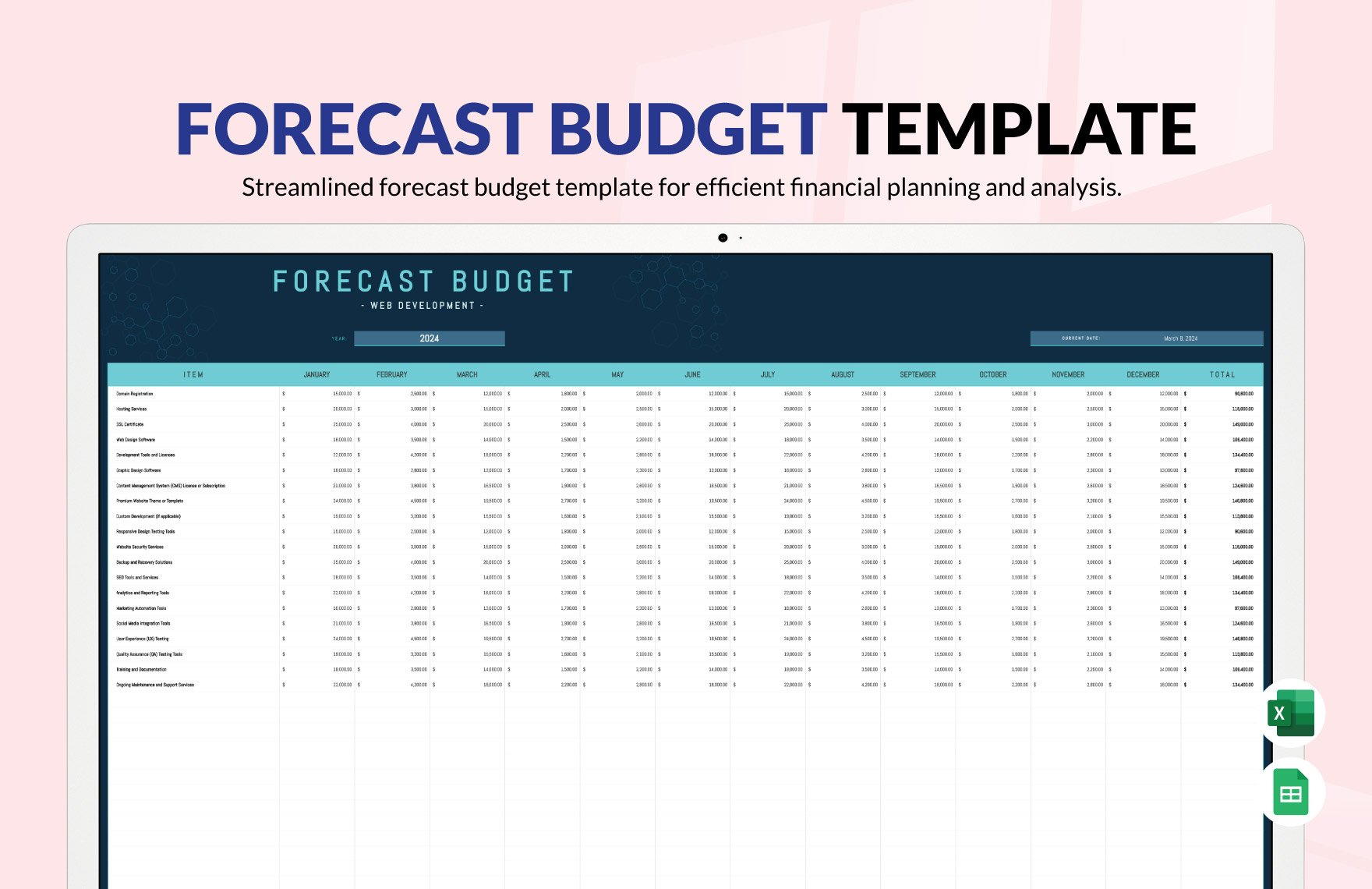

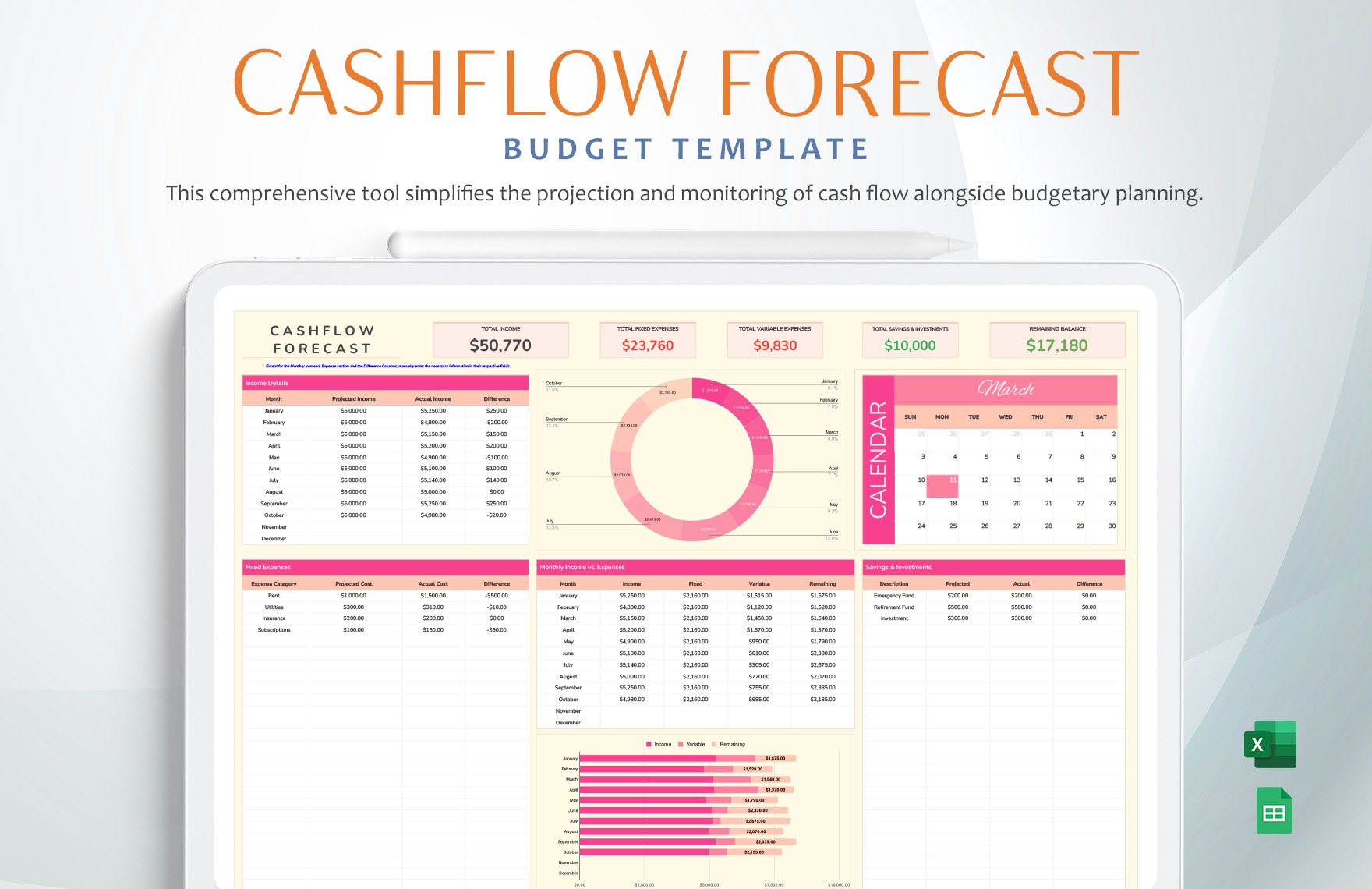

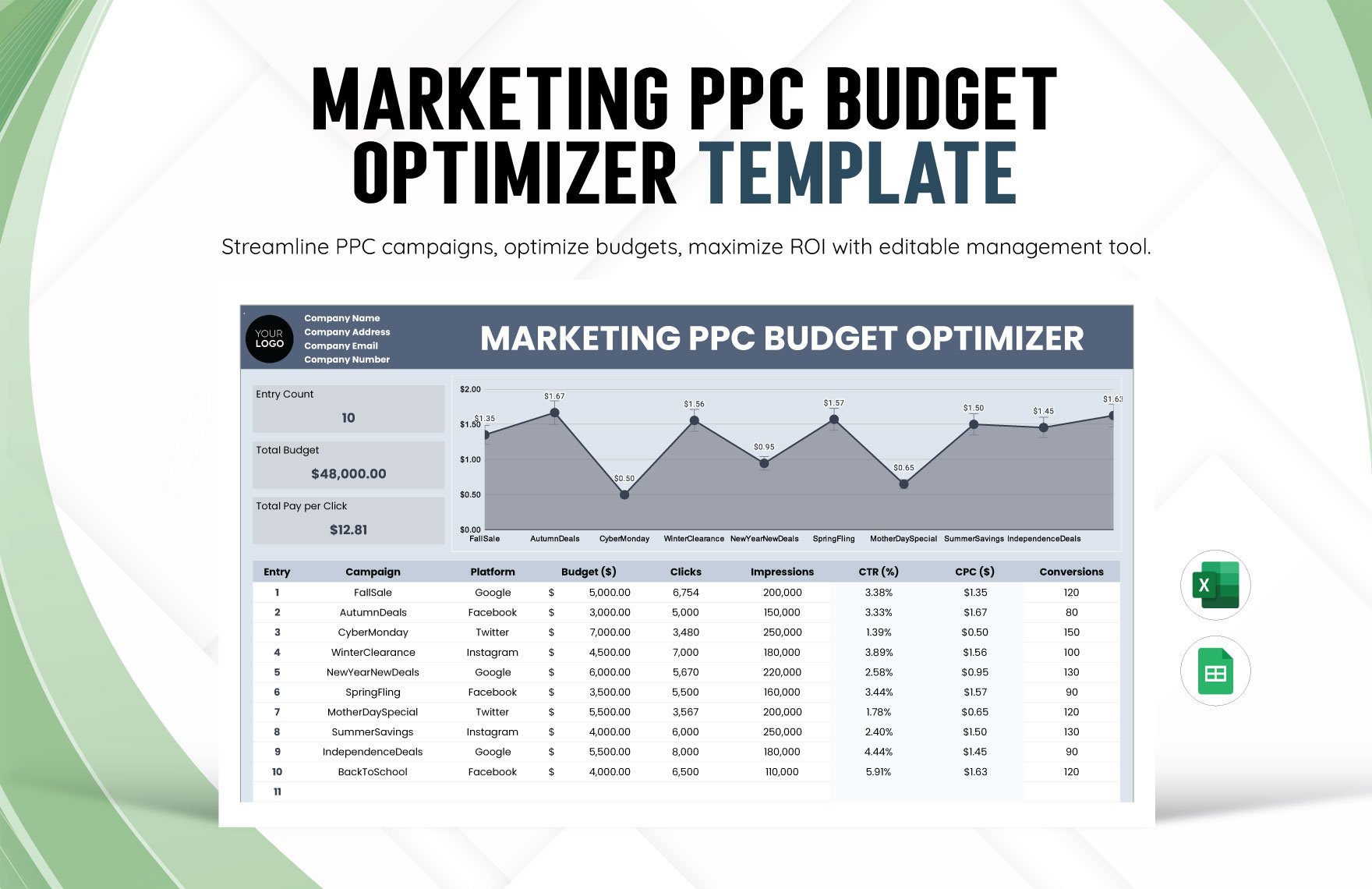

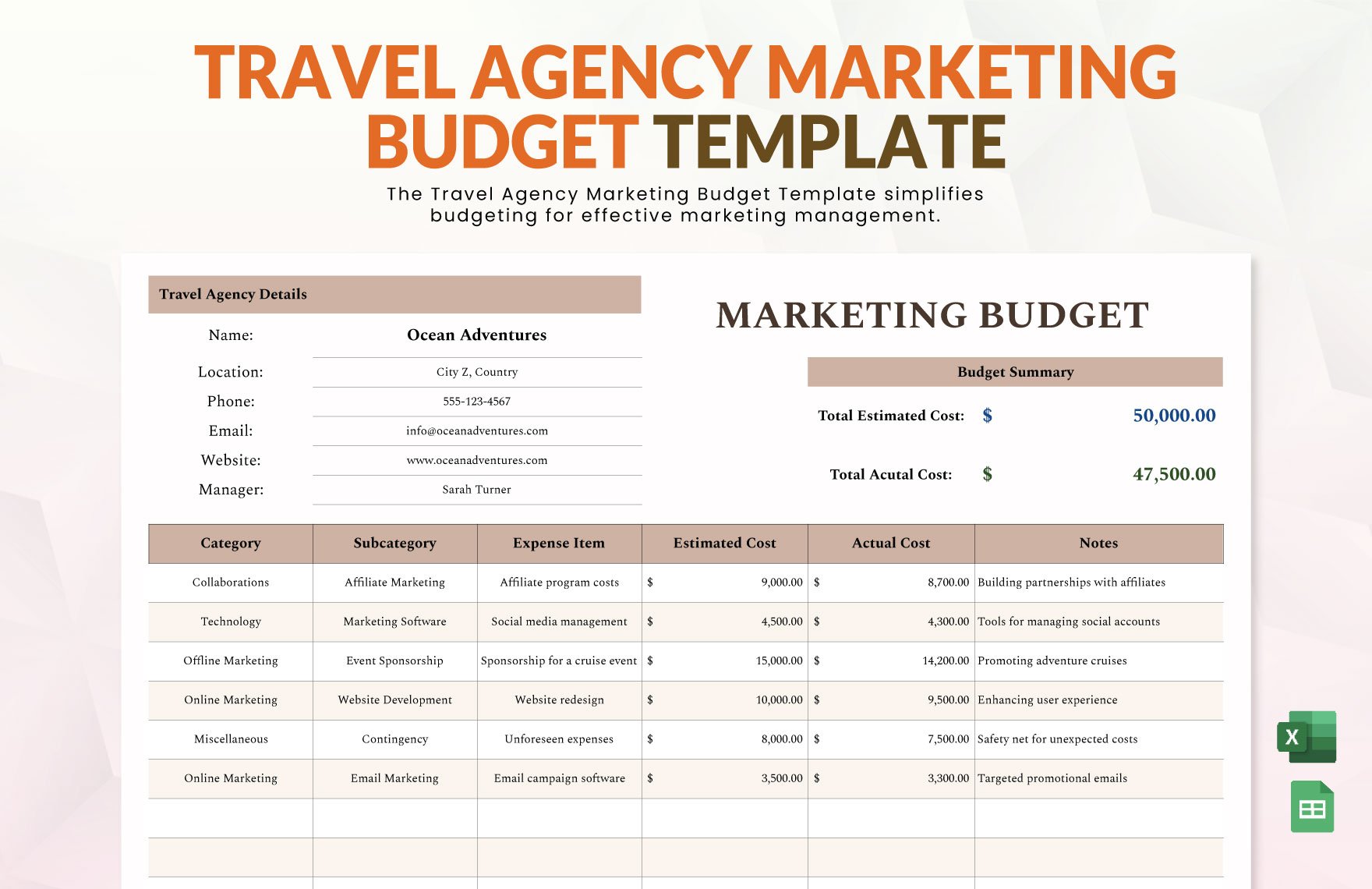

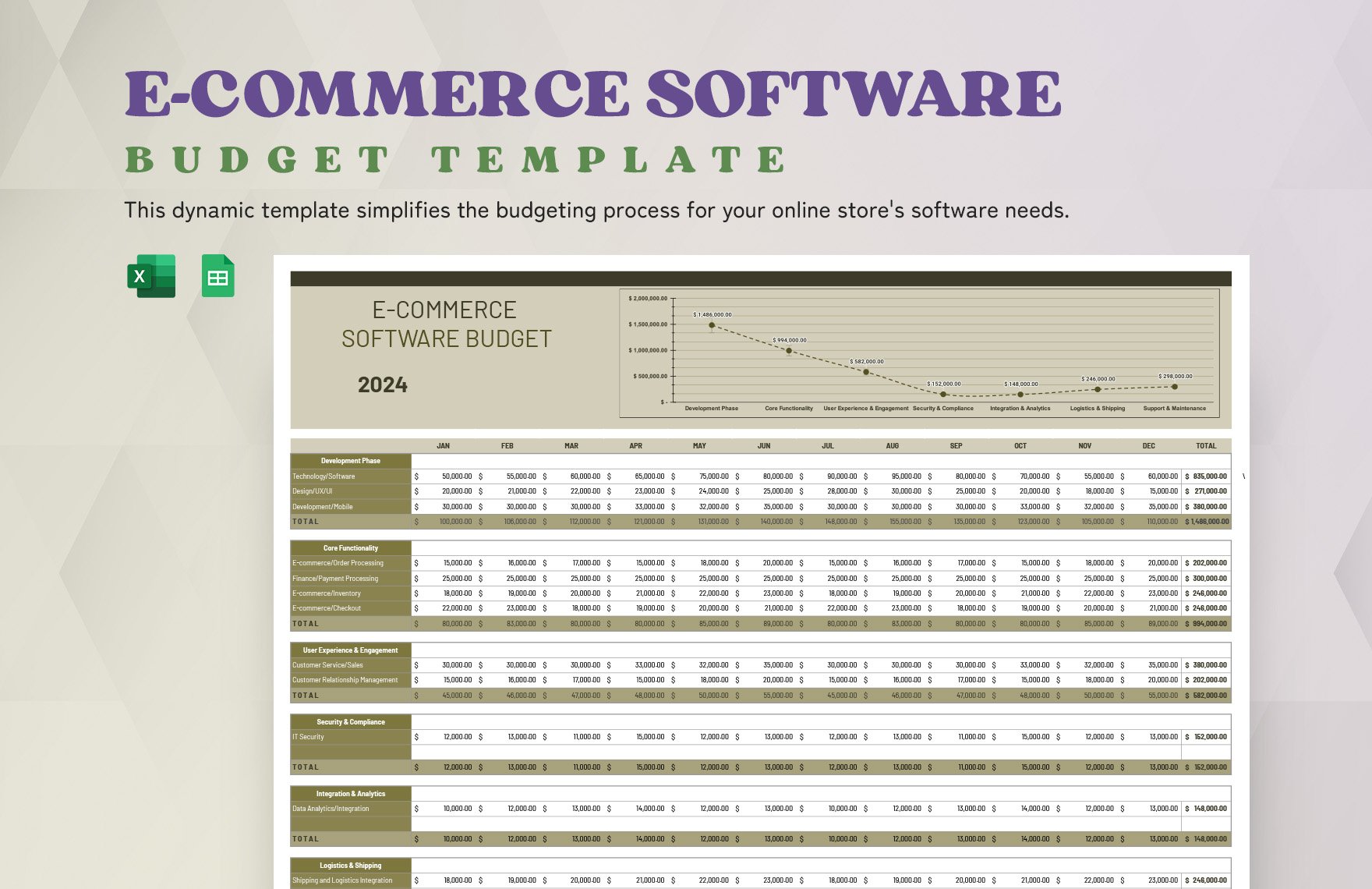

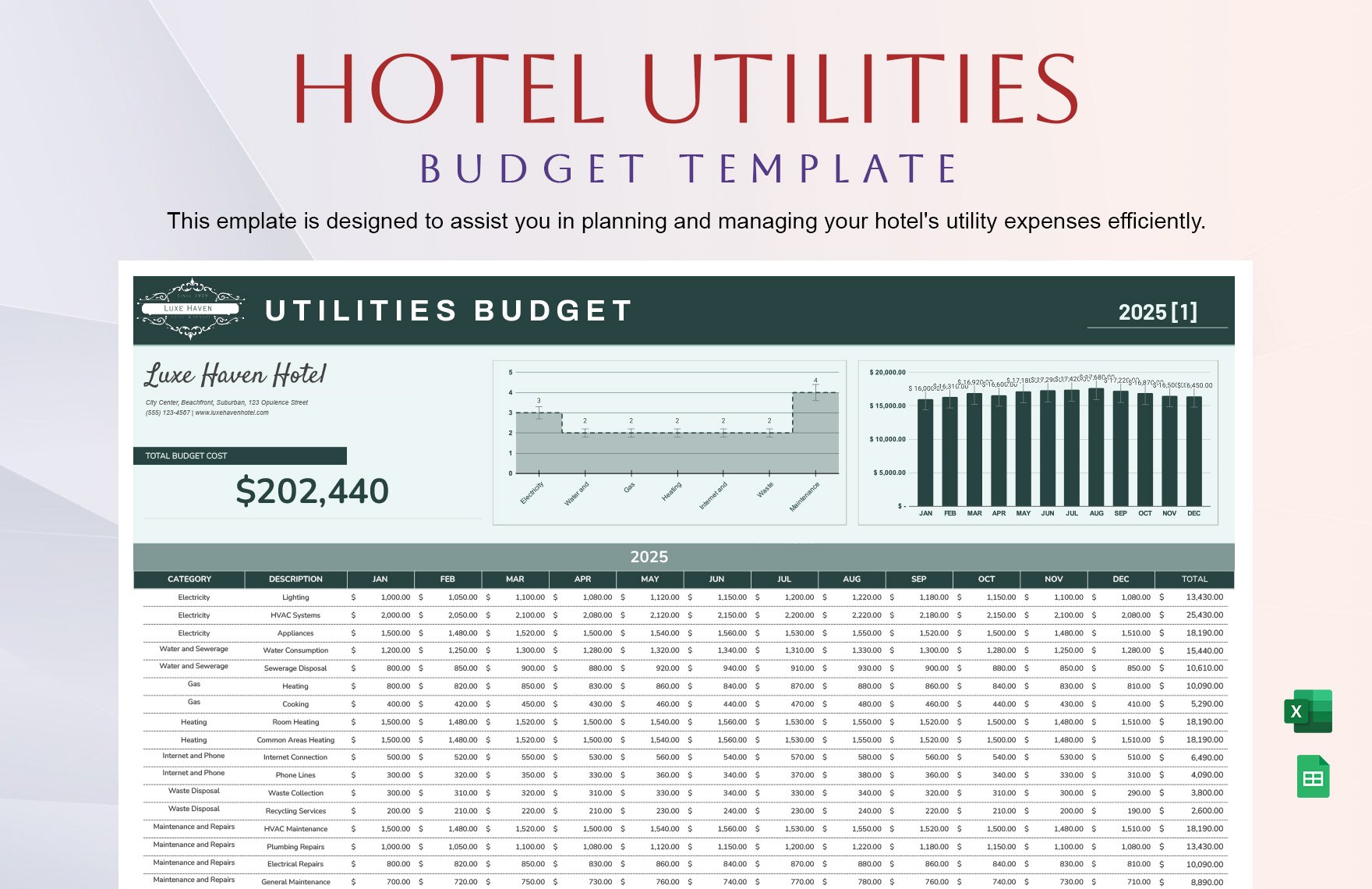

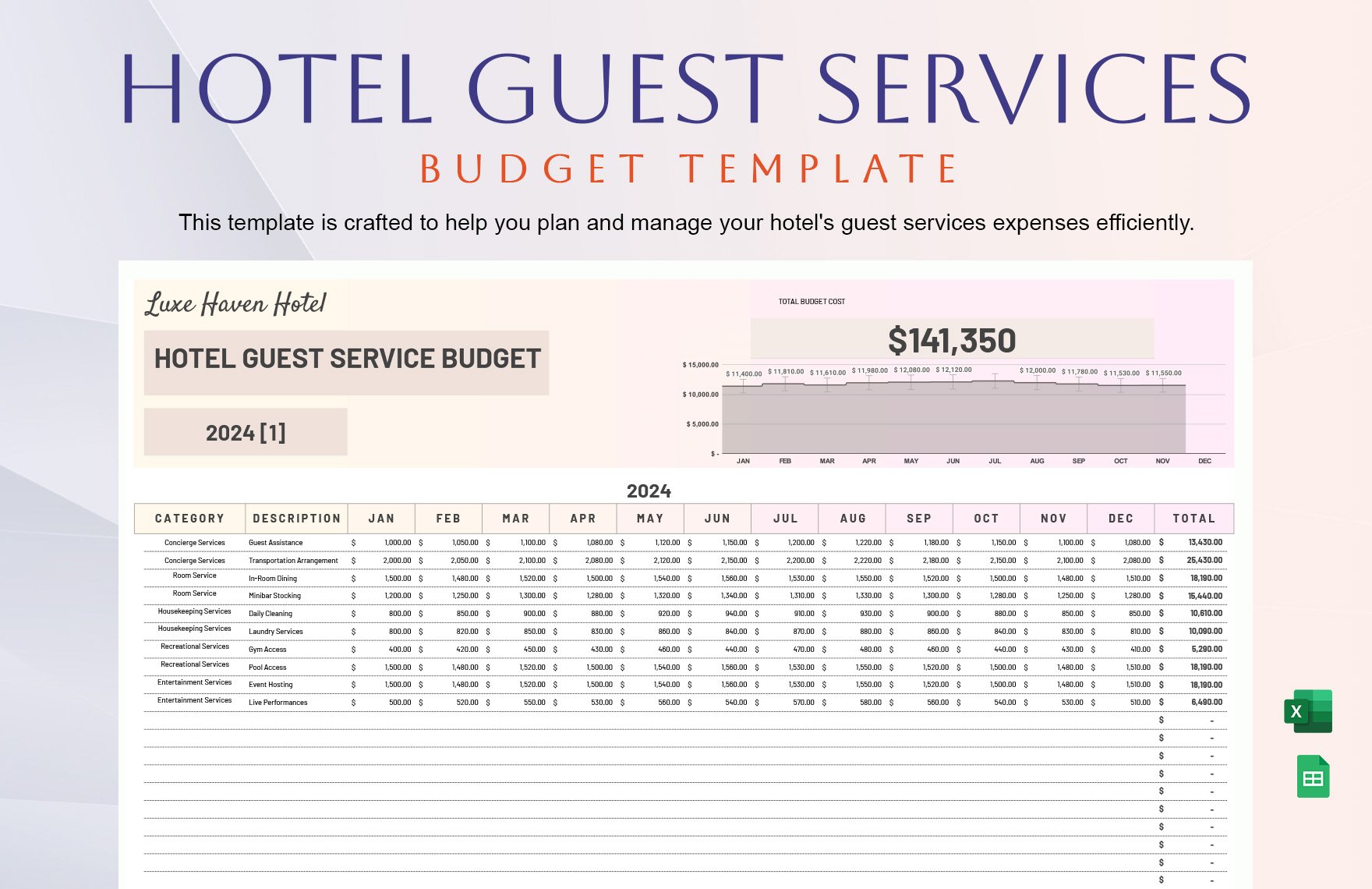

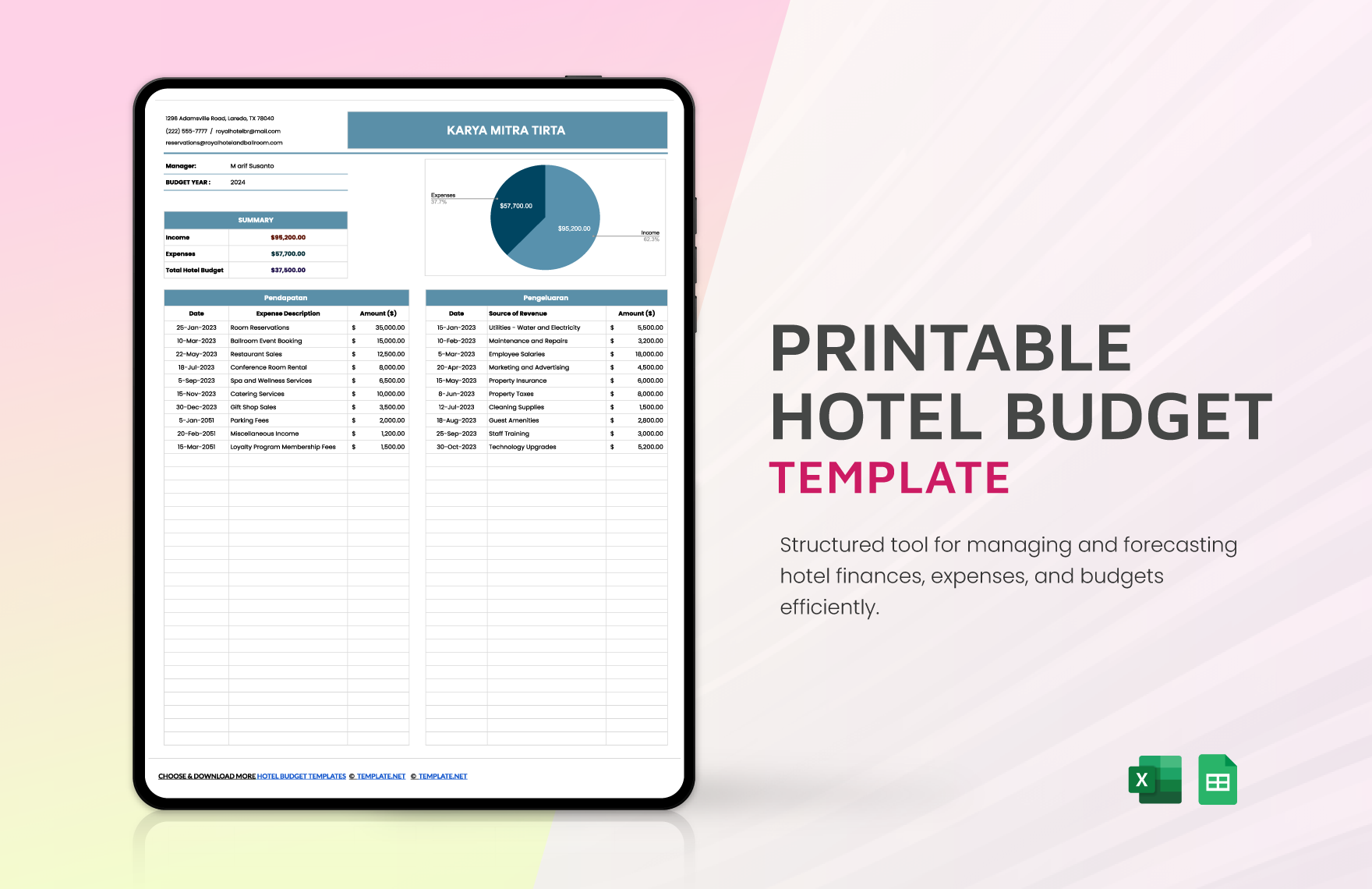

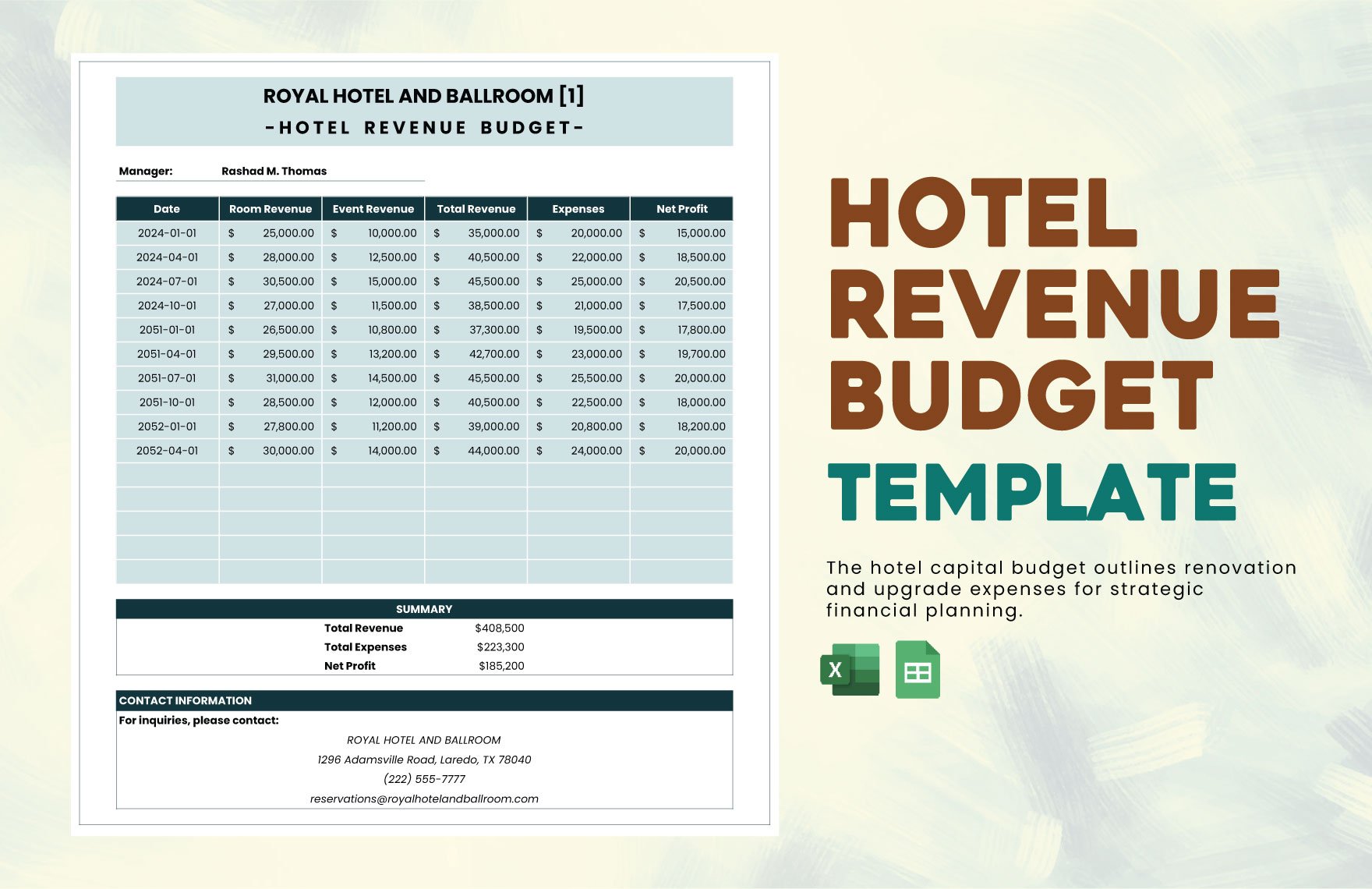

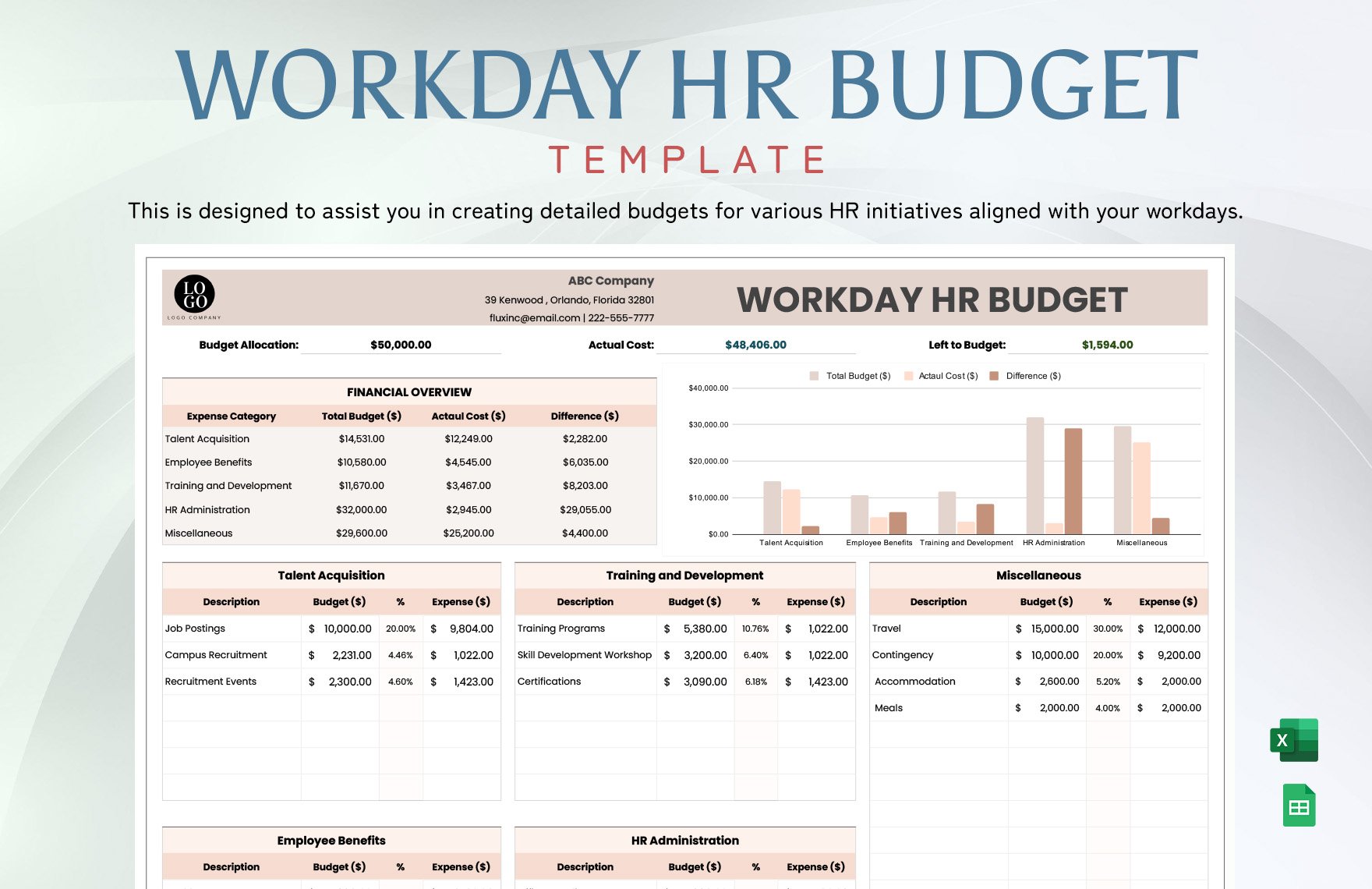

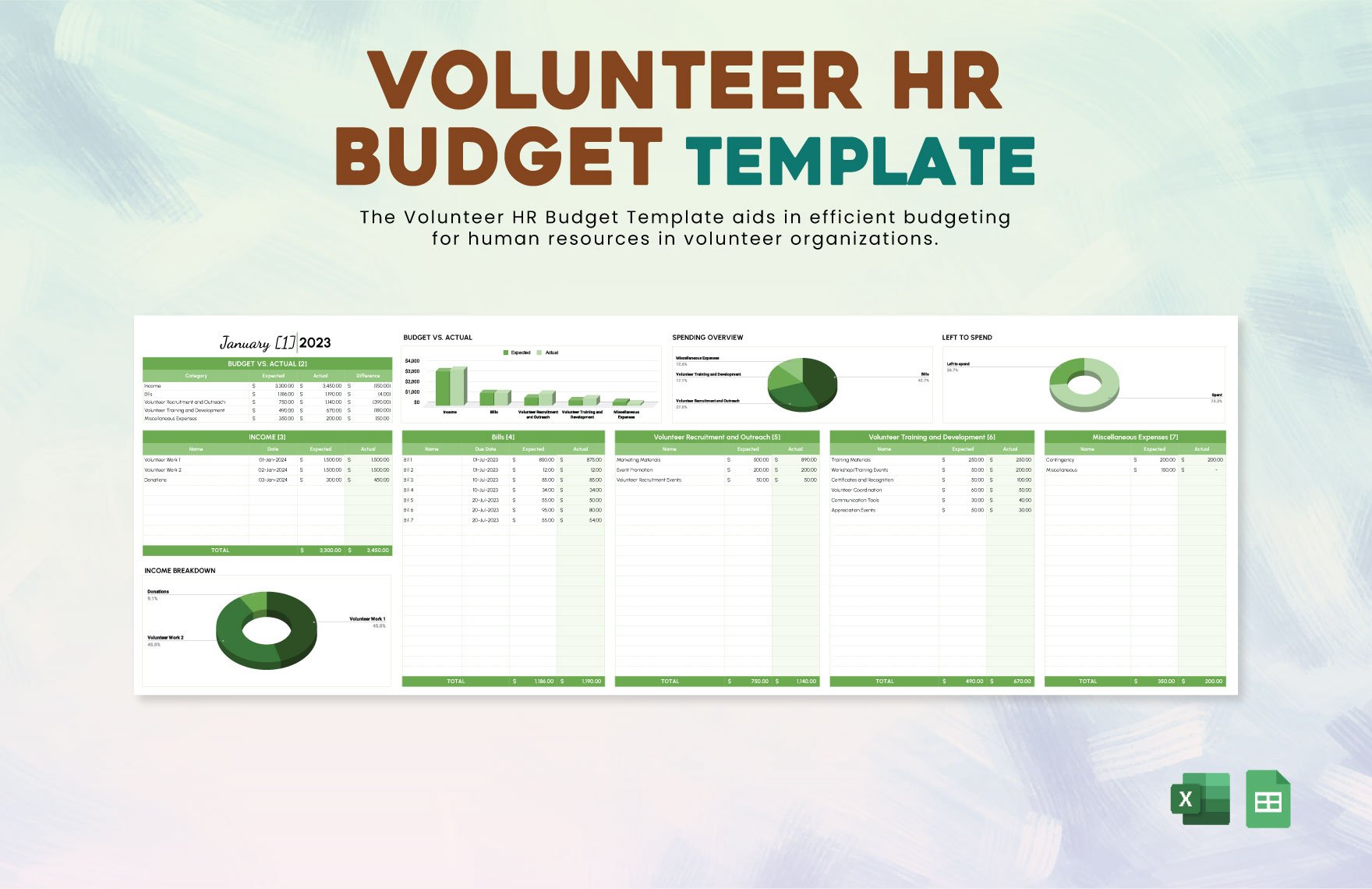

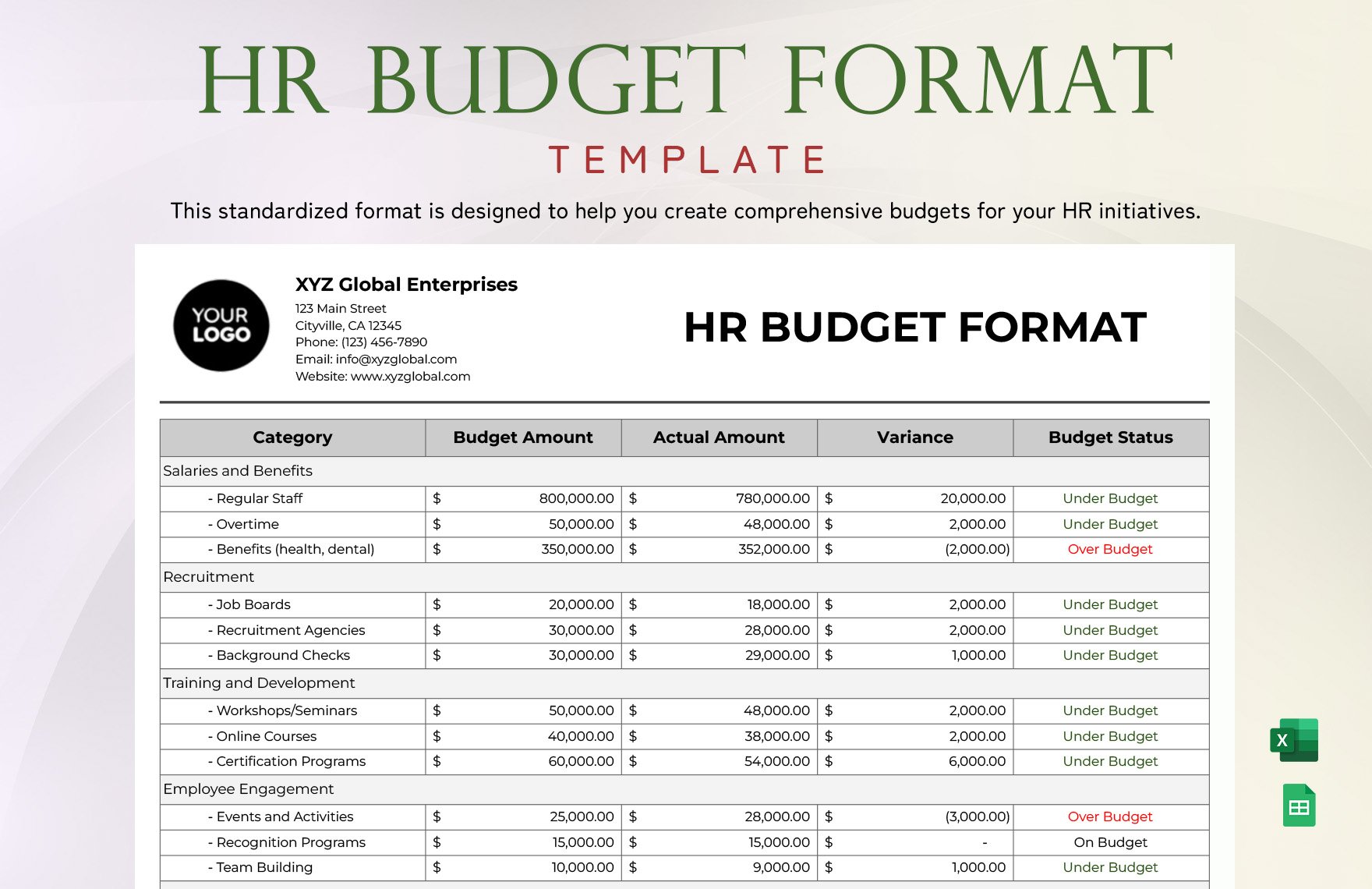

Keep your financial goals on track, enhance your budgeting processes, and achieve financial clarity with the Budget Sheet Templates from Template.net. Perfect for individuals, small business owners, or financial planners, these templates allow you to easily monitor expenses, manage income, and plan budgets efficiently. Whether you’re looking to track monthly expenditures or prepare a detailed financial report, the Budget Sheet Templates have you covered. Each template includes essential fields and formulas, ensuring accurate calculations and helping you stay organized. No advanced Excel skills are required to make use of these templates, and with their professional-grade design, you’ll present a polished financial plan every time. Explore customizable layouts for personal use, digital sharing, or print distribution, making financial management both accessible and streamlined.

Discover the many Budget Sheet Templates we have on hand to suit your every budgeting need. Select a template that fits your framework, swap in your financial data, and tweak the colors and fonts to align with your personal or brand style. Add advanced touches like dragging and dropping icons or graphics to make the sheets visually appealing, or try adding animated effects for a dynamic presentation. With AI-powered text tools, crafting the perfect budget sheet is a breeze, making budgeting not just necessary but engaging. Our library is regularly updated, bringing fresh designs to inspire your financial journey. Once your budget sheet is complete, download or share it via print or email, ensuring you have the tools to succeed at the click of a button. Ideal for multiple channels, these templates make managing money skill-free and more effective than ever before.