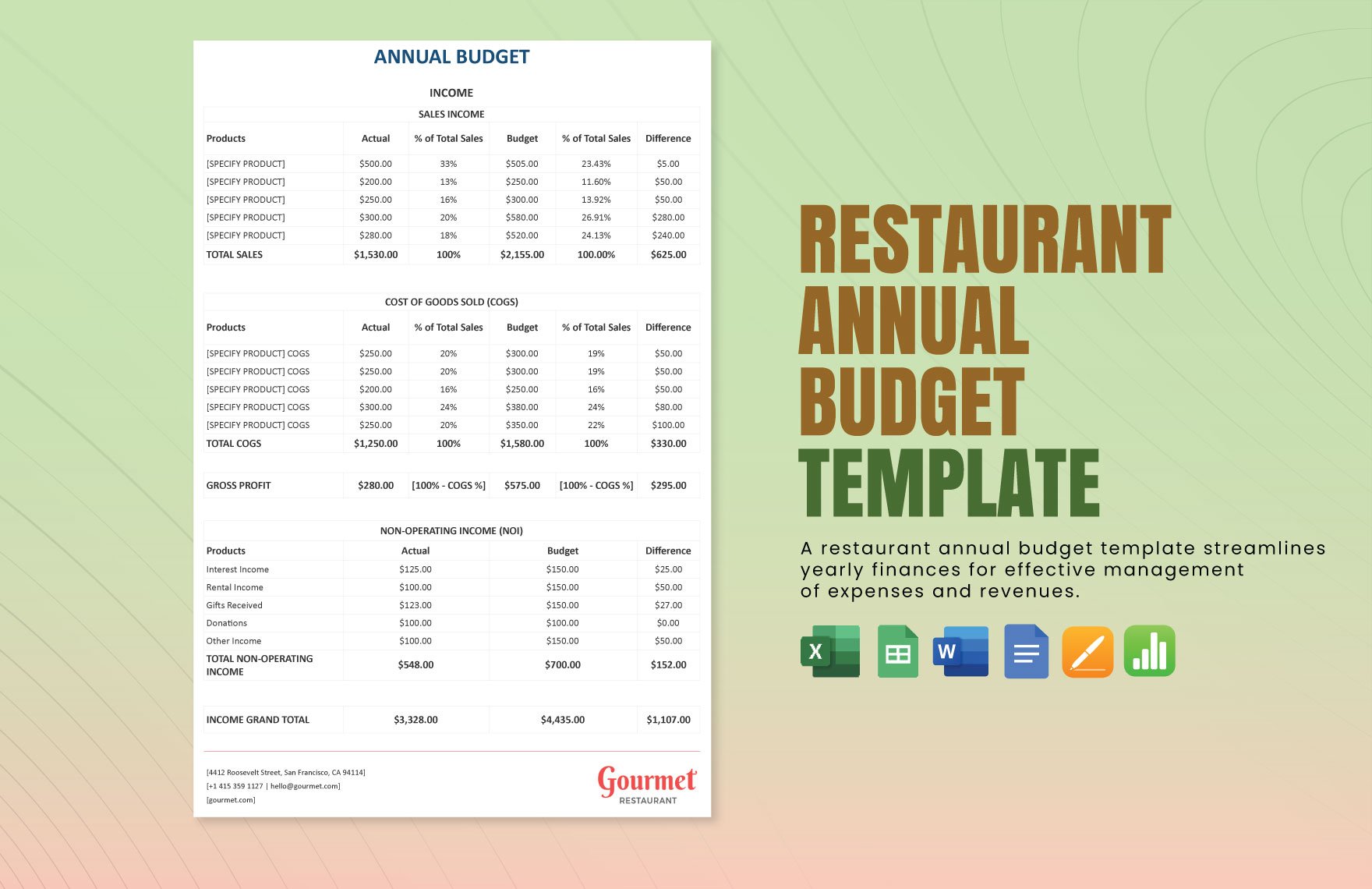

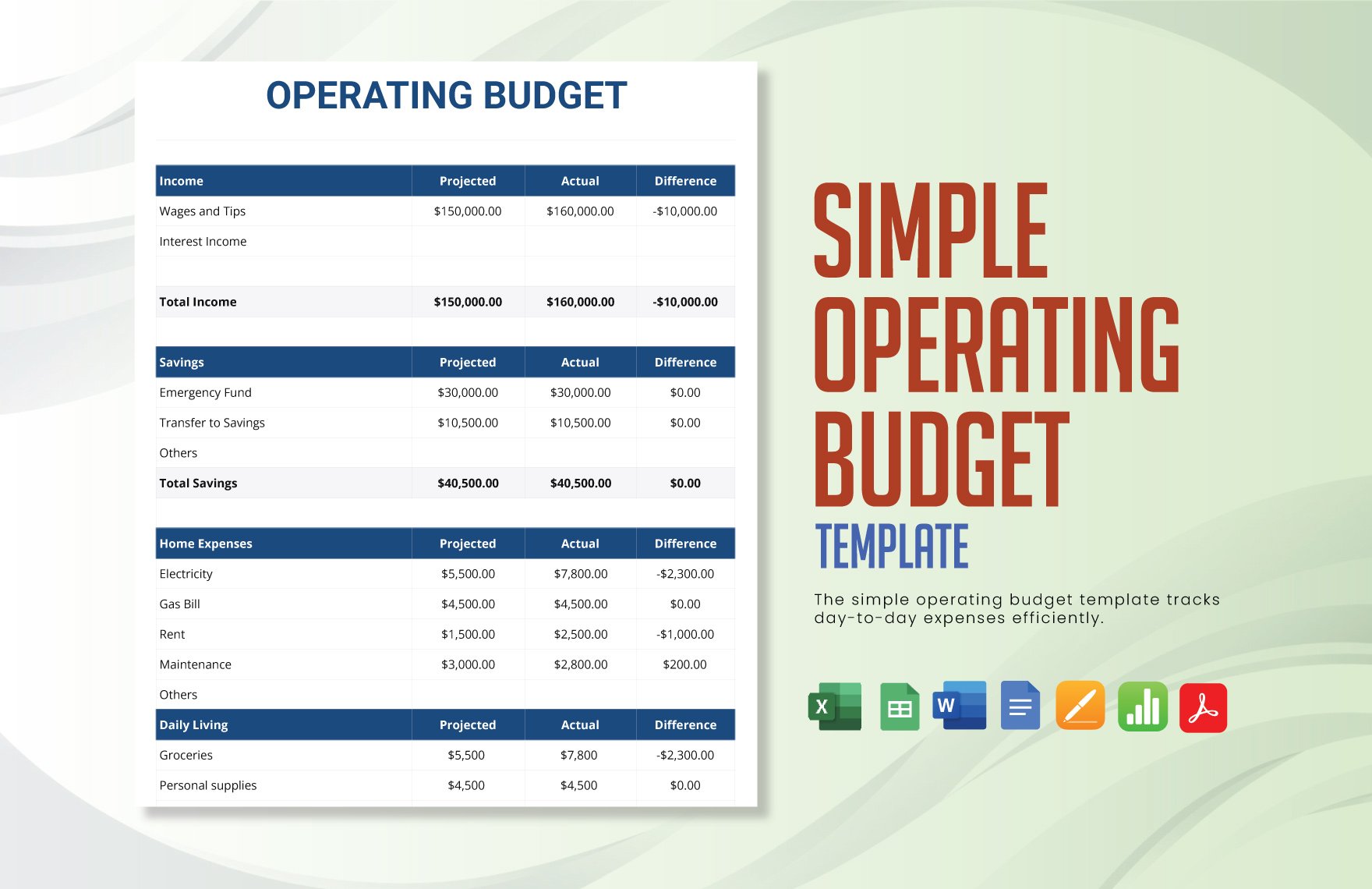

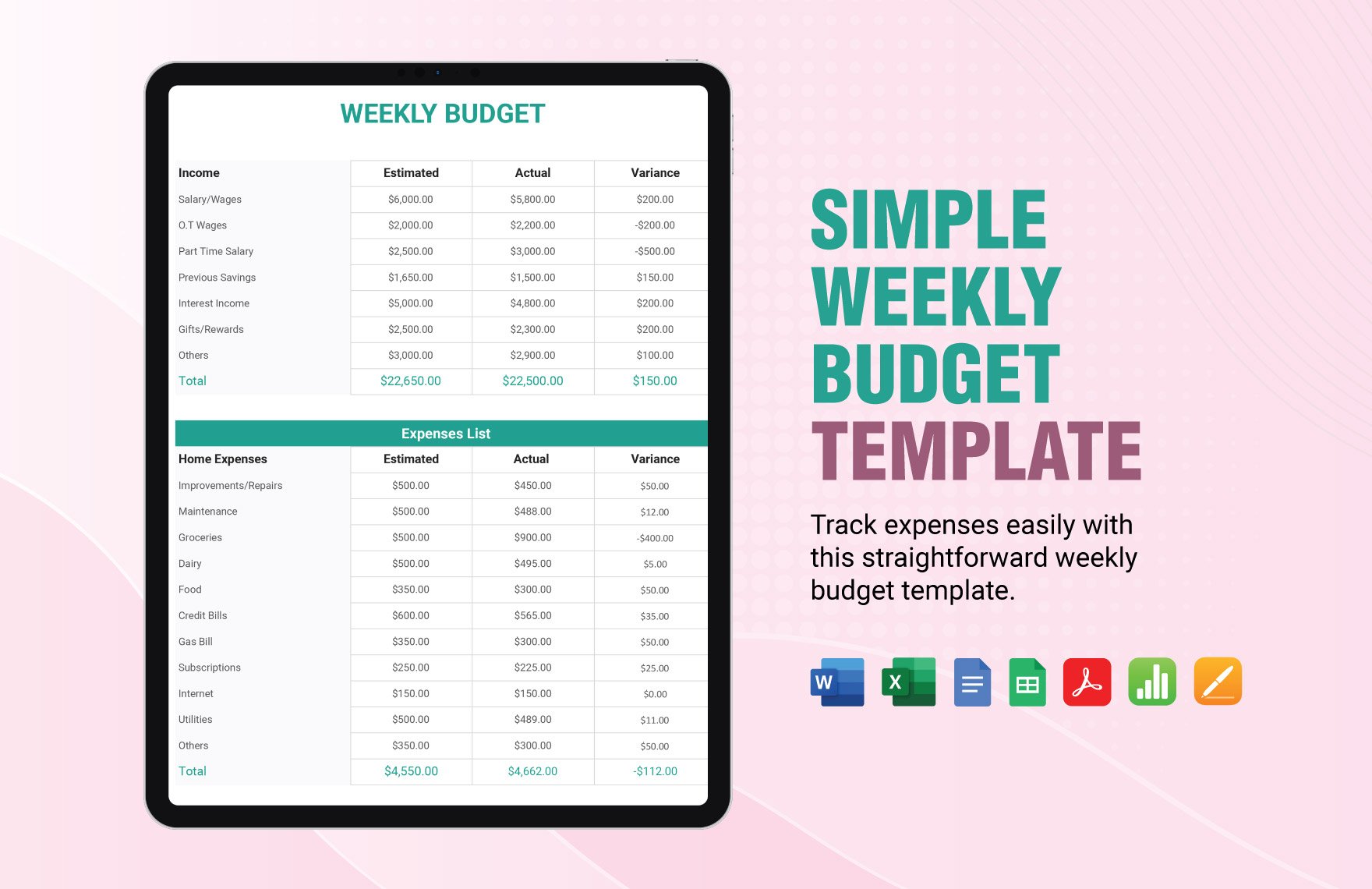

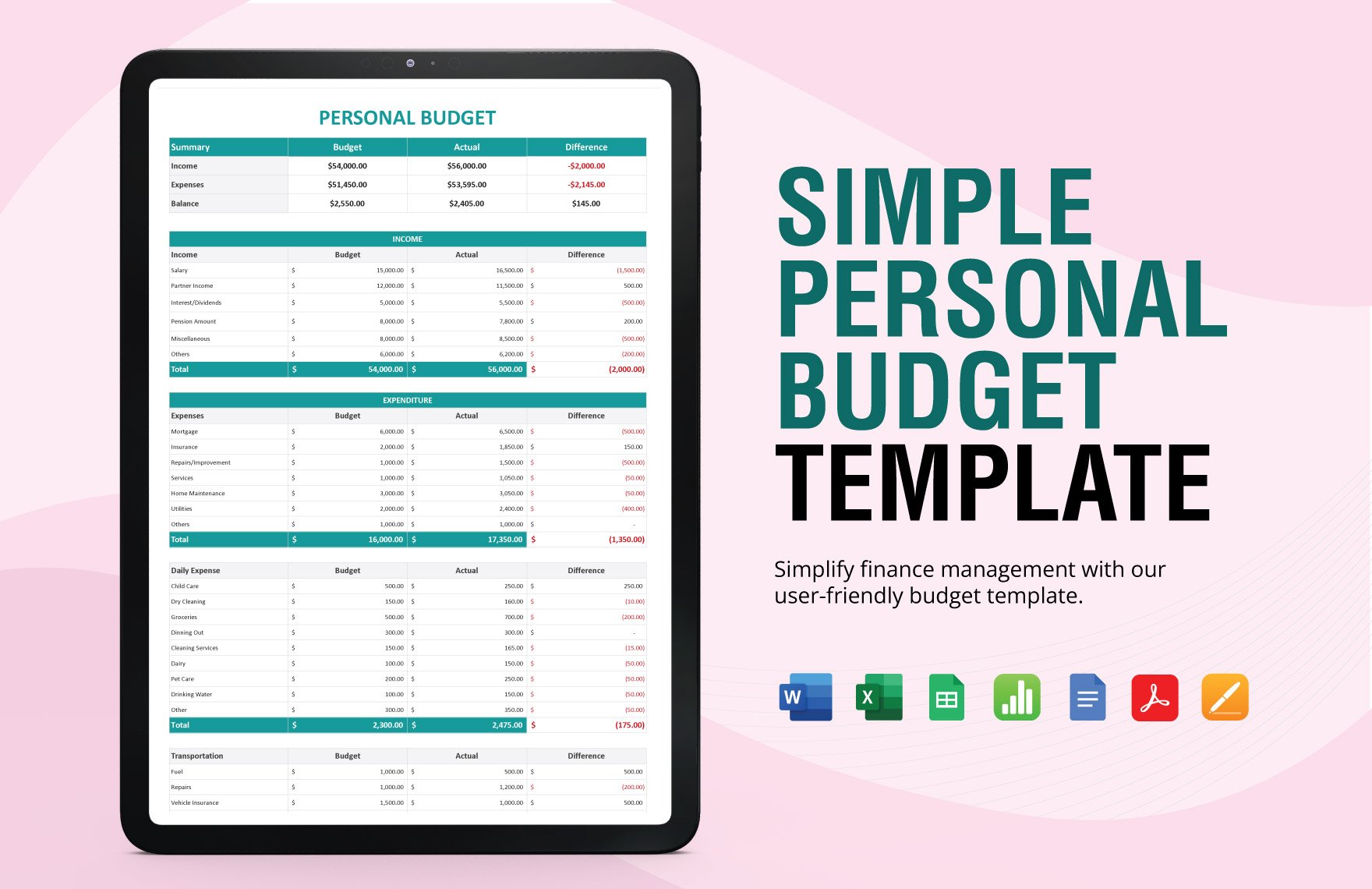

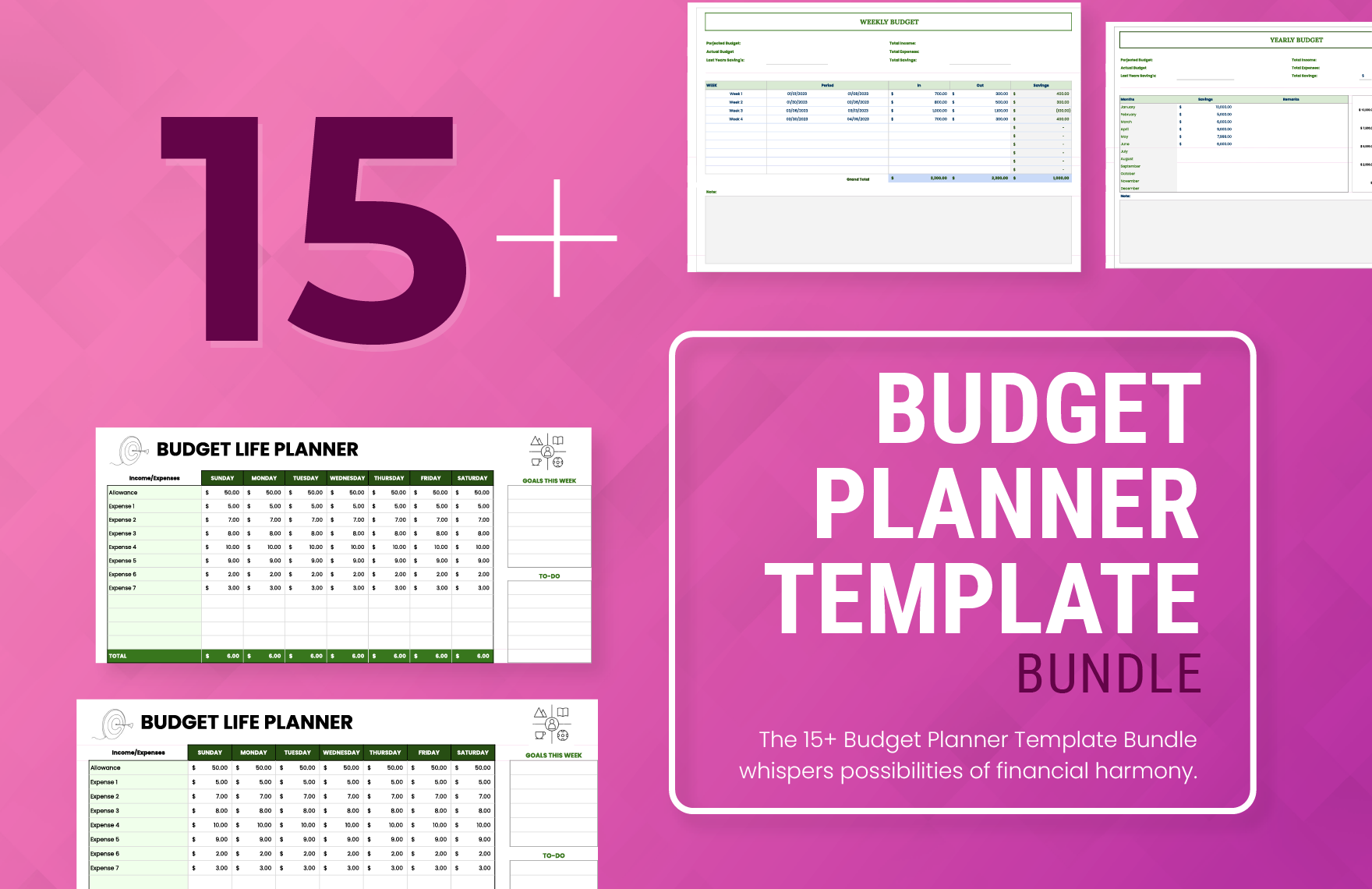

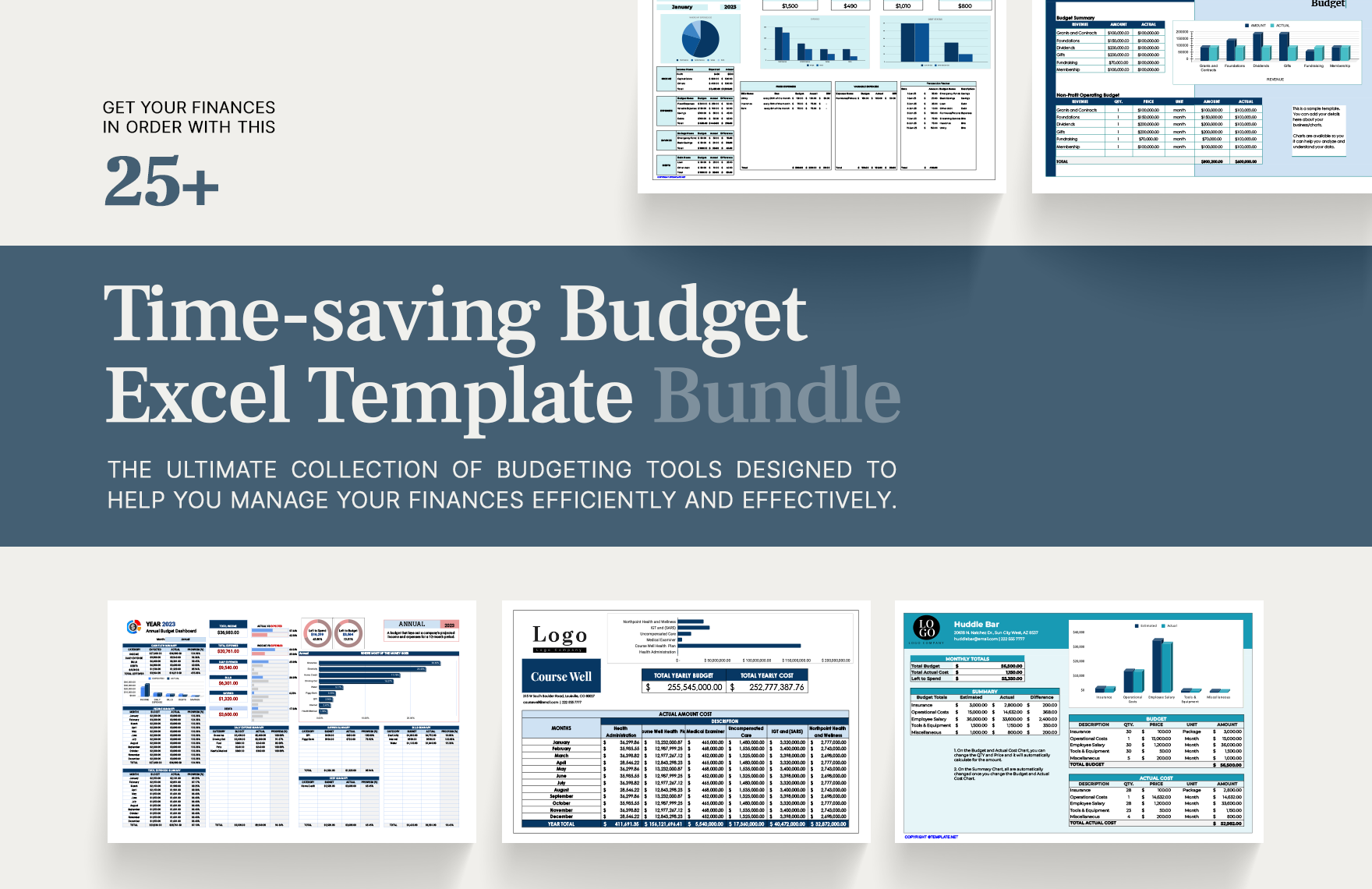

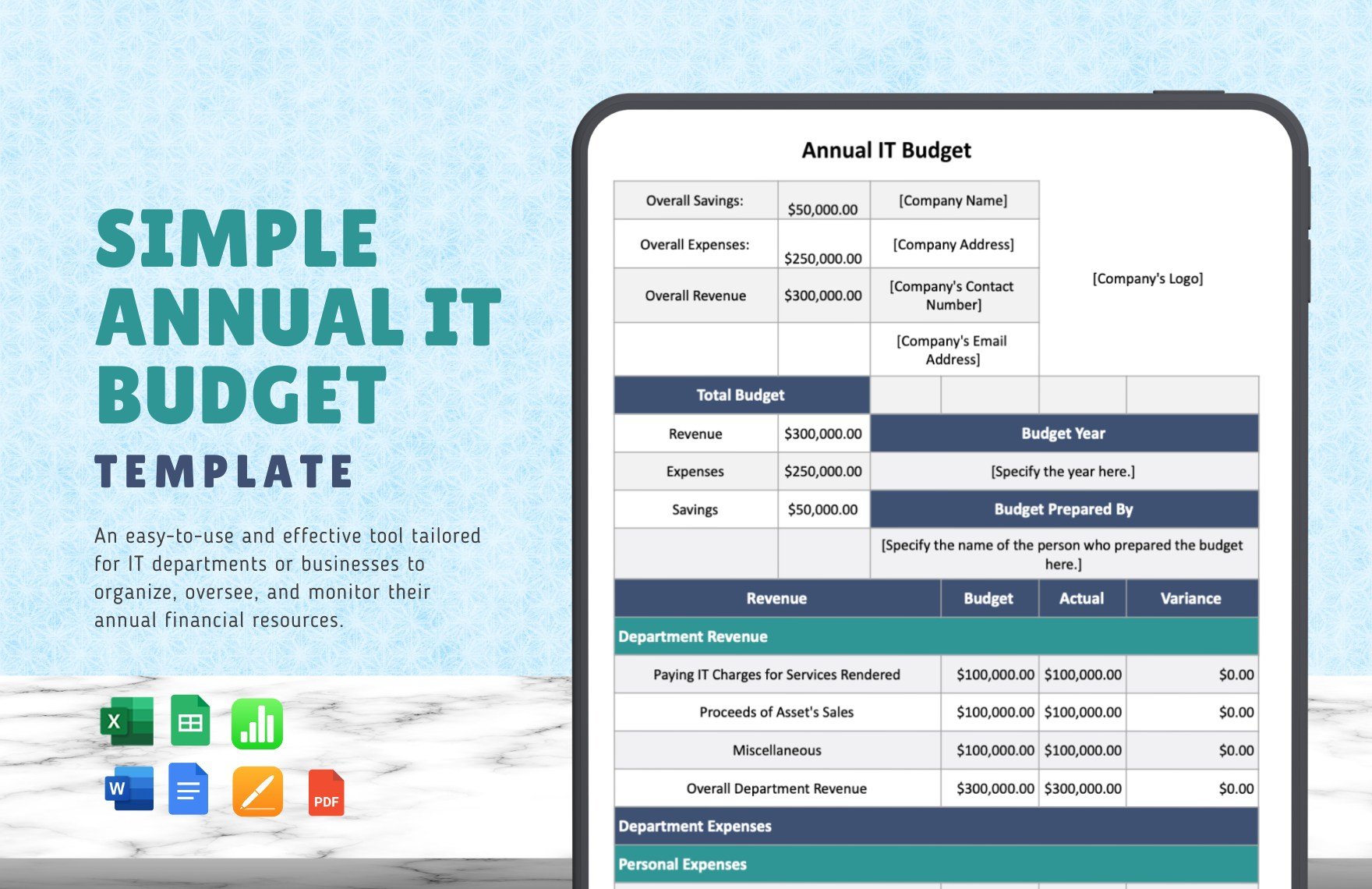

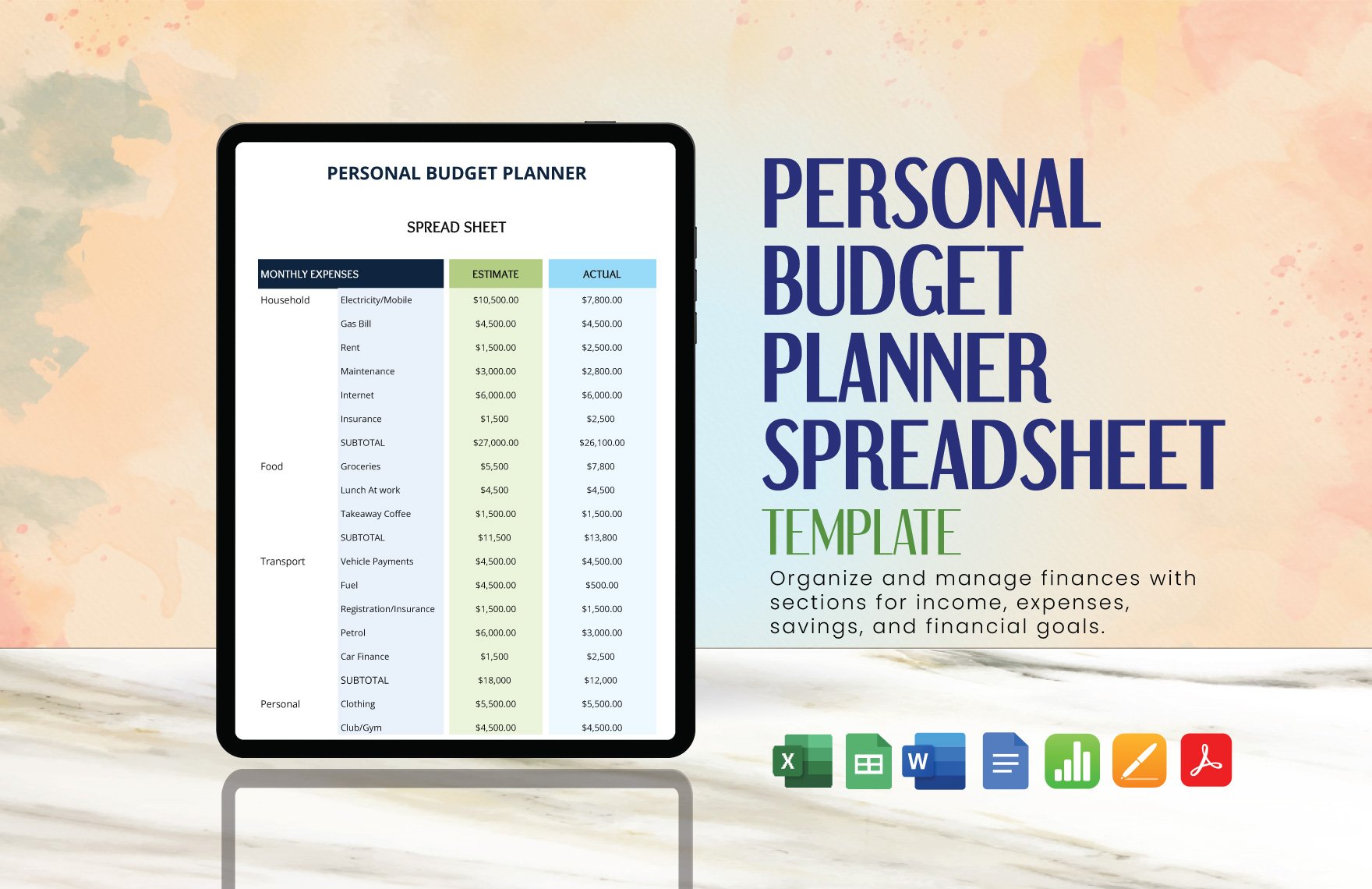

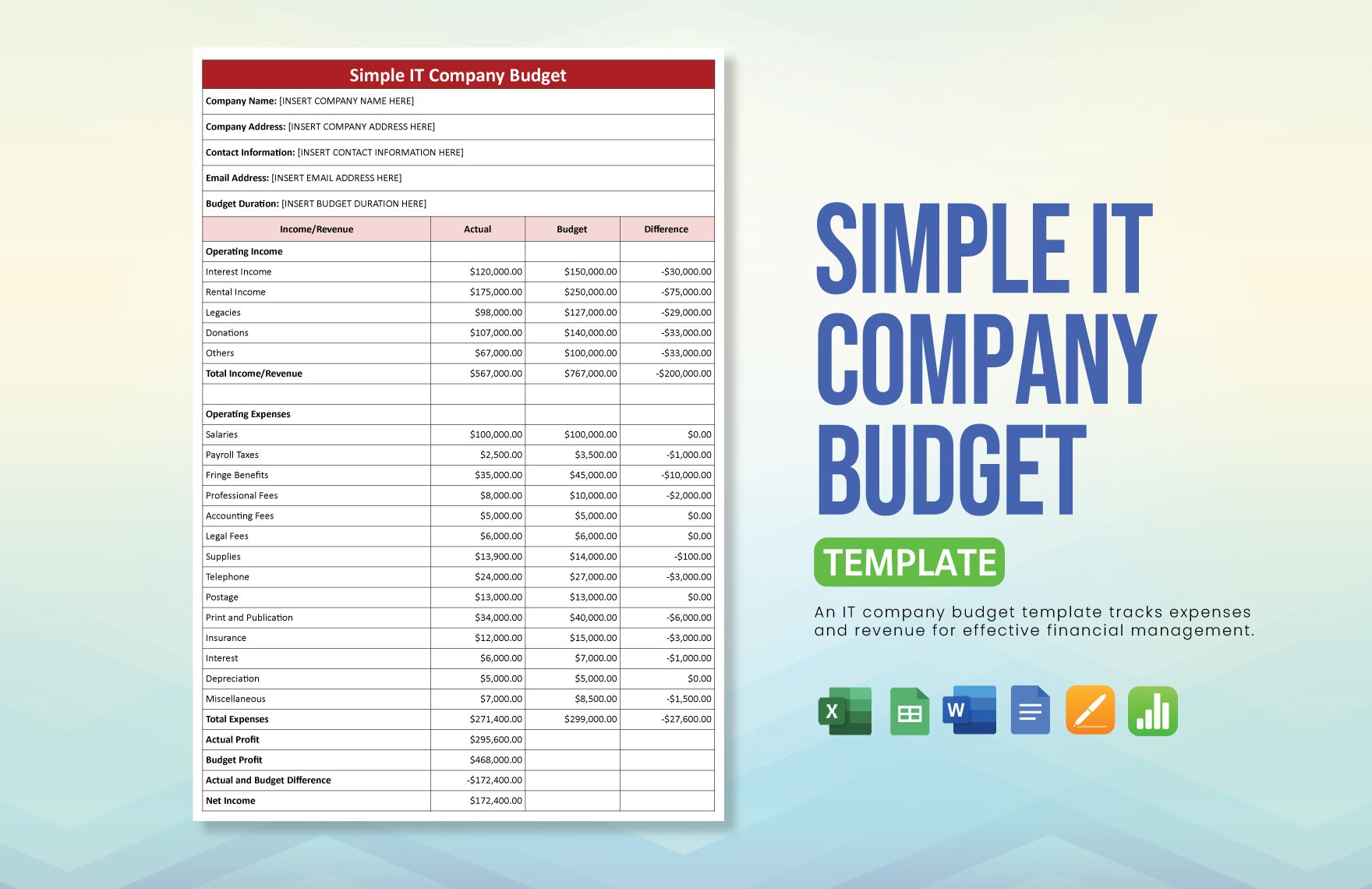

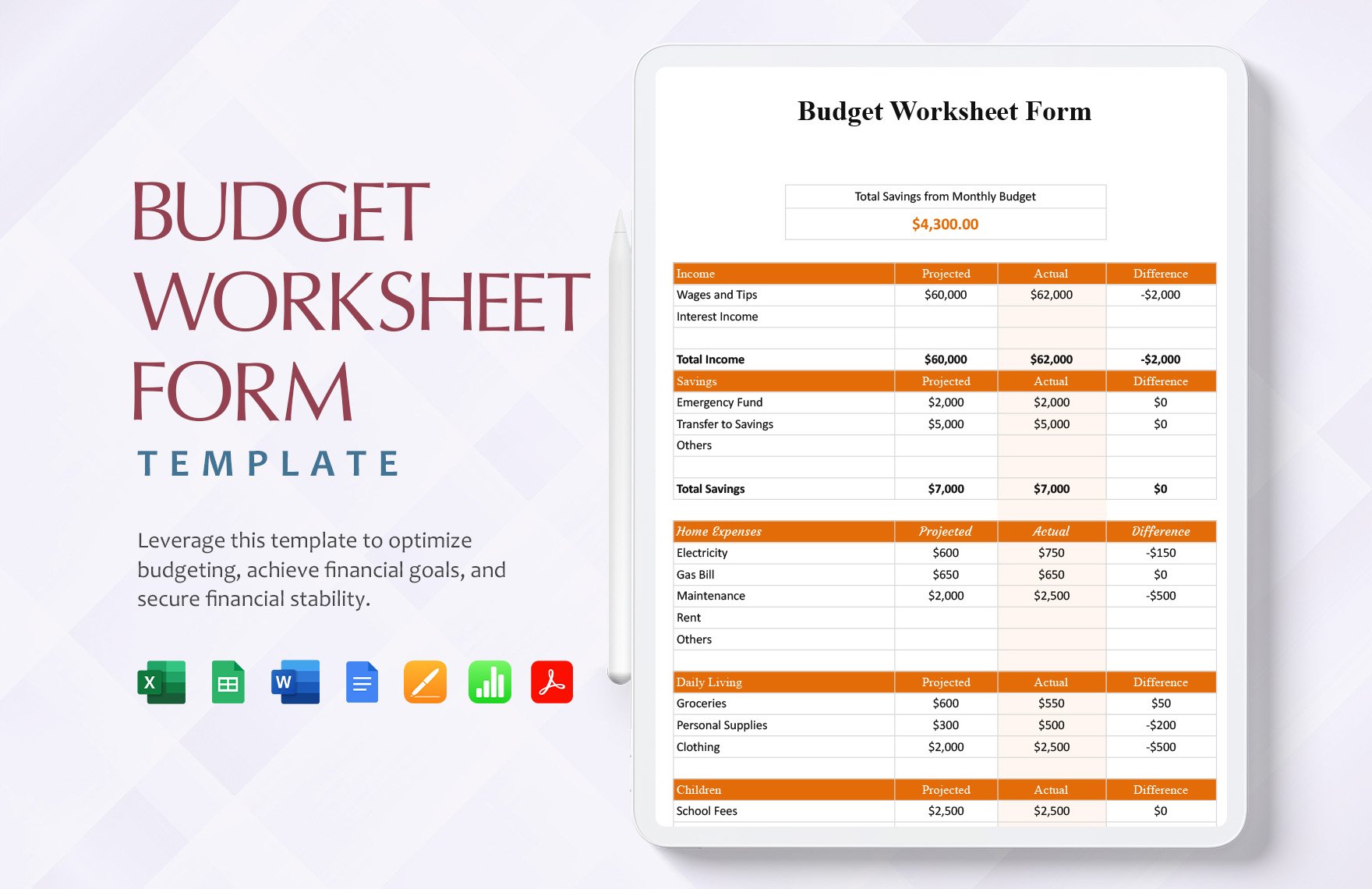

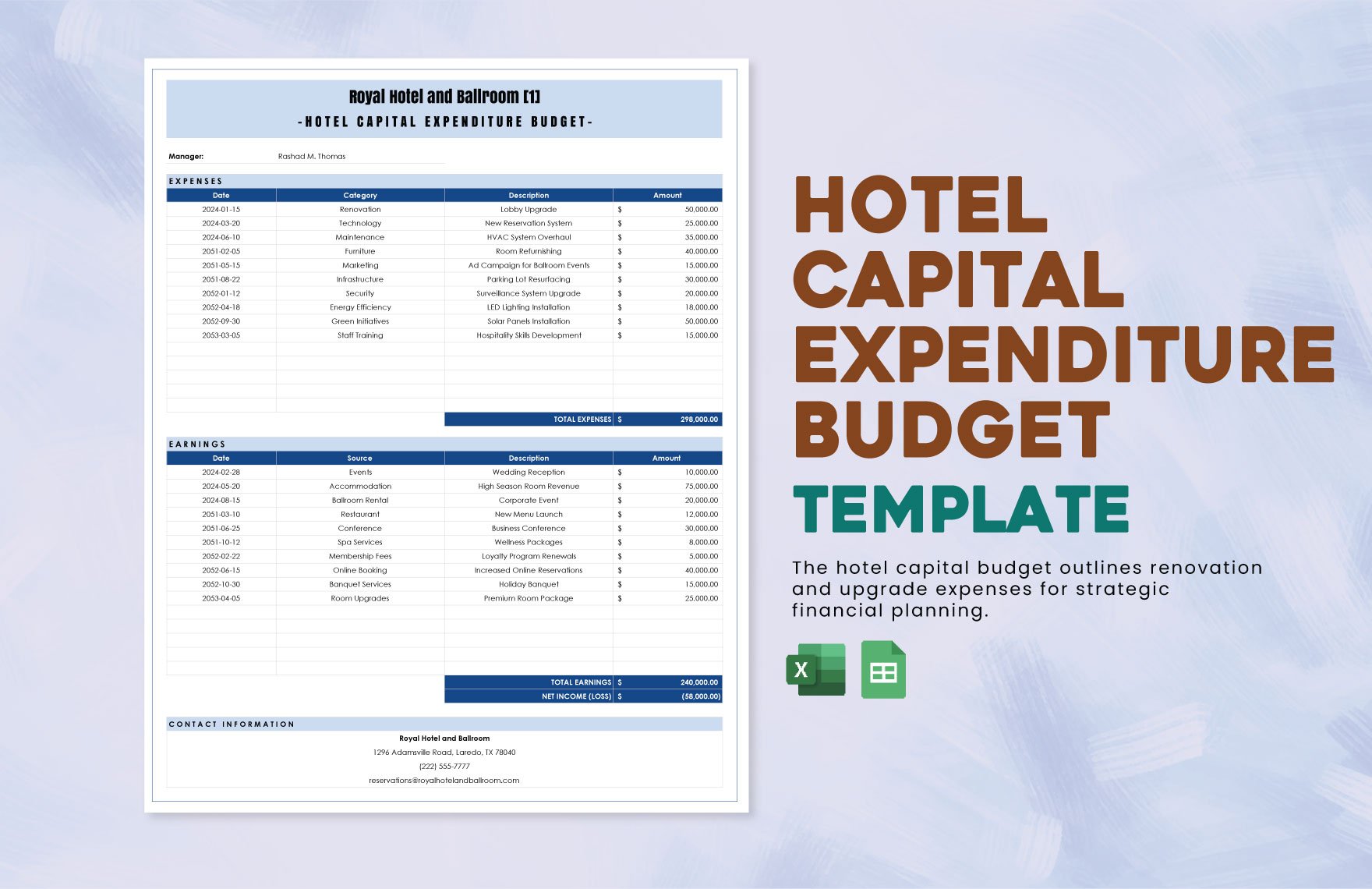

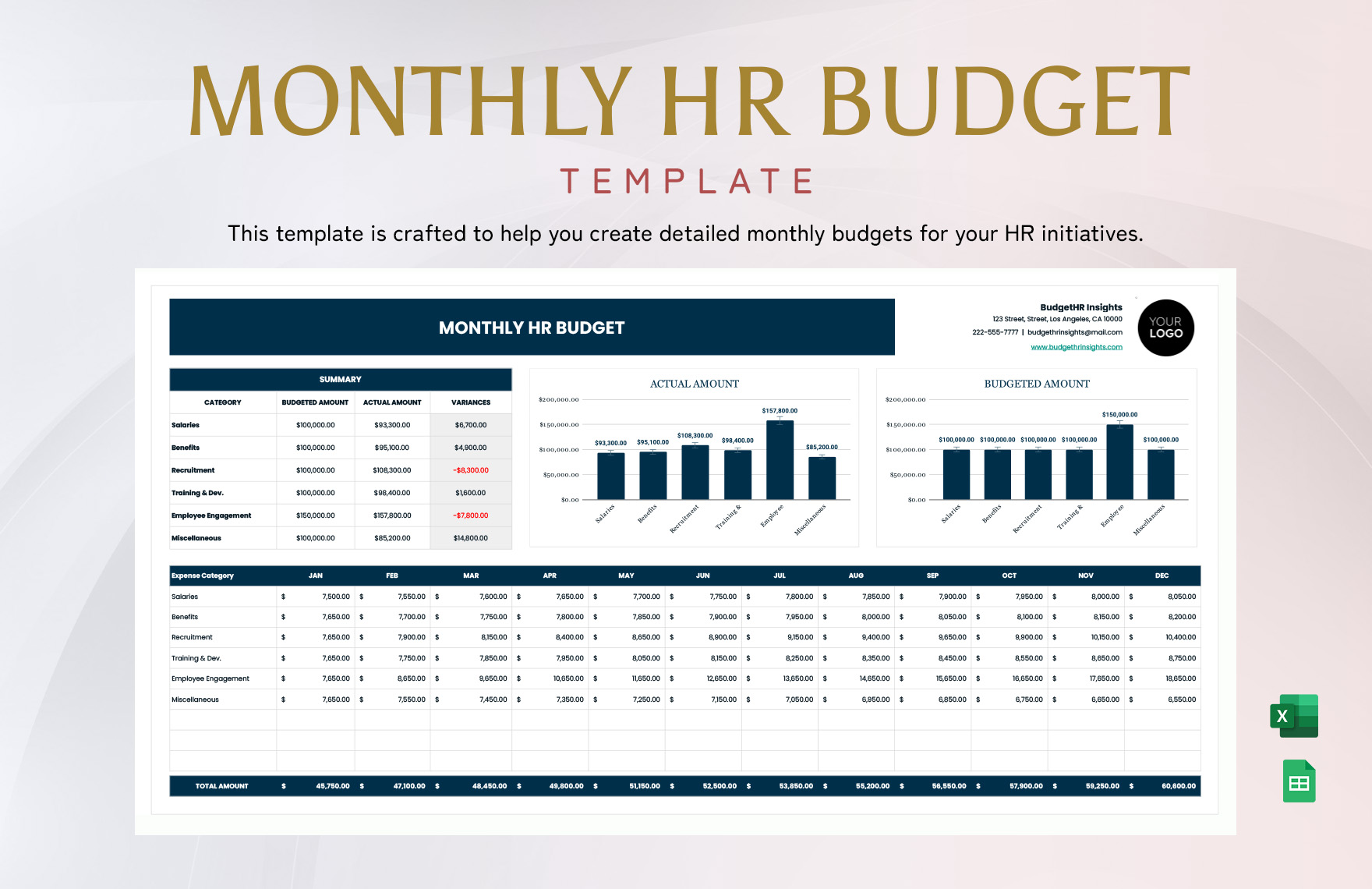

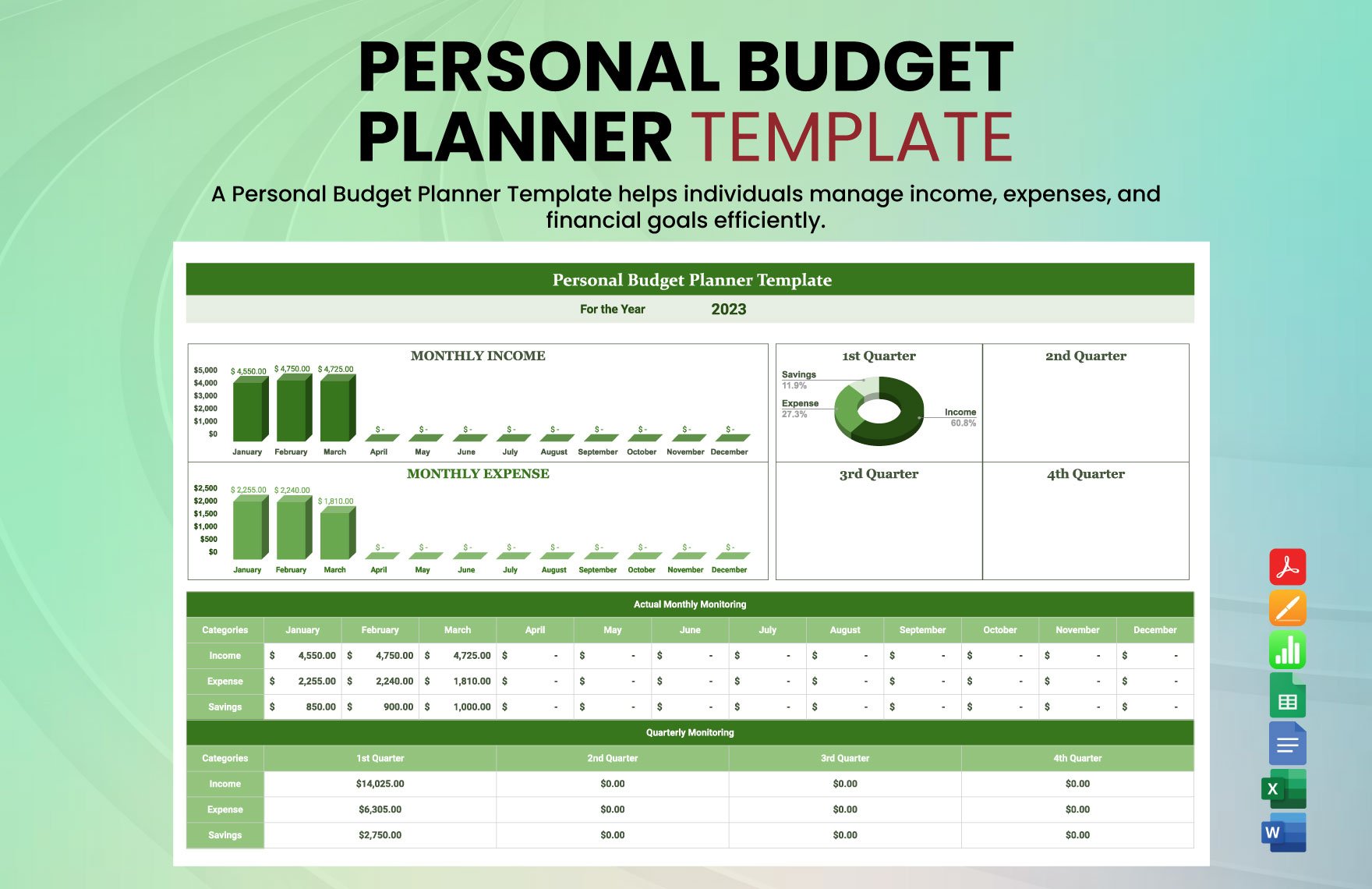

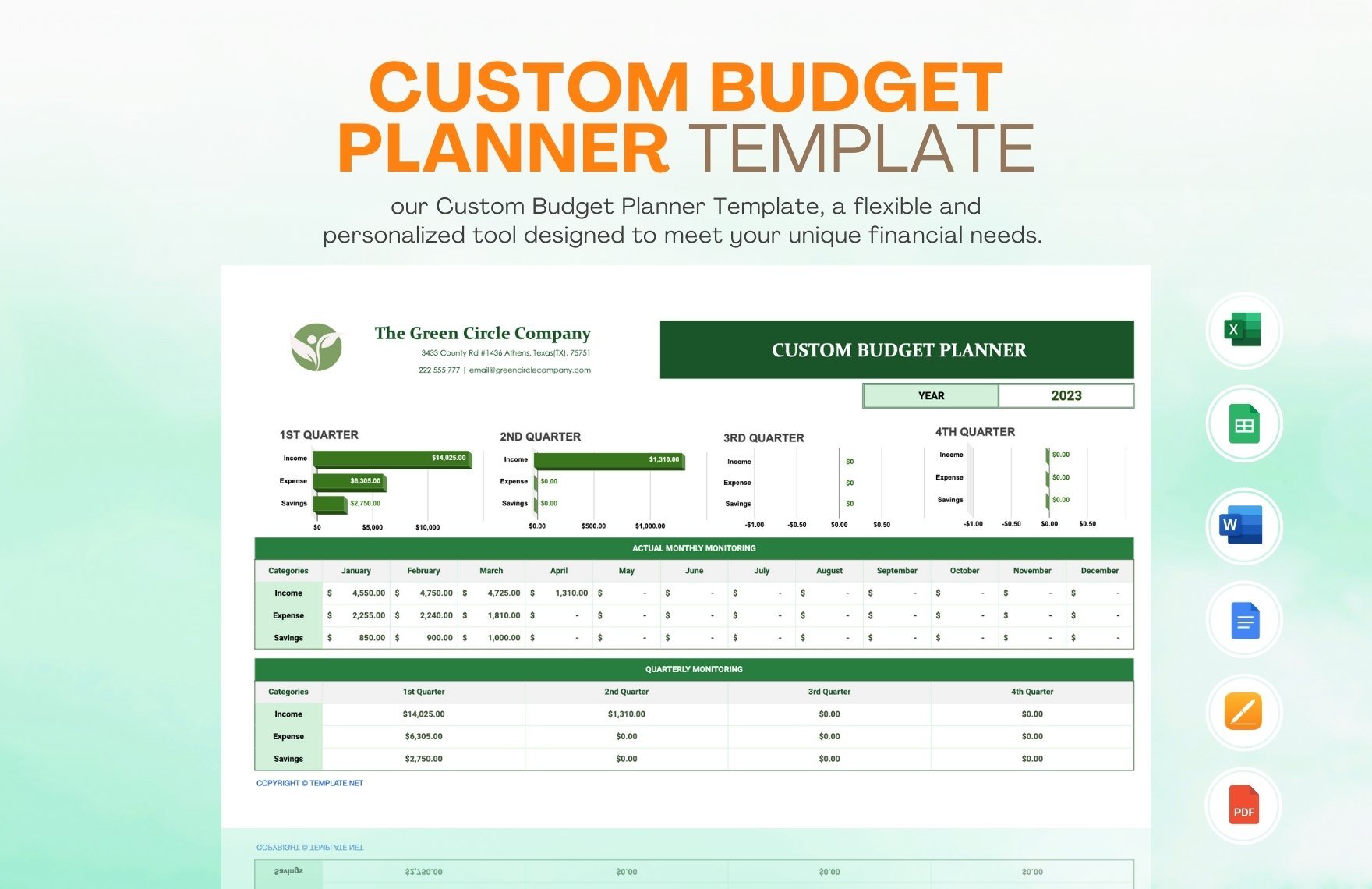

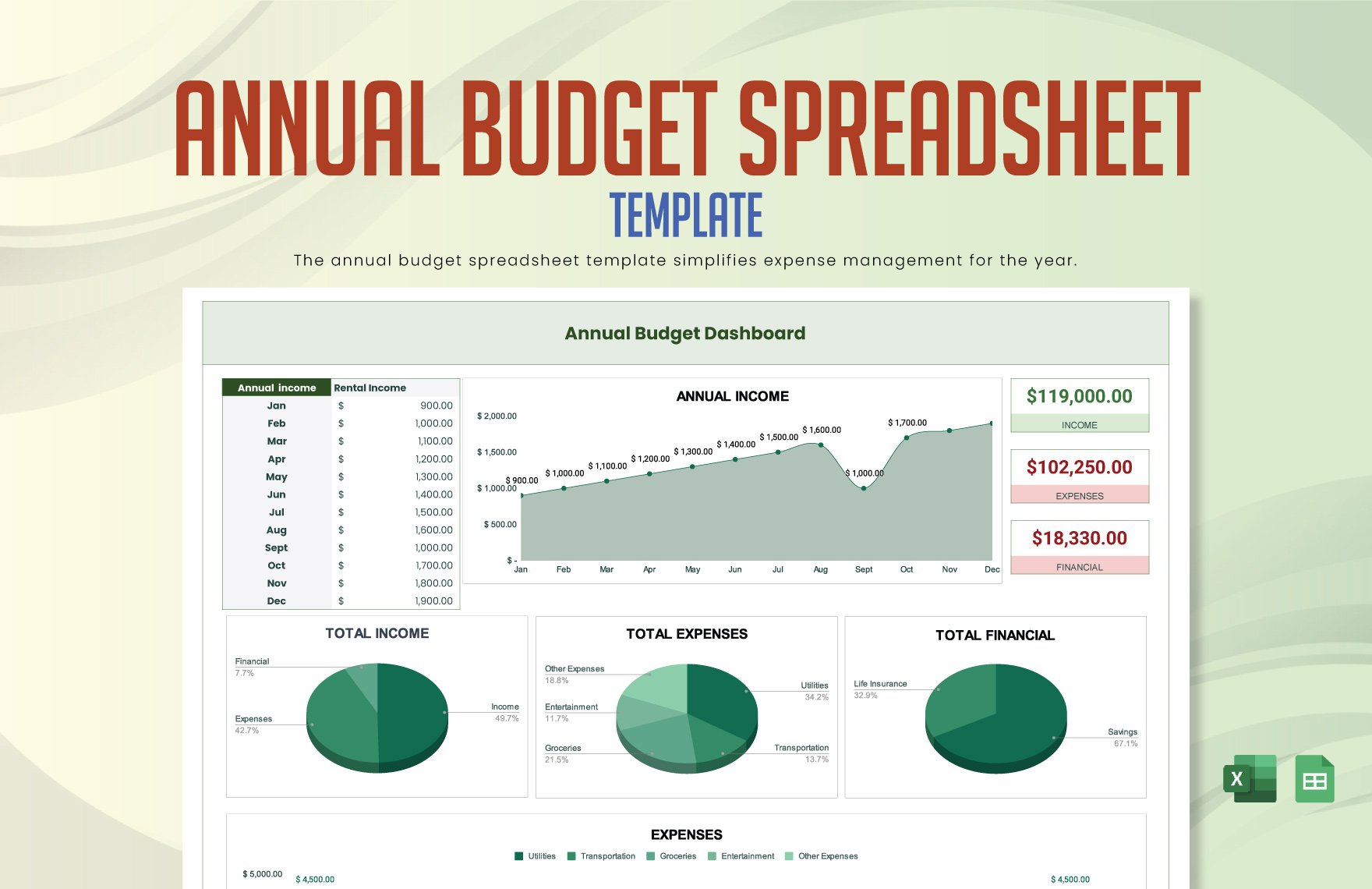

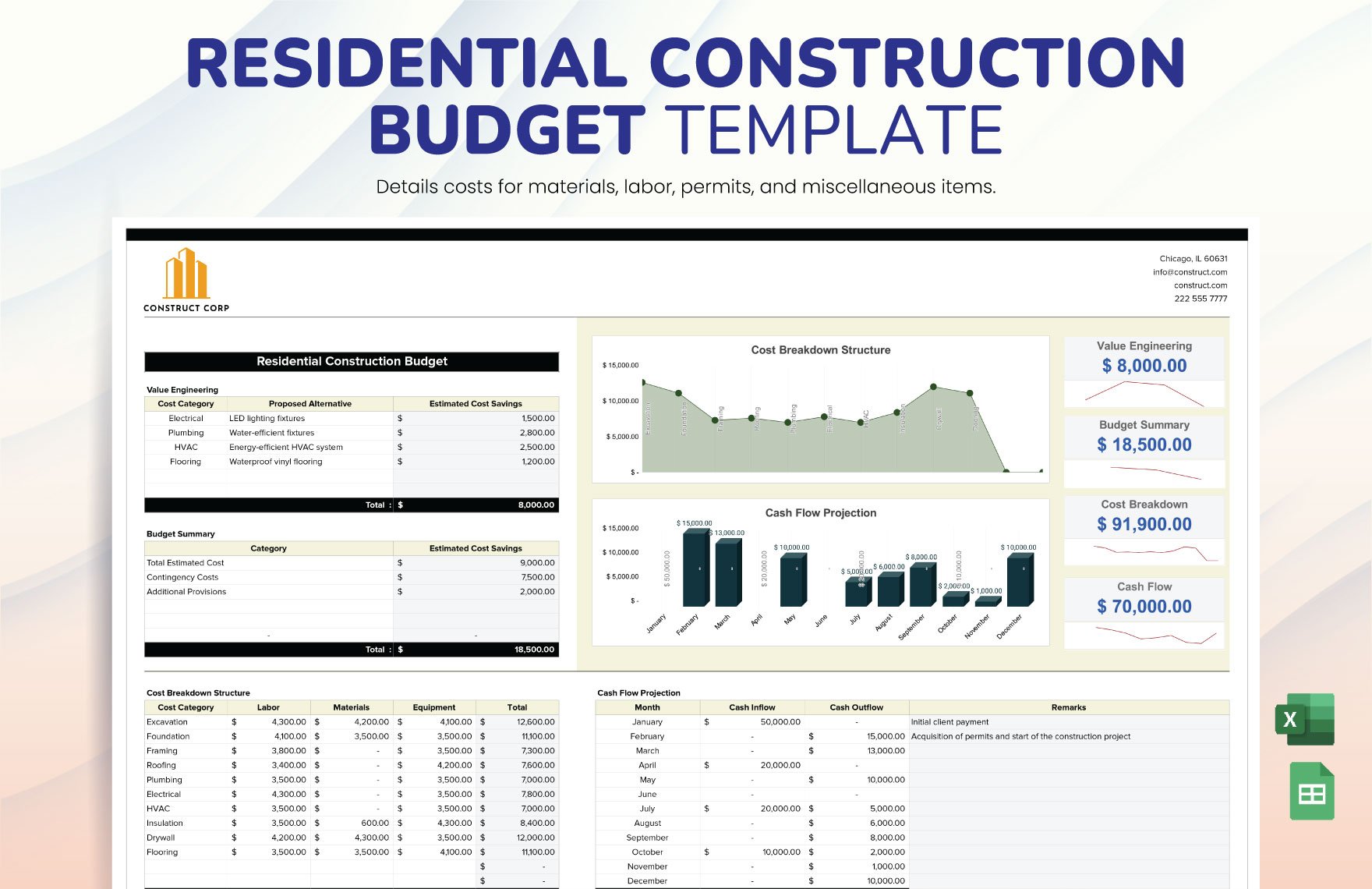

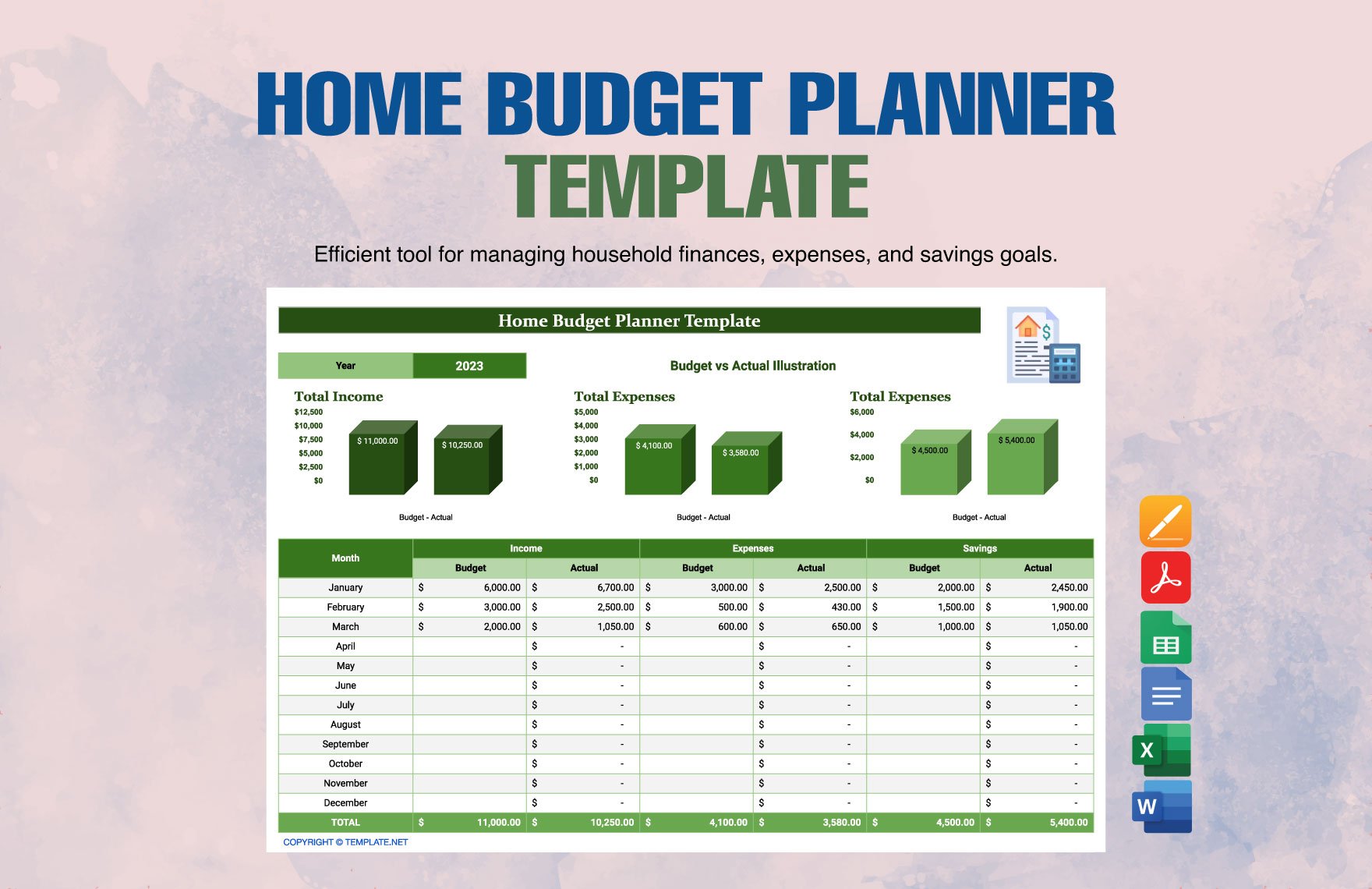

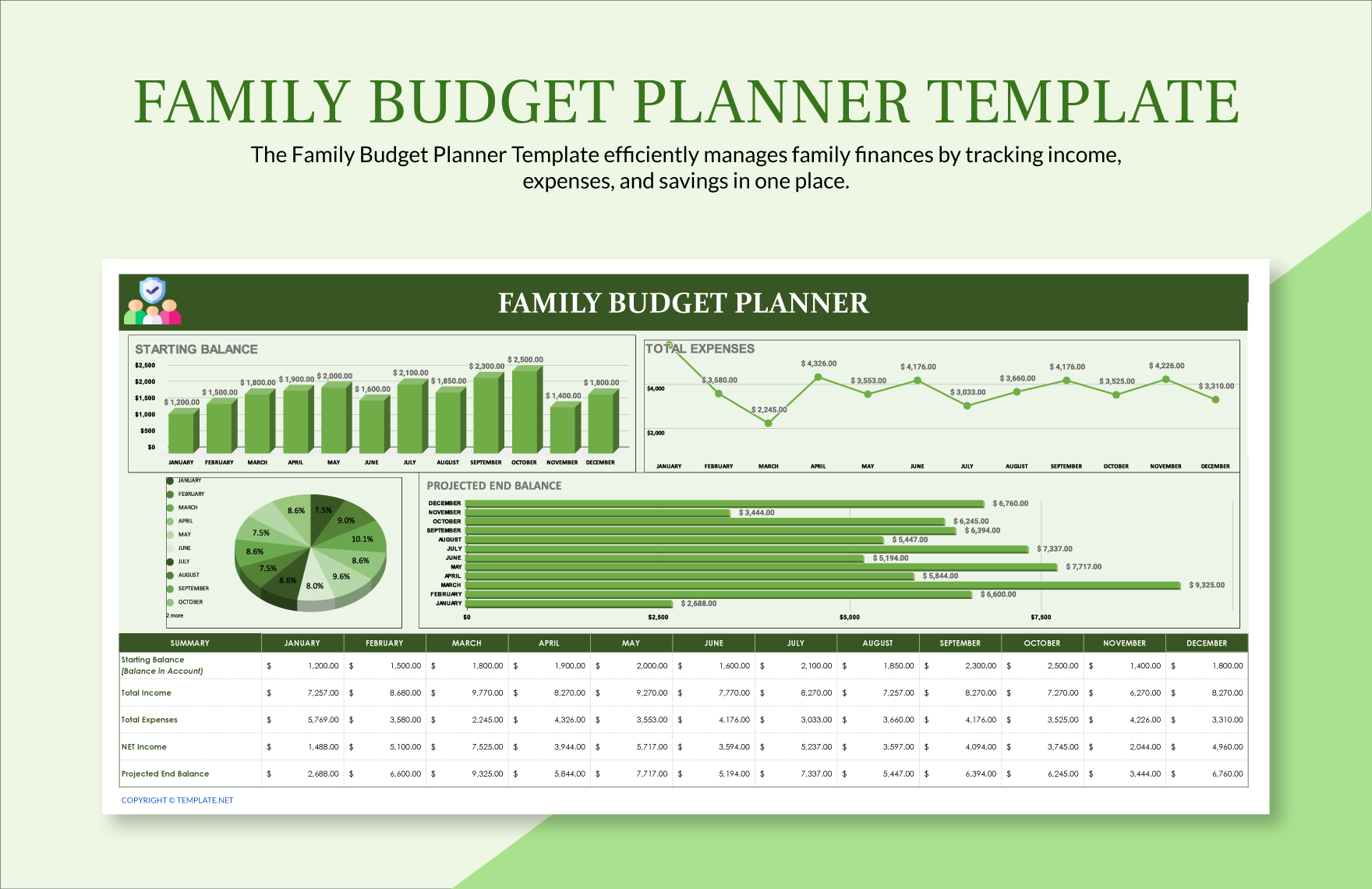

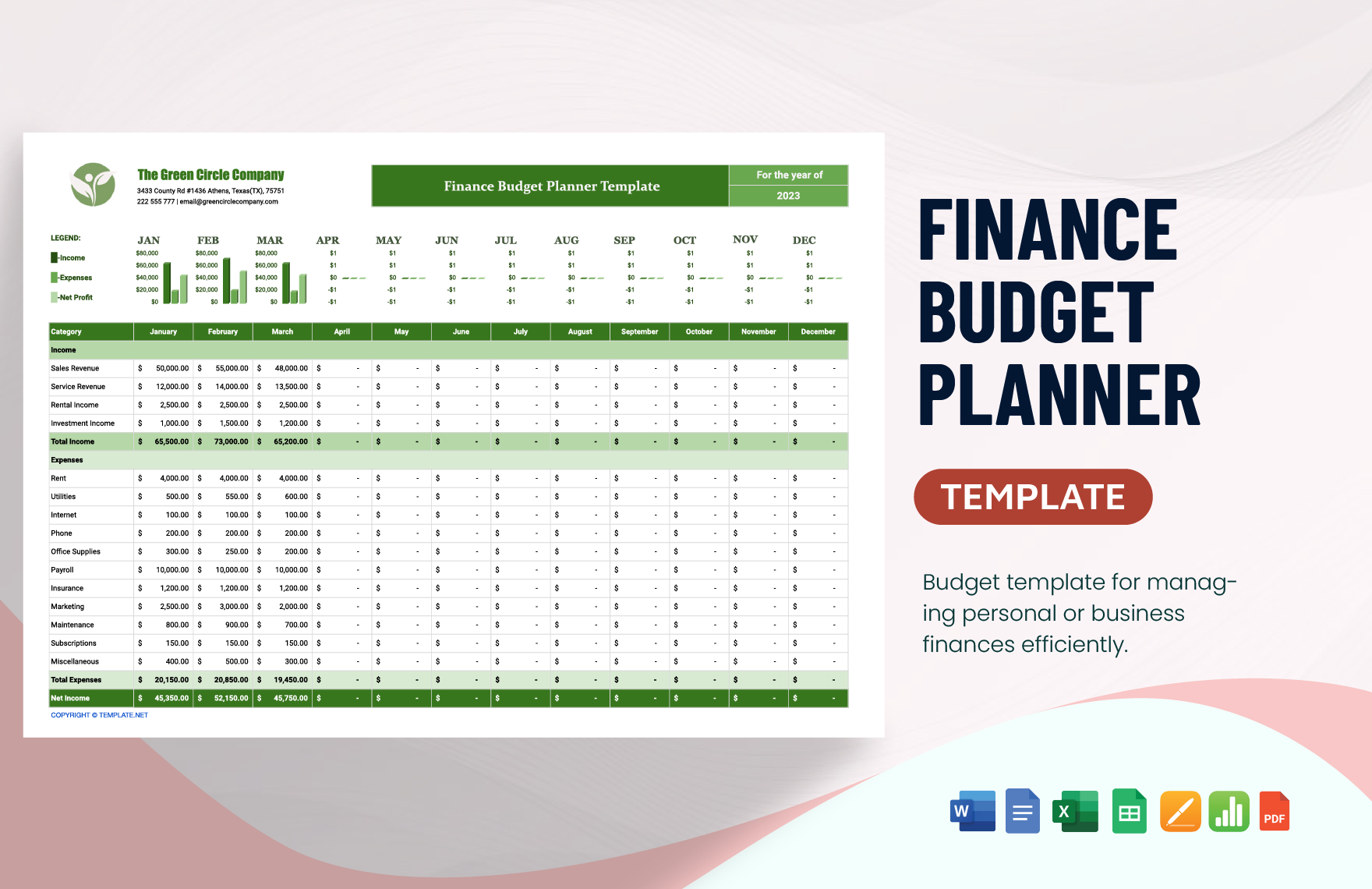

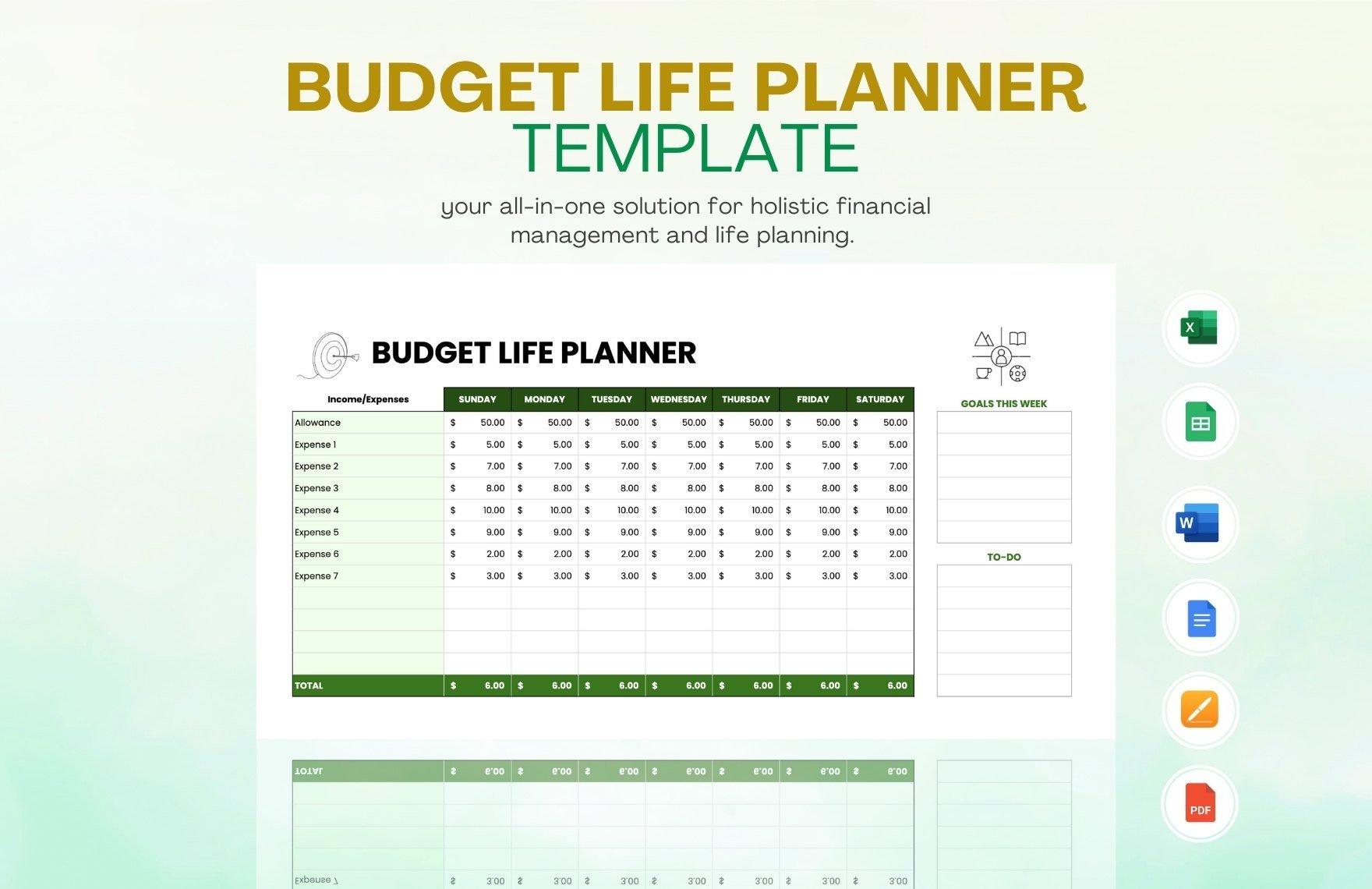

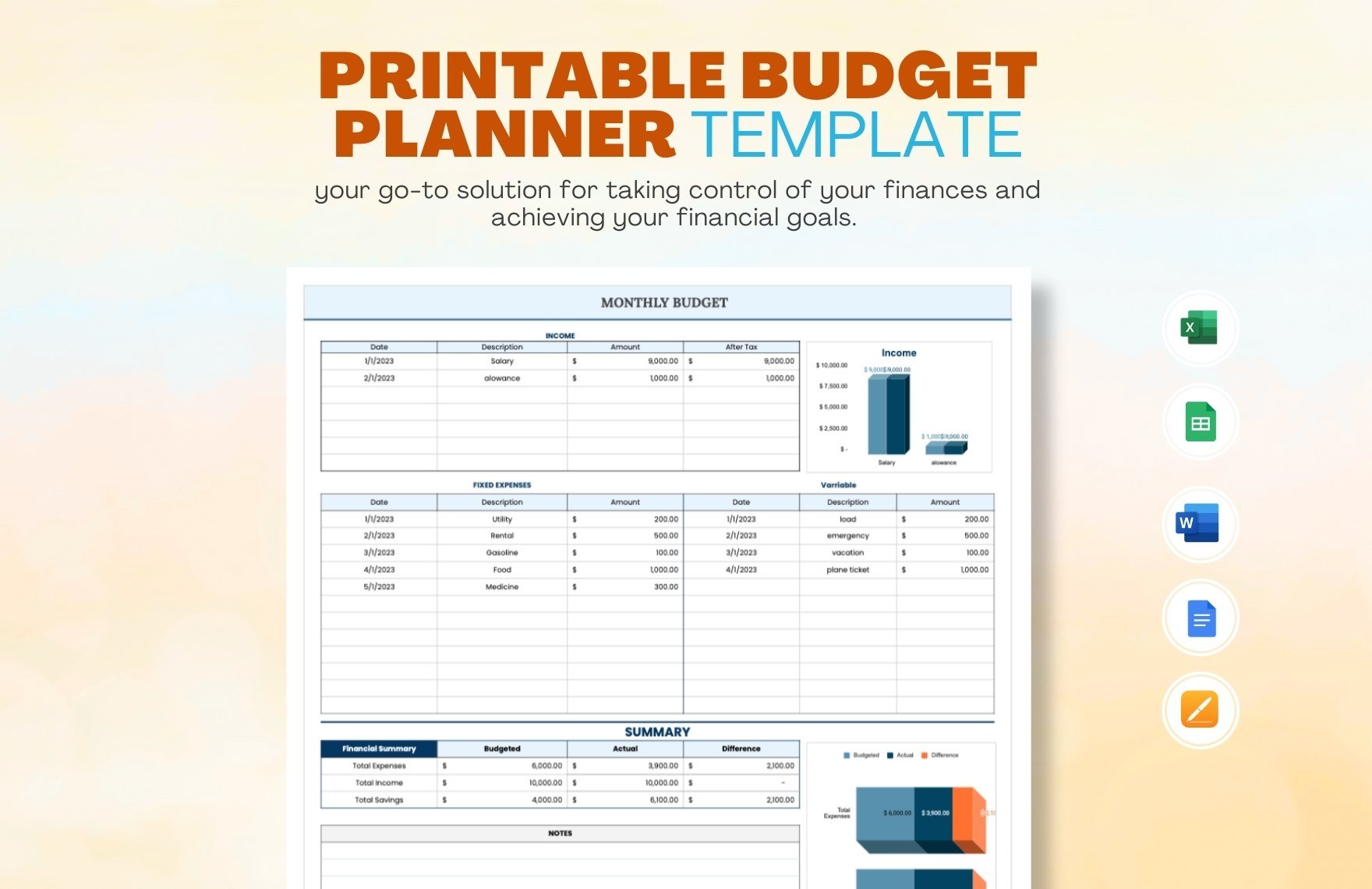

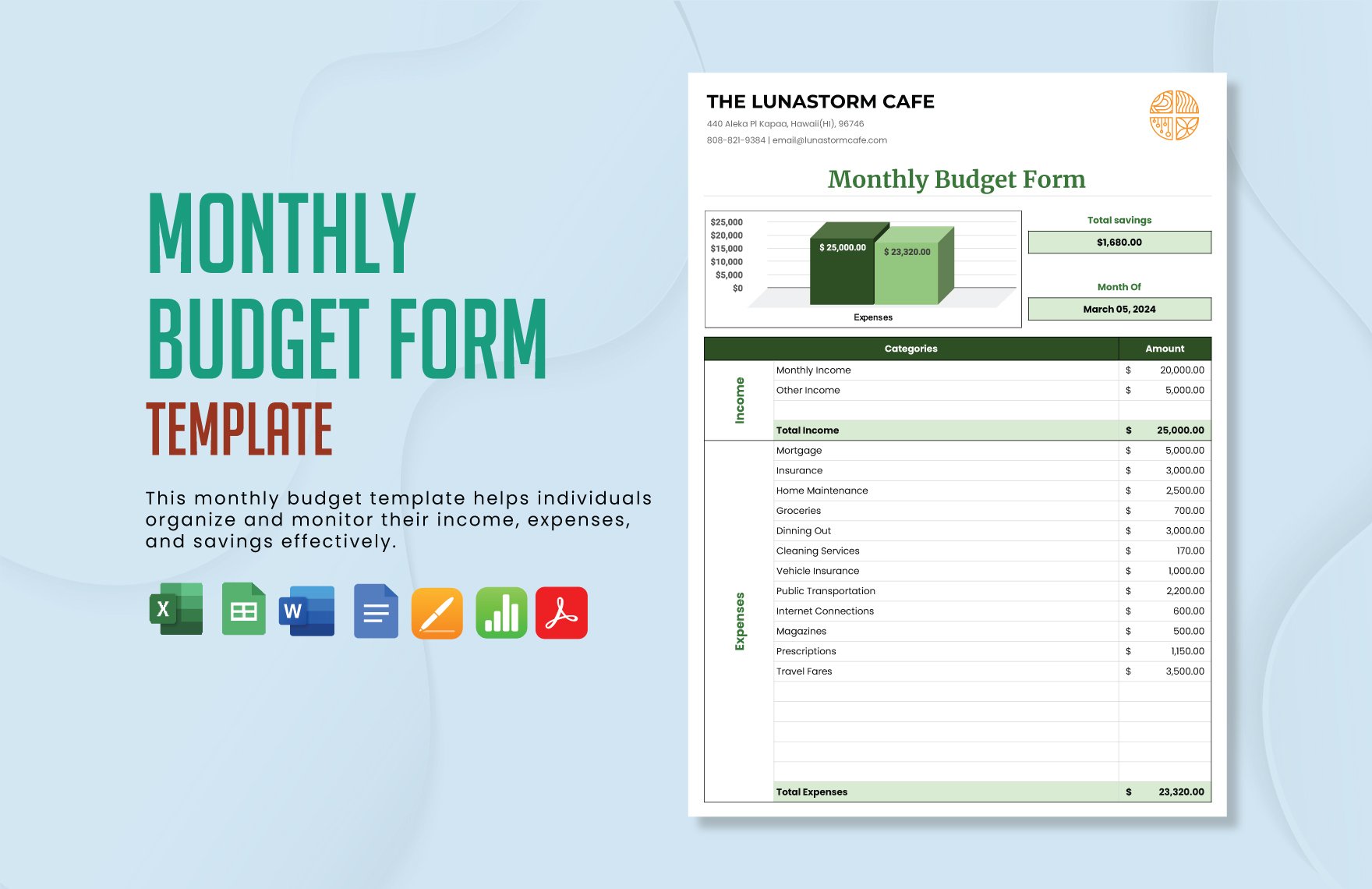

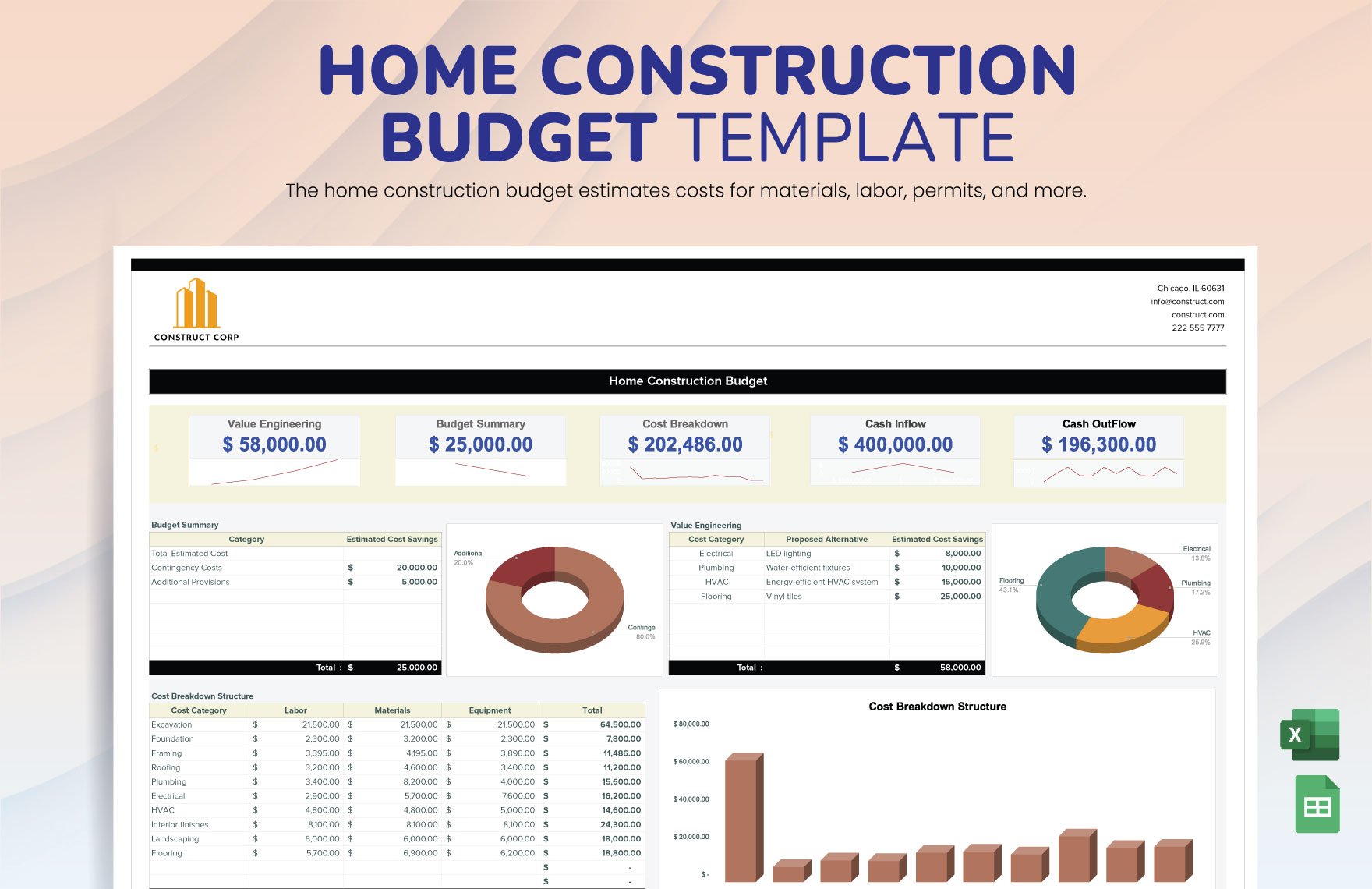

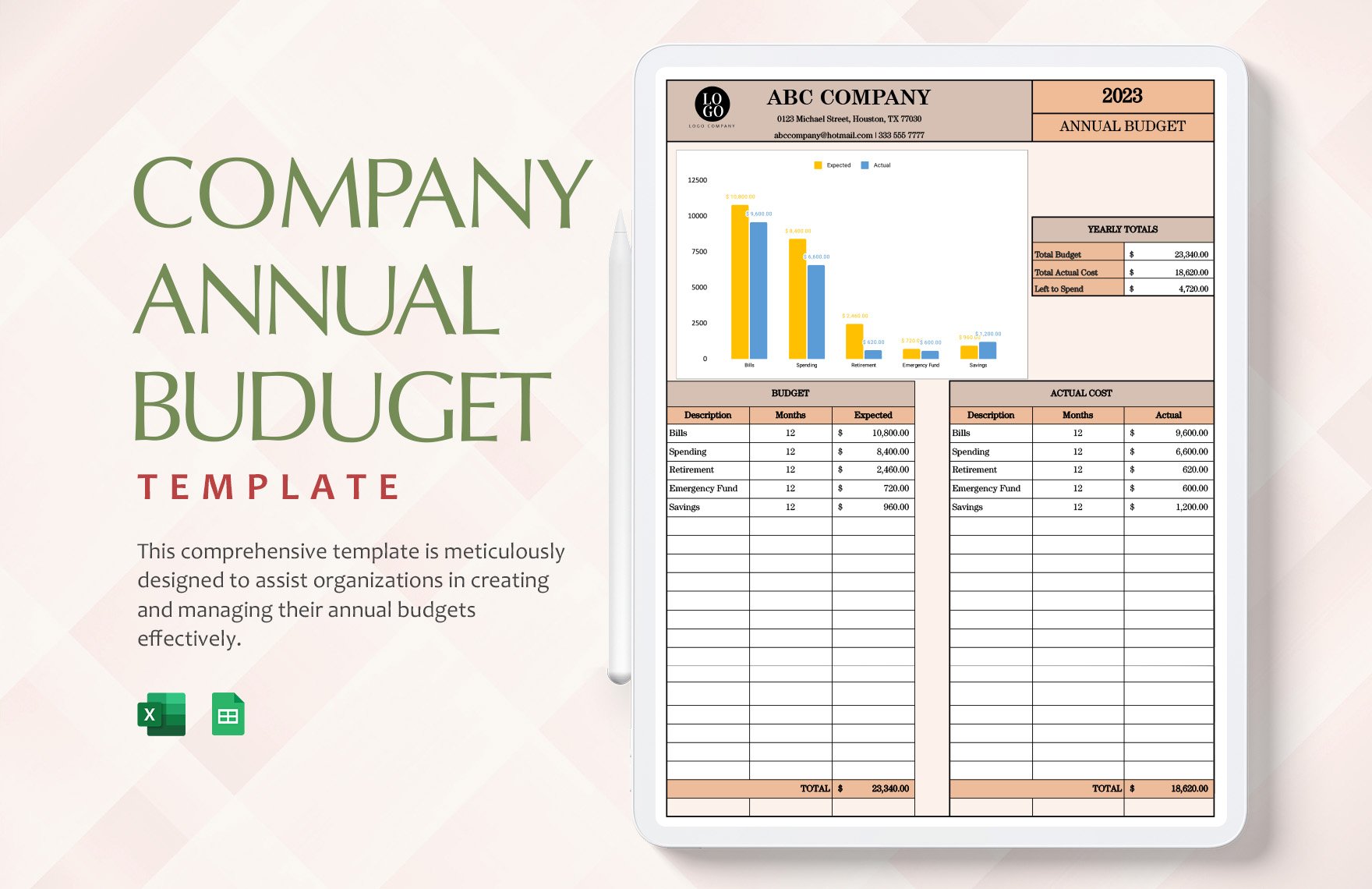

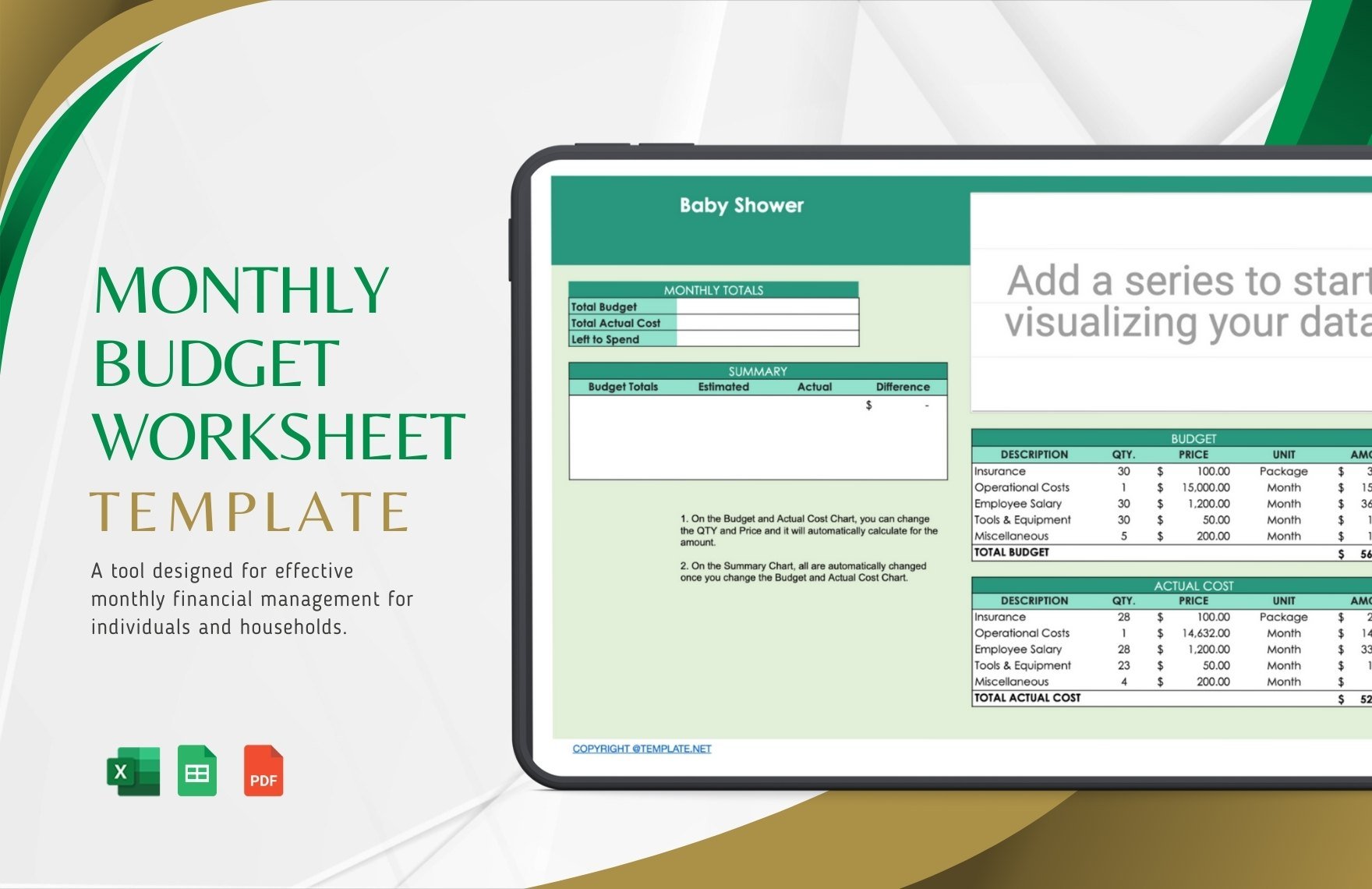

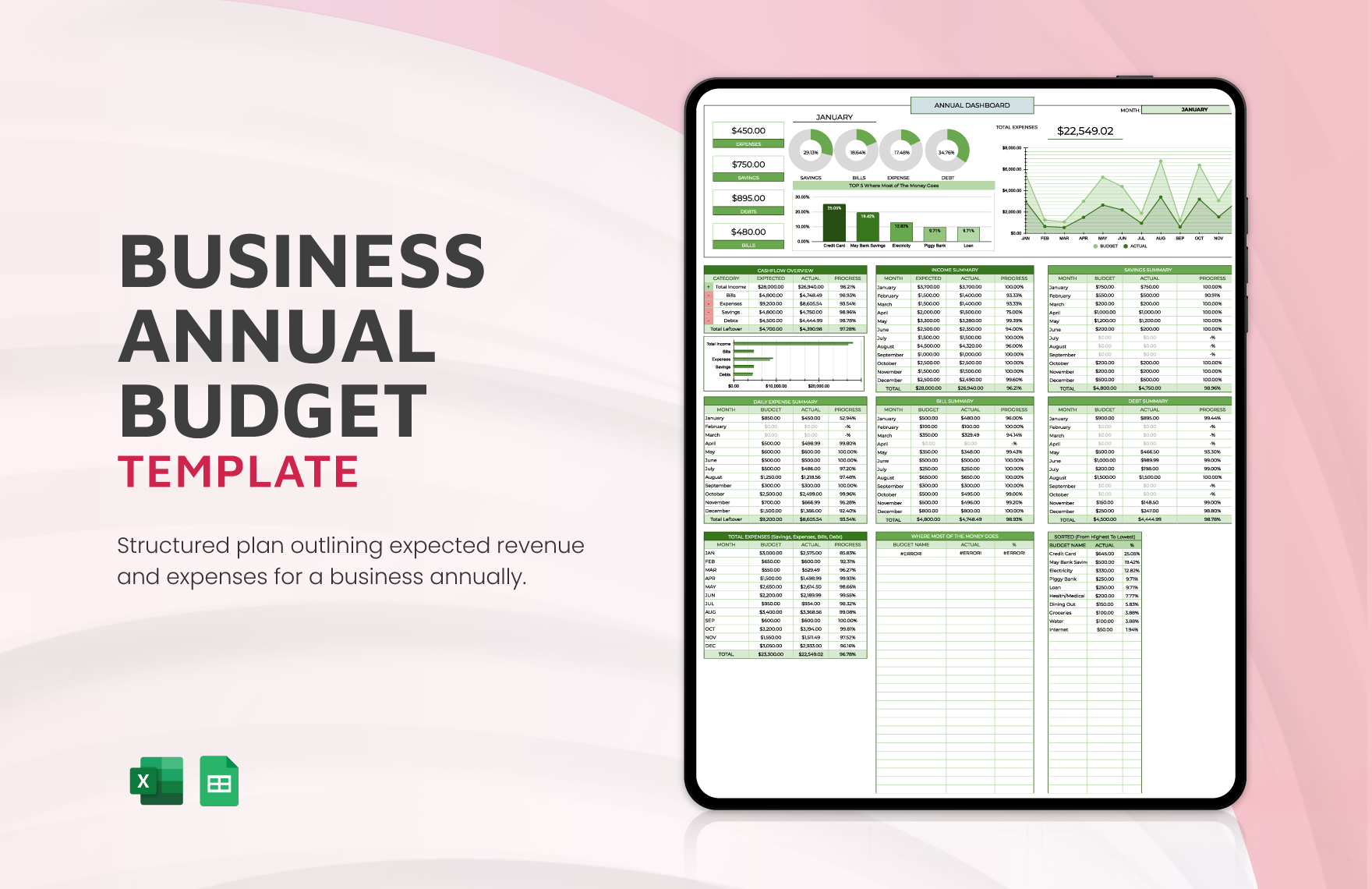

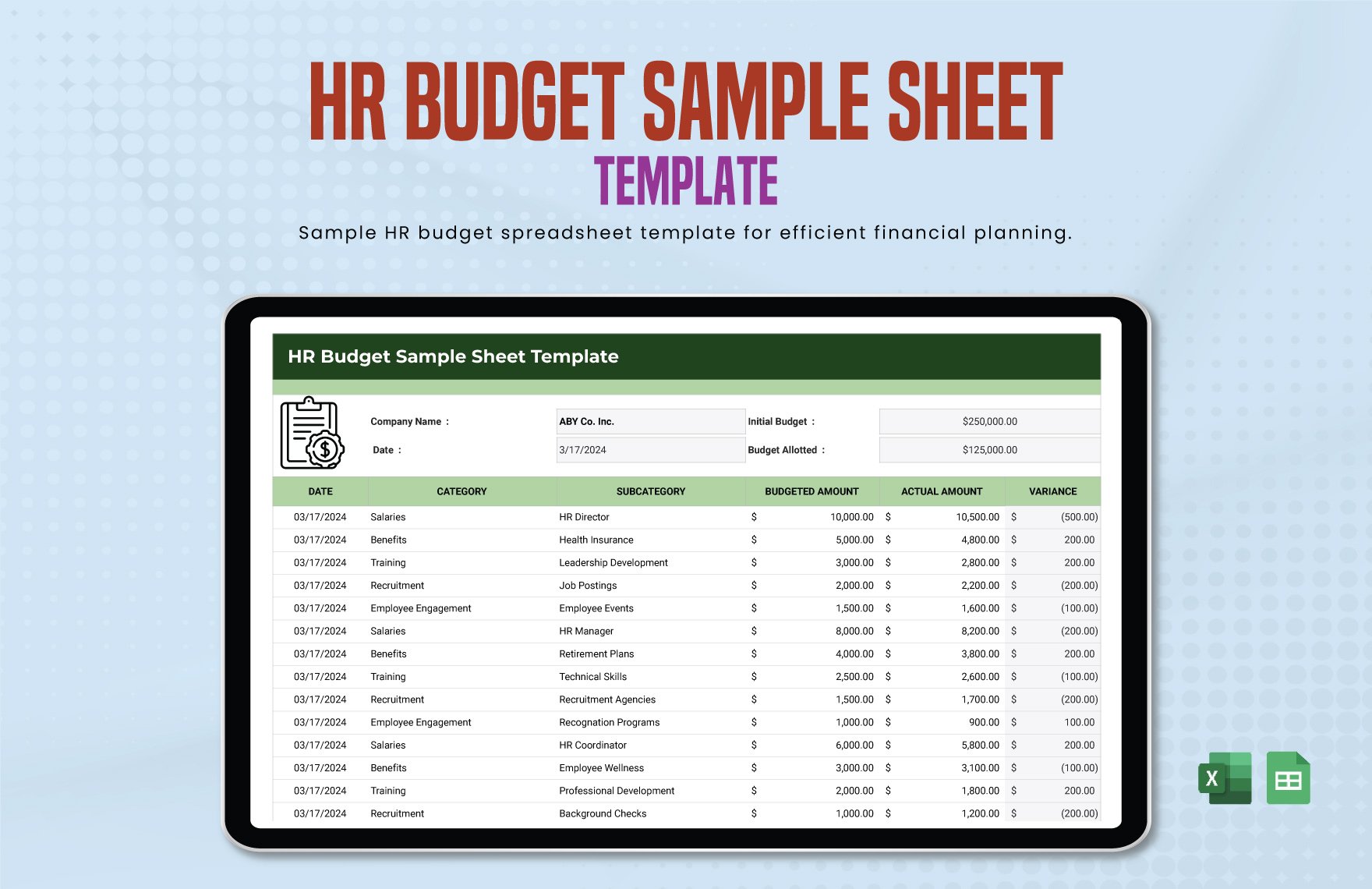

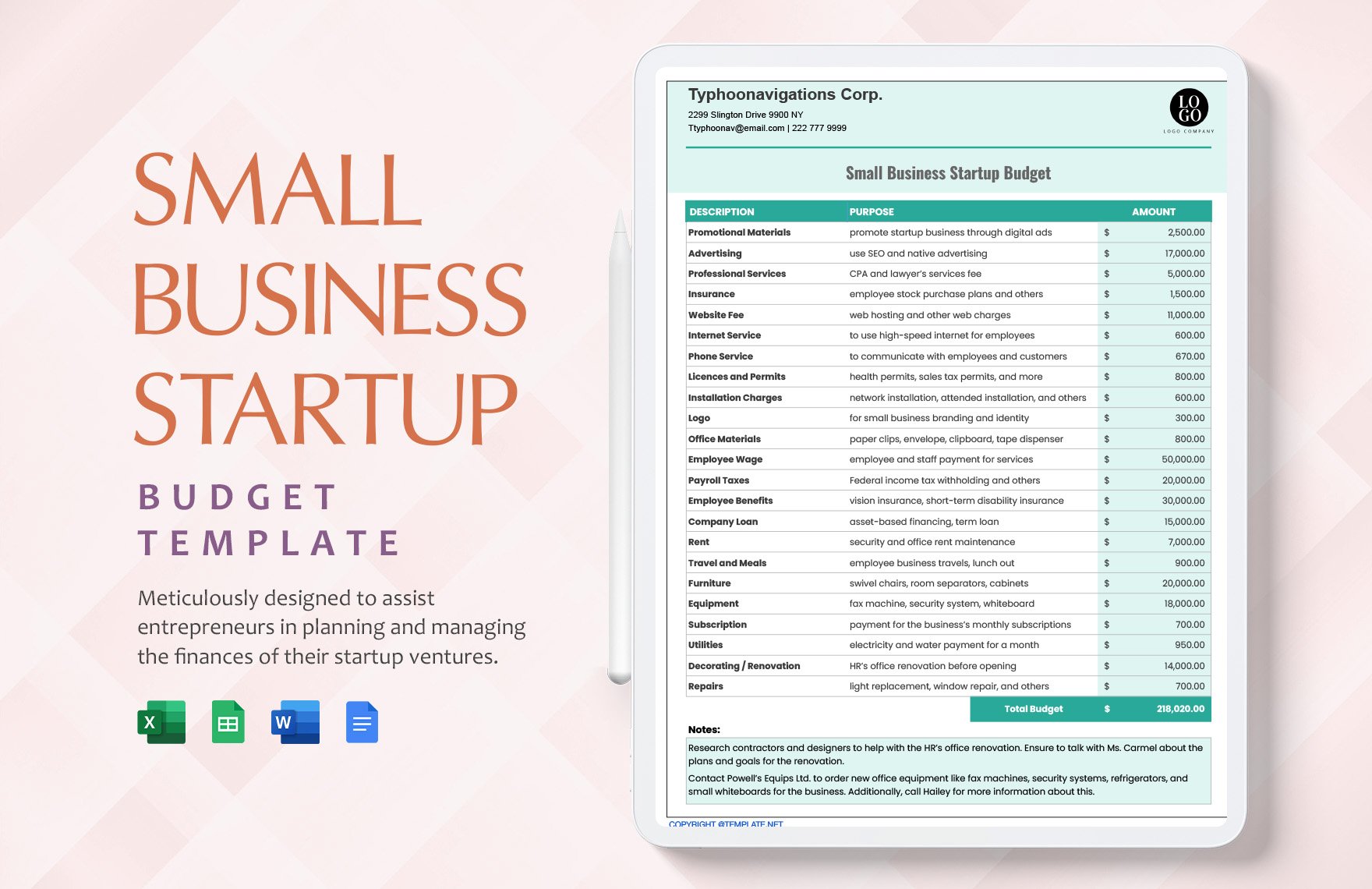

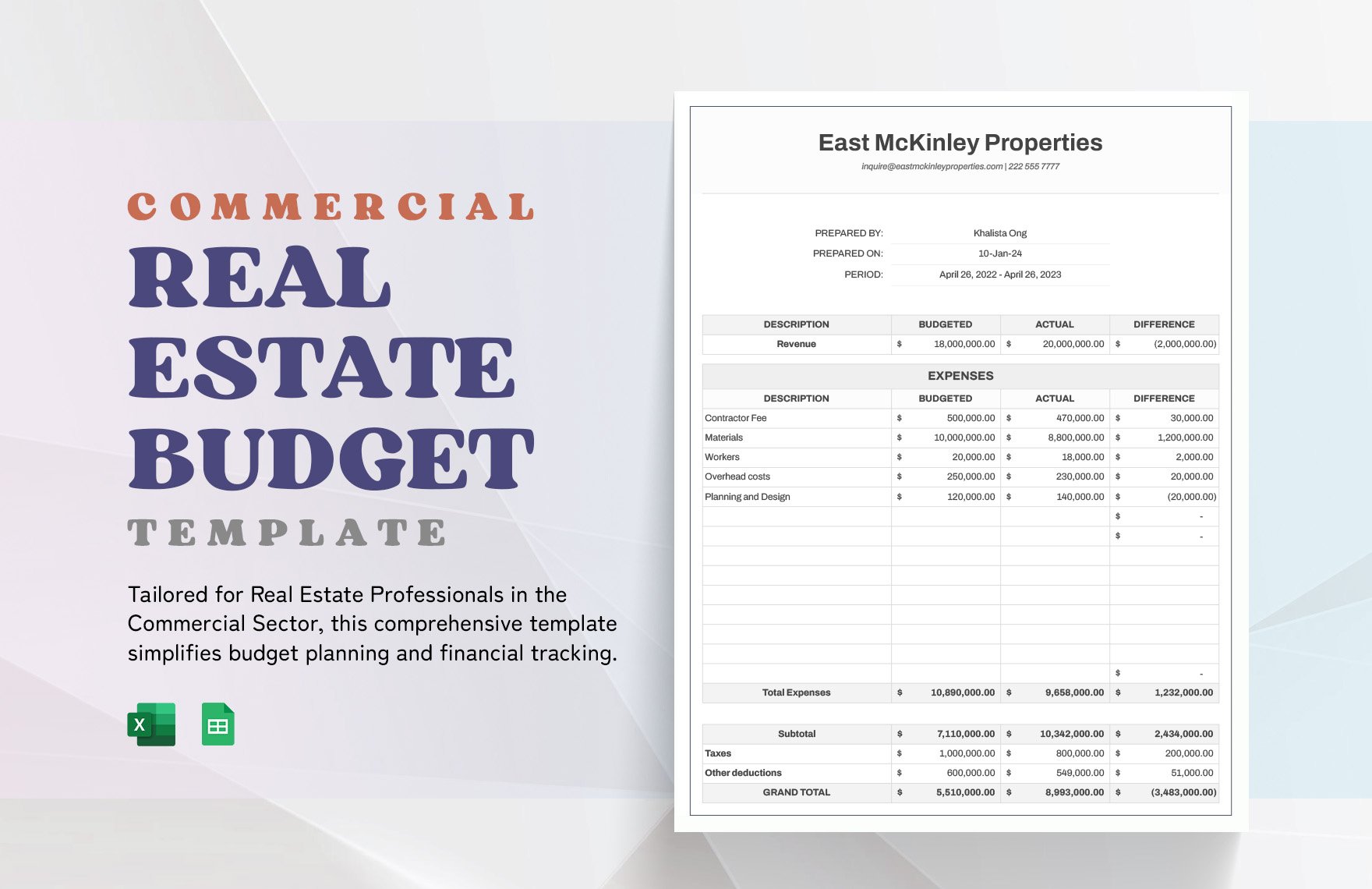

Financial literacy can help you effectively plan and manage anything that has to do with your finances. A first step to actualizing financial literacy is by creating simple daily, weekly, and monthly personal budgets. By practicing on a personal level, you can then apply your budgeting and financial management skills in your future business. If you want to get a headstart in the creating process, we have ready-made Simple Budget Templates that you can easily customize in Microsoft Excel. These templates are complete with the necessary components of a budget, along with the formulas needed to automate your tables. Get these templates today to streamline your finances efficiently and effectively!

How to Create a Simple Budget in Microsoft Excel

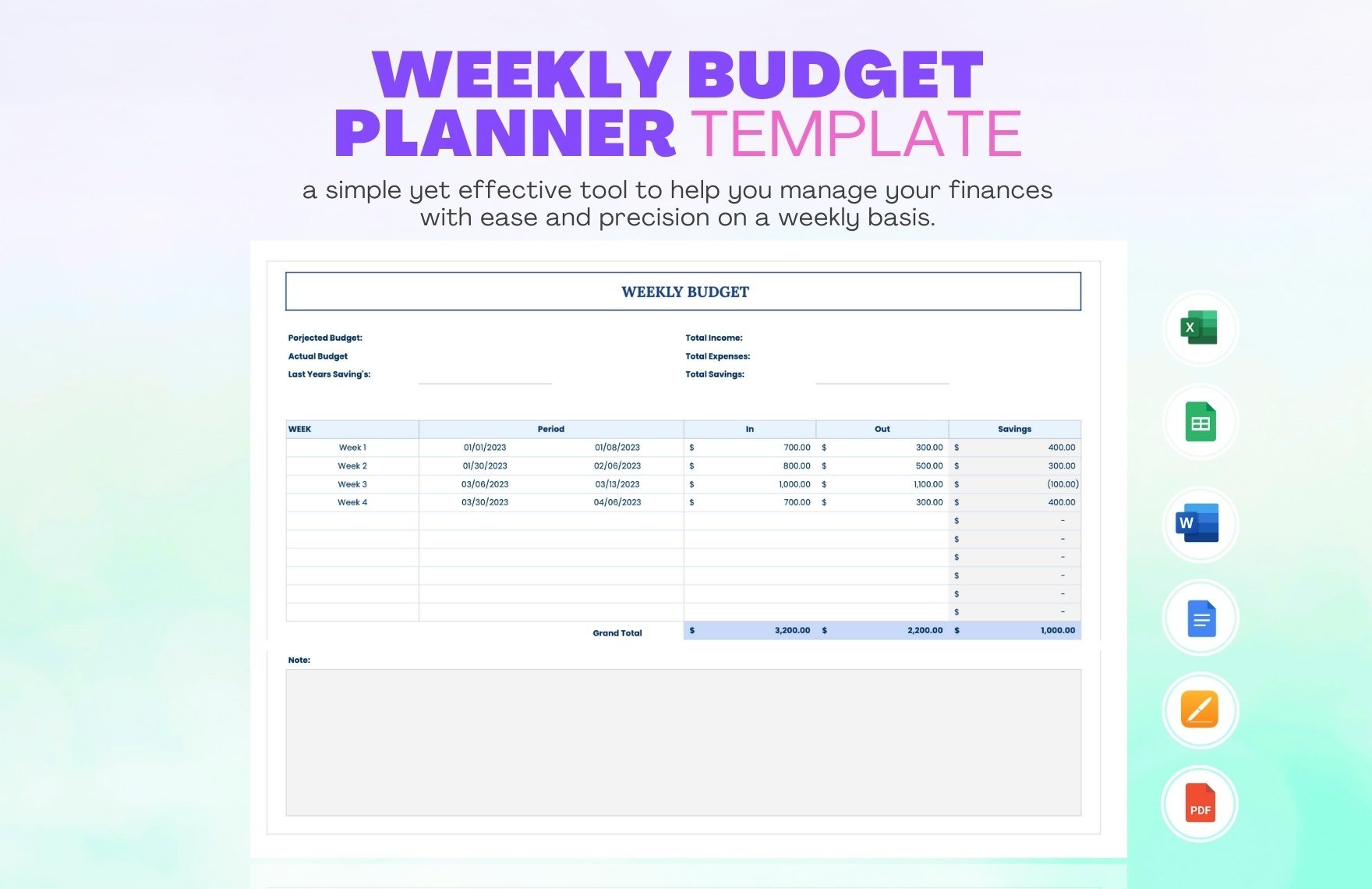

An article in CNBC states that consumers often exceed the average $197 weekly budget. Consumers spend an average of $340 weekly, and this excludes bills such as mortgage or rent, utilities, etc.; this means that consumers spend an average of $7,400 of extra expenses yearly. That is a lot of money! Learning how to create a budget and how to manage your finances can ensure that you don't overspend beyond your daily, weekly, or monthly budget.

We have some tips in creating an effective, simple budget in Microsoft Excel below, which are perfect for household, college student, and personal budgeting.

1. Note All Your Sources of Income

Before going down into the budgeting rabbit hole, you must first note your sources of income and how much is your after-tax income. Through this process, you have a clear idea of how much money you can have for savings and spendings. Your net income will be the foundation of your budget.

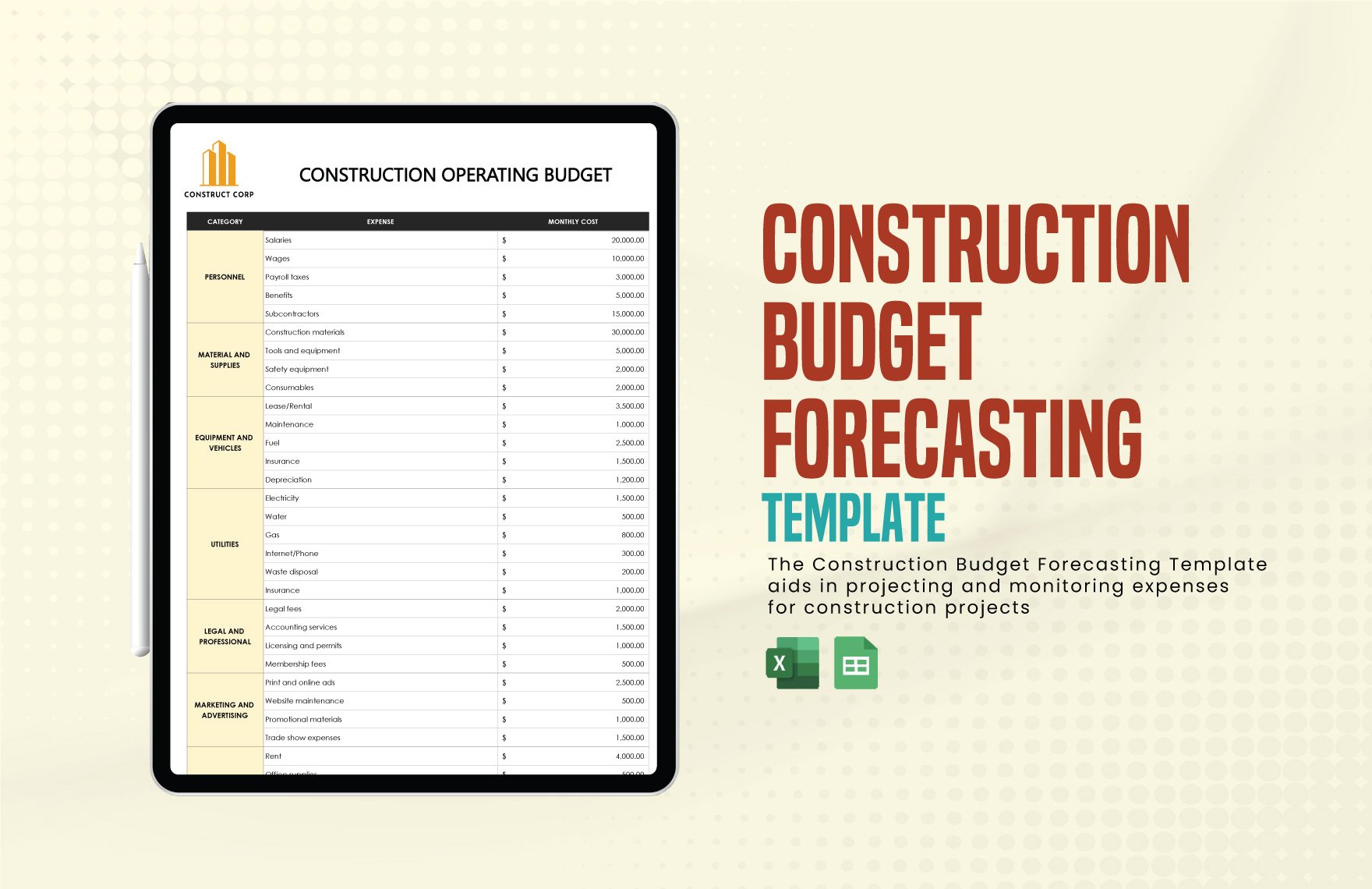

2. Break Expenses into Categories

A good strategy is to break your expenses into categories: bills and miscellaneous. On the bills category, you will input your fixed costs, such as mortgage or rent, car payments, cable and internet service, subscriptions, and so on. Meanwhile, in the miscellaneous category, list the variables that change every month, such as savings, groceries, gasoline, entertainment, and eating out.

3. Make Necessary Expense Adjustments

Once you have a total of your expenses, your next goal is to balance out your expenses and income columns. Doing this strategy means that your income is effectively budgeted toward your specific expenses and saving objectives. Basing on your calculations, adjust your spendings to ensure you don't blow your budget.

4. Track Your Spending

Creating a budget is only useful when you're mindful of your spending. Keep track of your spending by keeping receipts and immediately tallying them to your budget worksheet. Through this strategy, you can keep yourself accountable for sticking or not sticking to your budget.