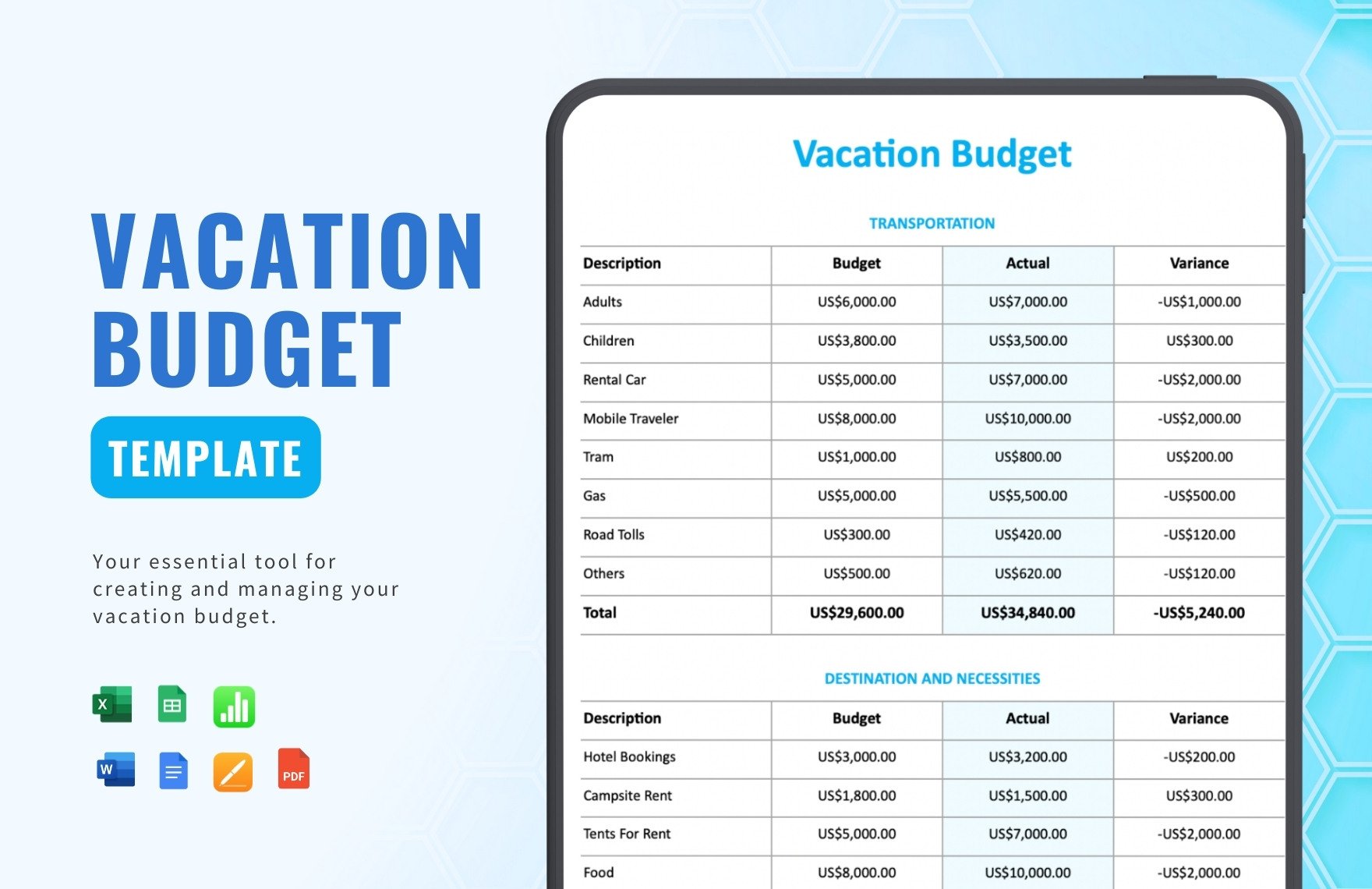

Bring Your Budgeting Goals to Life with University Budget Templates from Template.net

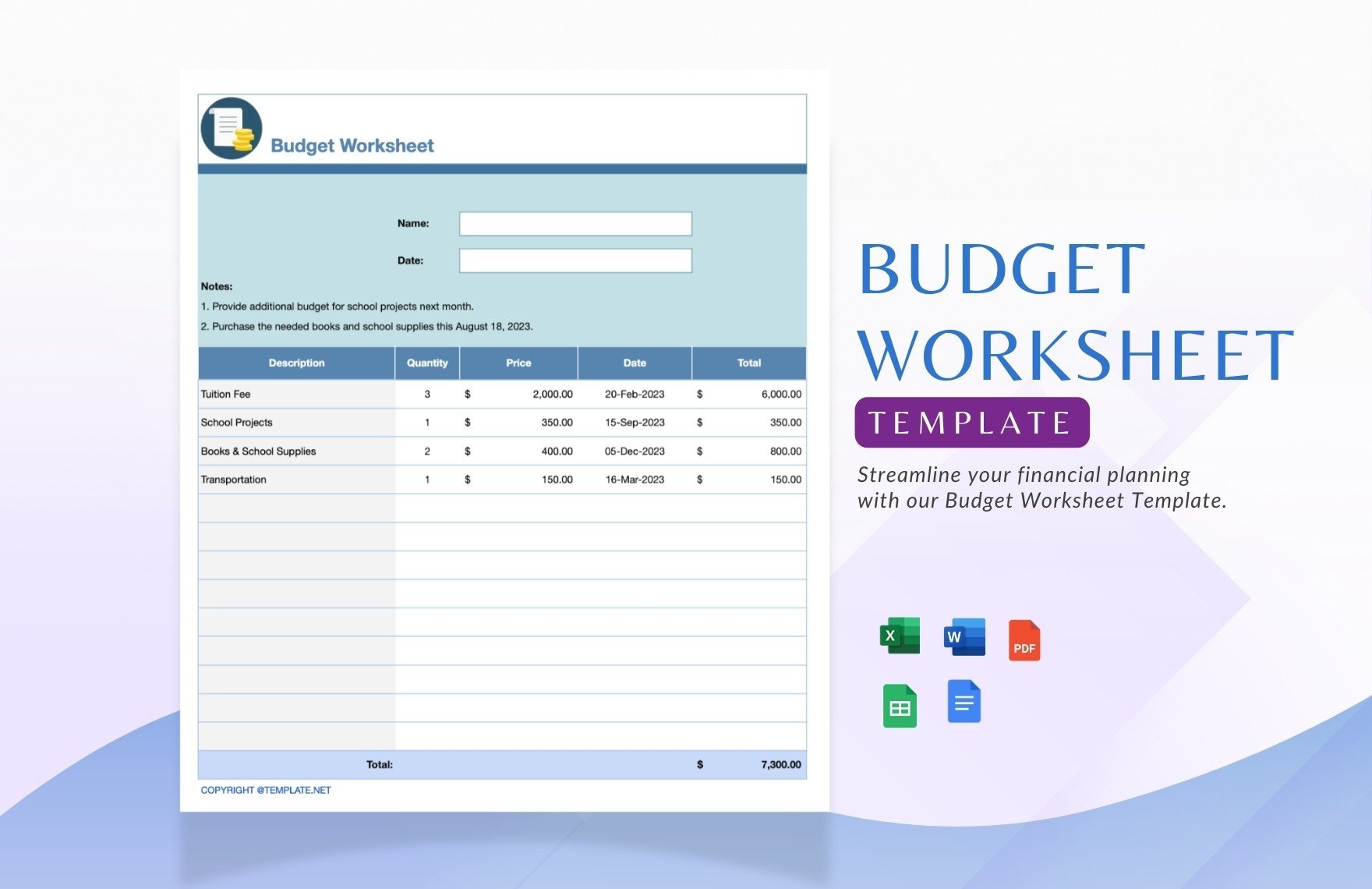

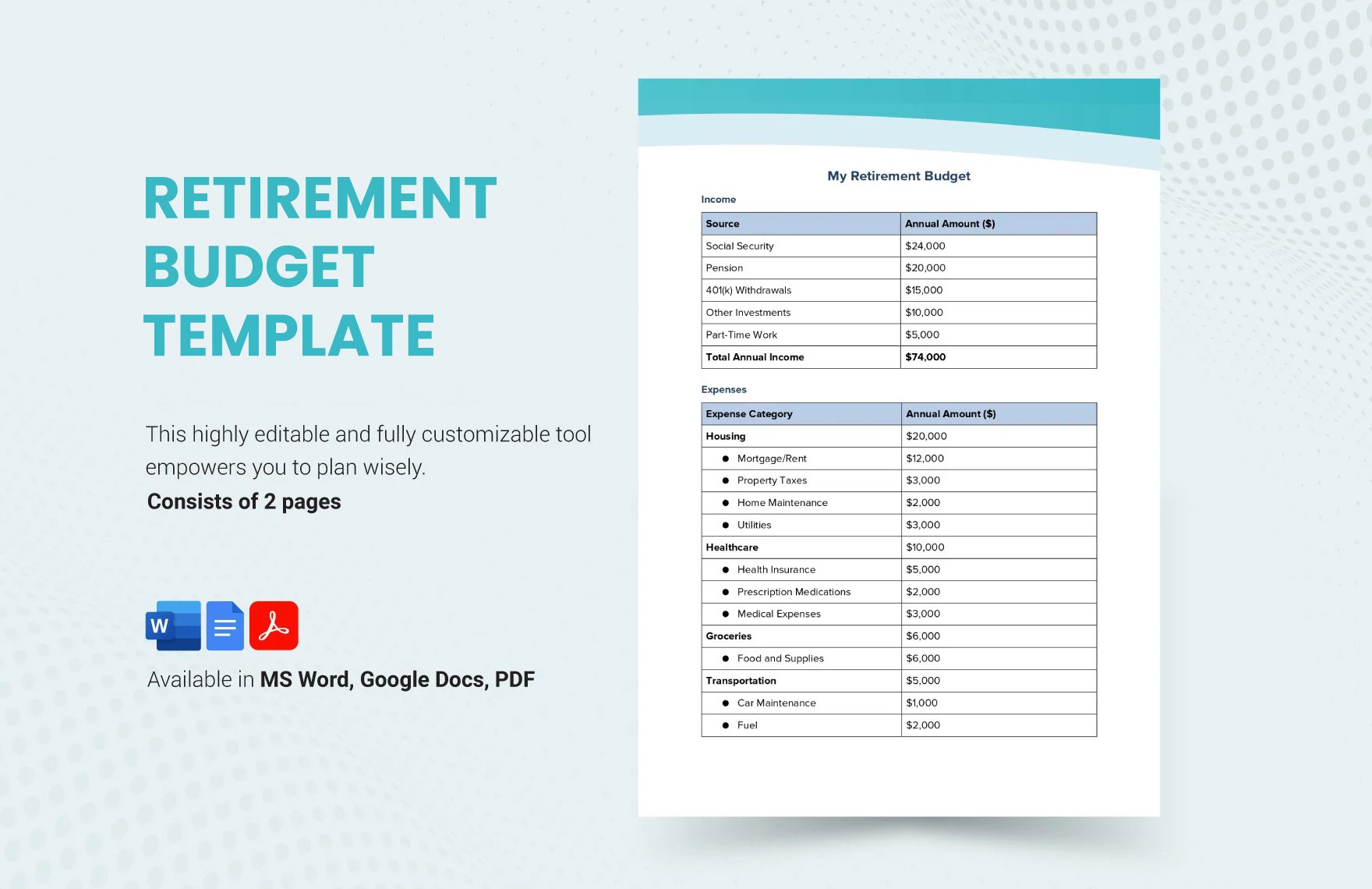

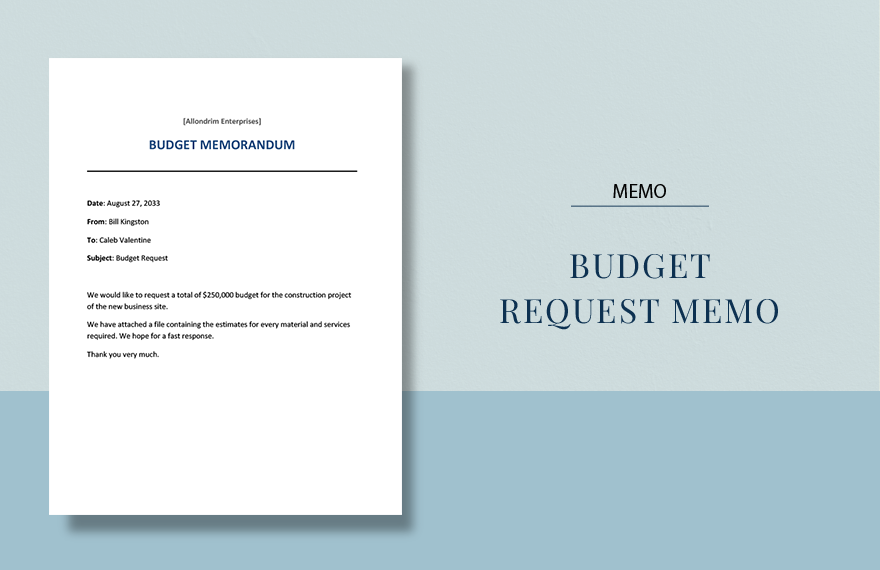

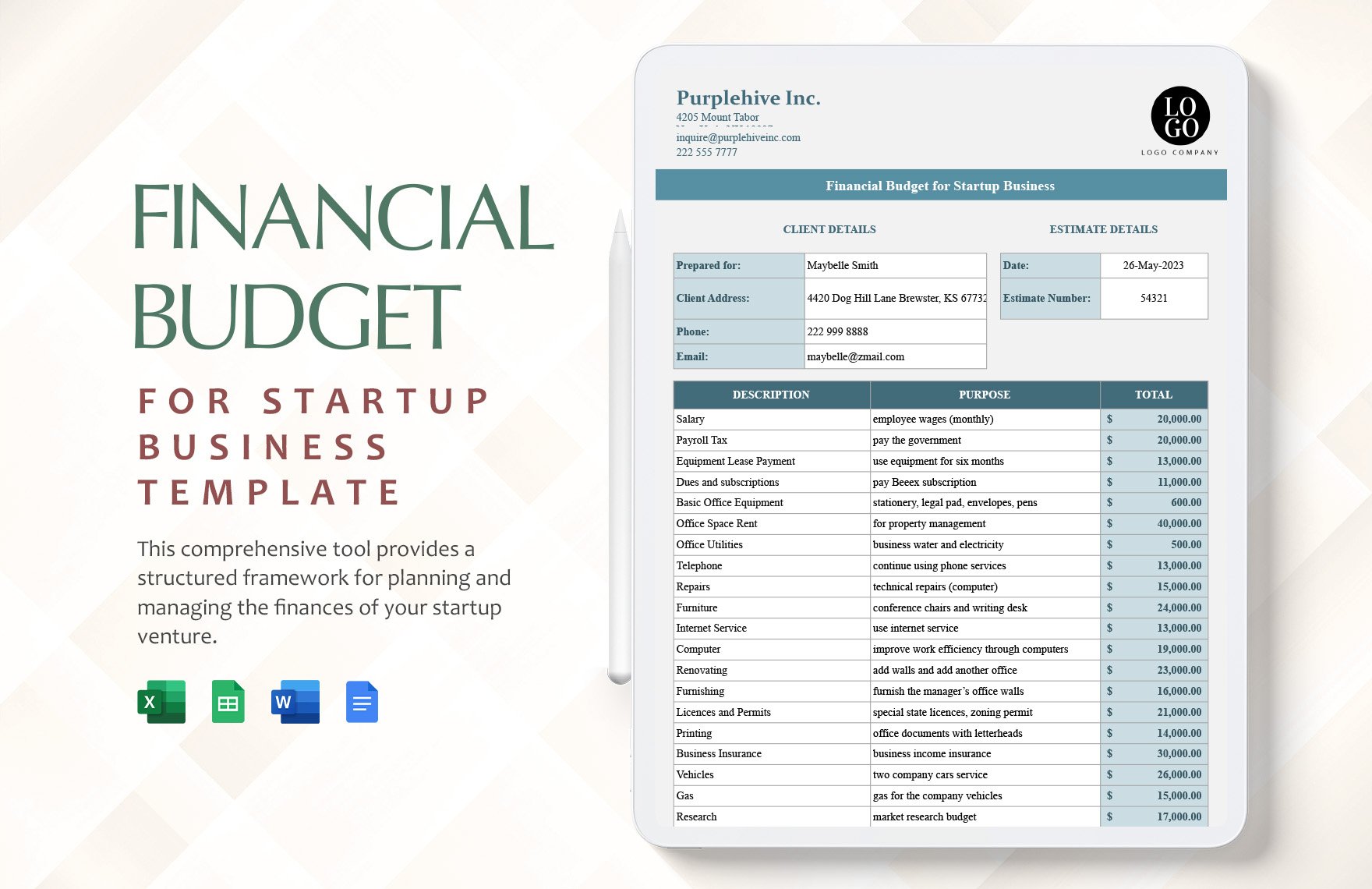

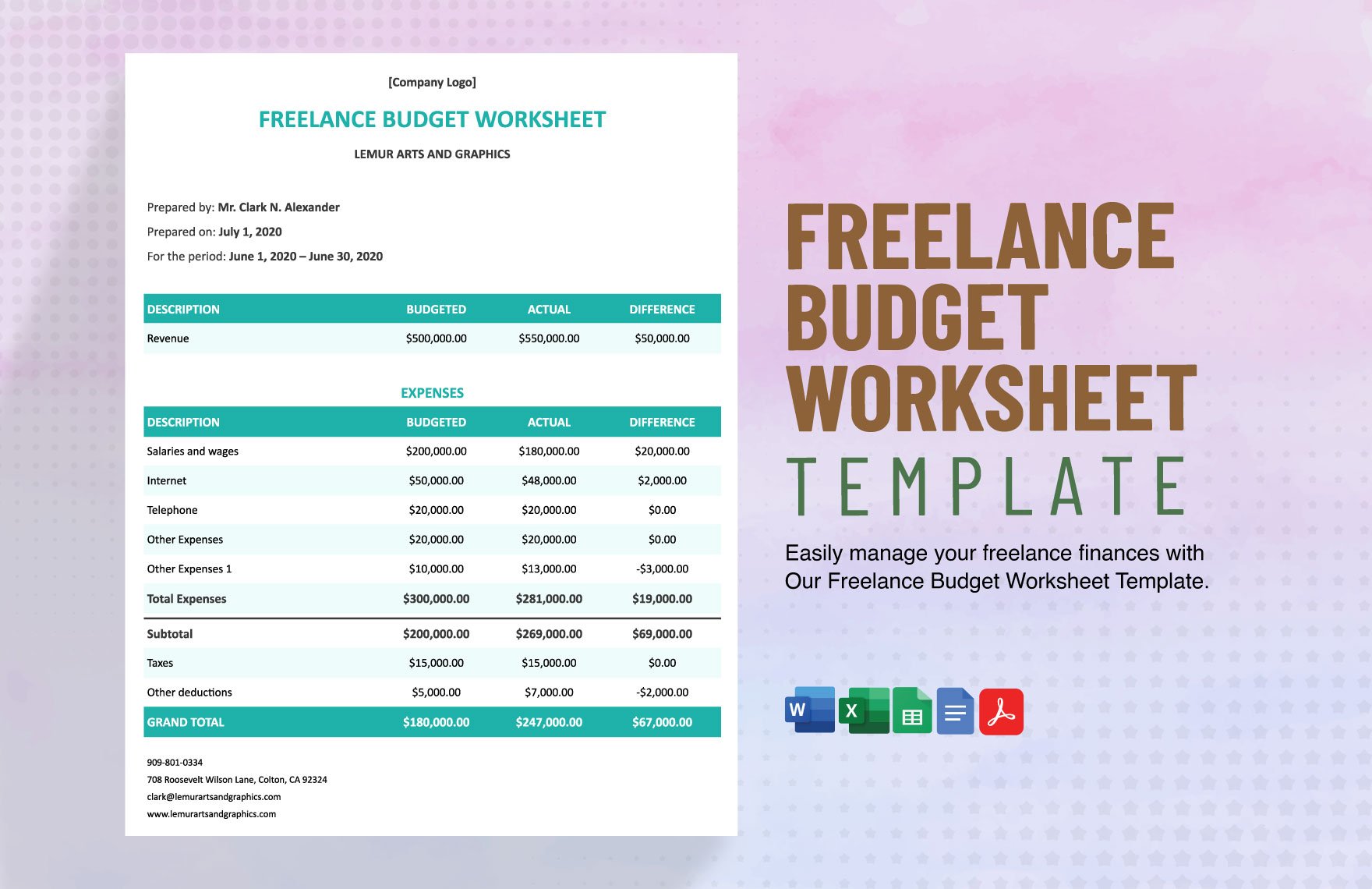

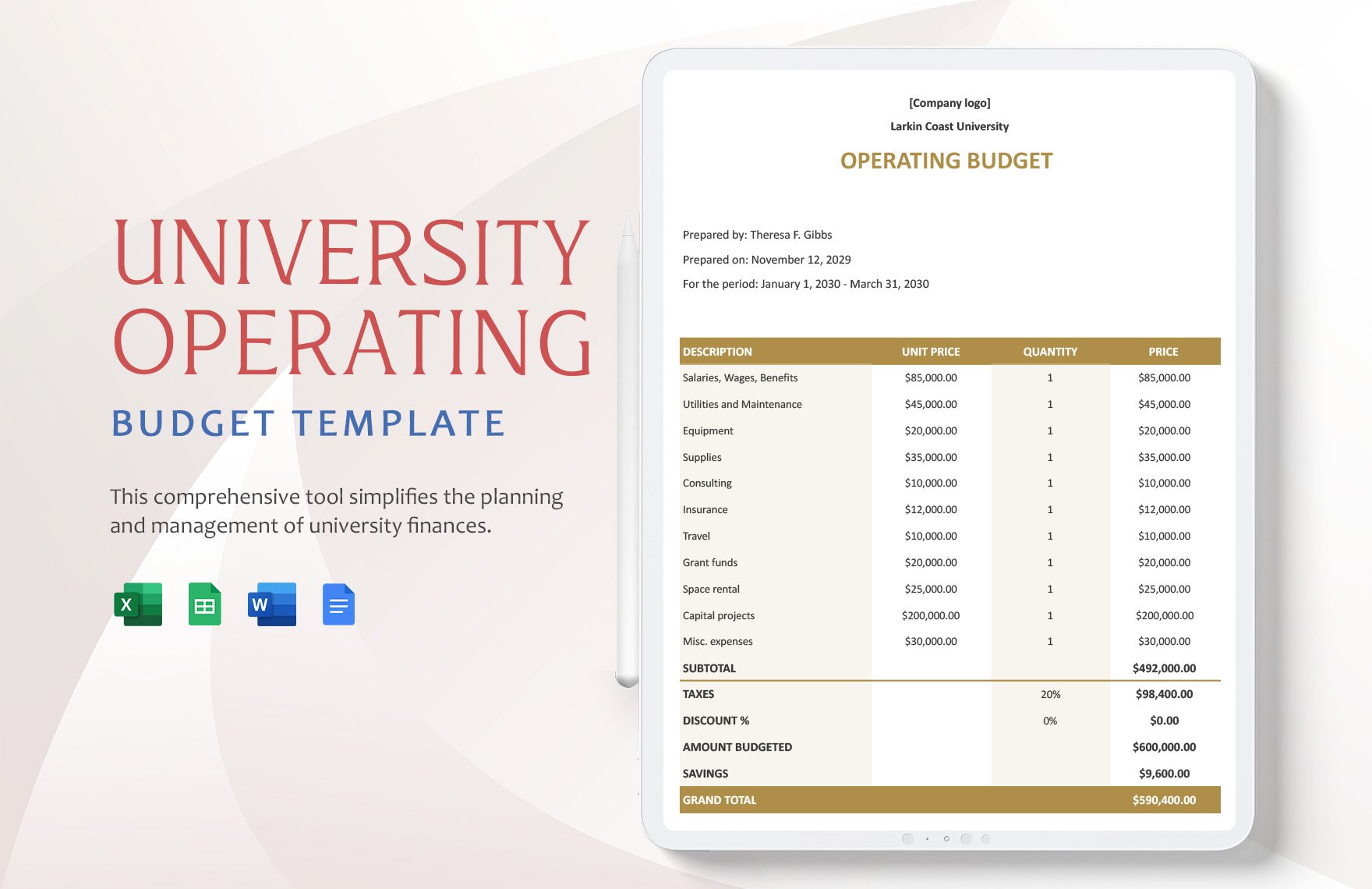

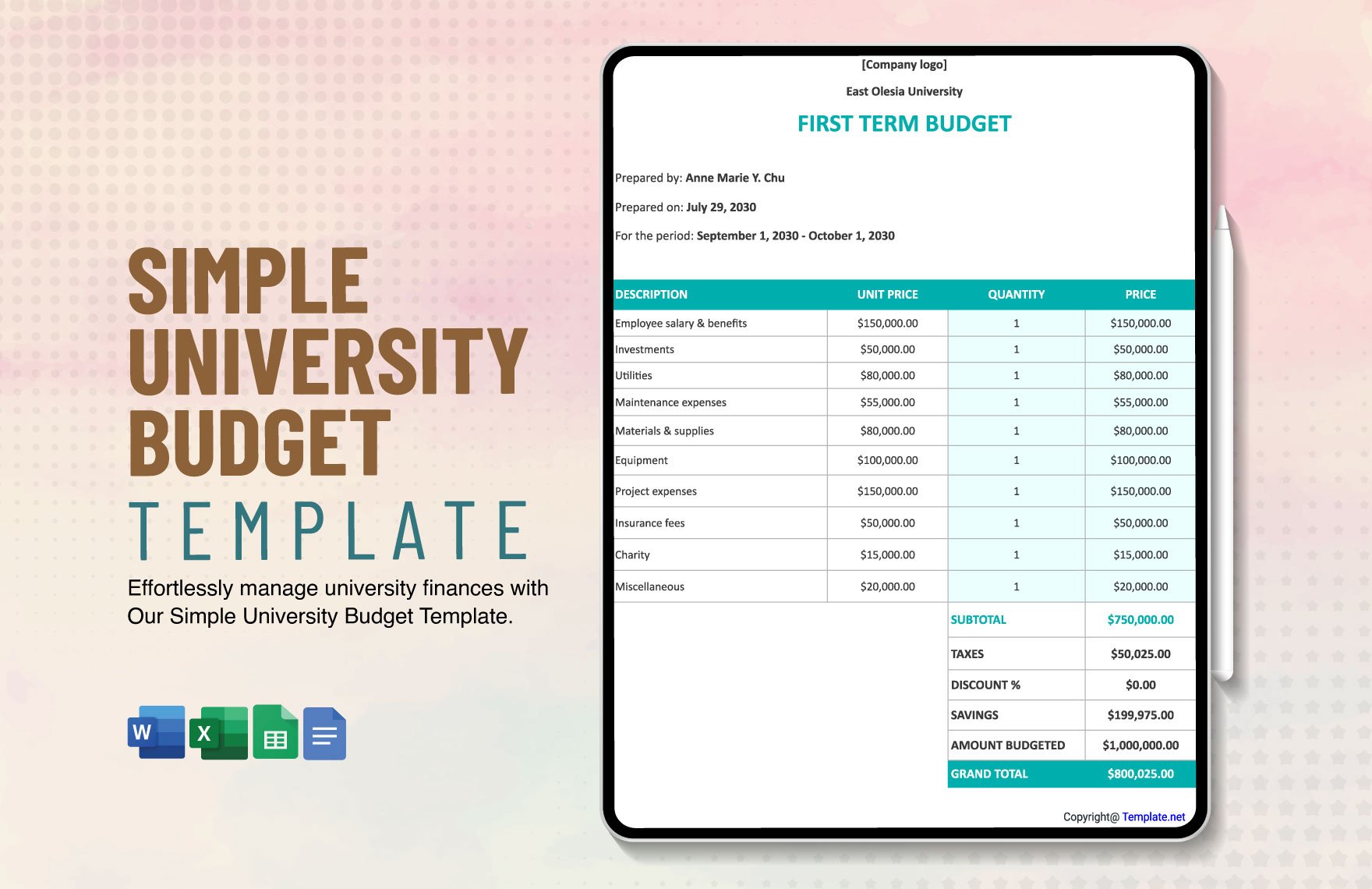

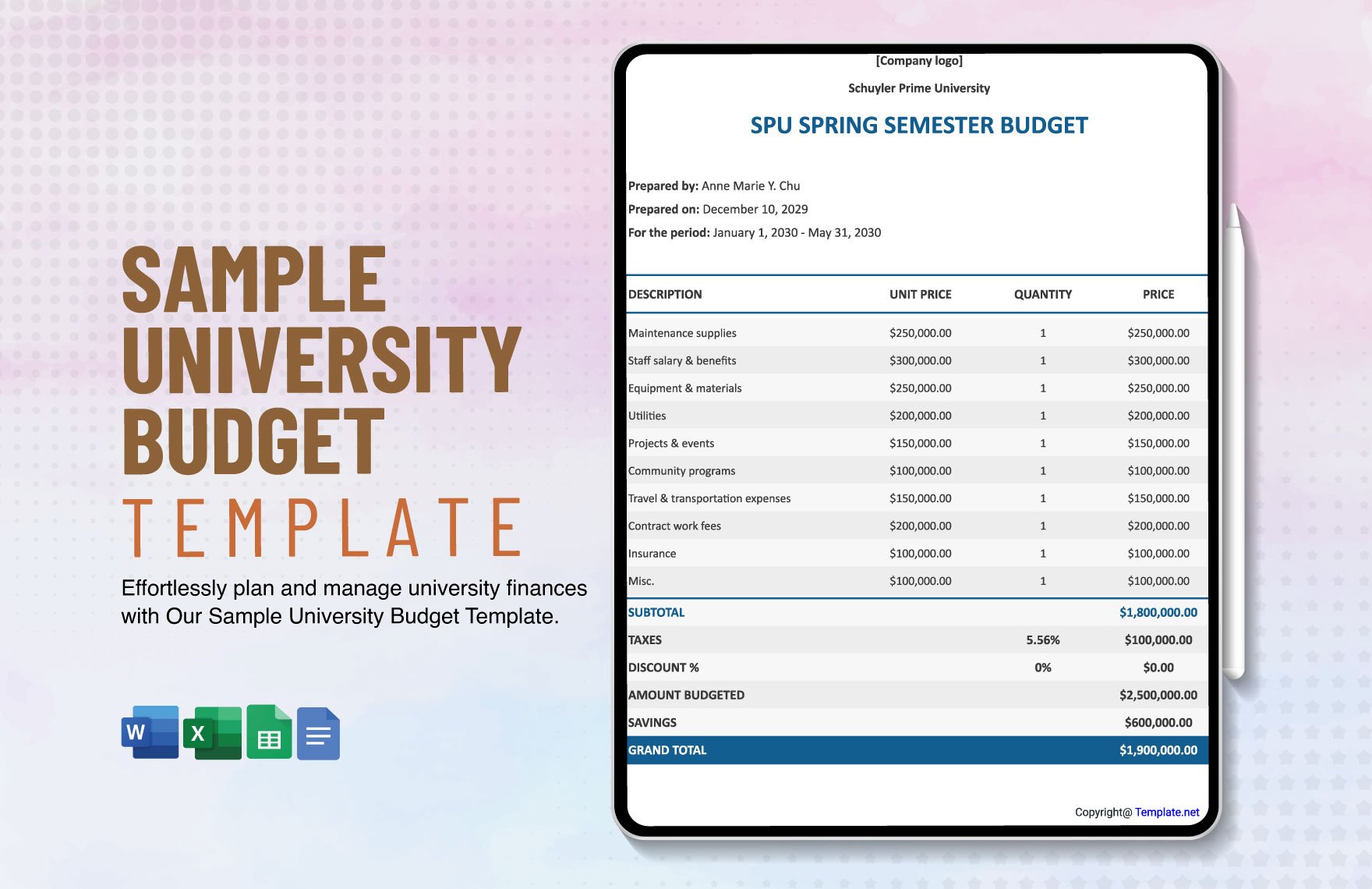

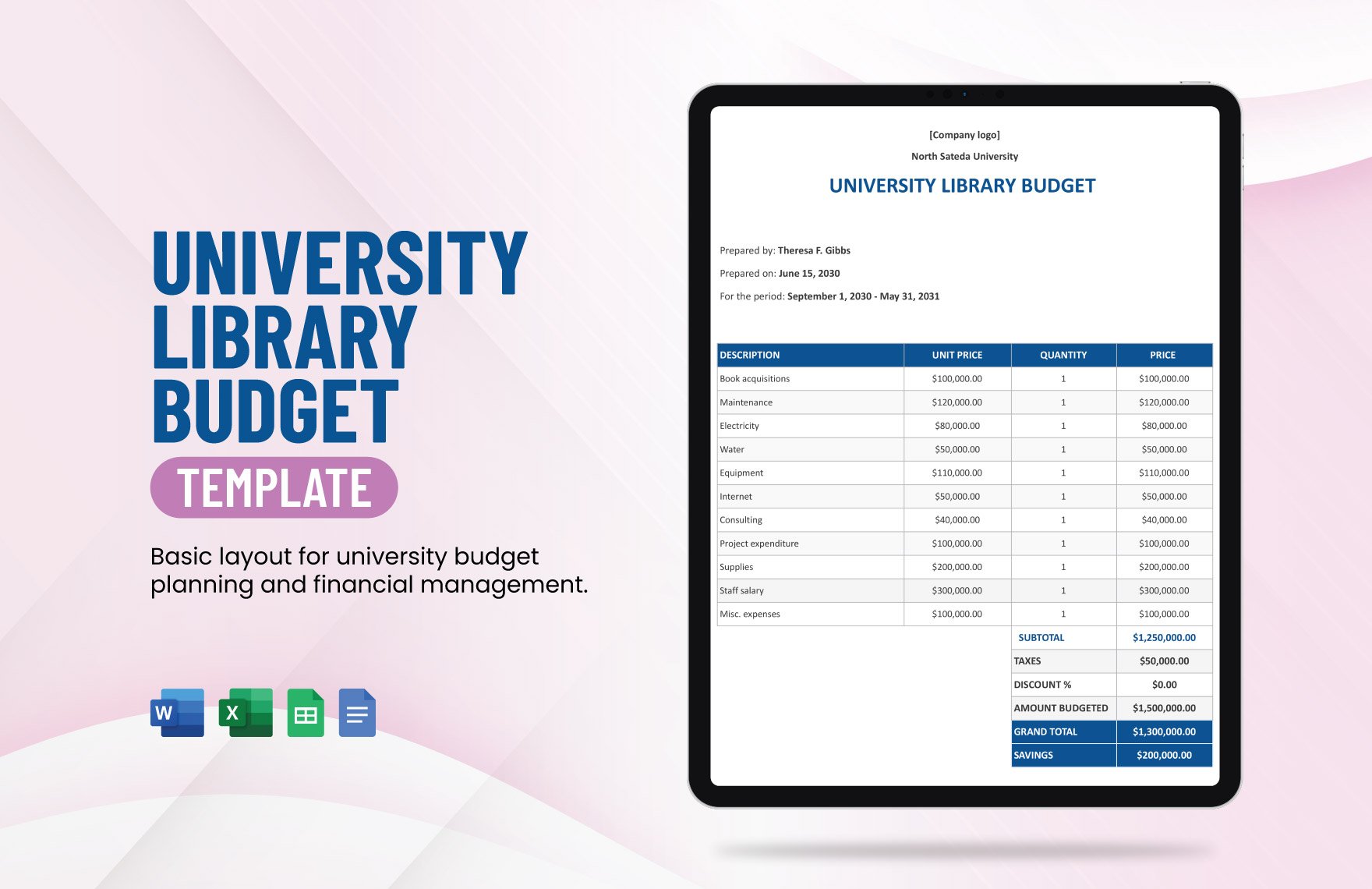

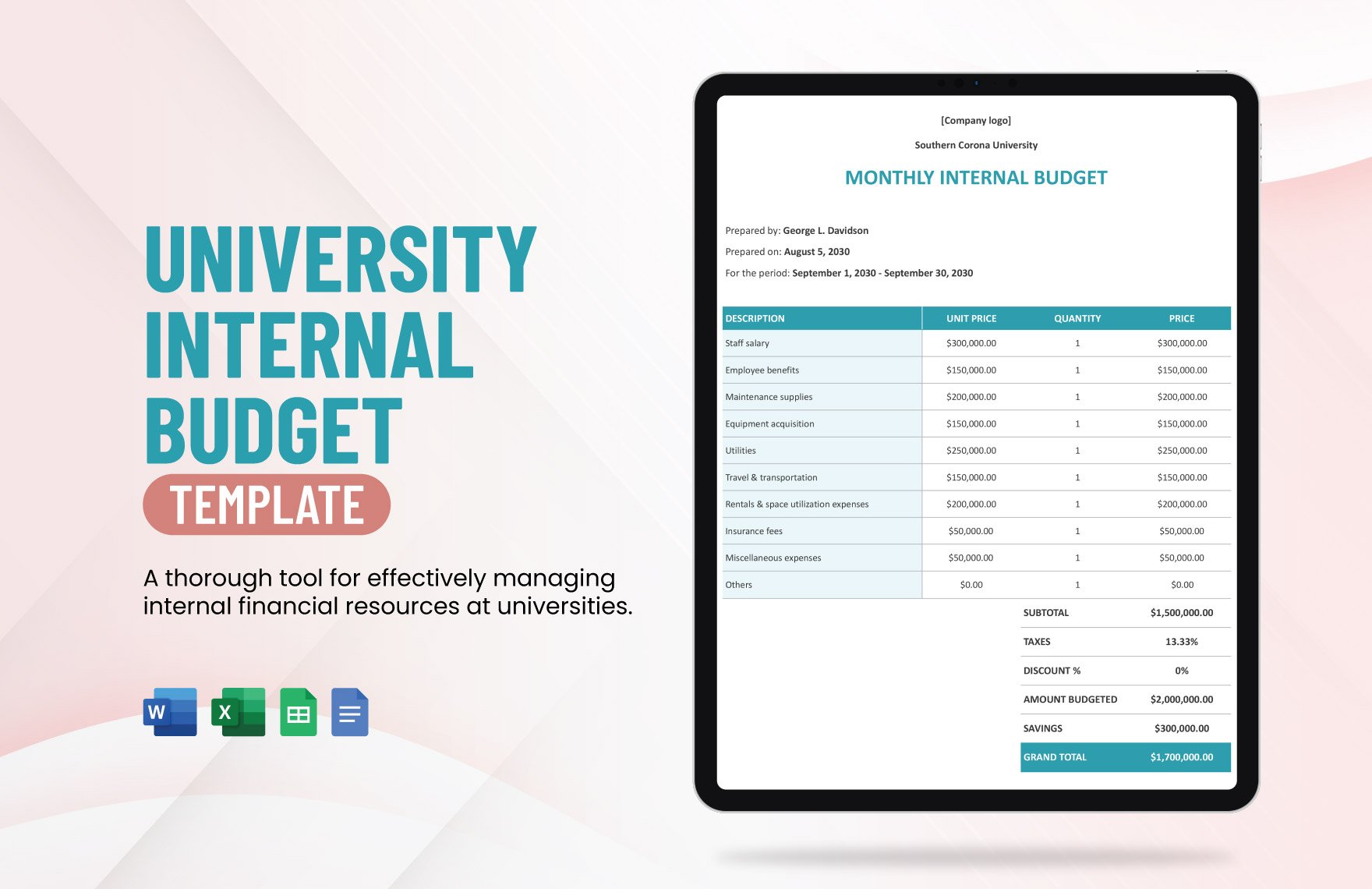

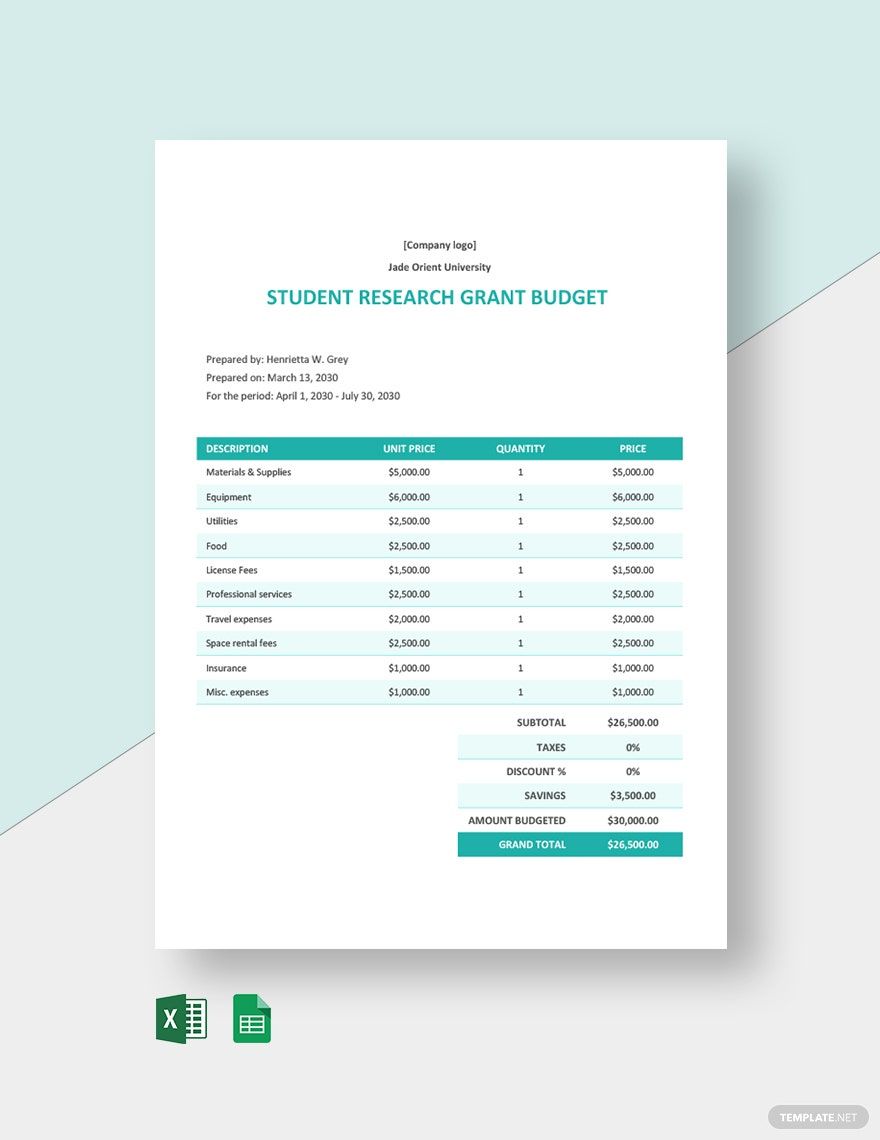

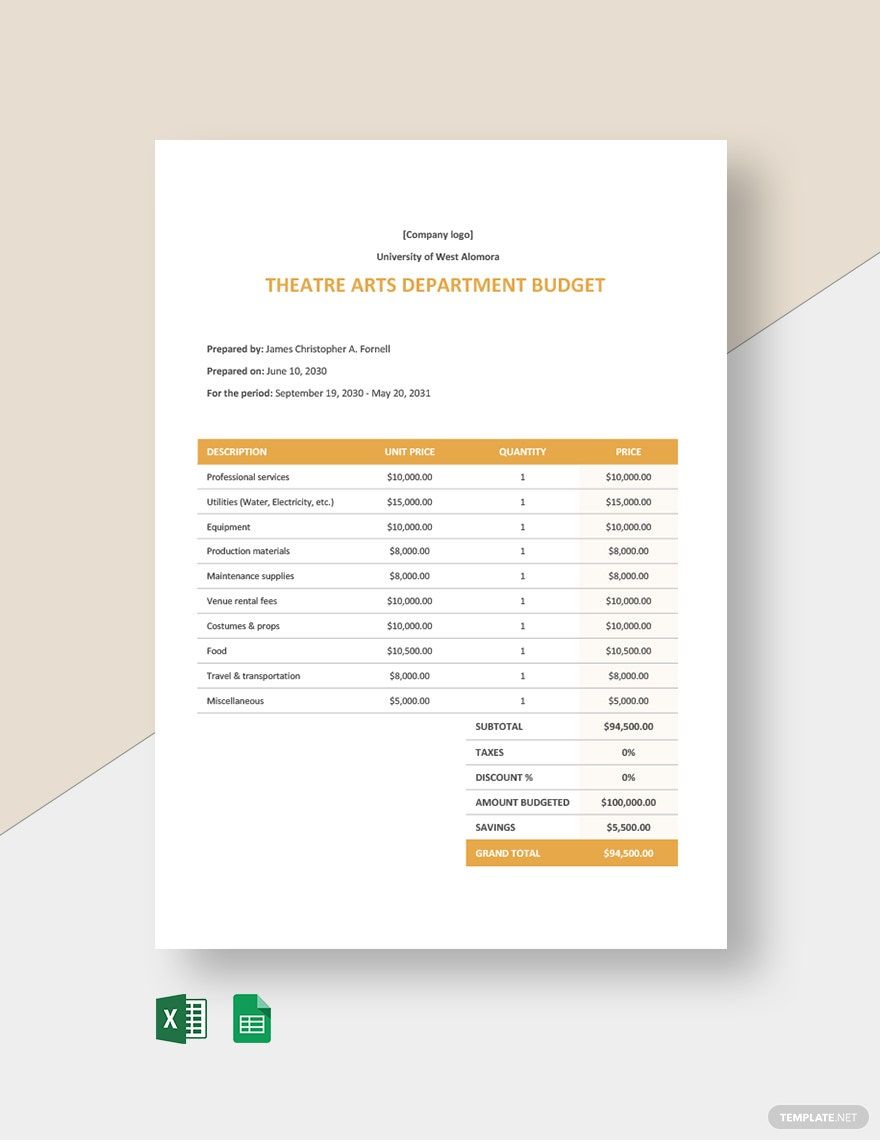

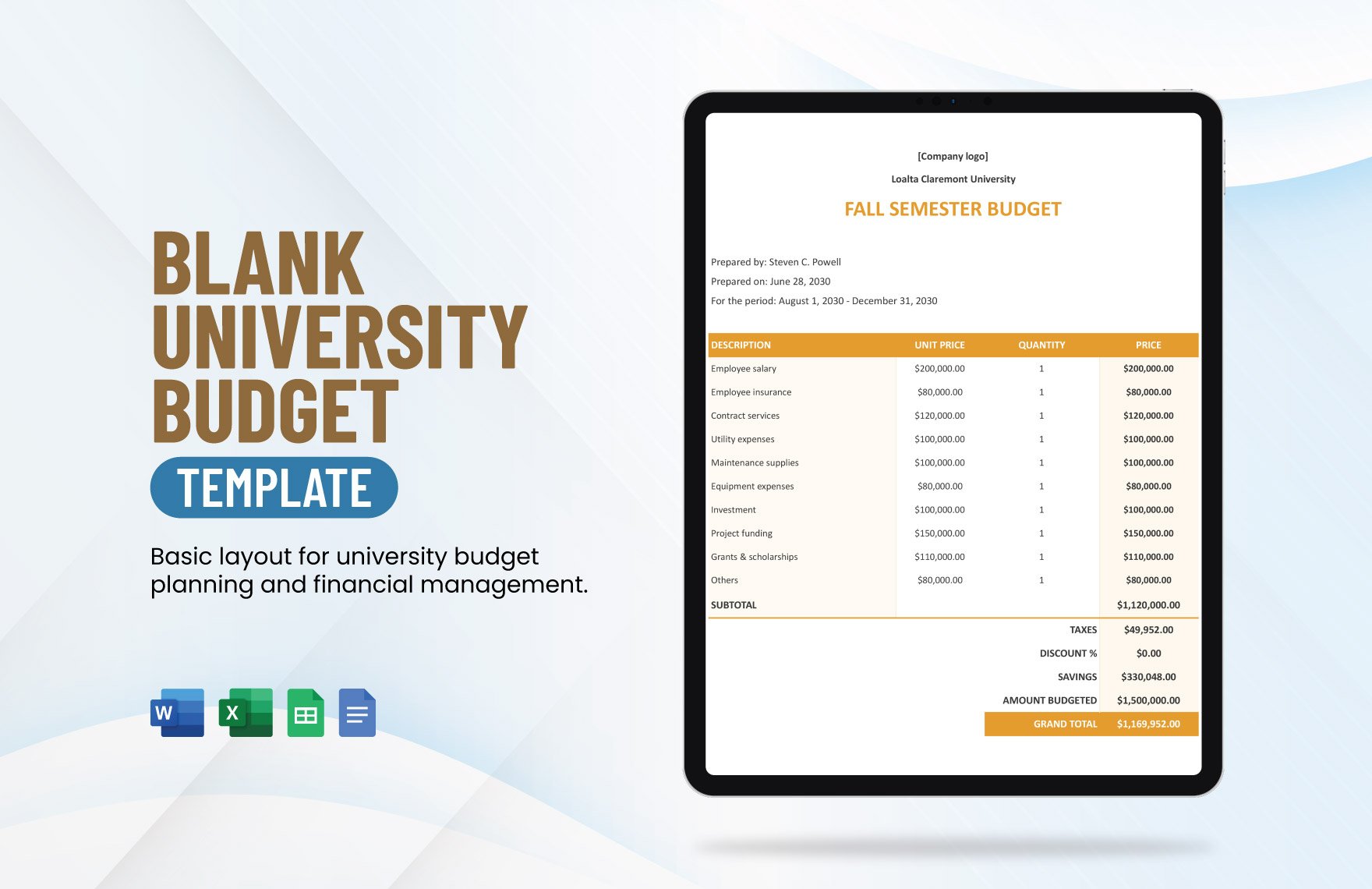

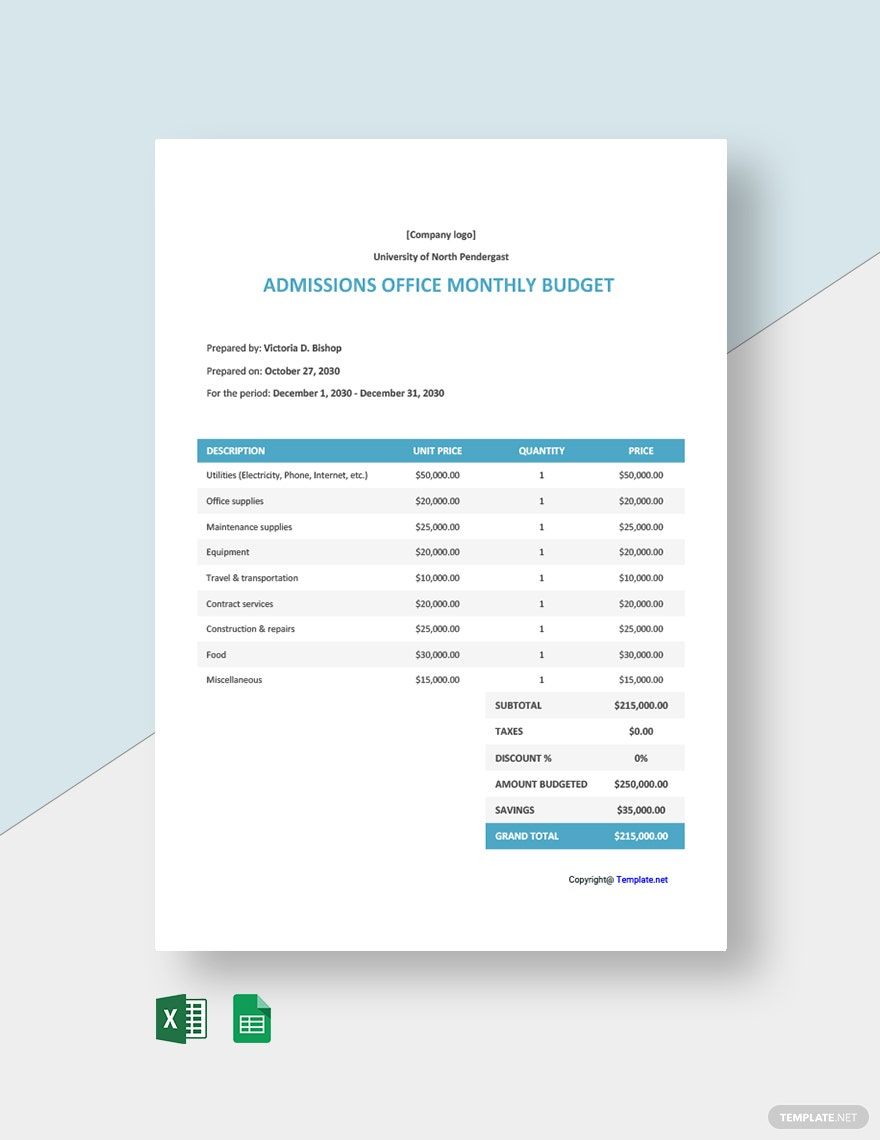

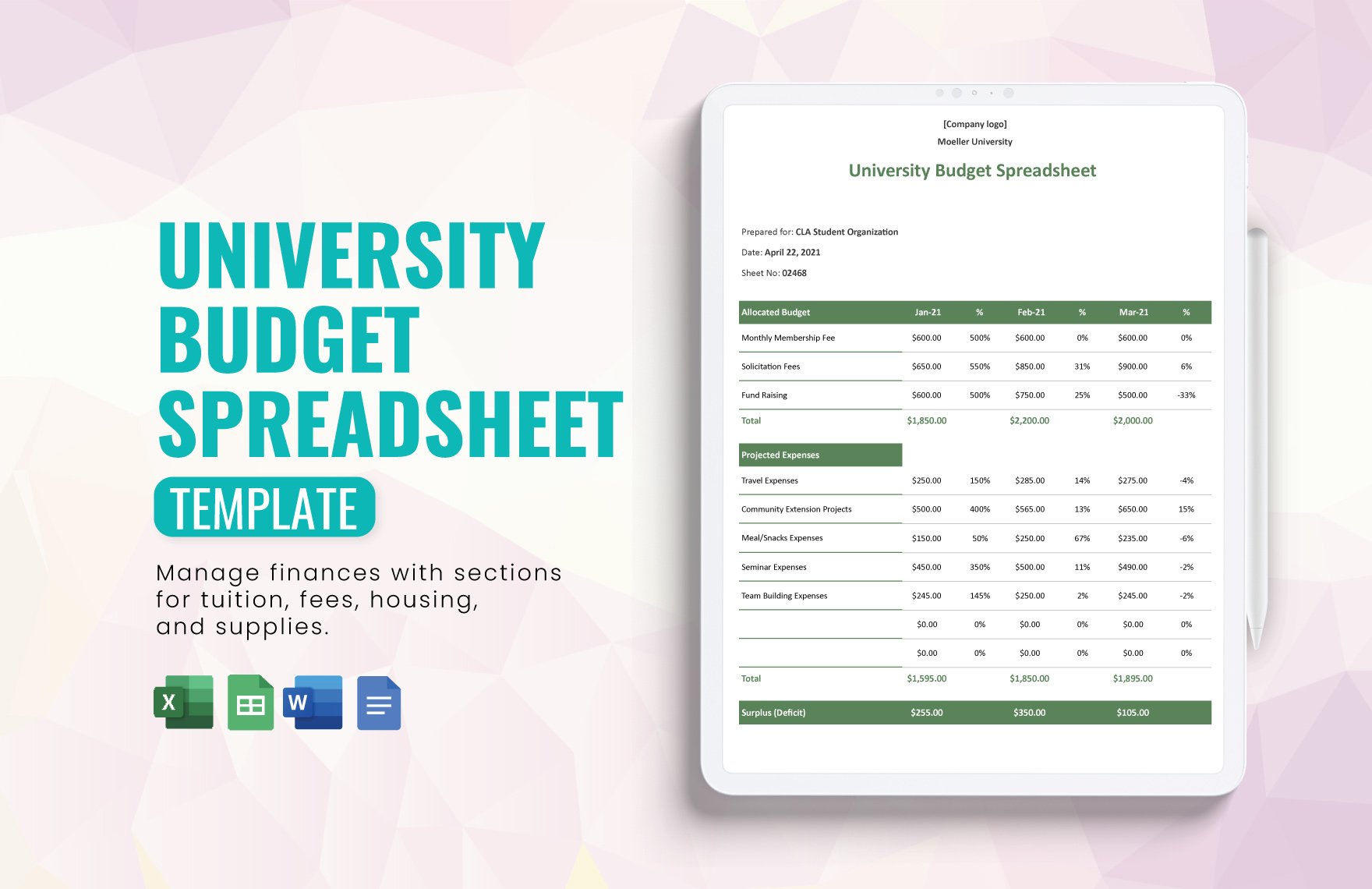

Keep your university administration engaged, enhance financial transparency, and achieve cost efficiency with University Budget Templates by Template.net. Designed for university finance officers, department heads, and budget planners, these templates empower users to streamline financial planning and reporting processes effortlessly. Whether you're organizing your annual budget meetings or seeking to promote a budget review session, these templates provide the structure you need. With pre-included elements like department-wise budget allocations and fiscal year summaries, alongside convenient customization of date ranges and expenditure categories, these templates eliminate any design barriers. Their intuitive layouts allow for professional-grade presentation without any prior design skills, and adaptable formats make them perfect for digital or printed distribution.

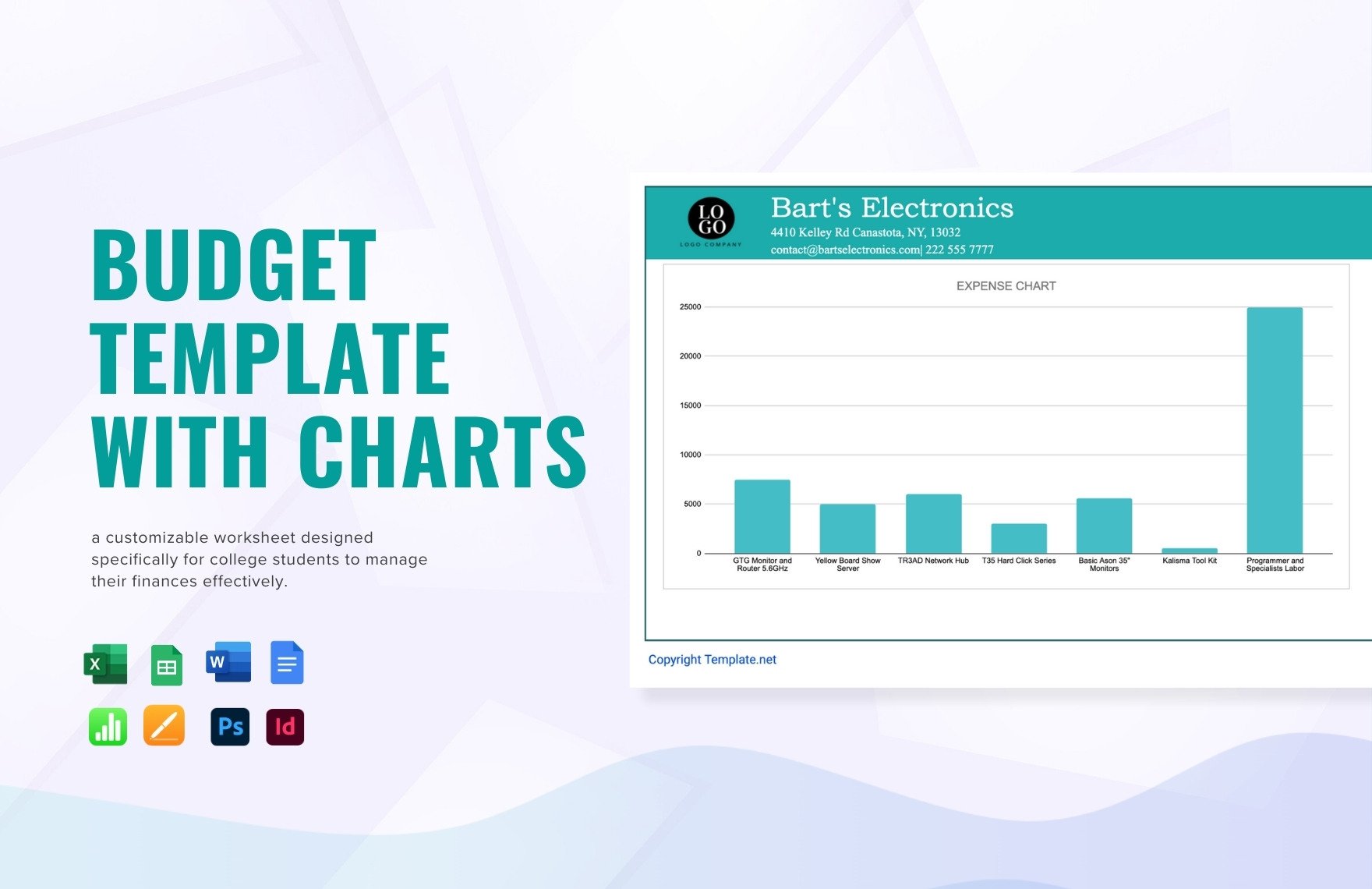

Discover the many University Budget Templates we have on hand to simplify your financial planning. Choose from an array of templates, swap in your specific departmental figures, and adjust colors and fonts to match your institution’s branding. Add an advanced touch by dragging and dropping downloadable charts and graphs, or even incorporating AI-powered recommendations for budget adjustments. The possibilities are endless and require no expert skills. With regularly updated templates and new designs added weekly, you’ll always stay ahead of the curve. Once you’ve customized your template to perfection, download or share them via link, print, email, or export for immediate implementation into your workflow.