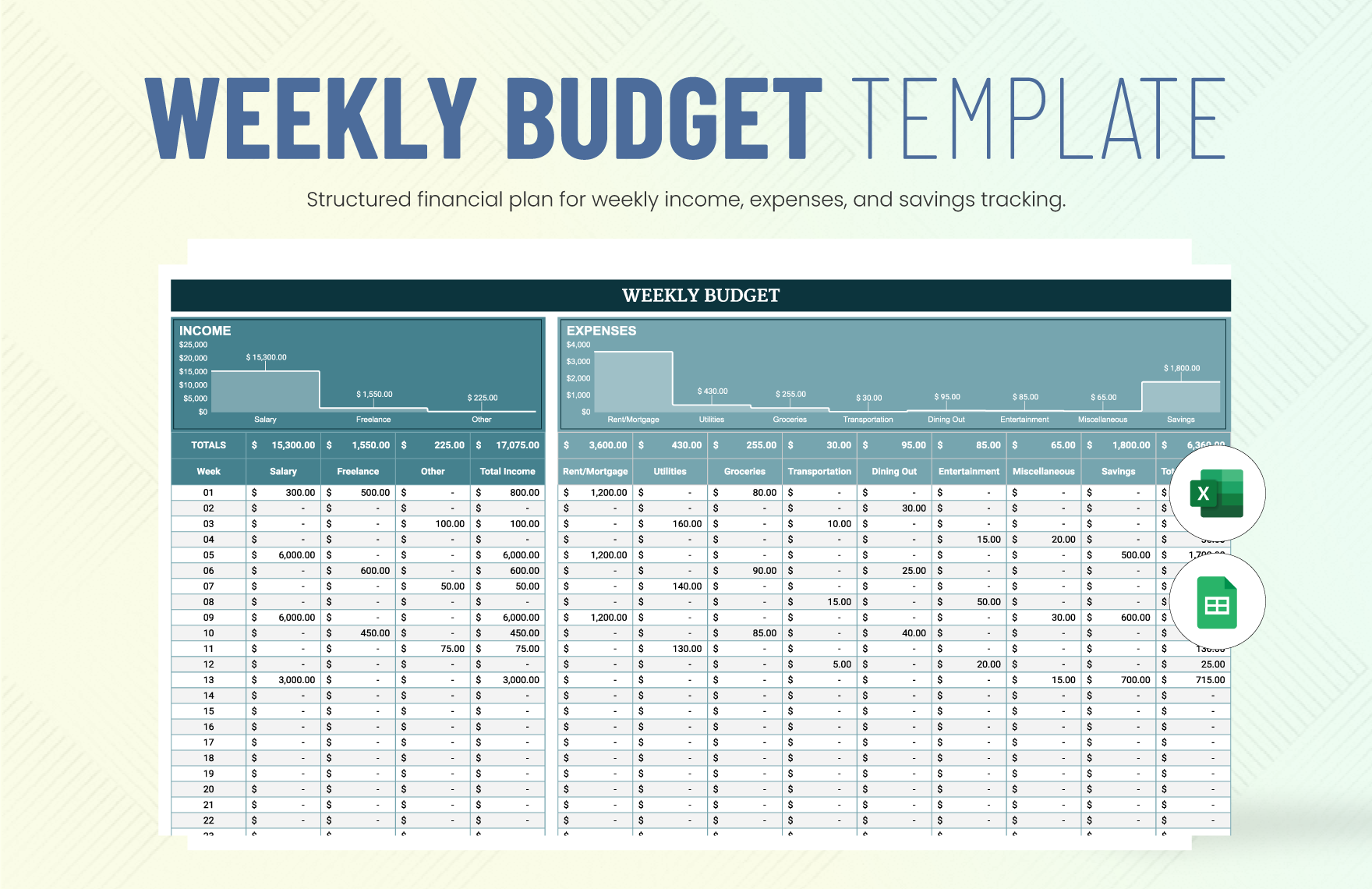

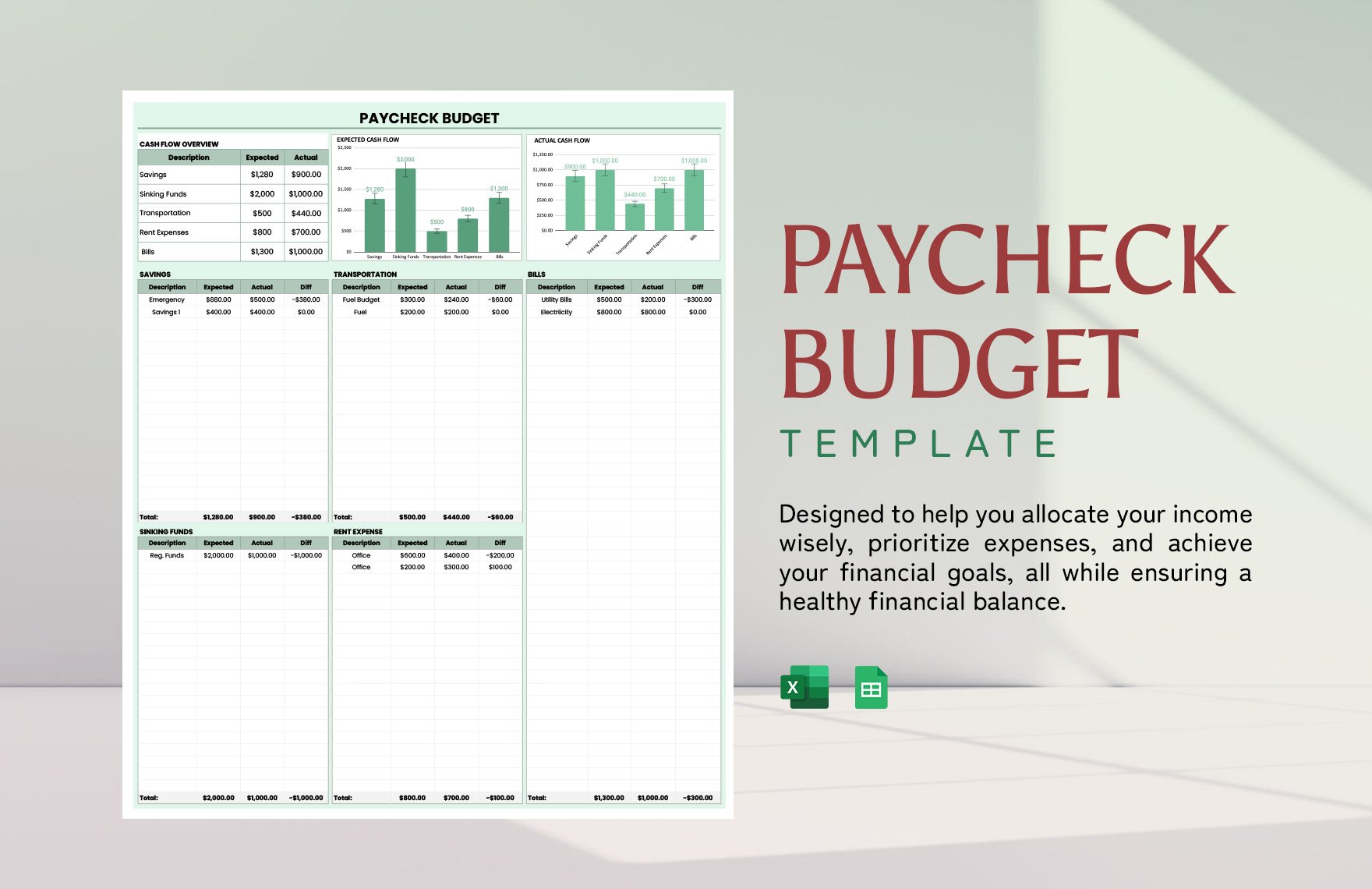

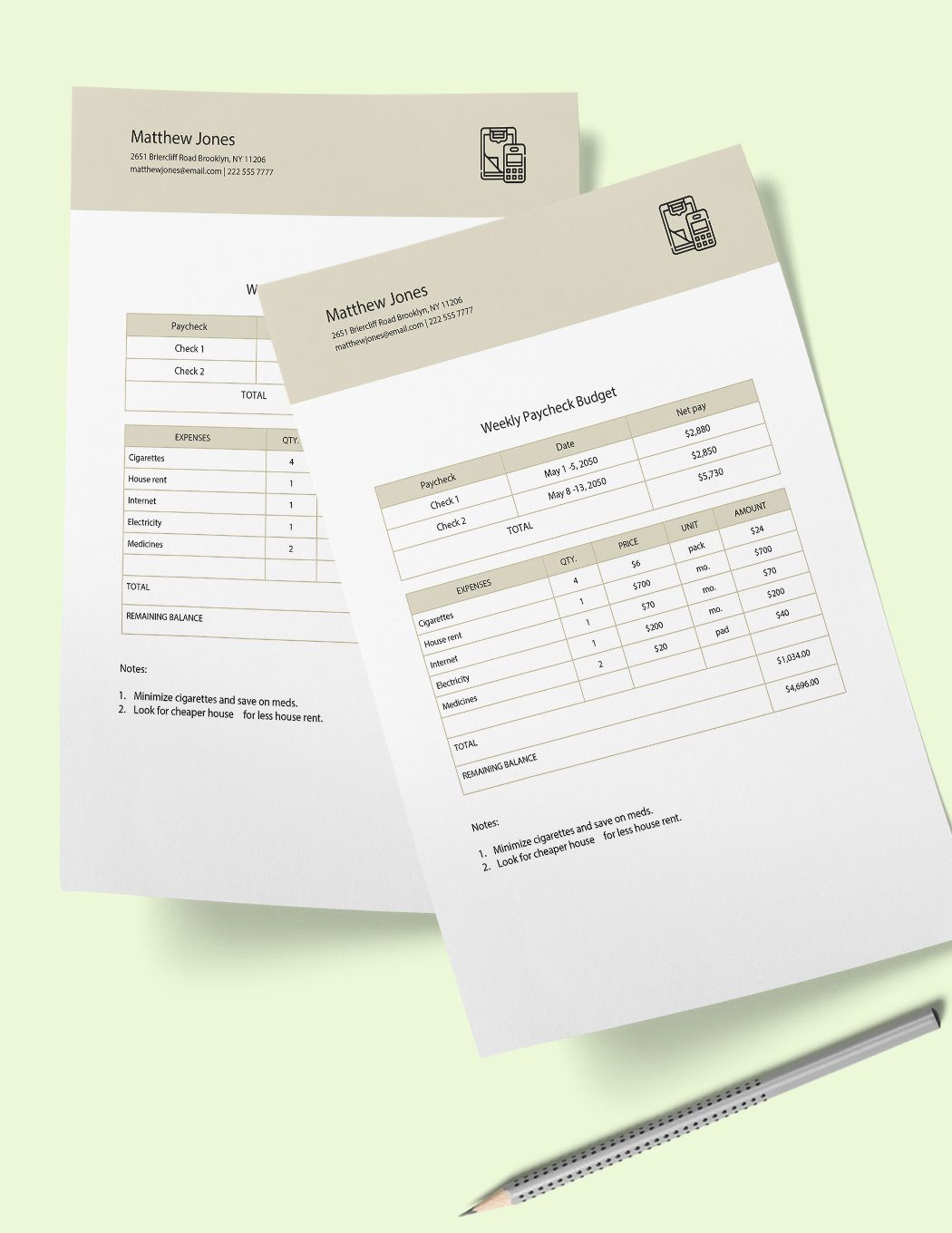

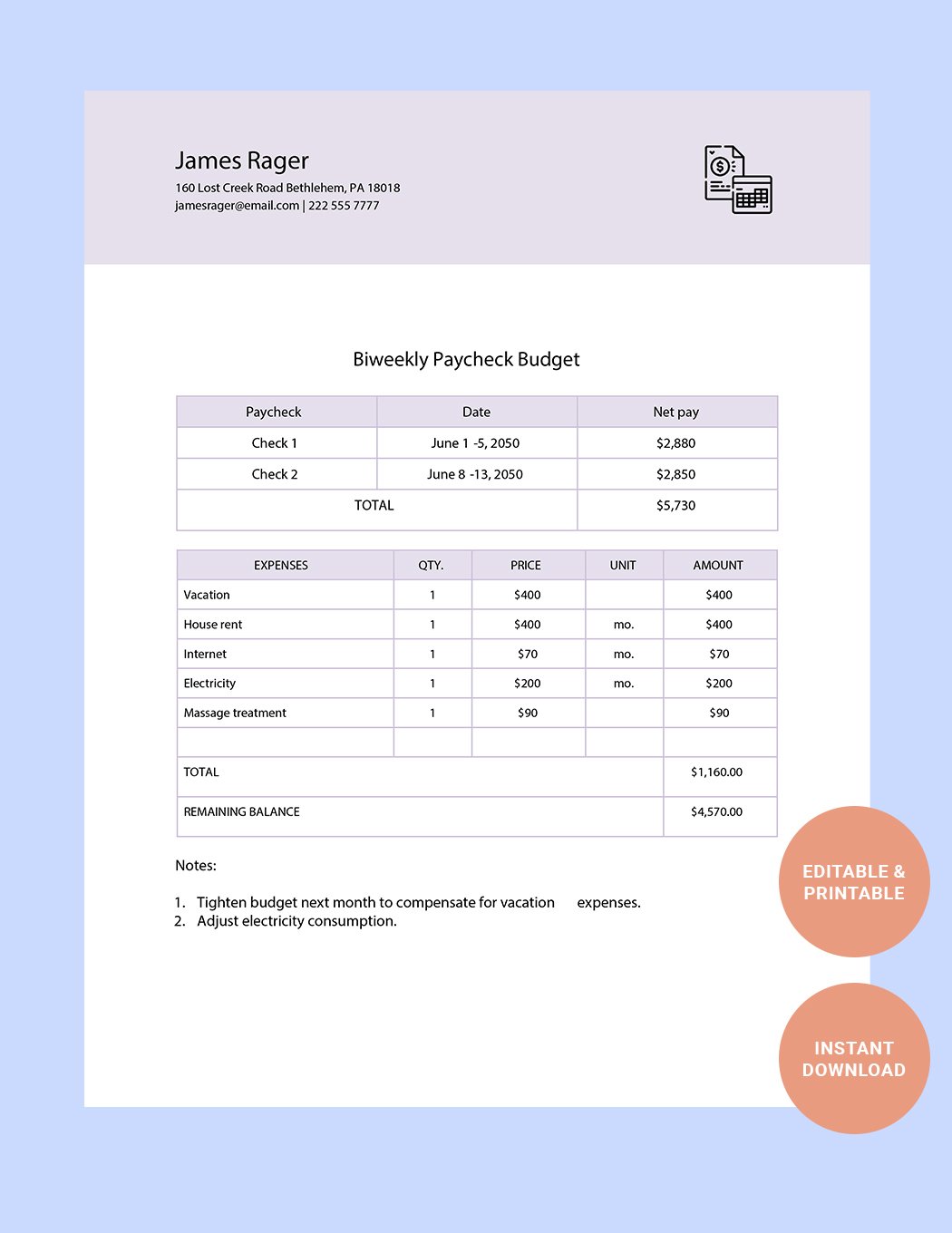

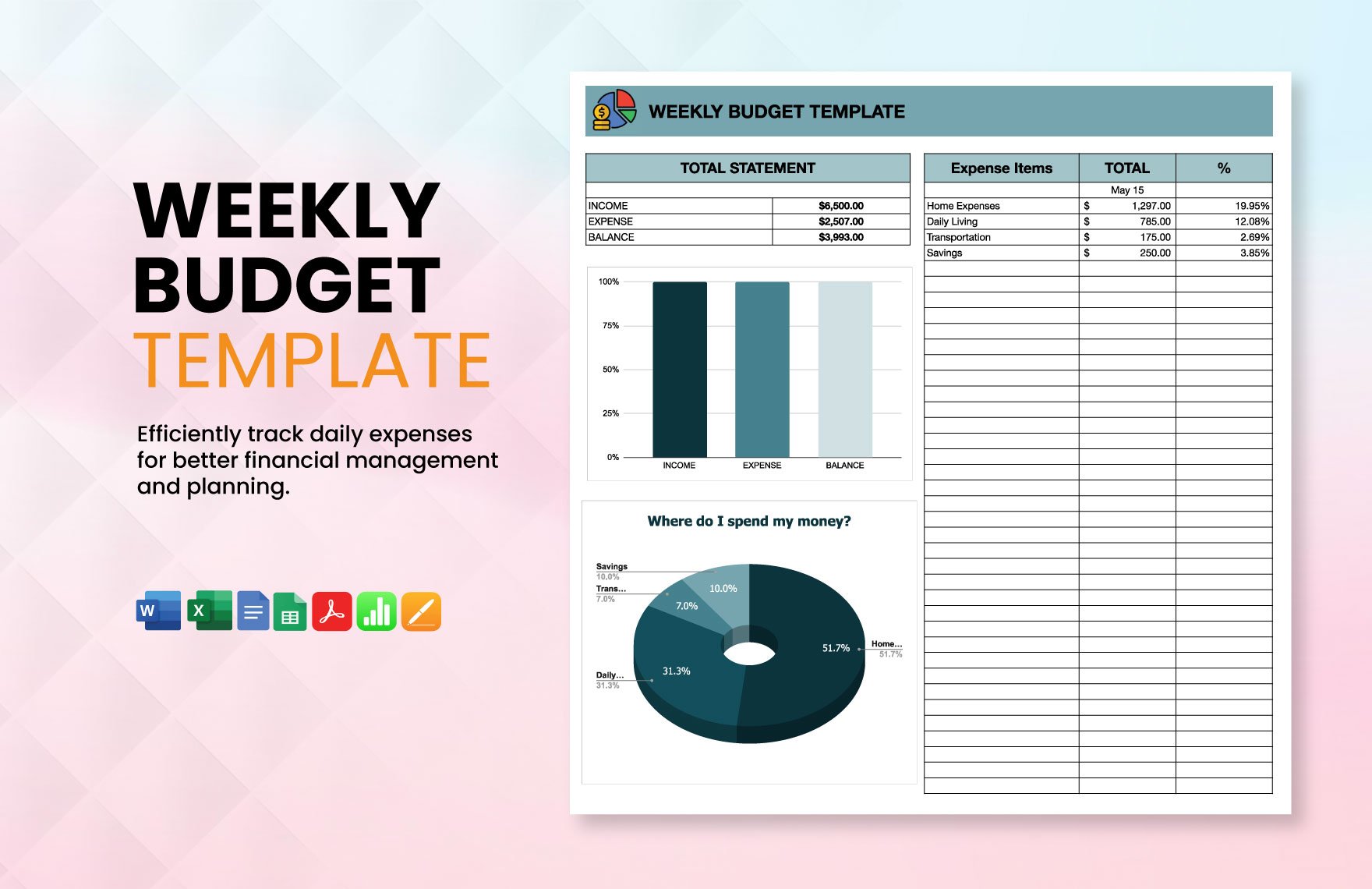

Bring Your Financial Goals to Life with Weekly Budget Templates from Template.net

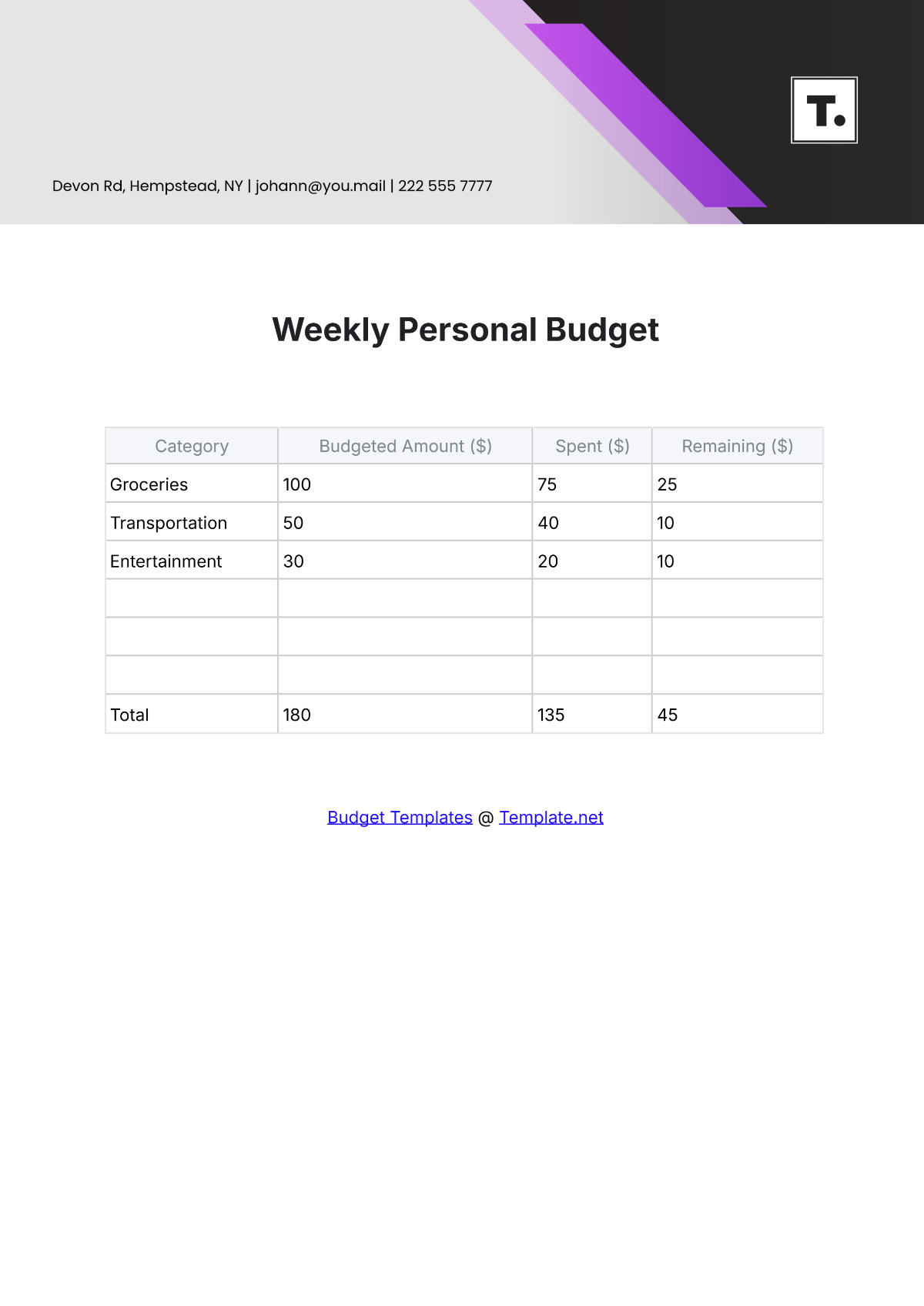

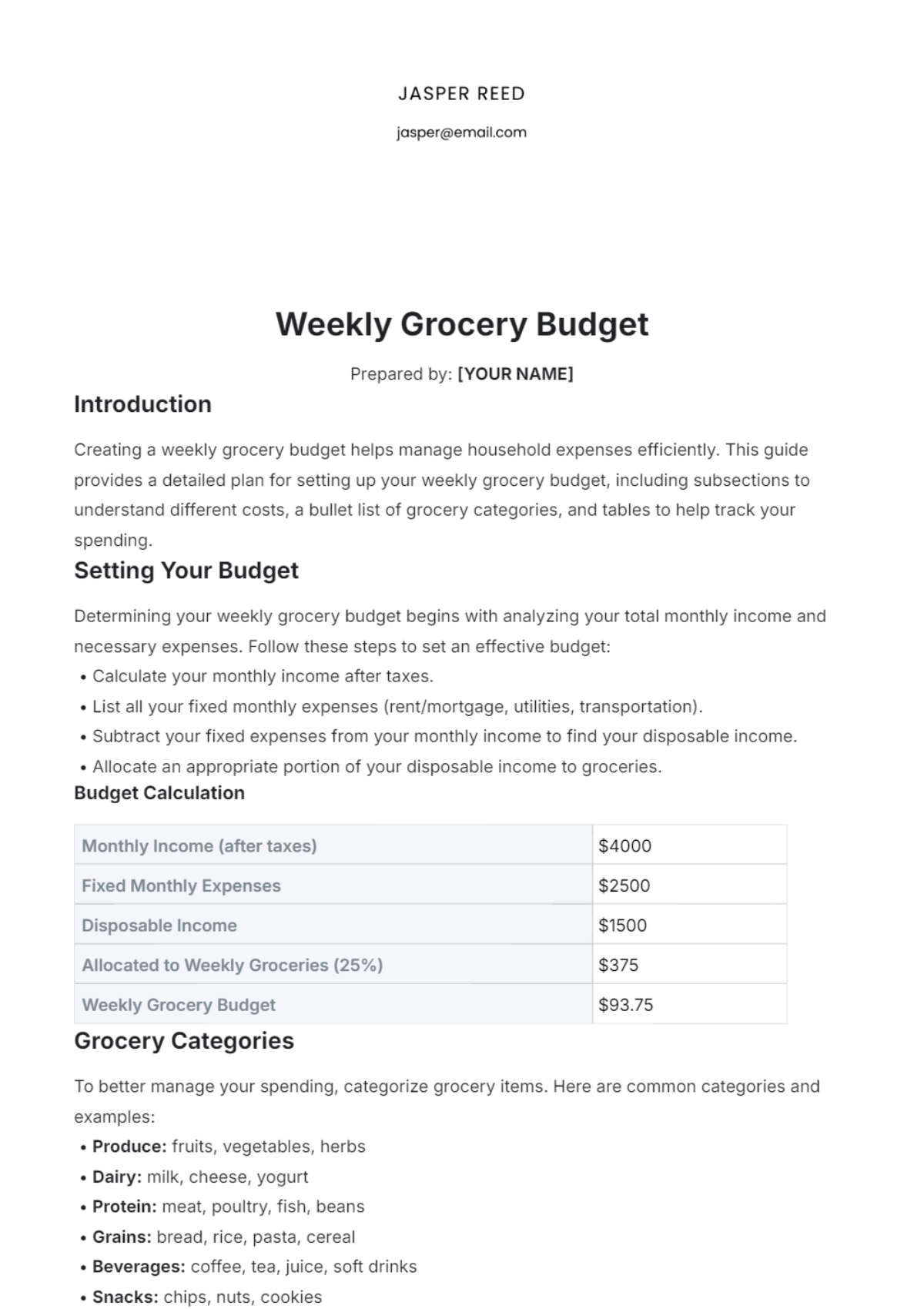

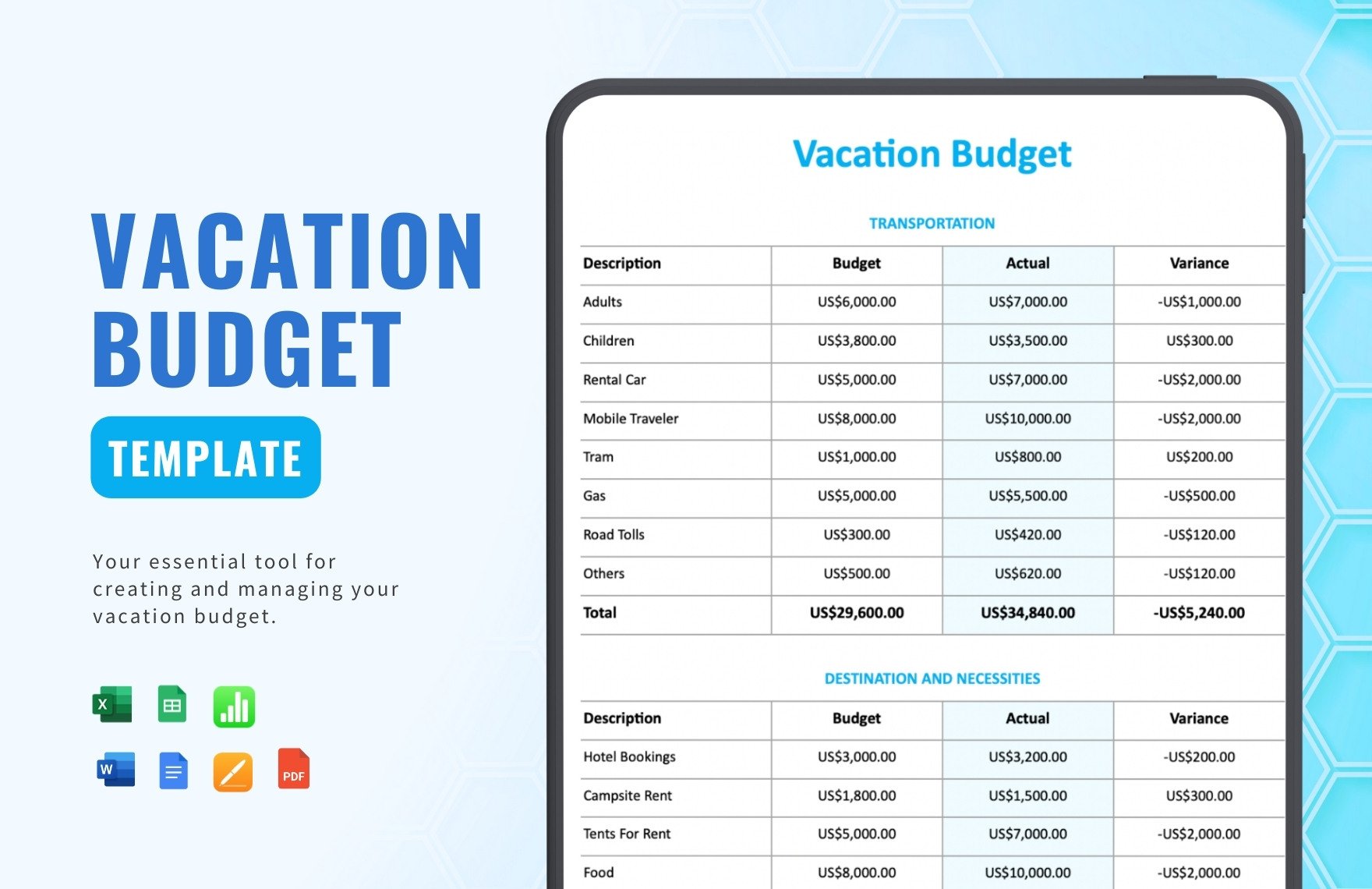

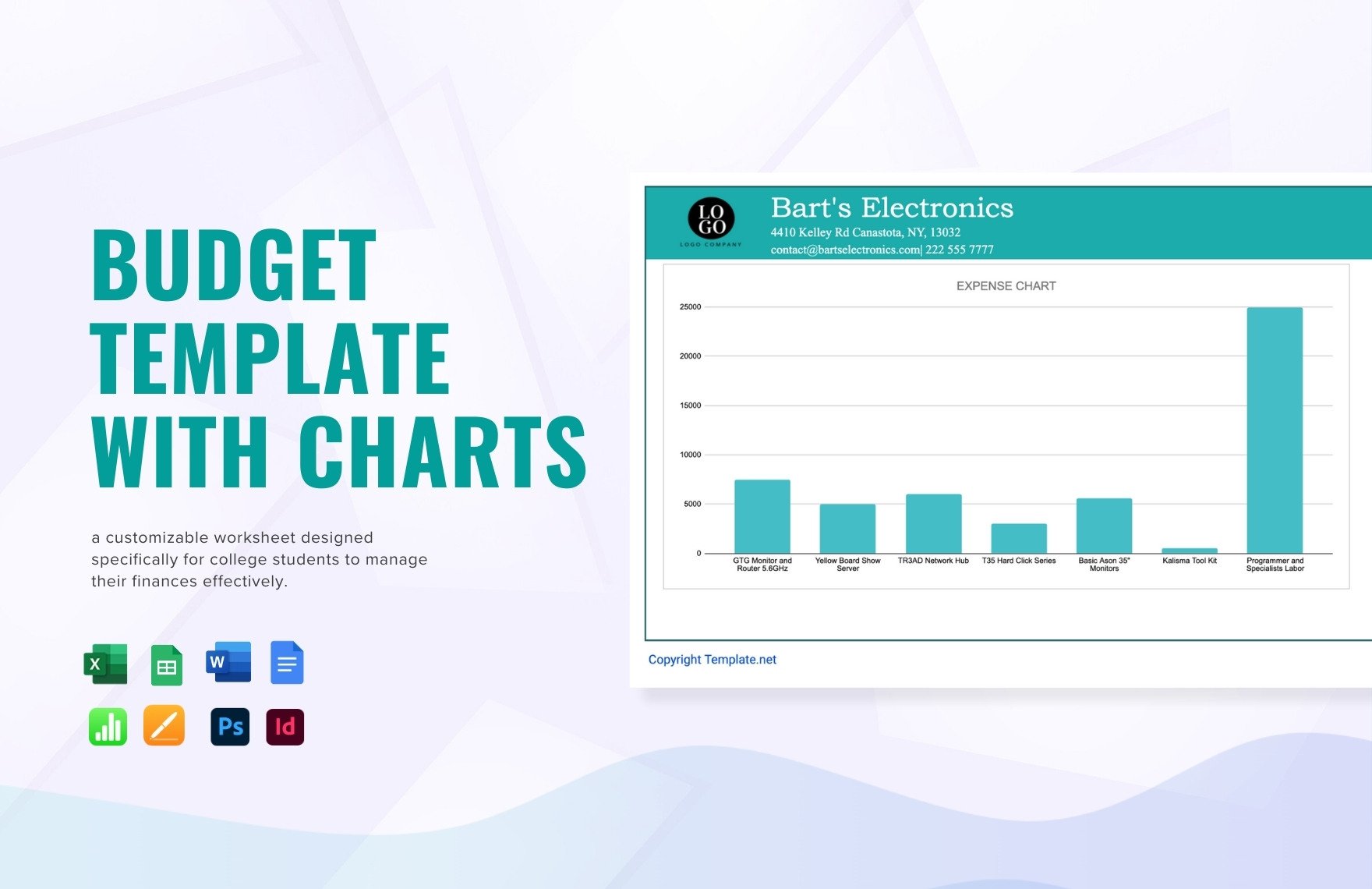

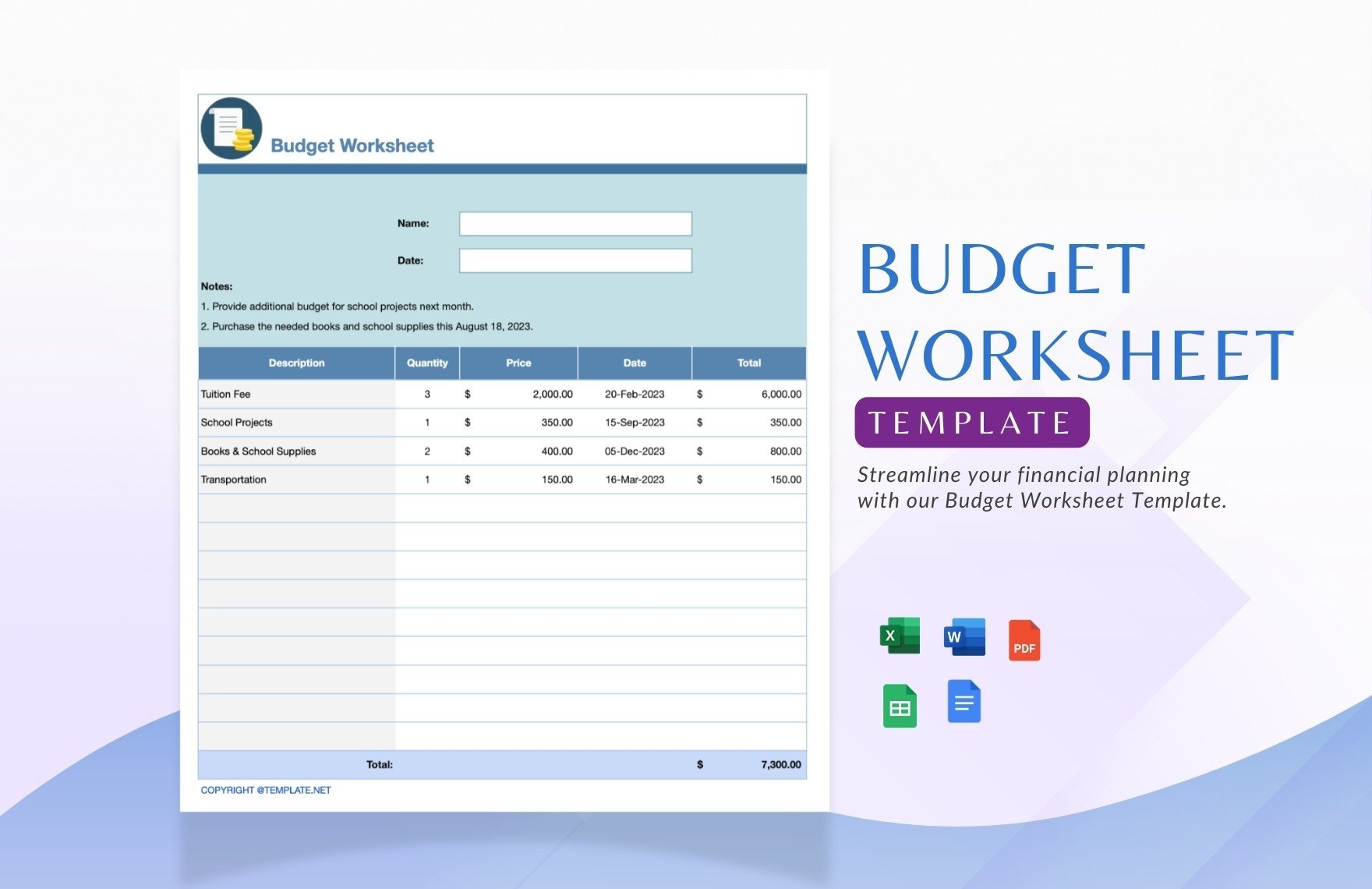

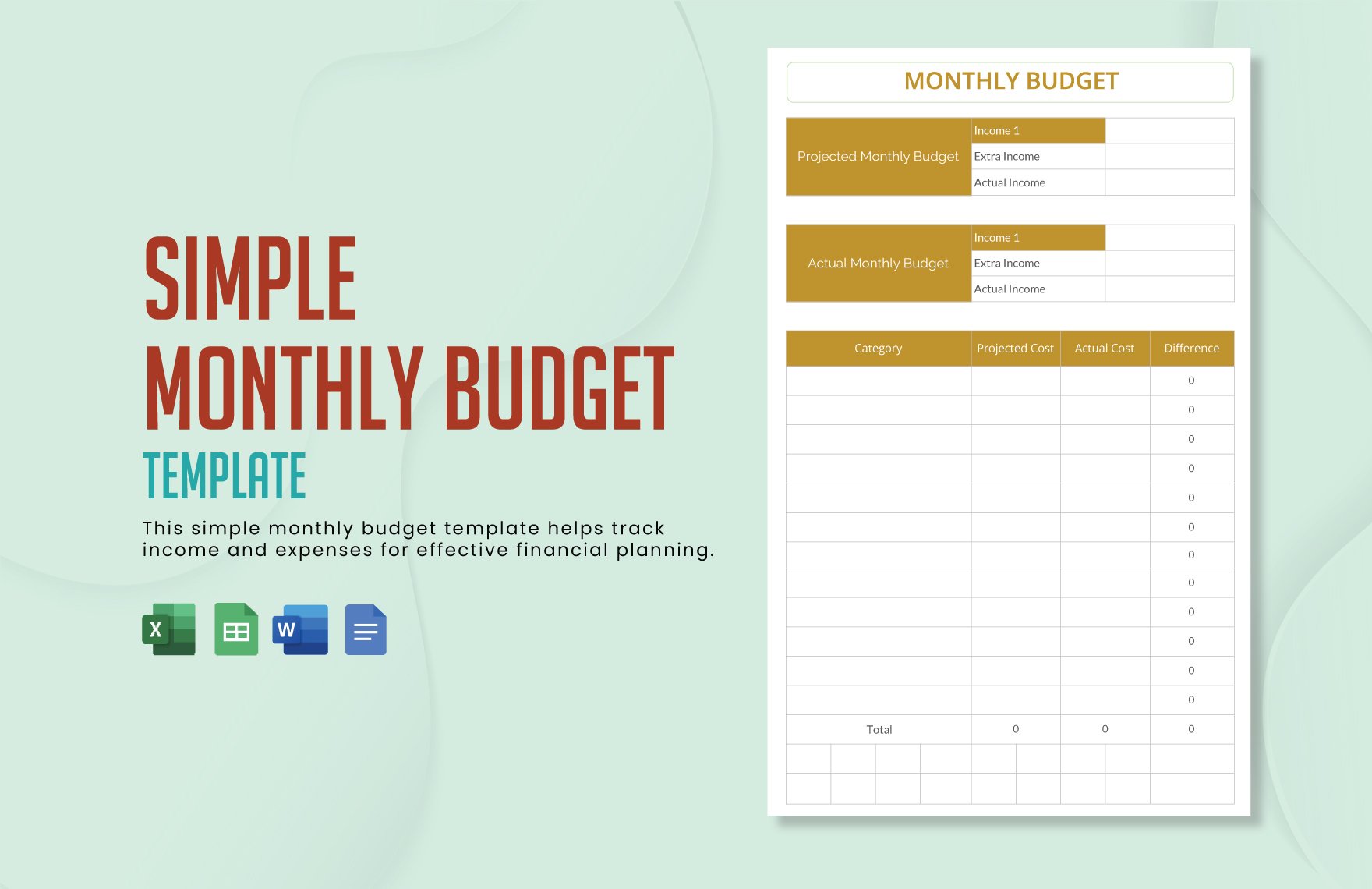

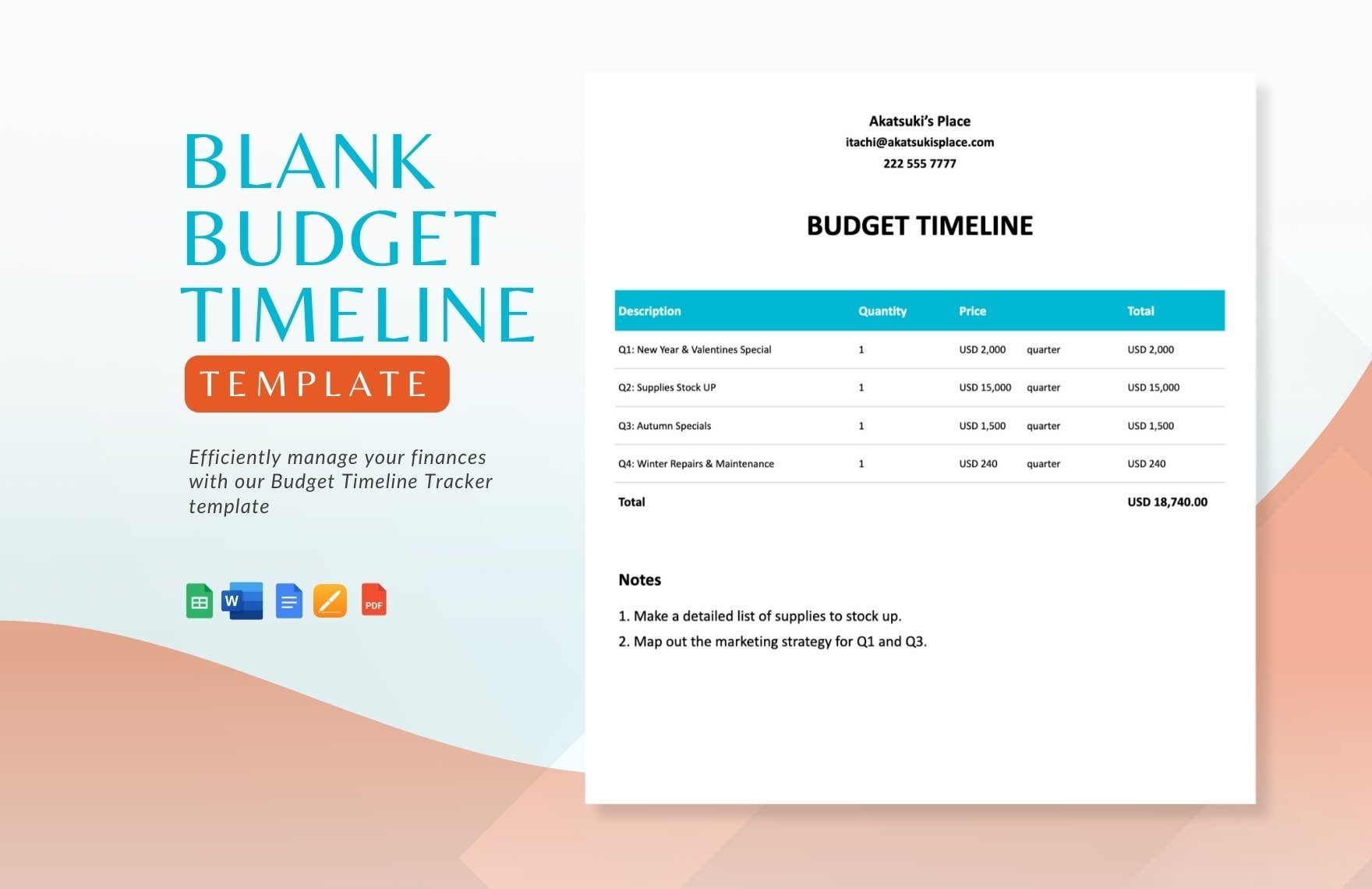

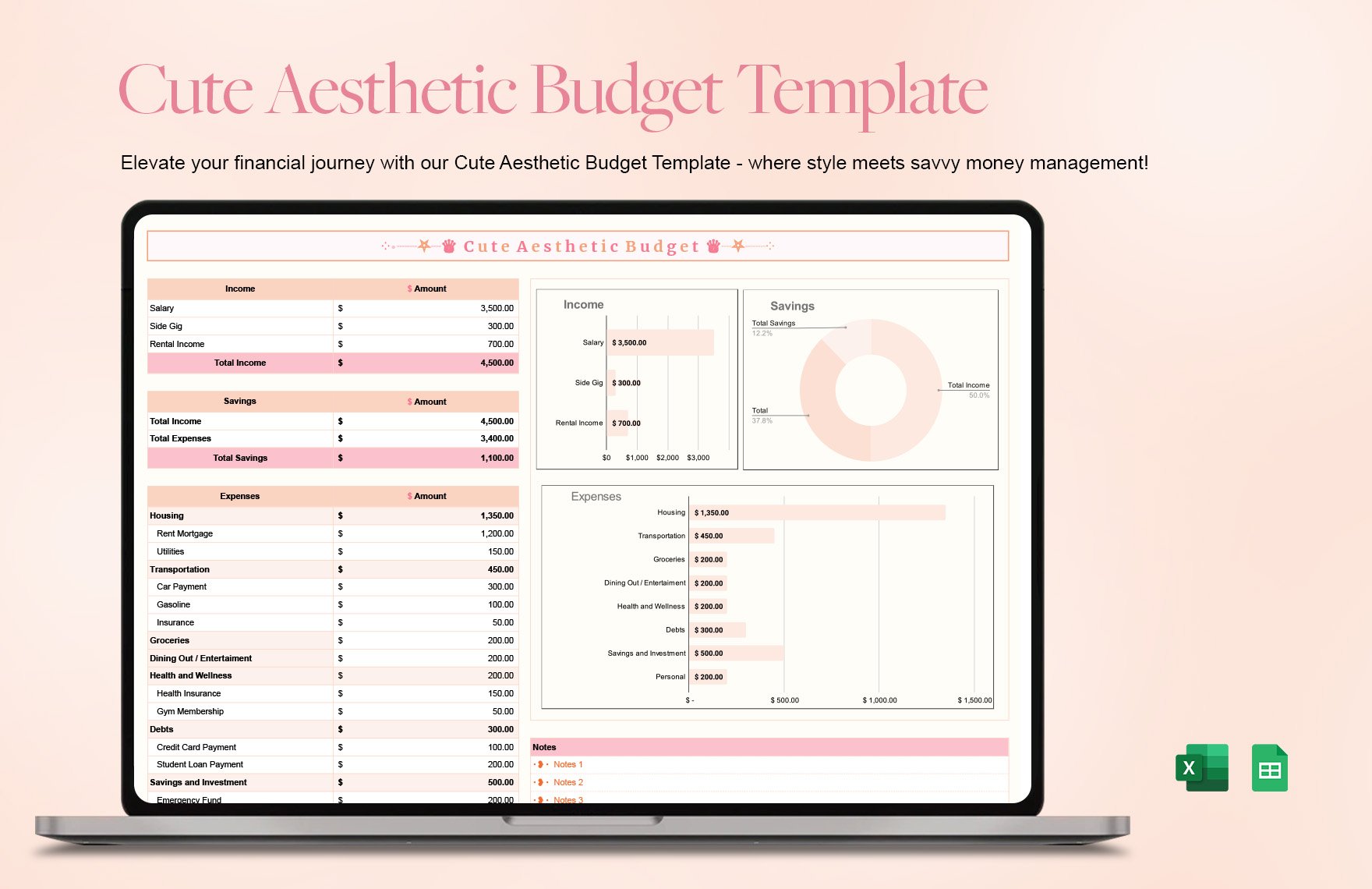

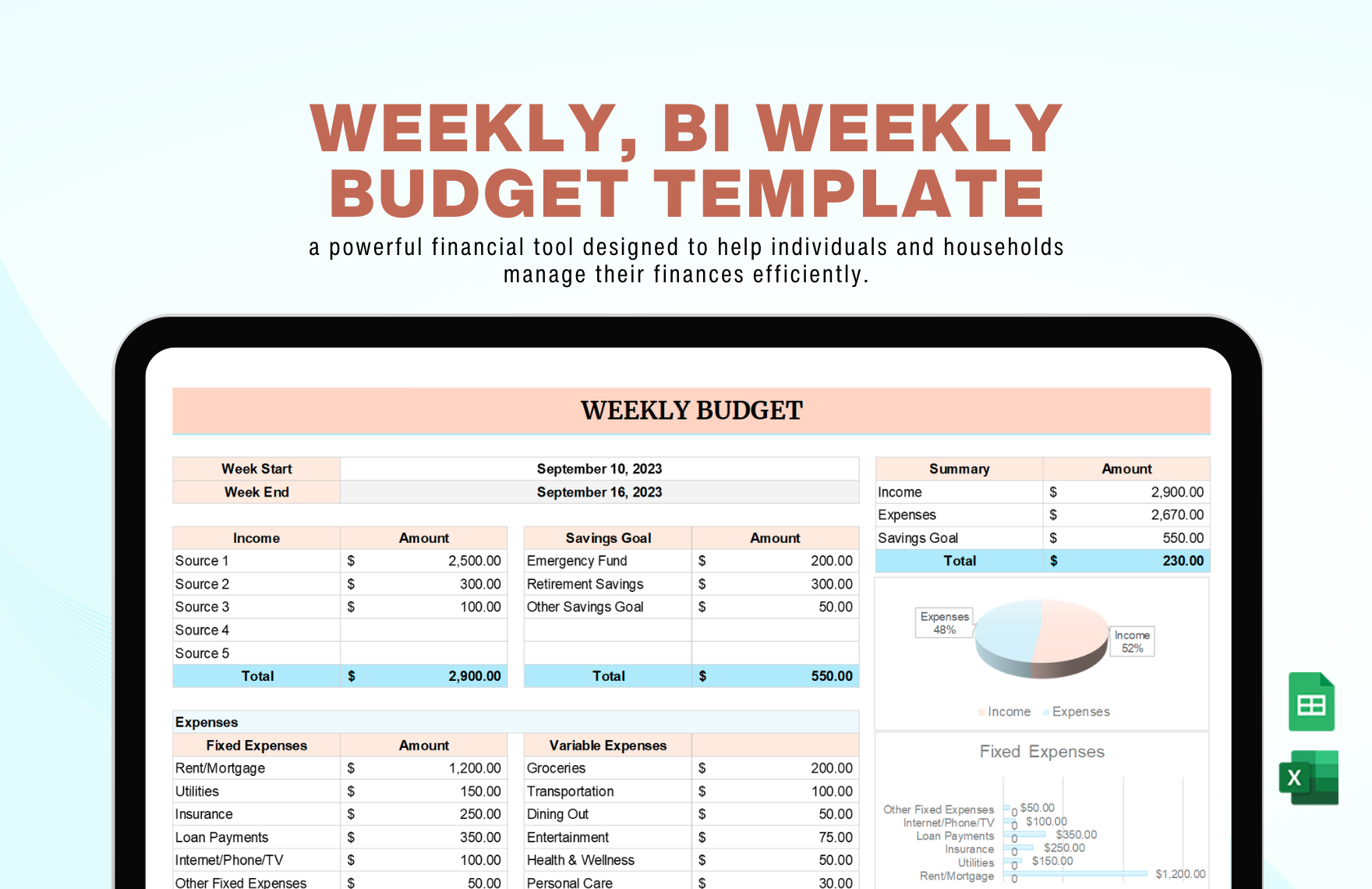

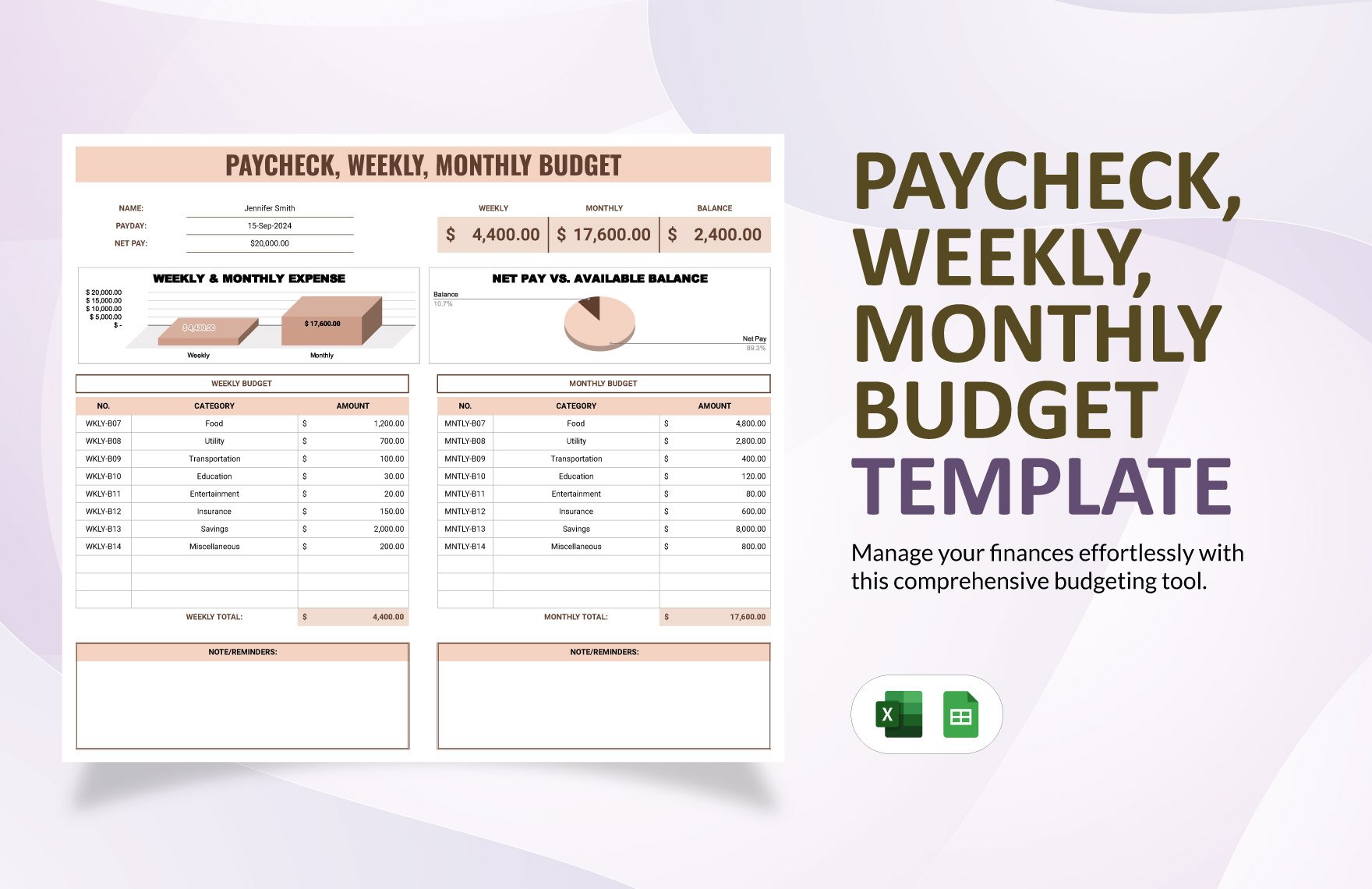

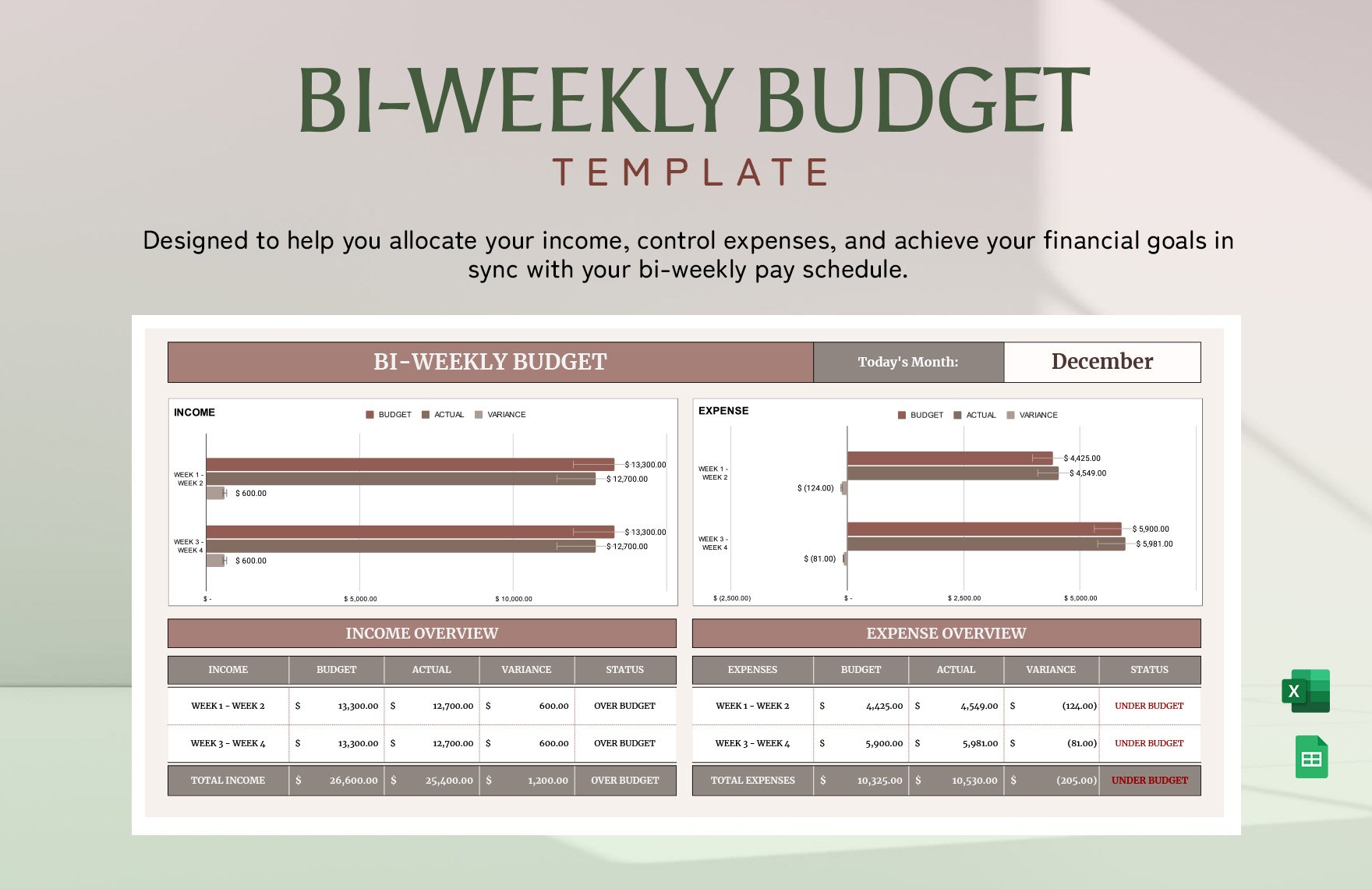

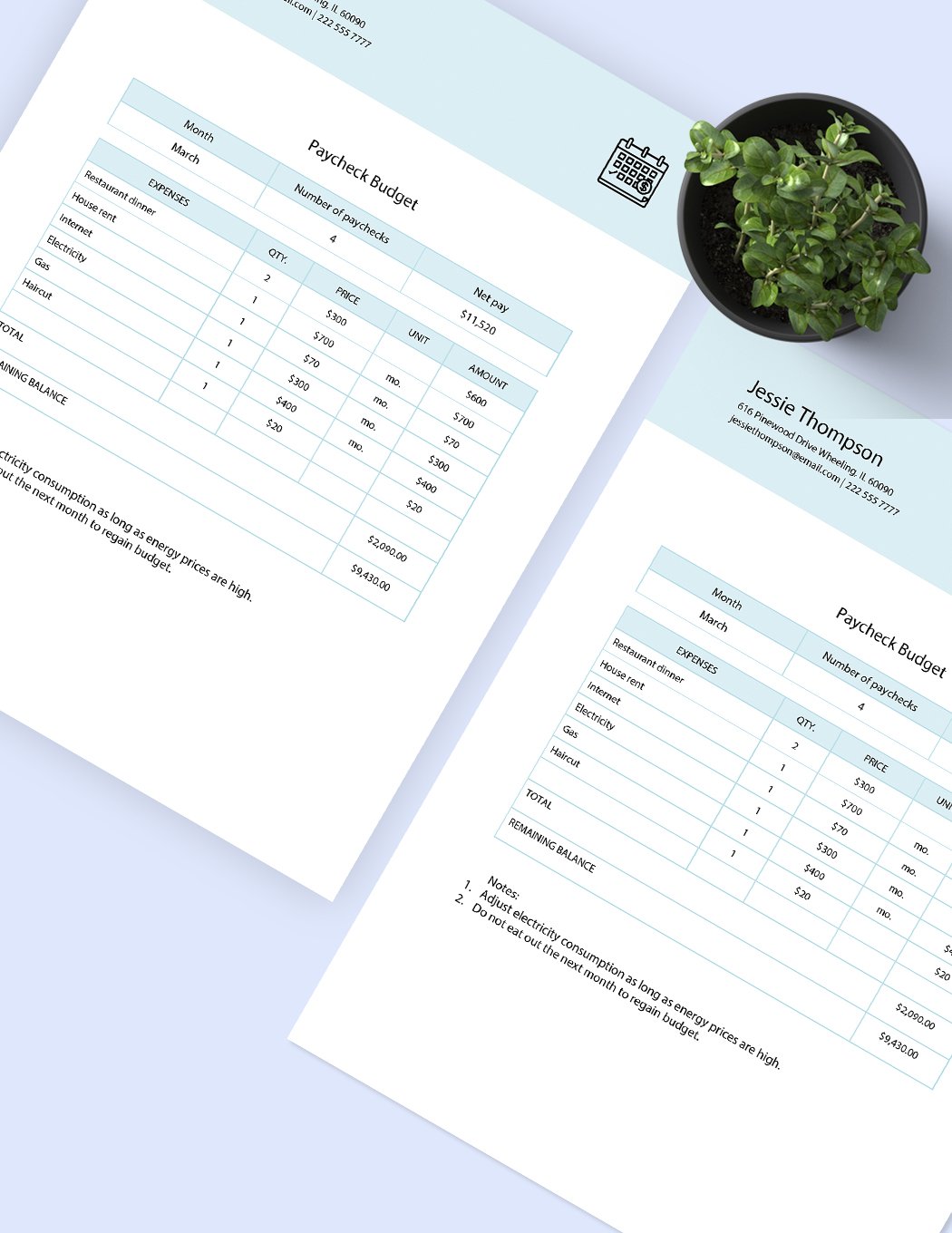

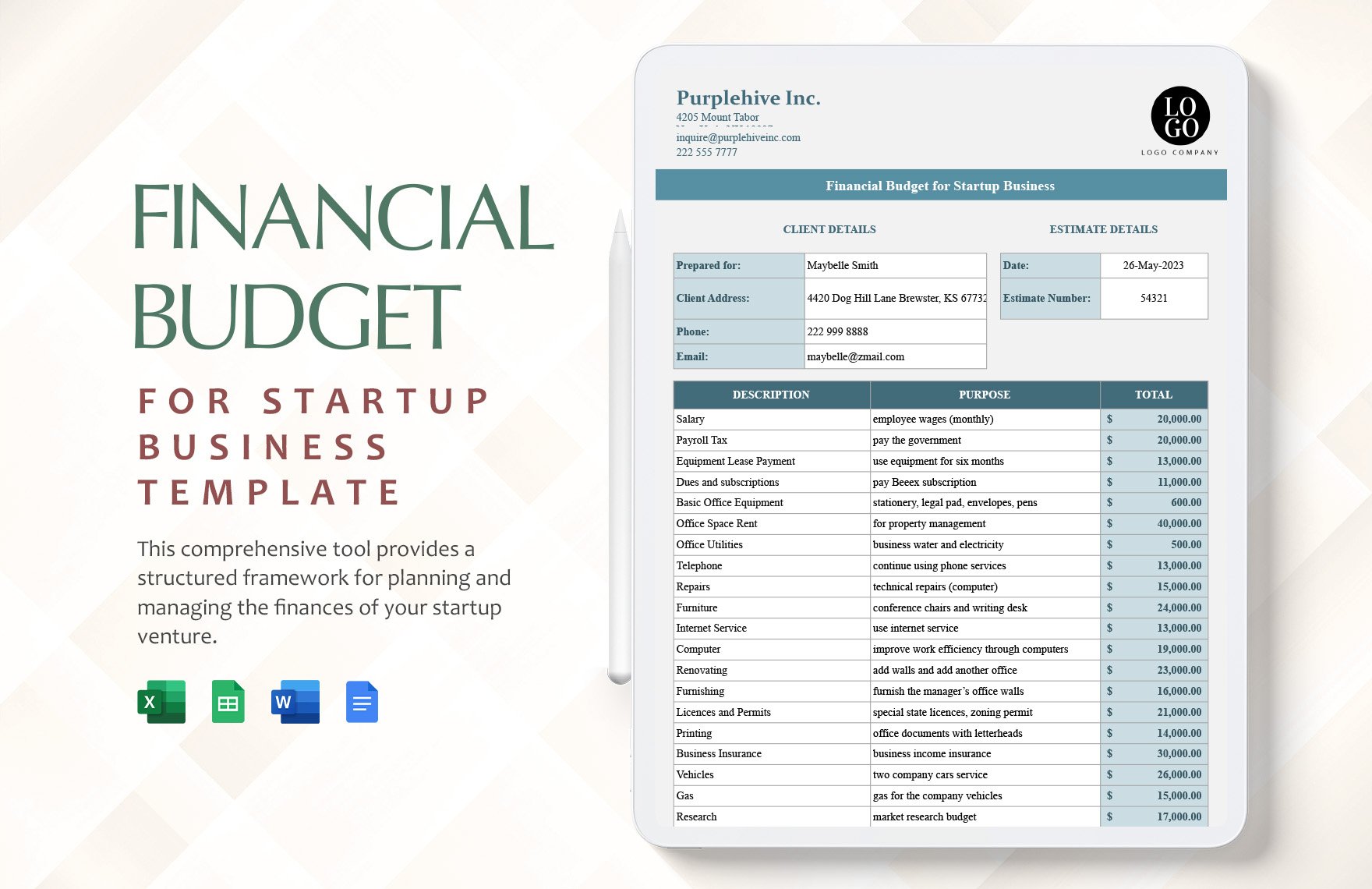

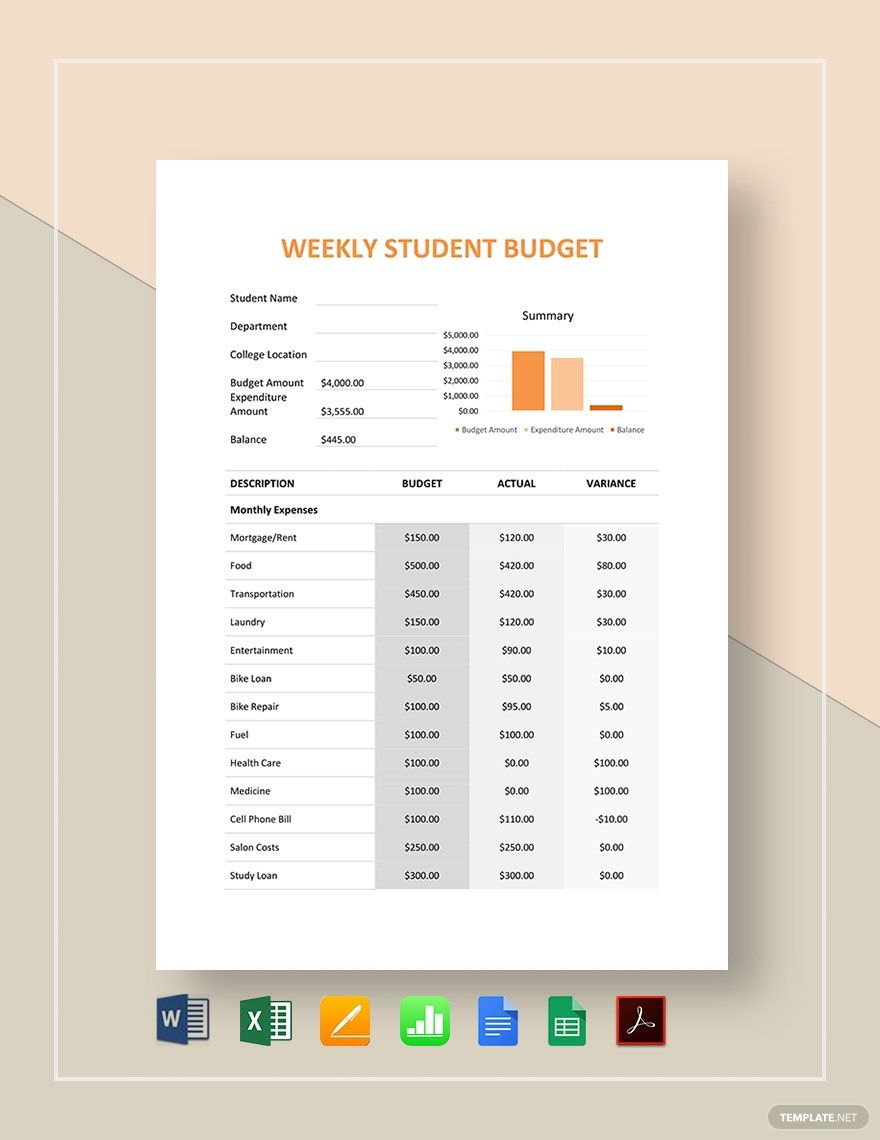

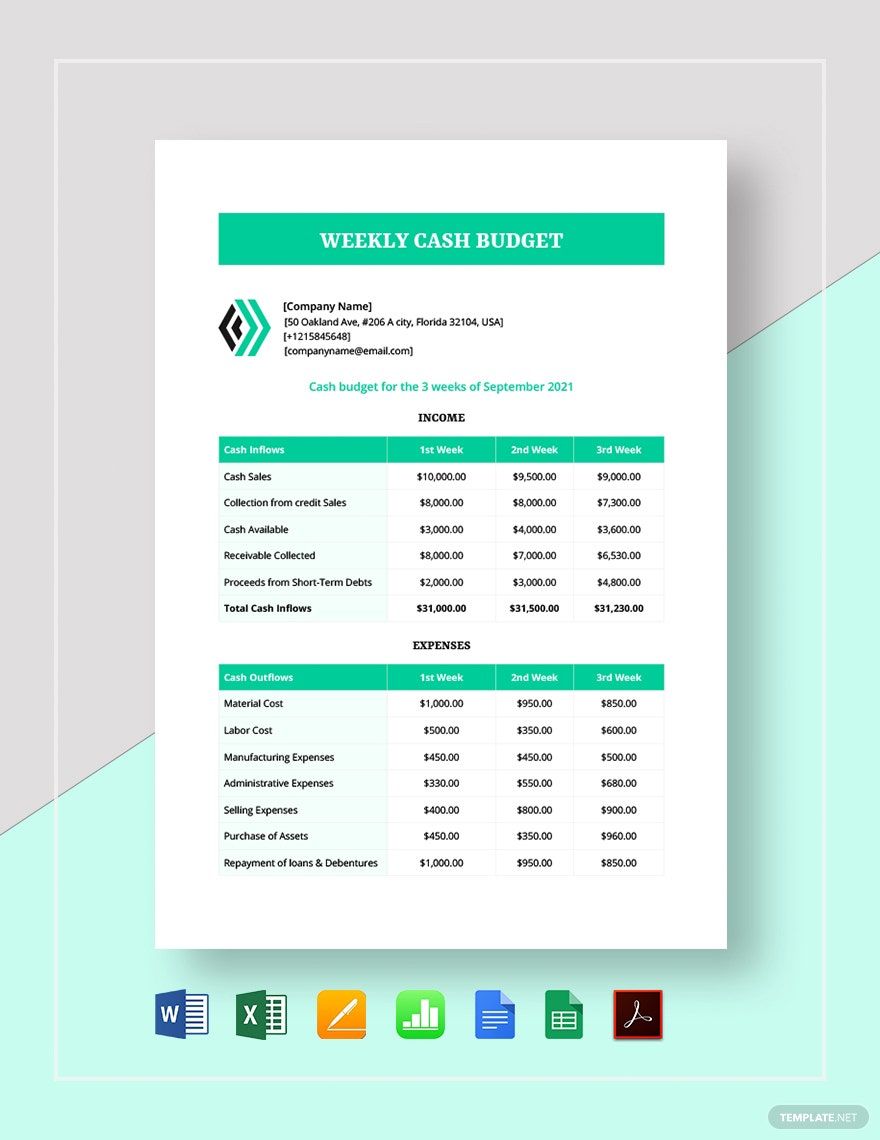

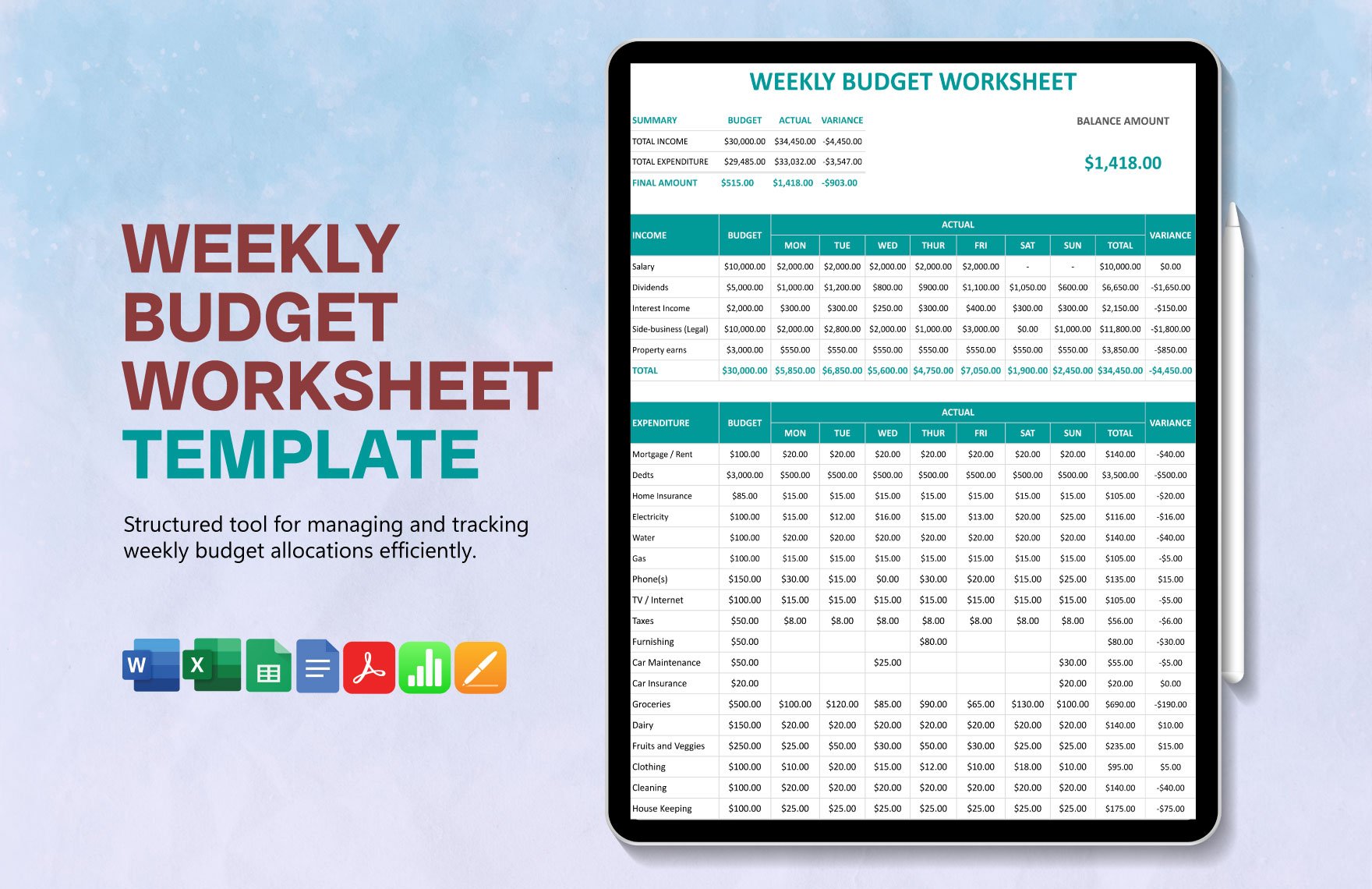

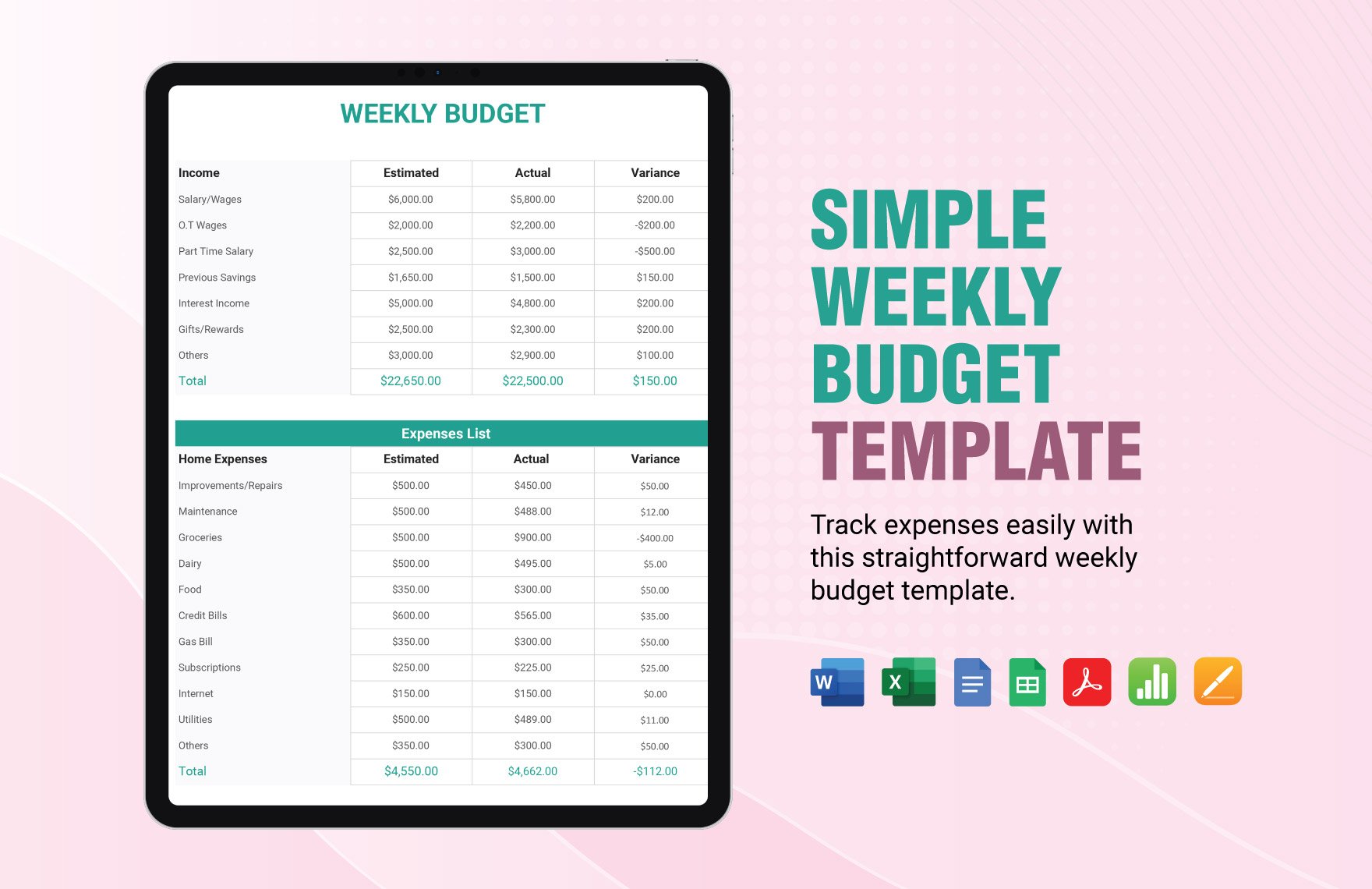

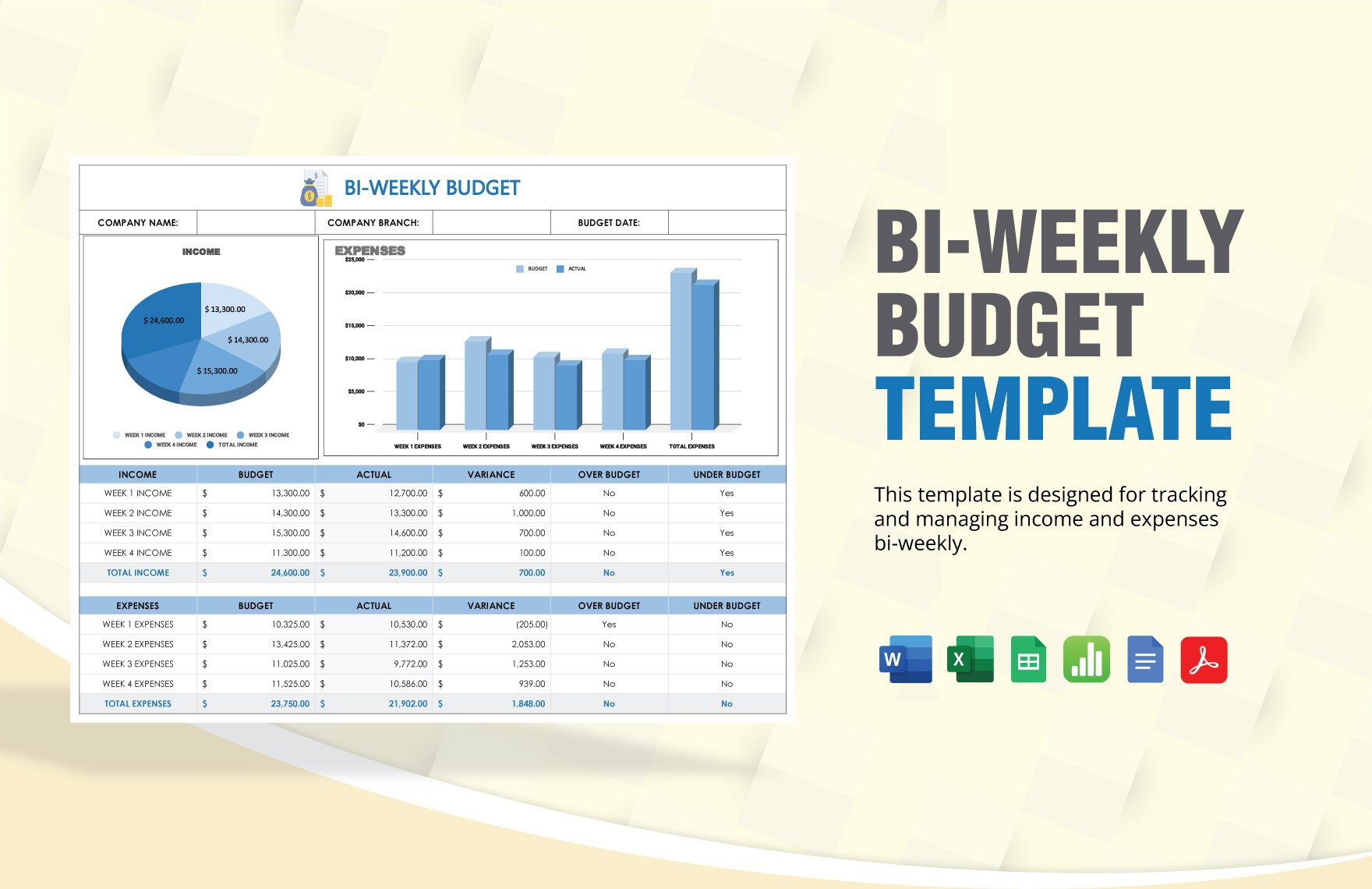

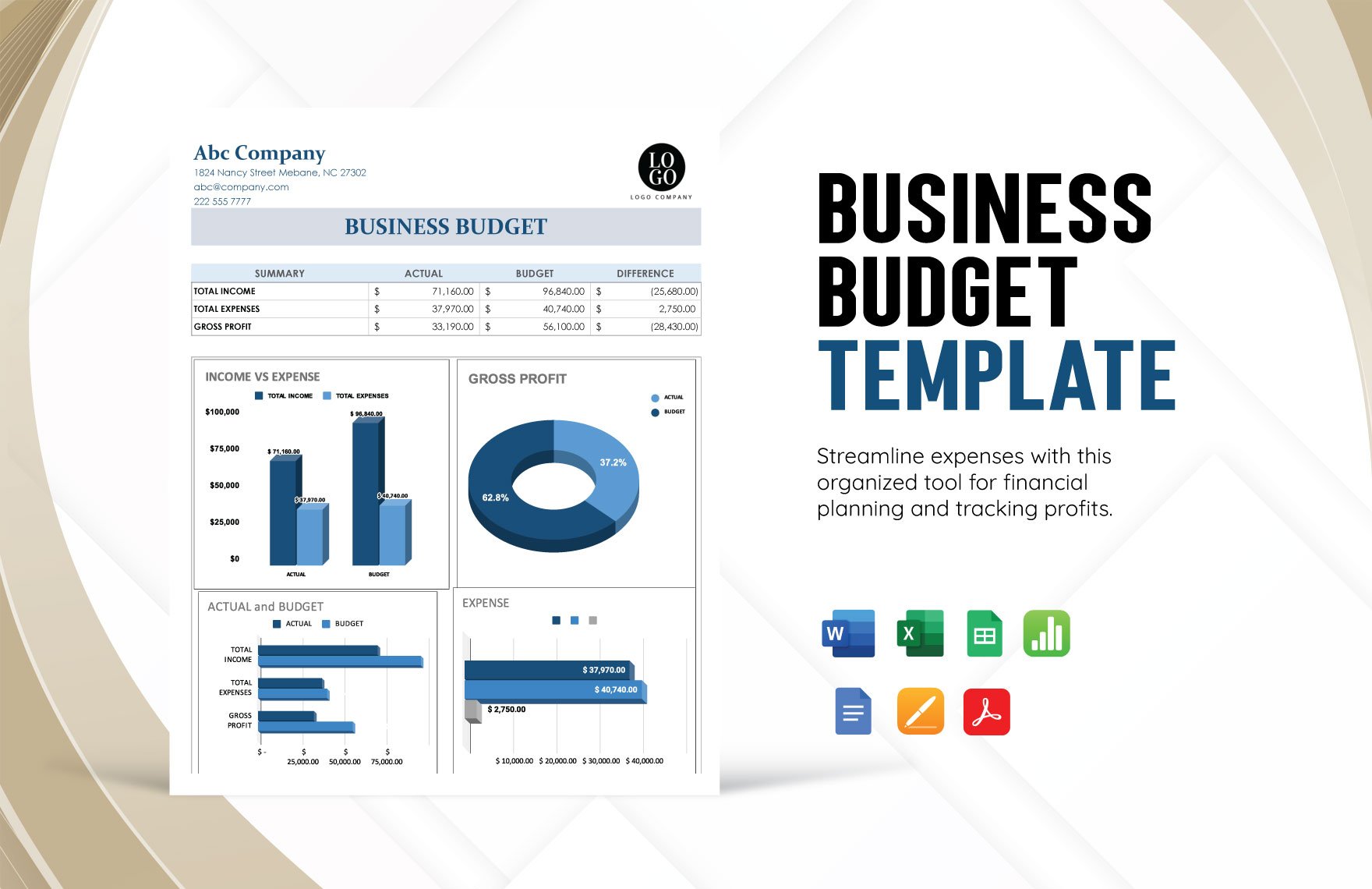

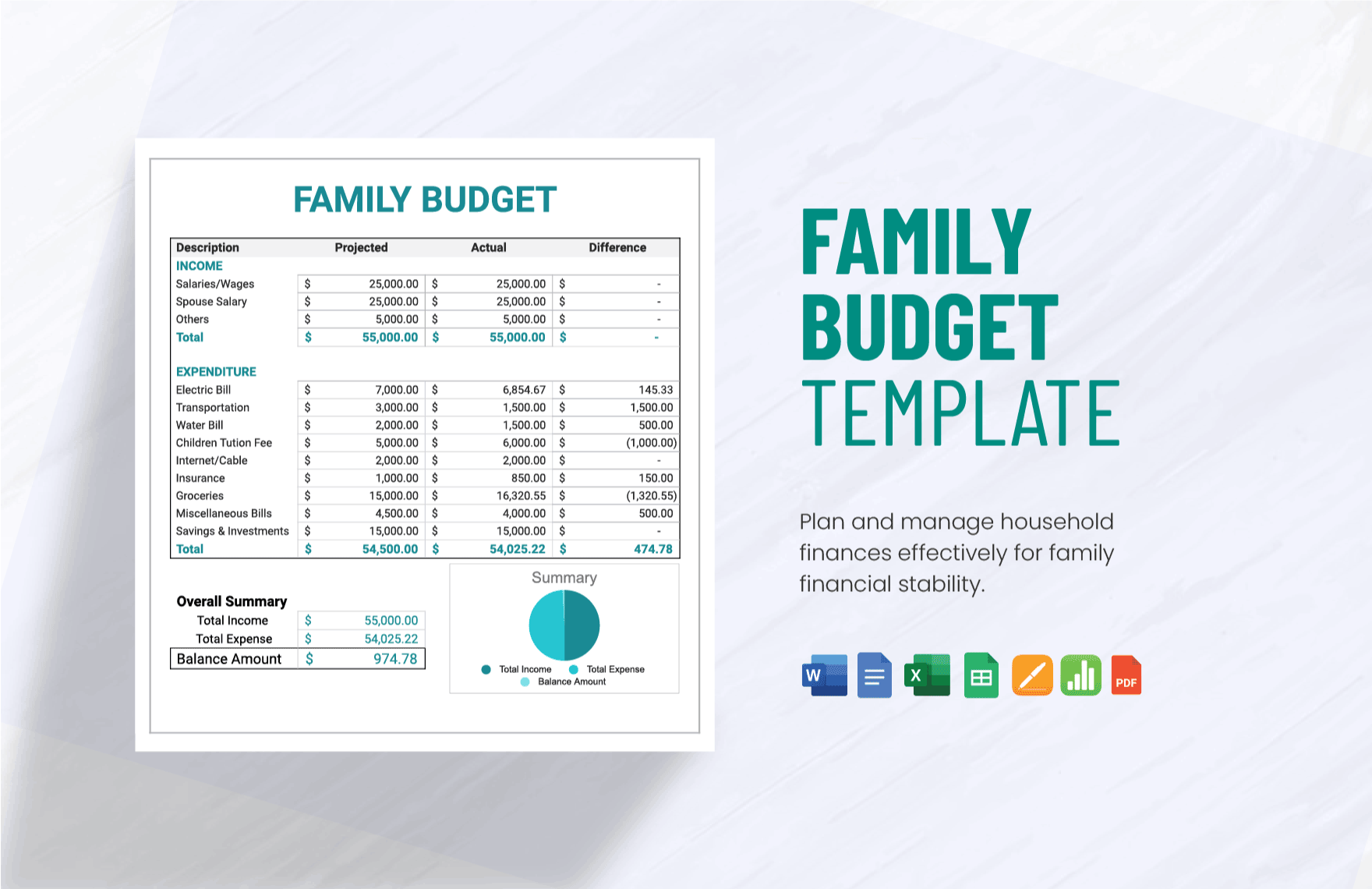

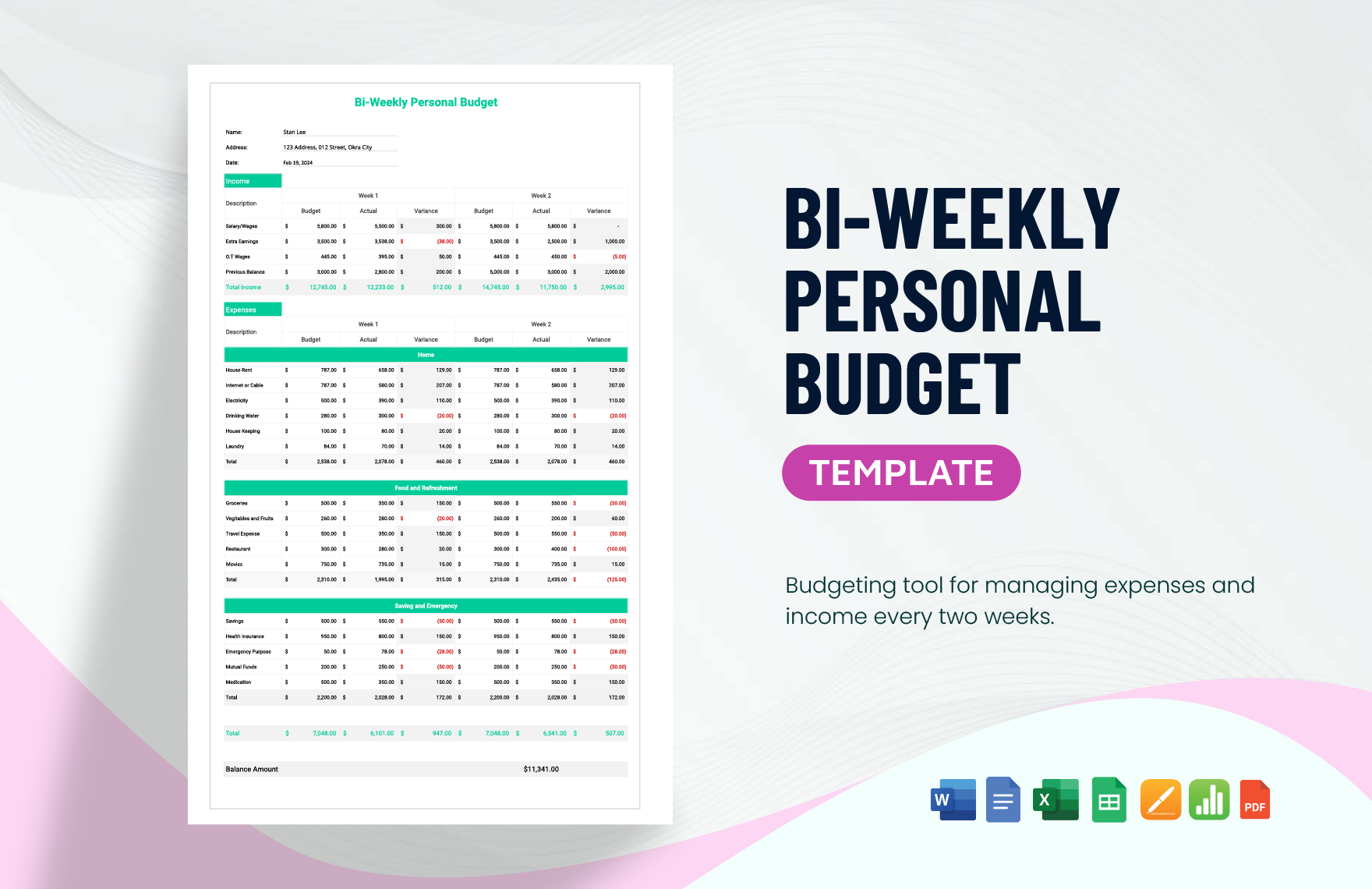

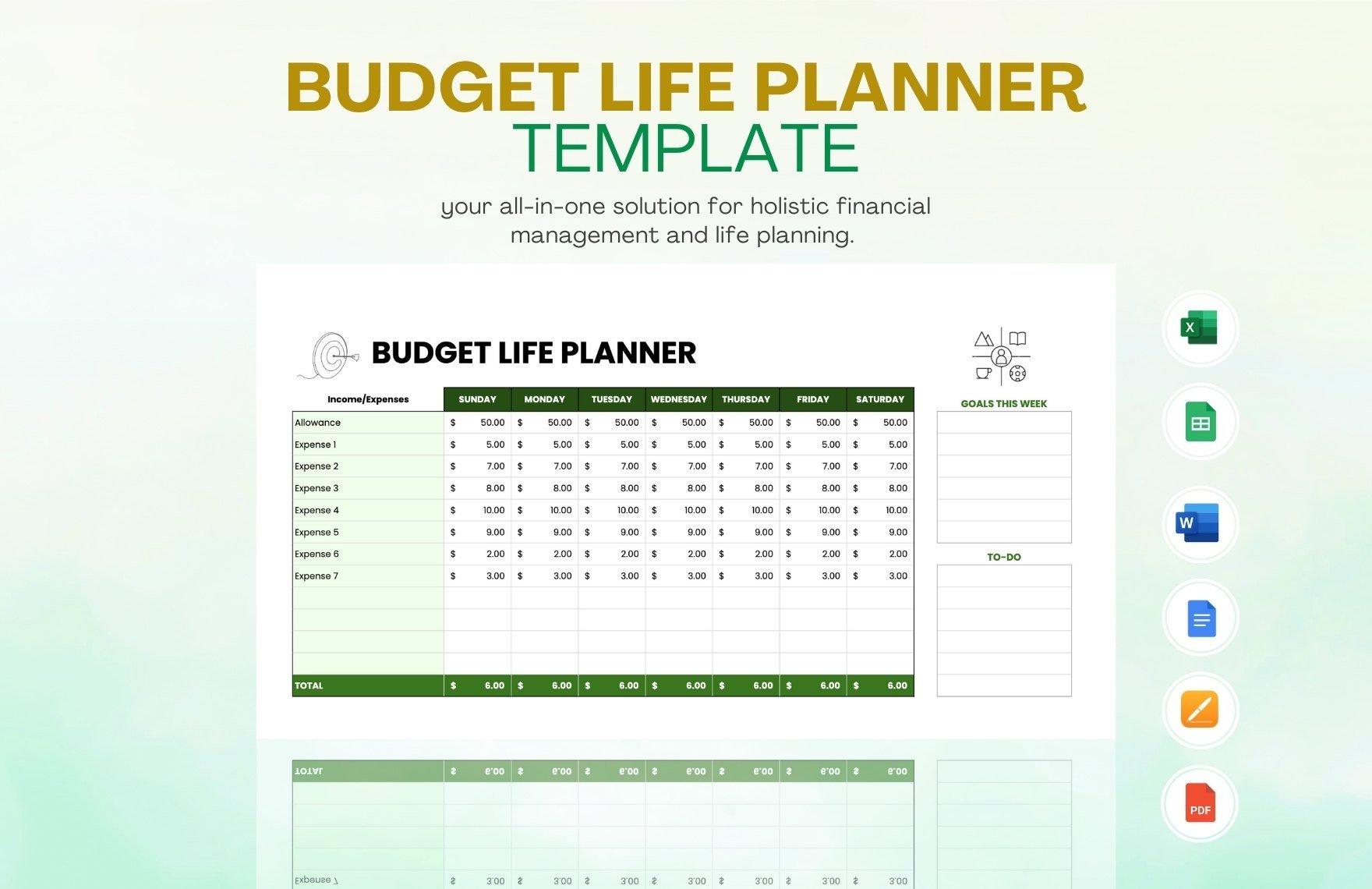

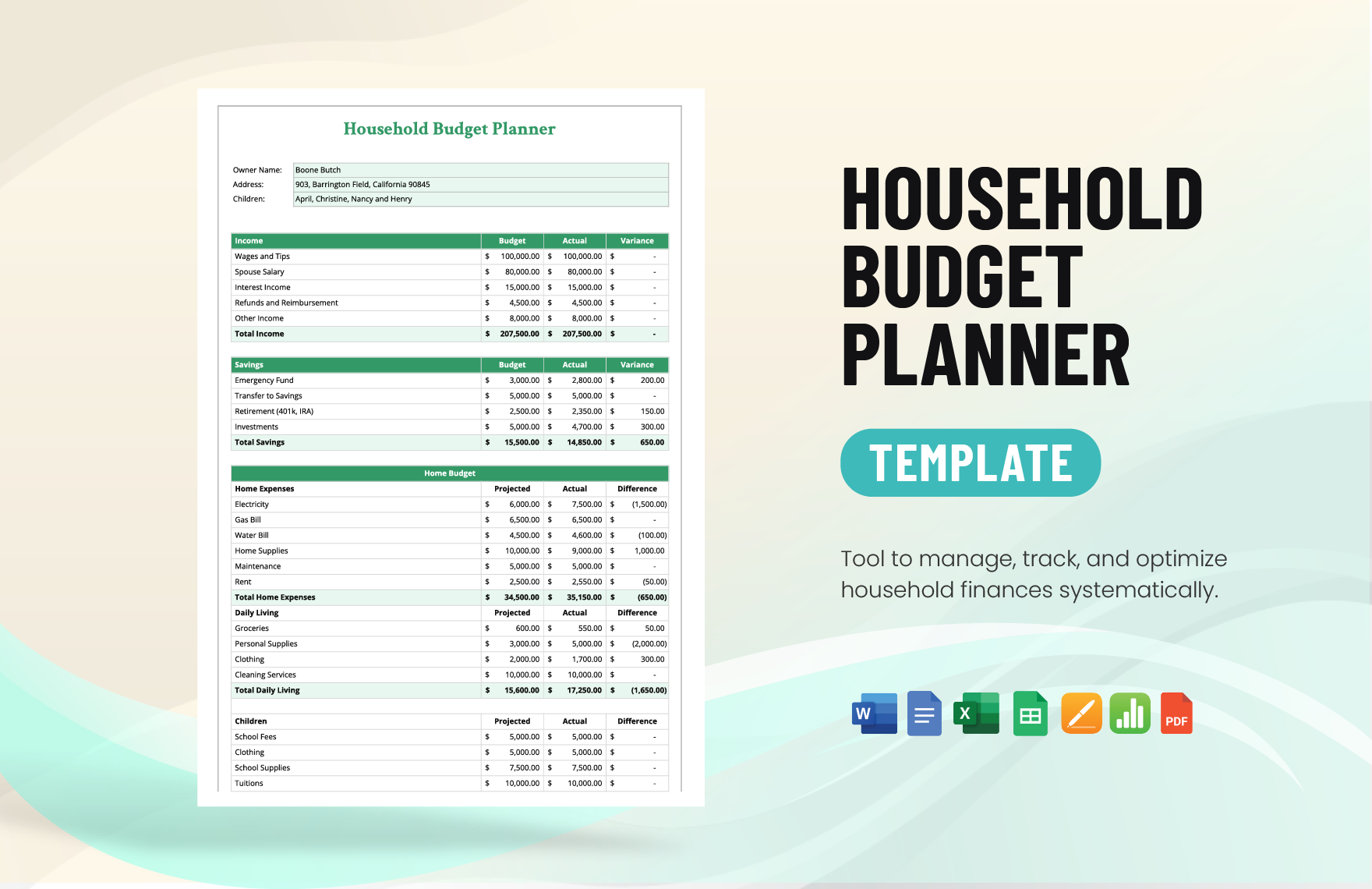

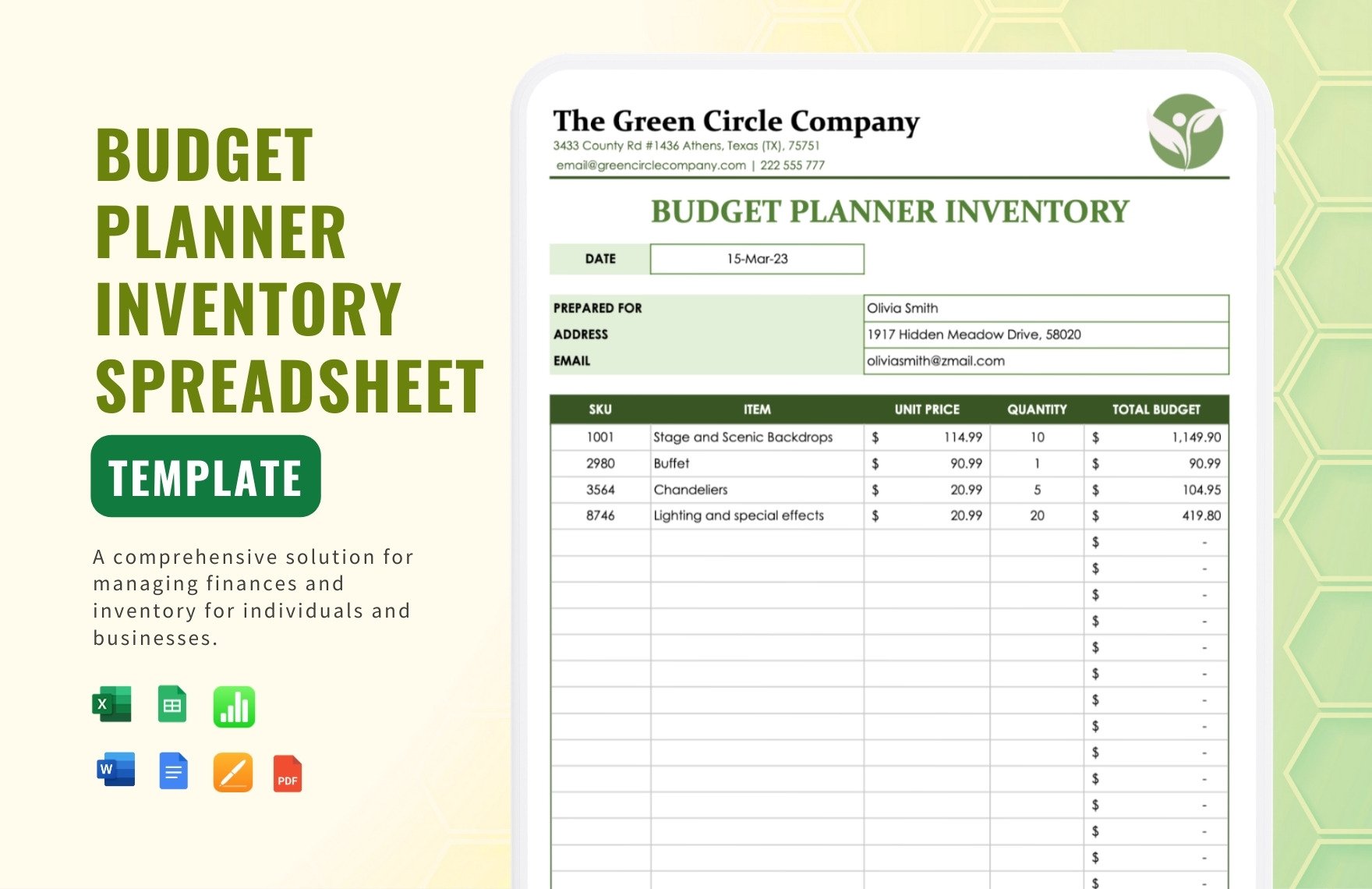

Keep your budgeting process streamlined, efficient, and insightful with Weekly Budget Templates from Template.net. Designed for anyone from personal finance novices to experienced accountants, these templates help you gain full control over your expenditures and savings. Utilize them to plan for an upcoming trip or manage household expenses, ensuring that all details like timeframes or specific cost categories are included. They require no advanced software skills and boast professional-grade designs, making it easy for you to customize layouts for both print and digital use. Enjoy the ease of organizing your finances and the potential savings from better budget adherence.

Discover the many Weekly Budget Templates we have on hand to suit every financial need. Begin by selecting a ready-made template, easily swapping in your personalized expense items or income streams, and tweaking colors and fonts to match your style. Enhance your budget sheet by dragging and dropping icons or graphics, adding animated effects, or utilizing our AI-powered text tools to keep your data dynamic. The possibilities are endless, and you'll appreciate the skill-free experience. Plus, our templates are regularly updated to include fresh designs. When you’re finished, download or share your comprehensive budget plans via email, print, or export to multiple channels, making collaboration in real-time a breeze.