44+ Simple Rental Agreement Templates – PDF, Word

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

Jul 04, 2023

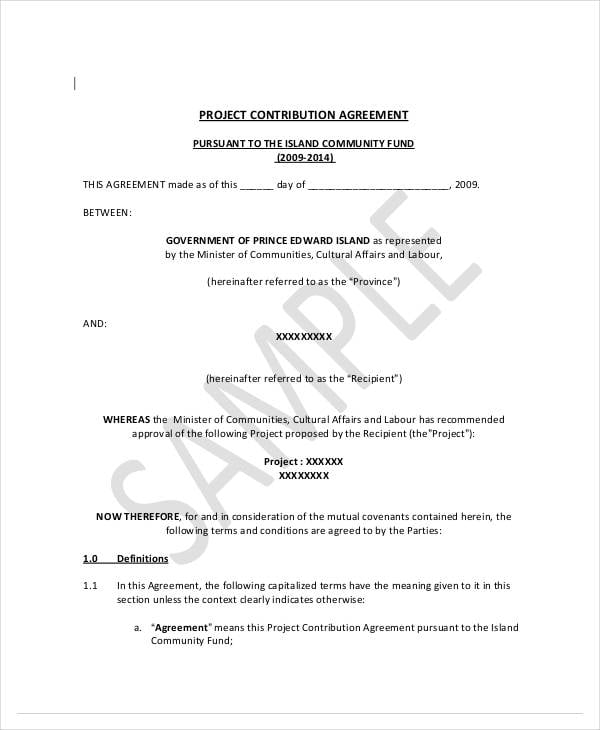

Contributions are an important part of a business. Whatever amount that comes out of it becomes useful for the operation of the business as a whole. Business owners also put in their contributions for the greater good of the business. But before any contribution comes to life, an agreement for it is written down. This is to ensure that both parties hold up to their responsibilities in the agreement, no matter what path it may take. Any contribution given in the business should be treated with utmost importance.

oracle.com

oracle.com xinfin.io

xinfin.io fiftrustee.worldbank.org

fiftrustee.worldbank.orgIn the business setting, a contribution means a lot of things. In the government, it is an imposed payment for a set of benefits such as life insurance, housing, and pension. This is common in many different countries, where part of the worker’s salary goes to the mandated government benefits and are being paid every month. They can use these benefits in case of hospitalization, purchasing a new home, or retiring early from the workforce. You can also see partnership agreement templates.

It usually consists of a life insurance benefit, housing benefit, pension and retirement benefits, and withholding taxes. Each benefit has a certain amount to pay every month. In the accounting field, a contribution is the amount left after direct variable costs is subtracted from the sales revenue. This amount is used to pay a direct cost. This contribution is also called gross income. You may also see donation agreement templates.

In the world of insurance, a contribution happens when two or more insurers are liable for the covered loss of insurance and participate in paying the said loss. After paying the loss, the insurer becomes entitled to an equitable contribution, which allows him to recover the payment from another insurer. Whatever contribution it may be, it is always important to do your part and give your share. You’ll have the maximum benefit of it in the long run. You can also read joint venture agreement templates.

charityballassociation.org

charityballassociation.org lexingtonlaw.com

lexingtonlaw.com open.edx.org

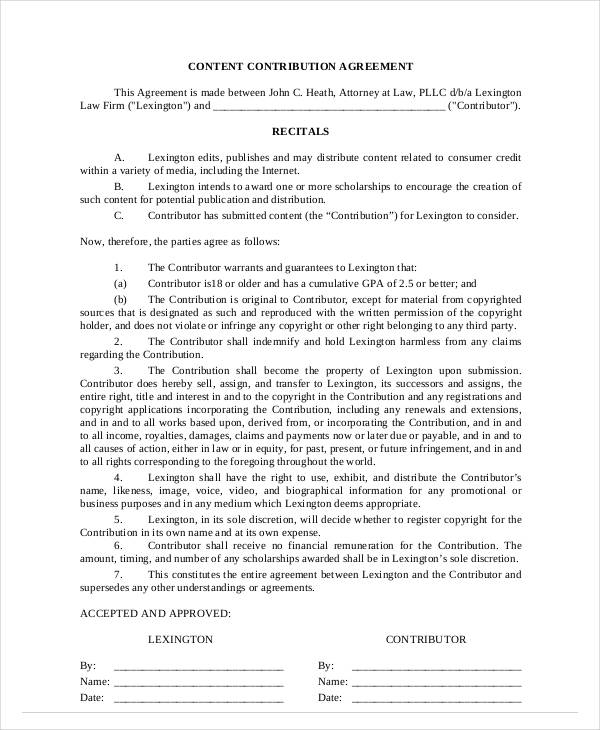

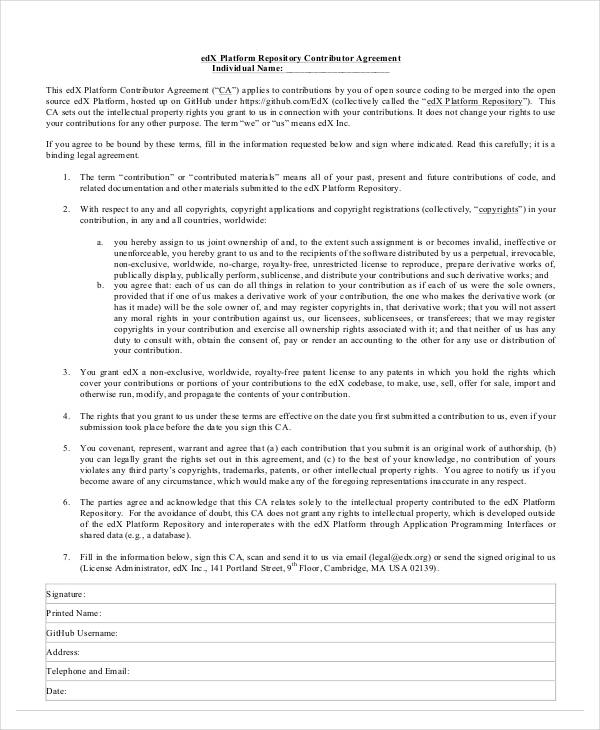

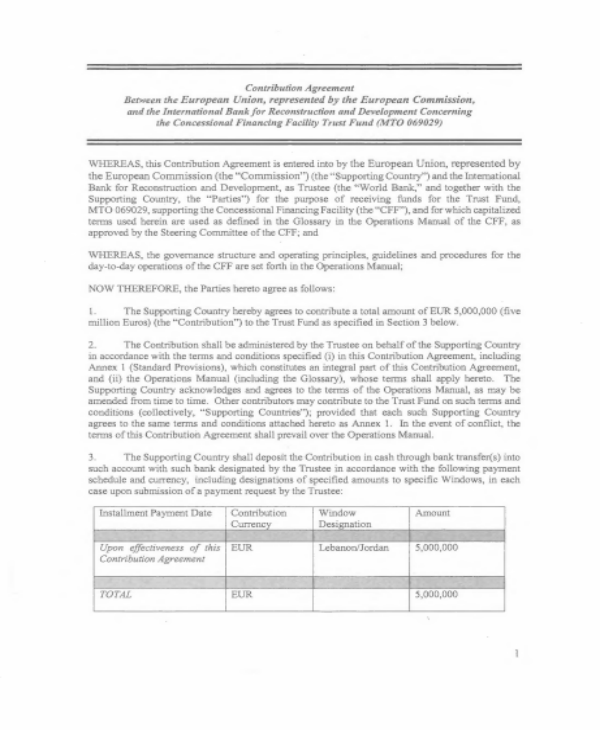

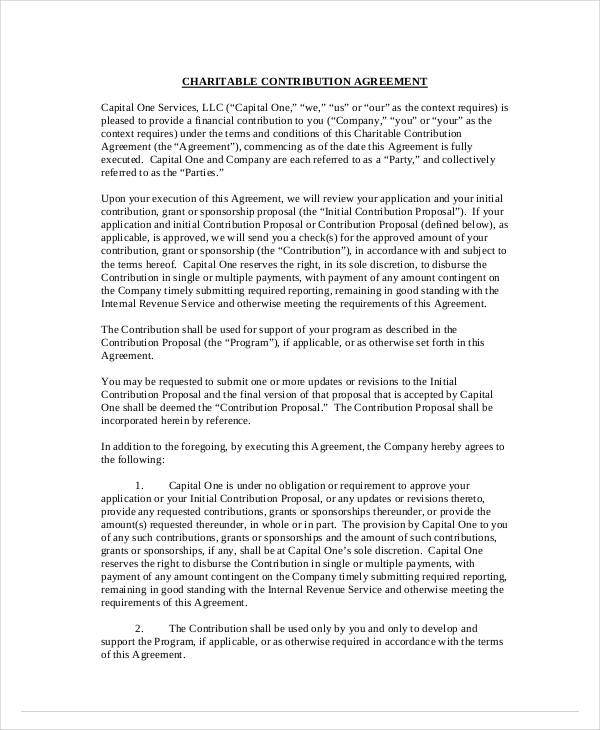

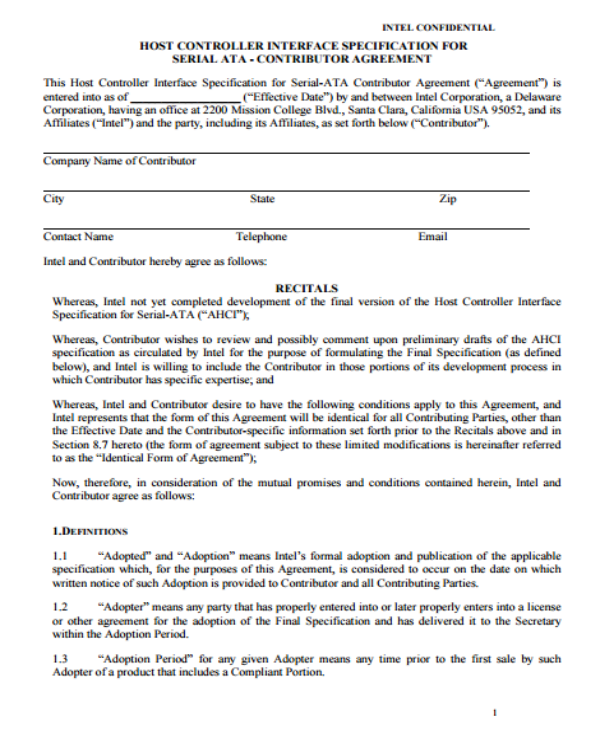

open.edx.orgWriting a contribution agreement is important when you want to give certain amounts of cash and in kind donations to a company. It is also written to lay out the conditions of an asset transfer. Writing this kind of agreement is easy with these steps:

Prior to writing the whole agreement, consult a legal team or hire a lawyer to help you with the laws to be used. You should also research about sample contribution agreements to help you in structuring your own document along the way. You can also consult a law library and government agencies that can help you understand what a contribution agreement is all about. You may also like volunteer confidentiality agreements.

You must identify the parties entering the agreement. Name the two companies joining the agreement. State the full name of the company, its address, contact numbers, and the chief executive officers. If it is a business owner instead of a company, state the full name of the person, his designation and his contact details. Give them names so you can refer to them using those as you draft the whole document. You may also see printable agreement forms.

What is being contributed by both parties should be specified in the agreement. If it is cash, write down the exact amount. For in kind contributions, make the list of the materials being donated. Include the quality, quantity, and brand. For liquids or any kind of contribution that expires, put the expiry date in the agreement. For artwork and computer codes, define each feature of these kind of contribution. You need to explain everything about the contribution so third party readers can easily identify what is being donated. You also have to put the purpose of the agreement. For example, a contribution can be used as a gift or an asset to the receiving party.

gov.pe.ca

gov.pe.ca pensionfund.org

pensionfund.org globalcff.org

globalcff.org apache.org

apache.org cybergrants.com

cybergrants.comThere is always a limitation to every agreement. For this kind of agreement, the limitations include that the time the contribution should be accepted. This is the main limitation that should be stated in the agreement. Set a time limit for the contribution to be accepted. Note how long it should remain pending before it is accepted, or the grounds for the contribution to be voided. Explain all the responsibilities of both parties in the contribution very clearly. Some contributions require approval and tax regulations before it gets accepted. You may also see sample agreements.

Every agreement is tied in to the law to help it become more imposing to both parties. Clearly define the laws that bind the agreement to it. It should also contain the repercussions if the agreement is breached or becomes invalidated. References such as government handbooks and tax regulations are good ones to use. Clearly specify the steps to be taken when the agreement is being breached, and all the possible implications that come along with it. You can also read collaboration agreement templates.

Go over the document and see where you could have possibly lacked in writing it. Make sure the document is free of spelling and grammar errors. Rewrite some parts when needed. You may also see church confidentiality agreements.

After editing and proofreading the document, distribute it to the parties involved and to the agencies stated in the agreement. They have to know what they have agreed on so they can affix their signatures. You can also check out restaurant investment agreement templates.

s21.q4cdn.com

s21.q4cdn.com intel.com

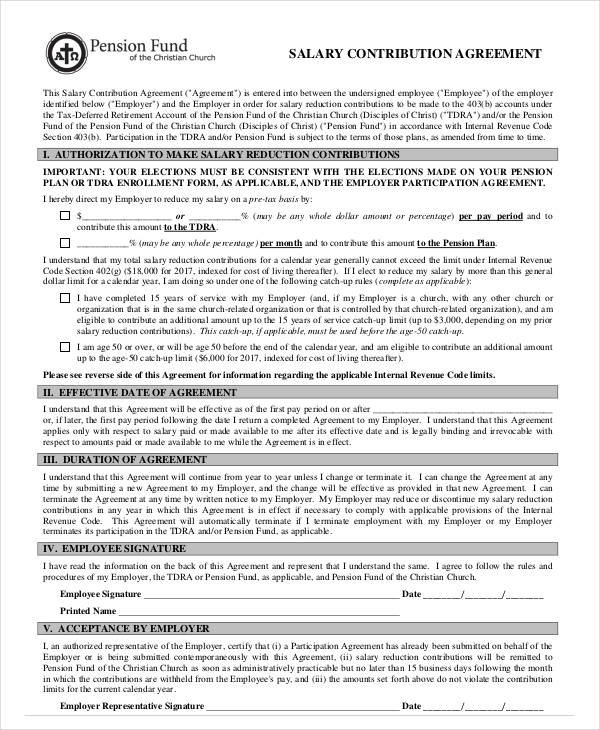

intel.comProfit and contribution are often confused with each other. One of the ultimate goals of business is gaining profit from their revenue as the business runs day by day. Profit is defined as the difference between amount earned and the amount spent for buying materials, making products and operating the business.

It is a financial gain. One of the measurements for profit is making a profit and loss report by the end of the month. Here, the report will show the profit gained, the amount spent for operations, and the total revenue earned by the business.

On the other hand, a contribution is something that comes out when the variable cost per unit is subtracted to the sales price per unit. It is closely tied to profit, as any amount of contribution will go to it when the fixed costs are paid off. The difference between the two is very glaring. Contributions just show the difference between the sales price and variable costs of specific products only. Profit shows the difference between the sales and costs for the entire business. The two are closely tied to each other in some way, but it’s very different. You can also like sample general partnership agreements.

Every contribution is held in such great importance. It can be used as a gift or an asset to the company, and it depends on the receiving party on how they will use it. If you need more related articles regarding agreements, go over our site for more information. You can also read standard confidentiality agreements.

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

A purchase and sale agreement is a compulsory legal document to have when a buyer and seller are entering into…

Living alone or with a family has enormous risks, and the responsibilities can be complicated to manage. Become a good…

Discovering and verifying the top ability is no simple undertaking. It requires a profound comprehension of the organization’s culture and…

An agreement that occurs between two parties where one party (the recruiter or recruiting firm) is appointed by the other…

During the 1848 revolutions in Europe, the term “logistics” played a crucial role in transferring goods, equipment, and military personnel.…

The recruitment services agreement is provided by the recruitment agencies. And, that acts as the middleman or the middle-party between…

Many projects among businesses involve heavy management and great plans sample that logistics will be relevant. Operations involve proper organization…

A simple tenancy agreement is a legally binding document that outlines the terms and conditions between a landlord and a…