44+ Simple Rental Agreement Templates – PDF, Word

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

Jul 04, 2023

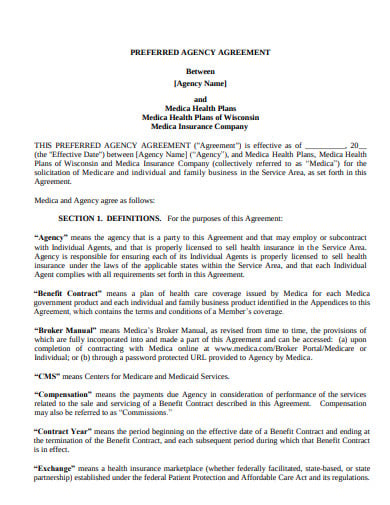

The insurance policy in insurance is an agreement between the insurer and the insured, known as the policy holder, that dictates the assertions that the insurer is legally obliged to pay. In return for an upfront payment, recognized as the premium, the insurer pledges to pay for losses incurred by dangers enclosed by the dialect of the policy.

equinemortality.com

equinemortality.com gia.org.sg

gia.org.sg hthtravelinsurance.com

hthtravelinsurance.com nextwaveins.com

nextwaveins.com ira.go.ke

ira.go.ke ciusolutions.com

ciusolutions.com careconnect.com

careconnect.com patriotmanagers.com

patriotmanagers.com imsgtx.com

imsgtx.com hbex.ca.gov

hbex.ca.gov agentpipeline.com

agentpipeline.com oldrepublictitle.com

oldrepublictitle.comThe insurance contract agreement is a contract whereby if certain defined events occur, the insurer promises to pay benefits to the insured or to a third party on his behalf. The event must be uncertain subject to the “principle of fortuitousness.” The instability can be either as to when the incident will occur (for example, in a life insurance policy, the time of the insured’s death is uncertain) or as to whether it will occur at all (for example, in a fire insurance policy, whether or not a fire will occur at all).

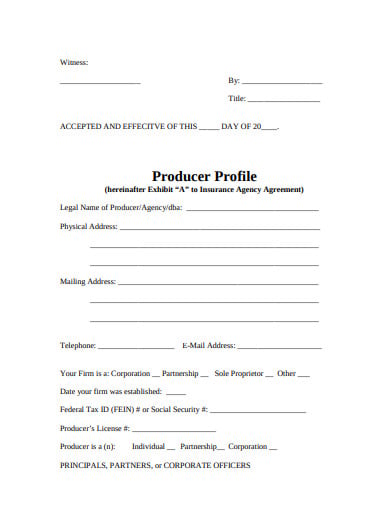

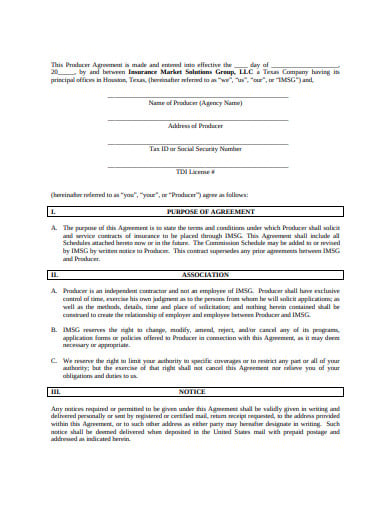

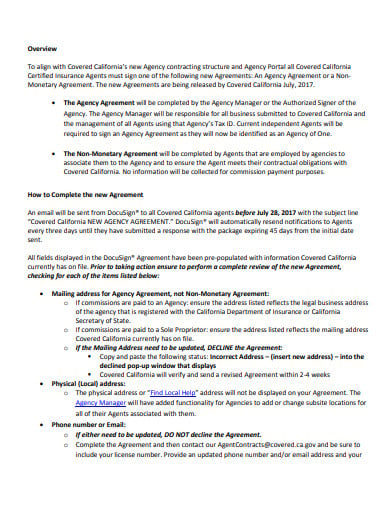

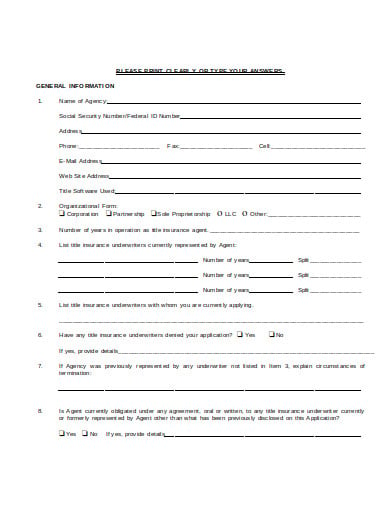

Historically, insurance policies have been written based on each type of risk (where risk was very narrowly defined), and a separate premium was calculated and charged for each sort of risk. The following points highlight the structure of an insurance contract:

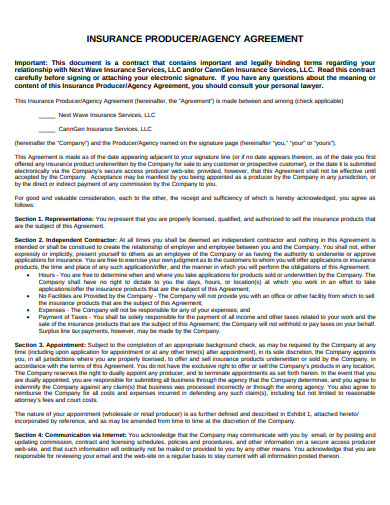

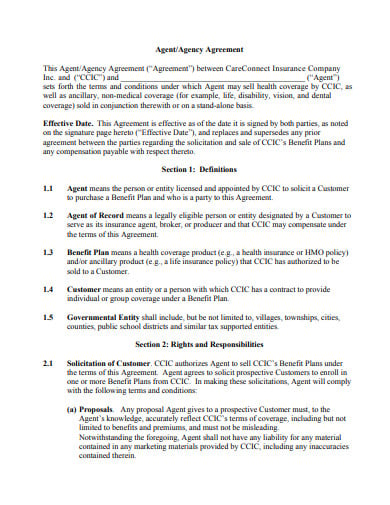

The section on agreements of an insurance policy defines the contracting parties and specifies that the relevant clauses form an insurance contract. It will typically assert the parties ‘ intentions regarding the subject matter of the insurance, the term of the policy, the dangers covered by the contract, the payment limits in the incident of an insured risk occurring, and the insured’s financial commitments.

Most insurance policies include a specified section of terms that provides a common understanding of certain aspects or phrases used across the insurance policy. This segment may be very important if the agreement is to avoid ambiguities.

This section, often referred to as the “insurance agreement,” sets out the insurance company’s promises to compensate the insured against some risk of loss. It will specifically describe the type of risks that are insured against and the person, land, or subject matter covered by the policy. An insurance agreement comes in two basic forms:

Exclusions are forms of conditional liability not protected under a contract or paid under it. There are three significant types of exclusions:

Circumstances are statutory clauses that require a specific fact or circumstance before obligations or duties arise under the contract. If contract conditions are not met, there is no obligation on the insurer to insure against the failure that is subject to the condition. That is, if an acceptable provision in the contract is not met, the insurer may deny a claim for damages. The insurer, for example, may file a claim and provide evidence of loss as a prerequisite for cover.

These are elements connected to the principal insurance contract used to change the policy’s tasks or responsibilities. Approval often places some condition on the insurer’s duty to compensate the insured or to cover a specific sort of loss. These may also change or remove express provisions in the heart of insurance policy. This is the main method used by underwriters to tailor a particular policy to suit a specific insured.

Policy riders refer to changes to an existing policy. The rider consists of the revised terms and is part of the initial insurance contract. The insurer will use a rider whenever the liability conditions change under the regulation of an insured.

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

A purchase and sale agreement is a compulsory legal document to have when a buyer and seller are entering into…

Living alone or with a family has enormous risks, and the responsibilities can be complicated to manage. Become a good…

Discovering and verifying the top ability is no simple undertaking. It requires a profound comprehension of the organization’s culture and…

An agreement that occurs between two parties where one party (the recruiter or recruiting firm) is appointed by the other…

During the 1848 revolutions in Europe, the term “logistics” played a crucial role in transferring goods, equipment, and military personnel.…

The recruitment services agreement is provided by the recruitment agencies. And, that acts as the middleman or the middle-party between…

Many projects among businesses involve heavy management and great plans sample that logistics will be relevant. Operations involve proper organization…

A simple tenancy agreement is a legally binding document that outlines the terms and conditions between a landlord and a…