44+ Simple Rental Agreement Templates – PDF, Word

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

Jul 11, 2023

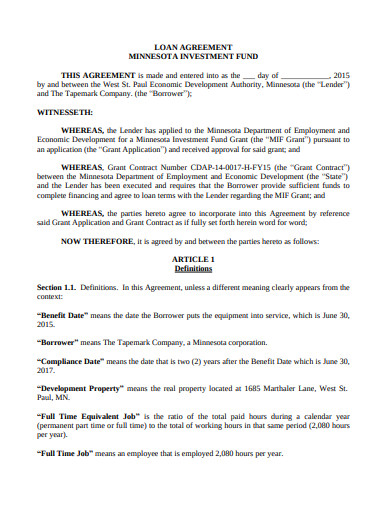

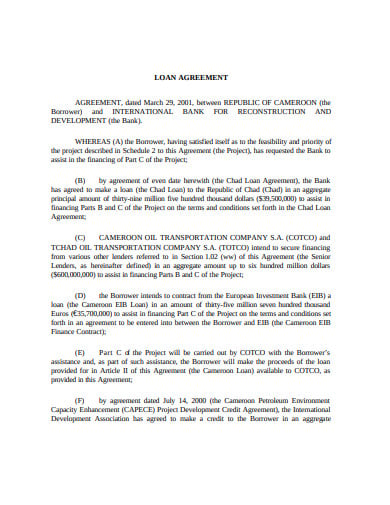

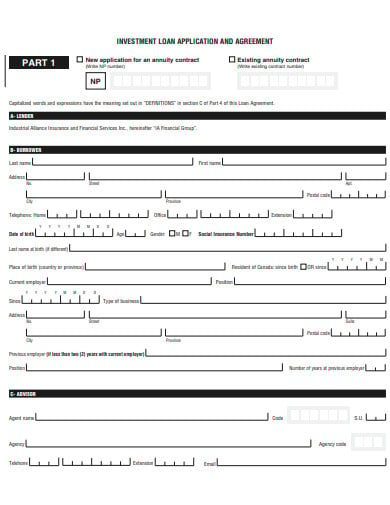

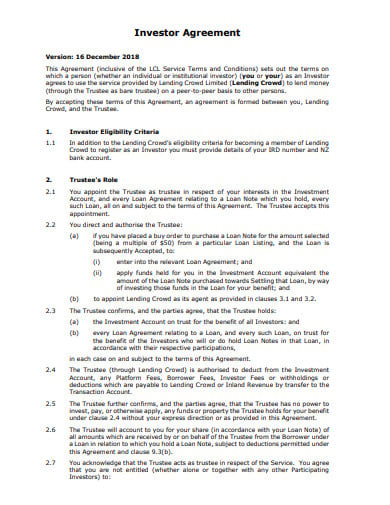

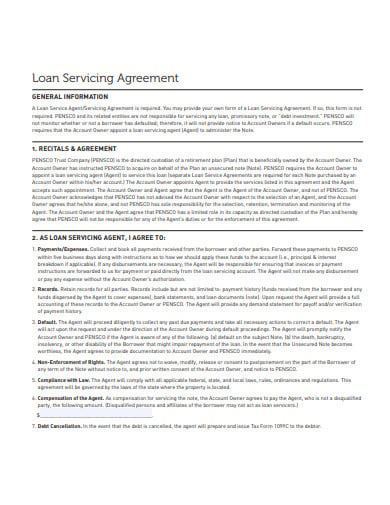

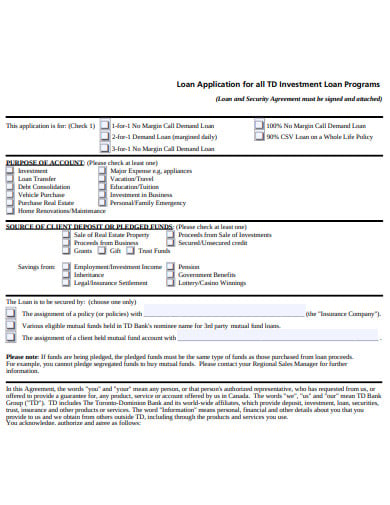

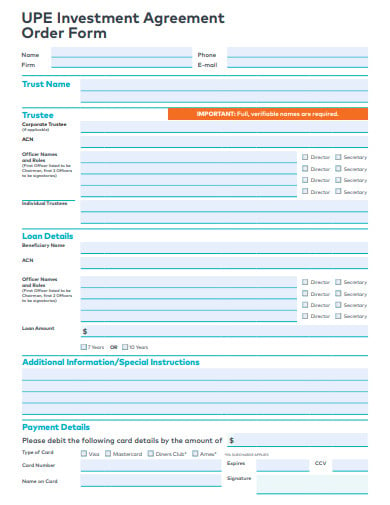

An investment loan agreement refers to a binding contract that is made between two or more parties to validate a loan process. There can be many types of loan agreements starting from simple promissory notes between friends and family to more detailed agreements like mortgages, auto loans, etc. A proper investment loan agreement can be just more than just short letters that states how long a borrower has to pay back back the money and what interest may be added to the principal.

wspmn.gov

wspmn.gov worldbank.org

worldbank.org iaa.secureweb.inalco.com

iaa.secureweb.inalco.com lendingcrowd.co.nz

lendingcrowd.co.nz acgov.org

acgov.org lvccld.org

lvccld.org novoco.com

novoco.com access-socialinvestment.org.uk

access-socialinvestment.org.uk pensco.com

pensco.com franklintempleton.ca

franklintempleton.ca uploads-ssl.webflow.com

uploads-ssl.webflow.comIt’s never easy to ask friends and family members for money, for you or the person you ask. When you write an informal personal payment agreement, you will make it easier to show your would-be lender that you find the loan to be a significant obligation and expect to repay the money. It takes little time to write the agreement, but it could be the one thing that will convince the lender like your parents or a family friend to lend you money.

Start by writing down the date at the top of that page. If you establish an informal private payment agreement before receiving the loan, please fill in the date you receive the money.

State the intent of the personal payment agreement and the terms and conditions for the return of the money. For instance, if you borrow $300 to repair your car, and plan to return $100 a week, note it down.

It is very important to provide the exact dates in your agreement. It is just common sense but ignoring it is quick. The repayment of the loan depends on the date of the formation of the agreement. To repay the money select a start and finish date and write down.

You can write “The lender and borrower agree to the terms mentioned above.” This must be only a few lines below the repayment schedule to highlight the fact that both parties agree.

The deal will be genuinely impossible to implement without a signature. Print the names of the lender and creditor below the declaration of agreement. Leave room for both to sign the treaty.

Go down to the office of the county clerk, and record the deal. The loan will now be covered against loss of paperwork by either party and will have the psychological effect of feeling “actual”.

The main purpose of a loan agreement is to explain what the parties who are involved in the agreement agree to, what duties each party has and for how long the agreement will last. A loan agreement must comply with state and federal laws which will cover both lender and borrower should both parties fail to comply with the agreement. The terms of the loan contract will differ depending on the type of loan, and which state or federal laws govern the performance obligations required by both parties.

Many loan contracts clearly define how the proceeds are to be used. The form of a loan made for a new home, a vehicle, how to pay off new or old debt, or how binding the terms are, is not made in the law. The loan contract signed is evidence that both the borrower and the lender agree that the funds will be used for a defined reason, how the loan will be repaid and at what rate of amortization. In case the money is not used for the stated reason, it should be immediately refunded to the lender

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

A purchase and sale agreement is a compulsory legal document to have when a buyer and seller are entering into…

Living alone or with a family has enormous risks, and the responsibilities can be complicated to manage. Become a good…

Discovering and verifying the top ability is no simple undertaking. It requires a profound comprehension of the organization’s culture and…

An agreement that occurs between two parties where one party (the recruiter or recruiting firm) is appointed by the other…

During the 1848 revolutions in Europe, the term “logistics” played a crucial role in transferring goods, equipment, and military personnel.…

The recruitment services agreement is provided by the recruitment agencies. And, that acts as the middleman or the middle-party between…

Many projects among businesses involve heavy management and great plans sample that logistics will be relevant. Operations involve proper organization…

A simple tenancy agreement is a legally binding document that outlines the terms and conditions between a landlord and a…