44+ Simple Rental Agreement Templates – PDF, Word

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

Aug 19, 2024

“Never invest in a business you cannot understand.” philanthropist and billionaire extraordinaire Warren Buffet’s advice seems really simple investment and obvious but you’d be surprised how many entrepreneurs regardless of the size of their businesses, as well as small business and big-time investors forget this, especially when they get to have that first taste of success. You may also see investment Agreements.

startupbootcamp.org

startupbootcamp.orgIt’s tempting to believe that success in an area you’re familiar with, would open doors for you to understand another, and such temptation becomes greater when you’ve gained good returns but you should learn to resist with conviction. Keep out of an industry you don’t understand, lest you lose half your life’s savings on it. You can also like real estate restaurant investment agreements.

mountainbizworks.org

mountainbizworks.orgResisting the urge to go with the equity market’s high knowing that it has a habit of swinging wildly on a regular basis on the least relevant news, rally and tends to crash on public opinion, celebrating or condemning the most mundane data points. It’s crucial not to get caught in the chaos but stick to your task and always, always stay rational in making investment decisions. You may also see Business Investment Agreements.

As someone who wants to invest on small business before trying how it pans out with the industry big boys, you should still take a moment to consider how you can put your hard-earned money to good use and grow it with hard work, staying informed and wise decisions instead of banking on a “bit of luck.” You may also look into Professional Agreements.

An investment defined in the business outline perspective is that exercise of putting money in a financial account, in your business, in a family’s, in a friend’s business, or even in some other companies’ business, for the ultimate goal of growing one’s money. Investment is an effort to get one’s money to “grow.” But investments can come in some other sample forms. For example, most people pursue further studies in their field or another related field to help them build on credentials that they can use to climb the career ladder. You may also see investor agreements.

Other people invest in gadgets, machinery and the latest internet technology to make their lives easier and more comfortable. Then you have businesses investing in people to build a team which would make up a strong workforce which would become their company’s front liners and manpower. You also have investments in business which could mean things you purchase or try to put what you can hopefully call as “money well-spent” from the get-go in order to help your business grow or add value to it. You may also see Investment Plans.

A good investor should, therefore, make decisions which correspond to the company’s current business goals. Try reviewing your business plan and your total debt. You should also avoid making assumptions regarding future revenue when you’re trying to weigh an opportunity because this isn’t the way to do business in the first place. In other words, do some risk mitigation by making sure you only enter the investment scene having surplus profits. Otherwise, it would simply be too dangerous and you may risk putting your business in jeopardy instead of adding value to it. You may also see more on Investor Templates.

When it comes to starting a small business as your firsthand investment, you don’t need to break the bank or obtain a sizable loan amount contrary to what others may have told you. It’s okay to start small as long as you start right, and it’s actually a good idea to start small. As long as you know how to manage your earnings well and take care of your operations, as long as you know how to carefully weigh each purchase and each acquisition, including investment opportunities that comes your way, you should be fine. Along the way, you’ll know whether or not they can increase the value of your business. You may also see funding agreements.

You can also take these simple tips to heart:

upm.uy

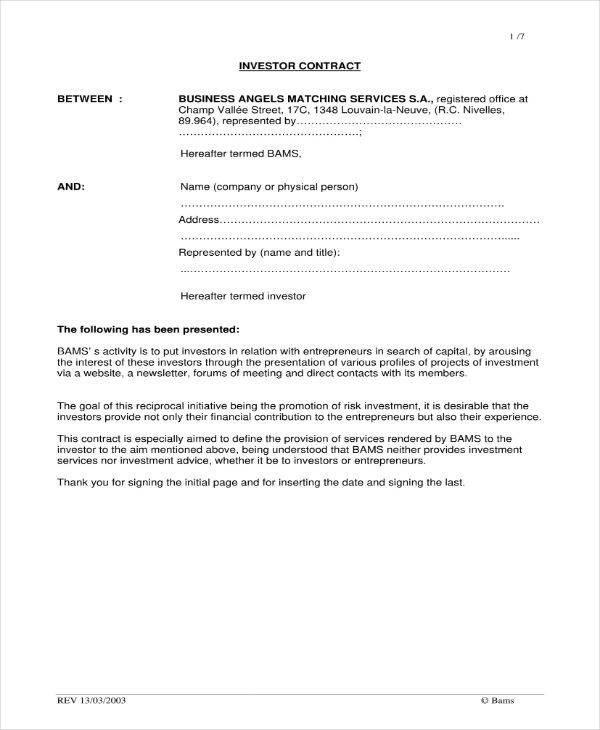

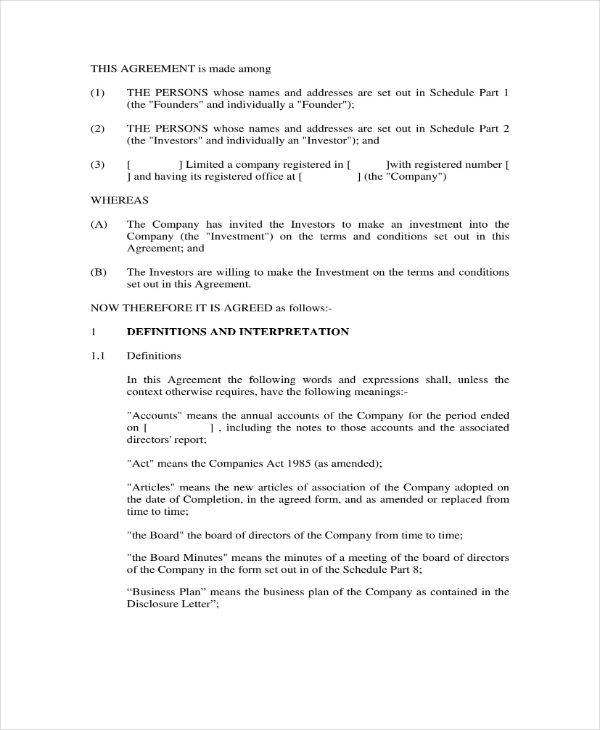

upm.uyMost businesses are privately owned and most of them intend to sell shares of stock to private investors. These transactions require an simple agreement between the two parties in order to have a record of the understanding outlining the terms and conditions set for the sale and works to protect both the company and the investor. You may also see management agreement templates.

Although every investment agreement format for small businesses contains information unique to the business, there are no hard and fast rules for the simple outline and format of the document. Business owners can make use of the investment agreement available on reliable websites or in this article. You can also modify the terms and conditions as necessary or create your custom template from scratch.

As what has been stated previously, business investments shouldn’t occur without a written document detailing certain terms they are agreeing to. Getting the common agreement in writing with the terms clearly laid out is always a wise move when it comes to any business transaction that involves money and it is especially important to make sure both parties are equally protected from legal disputes that may arise, or in the event that their situations change and decisions have to be made or amended.

Start-ups entering such agreements with any investor with a proposal should always make it official through a legal agreement. Simply put, If there’s no record, it didn’t happen. Formalizing agreements also give both investors and business owners a chance to consider and agree how they’re going to deal with unexpected circumstances or emergency situations such as the early exit of the other party, dispute or death in a worst-case scenario.

The basic structure of an investment agreement would typically include the following:

The investment agreement should also specify the percentage of ownership agreed with the investor, provisions for dilution, time frames and an printable outline of each party’s obligations in clear terms, causes for termination, arbitration and procedures for settlements. In signing the agreement, the parties should testify and make sure that they are authorized to enter into such a sample agreement and are financially and legally capable of investing money in the business. You may also see more on Buy Sell Agreements.

Any type of investment agreement would only be as good as the intention of both parties in committing to that agreement. You should make it a point to refuse an investment proposal no matter how well-defined and clearly written, from someone who is difficult to work with, someone who would likely cause your business more trouble than good, in terms of company management or make unsupported fraudulent claims later on.

In this case, the company will be badly represented and could be dragged into an ugly dispute which could turn the investment into a massive financial loss for the business, in many ways. You may also see work agreement templates.

Having a well-written and witnessed agreement in place are important evidence of the legality of the transaction made and the resulting ownership in the case of an untimely death by any of the parties involved. It cannot be emphasized enough that agreements protect the business owner from unfounded investor claims and would provide the investor with legal stand in the event of actual fraud. If the investor is part of the business, the agreement formalizes and legalizes his financial contribution and the percentage of company ownership to avoid future disputes over ownership rights. You may also see sample Legal Confidentiality Agreements.

angelcapitalassociation.org

angelcapitalassociation.org ban.org

ban.orgBuffet himself had emphasized that while it doesn’t take a genius to make wise investments, there is a lot of hard work and due diligence involved and some basic investing rules one should learn. Following those rules will help you become successful with your investment ventures. And although you aren’t really forced into sticking with the rules of the game treating it as your guide would help you make good decisions, personally and professionally. You can also check out cooperation agreements. Explore additional small business investment agreement templates on our website, template.net, to find a variety of options that suit your needs.

Legally mandatory documents that are required to be signed by both the parties are the simple rental agreement templates. These…

A purchase and sale agreement is a compulsory legal document to have when a buyer and seller are entering into…

Living alone or with a family has enormous risks, and the responsibilities can be complicated to manage. Become a good…

Discovering and verifying the top ability is no simple undertaking. It requires a profound comprehension of the organization’s culture and…

An agreement that occurs between two parties where one party (the recruiter or recruiting firm) is appointed by the other…

During the 1848 revolutions in Europe, the term “logistics” played a crucial role in transferring goods, equipment, and military personnel.…

The recruitment services agreement is provided by the recruitment agencies. And, that acts as the middleman or the middle-party between…

Many projects among businesses involve heavy management and great plans sample that logistics will be relevant. Operations involve proper organization…

A simple tenancy agreement is a legally binding document that outlines the terms and conditions between a landlord and a…