19+ Internship Application Templates in Google Docs | Word | Outlook | Apple Pages | PDF

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

Apr 12, 2023

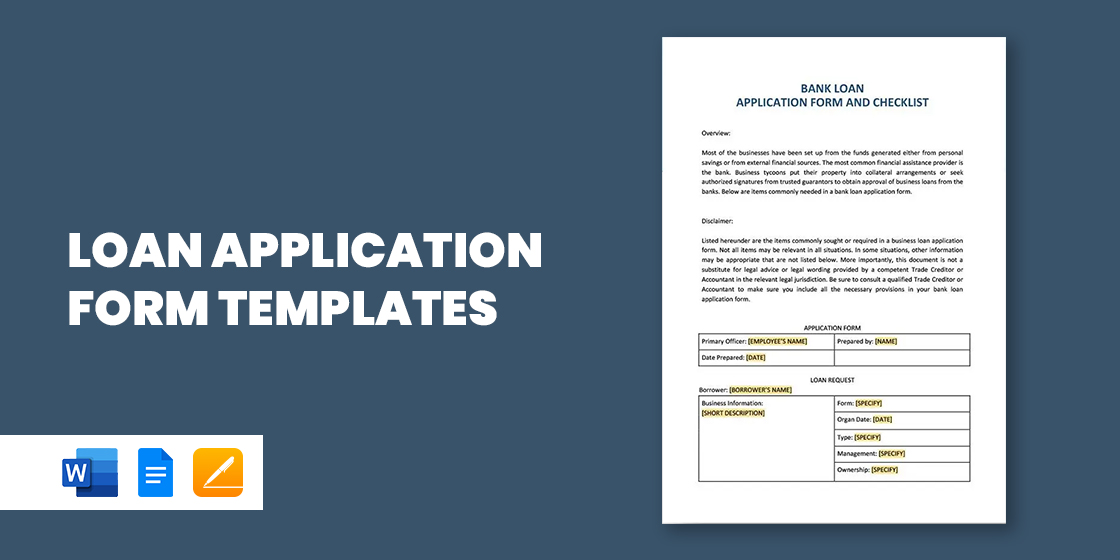

A loan is an amount of money that you borrow from a bank or organization with an interest rate. In paying the loan, you have to pay the amount you borrowed plus the interest. There is a designated date for paying the money that you borrowed, and it results in grave consequences if fail to do so. You may also see application form templates.

Getting a loan is very important if you don’t have the money to pay for hospital bills, in buying a new home, and in starting a business. In getting one, you must go to the nearest bank and fill in a loan application form.

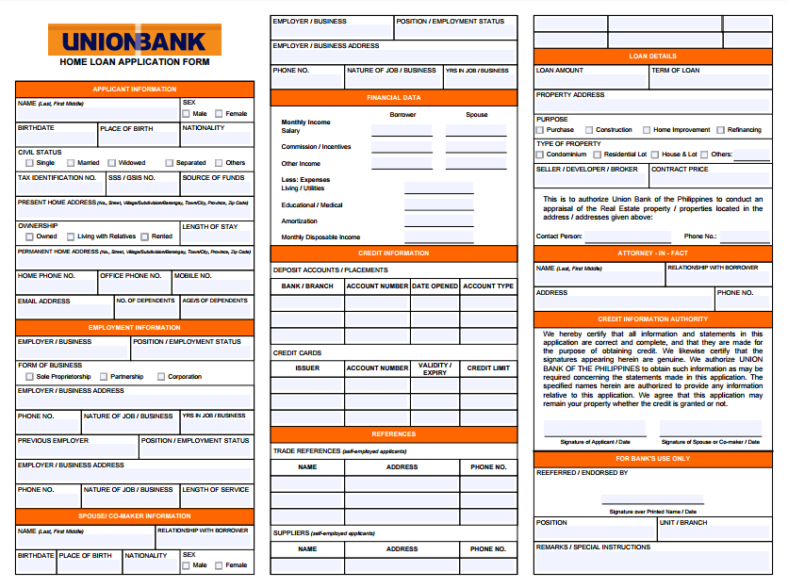

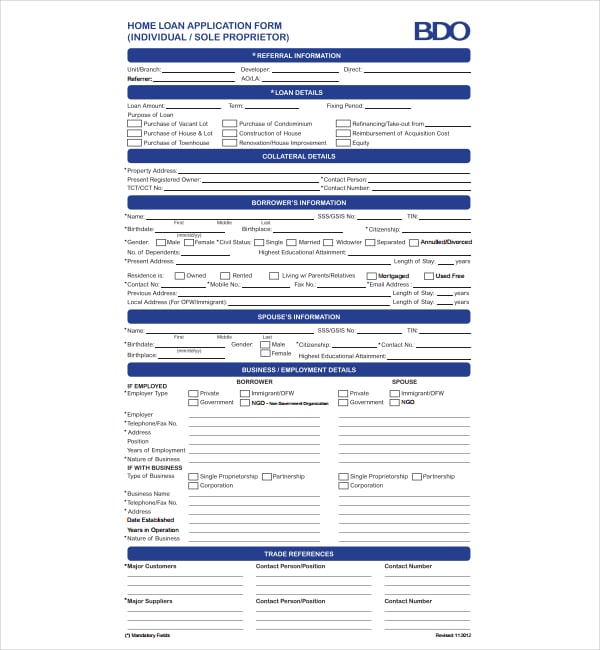

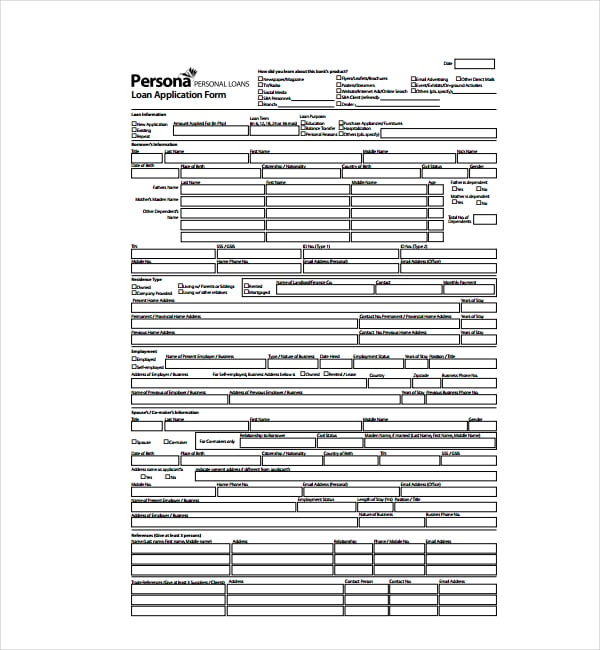

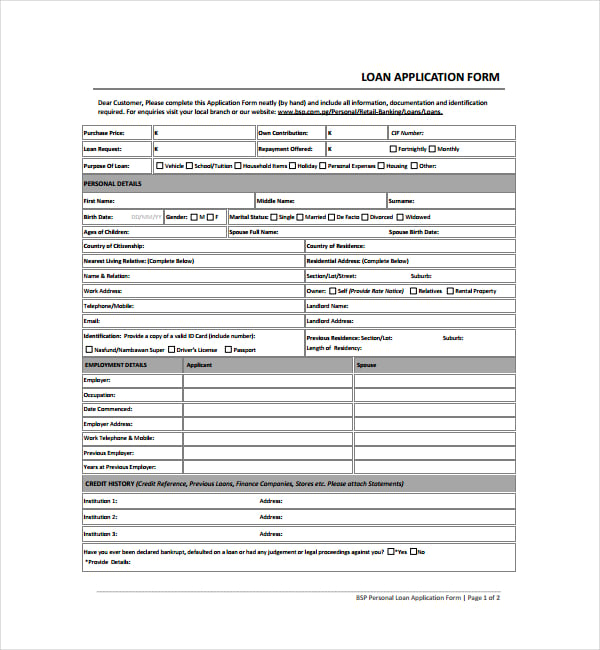

A loan application form is a piece of paper that has questions for people who want to apply for a simple loan. It asks about personal information of the borrower and the detailed business plan, income statement and cash flow statement if you use it for business purposes.

unionbankph.com

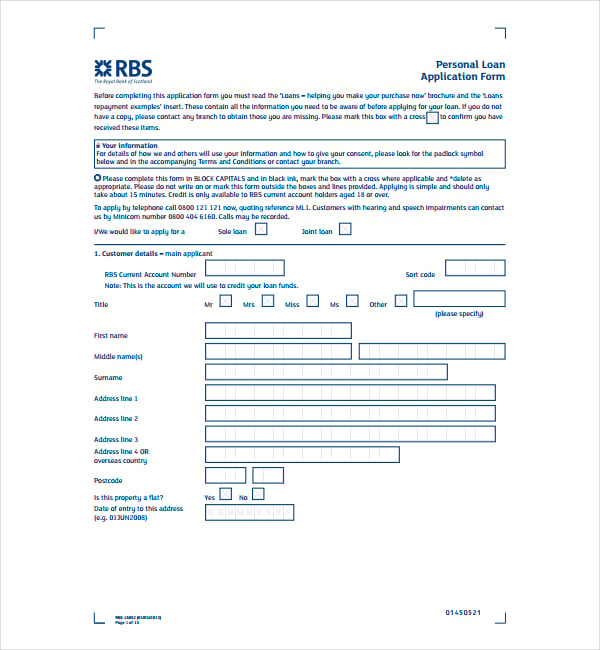

rbs.co.uk

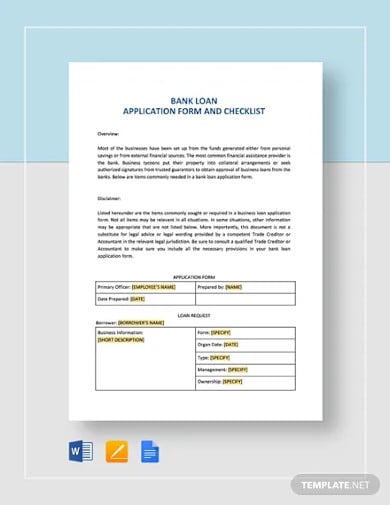

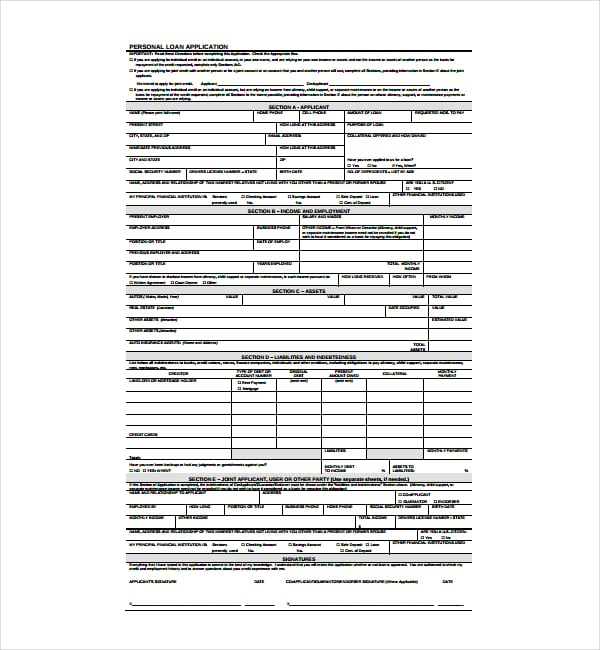

A loan application form in word is a lengthy document that needs credible information. It asks about personal information such as name, address, birth date, phone numbers and social security numbers. The form also asks your length of stay in your current residence. Usually, loans are granted to people who have stayed within the same residence for at least two years. You also need to fill out your marital status and the number of children you have. Your children are considered as your dependents.

Another part of the loan application that you have to fill out is your employment information. You need to fill out how long you have been working in your current job, your line of work and the information of your employer, your position in the company and your other work experiences. The information of the current employer includes the name, address, zip code and phone number. The lenders want a consistency that’s why they are asking for your employment information.

The next part of the loan application form asks about your income. You just have to be honest how much you are earning and how you earn the money. It also asks you about your current financial situation such as the credit and savings in your bank account. You may need to bring important financial documents when you meet with the banker in getting the loan. Some of the things that you have to declare include being a party to a lawsuit, declaring bankruptcy in your business for the past 7 years, and owning any type of property for the past 3 years. You may also see credit application templates.

People get loans to buy a new home for their family, cover up unexpected medical expenses and provide for the education of their children as well as securing their future. Loans are also used to purchase an automobile, going on a trip to another country, and renovation of homes and business spaces. The appropriate amount is lent to the person depending on the type of loan he purchases. You may also see membership application templates.

The questions stated in the loan application form are for purposes of record keeping and determining your capacity to pay. Just fill out whatever is asked in the form and submit it to the bank. You may also see mortgage application templates.

fnbwford.com

bdo.com.ph

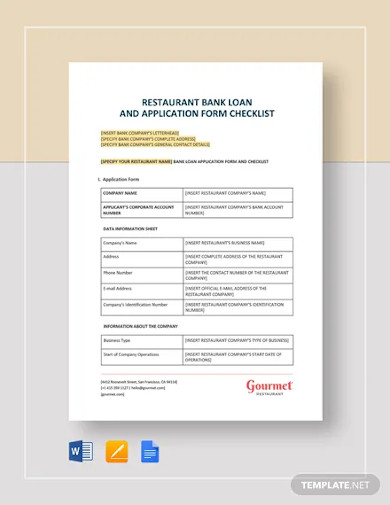

Getting a loan is not just about asking for money in a bank and having it in a snap. You have to tell the bank what kind of loan you need. Every type of loan has its own process and amount to be borrowed. To start, loans can either be secured or unsecured. A secured loan is the kind of loan that enables you to borrow money in exchange for a collateral. An unsecured loan is getting a loan based on your credit worth with no collateral at stake. You may also see job application templates.

This is a great type of loan for those who lack money for their college education. Student loans have reasonable interests and it does not have to be paid fully while the student is at school. There are various processes and types of student loans as well. On the other hand, the interest for student loans can increase as time passes by. This becomes a burden to pay just when they are starting their careers.

Personal loans are small amounts of money given to the borrower and can be used for any purpose. There is no collateral at stake for personal loans. Almost any bank can give this kind of loan. You can use it to buy new appliances, go on a vacation and any other stuff.

If you want to purchase a new home or an estate, a mortgage loan is the best type of loan for you. It is the biggest loan one can get in his lifetime since it involves homes. The loan is secured by the property you are aiming to buy. If you don’t pay in the right time, the bank can take away from you. The advantage of mortgage loans is it can help you get a home. It takes many years to save up for a home that is under your name until you die. You may also see printable business credit application forms.

For people who want to start a business, they should avail a small business loan. The requirement for this is a detailed business plan and cash flow statements to validate the authenticity of their business. Small business loans are secured loans so you have to prepare a collateral for this.

If you need some cash to use for unexpected purposes, you can ask for a cash advance. This is a very quick option if you really need the money right away. The downside of cash advances is the high-interest rate. It is a burden to pay especially if you don’t make enough money in your current job. You may also see membership application templates.

sterlingbankasia.com

bsp.com.pg

Getting a loan is not easy. We have to consider some things like our capacity to pay and our financial situation before getting one. However, loans have some perks and sweats that come along with meeting the loan requirements. You may also see college application templates.

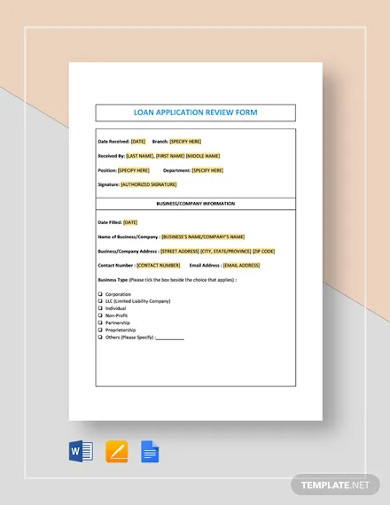

Bank loans are flexible. You just have to think about how to pay the amount regularly and nothing else. The good thing about banks is they don’t track how you use the money as long as you just pay on time. This buys you more time to invest the money and let it grow so you can pay on time. You may also see scholarship application form templates.

Credit card loans charge higher interest rates than bank loans. This gives you the heavier burden of paying for the money that you borrowed. Banks provide the lowest and cheapest interest charges compared to credit card loans.

In bank loans, you only have to pay the principal amount and the interest. It can save you so much money and the profits of your business are unharmed. Bank loans also provide tax benefits. An example of which is a tax exemption for bank loans intended for business purposes. You may also see lease application significance.

Bank loans put the repayment burden on the borrowers by having them pay on a monthly basis. This is a struggle especially if the borrower does not make enough money to get him by and pay the installments. Your credit score goes down once you make a late payment, and it will be harder for you to get loans in the future. Also, getting a bank loan with a variable rate can change depending on the condition of the market. It gets harder that way. You may also see club application templates.

Applying for a bank loan may be cheap, but you need to submit a truckload of requirements to be able to get one. It is a lengthy process and requires more time and collateral to put at stake. With unsecured loans, borrowers will be more burdened with higher interest rates. You may also see sample school application templates.

At some point in our life, we need to get a loan for something that will benefit us in the long term. The interest rate might be a burden to pay, but it is something we should risk for. We get loans for the people we love, and not for ourselves. Their future becomes more important than ours. You may also see lease application fundamentals.

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

No matter what kind of application form template you need you are expected to find that the greatest place to…

The need of membership template formats has increased in time due to business offers services. To better serve their customers’…

A job application is a letter that is submitted, along with the resume, when applying for a job. To beat…

Being a member of club may be a very fulfill knowledge in anticipation of the day the work of keep…

Many fresh graduates feel worried while it comes to making a winning application template; however, samples and formats related to…

Recruiting the perfect candidate for your company’s vacant job position proves to be one wearisome task. This is made especially…

There are a variety of reasons why a daycare application forms would be needed. The most common reason is that…

Volunteering for an organization gives individuals an opportunity to interact with like minded people and work selflessly towards achieving a…