19+ Internship Application Templates in Google Docs | Word | Outlook | Apple Pages | PDF

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

Feb 17, 2017

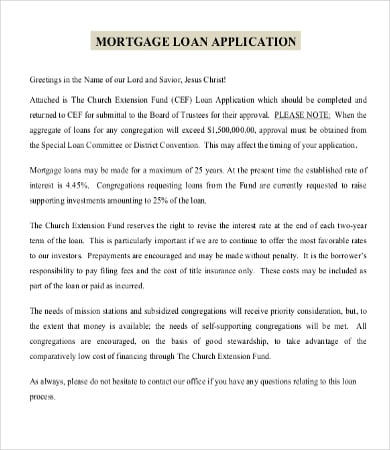

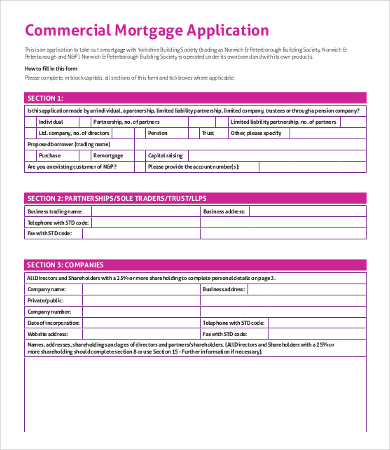

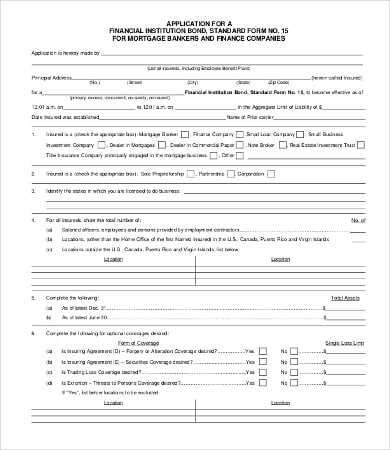

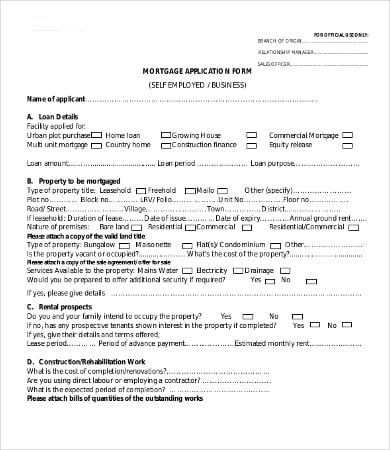

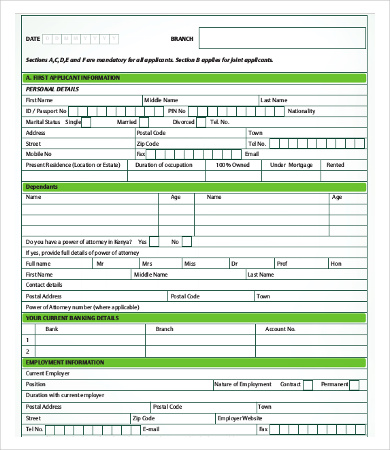

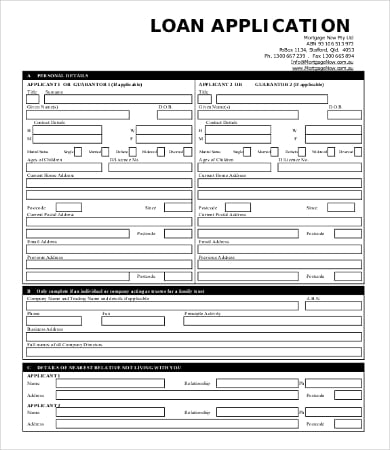

For many people, trying to attain their dream home is going to cost them a sheer, eye-watering amount of money. This is where the mortgage loan industry makes its living. They will loan you the amount to get a mortgage on the house, which you will then have to pay back incrementally until it is paid off and the house is fully yours. But how do you go about getting that huge loan in the first place?

Most lending institutions will require that you submit a loan application to them first. They are either providing this form, or you will have to supply one of your own. To help you make good on this and get the money you need, use an application template from this list of free PDF documents.

Wherever a serious amount of money is involved, there will be paperwork and a lot of consideration. This applies whether you are filling out a Loan Application or a Credit Application. Naturally, lenders are not going to be throwing money at everyone who applies. They require just enough detail to convince them you are worth lending the money to.

If you leave out any of the crucial information, your application will be immediately rejected. Make sure you have a good chance at getting to the processing stage by ensuring you have these details covered:

These are the basic details any mortgage application requires, but they are not the only details. Some lenders will require additional information, depending on the specific situation surrounding your case.

To make things easier for you, completely filling out any of these free mortgage application forms will make sure the lenders have all the information they need.

Also keep these in mind:

These forms are available as PDF files you can download and print for free. There will be a variety to cover different situations and application types, depending on your needs.

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

No matter what kind of application form template you need you are expected to find that the greatest place to…

The need of membership template formats has increased in time due to business offers services. To better serve their customers’…

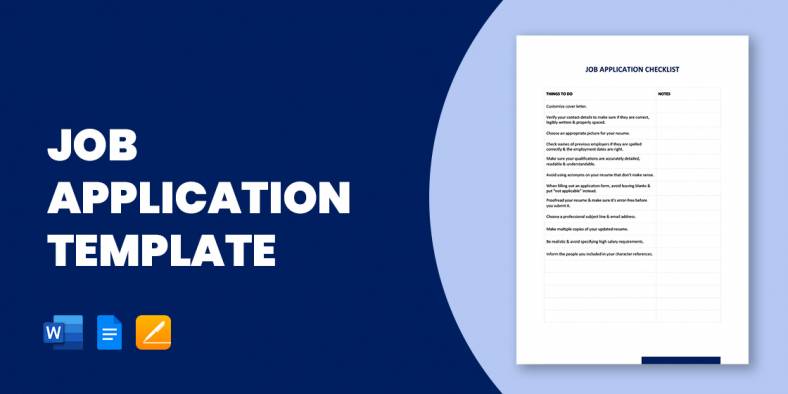

A job application is a letter that is submitted, along with the resume, when applying for a job. To beat…

Being a member of club may be a very fulfill knowledge in anticipation of the day the work of keep…

Many fresh graduates feel worried while it comes to making a winning application template; however, samples and formats related to…

Recruiting the perfect candidate for your company’s vacant job position proves to be one wearisome task. This is made especially…

There are a variety of reasons why a daycare application forms would be needed. The most common reason is that…

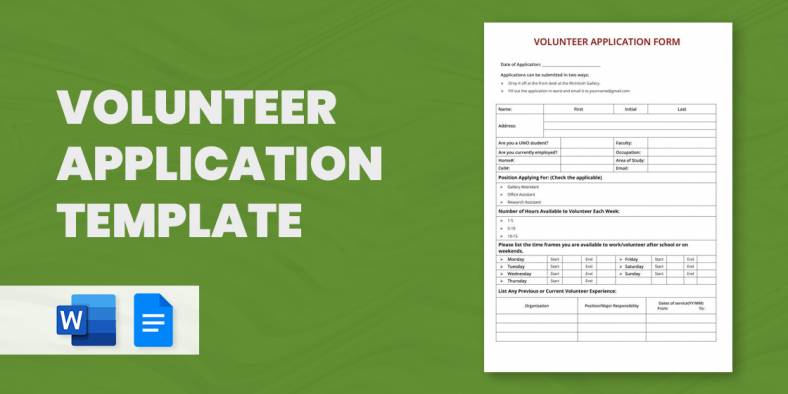

Volunteering for an organization gives individuals an opportunity to interact with like minded people and work selflessly towards achieving a…