19+ Internship Application Templates in Google Docs | Word | Outlook | Apple Pages | PDF

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

May 15, 2021

There are several high costs implicated in employing loan alteration companies, most of the people are started with do it yourself loan nowadays. This is giving Loan application template samples or formats to apply according to requirements. Though, you may want to attempt modify your sample loan all by manually, you want to recognize about the technique in information or you may get this quite a climbing and even not possible job. You can also see Job Application Template.

Guidelines of filling loan Applications Samples are different from one bank to an additional, but they are going to offer a leaflet on requirement for example that will assist you in fill these loan forms. You may also talk with some agent of the bank that helps out their loan and application.

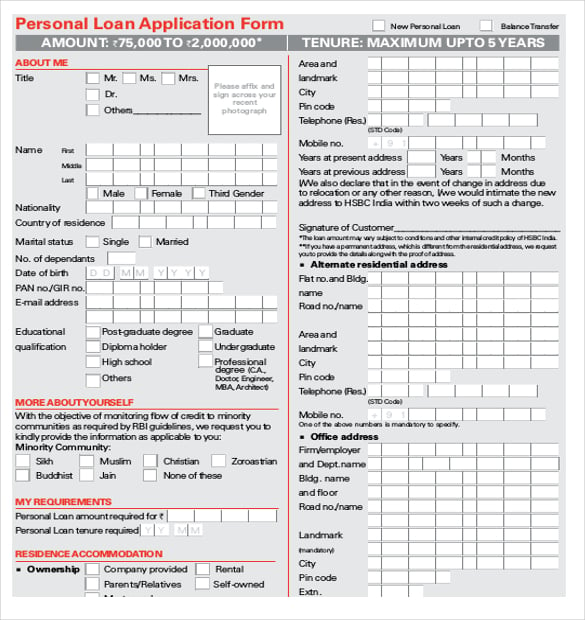

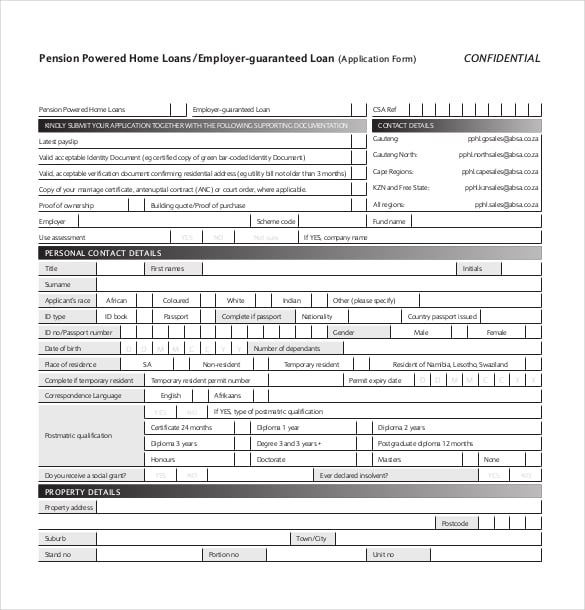

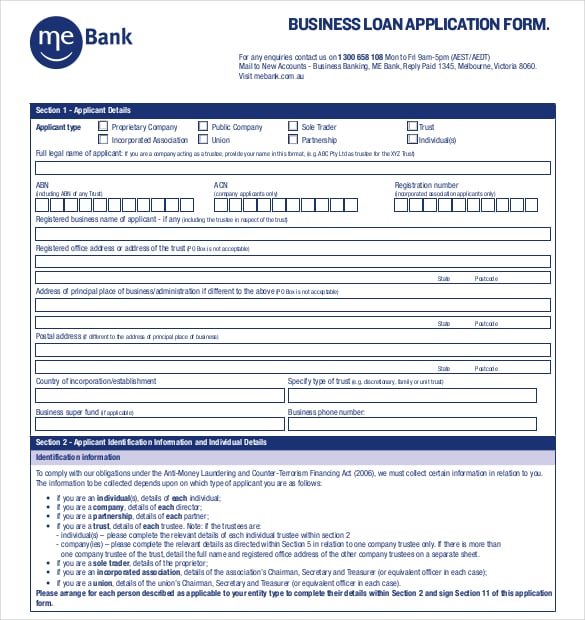

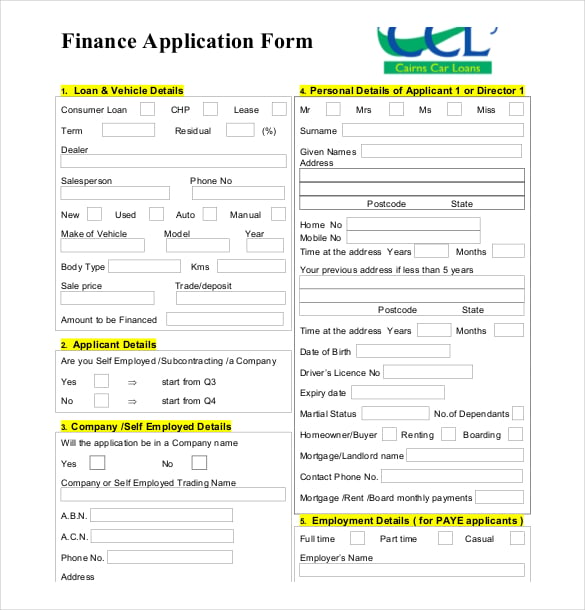

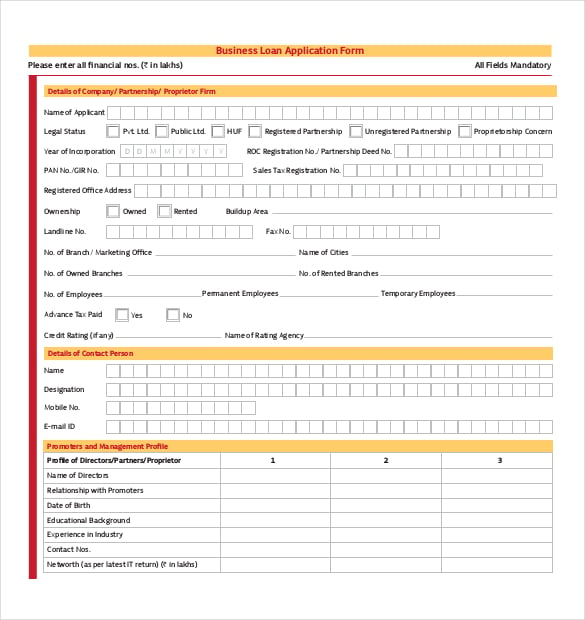

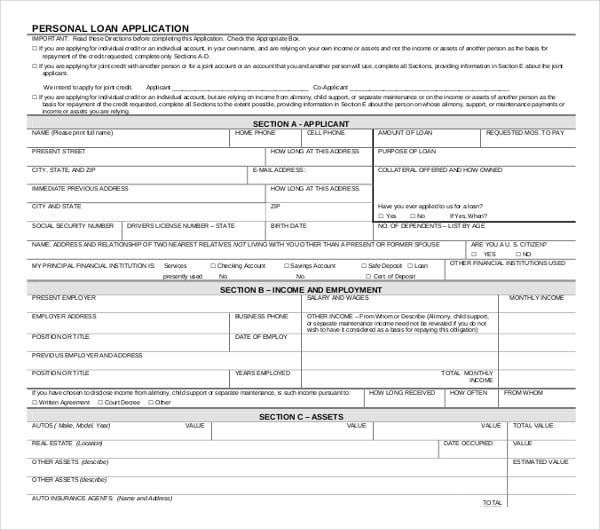

There are numerous loan application templates available on the internet. These generic templates can also be customized to meet specific requirements. Few of them are:

hsbc.co.in

hsbc.co.in  wgrf.co.za

wgrf.co.za  mebank.com.au

mebank.com.au  cairnscarloans.com.au

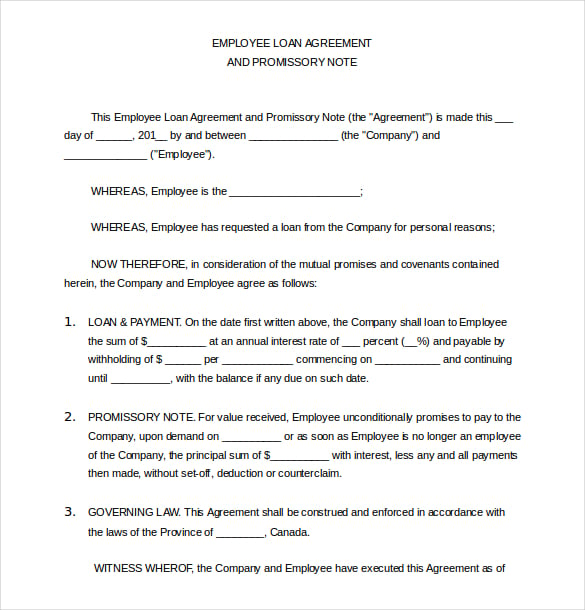

cairnscarloans.com.auThe most popular way to draw up a loan agreement is to use the loan application template. Most of the templates allow on screen editing while the agreement is being completed. On completion, the printouts of the agreement can be taken by both the lender and the applicant. The loan application template includes different sections which cater to the amount of money being lent and the terms of repayment. This also includes segments defining the lump sum payments or payments in installments done to the concerned party. The loan application templates can also cater to the payment procedures that may not include cash directly

The loan application template clearly lists both parties involved. It clarifies that each party is responsible for following the terms and conditions of the loan.

The loan application template includes a segment that clarifies the repayment terms of the loan. The repayment may be done in terms of monthly payments, yearly payments, payment after securing employment or a lump sum payment. The loan application templates can handle all types of repayment conditions. Clauses can also be added to negate payment or to change the terms and conditions of the loan. You may also see Sample Loan Application Letters

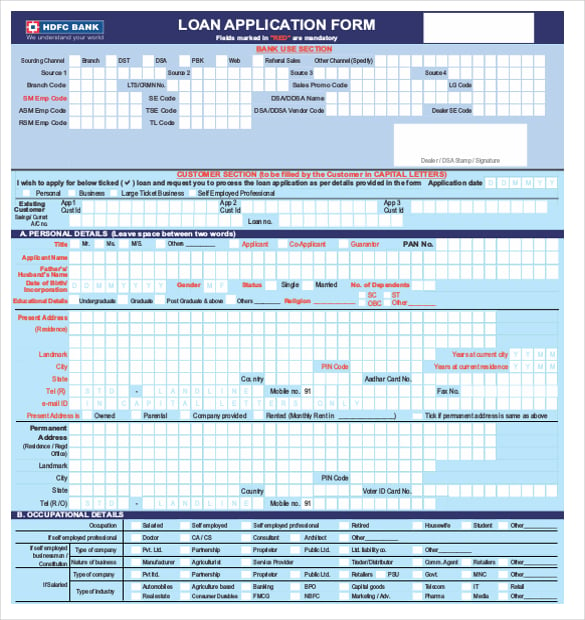

hdfcbank.com

hdfcbank.com contracts.org.in

contracts.org.in adityabirlafinance.com

adityabirlafinance.com  fnbwford.com

fnbwford.com success.bank

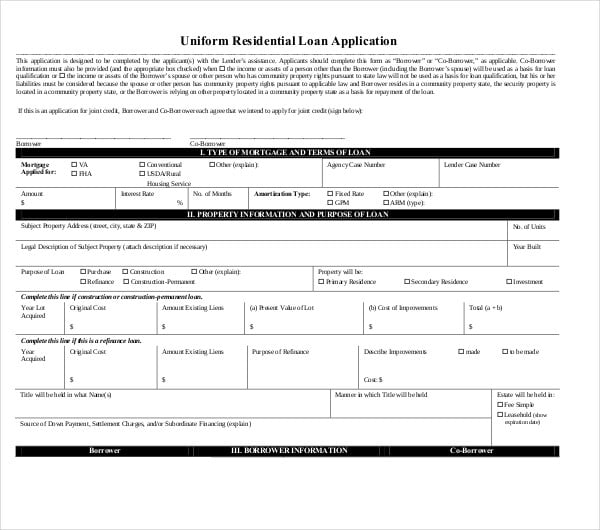

success.bank fanniemae.com

fanniemae.com hbdinc.org

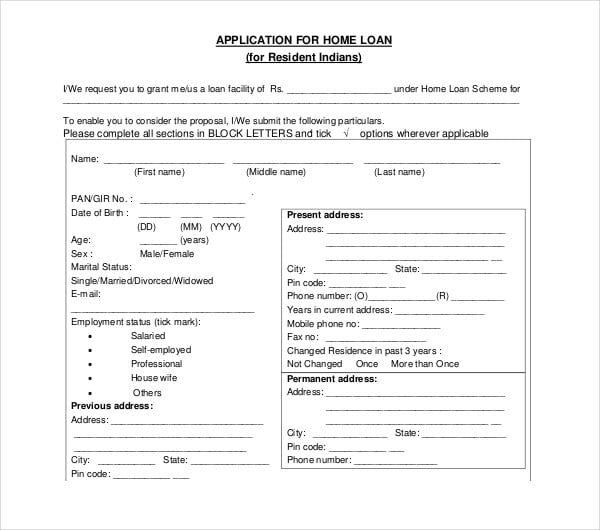

hbdinc.org bankofbaroda.com

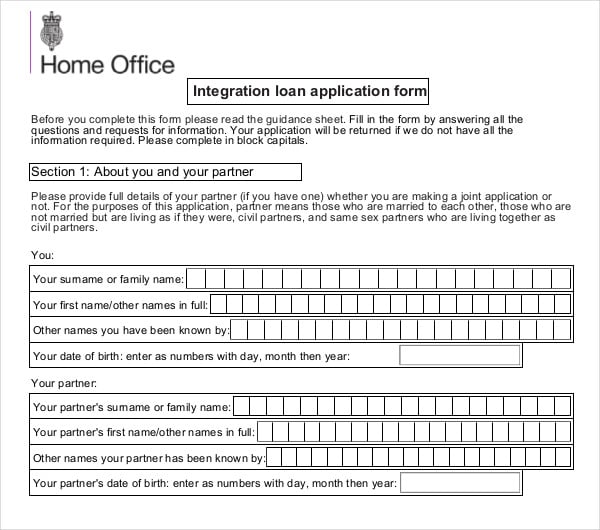

bankofbaroda.com assets.publishing.service.gov.uk

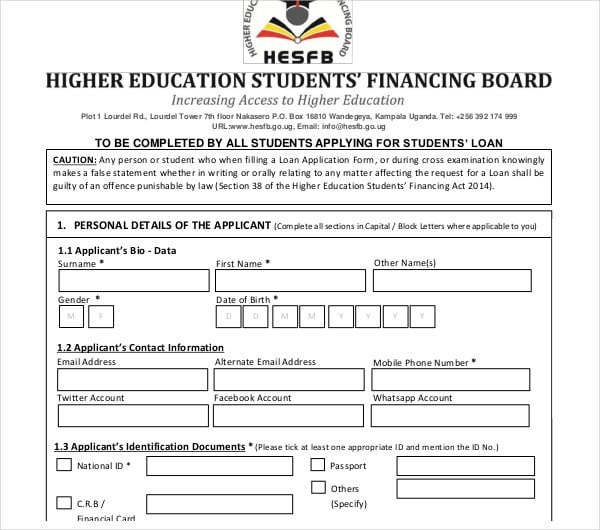

assets.publishing.service.gov.uk umu.ac.ug

umu.ac.ugWhile creating a loan application template, it is important to incorporate a section wherein the candidate is required to give all details about his current financial condition. The loan application template must have a section which requires the candidate to give details about his assets, liabilities and his past credit history.

Getting this information can help the banks to decide on the amount of loan that may be sanctioned to the applicant. In addition to this, the template can also have a segment which requires the candidate to provide essential information about the kind of collateral security offered by the candidate against the loan amount. You may also see Formal Application Letter Templates.

The loan application template can also be used to gain information about the gurantors. All these factors can help the lending institution to get all relevant information which can help to protect itself from the liability which may arise due to non payment of the loan.

If you have any DMCA issues on this post, please contact us!

Internships are huge ways to kick-start someone’s profession. Samples or formats of Internship application templates are offered by many companies…

No matter what kind of application form template you need you are expected to find that the greatest place to…

The need of membership template formats has increased in time due to business offers services. To better serve their customers’…

A job application is a letter that is submitted, along with the resume, when applying for a job. To beat…

Being a member of club may be a very fulfill knowledge in anticipation of the day the work of keep…

Many fresh graduates feel worried while it comes to making a winning application template; however, samples and formats related to…

Recruiting the perfect candidate for your company’s vacant job position proves to be one wearisome task. This is made especially…

There are a variety of reasons why a daycare application forms would be needed. The most common reason is that…

Volunteering for an organization gives individuals an opportunity to interact with like minded people and work selflessly towards achieving a…