9+ Logistics Risk Assessment Templates in PDF | MS Word

Risks are everywhere, and they significantly affect businesses. And when dealing with the supply chain, transportation, warehousing, and manufacturing all…

Jul 08, 2020

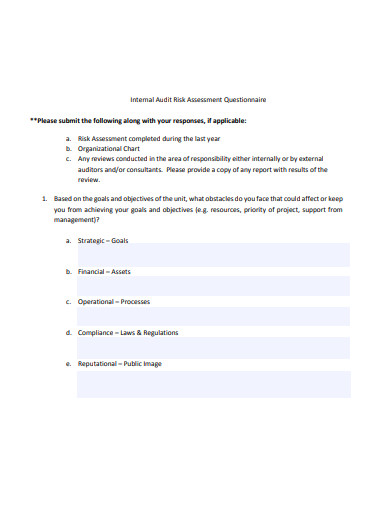

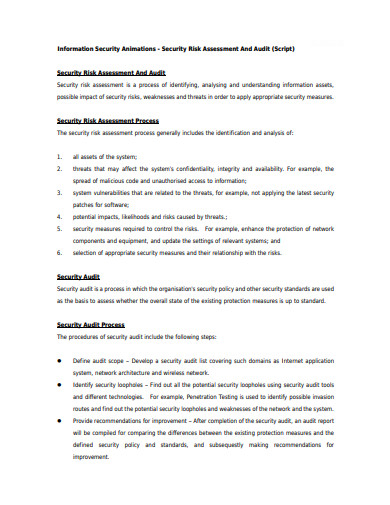

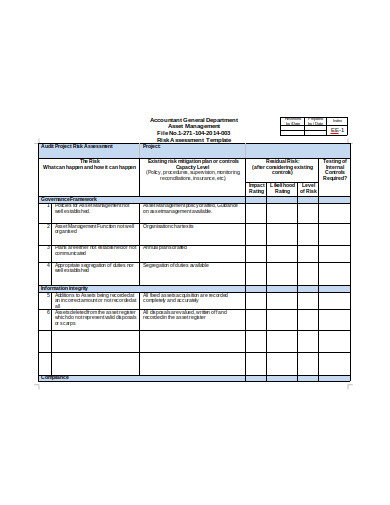

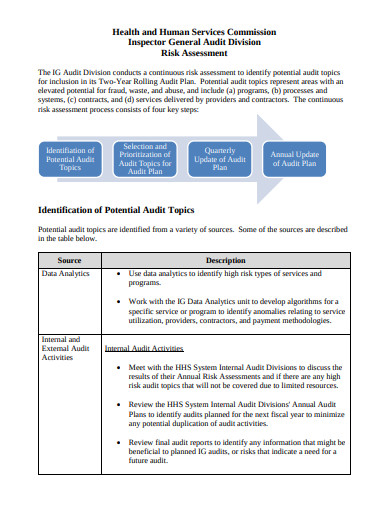

An Audit Risk Assessment is an assessment or evaluation of the is performed to understand the company and its environment. This includes the company’s internal control, identification and the assessment of the risk of material misstatement of the financial statement due to fraud or error.

wssu.edu

wssu.edu altec-usa.com

altec-usa.com oregontechsfstatic.azureedge.net

oregontechsfstatic.azureedge.net cbe.ust.hk

cbe.ust.hk infosec.gov.hk

infosec.gov.hk ias.gov.mw

ias.gov.mw cpaireland.ie

cpaireland.ie nd.gov

nd.gov sandiego.gov

sandiego.gov hhsc.texas.gov

hhsc.texas.gov gov.uk

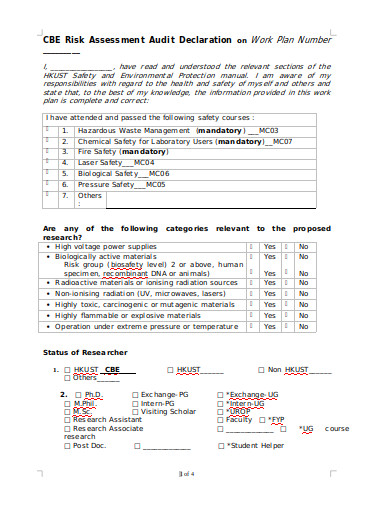

gov.ukThe term risk assessment can be used for the overall process of identifying hazardous and risk factors that have the potentials to cause harm, analyzing and evaluating the risks that are associated with hazards, devising appropriate ways to eliminate the hazard or control the risk.

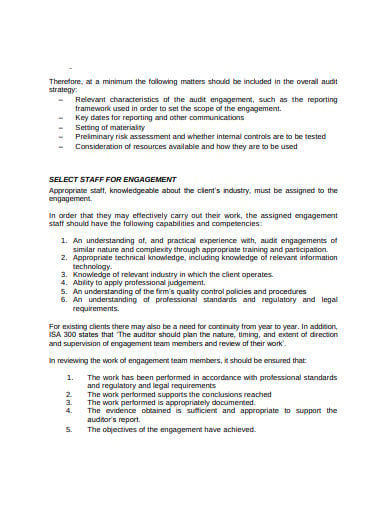

The company whose audit you will be conducting, you need to understand the market overview of the company. You will also have to know if the organization has any external regulatory agents. Another important thing is that you need to understand the company’s business strategy.

A very important element of the audit risk management process is an analyzation of the quality management of the organization. To understand an organization it is essential that you understand the organization’s management system. You can do that through interviews, taking note of the employee’s turnover, etc.

You can also understand it by finding out the term of the president, chief financial officer, chief executive officer in the organization. You can also examine a good sign of quality management if you see in the prior audits there are fewer numbers of accounting adjustments or there is no financial statement restatement.

The best way to get the all-round view of the business, people in the higher position, etc. it is better that you ask and talks to different employees of the different department. This will help you to get more information than you will get from the employees of the management.

For example, if you ask an employee of management about the payroll department, he might not be able to give you a better answer or proper information. But if you ask the employee of the payroll department information about there concerning department you will get a better answer.

You can use three analytical procedures to do an audit risk assessment.

Comparing the Financial figures of the current year to the previous year.

The analysis of the ratios like common ratio, inventory turnover, etc.

This is the procedure in which you analyze something based on other facts. For example, does the depreciation expense accurate based on the book value of all the fixed assets mentioned on the balance sheet.

Visiting the business location or the company or the department gives you first-hand experience. You will be able to get more information than what is written on the books and in the records. If you look through the company’s operation process you can get a better understanding.

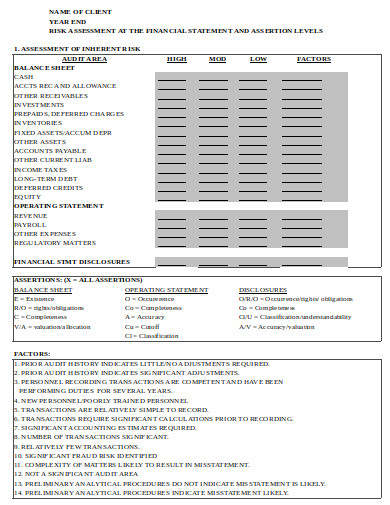

In this type of risk, the potential misstatement that is bound to happen will not be able to get controlled by the organization’s control system.

This is the type of risk that arises when the methods used for an audit cannot detect the material misstatement.

It is the type of risk where the organization’s financial statements are susceptible to material misstatement.

Risks are everywhere, and they significantly affect businesses. And when dealing with the supply chain, transportation, warehousing, and manufacturing all…

The audit assessment indicates to the general, orderly, examination, evaluation and the analysis of the business marketing conditions, both internal…

Security Assessment Questionnaire (SAQ) is basically a cloud duty for guiding business method management evaluations among your external and internal…

The leadership assessment survey template is formed with the aim of understanding business success to be an instantaneous reflection of…

Portfolio Assessment is the collective term for the assessment of a student’s work. This is the assessment of the student’s…

Formative assessment refers to a large sort of strategy that lecturers use to conduct in-process evaluations of student comprehension, learning…

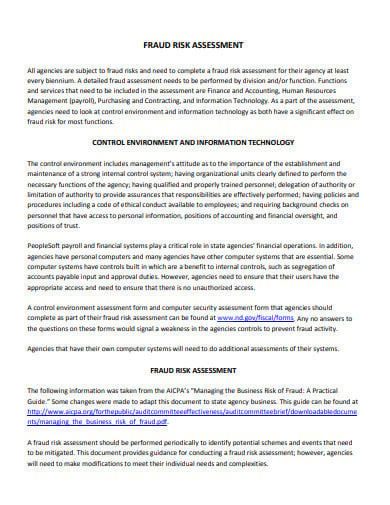

A fraud risk assessment is a type of management that is a device utilized by the board to distinguish and…

assessment templates word assessment pdf assessment pages assessment free assessment template health assessment hospitality industry risk assessment gifts and hospitality…

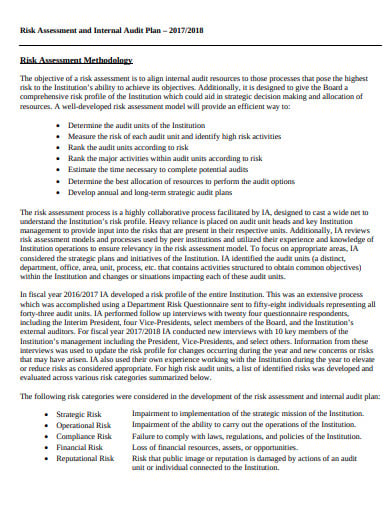

The establishment of an audit is referred to as risk assessment. Audit risk assessment methods are performed to acquire an…