9+ Logistics Risk Assessment Templates in PDF | MS Word

Risks are everywhere, and they significantly affect businesses. And when dealing with the supply chain, transportation, warehousing, and manufacturing all…

Jul 07, 2020

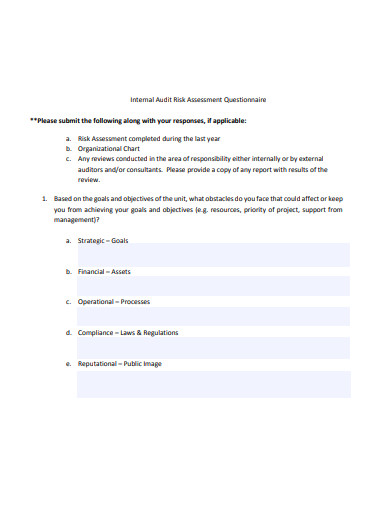

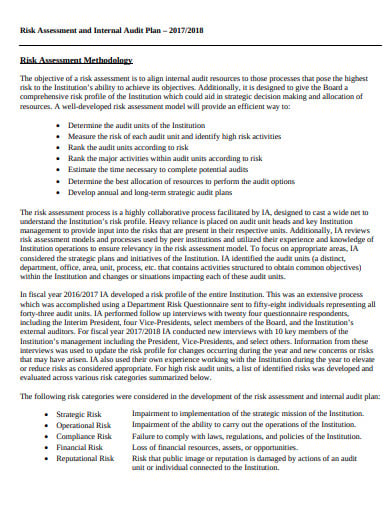

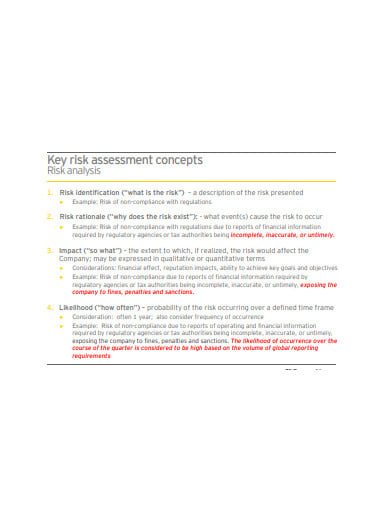

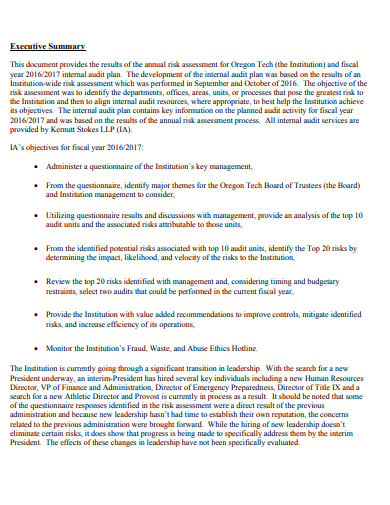

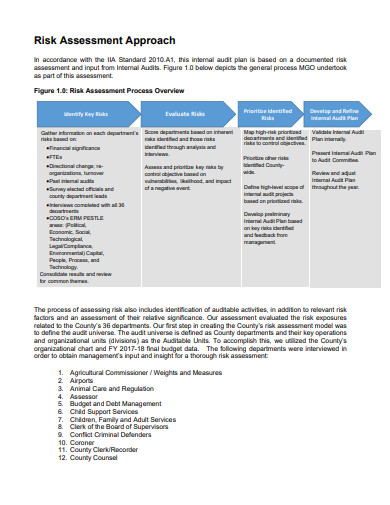

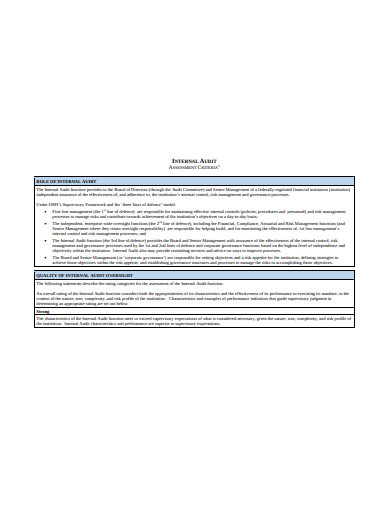

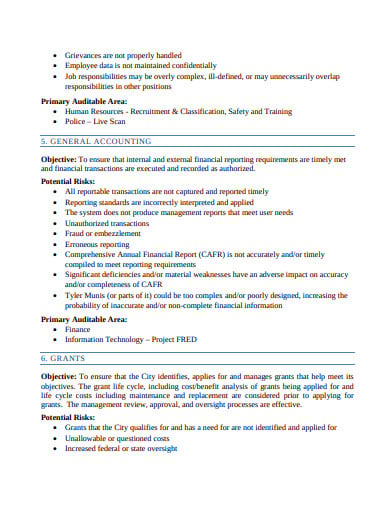

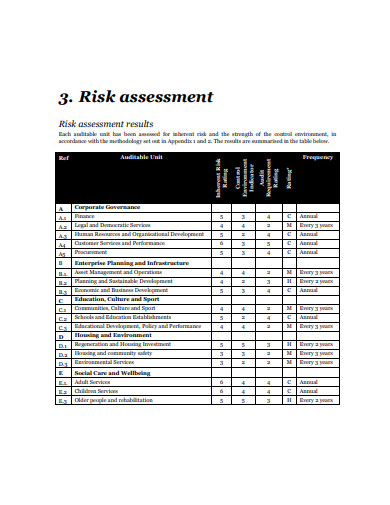

The establishment of an audit is referred to as risk assessment. Audit risk assessment methods are performed to acquire an understanding of your organization and its background, including your organization’s internal control, to recognize and evaluate the risks of material misstatement of the financial statements, whether due to scam or mistake. Have a look at the internal audit risk assessment templates provided down below and choose the one that best fits your purpose.

wssu.edu

wssu.edu oregontechsfstatic.azureedge.net

oregontechsfstatic.azureedge.net theccia.org

theccia.org

acua.org

acua.org chapters.theiia.org

chapters.theiia.org oit.edu

oit.edu finance.saccounty.net

finance.saccounty.net osfi-bsif.gc.ca

osfi-bsif.gc.ca cityofpasadena.net

cityofpasadena.net committees.aberdeencity.gov.uk

committees.aberdeencity.gov.uk icjce.es

icjce.es Step 1: Figure out hazards

Step 2: Determine who can be hurt, and in what way

Step 3: Evaluate the risks and take action

Step 4: Make a report of the findings

Step 5: Analyze the risk assessment

Risks are everywhere, and they significantly affect businesses. And when dealing with the supply chain, transportation, warehousing, and manufacturing all…

The audit assessment indicates to the general, orderly, examination, evaluation and the analysis of the business marketing conditions, both internal…

Security Assessment Questionnaire (SAQ) is basically a cloud duty for guiding business method management evaluations among your external and internal…

The leadership assessment survey template is formed with the aim of understanding business success to be an instantaneous reflection of…

Portfolio Assessment is the collective term for the assessment of a student’s work. This is the assessment of the student’s…

Formative assessment refers to a large sort of strategy that lecturers use to conduct in-process evaluations of student comprehension, learning…

A fraud risk assessment is a type of management that is a device utilized by the board to distinguish and…

assessment templates word assessment pdf assessment pages assessment free assessment template health assessment hospitality industry risk assessment gifts and hospitality…

The establishment of an audit is referred to as risk assessment. Audit risk assessment methods are performed to acquire an…