Best AI Text to Video Models & Templates

Introduction: AI Video Generation Is No Longer Experimental What began as short, unstable demo clips has evolved into production-grade systems…

Jul 07, 2020

A documented evaluation of whether or not an organization’s financial statements are objectively accurate along with the standards, proof, and hypotheses used to manage the audit is referred to as a business audit. An auditor states whether or not the financial statements are free of material error. Have a look at the business audit templates provided down below and choose the one that best fits your purpose.

icaew.com

icaew.com des.nh.gov

des.nh.gov pdfs.semanticscholar.org

pdfs.semanticscholar.org pitcher.com.au

pitcher.com.au ftms.edu.my

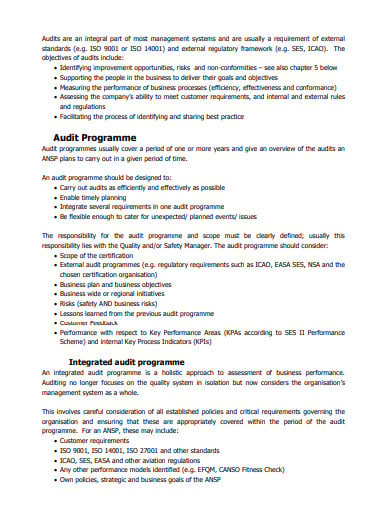

ftms.edu.my canso.org

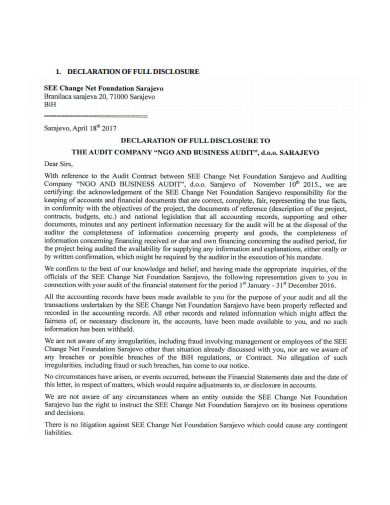

canso.org seechangenetwork.org

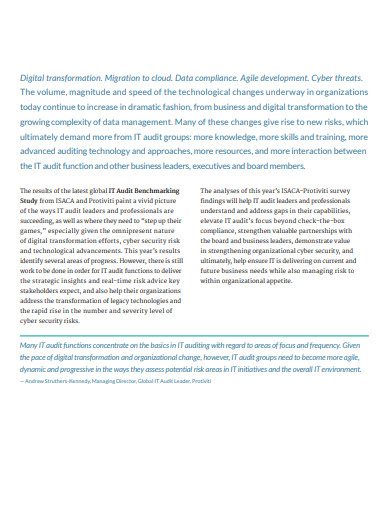

seechangenetwork.org protiviti.com

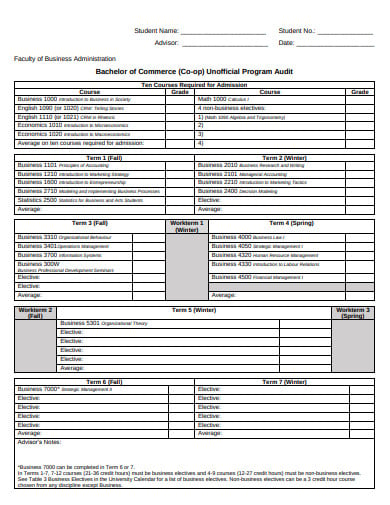

protiviti.com business.mun.ca

business.mun.ca triarchypress.net

triarchypress.net kau.se

kau.se accounting.rutgers.edu

accounting.rutgers.eduIntroduction: AI Video Generation Is No Longer Experimental What began as short, unstable demo clips has evolved into production-grade systems…

In today’s fast-paced digital world, efficiency and consistency are key to content creation, and this is where the power of…

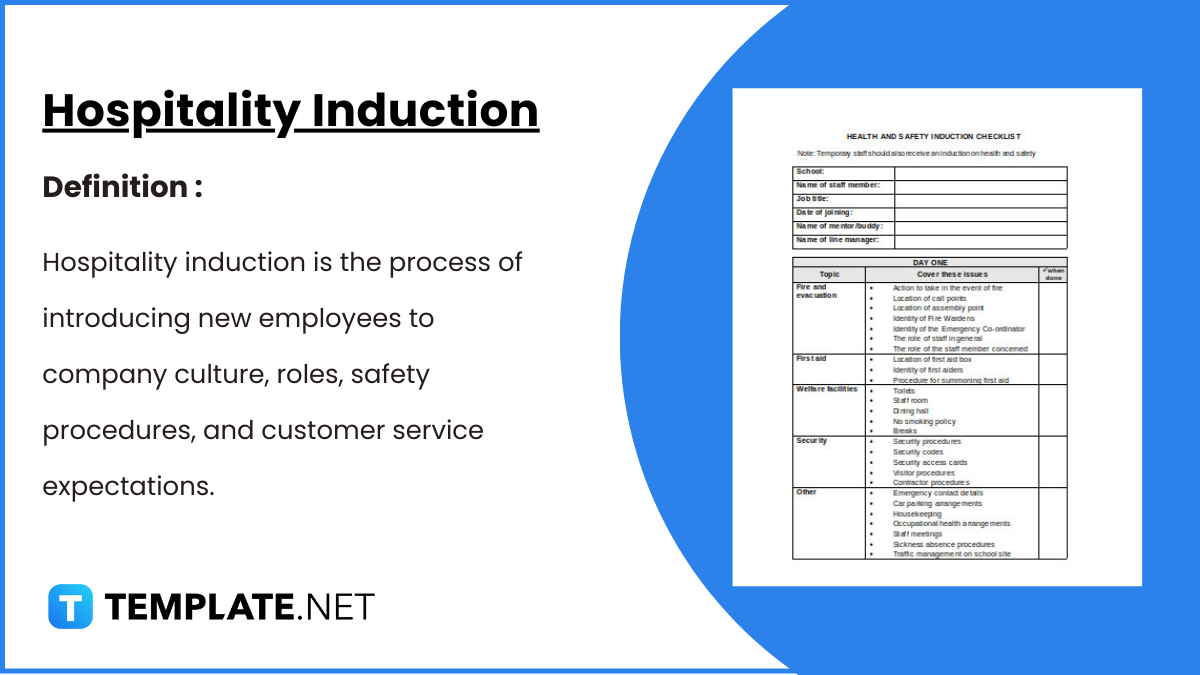

Hospitality Induction Templates are structured guides created specifically for the hospitality industry to facilitate the onboarding process for new employees.…

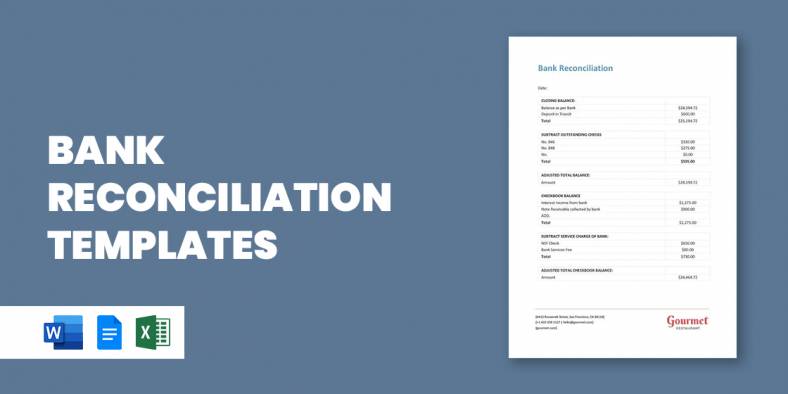

Whether you are a business or an organization, it is important for you to keep track of your business bank…

A Company Description provides meaningful and useful information about itself. The high-level review covers various elements of your small business…

A smartly designed restaurant menu can be a massive leverage to any food business.

Whether you need to keep neat records of received payments, or are looking for a template that helps you look…

The most widely recognized use for a sample letter of planning is the understudy who, after finishing secondary school, wishes…

The term “quotation” can refer to several things. While to some it may refer to a quote, which is proverbial.…