Training Calendar Template – 42+ Word, PDF, PSD Documents Download

Need the special calendar templates for your training purposes? Check out our special range of training calendar. These designs will…

Apr 25, 2023

If you’re going to start up a new business, you should know that there are going to be a bunch of bills that you will have to have to pay. Sometimes the problem isn’t just paying the bills but the act of having to keep track of every single one of them.

If one can’t keep track of what bills to pay, then there’s a very high chance in which that person may be forced to make late payments. So to ensure that it doesn’t happen, one will have to make use of a bill pay calendar. This article will teach you on how you can make use of this type of calendar so that you won’t ever have to worry about keeping track of your bills. You may also see budget calendar templates.

arlingtontx.com

consumerfinance.gov

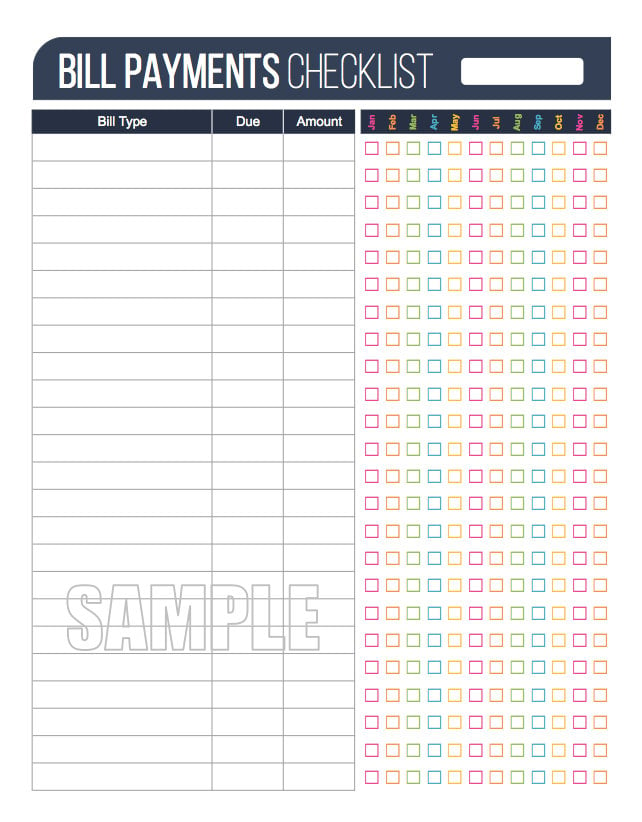

Since you’ll be making use of bill calendar templates, you’re going to have to learn how to create the bill schedule that you’ll be putting in it. The point of having a bill schedule is so that you will be able to determine what expenses you have already been able to pay, what bills are still due and it helps you rank bills by priority whenever you’re experiencing a cash flow imbalance. While the majority of small businesses can get by using a manual bills payment calendar, the majority make use of automated ones, especially if that business gathers more than 2 bills per day. A comprehensive schedule involves a tracking system, aging report, and cash flow emergency plan.

So, if you’re going to be coming up with a bill payment schedule in pages for your bill payment calendar, then here are the things that you’re going to have to do:

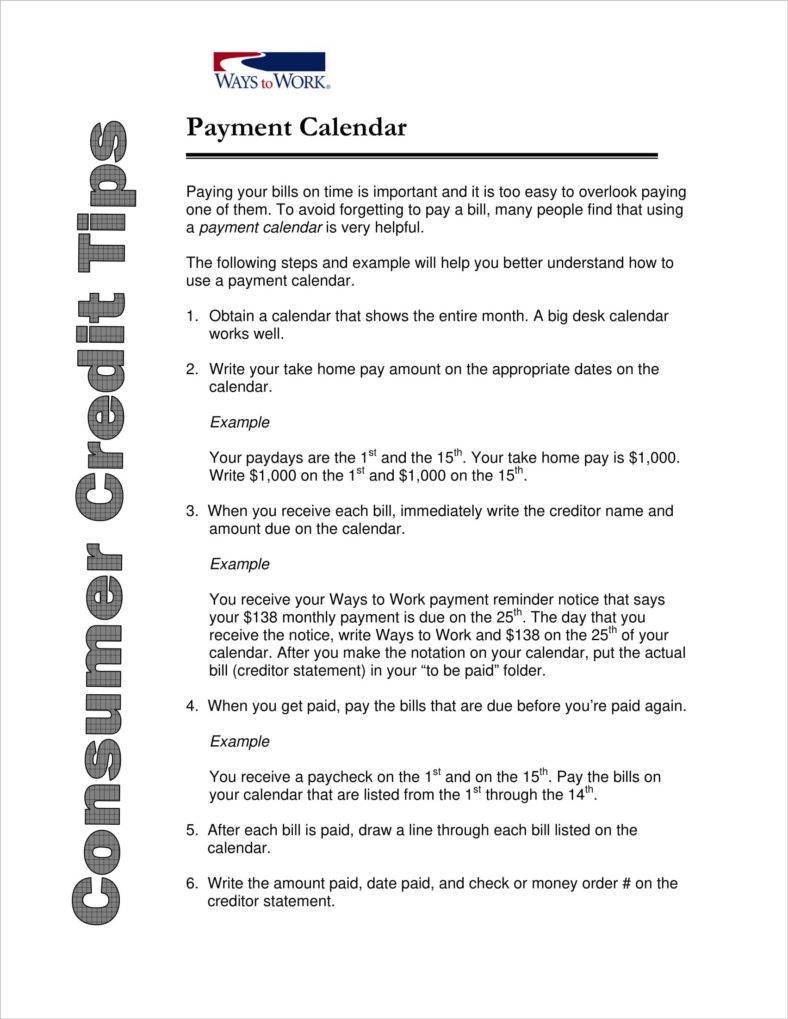

You should download a spreadsheet program such as Microsoft Excel to help you out in creating your bill payment calendar and schedule. Once you have it, create a spreadsheet with columns and labels that consist of the names of the biller, account number, expense type, invoice date, the amount due and payment due date.

If you’re going to make use of an automated program, then the only thing that you’re going to have to do is set up an individual file for each supplier or biller.

Schedule a specific period of time for each day. A good example would be the time when you open up the daily mail and where you enter incoming bills and even credit card expenses that you’re going to have to pay off. File paper copies of invoices and credit card receipts with the spreadsheet. If you’re using an automated system, then you’ll need to scan all of the receipts and invoices that you’ve managed to gather into the automated system.

courts.phila.gov

After you’ve managed to acquire all the bills within the week, you should gather, organize, and review every single one of them. If you’re using a computer spreadsheet, then automatically sort out all of the bills by their due dates. If you’re making use of an automated program to help you keep track of all of them, then you’re going to have to enter bills in due-date order on a separate sheet of paper. You may also see a calendar in words.

It’s best that you set up your own payment rules so that you can ensure you’ll be able to pay all of your bills. A good example would be paying and mailing out paper checks at least three to five days in advance before a bill’s due date. If you’re going to be paying your bills via online means, consider scheduling automatic payments for regular expenses such as utility and telephone bills and for others, such as credit card bills, it’s best that you schedule a one-time payment at least a day or two before the date on which the bill is due. You may also see simple calendar templates.

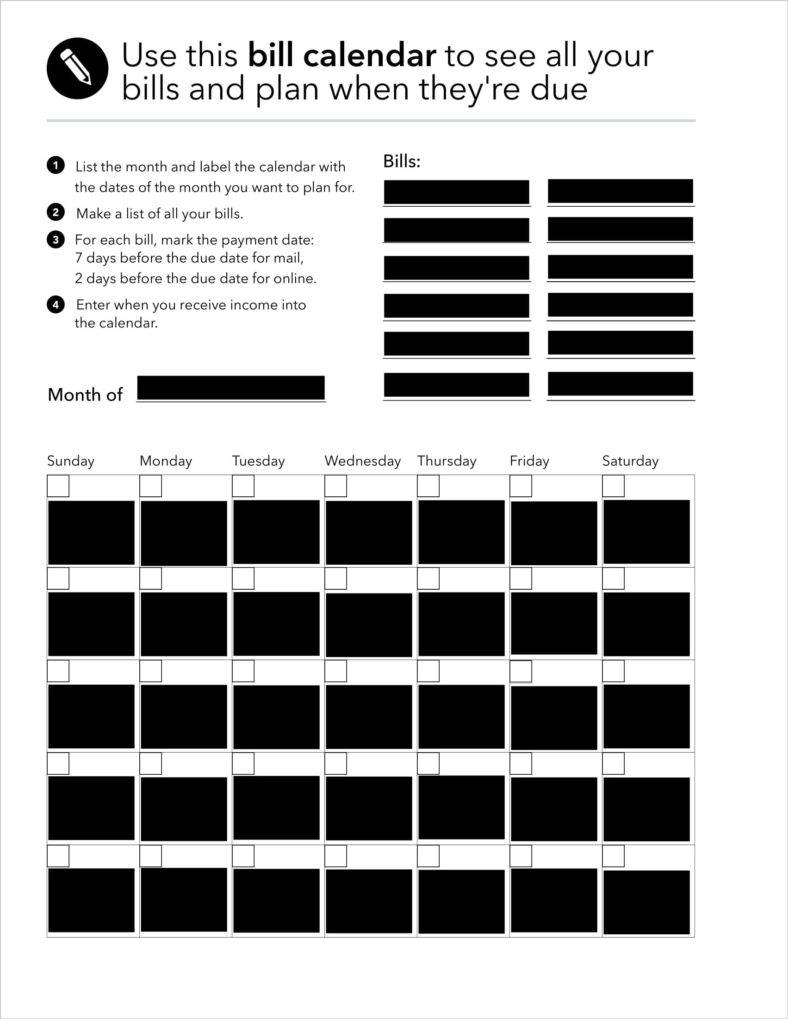

Whether you’re running a business or you’re just trying to get by, you should always remember that you need to stay on top of your bills. Never be behind on any of your payments as this could just lead to a lot of problems for you. You can easily prevent this by creating your very own monthly accounts payable aging schedule. You may also see excel calendar templates.

An aging schedule is a breakdown by supplier or creditor which shows if a bill has already been paid or is way past its due date. In an automated system, you can simply run an aging report. However, making use of a manual bill payment calendar outline will require you to have column labels consisting of the supplier’s name and total amount due. You’ll need to label these columns according to whether the bill is current or one to 30 days, 31 to 60 days or more than 60 days past due. You’ll need to fill in the spreadsheet according to the information that’s all within your bill payment schedule sample.

Having accounts payable aging schedule won’t just help you keep alert of all the bills that you may have forgotten, but it’s also a very helpful tool in assisting you and your business with the cash flow management.

There will always be consequences in the event that you aren’t able to pay certain bills by the end of the due date; which is the reason why you’re going to have to come up with a priority emergency schedule. It’s recommended that business owners who are facing a cash flow crisis must pay bills according to a simple schedule that puts business taxes and payroll first in line. The next step should be to pay bills that are at least 60 or more days past due as noted on your accounts payable aging report. Once that’s done, the next thing that you’re going to have to pay is for utility items, key suppliers, rent, vendors and any secured debts or loans carrying your personal guarantee. You may also see monthly calendar templates.

The last type of bills that you’re going to have to pay credit card bills, insurance bills, and miscellaneous business debts. If you think you’re able to do so, then you should pay at least some of the things you owe to every business creditor. This way, you’ll be able to lessen the bills and that will make things much easier on your business’s finances. You may also see calendar templates in pdf.

Now that you know how to come up with your payment schedule in word, you’ll need to learn how to manage your bills. The whole point of this process is, it will enable you to keep better track of your bills and prevent yourself from having any unpaid or late payments.

So, here are the things that you need to look after to manage all your bills effectively and efficiently:

Whether you’re running a business or you are a regular salaryman, list down all of the bills that your business pays constantly within the month. One of the best ways to help you with this is by keeping all of the invoices and receipts that you’re given and keeping them on your personal record. When the time comes for when you need to make a list of all the required bills that you need to pay, take them out so that you can easily write each one of them down.

Then you will need a dedicated place where you organize your bills. If you’re receiving physical copies of receipts or invoices, then it’s best that you keep a folder or a spreadsheet where you can put in all of them. If they’re all digital statements, you can easily save them via email or through automated programs.

In the event that you are behind any of your payments, there’s always that tempting feeling of wanting to avoid going through any of your bills. It’s best that you resist that temptation as you’re going to have to organize all of your bills, even the ones where you know you haven’t paid for yet. The reason for this is because you don’t want to be surprised by any additional fees or additional payments that you’re due.

To remove some of the stress and time pressure of paying your bills, make automatic bill payments when possible. This will take some of the load off you as all you have to do is put in on your bill payment calendar layout and mark it off whenever the day passes. You may be able to set up automatic payments through your bank, or your biller may deduct the amount of your bill from your account. Either way, having automated payments helps you streamline the bill-paying process and guarantees that you’re able to pay whatever bills you may have on the due date.

However, just because these bills are paid automatically does not mean you should forget about them. You still need to monitor the transactions to make sure you have enough money in your account to cover the bills and that no errors are made, such as being charged the wrong amount or even being twice double your usual amount. It takes some work on the front end, but by organizing and streamlining your payment process, you’ll be guaranteed that you pay all of your bills at the end of every month and during the time where they actually need to be paid. You may also like sample calendar templates.

If you would like to learn more about how you will go about creating a bill payment calendar or any other type of basic calendar, then what you’re going to have to do is go through our site, find the articles that have the necessary information you need, and utilize all the information you have been able to gather to help you and your business out. You may also see microsoft calendar format templates.

Need the special calendar templates for your training purposes? Check out our special range of training calendar. These designs will…

Everything in a company works according to the clock. Be it the meetings, the presentations, the events, the interviews—everything needs…

A church always has various events all through the year. It is essential to make a proper calendar that can…

Academic success does not happen overnight. It is coursework consisting of stressful days, busy weeks, and long months—making up a…

If you’re going to start up a new business, you should know that there are going to be a bunch…

When you’re working out, you want to be able to keep track of your own progress as time passes. You’ll…

Calendars templates have existed since time immemorial. They are mostly used as simple reminders for important meeting appointments or events…

Much like any other profession, it may be wise to use basic calendar templates in settings like daycares. After all,…

When it comes to your work there are a number of possible tools available to help you such as calendar…