40+ Word Checklist Templates

Due to limited memory and attention, we humans often forget to do tasks which we were supposed to perform. Our…

Sep 16, 2023

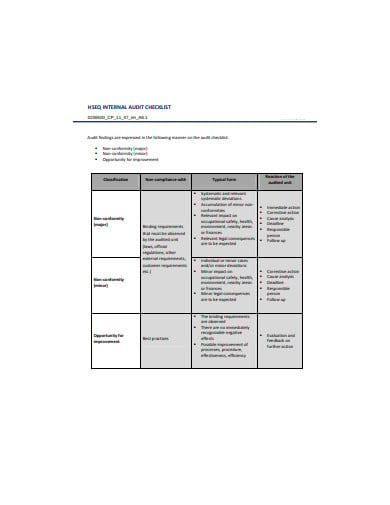

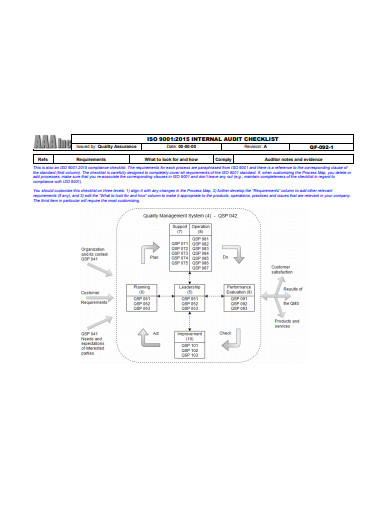

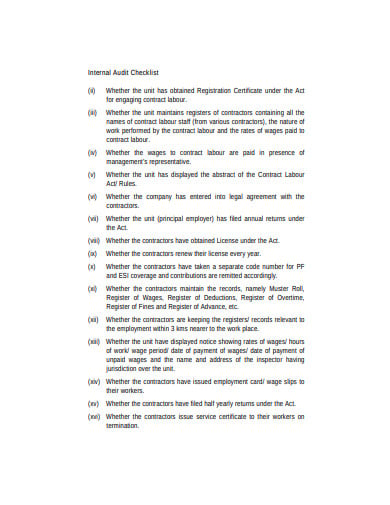

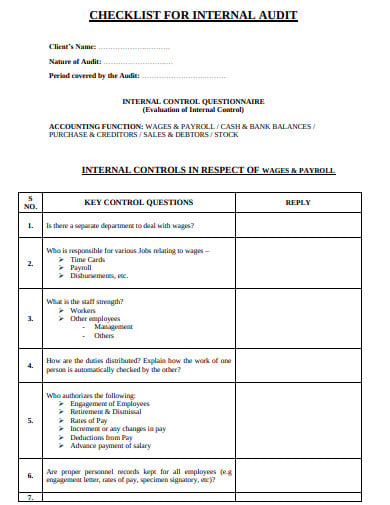

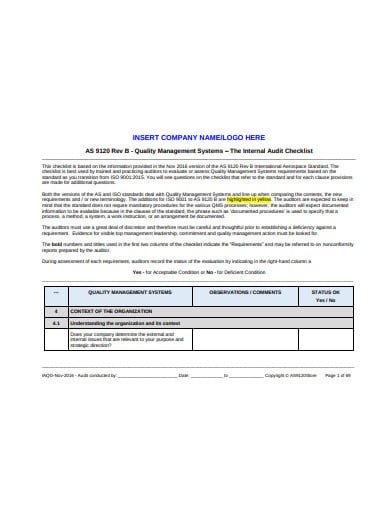

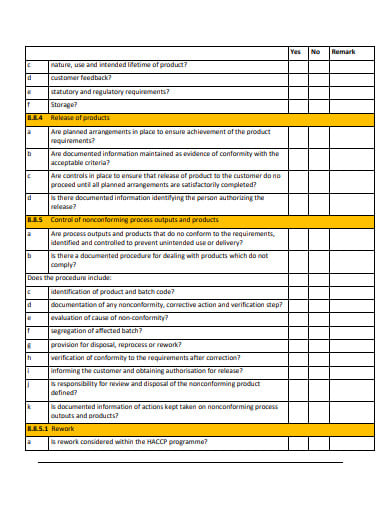

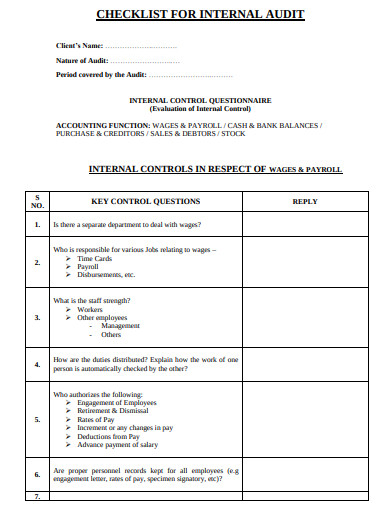

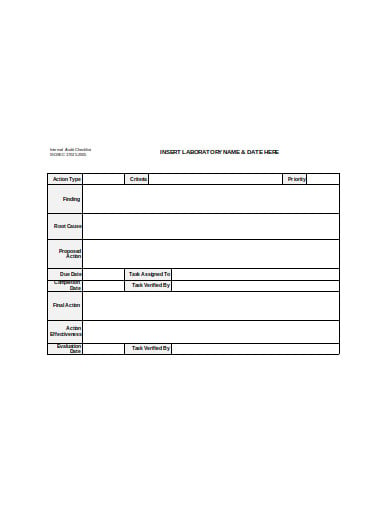

An internal audit checklist can help deliver meaningful results by promoting effective audit planning whether you are auditing a particular management system or simply updating an internal audit procedure. It helps in audit planning, reporting as well as problem-solving. This checklist delivers clear, concise and well-documented information that will be time-saving and will also provide long-term value for money.

cce-inc.com

cce-inc.com imsxp.com

imsxp.com kb.icai.org

kb.icai.org crs.org

crs.org fsnl.nic.in

fsnl.nic.in amazonaws.com

amazonaws.com uhbvn.org.in

uhbvn.org.in complianceonline.com

complianceonline.com fami-qs.org

fami-qs.org tcmservices.co.in

tcmservices.co.in nist.gov

nist.govOutline the main subject headings for the audit checklist to help draw a picture of the important pieces of an audit. These subject headings can include items like management, finance, and operations of a particular organization or company. These can be related to the various aspects of the business that you should focus on when conducting an audit. You must use a proper program like a spreadsheet application or simply paper and pencil to draft the sample checklist.

Now its time to place the subheadings under the main subject headings in your checklist. You can start placing management topics under the management subject heading and include topics related to the planning of the business and employee management. List out the subheadings like sales plan, pricing policies and annual budget to help audit the planning processes. This part will help in verifying that a sales plan exists, the pricing policy is in place and business operates within a realistic budget. You can also place subheadings like employee expectations, job descriptions and discipline procedures to escort an audit-related to employee management.

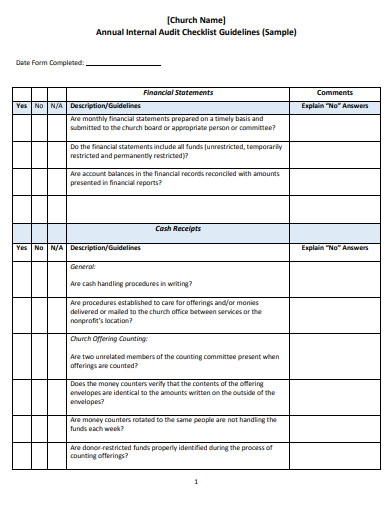

Set out the topics and functions that are related to the financial operations that are under the finance subject heading. You can include topics related to accounting practices as well as financial planning for the business. This division normally addresses the type of accounting system that is in place and also verify that the various accounting statements are prepared accurately. It then confirms that the owner understands the purpose behind all these statements.

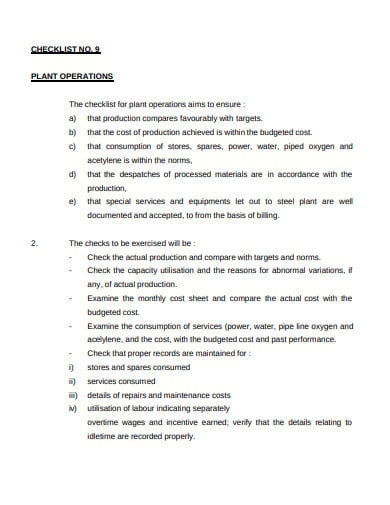

Put the functions are related to the operations of the business under the “operations” subject heading. This will include topics that are related to production along with marketing and promotions. For example, you will want to evaluate supplier relationships, inventory control measures, and training programs when it comes to production. You must address issues related to competitors, customer needs and promotion plans under marketing and promotions subheadings.

Make sure you take advantage of the help that is available to small businesses. You can take the help of the audit checklist that is provided by the U.S. Small Business Administration. It can help in guiding the creation of your business checklist. Make sure you read through it for guidance and add any kind of specific details like those that are related to quality and safety requirements, to your audit checklist.

An internal audit checklist usually helps you to determine the level to which your organization’s quality management system answers to the requirements. This is done by determining whether those requirements have been effectively implemented and maintained properly. The simple checklist will help you in assessing the status of your existing management system and also helps in identifying certain weaknesses and provide corrective actions for improvement.

The internal audit checklist can be considered one of the many tools that help the auditor in ensuring each internal audit addresses the mandatory requirements. It also serves as a reference point before, during and even after the audit procedure and it provides various benefits if it is developed for a specific audit and is used correctly.

Due to limited memory and attention, we humans often forget to do tasks which we were supposed to perform. Our…

A facility maintenance checklist is a priceless defense means to keep a building reliable and safe by periodical planning, checkups,…

A Recruitment Checklist is the to-do-list where you list down all the important details that you need to do or…

Logistics Performance Index indicates that America is one of the leading logistics industries in the globe. Its networks coordinate with…

The best way you can make sure that all cleaning go as planned is to have a cleaning checklist samples.…

A Resume Screening Checklist is a checklist that is prepared by the recruiter to list all the important points based…

HR Compliance Checklist is the tool that is used by HR professionals to make the preparations for the HR tools.…

A retirement party is the opportunity to celebrate the retiree’s past achievements as well as their future efforts. The party…

The mortgage business has gone through a lot of chapters in the industry, combating business challenges every year. According to…