40+ Word Checklist Templates

Due to limited memory and attention, we humans often forget to do tasks which we were supposed to perform. Our…

Sep 19, 2023

The mortgage business has gone through a lot of chapters in the industry, combating business challenges every year. According to the Mortgage Bankers Association, the mortgage industry is continually facing an increasing problem in terms of “interest rates, margin compression, and compliance requirements.” In the US, for instance, the mortgage industry has claimed its current status as one of the “largest and most complex home-financing markets” in the whole world, making substantial debt among Americans that amounted to 15.4 trillion dollars in the year 2018 with a total of 5.96 million homes sold. And if you’re one of those who wants to buy a home someday, a checklist template could provide so much help in the process. So, go over this post and enjoy the benefits that you can get from it.

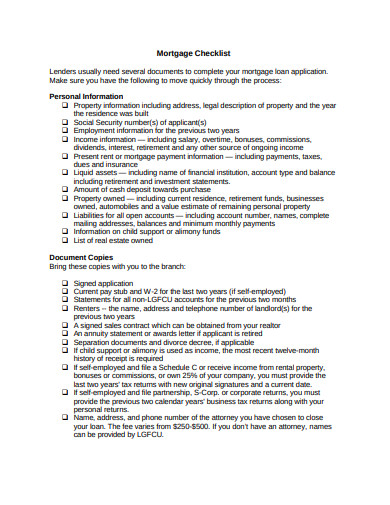

lgfcu.org

lgfcu.orgThis Mortgage Checklist Template is a document that lists all the necessary data and information that you need to provide to get accepted with your mortgage application. The file gives and defines every part of the checklist in a detailed manner. Aside from that, it is also made available in a portable document format (PDF) and readily downloadable. Hurry and get a copy of this sample checklist template now!

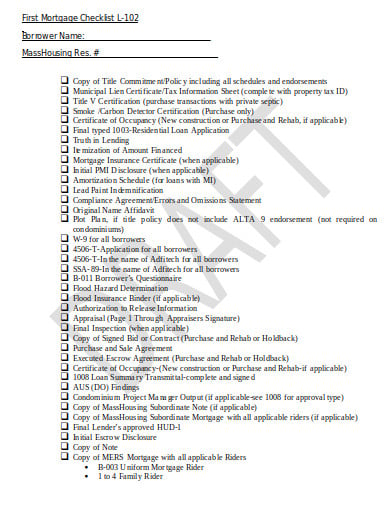

masshousing.com

masshousing.comDrafting a mortgage checklist from scratch can be pretty overwhelming and exhausting. However, if you opt to make one for yourself, make sure you follow this Mortgage Checklist Format. The file is fully accessible using a Microsoft Word file format. You can download it anytime you want. So why not get it today?

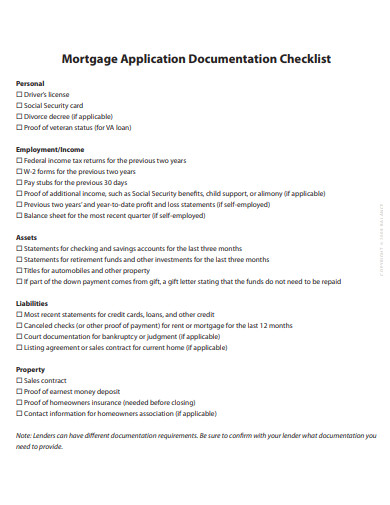

balancepro.net

balancepro.netTo effectively communicate what a borrower should provide in his/her application, you can make use of this Mortgage Documentation Checklist Template today. You may print it in any size and as many as you need. The template is made available in a portable document format (PDF), so there’s no problem downloading and storing it on your personal computer. What are you waiting for? Get this template now!

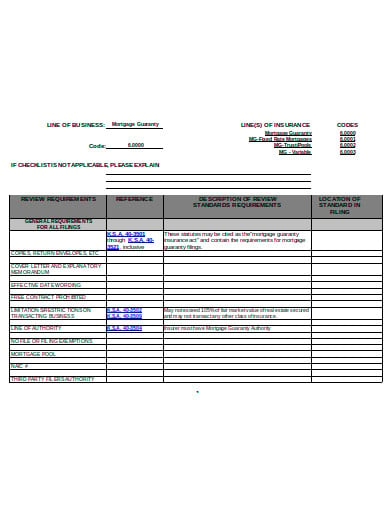

ksinsurance.org

ksinsurance.orgWhen a specified mortgage loan becomes non-performing (in default or close to being in default loan), lenders will usually go for the credit default guarantee, in which this measure is called a mortgage guarantee. It is a tool used by mortgage lenders to mitigate the risk and promote home-ownership. And if ever you a tool like this today, consider downloading this Mortgage Guaranty Checklist in DOC right now.

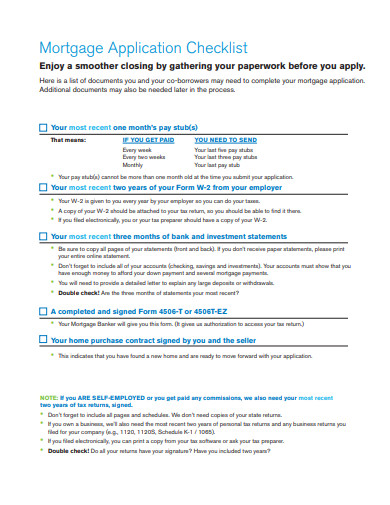

chase.com

chase.comLet this Mortgage Application Checklist Template be your guide in your application for a mortgage. To catch a full glimpse of this template, you download and review it using a portable document format (PDF). Admittedly, this file can help you more than you could ever imagine. So hurry and secure a copy immediately!

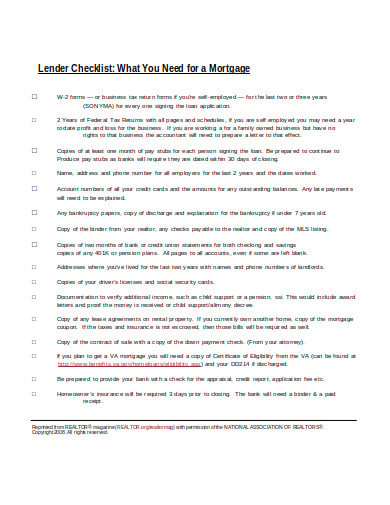

squarespace.com

squarespace.comWith this print-ready Lender Mortgage Checklist Example, you can now determine the procedures and the documents you might need in applying for a mortgage. And to get the full access to this file, make sure you have Microsoft Word on your computer. What are you waiting for? Download this example now!

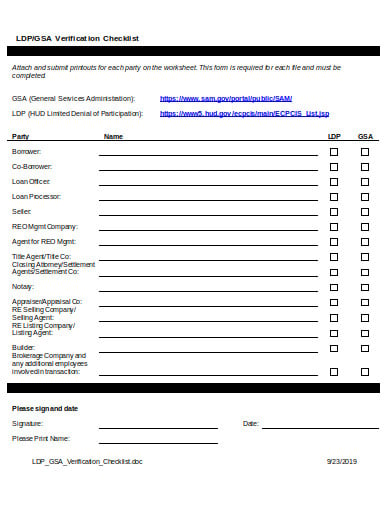

sierrapacificmortgage.com

sierrapacificmortgage.comA mortgage verification or a verification mortgage is a document that details your payment history. Usually, when you apply for a home loan, a lender will require this type of report to ensure and verify balances and late payments if there’s any. To see how a mortgage verification would look like, you may download this Mortgage Verification Checklist Sample anytime today. The file is available in a Microsoft Word file format, so it would be easier for you to have access to this sample document.

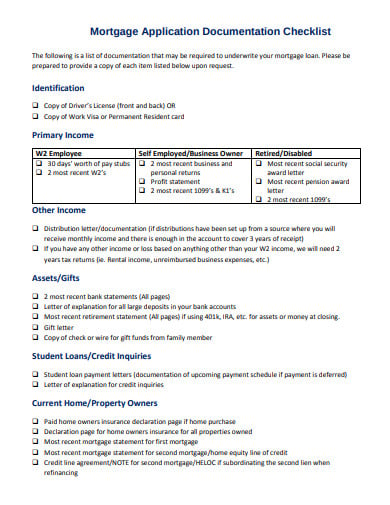

abricu.com

abricu.comGet to utilize this Mortgage Application Documentation Checklist to aid you when you plan to apply for a home sooner or later. It can be your guide in every document that you need to pass and every step that you need to take. Access to it using a portable document format (PDF) program anytime, anywhere. So, what are you still waiting for? Download it now!

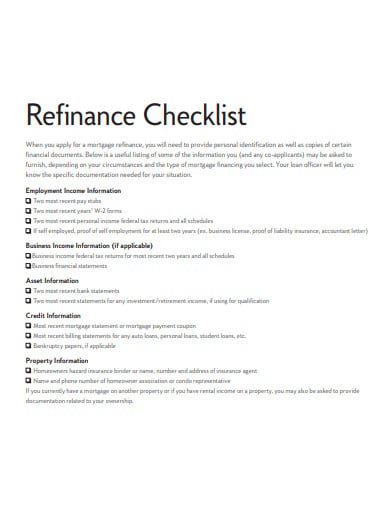

citizensone.com

citizensone.comWhen applying for a home loan refinance, your lender would require to pass or provide several documents and necessary information, such as proof of your income. To help you with the process, you need to have a copy of this Mortgage Refinance Checklist Template that you can download in a portable document format (PDF). Don’t waste a chance to download this template now. Secure it right away!

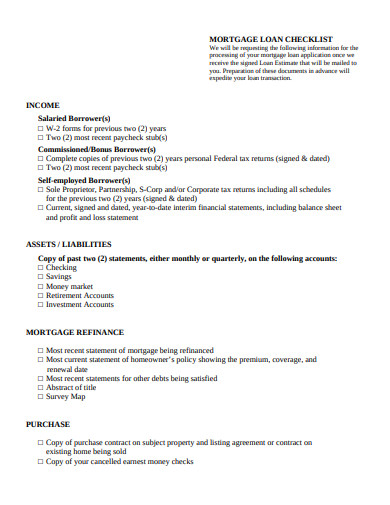

watertownsavingsbank.com

watertownsavingsbank.comAre you looking for a mortgage loan sample checklist that could help you in your application for a mortgage? Why don’t you try downloading this Mortgage Loan Checklist in PDF today? With this sample checklist with you, we assure you will get the help you need. What are still staring at your screen? Download this template now!

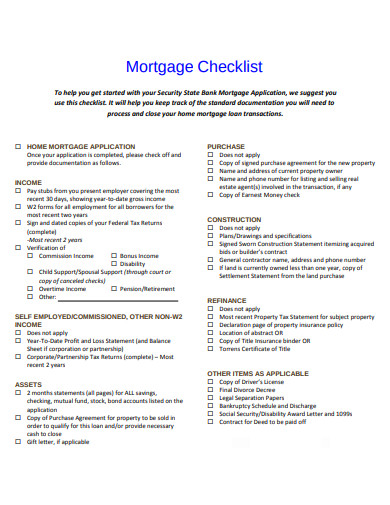

ssbmn.com

ssbmn.comIf you are on the hunt for a simple mortgage checklist, then this Simple Mortgage Checklist Template is what you should have to get your hands on. The template is readily accessible and easily downloadable using a portable document format. It can help you through in the process of applying for a home loan anytime you need it. Download now to your advantage!

A mortgage checklist is a document that guides and details the necessary steps that a borrower should take into account when he/she has a plan to apply for a mortgage or a home loan. The step-by-step guide below can be of great help to both the borrower and the lender. So, consider following it and learn something from the provided steps.

You can access a ready-made checklist template from template.net. Each model comes with preformatted content and a layout that you can keep as-is. All you have to do is provide the necessary information as to what it asks from you. In Google Docs, MS Word, Pages, and other file formats, you can modify it the way it pleases and satisfies you. So, make haste and get a template now!

When you decide to apply for a mortgage, the lender will usually ask for a guarantor or a co-signer. Hence, you will not just be providing your personal information but also the details of the guarantor. Often, this part will ask you to give your name, date of birth, place of birth, educational information, social security number, current housing information, and other necessary relevant details. Make sure to provide all of them. If in doubt, you can always ask for assistance from a front desk or a professional.

Employment details are as important as your personal information. This step requires your employer’s verification, income statement, and self-employment documents (if self-employed). These documents are necessary when you’re applying to a mortgage, for it will assure the lender that you are capable of paying for your loan or refinance your home. Otherwise, they will not accept your application.

Your financial information determines the possibility that you are likely to get accepted to a mortgage. A mortgage company will assess your application and will help you accomplish your request. In this step, make sure to provide your tax information, bank account(s) information, assets, personal property information, credit information, and rental property information.

As you can see, the process will demand you to gather a lot of information first before applying for a home loan. It’s a complex and dry process; however, you need to accomplish all of them to get your request. And in providing all this information, ensure that you’ve written them accurately and correctly in a document. You need to follow the checklist so you’ll leave out no essential details in the process.

Due to limited memory and attention, we humans often forget to do tasks which we were supposed to perform. Our…

A facility maintenance checklist is a priceless defense means to keep a building reliable and safe by periodical planning, checkups,…

A Recruitment Checklist is the to-do-list where you list down all the important details that you need to do or…

Logistics Performance Index indicates that America is one of the leading logistics industries in the globe. Its networks coordinate with…

The best way you can make sure that all cleaning go as planned is to have a cleaning checklist samples.…

A Resume Screening Checklist is a checklist that is prepared by the recruiter to list all the important points based…

HR Compliance Checklist is the tool that is used by HR professionals to make the preparations for the HR tools.…

A retirement party is the opportunity to celebrate the retiree’s past achievements as well as their future efforts. The party…

The mortgage business has gone through a lot of chapters in the industry, combating business challenges every year. According to…